Vitamins market By Type (Vitamin B, Vitamin E, Vitamin D, Vitamin C, Vitamin A, Vitamin K), By Source (Plants, Animals, Synthetic), By Application (Healthcare Products, Pharmaceuticals, Food and Beverages, Animal Feed, Personal Care), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

48922

-

July 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

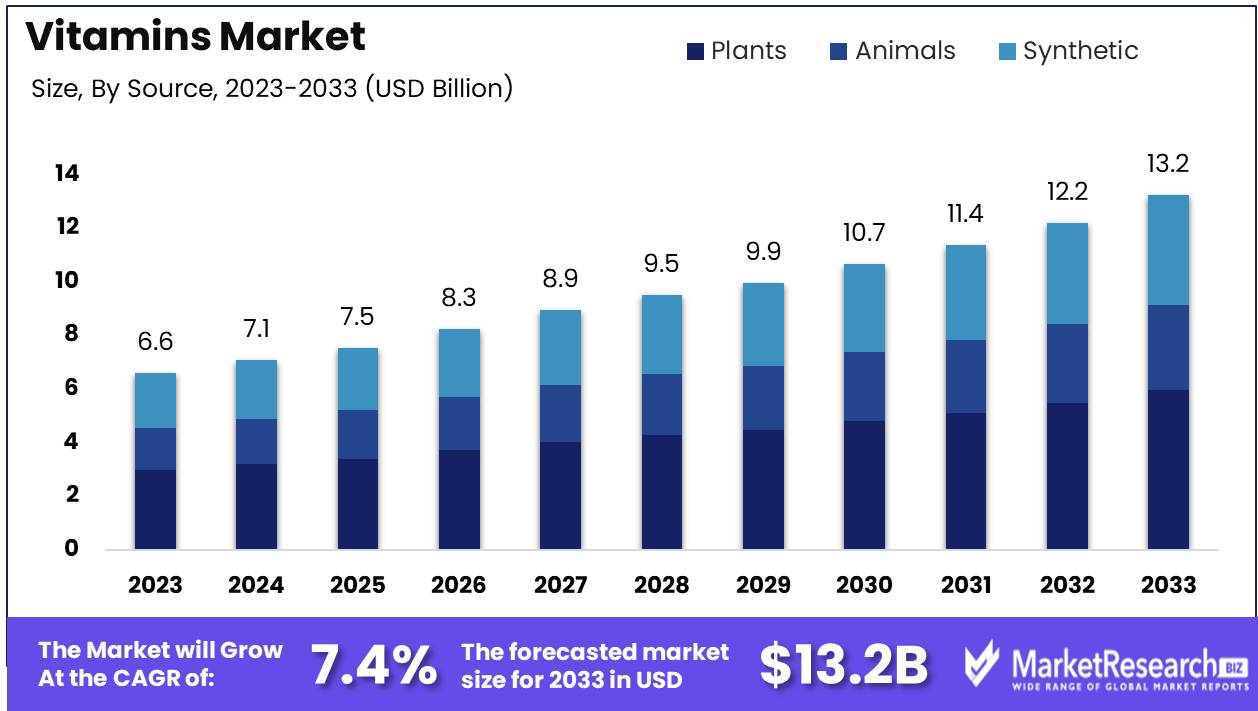

The Vitamins market was valued at USD 6.6 billion in 2023. It is expected to reach USD 13.2 billion by 2033, with a CAGR of 7.4% during the forecast period from 2024 to 2033.

The Vitamins Market encompasses the global trade and consumption of essential micronutrients, including vitamins A, B, C, D, E, and K, crucial for human health and wellness. This market is driven by increasing health awareness, rising incidences of vitamin deficiencies, and the growing popularity of preventive healthcare. Key segments include dietary supplements, fortified foods and beverages, and pharmaceuticals. Technological advancements in vitamin synthesis and increased consumer demand for natural and organic products also contribute to market growth. Major players include pharmaceutical giants, nutraceutical companies, and emerging startups, all competing to innovate and capture market share in this dynamic sector.

The vitamin market is experiencing robust growth, propelled by rising health awareness and an increasing prevalence of vitamin deficiency across global populations. The surge in consumer demand for health supplements, particularly vitamins, is driven by a greater focus on preventative healthcare and overall well-being. Additionally, the ongoing shift towards healthier lifestyles has led to a heightened consumption of vitamins, further fueling market expansion. Innovations in product formulations, including developing vegan and organic vitamins, open new avenues for market players. These trends indicate a strong positive trajectory for the vitamins market, with substantial opportunities for growth and expansion.

However, the market faces notable challenges that could hinder its growth. Regulatory complexities, particularly those related to approving and marketing vitamin supplements, present significant obstacles for manufacturers. Moreover, the risk of overconsumption and potential adverse health effects poses a concern, necessitating stringent regulations and consumer education. Despite these challenges, the market's potential remains promising, driven by continuous innovation and adaptation to consumer preferences. Market players who can navigate regulatory hurdles and capitalize on emerging trends are well-positioned to succeed in this dynamic and rapidly evolving landscape.

The market growth is significantly driven by the rising health awareness and the increasing prevalence of vitamin deficiency among global populations. Regulatory complexities and the risk of overconsumption pose challenges to market growth. Innovations in product formulations, coupled with the growing trend of vegan and organic vitamins, are creating new opportunities for market players.

Key Takeaways

- Market Growth: The Vitamins market was valued at USD 6.6 billion in 2023. It is expected to reach USD 13.2 billion by 2033, with a CAGR of 7.4% during the forecast period from 2024 to 2033.

- By Type: Vitamin B dominates the 2023 Vitamins Market, essential for energy and metabolism.

- By Source: Plant-based vitamins dominated the market, driven by consumer preference for natural products.

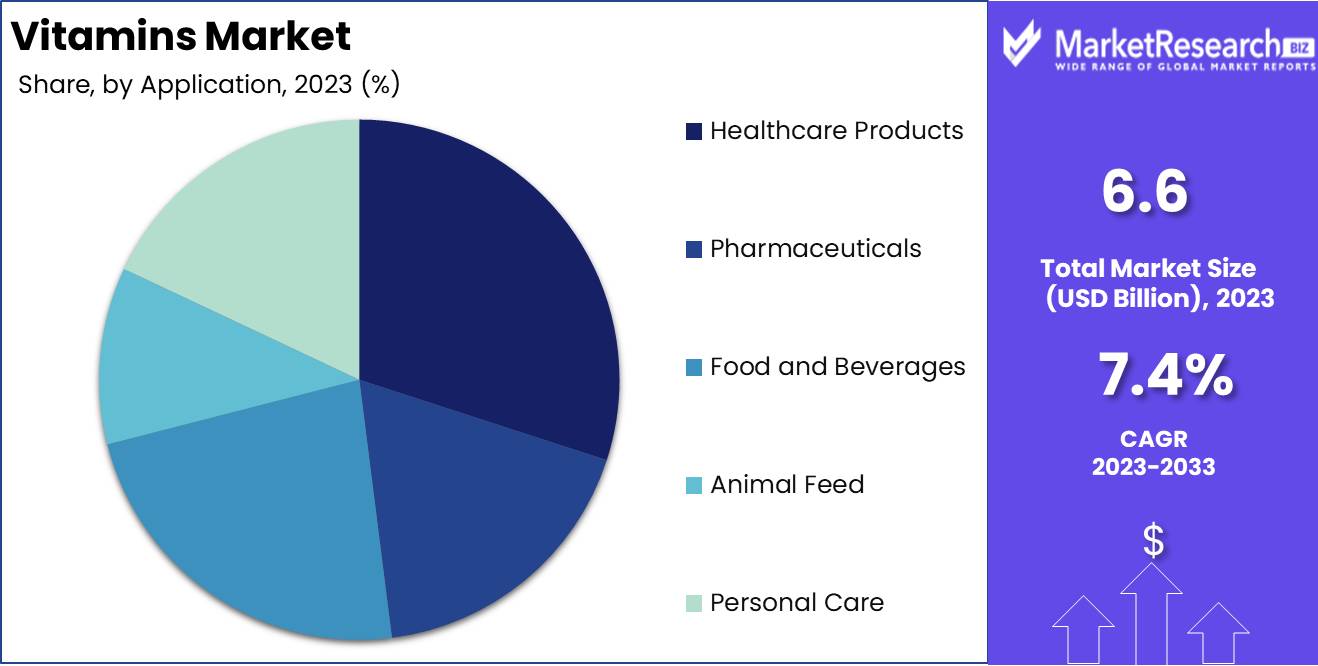

- By Application: Healthcare Products dominate the Vitamins Market enhancing overall health significantly.

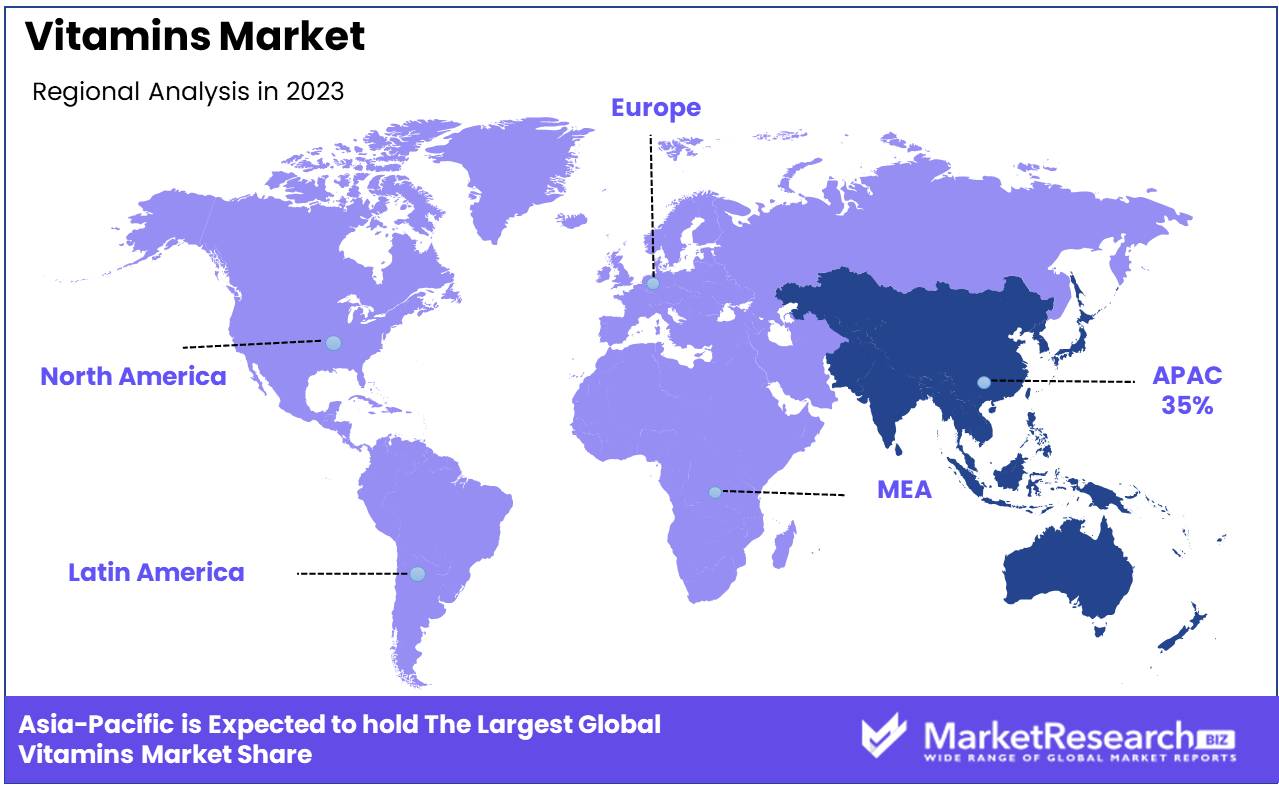

- Regional Dominance: Asia Pacific leads the vitamins market with a 35% largest market share and robust growth.

- Growth Opportunity: The global vitamins market growth is driven by personalized nutrition and e-commerce advancements.

Driving factors

Increasing Prevalence of Vitamin Deficiencies

The escalating prevalence of vitamin deficiencies globally acts as a fundamental driver for the vitamin market. This condition primarily arises from inadequate dietary intake, lifestyle choices, and certain health conditions that impede nutrient absorption. The global health crisis of vitamin deficiencies particularly of vitamins D, B12, and A spurs a heightened demand for supplements. For instance, it is estimated that about 1 billion people worldwide suffer from vitamin D deficiency, which has been linked to various chronic diseases such as osteoporosis and certain cancers. This widespread deficiency underpins the demand for vitamin D supplements, catalyzing growth across the entire vitamin market. By addressing these deficiencies, the market not only meets a critical health need but also expands its consumer base across regions with varying dietary gaps.

Growing Consumer Awareness About Health and Wellness

In parallel with the rise of vitamin deficiencies, there is a significant surge in consumer awareness regarding health and wellness. This trend is amplified by digital media, through which information about health benefits and the preventive capabilities of vitamins is widely disseminated. As consumers become more knowledgeable about the links between nutrient intake and long-term health outcomes, the demand for vitamin supplements increases. For example, awareness of vitamin C's role in boosting immunity has led to a marked increase in its consumption during seasonal flu peaks and global health crises. This informed consumer base is more likely to invest in dietary supplements as part of a holistic health regimen, fostering a proactive approach to health maintenance. This awareness fuels a sustained growth in the vitamins market, as consumers continue to prioritize health and wellness in their daily lives.

Proactive Health Management Fueling Market Growth

A fundamental shift towards preventive healthcare is reshaping the healthcare landscape, with individuals increasingly taking charge of their health through preventive measures. This paradigm shift includes the proactive use of vitamins to prevent nutrient deficiencies and mitigate health issues before they escalate. Preventive healthcare reduces the long-term costs associated with treating chronic diseases and aligns with the growing trend of health self-management among consumers. As a result, both healthcare providers and consumers are driving the demand for vitamins, recognizing their cost-effectiveness and benefits in maintaining general health and preventing diseases. This trend not only supports the current market growth but also ensures its expansion as preventive health measures become more integrated into routine healthcare practices.

Restraining Factors

Stringent Regulations and Quality Control Standards: Navigating Compliance for Market Stability

The vitamins market, pivotal in health and wellness, is significantly influenced by stringent regulations and quality control standards. These regulatory frameworks ensure product safety, efficacy, and quality, fostering consumer trust and market integrity. For instance, in the United States, the Food and Drug Administration (FDA) mandates rigorous compliance with Good Manufacturing Practices (GMP) for dietary supplements, which includes vitamins. These standards are pivotal in mitigating the risk of contamination and inaccuracies in product labeling, thus assuring consumers of product reliability.

However, these regulations also present challenges. The cost and complexity of compliance can be substantial, especially for new entrants and smaller players in the market. For example, achieving GMP certification involves considerable financial investment in production processes, testing, and quality assurance measures. Despite these challenges, adherence to stringent standards can ultimately serve as a market differentiator, distinguishing high-quality products in a crowded marketplace. Therefore, while these regulations restrain market entry, they simultaneously enhance market stability and growth by ensuring that only high-quality, compliant products reach consumers.

Potential Side Effects and Safety Concerns: A Dual-Edged Sword for Market Dynamics

The potential side effects and safety concerns associated with vitamin consumption play a dual role in the market's dynamics. On one hand, these concerns can act as a deterrent, influencing consumer behavior and potentially slowing market growth. For instance, excessive intake of fat-soluble vitamins such as Vitamin A can lead to toxicity, causing serious health issues such as liver damage and increased pressure on the brain. This risk of side effects can lead to increased consumer caution, impacting the sales of certain vitamin products.

On the other hand, these safety concerns also drive innovation and research within the industry, leading to the development of safer, more effective formulations. The market has seen a rise in the demand for naturally sourced vitamins and those with enhanced bioavailability, which are perceived as safer and more beneficial by consumers. Additionally, the industry has witnessed an increase in personalized vitamin solutions, tailored to individual health needs and reducing the risk of adverse effects.

Moreover, public awareness campaigns and educational initiatives by health organizations about the proper use of vitamins contribute to informed consumer choices, thereby mitigating safety concerns and supporting market growth.

By Type Analysis

Vitamin B dominates the 2023 Vitamins Market, essential for energy and metabolism.

In 2023, Vitamin B held a dominant market position in the "By Type" segment of the Vitamins market, reflecting its crucial role in metabolic processes and energy production. This segment, which includes Vitamin B, E, D, C, A, and K, showcases varied applications across multiple industries, including healthcare and pharmaceuticals, food and beverages, and personal care.

Vitamin E is followed closely, acclaimed for its antioxidant properties and benefits in skin care formulations and dietary supplements. The market demand for Vitamin D surged due to its essential role in bone health and immune system support, intensified by the global increase in awareness about vitamin D deficiency.

Vitamin C maintained a steady market share, driven by its popularity in immune boosting and its pivotal role in collagen synthesis, making it a favorite in both dietary supplements and cosmetics. Vitamin A was highlighted for its benefits in vision health and cell growth, leading to significant use in both medical therapies and fortified foods.

Lastly, Vitamin K has seen growth due to its applications in bone health and blood clotting processes. The expanding research on its benefits beyond clotting is opening new avenues for market expansion, particularly in the nutritional supplements sector. Collectively, these vitamins are integral to a robust health and wellness trend, influencing market dynamics significantly.

By Source Analysis

In 2023, Plant-based vitamins dominated the market, driven by consumer preference for natural products.

In 2023, Plants held a dominant market position in the "By Source" segment of the Vitamins market. This preference for plant-based sources is driven by the growing consumer inclination towards natural and organic products, as they are perceived to be safer and more sustainable compared to their synthetic counterparts. Plants, as a source, accounted for a significant share of the market, owing to these factors combined with the increasing vegan and vegetarian populations globally.

Meanwhile, animal sources also contributed notably to the market. Vitamins derived from animals are essential in catering to specific nutritional needs that are difficult to meet with plant-based vitamins alone, such as Vitamin B12, which is crucial for neurological health and is predominantly found in animal products.

The synthetic segment, while still substantial, has seen a slower growth rate. This trend is largely attributed to rising consumer awareness and skepticism towards synthetic additives in food and health products. However, synthetic vitamins continue to be pivotal in regions where cost-effectiveness and shelf stability are prioritized, providing essential nutrients without the constraints of natural source variability.

By Application Analysis

Healthcare Products dominate 2023 Vitamins Market enhancing overall health significantly.

In 2023, Healthcare Products held a dominant market position in the "By Application" segment of the Vitamins market. This segment leverages vitamins to enhance overall health outcomes and reduce the prevalence of chronic diseases. The substantial share held by Healthcare Products can be attributed to increased consumer awareness and growing health concerns, especially in the wake of global health crises.

Following closely, Pharmaceuticals also represent a significant portion of the market, utilizing vitamins in formulations to prevent deficiencies and support medical treatments. The synergy between pharmaceuticals and preventive health measures has fostered a robust growth trajectory in this segment.

The Food and Beverages sector capitalizes on the fortification of everyday consumables with vitamins, addressing public health goals by improving the nutritional quality of diets on a large scale. This segment has seen notable growth, driven by consumer preferences for functional and fortified foods.

Animal Feed is another vital segment, where vitamins are essential for the health and productivity of livestock and pets. This sector emphasizes the importance of nutritional additives to enhance growth, reproduction, and overall health of animals.

Lastly, the Personal Care segment integrates vitamins into products to enhance skin, hair, and nail health, aligning with the rising demand for natural and nutrient-rich personal care products. This trend reflects a broader consumer shift towards more holistic approaches to health and wellness.

Key Market Segments

By Type

- Vitamin B

- Vitamin E

- Vitamin D

- Vitamin C

- Vitamin A

- Vitamin K

By Source

- Plants

- Animals

- Synthetic

By Application

- Healthcare Products

- Pharmaceuticals

- Food and Beverages

- Animal Feed

- Personal Care

Growth Opportunity

Increasing Demand for Personalized Nutrition

The global vitamins market is poised for significant growth, driven by an increasing demand for personalized nutrition. As consumers become more health-conscious, there is a growing preference for tailored vitamin solutions that cater to individual nutritional needs. This trend is bolstered by advancements in technology, enabling companies to offer customized vitamin blends based on genetic, lifestyle, and health data. For instance, personalized vitamin subscription services have gained popularity, providing consumers with convenience and bespoke health solutions. This shift towards personalization is expected to drive market expansion, as it aligns with the broader trend of individualized healthcare.

Leveraging E-commerce and Direct-to-Consumer Sales

E-commerce and direct-to-consumer (DTC) sales channels present significant growth opportunities for the vitamins market. The convenience and accessibility of online shopping have revolutionized the way consumers purchase vitamins, particularly during the COVID-19 pandemic. The digital shift has led to the proliferation of online vitamin retailers and DTC brands, offering competitive pricing, subscription models, and targeted marketing strategies. Companies leveraging e-commerce platforms can reach a wider audience and gather valuable consumer insights to refine their product offerings. The integration of artificial intelligence and data analytics in online platforms further enhances the consumer experience, fostering brand loyalty and repeat purchases.

Latest Trends

Emerging New Supplement Categories: Innovation Driving Consumer Interest and Market Expansion

The vitamins market is witnessing a significant transformation with the emergence of new supplement categories. This trend is driven by increasing consumer awareness and demand for personalized health solutions. As individuals seek tailored options that address specific health concerns, companies are innovating beyond traditional multivitamins to include specialized supplements targeting areas such as cognitive enhancement, gut health, and immune support. This shift not only broadens the market landscape but also invites new entrants, fostering competition and innovation.

Hydration Boosters: Integrating Essential Vitamins for Enhanced Daily Wellness

Another noteworthy trend in the vitamins market is the rise of hydration boosters. These products, which combine essential vitamins with hydration benefits, are becoming increasingly popular among health-conscious consumers. Hydration boosters offer a dual function; they not only help maintain optimal hydration levels but also provide a convenient way to consume vitamins that may be lacking in regular diets. This trend is particularly appealing in the fitness and wellness community, where maintaining hydration is crucial. As a result, these products are expected to see robust growth, influencing market dynamics and consumer purchasing patterns.

Regional Analysis

Asia Pacific leads the vitamins market with a 35% share and robust growth.

The global vitamins market exhibits distinct regional dynamics, influenced by dietary habits, health awareness, and economic conditions. In North America, the market is driven by a surge in health-conscious consumers and an aging population, leading to a robust demand for dietary supplements. Europe mirrors this trend, with a strong emphasis on preventative healthcare propelling the consumption of vitamins. The European market benefits from stringent regulations ensuring high product quality, which boosts consumer trust.

Asia Pacific emerges as the dominating region in the vitamins market, accounting for approximately 35% of the global share. This dominance is fueled by increasing disposable incomes, urbanization, and growing awareness about nutritional deficiencies, particularly in countries like China and India. The region's market is expected to expand at a compound annual growth rate (CAGR) of 7.5% through the forecast period.

In contrast, the Middle East & Africa and Latin America markets are developing, with growth driven by improving healthcare infrastructure and rising health awareness among the middle class. These regions are witnessing increased investments from major global players who are tapping into the untapped potential of these markets, albeit from a smaller base compared to Asia Pacific and North America.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In the global vitamins market, key players such as BASF SE, DSM, and ADM continue to lead through strategic expansions and innovations. BASF SE and DSM have been prominent in enhancing their product portfolios and strengthening their global supply chains, which is pivotal in maintaining their market dominance. ADM's focus on integrating sustainability in its production processes appeals to the growing consumer demand for environmentally responsible sourcing.

SternVitamin GmbH & Co. KG and Glanbia plc are leveraging their expertise in tailored vitamin blends to cater to specific consumer health needs, thereby securing a competitive edge. The agility of these companies in adapting to consumer preferences aligns with market demands for customized nutrition solutions.

Lonza and Vitablend Nederland BV stand out with their advancements in encapsulation technologies which improve the stability and efficacy of vitamin supplements. This technological edge is crucial in markets where consumer preferences lean towards high-efficacy products.

Emerging players like Zagro and Wright Enrichment Inc. are expanding their geographic footprint, particularly in underserved markets, which could disrupt traditional market dynamics. Similarly, companies like Adisseo and Showa Denko K.K. are investing in R&D to innovate in the synthesis and delivery of vitamins, enhancing their competitive positioning.

Farbest Brands, Jubilant Life Sciences Ltd., and Vertellus Holdings LLC are focusing on regulatory compliance and high-quality manufacturing processes to maintain trust and reliability among consumers, which is essential in retaining market share in a highly regulated environment.

Market Key Players

- BASF SE

- DSM

- ADM

- SternVitamin GmbH & Co. KG

- Glanbia plc

- Lonza

- Vitablend Nederland BV

- Zagro.

- Wright Enrichment Inc.

- Adisseo

- Showa Denko K.K.

- Farbest Brands

- Jubilant Life Sciences Ltd.

- Vertellus Holdings LLC

Recent Development

- In June 2024, GNC Holdings announced a breakthrough in the development of a new formula that enhances the absorption of vitamins D and K. This innovation aims to improve bone health and cardiovascular health, addressing deficiencies more effectively.

- In April 2024, Pfizer Inc. acquired Bionutrients Ltd., a leading innovator in natural and organic vitamin solutions. This acquisition is part of Pfizer's strategy to expand its footprint in the natural supplements market.

- In March 2024, BASF SE announced the expansion of its vitamin A and E production facilities in Ludwigshafen, Germany. The expansion is aimed at increasing the company's production capacity to meet the growing global demand for vitamin supplements.

Report Scope

Report Features Description Market Value (2023) USD 6.6 Billion Forecast Revenue (2033) USD 13.2 Billion CAGR (2024-2032) 7.4% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Vitamin B, Vitamin E, Vitamin D, Vitamin C, Vitamin A, Vitamin K), By Source (Plants, Animals, Synthetic), By Application (Healthcare Products, Pharmaceuticals, Food and Beverages, Animal Feed, Personal Care) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape BASF SE, DSM, ADM, SternVitamin GmbH & Co. KG, Glanbia plc, Lonza, Vitablend Nederland BV, Zagro, Wright Enrichment Inc., Adisseo, Showa Denko K.K., Farbest Brands, Jubilant Life Sciences Ltd., Vertellus Holdings LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- BASF SE

- DSM

- ADM

- SternVitamin GmbH & Co. KG

- Glanbia plc

- Lonza

- Vitablend Nederland BV

- Zagro.

- Wright Enrichment Inc.

- Adisseo

- Showa Denko K.K.

- Farbest Brands

- Jubilant Life Sciences Ltd.

- Vertellus Holdings LLC