US Automatic Door Market By Type (Sliding Door, Swing Door, Revolving Door, Folding Door, Others), By Application (Institutional And Commercial, And Residential), and Forecast to 2028

-

13796

-

April 2023

-

44

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

The US automatic door market is expected to value at approximately US$ 2 Bn in 2019 and is projected to register a CAGR of 6.3% over the next 10 years. The US automatic door market report has been segmented on the basis of type and application.

US Automatic Door Market: Introduction

Automatic doors offer benefits such as responsive opening within minimum threshold. Automatic doors are found ideal for applications where space and front width are main constraints, especially in busy areas. In addition, they are, in a way, helpful for individuals with special needs to move around on their own.

US Automatic Door Market: Dynamics

Growing demand for automatic doors from various end users such as commercial establishments, hospitals, airports, bus stations, etc. is a major factor driving growth of the target market. For instance, various hospitals, clinics, and diagnostic centers are preferring these doors owing to convenience such as easy and quick mobility offered to patients and healthcare professionals. Furthermore, reconstruction activities in residential and non-residential buildings such as malls, airports, railways stations, hotels, multiplexes, etc., coupled with rising awareness regarding benefits of automatic doors are other major factors driving growth for the US automatic door market.

Favorable government regulations in various developed countries for providing ease of accessibility to disabled individuals at public places is anticipated to support adoption of automatic doors to a significant extent. For instance, the Americans with Disabilities Act (ADA) a federal law, makes it mandatory for private and public organizations to provide safe entry and exit for all including disabled individuals.

Furthermore, entry of new players and availability of variety of automatic doors in terms of frames is expected to support growth of the target market in coming years.

However, high initial investment and high maintenance costs may limit adoption by certain end users. In addition, possibilities of technical glitches in functioning of automatic doors may lead to low adoption of automatic doors and hamper growth of the target market to a certain extent.

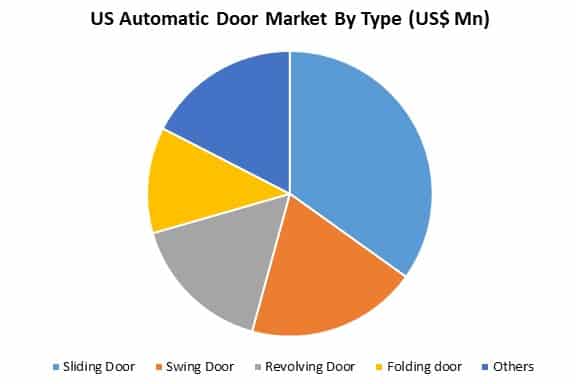

US Automatic Door Market Analysis by Type:

Among the type segments, currently, the sliding door segment dominates in the US market in terms of revenue and is expected to maintain its dominance over the forecast period. in addition, the sliding door type segment is projected to register highest CAGR of over 6.5% between 2019 and 2028. This can be attributable to benefits offered such as less space required for the sliding door to function as compared to other available options.

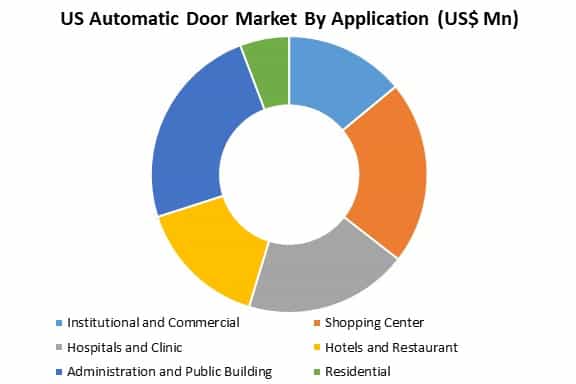

US Automatic Door Market Analysis by Application:

Among the application segments, currently, the institutional and commercial segment dominates in the US market in terms of revenue and is expected to maintain its dominance over the forecast period. Early adoption of automatic doors by administration and public buildings, and other commercial places is expected to lead to higher demand for automatic doors.

Some of the recent developments by players operating in the target market include:

- In May 2019, Continental Materials Corporation took over Serenity Fastrac Building Supply and Sliding Door Systems, both based in Colorado Springs, Colorado. Through this acquisition, the company aims to expand its national footprint.

- In July 2018, PGT Innovations, Inc., an US-based company, took over US-based Western Window Systems LLC, in order to increase its product offerings in premium outdoor/ indoor window and door category, as well as expand its presence in other regions.

- In the target market, major companies are focusing on providing reliable after-sale services to customers, which in turn enhances customer satisfaction. Extended after-sale services for repair and maintenance can create goodwill for the company and often results in building a loyal customer base.

US Automatic Door Market Segmentation:

Segmentation by Type:

- Sliding door

- Swing door

- Revolving door

- Folding door

- Others

Segmentation by Application:

- Institutional and commercial

- Shopping center

- Hospitals and clinic

- Hotels and restaurant

- Administration and Public Building

- Residential

-

- 1.1 Report Assumptions

- 1.2 Research Methodology

- 1.2.1.1 Abbreviations

- 2.1 Executive Summary

- 2.2 Drivers

- 2.3 Restraints

- 2.4 Opportunities

- 2.5 Trends

- 2.6 Acts & Standards: Outlook

- 2.6 Door Types

- 2.7 Working of Automatic Door: Flowchart

- 2.8 Construction Spending in the United States from 1998 to 2018, By Sector (US$ Bn)

- 2.9 Value Added of the Construction Industry as a Share (%) of GDP in the US from 2007–2018

- 2.10 Number of Production Workers within the US Construction Industry from 2008 to 2017 (in 1,000s)

- 2.11 Construction Forecast in the US from 2011 to 2022 (in US$ Bn)

- 2.12 US Automatic Door Market Outlook (2013–2028)

- 2.12.1 US Automatic Door Revenue (US$ Mn) (2013–2019)

- 2.12.2 US Automatic Door Revenue (US$ Mn) (2020–2028)

- 2.13 US Automatic Door Revenue by Type

- 2.13.1 US Automatic Door Revenue (US$ Mn) Comparison, by Type (2013–2019)

- 2.13.2 US Automatic Door Revenue (US$ Mn) Comparison, by Type (2020–2028)

- 2.14 US Automatic Door Revenue by Application

- 2.14.1 US Automatic Door Revenue (US$ Mn) Comparison, by Application (2013–2019)

- 2.14.2 US Automatic Door Revenue (US$ Mn) Comparison, by Application (2020–2028)

- 2.15 US Automatic Door Share (%) Comparison 2013–2028

- 2.15.1 US Automatic Door Market Share (%), by Type

- 2.15.2 US Automatic Door Share (%), by Application

- 3.1 ASSA ABLOY AB

- 3.1.1 Business Overview

- 3.1.2 Product/Service Portfolio

- 3.2 Royal Boon Edam International B.V.

- 3.2.1 Business Overview

- 3.2.2 Product/Service Portfolio

- 3.3 Dormakaba Holding AG

- 3.3.1 Business Overview

- 3.3.1.1 Product/Service Portfolio

- 3.3.2 Financial Overview

- 3.3.1 Business Overview

- 3.4 GEZE UK Ltd.

- 3.4.1 Business Overview

- 3.4.2 Product/Service Portfolio

- 3.5 STANLEY Access Technologies LLC

- 3.5.1 Business Overview

- 3.5.2 Product Portfolio

- 3.5.3 Financial Overview

- 3.6 Entrematic Group AB

- 3.6.1 Business Overview

- 3.7 Rite-Hite Corporation

- 3.7.1 Business Overview

- 3.7.2 Product Portfolio

- 3.8 PORTALP Automatic Doors

- 3.8.1 Business Overview

- 3.8.2 Product Portfolio

- 3.9 SHIPYARDDOOR PVC Fabric Door Systems

- 3.9.1 Business Overview

- 3.9.2 Product/Service Portfolio

- Gilgen Door Systems AG (Nabtesco Corporation)

- 3.9.2 Business Overview

- 3.9.3 Product Portfolio

- 3.9.4 Financial Overview

- 3.10 Thomas Door and Window Controls

- 3.10.1 Business Overview

- 3.10.2 Product Portfolio

- 4.1 Primary Research

- 4.2 Secondary Research

- 4.3 Report Scope

- 5.1 Who we are:

-

- Assa Abloy Group

- Boon Edam International B.V.

- Dormakaba Holding AG

- GEZE UK Ltd.

- STANLEY Access Technologies LLC

- Entrematic Group AB

- PORTALP Automatic Doors

- Rite-Hite

- SHIPYARDDOOR PVC Fabric Door Systems

- Gilgen Door Systems AG

- Thomas Door and Window Controls