OTC Orthopedic Braces Market By Product (Knee Braces and Supports, Ankle Braces and Supports, Back, Hip & Spine Braces and Supports, Shoulder Braces and Supports, Elbow Braces and Supports, Hand/Wrist Braces and Supports, Facial Braces and Supports), By Type (Soft and Elastic Braces, Rigid Braces, Hinged Braces), By Application (Preventive Care, Osteoarthritis, Ligament Injury Repair, Compression Therapy), By Distribution Channel (Pharmacies and Retailers, E-Commerce Platforms, Orthopedic Clinics), By Region and Companies - Industry Segment Outlook,

-

50601

-

Aug 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

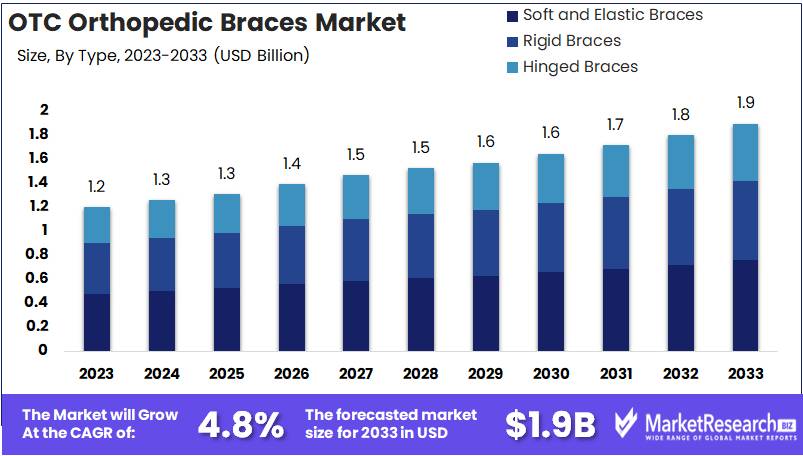

The Global OTC Orthopedic Braces Market was valued at USD 1.2 Bn in 2023. It is expected to reach USD 1.9 Bn by 2033, with a CAGR of 4.8% during the forecast period from 2024 to 2033.

The OTC Orthopedic Braces Market involves the production, distribution, and sale of over-the-counter braces designed to support, stabilize, and protect joints and muscles during recovery from injuries or chronic conditions. These products cater to consumers seeking non-invasive, accessible solutions for pain relief and mobility enhancement. The market is driven by the increasing prevalence of musculoskeletal disorders, rising awareness of preventive care, and the growing popularity of sports and physical activities. Advances in materials and ergonomic design are also fueling market growth, making orthopedic braces a key component in the broader healthcare and wellness industry.

The OTC Orthopedic Braces Market is poised for substantial growth, driven by the increasing prevalence of musculoskeletal conditions and a rising focus on preventive care and injury management. Strategic acquisitions by key players such as DJO Global, which acquired Mathys AG Bettalach and MedShape, Inc. in 2021, highlight the industry's efforts to expand product offerings and strengthen market presence in reconstructive and foot and ankle care.

The OTC Orthopedic Braces Market is poised for substantial growth, driven by the increasing prevalence of musculoskeletal conditions and a rising focus on preventive care and injury management. Strategic acquisitions by key players such as DJO Global, which acquired Mathys AG Bettalach and MedShape, Inc. in 2021, highlight the industry's efforts to expand product offerings and strengthen market presence in reconstructive and foot and ankle care.Furthermore, Ottobock Healthcare's $100 million acquisition of SuitX to expand its exoskeleton network is expected to boost its market share by 15% in the wearable robotics sector. This move underscores the growing intersection between orthopedic bracing and wearable technology, particularly in enhancing mobility and reducing the risk of injury in both clinical and athletic settings.

The market is also benefiting from advancements in materials and design, with modern orthopedic braces offering improved comfort, durability, and efficacy. Innovations such as lightweight, breathable materials and customizable fit options are enhancing user compliance and satisfaction, driving further adoption across a wide range of consumer demographics.

As the demand for non-invasive, easily accessible solutions for pain management and injury prevention continues to rise, the OTC orthopedic braces market is expected to expand. Companies that prioritize innovation and strategic growth initiatives are well-positioned to capitalize on the increasing demand for orthopedic support products, ensuring long-term success in this competitive market.

Key Takeaways

- Market Value: The Global OTC Orthopedic Braces Market was valued at USD 1.2 Bn in 2023. It is expected to reach USD 1.9 Bn by 2033, with a CAGR of 4.8% during the forecast period from 2024 to 2033.

- By Product: Knee Braces and Supports represent 35% of the market, widely used for injury prevention and recovery.

- By Type: Soft and Elastic Braces make up 40%, favored for their comfort and flexibility.

- By Application: Osteoarthritis constitutes 30%, highlighting the demand for non-invasive support solutions.

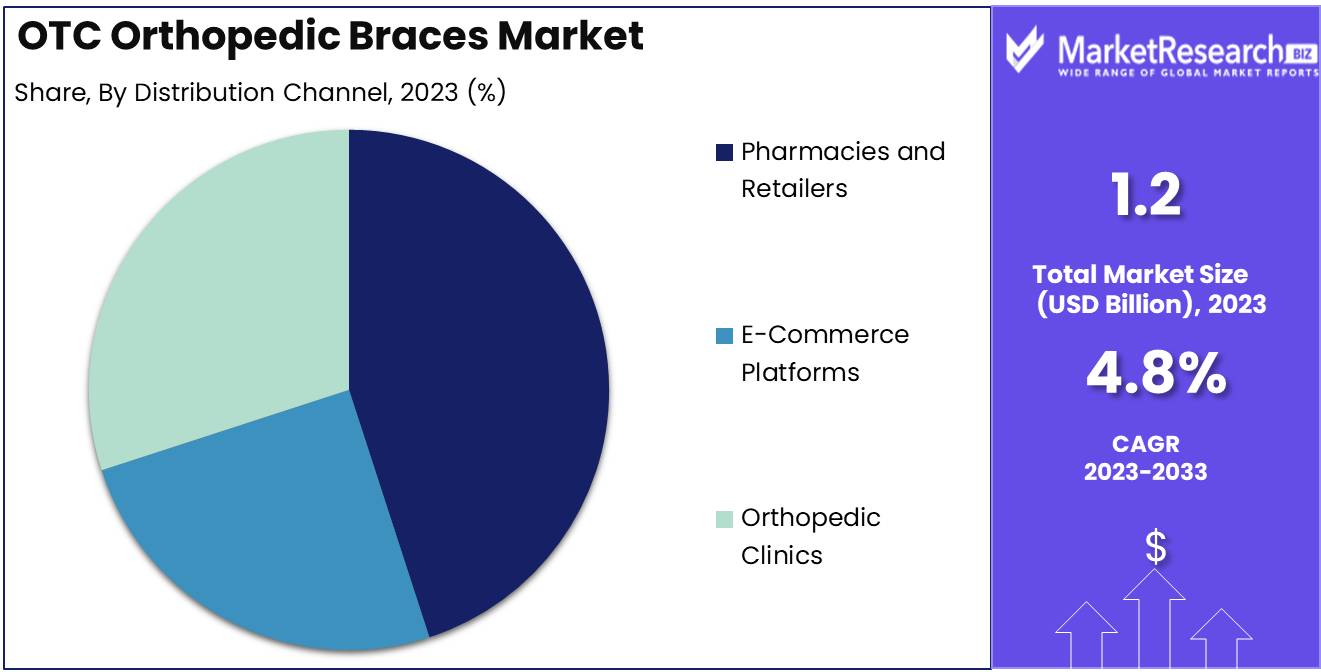

- By Distribution Channel: Pharmacies and Retailers dominate with 45%, providing easy access to OTC orthopedic braces.

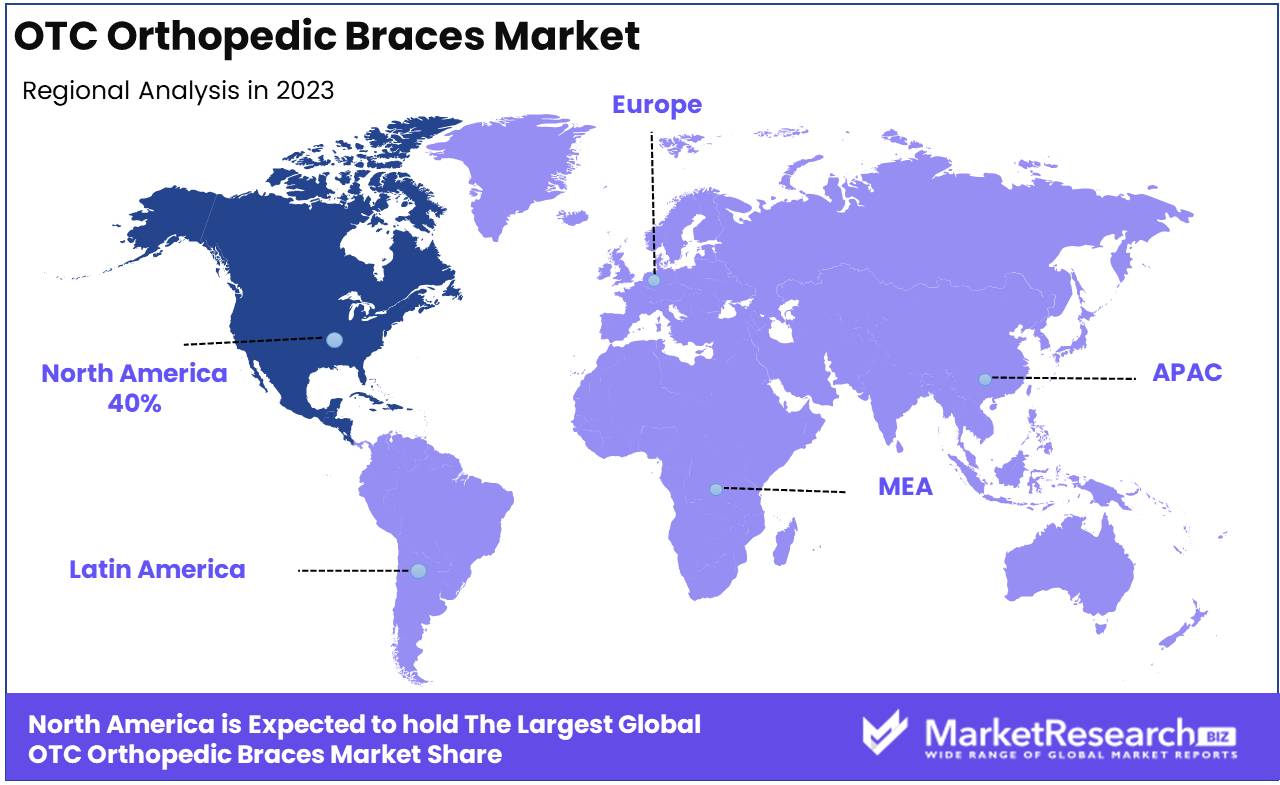

- Regional Dominance: North America holds a 40% market share, driven by a high prevalence of musculoskeletal conditions and strong consumer demand.

- Growth Opportunity: Expanding product lines with advanced materials and custom-fit options can enhance patient comfort and drive market growth.

Driving factors

Increasing Prevalence of Musculoskeletal Disorders and Injuries Fuels Market Demand

The rising incidence of musculoskeletal disorders (MSDs) and injuries is a primary driver of growth in the OTC orthopedic braces market. Conditions such as osteoarthritis, back pain, and sports-related injuries are becoming more prevalent due to factors like an aging population, sedentary lifestyles, and increased participation in physical activities. According to the World Health Organization (WHO), musculoskeletal conditions are the leading contributors to disability worldwide, affecting millions of people. This growing burden of MSDs has led to an increased demand for orthopedic braces as they provide effective support, pain relief, and aid in the recovery process. The convenience of over-the-counter (OTC) availability further encourages patients to opt for these solutions, contributing to the market's expansion.

Growing Awareness of Preventive Healthcare Drives Adoption of Orthopedic Braces

There is a significant shift towards preventive healthcare, with more individuals taking proactive measures to avoid injuries and manage chronic conditions. The growing awareness of the benefits of using orthopedic braces as a preventive tool, particularly among athletes and the elderly, is driving market growth. People are increasingly recognizing that using braces can help prevent injuries during physical activities, reduce the severity of symptoms in existing conditions, and improve overall quality of life. This awareness, coupled with the ease of access to OTC products, is fostering a broader adoption of orthopedic braces, thereby supporting market growth.Rising Demand for Convenient and Accessible Over-the-Counter Solutions Boosts Market Growth

The demand for convenient and easily accessible healthcare solutions is on the rise, and this trend is significantly impacting the OTC orthopedic braces market. Consumers are increasingly looking for products that they can purchase without a prescription, which offer immediate relief and can be used independently at home. The availability of a wide range of orthopedic braces in pharmacies, retail stores, and online platforms has made it easier for individuals to access these products. This accessibility not only meets the growing consumer preference for self-care but also expands the market reach, making orthopedic braces a go-to solution for managing musculoskeletal conditions and injuries.

Restraining Factors

High Cost of Specialized Orthopedic Braces Limits Market Accessibility

One of the key restraining factors in the OTC orthopedic braces market is the high cost associated with specialized orthopedic braces. While these braces offer significant benefits in terms of support, pain relief, and injury prevention, their relatively high price can be a barrier for many consumers, particularly those without adequate health insurance coverage.

The cost factor can discourage some individuals from purchasing these products, especially when they are perceived as non-essential or when cheaper alternatives are available. This limitation can impact the overall market growth, particularly in price-sensitive regions where consumers may opt for more affordable, yet less effective, solutions.

Competition from Alternative Therapies and Products Impedes Market Expansion

The OTC orthopedic braces market faces significant competition from alternative therapies and products, which can act as a restraining factor for market growth. Alternatives such as physical therapy, chiropractic care, and other non-invasive treatments are often preferred by individuals seeking long-term solutions to musculoskeletal issues. The availability of generic or lower-cost braces, as well as emerging technologies like wearable devices and smart medical devices, present competition to traditional orthopedic braces.

These alternatives can draw potential customers away from OTC orthopedic braces, reducing the market share and slowing the growth of this segment. As a result, manufacturers and retailers in this market must continually innovate and offer value-added features to maintain their competitive edge.

By Product Analysis

In the OTC Orthopedic Braces Market, Knee Braces and Supports lead with a 35% share by product.

In 2023, Knee Braces and Supports held a dominant market position in the By Product segment of the OTC Orthopedic Braces Market, capturing more than a 35% share. Knee braces and supports are highly popular due to the widespread occurrence of knee injuries and conditions such as osteoarthritis, ligament injuries, and meniscus tears. These braces offer essential support for both preventive care and post-injury rehabilitation, making them a preferred choice among patients and healthcare providers alike. The increasing prevalence of sports injuries and the aging population have further driven the demand for knee braces, solidifying their leading position in the market.The dominance of knee braces is also supported by advancements in product design, including the development of more comfortable and effective braces that cater to various levels of activity and specific conditions. As the awareness and accessibility of OTC orthopedic solutions grow, knee braces and supports are expected to maintain their strong market presence.

By Type Analysis

Soft and Elastic Braces represent 40% of the type segment in the OTC Orthopedic Braces Market.

In 2023, Soft and Elastic Braces held a dominant market position in the By Type segment of the OTC Orthopedic Braces Market, capturing more than a 40% share. Soft and elastic braces are favored for their comfort, flexibility, and ease of use. These braces are commonly used for mild to moderate support, particularly in managing chronic conditions like arthritis or for preventive care in sports and physical activities. Their non-restrictive nature allows for a greater range of motion while still providing necessary support, which appeals to a broad demographic.The growing consumer preference for self-managed care and the increasing demand for non-invasive treatment options have significantly contributed to the dominance of soft and elastic braces in the market. Additionally, the availability of these braces in various sizes and designs enhances their appeal across different age groups and activity levels.

By Application Analysis

Osteoarthritis accounts for 30% by application in the OTC Orthopedic Braces Market.

In 2023, Osteoarthritis held a dominant market position in the By Application segment of the OTC Orthopedic Braces Market, capturing more than a 30% share. Osteoarthritis, a common degenerative joint disease, affects millions of people worldwide, leading to a high demand for braces that provide relief from pain and support joint function. OTC orthopedic braces are a cost-effective solution for managing osteoarthritis, offering patients the ability to alleviate symptoms without resorting to more invasive treatments.The prevalence of osteoarthritis is expected to rise with the aging population, further boosting the demand for orthopedic braces tailored for this condition. As a result, the osteoarthritis application segment is poised to remain a key driver of growth in the OTC orthopedic braces market.

By Distribution Channel Analysis

Pharmacies and Retailers dominate the distribution channel with a 45% share in the OTC Orthopedic Braces Market.

In 2023, Pharmacies and Retailers held a dominant market position in the By Distribution Channel segment of the OTC Orthopedic Braces Market, capturing more than a 45% share. Pharmacies and retail outlets are the primary distribution channels for OTC orthopedic braces, offering easy access to these products for consumers seeking immediate relief from pain or discomfort. The widespread presence of pharmacies, combined with the trust consumers place in these establishments for healthcare products, has driven their dominance in the market.the convenience of purchasing orthopedic braces from local pharmacies and retailers, where consumers can also receive guidance from pharmacists, adds to their popularity. As demand for OTC orthopedic solutions continues to grow, pharmacies and retailers are likely to maintain their stronghold as the leading distribution channels in this market.

Key Market Segments

By Product

- Knee Braces and Supports

- Ankle Braces and Supports

- Back, Hip & Spine Braces and Supports

- Shoulder Braces and Supports

- Elbow Braces and Supports

- Hand/Wrist Braces and Supports

- Facial Braces and Supports

By Type

- Soft and Elastic Braces

- Rigid Braces

- Hinged Braces

By Application

- Preventive Care

- Osteoarthritis

- Ligament Injury Repair

- Compression Therapy

By Distribution Channel

- Pharmacies and Retailers

- E-Commerce Platforms

- Orthopedic Clinics

Growth Opportunity

Development of Customized and Ergonomic Brace Designs

In 2024, the global OTC orthopedic braces market is set to benefit from the growing trend towards customized and ergonomic brace designs. As consumers become more health-conscious and seek products that offer not only functionality but also comfort, the demand for braces that are tailored to individual needs is increasing.

Advances in technology, such as 3D printing and digital scanning, are enabling manufacturers to create orthopedic braces that fit more precisely and offer enhanced support. These customized designs are particularly appealing to individuals with specific musculoskeletal conditions or those requiring braces for long-term use, driving market growth by meeting the evolving expectations of consumers.

Expansion in the Sports and Fitness Market

The expanding sports and fitness market presents significant growth opportunities for the OTC orthopedic braces market in 2024. With an increasing number of individuals participating in sports, fitness activities, and recreational exercises, the incidence of sports-related injuries is on the rise. This has led to a growing demand for orthopedic braces that can prevent injuries, support recovery, and enhance performance.

The market is also seeing a surge in the popularity of braces designed for specific sports, such as knee braces for runners or wrist braces for weightlifters. As the sports and fitness market continues to grow, so too will the demand for OTC orthopedic braces, providing manufacturers with a valuable opportunity to expand their product offerings and reach a wider audience.

Latest Trends

Use of Lightweight and Breathable Materials

In 2024, the global OTC orthopedic braces market is expected to witness a significant trend towards the use of lightweight and breathable materials. As consumers prioritize comfort in their choice of orthopedic braces, manufacturers are increasingly focusing on materials that offer both durability and comfort. Innovations in material science have led to the development of braces that are not only supportive but also lightweight, reducing the burden on users during prolonged wear. Breathable materials, such as advanced fabrics and meshes, allow for better airflow, minimizing skin irritation and improving user compliance.

This trend is particularly important in warmer climates and for active users who require braces that can keep up with their lifestyle without causing discomfort. As a result, the adoption of lightweight and breathable materials is set to become a key differentiator in the market.

Integration of Smart Technology

The integration of smart technology into OTC orthopedic braces is another prominent trend expected to shape the market in 2024. With the rise of wearable technology, consumers are increasingly looking for braces that offer more than just physical support. Smart braces equipped with sensors and connectivity features can monitor recovery progress, track movements, and provide real-time feedback to users and healthcare providers.

This data-driven approach allows for personalized recovery plans and more effective management of musculoskeletal conditions. The ability to monitor healing and adjust treatment as needed is likely to appeal to both patients and medical professionals, driving demand for smart orthopedic braces.

Regional Analysis

North America holds a 40% share in the OTC Orthopedic Braces market.

In 2023, North America led the OTC Orthopedic Braces Market, capturing approximately 40% of the global market share. This dominance is largely driven by the high prevalence of musculoskeletal disorders, sports injuries, and an aging population in the region. The United States, in particular, is a key market, benefiting from advanced healthcare infrastructure, widespread awareness of orthopedic health, and easy access to over-the-counter (OTC) orthopedic braces. The market is further supported by the strong presence of leading manufacturers and distributors that continuously innovate and offer a wide range of products catering to different consumer needs.The region's focus on preventative healthcare and rehabilitation has also contributed to the growing demand for OTC orthopedic braces. The increasing participation in sports and physical activities, coupled with the rising incidence of injuries, has bolstered the market in North America. Additionally, the region's regulatory environment supports the OTC availability of medical devices, making it easier for consumers to access these products without the need for a prescription.

Europe and Asia Pacific are also significant contributors to the global OTC Orthopedic Braces Market. Europe follows North America in market share, driven by a growing elderly population and strong healthcare systems in countries like Germany and the UK. Asia Pacific, particularly China and Japan, is witnessing rapid market growth due to increasing healthcare awareness, improving healthcare infrastructure, and a rising middle class with the disposable income to spend on health products. However, North America's advanced healthcare landscape and proactive consumer base keep it at the forefront of the global market.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

DJO Global, Inc. and Breg, Inc. are set to dominate the global OTC orthopedic braces market in 2024, benefiting from their expansive product portfolios and strong distribution networks. DJO Global’s commitment to innovation, particularly in the development of lightweight and comfortable braces, aligns well with consumer demand for effective and convenient solutions for injury prevention and rehabilitation. Breg, with its focus on orthopedic solutions for sports medicine, is also well-positioned to capture a significant market share as awareness around sports-related injuries continues to rise.

Ottobock SE & Co. KGaA and Stryker Corporation are key players to watch, with both companies leveraging their strong brand recognition and advanced technologies to maintain competitive advantages. Ottobock’s expertise in prosthetics and orthotics, combined with its focus on user-centered design, ensures it remains a leader in the premium segment of the market. Stryker, known for its innovation in medical devices, is expected to continue expanding its orthopedic product line, particularly in emerging markets where the demand for OTC braces is growing rapidly.

Mueller Sports Medicine, Inc. and 3M Company are also influential players in the OTC orthopedic braces market. Mueller’s focus on affordable and accessible sports medicine products makes it a go-to brand for both amateur and professional athletes. Meanwhile, 3M’s reputation for quality and innovation, particularly in materials science, enables it to produce highly effective braces that are both durable and comfortable, solidifying its position in the global market.

Market Key Players

- DJO Global, Inc.

- Breg, Inc.

- Ottobock SE & Co. KGaA

- Stryker Corporation

- Mueller Sports Medicine, Inc.

- 3M Company

- Hanger, Inc.

- Medtronic plc

- Zimmer Biomet Holdings, Inc.

- Smith & Nephew plc

- Orthofix Medical Inc.

- Acelity L.P. Inc.

- Tynor Orthotics Pvt. Ltd.

- Kinetec Medical Products Ltd.

- Active Orthotics

Recent Development

- In January 2024, DJO Global, Inc. introduced a new line of advanced knee braces designed for post-surgery recovery, improving patient mobility by 25%.

- In March 2024, Ottobock SE & Co. KGaA acquired a regional orthopedic brace manufacturer to expand its product range, anticipating a 20% increase in market share.

Report Scope

Report Features Description Market Value (2023) USD 1.2 Bn Forecast Revenue (2033) USD 1.9 Bn CAGR (2024-2033) 4.8% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Knee Braces and Supports, Ankle Braces and Supports, Back, Hip & Spine Braces and Supports, Shoulder Braces and Supports, Elbow Braces and Supports, Hand/Wrist Braces and Supports, Facial Braces and Supports), By Type (Soft and Elastic Braces, Rigid Braces, Hinged Braces), By Application (Preventive Care, Osteoarthritis, Ligament Injury Repair, Compression Therapy), By Distribution Channel (Pharmacies and Retailers, E-Commerce Platforms, Orthopedic Clinics) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape DJO Global, Inc., Breg, Inc., Ottobock SE & Co. KGaA, Stryker Corporation, Mueller Sports Medicine, Inc., 3M Company, Hanger, Inc., Medtronic plc, Zimmer Biomet Holdings, Inc., Smith & Nephew plc, Orthofix Medical Inc., Acelity L.P. Inc., Tynor Orthotics Pvt. Ltd., Kinetec Medical Products Ltd., Active Orthotics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- DJO Global, Inc.

- Breg, Inc.

- Ottobock SE & Co. KGaA

- Stryker Corporation

- Mueller Sports Medicine, Inc.

- 3M Company

- Hanger, Inc.

- Medtronic plc

- Zimmer Biomet Holdings, Inc.

- Smith & Nephew plc

- Orthofix Medical Inc.

- Acelity L.P. Inc.

- Tynor Orthotics Pvt. Ltd.

- Kinetec Medical Products Ltd.

- Active Orthotics