Procurement Software Market By Deployment Type (On- Cloud, On- Premise), By Software Type (Supplier Management, Contract Management, And Other), By Organization Size (Small and Medium Enterprise(SMEs), Large Enterprise), BY Vertical (Retail, Automotive, Travel and Logistics, and Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

26328

-

Jul 2023

-

180

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

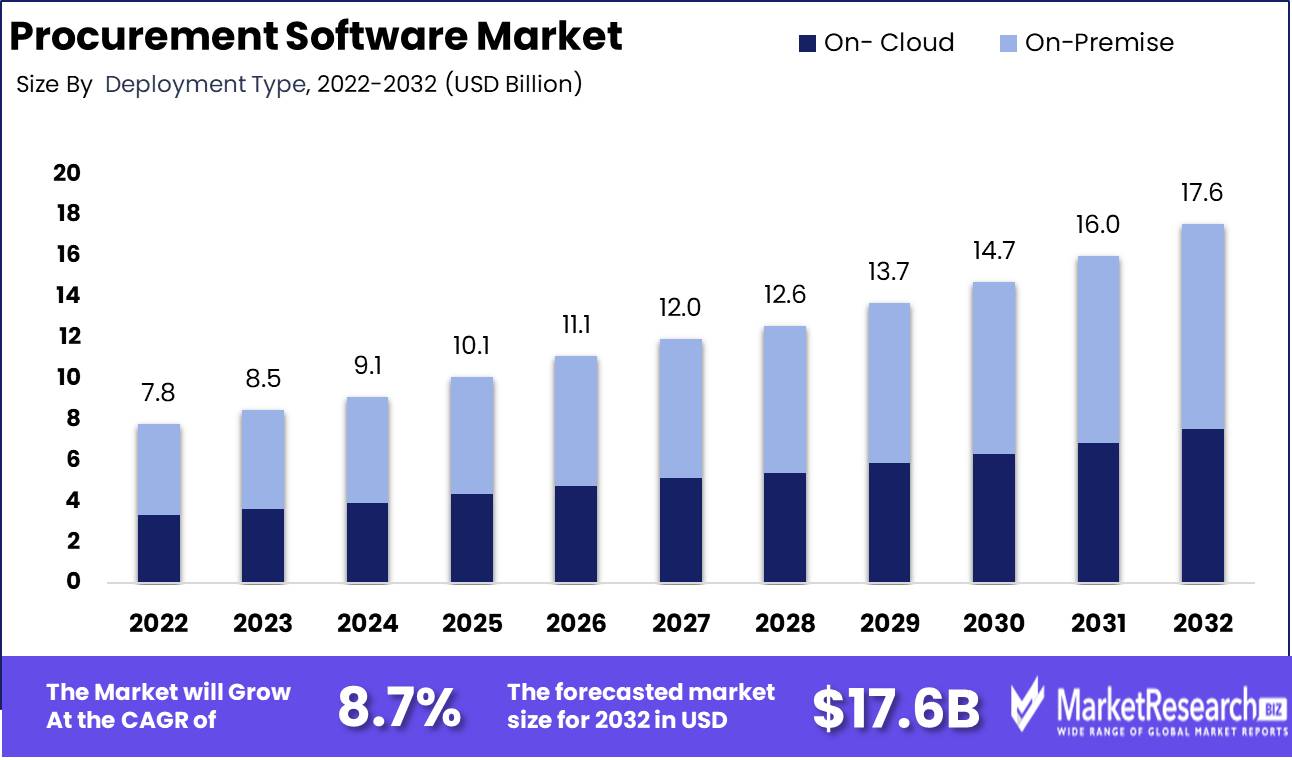

Procurement Software Market size is expected to be worth around USD 17.6 Bn by 2032 from USD 7.8 Bn in 2022, growing at a CAGR of 8.7% during the forecast period from 2023 to 2032.

The complex and multidimensional world of the procurement software Market is full of complexities that necessitate thorough analysis and scrutiny. Procurement software market applications are indispensable tools that facilitate and expedite the procurement process for businesses of all sizes, across diverse industries and sectors, from startups to large corporations, healthcare to retail, and manufacturing to automotive.

At its core, the procurement software market is an intricate and complex system that automates a multitude of procurement-related tasks, from sourcing and requisitioning to purchase order processing and invoicing, in order to save time, reduce errors, and improve the accuracy of procurement data. The increasing demand for the cloud-based procurement software market has ushered in a new era of convenience and accessibility, allowing businesses to access the market from anywhere, at any time.

Significant surges of innovation are propelling the industry's evolution in the procurement software market. These innovations feature, among other things, cutting-edge solutions that improve procurement management, expenditure analysis, and strategic sourcing. The procurement software market is an indispensable instrument that enables businesses to reduce costs, boost efficiencies, and become more competitive, a crucial factor in the current fast-paced business environment.

Driving factors

Increasing demand for procurement efficiency and automation:

Due to the growing demand for procurement automation and efficacy, the procurement software market is expanding significantly. In addition to streamlining the procurement process, procurement automation minimizes manual intervention, resulting in cost savings and increased operational efficiency. Increasing demand for procurement software solutions is driven by the need to automate processes, reduce errors, and improve the precision of procurement data. As a consequence, businesses in numerous industries are investing in procurement software to improve their procurement processes.

Cloud-based procurement solutions are on the rise

The proliferation of cloud-based procurement solutions is another market driver. These solutions provide numerous advantages, including reduced infrastructure costs, flexibility, scalability, and straightforward deployment. Cloud-based procurement software provides real-time access to procurement data, resulting in quicker and more informed decisions. In addition, they enable businesses to access procurement software from anywhere and at any time, facilitating the management of procurement processes across geographies.

Increasing use of mobile procurement technology

Mobile procurement technologies are being adopted at an increasing rate, resulting in an impressive market growth rate. Mobile procurement technologies enable procurement personnel to monitor procurement activities while on the move, resulting in cost and time savings. They increase the efficiency of the procurement process by allowing procurement professionals to evaluate and approve purchase orders, invoices, and contracts from their mobile devices. In addition, real-time access to procurement data enables quicker and more informed decision-making, which drives the adoption of mobile procurement technologies.

Restraining Factors

Insufficient Qualified Professionals:

The scarcity of qualified professionals is one of the most significant factors restraining the procurement software market. The procurement procedure is intricate and necessitates specialized knowledge and skill. The procurement software market is characterized by a dearth of competent professionals who can utilize the software to achieve optimal procurement outcomes.

Organizations can surmount this constraining factor by investing in training and development programs for their employees. Training and development programs can assist employees in acquiring the skills and knowledge necessary to utilize procurement software effectively. Investing in the training and development of employees can result in increased productivity, enhanced procurement outcomes, and ultimately the expansion of the procurement software market.

Integration Issues

Integration issues are an additional difficult factor impeding the growth of the procurement software market. Multiple software applications are utilized by numerous organizations to manage their business processes. It can be difficult to integrate procurement software with other software applications, resulting in decreased efficacy and slower procurement processes.

Organizations can surmount this constraining factor by adopting an integrated software approach. Using a single software solution to manage all business processes is an example of an integrated software approach. By implementing an integrated software strategy, organizations can eliminate the need for multiple software applications, resulting in increased efficiency, accelerated procurement processes, and the eventual expansion of the procurement software market.

Deployment Analysis

Over the years, the procurement software market has undergone a rapid transformation, with businesses utilizing innovative technological solutions to expedite their procurement processes. The On-Premise Segment, which dominates the market, is one of the most important segments of the procurement software market. This segment provides a multitude of benefits, which has led to its widespread adoption, resulting in a complex and diverse deployment environment.

In the procurement software market, the adoption of the On-Premise Segment is driven by the economic development of emerging economies. As they transition to a more efficient and cost-effective method of acquiring products and services, these markets are witnessing a significant increase in demand for procurement software. Emerging economies prefer the On-Premise segment over the Cloud segment because On-Premise solutions are tailored to their specific business needs.

Adoption of the On-Premise Segment in procurement software has become a globally prevalent trend among businesses. In this segment, organizations have control over the procurement process, resulting in solutions that are more localized and customized. In addition, the On-Premise Segment provides greater data privacy and security than other deployment models.

Software Analysis

The Spend Analysis Segment, which has been widely adopted by businesses, is another important segment of the procurement software market. Spend Analysis software enables organizations to analyze their procurement data to make informed decisions, optimize procurement processes, and increase cost savings. Understanding the trends and consumer behavior regarding the Spend Analysis Segment is essential for businesses to make informed decisions.

Similar to the On-Premise Segment, the Spend Analysis Segment of the procurement software market is being driven by the economic growth of emerging economies. Businesses in these sectors require solutions to assist them in analyzing their procurement data and optimizing their processes, which has led to a rise in Spend Analysis software adoption.

Because of its capacity to analyze and optimize procurement data, the Spend Analysis Segment of procurement software has grown in popularity. Utilizing this segment, businesses can identify areas of potential cost savings and concentrate their procurement efforts on the areas of greatest need. In addition, businesses can use the data to make well-informed decisions that increase efficiency and productivity.

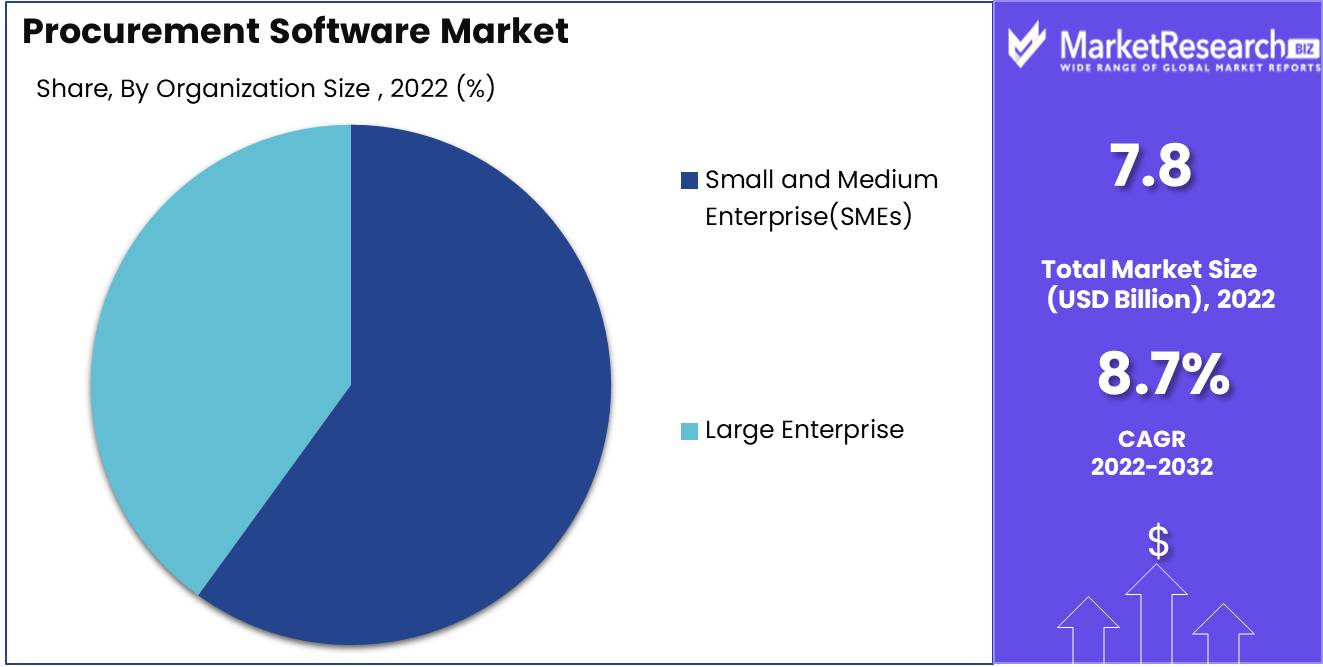

Organization Size Analysis

The SME segment dominates the procurement software market, and businesses prefer to select software solutions that cater to their specific business needs. Understanding the trends and behavior of consumers towards the SME segment is essential for companies to make informed decisions.

Economic growth in emerging economies is propelling the adoption of the Small and Medium Enterprise (SMEs) Segment in the Procurement Software Market Segment. Small and medium-sized businesses are flourishing in these markets, and they require solutions that are both cost-effective and customized to their business needs.

The SME segment of procurement software has gained popularity as a result of its capacity to provide cost-effective solutions that meet the specific needs of small and medium-sized enterprises. Software solutions that allow for customization, scalability, and simple deployment are preferred by many SMEs.

Because of its capacity to provide cost-effective and customized solutions that meet the specific needs of small and medium-sized businesses, the SME segment in the Procurement Software Market is anticipated to experience the quickest growth rate over the coming years. The adoption of procurement software solutions is increasing as SMEs strive for operational efficiency, cost reduction, and increased productivity.

Key Market Segments

By Deployment Type

- On- Cloud

- On-Premise

By Software Type

- Supplier Management

- Contract Management

- E-procurement

- E-sourcing

- Spend Analysis

By Organization Size

- Small and Medium Enterprise(SMEs)

- Large Enterprise

BY Vertical

- Retail

- Automotive

- Travel and Logistics

- Electronics

- IT and Telecommunication

- Mining

Growth Opportunity

Market Development of Procurement Software

The demand for procurement analytics is rising, the adoption of cloud-based solutions is increasing, and the procurement software market is constantly changing into a dynamic and competitive space. Integration of procurement systems with other enterprise solutions, emerging market opportunities, rising demand for mobile procurement solutions, and leveraging AI and machine learning capabilities all contribute to the market's growth.

Procurement Software in the Cloud

Cloud-based procurement software solutions have emerged as potent instruments with the ability to revolutionize procurement processes. It allows businesses to automate the entire procurement process, from payment requests. Cloud-based solutions have reduced entry barriers and provided small and medium-sized businesses with simple access to procurement technology, resulting in a higher adoption rate. Moreover, cloud solutions are scalable and cost-effective, which makes them appealing to organizations seeking solutions that are simpler to manage and deploy.

Procurement Tools for Mobile Devices

Increasing demand for mobile-based procurement solutions is another factor contributing to the expansion of the market for procurement software. Mobile procurement solutions enable procurement professionals to access vital procurement data swiftly, from any location, and on the go. This technology enables more efficient management of procurement processes, particularly for remote and field-based employees.

Latest Trends

Need for Greater Transparency and Management of Procurement Procedures

One of the most significant market trends in procurement software is the demand for enhanced visibility and management of procurement processes. Businesses want to know what they are purchasing, from whom they are purchasing it, how much they are spending, and when they are spending it. The procurement software provides businesses with real-time visibility into their procurement activities via a centralized platform.

In addition, it provides oversight over the entire procurement procedure, from payment requests. Purchasing software enables businesses to generate purchase orders, approve them, and automatically receive and match invoices. This level of automation reduces the possibility of errors and increases the procurement process's productivity.

Emphasis on Cost Reduction and Savings by Optimising Procurement

Another trend in procurement software is the emphasis on cost savings and cost reduction through procurement optimization. Procurement is a crucial area for accomplishing the objectives of cost-cutting and profit-boosting for businesses. Purchasing software equips businesses with the tools necessary to optimize procurement processes and generate cost savings.

By utilizing procurement software, businesses can identify cost-saving opportunities, negotiate better contracts, obtain greater discounts, and reduce rogue expenditures. In addition to tracking expenditures and identifying cost-cutting opportunities, procurement software permits companies to monitor their spending.

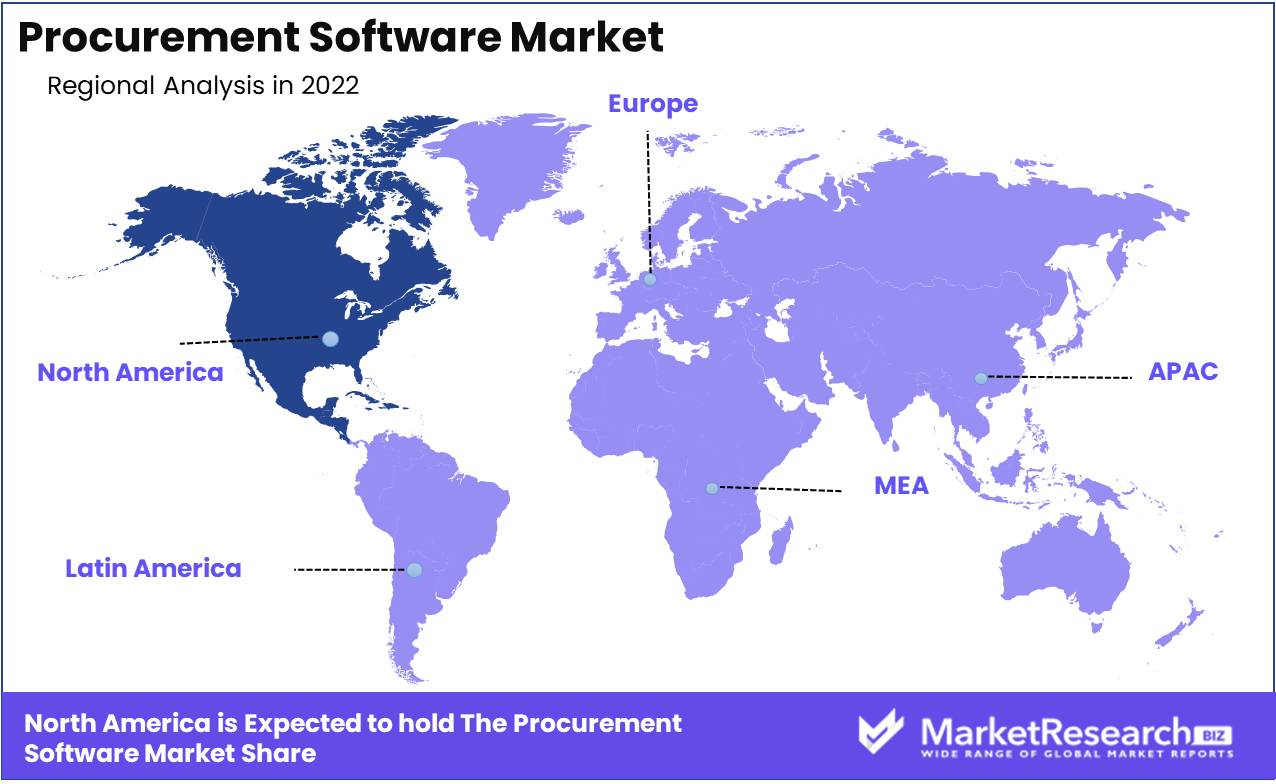

Regional Analysis

The procurement software market has been analyzed by Marketresearch.biz, and based on our findings, we predict that North America will remain the largest region in 2022. We have identified several factors that will propel the adoption of procurement software in the region, as well as a few potential obstacles.

Increasing demand for the automation of procurement processes is one of the primary drivers of the adoption of procurement software in North America. The benefits of procurement software for businesses include increased efficiency, cost savings, and enhanced precision. As a result, we anticipate that more North American businesses will invest in procurement software to automate their procurement processes.

The proliferation of e-commerce and online purchasing also contributes to the expansion of the North American procurement software market. To keep up with the pace of business, organizations must streamline their procurement processes in light of the rise of online purchasing. This can be accomplished with the aid of procurement software, which enables organizations to purchase goods and services online swiftly and efficiently.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The procurement software market is one of the fastest-growing IT sectors and is likely to keep rising over the next few years. Due to rising demand for procurement solutions across industries, new players have entered the market.

SAP Ariba is a major player in the procurement software market, offering a complete suite of solutions to automate procurement and improve supply chain performance. Many Fortune 500 companies use Ariba's solutions.

Coupa Software, another market leader, offers a cloud-based procurement platform that connects with ERP systems to deliver real-time data and analytics. The platform cuts expenses, boosts efficiency, and improves procurement.

JAGGAER, Ivalua, Determine, Zycus, and GEP are other procurement software market players. JAGGAER provides procurement solutions for healthcare, higher education, and manufacturing. Ivalua provides automotive, aerospace, and transportation procurement and supply chain solutions. Determine's procurement platform automates and improves expenditure management, whereas Zycus provides procurement solutions for healthcare, retail, and energy. Finally, GEP offers financial services, healthcare, and retail procurement solutions.

Top Key Players in the Procurement Software Market

- IBM

- Proactis

- Jaggaer

- BravoSolution SPA Coupa Software Inc.

- Infor

- JDA Software Group Inc.

- Tradeshift

- Vinimaya

- Basware

- Oracle

- SAP

- BuyerQuest Holdings Inc.

- Epicor Software Corporation

- Ivalua Inc.

- OpusCapita Group Oy

- Tungsten Corporation Plc.

- Zycus Inc

Recent Development

- SAP made headlines in 2021 with the introduction of its new procurement solution, SAP S/4HANA for advanced procurement. The new software promises to streamline procurement processes and provide greater visibility and control over spend management decisions, enabling businesses to make more informed decisions and achieve superior results.

- In 2021, Coupa Software, a prominent provider of cloud-based procurement solutions, announced the acquisition of LLamasoft, a provider of software for supply chain design and analytics.

- Amazon Business caused a stir in 2020 by introducing a new procurement feature dubbed "Business Prime." This feature provides free same-day and next-day delivery on eligible products, as well as additional enticing benefits such as spend analytics and purchasing controls.

- In 2020, Jaggaer, a prominent provider of procurement software solutions, made headlines by announcing the acquisition of BravoSolution, an additional provider of procurement software.

Report Scope

Report Features Description Market Value (2022) USD 7.8 Bn Forecast Revenue (2032) USD 17.6 Bn CAGR (2023-2032) 8.7% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Deployment Type: On- Cloud, On-Premise, By Software Type: Supplier Management, Contract Management, E-procurement, E-sourcing, Spend Analysis, By Organization Size: Small and Medium Enterprise(SMEs, Large Enterprise, BY Vertical: Retail, Automotive, Travel and Logistics, Electronics, IT and Telecommunication, Mining Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape IBM, Proactis, Jaggaer, BravoSolution SPA Coupa Software Inc., Infor, JDA Software Group Inc., Tradeshift, Vinimaya, Basware, Oracle, SAP, BuyerQuest Holdings Inc., Epicor Software Corporation, Ivalua Inc., OpusCapita Group Oy, Tungsten Corporation Plc., Zycus Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- IBM

- Proactis

- Jaggaer

- BravoSolution SPA Coupa Software Inc.

- Infor

- JDA Software Group Inc.

- Tradeshift

- Vinimaya

- Basware

- Oracle

- SAP

- BuyerQuest Holdings Inc.

- Epicor Software Corporation

- Ivalua Inc.

- OpusCapita Group Oy

- Tungsten Corporation Plc.

- Zycus Inc.