Returnable Packaging Market By Product Type (Pallets, Bottles, Crates, Dunnage, Drums & Barrel, Intermediate Bulk Containers (IBCs), Others), By Material (Plastic, Metal, Wood, Glass), By End-use (Food & Beverage, Automotive, Consumer Durables, Healthcare, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

48063

-

June 2024

-

136

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

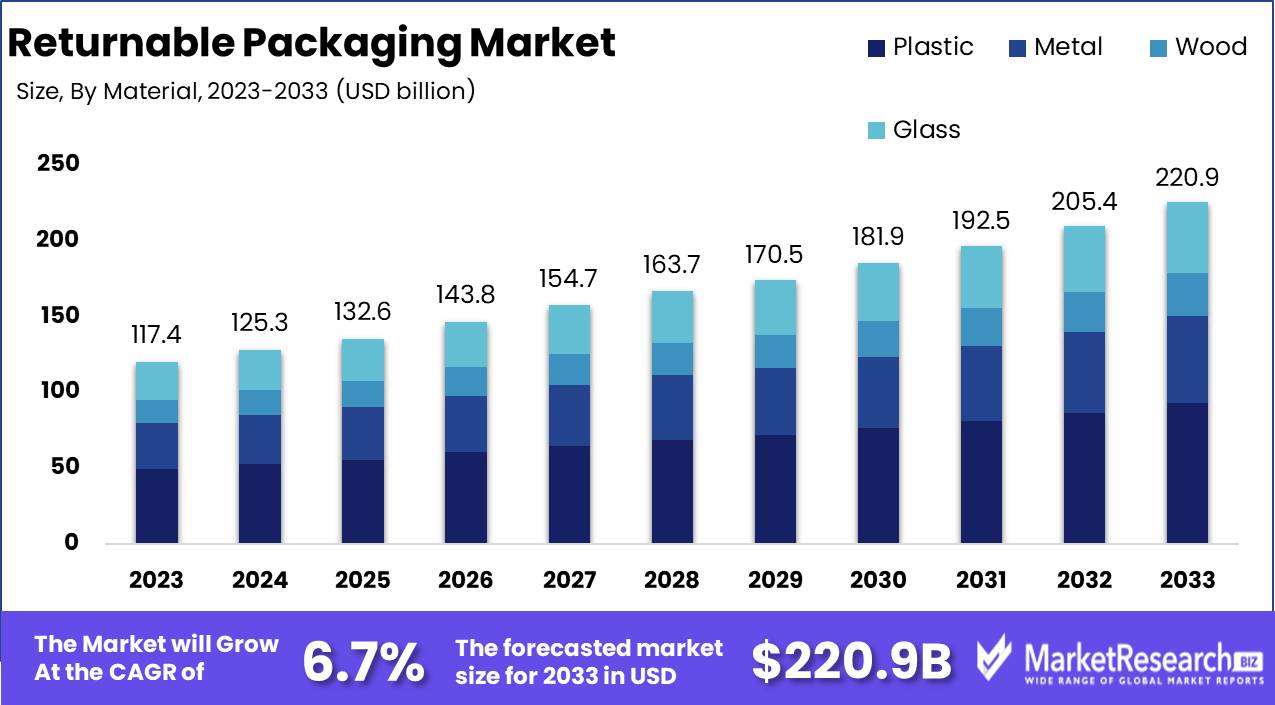

The Global Returnable Packaging Market was valued at USD 117.4 Bn in 2023. It is expected to reach USD 220.9 Bn by 2033, with a CAGR of 6.7% during the forecast period from 2024 to 2033.

The Returnable Packaging Market encompasses the production, distribution, and utilization of durable packaging solutions designed for multiple uses across various industries. This market includes a range of products such as pallets, crates, drums, and intermediate bulk containers (IBCs), which are used to transport goods efficiently and sustainably. Returnable packaging solutions are favored for their cost-effectiveness, environmental benefits, and ability to reduce waste compared to single-use packaging. The growth of this market is driven by increasing emphasis on sustainable practices, stringent environmental regulations, and the need for cost optimization in logistics and supply chain operations.

The Returnable Packaging Market is experiencing significant growth driven by sustainability concerns, cost-efficiency, and regulatory pressures. The market has evolved considerably since the early 20th century when plywood gained popularity in packaging. Notably, Ernest Shackleton ordered over 2,500 plywood boxes for his Antarctic expeditions, highlighting the material's durability and reliability. This historical reliance on reusable materials underscores the enduring appeal of returnable packaging solutions.

The Returnable Packaging Market is experiencing significant growth driven by sustainability concerns, cost-efficiency, and regulatory pressures. The market has evolved considerably since the early 20th century when plywood gained popularity in packaging. Notably, Ernest Shackleton ordered over 2,500 plywood boxes for his Antarctic expeditions, highlighting the material's durability and reliability. This historical reliance on reusable materials underscores the enduring appeal of returnable packaging solutions.A pivotal development occurred in 1990 when Amatech Inc. patented a collapsible plastic corrugated reusable packaging container, addressing the challenge of plastic's tendency to spring back to shape. This innovation marked a significant milestone, enabling more efficient storage and transport solutions, thus reducing logistical costs and environmental impact.

Current market trends indicate a strong shift towards returnable packaging solutions across various industries, including automotive, pharmaceuticals, and consumer goods. Companies are increasingly adopting these solutions to meet stringent environmental regulations and to align with corporate sustainability goals. The adoption of returnable packaging not only minimizes waste but also offers substantial cost savings through reduced material and disposal expenses.

Technological advancements in materials and design are enhancing the functionality and durability of returnable packaging. Innovations such as RFID tracking and smart packaging are further streamlining supply chain operations, providing real-time data on inventory and logistics, thereby improving efficiency.

Key Takeaways

- Market Growth: The Global Returnable Packaging Market was valued at USD 117.4 Bn in 2023. It is expected to reach USD 220.9 Bn by 2033, with a CAGR of 6.7% during the forecast period from 2024 to 2033.

- By Product Type: Intermediate Bulk Containers (IBCs) dominate the Returnable Packaging Market with a commanding market share of 34%.

- By Material: Plastic stands out as the leading material in the Returnable Packaging Market, capturing 42% of the market share, making it a preferred choice for manufacturers and end-users alike.

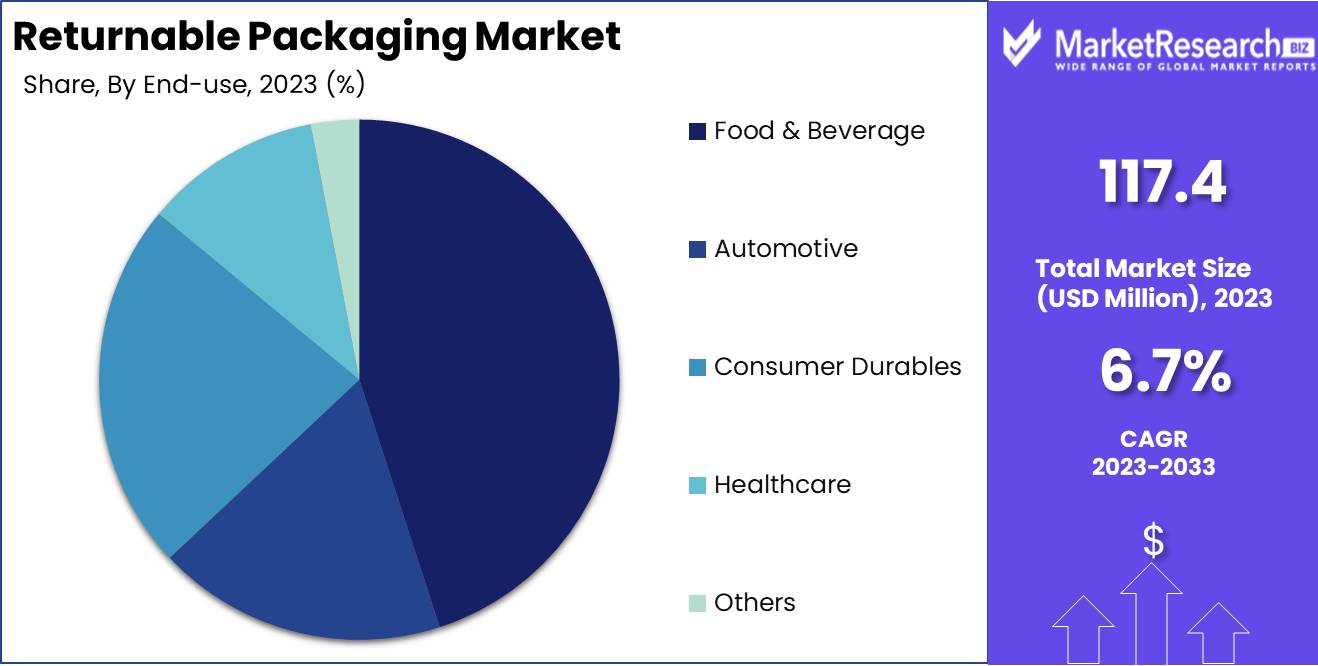

- By End-use: The Food & Beverage sector is the predominant end-user in the Returnable Packaging Market, holding a substantial 45% market share, to ensure product safety and reduce environmental impact.

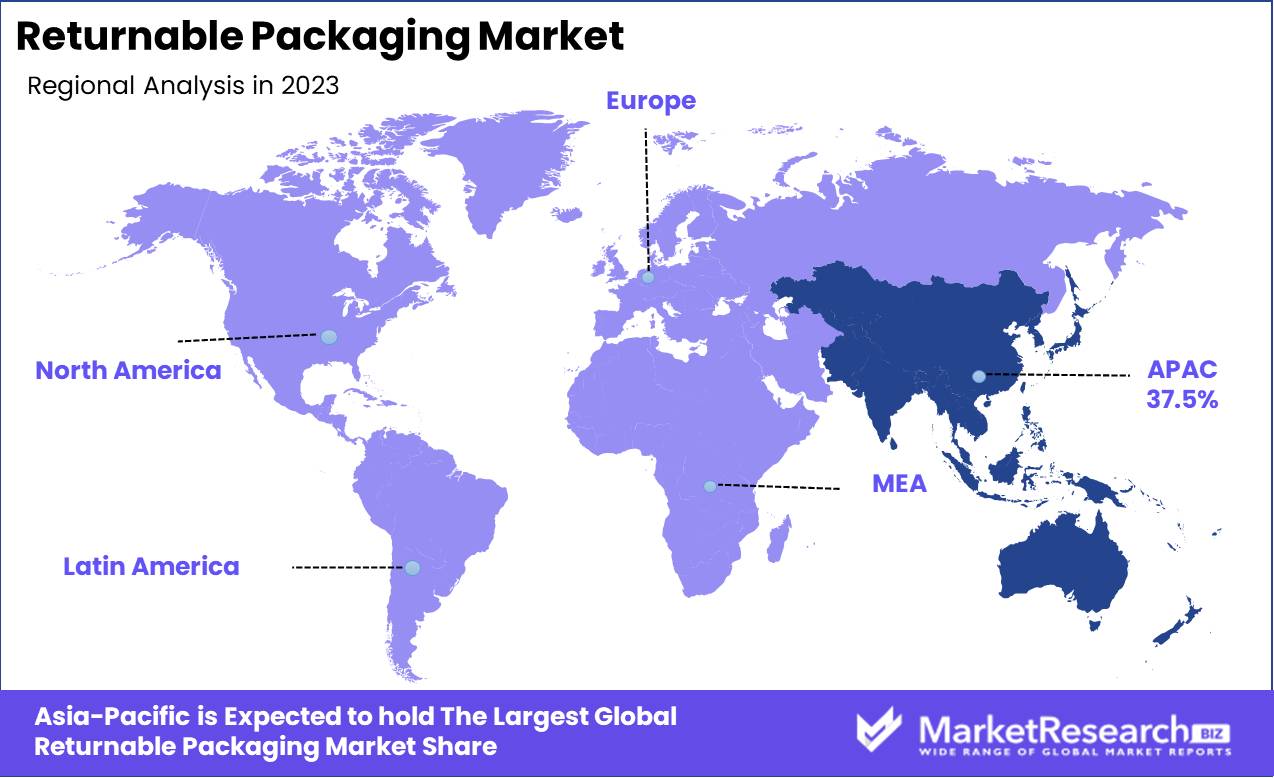

- Regional Dominance: Asia Pacific holds a commanding 37.5% share in the Returnable Packaging Market, reflecting strong regional adoption and market growth.

- Growth Opportunity: The shift towards sustainable practices is driving demand for returnable packaging solutions, offering cost savings and environmental benefits.

Driving factors

Sustainable Packaging

The growing awareness of environmental sustainability is a significant driver for the returnable packaging market. Consumers and businesses alike are increasingly prioritizing eco-friendly solutions, leading to a surge in demand for sustainable packaging. Returnable packaging aligns with these sustainability goals by reducing waste, lowering carbon footprints, and promoting circular economy practices.

This trend is supported by stringent government regulations and corporate sustainability initiatives, which mandate or encourage the use of recyclable and reusable packaging materials.

Advantages of Returnable Packaging

Returnable packaging offers several benefits that drive its adoption across various industries. These benefits include cost savings over time, as the need for single-use packaging is reduced, leading to lower material and disposal costs. Additionally, returnable packaging is often more durable and provides better protection for goods during transportation, reducing damage and loss.

The efficiency in handling and storage due to standardized sizes and shapes further enhances operational logistics, making returnable packaging a preferred choice for businesses aiming to optimize their supply chains.

Restraining Factors

Complexity of Reverse Logistics

The implementation of returnable packaging systems introduces complexities in reverse logistics, which is a significant factor impacting the market. Managing the return, cleaning, and redistribution of packaging materials requires sophisticated logistics and tracking systems. Companies must invest in technology and infrastructure to ensure the efficient handling of returned packaging, which can be a substantial initial investment.

The coordination needed to track and collect packaging from multiple end-users adds layers of complexity to supply chain operations. Despite these challenges, advancements in logistics technology and the increasing availability of third-party logistics providers specializing in reverse logistics are helping to mitigate these issues, making returnable packaging more viable for businesses.

Cleanliness and Quality Control Challenges

Maintaining the cleanliness and quality of returnable packaging is another critical factor that affects the market. The reuse of packaging materials necessitates rigorous cleaning and quality control processes to meet industry standards and ensure the safety and integrity of the products being transported. Any compromise in cleanliness or quality can lead to contamination, product recalls, and damage to brand reputation.

Companies need to establish stringent cleaning protocols and invest in high-quality materials that can withstand repeated use and cleaning cycles. Innovations in cleaning technology and materials science are improving the durability and hygiene of returnable packaging, addressing these concerns and supporting market growth.

By Product Type Analysis

In 2023, Intermediate Bulk Containers (IBCs) held a dominant market position in the By Product Type segment of the Returnable Packaging Market, capturing more than a 34% share. IBCs have emerged as the leading product type in the returnable packaging market. Their ability to store and transport large quantities of liquids and bulk materials efficiently has led to their widespread adoption across various industries, including chemicals, food and beverage, and pharmaceuticals.

Pallets are widely used in logistics and warehousing for the efficient handling and storage of goods. The increasing demand for durable and cost-effective packaging solutions is driving the growth of pallets in the returnable packaging market.

Returnable bottles, particularly in the beverage industry, are gaining popularity due to their sustainability and cost savings. The trend towards environmentally friendly packaging options is boosting the adoption of returnable bottles.

Crates are essential for the transportation of fresh produce, dairy products, and other perishable items. Their reusable nature and ability to provide adequate protection make them a preferred choice in the returnable packaging market.

Dunnage, used to secure and protect cargo during transportation, is crucial for reducing product damage. The rise in e-commerce and the need for safe and secure shipping solutions are contributing to the increased use of dunnage.

Drums and barrels are primarily used in the chemical and pharmaceutical industries for the storage and transportation of liquids. Their robust and reusable nature makes them a key component in the returnable packaging market.

This category includes various other types of returnable packaging solutions, such as reusable totes, racks, and containers. The diverse applications and benefits of these solutions continue to support their presence in the market.

By Material Analysis

In 2023, Plastic held a dominant market position in the By Material segment of the Returnable Packaging Market, capturing more than a 42% share. Plastic materials have gained significant traction in the returnable packaging market due to their durability, lightweight nature, and cost-effectiveness. The versatility of plastic allows for the production of various packaging solutions such as crates, pallets, bottles, and Intermediate Bulk Containers (IBCs). Advancements in recycling technologies have made plastic an increasingly sustainable option, further bolstering its dominance in the market.

Metal packaging, known for its robustness and high resistance to external factors, is primarily used in applications requiring enhanced durability and protection. Industries such as automotive, aerospace, and heavy machinery heavily rely on metal returnable packaging solutions like drums, barrels, and metal pallets.

Wooden packaging solutions, including pallets and crates, are favored for their eco-friendly properties and strength. The use of wood is prevalent in industries such as agriculture, food and beverage, and logistics. Wooden pallets, in particular, are a staple in the shipping and storage sectors due to their ease of repair and recyclability.

Glass, though less common in the returnable packaging market compared to other materials, is still vital for certain applications. The food and beverage industry often employs glass bottles and jars due to their inert nature, which ensures product safety and quality. Glass is highly reusable and recyclable, contributing to its appeal as a sustainable packaging option.

By End-use Analysis

In 2023, Food & Beverage held a dominant market position in the By End-use segment of the Returnable Packaging Market, capturing more than a 45% share. The Food & Beverage sector is the largest end-use segment in the returnable packaging market. The extensive use of returnable packaging solutions such as crates, pallets, and bottles in the transportation and storage of food products, beverages, and perishable goods drives this dominance. The increasing focus on sustainability and reducing packaging waste has led to a greater adoption of returnable packaging in this sector.

The automotive industry extensively utilizes returnable packaging solutions, including pallets, dunnage, and metal containers, for the safe and efficient transportation of parts and components. The need for robust and secure packaging to protect high-value items from damage during transit is a significant driver in this segment.

The Consumer Durables sector employs returnable packaging for the distribution of electronics, appliances, and other durable goods. Reusable packaging solutions help in reducing overall packaging costs and minimize environmental impact, which is crucial for companies aiming to enhance their sustainability profiles.

The Healthcare sector relies on returnable packaging to ensure the safe and secure transportation of medical devices, pharmaceuticals, and other sensitive products. The stringent regulatory environment governing the healthcare industry mandates the use of high-quality, hygienic packaging solutions.

This category encompasses various other end-use sectors that utilize returnable packaging solutions, such as retail, logistics, and industrial manufacturing. Each of these sectors has unique packaging requirements that benefit from the durability, cost-effectiveness, and sustainability of returnable packaging.

Key Market Segments

By Product Type

- Pallets

- Bottles

- Crates

- Dunnage

- Drums & Barrel

- Intermediate Bulk Containers (IBCs)

- Others

By Material

- Plastic

- Metal

- Wood

- Glass

By End-use

- Food & Beverage

- Automotive

- Consumer Durables

- Healthcare

- Others

Growth Opportunity

Food & Beverage Industry Expansion

The food and beverage industry is experiencing rapid growth, creating significant opportunities for the returnable packaging market. With increased production and consumption, the demand for efficient, cost-effective, and sustainable packaging solutions is rising. Returnable packaging meets these needs by providing durable, reusable containers that ensure product safety and freshness while reducing waste.

As companies in the food and beverage sector seek to optimize their supply chains and minimize their environmental footprint, the adoption of returnable packaging is expected to increase, driving market growth.

Sustainability for Brand Reputation

Sustainability has become a critical aspect of brand reputation, influencing consumer preferences and purchasing decisions. Companies are under pressure to demonstrate their commitment to environmental responsibility, and returnable packaging is a key strategy in this regard. By reducing the use of single-use plastics and minimizing waste, businesses can enhance their sustainability profiles and appeal to eco-conscious consumers.

The positive impact on brand reputation, coupled with potential cost savings, makes returnable packaging an attractive option for companies across various industries. This trend is anticipated to fuel the market's expansion as more businesses integrate sustainable practices into their operations.

Latest Trends

Recyclable and Reusable Materials

In 2024, the global returnable packaging market is expected to witness a strong emphasis on recyclable and reusable materials. This trend is driven by increasing environmental regulations and a growing consumer preference for sustainable products. Companies are investing in materials that not only can be reused multiple times but also recycled at the end of their lifecycle. This dual focus ensures minimal environmental impact and aligns with circular economy principles.

Advancements in materials such as bioplastics and durable composites are providing alternatives that are both eco-friendly and robust enough to withstand repeated use. This trend is likely to attract businesses aiming to enhance their sustainability credentials and reduce their ecological footprint.

Innovative Business Models

The adoption of innovative business models is another significant trend shaping the returnable packaging market in 2024. Companies are exploring new ways to optimize the use of returnable packaging, including leasing models, packaging-as-a-service (PaaS), and subscription services. These models offer businesses flexibility and reduce the upfront costs associated with purchasing packaging outright. For example, leasing allows companies to pay for packaging on a per-use basis, which can be more cost-effective and efficient.

PaaS and subscription services provide comprehensive solutions, including maintenance, cleaning, and logistics management, thereby simplifying the process for businesses and ensuring the packaging is always in optimal condition. These innovative models are expected to drive higher adoption rates and open new revenue streams for service providers.

Regional Analysis

Asia Pacific emerges as the dominant player, commanding a significant share of 37.5% in the market.

Asia Pacific stands out as the dominant force in the global returnable packaging market, capturing a substantial share of 37.5%. This regional leadership underscores the significant opportunities and challenges shaping the future of returnable packaging across diverse geographical markets. Rapid industrialization, coupled with increasing awareness about environmental sustainability, drives the adoption of returnable packaging solutions across industries. The region's substantial manufacturing output and export activities further bolster the demand for efficient and cost-effective packaging solutions.

North America holds a prominent position in the returnable packaging market, supported by stringent environmental regulations promoting sustainable packaging solutions. The region benefits from a mature logistics infrastructure and high adoption rates of reusable packaging systems in industries such as automotive, food and beverages, and electronics.

Europe represents another key market for returnable packaging, characterized by a strong emphasis on reducing carbon footprint and achieving circular economy goals. Countries like Germany and the Netherlands lead in implementing advanced returnable packaging systems across various sectors, contributing to the region's sustainable packaging initiatives.

The Middle East & Africa region is witnessing gradual adoption of returnable packaging systems, supported by growing investments in infrastructure and logistics. The emphasis on reducing packaging waste and improving supply chain efficiency is encouraging industries in the region to explore reusable packaging options, albeit at a slower pace compared to other regions.

Latin America shows promise in the returnable packaging market, fueled by increasing awareness among consumers and businesses regarding the benefits of sustainable packaging solutions.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global Returnable Packaging Market in 2024 is poised for significant advancements, driven by key players such as Amatech, Inc., Schoeller Allibert, and ORBIS Corporation. These companies, alongside others like RPR Inc., Tri-pack Packaging Systems Ltd., and NEFAB GROUP, are leveraging innovative technologies to enhance product durability and sustainability, meeting the growing demand for eco-friendly solutions.

Amatech, Inc. is expected to maintain its strong market presence with its customized packaging solutions, which cater to a variety of industries. Schoeller Allibert, known for its extensive portfolio of reusable packaging products, continues to innovate in materials and design, enhancing efficiency and sustainability in supply chains. ORBIS Corporation is likely to capitalize on its expertise in plastic reusable packaging, promoting cost-effective and environmentally friendly logistics solutions.

RPR Inc. and Tri-pack Packaging Systems Ltd. are anticipated to expand their market share through strategic partnerships and the introduction of new product lines. NEFAB GROUP's global reach and focus on tailor-made solutions position it well to meet the diverse needs of its clients. Similarly, IPL, Inc. and RPP Containers are expected to leverage their strong manufacturing capabilities to drive growth.

UBEECO Packaging Solutions and CHEP, recognized for their robust service networks and innovative solutions, are likely to continue playing pivotal roles in the market. PPS Midlands Limited, Celina, and Brambles are also expected to contribute significantly, focusing on sustainable and cost-effective packaging solutions.

Market Key Players

- Amatech, Inc.

- Schoeller Allibert

- ORBIS Corporation

- RPR Inc.

- Tri-pack Packaging Systems Ltd.

- NEFAB GROUP

- IPL, Inc.

- RPP Containers

- UBEECO Packaging Solutions

- CHEP

- PPS Midlands Limited

- Celina

- Brambles

Recent Development

- In May 2024, Novolex invested in OZZI, a reusable packaging provider. Eco-Products will enhance OZZI's growth, focusing on reusable containers and tracking technology for campuses, hospitals, and closed-loop systems.

- In April 2024, BioPak acquired reusable cup company Huskee, aiming to strengthen their circular economy initiatives. Huskee will expand its product offerings under BioPak's ownership, enhancing global green packaging efforts.

Report Scope

Report Features Description Market Value (2023) USD 117.4 Bn Forecast Revenue (2033) USD 220.9 Bn CAGR (2024-2033) 6.7% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Pallets, Bottles, Crates, Dunnage, Drums & Barrel, Intermediate Bulk Containers (IBCs), Others), By Material (Plastic, Metal, Wood, Glass), By End-use (Food & Beverage, Automotive, Consumer Durables, Healthcare, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Amatech, Inc., Schoeller Allibert, ORBIS Corporation, RPR Inc., Tri-pack Packaging Systems Ltd., NEFAB GROUP, IPL, Inc., RPP Containers, UBEECO Packaging Solutions, CHEP, PPS Midlands Limited, Celina, Brambles Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Returnable Packaging Market Overview

- 2.1. Returnable Packaging Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Returnable Packaging Market Dynamics

- 3. Global Returnable Packaging Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Returnable Packaging Market Analysis, 2016-2021

- 3.2. Global Returnable Packaging Market Opportunity and Forecast, 2023-2032

- 3.3. Global Returnable Packaging Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 3.3.1. Global Returnable Packaging Market Analysis by By Product Type: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 3.3.3. Pallets

- 3.3.4. Bottles

- 3.3.5. Crates

- 3.3.6. Dunnage

- 3.3.7. Drums & Barrel

- 3.3.8. Intermediate Bulk Containers (IBCs)

- 3.3.9. Others

- 3.4. Global Returnable Packaging Market Analysis, Opportunity and Forecast, By By Material, 2016-2032

- 3.4.1. Global Returnable Packaging Market Analysis by By Material: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material, 2016-2032

- 3.4.3. Plastic

- 3.4.4. Metal

- 3.4.5. Wood

- 3.4.6. Glass

- 3.5. Global Returnable Packaging Market Analysis, Opportunity and Forecast, By By End-use, 2016-2032

- 3.5.1. Global Returnable Packaging Market Analysis by By End-use: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-use, 2016-2032

- 3.5.3. Food & Beverage

- 3.5.4. Automotive

- 3.5.5. Consumer Durables

- 3.5.6. Healthcare

- 3.5.7. Others

- 4. North America Returnable Packaging Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Returnable Packaging Market Analysis, 2016-2021

- 4.2. North America Returnable Packaging Market Opportunity and Forecast, 2023-2032

- 4.3. North America Returnable Packaging Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 4.3.1. North America Returnable Packaging Market Analysis by By Product Type: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 4.3.3. Pallets

- 4.3.4. Bottles

- 4.3.5. Crates

- 4.3.6. Dunnage

- 4.3.7. Drums & Barrel

- 4.3.8. Intermediate Bulk Containers (IBCs)

- 4.3.9. Others

- 4.4. North America Returnable Packaging Market Analysis, Opportunity and Forecast, By By Material, 2016-2032

- 4.4.1. North America Returnable Packaging Market Analysis by By Material: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material, 2016-2032

- 4.4.3. Plastic

- 4.4.4. Metal

- 4.4.5. Wood

- 4.4.6. Glass

- 4.5. North America Returnable Packaging Market Analysis, Opportunity and Forecast, By By End-use, 2016-2032

- 4.5.1. North America Returnable Packaging Market Analysis by By End-use: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-use, 2016-2032

- 4.5.3. Food & Beverage

- 4.5.4. Automotive

- 4.5.5. Consumer Durables

- 4.5.6. Healthcare

- 4.5.7. Others

- 4.6. North America Returnable Packaging Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.6.1. North America Returnable Packaging Market Analysis by Country : Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.6.2.1. The US

- 4.6.2.2. Canada

- 4.6.2.3. Mexico

- 5. Western Europe Returnable Packaging Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Returnable Packaging Market Analysis, 2016-2021

- 5.2. Western Europe Returnable Packaging Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Returnable Packaging Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 5.3.1. Western Europe Returnable Packaging Market Analysis by By Product Type: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 5.3.3. Pallets

- 5.3.4. Bottles

- 5.3.5. Crates

- 5.3.6. Dunnage

- 5.3.7. Drums & Barrel

- 5.3.8. Intermediate Bulk Containers (IBCs)

- 5.3.9. Others

- 5.4. Western Europe Returnable Packaging Market Analysis, Opportunity and Forecast, By By Material, 2016-2032

- 5.4.1. Western Europe Returnable Packaging Market Analysis by By Material: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material, 2016-2032

- 5.4.3. Plastic

- 5.4.4. Metal

- 5.4.5. Wood

- 5.4.6. Glass

- 5.5. Western Europe Returnable Packaging Market Analysis, Opportunity and Forecast, By By End-use, 2016-2032

- 5.5.1. Western Europe Returnable Packaging Market Analysis by By End-use: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-use, 2016-2032

- 5.5.3. Food & Beverage

- 5.5.4. Automotive

- 5.5.5. Consumer Durables

- 5.5.6. Healthcare

- 5.5.7. Others

- 5.6. Western Europe Returnable Packaging Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.6.1. Western Europe Returnable Packaging Market Analysis by Country : Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.6.2.1. Germany

- 5.6.2.2. France

- 5.6.2.3. The UK

- 5.6.2.4. Spain

- 5.6.2.5. Italy

- 5.6.2.6. Portugal

- 5.6.2.7. Ireland

- 5.6.2.8. Austria

- 5.6.2.9. Switzerland

- 5.6.2.10. Benelux

- 5.6.2.11. Nordic

- 5.6.2.12. Rest of Western Europe

- 6. Eastern Europe Returnable Packaging Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Returnable Packaging Market Analysis, 2016-2021

- 6.2. Eastern Europe Returnable Packaging Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Returnable Packaging Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 6.3.1. Eastern Europe Returnable Packaging Market Analysis by By Product Type: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 6.3.3. Pallets

- 6.3.4. Bottles

- 6.3.5. Crates

- 6.3.6. Dunnage

- 6.3.7. Drums & Barrel

- 6.3.8. Intermediate Bulk Containers (IBCs)

- 6.3.9. Others

- 6.4. Eastern Europe Returnable Packaging Market Analysis, Opportunity and Forecast, By By Material, 2016-2032

- 6.4.1. Eastern Europe Returnable Packaging Market Analysis by By Material: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material, 2016-2032

- 6.4.3. Plastic

- 6.4.4. Metal

- 6.4.5. Wood

- 6.4.6. Glass

- 6.5. Eastern Europe Returnable Packaging Market Analysis, Opportunity and Forecast, By By End-use, 2016-2032

- 6.5.1. Eastern Europe Returnable Packaging Market Analysis by By End-use: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-use, 2016-2032

- 6.5.3. Food & Beverage

- 6.5.4. Automotive

- 6.5.5. Consumer Durables

- 6.5.6. Healthcare

- 6.5.7. Others

- 6.6. Eastern Europe Returnable Packaging Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.6.1. Eastern Europe Returnable Packaging Market Analysis by Country : Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.6.2.1. Russia

- 6.6.2.2. Poland

- 6.6.2.3. The Czech Republic

- 6.6.2.4. Greece

- 6.6.2.5. Rest of Eastern Europe

- 7. APAC Returnable Packaging Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Returnable Packaging Market Analysis, 2016-2021

- 7.2. APAC Returnable Packaging Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Returnable Packaging Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 7.3.1. APAC Returnable Packaging Market Analysis by By Product Type: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 7.3.3. Pallets

- 7.3.4. Bottles

- 7.3.5. Crates

- 7.3.6. Dunnage

- 7.3.7. Drums & Barrel

- 7.3.8. Intermediate Bulk Containers (IBCs)

- 7.3.9. Others

- 7.4. APAC Returnable Packaging Market Analysis, Opportunity and Forecast, By By Material, 2016-2032

- 7.4.1. APAC Returnable Packaging Market Analysis by By Material: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material, 2016-2032

- 7.4.3. Plastic

- 7.4.4. Metal

- 7.4.5. Wood

- 7.4.6. Glass

- 7.5. APAC Returnable Packaging Market Analysis, Opportunity and Forecast, By By End-use, 2016-2032

- 7.5.1. APAC Returnable Packaging Market Analysis by By End-use: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-use, 2016-2032

- 7.5.3. Food & Beverage

- 7.5.4. Automotive

- 7.5.5. Consumer Durables

- 7.5.6. Healthcare

- 7.5.7. Others

- 7.6. APAC Returnable Packaging Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.6.1. APAC Returnable Packaging Market Analysis by Country : Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.6.2.1. China

- 7.6.2.2. Japan

- 7.6.2.3. South Korea

- 7.6.2.4. India

- 7.6.2.5. Australia & New Zeland

- 7.6.2.6. Indonesia

- 7.6.2.7. Malaysia

- 7.6.2.8. Philippines

- 7.6.2.9. Singapore

- 7.6.2.10. Thailand

- 7.6.2.11. Vietnam

- 7.6.2.12. Rest of APAC

- 8. Latin America Returnable Packaging Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Returnable Packaging Market Analysis, 2016-2021

- 8.2. Latin America Returnable Packaging Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Returnable Packaging Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 8.3.1. Latin America Returnable Packaging Market Analysis by By Product Type: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 8.3.3. Pallets

- 8.3.4. Bottles

- 8.3.5. Crates

- 8.3.6. Dunnage

- 8.3.7. Drums & Barrel

- 8.3.8. Intermediate Bulk Containers (IBCs)

- 8.3.9. Others

- 8.4. Latin America Returnable Packaging Market Analysis, Opportunity and Forecast, By By Material, 2016-2032

- 8.4.1. Latin America Returnable Packaging Market Analysis by By Material: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material, 2016-2032

- 8.4.3. Plastic

- 8.4.4. Metal

- 8.4.5. Wood

- 8.4.6. Glass

- 8.5. Latin America Returnable Packaging Market Analysis, Opportunity and Forecast, By By End-use, 2016-2032

- 8.5.1. Latin America Returnable Packaging Market Analysis by By End-use: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-use, 2016-2032

- 8.5.3. Food & Beverage

- 8.5.4. Automotive

- 8.5.5. Consumer Durables

- 8.5.6. Healthcare

- 8.5.7. Others

- 8.6. Latin America Returnable Packaging Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.6.1. Latin America Returnable Packaging Market Analysis by Country : Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.6.2.1. Brazil

- 8.6.2.2. Colombia

- 8.6.2.3. Chile

- 8.6.2.4. Argentina

- 8.6.2.5. Costa Rica

- 8.6.2.6. Rest of Latin America

- 9. Middle East & Africa Returnable Packaging Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Returnable Packaging Market Analysis, 2016-2021

- 9.2. Middle East & Africa Returnable Packaging Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Returnable Packaging Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 9.3.1. Middle East & Africa Returnable Packaging Market Analysis by By Product Type: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 9.3.3. Pallets

- 9.3.4. Bottles

- 9.3.5. Crates

- 9.3.6. Dunnage

- 9.3.7. Drums & Barrel

- 9.3.8. Intermediate Bulk Containers (IBCs)

- 9.3.9. Others

- 9.4. Middle East & Africa Returnable Packaging Market Analysis, Opportunity and Forecast, By By Material, 2016-2032

- 9.4.1. Middle East & Africa Returnable Packaging Market Analysis by By Material: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material, 2016-2032

- 9.4.3. Plastic

- 9.4.4. Metal

- 9.4.5. Wood

- 9.4.6. Glass

- 9.5. Middle East & Africa Returnable Packaging Market Analysis, Opportunity and Forecast, By By End-use, 2016-2032

- 9.5.1. Middle East & Africa Returnable Packaging Market Analysis by By End-use: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-use, 2016-2032

- 9.5.3. Food & Beverage

- 9.5.4. Automotive

- 9.5.5. Consumer Durables

- 9.5.6. Healthcare

- 9.5.7. Others

- 9.6. Middle East & Africa Returnable Packaging Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.6.1. Middle East & Africa Returnable Packaging Market Analysis by Country : Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.6.2.1. Algeria

- 9.6.2.2. Egypt

- 9.6.2.3. Israel

- 9.6.2.4. Kuwait

- 9.6.2.5. Nigeria

- 9.6.2.6. Saudi Arabia

- 9.6.2.7. South Africa

- 9.6.2.8. Turkey

- 9.6.2.9. The UAE

- 9.6.2.10. Rest of MEA

- 10. Global Returnable Packaging Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Returnable Packaging Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Returnable Packaging Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Amatech, Inc.

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Schoeller Allibert

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. ORBIS Corporation

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. RPR Inc.

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Tri-pack Packaging Systems Ltd.

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. NEFAB GROUP

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. IPL, Inc.

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. RPP Containers

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. UBEECO Packaging Solutions

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. CHEP

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. PPS Midlands Limited

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. Brambles

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- 1. Executive Summary

-

- Amatech, Inc.

- Schoeller Allibert

- ORBIS Corporation

- RPR Inc.

- Tri-pack Packaging Systems Ltd.

- NEFAB GROUP

- IPL, Inc.

- RPP Containers

- UBEECO Packaging Solutions

- CHEP

- PPS Midlands Limited

- Celina

- Brambles