Remote Weapon Station Market Report By Platform Type (Land-based, Naval-based, Airborne), By Technology Type (Remote Controlled Weapon Station, Autonomous Weapon Station), By Weapon Type (Lethal Weapons [Machine Guns, Automatic Cannons, Missile Launchers, Others], Non-lethal Weapons [Acoustic Hailing Devices, Non-lethal Ammunition, Others]), By Application, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

7097

-

July 2024

-

325

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

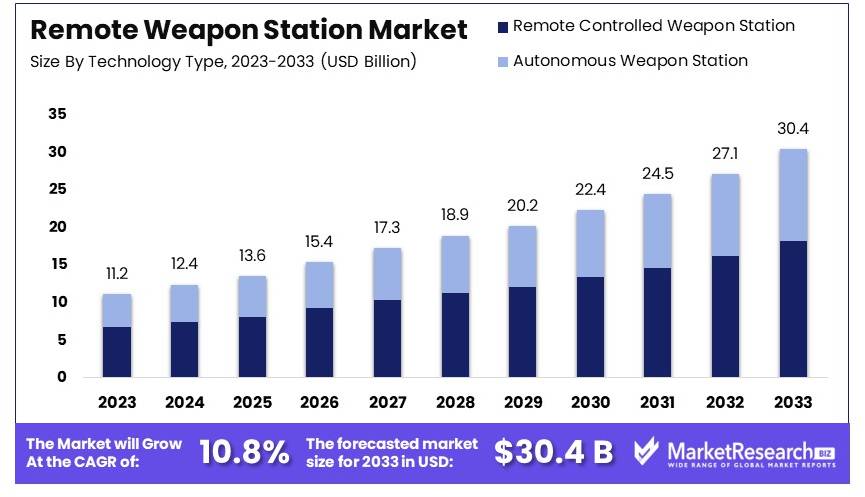

The Global Remote Weapon Station Market size is expected to be worth around USD 30.4 Billion by 2033, from USD 11.2 Billion in 2023, growing at a CAGR of 10.8% during the forecast period from 2024 to 2033.

The Remote Weapon Station (RWS) Market focuses on advanced weapon systems controlled remotely by operators. These systems are mounted on military vehicles, naval vessels, or stationary platforms. They enable soldiers to operate weapons from a safe distance, reducing exposure to enemy fire.

RWS integrates sensors, cameras, and fire control systems to improve targeting accuracy. This technology enhances operational efficiency and safety for military personnel. It is widely used in defense applications, including border security, combat operations, and surveillance.

Remote Weapon Stations (RWS) are becoming increasingly significant across various defense sectors, including the military, law enforcement, and border security. These systems enhance the operational capabilities of forces by allowing remote engagement with targets, thereby improving safety and efficiency.

In the United States, the Marine Corps has prioritized the production of the Marine Air Defense Integrated System (MADIS) RWS. This system, crucial for ground-based air defense, features a 30mm cannon and a 7.62mm machine gun, and it integrates with Stinger missiles and counter-unmanned aircraft systems. The MADIS RWS is part of a $94 million contract with Kongsberg, which also includes spares and training components.

Similarly, the US Army has contracted Kongsberg for an additional 409 Commonly Remotely Operated Weapon Stations (CROWS), bringing the total to over 22,000 units delivered globally. These systems are utilized across all branches of the US military, providing enhanced protection and operational flexibility.

Internationally, the demand for RWS continues to grow. Ukraine recently acquired 100 remote weapon systems from Australia, enhancing its defensive capabilities amid ongoing conflicts. These systems are part of a broader trend of modernizing military equipment to address evolving threats.

In Turkey, Aselsan has showcased its advanced SARP Next Gen Remote-Controlled Weapon Station. This system, designed for precision and mobility, is part of a broader effort to modernize and enhance the Turkish military’s operational capabilities.

Government initiatives and investments are pivotal in the development and deployment of RWS. The US government's continuous investment in these systems reflects a strategic focus on enhancing defense capabilities. The Marine Corps' move to full-rate production and the Army's large-scale acquisitions underscore the importance of these systems in modern warfare.

Innovations in RWS technology, such as the integration of advanced sensors and automated targeting systems, are also driving the market. The use of these systems in counter-drone operations, as demonstrated by EOS Defense Systems with their R600 model, highlights their versatility and critical role in addressing contemporary security challenges.

Key Takeaways

- Market Value: The Remote Weapon Station Market was valued at USD 11.2 billion in 2023, and is expected to reach USD 30.4 billion by 2033, with a CAGR of 10.8%.

- Platform Type Analysis: Land-based platforms dominated with 55%; significant for ground-based defense applications.

- Technology Type Analysis: Remote Controlled Weapon Stations led with 60%; essential for operational safety and efficiency.

- Weapon Type Analysis: Machine Guns held 70%; crucial for versatile and effective combat.

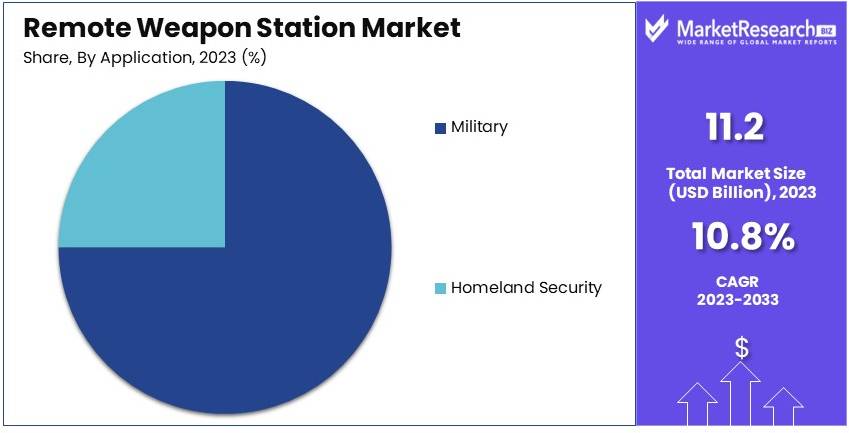

- Application Analysis: Military applications dominated with 75%; indicating high defense sector reliance.

- Dominant Region: North America led with 42%; major investment in defense technology.

- High Growth Region: Asia Pacific, significant for increasing defense budgets.

- Analyst Viewpoint: The market is highly competitive with potential for significant growth driven by technological advancements and defense spending.

Driving Factors

Increasing Demand for Force Protection and Enhanced Situational Awareness Drives Market Growth

The demand for advanced security measures and real-time monitoring capabilities is a key driver for the growth of the remote weapon station market. These systems provide enhanced situational awareness, allowing operators to detect and respond to potential threats from a safe distance. The U.S. Army, for example, has widely deployed remote weapon stations on its mine-resistant ambush-protected (MRAP) vehicles to improve force protection in hostile environments. These stations enable real-time surveillance and target engagement, significantly enhancing the operational efficiency and safety of military personnel.

Furthermore, remote weapon stations are equipped with advanced optics and sensors that facilitate continuous monitoring and quick response to emerging threats. This technology ensures that forces remain aware of their surroundings, even in complex and rapidly changing situations. The integration of these systems into military operations not only improves force protection but also enhances overall mission success rates. As global security threats continue to evolve, the adoption of remote weapon stations is expected to rise, driven by the need for effective and reliable defense solutions. This trend is supported by increased defense spending in various countries, aimed at upgrading their military capabilities and ensuring national security.

Technological Advancements in Optics, Sensors, and Targeting Systems Drive Market Growth

Continuous advancements in fiber optics, sensors, and targeting systems have significantly contributed to the growth of the remote weapon station market. These technological improvements enhance the accuracy, range, and functionality of remote weapon stations, enabling operators to identify and engage targets more effectively, even in challenging conditions. For instance, the integration of thermal imaging and night vision capabilities allows for round-the-clock operation of remote weapon stations, ensuring their effectiveness in both day and night scenarios.

Advanced sensors provide high-resolution imaging and precise target acquisition, which are critical for successful mission outcomes. These advancements have also led to the development of more compact and lightweight systems, making them easier to deploy across various platforms such as armored vehicles, naval ships, and unmanned ground vehicles. The continuous innovation in these technologies not only improves the performance of remote weapon stations but also reduces their operational costs, making them more accessible to a wider range of defense forces and security agencies.

Emphasis on Reducing Human Exposure to Combat Risks Drives Market Growth

Remote weapon stations offer a significant advantage by minimizing the exposure of personnel to direct combat situations, which is a crucial factor driving the market's growth. This factor has gained importance as militaries and law enforcement agencies seek to enhance personnel safety while maintaining operational effectiveness. The Israeli Defense Forces, for example, have extensively utilized remote weapon stations on their armored vehicles to reduce casualties during urban operations.

By allowing operators to control weapons from a safe distance, remote weapon stations help to mitigate the risks associated with direct combat. This not only protects the lives of soldiers and law enforcement officers but also improves their ability to perform their duties without the constant threat of injury or death. The emphasis on reducing human exposure to combat risks aligns with the broader trend of modernizing military forces and improving their operational capabilities through the use of advanced technologies.

Restraining Factors

High Acquisition and Maintenance Costs Restrain Market Growth

Remote weapon stations are complex systems that involve advanced technologies and specialized components, resulting in high acquisition and maintenance costs. This can be a significant barrier, particularly for nations or organizations with limited defense budgets. The high costs are not only for purchasing the systems but also for the ongoing expenses of maintaining and upgrading them.

Additionally, training personnel to operate and maintain these systems adds to the overall expense. This financial burden limits the market's growth potential as many countries or organizations may opt for more cost-effective alternatives. For example, small and developing nations might find it challenging to justify such significant expenditures in their defense budgets, leading to lower adoption rates of remote weapon stations.

Cybersecurity Concerns and Vulnerability to Hacking Restrain Market Growth

As remote weapon stations rely heavily on computer systems and data communication networks, they are susceptible to potential cyber threats, such as hacking or jamming. This vulnerability raises concerns about the integrity and reliability of these systems. Cybersecurity issues can undermine the confidence of military and defense organizations in the technology, hindering their widespread adoption.

For instance, a compromised remote weapon station could lead to unauthorized control or data breaches, posing serious operational risks. The fear of cyber attacks, especially in highly sensitive operations, can deter investment in these systems, thereby limiting market growth. Enhanced cybersecurity measures are essential to address these concerns and build trust in the technology.

Platform Type Analysis

Land-based platforms dominate with 55% due to their extensive use in military and homeland security operations.

The land-based segment is driven by the high demand for remote weapon stations on armored vehicles, infantry fighting vehicles, and mine-resistant ambush-protected (MRAP) vehicles. These systems enhance force protection and situational awareness, making them essential for ground operations. The U.S. Army, for instance, has extensively deployed remote weapon stations on its MRAP vehicles to improve operational efficiency and personnel safety in hostile environments. This widespread adoption is a key factor behind the dominance of the land-based segment. Additionally, ongoing modernization programs in various countries are expected to further boost this segment's growth. The increasing focus on upgrading military capabilities to address evolving threats is likely to sustain the demand for land-based remote weapon stations.

The naval-based segment holds significant potential, primarily driven by the integration of remote weapon stations on naval vessels for enhanced maritime security. These systems are crucial for defending ships against asymmetric threats such as small boats and drones. The naval segment is expected to grow steadily as countries invest in enhancing their naval capabilities. For example, the U.S. Navy has been equipping its ships with advanced remote weapon stations to improve defense mechanisms. However, the growth rate is relatively slower compared to the land-based segment due to the higher cost and complexity of integrating these systems on naval platforms.

The airborne segment, while the smallest, is gradually gaining traction. The use of remote weapon stations on unmanned aerial vehicles (UAVs) and helicopters provides a significant tactical advantage by allowing for precise engagement of targets from the air. This segment's growth is driven by the increasing adoption of UAVs for reconnaissance and combat missions. Despite its smaller share, the airborne segment is expected to see moderate growth due to technological advancements and the rising importance of air superiority in modern warfare.

Technology Type Analysis

Remote controlled weapon stations dominate with 60% due to their reliability and proven effectiveness.

Remote controlled weapon stations are widely preferred due to their established track record and ease of integration with existing military platforms. These systems allow operators to control weapons from a safe distance, significantly reducing the risk to personnel. The dominance of this segment is attributed to the increasing demand for reliable and cost-effective defense solutions. For instance, many military forces around the world have adopted remote controlled weapon stations for their armored vehicles, ensuring enhanced force protection and operational efficiency. The extensive use of these systems in various conflict zones has proven their effectiveness, reinforcing their market position.

Autonomous weapon stations, although currently holding a smaller market share, are expected to witness significant growth. These systems offer the advantage of operating independently, using artificial intelligence and advanced algorithms to identify and engage targets without human intervention. The development of autonomous systems is driven by the need for faster decision-making in combat situations and the reduction of human error. As technology advances, the reliability and capabilities of autonomous weapon stations are expected to improve, leading to increased adoption in the future. However, concerns related to ethical implications and the potential for unintended consequences may hinder the rapid adoption of fully autonomous systems.

The integration of advanced technologies such as machine learning, computer vision, and real-time data processing is expected to enhance the functionality of both remote controlled and autonomous weapon stations. The ongoing research and development efforts in this area aim to improve the accuracy, speed, and reliability of these systems, further driving their market growth. As military forces seek to modernize their capabilities, the demand for both types of weapon stations is anticipated to rise, with remote controlled systems maintaining their lead in the near term.

Weapon Type Analysis

Machine guns dominate with 70% due to their widespread use and effectiveness in combat operations.

Lethal weapons are the primary choice for remote weapon stations, with machine guns being the most commonly used. These weapons offer high firepower and versatility, making them suitable for various combat scenarios. The dominance of machine guns in this segment is driven by their proven effectiveness in providing suppressive fire and engaging multiple targets. The use of automatic cannons and missile launchers further enhances the capabilities of remote weapon stations, enabling them to tackle a wide range of threats. The integration of advanced targeting systems and sensors ensures precise engagement, making lethal weapons the preferred option for military forces.

Non-lethal weapons, although holding a smaller market share, are gaining importance in specific applications such as crowd control and peacekeeping missions. Acoustic hailing devices and non-lethal ammunition are commonly used in these scenarios to minimize casualties and control situations without escalating violence. The demand for non-lethal weapons is driven by the need for more humane methods of conflict resolution and the increasing emphasis on minimizing collateral damage. These systems are particularly valuable for homeland security operations, where the focus is on maintaining order without causing significant harm.

The ongoing advancements in both lethal and non-lethal weapon technologies are expected to drive market growth. The development of more precise and effective weapon systems, coupled with the integration of advanced targeting and control mechanisms, is likely to enhance the capabilities of remote weapon stations. As military and security forces continue to seek versatile and reliable solutions, the demand for both lethal and non-lethal weapons is anticipated to grow, with lethal weapons maintaining a dominant position due to their critical role in combat operations.

Application Analysis

Military segment dominates with 75% due to extensive use in defense operations.

The military segment is the largest application area for remote weapon stations, driven by the need for advanced defense systems to enhance force protection and operational effectiveness. These systems are extensively used in armored vehicles, naval ships, and UAVs to provide enhanced situational awareness and precise target engagement. The increasing focus on modernizing military capabilities and addressing evolving threats is a key factor behind the dominance of this segment. The U.S. Department of Defense, for example, has made significant investments in remote weapon stations to equip its forces with the latest technology and improve their combat readiness.

Homeland security, while holding a smaller market share, is becoming increasingly important. The use of remote weapon stations in border security, critical infrastructure protection, and counter-terrorism operations is driving growth in this segment. These systems provide security forces with the ability to monitor and respond to threats in real-time, enhancing their ability to maintain public safety and order. The integration of non-lethal weapons in homeland security operations is particularly valuable for minimizing casualties and maintaining control in sensitive situations.

The synergy between military and homeland security applications is expected to drive overall market growth. As both sectors continue to face diverse and evolving threats, the demand for versatile and reliable remote weapon stations is likely to increase. The ongoing advancements in technology and the integration of more sophisticated systems are anticipated to enhance the capabilities of remote weapon stations, further supporting their adoption in both military and homeland security applications.

Key Market Segments

By Platform Type

- Land-based

- Naval-based

- Airborne

By Technology Type

- Remote Controlled Weapon Station

- Autonomous Weapon Station

By Weapon Type

- Lethal Weapons

- Machine Guns

- Automatic Cannons

- Missile Launchers

- Others

- Non-lethal Weapons

- Acoustic Hailing Devices

- Non-lethal Ammunition

- Others

By Application

- Military

- Homeland Security

Growth Opportunities

Integration with Unmanned Systems and Artificial Intelligence Offers Growth Opportunity

The integration of remote weapon stations with unmanned systems and artificial intelligence presents significant growth opportunities. Combining these stations with unmanned aerial vehicles (UAVs) and unmanned ground vehicles (UGVs) enhances operational efficiency and effectiveness. AI and machine learning capabilities improve target recognition, tracking, and engagement.

This integration enables remote weapon stations to operate more autonomously, reducing the need for direct human intervention. The global shift towards automation and advanced technologies in defense is driving this trend. As a result, the market is expected to see increased adoption of AI-enhanced remote weapon stations, contributing to their growing market share and expanded application in modern warfare.

Development of Lightweight and Compact Designs Offers Growth Opportunity

The trend toward lighter and more compact remote weapon station designs is creating new market opportunities. These designs allow for integration with a wider range of platforms, including smaller vehicles and unmanned systems. This development is particularly beneficial in urban warfare and special operations where maneuverability and versatility are crucial.

The ability to deploy remote weapon stations on diverse platforms enhances their operational flexibility. Recent advancements in materials and engineering have made it possible to produce more efficient and compact systems. As these lightweight designs become more prevalent, the market is likely to expand, catering to a broader range of military and security applications.

Trending Factors

Increasing Demand for Maritime and Coastal Security Applications Are Trending Factors

The increasing demand for maritime and coastal security applications is a trending factor in the remote weapon station market. Enhanced situational awareness and target engagement capabilities make these systems valuable assets for naval and coastguard operations. They are particularly effective in counter-piracy and exclusive economic zone (EEZ) patrols.

The need to protect maritime borders and critical infrastructure has led to the growing adoption of remote weapon stations in these areas. The integration of advanced sensors and targeting systems further enhances their effectiveness. As maritime security concerns rise globally, the market for remote weapon stations in this sector is expected to grow significantly.

Modularity and Versatility in Platform Integration Are Trending Factors

The modularity and versatility of remote weapon stations are trending factors that drive market expansion. These systems are designed to be adaptable, allowing for integration with various platforms such as ground vehicles, naval vessels, and aerial platforms. This versatility caters to diverse defense and security requirements, expanding the market reach.

For instance, the U.S. Navy has integrated remote weapon stations on its littoral combat ships for enhanced maritime security operations. The ability to customize and upgrade these systems according to specific mission needs makes them highly desirable. As the demand for flexible and adaptable defense solutions grows, the market for modular remote weapon stations is likely to see substantial growth.

Regional Analysis

North America Dominates with 42% Market Share

North America holds a dominant position in the Remote Weapon Station Market, accounting for 42% of the market share. This dominance is driven by several key factors.

North America's dominance is largely due to significant defense spending by the United States, which is the largest defense budget in the world. Advanced military technology and a strong focus on modernizing defense systems contribute to this high market share. The U.S. Department of Defense's extensive investments in remote weapon stations and continuous technological advancements support this growth. Moreover, robust R&D activities and the presence of major defense manufacturers in the region further bolster market dominance.

The regional characteristics, including a strong industrial base and advanced technological infrastructure, significantly impact the market's performance. The demand for advanced security solutions and the continuous threat of global terrorism drive the adoption of remote weapon stations. Additionally, North America's strategic military initiatives and international defense collaborations enhance the region's market position. The integration of cutting-edge technologies such as AI and machine learning into remote weapon stations is particularly prevalent in this region, enhancing their capabilities and operational efficiency.

Market Share of Other Regions

Europe: Europe holds a significant share of the Remote Weapon Station Market, accounting for approximately 28%. The region benefits from substantial defense budgets in countries like the UK, France, and Germany. Ongoing military modernization programs and increased focus on homeland security drive market growth. Europe's collaborative defense initiatives and strong industrial base contribute to its substantial market presence.

Asia Pacific: Asia Pacific accounts for around 20% of the market share. The region's growth is driven by increasing defense expenditures in countries such as China, India, and Japan. Rapid technological advancements and the rising need for advanced security measures bolster market expansion. Additionally, geopolitical tensions and regional conflicts necessitate the adoption of advanced military technologies, including remote weapon stations.

Middle East & Africa: The Middle East & Africa region holds approximately 7% of the market share. The demand for remote weapon stations in this region is driven by ongoing conflicts, regional instability, and the need for enhanced security measures. Significant investments in defense by countries like Saudi Arabia and the UAE contribute to market growth. The region's strategic importance in global defense dynamics also supports the adoption of advanced military technologies.

Latin America: Latin America accounts for about 3% of the market share. The region's growth is primarily driven by efforts to modernize military capabilities and improve homeland security. Countries like Brazil and Mexico are investing in advanced defense technologies, including remote weapon stations, to address security challenges. However, economic constraints and political instability may limit the pace of market expansion in this region.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Remote Weapon Station (RWS) Market includes leading companies such as Kongsberg Gruppen, Elbit Systems Ltd., and others. These companies significantly shape market dynamics and advancements.

Kongsberg Gruppen leads the market with its advanced RWS technology. Its strong R&D and innovative solutions position it as a key player.

Elbit Systems Ltd. and Leonardo S.p.A. contribute significantly with their cutting-edge defense systems. Their strategic partnerships and extensive product portfolios enhance their market influence.

Rheinmetall AG and Saab AB focus on advanced weapon systems and integration capabilities. Their expertise in defense technology strengthens their market positioning.

FN Herstal and Raytheon Technologies Corporation provide high-quality RWS products. Their robust defense solutions and strategic market presence impact market trends.

BAE Systems plc and General Dynamics Corporation leverage their extensive defense experience. Their innovative RWS solutions and strong market strategies boost their influence.

ASELSAN A.Ş. and Northrop Grumman Corporation focus on electronic and automated defense systems. Their technological advancements and market reach position them as key players.

Thales Group and ST Engineering offer comprehensive defense solutions, including RWS. Their strategic positioning and continuous innovation enhance their market impact.

Rafael Advanced Defense Systems Ltd. and KMW+Nexter Defense Systems N.V. bring advanced military technologies to the market. Their strong defense capabilities and strategic alliances strengthen their market presence.

In summary, these companies drive the Remote Weapon Station Market through innovation, strategic positioning, and market influence. Their advanced technologies and robust defense solutions shape the market landscape.

Market Key Players

- Kongsberg Gruppen ASA

- Elbit Systems Ltd.

- Leonardo S.p.A.

- Rheinmetall AG

- Saab AB

- FN Herstal

- Raytheon Technologies Corporation

- BAE Systems plc

- General Dynamics Corporation

- ASELSAN A.Ş.

- Northrop Grumman Corporation

- Thales Group

- ST Engineering

- Rafael Advanced Defense Systems Ltd.

- KMW+Nexter Defense Systems N.V.

Recent Developments

April 2024 / EOS: EOS demonstrated the combat capabilities of its R600 Remote Weapon Station as a counter-drone weapon system. The R600 RWS is designed to enhance the operational effectiveness of defense forces by providing superior targeting and engagement capabilities against unmanned threats.

July 2023 / U.S. Marine Corps: The U.S. Marine Corps is transitioning to full-rate production of the Marine Air Defense Integrated System Remote Weapon Station (MADIS RWS), a critical component in its Ground-Based Air Defense portfolio. This system provides protection from drones and other aerial threats.

Report Scope

Report Features Description Market Value (2023) USD 11.2 Billion Forecast Revenue (2033) USD 30.4 Billion CAGR (2024-2033) 10.8% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Platform Type (Land-based, Naval-based, Airborne), By Technology Type (Remote Controlled Weapon Station, Autonomous Weapon Station), By Weapon Type (Lethal Weapons [Machine Guns, Automatic Cannons, Missile Launchers, Others], Non-lethal Weapons [Acoustic Hailing Devices, Non-lethal Ammunition, Others]), By Application (Military, Homeland Security) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Kongsberg Gruppen, Elbit Systems Ltd., Leonardo S.p.A., Rheinmetall AG, Saab AB, FN Herstal, Raytheon Technologies Corporation, BAE Systems plc, General Dynamics Corporation, ASELSAN A.S., Northrop Grumman Corporation, Thales Group, ST Engineering, Rafael Advanced Defense Systems Ltd., KMW+Nexter Defense Systems N.V. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Kongsberg Gruppen ASA

- Raytheon Company

- Elbit Systems Ltd.

- Saab AB

- Leonardo S.p.A.

- Electro Optic Systems

- BAE Systems plc

- Rheinmetall AG

- ASELSAN A.Ş.

- FN Herstal, S.A.