Spine Surgery Robots Market By Method (Minimally Invasive, Open Surgery, By Component (Systems & Services, Instrument & Accessories), By Application (Laminectomy, Foraminotomy, Microdiscectomy, Kyphoplasty, Spinal fusion, Others),By End-user (Hospitals, Specialty Clinics, Ambulatory Surgical Centers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

47303

-

June 2024

-

136

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

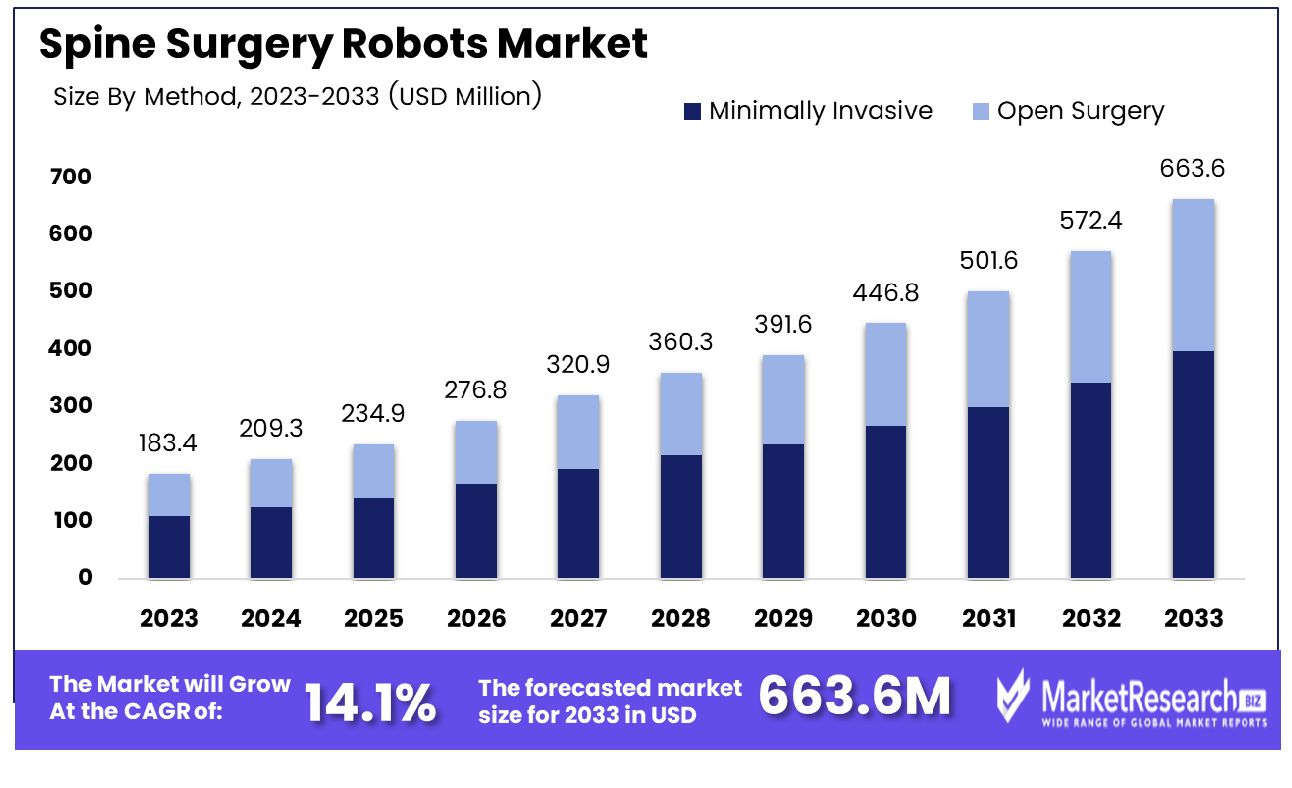

The Global Spine Surgery Robots Market was valued at USD 183.4 Mn in 2023. It is expected to reach USD 663.6 Mn by 2033, with a CAGR of 14.1% during the forecast period from 2024 to 2033.

The Spine Surgery Robots Market encompasses the development, production, and adoption of robotic systems designed to assist in spinal surgeries. These advanced robotic technologies enhance precision, reduce human error, and improve patient outcomes by providing surgeons with enhanced visualization, dexterity, and control. The market is driven by increasing incidences of spinal disorders, technological advancements, and a growing preference for minimally invasive surgical techniques. Key players in this market are innovating to offer integrated robotic solutions that streamline surgical procedures, reduce recovery times, and enhance overall efficiency in operating rooms, ultimately transforming the landscape of spine surgery.

The Spine Surgery Robots Market is poised for substantial growth, driven by the increasing prevalence of spinal disorders and a corresponding rise in the demand for advanced surgical interventions. With over 4.83 million spinal operations performed annually worldwide and 1.34 million in the United States alone, the need for precision and efficiency in spinal surgery is more pressing than ever. The advent of minimally invasive surgery (MIS) in 1987, marked by the first laparoscopic cholecystectomy, set the stage for significant innovations in surgical techniques, leading to the development of sophisticated robotic systems.

The Spine Surgery Robots Market is poised for substantial growth, driven by the increasing prevalence of spinal disorders and a corresponding rise in the demand for advanced surgical interventions. With over 4.83 million spinal operations performed annually worldwide and 1.34 million in the United States alone, the need for precision and efficiency in spinal surgery is more pressing than ever. The advent of minimally invasive surgery (MIS) in 1987, marked by the first laparoscopic cholecystectomy, set the stage for significant innovations in surgical techniques, leading to the development of sophisticated robotic systems.As technological advancements continue to accelerate, key players in the spine surgery robots market are focusing on integrating robotics with cutting-edge imaging and navigation technologies. This integration is expected to streamline surgical procedures, minimize recovery times, and optimize operating room efficiency. Moreover, the growing preference for MIS procedures, which are less invasive and offer quicker recovery compared to traditional open surgeries, is further propelling the adoption of robotic systems in spine surgery.

The market dynamics are also influenced by favorable regulatory landscapes and increasing investment in healthcare infrastructure, particularly in emerging economies. As the healthcare industry continues to prioritize patient-centric approaches and cost-effective solutions, the spine surgery robots market is anticipated to witness robust growth.

Key Takeaways

- Market Value: The Global Spine Surgery Robots Market was valued at USD 183.4 Mn in 2023. It is expected to reach USD 663.6 Mn by 2033, with a CAGR of 14.1% during the forecast period from 2024 to 2033.

- By Method: Minimally invasive procedures dominate the spine surgery robots market with 60% market share, reflecting a preference for less invasive surgical options that offer quicker recovery times.

- By Component: Systems & services lead the market with 55% share, driven by the high demand for advanced robotic systems and the accompanying maintenance and support services.

- By Application: Spinal fusion holds the largest share at 50%, highlighting its prevalence as a common and critical procedure in spinal surgeries.

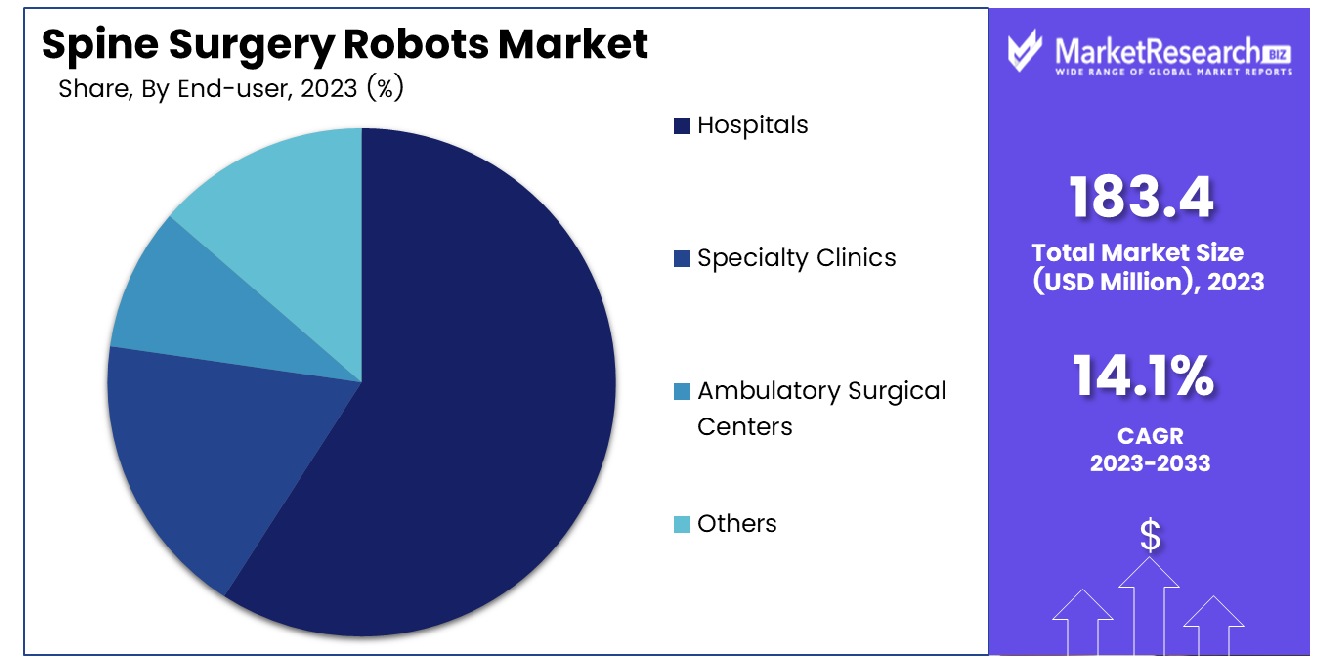

- By End-user: Hospitals account for 65% of the market, emphasizing their key role in adopting and utilizing advanced robotic technologies for spine surgeries.

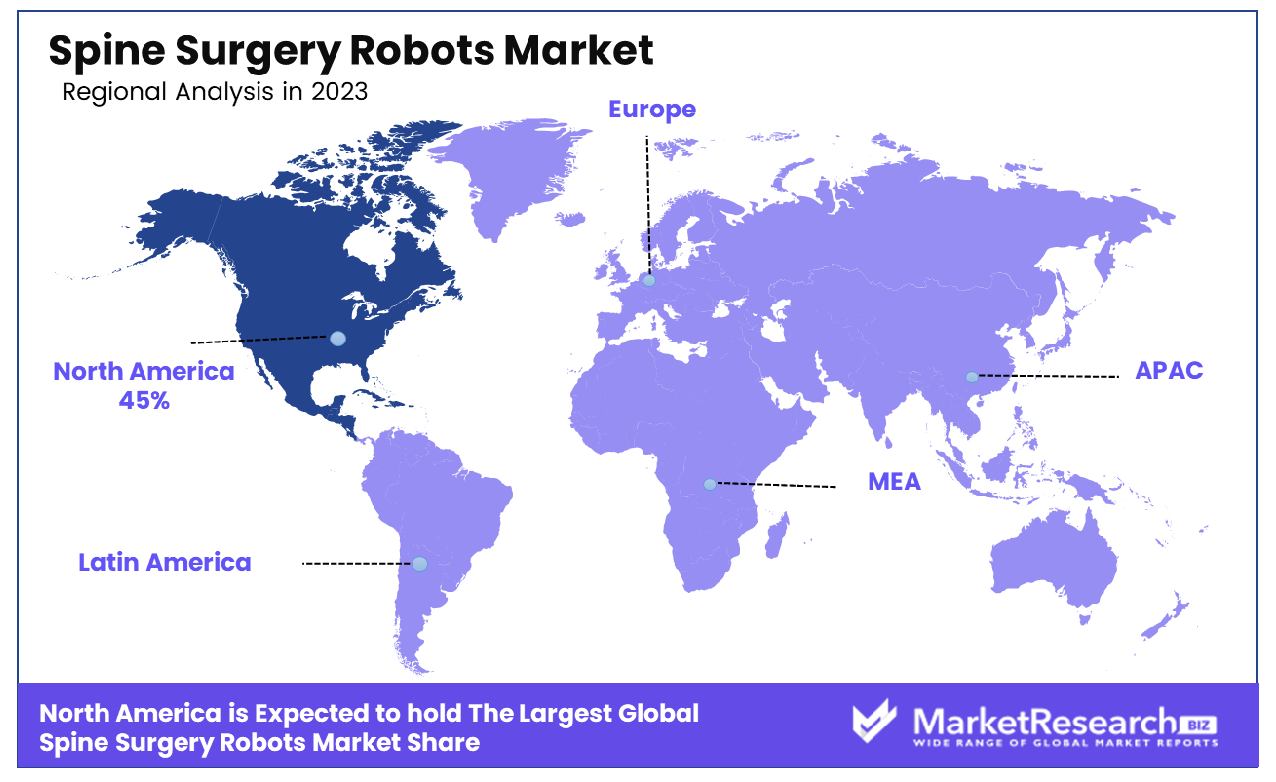

- Regional Dominance: North America dominates the spine surgery robots market with 45% share, reflecting the region's advanced healthcare infrastructure and high adoption rate of robotic technologies.

- Growth Opportunity: Expansion into ambulatory surgical centers presents a significant growth opportunity for spine surgery robots market, catering to the rising demand for outpatient spine procedures and enhancing accessibility to advanced surgical technologies.

Driving factors

Rising Complexity of Procedures

As medical technology advances, so does the complexity of spine surgeries. Conditions such as spinal deformities, degenerative disc diseases, and spinal tumors necessitate intricate surgical interventions. Conventional procedures often face limitations in addressing these complexities, leading to prolonged recovery times and higher risks for patients. Spine surgery robots offer precision and control, enabling surgeons to navigate through delicate anatomical structures with unparalleled accuracy. By incorporating robotics, surgeons can tackle even the most intricate procedures with enhanced dexterity and efficiency.

The rising complexity of procedures fuels the demand for spine surgery robots, as healthcare providers seek solutions that can optimize patient outcomes and minimize surgical risks.

Growing Adoption of Minimally Invasive Surgeries

Minimally invasive surgeries (MIS) have gained prominence in the field of spine surgery due to their numerous advantages over traditional open procedures. These techniques involve smaller incisions, reduced trauma to surrounding tissues, decreased blood loss, and faster recovery times for patients. As healthcare systems prioritize value-based care and patient-centric approaches, the demand for MIS continues to surge.

Spine surgery robots play a pivotal role in enhancing the feasibility and efficacy of minimally invasive techniques. Their advanced imaging capabilities and robotic assistance enable surgeons to perform complex maneuvers through tiny incisions with unprecedented precision. By facilitating MIS, spine surgery robots contribute to shorter hospital stays, decreased postoperative pain, and quicker return to daily activities for patients.

Restraining Factors

High Upfront Equipment and Maintenance Costs

The adoption of spine surgery robots is often hindered by the significant upfront investment required for purchasing and implementing the technology. The initial capital outlay for acquiring robotic systems, coupled with installation and training expenses, can pose financial challenges for healthcare institutions. Ongoing maintenance and service costs further contribute to the total cost of ownership, adding to the financial burden.

Despite these challenges, the value proposition offered by spine surgery robots lies in their potential to improve patient outcomes and operational efficiencies over the long term. Studies have shown that the precision and accuracy provided by robotic assistance can lead to fewer complications, reduced revision rates, and shorter hospital stays, ultimately translating into cost savings for healthcare providers. Stakeholders increasingly recognize the long-term benefits of investing in robotic platforms despite the initial cost barriers.

Difficulty in Automating Certain Procedures

Despite the capabilities of spine surgery robots, certain procedures present inherent challenges in terms of automation. The intricacies of spinal anatomy and the variability of patient conditions can pose obstacles to achieving full procedural automation. Tasks such as tissue manipulation, nerve identification, and decision-making based on intraoperative feedback require a level of human judgment and tactile sensitivity that current robotic systems struggle to replicate.

while complete automation may be elusive in certain cases, robotics can still augment surgeon capabilities and improve procedural outcomes through semi-autonomous assistance. By integrating advanced imaging modalities, real-time navigation algorithms, and intuitive user interfaces, spine surgery robots empower surgeons to perform complex maneuvers with greater precision and confidence.

By Method Analysis

Minimally invasive procedures dominate with 60% market share.

In 2023, Minimally Invasive techniques maintained a commanding market position in the By Method segment of the Spine Surgery Robots Market. Capturing over 60% of the market share, Minimally Invasive approaches demonstrated significant traction and preference among both healthcare providers and patients. This dominance underscores the growing acceptance and adoption of minimally invasive procedures within the realm of spine surgery.

The ascendancy of Minimally Invasive techniques signifies a paradigm shift in surgical methodologies, driven by advancements in robotic technologies and a collective pursuit of enhanced patient outcomes. With its emphasis on reduced trauma, shorter recovery times, and improved precision, Minimally Invasive approaches are reshaping the landscape of spine surgery.

Open Surgery techniques, while still relevant, faced challenges in maintaining market share amidst the burgeoning popularity of Minimally Invasive methods. As patients increasingly seek less invasive options with reduced post-operative complications, the demand for Open Surgery approaches has witnessed a relative decline.

By Component Analysis

Systems & services lead with 55% market share.

In 2023, Systems & Services emerged as the dominant force in the By Component segment of the Spine Surgery Robots Market, securing over 55% of the market share. This robust performance underscores the pivotal role played by comprehensive systems and associated services in driving the growth and functionality of spine surgery robotics.

Systems & Services encompass a broad spectrum of offerings, ranging from robotic surgical platforms to maintenance, training, and support services. Their prominence in the market reflects the increasing emphasis placed by healthcare providers on acquiring integrated solutions that optimize surgical workflows, enhance procedural efficiency, and ensure consistent patient outcomes.

Instrument & Accessories, while integral to the spine surgery robotics ecosystem, encountered stiff competition from the comprehensive solutions offered by Systems & Services. As healthcare facilities prioritize investments in cohesive robotic systems accompanied by tailored services, the demand for standalone instruments and accessories witnessed a proportionate decline.

By Application Analysis

Spinal fusion holds the largest share at 50%.

In 2023, Spinal Fusion emerged as the frontrunner in the By Application segment of the Spine Surgery Robots Market, seizing over 50% of the market share. This significant market dominance underscores the pivotal role played by robotic-assisted spinal fusion procedures in addressing a wide spectrum of spinal pathologies and degenerative conditions.

Spinal Fusion procedures, renowned for their efficacy in stabilizing the spine and alleviating symptoms associated with various spinal disorders, garnered considerable traction among healthcare providers and patients alike. The precision, control, and reproducibility offered by robotic systems have propelled spinal fusion to the forefront of spine surgery, enabling surgeons to achieve superior surgical outcomes and optimize patient recovery.

Laminectomy, Foraminotomy, Microdiscectomy, and Kyphoplasty, while vital components of the spine surgery repertoire, faced stiff competition from the dominant position held by Spinal Fusion in the market. While these procedures cater to specific spinal conditions and pathologies, the versatility and clinical utility of spinal fusion procedures have positioned them as the preferred choice for addressing a broader range of spinal disorders.

By End-user Analysis

Hospitals account for 65% of the market.

In 2023, Hospitals asserted their dominance in the By End-user segment of the Spine Surgery Robots Market, securing over 65% of the market share. This substantial market presence underscores the pivotal role played by hospitals as the primary providers of spine surgery services and the primary adopters of robotic-assisted surgical technologies.

Hospitals, with their comprehensive infrastructure, specialized medical staff, and robust patient referral networks, emerged as the preferred choice for spine surgery procedures utilizing robotic systems. The extensive resources available within hospital settings facilitate the integration of robotic technologies into surgical workflows, enabling healthcare providers to offer advanced treatment options and enhance patient care delivery.

Specialty Clinics, Ambulatory Surgical Centers, and other healthcare facilities, while contributing to the delivery of spine surgery services, faced formidable competition from the dominant position held by Hospitals in the market. The complex nature of spine surgery procedures, coupled with the high capital investment required for robotic systems, often favored larger hospital settings equipped with the necessary resources and patient volumes to support such technologies.

Key Market Segments

By Method

- Minimally Invasive

- Open Surgery

By Component

- Systems & Services

- Instrument & Accessories

By Application

- Laminectomy

- Foraminotomy

- Microdiscectomy

- Kyphoplasty

- Spinal fusion

- Others

By End-user

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Others

Growth Opportunity

Expanding Role in Minimally Invasive Surgeries

The increasing adoption of minimally invasive surgeries (MIS) represents a pivotal growth driver for the spine surgery robots market. As healthcare systems worldwide prioritize patient-centric approaches and value-based care, MIS techniques have emerged as preferred options for spine interventions.

The precision and control offered by robotic assistance are particularly advantageous in the realm of MIS, enabling surgeons to navigate complex anatomical structures with unprecedented accuracy. Market data reveals a substantial uptick in the utilization of spine surgery robots for minimally invasive procedures, underscoring the significant growth potential in this segment.

Addressing the Needs of Aging Populations

The demographic shift towards an aging population presents another compelling opportunity for market expansion. With a growing number of elderly individuals experiencing degenerative spinal conditions and age-related ailments, there is an escalating demand for advanced surgical interventions that can accommodate the unique needs of this demographic.

Spine surgery robots offer tailored solutions that cater to the complexities of geriatric patients, facilitating precise interventions with minimal tissue disruption and reduced postoperative complications. As the geriatric population continues to rise globally, the market for spine surgery robots is poised to witness sustained growth, driven by the imperative to deliver optimal outcomes for this demographic cohort.

Latest Trends

Advancements in Robotic Technology

One of the defining trends in the spine surgery robots market is the relentless pursuit of technological advancements. Manufacturers are investing heavily in research and development initiatives to enhance the capabilities of robotic systems, aiming to overcome existing limitations and push the boundaries of surgical precision. Advancements in artificial intelligence, machine learning, and real-time imaging are driving the evolution of spine surgery robots, empowering surgeons with unprecedented levels of accuracy and control.

These technological strides enable the customization of robotic platforms to address specific procedural challenges and patient needs, fostering a paradigm shift in the delivery of spinal interventions. Market data indicates a surge in investments in robotic innovation, reflecting the industry's commitment to staying at the forefront of medical technology.

Increased Awareness of Benefits

Another notable trend driving market dynamics is the heightened awareness of the benefits associated with spine surgery robots among healthcare providers, patients, and regulatory bodies. As clinical evidence continues to accumulate, demonstrating the efficacy and safety of robotic-assisted procedures, stakeholders are increasingly recognizing the value proposition offered by these technologies.

Surgeons are embracing robotics as valuable tools that augment their skills and improve patient outcomes, while patients are becoming more informed about the advantages of robotic-assisted surgeries, such as shorter recovery times and reduced risks. Regulatory authorities are responding to this growing awareness by streamlining approval processes and providing guidelines for the safe and effective use of spine surgery robots.

Regional Analysis

North America dominates spine surgery robots with 45% share.

North America continues to dominate the spine surgery robots market, commanding a substantial share of approximately 45%. This can be attributed to the high adoption rate of advanced medical technologies, coupled with well-established healthcare infrastructure and significant investments in research and development activities. The presence of key market players in this region further fuels the market growth.

Europe follows suit as a significant contributor to the spine surgery robots market. Countries like Germany, France, and the UK are witnessing rapid advancements in robotic-assisted surgical procedures, driven by supportive government initiatives and rising healthcare expenditure.

Asia Pacific emerges as a lucrative market for spine surgery robots, fueled by the growing healthcare infrastructure, increasing disposable income, and rising awareness about minimally invasive surgical procedures. Countries such as China, Japan, and India are witnessing a surge in demand for spine surgeries due to the rising prevalence of spinal disorders and a shift towards advanced treatment modalities.

Middle East & Africa and Latin America are experiencing steady growth in the adoption of spine surgery robots, albeit at a slower pace compared to other regions. Factors such as improving healthcare facilities, rising healthcare expenditure, and increasing awareness about the benefits of robotic-assisted surgeries are driving the market growth in these regions. However, challenges such as limited access to advanced medical technologies and stringent regulatory policies hinder the market expansion to some extent.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global Spine Surgery Robots Market showcases a landscape shaped by key players like Medtronic plc, Stryker, Zimmer Biomet, TransEnterix, Globus Medical, Inc., TINAVI Medical Technologies Co., Ltd., Point Robotics MedTech, Inc., NuVasive, Inc., CoreLink Surgical, Brainlab AG, Curexo, Inc., Accelus, Inc., and Synaptive Medical.

Analysts view these companies as pivotal contributors to the market's growth and innovation. Medtronic plc, a prominent player, leverages its extensive portfolio and robust R&D capabilities to offer cutting-edge robotic solutions for spine surgeries. Similarly, Stryker and Zimmer Biomet stand out for their advanced technological offerings and strong market presence, catering to the evolving needs of surgeons and patients worldwide.

TransEnterix, with its focus on robotic-assisted minimally invasive surgery, brings innovation to the market, enhancing surgical precision and patient outcomes. Globus Medical, Inc., known for its innovative spine implants and robotic-assisted platforms, continues to expand its market reach through strategic collaborations and product developments.

TINAVI Medical Technologies Co., Ltd., Point Robotics MedTech, Inc., and NuVasive, Inc., are also significant players driving market growth with their state-of-the-art robotic systems tailored for spine surgeries. CoreLink Surgical, Brainlab AG, Curexo, Inc., Accelus, Inc., and Synaptive Medical further contribute to market dynamics with their innovative technologies and strategic initiatives.

Market Key Players

- Medtronic plc

- Stryker

- Zimmer Biomet

- TransEnterix

- Globus Medical, Inc.

- TINAVI Medical Technologies Co., Ltd.

- Point Robotics MedTech, Inc.

- NuVasive, Inc.

- CoreLink Surgical

- Brainlab AG

- Curexo, Inc.

- Accelus, Inc.

- Synaptive Medical

Recent Development

- In June 2024, Viseon Inc. completes insider financing round, fueling 4K-ADV™ product development for open and minimally invasive surgery. 22% YTD growth in spine market. MaxView® 4K tech enhances safety and efficiency in OR.

- In May 2024, Medtronic plc pioneers low-cost robotic surgery with Hugo system and Mazor X Stealth spinal robot-assisted surgery device. Stryker Corporation focuses on orthopedic surgery with Mako robotic-arm-assisted surgery.

Report Scope

Report Features Description Market Value (2023) USD 183.4 Mn Forecast Revenue (2033) USD 663.6 Mn CAGR (2024-2033) 14.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Method (Minimally Invasive, Open Surgery, By Component (Systems & Services, Instrument & Accessories), By Application (Laminectomy, Foraminotomy, Microdiscectomy, Kyphoplasty, Spinal fusion, Others),By End-user (Hospitals, Specialty Clinics, Ambulatory Surgical Centers, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Medtronic plc, Stryker, Zimmer Biomet, TransEnterix, Globus Medical, Inc., TINAVI Medical Technologies Co., Ltd., Point Robotics MedTech, Inc., NuVasive, Inc., CoreLink Surgical, Brainlab AG, Curexo, Inc., Accelus, Inc., Synaptive Medical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Spine Surgery Robots Market Overview

- 2.1. Spine Surgery Robots Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Spine Surgery Robots Market Dynamics

- 3. Global Spine Surgery Robots Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Spine Surgery Robots Market Analysis, 2016-2021

- 3.2. Global Spine Surgery Robots Market Opportunity and Forecast, 2023-2032

- 3.3. Global Spine Surgery Robots Market Analysis, Opportunity and Forecast, By By Method, 2016-2032

- 3.3.1. Global Spine Surgery Robots Market Analysis by By Method: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Method, 2016-2032

- 3.3.3. Minimally Invasive

- 3.3.4. Open Surgery

- 3.4. Global Spine Surgery Robots Market Analysis, Opportunity and Forecast, By By Component, 2016-2032

- 3.4.1. Global Spine Surgery Robots Market Analysis by By Component: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Component, 2016-2032

- 3.4.3. Systems & Services

- 3.4.4. Instrument & Accessories

- 3.5. Global Spine Surgery Robots Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 3.5.1. Global Spine Surgery Robots Market Analysis by By Application: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 3.5.3. Laminectomy

- 3.5.4. Foraminotomy

- 3.5.5. Microdiscectomy

- 3.5.6. Kyphoplasty

- 3.5.7. Spinal fusion

- 3.5.8. Others

- 3.6. Global Spine Surgery Robots Market Analysis, Opportunity and Forecast, By By End-user, 2016-2032

- 3.6.1. Global Spine Surgery Robots Market Analysis by By End-user: Introduction

- 3.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-user, 2016-2032

- 3.6.3. Hospitals

- 3.6.4. Specialty Clinics

- 3.6.5. Ambulatory Surgical Centers

- 3.6.6. Others

- 4. North America Spine Surgery Robots Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Spine Surgery Robots Market Analysis, 2016-2021

- 4.2. North America Spine Surgery Robots Market Opportunity and Forecast, 2023-2032

- 4.3. North America Spine Surgery Robots Market Analysis, Opportunity and Forecast, By By Method, 2016-2032

- 4.3.1. North America Spine Surgery Robots Market Analysis by By Method: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Method, 2016-2032

- 4.3.3. Minimally Invasive

- 4.3.4. Open Surgery

- 4.4. North America Spine Surgery Robots Market Analysis, Opportunity and Forecast, By By Component, 2016-2032

- 4.4.1. North America Spine Surgery Robots Market Analysis by By Component: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Component, 2016-2032

- 4.4.3. Systems & Services

- 4.4.4. Instrument & Accessories

- 4.5. North America Spine Surgery Robots Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 4.5.1. North America Spine Surgery Robots Market Analysis by By Application: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 4.5.3. Laminectomy

- 4.5.4. Foraminotomy

- 4.5.5. Microdiscectomy

- 4.5.6. Kyphoplasty

- 4.5.7. Spinal fusion

- 4.5.8. Others

- 4.6. North America Spine Surgery Robots Market Analysis, Opportunity and Forecast, By By End-user, 2016-2032

- 4.6.1. North America Spine Surgery Robots Market Analysis by By End-user: Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-user, 2016-2032

- 4.6.3. Hospitals

- 4.6.4. Specialty Clinics

- 4.6.5. Ambulatory Surgical Centers

- 4.6.6. Others

- 4.7. North America Spine Surgery Robots Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.7.1. North America Spine Surgery Robots Market Analysis by Country : Introduction

- 4.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.7.2.1. The US

- 4.7.2.2. Canada

- 4.7.2.3. Mexico

- 5. Western Europe Spine Surgery Robots Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Spine Surgery Robots Market Analysis, 2016-2021

- 5.2. Western Europe Spine Surgery Robots Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Spine Surgery Robots Market Analysis, Opportunity and Forecast, By By Method, 2016-2032

- 5.3.1. Western Europe Spine Surgery Robots Market Analysis by By Method: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Method, 2016-2032

- 5.3.3. Minimally Invasive

- 5.3.4. Open Surgery

- 5.4. Western Europe Spine Surgery Robots Market Analysis, Opportunity and Forecast, By By Component, 2016-2032

- 5.4.1. Western Europe Spine Surgery Robots Market Analysis by By Component: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Component, 2016-2032

- 5.4.3. Systems & Services

- 5.4.4. Instrument & Accessories

- 5.5. Western Europe Spine Surgery Robots Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 5.5.1. Western Europe Spine Surgery Robots Market Analysis by By Application: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 5.5.3. Laminectomy

- 5.5.4. Foraminotomy

- 5.5.5. Microdiscectomy

- 5.5.6. Kyphoplasty

- 5.5.7. Spinal fusion

- 5.5.8. Others

- 5.6. Western Europe Spine Surgery Robots Market Analysis, Opportunity and Forecast, By By End-user, 2016-2032

- 5.6.1. Western Europe Spine Surgery Robots Market Analysis by By End-user: Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-user, 2016-2032

- 5.6.3. Hospitals

- 5.6.4. Specialty Clinics

- 5.6.5. Ambulatory Surgical Centers

- 5.6.6. Others

- 5.7. Western Europe Spine Surgery Robots Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.7.1. Western Europe Spine Surgery Robots Market Analysis by Country : Introduction

- 5.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.7.2.1. Germany

- 5.7.2.2. France

- 5.7.2.3. The UK

- 5.7.2.4. Spain

- 5.7.2.5. Italy

- 5.7.2.6. Portugal

- 5.7.2.7. Ireland

- 5.7.2.8. Austria

- 5.7.2.9. Switzerland

- 5.7.2.10. Benelux

- 5.7.2.11. Nordic

- 5.7.2.12. Rest of Western Europe

- 6. Eastern Europe Spine Surgery Robots Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Spine Surgery Robots Market Analysis, 2016-2021

- 6.2. Eastern Europe Spine Surgery Robots Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Spine Surgery Robots Market Analysis, Opportunity and Forecast, By By Method, 2016-2032

- 6.3.1. Eastern Europe Spine Surgery Robots Market Analysis by By Method: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Method, 2016-2032

- 6.3.3. Minimally Invasive

- 6.3.4. Open Surgery

- 6.4. Eastern Europe Spine Surgery Robots Market Analysis, Opportunity and Forecast, By By Component, 2016-2032

- 6.4.1. Eastern Europe Spine Surgery Robots Market Analysis by By Component: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Component, 2016-2032

- 6.4.3. Systems & Services

- 6.4.4. Instrument & Accessories

- 6.5. Eastern Europe Spine Surgery Robots Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 6.5.1. Eastern Europe Spine Surgery Robots Market Analysis by By Application: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 6.5.3. Laminectomy

- 6.5.4. Foraminotomy

- 6.5.5. Microdiscectomy

- 6.5.6. Kyphoplasty

- 6.5.7. Spinal fusion

- 6.5.8. Others

- 6.6. Eastern Europe Spine Surgery Robots Market Analysis, Opportunity and Forecast, By By End-user, 2016-2032

- 6.6.1. Eastern Europe Spine Surgery Robots Market Analysis by By End-user: Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-user, 2016-2032

- 6.6.3. Hospitals

- 6.6.4. Specialty Clinics

- 6.6.5. Ambulatory Surgical Centers

- 6.6.6. Others

- 6.7. Eastern Europe Spine Surgery Robots Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.7.1. Eastern Europe Spine Surgery Robots Market Analysis by Country : Introduction

- 6.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.7.2.1. Russia

- 6.7.2.2. Poland

- 6.7.2.3. The Czech Republic

- 6.7.2.4. Greece

- 6.7.2.5. Rest of Eastern Europe

- 7. APAC Spine Surgery Robots Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Spine Surgery Robots Market Analysis, 2016-2021

- 7.2. APAC Spine Surgery Robots Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Spine Surgery Robots Market Analysis, Opportunity and Forecast, By By Method, 2016-2032

- 7.3.1. APAC Spine Surgery Robots Market Analysis by By Method: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Method, 2016-2032

- 7.3.3. Minimally Invasive

- 7.3.4. Open Surgery

- 7.4. APAC Spine Surgery Robots Market Analysis, Opportunity and Forecast, By By Component, 2016-2032

- 7.4.1. APAC Spine Surgery Robots Market Analysis by By Component: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Component, 2016-2032

- 7.4.3. Systems & Services

- 7.4.4. Instrument & Accessories

- 7.5. APAC Spine Surgery Robots Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 7.5.1. APAC Spine Surgery Robots Market Analysis by By Application: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 7.5.3. Laminectomy

- 7.5.4. Foraminotomy

- 7.5.5. Microdiscectomy

- 7.5.6. Kyphoplasty

- 7.5.7. Spinal fusion

- 7.5.8. Others

- 7.6. APAC Spine Surgery Robots Market Analysis, Opportunity and Forecast, By By End-user, 2016-2032

- 7.6.1. APAC Spine Surgery Robots Market Analysis by By End-user: Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-user, 2016-2032

- 7.6.3. Hospitals

- 7.6.4. Specialty Clinics

- 7.6.5. Ambulatory Surgical Centers

- 7.6.6. Others

- 7.7. APAC Spine Surgery Robots Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.7.1. APAC Spine Surgery Robots Market Analysis by Country : Introduction

- 7.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.7.2.1. China

- 7.7.2.2. Japan

- 7.7.2.3. South Korea

- 7.7.2.4. India

- 7.7.2.5. Australia & New Zeland

- 7.7.2.6. Indonesia

- 7.7.2.7. Malaysia

- 7.7.2.8. Philippines

- 7.7.2.9. Singapore

- 7.7.2.10. Thailand

- 7.7.2.11. Vietnam

- 7.7.2.12. Rest of APAC

- 8. Latin America Spine Surgery Robots Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Spine Surgery Robots Market Analysis, 2016-2021

- 8.2. Latin America Spine Surgery Robots Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Spine Surgery Robots Market Analysis, Opportunity and Forecast, By By Method, 2016-2032

- 8.3.1. Latin America Spine Surgery Robots Market Analysis by By Method: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Method, 2016-2032

- 8.3.3. Minimally Invasive

- 8.3.4. Open Surgery

- 8.4. Latin America Spine Surgery Robots Market Analysis, Opportunity and Forecast, By By Component, 2016-2032

- 8.4.1. Latin America Spine Surgery Robots Market Analysis by By Component: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Component, 2016-2032

- 8.4.3. Systems & Services

- 8.4.4. Instrument & Accessories

- 8.5. Latin America Spine Surgery Robots Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 8.5.1. Latin America Spine Surgery Robots Market Analysis by By Application: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 8.5.3. Laminectomy

- 8.5.4. Foraminotomy

- 8.5.5. Microdiscectomy

- 8.5.6. Kyphoplasty

- 8.5.7. Spinal fusion

- 8.5.8. Others

- 8.6. Latin America Spine Surgery Robots Market Analysis, Opportunity and Forecast, By By End-user, 2016-2032

- 8.6.1. Latin America Spine Surgery Robots Market Analysis by By End-user: Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-user, 2016-2032

- 8.6.3. Hospitals

- 8.6.4. Specialty Clinics

- 8.6.5. Ambulatory Surgical Centers

- 8.6.6. Others

- 8.7. Latin America Spine Surgery Robots Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.7.1. Latin America Spine Surgery Robots Market Analysis by Country : Introduction

- 8.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.7.2.1. Brazil

- 8.7.2.2. Colombia

- 8.7.2.3. Chile

- 8.7.2.4. Argentina

- 8.7.2.5. Costa Rica

- 8.7.2.6. Rest of Latin America

- 9. Middle East & Africa Spine Surgery Robots Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Spine Surgery Robots Market Analysis, 2016-2021

- 9.2. Middle East & Africa Spine Surgery Robots Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Spine Surgery Robots Market Analysis, Opportunity and Forecast, By By Method, 2016-2032

- 9.3.1. Middle East & Africa Spine Surgery Robots Market Analysis by By Method: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Method, 2016-2032

- 9.3.3. Minimally Invasive

- 9.3.4. Open Surgery

- 9.4. Middle East & Africa Spine Surgery Robots Market Analysis, Opportunity and Forecast, By By Component, 2016-2032

- 9.4.1. Middle East & Africa Spine Surgery Robots Market Analysis by By Component: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Component, 2016-2032

- 9.4.3. Systems & Services

- 9.4.4. Instrument & Accessories

- 9.5. Middle East & Africa Spine Surgery Robots Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 9.5.1. Middle East & Africa Spine Surgery Robots Market Analysis by By Application: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 9.5.3. Laminectomy

- 9.5.4. Foraminotomy

- 9.5.5. Microdiscectomy

- 9.5.6. Kyphoplasty

- 9.5.7. Spinal fusion

- 9.5.8. Others

- 9.6. Middle East & Africa Spine Surgery Robots Market Analysis, Opportunity and Forecast, By By End-user, 2016-2032

- 9.6.1. Middle East & Africa Spine Surgery Robots Market Analysis by By End-user: Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-user, 2016-2032

- 9.6.3. Hospitals

- 9.6.4. Specialty Clinics

- 9.6.5. Ambulatory Surgical Centers

- 9.6.6. Others

- 9.7. Middle East & Africa Spine Surgery Robots Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.7.1. Middle East & Africa Spine Surgery Robots Market Analysis by Country : Introduction

- 9.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.7.2.1. Algeria

- 9.7.2.2. Egypt

- 9.7.2.3. Israel

- 9.7.2.4. Kuwait

- 9.7.2.5. Nigeria

- 9.7.2.6. Saudi Arabia

- 9.7.2.7. South Africa

- 9.7.2.8. Turkey

- 9.7.2.9. The UAE

- 9.7.2.10. Rest of MEA

- 10. Global Spine Surgery Robots Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Spine Surgery Robots Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Spine Surgery Robots Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Medtronic plc

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Stryker

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Zimmer Biomet

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. TransEnterix

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Globus Medical, Inc.

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. TINAVI Medical Technologies Co., Ltd.

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Point Robotics MedTech, Inc.

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. NuVasive, Inc.

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. CoreLink Surgical

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Brainlab AG

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. Curexo, Inc.

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. Synaptive Medical

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- 1. Executive Summary

-