Salicylic Acid Market Report By Form (Powder, Liquid), By Type (Natural, Synthetic), By Grade (Pharmaceutical, Cosmetic, Technical), By Application (Food and Beverage, Cosmetics and Personal Care, Pharmaceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

48271

-

July 2024

-

325

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

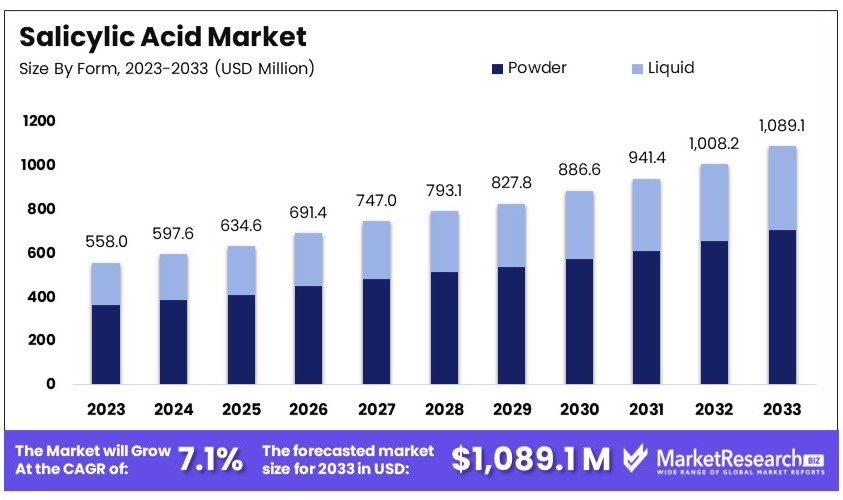

The Global Salicylic Acid Market size is expected to be worth around USD 1,089.1 Million by 2033, from USD 558.0 Million in 2023, growing at a CAGR of 7.1% during the forecast period from 2024 to 2033.

Salicylic Acid Market involves the production and distribution of a beta hydroxy acid used primarily in skincare and pharmaceutical applications. It is renowned for its efficacy in treating acne, psoriasis, and warts.

The cosmetic segment, driven by the demand for clear skin products, prominently fuels the market growth. Additionally, its use in haircare products to combat dandruff further diversifies its applications, making it a staple in personal care and medicinal formulations.

The global Salicylic Acid market exhibits dynamic growth trends and diverse regulatory environments across different regions. For instance, in 2023, China emerges as a key player, holding a significant share of the market in East Asia. The country's extensive production capabilities, coupled with its high consumption rates, notably influence global supply and demand dynamics.

Export and import dynamics also significantly influence the market, with Salicylic Acid, salts ranking as a notably traded product. China, France, and Germany are the leading exporters, which underscores the global nature of the market. Regulatory environments affect these dynamics, with an average tariff of 5.06% in 2018, marking Salicylic Acid as one of the lower tariff products, facilitating its global trade.

Moreover, the regulatory landscape across different countries imposes varied import duties and controls, further shaping the global market dynamics. For example, when importing goods into the Netherlands from outside the European Union (EU), businesses must comply with multiple taxes and duties, which are enforced by customs checks to regulate the market effectively.

These factors collectively influence the Salicylic Acid market, underpinning its growth, competitive landscape, and regional market shifts over the forecasted period.

Key Takeaways

- Market Value: The Salicylic Acid Market was valued at USD 558.0 million in 2023 and is expected to reach USD 1,089.1 million by 2033, with a CAGR of 7.1%.

- By Form Analysis: Powder dominates with 65.3%; favored for its ease of formulation and stability.

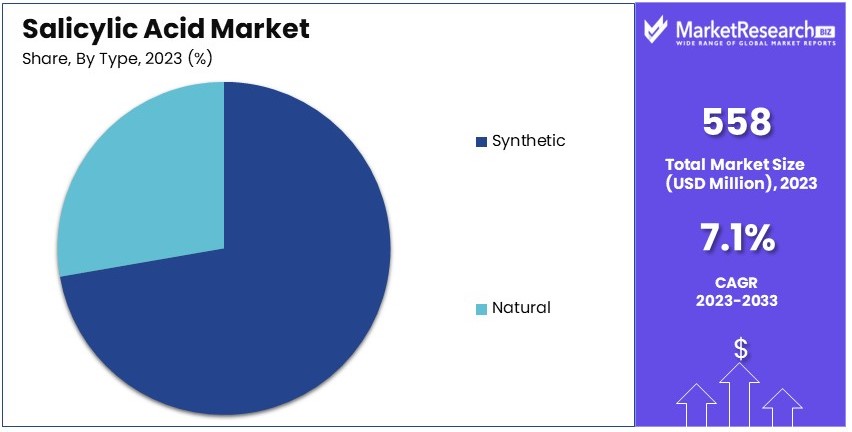

- By Type Analysis: Synthetic leads with 73.3%; preferred due to consistent quality and scalability.

- By Grade Analysis: Pharmaceutical holds 54.3%; critical for meeting stringent industry standards.

- By Application Analysis: Pharmaceuticals dominate at 43.4%; essential for its widespread use in pain and fever reduction.

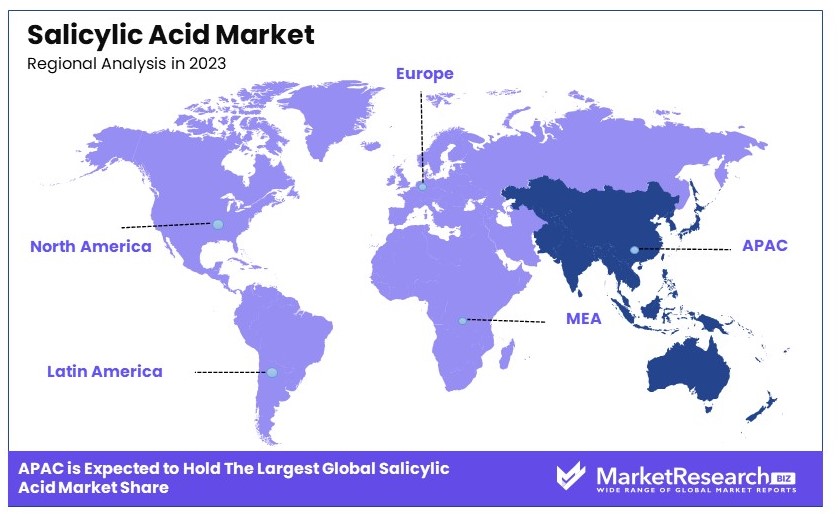

- Dominant Region: Asia Pacific with 43.3%; a major production hub with extensive industrial applications.

- Analyst Viewpoint: Market is growing steadily, driven by demand in pharmaceuticals and cosmetics, with innovation in synthetic formulations highlighted.

- Growth Opportunities: Development of bio-based salicylic acid could open new market segments, particularly in natural cosmetics.

Driving Factors

Increasing Demand from the Pharmaceutical Industry Drives Market Growth

Salicylic acid is widely used in the production of various pharmaceutical products, including acne drugs, anti-inflammatory drugs, and pain relievers. The rising prevalence of skin conditions like acne and the growing demand for over-the-counter and prescription medications are driving market growth. For example, topical salicylic acid treatments for acne have become increasingly popular due to their effectiveness in unclogging pores and reducing inflammation.

This rising demand from the pharmaceutical industry, combined with ongoing research and development, ensures continuous growth for the salicylic acid market. The synergy between the need for effective skin treatments and pharmaceutical advancements drives the expansion of the market, making salicylic acid a crucial ingredient in many medications.

Expanding Applications in Personal Care and Cosmetic Products Drive Market Growth

Salicylic acid is a popular ingredient in personal care and cosmetic products due to its exfoliating and keratolytic properties. The growing demand for anti-aging, skin-lightening, and acne-fighting products has fueled market growth. For instance, salicylic acid is commonly used in face washes, toners, and peels to improve skin texture and treat various skin conditions.

The personal care industry significantly impacts the salicylic acid market. The global skincare market was valued at USD 145.3 billion in 2020, reflecting the high demand for effective skincare solutions. Salicylic acid's ability to treat acne, exfoliate dead skin cells, and improve overall skin health makes it a preferred ingredient in many skincare products.

Rising Demand from the Food and Beverage Industry Drives Market Growth

Salicylic acid is used as a preservative and antimicrobial agent in the food and beverage industry. The increasing demand for shelf-stable and preservative-free products has driven market growth. For example, salicylic acid is used in the production of fruit juices, jams, and other food products to extend their shelf life and prevent microbial growth.

The food and beverage industry plays a crucial role in the salicylic acid market. The global market for food preservatives was valued at USD 2.6 billion in 2023, indicating a substantial demand for effective preservation solutions like salicylic acid. Its use in extending shelf life and ensuring food safety makes it an essential ingredient in many food products.

Restraining Factors

Limited Availability of Raw Materials Restrains Market Growth

The production of salicylic acid relies heavily on raw materials such as the bark of willow trees and phenol derived from petroleum sources. The limited availability and fluctuating prices of these raw materials significantly impact the production costs and supply chain of salicylic acid.

For example, disruptions in petroleum supply or overharvesting of willow trees can lead to shortages and increased costs. These challenges make it difficult for manufacturers to maintain consistent production levels and stable pricing, thereby restraining the growth of the salicylic acid market. This volatility in raw material supply can discourage investment and expansion efforts within the industry.

Competition from Alternative Products Restrains Market Growth

Salicylic acid faces stiff competition from alternative products like benzoic acid and sorbic acid. These alternatives offer similar functionalities and are often preferred due to factors such as cost-effectiveness, easier availability, and regulatory compliance.

For instance, in certain applications, benzoic acid and sorbic acid might be chosen over salicylic acid because they can be sourced more reliably or at a lower cost. This preference for alternatives limits the demand and market growth of salicylic acid. As a result, manufacturers of salicylic acid must continually innovate and differentiate their products to maintain market share in the face of these competitive pressures.

Form Analysis

Powder dominates with 65.3% due to its versatility and ease of use.

Powdered salicylic acid holds 65.3% of the market share, making it the dominant form. Its popularity is largely due to its versatility and ease of use in various applications. Powdered salicylic acid is easily mixed with other ingredients, making it suitable for a wide range of products in pharmaceuticals, cosmetics, and personal care. Its stability and longer shelf life compared to liquid form also contribute to its widespread use.

Liquid salicylic acid, while significant, holds a smaller share. This form is often used in formulations where precise concentrations are crucial, such as in liquid medications or certain cosmetic products. The liquid form allows for easy application and quick absorption, particularly in topical treatments for skin conditions. Despite its advantages, the need for special storage and handling conditions can limit its broader application compared to the powder form.

The dominance of the powder form is driven by its application in large-scale manufacturing processes where precise dosing and consistency are essential. In the pharmaceutical industry, powdered salicylic acid is a key ingredient in the production of various medications, including those for pain relief and anti-inflammatory treatments. In the cosmetics industry, it is widely used in acne treatments, exfoliants, and other skincare products due to its keratolytic properties.

Type Analysis

Synthetic dominates with 73.3% due to cost-effectiveness and availability.

Synthetic salicylic acid leads the market with a 73.3% share. Its dominance is attributed to its cost-effectiveness and consistent availability. Synthetic production methods ensure a steady supply of high-quality salicylic acid, which meets the stringent standards required for pharmaceutical and cosmetic applications. The synthetic form is also more affordable, making it accessible for large-scale manufacturing.

Natural salicylic acid, derived from plant sources like willow bark, holds a smaller market share. It appeals to consumers who prefer natural and organic products, particularly in the cosmetics and personal care segments. However, the extraction process is more complex and costly, leading to higher prices for natural salicylic acid products. Despite these challenges, the demand for natural salicylic acid is growing, driven by the increasing consumer preference for natural and sustainable ingredients.

The synthetic segment’s dominance is reinforced by the ability to produce salicylic acid in large quantities at a lower cost. This makes it a preferred choice for pharmaceutical companies and large cosmetic manufacturers. As demand for cost-effective and reliable ingredients continues to rise, the synthetic segment is expected to maintain its leading position.

Grade Analysis

Pharmaceutical grade dominates with 54.3% due to stringent quality requirements.

Pharmaceutical-grade salicylic acid holds 54.3% of the market share, making it the dominant grade. This grade is used in the production of various medications, including those for treating skin conditions, pain relief, and anti-inflammatory purposes. The stringent quality and purity standards required for pharmaceutical applications ensure the effectiveness and safety of the products, driving the demand for pharmaceutical-grade salicylic acid.

Cosmetic-grade salicylic acid is also significant, used extensively in skincare products for its exfoliating and anti-acne properties. While it holds a smaller share compared to pharmaceutical grade, the cosmetic grade is crucial in the beauty and personal care industry. Its applications include cleansers, toners, and treatment products designed to improve skin texture and clarity.

Technical grade salicylic acid, used in industrial applications, holds the smallest market share. It is utilized in the synthesis of other chemicals, preservatives, and in certain manufacturing processes. Despite its smaller market presence, technical-grade salicylic acid plays a vital role in various industrial applications, contributing to the overall demand for salicylic acid.

The dominance of pharmaceutical-grade salicylic acid is driven by the rigorous regulatory standards in the pharmaceutical industry. Ensuring the highest quality and purity is essential for producing safe and effective medications. This demand for high-quality ingredients in the pharmaceutical sector supports the continued dominance of pharmaceutical-grade salicylic acid.

Application Analysis

Pharmaceuticals dominate with 43.4% due to extensive medicinal uses.

Pharmaceuticals hold the largest share of the salicylic acid market, accounting for 43.4%. The extensive medicinal uses of salicylic acid, including its role in treating skin conditions, pain relief, and as an anti-inflammatory agent, drive this dominance. It is a key ingredient in many over-the-counter and prescription medications, supporting its significant market presence.

The cosmetics and personal care segment also holds a substantial share. Salicylic acid is widely used in skincare products for its exfoliating and anti-acne properties. Its ability to penetrate and clear pores makes it a popular choice in products designed to treat and prevent acne, as well as improve overall skin texture.

The food and beverage segment, while smaller, is important for its use as a preservative and food additive. Salicylic acid helps extend the shelf life of products and ensures their safety for consumption. Although its use in this segment is more limited compared to pharmaceuticals and cosmetics, it plays a critical role in food preservation.

Other applications, including its use in dyes, fragrances, and industrial processes, contribute to the overall demand for salicylic acid. These applications, while not as prominent, add to the versatility and importance of salicylic acid in various industries.

The dominance of the pharmaceutical segment is supported by the continuous demand for effective and safe medications. As the global healthcare industry grows, the need for high-quality pharmaceutical ingredients like salicylic acid remains strong, ensuring its leading position in the market.

Key Market Segments

By Form

- Powder

- Liquid

By Type

- Natural

- Synthetic

By Grade

- Pharmaceutical

- Cosmetic

- Technical

By Application

- Food and Beverage

- Cosmetics and Personal Care

- Pharmaceuticals

- Others

Growth Opportunities

Increasing Demand for Natural and Eco-friendly Products Offers Growth Opportunity

The trend towards natural and eco-friendly products is driving growth in the salicylic acid market. Derived from natural sources like willow bark, salicylic acid fits well with consumer preferences for organic and sustainable options.

This is particularly evident in the personal care industry, where demand for natural skincare products containing salicylic acid is rising. The pharmaceutical and agriculture sectors also benefit from this trend, as they seek eco-friendly ingredients. The growing consumer awareness and preference for natural products create a substantial market potential for salicylic acid, encouraging its use across various applications.

Expansion in Emerging Markets Offers Growth Opportunity

Emerging markets in Asia-Pacific and Latin America present significant opportunities for the salicylic acid market. Rising disposable incomes and increased awareness of personal care products drive demand in these regions.

Additionally, the growth of industrial sectors further boosts the need for salicylic acid. These markets are experiencing rapid economic development, leading to higher consumption of pharmaceuticals, cosmetics, and agricultural products. The expanding middle class and urbanization trends in these regions create a favorable environment for salicylic acid market growth, enhancing its application across diverse industries.

Trending Factors

Sustainable and Bio-based Production Methods Are Trending Factors

Sustainable and bio-based production methods are gaining popularity in the chemical industry, including salicylic acid production. Research focuses on finding alternative sources and eco-friendly manufacturing processes that align with global sustainability goals. This trend responds to increasing environmental concerns and regulatory pressures.

Companies investing in sustainable practices can attract environmentally conscious consumers and meet stricter environmental standards. The shift towards green chemistry and bio-based products not only reduces the environmental impact but also enhances the market appeal of salicylic acid, promoting its use in various applications.

Combination Products and Synergistic Formulations Are Trending Factors

The use of salicylic acid in combination with other active ingredients is a growing trend in the market. In skincare, for example, salicylic acid is often paired with other exfoliating agents or moisturizers to enhance product efficacy.

This trend improves the performance and appeal of products, meeting consumer demands for multifunctional solutions. Synergistic formulations that combine salicylic acid with other ingredients can address multiple skin concerns, offering better results. This approach increases the versatility and marketability of salicylic acid, driving its demand in the personal care industry and beyond.

Regional Analysis

Asia Pacific Dominates with 43.3% Market Share in the Salicylic Acid Market

Asia Pacific's dominant position in the salicylic acid market, holding a 43.3% share, is primarily driven by extensive manufacturing capacities and the burgeoning pharmaceutical and skincare industries within the region. The high concentration of cosmetic manufacturers in countries like South Korea and Japan, coupled with increasing demand for salicylic acid-based products for acne treatment and other skin conditions, propels this market share. Additionally, the competitive pricing strategies adopted by local manufacturers help maintain the region's leadership.

The market dynamics of Asia Pacific are characterized by rapid industrial growth and increasing consumer awareness about personal care and health. The region benefits from a robust supply chain and lower production costs, which facilitate the production of salicylic acid at competitive rates. Furthermore, favorable government policies aimed at promoting the pharmaceutical and cosmetics sectors amplify the market's expansion, making Asia Pacific a pivotal area for salicylic acid production and consumption.

Regional Market Shares and Statistics:

- North America: The region holds approximately 25% of the market, driven by advanced healthcare and cosmetics sectors, emphasizing high-quality, dermatologically approved ingredients.

- Europe: Europe accounts for about 20% of the market. Strong regulatory frameworks promoting safe cosmetic formulations contribute to steady demand for salicylic acid.

- Middle East & Africa: This region captures a smaller market share of around 6%. Growth is primarily driven by expanding cosmetic and pharmaceutical industries in key countries.

- Latin America: Latin America holds a market share of 6%, with growth influenced by increasing local manufacturing and rising awareness of skincare benefits among the population.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The salicylic acid market is competitive and driven by demand in pharmaceuticals and cosmetics. Key players like Merck & Co. Inc. lead with strong research and development capabilities. Their advanced products and global reach enhance their market influence.

Thermo Fisher Scientific and Spectrum Chemical Manufacturing Corp are significant due to their extensive product lines and reliable supply chains. Their strategic positioning in the market is reinforced by their reputation for quality and innovation.

Novocap and Seqens SAS are major players with a focus on high-quality production processes. Their strong presence in Europe boosts their market influence and competitive edge.

Alfa Aesar and Simco Chemicals cater to specialized segments, offering a range of chemicals including salicylic acid. Their niche market focus ensures steady demand and market positioning.

Shandong Xinhua Longxin Chemical Co. Ltd and Hebei Jingye Group from China are prominent due to their large-scale production capabilities and competitive pricing. Their strategic positioning in Asia contributes significantly to market dynamics.

Alta Laboratories and Siddharth Carbochem Products Ltd. are notable in the Indian market, providing cost-effective solutions and maintaining strong regional influence.

Overall, the salicylic acid market is shaped by the strategic actions and innovations of these key players. The market is characterized by a balance of large multinational corporations and specialized regional companies, each contributing to market growth and development. The combined efforts in research, quality production, and strategic positioning drive the market forward, meeting the growing demand in various industries.

Market Key Players

- Alfa Aesar

- Alta Laboratories

- Hebei Jingye Group

- Huayin Jinqiancheng

- JM Loveridge Limited

- Merck & Co. Inc.

- Novocap

- Seqens International

- Seqens SAS

- Shandong Xinhua Longxin Chemical Co. Ltd

- Siddharth Carbochem Products Ltd

- Simco Chemicals

- Spectrum Chemical Manufacturing Corp

- Thermo Fisher Scientific

- Zhenjiang Gaopeng Pharmaceutical Co., Ltd.

Recent Developments

- March 2023: Alta Laboratories reported a 5% increase in sales, achieving a monthly revenue of $30 million due to heightened demand for salicylic acid in skincare products, particularly for acne treatment.

- January 2023: Merck reported a 5% increase in sales for its Salicylic Acid products, amounting to a monthly revenue of $18 million, driven by strong demand in the skincare segment.

Report Scope

Report Features Description Market Value (2023) USD 558.0 Million Forecast Revenue (2033) USD 1,089.1 Million CAGR (2024-2033) 7.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Powder, Liquid), By Type (Natural, Synthetic), By Grade (Pharmaceutical, Cosmetic, Technical), By Application (Food and Beverage, Cosmetics and Personal Care, Pharmaceuticals, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Alfa Aesar, Alta Laboratories, Hebei Jingye Group, Huayin Jinqiancheng, JM Loveridge Limited, Merck & Co. Inc., Novocap, Seqens International, Seqens SAS, Shandong Xinhua Longxin Chemical Co. Ltd, Siddharth Carbochem Products Ltd, Simco Chemicals, Spectrum Chemical Manufacturing Corp, Thermo Fisher Scientific, Zhenjiang Gaopeng Pharmaceutical Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Alfa Aesar

- Alta Laboratories

- Hebei Jingye Group

- Huayin Jinqiancheng

- JM Loveridge Limited

- Merck & Co. Inc.

- Novocap

- Seqens International

- Seqens SAS

- Shandong Xinhua Longxin Chemical Co. Ltd

- Siddharth Carbochem Products Ltd

- Simco Chemicals

- Spectrum Chemical Manufacturing Corp

- Thermo Fisher Scientific

- Zhenjiang Gaopeng Pharmaceutical Co., Ltd.