Polypropylene Fiber Market By Form (Staple Fiber, Continuous Fiber), By Application (Hygiene and Mask, Filtration, Medical/Surgical, Consumer Goods, Industrial, Others), By End-Use Industry (Textile, Construction, Healthcare and Hygiene, Other), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

50791

-

Aug 2024

-

279

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

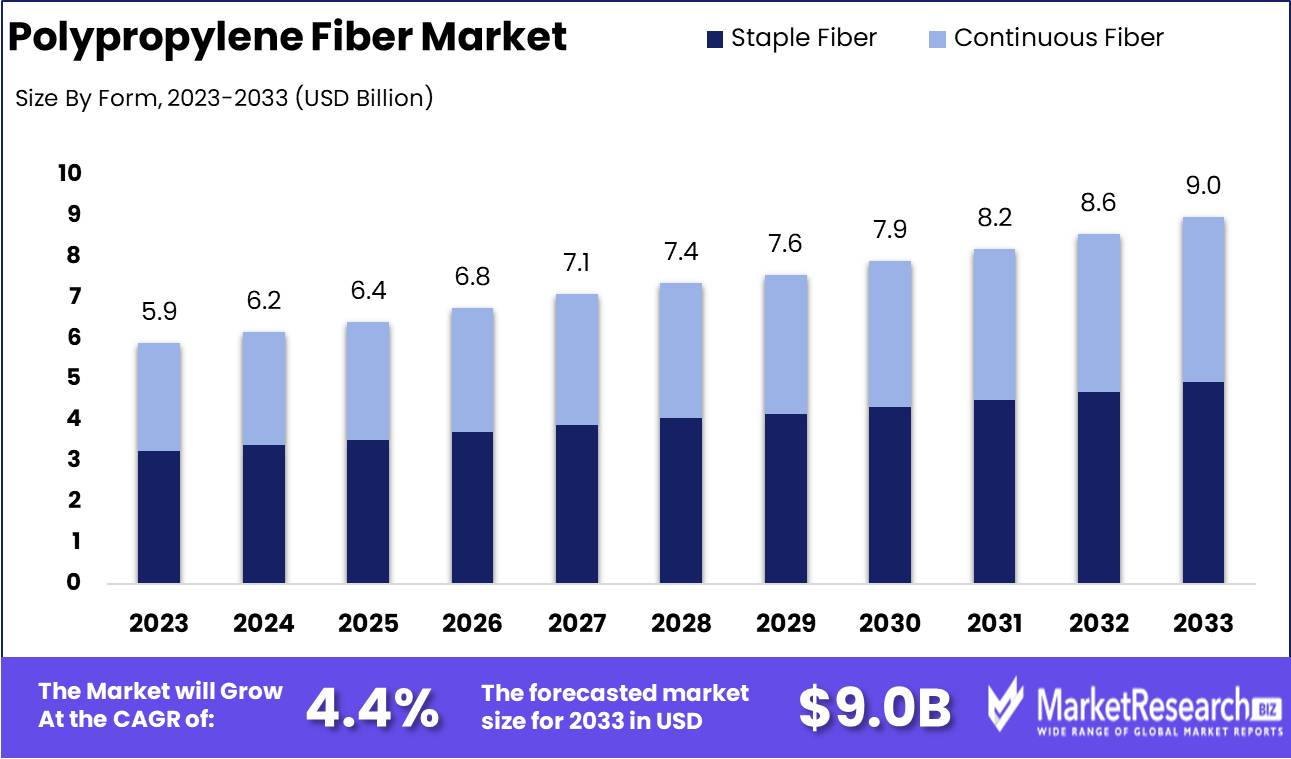

The Global Polypropylene Fiber Market was valued at USD 5.9 Bn in 2023. It is expected to reach USD 9.0 Bn by 2033, with a CAGR of 4.4% during the forecast period from 2024 to 2033.

The Polypropylene Fiber Market involves the production, distribution, and application of polypropylene fibers, which are widely used in industries such as construction, textiles, and automotive. Known for their durability, chemical resistance, and hydrophobic properties, these fibers are integral in enhancing the performance of concrete, improving the longevity of carpets and upholstery, and providing lightweight solutions in automotive applications. The market is driven by the demand for high-performance materials that offer strength, stain resistance, and cost efficiency across various sectors.

The Polypropylene Fiber Market is experiencing strong growth, driven by the material’s versatility and its critical role in enhancing the performance of various products across multiple industries. In the construction sector, the addition of polypropylene fiber at a rate of 1.5 kg/m³ to concrete mixtures has been shown to significantly increase compressive strength by up to 5 MPa and tensile strength by up to 0.5 MPa. This improvement in structural integrity makes polypropylene fiber an essential component in modern construction, particularly in projects requiring enhanced durability and crack resistance.

In the textile industry, polypropylene fibers are valued for their hydrophobic nature, which makes them highly resistant to moisture and stains. This property is particularly beneficial in the production of carpets and upholstery, where these fibers help maintain durability and appearance even under heavy foot traffic, with a lifespan of 5 to 10 years. The combination of strength, stain resistance, and cost-effectiveness has led to the widespread adoption of polypropylene fibers in both residential and commercial applications.

The automotive industry also benefits from the lightweight and durable nature of polypropylene fibers, which are increasingly used in interior components to reduce vehicle weight and improve fuel efficiency. As manufacturers continue to seek materials that offer both performance and sustainability, the demand for polypropylene fibers is expected to grow.

The polypropylene fiber market is characterized by its broad applicability and the significant benefits it offers across construction, textiles, and automotive industries. Companies that innovate in fiber production and application methods will be well-positioned to capitalize on the expanding opportunities in this dynamic market.

Key Takeaways

- By Form: Staple Fiber constitutes 55% of the market, widely used in textiles and hygiene products.

- By Application: Hygiene and Mask represents 40%, highlighting the demand for non-woven fibers in healthcare.

- By End-Use Industry: Healthcare and Hygiene makes up 45%, driven by the need for protective materials in medical applications.

- Regional Dominance: Asia Pacific holds a 45% market share, driven by the region's large textile manufacturing base.

- Growth Opportunity: Expanding the use of polypropylene fiber in medical and personal protective equipment can meet rising healthcare demands and drive market growth.

Driving factors

Growing Demand for Lightweight and Durable Materials in Construction and Automotive Industries

The polypropylene fiber market is experiencing substantial growth due to the increasing demand for lightweight and durable materials in the construction and automotive industries. Polypropylene fibers are valued for their high strength-to-weight ratio, chemical resistance, and durability, making them ideal for various applications in these sectors. In construction, polypropylene fibers are extensively used in concrete reinforcement, where they enhance the durability and lifespan of structures.

In the automotive industry, these fibers are utilized in manufacturing lightweight components, contributing to improved fuel efficiency and reduced emissions. This demand for high-performance materials is driving the expansion of the polypropylene fiber market as industries seek to optimize performance while reducing environmental impact.

Increasing Use in Geotextiles and Filtration Applications

The increasing use of polypropylene fibers in geotextiles and filtration applications is another key factor contributing to the market's growth. Polypropylene fibers are widely used in geotextiles due to their exceptional durability, resistance to biological and chemical degradation, and ability to filter and separate soil layers. These properties make them essential in civil engineering projects, such as road construction, drainage systems, and erosion control.

Polypropylene fibers are increasingly adopted in filtration applications, particularly in water and air filtration systems, where their chemical resistance and fine filtration capabilities are highly valued. The growth in infrastructure projects and environmental regulations are expected to further boost the demand for polypropylene fibers in these applications.

Rising Adoption in Hygiene and Medical Products

The rising adoption of polypropylene fibers in hygiene and medical products is significantly driving market growth. Polypropylene fibers are extensively used in nonwoven fabrics for disposable hygiene products, such as diapers, sanitary napkins, and wipes, due to their softness, lightweight, and cost-effectiveness. In the medical sector, these fibers are employed in surgical masks, gowns, and other protective clothing, where their high barrier properties and hypoallergenic nature are crucial.

The growing awareness of hygiene and the increasing demand for disposable medical products, especially in the context of global health concerns, are expected to drive the polypropylene fiber market further. The expanding healthcare sector, coupled with rising consumer awareness, underscores the critical role of polypropylene fibers in maintaining hygiene standards and protecting public health.

Restraining Factors

Fluctuations in Raw Material Prices

One of the significant restraining factors for the polypropylene fiber market is the fluctuation in raw material prices. Polypropylene fibers are derived from petroleum-based products, making their prices highly sensitive to changes in crude oil prices. Volatility in the global oil market can lead to unpredictable cost variations, impacting the overall production costs of polypropylene fibers.

These fluctuations can create challenges for manufacturers in maintaining competitive pricing, particularly in markets where cost efficiency is critical. As a result, the uncertainty in raw material pricing can deter potential investments and slow down the market's growth, especially during periods of significant price instability.

Environmental Concerns Related to Plastic Waste

Environmental concerns related to plastic waste pose another substantial challenge to the polypropylene fiber market. As a plastic-derived product, polypropylene fibers contribute to the broader issue of plastic pollution, which has garnered increasing attention from governments, environmental organizations, and consumers. The growing pressure to reduce plastic waste and promote sustainable practices has led to stricter regulations and a push for alternative, eco-friendly materials.

This shift towards sustainability may reduce the demand for polypropylene fibers, particularly in regions with stringent environmental regulations. Moreover, the negative perception associated with plastic products could drive consumers and industries to explore and adopt biodegradable or natural fiber alternatives, further restraining the market's growth.

By Form Analysis

Staple Fiber led the By Form segment of the Polypropylene Fiber Market, capturing over 55% share.

In 2023, Staple Fiber held a dominant market position in the By Form segment of the Polypropylene Fiber Market, capturing more than a 55% share. The widespread adoption of staple fibers is primarily attributed to their versatility and cost-effectiveness, making them a preferred choice in various industries such as automotive, textiles, and construction. Staple fibers' easy blendability with other materials enhances their usability in diverse applications, including non-woven fabrics, geotextiles, and carpets, which significantly drives their market share.

Continuous Fiber forms, while holding a smaller market share, are essential in applications requiring higher strength and durability. These fibers are increasingly utilized in the production of technical textiles and reinforced composites, particularly in sectors such as aerospace and industrial manufacturing. The growing demand for lightweight and high-performance materials is expected to bolster the continuous fiber segment, contributing to its steady growth in the polypropylene fiber market. However, the dominant position of staple fibers underscores their critical role in meeting the broad spectrum of industry needs, maintaining their leadership in the market.

By Application Analysis

Hygiene and Mask held a dominant position in the By Application segment of the Polypropylene Fiber Market, capturing more than 40% share.

In 2023, Hygiene and Mask held a dominant market position in the By Application segment of the Polypropylene Fiber Market, capturing more than a 40% share. The significant demand for hygiene products and face masks, particularly in the wake of the COVID-19 pandemic, has driven the growth of this segment. Polypropylene fibers are widely used in the production of non-woven fabrics, which are essential for manufacturing high-quality, breathable, and protective hygiene products and masks. The ongoing emphasis on health and safety, coupled with the rising awareness of personal hygiene, has solidified this segment's leadership in the market.

Filtration, Medical/Surgical, Consumer Goods, Industrial, and Others represent other critical applications of polypropylene fibers. The Filtration segment, although smaller, plays a vital role in industries requiring efficient and durable filtration materials. The Medical/Surgical application is also noteworthy, as polypropylene fibers are used extensively in surgical gowns, drapes, and other medical textiles due to their sterilizability and non-toxic nature. Consumer Goods and Industrial applications further highlight the versatility of polypropylene fibers across various end-use industries. Despite these segments' contributions, the Hygiene and Mask segment remains dominant, driven by sustained demand and the global focus on health and safety standards.

By End-Use Industry Analysis

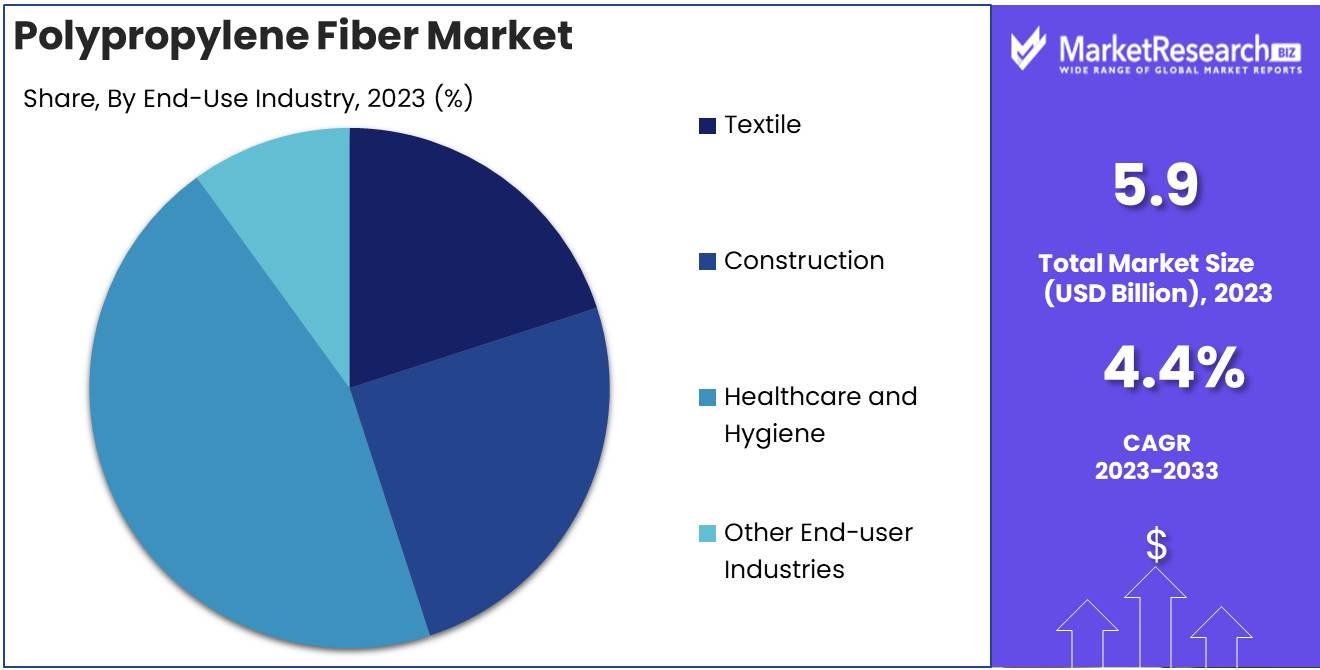

Healthcare and Hygiene led the By End-Use Industry segment of the Polypropylene Fiber Market, capturing over 45% share.

In 2023, Healthcare and Hygiene held a dominant market position in the By End-Use Industry segment of the Polypropylene Fiber Market, capturing more than a 45% share. The extensive use of polypropylene fibers in healthcare and hygiene products, such as face masks, surgical gowns, and sanitary products, has driven significant growth in this segment. The demand for high-performance, non-woven materials that offer superior barrier properties and comfort has surged, particularly in response to heightened global health awareness and stringent hygiene standards. This has positioned the healthcare and hygiene segment as the leading end-use industry for polypropylene fibers.

The Textile and Construction sectors also represent important applications for polypropylene fibers, although with smaller market shares. In the textile industry, polypropylene fibers are favored for their lightweight, durable, and moisture-resistant properties, making them ideal for sportswear, outdoor clothing, and home textiles. The Construction industry utilizes polypropylene fibers in concrete reinforcement and geotextiles, where their strength and resistance to chemical degradation provide enhanced durability in various building applications. Other End-user Industries contribute to the market's diversity, with applications ranging from automotive components to consumer goods. Despite these varied uses, the Healthcare and Hygiene sector's dominant position is expected to persist, driven by ongoing innovations and the critical need for reliable protective materials.

Key Market Segments

By Form

- Staple Fiber

- Continuous Fiber

By Application

- Hygiene and Mask

- Filtration

- Medical/Surgical

- Consumer Goods

- Industrial

- Others

By End-Use Industry

- Textile

- Construction

- Healthcare and Hygiene

- Other End-user Industries

Growth Opportunity

Development of Biodegradable and Eco-Friendly Polypropylene Fibers

The global polypropylene fiber market is set to experience significant growth in 2024, driven by the development of biodegradable and eco-friendly variants. As environmental concerns related to plastic waste continue to rise, there is an increasing demand for sustainable alternatives in various industries. Manufacturers are investing in research and development to create polypropylene fibers that retain their desirable properties—such as durability, lightweight, and chemical resistance—while also being biodegradable.

This innovation not only addresses environmental concerns but also opens up new market opportunities, particularly in regions with stringent environmental regulations. Companies that can effectively market these eco-friendly fibers are likely to gain a competitive advantage, driving growth in the polypropylene fiber market.

Expansion in Emerging Markets with Infrastructure Development Needs

Another significant opportunity lies in the expansion of polypropylene fibers in emerging markets, particularly those undergoing rapid infrastructure development. Countries in Asia, Africa, and Latin America are investing heavily in construction, transportation, and civil engineering projects, creating a robust demand for materials that offer durability and cost-effectiveness.

Polypropylene fibers are increasingly being used in these regions for applications such as concrete reinforcement, geotextiles, and road construction due to their performance benefits. The growing need for infrastructure development in these emerging markets provides a lucrative opportunity for polypropylene fiber manufacturers to expand their presence and capture market share.

Latest Trends

Use of Polypropylene Fiber in Nonwoven Fabrics for Personal Protective Equipment (PPE)

In 2024, the global polypropylene fiber market is expected to see a significant trend in the increased use of polypropylene fiber in nonwoven fabrics, particularly for personal protective equipment (PPE). The ongoing focus on public health, driven by the lessons learned from the COVID-19 pandemic, has led to sustained demand for high-quality PPE. Polypropylene fibers, known for their lightweight, durability, and excellent filtration properties, are a preferred material for manufacturing masks, gowns, and other protective gear.

This trend is likely to be further fueled by global health initiatives and government mandates that emphasize the importance of preparedness for future health emergencies. The continued use of polypropylene fibers in PPE will contribute to steady demand and market growth.

Innovations in Fiber Technology for Improved Strength and Durability

Another key trend in 2024 will be innovations in polypropylene fiber technology aimed at enhancing the strength and durability of the material. Research and development efforts are focused on creating fibers that can withstand more extreme conditions, making them suitable for a broader range of applications, including high-performance textiles and industrial uses.

These innovations not only improve the material's usability but also expand its potential applications, such as in automotive components, construction materials, and geotextiles. As industries increasingly demand materials that offer superior performance, these technological advancements are expected to drive the adoption of polypropylene fibers in new and existing markets.

Regional Analysis

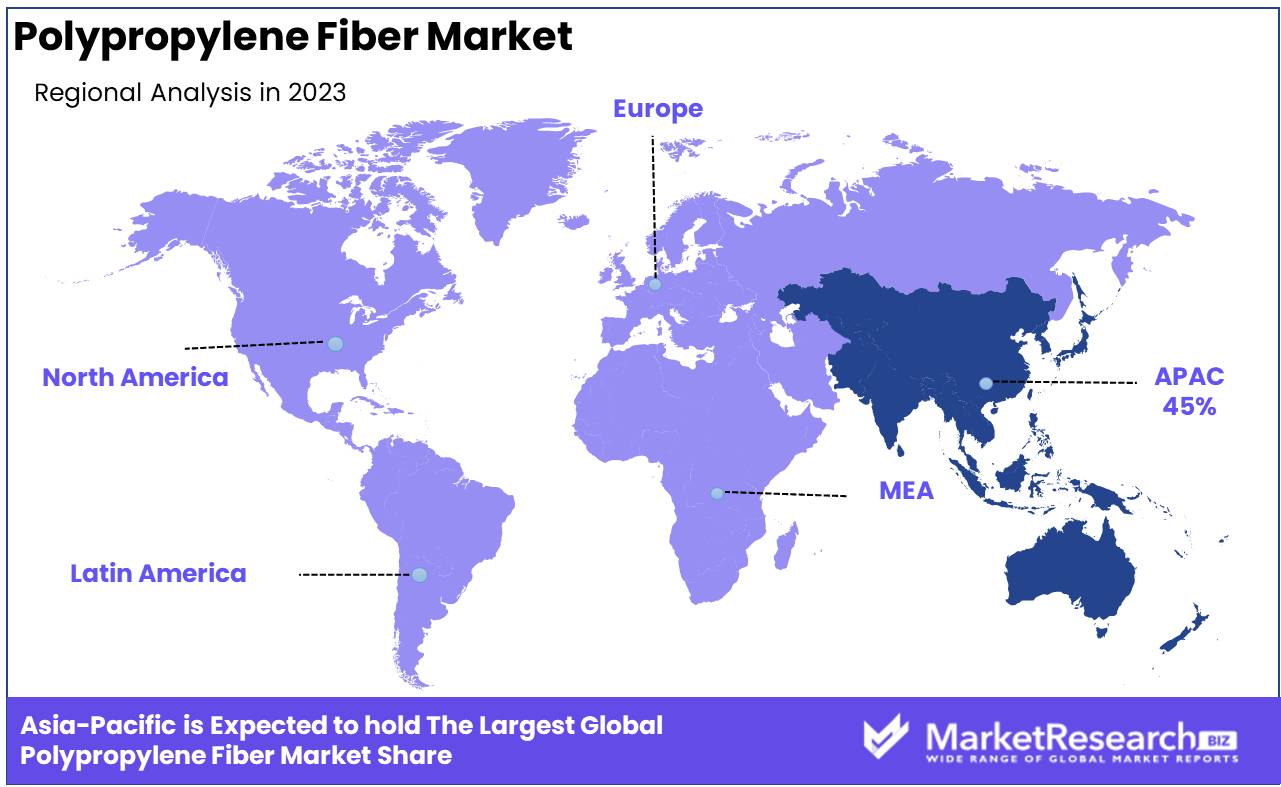

Asia Pacific holds a 45% share of the market.

The Polypropylene Fiber Market is prominently dominated by the Asia Pacific region, which accounts for approximately 45% of the global market share. This dominance is attributed to the region's robust manufacturing sector, particularly in countries like China, India, and Japan, where the demand for polypropylene fiber is driven by its widespread application in the automotive, construction, and textile industries. The rapid industrialization and urbanization in these countries have further fueled the growth of the market.Europe follows as a significant market, with strong demand stemming from the automotive and construction sectors. The region's focus on sustainable and lightweight materials has also contributed to the increased adoption of polypropylene fibers in various applications, including geotextiles and industrial fabrics.

North America holds a substantial market share, driven by the increasing use of polypropylene fibers in the automotive industry, especially in the United States. The region also sees growing demand in the construction sector, where the fibers are used for reinforcing concrete and other materials.

In the Middle East & Africa, the market is gradually expanding, with demand primarily concentrated in the construction sector. The region's growing infrastructure projects are expected to drive further growth in the coming years.

Latin America, though holding a smaller share of the market, is experiencing steady growth due to the increasing application of polypropylene fibers in construction and industrial sectors, particularly in Brazil and Mexico.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global Polypropylene Fiber market is poised for substantial growth, driven by the increasing demand across various end-use industries such as automotive, construction, and textiles. Key players like Belgian Fiber SA and International Fibers Group Holdings Ltd. are expected to maintain their leading positions by focusing on innovation and expanding their product offerings. Belgian Fiber SA is leveraging its expertise in fiber technology to produce high-quality, durable polypropylene fibers that meet the evolving needs of the construction and automotive sectors, where lightweight and high-strength materials are increasingly valued.

SABIC and Borealis AG, both major players in the petrochemical industry, are likely to play a crucial role in the market’s expansion by investing in advanced manufacturing processes and sustainability initiatives. SABIC, with its strong research and development capabilities, is focusing on enhancing the environmental performance of its polypropylene fibers, targeting sectors that demand sustainable solutions. Borealis AG, similarly, is expected to push the boundaries of innovation in fiber technology, particularly in the automotive industry, where there is a growing shift towards lightweight and recyclable materials.

Companies like Sinopec and Sika AG are anticipated to capitalize on their extensive market reach and product diversification. Sinopec’s integration across the petrochemical value chain allows it to offer cost-competitive polypropylene fibers, while Sika AG’s focus on high-performance fibers for construction applications positions it well in the market. Additionally, Indorama Ventures Public Company Ltd. and Mitsubishi Chemical Corporation are likely to strengthen their global market presence by expanding production capacities and exploring new applications for polypropylene fibers, thereby shaping the competitive landscape of the market in 2024.

Market Key Players

- Belgian Fiber SA

- International Fibers Group Holdings Ltd.

- SABIC

- Borealis AG

- Sinopec

- Sika AG

- Indorama Ventures Public Company Ltd.

- ABC Polymer Industries LLC

- Beaulieu Fibres International (BFI)

- Chemosvit Fibrochem SRO

- DuPont

- Fiberpartner Aps

- Freudenberg Group

- Radici Partecipazioni SpA

- Mitsubishi Chemical Corporation

Recent Development

- In January 2024, SABIC introduced a new high-performance polypropylene fiber for the automotive industry, enhancing durability by 30% and reducing material weight.

- In March 2024, Beaulieu Fibres International (BFI) expanded its production facilities in Europe, increasing polypropylene fiber output by 25% to meet rising demand in construction and geotextiles.

Report Scope

Report Features Description Market Value (2023) USD 5.9 Bn Forecast Revenue (2033) USD 9.0 Bn CAGR (2024-2033) 4.4% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Staple Fiber, Continuous Fiber), By Application (Hygiene and Mask, Filtration, Medical/Surgical, Consumer Goods, Industrial, Others), By End-Use Industry (Textile, Construction, Healthcare and Hygiene, Other) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Belgian Fiber SA, International Fibers Group Holdings Ltd., SABIC, Borealis AG, Sinopec, Sika AG, Indorama Ventures Public Company Ltd., ABC Polymer Industries LLC, Beaulieu Fibres International (BFI), Chemosvit Fibrochem SRO, DuPont, Fiberpartner Aps, Freudenberg Group, Radici Partecipazioni SpA, Mitsubishi Chemical Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Belgian Fiber SA

- International Fibers Group Holdings Ltd.

- SABIC

- Borealis AG

- Sinopec

- Sika AG

- Indorama Ventures Public Company Ltd.

- ABC Polymer Industries LLC

- Beaulieu Fibres International (BFI)

- Chemosvit Fibrochem SRO

- DuPont

- Fiberpartner Aps

- Freudenberg Group

- Radici Partecipazioni SpA

- Mitsubishi Chemical Corporation