Tractor Implements Market By Phase Type (Irrigation & Crop Protection, Tillage, Sowing & Planting, Harvesting & Threshing, Others), By Power Type (Powered, Unpowered), By Drive (2-wheel Drive, 4-wheel Drive), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

46647

-

May 2024

-

136

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Report Overview

- Key Takeaways

- Driving factors

- Restraining Factors

- Limited Financial Resources for Small Farms

- Availability of Rental/Borrowed Implements

- By Phase Type Analysis

- By Power Type Analysis

- By Drive Analysis

- Key Market Segments

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

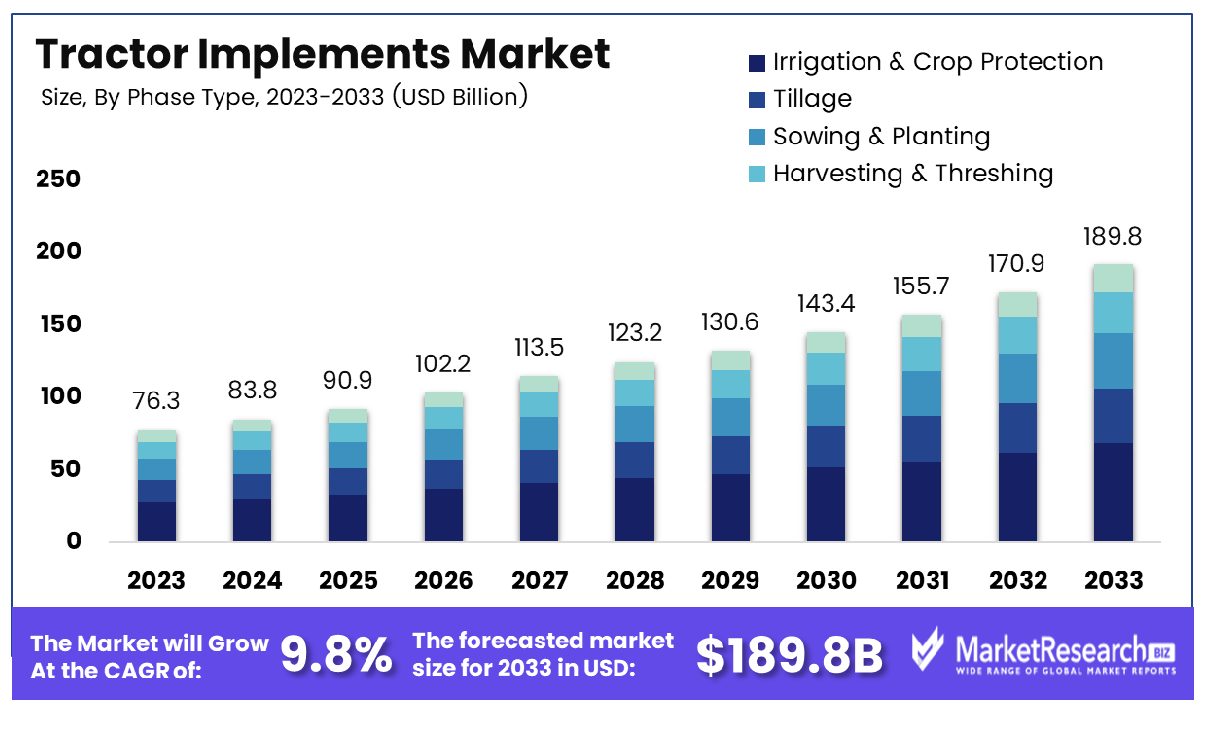

The Global Tractor Implements Market was valued at USD 76.3 Bn in 2023. It is expected to reach USD 189.8 Bn by 2033, with a CAGR of 9.8% during the forecast period from 2024 to 2033.

The Tractor Implements Market encompasses the diverse range of attachments and accessories designed to enhance the functionality and versatility of agricultural tractors. These implements include plows, cultivators, seeders, sprayers, and more, tailored to meet the evolving needs of modern farming practices. As agricultural technology advances, so too does the demand for specialized equipment that optimizes efficiency, productivity, and sustainability. This market segment serves as a critical support system for farmers and agricultural enterprises worldwide, facilitating precision farming techniques, soil management, and crop optimization strategies. Its growth trajectory is propelled by innovation, regulatory shifts, and the ever-evolving dynamics of global agriculture.

The Tractor Implements Market continues to exhibit robust growth fueled by an array of factors driving demand, coupled with technological advancements shaping the agricultural landscape. With the less than 40 HP segment dominating, commanding over 62.25% of the market share in 2023, it underscores a significant preference among farmers for compact and versatile machinery. This segment's dominance is indicative of the widespread adoption of smaller tractors for various agricultural tasks, especially among small to medium-sized farms.

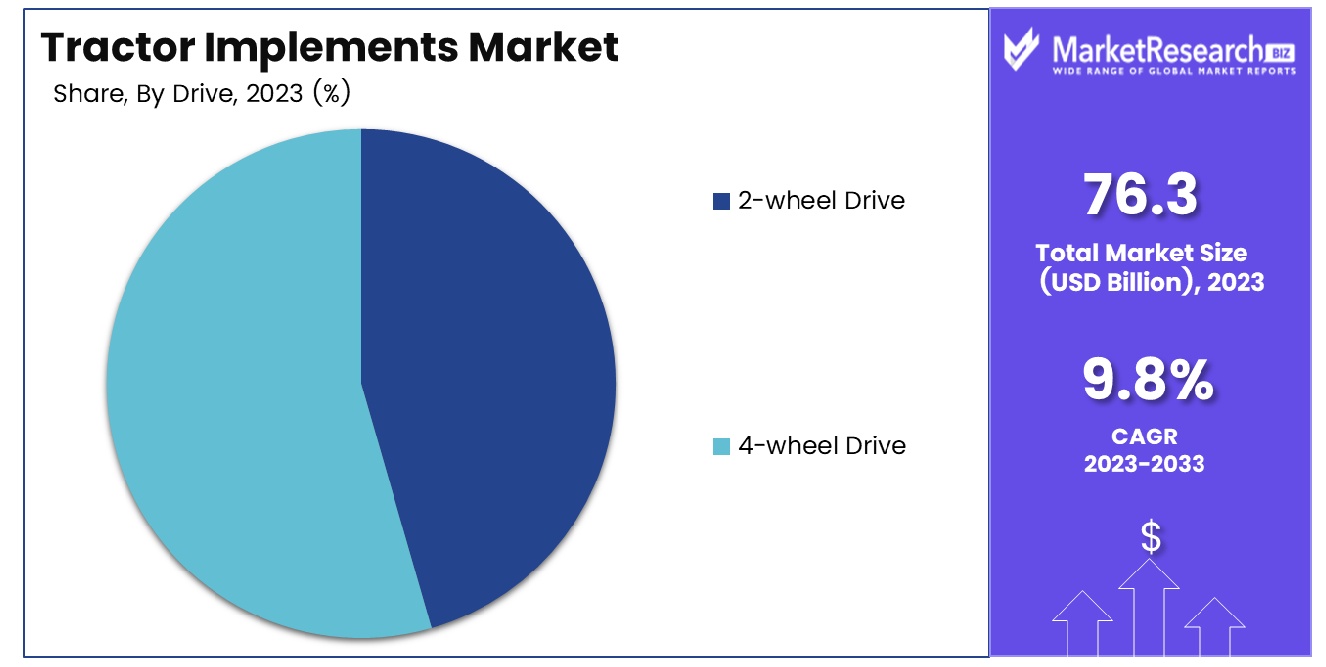

The 2WD segment's commanding share, comprising more than 80.78% of the market in 2023 and poised for accelerated growth, highlights a similar trend towards efficiency and cost-effectiveness. This preference is likely driven by the versatility and affordability offered by 2WD tractors, aligning with the evolving needs of farmers seeking agile solutions for diverse farming operations.

The market's trajectory reflects a confluence of factors, including technological innovations, evolving farming practices, and regulatory dynamics. As precision agriculture gains traction, propelled by advancements in sensor technology and data analytics, the demand for specialized tractor implements tailored for precision farming applications is expected to surge. Factors such as increasing labor costs, the need for sustainable farming practices, and the pursuit of higher yields are driving investments in advanced implements designed to optimize efficiency and productivity while minimizing environmental impact.

Key Takeaways

- Market Value: The Global Tractor Implements Market was valued at USD 76.3 Bn in 2023. It is expected to reach USD 189.8 Bn by 2033, with a CAGR of 9.8% during the forecast period from 2024 to 2033.

- By Phase Type: Harvesting & Threshing: Harvesting and threshing implements lead this segment, comprising about 45% of the market share.

- By Power Type: Powered implements are the dominant choice, holding about 60% of the market share.

- By Drive: 4-wheel Drive implements compatible with 4-wheel drive tractors are the prevailing choice, comprising roughly 55% of the market.

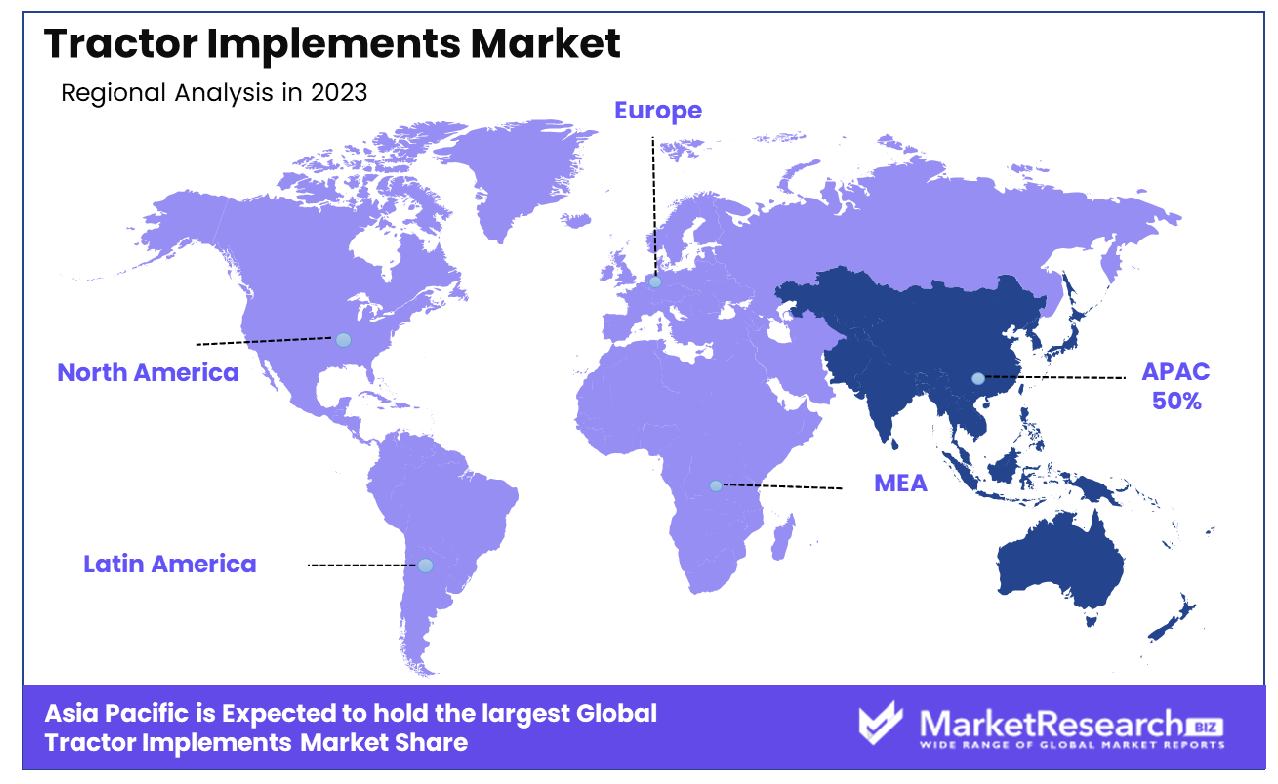

- Regional Dominance: The Asia-Pacific region dominates the tractor implements market, commanding approximately 50% of the market share

- Growth Opportunity: Growth opportunity for the tractor implements market lies in expanding product versatility and efficiency to meet evolving agricultural demands.

Driving factors

Increasing Food Demand and Agricultural Mechanization

As global populations rise and dietary preferences evolve, the demand for food, particularly staples like grains and vegetables, continues to escalate. This surge in demand places significant pressure on the agricultural sector to enhance productivity and efficiency. Agricultural mechanization, including the use of tractors and their implements, becomes indispensable in meeting this demand.

The implementation of modern farming techniques allows for increased land productivity, reduced labor requirements, and improved crop yields. According to recent statistics, the global population is expected to reach 9.7 billion by 2050, necessitating a 70% increase in food production. Tractor implements play a pivotal role in achieving this ambitious target by facilitating timely and precise farming operations, such as plowing, seeding, and harvesting.

Adoption of Farming Technologies

Innovations in farming technologies have revolutionized agricultural practices, offering farmers more efficient and sustainable methods to boost productivity. The adoption of precision agriculture, IoT (Internet of Things) sensors, and autonomous machinery has transformed traditional farming into a data-driven and highly optimized industry. Tractor implements are integral components of these advanced systems, seamlessly integrating with precision farming equipment to perform tasks with unparalleled accuracy and consistency.

By leveraging GPS guidance systems and advanced sensors, farmers can optimize input usage, minimize environmental impact, and maximize yields. The increasing adoption of farming technologies not only drives the demand for tractors but also spurs innovation in implement design, leading to more specialized and efficient solutions tailored to modern agricultural needs.

Use in Livestock Farming

While tractors are often associated with crop farming, their significance in livestock operations should not be underestimated. Tractor implements play a crucial role in various aspects of livestock farming, including land preparation for forage crops, pasture management, and feed production. Modern livestock operations demand efficient land utilization and forage management to sustain healthy herds and optimize production. Tractor-mounted implements such as mowers, balers, and hay rakes enable farmers to efficiently harvest and process forage crops, ensuring a steady and nutritious food supply for livestock.

Implements like loaders and spreaders aid in manure management, contributing to soil fertility and environmental sustainability. As the global demand for meat and dairy products continues to rise, driven by population growth and changing dietary habits, the role of tractors and their implements in supporting efficient livestock farming becomes increasingly vital to meet this demand sustainably.

Restraining Factors

Limited Financial Resources for Small Farms

For small-scale farmers, financial constraints often present significant barriers to adopting modern agricultural machinery, including tractors and implements. Limited access to capital restricts their ability to invest in expensive equipment outright, leading to reliance on alternative solutions such as used equipment markets or financing options. However, the initial investment is only part of the equation; ongoing maintenance and operational costs also pose challenges for small farm operators.

The affordability and cost-effectiveness of tractor implements play a crucial role in enabling small farms to mechanize their operations. Implement manufacturers and agricultural machinery dealers increasingly offer flexible financing schemes, lease-to-own options, and affordable used equipment programs tailored to the needs of small-scale farmers.

Availability of Rental/Borrowed Implements

Recognizing the challenges faced by small farmers in acquiring machinery, the availability of rental and borrowed implements emerges as a viable solution to overcome financial barriers. Cooperative arrangements, community machinery pools, and rental services offer smallholders access to a wide range of tractor implements without the need for substantial upfront investments. By sharing resources and leveraging economies of scale, farmers can access modern equipment at a fraction of the cost of ownership.

Rental services often provide flexibility in terms of equipment selection and usage duration, allowing farmers to match implements to specific tasks and seasonal requirements. The availability of rental and borrowed implements not only addresses affordability concerns but also promotes resource efficiency and collaboration within farming communities.

By Phase Type Analysis

In 2023, Harvesting & Threshing held a dominant market position in the By Phase Type segment of the Tractor Implements Market, capturing more than a 45% share.

As the leading segment with over a 45% market share in 2023, Harvesting & Threshing dominates the Tractor Implements Market by Phase Type. This segment's prominence is attributed to the essential role of harvesting in the agricultural process and the critical need for timely and efficient crop processing. The high demand for harvesting and threshing equipment reflects the importance of minimizing post-harvest losses and ensuring the quality of the produce. Technological advancements in this segment, such as automation and precision farming tools, further bolster its market position.

The Irrigation & Crop Protection segment is integral to modern farming, emphasizing the importance of efficient water usage and safeguarding crops from pests and diseases. This segment's growth is driven by advancements in irrigation technologies and the increasing adoption of integrated pest management practices. Farmers are increasingly investing in sophisticated irrigation systems and crop protection machinery to enhance yield and ensure sustainable farming practices.

Tillage remains a critical phase in the agricultural cycle, involving soil preparation for planting. The Tillage segment includes a variety of implements such as plows, harrows, and cultivators. With a focus on improving soil health and structure, this segment sees steady demand, driven by the necessity of maintaining optimal soil conditions for crop production.

The Sowing & Planting segment encompasses equipment used for the precise placement of seeds and seedlings. Innovations in this segment aim at increasing planting accuracy, reducing seed wastage, and improving crop yields. The demand for advanced sowing and planting machinery is influenced by the need for higher productivity and the trend towards mechanization in farming operations.

The 'Others' category in the Tractor Implements Market includes a variety of miscellaneous equipment that supports various agricultural activities. This segment covers implements used for tasks such as weed control, fertilizer application, and farm maintenance.

By Power Type Analysis

In 2023, Powered held a dominant market position in the By Power Type segment of the Tractor Implements Market, capturing more than a 60% share.

The Powered segment, encompassing a range of tractor implements that require an external power source, dominated the Tractor Implements Market by Power Type in 2023. This segment's commanding position, with over 60% market share, underscores the significant demand for implements that enhance operational efficiency and productivity. Powered implements include equipment such as powered plows, harrows, sprayers, and balers, which are integral to modern mechanized farming practices.

The Unpowered segment includes a variety of tractor implements that operate without an external power source, relying instead on the mechanical force generated by the tractor itself. This segment includes implements such as simple plows, harrows, and trailers. While the unpowered segment holds a smaller share of the market compared to its powered counterpart, it remains an essential component of the agricultural machinery landscape. The demand for unpowered implements is primarily driven by their cost-effectiveness and simplicity, making them accessible to smaller farms and operations with limited budgets.

By Drive Analysis

In 2023, 4-wheel Drive held a dominant market position in the By Drive segment of the Tractor Implements Market, capturing more than a 55% share.

Dominating the Tractor Implements Market by Drive Type in 2023, the 4-wheel Drive segment captured more than 55% of the market share. This segment's strong position is driven by the growing demand for implements that can handle more challenging terrain and heavier workloads. 4-wheel drive implements provide superior traction and stability, making them ideal for a wide range of agricultural tasks, from plowing and tillage to harvesting and transporting. The increasing adoption of 4-wheel drive tractors, especially in large-scale and commercial farming operations, has significantly contributed to the growth of this segment.

The 2-wheel Drive segment comprises tractor implements designed for tractors with power delivered to two wheels, typically the rear wheels. This segment is characterized by simplicity and lower cost, making it a popular choice for small to medium-sized farms and less demanding agricultural tasks. 2-wheel drive implements are often preferred in regions with flatter terrain and lighter soil conditions where the additional traction provided by 4-wheel drive is not necessary.

Key Market Segments

By Phase Type

- Irrigation & Crop Protection

- Tillage

- Sowing & Planting

- Harvesting & Threshing

- Others

By Power Type

- Powered

- Unpowered

By Drive

- 2-wheel Drive

- 4-wheel Drive

Growth Opportunity

Meeting the Demand for Sustainable Agriculture

The year 2024 presents a pivotal moment for the global tractor implements market, characterized by burgeoning opportunities fueled by the imperative of sustainable agriculture. As environmental concerns intensify and consumer preferences shift towards eco-friendly practices, the demand for sustainable farming solutions continues to soar.

Tractor implements, essential components of modern agricultural machinery, play a central role in advancing sustainability objectives by enabling precision farming, conservation tillage, and resource-efficient practices. To capitalize on this opportunity, tractor implement manufacturers must prioritize innovation and develop solutions that optimize resource usage, minimize environmental footprint, and enhance farm sustainability. Collaboration with stakeholders across the agricultural value chain, including farmers, agritech companies, and policymakers, is essential to drive adoption and scale sustainable practices effectively.

R&D for Efficient Machinery

In tandem with sustainability efforts, ongoing research and development (R&D) initiatives aimed at enhancing the efficiency and performance of agricultural machinery present significant growth avenues for the tractor implements market. Rapid advancements in technology, including artificial intelligence, automation, and precision agriculture, offer unprecedented opportunities to revolutionize farming practices and address productivity challenges.

By investing in R&D, tractor implement manufacturers can develop innovative solutions tailored to the evolving needs of farmers, such as autonomous implements, smart sensors, and data-driven decision support systems. These technological innovations not only improve operational efficiency and yield outcomes but also reduce input costs and environmental impact.

Latest Trends

Focus on Environmental Sustainability

In 2024, the global tractor implements market is witnessing a pronounced shift towards environmental sustainability, driven by regulatory pressures, consumer demand, and industry initiatives. With growing awareness of climate change and its impact on agricultural productivity, stakeholders across the value chain are increasingly prioritizing sustainable practices. Tractor implements, as essential tools in modern agriculture, are at the forefront of this sustainability drive.

Manufacturers are investing in research and development to develop implements that minimize soil erosion, reduce chemical usage, and optimize resource utilization. From precision planting systems to conservation tillage equipment, the market is witnessing a proliferation of sustainable solutions designed to enhance both productivity and environmental stewardship.

Emergence of Financing and Leasing Options

Another prominent trend shaping the global tractor implements market in 2024 is the emergence of financing and leasing options aimed at addressing the affordability barrier, particularly for small-scale farmers. Recognizing the capital-intensive nature of agricultural machinery, manufacturers and financial institutions are offering flexible financing schemes, lease-to-own programs, and rental options to make tractor implements more accessible to farmers with limited resources.

This trend not only expands market reach but also fosters greater adoption of modern machinery, driving demand for tractor implements globally. Leasing arrangements enable farmers to access the latest technology without bearing the full burden of ownership, promoting equipment upgrades and technological innovation within the industry.

Regional Analysis

Tractor Implements Market in 2023 is led by the Asia-Pacific region, with a dominant 50% market share

In 2023, Asia-Pacific emerged as the dominant region in the Tractor Implements Market, capturing a substantial 50% share. This dominance is driven by the region's vast agricultural sector, rapid mechanization, and significant investments in modern farming equipment. Countries like China and India are major contributors, with extensive agricultural lands and a high demand for efficient farming tools. Government initiatives to support farmers, subsidies on agricultural machinery, and the rising adoption of precision farming techniques further bolster the market in this region.

North America holds a significant position in the market, driven by advanced farming practices and a high degree of mechanization. The United States and Canada are key markets where the adoption of innovative tractor implements, such as precision planting and harvesting tools, is prevalent.

Europe also plays a crucial role in the Tractor Implements Market, with a focus on sustainable and efficient farming practices. Countries like Germany, France, and the UK are leading markets within the region, characterized by a high level of technology adoption and government support for sustainable agriculture.

In Latin America the market is driven by the large-scale agricultural activities in countries such as Brazil and Argentina. The region's extensive arable land and favorable climatic conditions for diverse crops necessitate the use of efficient tractor implements.

Middle East & Africa region, while having a smaller share compared to others, is witnessing gradual growth in the Tractor Implements Market. The increasing focus on improving agricultural productivity, especially in countries like South Africa and Egypt, is driving the demand for modern farming equipment.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global Tractor Implements Market witnessed significant contributions from key players such as NANOSYS, INC, Sigma-Aldrich Co., Nanoco Technologies Limited, Thermo Fisher Scientific Inc., The Dow Chemical Company, Ocean NanoTech, QD Laser, Inc., NnCrystal US Corporation, and UbiQD Inc. These companies have played instrumental roles in shaping the market landscape through innovative products and strategic initiatives.

NANOSYS, INC stands out as a leader in the development and commercialization of nanomaterials for tractor implements. With a strong focus on research and development, NANOSYS has been at the forefront of introducing cutting-edge technologies that enhance the efficiency and performance of tractor implements. Their contributions have significantly impacted the market by introducing advanced materials that improve durability, strength, and precision in farming operations.

Sigma-Aldrich Co. and Thermo Fisher Scientific Inc. have been pivotal in providing high-quality chemicals and analytical solutions essential for the manufacturing and testing processes of tractor implements. Their extensive product portfolios cater to the diverse needs of tractor implement manufacturers, ensuring compliance with stringent regulatory standards and optimal performance in various agricultural conditions.

Nanoco Technologies Limited and Ocean NanoTech have been instrumental in driving innovation in nanotechnology applications for tractor implements. Their expertise in nanoparticle synthesis and functionalization has led to the development of novel materials with enhanced properties such as improved sensing capabilities, increased durability, and enhanced energy efficiency.

The Dow Chemical Company and UbiQD Inc. have been key players in the development of quantum dot technologies for tractor implements. Quantum dots offer unique advantages such as high luminescence, tunable optical properties, and excellent stability, making them ideal for applications such as sensors, displays, and imaging systems in tractor implements.

Market Key Players

- NANOSYS, INC

- Sigma-Aldrich Co.

- Nanoco Technologies Limited

- Thermo Fisher Scientific Inc.

- The Dow Chemical Company

- Ocean NanoTech.

- QD Laser, Inc.

- NnCrystal US Corporation

- UbiQD Inc.

Recent Development

- In May 2024, Escorts Kubota plans to invest Rs 4,500 crore over 3-4 years for a new plant expansion, aiming to boost manufacturing capacity. Bharat Madan, full-time director and CFO, confirms the investment.

- In May 2024, VST ZETOR introduces a new line of higher HP tractors, catering to 60% of India's tractor market. Leveraging VST's expertise and ZETOR's legacy, they aim to deliver durability and versatility to Indian farmers.

Report Scope

Report Features Description Market Value (2023) USD 76.3 Bn Forecast Revenue (2033) USD 189.8 Bn CAGR (2024-2033) 9.8% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Phase Type (Irrigation & Crop Protection, Tillage, Sowing & Planting, Harvesting & Threshing, Others), By Power Type (Powered, Unpowered), By Drive (2-wheel Drive, 4-wheel Drive) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape NANOSYS, INC, Sigma-Aldrich Co., Nanoco Technologies Limited, Thermo Fisher Scientific Inc., The Dow Chemical Company, Ocean NanoTech., QD Laser, Inc., NnCrystal US Corporation, UbiQD Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Tractor Implements Market Overview

- 2.1. Tractor Implements Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Tractor Implements Market Dynamics

- 3. Global Tractor Implements Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Tractor Implements Market Analysis, 2016-2021

- 3.2. Global Tractor Implements Market Opportunity and Forecast, 2023-2032

- 3.3. Global Tractor Implements Market Analysis, Opportunity and Forecast, By By Phase Type, 2016-2032

- 3.3.1. Global Tractor Implements Market Analysis by By Phase Type: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Phase Type, 2016-2032

- 3.3.3. Irrigation & Crop Protection

- 3.3.4. Tillage

- 3.3.5. Sowing & Planting

- 3.3.6. Harvesting & Threshing

- 3.3.7. Others

- 3.4. Global Tractor Implements Market Analysis, Opportunity and Forecast, By By Power Type, 2016-2032

- 3.4.1. Global Tractor Implements Market Analysis by By Power Type: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Power Type, 2016-2032

- 3.4.3. Powered

- 3.4.4. Unpowered

- 3.5. Global Tractor Implements Market Analysis, Opportunity and Forecast, By By Drive, 2016-2032

- 3.5.1. Global Tractor Implements Market Analysis by By Drive: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Drive, 2016-2032

- 3.5.3. 2-wheel Drive

- 3.5.4. 4-wheel Drive

- 4. North America Tractor Implements Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Tractor Implements Market Analysis, 2016-2021

- 4.2. North America Tractor Implements Market Opportunity and Forecast, 2023-2032

- 4.3. North America Tractor Implements Market Analysis, Opportunity and Forecast, By By Phase Type, 2016-2032

- 4.3.1. North America Tractor Implements Market Analysis by By Phase Type: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Phase Type, 2016-2032

- 4.3.3. Irrigation & Crop Protection

- 4.3.4. Tillage

- 4.3.5. Sowing & Planting

- 4.3.6. Harvesting & Threshing

- 4.3.7. Others

- 4.4. North America Tractor Implements Market Analysis, Opportunity and Forecast, By By Power Type, 2016-2032

- 4.4.1. North America Tractor Implements Market Analysis by By Power Type: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Power Type, 2016-2032

- 4.4.3. Powered

- 4.4.4. Unpowered

- 4.5. North America Tractor Implements Market Analysis, Opportunity and Forecast, By By Drive, 2016-2032

- 4.5.1. North America Tractor Implements Market Analysis by By Drive: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Drive, 2016-2032

- 4.5.3. 2-wheel Drive

- 4.5.4. 4-wheel Drive

- 4.6. North America Tractor Implements Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.6.1. North America Tractor Implements Market Analysis by Country : Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.6.2.1. The US

- 4.6.2.2. Canada

- 4.6.2.3. Mexico

- 5. Western Europe Tractor Implements Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Tractor Implements Market Analysis, 2016-2021

- 5.2. Western Europe Tractor Implements Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Tractor Implements Market Analysis, Opportunity and Forecast, By By Phase Type, 2016-2032

- 5.3.1. Western Europe Tractor Implements Market Analysis by By Phase Type: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Phase Type, 2016-2032

- 5.3.3. Irrigation & Crop Protection

- 5.3.4. Tillage

- 5.3.5. Sowing & Planting

- 5.3.6. Harvesting & Threshing

- 5.3.7. Others

- 5.4. Western Europe Tractor Implements Market Analysis, Opportunity and Forecast, By By Power Type, 2016-2032

- 5.4.1. Western Europe Tractor Implements Market Analysis by By Power Type: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Power Type, 2016-2032

- 5.4.3. Powered

- 5.4.4. Unpowered

- 5.5. Western Europe Tractor Implements Market Analysis, Opportunity and Forecast, By By Drive, 2016-2032

- 5.5.1. Western Europe Tractor Implements Market Analysis by By Drive: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Drive, 2016-2032

- 5.5.3. 2-wheel Drive

- 5.5.4. 4-wheel Drive

- 5.6. Western Europe Tractor Implements Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.6.1. Western Europe Tractor Implements Market Analysis by Country : Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.6.2.1. Germany

- 5.6.2.2. France

- 5.6.2.3. The UK

- 5.6.2.4. Spain

- 5.6.2.5. Italy

- 5.6.2.6. Portugal

- 5.6.2.7. Ireland

- 5.6.2.8. Austria

- 5.6.2.9. Switzerland

- 5.6.2.10. Benelux

- 5.6.2.11. Nordic

- 5.6.2.12. Rest of Western Europe

- 6. Eastern Europe Tractor Implements Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Tractor Implements Market Analysis, 2016-2021

- 6.2. Eastern Europe Tractor Implements Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Tractor Implements Market Analysis, Opportunity and Forecast, By By Phase Type, 2016-2032

- 6.3.1. Eastern Europe Tractor Implements Market Analysis by By Phase Type: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Phase Type, 2016-2032

- 6.3.3. Irrigation & Crop Protection

- 6.3.4. Tillage

- 6.3.5. Sowing & Planting

- 6.3.6. Harvesting & Threshing

- 6.3.7. Others

- 6.4. Eastern Europe Tractor Implements Market Analysis, Opportunity and Forecast, By By Power Type, 2016-2032

- 6.4.1. Eastern Europe Tractor Implements Market Analysis by By Power Type: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Power Type, 2016-2032

- 6.4.3. Powered

- 6.4.4. Unpowered

- 6.5. Eastern Europe Tractor Implements Market Analysis, Opportunity and Forecast, By By Drive, 2016-2032

- 6.5.1. Eastern Europe Tractor Implements Market Analysis by By Drive: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Drive, 2016-2032

- 6.5.3. 2-wheel Drive

- 6.5.4. 4-wheel Drive

- 6.6. Eastern Europe Tractor Implements Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.6.1. Eastern Europe Tractor Implements Market Analysis by Country : Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.6.2.1. Russia

- 6.6.2.2. Poland

- 6.6.2.3. The Czech Republic

- 6.6.2.4. Greece

- 6.6.2.5. Rest of Eastern Europe

- 7. APAC Tractor Implements Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Tractor Implements Market Analysis, 2016-2021

- 7.2. APAC Tractor Implements Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Tractor Implements Market Analysis, Opportunity and Forecast, By By Phase Type, 2016-2032

- 7.3.1. APAC Tractor Implements Market Analysis by By Phase Type: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Phase Type, 2016-2032

- 7.3.3. Irrigation & Crop Protection

- 7.3.4. Tillage

- 7.3.5. Sowing & Planting

- 7.3.6. Harvesting & Threshing

- 7.3.7. Others

- 7.4. APAC Tractor Implements Market Analysis, Opportunity and Forecast, By By Power Type, 2016-2032

- 7.4.1. APAC Tractor Implements Market Analysis by By Power Type: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Power Type, 2016-2032

- 7.4.3. Powered

- 7.4.4. Unpowered

- 7.5. APAC Tractor Implements Market Analysis, Opportunity and Forecast, By By Drive, 2016-2032

- 7.5.1. APAC Tractor Implements Market Analysis by By Drive: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Drive, 2016-2032

- 7.5.3. 2-wheel Drive

- 7.5.4. 4-wheel Drive

- 7.6. APAC Tractor Implements Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.6.1. APAC Tractor Implements Market Analysis by Country : Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.6.2.1. China

- 7.6.2.2. Japan

- 7.6.2.3. South Korea

- 7.6.2.4. India

- 7.6.2.5. Australia & New Zeland

- 7.6.2.6. Indonesia

- 7.6.2.7. Malaysia

- 7.6.2.8. Philippines

- 7.6.2.9. Singapore

- 7.6.2.10. Thailand

- 7.6.2.11. Vietnam

- 7.6.2.12. Rest of APAC

- 8. Latin America Tractor Implements Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Tractor Implements Market Analysis, 2016-2021

- 8.2. Latin America Tractor Implements Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Tractor Implements Market Analysis, Opportunity and Forecast, By By Phase Type, 2016-2032

- 8.3.1. Latin America Tractor Implements Market Analysis by By Phase Type: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Phase Type, 2016-2032

- 8.3.3. Irrigation & Crop Protection

- 8.3.4. Tillage

- 8.3.5. Sowing & Planting

- 8.3.6. Harvesting & Threshing

- 8.3.7. Others

- 8.4. Latin America Tractor Implements Market Analysis, Opportunity and Forecast, By By Power Type, 2016-2032

- 8.4.1. Latin America Tractor Implements Market Analysis by By Power Type: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Power Type, 2016-2032

- 8.4.3. Powered

- 8.4.4. Unpowered

- 8.5. Latin America Tractor Implements Market Analysis, Opportunity and Forecast, By By Drive, 2016-2032

- 8.5.1. Latin America Tractor Implements Market Analysis by By Drive: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Drive, 2016-2032

- 8.5.3. 2-wheel Drive

- 8.5.4. 4-wheel Drive

- 8.6. Latin America Tractor Implements Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.6.1. Latin America Tractor Implements Market Analysis by Country : Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.6.2.1. Brazil

- 8.6.2.2. Colombia

- 8.6.2.3. Chile

- 8.6.2.4. Argentina

- 8.6.2.5. Costa Rica

- 8.6.2.6. Rest of Latin America

- 9. Middle East & Africa Tractor Implements Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Tractor Implements Market Analysis, 2016-2021

- 9.2. Middle East & Africa Tractor Implements Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Tractor Implements Market Analysis, Opportunity and Forecast, By By Phase Type, 2016-2032

- 9.3.1. Middle East & Africa Tractor Implements Market Analysis by By Phase Type: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Phase Type, 2016-2032

- 9.3.3. Irrigation & Crop Protection

- 9.3.4. Tillage

- 9.3.5. Sowing & Planting

- 9.3.6. Harvesting & Threshing

- 9.3.7. Others

- 9.4. Middle East & Africa Tractor Implements Market Analysis, Opportunity and Forecast, By By Power Type, 2016-2032

- 9.4.1. Middle East & Africa Tractor Implements Market Analysis by By Power Type: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Power Type, 2016-2032

- 9.4.3. Powered

- 9.4.4. Unpowered

- 9.5. Middle East & Africa Tractor Implements Market Analysis, Opportunity and Forecast, By By Drive, 2016-2032

- 9.5.1. Middle East & Africa Tractor Implements Market Analysis by By Drive: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Drive, 2016-2032

- 9.5.3. 2-wheel Drive

- 9.5.4. 4-wheel Drive

- 9.6. Middle East & Africa Tractor Implements Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.6.1. Middle East & Africa Tractor Implements Market Analysis by Country : Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.6.2.1. Algeria

- 9.6.2.2. Egypt

- 9.6.2.3. Israel

- 9.6.2.4. Kuwait

- 9.6.2.5. Nigeria

- 9.6.2.6. Saudi Arabia

- 9.6.2.7. South Africa

- 9.6.2.8. Turkey

- 9.6.2.9. The UAE

- 9.6.2.10. Rest of MEA

- 10. Global Tractor Implements Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Tractor Implements Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Tractor Implements Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. NANOSYS, INC

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Sigma-Aldrich Co.

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Nanoco Technologies Limited

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Thermo Fisher Scientific Inc.

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. The Dow Chemical Company

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Ocean NanoTech.

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. QD Laser, Inc.

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. NnCrystal US Corporation

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. UbiQD Inc.

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- 1. Executive Summary

-

- NANOSYS, INC

- Sigma-Aldrich Co.

- Nanoco Technologies Limited

- Thermo Fisher Scientific Inc.

- The Dow Chemical Company

- Ocean NanoTech.

- QD Laser, Inc.

- NnCrystal US Corporation

- UbiQD Inc.