Nutraceutical Packaging Market By Packaging Type (Bottles, Cans and Jars, Bags and Pouches, Cartons, Others), By Product (Dietary Supplements, Functional Foods, Herbal Products, Isolated Nutrient Supplements, Other), By Material (Plastic, Glass, Metal, Paper and paperboard, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

48114

-

June 2024

-

300

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

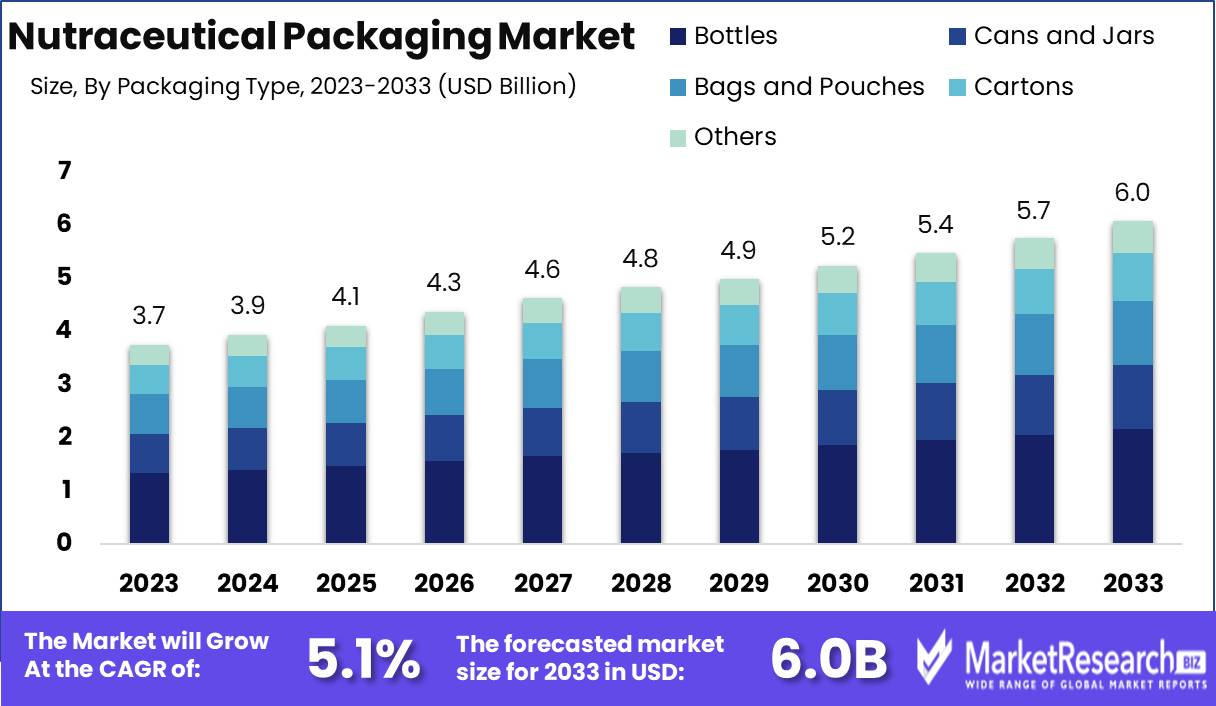

The Nutraceutical Packaging Market was valued at USD 3.7 billion in 2023. It is expected to reach USD 6.0 billion by 2033, with a CAGR of 5.1% during the forecast period from 2024 to 2033.

The nutraceutical packaging market encompasses the production and innovation of packaging solutions specifically designed for dietary supplements, functional foods, and beverages. This market is driven by stringent regulatory standards, consumer demand for sustainable and tamper-evident packaging, and the growing global health consciousness. Key trends include advancements in materials such as bioplastics and eco-friendly options, intelligent packaging technologies for enhanced product traceability, and designs that ensure product integrity and shelf life. Major players in this market continuously innovate to meet the dual objectives of compliance and consumer appeal, fostering a dynamic and competitive landscape.

The nutraceutical packaging market is poised for substantial growth, driven by a convergence of several key factors. Firstly, increasing consumer health awareness is a significant catalyst. The global shift towards healthier lifestyles has heightened demand for nutraceutical products, including dietary supplements and functional foods. This trend is particularly pronounced in developed economies where aging populations are keenly seeking products that enhance longevity and wellness. Consequently, packaging solutions that preserve the efficacy and shelf-life of these products are in high demand. The demographic shift towards an older population amplifies this need, as seniors typically have higher consumption rates of such products.

Furthermore, sustainability concerns are influencing packaging choices, with a growing emphasis on eco-friendly materials. However, this brings cost pressures to the forefront as manufacturers strive to balance the expense of sustainable materials with the imperative of maintaining profitability.

Moreover, the market faces challenges related to supply chain disruptions, which have become increasingly prevalent. These disruptions can affect the availability and cost of packaging materials, thereby impacting production timelines and cost structures. Manufacturers are compelled to navigate these complexities while ensuring that their packaging solutions meet regulatory standards and consumer expectations for safety and quality. As the nutraceutical sector continues to expand, companies that innovate in packaging offering solutions that are both sustainable and cost-effective are likely to gain a competitive edge.

Key Takeaways

- Market Growth: The Nutraceutical Packaging Market was valued at USD 3.7 billion in 2023. It is expected to reach USD 6.0 billion by 2033, with a CAGR of 5.1% during the forecast period from 2024 to 2033.

- By Packaging Type: Bottles dominated the nutraceutical packaging market by versatility.

- By Product: Dietary Supplements dominated the dynamic nutraceutical packaging market

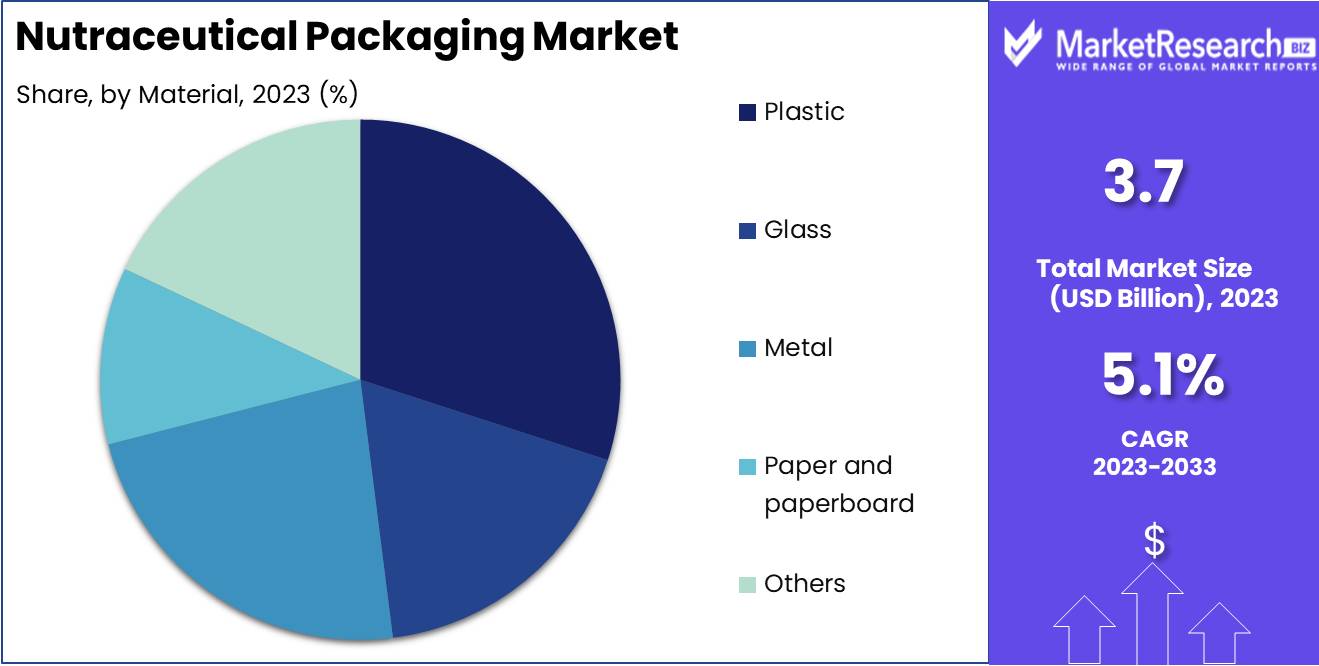

- By Material: Plastic-dominated nutraceutical packaging due to versatility and cost.

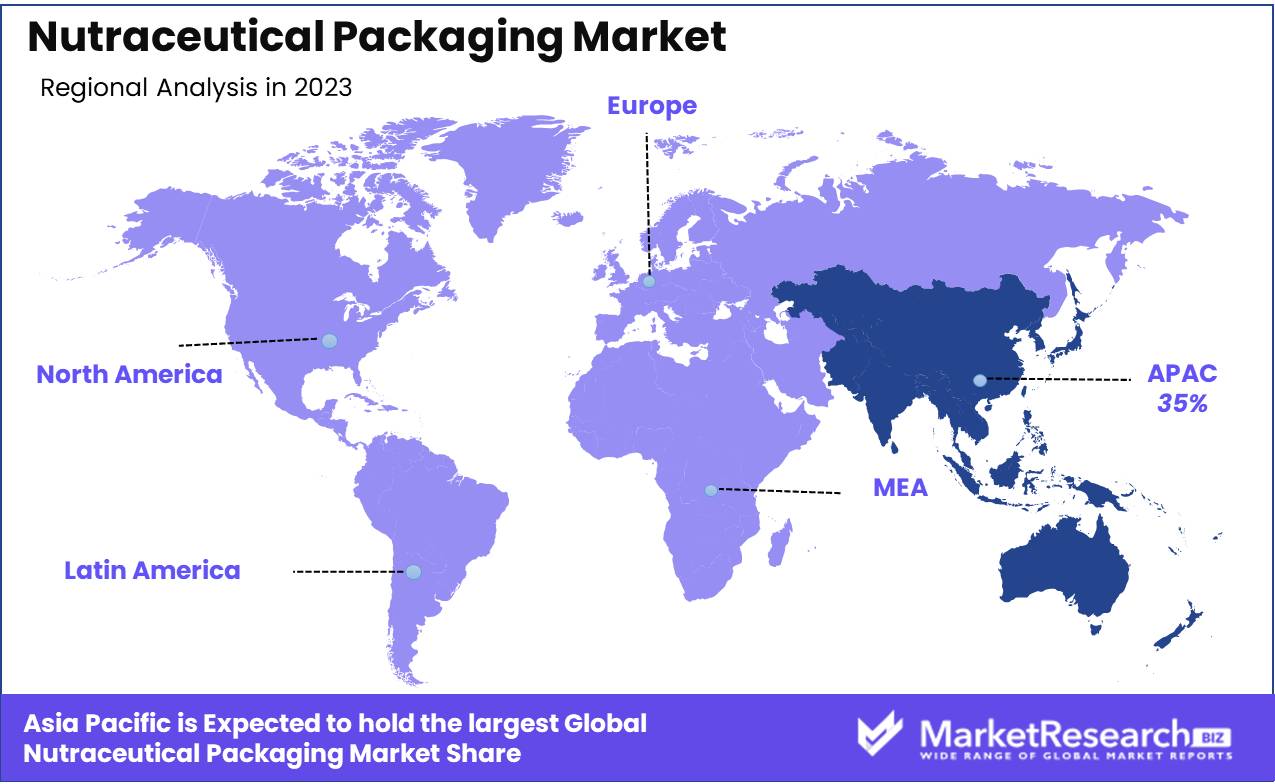

- Regional Dominance: Asia Pacific leads the nutraceutical packaging market with over 35% share.

- Growth Opportunity: The nutraceutical packaging market offers growth through sustainable materials and advanced technologies that extend product shelf life.

Driving factors

Rising Consumer Demand for Health and Wellness Products: A Catalyst for Nutraceutical Packaging Market Expansion

The surge in consumer interest in health and wellness products is a primary driver of growth in the nutraceutical packaging market. As consumers become increasingly health-conscious, there is a corresponding rise in the consumption of vitamins, dietary supplements, and functional foods. This trend is underpinned by an aging population, rising disposable incomes, and heightened awareness of preventive healthcare.

This burgeoning demand necessitates innovative and attractive packaging solutions that ensure product integrity, extend shelf life, and comply with regulatory standards. Consequently, manufacturers are investing in high-quality, tamper-evident, and child-resistant packaging to meet consumer expectations and regulatory requirements, driving market growth.

Advancements in Packaging Technologies: Enhancing Functionality and Appeal in Nutraceutical Packaging

Technological advancements in packaging are significantly contributing to the growth of the nutraceutical packaging market. Innovations such as active packaging, which includes oxygen scavengers and moisture regulators, help maintain product quality and extend shelf life. Intelligent packaging solutions, like time-temperature indicators and freshness sensors, offer real-time data on product conditions, ensuring optimal consumption and compliance with storage guidelines.

Moreover, the adoption of sustainable materials and eco-friendly packaging solutions is becoming increasingly important. According to a report the global sustainable packaging market is projected to grow at a CAGR of 5.7%, reaching $341.7 billion by 2026. Nutraceutical companies are leveraging these advancements to enhance the functionality and visual appeal of their products, which in turn boosts consumer trust and loyalty, fostering market expansion.

Incorporation of Digital Integration Technologies: Transforming Consumer Interaction and Supply Chain Efficiency

The integration of digital technologies into nutraceutical packaging is revolutionizing the market by enhancing consumer engagement and improving supply chain efficiencies. Smart packaging solutions, such as QR codes and NFC tags, allow consumers to access detailed product information, authenticity verification, and usage instructions via their smartphones. This transparency builds consumer confidence and encourages brand loyalty.

Digital integration also facilitates better inventory management and traceability within the supply chain. Technologies like blockchain ensure the provenance and integrity of products, mitigating risks of counterfeiting and ensuring compliance with stringent regulatory standards. A study estimates that the implementation of blockchain technology in the supply chain could reduce counterfeiting in the pharmaceutical industry by up to 30%. The nutraceutical packaging market benefits from these efficiencies, resulting in lower operational costs and enhanced product safety, which in turn stimulates market growth.

Restraining Factors

Higher Cost Consideration as Compared to Conventional Packaging

The elevated cost associated with nutraceutical packaging compared to conventional options is a significant restraining factor for the market. This cost differential stems from the specialized materials and technologies required to ensure product integrity and compliance with regulatory standards. Nutraceutical packaging often necessitates advanced barrier properties to protect sensitive ingredients from environmental factors, increasing production costs.

For instance, using materials that provide superior oxygen and moisture barriers is crucial for maintaining the efficacy of nutraceutical products, which can degrade if exposed to air or humidity. Additionally, these packages may require sophisticated manufacturing processes and quality assurance measures, further driving up costs. Consequently, manufacturers may hesitate to adopt these packaging solutions due to the potential impact on profit margins, particularly in price-sensitive markets.

This higher cost can also influence consumer pricing, potentially limiting market growth as higher prices may deter some consumers from purchasing nutraceutical products. Thus, while the benefits of enhanced packaging are clear in terms of product quality and shelf life, the cost considerations present a substantial barrier to widespread market adoption.

Preserving Nutraceutical Quality by Overcoming Challenges of Shelf Life and Product Stability

The necessity of preserving the quality of nutraceuticals poses significant challenges related to shelf life and product stability, directly impacting the packaging market. Nutraceutical products often contain bioactive compounds that are sensitive to light, oxygen, and moisture, necessitating advanced packaging solutions to maintain their efficacy and safety over time.

For example, the shelf life of nutraceuticals can be compromised if the packaging does not adequately protect against environmental factors. This can lead to product degradation, reducing effectiveness and potentially resulting in health risks for consumers. To mitigate these risks, packaging must incorporate features such as UV protection, oxygen absorbers, and moisture barriers.

These protective measures, while essential, increase the complexity and cost of packaging solutions. Moreover, ensuring product stability throughout the supply chain from production to consumer use requires stringent quality control and testing protocols, further adding to the cost and complexity of packaging.

By Packaging Type Analysis

In 2023, Bottles dominated the nutraceutical packaging market by versatility.

In 2023, Bottles held a dominant market position in the 'By Packaging Type' segment of the nutraceutical packaging market. This preeminence can be attributed to several key factors. Bottles offer superior protection and shelf stability for nutraceutical products, ensuring the integrity and efficacy of vitamins, supplements, and other health-related goods. Their versatility in size and material options ranging from glass to high-density polyethylene (HDPE) caters to diverse consumer preferences and regulatory requirements.

Cans and jars, while less dominant, play a crucial role in the market by providing robust protection and easy accessibility, particularly for powdered and liquid formulations. Their rigid structure and resealable options enhance user convenience and product longevity.

Bags and pouches are gaining traction due to their lightweight nature and cost-effectiveness. These flexible packaging solutions are particularly favored for single-use products and samples, offering convenience and portion control.

Cartons, often used for secondary packaging, add a layer of protection and are instrumental in brand differentiation through advanced printing and design capabilities. They are increasingly utilized for bulk or multi-pack products.

The 'Others' category encompasses innovative and niche packaging types such as blister packs and stick packs, which cater to specific product needs and consumer preferences for portability and precise dosing.

By Product Analysis

Dietary Supplements dominated the dynamic nutraceutical packaging market in 2023.

In 2023, Dietary Supplements held a dominant market position in the "By Product" segment of the Nutraceutical Packaging Market. This segment includes five key subcategories: dietary supplements, functional foods, herbal products, isolated nutrient supplements, and others. Dietary supplements led the market, driven by increasing consumer awareness of health and wellness, alongside a growing preference for preventive healthcare. The convenience and perceived benefits of vitamins, minerals, and probiotics have bolstered demand, significantly impacting packaging innovations to ensure product integrity and extend shelf life.

Functional foods, encompassing fortified foods and beverages, also demonstrated robust growth, reflecting consumer trends toward nutrition-rich diets that support specific health benefits such as heart health, weight management, and improved digestion. Herbal products, leveraging the global shift towards natural and organic ingredients, captured substantial market interest, especially in regions with a strong tradition of herbal medicine.

Isolated nutrient supplements, which provide concentrated doses of single nutrients like omega-3 fatty acids or antioxidants, catered to niche markets but showed significant potential due to their targeted health benefits. Lastly, the "Other" category, including protein powders and energy bars, witnessed steady growth, supported by the fitness and sports nutrition sectors.

By Material Analysis

In 2023, Plastic dominated nutraceutical packaging due to versatility and cost.

In 2023, Plastic held a dominant market position in the "By Material" segment of the nutraceutical packaging market. This can be attributed to plastic's versatile properties, including durability, lightweight nature, and cost-effectiveness. These characteristics make plastic an ideal choice for a variety of nutraceutical products, from vitamins to protein powders, ensuring product protection and consumer convenience. Additionally, innovations in biodegradable and recyclable plastics have bolstered its appeal amidst growing environmental concerns.

Glass, while accounting for a smaller market share, remains preferred for high-end and sensitive formulations due to its impermeability and non-reactive nature, ensuring product purity and longevity. Metal packaging, primarily aluminum, is valued for its superior barrier properties against light, moisture, and oxygen, making it suitable for products requiring extended shelf life.

Paper and paperboard, although less prevalent, are gaining traction due to increasing demand for sustainable packaging solutions. Their biodegradability and recyclability align with the rising consumer preference for eco-friendly products. Other materials, such as bio-based plastics and hybrid packaging solutions, also contribute to the market, offering unique advantages in terms of sustainability and functionality.

Key Market Segments

By Packaging Type

- Bottles

- Cans and Jars

- Bags and Pouches

- Cartons

- Others

By Product

- Dietary Supplements

- Functional Foods

- Herbal Products

- Isolated Nutrient Supplements

- Other

By Material

- Plastic

- Glass

- Metal

- Paper and paperboard

- Others

Growth Opportunity

Embracing Sustainable and Eco-friendly Packaging

The shift towards sustainability is a key opportunity for the nutraceutical packaging market in 2024. As consumers become increasingly environmentally conscious, demand for eco-friendly packaging solutions is surging. Companies investing in biodegradable, recyclable, and compostable materials are well-positioned to capitalize on this trend. Innovations such as plant-based plastics and reusable packaging can significantly reduce the environmental footprint, aligning with global sustainability goals and regulatory pressures. This shift not only enhances brand image but also meets the growing consumer preference for green products.

Extending Shelf Life through Advanced Packaging Technologies

Advancements in packaging technologies that extend the shelf life of nutraceutical products represent another critical growth area. Ensuring product integrity and potency over extended periods is crucial in the competitive nutraceutical market. Solutions such as active and intelligent packaging, which can control moisture levels and release preservatives, are gaining traction. These technologies help in maintaining product quality, reducing waste, and improving consumer trust. Packaging that enhances shelf life also supports global distribution, enabling companies to expand their reach without compromising product efficacy.

Latest Trends

Sustainable and Eco-Friendly Packaging: Pioneering the Future

As consumer awareness around environmental impact continues to rise, the nutraceutical packaging market is expected to witness a significant shift towards sustainable and eco-friendly solutions. Companies are increasingly adopting materials such as biodegradable plastics, recycled paper, and plant-based polymers to reduce their carbon footprint and appeal to eco-conscious consumers. This trend is not only driven by consumer demand but also by stringent government regulations aimed at reducing plastic waste. Additionally, brands are investing in innovative technologies that minimize environmental impact, such as water-based inks and adhesives that are easier to recycle. The focus on sustainability is becoming a key differentiator in the competitive nutraceutical market, positioning eco-friendly packaging as a critical component of corporate social responsibility and brand strategy.

Jars and Canisters: Enhancing Consumer Convenience and Product Protection

Jars and canisters are expected to gain prominence in the nutraceutical packaging market due to their superior ability to protect product integrity and enhance consumer convenience. These packaging formats offer robust protection against moisture, light, and air, which are crucial for maintaining the potency and shelf-life of nutraceutical products. Moreover, jars and canisters are user-friendly, providing ease of use with features such as screw-top lids and wide openings for easy access. This trend is particularly evident in the packaging of powders, capsules, and gummies, where maintaining product quality is paramount. Furthermore, the aesthetic appeal and premium feel of jars and canisters are instrumental in attracting consumers, offering brands an opportunity to differentiate their products on retail shelves. As the demand for premium and convenient packaging solutions grows, jars and canisters are poised to become a staple in the nutraceutical packaging landscape.

Regional Analysis

Asia Pacific leads the nutraceutical packaging market with over 35% share.

The nutraceutical packaging market exhibits notable regional variations, driven by factors such as consumer health awareness, regulatory frameworks, and technological advancements. In North America, the market is bolstered by high consumer demand for dietary supplements and functional foods, with the U.S. leading the charge due to robust healthcare infrastructure and a well-established nutraceutical industry. Europe follows closely, benefiting from stringent regulatory standards that enhance packaging quality and safety, with countries like Germany and the UK at the forefront due to their significant market shares and innovative packaging solutions.

Asia Pacific, the dominant region, commands the largest market share at approximately 35%, driven by a burgeoning middle class, rising health consciousness, and rapid urbanization. China and India are pivotal markets, supported by large populations and increasing disposable incomes, which contribute to heightened demand for nutraceutical products and, consequently, innovative packaging solutions.

The Middle East & Africa region shows steady growth, propelled by increasing investments in the healthcare sector and growing awareness of nutraceutical benefits, particularly in the UAE and South Africa. Latin America, while smaller in market size, displays potential with Brazil and Mexico leading due to their expanding consumer base and improving economic conditions.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global nutraceutical packaging market is poised for robust growth in 2024, driven by increased consumer demand for health supplements and functional foods. Key players in this market exhibit diverse capabilities and strategic advantages.

Alpha Packaging and Amcor Limited are leaders in sustainable packaging solutions, leveraging innovative materials to meet environmental standards. Their focus on lightweight and recyclable packaging aligns with global sustainability trends, positioning them favorably in an eco-conscious market.

Gerresheimer AG and Mondi Plc. stand out for their advanced manufacturing technologies and extensive global reach. Their ability to offer high-quality, customized packaging solutions caters to the diverse needs of nutraceutical manufacturers, enhancing product differentiation and consumer appeal. RPC Group and Graham Packaging Company are noted for their expertise in rigid plastic packaging. Their strong R&D capabilities and investment in new technologies ensure a steady pipeline of innovative products that meet evolving market requirements.

Sonoco Products Company and Constantia Flexible Group GmbH excel in flexible packaging solutions. Their robust portfolios, combined with strong supply chain efficiencies, enable them to deliver cost-effective and versatile packaging options. Smaller but strategically significant players like Law Print & Packaging Management Ltd. and American Nutritional Corporation provide niche solutions, focusing on personalized service and agility. Their ability to quickly adapt to market changes offers a competitive edge in a dynamic industry.

PontEurope and Arizona Nutritional Supplements LLC are integral in providing end-to-end solutions, from packaging design to fulfillment, catering to brands seeking comprehensive service offerings. Comar and Medifilm AG specialize in pharmaceutical-grade packaging, ensuring compliance with stringent regulatory standards, which is crucial for nutraceutical products that cross into medical markets. The concerted efforts of these key players to innovate, optimize supply chains, and adhere to sustainability and regulatory standards will shape the competitive landscape of the nutraceutical packaging market in 2024, driving growth and enhancing consumer trust in nutraceutical products.

Market Key Players

- Alpha Packaging

- Amcor Limited

- Gerresheimer AG

- Mondi Plc.

- RPC Group

- Graham Packaging Company

- Sonoco Products Company

- Constantia Flexible Group GmbH

- ALPLA Werke Alwin Lehner GmbH & Co KG

- Flex-pack

- Innovia Film

- Law Print & Packaging Management Ltd.

- American Nutritional Corporation

- Wasdell Packaging Group

- PontEurope

- Arizona Nutritional Supplements LLC

- Comar

- Medifilm AG

- Origin Pharma Packaging

- CSB Nutrition Corporation

- Nutra Solutions

Recent Development

- In April 2024, Gerresheimer AG introduced an innovative smart packaging solution for nutraceuticals. This development includes integrated Near Field Communication (NFC) technology, enabling consumers to access product information and verify authenticity via their smartphones, thereby enhancing consumer trust and engagement.

- In March 2024, Amcor Plc announced the launch of a new line of sustainable packaging solutions tailored for the nutraceutical sector. The new packaging options include recyclable and compostable materials, aligning with the increasing consumer demand for eco-friendly products.

- In February 2024, Berry Global Group, Inc. unveiled its advanced barrier technology packaging designed to extend the shelf life of nutraceutical products. The new barrier packaging is particularly beneficial for products sensitive to moisture and oxygen, ensuring better preservation of product quality and efficacy.

Report Scope

Report Features Description Market Value (2023) USD 3.7 Billion Forecast Revenue (2033) USD 6.0 Billion CAGR (2024-2032) 5.1% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Packaging Type (Bottles, Cans and Jars, Bags and Pouches, Cartons, Others), By Product (Dietary Supplements, Functional Foods, Herbal Products, Isolated Nutrient Supplements, Other), By Material (Plastic, Glass, Metal, Paper and paperboard, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Alpha Packaging, Amcor Limited, Gerresheimer AG, Mondi Plc., RPC Group, Graham Packaging Company, Sonoco Products Company, Constantia Flexible Group GmbH, ALPLA Werke Alwin Lehner GmbH & Co KG, Flex-pack, Innovia Film, Law Print & Packaging Management Ltd., American Nutritional Corporation, Wasdell Packaging Group, PontEurope, Arizona Nutritional Supplements LLC, Comar, Medifilm AG, Origin Pharma Packaging, CSB Nutrition Corporation, Nutra Solutions Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Nutraceutical Packaging Market Overview

- 2.1. Nutraceutical Packaging Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Nutraceutical Packaging Market Dynamics

- 3. Global Nutraceutical Packaging Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Nutraceutical Packaging Market Analysis, 2016-2021

- 3.2. Global Nutraceutical Packaging Market Opportunity and Forecast, 2023-2032

- 3.3. Global Nutraceutical Packaging Market Analysis, Opportunity and Forecast, By Packaging Type, 2016-2032

- 3.3.1. Global Nutraceutical Packaging Market Analysis by Packaging Type: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Packaging Type, 2016-2032

- 3.3.3. Bottles

- 3.3.4. Cans and Jars

- 3.3.5. Bags and Pouches

- 3.3.6. Cartons

- 3.3.7. Others

- 3.4. Global Nutraceutical Packaging Market Analysis, Opportunity and Forecast, By Product, 2016-2032

- 3.4.1. Global Nutraceutical Packaging Market Analysis by Product: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product, 2016-2032

- 3.4.3. Dietary Supplements

- 3.4.4. Functional Foods

- 3.4.5. Herbal Products

- 3.4.6. Isolated Nutrient Supplements

- 3.4.7. Other

- 3.5. Global Nutraceutical Packaging Market Analysis, Opportunity and Forecast, By Material, 2016-2032

- 3.5.1. Global Nutraceutical Packaging Market Analysis by Material: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Material, 2016-2032

- 3.5.3. Plastic

- 3.5.4. Glass

- 3.5.5. Metal

- 3.5.6. Paper and paperboard

- 3.5.7. Others

- 4. North America Nutraceutical Packaging Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Nutraceutical Packaging Market Analysis, 2016-2021

- 4.2. North America Nutraceutical Packaging Market Opportunity and Forecast, 2023-2032

- 4.3. North America Nutraceutical Packaging Market Analysis, Opportunity and Forecast, By Packaging Type, 2016-2032

- 4.3.1. North America Nutraceutical Packaging Market Analysis by Packaging Type: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Packaging Type, 2016-2032

- 4.3.3. Bottles

- 4.3.4. Cans and Jars

- 4.3.5. Bags and Pouches

- 4.3.6. Cartons

- 4.3.7. Others

- 4.4. North America Nutraceutical Packaging Market Analysis, Opportunity and Forecast, By Product, 2016-2032

- 4.4.1. North America Nutraceutical Packaging Market Analysis by Product: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product, 2016-2032

- 4.4.3. Dietary Supplements

- 4.4.4. Functional Foods

- 4.4.5. Herbal Products

- 4.4.6. Isolated Nutrient Supplements

- 4.4.7. Other

- 4.5. North America Nutraceutical Packaging Market Analysis, Opportunity and Forecast, By Material, 2016-2032

- 4.5.1. North America Nutraceutical Packaging Market Analysis by Material: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Material, 2016-2032

- 4.5.3. Plastic

- 4.5.4. Glass

- 4.5.5. Metal

- 4.5.6. Paper and paperboard

- 4.5.7. Others

- 4.6. North America Nutraceutical Packaging Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.6.1. North America Nutraceutical Packaging Market Analysis by Country : Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.6.2.1. The US

- 4.6.2.2. Canada

- 4.6.2.3. Mexico

- 5. Western Europe Nutraceutical Packaging Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Nutraceutical Packaging Market Analysis, 2016-2021

- 5.2. Western Europe Nutraceutical Packaging Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Nutraceutical Packaging Market Analysis, Opportunity and Forecast, By Packaging Type, 2016-2032

- 5.3.1. Western Europe Nutraceutical Packaging Market Analysis by Packaging Type: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Packaging Type, 2016-2032

- 5.3.3. Bottles

- 5.3.4. Cans and Jars

- 5.3.5. Bags and Pouches

- 5.3.6. Cartons

- 5.3.7. Others

- 5.4. Western Europe Nutraceutical Packaging Market Analysis, Opportunity and Forecast, By Product, 2016-2032

- 5.4.1. Western Europe Nutraceutical Packaging Market Analysis by Product: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product, 2016-2032

- 5.4.3. Dietary Supplements

- 5.4.4. Functional Foods

- 5.4.5. Herbal Products

- 5.4.6. Isolated Nutrient Supplements

- 5.4.7. Other

- 5.5. Western Europe Nutraceutical Packaging Market Analysis, Opportunity and Forecast, By Material, 2016-2032

- 5.5.1. Western Europe Nutraceutical Packaging Market Analysis by Material: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Material, 2016-2032

- 5.5.3. Plastic

- 5.5.4. Glass

- 5.5.5. Metal

- 5.5.6. Paper and paperboard

- 5.5.7. Others

- 5.6. Western Europe Nutraceutical Packaging Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.6.1. Western Europe Nutraceutical Packaging Market Analysis by Country : Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.6.2.1. Germany

- 5.6.2.2. France

- 5.6.2.3. The UK

- 5.6.2.4. Spain

- 5.6.2.5. Italy

- 5.6.2.6. Portugal

- 5.6.2.7. Ireland

- 5.6.2.8. Austria

- 5.6.2.9. Switzerland

- 5.6.2.10. Benelux

- 5.6.2.11. Nordic

- 5.6.2.12. Rest of Western Europe

- 6. Eastern Europe Nutraceutical Packaging Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Nutraceutical Packaging Market Analysis, 2016-2021

- 6.2. Eastern Europe Nutraceutical Packaging Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Nutraceutical Packaging Market Analysis, Opportunity and Forecast, By Packaging Type, 2016-2032

- 6.3.1. Eastern Europe Nutraceutical Packaging Market Analysis by Packaging Type: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Packaging Type, 2016-2032

- 6.3.3. Bottles

- 6.3.4. Cans and Jars

- 6.3.5. Bags and Pouches

- 6.3.6. Cartons

- 6.3.7. Others

- 6.4. Eastern Europe Nutraceutical Packaging Market Analysis, Opportunity and Forecast, By Product, 2016-2032

- 6.4.1. Eastern Europe Nutraceutical Packaging Market Analysis by Product: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product, 2016-2032

- 6.4.3. Dietary Supplements

- 6.4.4. Functional Foods

- 6.4.5. Herbal Products

- 6.4.6. Isolated Nutrient Supplements

- 6.4.7. Other

- 6.5. Eastern Europe Nutraceutical Packaging Market Analysis, Opportunity and Forecast, By Material, 2016-2032

- 6.5.1. Eastern Europe Nutraceutical Packaging Market Analysis by Material: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Material, 2016-2032

- 6.5.3. Plastic

- 6.5.4. Glass

- 6.5.5. Metal

- 6.5.6. Paper and paperboard

- 6.5.7. Others

- 6.6. Eastern Europe Nutraceutical Packaging Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.6.1. Eastern Europe Nutraceutical Packaging Market Analysis by Country : Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.6.2.1. Russia

- 6.6.2.2. Poland

- 6.6.2.3. The Czech Republic

- 6.6.2.4. Greece

- 6.6.2.5. Rest of Eastern Europe

- 7. APAC Nutraceutical Packaging Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Nutraceutical Packaging Market Analysis, 2016-2021

- 7.2. APAC Nutraceutical Packaging Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Nutraceutical Packaging Market Analysis, Opportunity and Forecast, By Packaging Type, 2016-2032

- 7.3.1. APAC Nutraceutical Packaging Market Analysis by Packaging Type: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Packaging Type, 2016-2032

- 7.3.3. Bottles

- 7.3.4. Cans and Jars

- 7.3.5. Bags and Pouches

- 7.3.6. Cartons

- 7.3.7. Others

- 7.4. APAC Nutraceutical Packaging Market Analysis, Opportunity and Forecast, By Product, 2016-2032

- 7.4.1. APAC Nutraceutical Packaging Market Analysis by Product: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product, 2016-2032

- 7.4.3. Dietary Supplements

- 7.4.4. Functional Foods

- 7.4.5. Herbal Products

- 7.4.6. Isolated Nutrient Supplements

- 7.4.7. Other

- 7.5. APAC Nutraceutical Packaging Market Analysis, Opportunity and Forecast, By Material, 2016-2032

- 7.5.1. APAC Nutraceutical Packaging Market Analysis by Material: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Material, 2016-2032

- 7.5.3. Plastic

- 7.5.4. Glass

- 7.5.5. Metal

- 7.5.6. Paper and paperboard

- 7.5.7. Others

- 7.6. APAC Nutraceutical Packaging Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.6.1. APAC Nutraceutical Packaging Market Analysis by Country : Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.6.2.1. China

- 7.6.2.2. Japan

- 7.6.2.3. South Korea

- 7.6.2.4. India

- 7.6.2.5. Australia & New Zeland

- 7.6.2.6. Indonesia

- 7.6.2.7. Malaysia

- 7.6.2.8. Philippines

- 7.6.2.9. Singapore

- 7.6.2.10. Thailand

- 7.6.2.11. Vietnam

- 7.6.2.12. Rest of APAC

- 8. Latin America Nutraceutical Packaging Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Nutraceutical Packaging Market Analysis, 2016-2021

- 8.2. Latin America Nutraceutical Packaging Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Nutraceutical Packaging Market Analysis, Opportunity and Forecast, By Packaging Type, 2016-2032

- 8.3.1. Latin America Nutraceutical Packaging Market Analysis by Packaging Type: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Packaging Type, 2016-2032

- 8.3.3. Bottles

- 8.3.4. Cans and Jars

- 8.3.5. Bags and Pouches

- 8.3.6. Cartons

- 8.3.7. Others

- 8.4. Latin America Nutraceutical Packaging Market Analysis, Opportunity and Forecast, By Product, 2016-2032

- 8.4.1. Latin America Nutraceutical Packaging Market Analysis by Product: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product, 2016-2032

- 8.4.3. Dietary Supplements

- 8.4.4. Functional Foods

- 8.4.5. Herbal Products

- 8.4.6. Isolated Nutrient Supplements

- 8.4.7. Other

- 8.5. Latin America Nutraceutical Packaging Market Analysis, Opportunity and Forecast, By Material, 2016-2032

- 8.5.1. Latin America Nutraceutical Packaging Market Analysis by Material: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Material, 2016-2032

- 8.5.3. Plastic

- 8.5.4. Glass

- 8.5.5. Metal

- 8.5.6. Paper and paperboard

- 8.5.7. Others

- 8.6. Latin America Nutraceutical Packaging Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.6.1. Latin America Nutraceutical Packaging Market Analysis by Country : Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.6.2.1. Brazil

- 8.6.2.2. Colombia

- 8.6.2.3. Chile

- 8.6.2.4. Argentina

- 8.6.2.5. Costa Rica

- 8.6.2.6. Rest of Latin America

- 9. Middle East & Africa Nutraceutical Packaging Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Nutraceutical Packaging Market Analysis, 2016-2021

- 9.2. Middle East & Africa Nutraceutical Packaging Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Nutraceutical Packaging Market Analysis, Opportunity and Forecast, By Packaging Type, 2016-2032

- 9.3.1. Middle East & Africa Nutraceutical Packaging Market Analysis by Packaging Type: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Packaging Type, 2016-2032

- 9.3.3. Bottles

- 9.3.4. Cans and Jars

- 9.3.5. Bags and Pouches

- 9.3.6. Cartons

- 9.3.7. Others

- 9.4. Middle East & Africa Nutraceutical Packaging Market Analysis, Opportunity and Forecast, By Product, 2016-2032

- 9.4.1. Middle East & Africa Nutraceutical Packaging Market Analysis by Product: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product, 2016-2032

- 9.4.3. Dietary Supplements

- 9.4.4. Functional Foods

- 9.4.5. Herbal Products

- 9.4.6. Isolated Nutrient Supplements

- 9.4.7. Other

- 9.5. Middle East & Africa Nutraceutical Packaging Market Analysis, Opportunity and Forecast, By Material, 2016-2032

- 9.5.1. Middle East & Africa Nutraceutical Packaging Market Analysis by Material: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Material, 2016-2032

- 9.5.3. Plastic

- 9.5.4. Glass

- 9.5.5. Metal

- 9.5.6. Paper and paperboard

- 9.5.7. Others

- 9.6. Middle East & Africa Nutraceutical Packaging Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.6.1. Middle East & Africa Nutraceutical Packaging Market Analysis by Country : Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.6.2.1. Algeria

- 9.6.2.2. Egypt

- 9.6.2.3. Israel

- 9.6.2.4. Kuwait

- 9.6.2.5. Nigeria

- 9.6.2.6. Saudi Arabia

- 9.6.2.7. South Africa

- 9.6.2.8. Turkey

- 9.6.2.9. The UAE

- 9.6.2.10. Rest of MEA

- 10. Global Nutraceutical Packaging Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Nutraceutical Packaging Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Nutraceutical Packaging Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Alpha Packaging

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Amcor Limited

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Gerresheimer AG

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Mondi Plc.

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. RPC Group

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Graham Packaging Company

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Sonoco Products Company

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Constantia Flexible Group GmbH

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. ALPLA Werke Alwin Lehner GmbH & Co KG

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Flex-pack

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. Innovia Film

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. American Nutritional Corporation

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 11.16. Wasdell Packaging Group

- 11.16.1. Company Overview

- 11.16.2. Financial Highlights

- 11.16.3. Product Portfolio

- 11.16.4. SWOT Analysis

- 11.16.5. Key Strategies and Developments

- 11.17. PontEurope

- 11.17.1. Company Overview

- 11.17.2. Financial Highlights

- 11.17.3. Product Portfolio

- 11.17.4. SWOT Analysis

- 11.17.5. Key Strategies and Developments

- 11.18. Arizona Nutritional Supplements LLC

- 11.18.1. Company Overview

- 11.18.2. Financial Highlights

- 11.18.3. Product Portfolio

- 11.18.4. SWOT Analysis

- 11.18.5. Key Strategies and Developments

- 11.19. Comar

- 11.19.1. Company Overview

- 11.19.2. Financial Highlights

- 11.19.3. Product Portfolio

- 11.19.4. SWOT Analysis

- 11.19.5. Key Strategies and Developments

- 11.20. Medifilm AG

- 11.20.1. Company Overview

- 11.20.2. Financial Highlights

- 11.20.3. Product Portfolio

- 11.20.4. SWOT Analysis

- 11.20.5. Key Strategies and Developments

- 11.21. Origin Pharma Packaging

- 11.21.1. Company Overview

- 11.21.2. Financial Highlights

- 11.21.3. Product Portfolio

- 11.21.4. SWOT Analysis

- 11.21.5. Key Strategies and Developments

- 11.22. CSB Nutrition Corporation

- 11.22.1. Company Overview

- 11.22.2. Financial Highlights

- 11.22.3. Product Portfolio

- 11.22.4. SWOT Analysis

- 11.22.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

"

- List of Figures

- "

- Figure 1: Global Nutraceutical Packaging Market Revenue (US$ Mn) Market Share by Packaging Type in 2022

- Figure 2: Global Nutraceutical Packaging Market Market Attractiveness Analysis by Packaging Type, 2016-2032

- Figure 3: Global Nutraceutical Packaging Market Revenue (US$ Mn) Market Share by Productin 2022

- Figure 4: Global Nutraceutical Packaging Market Market Attractiveness Analysis by Product, 2016-2032

- Figure 5: Global Nutraceutical Packaging Market Revenue (US$ Mn) Market Share by Materialin 2022

- Figure 6: Global Nutraceutical Packaging Market Market Attractiveness Analysis by Material, 2016-2032

- Figure 7: Global Nutraceutical Packaging Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 8: Global Nutraceutical Packaging Market Market Attractiveness Analysis by Region, 2016-2032

- Figure 9: Global Nutraceutical Packaging Market Market Revenue (US$ Mn) (2016-2032)

- Figure 10: Global Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 11: Global Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Packaging Type (2016-2032)

- Figure 12: Global Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Product (2016-2032)

- Figure 13: Global Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Material (2016-2032)

- Figure 14: Global Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 15: Global Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Packaging Type (2016-2032)

- Figure 16: Global Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Product (2016-2032)

- Figure 17: Global Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Material (2016-2032)

- Figure 18: Global Nutraceutical Packaging Market Market Share Comparison by Region (2016-2032)

- Figure 19: Global Nutraceutical Packaging Market Market Share Comparison by Packaging Type (2016-2032)

- Figure 20: Global Nutraceutical Packaging Market Market Share Comparison by Product (2016-2032)

- Figure 21: Global Nutraceutical Packaging Market Market Share Comparison by Material (2016-2032)

- Figure 22: North America Nutraceutical Packaging Market Revenue (US$ Mn) Market Share by Packaging Typein 2022

- Figure 23: North America Nutraceutical Packaging Market Market Attractiveness Analysis by Packaging Type, 2016-2032

- Figure 24: North America Nutraceutical Packaging Market Revenue (US$ Mn) Market Share by Productin 2022

- Figure 25: North America Nutraceutical Packaging Market Market Attractiveness Analysis by Product, 2016-2032

- Figure 26: North America Nutraceutical Packaging Market Revenue (US$ Mn) Market Share by Materialin 2022

- Figure 27: North America Nutraceutical Packaging Market Market Attractiveness Analysis by Material, 2016-2032

- Figure 28: North America Nutraceutical Packaging Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 29: North America Nutraceutical Packaging Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 30: North America Nutraceutical Packaging Market Market Revenue (US$ Mn) (2016-2032)

- Figure 31: North America Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 32: North America Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Packaging Type (2016-2032)

- Figure 33: North America Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Product (2016-2032)

- Figure 34: North America Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Material (2016-2032)

- Figure 35: North America Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 36: North America Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Packaging Type (2016-2032)

- Figure 37: North America Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Product (2016-2032)

- Figure 38: North America Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Material (2016-2032)

- Figure 39: North America Nutraceutical Packaging Market Market Share Comparison by Country (2016-2032)

- Figure 40: North America Nutraceutical Packaging Market Market Share Comparison by Packaging Type (2016-2032)

- Figure 41: North America Nutraceutical Packaging Market Market Share Comparison by Product (2016-2032)

- Figure 42: North America Nutraceutical Packaging Market Market Share Comparison by Material (2016-2032)

- Figure 43: Western Europe Nutraceutical Packaging Market Revenue (US$ Mn) Market Share by Packaging Typein 2022

- Figure 44: Western Europe Nutraceutical Packaging Market Market Attractiveness Analysis by Packaging Type, 2016-2032

- Figure 45: Western Europe Nutraceutical Packaging Market Revenue (US$ Mn) Market Share by Productin 2022

- Figure 46: Western Europe Nutraceutical Packaging Market Market Attractiveness Analysis by Product, 2016-2032

- Figure 47: Western Europe Nutraceutical Packaging Market Revenue (US$ Mn) Market Share by Materialin 2022

- Figure 48: Western Europe Nutraceutical Packaging Market Market Attractiveness Analysis by Material, 2016-2032

- Figure 49: Western Europe Nutraceutical Packaging Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 50: Western Europe Nutraceutical Packaging Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 51: Western Europe Nutraceutical Packaging Market Market Revenue (US$ Mn) (2016-2032)

- Figure 52: Western Europe Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 53: Western Europe Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Packaging Type (2016-2032)

- Figure 54: Western Europe Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Product (2016-2032)

- Figure 55: Western Europe Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Material (2016-2032)

- Figure 56: Western Europe Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 57: Western Europe Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Packaging Type (2016-2032)

- Figure 58: Western Europe Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Product (2016-2032)

- Figure 59: Western Europe Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Material (2016-2032)

- Figure 60: Western Europe Nutraceutical Packaging Market Market Share Comparison by Country (2016-2032)

- Figure 61: Western Europe Nutraceutical Packaging Market Market Share Comparison by Packaging Type (2016-2032)

- Figure 62: Western Europe Nutraceutical Packaging Market Market Share Comparison by Product (2016-2032)

- Figure 63: Western Europe Nutraceutical Packaging Market Market Share Comparison by Material (2016-2032)

- Figure 64: Eastern Europe Nutraceutical Packaging Market Revenue (US$ Mn) Market Share by Packaging Typein 2022

- Figure 65: Eastern Europe Nutraceutical Packaging Market Market Attractiveness Analysis by Packaging Type, 2016-2032

- Figure 66: Eastern Europe Nutraceutical Packaging Market Revenue (US$ Mn) Market Share by Productin 2022

- Figure 67: Eastern Europe Nutraceutical Packaging Market Market Attractiveness Analysis by Product, 2016-2032

- Figure 68: Eastern Europe Nutraceutical Packaging Market Revenue (US$ Mn) Market Share by Materialin 2022

- Figure 69: Eastern Europe Nutraceutical Packaging Market Market Attractiveness Analysis by Material, 2016-2032

- Figure 70: Eastern Europe Nutraceutical Packaging Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 71: Eastern Europe Nutraceutical Packaging Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 72: Eastern Europe Nutraceutical Packaging Market Market Revenue (US$ Mn) (2016-2032)

- Figure 73: Eastern Europe Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 74: Eastern Europe Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Packaging Type (2016-2032)

- Figure 75: Eastern Europe Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Product (2016-2032)

- Figure 76: Eastern Europe Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Material (2016-2032)

- Figure 77: Eastern Europe Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 78: Eastern Europe Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Packaging Type (2016-2032)

- Figure 79: Eastern Europe Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Product (2016-2032)

- Figure 80: Eastern Europe Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Material (2016-2032)

- Figure 81: Eastern Europe Nutraceutical Packaging Market Market Share Comparison by Country (2016-2032)

- Figure 82: Eastern Europe Nutraceutical Packaging Market Market Share Comparison by Packaging Type (2016-2032)

- Figure 83: Eastern Europe Nutraceutical Packaging Market Market Share Comparison by Product (2016-2032)

- Figure 84: Eastern Europe Nutraceutical Packaging Market Market Share Comparison by Material (2016-2032)

- Figure 85: APAC Nutraceutical Packaging Market Revenue (US$ Mn) Market Share by Packaging Typein 2022

- Figure 86: APAC Nutraceutical Packaging Market Market Attractiveness Analysis by Packaging Type, 2016-2032

- Figure 87: APAC Nutraceutical Packaging Market Revenue (US$ Mn) Market Share by Productin 2022

- Figure 88: APAC Nutraceutical Packaging Market Market Attractiveness Analysis by Product, 2016-2032

- Figure 89: APAC Nutraceutical Packaging Market Revenue (US$ Mn) Market Share by Materialin 2022

- Figure 90: APAC Nutraceutical Packaging Market Market Attractiveness Analysis by Material, 2016-2032

- Figure 91: APAC Nutraceutical Packaging Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 92: APAC Nutraceutical Packaging Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 93: APAC Nutraceutical Packaging Market Market Revenue (US$ Mn) (2016-2032)

- Figure 94: APAC Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 95: APAC Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Packaging Type (2016-2032)

- Figure 96: APAC Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Product (2016-2032)

- Figure 97: APAC Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Material (2016-2032)

- Figure 98: APAC Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 99: APAC Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Packaging Type (2016-2032)

- Figure 100: APAC Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Product (2016-2032)

- Figure 101: APAC Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Material (2016-2032)

- Figure 102: APAC Nutraceutical Packaging Market Market Share Comparison by Country (2016-2032)

- Figure 103: APAC Nutraceutical Packaging Market Market Share Comparison by Packaging Type (2016-2032)

- Figure 104: APAC Nutraceutical Packaging Market Market Share Comparison by Product (2016-2032)

- Figure 105: APAC Nutraceutical Packaging Market Market Share Comparison by Material (2016-2032)

- Figure 106: Latin America Nutraceutical Packaging Market Revenue (US$ Mn) Market Share by Packaging Typein 2022

- Figure 107: Latin America Nutraceutical Packaging Market Market Attractiveness Analysis by Packaging Type, 2016-2032

- Figure 108: Latin America Nutraceutical Packaging Market Revenue (US$ Mn) Market Share by Productin 2022

- Figure 109: Latin America Nutraceutical Packaging Market Market Attractiveness Analysis by Product, 2016-2032

- Figure 110: Latin America Nutraceutical Packaging Market Revenue (US$ Mn) Market Share by Materialin 2022

- Figure 111: Latin America Nutraceutical Packaging Market Market Attractiveness Analysis by Material, 2016-2032

- Figure 112: Latin America Nutraceutical Packaging Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 113: Latin America Nutraceutical Packaging Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 114: Latin America Nutraceutical Packaging Market Market Revenue (US$ Mn) (2016-2032)

- Figure 115: Latin America Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 116: Latin America Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Packaging Type (2016-2032)

- Figure 117: Latin America Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Product (2016-2032)

- Figure 118: Latin America Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Material (2016-2032)

- Figure 119: Latin America Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 120: Latin America Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Packaging Type (2016-2032)

- Figure 121: Latin America Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Product (2016-2032)

- Figure 122: Latin America Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Material (2016-2032)

- Figure 123: Latin America Nutraceutical Packaging Market Market Share Comparison by Country (2016-2032)

- Figure 124: Latin America Nutraceutical Packaging Market Market Share Comparison by Packaging Type (2016-2032)

- Figure 125: Latin America Nutraceutical Packaging Market Market Share Comparison by Product (2016-2032)

- Figure 126: Latin America Nutraceutical Packaging Market Market Share Comparison by Material (2016-2032)

- Figure 127: Middle East & Africa Nutraceutical Packaging Market Revenue (US$ Mn) Market Share by Packaging Typein 2022

- Figure 128: Middle East & Africa Nutraceutical Packaging Market Market Attractiveness Analysis by Packaging Type, 2016-2032

- Figure 129: Middle East & Africa Nutraceutical Packaging Market Revenue (US$ Mn) Market Share by Productin 2022

- Figure 130: Middle East & Africa Nutraceutical Packaging Market Market Attractiveness Analysis by Product, 2016-2032

- Figure 131: Middle East & Africa Nutraceutical Packaging Market Revenue (US$ Mn) Market Share by Materialin 2022

- Figure 132: Middle East & Africa Nutraceutical Packaging Market Market Attractiveness Analysis by Material, 2016-2032

- Figure 133: Middle East & Africa Nutraceutical Packaging Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 134: Middle East & Africa Nutraceutical Packaging Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 135: Middle East & Africa Nutraceutical Packaging Market Market Revenue (US$ Mn) (2016-2032)

- Figure 136: Middle East & Africa Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 137: Middle East & Africa Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Packaging Type (2016-2032)

- Figure 138: Middle East & Africa Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Product (2016-2032)

- Figure 139: Middle East & Africa Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Material (2016-2032)

- Figure 140: Middle East & Africa Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 141: Middle East & Africa Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Packaging Type (2016-2032)

- Figure 142: Middle East & Africa Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Product (2016-2032)

- Figure 143: Middle East & Africa Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Material (2016-2032)

- Figure 144: Middle East & Africa Nutraceutical Packaging Market Market Share Comparison by Country (2016-2032)

- Figure 145: Middle East & Africa Nutraceutical Packaging Market Market Share Comparison by Packaging Type (2016-2032)

- Figure 146: Middle East & Africa Nutraceutical Packaging Market Market Share Comparison by Product (2016-2032)

- Figure 147: Middle East & Africa Nutraceutical Packaging Market Market Share Comparison by Material (2016-2032)

"

- List of Tables

- "

- Table 1: Global Nutraceutical Packaging Market Market Comparison by Packaging Type (2016-2032)

- Table 2: Global Nutraceutical Packaging Market Market Comparison by Product (2016-2032)

- Table 3: Global Nutraceutical Packaging Market Market Comparison by Material (2016-2032)

- Table 4: Global Nutraceutical Packaging Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 5: Global Nutraceutical Packaging Market Market Revenue (US$ Mn) (2016-2032)

- Table 6: Global Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 7: Global Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Packaging Type (2016-2032)

- Table 8: Global Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Product (2016-2032)

- Table 9: Global Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Material (2016-2032)

- Table 10: Global Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 11: Global Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Packaging Type (2016-2032)

- Table 12: Global Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Product (2016-2032)

- Table 13: Global Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Material (2016-2032)

- Table 14: Global Nutraceutical Packaging Market Market Share Comparison by Region (2016-2032)

- Table 15: Global Nutraceutical Packaging Market Market Share Comparison by Packaging Type (2016-2032)

- Table 16: Global Nutraceutical Packaging Market Market Share Comparison by Product (2016-2032)

- Table 17: Global Nutraceutical Packaging Market Market Share Comparison by Material (2016-2032)

- Table 18: North America Nutraceutical Packaging Market Market Comparison by Product (2016-2032)

- Table 19: North America Nutraceutical Packaging Market Market Comparison by Material (2016-2032)

- Table 20: North America Nutraceutical Packaging Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 21: North America Nutraceutical Packaging Market Market Revenue (US$ Mn) (2016-2032)

- Table 22: North America Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 23: North America Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Packaging Type (2016-2032)

- Table 24: North America Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Product (2016-2032)

- Table 25: North America Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Material (2016-2032)

- Table 26: North America Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 27: North America Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Packaging Type (2016-2032)

- Table 28: North America Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Product (2016-2032)

- Table 29: North America Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Material (2016-2032)

- Table 30: North America Nutraceutical Packaging Market Market Share Comparison by Country (2016-2032)

- Table 31: North America Nutraceutical Packaging Market Market Share Comparison by Packaging Type (2016-2032)

- Table 32: North America Nutraceutical Packaging Market Market Share Comparison by Product (2016-2032)

- Table 33: North America Nutraceutical Packaging Market Market Share Comparison by Material (2016-2032)

- Table 34: Western Europe Nutraceutical Packaging Market Market Comparison by Packaging Type (2016-2032)

- Table 35: Western Europe Nutraceutical Packaging Market Market Comparison by Product (2016-2032)

- Table 36: Western Europe Nutraceutical Packaging Market Market Comparison by Material (2016-2032)

- Table 37: Western Europe Nutraceutical Packaging Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 38: Western Europe Nutraceutical Packaging Market Market Revenue (US$ Mn) (2016-2032)

- Table 39: Western Europe Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 40: Western Europe Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Packaging Type (2016-2032)

- Table 41: Western Europe Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Product (2016-2032)

- Table 42: Western Europe Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Material (2016-2032)

- Table 43: Western Europe Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 44: Western Europe Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Packaging Type (2016-2032)

- Table 45: Western Europe Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Product (2016-2032)

- Table 46: Western Europe Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Material (2016-2032)

- Table 47: Western Europe Nutraceutical Packaging Market Market Share Comparison by Country (2016-2032)

- Table 48: Western Europe Nutraceutical Packaging Market Market Share Comparison by Packaging Type (2016-2032)

- Table 49: Western Europe Nutraceutical Packaging Market Market Share Comparison by Product (2016-2032)

- Table 50: Western Europe Nutraceutical Packaging Market Market Share Comparison by Material (2016-2032)

- Table 51: Eastern Europe Nutraceutical Packaging Market Market Comparison by Packaging Type (2016-2032)

- Table 52: Eastern Europe Nutraceutical Packaging Market Market Comparison by Product (2016-2032)

- Table 53: Eastern Europe Nutraceutical Packaging Market Market Comparison by Material (2016-2032)

- Table 54: Eastern Europe Nutraceutical Packaging Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: Eastern Europe Nutraceutical Packaging Market Market Revenue (US$ Mn) (2016-2032)

- Table 56: Eastern Europe Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: Eastern Europe Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Packaging Type (2016-2032)

- Table 58: Eastern Europe Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Product (2016-2032)

- Table 59: Eastern Europe Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Material (2016-2032)

- Table 60: Eastern Europe Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 61: Eastern Europe Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Packaging Type (2016-2032)

- Table 62: Eastern Europe Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Product (2016-2032)

- Table 63: Eastern Europe Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Material (2016-2032)

- Table 64: Eastern Europe Nutraceutical Packaging Market Market Share Comparison by Country (2016-2032)

- Table 65: Eastern Europe Nutraceutical Packaging Market Market Share Comparison by Packaging Type (2016-2032)

- Table 66: Eastern Europe Nutraceutical Packaging Market Market Share Comparison by Product (2016-2032)

- Table 67: Eastern Europe Nutraceutical Packaging Market Market Share Comparison by Material (2016-2032)

- Table 68: APAC Nutraceutical Packaging Market Market Comparison by Packaging Type (2016-2032)

- Table 69: APAC Nutraceutical Packaging Market Market Comparison by Product (2016-2032)

- Table 70: APAC Nutraceutical Packaging Market Market Comparison by Material (2016-2032)

- Table 71: APAC Nutraceutical Packaging Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 72: APAC Nutraceutical Packaging Market Market Revenue (US$ Mn) (2016-2032)

- Table 73: APAC Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 74: APAC Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Packaging Type (2016-2032)

- Table 75: APAC Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Product (2016-2032)

- Table 76: APAC Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Material (2016-2032)

- Table 77: APAC Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 78: APAC Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Packaging Type (2016-2032)

- Table 79: APAC Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Product (2016-2032)

- Table 80: APAC Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Material (2016-2032)

- Table 81: APAC Nutraceutical Packaging Market Market Share Comparison by Country (2016-2032)

- Table 82: APAC Nutraceutical Packaging Market Market Share Comparison by Packaging Type (2016-2032)

- Table 83: APAC Nutraceutical Packaging Market Market Share Comparison by Product (2016-2032)

- Table 84: APAC Nutraceutical Packaging Market Market Share Comparison by Material (2016-2032)

- Table 85: Latin America Nutraceutical Packaging Market Market Comparison by Packaging Type (2016-2032)

- Table 86: Latin America Nutraceutical Packaging Market Market Comparison by Product (2016-2032)

- Table 87: Latin America Nutraceutical Packaging Market Market Comparison by Material (2016-2032)

- Table 88: Latin America Nutraceutical Packaging Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 89: Latin America Nutraceutical Packaging Market Market Revenue (US$ Mn) (2016-2032)

- Table 90: Latin America Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 91: Latin America Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Packaging Type (2016-2032)

- Table 92: Latin America Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Product (2016-2032)

- Table 93: Latin America Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Material (2016-2032)

- Table 94: Latin America Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 95: Latin America Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Packaging Type (2016-2032)

- Table 96: Latin America Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Product (2016-2032)

- Table 97: Latin America Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Material (2016-2032)

- Table 98: Latin America Nutraceutical Packaging Market Market Share Comparison by Country (2016-2032)

- Table 99: Latin America Nutraceutical Packaging Market Market Share Comparison by Packaging Type (2016-2032)

- Table 100: Latin America Nutraceutical Packaging Market Market Share Comparison by Product (2016-2032)

- Table 101: Latin America Nutraceutical Packaging Market Market Share Comparison by Material (2016-2032)

- Table 102: Middle East & Africa Nutraceutical Packaging Market Market Comparison by Packaging Type (2016-2032)

- Table 103: Middle East & Africa Nutraceutical Packaging Market Market Comparison by Product (2016-2032)

- Table 104: Middle East & Africa Nutraceutical Packaging Market Market Comparison by Material (2016-2032)

- Table 105: Middle East & Africa Nutraceutical Packaging Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 106: Middle East & Africa Nutraceutical Packaging Market Market Revenue (US$ Mn) (2016-2032)

- Table 107: Middle East & Africa Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 108: Middle East & Africa Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Packaging Type (2016-2032)

- Table 109: Middle East & Africa Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Product (2016-2032)

- Table 110: Middle East & Africa Nutraceutical Packaging Market Market Revenue (US$ Mn) Comparison by Material (2016-2032)

- Table 111: Middle East & Africa Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 112: Middle East & Africa Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Packaging Type (2016-2032)

- Table 113: Middle East & Africa Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Product (2016-2032)

- Table 114: Middle East & Africa Nutraceutical Packaging Market Market Y-o-Y Growth Rate Comparison by Material (2016-2032)

- Table 115: Middle East & Africa Nutraceutical Packaging Market Market Share Comparison by Country (2016-2032)

- Table 116: Middle East & Africa Nutraceutical Packaging Market Market Share Comparison by Packaging Type (2016-2032)

- Table 117: Middle East & Africa Nutraceutical Packaging Market Market Share Comparison by Product (2016-2032)

- Table 118: Middle East & Africa Nutraceutical Packaging Market Market Share Comparison by Material (2016-2032)

- 1. Executive Summary

-

- Alpha Packaging

- Amcor Limited

- Gerresheimer AG

- Mondi Plc.

- RPC Group

- Graham Packaging Company

- Sonoco Products Company

- Constantia Flexible Group GmbH

- ALPLA Werke Alwin Lehner GmbH & Co KG

- Flex-pack

- Innovia Film

- Law Print & Packaging Management Ltd.

- American Nutritional Corporation

- Wasdell Packaging Group

- PontEurope

- Arizona Nutritional Supplements LLC

- Comar

- Medifilm AG

- Origin Pharma Packaging

- CSB Nutrition Corporation

- Nutra Solutions