Vacation Rental Market, By Accommodation Type (Home, Apartments, Resort/Condominium, Others), By Booking Mode (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

49344

-

July 2024

-

136

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

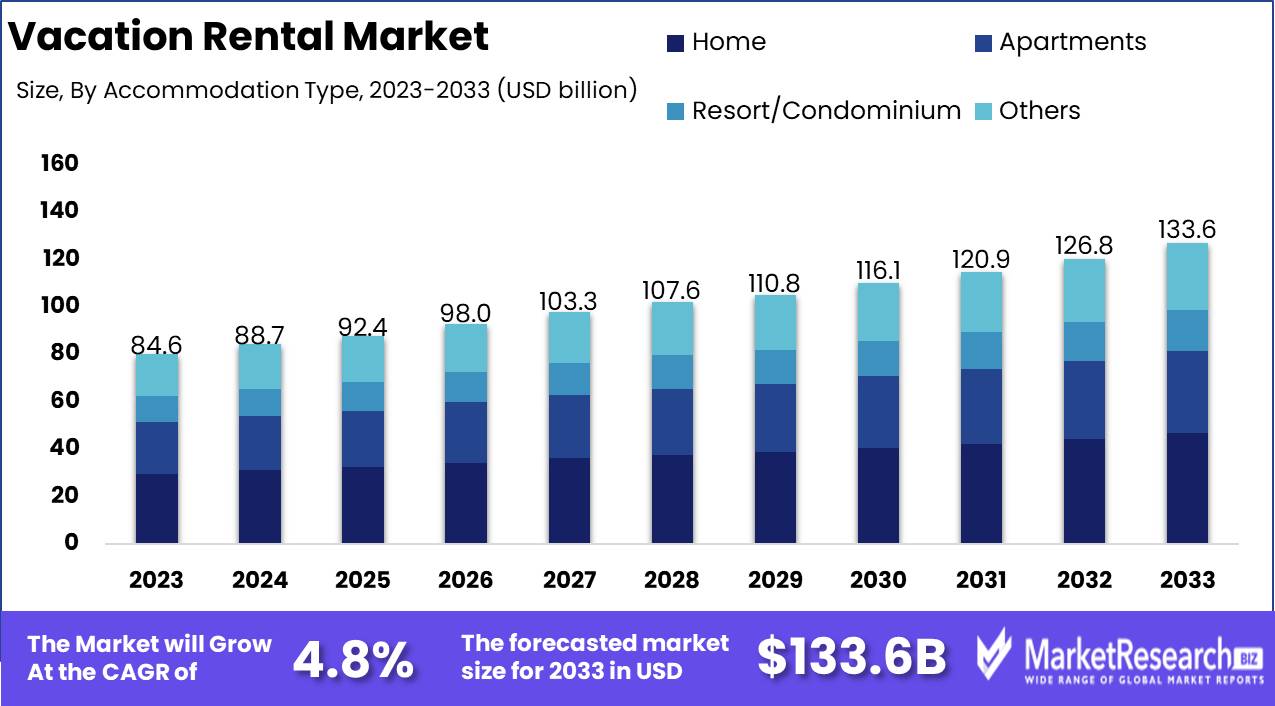

The Global Vacation Rental Market was valued at USD 84.6 Bn in 2023. It is expected to reach USD 133.6 Bn by 2033, with a CAGR of 4.8% during the forecast period from 2024 to 2033.

The vacation rental market encompasses short-term accommodation options rented to travelers and tourists, ranging from privately-owned homes and apartments to professionally managed properties. This market segment offers a diverse range of lodging alternatives beyond traditional hotels, catering to varying preferences for location, amenities, and budget. It includes platforms such as Airbnb, Vrbo, and Booking.com, which facilitate the booking process, as well as property management companies that maintain and service these rentals. The vacation rental market has seen significant growth driven by the increasing popularity of experiential travel and the desire for unique, home-like stays.

The vacation rental market is undergoing a transformative phase, marked by significant growth and strategic consolidation. With travelers increasingly seeking personalized and unique lodging experiences, the demand for vacation rentals continues to rise, presenting lucrative opportunities for both property owners and investors. The market's expansion is underpinned by several key drivers: technological advancements in booking platforms, shifts in consumer preferences towards experiential travel, and the proliferation of remote work, which has blurred the lines between vacation and workspaces.

A pivotal development in the industry occurred in August 2022, when Oravel Stays (OYO) acquired Bornholmske Feriehuse, a vacation rental operator, to bolster its presence in the European market. This strategic acquisition highlights the trend of consolidation within the industry, as major players seek to diversify their portfolios and enhance their geographical reach. Furthermore, Airbnb's reported 31% year-over-year increase in revenue for Q1 2023 underscores the robust demand and strong financial performance within the sector.

The competitive landscape is becoming increasingly dynamic, with established platforms expanding their service offerings and new entrants striving to capture market share. To sustain growth and profitability, companies must focus on leveraging data analytics to enhance customer experiences, streamline operations, and optimize pricing strategies. Additionally, maintaining high standards of property management and guest satisfaction will be critical in retaining customer loyalty and fostering repeat business. As the vacation rental market continues to evolve, stakeholders must remain agile and responsive to emerging trends and consumer behaviors to capitalize on the abundant opportunities within this vibrant sector.

Key Takeaways

- Market Value: The Global Vacation Rental Market was valued at USD 84.6 Bn in 2023. It is expected to reach USD 133.6 Bn by 2033, with a CAGR of 4.8% during the forecast period from 2024 to 2033.

- By Accommodation Type: Home rentals lead the segment, accounting for 40% of the market, offering tourists a homely and personalized lodging experience.

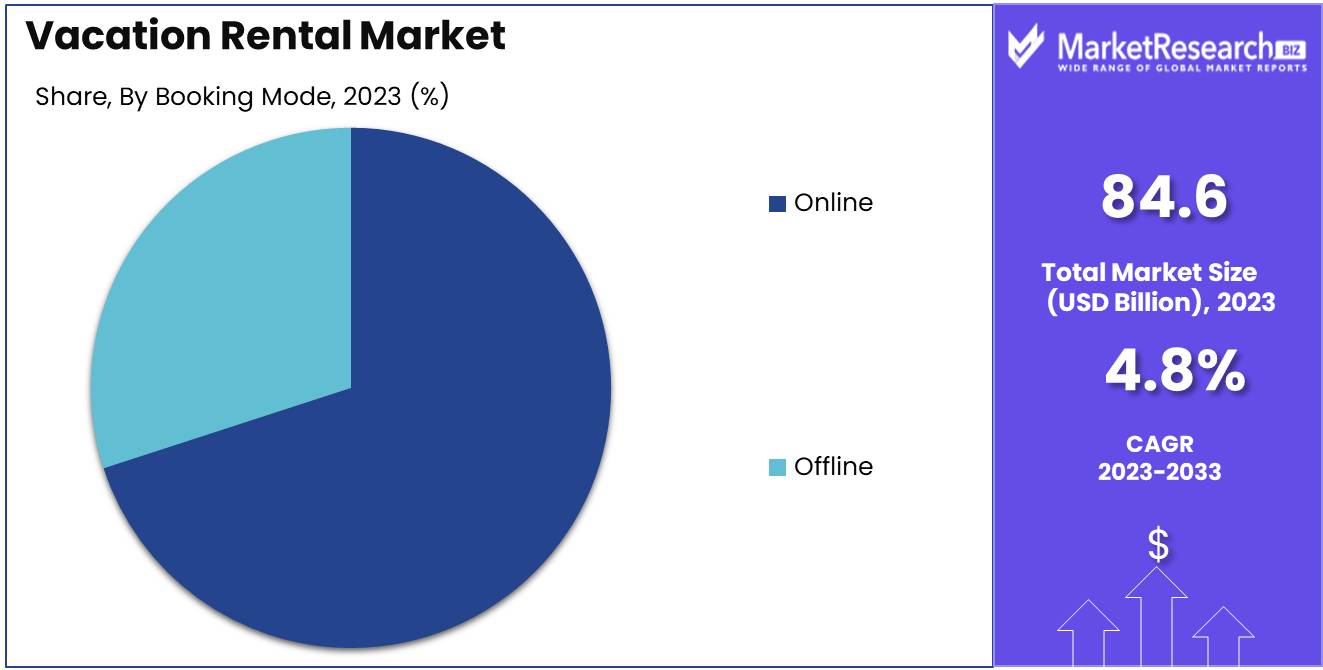

- By Booking Mode: Online bookings dominate, comprising 70%, reflecting the convenience and wide accessibility of digital platforms.

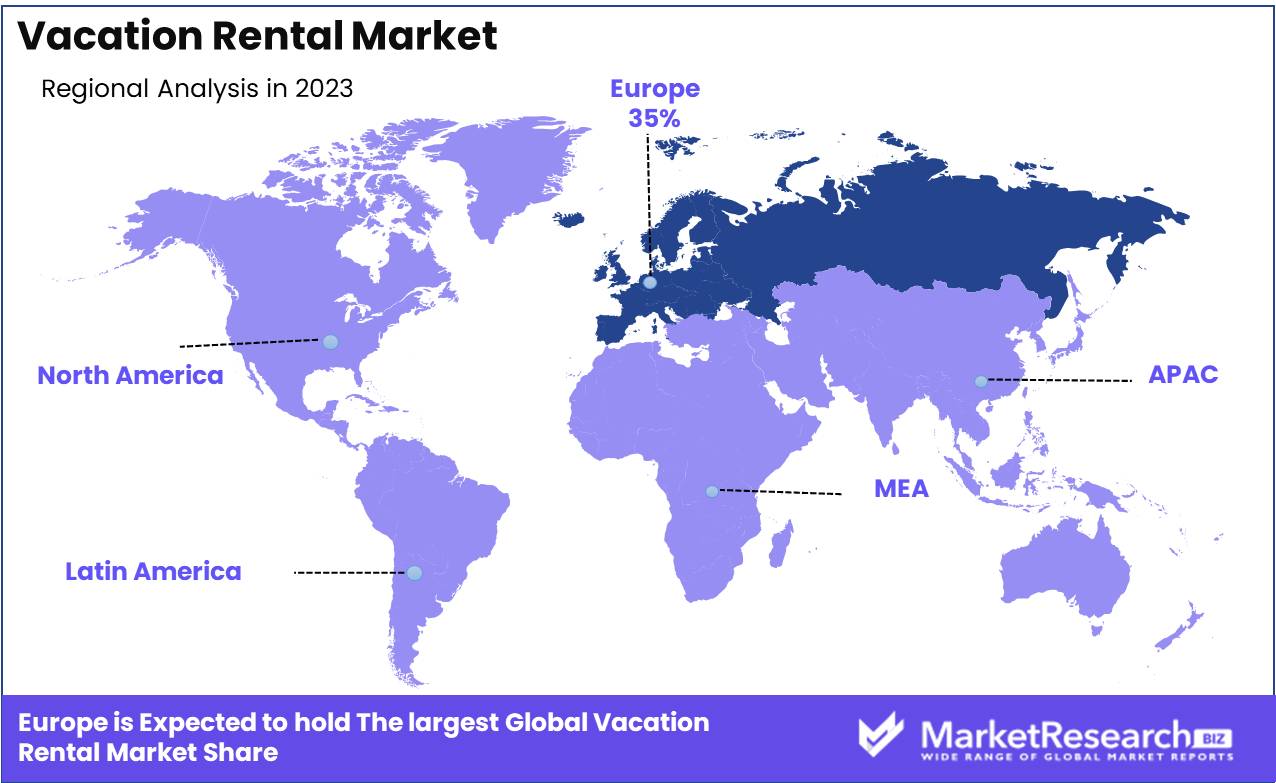

- Regional Dominance: Europe holds a 35% market share, driven by its rich cultural heritage and a vast array of tourist destinations.

- Growth Opportunity: Expanding the market through partnerships with local tourism boards and enhancing virtual reality tours can significantly attract more travelers.

Driving factors

Rising Popularity of Experiential Travel

The vacation rental market is experiencing robust growth due to the increasing popularity of experiential travel. Travelers today are seeking authentic, immersive experiences that allow them to connect deeply with local cultures and environments. This shift in preference favors vacation rentals, which often provide a more personalized and homely stay compared to traditional hotels.

Properties in unique locations, offering distinctive cultural, historical, or natural attributes, cater directly to this demand. The trend towards experiential travel enhances the appeal of vacation rentals, driving higher occupancy rates and repeat visits, ultimately contributing to market expansion.

Growth in Online Booking Platforms

Online booking platforms have revolutionized the vacation rental market by making it easier for travelers to find and book accommodations. Platforms like Airbnb, Vrbo, and Booking.com have significantly increased the visibility and accessibility of vacation rentals. They offer comprehensive search functionalities, user reviews, and secure payment options, which simplify the booking process for consumers.

The convenience provided by these platforms has democratized access to vacation rentals, attracting a wider audience. Moreover, these platforms offer property owners robust tools for managing listings, optimizing pricing, and communicating with guests, which further supports market growth.

Increasing Number of Property Owners Renting Out Spaces

The vacation rental market is also benefitting from a growing number of property owners choosing to rent out their spaces. Economic incentives, such as the potential for substantial rental income, are encouraging more individuals to enter the market. Additionally, the ease of listing properties on online platforms and the relatively low barriers to entry make vacation rentals an attractive option for property owners.

This influx of new properties increases the overall supply and diversity of available accommodations, catering to a broader range of traveler preferences and budgets. As more property owners participate in the market, the variety and quality of offerings improve, making vacation rentals a competitive choice against traditional hotels.

Restraining Factors

Regulatory and Zoning Challenges

Regulatory and zoning challenges pose significant hurdles for the vacation rental market, potentially stifling growth and complicating operations for property owners. Various municipalities and governments around the world have implemented strict regulations and zoning laws that limit or outright ban short-term rentals. These regulations often stem from concerns about housing affordability, neighborhood character, and the impact on long-term rental markets.

In cities with high tourist volumes, local authorities have introduced measures such as limiting the number of days a property can be rented out, requiring special licenses, and imposing heavy fines for non-compliance. These restrictions can deter potential property owners from entering the market or prompt existing hosts to exit. The complexity and variability of these regulations across different regions add to the operational burden for vacation rental platforms, which must ensure compliance to avoid legal repercussions.

Competition from Traditional Hotels

Traditional hotels continue to be a formidable competitor to the vacation rental market, leveraging their established reputations, loyalty programs, and extensive amenities to attract travelers. Hotels often provide a standardized level of service and security that appeals to certain segments of travelers, particularly business travelers and those seeking a hassle-free experience.

Hotels also benefit from economies of scale, allowing them to offer competitive pricing and extensive marketing campaigns that can overshadow individual vacation rental listings. The presence of global hotel chains with significant resources further intensifies this competition, as they can afford to innovate and enhance their offerings continually.

By Accommodation Type Analysis

In 2023, Home held a dominant market position in the By Accommodation Type segment of the Vacation Rental Market, capturing more than a 40% share.

In 2023, Home held a dominant market position in the By Accommodation Type segment of the Vacation Rental Market, capturing more than a 40% share. This dominance is driven by the growing preference for spacious, private accommodations that offer a homely experience, especially for families and groups. Homes provide the convenience of multiple rooms, kitchens, and outdoor spaces, making them ideal for longer stays and more personalized experiences. The increasing demand for vacation homes in popular tourist destinations and the rise of platforms like Airbnb and Vrbo that facilitate easy booking and listing of homes contribute to their leading market position.

Apartments are also a significant segment, particularly in urban areas where travelers seek proximity to city attractions and business centers. They offer a balance between home-like amenities and the convenience of city living.

Resort/Condominium accommodations cater to tourists looking for a blend of luxury and convenience, often offering amenities such as pools, gyms, and concierge services. While they attract a niche market, their share is less than that of homes due to higher costs and limited availability in some regions.

Others include various non-traditional rental types such as houseboats, treehouses, and unique stays that offer distinct experiences. Although growing in popularity, their market share remains modest due to their specialized and limited nature.

By Booking Mode Analysis

In 2023, Online held a dominant market position in the By Booking Mode segment of the Vacation Rental Market, capturing more than a 70% share.

In 2023, Online held a dominant market position in the By Booking Mode segment of the Vacation Rental Market, capturing more than a 70% share. The significant market share is driven by the convenience, accessibility, and extensive reach of online booking platforms. Websites and apps like Airbnb, Booking.com, and Vrbo have revolutionized the vacation rental industry by offering comprehensive listings, user reviews, secure payment options, and easy booking processes.

Offline booking, which includes traditional methods such as phone reservations and in-person bookings through travel agencies, still plays a role, particularly among older travelers and in regions with limited internet access. However, its market share is significantly smaller compared to online booking due to the widespread preference for the ease and efficiency of digital platforms.

Key Market Segments

By Accommodation Type

- Home

- Apartments

- Resort/Condominium

- Others

By Booking Mode

- Online

- Offline

Growth Opportunity

Expansion into Non-Traditional Destinations

The global vacation rental market in 2024 is poised for substantial growth, driven in part by the expansion of vacation rentals into non-traditional destinations. As travelers seek unique and less-crowded locales, property owners and platforms are capitalizing on this trend by offering rentals in rural areas, small towns, and emerging tourist regions.

This not only diversifies the market but also distributes tourism-related economic benefits more broadly. The increasing accessibility of these areas, supported by improved transportation and digital connectivity, makes them attractive alternatives to traditional tourist hotspots.

Development of Luxury and Themed Rental Properties

Another significant opportunity lies in the development of luxury and themed rental properties. High-end vacation rentals are gaining popularity among affluent travelers who desire exclusive experiences and premium amenities. From opulent villas and chic urban lofts to properties with specific themes like wellness retreats or eco-friendly accommodations, this segment is expanding rapidly.

Catering to niche markets with specialized offerings enhances customer satisfaction and drives higher profit margins, positioning the vacation rental market to capture a larger share of the luxury travel segment.

Latest Trends

Personalized Booking Experiences

In 2024, the global vacation rental market is increasingly leveraging artificial intelligence (AI) and machine learning to enhance personalized booking experiences. These technologies enable platforms to analyze vast amounts of data on traveler preferences, behaviors, and booking histories, offering tailored recommendations and dynamic pricing models. Personalized experiences not only improve customer satisfaction but also drive higher conversion rates and repeat bookings. For instance, AI-powered chatbots provide instant customer support, and machine learning development suggest ideal properties based on individual travel habits, making the booking process more intuitive and user-friendly.

Integration of Sustainable Practices

Sustainability is another critical trend shaping the vacation rental market in 2024. Travelers increasingly seek eco-friendly accommodations that minimize environmental impact. Property owners and platforms are responding by implementing green practices such as using renewable energy sources, offering recycling programs, and promoting local, sustainable tourism activities.

These efforts appeal to environmentally conscious travelers and align with global sustainability goals, enhancing the market's reputation and competitiveness.

Regional Analysis

In 2023, Europe dominated the Vacation Rental Market, capturing 35% of the market share.

In 2023, Europe held a dominant position in the Vacation Rental Market, capturing 35% of the market share. This leadership is driven by the region's rich cultural heritage, diverse landscapes, and well-established tourism infrastructure. Countries such as France, Italy, Spain, and the UK are major contributors, with their picturesque cities, historic landmarks, and scenic countryside attracting millions of tourists annually. The rising popularity of short-term rentals and the proliferation of online booking platforms like Airbnb and Booking.com further enhance Europe's market position.

North America follows, driven by high tourism rates in the US and Canada, a strong economy, and a trend toward staycations. Digital platform adoption and diverse destinations support its significant market share.

Asia Pacific is rapidly growing due to rising disposable incomes, a burgeoning middle class, and increased travel interest in China, India, and Japan. The region's market share is expanding with more rental properties on digital platforms.

Middle East & Africa show potential with increased tourism initiatives and investments in places like the UAE and South Africa. However, market share remains modest due to economic constraints.

Latin America is growing, led by Brazil and Mexico, with diverse destinations and rising tourism. Despite expansion, market share is smaller due to economic variability and slower platform adoption.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global vacation rental market in 2024 is poised for significant growth, driven by evolving consumer preferences and advancements in technology. Key players such as Airbnb, Inc., VRBO, Booking Holdings Inc., TripAdvisor, Inc., and Vacasa, Inc. are leading this transformation.

Airbnb, Inc. remains at the forefront, leveraging its extensive network and innovative business model. Its strategic investments in AI and machine learning enhance user experience and property management, providing a competitive edge. VRBO continues to capitalize on its niche in family and group travel, focusing on providing tailored experiences and enhancing customer loyalty through advanced data analytics.

Booking Holdings Inc. integrates vacation rentals with its broader travel ecosystem, offering seamless booking experiences across various travel needs. This integration strengthens its market position by catering to diverse customer preferences. TripAdvisor, Inc. utilizes its vast repository of user-generated content to drive engagement and trust, positioning itself as a go-to platform for vacation rental reviews and bookings.

Vacasa, Inc. differentiates itself with a strong focus on professional property management, offering homeowners comprehensive services from marketing to maintenance. This approach ensures consistent quality and reliability, appealing to both property owners and renters. Marriott International, Inc. leverages its brand reputation and loyalty programs to attract customers seeking reliable and high-standard vacation rentals.

Sykes Holiday Cottages Ltd. and Evolve Vacation Rental Network, Inc. continue to thrive in their respective regions, emphasizing local expertise and personalized service. Hopper, Inc. and Getaway House, Inc. are gaining traction with innovative offerings tailored to modern travelers' needs, such as predictive pricing and unique, minimalist stays.

Pacaso, Inc. and Sonder Holdings, Inc. disrupt the market with novel concepts like property co-ownership and hotel-like amenities in rental homes, respectively. These companies exemplify the dynamic nature of the vacation rental market, which in 2024 will continue to evolve with consumer demand and technological advancements driving growth and competition.

Market Key Players

- Airbnb, Inc.

- VRBO

- Booking Holdings Inc.

- TripAdvisor, Inc.

- Vacasa, Inc.

- Marriott International, Inc.

- Sykes Holiday Cottages Ltd.

- Evolve Vacation Rental Network, Inc.

- Hopper, Inc.

- Getaway House, Inc.

- Pacaso, Inc.

- Sonder Holdings, Inc.

Recent Development

- In June 2024, Airbnb introduced new luxury rental options, enhancing its portfolio to cater to high-end travelers and expanding market reach.

- In May 2024, Booking.com launched a feature allowing direct communication between hosts and guests, improving customer service and booking experience.

Report Scope

Report Features Description Market Value (2023) USD 84.6 Bn Forecast Revenue (2033) USD 133.6 Bn CAGR (2024-2033) 4.8% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Vacation Rental Market, By Accommodation Type (Home, Apartments, Resort/Condominium, Others), By Booking Mode (Online, Offline) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Airbnb, Inc., VRBO, Booking Holdings Inc., TripAdvisor, Inc., Vacasa, Inc., Marriott International, Inc., Sykes Holiday Cottages Ltd., Evolve Vacation Rental Network, Inc., Hopper, Inc., Getaway House, Inc., Pacaso, Inc., Sonder Holdings, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Airbnb, Inc.

- VRBO

- Booking Holdings Inc.

- TripAdvisor, Inc.

- Vacasa, Inc.

- Marriott International, Inc.

- Sykes Holiday Cottages Ltd.

- Evolve Vacation Rental Network, Inc.

- Hopper, Inc.

- Getaway House, Inc.

- Pacaso, Inc.

- Sonder Holdings, Inc.