Patient Engagement Technology Market By Delivery Type (Web & Cloud-based, On-premise), By Component (Software and Hardware, Services), By Functionality (Communication, Health Tracking & Insights, Billing & Payments, Administrative, Patient Education, Others), By Therapeutic Area (Health & Wellness, Chronic Disease Management, Others), By Application (Population Health Management, Outpatient Health Management, In-Patient Health Management, Others), By End-User (Payers, Providers, Others), By Region And Companies - Industry Segment Outlook, Market Ass

-

47931

-

June 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Report Overview

- Key Takeaways

- Driving factors

- Restraining Factors

- By Delivery Type Analysis

- By Component Analysis

- By Functionality Analysis

- By Therapeutic Area Analysis

- By Application Analysis

- By End-User Analysis

- Key Market Segments

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

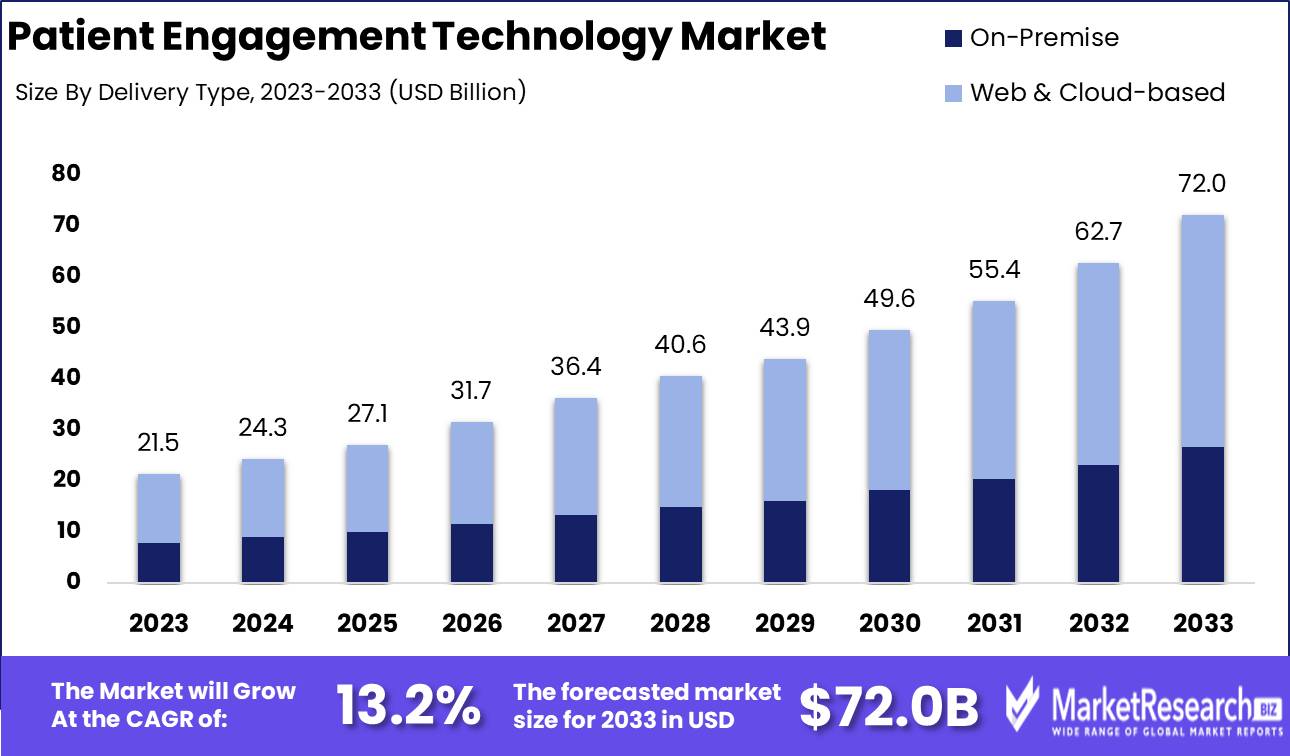

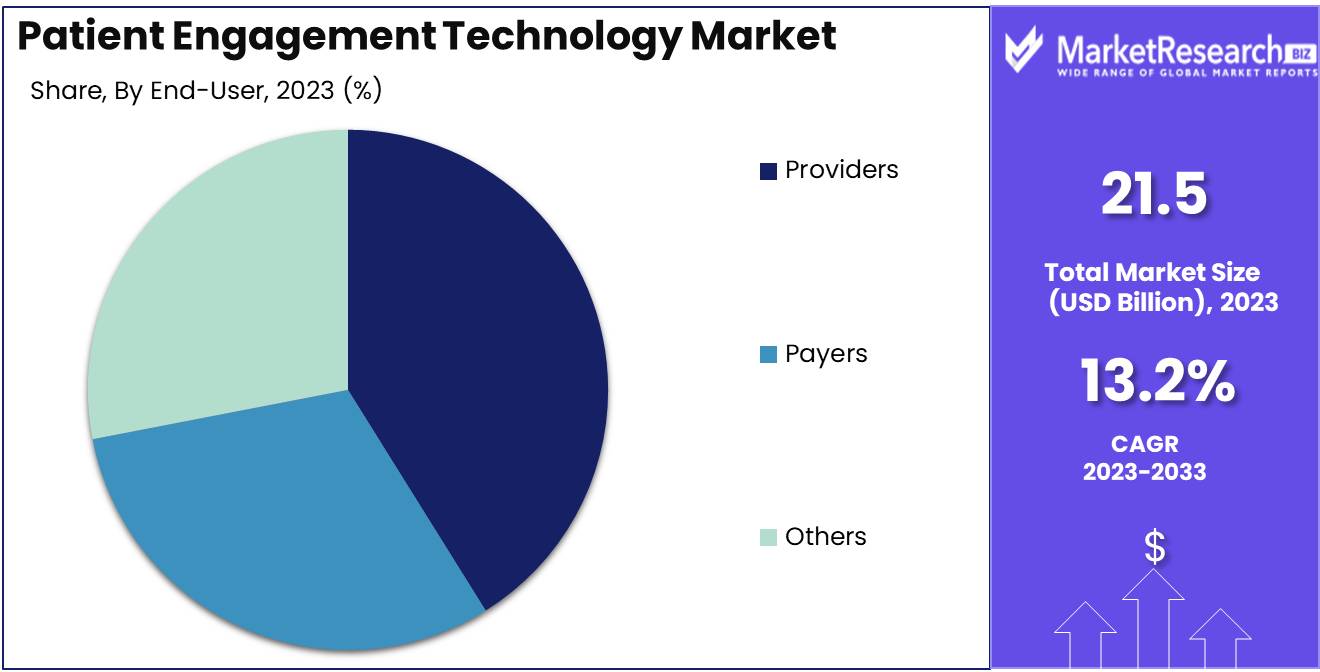

The Patient Engagement Technology Market was valued at USD 21.5 billion in 2023. It is expected to reach USD 72.0 billion by 2033, with a CAGR of 13.2% during the forecast period from 2024 to 2033.

The Patient Engagement Technology Market encompasses a broad spectrum of digital tools and solutions designed to facilitate active patient participation in their healthcare journey. These technologies, including mobile health apps, patient portals, telehealth platforms, and wearable devices, aim to enhance communication between patients and healthcare providers, improve health outcomes, and foster a more personalized and efficient care experience. By leveraging real-time data, educational resources, and interactive interfaces, patient engagement technologies empower individuals to manage their health proactively, ultimately driving better clinical outcomes and increasing patient satisfaction. This market is pivotal in transforming healthcare delivery through enhanced connectivity and patient-centric care models.

The Patient Engagement Technology Market is experiencing a significant transformation, driven by the rising adoption of digital health solutions. The proliferation of mobile health apps, telehealth services, and patient portals is redefining patient-provider interactions, enhancing accessibility, and fostering greater patient involvement in their own healthcare management. This shift towards digital platforms is improving patient satisfaction and streamlining operational efficiencies for healthcare providers.

Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) technologies is propelling the market forward, enabling personalized patient care and predictive analytics. These advanced technologies facilitate more precise diagnosis, tailored treatment plans, and proactive health management, thereby improving patient outcomes and reducing healthcare costs.

However, the rapid expansion of patient engagement technologies also brings forth significant challenges, particularly in the realm of data privacy and security. With stringent regulations such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States, ensuring the confidentiality and integrity of patient data is paramount. Healthcare organizations must navigate the complex landscape of regulatory compliance while implementing robust security measures to protect sensitive health information from breaches and cyber threats. As the market continues to evolve, the ability to balance innovation with rigorous data protection will be critical to maintaining the patient trust and achieving sustainable growth.

Key Takeaways

- Market Growth: The Patient Engagement Technology Market was valued at USD 21.5 billion in 2023. It is expected to reach USD 72.0 billion by 2033, with a CAGR of 13.2% during the forecast period from 2024 to 2033.

- By Delivery Type: Web & Cloud-based delivery dominated the patient engagement technology market.

- By Component: Software and Hardware dominated Patient Engagement Technology over Services.

- By Functionality: Communication dominated the Patient Engagement Technology Market by functionality.

- By Therapeutic Area: Chronic Disease Management dominated the Patient Engagement Technology Market.

- By Application: Population Health Management dominated the Patient Engagement Technology market.

- By End-User: Providers dominated the Patient Engagement Technology Market by end-user.

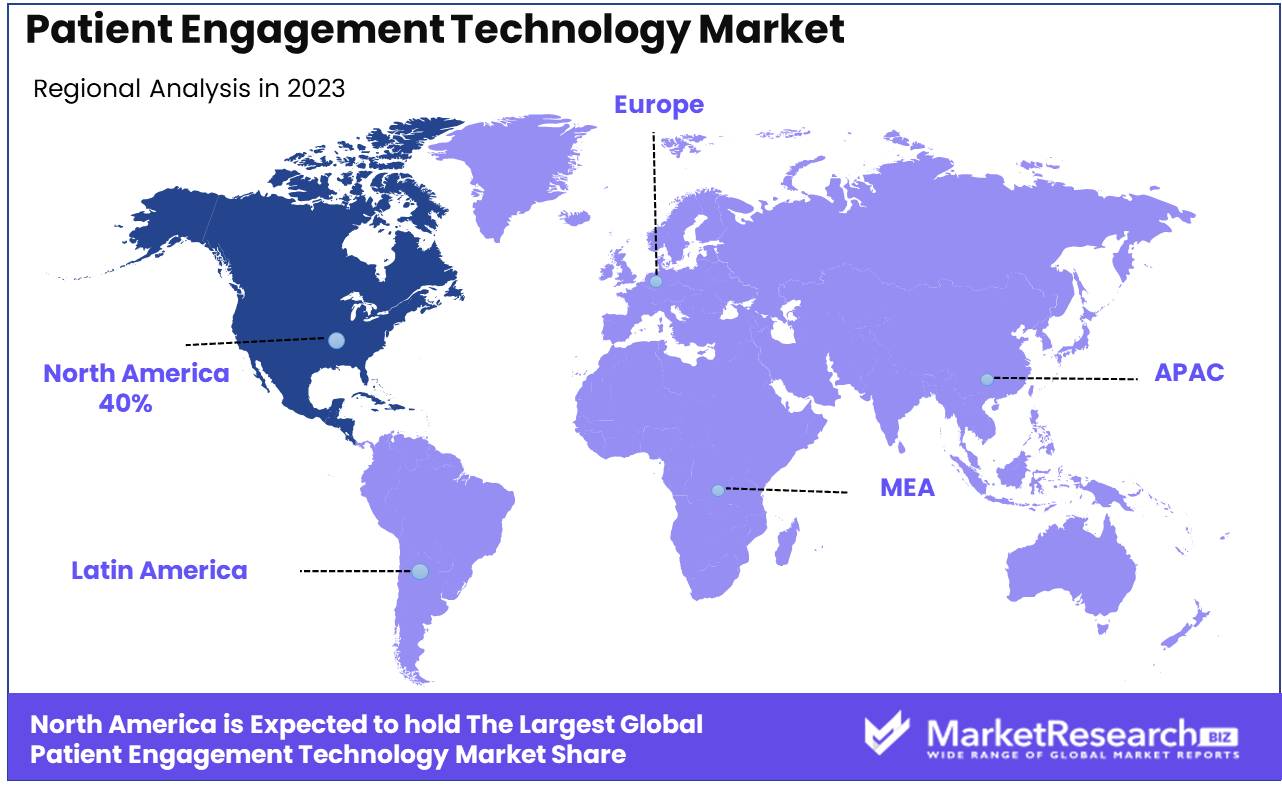

- Regional Dominance: North America dominates the Patient Engagement Technology market, holding 40% share.

- Growth Opportunity: The convergence of AI, machine learning, and EHR integration is revolutionizing patient care, driving efficiency, and fostering market growth.

Driving factors

Increasing Adoption of Mobile Health (mHealth) Technologies: Empowering Patient Engagement

The rapid adoption of mobile health (mHealth) technologies is a primary driver for the growth of the Patient Engagement Technology Market. mHealth solutions, which include mobile apps, wearable devices, and remote monitoring tools, facilitate real-time patient engagement, allowing for continuous health monitoring and communication between patients and healthcare providers. The convenience and accessibility of mHealth technologies empower patients to take an active role in managing their health, leading to better adherence to treatment plans and improved health outcomes.

According to a recent survey, over 60% of patients expressed a preference for mHealth solutions to manage their health conditions. The integration of mHealth into patient engagement strategies also supports telemedicine, enabling virtual consultations and remote diagnostics, which are critical in reducing the need for in-person visits, especially in rural or underserved areas. This technological advancement not only enhances patient satisfaction but also significantly reduces healthcare costs, making it an attractive option for healthcare providers aiming to improve efficiency and patient outcomes.

Rise in Prevalence of Chronic Diseases: Driving Demand for Continuous Engagement

The increasing prevalence of chronic diseases such as diabetes, cardiovascular diseases, and respiratory disorders is a significant factor propelling the Patient Engagement Technology Market. Chronic diseases require ongoing management and continuous patient engagement to monitor symptoms, manage medications, and adjust treatment plans. Technologies that facilitate patient engagement provide essential tools for patients to track their health metrics, receive reminders for medication, and access educational resources about their conditions.

Statistics indicate that chronic diseases account for approximately 75% of global healthcare spending, highlighting the substantial economic burden they impose. Patient engagement technologies help mitigate this burden by enabling proactive disease management and preventing complications through timely interventions. For instance, the use of connected health devices and patient portals allows for regular health data monitoring and direct communication with healthcare providers, leading to more personalized and effective care plans.

Shift Towards Value-Based Care: Incentivizing Patient-Centered Engagement

The healthcare industry's shift towards value-based care models is another critical driver of the Patient Engagement Technology Market. Value-based care emphasizes patient outcomes and cost-efficiency rather than the volume of services provided. This paradigm shift encourages healthcare providers to adopt patient engagement technologies that enhance the quality of care, improve patient satisfaction, and reduce overall healthcare costs.

Under value-based care, healthcare providers are incentivized to ensure patients are actively involved in their health management. Patient engagement technologies, such as electronic health records (EHRs) with integrated patient portals, enable patients to access their medical information, communicate with their care team, and participate in decision-making processes. Studies have shown that engaged patients are more likely to adhere to their treatment plans, leading to better health outcomes and lower readmission rates. This not only benefits patients but also aligns with the financial incentives for providers under value-based care contracts.

Restraining Factors

High Investment Requirements Limit Market Adoption

The patient engagement technology market faces significant growth constraints due to the substantial capital investments necessary for implementation. This technology typically involves advanced software, hardware, and ongoing maintenance costs, which can be prohibitively expensive for many healthcare providers, especially smaller practices and those in developing regions. According to industry reports, the initial setup cost can range from hundreds of thousands to several million dollars, depending on the scale and complexity of the deployment.

The financial burden includes not only the direct costs of purchasing and integrating the technology but also indirect costs such as training staff, upgrading existing IT infrastructure, and ensuring compliance with regulatory standards. These expenses can deter healthcare providers from adopting patient engagement solutions, thereby slowing market growth.

Additionally, the return on investment (ROI) for these technologies can be difficult to quantify and may take several years to materialize, further discouraging immediate adoption. Consequently, only larger healthcare organizations with substantial financial resources can afford these technologies, leading to a slower, uneven market expansion.

Skill Shortage Hampers Technology Implementation

Another critical factor impeding the growth of the patient engagement technology market is the scarcity of skilled IT professionals. The implementation and maintenance of these sophisticated systems require a workforce with specialized knowledge in healthcare IT, cybersecurity, data management, and user interface design. However, there is a notable shortage of such professionals, exacerbated by the rapid pace of technological advancement and the expanding scope of healthcare IT needs.

A survey indicated that over 60% of healthcare organizations face challenges in recruiting adequately skilled IT staff. This shortage not only slows the pace of new implementations but also impacts the ongoing performance and reliability of existing systems. Without sufficient IT support, healthcare providers struggle to leverage the full potential of patient engagement technologies, leading to suboptimal user experiences and decreased patient satisfaction.

Moreover, the shortage of skilled professionals often results in higher salaries and increased operational costs for healthcare providers, which adds to the financial burden discussed previously. The combined effect of high costs and a lack of skilled IT personnel creates a significant barrier to market growth, making it difficult for many healthcare organizations to justify the investment in patient engagement technologies.

By Delivery Type Analysis

In 2023, Web & Cloud-based delivery dominated the patient engagement technology market.

In 2023, The Web & Cloud-based delivery type held a dominant market position in the Patient Engagement Technology Market. This segment's leadership is attributed to its inherent scalability, flexibility, and cost-efficiency, which are critical factors in modern healthcare delivery. Web & Cloud-based solutions enable seamless integration with existing health IT systems, facilitating real-time data access and analytics that enhance patient-provider communication and engagement. The shift towards remote healthcare services and telemedicine has further accelerated the adoption of these technologies, providing patients with continuous and convenient access to care.

Conversely, the On-Premise delivery type, while less prevalent, remains significant for healthcare providers prioritizing data control and security. On-premise solutions offer robust customization options and compliance with stringent regulatory requirements, appealing particularly to large hospitals and healthcare systems with substantial IT infrastructure. However, the higher upfront costs and maintenance requirements pose challenges, limiting their adoption compared to Web & Cloud-based counterparts. Despite this, the On-Premise segment continues to serve niche markets where data sensitivity and control are paramount, ensuring its relevance in the overall landscape of patient engagement technologies.

By Component Analysis

In 2023, Software and Hardware dominated Patient Engagement Technology over Services.

In 2023, Software and Hardware held a dominant market position in the "By Component" segment of the Patient Engagement Technology Market, overshadowing the Services component. The software and hardware segment's preeminence can be attributed to the increasing demand for integrated health management solutions and the rapid adoption of advanced technologies such as artificial intelligence (AI) and machine learning (ML) in patient care. These technologies enhance the functionalities of electronic health records (EHRs), patient portals, and mobile health applications, providing seamless communication and real-time health monitoring. The growing emphasis on personalized medicine and the need for efficient data management systems have further propelled the adoption of sophisticated software solutions and robust hardware infrastructure.

Conversely, the Services segment, while significant, experienced comparatively moderate growth. This segment encompasses implementation, training, and maintenance services essential for the optimal utilization of patient engagement technologies. Although crucial, these services are often considered supplementary to the primary software and hardware systems. Nevertheless, as healthcare providers continue to seek comprehensive solutions that include both technology and support services, the Services segment is poised for steady expansion, driven by the ongoing need for specialized expertise in deploying and managing complex patient engagement systems.

By Functionality Analysis

In 2023, Communication dominated the Patient Engagement Technology Market by functionality.

In 2023, Communication held a dominant market position in the By Functionality segment of the Patient Engagement Technology Market. This segment's leading role is driven by the increasing demand for efficient, real-time communication channels between patients and healthcare providers. Tools such as patient portals, telehealth services, and secure messaging platforms are pivotal in enhancing patient engagement, ensuring timely medical advice, and fostering stronger patient-provider relationships.

Billing & Payments functionality also saw significant adoption, reflecting the growing need for streamlined financial interactions within the healthcare ecosystem. Solutions that enable electronic billing, automated payment reminders, and easy payment methods improve patient satisfaction and reduce administrative burdens.

Health Tracking & Insights, which includes wearable devices and mobile health apps, has become crucial for continuous patient monitoring and personalized healthcare. These tools empower patients to actively manage their health by tracking vital signs, medication adherence, and lifestyle factors, thereby improving health outcomes.

Administrative functions, encompassing appointment scheduling, electronic health records management, and staff coordination, are essential for operational efficiency in healthcare settings. These systems reduce paperwork, minimize errors, and optimize resource allocation.

Patient Education platforms provide valuable resources for disease management, treatment plans, and preventive care, promoting informed decision-making and adherence to medical advice.

Lastly, the Others category, which includes functionalities like remote patient monitoring and feedback systems, plays a supportive role in comprehensive patient engagement strategies, ensuring a holistic approach to patient care and satisfaction.

By Therapeutic Area Analysis

In 2023, Chronic Disease Management dominated the Patient Engagement Technology Market.

In 2023, Chronic Disease Management held a dominant market position in the By Therapeutic Area segment of the Patient Engagement Technology Market. This dominance is attributed to the rising prevalence of chronic diseases such as diabetes, cardiovascular diseases, and cancer, which necessitate continuous monitoring and management. Advanced technologies facilitating remote patient monitoring, telehealth consultations, and personalized treatment plans have significantly enhanced patient outcomes and adherence to treatment regimens.

The Health & Wellness segment also exhibited robust growth, driven by increased consumer awareness and proactive health management trends. Innovations in fitness tracking, mental health apps, and preventative care programs have empowered individuals to maintain healthier lifestyles, thereby reducing healthcare costs and improving quality of life.

The Others category, encompassing various emerging therapeutic areas, saw moderate growth as new technologies and applications are continuously being integrated into patient care. These include rehabilitation programs, maternal health solutions, and pediatric care technologies, reflecting the broadening scope of patient engagement tools. Overall, the market's expansion across these segments underscores the critical role of patient engagement technology in modern healthcare delivery.

By Application Analysis

In 2023, Population Health Management dominated the Patient Engagement Technology market.

In 2023, Population Health Management held a dominant market position in the By Application segment of the Patient Engagement Technology Market. This segment's prominence can be attributed to the increasing emphasis on preventive care, chronic disease management, and the integration of advanced data analytics in healthcare systems. Population Health Management solutions are designed to improve health outcomes by targeting large groups through the use of data-driven insights and coordinated care efforts.

Outpatient Health Management, the second key segment, focuses on enhancing patient care outside hospital settings, reducing readmission rates, and improving follow-up care through telehealth and mobile health applications. This segment is driven by the growing need for cost-effective care delivery models and patient convenience.

In-Patient Health Management, although essential, ranks lower due to its narrower focus on hospital-admitted patients. This segment leverages technologies to enhance patient experiences and outcomes during hospital stays, emphasizing real-time monitoring and care coordination within hospital settings.

Lastly, the Others category encompasses various niche applications, including home healthcare and remote patient monitoring, reflecting a growing trend towards comprehensive, patient-centric care models that extend beyond traditional healthcare environments. Each of these segments contributes uniquely to the overarching goal of improved patient engagement and outcomes.

By End-User Analysis

In 2023, Providers dominated the Patient Engagement Technology Market by end-users.

In 2023, Providers held a dominant market position in the 'By End-User' segment of the Patient Engagement Technology Market. This supremacy can be attributed to several critical factors. Firstly, healthcare providers are increasingly leveraging patient engagement technologies to enhance patient outcomes, streamline workflows, and improve patient satisfaction. By integrating advanced solutions such as patient portals, mobile health apps, and remote monitoring tools, providers can offer more personalized and efficient care. Additionally, the rising emphasis on value-based care models, which prioritize patient engagement and outcomes, further drives the adoption of these technologies among providers.

Meanwhile, payers are also significant players, utilizing patient engagement technologies to manage patient information, optimize care coordination, and reduce costs associated with chronic disease management. Their investments in these technologies facilitate better communication between patients and healthcare teams, leading to improved health outcomes and reduced hospital readmissions.

Lastly, other stakeholders, including government agencies and non-profit organizations, contribute to the market by advocating for patient-centered care initiatives and funding technology advancements. Together, these segments underscore a comprehensive approach to enhancing patient engagement through innovative technology solutions.

Key Market Segments

Growth Opportunity

Advancements in Artificial Intelligence and Machine Learning

AI and machine learning are revolutionizing patient engagement by enabling personalized and predictive healthcare solutions. These technologies facilitate the analysis of vast amounts of patient data to identify patterns and predict health outcomes. For instance, AI-driven chatbots and virtual health assistants are enhancing patient interaction by providing 24/7 support, answering health-related queries, and reminding patients about medication adherence and appointments. Furthermore, predictive analytics can help healthcare providers identify at-risk patients and intervene proactively, thus improving patient outcomes and reducing healthcare costs. As AI and machine learning technologies continue to evolve, they will offer increasingly sophisticated tools for enhancing patient engagement.

Integration with Electronic Health Records (EHRs)

The seamless integration of patient engagement platforms with EHRs is another pivotal factor contributing to market growth. EHRs store comprehensive patient health information, and their integration with engagement platforms allows for a more holistic view of patient health. This integration enables real-time data sharing between patients and healthcare providers, fostering improved communication and coordinated care. Patients can easily access their health records, track their progress, and share information with their care team, thereby enhancing their involvement in their own healthcare. For providers, integrated systems streamline workflows and reduce administrative burdens, allowing for more focused patient care.

Latest Trends

Emergence of Integrated Patient Engagement Solutions

The patient engagement technology market is poised to see significant advancements with the emergence of integrated patient engagement solutions. These solutions are expected to streamline various aspects of patient care by consolidating communication channels, health records, and care management tools into unified platforms. This trend is driven by the need for seamless patient experiences and the growing emphasis on holistic healthcare approaches. By integrating functionalities such as telehealth, appointment scheduling, remote monitoring, and patient education, healthcare providers can enhance patient outcomes and operational efficiencies. The integration of these diverse functionalities will not only improve patient satisfaction but also facilitate better data analytics, leading to more personalized and effective care plans.

Increasing Adoption of Cloud-based Delivery Models

Cloud-based delivery models are gaining traction in the patient engagement technology market, offering scalability, cost-efficiency, and enhanced data accessibility. The adoption of cloud-based platforms is expected to accelerate, driven by their ability to support remote healthcare delivery and real-time data sharing. These models provide healthcare organizations with the flexibility to deploy solutions quickly and adapt to changing patient needs without substantial upfront investments in IT infrastructure. Furthermore, cloud-based systems enable enhanced interoperability among different healthcare systems, fostering better collaboration and continuity of care. The shift towards cloud solutions also addresses critical concerns around data security and compliance, as leading providers incorporate robust security measures and adhere to stringent regulatory standards.

Regional Analysis

North America dominates the Patient Engagement Technology market, holding a 40% share.

The Patient Engagement Technology market demonstrates significant regional variation, each marked by distinct adoption rates, regulatory environments, and healthcare infrastructures. North America leads this market, driven by substantial investments in healthcare IT, a robust regulatory framework, and a high adoption rate of advanced healthcare solutions. In 2023, North America accounted for approximately 40% of the global market share, reflecting its dominance. The presence of key market players and favorable government initiatives further bolster the region's leadership.

Europe follows closely, with a market share of around 25%, underpinned by strong government support for digital health initiatives and widespread adoption of patient engagement platforms in countries like Germany, the UK, and France. The region's focus on enhancing healthcare efficiency and patient outcomes drives demand for these technologies.

The Asia Pacific region is poised for rapid growth, projected to achieve the highest CAGR of over 15% from 2024 to 2030. Factors such as increasing healthcare expenditure, growing awareness of digital health solutions, and significant investments in healthcare infrastructure in countries like China, India, and Japan contribute to this upward trend.

In the Middle East & Africa, market growth is driven by increasing investments in healthcare infrastructure and a growing emphasis on patient-centered care, although the region currently holds a smaller market share due to varying levels of economic development and technological adoption. Latin America, with a share of around 10%, is also experiencing growth, propelled by improvements in healthcare infrastructure and rising investments in digital health initiatives across countries such as Brazil and Mexico.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Patient Engagement Technology market in 2024 is set for significant growth, driven by the increasing emphasis on patient-centered care and the integration of advanced technologies in healthcare. Key players such as Cerner Corporation (Oracle), Epic Systems Corporation, and NextGen Healthcare, Inc. are poised to dominate due to their comprehensive electronic health record (EHR) solutions and robust patient engagement platforms.

Cerner Corporation, now a part of Oracle, leverages Oracle's extensive cloud capabilities to enhance patient data accessibility and interoperability, ensuring seamless healthcare delivery. Epic Systems Corporation continues to be a major force with its MyChart application, which empowers patients through real-time access to their health records and direct communication with providers.

NextGen Healthcare, Inc. is notable for its tailored solutions that cater to ambulatory care, enhancing patient engagement through personalized care plans and efficient practice management tools. Similarly, Allscripts Healthcare, LLC and Athenahealth, Inc. are key players, offering integrated EHR and practice management solutions that facilitate better patient-provider interactions and improved care coordination.

Emerging players like Klara Technologies, Inc. and Solutionreach, Inc. focus on patient communication and appointment management, addressing critical gaps in patient engagement through user-friendly interfaces and advanced messaging systems.

Philips N.V. and ResMed bring a unique angle with their strengths in telehealth and remote patient monitoring, crucial in managing chronic diseases and enhancing patient compliance. Meanwhile, IBM's Watson Health and Nuance Communications, Inc. leverages AI-driven insights to personalize patient care and streamline clinical workflows.

Overall, the competitive landscape of the Patient Engagement Technology market in 2024 is characterized by a blend of established healthcare IT giants and innovative newcomers, all driving towards a more connected, efficient, and patient-centric healthcare ecosystem.

Market Key Players

- Cerner Corporation (Oracle)

- NextGen Healthcare, Inc.

- Epic Systems Corporation

- Allscripts Healthcare, LLC

- McKesson Corporation

- ResMed

- Koninklijke Philips N.V.

- Klara Technologies, Inc.

- CPSI

- Experian Information Solutions, Inc.

- Athenahealth, Inc.

- Solutionreach, Inc.

- IBM

- MEDHOST

- Nuance Communications, Inc.

Recent Development

- In April 2024, Greenway Health partnered with Ambient AI Assistant Nabla to integrate AI technology into Greenway's EHR solutions. This integration aims to save clinicians up to two hours per day by automating clinical documentation, thus reducing administrative burdens and enhancing patient engagement by allowing providers to focus more on patient care.

- In April 2024, Matrix Medical Network joined forces with Linkwell Health to utilize Linkwell's omnichannel engagement platform. This collaboration aims to enhance patient experience and health outcomes by leveraging personalized patient activation strategies and meeting patients in their communities to improve service utilization.

- In September 2023, Zocdoc introduced Zocdoc Practice Solutions, a suite of free tools designed to aid healthcare providers in engaging patients. This new suite includes various features to improve patient communication and streamline appointment management, thereby boosting overall patient engagement.

Report Scope

Report Features Description Market Value (2023) USD 21.5 Billion Forecast Revenue (2033) USD 72.0 Billion CAGR (2024-2032) 13.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Delivery Type (Web & Cloud-based, On-premise), By Component (Software and Hardware, Services), By Functionality (Communication, Health Tracking & Insights, Billing & Payments, Administrative, Patient Education, Others), By Therapeutic Area (Health & Wellness, Chronic Disease Management, Others), By Application (Population Health Management, Outpatient Health Management, In-Patient Health Management, Others), By End-User (Payers, Providers, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Cerner Corporation (Oracle), NextGen Healthcare, Inc., Epic Systems Corporation, Allscripts Healthcare, LLC, McKesson Corporation, ResMed, Koninklijke Philips N.V., Klara Technologies, Inc., CPSI, Experian Information Solutions, Inc., athenahealth, Inc., Solutionreach, Inc., IBM, MEDHOST, Nuance Communications, Inc. Customization Scope Customization for segments at the regional/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Cerner Corporation (Oracle)

- NextGen Healthcare, Inc.

- Epic Systems Corporation

- Allscripts Healthcare, LLC

- McKesson Corporation

- ResMed

- Koninklijke Philips N.V.

- Klara Technologies, Inc.

- CPSI

- Experian Information Solutions, Inc.

- Athenahealth, Inc.

- Solutionreach, Inc.

- IBM

- MEDHOST

- Nuance Communications, Inc.