Silanes Market By Product (Alkyl Silane, Sulfur Silane, Amino Silane, Vinyl Silane, Epoxy Silane, Methacrylate Silane, Mono/Chloro Silane, Other Products) By Application (Paints & Coatings, Adhesives & Sealants, Rubber & Plastics, Fiber Treatment, Electronics & Semiconductor, Other Applications), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

39703

-

July 2023

-

179

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

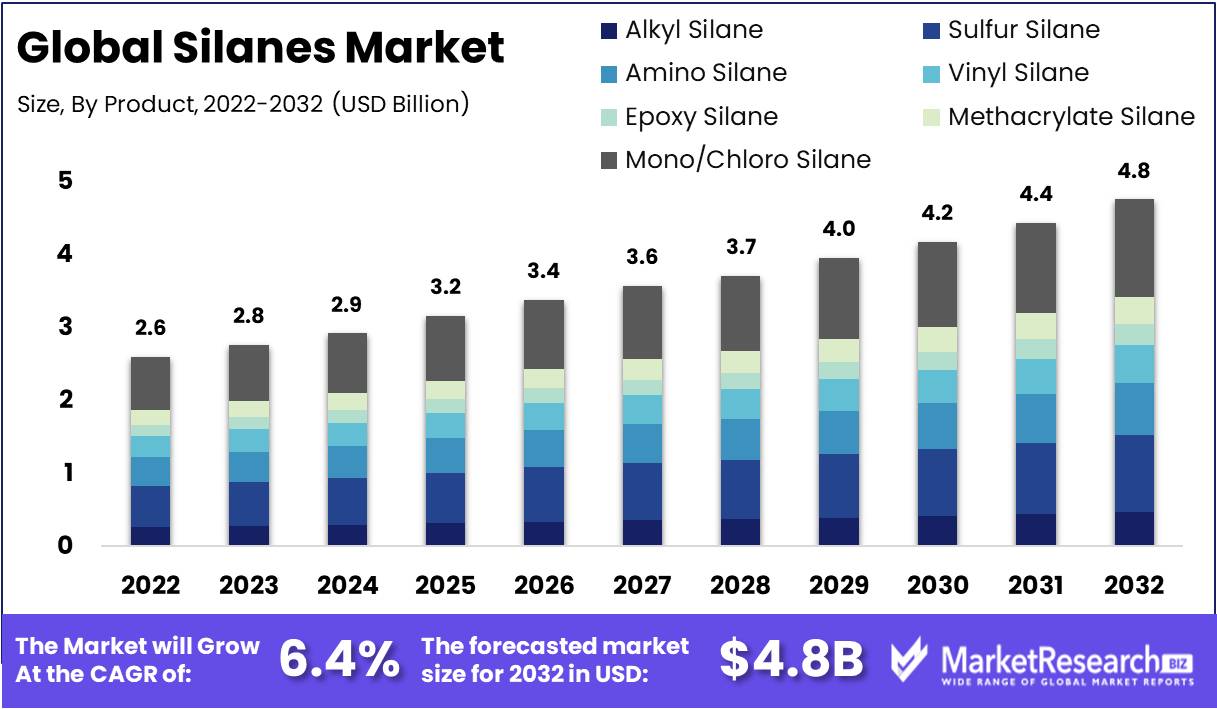

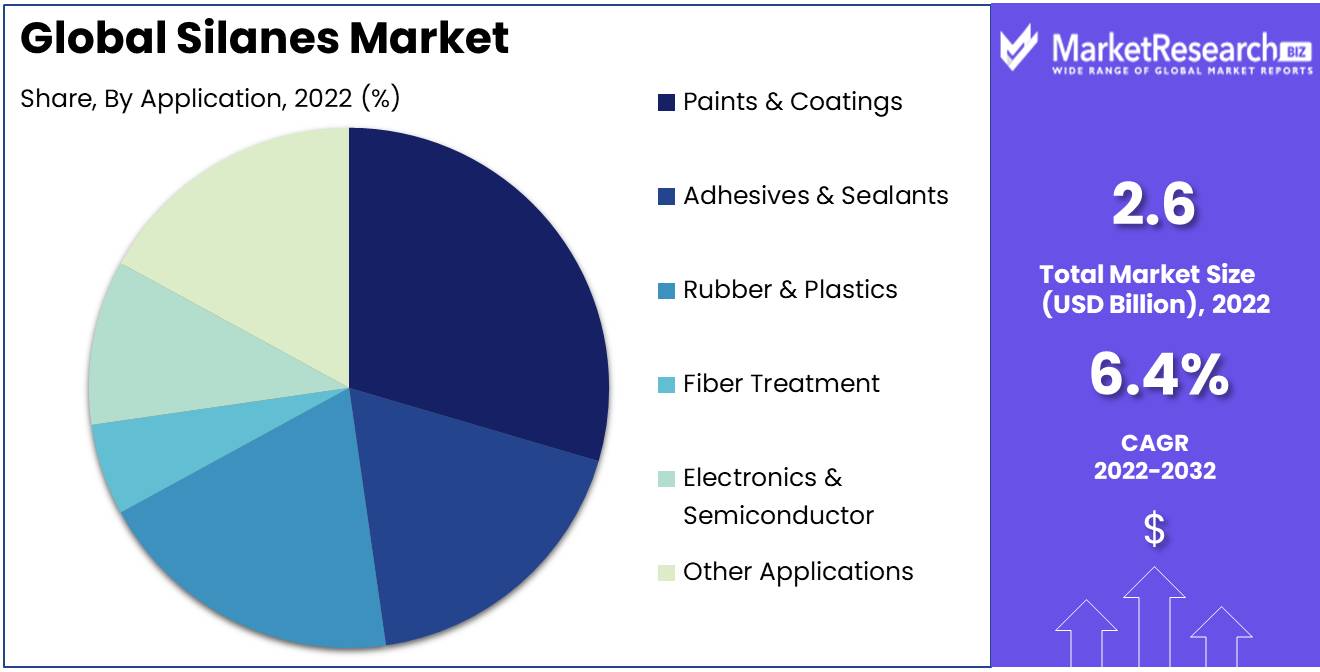

Silanes Market size is expected to be worth around USD 4.8 Bn by 2032 from USD 2.6 Bn in 2022, growing at a CAGR of 6.4% during the forecast period from 2023 to 2032.

In recent years, the silanes market has experienced a phenomenal expansion as industries have realized their significance and advantages. Here, we embark on a journey to unravel the complexities of this market by examining its many facets, diverse applications, and potential to reshape numerous industries. Prepare for an enthralling journey through the complex world of silanes.

So, what are these silanes exactly? They are mesmerizing chemical marvels in which a central silicon atom dances in harmony with numerous organic companions. Their adaptability and originality qualify them as transformative agents, influencing a variety of products and services in unanticipated ways.

Behold! As we enter the domain of the silanes market, we encounter a tapestry of significant innovations that have propelled this market to new heights. Nanotechnology, that wondrous domain of the infinitesimal, has unlocked novel opportunities, allowing silanes market to perform their enchantment as functionalizing agents in the production of astounding nanomaterials. Observe the emergence of robust composite materials, which have had their properties enhanced and their potential unlocked.

However, there is more! The silanes market has attracted the interest of numerous industries, resulting in an investment mania. The automotive industry has submitted to the power of silanes by incorporating them into tire compounds, thereby bestowing increased traction, decreased rolling resistance, and unmatched performance. Not to be surpassed, the construction industry has embraced the silanes market in coatings and sealants, reinforcing structures with unyielding durability and water-repellency.

The expansion and applications of the silanes market are comparable to a symphony, with each industry performing its own melody. Due to their harmonious compatibility and cell-adhesive charms, silanes are woven into the healthcare industry's cadence, where they are used to create medical implants and drug delivery systems. In the field of electronics, silanes market conducts their ethereal orchestra as dielectric layers, surface modifiers, and adhesion promoters. Observe as they ascend into the heavens, making their way into solar panels and energy storage systems in the limitless domain of energy, thereby elevating efficiency and performance to celestial heights.

However, we must not lose perspective of our moral compass amidst this awe-inspiring spectacle. The emergence of the silanes market is accompanied by ethical concerns that require our attention. We keep a close watch on the horizon of transparency, with a desire for explicability and a demand for accountability. To tame any latent dangers associated with these enigmatic compounds, proper handling, disposal, and compliance with safety protocols must take center stage.

Driving Factors

Increasing Demand for Adhesion Promoters and Coupling Agents

On the silanes market, the demand for adhesion promoters and coupling agents has increased dramatically. These compounds are essential to numerous industries, including the automotive, construction, and electronics sectors. The demand for adhesion promoters and coupling agents in these industries has skyrocketed as the need for improved performance and durability continues to rise.

Growth of Industries such as Automotive, Construction, and Electronics

The demand for high-performance vehicles has increased the demand for innovative materials and technologies in the automotive industry. In automotive coatings, adhesives, and sealants, the silanes market plays a crucial role in providing superior adhesion, corrosion resistance, and durability. As the automotive industry continues to develop and flourish, the demand for silanes is anticipated to increase steadily.

Advancements in Material Science and Surface Treatment Technologies

The growth and expansion of the silanes market have resulted from continuous advancements in material science and surface treatment technologies. Researchers and scientists are continuously searching for new methods to enhance the material properties and surface functionalities, which drives the demand for innovative silanes.

Expansion of Silicone and Rubber Industries

The growth of the silicone and rubber industries has contributed significantly to the expansion of the silanes market. Silicones and rubber products are utilized extensively in numerous industries, such as construction, automotive, healthcare, and consumer goods. Silanes play a crucial role in enhancing the functionality and efficacy of these materials.

Restraining Factors

Potential Toxicity and Environmental Concerns

The silanes market is vital to numerous industries, from automotive to construction. However, despite their numerous benefits, it is essential to consider the potential market restraints associated with their use. One of the major concerns is the potential for toxicity and environmental impact.

Regulatory Restrictions and Compliance Requirements

In the ever-changing environment of chemical regulations, it is crucial for companies operating in the silanes market to maintain a thorough understanding of regulatory restrictions and compliance requirements. These regulations guarantee the safety of products and the protection of human health and the environment. Failure to comply with these stringent regulations may result in fines and other legal repercussions.

Potential Challenges in Silane Synthesis and Stability

Silane synthesis is a complicated procedure that requires skill and accuracy. Frequently, manufacturers face obstacles associated with the synthesis and stability of the silanes market. The chemical reactions involved in silane production are delicate, and variables such as temperature, pressure, and catalysts can have a significant impact on the final product. It is essential for the successful application of silanes to maintain their purity and stability throughout their lifecycle.

The Threat of Competition from Alternative Chemical Agents

Although silanes have demonstrated their efficacy in a variety of applications, they encounter stiff competition from other chemical agents. Frequently, these competing substances possess distinctive properties or provide more cost-effective options. Manufacturers operating in the silanes market must perpetually innovate in order to remain competitive, offering enhanced customer performance and value.

Product Analysis

In recent years, the silanes market has experienced significant growth, with the mono/chloro silane segment leading the way. Silanes are a class of compounds that contain silicon atoms bonded to organic groups, and they have a wide range of industrial applications. The mono/chloro silane segment has emerged as the dominant force within the silanes market, propelling the expansion and development of this industry.

The economic growth of emerging societies is one of the primary contributors to the dominance of the mono/chloro silane segment. These societies have experienced rapid industrialization and infrastructure growth, resulting in an increase in silanes market demand. Due to their versatility and extensive range of applications, mono/chloro silanes have become the material of choice for many industries in these economies. The increasing demand for improved building materials, automotive parts, and electronic devices in these emerging economies has fuelled the growth of the mono/chloro silane market.

The consumer trend and behavior toward the mono/chloro silanes market also contribute significantly to their market dominance. In order to improve efficacy and durability, consumers are increasingly turning to mono- and poly-layers. Consumers are intrigued by the ability of these compounds to enhance the adhesion, stability, and weather resistance of coatings, paints, and adhesives. In addition, the increasing demand for eco-friendly and sustainable products has fuelled the growth of the mono/chloro silanes market, as these chemicals are known for their low toxicity and sustainability.

Application Analysis

The paint and coatings sector has emerged as the dominant participant in the silanes market. This segment has applicability in a variety of industries, including the automotive, construction, and consumer goods sectors. In paints and coatings, the adaptability and performance-enhancing properties of silanes have led to their pervasive use.

Similar to the mono/chloro silane segment, economic development in emerging economies plays a significant role in propelling paint and coatings adoption in the silanes market. The rapid growth of urbanization and infrastructure development in these economies has increased the demand for paints and coatings of superior quality. The capacity to improve the performance of a product is a key factor in the success of any business. In emerging economies, the construction industry has experienced significant development, resulting in an increase in demand for high-performance paints and coatings.

Consumer trends and behavior also contribute to the segment's dominance in the silanes market. Consumers are increasingly interested in paints and coatings that provide not only visual appeal but also resistance to severe environmental conditions. Silanes are regarded as ideal additives for paints and coatings due to their capacity to improve adhesion, weather resistance, and surface properties. In addition, growing awareness of the environmental impact of conventional paints and coatings has led to a transition toward eco-friendly alternatives, which has further fueled the demand for silane-based products in this market segment.

Key Market Segments

By Product

- Alkyl Silane

- Sulfur Silane

- Amino Silane

- Vinyl Silane

- Epoxy Silane

- Methacrylate Silane

- Mono/Chloro Silane

- Other Products

By Application

- Paints & Coatings

- Adhesives & Sealants

- Rubber & Plastics

- Fiber Treatment

- Electronics & Semiconductor

- Other Applications

Growth Opportunity

Development of Novel and Functional Silane Derivatives

The development of novel and functional silane derivatives presents a tremendous opportunity for growth in the silanes market. Silane derivatives with enhanced functionalities, including enhanced adhesion, durability, and corrosion resistance, are in high demand across numerous industries. Manufacturers who invest in R&D to create innovative silane-based solutions can obtain a competitive advantage and access new market segments.

Expansion into Emerging Markets with Infrastructure Development

Emerging markets, fueled by infrastructure development and accelerated industrialization, offer a fertile environment for the expansion of the silanes market. Increasing urbanization and construction activities in these regions necessitate the use of resilient, high-performance materials. With their superior bonding properties and resistance to degradation, silanes are indispensable in such applications.

Collaboration with Manufacturers and End Users for Customized Solutions

Another growth opportunity in the silanes market is collaboration with manufacturers and end consumers. Through close collaboration, manufacturers can comprehend the unique needs and obstacles of their consumers. This enables them to develop tailored solutions to suit their specific needs.

Adoption of Green and Sustainable Silane Manufacturing Practices

As environmental concerns increase, the silanes market is experiencing a transition toward green and sustainable production methods. Manufacturers are increasingly implementing eco-friendly processes in an effort to reduce their carbon footprint and hazardous chemical usage. Investment in sustainable manufacturing practices not only aligns with global sustainability objectives but also improves brand reputation and consumer confidence.

Latest Trends

Growth of Silanes in Adhesive and Sealant Applications

In recent years, the adhesive and sealant industry has experienced significant growth, with Silanes Market playing a crucial role in improving the efficacy of these products. Silane adhesion promoters function as a bridge between the substrate and the adhesive, thereby enhancing the bond's strength and durability. Their exceptional ability to establish strong chemical bonds with diverse surfaces, including metals, glass, and ceramics, renders them indispensable in this industry. In addition, Silanes Market offer exceptional resistance to moisture, temperature, and chemicals, thereby extending the durability of adhesive and sealant applications. As the adhesive and sealant market continues to grow, silanes are anticipated to be in high demand.

Demand for Silane Based Coatings and Surface Treatments

In recent years, the use of silanes in coatings and surface treatments has acquired tremendous momentum. Silanes Market function as coupling agents, enhancing the compatibility of organic and inorganic substances. This improves adhesion, hydration, and dispersibility, resulting in enhanced coating performance. In addition, silanes exhibit exceptional corrosion resistance, UV protection, and water repellency, making them ideal for a variety of applications, including architectural coatings, automotive coatings, and industrial coatings. Increasing demand for sustainable and high-performance coatings has fuelled the adoption of silane-based solutions, thereby driving the expansion of the silane market in this segment.

Utilization of Silanes in Rubber and Tire Industries

Due to their ability to improve the properties of rubber compounds and the performance of tires, Silanes Market are widely utilized in the rubber and tire industries. Silane coupling agents are essential for reinforcing additives, such as carbon black and silica, with the rubber matrix, resulting in enhanced tear strength, abrasion resistance, and dynamic properties. This results in the creation of high-performance tires with improved traction, fuel efficiency, and durability. In addition, Silanes Market contributes to the reduction of rolling resistance, resulting in decreased energy consumption and carbon emissions. In the future years, the demand for silanes is anticipated to be fueled by the ongoing development of the rubber and tire industries.

Rise of Silane Modified Polymers and Hybrid Materials

Due to their exceptional properties and numerous applications, silane-modified polymers and hybrid materials have acquired tremendous popularity. Silane functionalization permits the incorporation of organic and inorganic components, resulting in enhanced adhesion, flexibility, and strength in the materials. These hybrid materials are utilized in a variety of industries, including construction, automotive, electronics, and healthcare. For example, silane-modified adhesives and sealants are extensively used in the construction industry for bonding and sealing purposes due to their exceptional durability, weather resistance, and flexibility. The adaptability of silane-modified polymers and hybrid materials has propelled their market growth and further broadened the Silanes Market's scope across numerous industries.

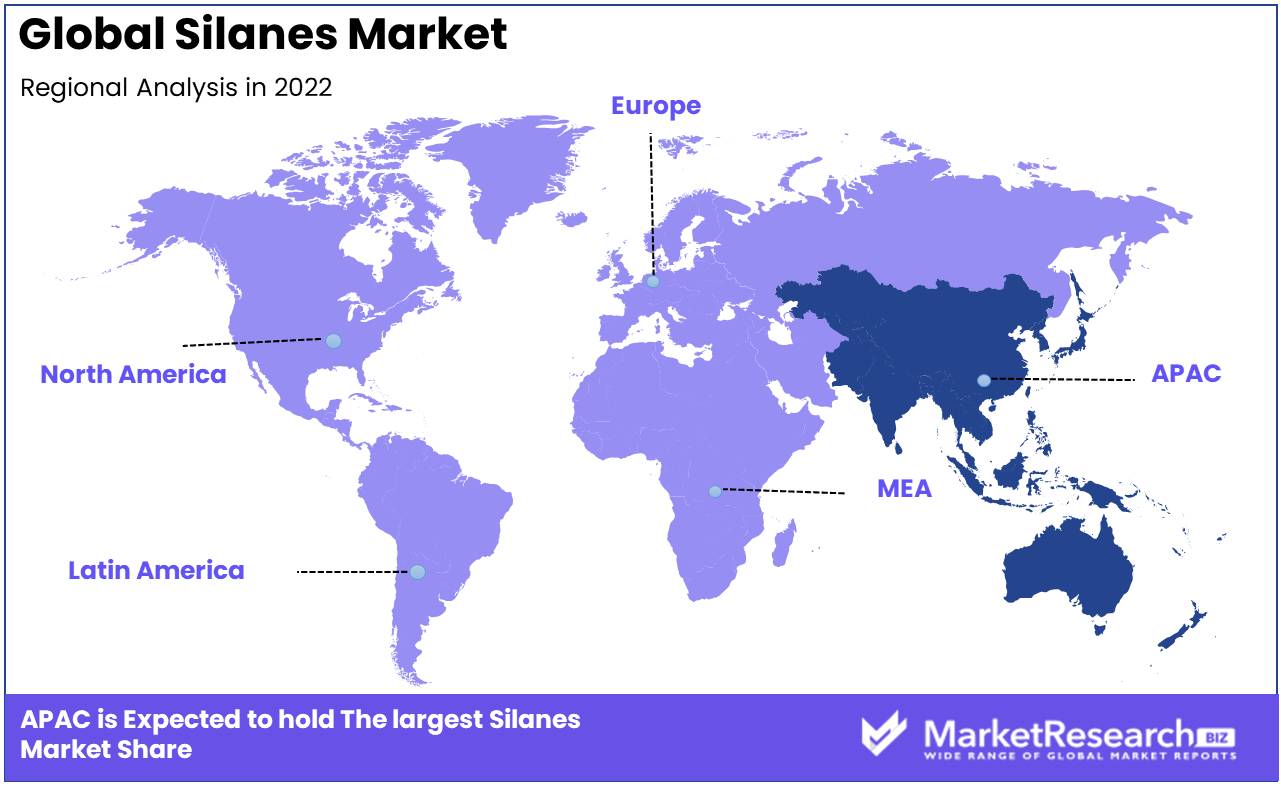

Regional Analysis

The Asia-Pacific region continues to dominate the global silanes market, exhibiting a remarkable growth trajectory that shows no sign of abating. Due to their diverse properties and broad range of applications, silanes, a key class of specialty chemicals, have become a crucial component in numerous industries. In industries such as automotive, construction, electronics, and energy, the silanes market has emerged as a game-changer due to their exceptional adhesive, water-repellent, and strengthening properties.

In recent years, the Asia-Pacific region's manufacturing capabilities and technological advancements have significantly increased, propelling it to the vanguard of the global market. Multiple factors, including robust infrastructure development, increasing urbanization, rising disposable incomes, and a growing population, contribute to the region's remarkable growth. These factors have resulted in a flourishing demand for silanes, which has contributed to Asia-Pacific's dominance in the silanes market.

China, the undisputed powerhouse of the Asia-Pacific region, is a leader in the production and utilization of silanes. The country's remarkable manufacturing capabilities and constant technological advances have propelled it to become the world's largest silanes market. China's robust automotive, construction, and electronics industries, which rely largely on silanes, have increased demand for these specialty chemicals. In addition, China's government initiatives promoting urban development and infrastructure projects have bolstered the growth of the silanes market, creating lucrative opportunities for both domestic and international participants.

Japan is another major force in the Asia-Pacific region. Japan, a nation renowned for its technological prowess and excellence, has consistently adopted innovation and leads the silanes industry in terms of research and development. Japanese firms have been at the forefront of the development of cutting-edge silanes with enhanced functionalities, catering to the ever-evolving requirements of various industries. Japan's commitment to sustainability and emphasis on eco-friendly products have contributed to the increase in demand for silanes.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Companies such as Dalian F.T.Z CREDIT Chemical Technology Development Co. Ltd., Denka Company Limited, GELEST INC., Linde, LINGGAS LTD., and Dalian Resourcea Co.Ltd. have introduced expertise and innovations to the silanes market, which is undergoing a period of transformation. Their contributions to the industry have not only contributed to its expansion but have also had an impact on other industrial sectors. As these key actors continue to innovate and raise the bar, the future of the silanes market appears bright, with innumerable opportunities for expansion.

On the silanes market, Dalian F.T.Z CREDIT Chemical Technology Development Co., Ltd. is well-known for its extensive selection of high-quality silanes and related chemical products. With an unwavering commitment to research and development, they consistently provide cutting-edge solutions to meet the evolving needs of industries around the globe. Their expertise extends beyond silanes to functional polysiloxanes, organosilicon lubricants, and resins, allowing them to offer customers comprehensive solutions.

Denka Company Limited is a globally recognized leader in the production of advanced silanes market and functional materials, serving a vast array of industries, including the automotive, electronics, construction, and healthcare sectors. Denka's silanes market offers superior performance, enhancing a variety of applications such as adhesives, coatings, and sealants by virtue of their extraordinary quality standards. Denka seeks to achieve sustainable growth and contribute to the creation of materials that enhance the quality of life through its ongoing research and development efforts.

GELEST INC., a pioneering company in the field of silanes and metal-organics, has contributed significantly to the development of the silanes market. Industries such as electronics, energy, and pharmaceuticals have been transformed by their innovative technologies and customized solutions. GELEST's dedication to producing high-purity silanes and functional materials has earned them a stellar reputation. By focusing on research and development, they remain at the forefront of innovation, continually introducing new products and applications to satisfy their customers' evolving needs.

LINGGAS LTD is a significant player in the silanes market, specializing in the production of monosilane gas of the highest purity. The semiconductor industry makes extensive use of monosilane gas, which plays a crucial role in the production of thin-film transistors, solar cells, and other electronic components. The commitment of LINGGAS to quality and dependability has made them a top choice among semiconductor manufacturers around the world. Their dedication to continuous development and technological progress positions them as one of the industry's top providers of innovative solutions.

Top Key Players in Silanes Market

- Dalian F.T.Z CREDIT Chemical Technology Development Co. Ltd.

- Denka Company Limited

- GELEST INC.

- Linde

- LINGGAS LTD.

- Dalian Resourcea Co.Ltd.

- abcr GmbH

- Qufu Chenguang Chemical Co.Ltd.

- Air Liquide

- Air Products and Chemicals Inc.

- The Chemical Company

- ENF Ltd.

- Thomas Publishing Company

- Matheson Tri-Gas Inc.

- NANJING UNION SILICON CHEMICAL CO.LTD.

- SK materials Co.Ltd.

- Praxair Technology Inc.

- Shin-Etsu Chemical Co. Ltd.

Recent Development

- In 2023, in an effort to redefine silane applications in the construction industry, Wacker Chemie introduced an innovative line of silanes tailored to the industry's specific needs. These advanced silanes are poised to revolutionize construction processes by increasing durability, optimizing performance, and reducing overall costs due to their improved functionalities and properties. This revolutionary release demonstrates Wacker Chemie's dedication to advancing progress and innovation in the silanes market.

- In 2022, Momentive Performance Materials has announced a significant expansion of its domestic production capacity for silanes. This expansion is in response to the increasing demand for silanes. This strategic move aims to meet escalating market demands and guarantee a steady supply of high-quality silanes for diverse industries, including the automotive, electronics, and coatings sectors. Momentive Performance Materials seeks to consolidate its position as the leading provider of cutting-edge silanes on the silanes market by expanding its manufacturing capabilities.

- In 2021, Evonik Industries, a global leader in specialty chemicals, and Dow Chemical Company, a multinational corporation, have joined forces to advance silane technology. Both companies intend to develop innovative silane products with enhanced performance characteristics, enhanced sustainability, and expanded application possibilities by combining their respective expertise and resources. This partnership exemplifies the industry's dedication to fostering development and exploring new frontiers in the silanes market.

Report Scope

Report Features Description Market Value (2022) USD 2.6 Bn Forecast Revenue (2032) USD 4.8 Bn CAGR (2023-2032) 6.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Alkyl Silane, Sulfur Silane, Amino Silane, Vinyl Silane, Epoxy Silane, Methacrylate Silane, Mono/Chloro Silane, Other Products)

By Application (Paints & Coatings, Adhesives & Sealants, Rubber & Plastics, Fiber Treatment, Electronics & Semiconductor, Other Applications)Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Dalian F.T.Z CREDIT Chemical Technology Development Co. Ltd., Denka Company Limited, GELEST INC., Linde, LINGGAS LTD., Dalian Resourcea Co.Ltd., abcr GmbH, Qufu Chenguang Chemical Co.Ltd., Air Liquide, Air Products and Chemicals Inc., The Chemical Company, ENF Ltd., Thomas Publishing Company, Matheson Tri-Gas Inc., NANJING UNION SILICON CHEMICAL CO.LTD., SK materials Co.Ltd., Praxair Technology Inc., Shin-Etsu Chemical Co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Silanes Market Overview

- 2.1. Silanes Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Silanes Market Dynamics

- 3. Global Silanes Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Silanes Market Analysis, 2016-2021

- 3.2. Global Silanes Market Opportunity and Forecast, 2023-2032

- 3.3. Global Silanes Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 3.3.1. Global Silanes Market Analysis By Product: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 3.3.3. Alkyl Silane

- 3.3.4. Sulfur Silane

- 3.3.5. Amino Silane

- 3.3.6. Vinyl Silane

- 3.3.7. Epoxy Silane

- 3.3.8. Methacrylate Silane

- 3.3.9. Mono/Chloro Silane

- 3.4. Global Silanes Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 3.4.1. Global Silanes Market Analysis By Application: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 3.4.3. Paints & Coatings

- 3.4.4. Adhesives & Sealants

- 3.4.5. Rubber & Plastics

- 3.4.6. Fiber Treatment

- 3.4.7. Electronics & Semiconductor

- 3.4.8. Other Applications

- 4. North America Silanes Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Silanes Market Analysis, 2016-2021

- 4.2. North America Silanes Market Opportunity and Forecast, 2023-2032

- 4.3. North America Silanes Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 4.3.1. North America Silanes Market Analysis By Product: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 4.3.3. Alkyl Silane

- 4.3.4. Sulfur Silane

- 4.3.5. Amino Silane

- 4.3.6. Vinyl Silane

- 4.3.7. Epoxy Silane

- 4.3.8. Methacrylate Silane

- 4.3.9. Mono/Chloro Silane

- 4.4. North America Silanes Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 4.4.1. North America Silanes Market Analysis By Application: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 4.4.3. Paints & Coatings

- 4.4.4. Adhesives & Sealants

- 4.4.5. Rubber & Plastics

- 4.4.6. Fiber Treatment

- 4.4.7. Electronics & Semiconductor

- 4.4.8. Other Applications

- 4.5. North America Silanes Market Analysis, Opportunity and Forecast, By Country, 2016-2032

- 4.5.1. North America Silanes Market Analysis by Country : Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country, 2016-2032

- 4.5.2.1. The US

- 4.5.2.2. Canada

- 4.5.2.3. Mexico

- 5. Western Europe Silanes Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Silanes Market Analysis, 2016-2021

- 5.2. Western Europe Silanes Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Silanes Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 5.3.1. Western Europe Silanes Market Analysis By Product: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 5.3.3. Alkyl Silane

- 5.3.4. Sulfur Silane

- 5.3.5. Amino Silane

- 5.3.6. Vinyl Silane

- 5.3.7. Epoxy Silane

- 5.3.8. Methacrylate Silane

- 5.3.9. Mono/Chloro Silane

- 5.4. Western Europe Silanes Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 5.4.1. Western Europe Silanes Market Analysis By Application: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 5.4.3. Paints & Coatings

- 5.4.4. Adhesives & Sealants

- 5.4.5. Rubber & Plastics

- 5.4.6. Fiber Treatment

- 5.4.7. Electronics & Semiconductor

- 5.4.8. Other Applications

- 5.5. Western Europe Silanes Market Analysis, Opportunity and Forecast, By Country, 2016-2032

- 5.5.1. Western Europe Silanes Market Analysis by Country : Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country, 2016-2032

- 5.5.2.1. Germany

- 5.5.2.2. France

- 5.5.2.3. The UK

- 5.5.2.4. Spain

- 5.5.2.5. Italy

- 5.5.2.6. Portugal

- 5.5.2.7. Ireland

- 5.5.2.8. Austria

- 5.5.2.9. Switzerland

- 5.5.2.10. Benelux

- 5.5.2.11. Nordic

- 5.5.2.12. Rest of Western Europe

- 6. Eastern Europe Silanes Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Silanes Market Analysis, 2016-2021

- 6.2. Eastern Europe Silanes Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Silanes Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 6.3.1. Eastern Europe Silanes Market Analysis By Product: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 6.3.3. Alkyl Silane

- 6.3.4. Sulfur Silane

- 6.3.5. Amino Silane

- 6.3.6. Vinyl Silane

- 6.3.7. Epoxy Silane

- 6.3.8. Methacrylate Silane

- 6.3.9. Mono/Chloro Silane

- 6.4. Eastern Europe Silanes Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 6.4.1. Eastern Europe Silanes Market Analysis By Application: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 6.4.3. Paints & Coatings

- 6.4.4. Adhesives & Sealants

- 6.4.5. Rubber & Plastics

- 6.4.6. Fiber Treatment

- 6.4.7. Electronics & Semiconductor

- 6.4.8. Other Applications

- 6.5. Eastern Europe Silanes Market Analysis, Opportunity and Forecast, By Country, 2016-2032

- 6.5.1. Eastern Europe Silanes Market Analysis by Country : Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country, 2016-2032

- 6.5.2.1. Russia

- 6.5.2.2. Poland

- 6.5.2.3. The Czech Republic

- 6.5.2.4. Greece

- 6.5.2.5. Rest of Eastern Europe

- 7. APAC Silanes Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Silanes Market Analysis, 2016-2021

- 7.2. APAC Silanes Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Silanes Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 7.3.1. APAC Silanes Market Analysis By Product: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 7.3.3. Alkyl Silane

- 7.3.4. Sulfur Silane

- 7.3.5. Amino Silane

- 7.3.6. Vinyl Silane

- 7.3.7. Epoxy Silane

- 7.3.8. Methacrylate Silane

- 7.3.9. Mono/Chloro Silane

- 7.4. APAC Silanes Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 7.4.1. APAC Silanes Market Analysis By Application: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 7.4.3. Paints & Coatings

- 7.4.4. Adhesives & Sealants

- 7.4.5. Rubber & Plastics

- 7.4.6. Fiber Treatment

- 7.4.7. Electronics & Semiconductor

- 7.4.8. Other Applications

- 7.5. APAC Silanes Market Analysis, Opportunity and Forecast, By Country, 2016-2032

- 7.5.1. APAC Silanes Market Analysis by Country : Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country, 2016-2032

- 7.5.2.1. China

- 7.5.2.2. Japan

- 7.5.2.3. South Korea

- 7.5.2.4. India

- 7.5.2.5. Australia & New Zeland

- 7.5.2.6. Indonesia

- 7.5.2.7. Malaysia

- 7.5.2.8. Philippines

- 7.5.2.9. Singapore

- 7.5.2.10. Thailand

- 7.5.2.11. Vietnam

- 7.5.2.12. Rest of APAC

- 8. Latin America Silanes Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Silanes Market Analysis, 2016-2021

- 8.2. Latin America Silanes Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Silanes Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 8.3.1. Latin America Silanes Market Analysis By Product: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 8.3.3. Alkyl Silane

- 8.3.4. Sulfur Silane

- 8.3.5. Amino Silane

- 8.3.6. Vinyl Silane

- 8.3.7. Epoxy Silane

- 8.3.8. Methacrylate Silane

- 8.3.9. Mono/Chloro Silane

- 8.4. Latin America Silanes Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 8.4.1. Latin America Silanes Market Analysis By Application: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 8.4.3. Paints & Coatings

- 8.4.4. Adhesives & Sealants

- 8.4.5. Rubber & Plastics

- 8.4.6. Fiber Treatment

- 8.4.7. Electronics & Semiconductor

- 8.4.8. Other Applications

- 8.5. Latin America Silanes Market Analysis, Opportunity and Forecast, By Country, 2016-2032

- 8.5.1. Latin America Silanes Market Analysis by Country : Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country, 2016-2032

- 8.5.2.1. Brazil

- 8.5.2.2. Colombia

- 8.5.2.3. Chile

- 8.5.2.4. Argentina

- 8.5.2.5. Costa Rica

- 8.5.2.6. Rest of Latin America

- 9. Middle East & Africa Silanes Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Silanes Market Analysis, 2016-2021

- 9.2. Middle East & Africa Silanes Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Silanes Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 9.3.1. Middle East & Africa Silanes Market Analysis By Product: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 9.3.3. Alkyl Silane

- 9.3.4. Sulfur Silane

- 9.3.5. Amino Silane

- 9.3.6. Vinyl Silane

- 9.3.7. Epoxy Silane

- 9.3.8. Methacrylate Silane

- 9.3.9. Mono/Chloro Silane

- 9.4. Middle East & Africa Silanes Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 9.4.1. Middle East & Africa Silanes Market Analysis By Application: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 9.4.3. Paints & Coatings

- 9.4.4. Adhesives & Sealants

- 9.4.5. Rubber & Plastics

- 9.4.6. Fiber Treatment

- 9.4.7. Electronics & Semiconductor

- 9.4.8. Other Applications

- 9.5. Middle East & Africa Silanes Market Analysis, Opportunity and Forecast, By Country, 2016-2032

- 9.5.1. Middle East & Africa Silanes Market Analysis by Country : Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country, 2016-2032

- 9.5.2.1. Algeria

- 9.5.2.2. Egypt

- 9.5.2.3. Israel

- 9.5.2.4. Kuwait

- 9.5.2.5. Nigeria

- 9.5.2.6. Saudi Arabia

- 9.5.2.7. South Africa

- 9.5.2.8. Turkey

- 9.5.2.9. The UAE

- 9.5.2.10. Rest of MEA

- 10. Global Silanes Market Analysis, Opportunity and Forecast, By Region, 2016-2032

- 10.1. Global Silanes Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region, 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Silanes Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Dalian F.T.Z CREDIT Chemical Technology Development Co. Ltd.

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Denka Company Limited

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. GELEST INC.

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Linde

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. LINGGAS LTD.

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Dalian Resourcea Co.Ltd.

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. abcr GmbH

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Qufu Chenguang Chemical Co.Ltd.

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Air Liquide

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Air Products and Chemicals Inc.

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13. The Chemical Company

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. ENF Ltd.

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. Thomas Publishing Company

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 11.16. Matheson Tri-Gas Inc.

- 11.16.1. Company Overview

- 11.16.2. Financial Highlights

- 11.16.3. Product Portfolio

- 11.16.4. SWOT Analysis

- 11.16.5. Key Strategies and Developments

- 11.17. NANJING UNION SILICON CHEMICAL CO.LTD.

- 11.17.1. Company Overview

- 11.17.2. Financial Highlights

- 11.17.3. Product Portfolio

- 11.17.4. SWOT Analysis

- 11.17.5. Key Strategies and Developments

- 11.18. SK materials Co.Ltd.

- 11.18.1. Company Overview

- 11.18.2. Financial Highlights

- 11.18.3. Product Portfolio

- 11.18.4. SWOT Analysis

- 11.18.5. Key Strategies and Developments

- 11.19. Praxair Technology Inc.

- 11.19.1. Company Overview

- 11.19.2. Financial Highlights

- 11.19.3. Product Portfolio

- 11.19.4. SWOT Analysis

- 11.19.5. Key Strategies and Developments

- 11.20. Shin-Etsu Chemical Co. Ltd.

- 11.20.1. Company Overview

- 11.20.2. Financial Highlights

- 11.20.3. Product Portfolio

- 11.20.4. SWOT Analysis

- 11.20.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

List of Figures

- Figure 1: Global Silanes Market Revenue (US$ Mn) Market Share By Product in 2022

- Figure 2: Global Silanes Market Attractiveness Analysis By Product, 2016-2032

- Figure 3: Global Silanes Market Revenue (US$ Mn) Market Share By Applicationin 2022

- Figure 4: Global Silanes Market Attractiveness Analysis By Application, 2016-2032

- Figure 5: Global Silanes Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 6: Global Silanes Market Attractiveness Analysis by Region, 2016-2032

- Figure 7: Global Silanes Market Revenue (US$ Mn) (2016-2032)

- Figure 8: Global Silanes Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 9: Global Silanes Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Figure 10: Global Silanes Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Figure 11: Global Silanes Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 12: Global Silanes Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Figure 13: Global Silanes Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Figure 14: Global Silanes Market Share Comparison by Region (2016-2032)

- Figure 15: Global Silanes Market Share Comparison By Product (2016-2032)

- Figure 16: Global Silanes Market Share Comparison By Application (2016-2032)

- Figure 17: North America Silanes Market Revenue (US$ Mn) Market Share By Productin 2022

- Figure 18: North America Silanes Market Attractiveness Analysis By Product, 2016-2032

- Figure 19: North America Silanes Market Revenue (US$ Mn) Market Share By Applicationin 2022

- Figure 20: North America Silanes Market Attractiveness Analysis By Application, 2016-2032

- Figure 21: North America Silanes Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 22: North America Silanes Market Attractiveness Analysis by Country, 2016-2032

- Figure 23: North America Silanes Market Revenue (US$ Mn) (2016-2032)

- Figure 24: North America Silanes Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 25: North America Silanes Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Figure 26: North America Silanes Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Figure 27: North America Silanes Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 28: North America Silanes Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Figure 29: North America Silanes Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Figure 30: North America Silanes Market Share Comparison by Country (2016-2032)

- Figure 31: North America Silanes Market Share Comparison By Product (2016-2032)

- Figure 32: North America Silanes Market Share Comparison By Application (2016-2032)

- Figure 33: Western Europe Silanes Market Revenue (US$ Mn) Market Share By Productin 2022

- Figure 34: Western Europe Silanes Market Attractiveness Analysis By Product, 2016-2032

- Figure 35: Western Europe Silanes Market Revenue (US$ Mn) Market Share By Applicationin 2022

- Figure 36: Western Europe Silanes Market Attractiveness Analysis By Application, 2016-2032

- Figure 37: Western Europe Silanes Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 38: Western Europe Silanes Market Attractiveness Analysis by Country, 2016-2032

- Figure 39: Western Europe Silanes Market Revenue (US$ Mn) (2016-2032)

- Figure 40: Western Europe Silanes Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 41: Western Europe Silanes Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Figure 42: Western Europe Silanes Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Figure 43: Western Europe Silanes Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 44: Western Europe Silanes Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Figure 45: Western Europe Silanes Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Figure 46: Western Europe Silanes Market Share Comparison by Country (2016-2032)

- Figure 47: Western Europe Silanes Market Share Comparison By Product (2016-2032)

- Figure 48: Western Europe Silanes Market Share Comparison By Application (2016-2032)

- Figure 49: Eastern Europe Silanes Market Revenue (US$ Mn) Market Share By Productin 2022

- Figure 50: Eastern Europe Silanes Market Attractiveness Analysis By Product, 2016-2032

- Figure 51: Eastern Europe Silanes Market Revenue (US$ Mn) Market Share By Applicationin 2022

- Figure 52: Eastern Europe Silanes Market Attractiveness Analysis By Application, 2016-2032

- Figure 53: Eastern Europe Silanes Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 54: Eastern Europe Silanes Market Attractiveness Analysis by Country, 2016-2032

- Figure 55: Eastern Europe Silanes Market Revenue (US$ Mn) (2016-2032)

- Figure 56: Eastern Europe Silanes Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 57: Eastern Europe Silanes Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Figure 58: Eastern Europe Silanes Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Figure 59: Eastern Europe Silanes Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 60: Eastern Europe Silanes Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Figure 61: Eastern Europe Silanes Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Figure 62: Eastern Europe Silanes Market Share Comparison by Country (2016-2032)

- Figure 63: Eastern Europe Silanes Market Share Comparison By Product (2016-2032)

- Figure 64: Eastern Europe Silanes Market Share Comparison By Application (2016-2032)

- Figure 65: APAC Silanes Market Revenue (US$ Mn) Market Share By Productin 2022

- Figure 66: APAC Silanes Market Attractiveness Analysis By Product, 2016-2032

- Figure 67: APAC Silanes Market Revenue (US$ Mn) Market Share By Applicationin 2022

- Figure 68: APAC Silanes Market Attractiveness Analysis By Application, 2016-2032

- Figure 69: APAC Silanes Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 70: APAC Silanes Market Attractiveness Analysis by Country, 2016-2032

- Figure 71: APAC Silanes Market Revenue (US$ Mn) (2016-2032)

- Figure 72: APAC Silanes Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 73: APAC Silanes Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Figure 74: APAC Silanes Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Figure 75: APAC Silanes Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 76: APAC Silanes Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Figure 77: APAC Silanes Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Figure 78: APAC Silanes Market Share Comparison by Country (2016-2032)

- Figure 79: APAC Silanes Market Share Comparison By Product (2016-2032)

- Figure 80: APAC Silanes Market Share Comparison By Application (2016-2032)

- Figure 81: Latin America Silanes Market Revenue (US$ Mn) Market Share By Productin 2022

- Figure 82: Latin America Silanes Market Attractiveness Analysis By Product, 2016-2032

- Figure 83: Latin America Silanes Market Revenue (US$ Mn) Market Share By Applicationin 2022

- Figure 84: Latin America Silanes Market Attractiveness Analysis By Application, 2016-2032

- Figure 85: Latin America Silanes Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 86: Latin America Silanes Market Attractiveness Analysis by Country, 2016-2032

- Figure 87: Latin America Silanes Market Revenue (US$ Mn) (2016-2032)

- Figure 88: Latin America Silanes Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 89: Latin America Silanes Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Figure 90: Latin America Silanes Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Figure 91: Latin America Silanes Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 92: Latin America Silanes Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Figure 93: Latin America Silanes Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Figure 94: Latin America Silanes Market Share Comparison by Country (2016-2032)

- Figure 95: Latin America Silanes Market Share Comparison By Product (2016-2032)

- Figure 96: Latin America Silanes Market Share Comparison By Application (2016-2032)

- Figure 97: Middle East & Africa Silanes Market Revenue (US$ Mn) Market Share By Productin 2022

- Figure 98: Middle East & Africa Silanes Market Attractiveness Analysis By Product, 2016-2032

- Figure 99: Middle East & Africa Silanes Market Revenue (US$ Mn) Market Share By Applicationin 2022

- Figure 100: Middle East & Africa Silanes Market Attractiveness Analysis By Application, 2016-2032

- Figure 101: Middle East & Africa Silanes Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 102: Middle East & Africa Silanes Market Attractiveness Analysis by Country, 2016-2032

- Figure 103: Middle East & Africa Silanes Market Revenue (US$ Mn) (2016-2032)

- Figure 104: Middle East & Africa Silanes Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 105: Middle East & Africa Silanes Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Figure 106: Middle East & Africa Silanes Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Figure 107: Middle East & Africa Silanes Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 108: Middle East & Africa Silanes Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Figure 109: Middle East & Africa Silanes Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Figure 110: Middle East & Africa Silanes Market Share Comparison by Country (2016-2032)

- Figure 111: Middle East & Africa Silanes Market Share Comparison By Product (2016-2032)

- Figure 112: Middle East & Africa Silanes Market Share Comparison By Application (2016-2032)

List of Tables

- Table 1: Global Silanes Market Comparison By Product (2016-2032)

- Table 2: Global Silanes Market Comparison By Application (2016-2032)

- Table 3: Global Silanes Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 4: Global Silanes Market Revenue (US$ Mn) (2016-2032)

- Table 5: Global Silanes Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 6: Global Silanes Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Table 7: Global Silanes Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Table 8: Global Silanes Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 9: Global Silanes Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Table 10: Global Silanes Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Table 11: Global Silanes Market Share Comparison by Region (2016-2032)

- Table 12: Global Silanes Market Share Comparison By Product (2016-2032)

- Table 13: Global Silanes Market Share Comparison By Application (2016-2032)

- Table 14: North America Silanes Market Comparison By Application (2016-2032)

- Table 15: North America Silanes Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 16: North America Silanes Market Revenue (US$ Mn) (2016-2032)

- Table 17: North America Silanes Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 18: North America Silanes Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Table 19: North America Silanes Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Table 20: North America Silanes Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 21: North America Silanes Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Table 22: North America Silanes Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Table 23: North America Silanes Market Share Comparison by Country (2016-2032)

- Table 24: North America Silanes Market Share Comparison By Product (2016-2032)

- Table 25: North America Silanes Market Share Comparison By Application (2016-2032)

- Table 26: Western Europe Silanes Market Comparison By Product (2016-2032)

- Table 27: Western Europe Silanes Market Comparison By Application (2016-2032)

- Table 28: Western Europe Silanes Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 29: Western Europe Silanes Market Revenue (US$ Mn) (2016-2032)

- Table 30: Western Europe Silanes Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 31: Western Europe Silanes Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Table 32: Western Europe Silanes Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Table 33: Western Europe Silanes Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 34: Western Europe Silanes Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Table 35: Western Europe Silanes Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Table 36: Western Europe Silanes Market Share Comparison by Country (2016-2032)

- Table 37: Western Europe Silanes Market Share Comparison By Product (2016-2032)

- Table 38: Western Europe Silanes Market Share Comparison By Application (2016-2032)

- Table 39: Eastern Europe Silanes Market Comparison By Product (2016-2032)

- Table 40: Eastern Europe Silanes Market Comparison By Application (2016-2032)

- Table 41: Eastern Europe Silanes Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 42: Eastern Europe Silanes Market Revenue (US$ Mn) (2016-2032)

- Table 43: Eastern Europe Silanes Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 44: Eastern Europe Silanes Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Table 45: Eastern Europe Silanes Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Table 46: Eastern Europe Silanes Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 47: Eastern Europe Silanes Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Table 48: Eastern Europe Silanes Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Table 49: Eastern Europe Silanes Market Share Comparison by Country (2016-2032)

- Table 50: Eastern Europe Silanes Market Share Comparison By Product (2016-2032)

- Table 51: Eastern Europe Silanes Market Share Comparison By Application (2016-2032)

- Table 52: APAC Silanes Market Comparison By Product (2016-2032)

- Table 53: APAC Silanes Market Comparison By Application (2016-2032)

- Table 54: APAC Silanes Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: APAC Silanes Market Revenue (US$ Mn) (2016-2032)

- Table 56: APAC Silanes Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: APAC Silanes Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Table 58: APAC Silanes Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Table 59: APAC Silanes Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 60: APAC Silanes Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Table 61: APAC Silanes Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Table 62: APAC Silanes Market Share Comparison by Country (2016-2032)

- Table 63: APAC Silanes Market Share Comparison By Product (2016-2032)

- Table 64: APAC Silanes Market Share Comparison By Application (2016-2032)

- Table 65: Latin America Silanes Market Comparison By Product (2016-2032)

- Table 66: Latin America Silanes Market Comparison By Application (2016-2032)

- Table 67: Latin America Silanes Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 68: Latin America Silanes Market Revenue (US$ Mn) (2016-2032)

- Table 69: Latin America Silanes Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 70: Latin America Silanes Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Table 71: Latin America Silanes Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Table 72: Latin America Silanes Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 73: Latin America Silanes Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Table 74: Latin America Silanes Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Table 75: Latin America Silanes Market Share Comparison by Country (2016-2032)

- Table 76: Latin America Silanes Market Share Comparison By Product (2016-2032)

- Table 77: Latin America Silanes Market Share Comparison By Application (2016-2032)

- Table 78: Middle East & Africa Silanes Market Comparison By Product (2016-2032)

- Table 79: Middle East & Africa Silanes Market Comparison By Application (2016-2032)

- Table 80: Middle East & Africa Silanes Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 81: Middle East & Africa Silanes Market Revenue (US$ Mn) (2016-2032)

- Table 82: Middle East & Africa Silanes Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 83: Middle East & Africa Silanes Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Table 84: Middle East & Africa Silanes Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Table 85: Middle East & Africa Silanes Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 86: Middle East & Africa Silanes Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Table 87: Middle East & Africa Silanes Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Table 88: Middle East & Africa Silanes Market Share Comparison by Country (2016-2032)

- Table 89: Middle East & Africa Silanes Market Share Comparison By Product (2016-2032)

- Table 90: Middle East & Africa Silanes Market Share Comparison By Application (2016-2032)

- 1. Executive Summary

-

- Dalian F.T.Z CREDIT Chemical Technology Development Co. Ltd.

- Denka Company Limited

- GELEST INC.

- Linde

- LINGGAS LTD.

- Dalian Resourcea Co.Ltd.

- abcr GmbH

- Qufu Chenguang Chemical Co.Ltd.

- Air Liquide

- Air Products and Chemicals Inc.

- The Chemical Company

- ENF Ltd.

- Thomas Publishing Company

- Matheson Tri-Gas Inc.

- NANJING UNION SILICON CHEMICAL CO.LTD.

- SK materials Co.Ltd.

- Praxair Technology Inc.

- Shin-Etsu Chemical Co. Ltd.