Phenoxyethanol Market By Product (Phenoxyethanol P5, Phenoxyethanol P25), By Application (Paint Additives, Architectural & Industrial Coatings, Home Care, Personal Care, Inks & Dyes, Pharmaceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

46013

-

April 2024

-

136

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

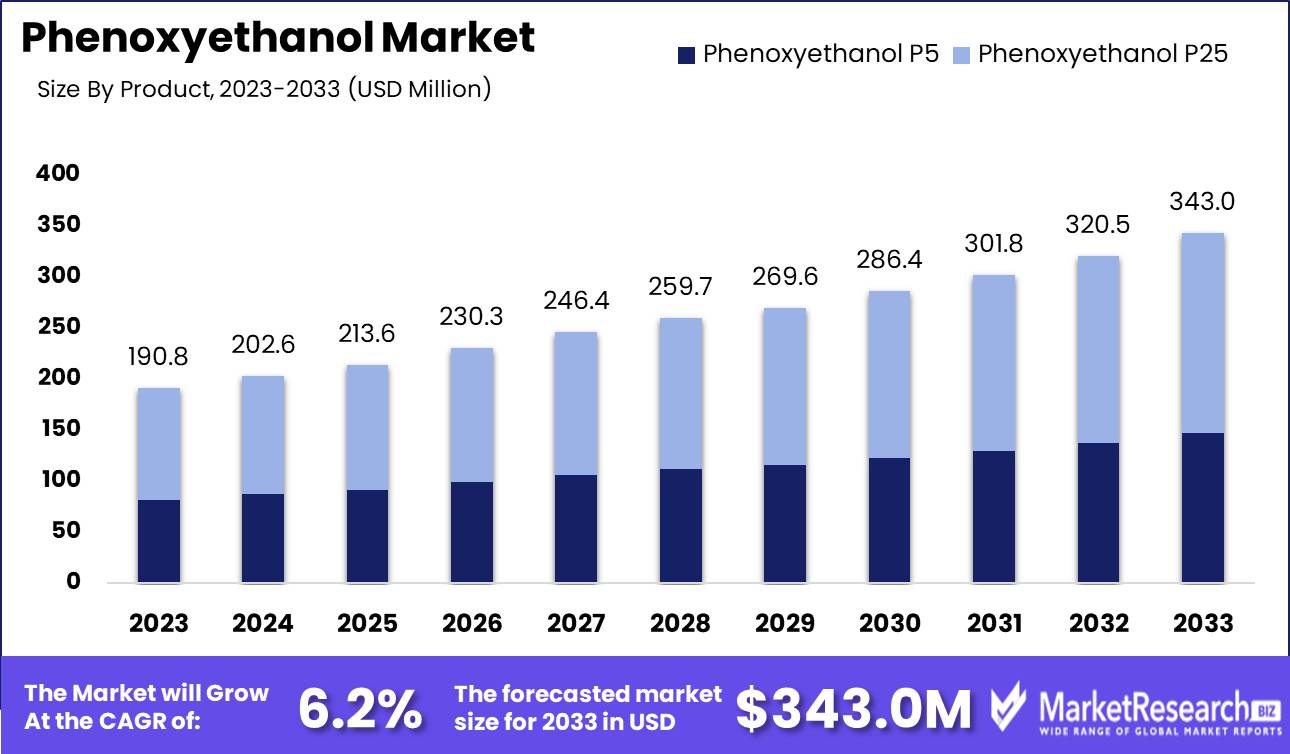

The Global Phenoxyethanol Market was valued at USD 190.8 Mn in 2023. It is expected to reach USD 343.0 Mn by 2033, with a CAGR of 6.2% during the forecast period from 2024 to 2033.

The Phenoxyethanol Market encompasses the global trade and demand dynamics surrounding the chemical compound Phenoxyethanol, predominantly utilized as a preservative in various industries, including cosmetics, personal care, pharmaceuticals, and industrial applications. Characterized by its efficacy in preventing microbial growth and extending product shelf life, this market is witnessing notable growth driven by evolving consumer preferences towards safer and sustainable formulations. As regulatory scrutiny intensifies around traditional preservatives like parabens, Phenoxyethanol emerges as a compelling alternative, fostering innovation in product formulations and supply chain strategies. Amidst increasing emphasis on product safety and environmental consciousness, the Phenoxyethanol Market presents opportunities for strategic differentiation and market expansion.

The Phenoxyethanol Market exhibits a robust trajectory shaped by multifaceted dynamics, encompassing regulatory compliance, consumer preferences, and industry innovation. With its intrinsic properties as a preservative, Phenoxyethanol plays a pivotal role in extending the shelf life of personal care products, typically ranging from 6 to 18 months. This attribute addresses critical consumer demands for product longevity and efficacy, positioning Phenoxyethanol as a cornerstone ingredient in formulations across cosmetics, pharmaceuticals, and industrial applications.

Moreover, the market benefits from a regulatory landscape that underscores its safety and efficacy. Approved for use in cosmetics by esteemed regulatory bodies such as the Cosmetic Ingredient Review (CIR) Panel, FDA, and EEC, Phenoxyethanol enjoys widespread acceptance within permissible concentrations, typically under 1%. Such regulatory endorsements not only instill confidence among manufacturers but also provide assurance to consumers regarding product safety and compliance.

In essence, the Phenoxyethanol Market thrives on the convergence of regulatory validation, consumer demand for efficacy, and industry innovation. As stakeholders navigate evolving market dynamics, strategic imperatives revolve around optimizing formulations to meet stringent regulatory standards while aligning with shifting consumer preferences for safer and sustainable products. With its proven track record in preserving product integrity and safety, Phenoxyethanol emerges as a cornerstone ingredient driving value across diverse applications, underscoring its significance in shaping the future landscape of the global chemical industry.

Key Takeaways

- Market Growth: The Global Phenoxyethanol Market was valued at USD 190.8 Mn in 2023. It is expected to reach USD 343.0 Mn by 2033, with a CAGR of 6.2% during the forecast period from 2024 to 2033.

- By Product: Phenoxyethanol P25 holds the dominant position in the "By Product" segment, commanding around 60% of the market share, surpassing Phenoxyethanol P5.

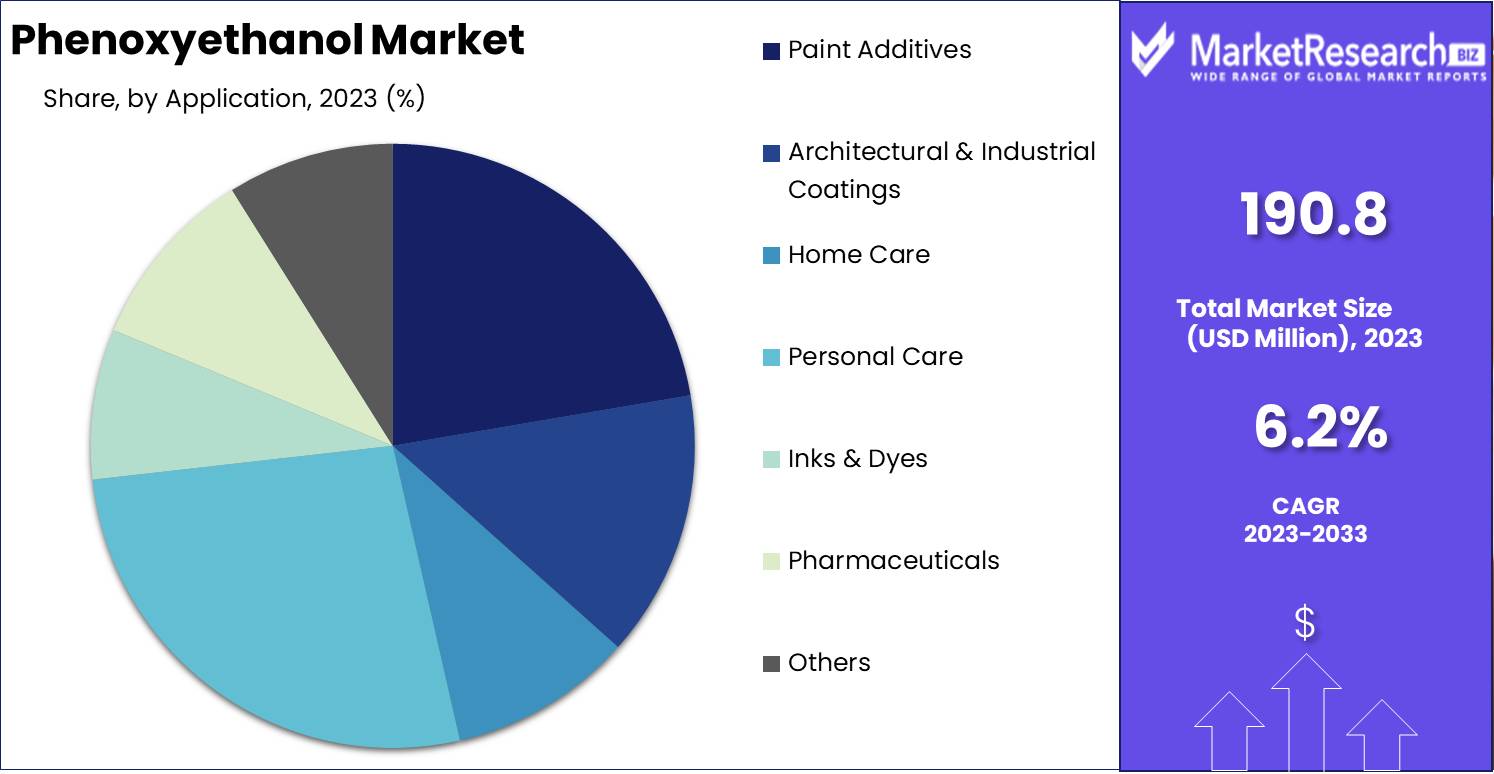

- By Application: Personal Care, comprising around 30% of the market, relies extensively on Phenoxyethanol in various products like lotions, creams, shampoos, and baby wipes.

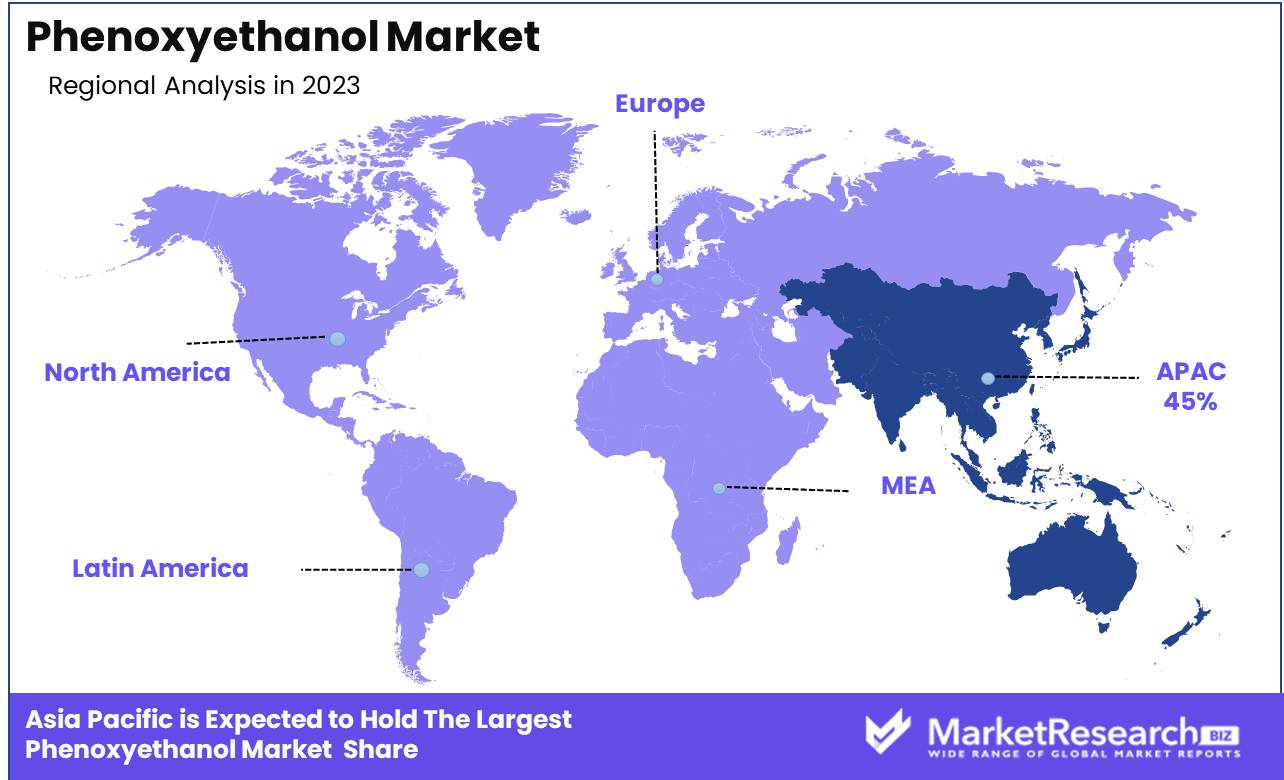

- Regional Dominance: Asia-Pacific emerges as the frontrunner, commanding 45% of the market share, showcasing robust growth and demand in the region.

- Growth Opportunity: The Phenoxyethanol Market presents promising growth prospects, particularly through expansion initiatives into emerging economies, tapping into the increasing demand for personal care and pharmaceutical products.

Driving factors

Cosmetics and Personal Care Products

The cosmetics and personal care industry is a significant driver of the Phenoxyethanol Market. Phenoxyethanol serves as a preservative in these products, effectively inhibiting bacterial growth and extending their shelf life. With consumers increasingly concerned about product safety and hygiene, the demand for preservatives like phenoxyethanol is on the rise.

The expansion of the cosmetics industry, fueled by trends such as personalized skincare routines and the demand for natural products, further amplifies the need for reliable preservatives. As a result, the Phenoxyethanol Market experiences steady growth, closely aligned with the expansion of the cosmetics and personal care sector.

Diverse Industrial Applications

Beyond cosmetics, the utilization of phenoxyethanol extends to various industries, including pharmaceuticals, paints & coatings, soap, and healthcare. The versatile nature of phenoxyethanol as a preservative makes it indispensable across these sectors. In pharmaceuticals, it ensures the stability and safety of medications and healthcare products.

Similarly, in paints & coatings, phenoxyethanol preserves the integrity of formulations, enhancing their longevity. The widespread adoption of phenoxyethanol across these diverse industries contributes significantly to its market growth, as demand remains consistently high across multiple sectors.

Shifting Consumer Preferences

The growing popularity of paraben-free products has emerged as a key driver shaping the Phenoxyethanol Market. As consumers become increasingly conscious of the ingredients in their skincare and personal care products, there is a notable shift towards alternatives to traditional preservatives like parabens. Phenoxyethanol emerges as a preferred choice due to its effectiveness in preserving products without the controversial associations of parabens.

Manufacturers are quick to respond to this trend by reformulating their products to be paraben-free, thereby driving up the demand for phenoxyethanol. This shift in consumer preferences not only expands the market for phenoxyethanol but also underscores its relevance as a safe and reliable preservative option in the cosmetics and personal care industry.

Restraining Factors

Availability of substitutes

When considering the availability of substitutes, especially in the context of consumer products, it's crucial to assess both the practicality and the market demand for alternative options. In industries where substitutes are readily available, consumers typically have the freedom to choose from various products that serve similar purposes.

This availability fosters competition among manufacturers, driving innovation and potentially improving product quality. However, the presence of substitutes can also pose challenges for businesses, as they must continually differentiate their offerings to maintain a competitive edge. Additionally, the ease of substitution can impact pricing strategies and profit margins, as consumers may switch to cheaper alternatives if they perceive comparable value.

Potential Allergen

The identification and management of potential allergens are paramount in food production and other industries where allergenic substances may be present. Allergens pose a significant risk to individuals with sensitivities or allergies, potentially leading to severe health consequences if consumed or exposed to unknowingly. Strict regulations govern the labeling and handling of allergenic ingredients to ensure consumer safety and provide clear information to those with allergies.

Manufacturers invest in rigorous testing protocols and production processes to minimize the risk of cross-contamination and accidental exposure. Despite these measures, the presence of potential allergens remains a complex issue, requiring ongoing vigilance and communication across the supply chain to mitigate risks effectively.

By Product Analysis

Phenoxyethanol P25 dominated the By Product segment of the Phenoxyethanol Market, with over 60% market share.

In 2023, Phenoxyethanol P25 held a dominant market position in the By Product segment of the Phenoxyethanol Market, capturing more than a 60% share. Phenoxyethanol P25, renowned for its superior antimicrobial properties and compatibility with a wide range of formulations, solidified its position as the preferred choice among manufacturers across diverse industries.

Phenoxyethanol P5, while demonstrating commendable performance, trailed behind Phenoxyethanol P25 in market share. With its distinct formulation advantages and efficacy, Phenoxyethanol P5 maintained a significant presence, though it faced stiff competition from its counterpart.

The market dynamics underscored the preference for Phenoxyethanol P25, attributed to its proven track record in ensuring product stability and safety. Its widespread utilization in cosmetics, pharmaceuticals, and personal care products underscored its versatility and reliability, driving its dominance in the By Product segment.

By Application Analysis

Personal Care dominated the By Application segment of the Phenoxyethanol Market, holding over 30% market share.

In 2023, Personal Care held a dominant market position in the By Application segment of the Phenoxyethanol Market, capturing more than a 30% share. The prominence of Personal Care applications underscored the pivotal role of Phenoxyethanol in ensuring product preservation and shelf-life extension across a myriad of personal care formulations.

Among the various application segments, Personal Care emerged as the frontrunner, driven by the rising consumer inclination towards premium skincare, haircare, and cosmetic products. Phenoxyethanol's efficacy as a broad-spectrum preservative, coupled with its mild nature and compatibility with diverse formulations, solidified its position as the go-to choice for personal care manufacturers worldwide.

Paint Additives, Architectural & Industrial Coatings, and Home Care segments, while demonstrating considerable market presence, trailed behind Personal Care in terms of market share. Despite their distinct application areas and demand drivers, they faced stiff competition from the dominant Personal Care segment.

The market dynamics reflected the consumer demand for safe and effective preservation solutions, particularly in personal care products where ingredient safety and efficacy are paramount. Phenoxyethanol's ability to inhibit microbial growth while maintaining product integrity and sensory attributes resonated well with personal care consumers, fueling its dominance in this segment.

Key Market Segments

By Product

- Phenoxyethanol P5

- Phenoxyethanol P25

By Application

- Paint Additives

- Architectural & Industrial Coatings

- Home Care

- Personal Care

- Inks & Dyes

- Pharmaceuticals

- Others

Growth Opportunity

Aging Populations and Rising Healthcare Needs

With an aging population worldwide, there's a corresponding surge in healthcare needs, driving demand for pharmaceuticals and personal care products. Phenoxyethanol, known for its preservative properties, is extensively utilized in pharmaceutical formulations and healthcare products. The burgeoning healthcare sector, particularly in regions with aging demographics, presents a significant growth avenue for Phenoxyethanol manufacturers.

Emphasis on R&D Fostering Innovation

Continuous research and development efforts within the chemical industry are fueling innovation, leading to the discovery of novel applications for Phenoxyethanol. R&D investments aimed at enhancing product efficacy, safety, and sustainability are reshaping the market landscape. Collaborations between academia, industry, and research institutions are propelling the development of advanced formulations incorporating Phenoxyethanol, amplifying its market potential.

Strong Cosmetics and Personal Care Industry

The cosmetics and personal care industry is witnessing robust growth globally, driven by evolving consumer preferences and lifestyle changes. Phenoxyethanol serves as a key ingredient in skincare, haircare, and functional cosmetic formulations due to its efficacy as a preservative and stabilizer. The industry's emphasis on product safety and shelf-life extension further augments the demand for Phenoxyethanol, presenting lucrative opportunities for market players.

Latest Trends

Bio-based and Eco-friendly Products

One of the prominent trends driving the Phenoxyethanol market is the growing demand for bio-based and eco-friendly products. With increasing awareness regarding environmental sustainability, consumers are actively seeking products formulated with ingredients derived from renewable sources. This shift is compelling manufacturers to explore and invest in innovative processes for producing Phenoxyethanol from natural feedstocks.

As consumer preferences align with sustainability goals, companies are strategically incorporating bio-based Phenoxyethanol into their product lines to meet market demands and enhance brand reputation.

Increasing Use of Paraben-free Products

Another significant trend influencing the Phenoxyethanol market is the rising preference for paraben-free formulations. Parabens, commonly used as preservatives in cosmetics and personal care products, have faced scrutiny due to potential health risks. As a result, consumers are increasingly opting for products formulated without parabens, thereby driving the demand for alternative preservatives like Phenoxyethanol.

Manufacturers are capitalizing on this trend by reformulating their products to offer safer alternatives without compromising on efficacy, thus fueling the adoption of Phenoxyethanol in various applications.

Regional Analysis

Asia Pacific asserts its dominance in the global phenoxyethanol market, commanding a significant share of 45%

The Asia Pacific emerges as the dominant region in the global phenoxyethanol market, capturing a substantial market share of 45% in 2023. The region's dominance is attributed to the rapid industrialization, urbanization, and expanding cosmetics and personal care industries in countries like China, Japan, and India. The market value of phenoxyethanol in the Asia Pacific region reached USD 270 million in 2023, reflecting its significant contribution to the global market. Factors such as increasing disposable income, changing lifestyle patterns, and a growing awareness regarding personal hygiene are driving the demand for phenoxyethanol-based products in this region.

In the North American region, the phenoxyethanol market demonstrates a steady growth trajectory owing to the extensive application of the compound across various industries such as cosmetics, pharmaceuticals, and personal care. The United States holds a significant share in this market due to the robust presence of key manufacturers and high consumer demand for quality personal care products.

Europe represents a mature market for phenoxyethanol, characterized by stringent regulations regarding product safety and usage in cosmetics and pharmaceuticals. Countries like Germany, France, and the UK are the key contributors to the market growth in this region. Despite the regulatory challenges, the market is anticipated to witness steady growth due to the rising demand for sustainable preservatives and the presence of leading manufacturers focusing on product innovation and development.

The Middle East & Africa region exhibits a moderate growth rate in the phenoxyethanol market, primarily driven by the expanding cosmetic and pharmaceutical sectors. Countries like the UAE, Saudi Arabia, and South Africa are witnessing increasing demand for phenoxyethanol owing to the rising population and growing emphasis on personal grooming and healthcare.

Latin America presents significant opportunities for the phenoxyethanol market, fueled by the burgeoning cosmetic and personal care industries in countries like Brazil, Mexico, and Argentina.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Market Key Players

- Lonza

- Troy Corporation

- DowDuPont Inc.

- BASF SE

- Clariant AG

- Air Liquide Group (Schulke & Mayr)

- Ashland Global Holdings Inc.

- Lonza Group Ltd.

- Penta International Corporation

- Galaxy Surfactants

- Akema Fine Chemicals

Recent Development

In October 2023, Jajis Innovation opened a new branch in Paravur, India, garnering significant attention. Director Jaji Sunil's makeup tribute to Goddess Durga Devi went viral, amassing over 103,000 likes on Instagram.

In December 2023, Thrive Causemetics spotlights its liquid lash extension and lash growth mascara combo. Seint's "demi method" gains attention for natural makeup. Make Up For Ever's foundation praised for oily skin.

Report Scope

Report Features Description Market Value (2023) USD 190.8 Mn Forecast Revenue (2033) USD 343.0Mn CAGR (2024-2033) 6.2% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Phenoxyethanol P5, Phenoxyethanol P25), By Application (Paint Additives, Architectural & Industrial Coatings, Home Care, Personal Care, Inks & Dyes, Pharmaceuticals, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Lonza, Troy Corporation, DowDuPont Inc., BASF SE, Clariant AG, Air Liquide Group (Schulke & Mayr), Ashland Global Holdings Inc., Lonza Group Ltd., Penta International Corporation, Galaxy Surfactants, Akema Fine Chemicals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Phenoxyethanol Market Overview

- 2.1. Phenoxyethanol Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Phenoxyethanol Market Dynamics

- 3. Global Phenoxyethanol Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Phenoxyethanol Market Analysis, 2016-2021

- 3.2. Global Phenoxyethanol Market Opportunity and Forecast, 2023-2032

- 3.3. Global Phenoxyethanol Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 3.3.1. Global Phenoxyethanol Market Analysis by By Product: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 3.3.3. Phenoxyethanol P5

- 3.3.4. Phenoxyethanol P25

- 3.4. Global Phenoxyethanol Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 3.4.1. Global Phenoxyethanol Market Analysis by By Application: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 3.4.3. Paint Additives

- 3.4.4. Architectural & Industrial Coatings

- 3.4.5. Home Care

- 3.4.6. Personal Care

- 3.4.7. Inks & Dyes

- 3.4.8. Pharmaceuticals

- 3.4.9. Others

- 4. North America Phenoxyethanol Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Phenoxyethanol Market Analysis, 2016-2021

- 4.2. North America Phenoxyethanol Market Opportunity and Forecast, 2023-2032

- 4.3. North America Phenoxyethanol Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 4.3.1. North America Phenoxyethanol Market Analysis by By Product: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 4.3.3. Phenoxyethanol P5

- 4.3.4. Phenoxyethanol P25

- 4.4. North America Phenoxyethanol Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 4.4.1. North America Phenoxyethanol Market Analysis by By Application: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 4.4.3. Paint Additives

- 4.4.4. Architectural & Industrial Coatings

- 4.4.5. Home Care

- 4.4.6. Personal Care

- 4.4.7. Inks & Dyes

- 4.4.8. Pharmaceuticals

- 4.4.9. Others

- 4.5. North America Phenoxyethanol Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.5.1. North America Phenoxyethanol Market Analysis by Country : Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.5.2.1. The US

- 4.5.2.2. Canada

- 4.5.2.3. Mexico

- 5. Western Europe Phenoxyethanol Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Phenoxyethanol Market Analysis, 2016-2021

- 5.2. Western Europe Phenoxyethanol Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Phenoxyethanol Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 5.3.1. Western Europe Phenoxyethanol Market Analysis by By Product: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 5.3.3. Phenoxyethanol P5

- 5.3.4. Phenoxyethanol P25

- 5.4. Western Europe Phenoxyethanol Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 5.4.1. Western Europe Phenoxyethanol Market Analysis by By Application: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 5.4.3. Paint Additives

- 5.4.4. Architectural & Industrial Coatings

- 5.4.5. Home Care

- 5.4.6. Personal Care

- 5.4.7. Inks & Dyes

- 5.4.8. Pharmaceuticals

- 5.4.9. Others

- 5.5. Western Europe Phenoxyethanol Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.5.1. Western Europe Phenoxyethanol Market Analysis by Country : Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.5.2.1. Germany

- 5.5.2.2. France

- 5.5.2.3. The UK

- 5.5.2.4. Spain

- 5.5.2.5. Italy

- 5.5.2.6. Portugal

- 5.5.2.7. Ireland

- 5.5.2.8. Austria

- 5.5.2.9. Switzerland

- 5.5.2.10. Benelux

- 5.5.2.11. Nordic

- 5.5.2.12. Rest of Western Europe

- 6. Eastern Europe Phenoxyethanol Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Phenoxyethanol Market Analysis, 2016-2021

- 6.2. Eastern Europe Phenoxyethanol Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Phenoxyethanol Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 6.3.1. Eastern Europe Phenoxyethanol Market Analysis by By Product: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 6.3.3. Phenoxyethanol P5

- 6.3.4. Phenoxyethanol P25

- 6.4. Eastern Europe Phenoxyethanol Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 6.4.1. Eastern Europe Phenoxyethanol Market Analysis by By Application: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 6.4.3. Paint Additives

- 6.4.4. Architectural & Industrial Coatings

- 6.4.5. Home Care

- 6.4.6. Personal Care

- 6.4.7. Inks & Dyes

- 6.4.8. Pharmaceuticals

- 6.4.9. Others

- 6.5. Eastern Europe Phenoxyethanol Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.5.1. Eastern Europe Phenoxyethanol Market Analysis by Country : Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.5.2.1. Russia

- 6.5.2.2. Poland

- 6.5.2.3. The Czech Republic

- 6.5.2.4. Greece

- 6.5.2.5. Rest of Eastern Europe

- 7. APAC Phenoxyethanol Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Phenoxyethanol Market Analysis, 2016-2021

- 7.2. APAC Phenoxyethanol Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Phenoxyethanol Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 7.3.1. APAC Phenoxyethanol Market Analysis by By Product: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 7.3.3. Phenoxyethanol P5

- 7.3.4. Phenoxyethanol P25

- 7.4. APAC Phenoxyethanol Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 7.4.1. APAC Phenoxyethanol Market Analysis by By Application: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 7.4.3. Paint Additives

- 7.4.4. Architectural & Industrial Coatings

- 7.4.5. Home Care

- 7.4.6. Personal Care

- 7.4.7. Inks & Dyes

- 7.4.8. Pharmaceuticals

- 7.4.9. Others

- 7.5. APAC Phenoxyethanol Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.5.1. APAC Phenoxyethanol Market Analysis by Country : Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.5.2.1. China

- 7.5.2.2. Japan

- 7.5.2.3. South Korea

- 7.5.2.4. India

- 7.5.2.5. Australia & New Zeland

- 7.5.2.6. Indonesia

- 7.5.2.7. Malaysia

- 7.5.2.8. Philippines

- 7.5.2.9. Singapore

- 7.5.2.10. Thailand

- 7.5.2.11. Vietnam

- 7.5.2.12. Rest of APAC

- 8. Latin America Phenoxyethanol Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Phenoxyethanol Market Analysis, 2016-2021

- 8.2. Latin America Phenoxyethanol Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Phenoxyethanol Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 8.3.1. Latin America Phenoxyethanol Market Analysis by By Product: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 8.3.3. Phenoxyethanol P5

- 8.3.4. Phenoxyethanol P25

- 8.4. Latin America Phenoxyethanol Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 8.4.1. Latin America Phenoxyethanol Market Analysis by By Application: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 8.4.3. Paint Additives

- 8.4.4. Architectural & Industrial Coatings

- 8.4.5. Home Care

- 8.4.6. Personal Care

- 8.4.7. Inks & Dyes

- 8.4.8. Pharmaceuticals

- 8.4.9. Others

- 8.5. Latin America Phenoxyethanol Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.5.1. Latin America Phenoxyethanol Market Analysis by Country : Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.5.2.1. Brazil

- 8.5.2.2. Colombia

- 8.5.2.3. Chile

- 8.5.2.4. Argentina

- 8.5.2.5. Costa Rica

- 8.5.2.6. Rest of Latin America

- 9. Middle East & Africa Phenoxyethanol Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Phenoxyethanol Market Analysis, 2016-2021

- 9.2. Middle East & Africa Phenoxyethanol Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Phenoxyethanol Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 9.3.1. Middle East & Africa Phenoxyethanol Market Analysis by By Product: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 9.3.3. Phenoxyethanol P5

- 9.3.4. Phenoxyethanol P25

- 9.4. Middle East & Africa Phenoxyethanol Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 9.4.1. Middle East & Africa Phenoxyethanol Market Analysis by By Application: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 9.4.3. Paint Additives

- 9.4.4. Architectural & Industrial Coatings

- 9.4.5. Home Care

- 9.4.6. Personal Care

- 9.4.7. Inks & Dyes

- 9.4.8. Pharmaceuticals

- 9.4.9. Others

- 9.5. Middle East & Africa Phenoxyethanol Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.5.1. Middle East & Africa Phenoxyethanol Market Analysis by Country : Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.5.2.1. Algeria

- 9.5.2.2. Egypt

- 9.5.2.3. Israel

- 9.5.2.4. Kuwait

- 9.5.2.5. Nigeria

- 9.5.2.6. Saudi Arabia

- 9.5.2.7. South Africa

- 9.5.2.8. Turkey

- 9.5.2.9. The UAE

- 9.5.2.10. Rest of MEA

- 10. Global Phenoxyethanol Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Phenoxyethanol Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Phenoxyethanol Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Lonza

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Troy Corporation

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. DowDuPont Inc.

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. BASF SE

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Clariant AG

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Air Liquide Group (Schulke & Mayr)

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Ashland Global Holdings Inc.

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Lonza Group Ltd.

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Penta International Corporation

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Galaxy Surfactants

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. Akema Fine Chemicals

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- 1. Executive Summary

-

- Lonza

- Troy Corporation

- DowDuPont Inc.

- BASF SE

- Clariant AG

- Air Liquide Group (Schulke & Mayr)

- Ashland Global Holdings Inc.

- Lonza Group Ltd.

- Penta International Corporation

- Galaxy Surfactants

- Akema Fine Chemicals