Railway Cybersecurity Market By Offering (Solutions and Services), By Type (Infrastructural and On-board), By Security Type (Application Security, Network Security, Data Protection, End Point Security, System Administration), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

49179

-

July 2024

-

300

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

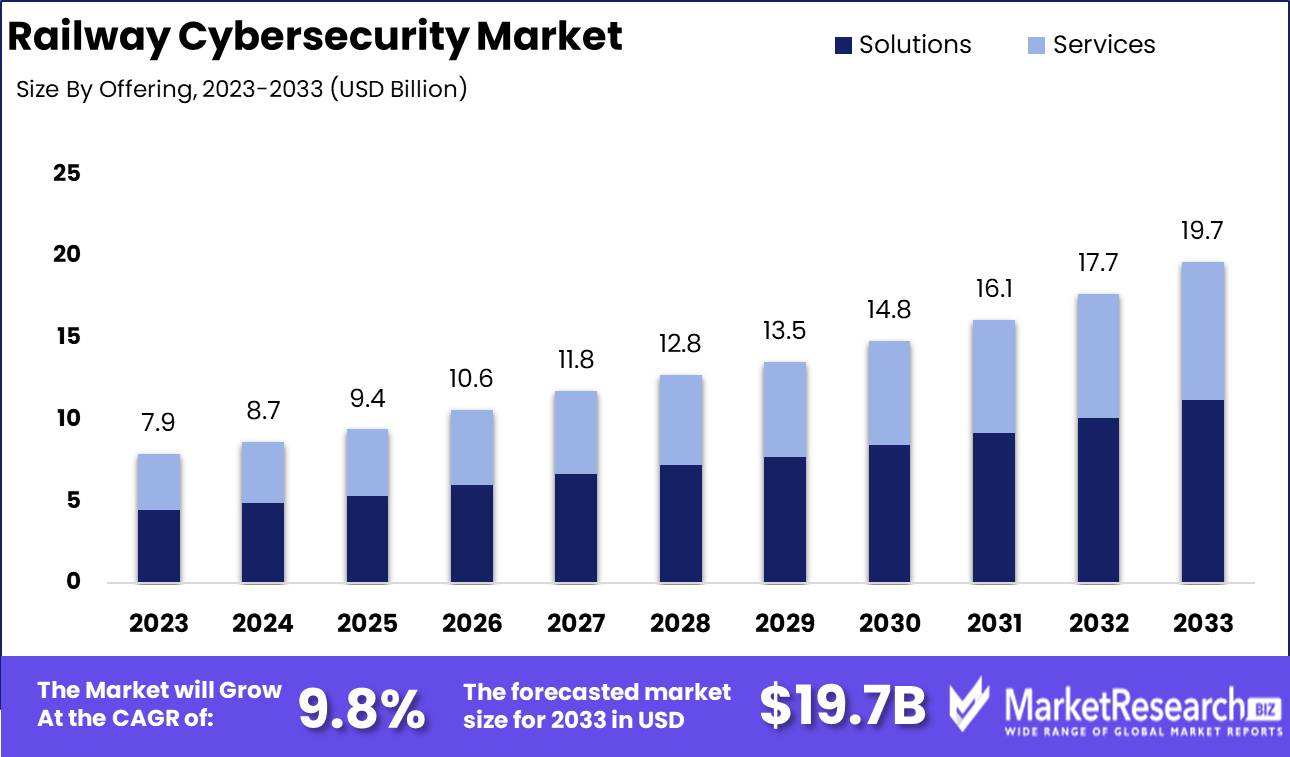

The Railway Cybersecurity Market was valued at USD 7.9 billion in 2023. It is expected to reach USD 19.7 billion by 2033, with a CAGR of 9.8% during the forecast period from 2024 to 2033.

The Railway Cybersecurity Market encompasses technologies and services to protect railway systems from cyber threats and vulnerabilities. This market addresses the increasing need for robust security protocols to safeguard critical railway infrastructure, including control systems, signaling, communication networks, and onboard services. As rail operations become more digitized and interconnected, the risk of cyberattacks heightens, necessitating advanced cybersecurity solutions. This market segment involves comprehensive strategies such as threat detection, risk assessment, response management, and continuous monitoring, ensuring the integrity and resilience of railway operations against cyber incidents.

The Railway Cybersecurity Market is witnessing substantial growth driven by the rapid digitalization of railway systems, a surge in cyber-attacks, and rigorous enforcement of cybersecurity mandates by governments globally. These factors collectively underline the critical need for robust cybersecurity frameworks to safeguard sensitive data and ensure uninterrupted railway operations. The integration of the Internet of Things (IoT) and automation within the railway infrastructure is catalyzing the demand for sophisticated cybersecurity measures. As railway systems incorporate more advanced technologies, the potential surface for cyber threats expands, necessitating enhanced security solutions that can preempt, diagnose, and counteract threats effectively.

Despite the evident momentum, the market faces significant challenges that could impede growth. The high costs associated with developing and implementing comprehensive cybersecurity solutions pose a considerable barrier, particularly for regions with constrained budgets. Additionally, the complexity of modern railway systems, which often integrate diverse technologies and platforms, complicates the deployment of uniform security measures.

However, the future of railway cybersecurity appears promising, with a shift towards leveraging cloud-based security solutions and blockchain technology to enhance the integrity and security of transactions and data. The adoption of machine learning and artificial intelligence is also becoming pivotal, offering predictive capabilities that enable real-time threat detection and resolution, thus fortifying the security landscape of the railway industry.

Key Takeaways

- Market Growth: The Railway Cybersecurity Market was valued at USD 7.9 billion in 2023. It is expected to reach USD 19.7 billion by 2033, with a CAGR of 9.8% during the forecast period from 2024 to 2033.

- By Offering: Solutions dominated the Railway Cybersecurity Market, safeguarding critical infrastructure.

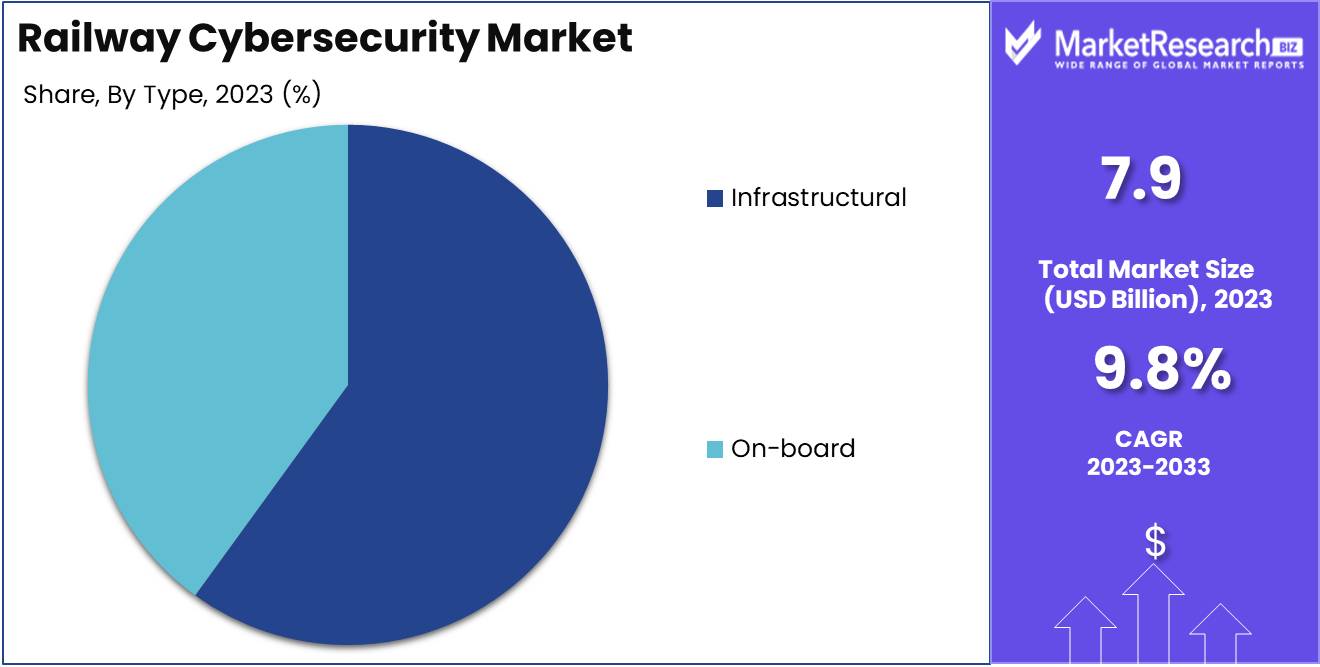

- By Type: The Infrastructural segment dominated the Railway Cybersecurity Market.

- By Security Type: Application Security dominates the 2023 Railway Cybersecurity Market's security type segment.

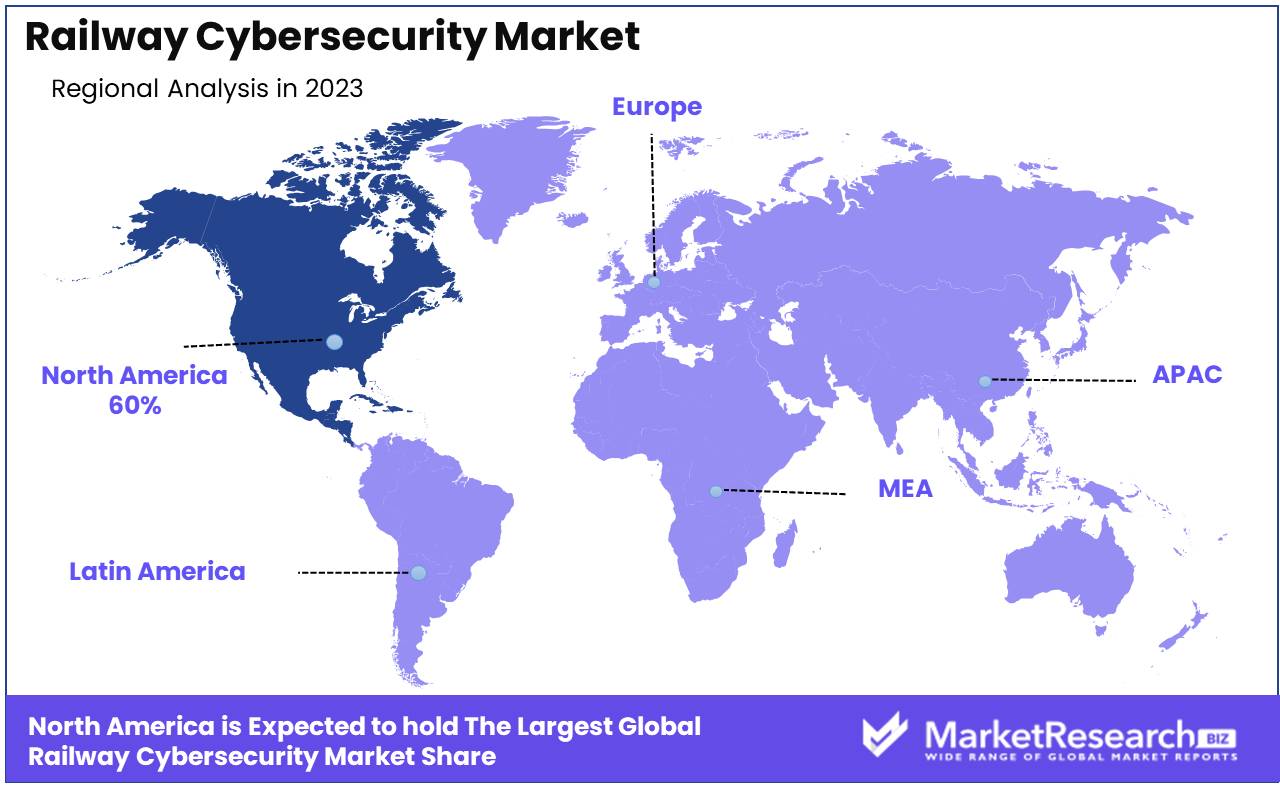

- Regional Dominance: North America leads Railway Cybersecurity, holding 35% of the global market share.

- Growth Opportunity: The global railway cybersecurity market will thrive on cloud adoption and advanced technologies like AI and IoT, enhancing safety and efficiency.

Driving factors

Surge in Demand for Passenger and Freight Capacity

The increasing demand for enhanced passenger and freight capacity in rail networks significantly influences the global railway cybersecurity market. As urbanization progresses and global trade expands, railways are under pressure to accommodate higher volumes of passengers and goods. This necessitates sophisticated cybersecurity solutions to protect data and ensure the operational efficiency of increasingly digitalized railway systems. The push for higher capacity often involves the integration of advanced telematics, automated control systems, and real-time monitoring, all of which expand the attack surface for potential cyber threats. Thus, the need to secure these systems from intrusion and ensure uninterrupted service drives investments in cybersecurity.

Increase in the Number of Railway Projects Across the Globe

The proliferation of railway projects worldwide acts as a catalyst for growth in the railway cybersecurity market. Each new railway project, from high-speed rail lines to urban transit systems, incorporates a significant component of digital technology for operations, safety, and customer service. The deployment of these technologies requires robust cybersecurity measures to protect against threats that could compromise safety and operational reliability. For instance, projects involving smart signaling systems and automated operations are particularly vulnerable to cyber-attacks, which could lead to severe disruptions. The global increase in railway infrastructure development thus directly contributes to heightened demand for comprehensive cybersecurity solutions.

Rising Number of Cyber Attacks on Railway Networks and Infrastructure

The escalating frequency and sophistication of cyber-attacks targeting railway networks play a crucial role in driving the railway cybersecurity market. Railway systems, integral to national infrastructure, are becoming prime targets for cybercriminals and state-sponsored attacks. The consequences of such attacks can range from data breaches and financial loss to severe disruptions in railway operations and threats to passenger safety. This vulnerability highlights the critical need for advanced cybersecurity solutions that not only protect against current threats but are also adaptable to evolving tactics by cyber adversaries. The industry's response has been to prioritize cybersecurity investments, focusing on advanced threat detection, response strategies, and system-hardening measures to safeguard critical infrastructure.

Restraining Factors

High Cost of Railway Cybersecurity Solutions and Services

The railway cybersecurity market is notably influenced by the substantial costs associated with implementing cybersecurity solutions and services. These costs stem from the need for advanced technologies to safeguard against sophisticated cyber threats, as well as the ongoing maintenance and updates required to keep security measures effective. Financially, this poses a significant barrier for many operators, particularly in emerging markets or smaller regional players, who may find the high initial and ongoing costs prohibitive. This financial hurdle can restrain market growth by limiting the adoption rate of advanced cybersecurity solutions. The expense associated with deploying these technologies can deter investment in cybersecurity, leading to slower market growth rates as potential buyers opt for cheaper, less effective solutions or delay upgrades and new installations altogether.

Data Privacy and Security Concerns

Data privacy and security concerns form another critical restraint in the railway cybersecurity market. As railway systems become increasingly interconnected and reliant on data-driven technologies, the potential impact of data breaches grows. This risk is a significant concern for railway operators, as breaches could lead to severe financial, operational, and reputational damage. Concerns about the ability to adequately protect passenger and operational data can deter railway operators from adopting new technologies that are perceived as vulnerable. The hesitancy to embrace fully integrated cybersecurity solutions, despite their potential benefits, can slow market growth. Operators might opt for minimal compliance rather than investing in comprehensive solutions, thereby not only risking security breaches but also impeding the holistic growth of cybersecurity measures within the industry.

By Offering Analysis

In 2023, Solutions dominated the Railway Cybersecurity Market, safeguarding critical infrastructure.

In 2023, Solutions held a dominant market position in the "By Offering" segment of the Railway Cybersecurity Market. This segment includes both solutions and services, with solutions emerging as the predominant category. The prominence of solutions in this market is attributed to the escalating demand for advanced cybersecurity measures to protect critical infrastructure and data integrity in railway systems. The solutions offered in this sector are designed to thwart a range of cyber threats including data breaches, unauthorized access, and other forms of cyberattacks that are becoming increasingly sophisticated.

Additionally, the services segment, although smaller, plays a crucial role by providing essential support, maintenance, and consulting services that complement the cybersecurity solutions. These services ensure that cybersecurity measures are continuously updated and aligned with evolving threat patterns, thus providing a comprehensive security framework. The integration of both solutions and services is vital for creating a resilient cybersecurity posture in the rapidly evolving landscape of railway transport. This synergy is crucial for safeguarding against potential cyber vulnerabilities and ensuring the smooth operation of railway systems worldwide.

By Type Analysis

In 2023, The Infrastructural segment dominated the Railway Cybersecurity Market.

In 2023, The Infrastructural segment held a dominant market position in the "By Type" category of the Railway Cybersecurity Market. This segment encompasses a broad array of systems and technologies designed to secure critical railway infrastructure against cyber threats, including data management systems and network security solutions. The predominance of the Infrastructural segment can be attributed to the escalating need for robust security frameworks to protect against increasing cyber threats targeting essential control systems and operational technologies. This sector is pivotal in ensuring the integrity and resilience of the railway's backbone infrastructure, which includes signal systems, routing controls, and communication networks.

Conversely, the Onboard segment also plays a critical role, focusing on cybersecurity solutions that are deployed directly on trains. This includes security for onboard passenger information systems, automated control systems, and connected devices within the training environment. The demand in this segment is driven by the growing integration of IoT technologies in rail vehicles, necessitating enhanced security measures to safeguard against both external breaches and internal vulnerabilities. Together, these segments form the comprehensive landscape of cybersecurity initiatives critical for the modern railway industry, reflecting a proactive approach to mitigating cyber risks in an increasingly digital and interconnected era.

By Security Type Analysis

Application Security dominates the 2023 Railway Cybersecurity Market's security type segment.

In 2023, Application Security held a dominant market position in the By Security Type segment of the Railway Cybersecurity Market. This segment encompasses critical facets of cybersecurity, specifically designed to shield applications from threats and unauthorized access that could compromise the operational integrity of railway systems. Application Security is vital for protecting software applications from external threats and vulnerabilities, ensuring the security and reliability of ticketing systems, operation control systems, and passenger information systems among others.

Following closely, Network Security also plays a crucial role by safeguarding the data transfer across railway networks, preventing unauthorized intrusions that could lead to data breaches or operational disruptions. Data Protection ensures the integrity and confidentiality of sensitive data such as passenger information and operational data, which is fundamental in maintaining trust and compliance with data protection regulations.

End Point Security is another critical segment, focusing on protecting the endpoints of network connections in railway systems, such as terminals and onboard devices, from malware, ransomware, and other cyber threats. Lastly, System Administration provides the overarching framework that supports the maintenance of security protocols, updates, and system checks to ensure that all security measures are continuously aligned with the latest cybersecurity practices and threats. Together, these segments form the backbone of a comprehensive cybersecurity strategy essential for the modern railway industry.

Key Market Segments

By Offering

- Solutions

- Services

By Type

- Infrastructural

- On-board

By Security Type

- Application Security

- Network Security

- Data Protection

- End Point Security

- System Administration

Growth Opportunity

Increasing Adoption of Cloud-Based Services

The global railway cybersecurity market is poised for significant growth, primarily driven by the increasing adoption of cloud-based services. This trend is expected to revolutionize the railway industry by enhancing data management and security across operational networks. Cloud-based platforms offer scalable and flexible solutions that enable real-time monitoring and management of cybersecurity threats, which is crucial for the safety and reliability of railway operations. As more railway operators transition to cloud services, the demand for robust cybersecurity solutions that can protect against data breaches and cyber-attacks is anticipated to surge. This shift not only promises improved operational efficiency but also opens substantial market opportunities for cybersecurity providers specializing in cloud security.

Adoption of Advanced Technologies

Parallelly, the integration of advanced technologies such as Artificial Intelligence (AI) and the Internet of Things (IoT) within the railway sector further compounds the growth prospects of the railway cybersecurity market. AI-driven cybersecurity solutions can proactively detect and mitigate potential threats, enhancing the security posture of railway networks. Meanwhile, IoT technology facilitates the interconnectivity of railway infrastructure, making the system more efficient but also more susceptible to cyber threats. The adoption of these advanced technologies necessitates sophisticated cybersecurity measures, thus creating a burgeoning demand for innovative and effective cybersecurity solutions. Market players that can offer integrated, technology-driven security solutions are likely to capture significant growth opportunities in this evolving landscape.

Latest Trends

Growing Adoption of IoT and Smart Technologies

The Railway Cybersecurity Market is witnessing a substantial transformation due to the increasing integration of IoT and smart technologies in rail infrastructure. This evolution is instrumental in enhancing operational efficiency and passenger services but simultaneously broadens the attack surface for cyber threats. As railways adopt more connected technologies, the imperative for robust cybersecurity solutions escalates to protect sensitive data and ensure the safety of rail operations. This trend is driving demand for advanced monitoring and real-time threat detection systems, highlighting the critical need for investment in state-of-the-art cybersecurity measures.

Increased Sophistication of Cyberattacks

Parallel to technological advancements, the sophistication of cyberattacks targeting the railway sector has intensified. Cyber adversaries are employing more complex strategies, such as ransomware and phishing attacks, aimed at disrupting operations and extorting significant financial gains. The increase in these high-profile cyberattacks necessitates a proactive approach to cybersecurity practices within the railway industry. It is essential for stakeholders to prioritize the development of resilient cyber defenses and to foster a culture of continuous improvement and adaptation to new threats. The market is responding with enhanced encryption technologies, stronger firewalls, and comprehensive staff training programs to combat these evolving threats.

Regional Analysis

North America leads Railway Cybersecurity, holding 35% global market share.

The Railway Cybersecurity Market exhibits diverse characteristics across global regions, shaped by varying technological adoption rates and regional security challenges. In North America, the market is robust, driven by significant investments in digital infrastructure and stringent regulatory standards aimed at protecting critical transportation networks. North America dominates the sector, holding approximately 35% of the global market share. This region's prominence is bolstered by ongoing upgrades to rail systems and heightened cybersecurity measures against increasing cyber threats.

Europe follows closely, with a proactive stance on cybersecurity due to rising threats to its extensive and heavily utilized rail systems. Initiatives such as the EU's NIS Directive enhance the market's growth by mandating critical service operators, including railways, to adopt enhanced security practices.

In Asia Pacific, rapid urbanization and expanding rail networks contribute to market growth, driven by countries like China and India, which are heavily investing in rail infrastructure and cybersecurity solutions to protect against cyber espionage and service disruptions.

The Middle East & Africa region, though smaller in market size, is experiencing gradual growth. Investments in rail infrastructure projects across the Gulf Cooperation Council (GCC) countries are accompanied by a growing awareness of cybersecurity needs.

Latin America's market is emerging, with gradual enhancements in rail infrastructure and cybersecurity awareness. However, it remains the least developed region in terms of cybersecurity implementations in railways.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In the global Railway Cybersecurity Market for 2024, several key players are poised to significantly shape industry dynamics. Alstom and Siemens AG continue to lead with their robust cybersecurity solutions tailored to railway systems, focusing on real-time threat detection and system resilience. Their strategic collaborations with technology firms enhance their offerings, positioning them at the forefront of the market.

Cisco Systems, Inc., and Huawei Technologies Co., Ltd., are pivotal in integrating advanced networking technologies with cybersecurity measures. Their expertise in cloud-based security services and end-to-end encryption technologies cater to the growing demand for secure data transmission across railway networks.

IBM's application of artificial intelligence in cybersecurity presents innovative threat intelligence and risk management solutions. This approach not only addresses immediate threats but also predicts and mitigates potential future vulnerabilities in railway systems.

Thales Group and Raytheon Technologies Corporation underscore their presence with cutting-edge cybersecurity analytics and defense mechanisms. Their focus on comprehensive security management systems ensures high levels of protection for critical infrastructure.

Nokia Corporation leverages its telecommunications expertise to provide secure communications solutions that are vital for the safety and reliability of railway operations. Their advanced monitoring and encryption technologies play a critical role in safeguarding against cyber threats.

Lastly, Hitachi, Ltd. and Webtec Corporation bring specialized cybersecurity solutions that integrate seamlessly with existing railway infrastructure, emphasizing cost-effectiveness and scalability, crucial for global market adaptation. These companies, by advancing cybersecurity technologies and fostering strategic partnerships, drive the railway industry towards enhanced security and operational efficiency.

Market Key Players

- Alstom

- Cisco Systems, Inc.

- Hitachi, Ltd.

- Huawei Technologies Co., Ltd.

- International Business Machine Corporation (IBM)

- Nokia Corporation

- Raytheon Technologies Corporation

- Siemens AG

- Thales Group

- Webtec Corporation

Recent Development

- In March 2024, Alstom highlighted the importance of implementing international cybersecurity standards such as CENELEC TS-50701 and IEC 62443. These standards are designed to ensure the security and resilience of critical railway infrastructure and rolling stock.

- In March 2023, IBM launched "Project Quantum Leap," a significant initiative aimed at advancing commercial quantum computing. This project reflects a major technological advancement and demonstrates IBM's commitment to pushing the boundaries of quantum technology, which includes applications in cybersecurity.

Report Scope

Report Features Description Market Value (2023) USD 7.9 Billion Forecast Revenue (2033) USD 19.7 Billion CAGR (2024-2032) 9.8% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Offering (Solutions and Services), By Type (Infrastructural and On-board), By Security Type (Application Security, Network Security, Data Protection, End Point Security, System Administration) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Alstom, Cisco Systems, Inc., Hitachi, Ltd., Huawei Technologies Co., Ltd., International Business Machine Corporation (IBM), Nokia Corporation, Raytheon Technologies Corporation, Siemens AG, Thales Group, Webtec Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Alstom

- Cisco Systems, Inc.

- Hitachi, Ltd.

- Huawei Technologies Co., Ltd.

- International Business Machine Corporation (IBM)

- Nokia Corporation

- Raytheon Technologies Corporation

- Siemens AG

- Thales Group

- Webtec Corporation