Proximity Sensor Market Report By Sensor Type (Inductive Proximity Sensors, Capacitive Proximity Sensors, Ultrasonic Proximity Sensors, Optical Proximity Sensors, Magnetic Proximity Sensors, Others), By Technology (Analog Sensors, Digital Sensors, Laser Sensors), By Sensing Range (Short Range [Up to 10 cm], Medium Range [10 cm to 1 m], Long Range [Above 1 m]), By Application, By End-User Industry, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

49691

-

July 2024

-

325

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

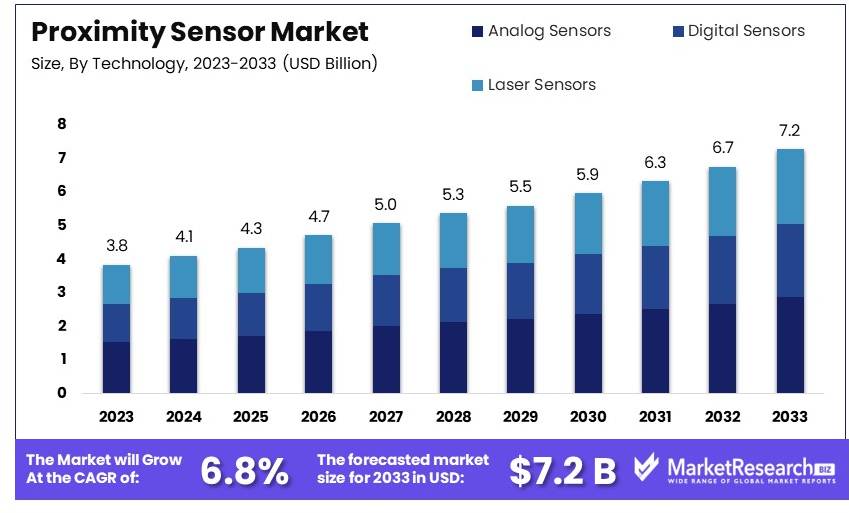

The Global Proximity Sensor Market size is expected to be worth around USD 7.2 Billion by 2033, from USD 3.8 Billion in 2023, growing at a CAGR of 6.8% during the forecast period from 2024 to 2033.

The proximity sensor market involves sensors that detect the presence or absence of objects without physical contact. These sensors are widely used in automotive, consumer electronics, industrial automation, and aerospace sectors.

Key drivers include rising automation, increasing demand for safety features in vehicles, and advancements in sensor technology. The market is segmented by type, technology, application, and region. Innovations in miniaturization and integration with IoT devices are influencing market trends. Major players focus on R&D and strategic partnerships to enhance product offerings and capture market share.

The proximity sensor market is growing rapidly due to advancements in technology and increasing demand across various industries. Proximity sensors are crucial in automation, consumer electronics, automotive, and industrial applications. These sensors detect objects without physical contact, making them ideal for a wide range of uses.

Technological advancements have significantly enhanced the capabilities of proximity sensors. For example, improvements in accuracy and sensitivity allow for better performance in complex environments. The automotive industry, in particular, benefits from these advancements. Proximity sensors are used in advanced driver-assistance systems (ADAS) to enhance vehicle safety and provide features like parking assistance and collision avoidance.

The consumer electronics sector also drives market growth. Smartphones and wearable devices increasingly incorporate proximity sensors to enable features such as touchless control and power management. This trend highlights the growing importance of sensors in enhancing user experience and device functionality.

The industrial sector leverages proximity sensors for automation and process control. These sensors improve operational efficiency and safety in manufacturing plants by enabling precise detection and measurement. The rise of Industry 4.0 and the Internet of Things (IoT) further boosts the adoption of proximity sensors in industrial applications.

Despite the positive outlook, the market faces challenges. High costs of advanced sensors and competition from alternative technologies can hinder growth. However, ongoing research and development efforts aim to overcome these obstacles and drive further innovation.

In conclusion, the proximity sensor market is set for continued expansion. Technological advancements, increasing demand in automotive and consumer electronics, and the rise of automation in industries drive this growth. Companies investing in innovation and addressing cost challenges are well-positioned to succeed in this dynamic market.

Key Takeaways

- Market Value: The Proximity Sensor Market was valued at USD 3.8 billion in 2023 and is expected to reach USD 7.2 billion by 2033, with a CAGR of 6.8%.

- By Sensor Type Analysis: Inductive Proximity Sensors dominated with 35%; preferred for their reliability in industrial applications.

- By Technology Analysis: Analog Sensors dominated with 40%; widely used due to their simplicity and cost-effectiveness.

- By Sensing Range Analysis: Short Range (Up to 10 cm) dominated with 45%; suitable for precise and close-range detection.

- By Application Analysis: Automotive dominated with 35%; critical for enhancing vehicle safety and automation.

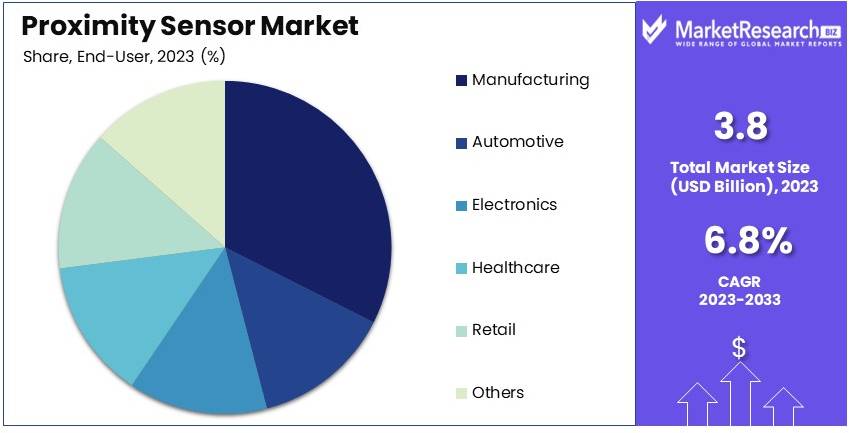

- By End-User Industry Analysis: Manufacturing dominated with 40%; driven by the need for automation and efficiency in production processes.

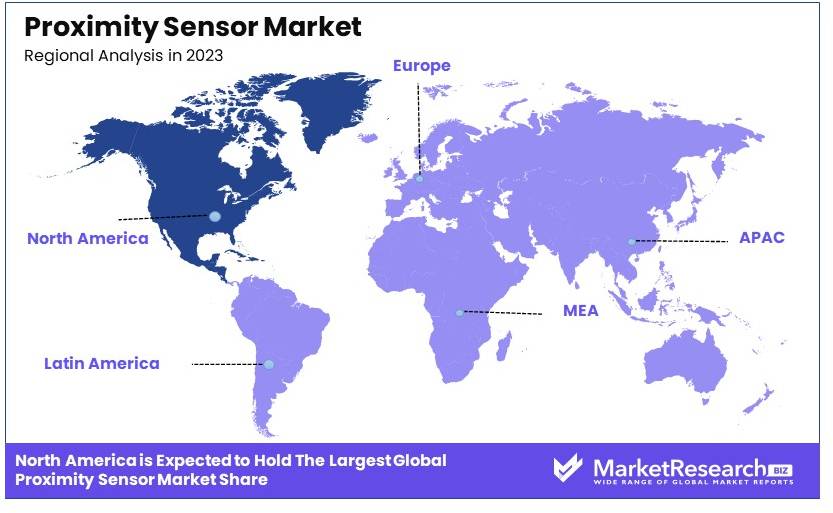

- Dominant Region: North America 35%; due to technological advancements and strong industrial base.

- High Growth Region: Asia-Pacific; expected to grow due to rapid industrialization and increasing adoption of automation technologies.

- Analyst Viewpoint: The market is expanding with growing applications in various industries. Future growth will be fueled by advancements in sensor technologies.

- Growth Opportunities: Companies can explore integration of IoT and AI for smart sensing solutions to enhance operational efficiency.

Driving Factors

Increasing Adoption of Automation in Various Industries Drives Market Growth

The increasing adoption of automation across multiple sectors is significantly driving the demand for proximity sensors. Industries such as manufacturing, automotive, and consumer electronics rely heavily on automation to improve efficiency, safety, and precision.

Proximity sensors play a crucial role in these automated systems. In automotive manufacturing, for example, they are extensively used in robotic assembly lines to detect components and prevent collisions. Companies like SICK AG have developed advanced proximity sensors specifically designed for industrial automation. These sensors help ensure that automated processes run smoothly and safely, which boosts their demand.

As more industries embrace automation to enhance productivity and reduce operational costs, the market for proximity sensors continues to grow. The integration of these sensors into automated systems across various sectors underscores their importance and drives market expansion.

Rising Demand in Smartphone and Consumer Electronics Drives Market Growth

The proliferation of smartphones and other consumer electronic devices has significantly boosted the proximity sensor market. These sensors are vital for various functions in smartphones, such as turning off the display when the device is held near the face during calls to save battery life and prevent accidental touches.

For example, Apple's iPhones use proximity sensors to detect when the phone is near the user's ear, automatically disabling the touchscreen to avoid unintended inputs. This widespread application has led to increased production and innovation in miniaturized proximity sensors.

The continuous advancement in smartphone technology and the growing consumer electronics market drive the demand for proximity sensors. As new devices and features emerge, the need for reliable and efficient sensors grows, contributing to the overall market growth.

Growth in the Automotive Safety Systems Drives Market Growth

The automotive industry's focus on enhancing vehicle safety has led to increased integration of proximity sensors in advanced driver assistance systems (ADAS). These sensors are used for functions like parking management, collision avoidance, and blind spot detection.

For instance, companies like Bosch have developed ultrasonic proximity sensors for parking assist systems, which help drivers park safely by detecting obstacles around the vehicle. The growing adoption of such safety features in mid-range and economy vehicles has expanded the market for proximity sensors.

The emphasis on vehicle safety and the implementation of ADAS in more car models drive the demand for proximity sensors. As automotive technology advances, the integration of these sensors becomes more widespread, supporting market growth and innovation in sensor technology.

Restraining Factors

Technical Limitations and Environmental Factors Restrain Market Growth

Proximity sensors can be affected by environmental conditions such as temperature, humidity, and electromagnetic interference. These factors can lead to false readings or reduced accuracy in certain applications. For instance, inductive proximity sensors used in industrial settings may face challenges in high-temperature environments or near strong electromagnetic fields, limiting their effectiveness.

These technical limitations can restrict the use of proximity sensors in critical applications where absolute reliability is necessary. In environments where precision is crucial, such as in medical devices or aerospace, any inconsistency in sensor performance can pose significant risks, thereby hindering the broader adoption of proximity sensors in these fields.

High Initial Costs for Advanced Proximity Sensing Systems Restrain Market Growth

While the cost of basic proximity sensors has decreased, advanced systems with higher accuracy and additional features remain expensive. This high initial investment can be a barrier for small and medium-sized enterprises (SMEs) looking to implement automation or upgrade their existing systems.

For example, LiDAR-based proximity sensing systems used in autonomous vehicles are highly accurate but also very costly, slowing down the widespread adoption of fully autonomous vehicles. The financial burden associated with acquiring and integrating these advanced systems can deter SMEs from investing in proximity sensors, thereby limiting market growth and technological advancement in various industries.

Sensor Type Analysis

Inductive Proximity Sensors dominate with 35% due to their reliability and widespread use in industrial applications.

The Proximity Sensor Market is segmented by sensor type, with Inductive Proximity Sensors leading at 35% of the market share. These sensors are highly reliable and are widely used in industrial applications for detecting metallic objects. Their robustness and resistance to harsh environments make them ideal for manufacturing and automation processes. Inductive sensors are favored for their durability and precision, ensuring consistent performance even in challenging conditions.

Capacitive Proximity Sensors hold a 25% market share. These sensors are versatile and can detect both metallic and non-metallic objects. They are commonly used in applications where sensitivity to various materials is required, such as in packaging and material handling. Capacitive sensors are valued for their flexibility and ability to detect objects through various surfaces.

Ultrasonic Proximity Sensors account for 20% of the market. These sensors use sound waves to detect objects and are particularly useful in environments where dust, dirt, or moisture is present. Ultrasonic sensors are popular in automotive and industrial automation applications for their ability to measure distance and detect objects accurately over long ranges.

Optical Proximity Sensors hold a 10% share. These sensors use light to detect objects and are widely used in consumer electronics, such as smartphones and tablets, for touchless control and presence detection. Optical sensors are also used in safety and security applications due to their high sensitivity and accuracy.

Magnetic Proximity Sensors account for 5% of the market. These sensors detect the presence of magnetic fields and are commonly used in security systems, automotive applications, and industrial automation. Magnetic sensors are valued for their simplicity and reliability in detecting magnetic objects or fields.

Other types of proximity sensors make up the remaining 5%. This category includes specialized sensors that cater to niche applications and emerging technologies. These sensors offer unique features and are often used in specific industries where conventional sensors may not be suitable.

Technology Analysis

Analog Sensors dominate with 40% due to their ability to provide continuous output signals for precise measurements.

In the proximity sensor market, Analog Sensors lead with a 40% share. These sensors provide continuous output signals, allowing for precise measurements and control. Analog sensors are widely used in industrial automation, manufacturing, and automotive applications where accurate and real-time data is crucial. Their ability to deliver detailed information makes them indispensable in processes requiring fine control and adjustments.

Digital Sensors hold a 35% market share. These sensors provide discrete signals, making them ideal for applications requiring simple on/off detection. Digital sensors are popular in consumer electronics, automotive, and healthcare industries due to their ease of integration and straightforward functionality. They offer reliable performance for basic detection tasks and are cost-effective solutions for many applications.

Laser Sensors account for 25% of the market. These sensors use laser technology to detect objects and measure distances with high precision. Laser sensors are used in advanced manufacturing, robotics, and quality control applications where accuracy is paramount. Their ability to provide precise and non-contact measurements makes them suitable for complex and high-precision tasks.

Sensing Range Analysis

Short Range (Up to 10 cm) dominates with 45% due to its widespread use in consumer electronics and industrial automation.

In the proximity sensor market segmented by sensing range, Short Range sensors lead with a 45% share. These sensors are commonly used in consumer electronics, such as smartphones and tablets, for functions like screen wake-up and touchless interaction. They are also used in industrial automation for detecting small objects or components at close distances. The high demand for compact and precise sensors in these applications drives the dominance of short-range sensors.

Medium Range (10 cm to 1 m) sensors hold a 35% market share. These sensors are used in automotive applications, such as parking assistance and collision avoidance systems, as well as in industrial automation for detecting objects within moderate distances. Medium-range sensors offer a balance between range and accuracy, making them versatile for various applications.

Long Range (Above 1 m) sensors account for 20% of the market. These sensors are used in applications requiring the detection of objects over long distances, such as in security systems, inventory management, and large-scale industrial automation. Long-range sensors provide the capability to monitor large areas and detect objects from a distance, ensuring safety and efficiency in various operations.

Application Analysis

Automotive dominates with 35% due to the high demand for advanced driver assistance systems and safety features.

In the proximity sensor market segmented by application, Automotive leads with a 35% share. The demand for advanced driver assistance systems (ADAS), parking sensors, and collision avoidance systems drives this segment. Proximity sensors play a crucial role in enhancing vehicle safety and automation, making them essential components in modern automobiles. The growth of electric and autonomous vehicles further boosts the demand for proximity sensors in the automotive industry.

Industrial Automation holds a 30% market share. These sensors are used in manufacturing processes to detect objects, control machinery, and ensure safety. The increasing adoption of automation and Industry 4.0 technologies drives the demand for proximity sensors in industrial applications. These sensors help improve efficiency, reduce downtime, and enhance operational safety.

Consumer Electronics account for 20% of the market. Proximity sensors are widely used in smartphones, tablets, and other electronic devices for touchless control, screen wake-up, and user presence detection. The continuous innovation in consumer electronics and the demand for smart devices drive this segment's growth.

Healthcare holds a 10% share. Proximity sensors are used in medical devices and equipment for applications such as patient monitoring, touchless operation, and safety. The increasing focus on healthcare automation and the need for advanced medical technologies drive the demand for proximity sensors in this sector.

Other applications make up the remaining 5%. This category includes niche and emerging applications where proximity sensors provide valuable functionality. These applications range from retail and logistics to environmental monitoring and smart infrastructure.

End-User Industry Analysis

Manufacturing dominates with 40% due to the extensive use of sensors in automation and process control.

In the proximity sensor market segmented by end-user industry, Manufacturing leads with a 40% share. The extensive use of proximity sensors in automation, process control, and quality assurance drives this segment. Sensors are used to detect objects, control machinery, and ensure operational safety, making them critical components in modern manufacturing processes. The push towards smart factories and Industry 4.0 further fuels the demand for proximity sensors in this industry.

Automotive holds a 25% market share. The increasing integration of proximity sensors in vehicles for safety, automation, and driver assistance systems drives this segment. The growth of electric and autonomous vehicles also contributes to the rising demand for proximity sensors in the automotive sector.

Electronics account for 15% of the market. Proximity sensors are used in the production and functioning of various electronic devices, including smartphones, tablets, and wearable technology. The continuous innovation in the electronics industry and the demand for smart devices drive the growth of this segment.

Healthcare holds a 10% share. Proximity sensors are used in medical devices and equipment for patient monitoring, safety, and automation. The increasing focus on healthcare technology and the need for advanced medical solutions drive the demand for proximity sensors in this sector.

Retail makes up 5% of the market. Proximity sensors are used in retail for applications such as inventory management, security, and customer interaction. The growth of smart retail solutions and the need for efficient operations drive this segment's growth.

Other industries account for the remaining 5%. This category includes emerging and niche industries where proximity sensors provide valuable functionality, such as logistics, environmental monitoring, and smart infrastructure.

Key Market Segments

By Sensor Type

- Inductive Proximity Sensors

- Capacitive Proximity Sensors

- Ultrasonic Proximity Sensors

- Optical Proximity Sensors

- Magnetic Proximity Sensors

- Others

By Technology

- Analog Sensors

- Digital Sensors

- Laser Sensors

By Sensing Range

- Short Range (Up to 10 cm)

- Medium Range (10 cm to 1 m)

- Long Range (Above 1 m)

By Application

- Automotive

- Industrial Automation

- Consumer Electronics

- Healthcare

- Others

By End-User Industry

- Manufacturing

- Automotive

- Electronics

- Healthcare

- Retail

- Others

Growth Opportunities

Integration with AI and Machine Learning Offers Growth Opportunity

There is significant potential in combining proximity sensors with artificial intelligence (AI) and machine learning algorithms to create more intelligent and adaptive systems. This integration can enhance the accuracy and capabilities of proximity sensing, opening up new applications.

For example, startups like Prophesee are developing event-based proximity sensors that use AI to drastically reduce power consumption and improve response times in applications like autonomous drones and robotics. By leveraging AI and machine learning, proximity sensor companies can offer advanced solutions that meet evolving industry needs, driving innovation and market growth.

Advancements in 3D Sensing Technology Offer Growth Opportunity

The development of 3D proximity sensing technologies presents a major growth opportunity. These advanced sensors can provide more detailed spatial information, which is crucial for applications in augmented reality, gesture recognition, and advanced robotics.

For instance, Apple's TrueDepth camera system, which uses 3D sensing for facial recognition, demonstrates the potential of advanced proximity sensing in consumer electronics. By investing in 3D sensing technology, companies can enhance product functionalities, cater to high-tech industries, and create new market segments, fueling overall market expansion.

Trending Factors

Miniaturization and Increased Sensitivity Are Trending Factors

There's a growing trend towards smaller, more sensitive proximity sensors. This miniaturization allows for integration into smaller devices and enables new applications. For instance, ams AG has developed ultra-small proximity sensors for earbuds, enabling features like automatic ear detection and improved battery life management in true wireless stereo (TWS) devices.

This trend supports the development of compact and efficient electronics, enhancing user experiences and driving innovation. By focusing on miniaturization and sensitivity, proximity sensor manufacturers can meet evolving market demands, expand application possibilities, and foster market growth.

Non-Contact Sensing for Hygiene and Safety Are Trending Factors

In the wake of global health concerns, there's an increasing trend towards non-contact interfaces in public spaces and workplaces. Proximity sensors are playing a key role in enabling touchless controls for elevators, doors, and public facilities. For example, companies like Touchless.ai are developing proximity sensor-based solutions for converting existing touchscreen kiosks into touchless interfaces, addressing hygiene concerns in public spaces.

This trend highlights the importance of safety and cleanliness, driving demand for non-contact technologies. By providing innovative touchless solutions, proximity sensor companies can enhance public health measures, attract new customers, and drive market expansion.

Regional Analysis

North America Dominates with 35% Market Share in the Proximity Sensor Market

North America's prominent 35% market share in the proximity sensor market is driven by the region’s advanced manufacturing and automotive sectors. High adoption of automation technologies across industries and substantial investments in IoT (Internet of Things) and smart manufacturing techniques have fueled the demand for proximity sensors. The presence of key technology leaders and innovators in the region also plays a crucial role in pushing forward new developments in sensor technology.

The proximity sensor market in North America is supported by a robust technological infrastructure and a strong focus on safety and efficiency in industrial operations. These sensors are extensively used in automotive, aerospace, and manufacturing for object detection, vehicle safety, and automation processes. The trend towards smarter cities and homes in the U.S. and Canada boosts the use of these sensors in various applications, enhancing market growth.

The future of the proximity sensor market in North America is likely to see sustained growth with the ongoing trends in automation and digitization across industries. As technology evolves, the integration of AI and machine learning in sensor technology could open new avenues for advanced applications, maintaining the region's dominance in the market.

Regional Market Share and Growth Statistics

- Europe: Europe holds a 30% share of the market, supported by its strong automotive industry and stringent safety regulations that drive the adoption of advanced sensor technologies.

- Asia Pacific: Asia Pacific controls 25% of the market. Rapid industrialization, especially in China and India, and the expansion of manufacturing facilities are key growth drivers.

- Middle East & Africa: With a 5% market share, the Middle East & Africa region is slowly adopting modern industrial technologies, including sensors, influenced by growing urbanization and industrial diversification.

- Latin America: Capturing 5% of the market, Latin America’s growth is limited but gradually increasing with the modernization of its manufacturing capabilities and automotive sector.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The proximity sensor market is led by key players with significant market impact and strategic positioning. Omron Corporation and Honeywell International Inc. are recognized for their high-quality sensors and extensive product lines. Sick AG and Pepperl+Fuchs GmbH are known for their technological innovations and reliable solutions.

Balluff GmbH and Avago Technologies (Broadcom Inc.) leverage advanced technology to enhance their market presence. Panasonic Corporation and Schneider Electric SE offer diverse sensor solutions, catering to various industries. Rockwell Automation, Inc. and IFM Electronic GmbH provide specialized sensors, strengthening their market positions.

Texas Instruments Inc. and STMicroelectronics N.V. are key players with strong research and development capabilities. Vishay Intertechnology, Inc. and Keyence Corporation are known for their innovative sensor technologies. Eaton Corporation offers reliable and efficient sensor solutions, boosting its market influence.

These companies maintain their competitive edge through technological advancements, extensive product lines, and strong market presence. Their ability to provide reliable and innovative solutions drives their leadership in the proximity sensor market.

Market Key Players

- Omron Corporation

- Honeywell International Inc.

- Sick AG

- Pepperl+Fuchs GmbH

- Balluff GmbH

- Avago Technologies (Broadcom Inc.)

- Panasonic Corporation

- Schneider Electric SE

- Rockwell Automation, Inc.

- IFM Electronic GmbH

- Texas Instruments Inc.

- STMicroelectronics N.V.

- Vishay Intertechnology, Inc.

- Keyence Corporation

- Eaton Corporation

Recent Developments

- April 2024: Honeywell introduced the GAPS Series proximity sensors, designed for aerospace applications. These sensors provide on/off output and can be configured with health monitoring features to reduce downtime and maintenance costs. The GAPS Series uses advanced technology to improve reliability and environmental adaptability, crucial for applications in harsh conditions such as aircraft landing gear and cargo loading systems.

- May 2024: Broadcom has focused on enhancing the performance and efficiency of its proximity sensors. Their recent developments include high-resolution sensors with improved accuracy and reduced power consumption, targeting applications in smartphones, wearables, and automotive systems. This innovation helps Broadcom maintain a competitive edge in the proximity sensor market by catering to the growing demand for precise and efficient sensing solutions.

Report Scope

Report Features Description Market Value (2023) USD 3.8 Billion Forecast Revenue (2033) USD 7.2 Billion CAGR (2024-2033) 6.8% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Sensor Type (Inductive Proximity Sensors, Capacitive Proximity Sensors, Ultrasonic Proximity Sensors, Optical Proximity Sensors, Magnetic Proximity Sensors, Others), By Technology (Analog Sensors, Digital Sensors, Laser Sensors), By Sensing Range (Short Range [Up to 10 cm], Medium Range [10 cm to 1 m], Long Range [Above 1 m]), By Application (Automotive, Industrial Automation, Consumer Electronics, Healthcare, Others), By End-User Industry (Manufacturing, Automotive, Electronics, Healthcare, Retail, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Omron Corporation, Honeywell International Inc., Sick AG, Pepperl+Fuchs GmbH, Balluff GmbH, Avago Technologies (Broadcom Inc.), Panasonic Corporation, Schneider Electric SE, Rockwell Automation, Inc., IFM Electronic GmbH, Texas Instruments Inc., STMicroelectronics N.V., Vishay Intertechnology, Inc., Keyence Corporation, Eaton Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Omron Corporation

- Honeywell International Inc.

- Sick AG

- Pepperl+Fuchs GmbH

- Balluff GmbH

- Avago Technologies (Broadcom Inc.)

- Panasonic Corporation

- Schneider Electric SE

- Rockwell Automation, Inc.

- IFM Electronic GmbH

- Texas Instruments Inc.

- STMicroelectronics N.V.

- Vishay Intertechnology, Inc.

- Keyence Corporation

- Eaton Corporation