Spa Market By Type (Club/Salon Spa, Hotel/Resort Spa, Medical Spa, Destination Spa, Day Spa, Thermal/Mineral Spring Spa), By Service Type (Massage Therapies, Facials, Body Treatments, Salon Services, Others), By End User (Men, Women), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

49346

-

July 2024

-

136

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

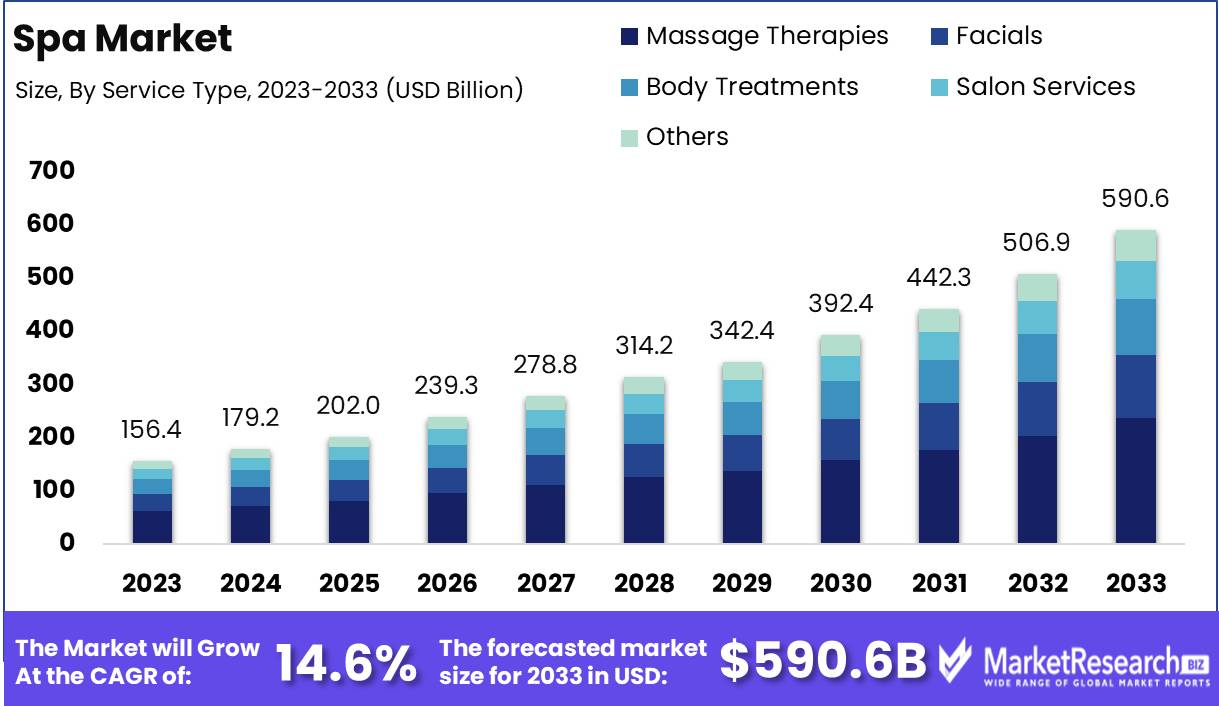

The Global Spa Market was valued at USD 156.4 Bn in 2023. It is expected to reach USD 590.6 Bn by 2033, with a CAGR of 14.6% during the forecast period from 2024 to 2033.

The spa market encompasses a broad array of services and treatments aimed at enhancing wellness, relaxation, and aesthetic appeal. This sector includes day spas, destination spas, medical spas, and resort spas offering a range of services such as massages, facials, body treatments, and hydrotherapy. The market is driven by rising consumer awareness of health and wellness, increasing disposable incomes, and a growing demand for personalized and luxurious experiences. Technological advancements and innovative treatments are continually evolving, contributing to the sector's dynamic growth and expansion.

The spa market is experiencing a dynamic growth trajectory, fueled by an increasing emphasis on wellness and self-care among consumers. The sector is characterized by a diverse range of offerings, from traditional massages and facials to advanced treatments and wellness experiences. One notable trend is the rising popularity of specialized massage techniques designed to reduce facial inflammation and puffiness by draining built-up toxins and waste. The demand for this treatment has surged, with search interest increasing by 83%, reflecting a broader consumer shift towards non-invasive, natural aesthetic solutions.

The spa market is experiencing a dynamic growth trajectory, fueled by an increasing emphasis on wellness and self-care among consumers. The sector is characterized by a diverse range of offerings, from traditional massages and facials to advanced treatments and wellness experiences. One notable trend is the rising popularity of specialized massage techniques designed to reduce facial inflammation and puffiness by draining built-up toxins and waste. The demand for this treatment has surged, with search interest increasing by 83%, reflecting a broader consumer shift towards non-invasive, natural aesthetic solutions.Additionally, the spa market is witnessing the integration of innovative wellness experiences, such as SpaSnow cabins. These cabins, chilled to minus 10 to 15 degrees Celsius, stimulate circulation and boost metabolism, providing a unique addition to luxury spas. The adoption of such treatments underscores the market's focus on offering differentiated and immersive experiences that cater to sophisticated consumer preferences.

The competitive landscape of the spa market is increasingly vibrant, with providers continuously seeking to enhance their service offerings and incorporate cutting-edge technologies. To maintain a competitive edge, spas must invest in staff training, adopt the latest wellness trends, and ensure a high level of service personalization. Digital platforms for marketing and customer engagement can drive brand loyalty and expand customer reach. As the spa market evolves, businesses must remain agile, embracing innovation and emerging consumer trends to capitalize on the growing demand for wellness and relaxation services.

Key Takeaways

- Market Value: The Global Spa Market was valued at USD 156.4 Bn in 2023. It is expected to reach USD 590.6 Bn by 2033, with a CAGR of 14.6% during the forecast period from 2024 to 2033.

- By Type: Day Spa services account for 30% of the market, offering convenience and accessibility for relaxation and wellness treatments.

- By Service Type: Massage Therapies lead with 40%, popular for their health benefits and stress relief.

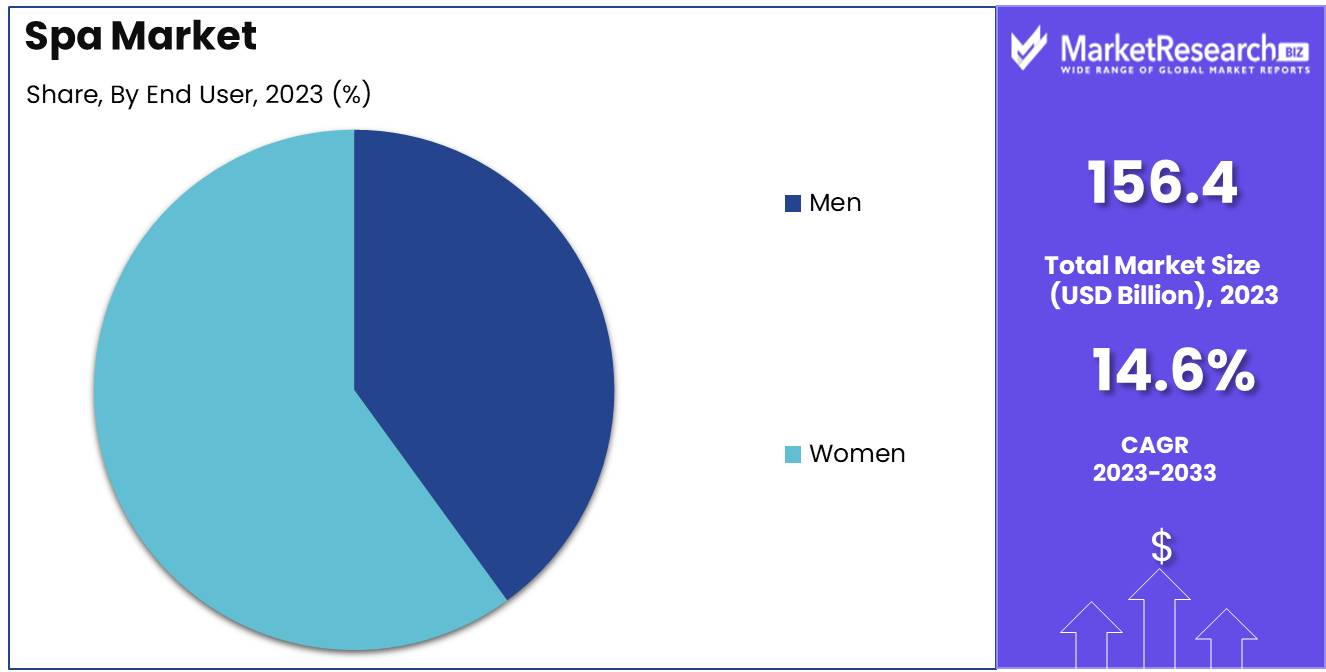

- By End User: Women are the predominant clients, making up 60% of spa visitors, driven by increasing health and wellness consciousness.

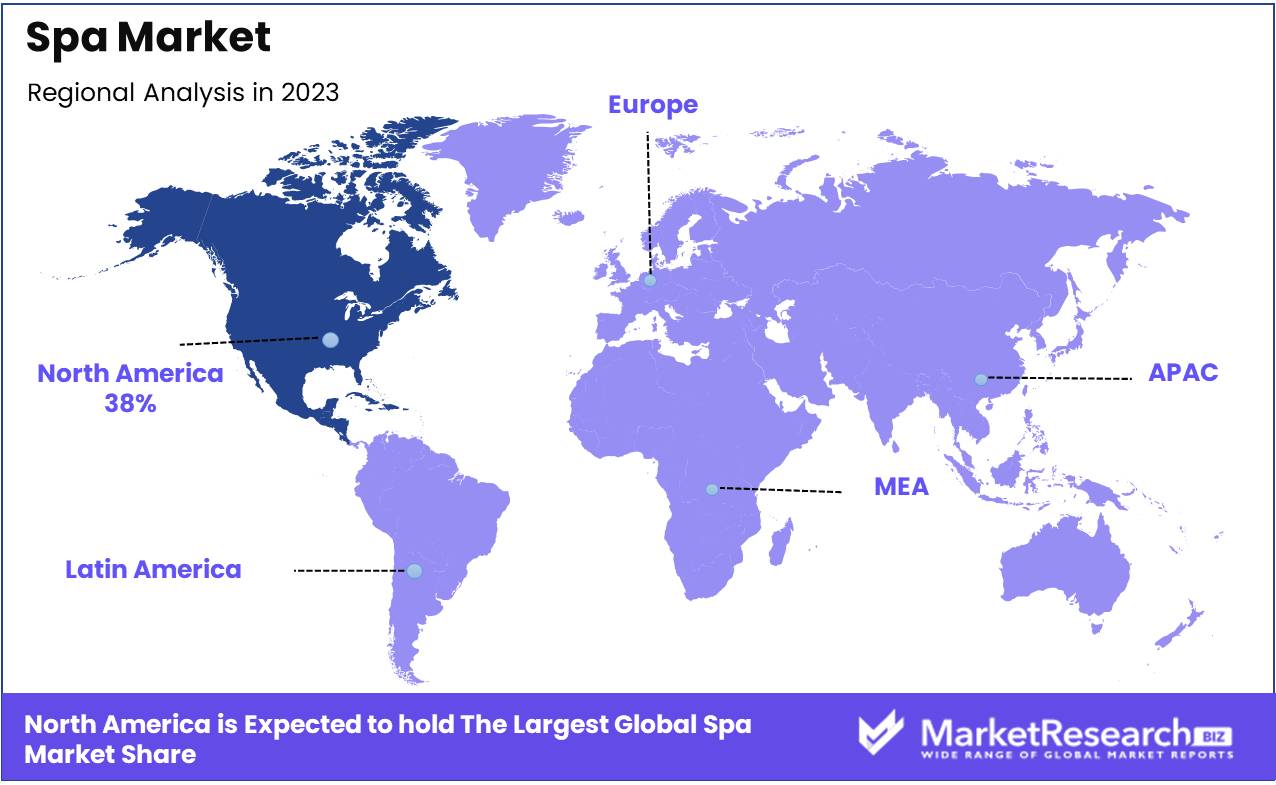

- Regional Dominance: North America holds 38% of the market, influenced by a strong wellness culture and high disposable income.

- Growth Opportunity: Developing personalized and wellness-focused spa programs can cater to the evolving consumer demands for customized health services.

Driving factors

Increasing Consumer Focus on Wellness and Self-Care

The spa market is experiencing robust growth driven by an increasing consumer focus on wellness and self-care. Modern lifestyles, characterized by high stress and fast-paced routines, have heightened awareness about the importance of mental and physical well-being. Consumers are now more willing to invest in experiences that promote relaxation, reduce stress, and improve overall health.

This shift towards holistic health is driving demand for spa services that offer therapeutic treatments, including massages, facials, and wellness therapies. The trend towards self-care is further amplified by social media, where wellness influencers and celebrities promote spa visits as essential for maintaining a balanced lifestyle.

Growing Disposable Incomes

The growth of the spa market is significantly bolstered by rising disposable incomes. As economies strengthen and individuals' purchasing power increases, consumers are more inclined to spend on luxury and discretionary services, including spa treatments. This financial capability allows a broader segment of the population to access and enjoy spa services, which were once considered exclusive to higher-income groups.

The willingness to spend on premium wellness experiences is driving the expansion of the spa market, with consumers seeking high-quality treatments and personalized services. This trend is particularly evident in emerging markets, where economic growth is creating new opportunities for the spa industry.

Restraining Factors

High Operational Costs

One of the significant restraining factors for the spa market is the high operational costs associated with running a spa. These costs include expenses for high-quality products, advanced equipment, skilled labor, and maintaining a luxurious and comfortable environment for clients. Additionally, spas often require significant investment in infrastructure, regular maintenance, and compliance with health and safety regulations.

The need for continuous innovation and the provision of a wide range of services to meet diverse customer demands further escalates costs. These financial burdens can be particularly challenging for smaller spas or new entrants in the market, potentially limiting their ability to compete and grow.

Economic Downturns Impacting Discretionary Spending

Economic downturns pose a considerable threat to the spa market by affecting discretionary spending. During periods of economic instability, consumers tend to prioritize essential expenditures over luxury services like spa treatments. This shift in spending behavior can lead to a significant decrease in spa visits, impacting the revenue streams of spa businesses.

The sensitivity of the spa market to economic fluctuations makes it vulnerable to downturns, as consumers cut back on non-essential services. This volatility can hinder the market's growth, as spas may struggle to attract and retain customers in uncertain economic conditions, leading to reduced profitability and potential closures.

By Type Analysis

In 2023, Day Spa held a dominant market position in the By Type segment of the Spa Market, capturing more than a 30% share.

In 2023, Day Spa held a dominant market position in the By Type segment of the Spa Market, capturing more than a 30% share. This dominance is driven by the increasing demand for accessible and convenient wellness services that cater to the busy lifestyles of consumers. Day spas offer a variety of treatments such as massages, facials, and body treatments that can be completed in a few hours, making them a popular choice for individuals seeking quick relaxation and rejuvenation.

Club/Salon Spa provides a mix of beauty and wellness services, often featuring fitness facilities and beauty treatments. While they cater to a dedicated clientele, their market share is smaller compared to day spas due to their specialized focus and membership-based access.

Hotel/Resort Spa offers luxury spa experiences to travelers and guests, combining relaxation with hospitality. Despite their appeal, their market share is less than day spas because of their higher costs and the limited frequency of visits by the general population.

Medical Spa integrates medical treatments with traditional spa services, focusing on cosmetic procedures and therapeutic treatments. Although growing in popularity, their market share is modest compared to day spas due to the specialized nature of their services and higher prices.

Destination Spa provides comprehensive wellness programs and retreats, often requiring longer stays. Their market share is smaller compared to day spas due to the commitment and higher cost involved in such extended wellness retreats.

Thermal / Mineral cosmetics Spring Spa utilizes natural mineral waters for therapeutic treatments. While valued for their unique offerings, their market share is limited compared to day spas due to geographic restrictions and niche market appeal.

By Service Type Analysis

In 2023, Massage Therapies held a dominant market position in the By Service Type segment of the Spa Market, capturing more than a 40% share.

In 2023, Massage Therapies held a dominant market position in the By Service Type segment of the Spa Market, capturing more than a 40% share. The prominence of massage therapies is driven by their effectiveness in relieving stress, reducing pain, and promoting overall wellness. The increasing awareness of the benefits of massage, coupled with a growing interest in holistic health practices, supports the high demand for these services. Additionally, the availability of various types of massage therapies, including Swedish, deep tissue, and hot stone massages, caters to a wide range of customer preferences and needs.

Facials are also a significant segment, offering skincare treatments that address various skin concerns such as aging, acne, and hydration. While popular, their market share is smaller compared to massage therapies due to the more specific nature of their benefits.

Body Treatments encompass services like body scrubs, wraps, and detox treatments, aiming to rejuvenate and exfoliate the skin. Despite their appeal, their market share is less dominant compared to massage therapies due to their more specialized focus.

Salon Services include hair, nail, and cosmetic treatments, often integrated within spa settings. Although essential for beauty maintenance, their market share is smaller compared to therapeutic services like massages due to their different target audience.

Others encompass a variety of wellness and relaxation services such as aromatherapy, hydrotherapy, and yoga sessions. While they contribute to the overall spa experience, their collective market share is modest compared to the core services of massage therapies and facials.

By End User Analysis

In 2023, Women held a dominant market position in the By End User segment of the Spa Market, capturing more than a 60% share.

In 2023, Women held a dominant market position in the By End User segment of the Spa Market, capturing more than a 60% share. This dominance is driven by the high demand for wellness and beauty services among women, who are more likely to seek spa treatments for relaxation, skincare, and overall well-being. The increasing focus on self-care, coupled with higher disposable incomes, contributes to the significant market share of women in the spa industry.

Men are also an important segment, with a growing number of men seeking spa services for stress relief, skincare, and grooming. While the market share of men is increasing, it remains smaller compared to women due to traditional gender norms and less targeted marketing.

Key Market Segments

By Type

- Club/Salon Spa

- Hotel/Resort Spa

- Medical Spa

- Destination Spa

- Day Spa

- Thermal/Mineral Spring Spa

By Service Type

- Massage Therapies

- Facials

- Body Treatments

- Salon Services

- Others

By End User

- Men

- Women

Growth Opportunity

Development of Specialized Wellness Treatments

The development of specialized wellness treatments presents a significant growth opportunity for the global spa market in 2024. As consumers become more discerning and wellness-focused, there is a growing demand for personalized and niche treatments that cater to specific health and wellness needs. Innovations in this area include treatments targeting mental health, such as stress relief and mindfulness therapies, as well as physical wellness, including advanced skincare, anti-aging treatments, and detox programs.

By offering specialized services, spas can differentiate themselves in a competitive market, attract a more diverse clientele, and command premium pricing, thereby boosting their revenue streams and market share.

Expansion of Medical and Therapeutic Spas

The expansion of medical and therapeutic spas is another promising opportunity for the spa market in 2024. Medical spas combine traditional spa services with medical treatments, such as dermatology, physiotherapy equipment, and cosmetic procedures, administered under the supervision of healthcare professionals. This hybrid model appeals to consumers seeking comprehensive wellness solutions that address both aesthetic and health concerns.

The growing emphasis on preventive healthcare and holistic wellness is driving the demand for such integrated services. By expanding into the medical and therapeutic spa segment, businesses can tap into a new market of health-conscious consumers looking for reliable, medically supervised treatments, enhancing their credibility and profitability.

Latest Trends

Integration of Technology for Personalized Spa Experiences

The integration of advanced technology to provide personalized spa experiences is a leading trend in the global spa market for 2024. Spas are increasingly utilizing data analytics, artificial intelligence (AI), and Internet of Things (IoT) devices to tailor treatments to individual customer needs. Personalized wellness plans, created using data from wearable devices and health apps, allow spas to offer customized therapies that target specific health goals and preferences.

Virtual reality (VR) and augmented reality (AR) technologies are being used to enhance relaxation experiences and provide immersive wellness environments. This technological advancement not only improves customer satisfaction by offering bespoke services but also increases operational efficiency and helps in retaining a loyal customer base.

Rising Popularity of Eco-Friendly and Sustainable Spa Practices

The rising popularity of eco-friendly and sustainable spa practices is another significant trend shaping the spa market in 2024. Consumers are becoming more environmentally conscious and prefer businesses that prioritize sustainability. Spas are responding by adopting green practices, such as using organic and natural products, implementing energy-efficient systems, and reducing waste through recycling and sustainable sourcing.

Eco-friendly design elements, such as natural lighting, water conservation measures, and the use of renewable materials, are also becoming standard in new spa constructions. By embracing sustainability, spas can attract a growing segment of eco-conscious consumers and enhance their brand image as responsible and ethical businesses.

Regional Analysis

In 2023, North America dominated the Spa Market, capturing 38% of the market share.

North America’s dominance is driven by the high demand for wellness and relaxation services, particularly in the United States and Canada with 38% of the market share. The region benefits from a well-established spa industry, with a wide range of services including luxury, medical, and day spas. The increasing focus on health and wellness, coupled with high disposable incomes and the growing popularity of holistic treatments, supports the strong market position. The presence of major spa chains and the rising trend of wellness tourism further enhance North America's leading market share.

Europe follows closely, driven by its rich spa heritage and a strong focus on wellness tourism. Countries such as Germany, France, and Italy are key players, with a high number of thermal and mineral spring spas. The emphasis on preventive healthcare and a growing aging population seeking therapeutic treatments contribute to Europe’s significant market share.

Asia Pacific is experiencing rapid growth in the spa market, fueled by increasing disposable incomes, urbanization, and a rising middle class in countries. The region's rich traditions in wellness and alternative medicine, combined with the booming tourism industry, support the expanding market.

Middle East & Africa show promising potential, supported by rising investments in the hospitality and wellness sectors. The increasing number of luxury resorts and the growth of wellness tourism contribute to market development.

Latin America is emerging as a growing market for spas, with Brazil and Mexico leading the demand. The region benefits from a rising awareness of health and wellness, an expanding middle class, and an increase in tourism activities.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global spa market in 2024 is experiencing robust growth driven by increasing consumer demand for wellness and relaxation. Key players such as Woodhouse Spas, Hand & Stone Franchise Corp., The Ritz-Carlton Spa, and Mandara Spa are leading this expansion.

Woodhouse Spas excels in offering a consistent, high-quality spa experience across its franchises, capitalizing on the growing trend of self-care and wellness. Their focus on providing a luxurious yet accessible spa experience ensures a broad customer base. Hand & Stone Franchise Corp. continues to expand its footprint with a franchise model that emphasizes affordability and convenience, attracting a diverse clientele seeking regular wellness treatments.

The Ritz-Carlton Spa sets the standard for luxury spa services, leveraging the Ritz-Carlton brand’s reputation for excellence. Their exclusive offerings and bespoke treatments cater to high-end consumers, ensuring a premium spa experience. Mandara Spa, with its origins in Bali, integrates traditional and modern therapies, appealing to consumers seeking authentic and holistic wellness experiences.

AYANA Hospitality and Royal Champagne Hotel & Spa focus on providing unique, destination spa experiences. Their emphasis on combining luxurious accommodations with world-class spa facilities attracts discerning travelers seeking comprehensive wellness retreats. Banyan Tree Hotels & Resorts continues to lead with its signature blend of Asian-inspired treatments and eco-conscious practices, appealing to environmentally aware consumers.

Miraval Group and Mandarin Oriental Hotel Group emphasize holistic wellness, offering integrated programs that combine physical, mental, and spiritual well-being. Their comprehensive wellness offerings cater to consumers seeking transformative spa experiences. Four Seasons Hotels Limited maintains its leadership in the luxury spa segment, providing personalized services and exclusive treatments that enhance their brand’s prestige.

Market Key Players

- Woodhouse Spas

- Hand & Stone Franchise Corp.

- The Ritz-Carlton Spa

- Mandara Spa

- AYANA Hospitality

- Royal Champagne Hotel & Spa

- Banyan Tree Hotels & Resorts

- Miraval Group

- Mandarin Oriental Hotel Group

- Four Seasons Hotels Limited

Recent Development

- In May 2024, Marriott International expanded its spa services with wellness-focused treatments, targeting health-conscious consumers and enhancing guest experience.

- In April 2024, Hilton launched a new line of eco-friendly spa products, aligning with sustainability goals and attracting environmentally conscious clientele.

Report Scope

Report Features Description Market Value (2023) USD 156.4 Bn Forecast Revenue (2033) USD 590.6 Bn CAGR (2024-2033) 14.6% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Club/Salon Spa, Hotel/Resort Spa, Medical Spa, Destination Spa, Day Spa, Thermal/Mineral Spring Spa), By Service Type (Massage Therapies, Facials, Body Treatments, Salon Services, Others), By End User (Men, Women) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Woodhouse Spas, Hand & Stone Franchise Corp., The Ritz-Carlton Spa, Mandara Spa, AYANA Hospitality, Royal Champagne Hotel & Spa, Banyan Tree Hotels & Resorts, Miraval Group, Mandarin Oriental Hotel Group, Four Seasons Hotels Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Woodhouse Spas

- Hand & Stone Franchise Corp.

- The Ritz-Carlton Spa

- Mandara Spa

- AYANA Hospitality

- Royal Champagne Hotel & Spa

- Banyan Tree Hotels & Resorts

- Miraval Group

- Mandarin Oriental Hotel Group

- Four Seasons Hotels Limited