Travel Expense Management Software Market By Organization Size (Large sized Enterprises, Small and Medium-sized Enterprises), By Industry Vertical (IT and Telecom, BFSI, Manufacturing, Public Sector, Healthcare, Others), By Deployment Type (On-premise, Cloud), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

48942

-

July 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

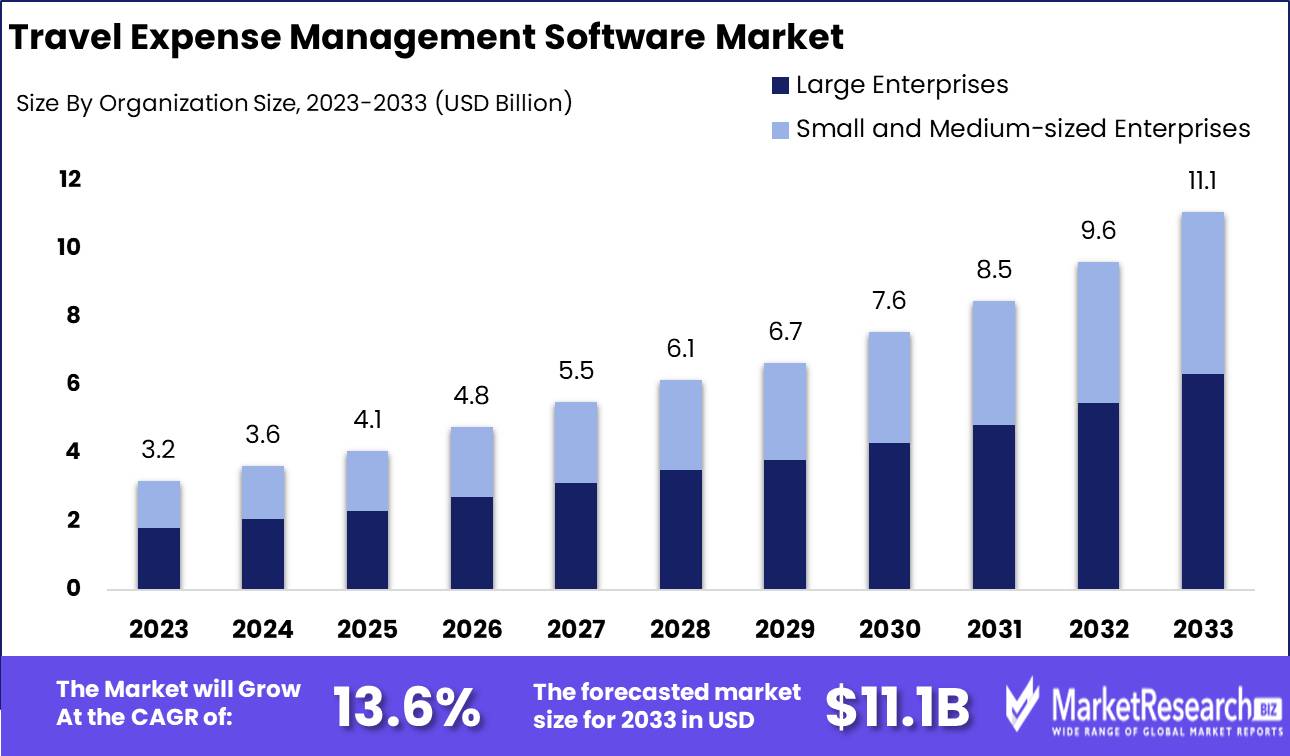

The Travel Expense Management Software Market was valued at USD 3.2 billion in 2023. It is expected to reach USD 11.1 billion by 2033, with a CAGR of 13.6% during the forecast period from 2024 to 2033.

The Travel Expense Management Software Market encompasses digital solutions designed to automate and streamline the process of managing business travel expenses. These software applications offer features such as expense tracking, report generation, receipt management, and policy compliance, facilitating greater efficiency and accuracy in financial reporting. They integrate with corporate systems to provide real-time data and analytics, enhancing cost control and decision-making.

The Travel Expense Management Software Market is poised for significant growth driven by several key factors. The increasing adoption of cloud-based solutions is a primary driver, providing enhanced scalability and flexibility that meet the evolving needs of businesses. This shift towards the cloud allows organizations to efficiently manage their expenses without the constraints of traditional on-premise systems. Additionally, there is a growing demand for automated solutions to reduce manual errors and streamline expense reporting processes. Automation not only enhances accuracy but also improves overall efficiency, enabling businesses to better control their travel and expense budgets.

However, the market faces notable challenges that could impede its growth. Data security concerns are paramount, as the potential risks associated with data breaches and security threats pose significant challenges. Companies must invest in robust security measures to protect sensitive financial information. Integration issues also present obstacles, as the seamless integration of travel expense management software with existing enterprise systems can be complex and resource-intensive.

Despite these challenges, continuous advancements in AI and machine learning are expected to drive the development of more sophisticated and intelligent expense management solutions. These advancements will enable predictive analytics, better fraud detection, and personalized user experiences, further enhancing the value proposition of travel expense management software. The market's trajectory indicates a trend towards more integrated, secure, and intelligent solutions, meeting the demands of modern businesses seeking efficiency and reliability in managing travel expenses.

Key Takeaways

- Market Growth: The Travel Expense Management Software Market was valued at USD 3.2 billion in 2023. It is expected to reach USD 11.1 billion by 2033, with a CAGR of 13.6% during the forecast period from 2024 to 2033.

- By Organization Size: Large Enterprises dominate the Travel Expense Management Software Market

- By Industry Vertical: IT and Telecom lead Travel Expense Management Software adoption in 2023.

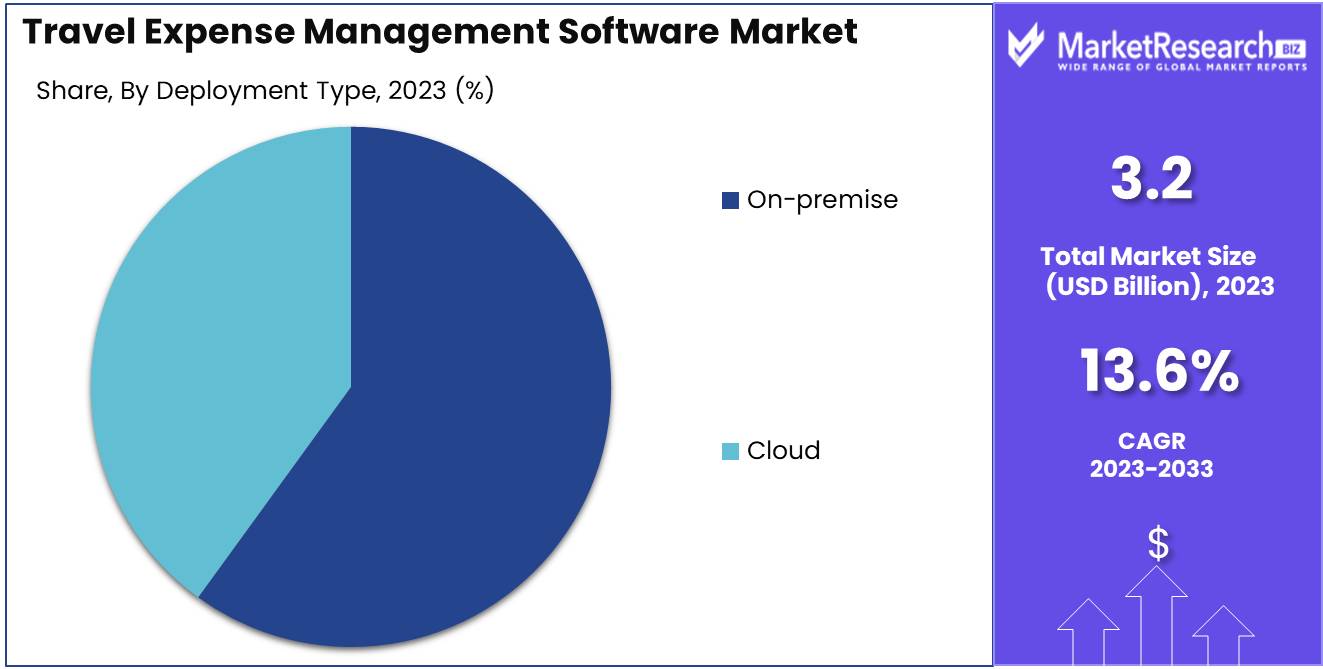

- By Deployment Type: On-premise dominated Travel Expense Management, with cloud gaining rapidly.

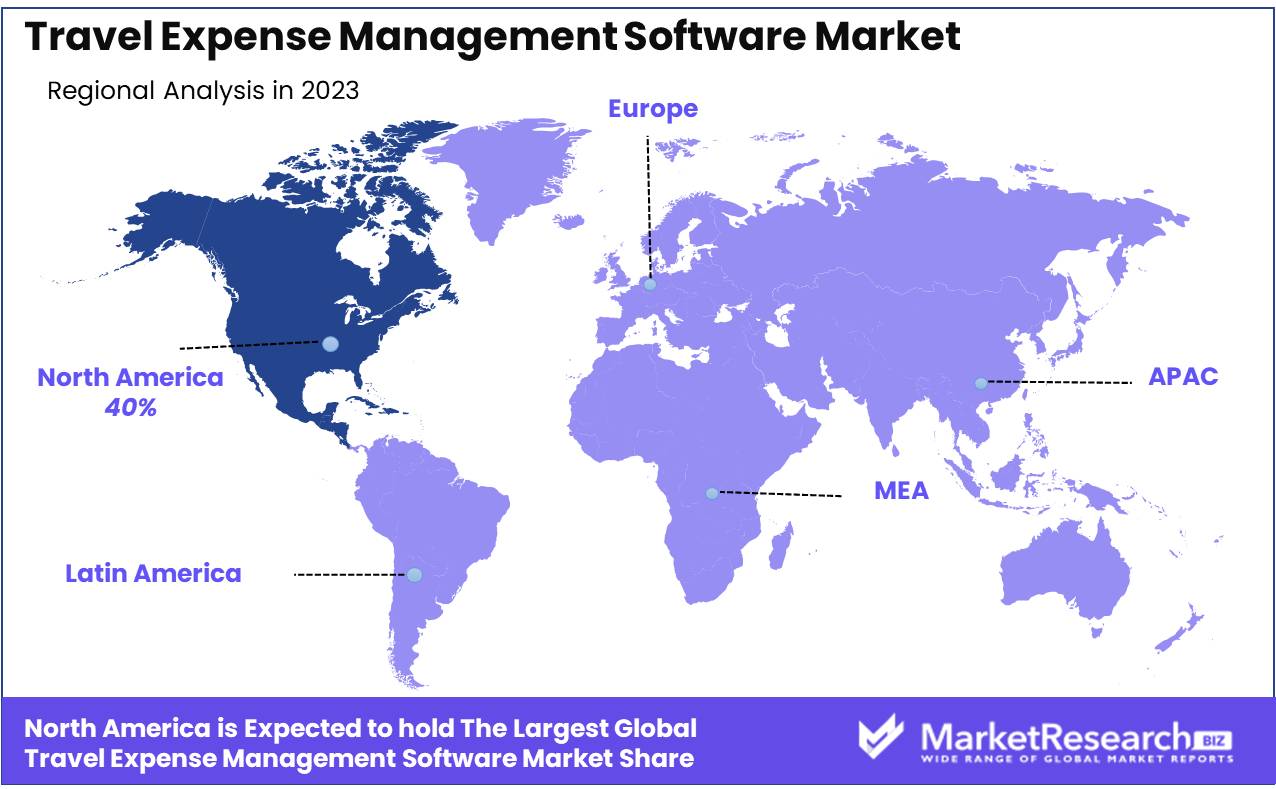

- Regional Dominance: North America dominates the Travel Expense Management Software Market with a 40% largest share.

- Growth Opportunity: The Travel Expense Management Software Market is set to expand significantly, driven by mobile integration and AI-enhanced automation.

Driving factors

Increasing Globalization and Growth of Corporate Operations

The travel expense management software market is experiencing robust growth, primarily driven by the increasing globalization and expansion of corporate operations. As businesses extend their reach across multiple geographical boundaries, the complexity and frequency of business travel have surged. This global expansion necessitates sophisticated solutions for managing travel expenses to ensure compliance with varied regional tax laws and regulations. The proliferation of multinational corporations is directly proportional to the demand for travel expense management software, which helps companies maintain oversight and manage costs effectively in diverse operating environments.

Need to Streamline and Automate Travel Expense Management Processes

A significant driving factor for the adoption of travel expense management software is the need to streamline and automate expense management processes. Manual methods are often time-consuming and prone to errors, leading to inefficiencies and potential financial discrepancies. Automated solutions offer substantial improvements by reducing the administrative burden, minimizing errors, and speeding up the reimbursement process. Automation also facilitates adherence to corporate policies and enhances the accuracy of expense tracking and reporting. The transition from traditional methods to automated systems is a critical component in enhancing operational efficiency, thereby fueling market growth.

Requirement for Real-Time Visibility and Control Over Travel Spending

The demand for real-time visibility and control over travel expenditures is another critical factor propelling the market for travel expense management software. Organizations are increasingly seeking ways to monitor travel expenses as they occur, enabling immediate adjustments and better budget management. Real-time data provides executives with the insights needed to make informed decisions, optimize spending, and prevent budget overruns. This capability is particularly important in today's dynamic business environment, where financial agility and responsiveness are crucial to maintaining competitive advantage. The integration of real-time analytics into travel expense management software not only helps in controlling costs but also in forecasting future spending more accurately.

Restraining Factors

High Initial Investment: Barrier to Entry and Adoption

The high initial investment required for the implementation and maintenance of travel expense management software presents a significant barrier to entry for small and medium-sized enterprises (SMEs). This upfront cost often includes expenses related to purchasing software licenses, integrating the software with existing systems, training staff, and ongoing support and updates. These expenditures can deter smaller companies with limited budgets from adopting such systems, potentially slowing the overall market growth. Statistically, smaller enterprises, which constitute a substantial portion of the business landscape, are less likely to invest in advanced software solutions due to cost concerns. This reluctance can result in a slower adoption rate, which in turn affects the market's expansion pace. By limiting the user base to primarily larger corporations that can afford these costs, the market may experience restricted growth in certain segments.

Data Security and Privacy Concerns: Impact on Market Trust and Expansion

Data security and privacy concerns are paramount in the travel expense management software market, as these systems handle sensitive financial and personal information. The apprehension regarding data breaches and inadequate privacy protections can influence potential client's decision-making processes, leading to hesitancy in adopting these solutions. In the context of increasing cyber threats and stringent regulatory requirements for data protection (such as GDPR in Europe), companies are cautious. Any potential security vulnerability can not only lead to financial losses but also damage reputational equity, which is critical in the software industry. Market statistics reflect that enterprises prioritize security features when selecting software solutions, with a significant percentage of potential buyers citing security as a key determinant. This emphasis on security can restrict market growth by slowing down the adoption rate, as businesses may opt to delay purchases until they can verify the robustness of security measures.

By Organization Size Analysis

Large Enterprises dominate the Travel Expense Management Software Market in 2023.

In 2023, Large Enterprises held a dominant market position in the "By Organization Size" segment of the Travel Expense Management Software Market. This segment is bifurcated into two main categories: Large Enterprises and Small and Medium-sized Enterprises (SMEs). Large Enterprises have historically leveraged such software to streamline expense reporting, enforce corporate policies, and achieve comprehensive visibility into organizational spending. Their substantial financial and technological resources allow for the integration of advanced features, such as artificial intelligence and real-time data analytics, which significantly enhance the efficiency of travel expense management.

On the other hand, Small and Medium-sized Enterprises are increasingly adopting these solutions, driven by the need for cost-effective, scalable platforms that can accommodate growth without the complexity associated with larger systems. This trend is bolstered by the availability of cloud-based solutions, which lower the entry barrier for SMEs seeking to implement robust travel expense management systems.

By Industry Vertical Analysis

IT and Telecom lead Travel Expense Management Software adoption in 2023.

In 2023, The IT and Telecom sector held a dominant market position in the "By Industry Vertical" segment of the Travel Expense Management Software Market. This sector leveraged advanced technologies to streamline travel expense reporting and compliance, thereby optimizing operational costs and enhancing productivity. The BFSI sector followed closely, implementing these solutions to ensure stringent adherence to financial controls and regulatory standards, which is critical in financial operations. In the manufacturing sector, the adoption of travel expense management software facilitated the tracking and management of expenses for on-site projects and client visits, crucial for budget adherence and financial forecasting.

The public sector saw significant adoption as well, driven by the need for transparent and accountable financial reporting. Healthcare institutions integrated these solutions to manage the complexities of travel expenses associated with medical conferences and training.

The "Others" category, encompassing various industries, also adopted these solutions at a growing rate, driven by the universal need to minimize time spent on administrative tasks and reduce errors in expense management, thus allowing organizations to reallocate resources towards core activities and strategic initiatives.

By Deployment Type Analysis

In 2023, On-premise dominated Travel Expense Management, with the cloud gaining rapidly.

In 2023, The On-premise deployment held a dominant market position in the By Deployment Type segment of the Travel Expense Management Software Market. This dominance can be attributed to the enhanced security and control that on-premise solutions offer, which are highly valued by large enterprises with complex expense management needs and stringent data control regulations. On-premise solutions provide organizations with the capability to customize and integrate with existing in-house systems, which is often crucial for maintaining operational consistency and data integrity.

Conversely, the Cloud-based deployment is rapidly gaining traction, primarily due to its scalability, reduced upfront costs, and ease of access from multiple locations. This deployment type appeals particularly to small and medium-sized enterprises that prioritize flexibility and cost efficiency. Cloud solutions also facilitate real-time data analytics and integration with mobile applications, enhancing user experience and operational efficiency. The growth in this segment reflects a broader trend toward digital transformation in business processes, driven by the increasing demand for mobility and collaboration in expense management practices.

Key Market Segments

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises

By Industry Vertical

- IT and Telecom

- BFSI

- Manufacturing

- Public Sector

- Healthcare

- Others

By Deployment Type

- On-premise

- Cloud

Growth Opportunity

Mobile Adoption Drives Market Expansion

The global Travel Expense Management Software Market is poised for substantial growth fueled by the increasing adoption of mobile devices and user-friendly mobile applications. As businesses continue to globalize and workforces become more mobile, the demand for accessible, on-the-go solutions to manage travel expenditures is skyrocketing. This trend is driving the development of mobile-first platforms that offer real-time expense tracking, approval, and reporting functionalities directly from smartphones and tablets. This mobile integration caters to the growing need for efficiency and immediacy in expense management among traveling employees, providing a significant growth opportunity for market players.

AI and Machine Learning: Enhancing Automation

Further amplifying this growth is the integration of Artificial Intelligence (AI) and Machine Learning (ML) within these software solutions. AI and ML are transforming the Travel Expense Management Software Market by automating complex processes such as the submission, review, approval, and reconciliation of travel expenses. These technologies not only reduce the time and effort involved in managing expenses but also enhance compliance and accuracy by minimizing human error. The predictive analytics capabilities of AI enable businesses to forecast travel costs and budget more effectively, offering a strategic advantage in financial planning.

Latest Trends

Real-Time Expense Tracking and Visibility

The travel expense management software market is witnessing a significant shift towards real-time expense tracking and visibility. This trend is largely driven by the need for enhanced transparency and control over expenses as businesses increasingly globalize and seek more agile financial operations. Real-time tracking technology enables organizations to monitor expenditures as they occur, ensuring that budgeting is more accurate and financial anomalies are addressed promptly. This capability not only streamlines the expense management process but also empowers companies to make informed decisions rapidly, enhancing overall operational efficiency.

Automated Compliance Checks

Another prominent trend shaping the travel expense management software market is the integration of automated compliance checks. As regulatory environments across various regions become more complex, the demand for software that can automatically ensure compliance with local and international regulations is growing. This technology minimizes the risk of financial penalties and reputational damage associated with non-compliance. Automated checks reduce the workload on finance teams by flagging potential issues before they become problematic, thereby facilitating a smoother compliance process. This trend is particularly beneficial for multinational corporations that must navigate diverse regulatory landscapes, ensuring that all transactions adhere to the pertinent legal standards.

Regional Analysis

North America dominates the Travel Expense Management Software Market with a 40% largest share.

The Travel Expense Management Software Market exhibits varied regional dynamics across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. North America stands as the dominating region, accounting for approximately 40% of the largest market share, driven by the early adoption of advanced technologies and the presence of key market players such as SAP Concur, Certify, and Expensify. The region's market size is bolstered by the extensive use of travel expense management solutions by large enterprises and SMEs aiming to streamline their expense reporting processes.

In Europe, the market is characterized by stringent regulatory requirements and a growing emphasis on digital transformation within organizations, contributing to significant growth. The region holds a substantial market share, driven by countries like Germany, the UK, and France, where corporate travel expenditure is notably high.

The Asia Pacific region is experiencing rapid growth, fueled by the increasing adoption of cloud-based solutions and the expanding corporate sector in countries like China, India, and Japan. The region's market share is projected to expand significantly, supported by rising economic activities and a surge in business travel.

The Middle East & Africa and Latin America regions are witnessing gradual adoption, with growth driven by emerging economies and increasing investment in business infrastructure. Despite their smaller market shares, these regions are expected to offer lucrative opportunities for market players in the coming years due to the rising focus on efficient expense management solutions.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Travel Expense Management Software Market is projected to witness significant growth in 2024, driven by the increasing need for efficient and streamlined expense management solutions across various industries. Key players in this market are anticipated to play a crucial role in shaping its future landscape.

SAP Concur, acquired by SAP SE, continues to dominate the market with its comprehensive suite of travel and expense management solutions, leveraging SAP's extensive enterprise resource planning (ERP) capabilities. Workday Inc. and Coupa Software Inc. are also key contenders, known for their robust cloud-based financial and spend management platforms that cater to the evolving needs of global enterprises.

Basware Corporation and Expensify Inc. are expected to maintain their competitive edge through innovative solutions that simplify expense reporting and improve compliance. DATABASICS Inc. and TripActions Inc. are poised for growth, offering user-friendly platforms that enhance travel booking and expense management efficiency.

Infor Inc. and Emburse Inc. are likely to gain traction due to their focus on integrating advanced analytics and artificial intelligence (AI) to optimize expense workflows. Zoho Corporation Pvt. Ltd. and Chrome River Technologies, Inc. are set to expand their market presence with scalable solutions tailored for small to medium-sized enterprises (SMEs).

Oracle Corporation and Apptricity Corp. remain significant players, providing robust enterprise-level solutions. Meanwhile, KDS Inc. (American Express GBT) and Interplx Inc. (Serko Limited) are expected to benefit from strategic partnerships and acquisitions. 8Common Limited and Avidxchange Inc. are anticipated to grow by targeting niche markets with specialized offerings.

Market Key Players

- SAP Concur (acquired by SAP SE)

- Workday Inc.

- Coupa Software Inc.

- Basware Corporation

- Expensify Inc.

- DATABASICS Inc.

- TripActions Inc.

- Infor Inc.

- Emburse Inc.

- Zoho Corporation Pvt. Ltd.

- Chrome River Technologies, Inc.

- Oracle Corporation

- Apptricity Corp.

- KDS Inc. (American Express GBT)

- Interplx Inc. (Serko Limited)

- 8Common Limited

- Avidxchange Inc.

Recent Development

- In May 2024, Workday Inc. introduced new features in its expense management software, focusing on enhanced user experience and advanced analytics. The updates include AI-powered expense categorization and real-time fraud detection capabilities.

- In March 2024, Emburse announced a strategic partnership with SAP Concur to integrate their respective expense management platforms. This collaboration is intended to provide users with a more seamless and efficient experience in managing travel expenses.

- In January 2024, Coupa Software Inc. acquired a smaller competitor, ExpenseBot, to expand its capabilities in AI-driven expense management solutions. This acquisition aims to enhance Coupa's existing platform with advanced automation features.

Report Scope

Report Features Description Market Value (2023) USD 3.2 Billion Forecast Revenue (2033) USD 11.1 Billion CAGR (2024-2032) 13.6% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Organization Size (Large sized Enterprises, Small and Medium-sized Enterprises), By Industry Vertical (IT and Telecom, BFSI, Manufacturing, Public Sector, Healthcare, Others), By Deployment Type (On-premise, Cloud) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape SAP Concur (acquired by SAP SE), Workday Inc., Coupa Software Inc., Basware Corporation, Expensify Inc., DATABASICS Inc., TripActions Inc., Infor Inc., Emburse Inc., Zoho Corporation Pvt. Ltd., Chrome River Technologies, Inc., Oracle Corporation, Apptricity Corp., KDS Inc. (American Express GBT), Interplx Inc. (Serko Limited), 8Common Limited, Avidxchange Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- SAP Concur (acquired by SAP SE)

- Workday Inc.

- Coupa Software Inc.

- Basware Corporation

- Expensify Inc.

- DATABASICS Inc.

- TripActions Inc.

- Infor Inc.

- Emburse Inc.

- Zoho Corporation Pvt. Ltd.

- Chrome River Technologies, Inc.

- Oracle Corporation

- Apptricity Corp.

- KDS Inc. (American Express GBT)

- Interplx Inc. (Serko Limited)

- 8Common Limited

- Avidxchange Inc.