Stainless Steel Market By Type (Austenitic Stainless Steels, Martensitic Stainless Steels, Ferritic Stainless Steels, Precipitation Hard Stainless Steel), By Application (Automotive and Transportation, Building and Construction, Heavy Industries), By Grades (200 Series, 300 Series, 400 Series, Duplex Series), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

49421

-

July 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

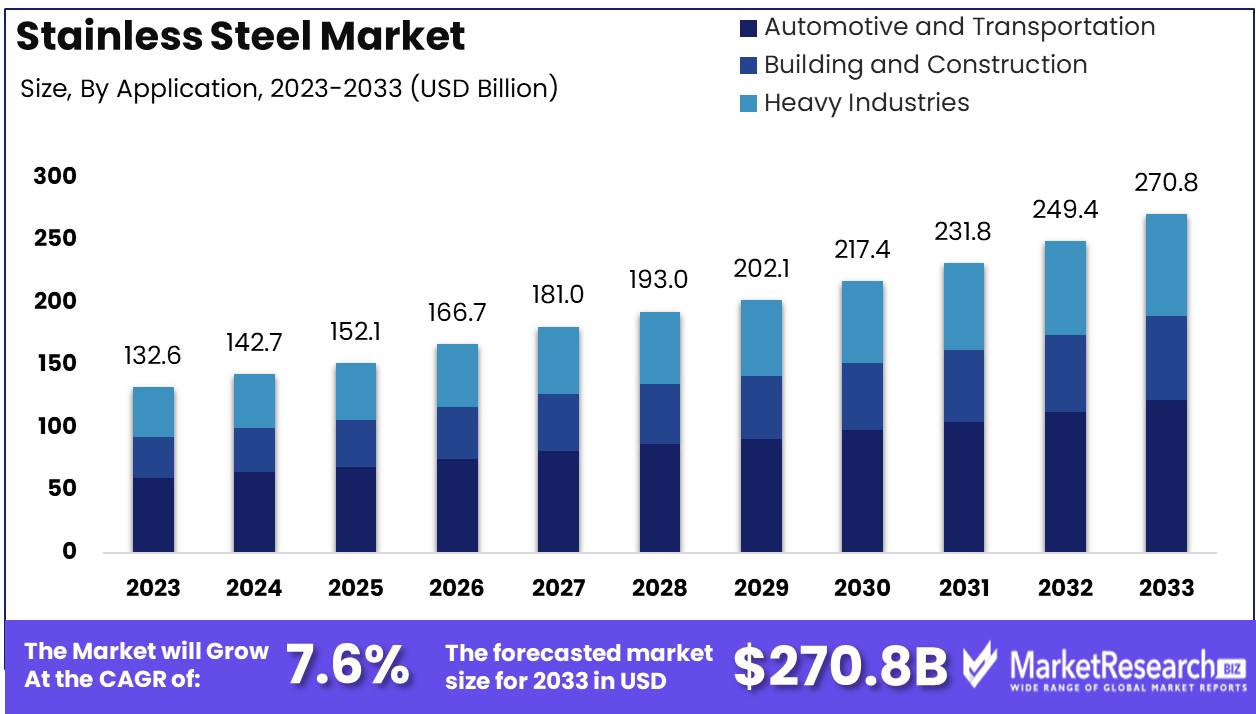

The Stainless Steel Market was valued at USD 132.6 billion in 2023. It is expected to reach USD 270.8 billion by 2033, with a CAGR of 7.6% during the forecast period from 2024 to 2033.

The Stainless Steel Market encompasses the global industry engaged in the production, processing, and distribution of stainless steel products. Stainless steel, known for its corrosion resistance, strength, and aesthetic appeal, finds applications across diverse sectors, including construction, automotive, aerospace, and consumer goods. The market is driven by increasing demand for durable and sustainable materials, advancements in manufacturing technologies, and the growing emphasis on environmental sustainability.

The Stainless Steel Market is poised for substantial growth, driven by increasing demand in key sectors such as construction, infrastructure, and automotive industries. The resilience and durability of stainless steel make it an indispensable material for modern construction projects, with its use proliferating in skyscrapers, bridges, and public infrastructure. The automotive and transportation industries are also witnessing heightened demand for stainless steel due to its strength, corrosion resistance, and recyclability, which align with the industry's shift towards sustainability and lightweight materials.

However, market volatility remains a significant concern, particularly with the fluctuation in raw material prices, notably nickel and chromium. This volatility necessitates strategic procurement and risk management approaches for manufacturers and end-users alike.

Moreover, the stainless steel market is increasingly influenced by sustainability trends and the emphasis on recycling. The recyclability of stainless steel not only contributes to its appeal in green construction and eco-friendly automotive manufacturing but also aligns with global regulatory and consumer shifts towards environmental responsibility. The industry's commitment to sustainability is expected to drive innovation in production processes and recycling technologies, further bolstering the market's growth trajectory. However, manufacturers must navigate the challenges posed by raw material price volatility, which can impact production costs and pricing strategies.

Key Takeaways

- Market Growth: The Stainless Steel Market was valued at USD 132.6 billion in 2023. It is expected to reach USD 270.8 billion by 2033, with a CAGR of 7.6% during the forecast period from 2024 to 2033.

- By Type: Austenitic Stainless Steel dominated the diverse stainless steel market.

- By Application: Automotive and Transportation dominated the Stainless Steel Market applications.

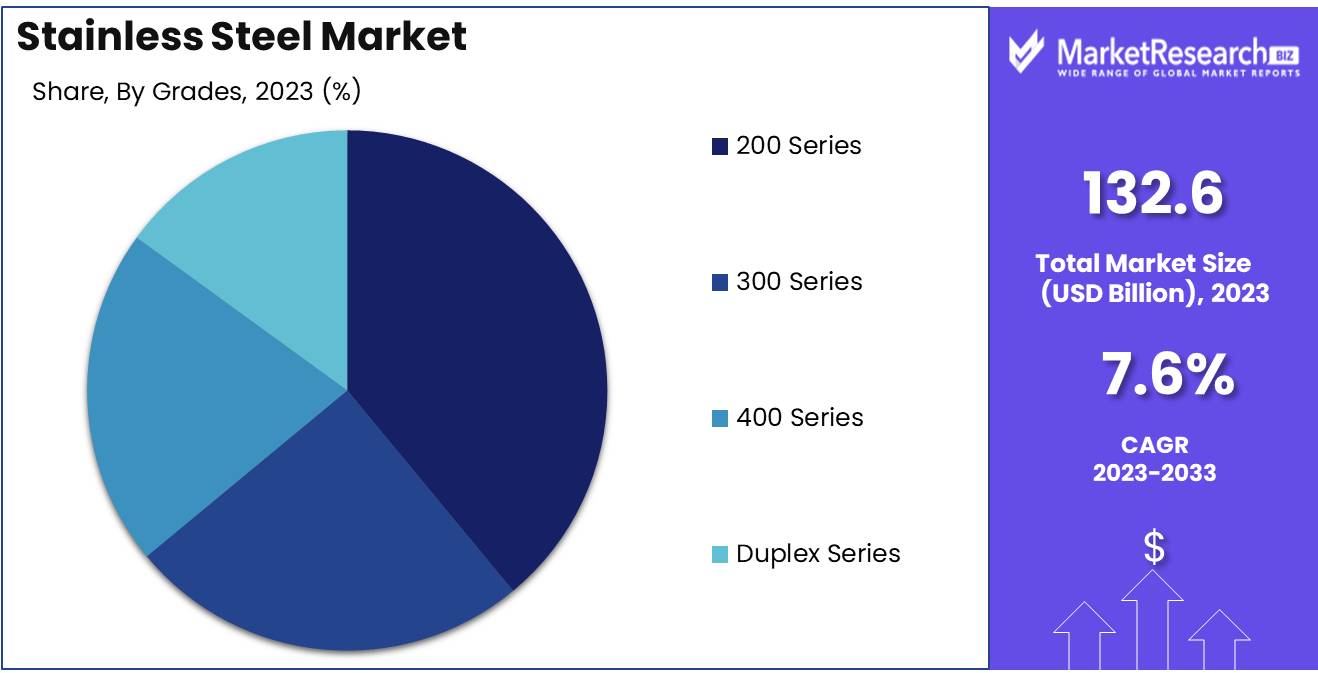

- By Grades: The 200 Series dominated the Stainless Steel Market by grades.

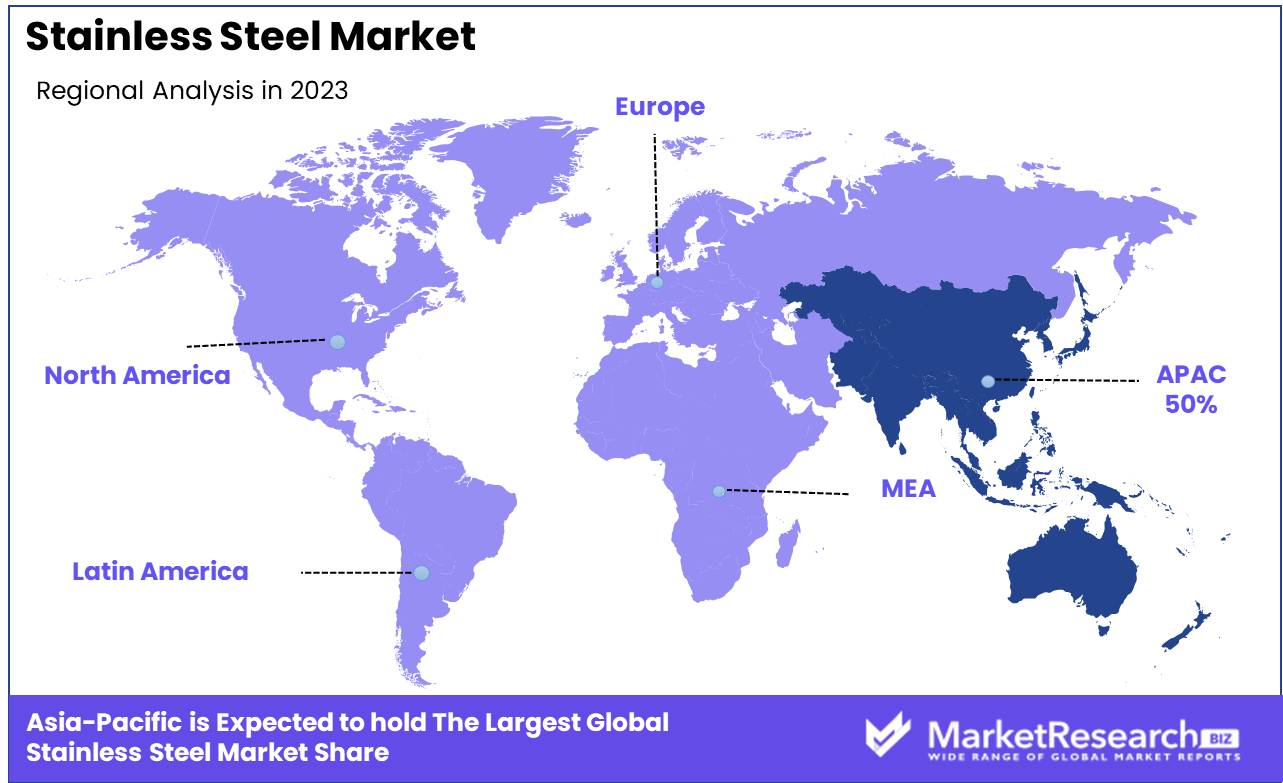

- Regional Dominance: Asia Pacific dominates, holding 50% market's largest share in stainless steel.

- Growth Opportunity: The global stainless steel market is poised for substantial growth, fueled by the rising emphasis on sustainability and the booming construction and infrastructure sectors.

Driving factors

Technological Advancements in Stainless Steel Production

The evolution of stainless steel production technologies has significantly contributed to the market's growth. Innovations in production methods, such as continuous casting, advanced alloying techniques, and precision manufacturing, have resulted in enhanced product quality, reduced production costs, and increased efficiency. These advancements have made stainless steel more accessible and affordable, thereby boosting its adoption across various industries. For instance, modern techniques have enabled the production of high-strength, corrosion-resistant stainless steel grades that meet stringent industry standards, driving market demand. The global stainless steel market has experienced a growth rate of approximately 5.4% annually, partially attributable to these technological improvements.

Increasing Demand from the Construction Industry

The construction industry is a major consumer of stainless steel, driven by the material's durability, corrosion resistance, and aesthetic appeal. The rise in infrastructure development projects, particularly in emerging economies, has fueled the demand for stainless steel. Applications in building facades, structural components, and interior design elements have expanded, given the material's longevity and low maintenance requirements. According to industry reports, the construction sector accounts for about 35% of the global stainless steel consumption. This substantial share underscores the material's critical role in modern construction practices, with market growth projected at 6% annually in this sector.

Growing Automotive Sector

The automotive industry has increasingly relied on stainless steel for various components due to its strength, weight-saving potential, and resistance to extreme conditions. Stainless steel is used in exhaust systems, trim, structural components, and fuel tanks, contributing to vehicle durability and performance. The shift towards electric vehicles (EVs) has further augmented stainless steel demand, as the material supports the lightweight and robust design requirements of EVs. The automotive sector's contribution to the stainless steel market is notable, with an estimated annual growth rate of 4.8%. As automotive manufacturers continue to innovate and prioritize sustainability, the demand for stainless steel is expected to rise correspondingly.

Restraining Factors

High Initial Investment: A Barrier to Market Entry

The stainless steel market, while poised for growth due to its applications in various industries, faces significant challenges due to the high initial investment required. The production of stainless steel involves substantial capital expenditure on advanced manufacturing facilities, sophisticated technology, and skilled labor. These costs can deter new entrants and limit the expansion of existing players. The necessity for continuous investment in research and development to innovate and improve product quality further exacerbates this financial burden.

Consequently, smaller companies may find it difficult to compete, leading to market consolidation where only large, financially robust firms dominate. This dynamic can stifle competition and innovation, potentially slowing overall market growth. Without adequate financial resources, the industry’s ability to scale up operations and meet increasing demand could be significantly hindered, impacting its growth trajectory.

Supply Disruptions: Interruptions in Raw Material Availability

Supply disruptions are another critical restraining factor impacting the growth of the stainless steel market. Stainless steel production relies heavily on the availability of raw materials such as nickel, chromium, and iron ore. These materials are often sourced from a limited number of global suppliers, making the supply chain vulnerable to geopolitical tensions, trade restrictions, and natural disasters. Any interruption in the supply of these essential raw materials can lead to increased production costs and delays, affecting the overall market supply.

For instance, geopolitical instability in key producing regions or trade disputes can lead to sudden shortages or price spikes, disrupting the balance between supply and demand. This uncertainty makes it difficult for manufacturers to plan and execute long-term strategies, thereby slowing market growth. Additionally, the industry’s reliance on imported raw materials means that fluctuations in currency exchange rates can further complicate cost structures and pricing strategies, adding another layer of financial risk.

By Type Analysis

In 2023, Austenitic Stainless steel dominated the diverse stainless steel market.

In 2023, Austenitic Stainless steel held a dominant market position in the "By Type" segment of the Stainless Steel Market. Known for their excellent corrosion resistance and superior formability, austenitic grades such as 304 and 316 are widely utilized in a variety of industries, including construction, automotive, and consumer goods. This type of stainless steel is characterized by its non-magnetic nature and high chromium and nickel content, making it suitable for harsh environments.

Martensitic Stainless Steels, on the other hand, are valued for their high strength and hardness. They find extensive applications in the production of cutlery, surgical instruments, and turbine blades, where wear resistance and durability are critical.

Ferritic Stainless Steel is magnetic and contains lower carbon levels, offering moderate corrosion resistance and good formability. They are predominantly used in automotive exhaust systems and industrial equipment.

Precipitation Hardening Stainless Steels combine high strength with corrosion resistance, achieved through heat treatment processes. These steels are typically used in aerospace, defense, and high-tech industries, where precision and reliability are paramount.

By Application Analysis

In 2023, Automotive and Transportation dominated the Stainless Steel Market applications.

In 2023, The Automotive and Transportation segment held a dominant market position in the Stainless Steel Market by Application. The segment's substantial demand stems from the automotive industry's increasing focus on lightweight, corrosion-resistant materials to enhance fuel efficiency and durability. Stainless steel's properties, such as high strength and resistance to corrosion and extreme temperatures, make it a preferred choice for manufacturing various automotive components, including exhaust systems, fuel tanks, and structural parts.

The Building and Construction sector also showcased significant demand, driven by stainless steel's aesthetic appeal, longevity, and low maintenance requirements. Its application in architectural elements, roofing, cladding, and structural components underlines the material's versatility and durability, which are critical in modern construction projects.

Heavy Industries, encompassing sectors like chemical processing, oil and gas, and power generation, continued to be substantial consumers of stainless steel. The material's resistance to harsh environments, chemicals, and high temperatures ensures reliability and safety in critical applications, thus maintaining its relevance and demand within these industrial sectors. Collectively, these segments underscore the widespread and critical applications of stainless steel across diverse industries.

By Grades Analysis

In 2023, The 200 Series dominated the Stainless Steel Market by grades.

In 2023, The 200 Series held a dominant market position in the "By Grades" segment of the Stainless Steel Market. This series, known for its high corrosion resistance and affordability, gained significant traction due to the increasing demand in the manufacturing of kitchenware, automotive parts, and industrial equipment. The 200 Series is preferred for its lower nickel content, which makes it a cost-effective alternative amidst fluctuating raw material prices.

Meanwhile, the 300 Series, characterized by its superior corrosion resistance and strength due to higher nickel and chromium content, maintained a substantial market share. This series is extensively used in the construction, automotive, and heavy machinery sectors.

The 400 Series, recognized for its high carbon content, offering excellent wear resistance, also showed strong performance, particularly in the automotive and appliance manufacturing industries.

The Duplex Series noted for its exceptional strength and resistance to stress corrosion cracking, is increasingly utilized in the oil & gas, chemical, and desalination industries, owing to its ability to withstand harsh environments. Collectively, these segments underscore the diverse applications and robust demand driving the stainless steel market forward.

Key Market Segments

By Type

- Austenitic Stainless Steels

- Martensitic Stainless Steels

- Ferritic Stainless Steels

- Precipitation Hard Stainless Steel

By Application

- Automotive and Transportation

- Building and Construction

- Heavy Industries

By Grades

- 200 Series

- 300 Series

- 400 Series

- Duplex Series

Growth Opportunity

Sustainable and Eco-Friendly Products

The global stainless steel market presents significant opportunities driven by a growing demand for sustainable and eco-friendly products. Stainless steel is recognized for its 100% recyclability, which positions it as a critical material in promoting a circular economy. The increased awareness and stringent environmental regulations are compelling industries to opt for materials with lower environmental impacts.

As a result, the adoption of stainless steel in various applications, from household items to industrial equipment, is anticipated to rise. The market is likely to see a surge in innovations aimed at enhancing the sustainability of stainless steel production processes, such as energy-efficient manufacturing techniques and waste minimization practices.

Growth in Construction and Infrastructure

Another pivotal factor contributing to the growth of the stainless steel market is the robust expansion of the construction and infrastructure sectors. Stainless steel's durability, corrosion resistance, and aesthetic appeal make it an ideal choice for various construction applications, including structural components, facades, and bridges. The ongoing urbanization and industrialization, particularly in emerging economies, are driving substantial investments in infrastructure projects. These projects require materials that offer longevity and minimal maintenance, further propelling the demand for stainless steel. Additionally, government initiatives aimed at modernizing infrastructure and building smart cities are expected to significantly boost market growth.

Latest Trends

Focus on Sustainability and Recycling

The stainless steel market is expected to witness a significant shift towards sustainability and recycling. This trend is driven by increasing environmental regulations and a growing awareness of the environmental impact of traditional steel production methods. The industry is likely to invest heavily in recycling technologies, aiming to reduce waste and lower carbon emissions. The adoption of circular economy principles will be prominent, with companies emphasizing the use of recycled stainless steel in their products. This focus not only meets regulatory requirements but also appeals to environmentally conscious consumers, enhancing brand reputation and market positioning.

Technological Advancements and Product Innovation

Technological advancements and product innovation will play a crucial role in shaping the stainless steel market. The integration of advanced manufacturing technologies, such as additive manufacturing and artificial intelligence, is expected to streamline production processes, enhance efficiency, and reduce costs. Innovations in alloy compositions and surface treatments will lead to the development of high-performance stainless steel products with superior corrosion resistance, strength, and durability. These advancements will cater to the growing demand in critical sectors such as aerospace, automotive, and construction, where the need for reliable and high-quality materials is paramount.

Regional Analysis

Asia Pacific dominates, holding 50% market's largest share in stainless steel.

The global Stainless Steel Market demonstrates varying growth trends across different regions, influenced by industrial applications and economic developments. In North America, the market is driven by high demand from the automotive and construction sectors, with the U.S. being a major contributor due to its robust industrial base. Europe follows, marked by significant consumption in Germany, France, and the UK, where the automotive and aerospace industries are primary consumers.

Asia Pacific dominates the market, accounting for approximately 50% of the global share, propelled by rapid industrialization and urbanization in China and India, coupled with significant investments in infrastructure and manufacturing sectors. In China alone, the stainless steel production capacity surpasses 30 million tons annually, reflecting its pivotal role in global supply chains. The Middle East & Africa region experiences moderate growth, driven by construction projects and the oil & gas sector, with the UAE and Saudi Arabia being key markets.

Latin America shows steady demand, particularly in Brazil and Mexico, where the stainless steel market is supported by the construction and automotive industries. The Asia Pacific region's dominance is further reinforced by favorable government policies and the availability of raw materials, establishing it as the leading market for stainless steel production and consumption.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global stainless steel market is poised for significant growth, driven by robust demand across various industries including construction, automotive, and consumer goods. Key players such as Acerinox S.A., Aperam Stainless Steel, and ArcelorMittal are anticipated to capitalize on this demand surge through strategic investments in technological advancements and production capabilities.

Acerinox S.A. and Aperam Stainless Steel are expected to leverage their extensive distribution networks and innovative product portfolios to strengthen their market positions. ArcelorMittal, renowned for its expansive global footprint, is likely to benefit from its vertically integrated operations and strong focus on sustainability initiatives, catering to the increasing demand for eco-friendly products.

Baosteel Group and Jindal Stainless Ltd are projected to maintain their competitive edge by expanding their manufacturing capacities and enhancing product quality. Their commitment to research and development is expected to yield advanced stainless steel solutions, meeting the evolving requirements of end-use industries.

Nippon Steel Corpo. and Outokumpu are expected to play pivotal roles in driving market innovation, with significant investments in new production technologies and smart manufacturing practices. POSCO and Yieh United Steel Corporation are anticipated to strengthen their market share through strategic collaborations and mergers, optimizing their supply chain efficiencies.

ThyssenKrupp Stainless GmbH and AK Steel Corporation are likely to focus on niche applications and specialized products to capture emerging market opportunities. JFE Steel Corporation, along with other key players, is expected to contribute to market growth through diversification strategies and customer-centric approaches, ensuring sustained competitiveness in the global stainless steel market.

Market Key Players

- Acerinox S.A

- Aperam Stainless Steel

- Acre lot Mittal

- Baosteel Group

- Jindal Stainless Ltd

- Nippon Steel Corp.

- Outolkumpu

- POSCO

- Yieh United Steel Corporation

- ThyssenKrupp Stainless GmbH

- AK Steel Corporation

- JFE Steel Corpo.

- Other Key Players

Recent Development

- In January 2024, it was reported that the European stainless steel market started the year with an optimistic outlook. The market is experiencing a surge in demand from the domestic industry despite being overwhelmed by imports from China. Local manufacturers are also increasing their purchase of raw materials from Russia to meet this demand.

- In January 2024, Jindal Stainless received regulatory approval for its merger with Jindal Stainless (Hisar) from the National Company Law Tribunal (NCLT). This merger aims to streamline operations and enhance the company's market position.

- In November 2023, Outokumpu, a major stainless steel producer, adjusted its production and pricing strategy in response to lower consumption and higher production levels. This move was influenced by decreasing production costs and a surplus in the market, leading to price reductions in December.

Report Scope

Report Features Description Market Value (2023) USD 132.6 Billion Forecast Revenue (2033) USD 270.8 Billion CAGR (2024-2032) 7.6% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Austenitic Stainless Steels, Martensitic Stainless Steels, Ferritic Stainless Steels, Precipitation Hard Stainless Steel), By Application (Automotive and Transportation, Building and Construction, Heavy Industries), By Grades (200 Series, 300 Series, 400 Series, Duplex Series) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Acerinox S.A, Aperam Stainless Steel, Acre lot Mittal, Baosteel Group, Jindal Stainless Ltd, Nippon Steel Corp., Outolkumpu, POSCO, Yieh United Steel Corporation, ThyssenKrupp Stainless GmbH, AK Steel Corporation, JFE Steel Corpo., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Acerinox S.A

- Aperam Stainless Steel

- Acre lot Mittal

- Baosteel Group

- Jindal Stainless Ltd

- Nippon Steel Corp.

- Outolkumpu

- POSCO

- Yieh United Steel Corporation

- ThyssenKrupp Stainless GmbH

- AK Steel Corporation

- JFE Steel Corpo.

- Other Key Players