Telemonitoring System Market By Product Type (COPD Telemonitoring System, Blood Pressure Telemonitoring System, Glucose Level Telemonitoring System, Cardiac Telemonitoring System, Others), By End-User (Home Care, Hospital Care, Long-Term Care Centers), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

48518

-

July 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

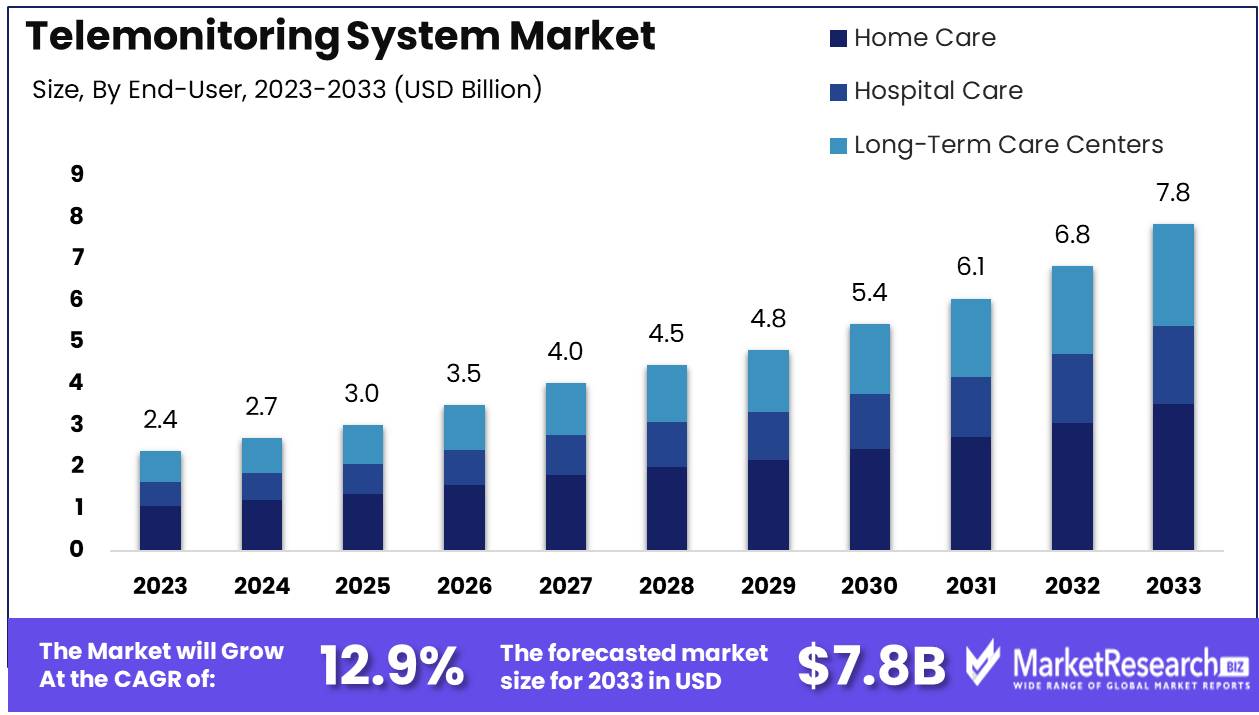

The Telemonitoring System Market was valued at USD 2.4 billion in 2023. It is expected to reach USD 7.8 billion by 2033, with a CAGR of 12.9% during the forecast period from 2024 to 2033.

The Telemonitoring System Market encompasses a range of technologies and solutions designed to remotely monitor patients' health conditions, enabling real-time data transmission to healthcare providers. This market is driven by advancements in wireless communication, the increasing prevalence of chronic diseases, and the need for cost-effective healthcare delivery. Telemonitoring systems facilitate continuous patient monitoring, improve disease management, and enhance patient outcomes by enabling timely interventions. The market includes wearable sensors, mobile health applications, and cloud-based platforms, which collectively streamline healthcare operations and reduce hospital readmissions. Integrating electronic health records further enhances the utility and efficiency of telemonitoring systems.

The telemonitoring system market is poised for substantial growth, driven by demographic and epidemiological trends. The rising prevalence of chronic diseases, notably diabetes and cardiovascular conditions, underscores the necessity for continuous patient monitoring, thus propelling the demand for telemonitoring solutions. The increasing geriatric population further accentuates this need, as elderly patients often require sustained and home-based care, making telemonitoring systems an indispensable tool in modern healthcare. These factors collectively highlight a robust market trajectory, marked by a shift toward integrated, patient-centric healthcare delivery models.

However, the market's growth is not without its challenges. The high costs associated with telemonitoring systems and devices present a significant barrier to widespread adoption, particularly in cost-sensitive healthcare environments. Additionally, privacy and security concerns related to patient data remain a critical issue, as the increasing digitization of healthcare records necessitates stringent data protection measures. Addressing these challenges requires a multifaceted approach, involving regulatory frameworks, technological advancements in cybersecurity, and cost-reduction strategies.

Key Takeaways

- Market Growth: The Telemonitoring System Market was valued at USD 2.4 billion in 2023. It is expected to reach USD 7.8 billion by 2033, with a CAGR of 12.9% during the forecast period from 2024 to 2033.

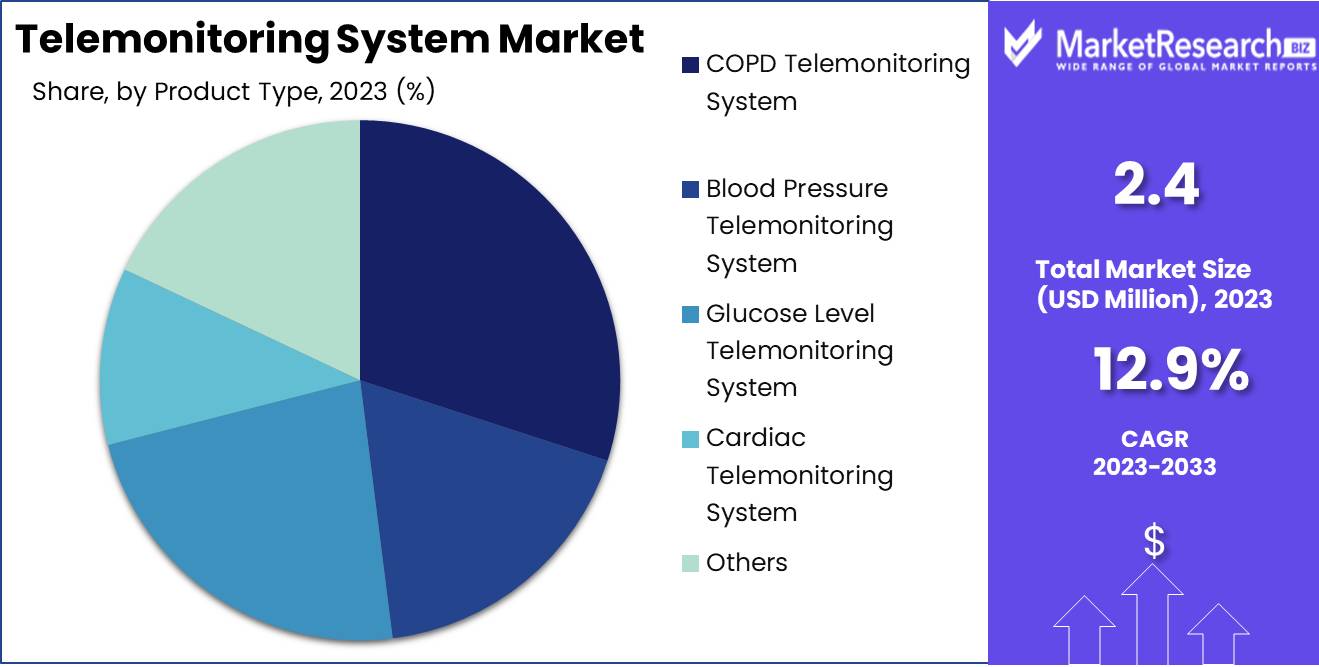

- By Product Type: COPD Telemonitoring Systems dominated the telemonitoring system market.

- By End-User: Home Care dominated the Telemonitoring System Market's end-user segment.

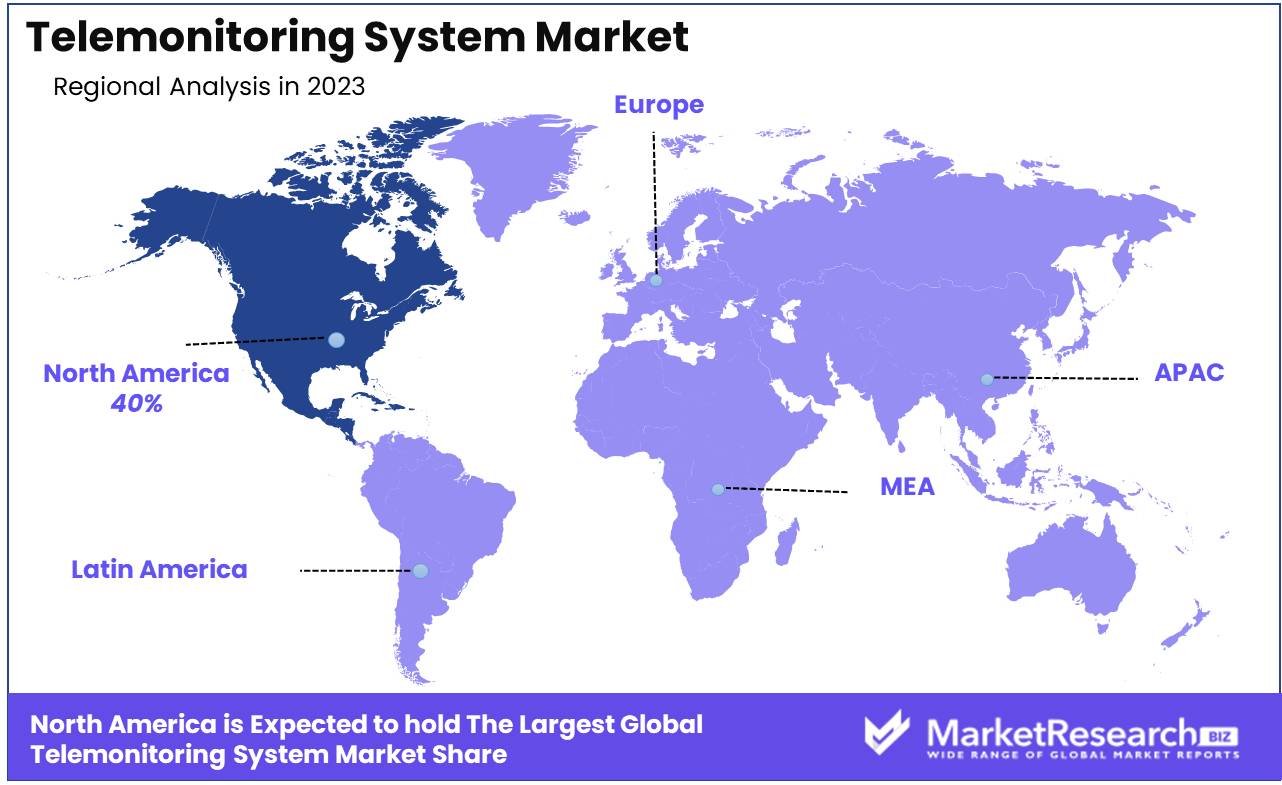

- Regional Dominance: North America dominates the telemonitoring market with a 40% largest share.

- Growth Opportunity: The global telemonitoring system market is set for robust growth, driven by IoT advancements and cardiac telemonitoring adoption.

Driving factors

Rising Prevalence of Chronic Diseases: A Catalyst for Telemonitoring System Adoption

The escalating prevalence of chronic diseases, such as diabetes, cardiovascular disorders, and respiratory conditions, is a significant driver for the Telemonitoring System Market. Chronic diseases require ongoing monitoring and management, which telemonitoring systems effectively facilitate by enabling continuous, real-time health data tracking and remote patient management. According to recent data, the number of individuals diagnosed with chronic diseases has increased by approximately 7% annually, necessitating more efficient healthcare solutions. This growing need has propelled the demand for telemonitoring systems, as they help reduce hospital visits, minimize healthcare costs, and improve patient outcomes through timely interventions.

Increasing Healthcare Expenditure: Fueling Market Expansion

The rise in healthcare expenditure globally is another crucial factor contributing to the growth of the telemonitoring system market. Governments and private healthcare providers are increasingly investing in advanced healthcare technologies to enhance patient care and optimize operational efficiency. Global healthcare expenditure is projected to grow at a CAGR of 4.1% from 2023 to 2028, reflecting a robust investment trend in innovative healthcare solutions, including telemonitoring systems. The allocation of funds towards telemonitoring infrastructure and services underscores the recognition of its potential to streamline patient monitoring, improve chronic disease management, and reduce the overall burden on healthcare systems.

Growing Aging Population: Amplifying the Need for Telemonitoring Solutions

The aging population is expanding rapidly, particularly in regions such as North America, Europe, and parts of Asia. The global population aged 60 years or over is expected to reach 2.1 billion by 2050, doubling from 2017 figures. This demographic shift is driving the demand for telemonitoring systems as older adults are more prone to chronic illnesses and require frequent health monitoring. Telemonitoring provides a viable solution for managing the health of the elderly by allowing continuous, remote monitoring, thereby ensuring timely medical interventions and reducing the need for in-person consultations. This not only enhances the quality of life for the elderly but also alleviates the pressure on healthcare facilities.

Restraining Factors

High Initial Costs and Maintenance Expenses

The telemonitoring system market faces significant financial barriers due to high initial costs and ongoing maintenance expenses. These systems often require substantial investments in advanced technology, including high-quality sensors, software, and secure data transmission infrastructure. For instance, setting up a comprehensive telemonitoring system can cost healthcare providers between $2,000 to $10,000 per patient annually, depending on the complexity and scope of the monitoring required. This high upfront cost can be prohibitive for smaller healthcare facilities or those in resource-limited settings, thus slowing the widespread adoption of telemonitoring systems.

Additionally, maintenance expenses add to the financial burden. Regular updates, calibration of equipment, and technical support services are essential to ensure the reliability and accuracy of telemonitoring systems. These ongoing costs can deter healthcare providers from investing in telemonitoring solutions, especially when budgets are constrained. The cumulative financial impact of these expenses can significantly slow market growth, as potential buyers may opt for less costly alternatives or delay adoption until prices decrease or more affordable solutions become available.

Lack of Reimbursement Policies and Insurance Coverage

Another critical restraining factor in the telemonitoring system market is the lack of reimbursement policies and insurance coverage. In many regions, healthcare reimbursement frameworks have not fully adapted to include telemonitoring services. Without comprehensive reimbursement policies, healthcare providers and patients may be reluctant to invest in telemonitoring solutions, as out-of-pocket expenses can be substantial.

For instance, in the United States, Medicare has limited reimbursement for telehealth services, including telemonitoring, to certain conditions and types of healthcare providers. This restriction significantly reduces the financial incentive for widespread adoption. According to a survey, approximately 65% of healthcare providers cited inadequate reimbursement as a major barrier to adopting telemonitoring systems. Without the assurance of cost recovery through insurance, many providers and patients might forgo these advanced healthcare solutions, thereby impeding market growth.

By Product Type Analysis

In 2023, COPD Telemonitoring System dominated the telemonitoring system market.

In 2023, The COPD Telemonitoring System held a dominant market position in the By Product Type segment of the Telemonitoring System Market. The increased prevalence of Chronic Obstructive Pulmonary Disease (COPD) and the rising adoption of telehealth solutions for chronic disease management were significant contributors to this dominance. The COPD Telemonitoring System's ability to provide continuous, real-time monitoring of respiratory parameters has been crucial in improving patient outcomes and reducing hospital readmissions.

Following closely, the Blood Pressure Telemonitoring System gained substantial traction due to the growing incidence of hypertension and cardiovascular diseases. This system's integration with mobile health applications and wearable devices enhanced patient compliance and self-management.

The Glucose Level Telemonitoring System also saw significant growth, driven by the increasing prevalence of diabetes and the need for constant blood sugar level monitoring. Advances in sensor technology and non-invasive monitoring methods further bolstered its market position.

The Cardiac Telemonitoring System, designed for continuous cardiac rhythm monitoring, played a vital role in managing arrhythmias and heart failure, contributing to its notable market share.

Finally, other telemonitoring systems, including those for sleep apnea, asthma, and other chronic conditions, collectively maintained a steady presence, driven by the broader acceptance of telehealth solutions and technological advancements in remote patient monitoring.

By End-User Analysis

In 2023, Home Care dominated the Telemonitoring System Market's end-user segment.

In 2023, Home Care held a dominant market position in the By End-User segment of the Telemonitoring System Market. The rising preference for at-home healthcare services, driven by the aging population and the increasing incidence of chronic diseases, significantly contributed to this dominance. Home care telemonitoring systems offer patients the convenience of receiving medical care in the comfort of their own homes, which has been a crucial factor in their widespread adoption. These systems enable continuous monitoring, early detection of potential health issues, and timely medical interventions, thereby improving patient outcomes and reducing hospital readmissions.

Hospital Care represented the second-largest segment. Telemonitoring systems in hospitals are utilized to enhance patient monitoring, particularly in intensive care units (ICUs) and for post-operative care, ensuring that patients receive immediate medical attention when needed. The integration of these systems with electronic health records (EHRs) further enhances their utility, providing healthcare professionals with comprehensive patient data for informed decision-making.

Long-Term Care Centers also adopted telemonitoring systems, albeit at a slower pace compared to home care and hospital care. These systems aid in managing the health of residents with chronic conditions, ensuring consistent monitoring and reducing the burden on healthcare staff. However, budget constraints and the need for technical training remain challenges for widespread adoption in this segment.

Key Market Segments

By Product Type

- COPD Telemonitoring System

- Blood Pressure Telemonitoring System

- Glucose Level Telemonitoring System

- Cardiac Telemonitoring System

- Others

By End-User

- Home Care

- Hospital Care

- Long-Term Care Centers

Growth Opportunity

Advancements in IoT and Wearable Technologies

One of the primary growth drivers for the telemonitoring system market is the rapid advancement in the Internet of Things (IoT) and wearable technologies. These innovations are revolutionizing the healthcare sector by facilitating continuous health monitoring. IoT devices and wearables such as smartwatches, fitness trackers, and advanced medical devices are increasingly being integrated with telemonitoring systems. These technologies provide accurate and real-time health data, enabling early detection of potential health issues and timely medical intervention. The proliferation of these devices is expected to expand the telemonitoring market significantly, as they offer more comprehensive and user-friendly solutions for both patients and healthcare providers.

Adoption of Cardiac Telemonitoring

The adoption of cardiac telemonitoring is another crucial factor contributing to market growth. With the rising prevalence of cardiovascular diseases, there is a growing need for effective and efficient monitoring solutions. Cardiac telemonitoring systems allow for continuous monitoring of heart conditions, providing critical data that can help in managing and preventing cardiac events. This technology is particularly beneficial for patients with chronic heart conditions, offering them the convenience of being monitored from the comfort of their homes. The increasing acceptance and implementation of cardiac telemonitoring systems are expected to drive substantial growth in the telemonitoring market.

Latest Trends

Growing Integration of AI and Machine Learning

The telemonitoring system market is expected to witness significant advancements, driven primarily by the growing integration of artificial intelligence (AI) and machine learning (ML). These technologies are enhancing the efficiency and accuracy of telemonitoring systems, enabling real-time data analysis and predictive analytics. AI and ML algorithms can process vast amounts of patient data, identifying patterns and trends that might be missed by traditional methods. This leads to more accurate diagnoses, personalized treatment plans, and proactive healthcare management. Additionally, AI-powered telemonitoring systems can continuously learn and adapt, improving their performance over time and offering better outcomes for patients and healthcare providers alike.

Rising Use of Telemonitoring Systems

The adoption of telemonitoring systems is on the rise, fueled by the growing need for remote healthcare solutions. This trend is particularly evident in the context of the aging population and the increasing prevalence of chronic diseases. Telemonitoring systems enable continuous monitoring of patient's health conditions from the comfort of their homes, reducing the need for frequent hospital visits and minimizing healthcare costs. Moreover, the COVID-19 pandemic has accelerated the acceptance and utilization of telehealth services, with telemonitoring systems playing a crucial role in managing patient care remotely. As healthcare providers and patients become more accustomed to these technologies, the demand for telemonitoring systems is expected to grow, driving further innovations and market expansion.

Regional Analysis

North America dominates the telemonitoring market with a 40% largest share.

The Telemonitoring System Market exhibits varied growth patterns across different regions, with North America emerging as the dominant market, holding a significant largest market share of approximately 40% in 2023. This region's dominance can be attributed to the advanced healthcare infrastructure, high adoption of telehealth solutions, and supportive government initiatives, such as the U.S. Health Information Technology for Economic and Clinical Health (HITECH) Act. Additionally, the presence of major market players and increased investment in healthcare technology further bolster North America's market position.

In Europe, the market is driven by the increasing geriatric population and the rising prevalence of chronic diseases. Countries like Germany, the UK, and France lead in the adoption of telemonitoring systems, supported by favorable reimbursement policies and a growing focus on remote patient monitoring.

The Asia Pacific region is expected to witness the highest growth rate, primarily due to the expanding healthcare sector in countries like China, India, and Japan. Government initiatives to improve healthcare access, coupled with the increasing penetration of smartphones and the internet, are key growth drivers in this region.

The Middle East & Africa region shows moderate growth, influenced by improving healthcare infrastructure and increasing awareness of telehealth solutions. Similarly, Latin America is experiencing steady growth due to rising healthcare expenditures and the growing adoption of digital health technologies.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Telemonitoring System Market in 2024 is poised for substantial growth, driven by the increasing demand for remote patient monitoring solutions. Key companies in the market are strategically positioned to leverage technological advancements and expand their market share.

Allscripts Healthcare Solutions Inc. is expected to enhance its market presence through robust electronic health record (EHR) systems integrated with telemonitoring capabilities, aiming to improve patient outcomes and operational efficiencies. Abbott Laboratories will likely continue to capitalize on its strong portfolio of diagnostic tools, integrating telemonitoring features to provide comprehensive patient care solutions, particularly in chronic disease management.

AMD Global Telemedicine, Inc. is anticipated to drive growth by offering innovative telemedicine solutions that enable real-time patient monitoring and diagnostics, catering to the needs of healthcare providers in remote locations. General Electric Company is set to leverage its extensive experience in healthcare technologies to deliver advanced telemonitoring systems, focusing on enhancing patient care through data-driven insights and analytics.

Care Innovations LLC is expected to maintain a competitive edge by providing tailored telemonitoring solutions that address the specific needs of elderly care and chronic disease management, facilitating better patient engagement and adherence to treatment plans. InTouch Health will likely expand its market reach by offering comprehensive telehealth platforms that integrate telemonitoring functionalities, aiming to streamline clinical workflows and improve patient care delivery.

Honeywell Life Care Solutions is poised to enhance its telemonitoring offerings by integrating advanced sensor technologies and IoT capabilities, enabling continuous and accurate patient monitoring. McKesson Corporation is anticipated to leverage its vast distribution network and expertise in healthcare services to promote the adoption of telemonitoring systems, enhancing patient access to quality care.

Koninklijke Philips NV is expected to drive innovation in telemonitoring through its strong focus on connected care solutions, aiming to deliver seamless and integrated patient monitoring experiences. Medtronic Plc will likely continue to lead the market with its advanced medical devices and telemonitoring solutions, focusing on improving patient outcomes through continuous monitoring and timely interventions.

Market Key Players

- Allscripts Healthcare Solutions Inc.

- Abbott Laboratories

- AMD Global Telemedicine, Inc.

- General Electric Company

- Care Innovations LLC

- InTouch Health

- Honeywell Life Care Solutions

- McKesson Corporation.

- Koninklijke Philips NV

- Medtronic Plc

Recent Development

- In April 2024, Boston Scientific announced a partnership with a leading healthcare provider to deploy their latest telemonitoring solutions. This collaboration aims to expand access to remote monitoring for patients with chronic illnesses across multiple regions in North America and Europe.

- In March 2024, Philips Healthcare introduced a new telemonitoring platform, focusing on remote management of chronic diseases. This platform includes features for continuous glucose monitoring and cardiovascular health tracking, aiming to support patients with diabetes and heart conditions.

- In February 2024, Medtronic launched an advanced telemonitoring system for cardiac patients. This system enhances remote patient monitoring by integrating AI to predict potential cardiac events, improving patient outcomes and reducing hospital readmissions.

Report Scope

Report Features Description Market Value (2023) USD 2.4 Billion Forecast Revenue (2033) USD 7.8 Billion CAGR (2024-2032) 12.9% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (COPD Telemonitoring System, Blood Pressure Telemonitoring System, Glucose Level Telemonitoring System, Cardiac Telemonitoring System, Others), By End-User (Home Care, Hospital Care, Long-Term Care Centers) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Allscripts Healthcare Solutions Inc., Abbott Laboratories, AMD Global Telemedicine, Inc., General Electric Company, Care Innovations LLC, InTouch Health, Honeywell Life Care Solutions, McKesson Corporation., Koninklijke Philips NV, Medtronic Plc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Allscripts Healthcare Solutions Inc.

- Abbott Laboratories

- AMD Global Telemedicine, Inc.

- General Electric Company

- Care Innovations LLC

- InTouch Health

- Honeywell Life Care Solutions

- McKesson Corporation.

- Koninklijke Philips NV

- Medtronic Plc