Perlite Vermiculite Market By Product (Perlite and Vermiculite), By Application (Construction Industry, Horticultural, Filler, Filter Aid, Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

49535

-

July 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

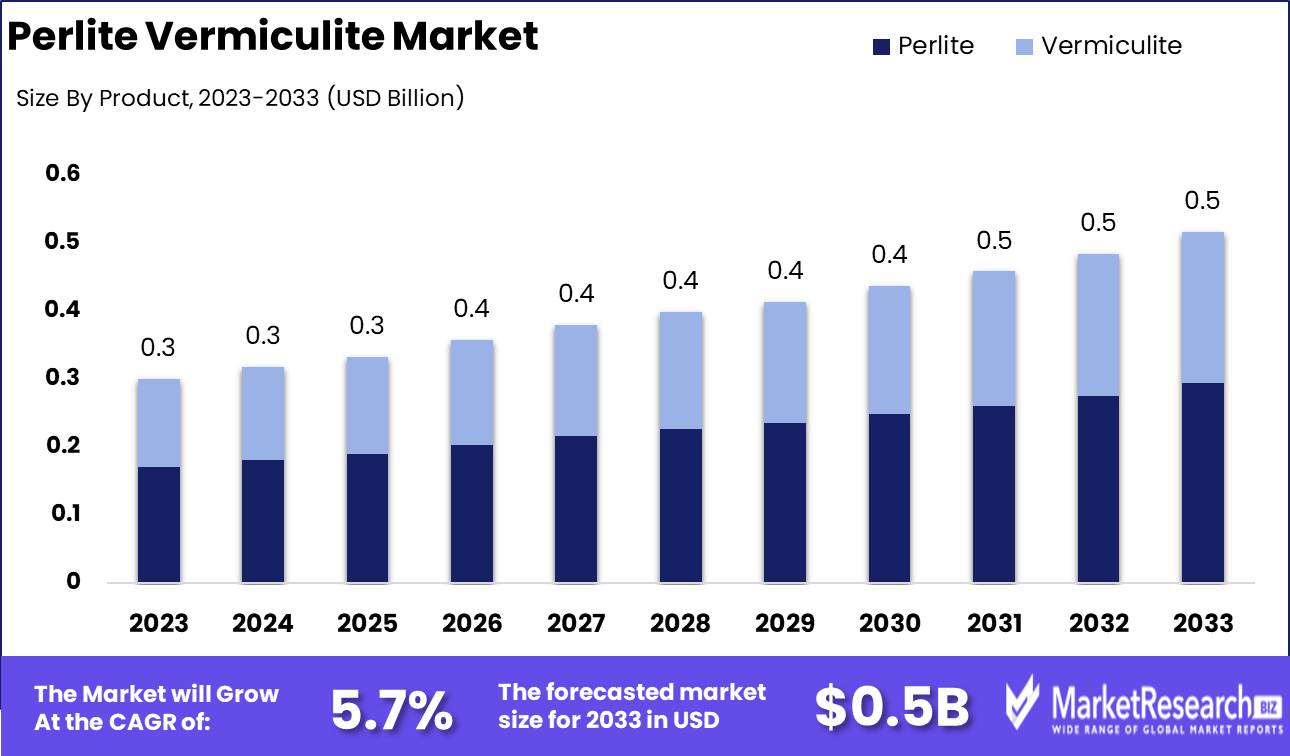

The Perlite Vermiculite Market was valued at USD 0.3 billion in 2023. It is expected to reach USD 0.5 billion by 2033, with a CAGR of 5.7% during the forecast period from 2024 to 2033.

The Perlite Vermiculite Market encompasses the global production, distribution, and utilization of two critical mineral products: perlite and vermiculite. Perlite, a volcanic glass, expands when heated, creating a lightweight, porous material ideal for insulation, filtration, and horticulture. Vermiculite, a hydrated magnesium aluminum silicate, expands similarly, offering exceptional fire resistance, insulation, and soil conditioning properties. The market is driven by demand from agriculture, construction, and industrial sectors, with applications ranging from lightweight concrete and plaster aggregates to soil amendments and fireproofing materials. Innovations in sustainable mining and processing technologies further bolster the growth and environmental stewardship within this market.

The Perlite Vermiculite Market is poised for robust growth, fueled by escalating demand across the construction and horticulture sectors. Perlite and vermiculite are extensively utilized for their unique properties such as insulation, aeration, and moisture retention, making them indispensable in both lightweight plasters and concretes in construction, as well as soil-free growing mixes in horticulture. This dual utility propels their adoption, mirroring the expansion of these sectors.

Furthermore, technological advancements are enhancing the efficiency and applicability of perlite and vermiculite. Innovations in processing techniques not only increase yield but also improve the quality of the final products, thereby broadening their applications and market reach.

However, the market faces significant challenges due to supply chain disruptions that have escalated costs and hampered production continuity. These disruptions, stemming from global logistical bottlenecks and intermittent raw material shortages, have necessitated a strategic reevaluation of supply chain models within the industry. Companies are increasingly adopting resilient supply chain strategies that include diversifying sources and leveraging digital tools to enhance supply chain visibility and responsiveness. This strategic pivot is not only crucial for mitigating current disruptions but also positions businesses to capitalize on emerging market opportunities efficiently.

Key Takeaways

- Market Growth: The Perlite Vermiculite Market was valued at USD 0.3 billion in 2023. It is expected to reach USD 0.5 billion by 2033, with a CAGR of 5.7% during the forecast period from 2024 to 2033.

- By Product: Perlite dominated the Perlite Vermiculite Market with superior properties.

- By Application: The Construction Industry dominated the versatile Perlite Vermiculite Market.

- Regional Dominance: North America leads the Perlite Vermiculite Market with a 35% largest share, driven by agriculture.

- Growth Opportunity: The perlite and vermiculite market is set to grow, driven by advancements in the agriculture and water treatment sectors.

Driving factors

Increasing Demand from Construction Fuels Market Expansion

Due to their widespread use in lightweight concrete and plaster, insulation, and fireproofing applications, the construction industry is a significant driver of the perlite and vermiculite market. As urbanization accelerates, the demand for new residential, commercial, and infrastructure projects has surged, creating a robust need for construction materials that are both effective and sustainable. Perlite, known for its excellent thermal and acoustic insulation properties, and vermiculite, valued for its fire-resistant characteristics, are increasingly incorporated into building materials to enhance performance and safety. According to recent market analysis, the global construction industry is expected to grow at a CAGR of approximately 5.4% from 2023 to 2028, which is anticipated to significantly boost the demand for perlite and vermiculite in various construction applications.

Agricultural Applications Drive Product Adoption

Agriculture represents another critical application area for perlite and vermiculite, primarily due to their beneficial properties in soil conditioning and hydroponics. Perlite improves soil aeration and drainage, crucial for healthy plant growth, while vermiculite enhances moisture retention and nutrient exchange. The increasing emphasis on sustainable agriculture practices and the growing adoption of hydroponic and vertical farming techniques have amplified the demand for these minerals. For instance, the global vertical farming market is projected to grow at a CAGR of 20.4% from 2021 to 2028, highlighting the potential for substantial market growth for perlite and vermiculite as essential components in these innovative farming systems.

Green Building Initiatives Enhance Market Demand

The rise of green building initiatives globally has significantly impacted the perlite and vermiculite market. These materials align well with the principles of sustainable construction, offering environmental benefits such as reduced energy consumption and enhanced building longevity. Governments and organizations worldwide are increasingly advocating for green building certifications like LEED and BREEAM, which prioritize the use of environmentally friendly and sustainable materials. The global green building materials market is expected to grow at a CAGR of 11.3% from 2021 to 2027, underscoring the importance of eco-friendly construction practices. Perlite and vermiculite, with their natural origin and recyclability, are well-positioned to meet this rising demand, thus driving market growth.

Restraining Factors

Impact of Substitutes on Perlite Vermiculite Market Growth

The presence of substitutes in the market significantly restrains the growth of the perlite and vermiculite market. Substitutes such as expanded clay, foam glass, and peat moss offer similar benefits in applications like horticulture, construction, and industrial processing, thereby reducing the demand for perlite and vermiculite. For instance, expanded clay, known for its lightweight and insulation properties, competes directly with perlite and vermiculite in the construction sector. Additionally, foam glass, with its superior thermal insulation capabilities, poses a strong alternative for industrial applications.

The availability of these substitutes often comes at a lower cost or with added benefits, making them attractive to end-users. This economic advantage puts pressure on the perlite and vermiculite market to maintain competitive pricing, which can impact profitability and investment in innovation. As a result, market growth is curtailed as consumers opt for these alternatives, especially in cost-sensitive regions.

Health Concerns Affecting Market Dynamics

Health concerns associated with perlite and vermiculite, particularly the potential for exposure to asbestos in some vermiculite sources, have a considerable restraining effect on market growth. Vermiculite mined from certain sources, such as the Libby mine in Montana, has been found to contain asbestos, a known carcinogen. This has led to stringent regulations and a decline in consumer confidence, as safety becomes a paramount concern.

The construction industry, a major consumer of perlite and vermiculite, faces rigorous health and safety regulations. The potential health risks necessitate additional safety measures and monitoring, increasing operational costs and compliance burdens for companies. In horticulture, where perlite and vermiculite are widely used for soil aeration and moisture retention, these health concerns can deter usage, particularly among organic growers who prioritize safety and environmental impact.

Moreover, these health concerns drive research and development towards safer alternatives, which further impacts the demand for perlite and vermiculite. The market must navigate these challenges by investing in improved processing techniques to eliminate contaminants and by enhancing transparency and safety standards to rebuild consumer trust.

By Product Analysis

In 2023, Perlite dominated the Perlite Vermiculite Market with superior properties.

In 2023, Perlite held a dominant market position in the "By Product" segment of the Perlite Vermiculite Market. This segment also prominently features Vermiculite, but Perlite's superior properties in terms of water retention, aeration, and nutrient release significantly contributed to its leading status. Perlite, known for its lightweight and chemically inert characteristics, has been extensively utilized in horticulture to improve soil aeration and moisture retention. This has bolstered its adoption across various agricultural applications, driving its dominance in the market.

On the other hand, Vermiculite, while also used in similar applications due to its capacity to retain more water and later release it when needed, generally finds preference in situations requiring higher moisture retention over longer periods. Despite its benefits, the market share of Vermiculite remains lower compared to Perlite, partly due to the latter's broader utility and efficiency in diverse growing conditions. Together, these materials support a dynamic market environment, with Perlite leading in adoption due to its versatile and efficient nature in promoting plant growth and soil health.

By Application Analysis

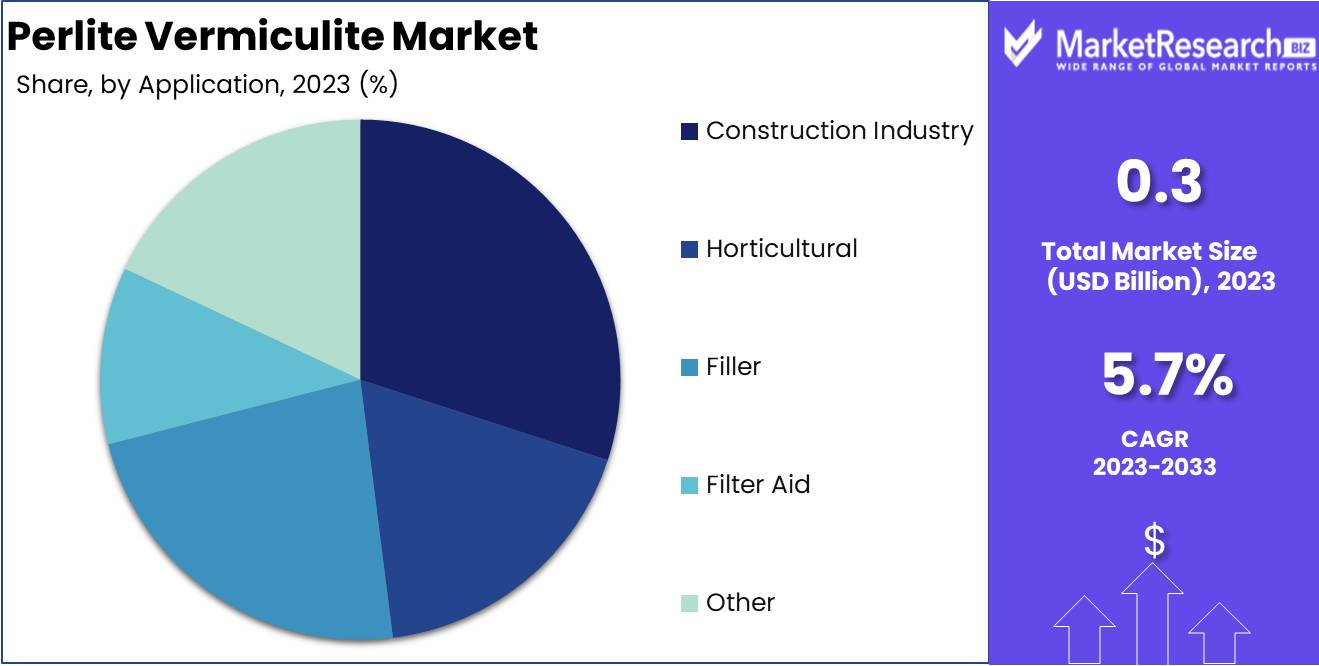

In 2023, The Construction Industry dominated the versatile Perlite Vermiculite Market.

In 2023, The Construction Industry held a dominant market position in the Perlite Vermiculite Market, particularly in the By Application segment. This dominance can be attributed to the extensive utilization of perlite and vermiculite in construction applications due to their exceptional insulation properties, lightweight nature, and fire resistance. Perlite and vermiculite are crucial in providing cost-effective and sustainable building solutions, which significantly enhance energy efficiency in buildings.

Additionally, the Horticultural sector also leverages these materials for soil aeration and moisture retention, promoting healthier plant growth and increased agricultural productivity. In the Filler segment, perlite and vermiculite are valued for their ability to lighten the weight of products without compromising strength, making them ideal for use in plasters, ceramics, and plastic composites.

As a Filter Aid, these materials are indispensable in the filtration processes of food and beverage production, pharmaceuticals, and chemical manufacturing, due to their high porosity and low density, which facilitate the efficient separation of liquids and solids.

Furthermore, the Other applications of perlite and vermiculite include their use in fireproofing and heat insulation, underscoring their versatility and broadening their applicability across various industries. Collectively, these segments underscore the substantial impact and diverse applications of perlite and vermiculite within the market, highlighting their integral role in multiple industrial sectors.

Key Market Segments

By Product

- Perlite

- Vermiculite

By Application

- Construction Industry

- Horticultural

- Filler

- Filter Aid

- Other

Growth Opportunity

Growth Opportunities in the Growing Agriculture Sector

The global perlite and vermiculite market is poised for significant expansion, primarily driven by the burgeoning agriculture sector. Perlite and vermiculite are integral to modern agricultural practices due to their ability to enhance soil aeration and water retention. This is crucial for crop cultivation, especially in regions with arid climates or suboptimal soil conditions. The increasing demand for high-yield crops necessitates the adoption of advanced agronomic technologies, wherein perlite and vermiculite play critical roles. Their unique properties facilitate the extended release of nutrients, which is essential for the sustained growth of a wide range of agricultural crops. The expanding organic farming trend further underscores the importance of these materials, as they are both natural and sustainable soil amendments.

Increasing Water Treatment Applications

Parallel to their agricultural applications, perlite and vermiculite are increasingly being utilized in water treatment processes. This trend is driven by the escalating need for clean and safe water in both developing and developed countries. Perlite and vermiculite's natural filtering properties make them excellent choices for removing impurities and heavy metals from water. The escalation in industrial activities has heightened the necessity for effective water treatment solutions to mitigate environmental impacts, thus broadening the market for perlite and vermiculite. Furthermore, regulatory pressures and increased environmental awareness are catalyzing the adoption of more sustainable and effective water purification methods, thereby propelling the demand for these minerals.

Latest Trends

Embracing Sustainable Practices: A Strategic Imperative for the Perlite Vermiculite Market

The Perlite Vermiculite Market is witnessing a transformative shift towards sustainable practices. This trend is driven by the increasing regulatory pressures and growing consumer demand for environmentally friendly products. Companies are adopting green mining techniques and improving the energy efficiency of their processing operations. This shift not only helps in reducing the environmental footprint but also enhances the brand image and competitiveness of market players. Moreover, the use of recycled materials and the implementation of waste management strategies are becoming prevalent, further solidifying sustainability as a core component of strategic planning within the industry.

Exploring Innovative Applications: Expanding Market Horizons

The market for perlite and vermiculite is also experiencing a surge in innovative applications across various sectors. These materials will be increasingly used in advanced horticulture, lightweight plasters and concrete, and fire-resistant building materials. The unique properties of perlite and vermiculite, such as low density, thermal insulation, and fire resistance, are being leveraged in high-performance applications. Additionally, the exploration of new uses in filtration and biotechnological applications is opening up new avenues for growth. The ability to innovate and find novel applications is crucial for companies aiming to capture new market segments and achieve competitive advantage in a dynamic market environment.

Regional Analysis

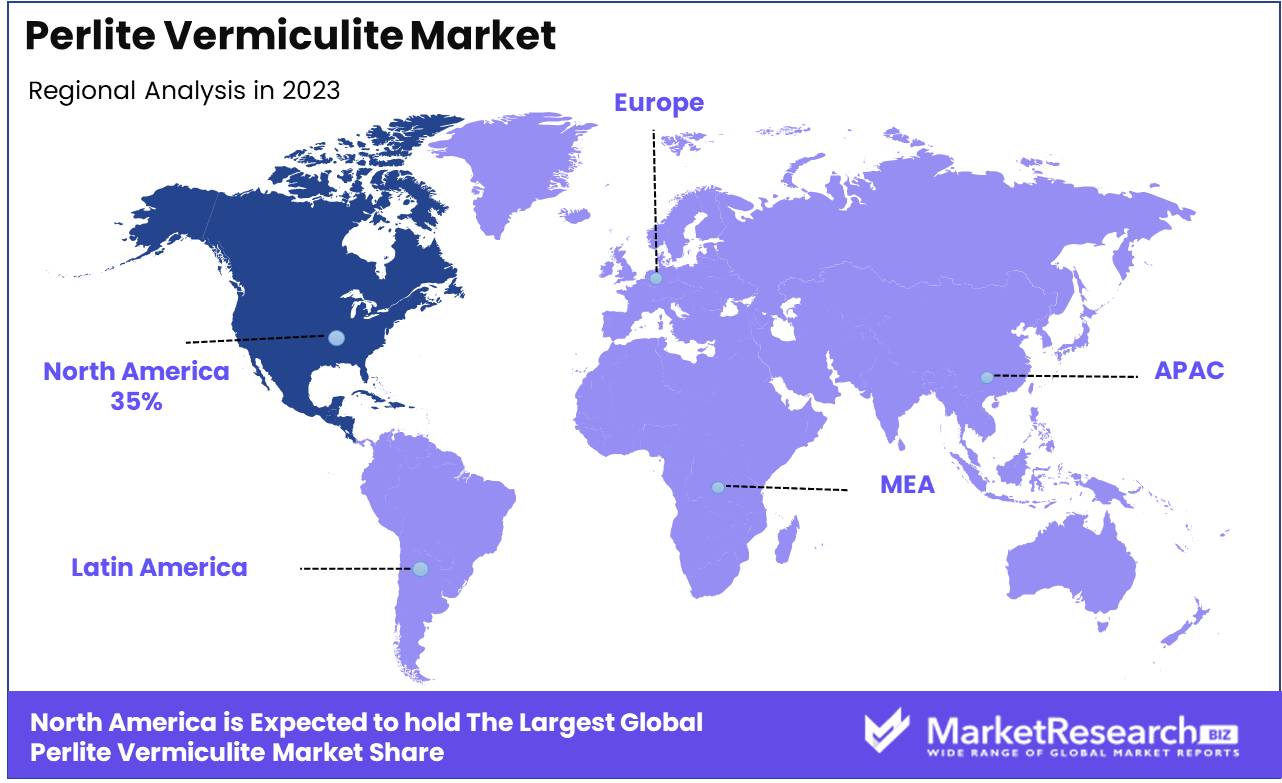

North America leads the Perlite Vermiculite Market with a 35% largest share, driven by agriculture.

The Perlite Vermiculite Market exhibits diverse dynamics across various global regions, reflecting the varying demand patterns and industrial applications. In North America, the market is strongly driven by the expanding horticulture and agriculture sectors, utilizing perlite and vermiculite for soil aeration and moisture retention. This region dominates the global landscape with approximately 35% market share, supported by advanced agricultural practices and high demand for organic farming solutions.

Europe follows, with significant consumption attributed to the construction sector, where these materials are favored for insulation and lightweight plaster formulations. The market benefits from stringent building regulations favoring energy-efficient materials. Asia Pacific is witnessing rapid growth, driven by agricultural expansions and urbanization, pushing demand for perlite and vermiculite in construction and hydroponics. The region is expected to exhibit the highest growth rate over the forecast period.

In the Middle East & Africa, the market is developing steadily with increased utilization in oil & gas applications, where perlite and vermiculite are used for filtration and insulation. Latin America shows promising growth, particularly in agricultural applications, as countries like Brazil expand their agro-industrial base, leveraging these minerals for soil enhancement and pest-resistant planting solutions.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The Perlite Vermiculite Market continues to exhibit robust growth, driven by key global players who leverage both strategic market positioning and technological innovation to capture significant market shares. Among the notable companies, IPM and Showa Denko stand out for their extensive geographic reach and comprehensive product portfolios. Imerys Performance Additives remains pivotal due to its advanced technological capabilities and strong R&D focus, allowing it to deliver high-quality solutions across various industries.

The Genper Group and Dicalite Management Group have differentiated themselves through strategic expansions and investments in production capacity, enhancing their ability to meet the growing demand for perlite and vermiculite in agricultural and industrial applications. Furthermore, Bergama Mining and Aegean Perlites are recognized for their regional dominance and supply reliability, which are critical for maintaining long-term client relationships.

Smaller but agile companies like EP Minerals and Perlite Hellas are carving niches by focusing on specialized applications and sustainable mining practices, appealing to environmentally conscious consumers. Companies such as Termolita and MITSUI MINING & SMELTING are expanding their market footprint through strategic partnerships and acquisitions, which enable them to improve their operational efficiencies and market coverage.

Additionally, emerging players like AUSPERL and ACCIMIN are showing significant potential by tapping into emerging markets with customized products. Samrec Vermiculite Zimbabwe and Brazil Minérios are making inroads in their respective regional markets by leveraging local resources and cost-effective production methods.

Market Key Players

- IPM

- Showa Denko

- Imerys Performance Additives

- Genper Group

- Dicalite Management Group

- Bergama Mining

- Aegean Perlites

- EP Minerals

- Perlite Hellas

- Termolita

- Zhongsen

- Zhongnan

- Zhongxin

- MITSUI MINING & SMELTING

- Palabora Mining Company

- Blue Pacific Minerals

- Therm-O-Rock

- Cevahir Holding

- Perlit-92 Kft

- Jinhualan

- AUSPERL

- Mayue

- ACCIMIN

- Samrec Vermiculite Zimbabwe

- Brasil Minérios

- Virginia Vermiculite

- Yuli Xinlong

Recent Development

- In May 2024, EP Minerals, a U.S.-based leader in perlite and diatomaceous earth products, announced the expansion of its production facility in Nevada. This enhancement is expected to increase the company's perlite output by 20%, addressing the growing demand in industrial and agricultural applications.

- In March 2024, BASF introduced a new line of sustainable vermiculite products designed for the agriculture and hydroponics sectors. These products, developed through innovative processing methods, aim to improve soil aeration and water retention while reducing the environmental impact of traditional vermiculite production processes.

- In February 2024, Imerys, a global leader in mineral-based specialty solutions, announced the acquisition of a leading perlite producer to expand its product portfolio and enhance its presence in the horticulture and construction markets. This strategic move aims to leverage synergies and strengthen Imery's market position by integrating advanced perlite production technologies.

Report Scope

Report Features Description Market Value (2023) USD 0.3 Billion Forecast Revenue (2033) USD 0.5 Billion CAGR (2024-2032) 5.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Perlite and Vermiculite), By Application (Construction Industry, Horticultural, Filler, Filter Aid, Other) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape IPM, Showa Denko, Imerys Performance Additives, Genper Group, Dicalite Management Group, Bergama Mining, Aegean Perlites, EP Minerals, Perlite Hellas, Termolita, Zhongsen, Zhongnan, Zhongxin, MITSUI MINING & SMELTING, Palabora Mining Company, Blue Pacific Minerals, Therm-O-Rock, Cevahir Holding, Perlit-92 Kft, Jinhualan, AUSPERL, Mayue, ACCIMIN, Samrec Vermiculite Zimbabwe, Brasil Minérios, Virginia Vermiculite, Yuli Xinlong Customization Scope Customization for segments at the regional/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- IPM

- Showa Denko

- Imerys Performance Additives

- Genper Group

- Dicalite Management Group

- Bergama Mining

- Aegean Perlites

- EP Minerals

- Perlite Hellas

- Termolita

- Zhongsen

- Zhongnan

- Zhongxin

- MITSUI MINING & SMELTING

- Palabora Mining Company

- Blue Pacific Minerals

- Therm-O-Rock

- Cevahir Holding

- Perlit-92 Kft

- Jinhualan

- AUSPERL

- Mayue

- ACCIMIN

- Samrec Vermiculite Zimbabwe

- Brasil Minérios

- Virginia Vermiculite

- Yuli Xinlong