Global Postpartum Hemorrhage Pph Treatment Devices Market By Product(Uterine Balloon Tamponades, Non-pneumatic Anti-shock Garments (NASG), Uniject Prefilled Injection Systems), By End User(Hospitals, Clinics, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

49123

-

July 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

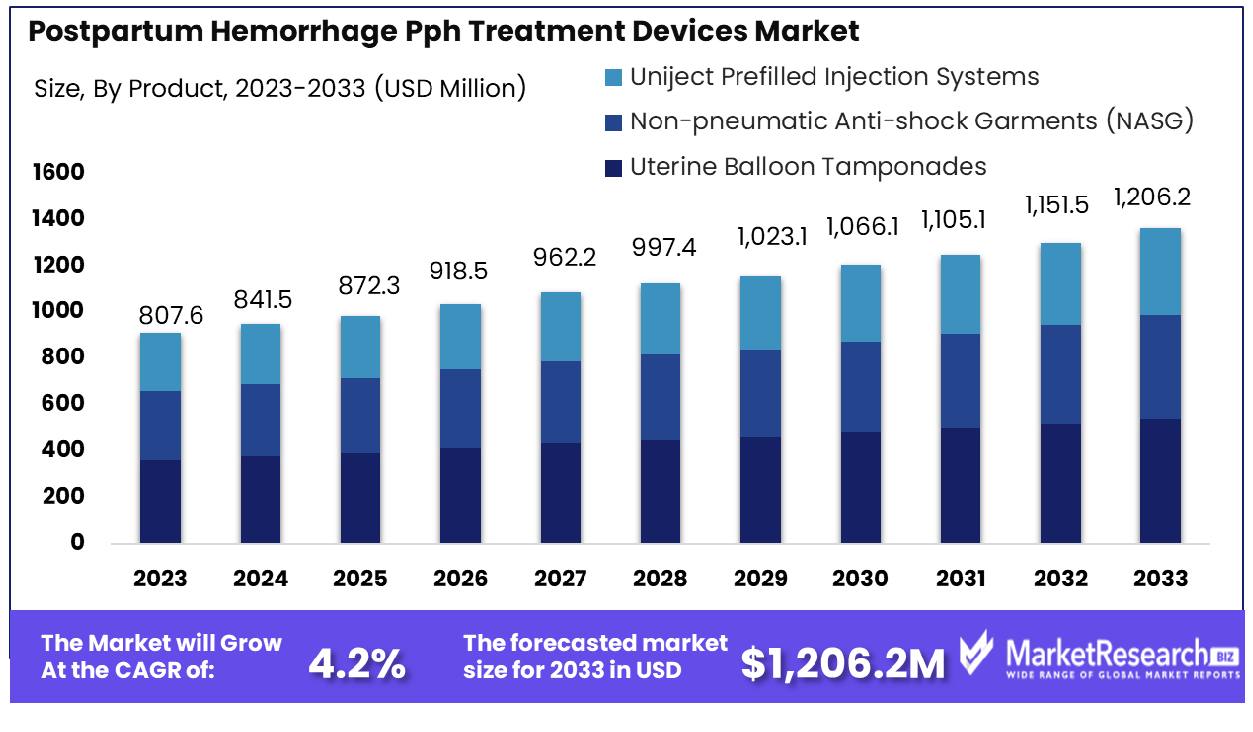

The Global Postpartum Hemorrhage Pph Treatment Devices Market was valued at USD 807.6 million in 2023. It is expected to reach USD 1,206.2 million by 2033, with a CAGR of 4.2% during the forecast period from 2024 to 2033.

The Postpartum Hemorrhage (PPH) Treatment Devices Market encompasses a range of medical instruments and products designed specifically to manage and treat excessive bleeding following childbirth. This market segment addresses critical needs within maternal healthcare, providing innovative solutions such as uterine balloon tamponade systems, vacuum-induced uterine devices, and pharmacological agents, among others.

These devices are essential for improving maternal outcomes by efficiently controlling hemorrhage, thus reducing the global maternal mortality rate. Market growth is driven by the rising incidences of PPH, advancements in medical technologies, and increased awareness and healthcare spending in emerging economies.

The Postpartum Hemorrhage (PPH) Treatment Devices Market is undergoing significant transformation, driven by the rising prevalence and severity of PPH cases worldwide. The escalation in PPH incidence, as evidenced by the increase from 1.5% in 1999 to 4.1% in 2009, and the specific rise in atonic PPH from 1% to 3.4% over the same period, underscores a growing market demand for effective treatment solutions.

This alarming trend has positioned PPH as a leading cause of maternal mortality globally, contributing to approximately 70,000 deaths annually. In developing regions, the situation is particularly dire, with some countries reporting maternal mortality rates exceeding 1000 per 100,000 live births, where PPH accounts for 60% of these fatalities. This represents a substantial challenge and a critical opportunity for market players in the PPH treatment devices sector.

Investment in this market not only promises substantial returns but also aligns with global health priorities aimed at reducing maternal mortality. Innovations in device effectiveness, accessibility, and ease of use are crucial for addressing the unmet needs in both developed and developing markets.

Companies that prioritize technological advancements and strategic partnerships to enhance the distribution and affordability of these lifesaving devices stand to gain significant competitive advantages. The market's growth trajectory is supported by increased healthcare expenditures and a stronger emphasis on maternal health, marking it as a priority area for stakeholders across the healthcare ecosystem.

Key Takeaways

- Market Growth: The Global Postpartum Hemorrhage Pph Treatment Devices Market was valued at USD 807.6 million in 2023. It is expected to reach USD 1,206.2 million by 2033, with a CAGR of 4.2% during the forecast period from 2024 to 2033.

- By Product: Uterine balloon tamponades dominated the market with a 45.2% share.

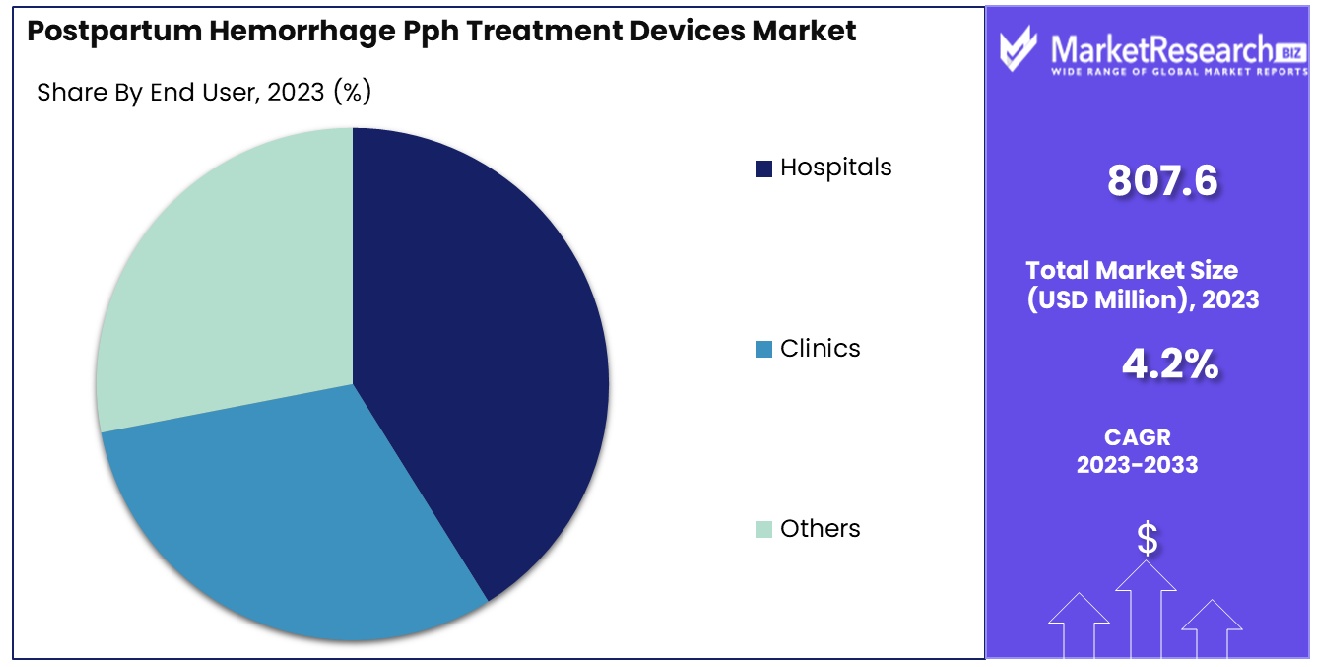

- By End User: Hospitals dominate with a 60% share of end-user demand.

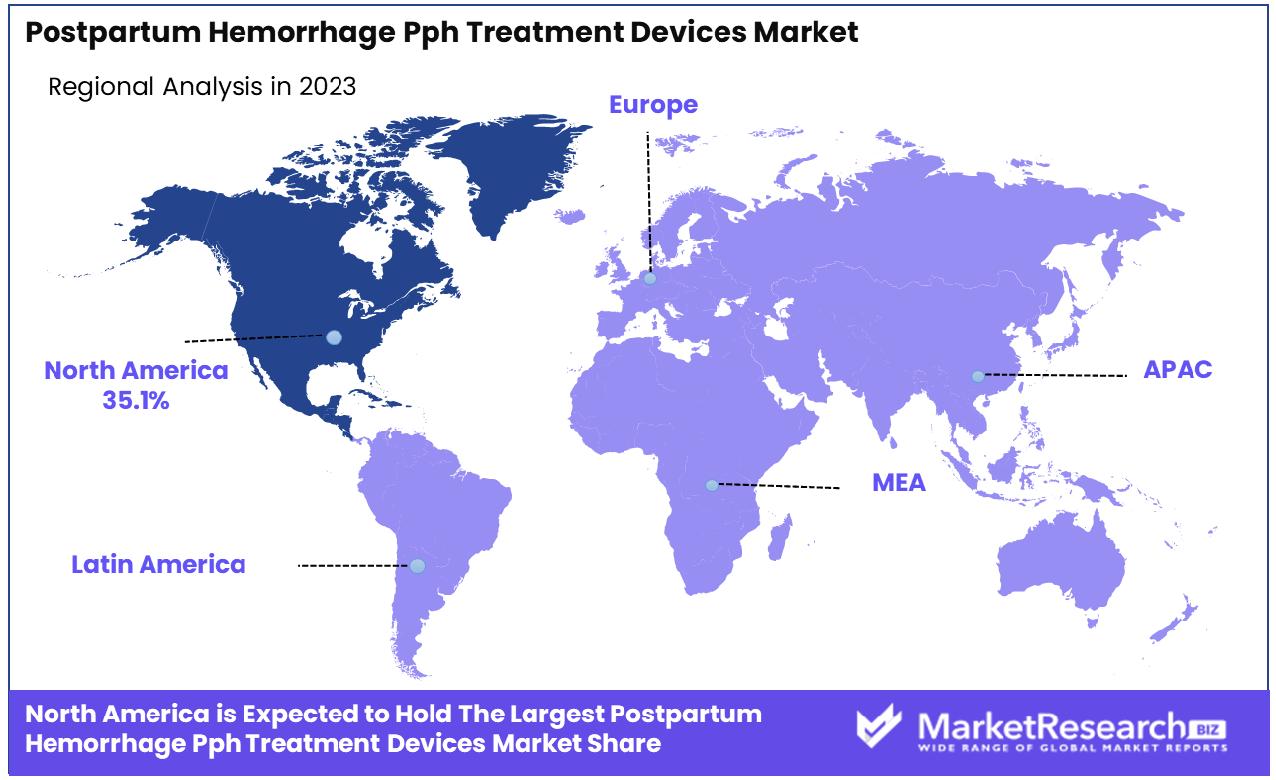

- Regional Dominance: North America holds a 35.1% share in the PPH treatment devices market.

Driving factors

Rising Global Incidence of Postpartum Hemorrhage

The increasing global incidence of postpartum hemorrhage (PPH) is a primary driver for the growth of the PPH treatment devices market. As more women experience complications related to childbirth, the demand for effective treatment solutions escalates.

The World Health Organization estimates that about 14 million women suffer from postpartum hemorrhage annually, which underscores the urgent need for comprehensive treatment options. This rising incidence directly correlates with heightened market demand for devices such as uterine balloon tamponades and other hemorrhage control systems, thereby propelling the market growth.

Advancements in Medical Technology Enhancing Treatment Effectiveness

Technological advancements in the medical field have significantly enhanced the effectiveness of treatments for postpartum hemorrhage, contributing to market growth. Innovations in treatment devices, such as the development of more efficient and safer uterine tamponade systems, have improved patient outcomes.

These advancements not only offer better clinical solutions but also reduce long-term healthcare costs by minimizing complications and hospital stays. As a result, there is an increased adoption rate of advanced treatment devices across healthcare facilities, boosting the market's expansion.

Increased Awareness and Healthcare Initiatives Promoting Maternal Health

Heightened awareness and various global healthcare initiatives aimed at improving maternal health are crucial factors driving the demand for PPH treatment devices. Governmental and non-governmental organizations worldwide are implementing programs to educate healthcare professionals and the public about the risks of postpartum hemorrhage and the importance of timely medical intervention.

These initiatives, combined with increased funding for maternal health, have led to wider accessibility and adoption of PPH treatment solutions. Consequently, this broadened awareness and enhanced healthcare infrastructure significantly fuel the market's growth by ensuring that effective treatments are more widely available and utilized.

Restraining Factors

High Cost of Advanced Treatment Devices

The high cost associated with advanced postpartum hemorrhage (PPH) treatment devices significantly restrains market growth. These sophisticated devices, which are crucial for effectively managing severe cases of PPH, often come with a hefty price tag that can be prohibitive for healthcare facilities, especially in low- to middle-income countries.

The financial burden of acquiring and maintaining these advanced devices limits their accessibility and adoption, particularly in regions where healthcare funding is constrained. This financial barrier not only affects the immediate availability of these critical healthcare solutions but also impacts the overall expansion of the PPH treatment devices market by reducing the potential customer base.

Lack of Trained Professionals in Emerging Regions

A critical restraining factor for the growth of the PPH treatment devices market is the lack of adequately trained healthcare professionals in emerging regions. The effectiveness of advanced PPH treatment devices heavily relies on the skill and knowledge of the operators. In many parts of the world, particularly in underdeveloped and developing regions, there is a significant shortage of personnel who are trained to use these sophisticated devices.

This lack of expertise not only hinders the proper utilization of available technologies but also discourages healthcare facilities from investing in advanced devices, thereby further restraining market growth. The combined challenge of high costs and insufficient training creates a significant barrier to the adoption and effective use of PPH treatment technologies, directly impacting the market’s potential for expansion.

By Product Analysis

Uterine Balloon Tamponades dominate the market with a substantial 45.2% share, leading in treatment efficacy.

In 2023, Uterine Balloon Tamponades held a dominant market position in the by-product segment of the Postpartum Hemorrhage (PPH) Treatment Devices Market, capturing more than a 45.2% share. This significant market share can be attributed to the increasing prevalence of postpartum hemorrhage, coupled with the device's effectiveness in controlling severe bleeding. The adoption of uterine balloon tamponades is further driven by their minimally invasive nature and ease of use, making them a preferred choice among healthcare providers.

Non-pneumatic Anti-shock Garments (NASG) also exhibited notable market presence, though trailing behind uterine balloon tamponades. NASGs accounted for a considerable portion of the market due to their critical role in stabilizing patients with hypovolemic shock by compressing the lower body and thereby enhancing blood flow to vital organs. The growing awareness and usage of NASG in low-resource settings have bolstered their market penetration, emphasizing their importance in PPH management where advanced medical facilities may be lacking.

Uniject Prefilled Injection Systems represented another vital component within the PPH treatment devices market. These systems, designed for the precise and timely administration of oxytocin, have gained traction due to their convenience, accuracy, and reduced risk of dosage errors. The expanding initiatives by healthcare organizations to improve maternal health, particularly in developing regions, have significantly contributed to the increased adoption of these injection systems.

Overall, the Postpartum Hemorrhage Treatment Devices Market has seen substantial growth driven by these key product segments. The dominance of uterine balloon tamponades underscores their critical role in managing PPH, while the rising utilization of NASGs and Uniject Prefilled Injection Systems highlights the ongoing efforts to enhance maternal care through innovative and accessible treatment solutions. The market is poised for continued expansion as advancements in medical technology and increased healthcare investments further drive the adoption of these essential devices.

By End User Analysis

Hospitals are the primary end users, holding a significant 60% market share for PPH treatment devices.

In 2023, Hospitals held a dominant market position in the By End User segment of the Postpartum Hemorrhage (PPH) Treatment Devices Market, capturing more than a 60% share. This dominance is largely attributed to the extensive availability of advanced medical facilities and the presence of skilled healthcare professionals in hospital settings, which ensure timely and effective management of postpartum hemorrhage. The comprehensive nature of hospital care, which includes immediate access to surgical interventions and a wide range of treatment devices, significantly contributes to their substantial market share.

Clinics, while secondary to hospitals, also represented a significant portion of the market. Clinics accounted for a notable share due to their accessibility and the critical role they play in maternal health care, especially in rural and semi-urban areas. The increasing establishment of specialized maternal clinics and the integration of PPH treatment protocols have bolstered the use of PPH treatment devices in these settings. Clinics often serve as the first point of contact for many patients, and their role in the early detection and management of PPH is crucial, driving the market growth within this segment.

The 'Others' category, encompassing birthing centers, home births attended by midwives, and other non-traditional healthcare settings, also contributed to the market dynamics. Although this segment holds a smaller share compared to hospitals and clinics, its growth is driven by the increasing preference for personalized and home-based birthing experiences. The adoption of PPH treatment devices in these settings is growing, supported by advancements in portable and easy-to-use medical devices that ensure safety and effectiveness in non-hospital environments.

Overall, the Postpartum Hemorrhage Treatment Devices Market by end users is dominated by hospitals, reflecting their pivotal role in comprehensive maternal healthcare. Clinics continue to play a vital role, particularly in expanding healthcare access, while the 'Others' segment highlights the evolving preferences and advancements in maternal care options. The market's growth is supported by ongoing investments in healthcare infrastructure and the continuous improvement of PPH management protocols across various healthcare settings.

Key Market Segments

By Product

- Uterine Balloon Tamponades

- Non-pneumatic Anti-shock Garments (NASG)

- Uniject Prefilled Injection Systems

By End User

- Hospitals

- Clinics

- Others

Growth Opportunity

Emerging Markets with Improving Healthcare Infrastructure

The global Postpartum Hemorrhage (PPH) treatment devices market in 2023 presents significant opportunities, particularly in emerging markets that are experiencing improvements in healthcare infrastructure. As countries such as India, Brazil, and parts of Africa enhance their healthcare facilities and services, there is a growing demand for advanced smart medical devices, including those used for the treatment of PPH.

These regions are seeing increased government and private investment in healthcare, which facilitates the adoption of modern medical technologies. With the rising focus on maternal health and the reduction of childbirth-related fatalities, these markets offer a fertile ground for the expansion of PPH treatment solutions. Companies that can navigate the regulatory landscapes and establish partnerships with local healthcare providers stand to gain substantial market share.

Development of Cost-Effective Treatment Solutions

Another significant opportunity in 2023 lies in the development and distribution of cost-effective treatment solutions for PPH. There is a pressing need for affordable medical devices that do not compromise on quality or effectiveness, especially in low- and middle-income countries where healthcare budgets are limited.

Innovations that reduce the cost of production and maintenance of PPH treatment devices could revolutionize market dynamics, making these life-saving technologies accessible to a broader range of healthcare facilities globally. Manufacturers that invest in research and development to create economically viable products can tap into extensive new customer segments, thereby driving market growth and expanding their global footprint in the PPH treatment domain.

Latest Trends

Integration of AI and Machine Learning in Diagnostic and Treatment Devices

In 2023, a transformative trend within the global Postpartum Hemorrhage (PPH) treatment devices market is the integration of artificial intelligence (AI) and machine learning (ML) technologies. These technologies are being harnessed to enhance the accuracy and efficiency of PPH diagnostic and treatment devices. AI and ML algorithms are increasingly used to predict the risk of PPH, analyze patient data in real time, and provide decision support for healthcare providers.

This capability not only improves patient outcomes by enabling quicker and more accurate interventions but also helps in personalizing treatment plans based on predictive analytics. As AI integration becomes more widespread, we expect a surge in demand for these advanced devices, driving innovation and competition among manufacturers.

Increasing Adoption of Non-Invasive Treatment Methods

Another significant trend is the increasing adoption of non-invasive treatment methods for managing postpartum hemorrhage. Traditional approaches often involve invasive techniques that can be risky and require longer recovery times. In contrast, non-invasive methods, such as external uterine massage devices and advanced drug delivery systems, are gaining favor for their efficacy and minimal patient discomfort.

These methods not only enhance patient safety and comfort but also reduce the time spent in hospitals, which is a crucial factor in healthcare cost management. The shift towards non-invasive techniques is expected to expand the market as these methods meet the growing demand for safer and more patient-friendly medical treatments, appealing to a broader range of healthcare providers and patients globally.

Regional Analysis

North America leads the PPH Treatment Devices Market with a substantial 35.1% share.

North America dominates the market with a 35.1% share, driven by advanced healthcare infrastructure, heightened awareness regarding maternal health, and substantial investments in medical technology. The United States leads within this region, thanks to robust healthcare policies and the rapid adoption of technologically advanced PPH treatment devices.

Europe follows, with a strong emphasis on healthcare innovation and government funding supporting the development and dissemination of new treatment modalities. Countries like Germany, the UK, and France are at the forefront, integrating AI and ML in PPH management, further propelling market growth.

The Asia Pacific region is identified as a high-growth area, mainly due to improving healthcare infrastructure and increasing government initiatives aimed at enhancing maternal care in populous countries such as China and India. This region benefits from rising healthcare expenditures and a growing number of hospitals adopting modern medical devices.

The Middle East & Africa and Latin America regions, while smaller in market size, are gradually expanding. Increased awareness about maternal health and governmental efforts to upgrade healthcare facilities provide a foundation for future growth. Specifically, countries like Brazil and South Africa are spearheading the adoption of non-invasive treatment devices, contributing to regional market expansion.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

BD (U.S.) and General Electric (U.S.) remain frontrunners, leveraging their extensive research and development capabilities to introduce technologically advanced solutions that enhance the efficiency and safety of PPH treatments. These industry giants continue to dominate due to their robust global distribution networks and brand reputation.

BACTIGUARD AB (Sweden) stands out in the European market by integrating anti-infection technologies in their PPH devices, addressing the critical need for reducing post-treatment complications. Their focus on safety and innovation positions them as a key player in Europe.

Boen Healthcare Co., Ltd. (China) and Angiplast Pvt. Ltd. (India) are significant contributors in the Asia Pacific region, capitalizing on the expanding healthcare infrastructure and increasing local demand for cost-effective medical devices. These companies are pivotal in making affordable and reliable PPH treatment solutions accessible in emerging markets.

RevMedx (U.S.) and Inpress Technologies Inc. (U.S.) are noted for their groundbreaking approaches to non-invasive treatment methods, particularly through the development of innovative tamponade devices and advanced drug delivery systems.

Teleflex Incorporated (U.S.) and Utah Medical Products Inc. (U.S.) continue to enhance their product offerings with user-friendly designs that facilitate ease of use in emergency medical scenarios, thus ensuring rapid adoption in both hospital and outpatient settings.

3rd Stone Design (U.S.) and ZOEX (U.S.) are pushing the boundaries with portable and easy-to-use devices that are ideal for use in remote areas, addressing the gap in healthcare accessibility.

Lastly, SARA HEALTH CARE (India), Vitality Medical (U.S.), and Davol (India) contribute to the market by focusing on scalable production and distribution strategies that meet the rising global demand for PPH treatment devices, ensuring their presence in both developed and developing markets.

Market Key Players

- BD (U.S.)

- General Electric (U.S.)

- BACTIGUARD AB (Sweden)

- Boen Healthcare Co., Ltd. (China)

- Cook (U.S.)

- RevMedx (U.S.)

- SARA HEALTH CARE (India)

- Inpress Technologies Inc. (U.S.)

- Vitality Medical (U.S.)

- Angiplast Pvt. Ltd. (India)

- Davol (India)

- 3rd Stone Design (U.S.)

- Teleflex Incorporated (U.S.)

- Utah Medical Products Inc. (U.S.)

- ZOEX (U.S.)

Recent Development

- In March 2024, BD announced the launch of a new balloon tamponade system designed specifically for the management of severe postpartum hemorrhage. This system is designed to be quicker to deploy and more effective in stopping bleeding, promising to improve outcomes in critical care situations.

- In November 2023, Boen Healthcare expanded its production facility with an investment of $3 million. This expansion aims to increase the manufacturing capacity of their innovative PPH treatment devices by 30%, addressing the growing global demand.

- In July 2023, BACTIGUARD AB introduced a new infection control catheter that reduces the risk of infection during the treatment of postpartum hemorrhage. This product release is part of their expanded focus on maternal health and safety.

Report Scope

Report Features Description Market Value (2023) USD 807.6 Million Forecast Revenue (2033) USD 1,206.2 Million CAGR (2024-2032) 4.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Uterine Balloon Tamponades, Non-pneumatic Anti-shock Garments (NASG), Uniject Prefilled Injection Systems), By End User(Hospitals, Clinics, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape BD (U.S.), General Electric (U.S.), BACTIGUARD AB (Sweden), Boen Healthcare Co., Ltd. (China), Cook (U.S.), RevMedx (U.S.), SARA HEALTH CARE (India), Inpress Technologies Inc. (U.S.), Vitality Medical (U.S.), Angiplast Pvt. Ltd. (India), Davol (India), 3rd Stone Design (U.S.), Teleflex Incorporated (U.S.), Utah Medical Products Inc. (U.S.), ZOEX (U.S.) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- BD (U.S.)

- General Electric (U.S.)

- BACTIGUARD AB (Sweden)

- Boen Healthcare Co., Ltd. (China)

- Cook (U.S.)

- RevMedx (U.S.)

- SARA HEALTH CARE (India)

- Inpress Technologies Inc. (U.S.)

- Vitality Medical (U.S.)

- Angiplast Pvt. Ltd. (India)

- Davol (India)

- 3rd Stone Design (U.S.)

- Teleflex Incorporated (U.S.)

- Utah Medical Products Inc. (U.S.)

- ZOEX (U.S.)