Ultra Secure Smartphone Market By Operating System (Android, iOS), By End User (Government Agencies, Aerospace & Defense, Enterprises), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

50554

-

August 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

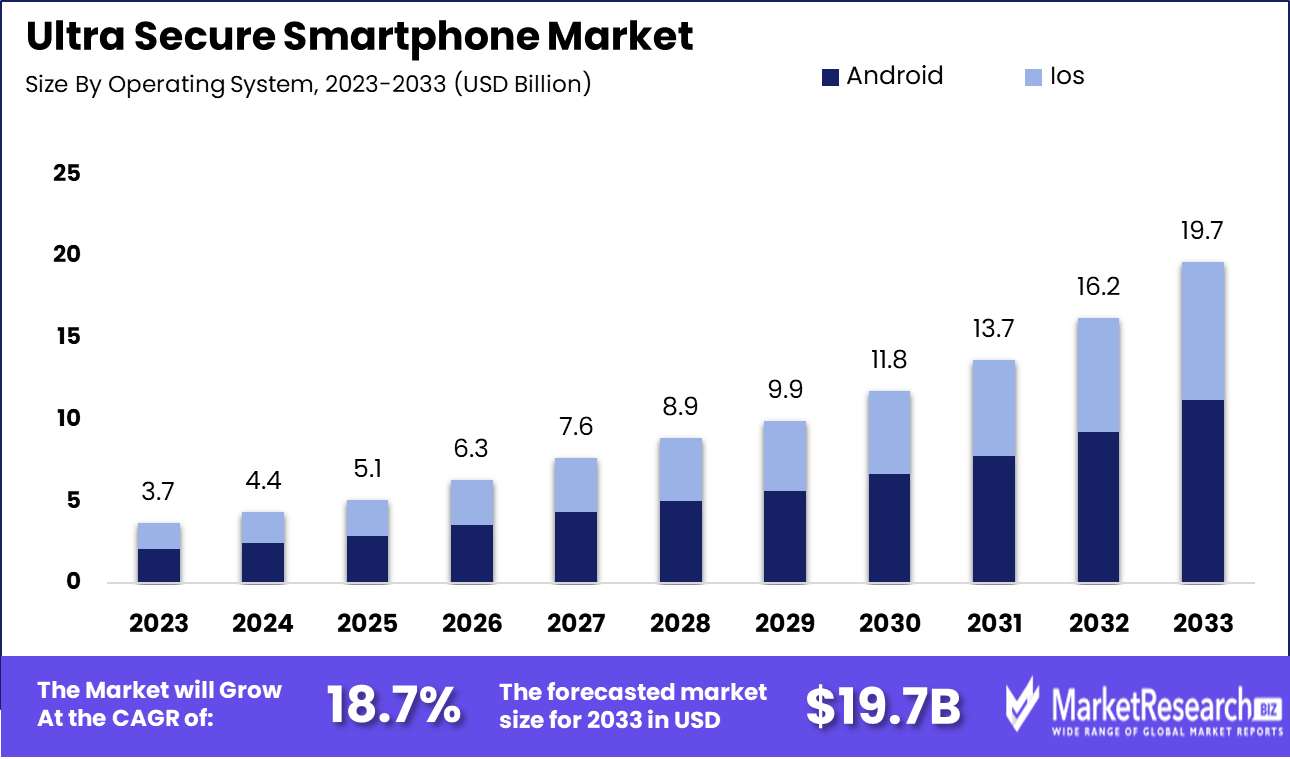

The Ultra Secure Smartphone Market was valued at USD 3.7 billion in 2023. It is expected to reach USD 19.7 billion by 2033, with a CAGR of 18.7% during the forecast period from 2024 to 2033.

The Ultra Secure Smartphone Market encompasses mobile devices engineered with advanced security features to protect sensitive data and communications. These smartphones integrate high-level encryption, secure operating systems, biometric authentication, and specialized hardware components, ensuring maximum protection against cyber threats, unauthorized access, and data breaches.

The Ultra Secure Smartphone Market is poised for significant growth as cybersecurity threats continue to rise globally. These specialized devices, designed with advanced encryption and secure communication capabilities, are increasingly in demand across government, defense, and corporate sectors. The growing complexity of cyberattacks, coupled with stringent government regulations mandating secure communication channels, has accelerated the adoption of ultra-secure smartphones. Furthermore, the integration of cutting-edge technologies such as quantum encryption and AI-driven threat detection is enhancing the security features of these devices, making them an essential tool for organizations that prioritize data protection.

However, the market faces challenges, particularly concerning the limited features and high costs associated with these devices. Unlike consumer smartphones, ultra-secure smartphones often sacrifice convenience and user experience for security, which can deter broader adoption. The successful integration of ultra-secure features with more user-friendly interfaces will be key to unlocking new growth opportunities. As the market expands, stakeholders must balance security with usability to drive adoption across various industries, ensuring that ultra-secure smartphones remain at the forefront of mobile security solutions.

Key Takeaways

- Market Growth: The Ultra Secure Smartphone Market was valued at USD 3.7 billion in 2023. It is expected to reach USD 19.7 billion by 2033, with a CAGR of 18.7% during the forecast period from 2024 to 2033.

- By Operating System: Android dominated the Ultra Secure Smartphone Market with over 60% share.

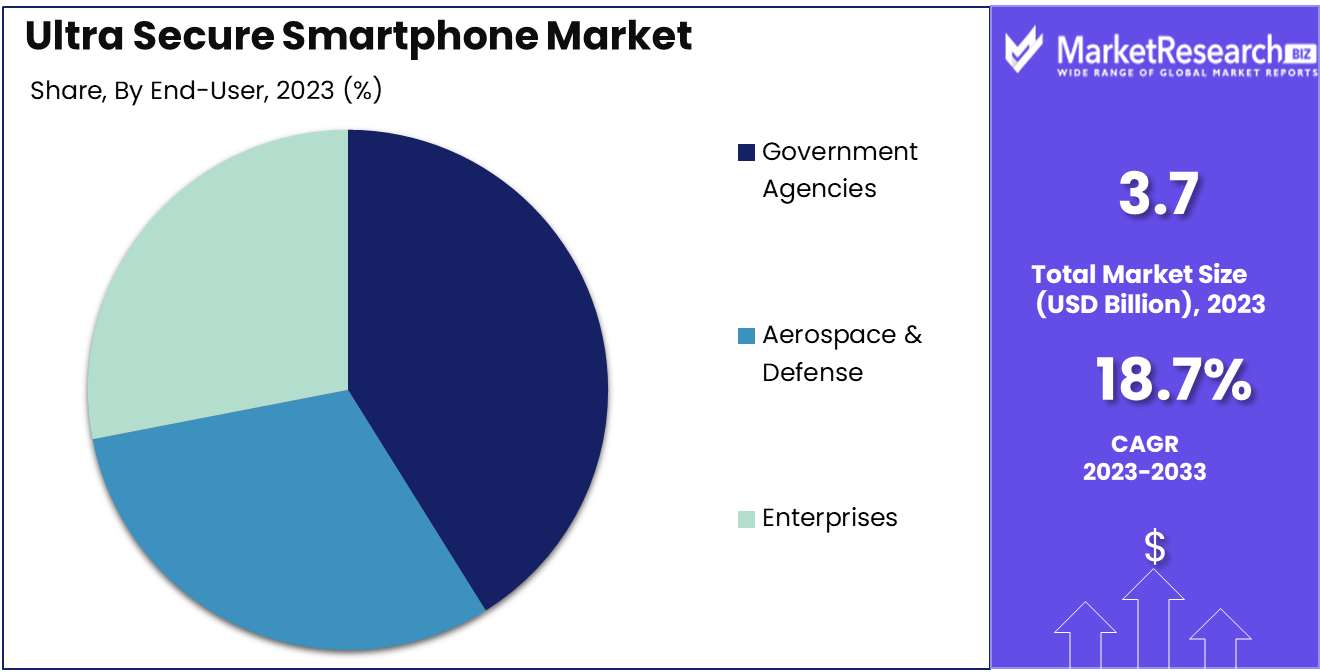

- By End User: Government Agencies dominated the Ultra Secure Smartphone Market.

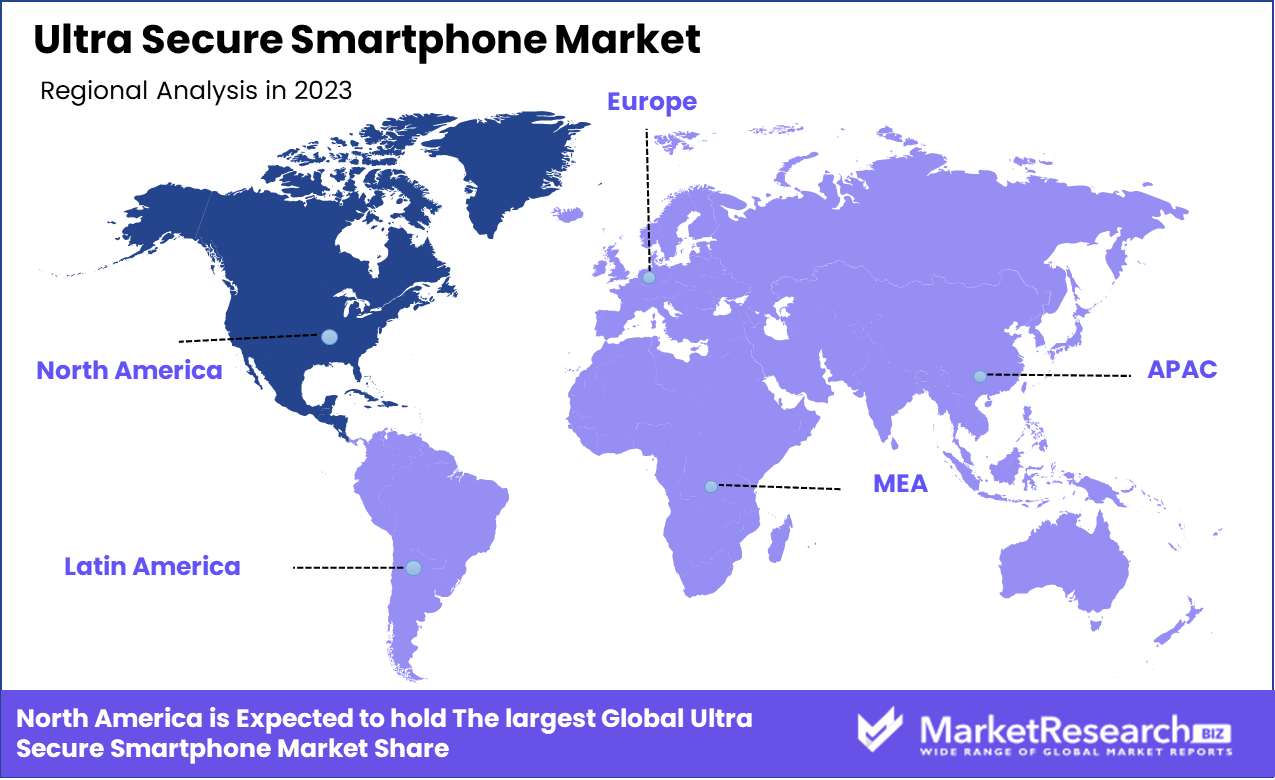

- Regional Dominance: North America leads the Ultra Secure Smartphone Market, holding a 40% share.

- Growth Opportunity: The ultra-secure smartphone market will thrive on rising data security concerns and increased enterprise adoption.

Driving factors

Heightened Cybersecurity Needs Drive Demand for Ultra Secure Smartphones

The increasing frequency of cyber threats and data breaches has significantly amplified the demand for ultra-secure smartphones. As more personal and sensitive information is stored on mobile devices, the risk of data breaches has escalated, prompting consumers and enterprises to seek more secure solutions. This need is particularly pressing in industries such as finance, healthcare, and defense, where the consequences of data breaches can be severe. According to recent data, cybercrime costs are expected to reach $10.5 trillion annually by 2025, further underscoring the critical need for devices that offer advanced security features such as encrypted communications, secure boot processes, and robust authentication methods. Ultra-secure smartphones are uniquely positioned to meet these needs, driving their adoption across sectors.

Remote Work and Digital Transactions Fuel Market Expansion

The growing trend of remote work and the rise of digital transactions have further catalyzed the growth of the ultra-secure smartphone market. The COVID-19 pandemic accelerated the shift towards remote work, with a significant portion of the workforce now operating in hybrid or fully remote environments. This shift has increased the reliance on mobile devices for accessing corporate networks, conducting transactions, and communicating sensitive information.

Consequently, there is a heightened demand for smartphones that can safeguard against potential security vulnerabilities in these digital workflows. Additionally, the surge in digital transactions, particularly in e-commerce and mobile banking, has raised the stakes for securing mobile devices, as any breach can lead to financial losses and reputational damage. Together, these trends create a strong impetus for the adoption of ultra-secure smartphones that can offer unparalleled protection.

Government Regulations and Compliance Requirements Bolster Market Growth

Government regulations and compliance requirements are playing a crucial role in driving the adoption of ultra-secure smartphones. Regulatory bodies across the globe are implementing stringent data protection laws, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States, which mandate higher standards of data security for organizations.

Companies must comply with these regulations to avoid hefty fines and legal repercussions, making ultra-secure smartphones an essential component of their security strategies. These devices are designed to meet or exceed regulatory requirements, offering features like end-to-end encryption and secure storage that align with legal mandates. As regulatory environments continue to evolve, the demand for compliant and secure mobile devices is expected to rise, further propelling the growth of the ultra-secure smartphone market.

Restraining Factors

Balancing Security and User Convenience: A Critical Dilemma

The trade-off between security and convenience poses a significant restraining factor for the Ultra Secure Smartphone Market. While these devices are designed with advanced encryption and privacy features to protect user data, these same features can often compromise ease of use. Ultra-secure smartphones typically require more complex authentication processes, limited third-party app compatibility, and restricted device functionalities. This complexity can deter a broader customer base, as many users prioritize convenience and seamless user experience over heightened security measures. As a result, the market growth is constrained by the need to appeal to security-conscious users without alienating those who favor convenience.

Navigating the Challenge of Rapid Technological Advancements

The rapid pace of technological advancements represents another restraining factor for the Ultra Secure Smartphone Market. With the continuous evolution of cyber threats, ultra-secure smartphones must constantly innovate to stay ahead of potential vulnerabilities. However, this rapid technological change can also lead to shorter product life cycles, increased R&D costs, and the need for frequent updates.

Moreover, consumers may be hesitant to invest in expensive ultra-secure devices if they believe a more advanced model will soon be released, leading to a potential stagnation in market demand. The necessity to continuously update and innovate can strain both manufacturers and consumers, thereby restraining the market’s overall growth trajectory.

By Operating System Analysis

Android dominated the Ultra Secure Smartphone Market with over 60% share.

In 2023, Android held a dominant market position in the By Operating System segment of the Ultra Secure Smartphone Market, accounting for a significant share of over 60%. This dominance can be attributed to Android's extensive adaptability and customizability, which appeal to a broad range of security-focused enterprises and government organizations. The open-source nature of Android enables manufacturers to integrate advanced security features, such as biometric authentication, encrypted communication, and secure boot processes, tailored to specific security needs. Furthermore, Android's widespread use across various devices and its large developer ecosystem support the continuous enhancement of security protocols.

Conversely, iOS maintained a strong presence with approximately 40% of the market share. iOS's reputation for robust security, backed by Apple's closed ecosystem and rigorous app vetting process, continues to attract users who prioritize privacy and data protection. The introduction of features like Advanced Data Protection and the iCloud Private Relay in iOS further solidifies its standing in the ultra-secure smartphone segment. Despite its smaller market share compared to Android, iOS remains a preferred choice for users seeking a highly secure and controlled mobile environment.

By End User Analysis

In 2023, Government Agencies dominated the Ultra Secure Smartphone Market.

In 2023, The Government agencies segment maintained a dominant market position in the By End User segment of the Ultra Secure Smartphone Market, driven by their increasing need for highly secure communication channels. The growing incidence of cyber threats, espionage, and data breaches has compelled government bodies to invest heavily in ultra-secure smartphones, ensuring the protection of sensitive information. These agencies account for the largest share due to stringent regulatory requirements and the critical nature of their operations.

Aerospace & Defense follow closely, with the demand for secure communication tools pivotal for military operations and strategic defense initiatives. Integrating ultra-secure smartphones into defense protocols is crucial to maintaining national security, contributing significantly to market growth in this sector.

Enterprises also represent a notable share in this segment, particularly in industries where data confidentiality is paramount, such as finance and healthcare. The rise in corporate espionage and the need for compliance with data protection regulations have led enterprises to adopt ultra-secure smartphones as a key component of their cybersecurity strategies.

Key Market Segments

By Operating System

- Android

- iOS

By End User

- Government Agencies

- Aerospace & Defense

- Enterprises

Growth Opportunity

Increasing Importance of Data Security

The ultra-secure smartphone market is poised for substantial growth, driven by the escalating importance of data security. As cyber threats become more sophisticated, both individuals and enterprises are increasingly recognizing the need for robust, secure communication channels. Ultra-secure smartphones, equipped with advanced encryption and secure hardware, are emerging as a critical solution to protect sensitive information. The growing emphasis on protecting personal and corporate data from breaches and unauthorized access presents a significant growth opportunity for manufacturers and service providers in this market.

Growing Adoption in Enterprises

The adoption of ultra-secure smartphones is witnessing a marked increase in the enterprise sector, driven by the need to safeguard confidential business communications. With the rise of remote work and the use of mobile devices for critical business operations, organizations are prioritizing investments in secure communication tools. This trend is particularly pronounced in industries such as finance, healthcare, and government, where data protection is paramount. The increasing demand for enterprise-grade security features, such as end-to-end encryption and secure authentication methods, is expected to further fuel the growth of the ultra-secure smartphone market.

Latest Trends

Surge in Android-Based Ultra-Secure Smartphones

The Ultra Secure Smartphone Market is expected to witness a significant shift toward Android-based devices. This trend is driven by the growing demand for customizable and scalable security solutions in both governmental and enterprise sectors. Android’s open-source nature allows for extensive security modifications, enabling manufacturers to develop ultra-secure smartphones tailored to specific organizational needs. The proliferation of Android devices in the ultra-secure segment can be attributed to their flexibility and compatibility with various security protocols, making them a preferred choice over traditional, proprietary systems. This trend is anticipated to lead to a rise in market share for Android-based ultra-secure smartphones, positioning them as a dominant force in the industry.

Integration of AI-Driven Security Features

The integration of AI-driven security features is another key trend shaping the Ultra Secure Smartphone Market. As cyber threats become increasingly sophisticated, there is a heightened need for advanced security measures that can proactively detect and mitigate risks. AI-powered features, such as real-time threat detection, biometric authentication, and anomaly detection, are being increasingly adopted in ultra-secure smartphones to enhance their protective capabilities. These AI-driven solutions not only offer superior security but also provide a more user-friendly experience, reducing the likelihood of security breaches due to human error. The integration of Artificial intelligence in ultra-secure smartphones is expected to drive innovation and set new standards for security in mobile devices.

Regional Analysis

North America leads the Ultra Secure Smartphone Market, holding a 40% share.

The Ultra Secure Smartphone Market exhibits notable regional variations, driven by differing levels of demand for high-security communication devices. North America dominates the market, holding approximately 40% of the global share. This dominance is attributed to the significant presence of government and defense sectors, along with increasing concerns over data breaches and cyber threats in the region. The U.S. leads in adoption, driven by stringent regulatory requirements and the growing demand for secure communication in corporate environments.

In Europe, the market is driven by regulatory mandates and the need for secure communication solutions within industries such as defense and finance. The region holds a substantial share, with countries like Germany and the U.K. being key contributors.

Asia Pacific region is witnessing rapid growth, fueled by increasing digitalization, rising cybersecurity threats, and the adoption of secure smartphones by government agencies in countries like China and India. The region is expected to register a significant CAGR during the forecast period.

The Middle East & Africa and Latin America are emerging markets, with growing adoption of secure communication devices driven by increasing government investments in cybersecurity. However, these regions currently hold a smaller market share compared to North America and Europe.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Ultra Secure Smartphone Market is poised for significant growth, driven by the increasing demand for advanced security solutions in the mobile communications sector. Leading the market are key players such as Atos SE, Apple Inc., BlackBerry Limited, and SAMSUNG, all of whom are leveraging their technological expertise and strong brand presence to dominate the industry.

Atos SE and Thales Group are expected to lead the enterprise segment, providing secure communication solutions tailored for governmental and defense sectors, where data protection is paramount. Their strong relationships with government bodies and their investment in cybersecurity innovations will continue to drive their growth.

Apple Inc. and SAMSUNG remain dominant in the consumer segment, integrating advanced encryption and biometric technologies into their flagship models. Apple's reputation for privacy and security, coupled with Samsung's broad product range and global reach, positions them well to capture a substantial market share.

BlackBerry Limited and Silent Circle continue to cater to niche markets requiring ultra-secure communications, such as financial institutions and corporate clients. Their focus on software-driven security solutions sets them apart from other hardware-centric competitors.

Emerging players like SIRIN LABS and Dark Matter are gaining traction by offering blockchain-enabled smartphones, appealing to users concerned with both privacy and cryptocurrency security. Meanwhile, Boeing and Nokia are leveraging their experience in secure communications to expand their presence in this growing market.

Overall, the competitive landscape in the Ultra Secure Smartphone Market is characterized by a blend of established technology giants and innovative niche players, each carving out their own segment in a rapidly evolving industry.

Market Key Players

- Atos SE

- Apple Inc.

- BlackBerry Limited

- SAMSUNG

- Silent Circle

- Koninklijke Philips N.V.

- Thales Group

- Boeing

- Nokia

- HTC Corporation

- SIRIN LABS

- XOLO

- Micromax

- Gryphon

- Bittium

- Dark Matter

- Cog Systems

Recent Development

- In July 2024, Silent Circle unveiled the Silent Phone Pro, an ultra-secure smartphone aimed at executives and professionals, with end-to-end encryption and proprietary security features, ensuring protection against cyber threats and data breaches.

- In May 2024, Sirin Labs announced the release of its Finney 2.0 smartphone, designed with blockchain-based security protocols, ensuring an ultra-secure environment for cryptocurrency transactions and data privacy.

- In April 2024, Bittium introduced its next-generation ultra-secure smartphone, the Bittium Tough Mobile 3, featuring advanced cybersecurity features, including a secure boot and a hardened operating system to protect sensitive data.

- In March 2024, BlackBerry launched a new version of its ultra-secure smartphone, the BlackBerry SecuSmart 5G, incorporating enhanced encryption and AI-driven threat detection to cater to government agencies and enterprise clients.

Report Scope

Report Features Description Market Value (2023) USD 3.7 Billion Forecast Revenue (2033) USD 19.7 Billion CAGR (2024-2032) 18.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Operating System (Android, iOS), By End User (Government Agencies, Aerospace & Defense, Enterprises) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Atos SE, Apple Inc., BlackBerry Limited, SAMSUNG, Silent Circle, Koninklijke Philips N.V., Thales Group, Boeing, Nokia, HTC Corporation, SIRIN LABS, XOLO, Micromax, Gryphon, Bittium, Dark Matter, Cog Systems Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Atos SE

- Apple Inc.

- BlackBerry Limited

- SAMSUNG

- Silent Circle

- Koninklijke Philips N.V.

- Thales Group

- Boeing

- Nokia

- HTC Corporation

- SIRIN LABS

- XOLO

- Micromax

- Gryphon

- Bittium

- Dark Matter

- Cog Systems