Network Monitoring Technology Market By Offering (Equipment, Network TAPs, Data Monitoring Switches, Software & Services), By Bandwidth (1 To 10 Gbps, 40 Gbps, 100 Gbps), By Technology (Ethernet, Fiber Optic, InfiniBand), By End User (Enterprises, Telecommunications Industry, Government Organizations, Cloud Service Providers), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

51101

-

September 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

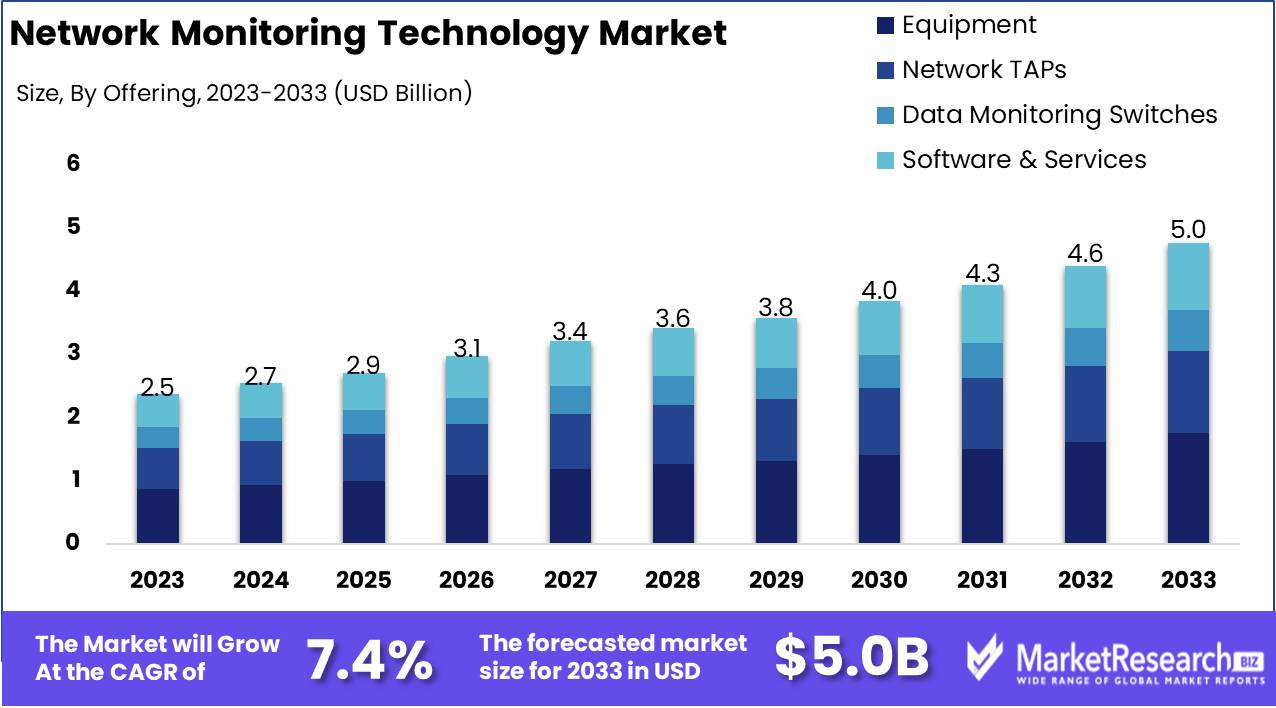

The Network Monitoring Technology Market was valued at USD 2.5 billion in 2023. It is expected to reach USD 5.0 billion by 2033, with a CAGR of 7.4% during the forecast period from 2024 to 2033.

The Network Monitoring Technology Market encompasses the tools, software, and solutions that enable organizations to monitor, analyze, and optimize their network infrastructure's performance, security, and health. These technologies offer real-time visibility into network traffic, identify bottlenecks, detect anomalies, and ensure reliable data transmission across various devices and applications.

The Network Monitoring Technology Market is poised for significant growth, driven by the increasing complexity of modern networks, heightened cybersecurity threats, and advancements in AI and automation integration. As organizations expand their digital infrastructure, the need for robust network monitoring tools has intensified. Networks have evolved beyond traditional frameworks to include a multitude of devices, virtualized environments, and cloud services. This complexity, while offering scalability and flexibility, also presents challenges in terms of visibility and management, thereby fueling demand for advanced network monitoring solutions. The rise in cybersecurity threats, particularly ransomware attacks and data breaches, has further underscored the necessity of proactive monitoring systems capable of detecting real-time vulnerabilities.

Despite these drivers, high initial costs remain a barrier for smaller enterprises, potentially limiting adoption in the short term. However, integrating AI and automation is expected to be a transformative factor in the market. AI-powered solutions enable predictive analytics, anomaly detection, and automated responses, which significantly enhance network performance and security. These technologies not only reduce operational complexity but also lower long-term costs, making network monitoring tools more accessible to a broader range of organizations. As AI and automation continue to mature, the market is likely to witness accelerated growth, particularly among industries with complex IT ecosystems such as finance, healthcare, and telecommunications. The ongoing evolution of network monitoring technology will be essential in ensuring secure, efficient, and scalable operations in an increasingly interconnected world.

Key Takeaways

- Market Growth: The Network Monitoring Technology Market was valued at USD 2.5 billion in 2023. It is expected to reach USD 5.0 billion by 2033, with a CAGR of 7.4% during the forecast period from 2024 to 2033.

- By Offering: Equipment dominated the Network Monitoring Technology Market offerings.

- By Bandwidth: 1 to 10 Gbps segment dominated network monitoring bandwidth.

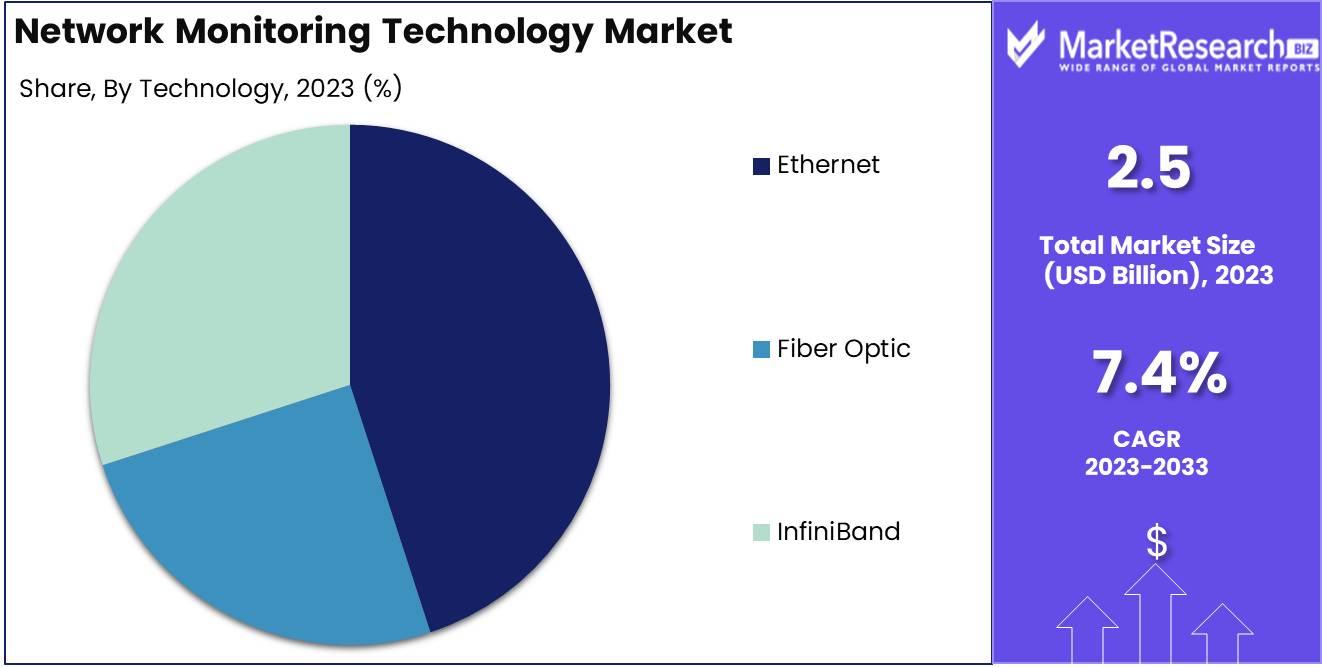

- By Technology: Ethernet dominated network monitoring due to cost-effectiveness and scalability.

- By End User: Enterprises held a dominant position in network monitoring technology.

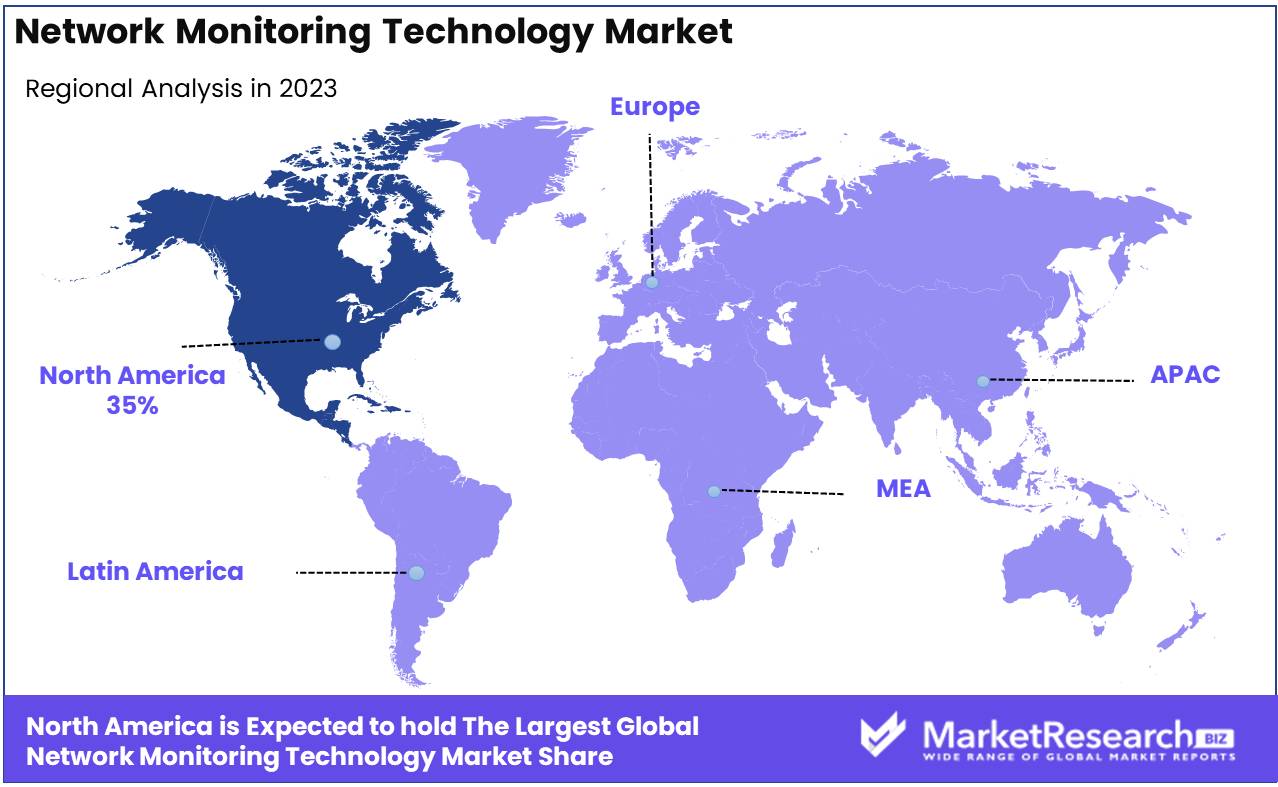

- Regional Dominance: North America dominates the Network Monitoring Technology Market with a 35% largest share.

- Growth Opportunity: The global network monitoring market is set for strong growth, driven by the rising adoption of cloud services and advancements in AI/ML, enhancing visibility, security, and operational efficiency.

Driving factors

Increasing Complexity of IT Infrastructures Driving the Need for Advanced Network Monitoring Solutions

The continuous evolution of IT infrastructures, including the adoption of cloud computing, virtualization, and the proliferation of IoT devices, is significantly contributing to the growth of the network monitoring technology market. Enterprises are increasingly dealing with hybrid and multi-cloud environments, decentralized networks, and vast amounts of data, creating complex networks that require sophisticated tools to manage. Traditional network monitoring tools are no longer adequate to handle the demands of these modern infrastructures, leading to a surge in demand for advanced solutions that provide real-time insights and comprehensive visibility into network performance.

As businesses scale and adopt more agile infrastructures, network monitoring tools are becoming essential for ensuring seamless operation and mitigating downtime. According to industry estimates, the global adoption of cloud services is expected to grow at a compound annual growth rate (CAGR) of approximately 17% through 2025, further driving demand for robust network monitoring technologies capable of managing these intricate systems.

Rising Cybersecurity Threats Accelerating the Adoption of Network Monitoring Technology

With the growing frequency and sophistication of cybersecurity threats, businesses are placing greater emphasis on network security, thus fueling the network monitoring technology market. As cyberattacks become more advanced, the need for early detection and rapid response mechanisms is critical. Network monitoring solutions play a pivotal role in identifying anomalies, detecting potential threats, and ensuring data integrity by providing constant oversight of network traffic and performance.

High-profile data breaches, ransomware attacks, and other cyber threats are pressuring organizations to invest in monitoring tools that offer real-time security insights and automated responses to suspicious activities. The global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, reflecting the urgency for companies to adopt network monitoring technologies as a proactive defense against these threats. This trend is especially pronounced in industries with stringent regulatory compliance requirements, such as finance, healthcare, and government sectors, where continuous monitoring for cybersecurity purposes is not only critical but often mandated.

Demand for Continuous Monitoring Enhancing Market Growth

The growing need for continuous network monitoring is another major factor propelling the market. As businesses prioritize operational efficiency, uptime, and user experience, continuous monitoring solutions have become indispensable. Real-time monitoring provides ongoing visibility into network performance, enabling the detection of issues before they escalate into significant problems, thus preventing downtime and ensuring seamless operations.

Organizations increasingly rely on networks to support critical business functions, and any disruption can lead to substantial financial losses. Continuous monitoring allows businesses to maintain optimal network performance, address bottlenecks proactively, and improve customer satisfaction. As a result, the demand for 24/7 monitoring solutions is expected to grow at a substantial pace, especially in industries that rely on constant network availability, such as e-commerce, telecom, and cloud service providers.

In tandem with rising cybersecurity concerns, continuous monitoring also acts as a first line of defense against potential cyber threats, enabling immediate detection of unusual patterns or anomalies. The integration of artificial intelligence (AI) and machine learning (ML) technologies in network monitoring systems is enhancing the predictive capabilities of these tools, leading to more precise threat identification and improved overall network resilience.

Restraining Factors

High Implementation Costs Hindering Adoption in Small and Medium-Sized Enterprises

The high implementation costs associated with network monitoring technology represent a significant restraining factor, particularly for small and medium-sized enterprises (SMEs). The initial expenses include not only the acquisition of advanced hardware and software but also the costs associated with system integration, customization, and ongoing maintenance. For many organizations, especially those with limited IT budgets, these upfront expenditures can be prohibitive. The requirement for highly skilled personnel to manage and optimize these systems further amplifies these costs.

The reluctance of smaller enterprises to invest in such solutions slows the overall market growth, as SMEs form a considerable portion of the potential user base. Larger enterprises, although better equipped to absorb these costs, still face challenges in justifying the return on investment (ROI), which further impacts the market. According to industry reports, companies with less than 500 employees often report that implementation costs can consume 10-15% of their total IT budgets, making the adoption of network monitoring technologies unsustainable for some.

Integration Challenges Slowing Deployment Across Complex IT Infrastructures

Integration challenges are another major restraint that impedes the growth of the network monitoring technology market. In today’s IT landscape, enterprises often employ a wide range of legacy systems, cloud platforms, and third-party applications, creating a complex environment where seamless integration is critical yet difficult to achieve. The heterogeneity of these infrastructures leads to compatibility issues, which can result in delayed deployments or suboptimal system performance.

These challenges are exacerbated by the increasing shift towards hybrid and multi-cloud environments. Ensuring that network monitoring tools can work seamlessly across on-premise, cloud-based, and virtualized networks without causing disruptions or performance degradation is a key concern. The costs and technical expertise required to ensure full integration further contribute to delayed adoption, particularly in large enterprises that operate intricate IT ecosystems.

By Offering Analysis

In 2023, Equipment dominated the Network Monitoring Technology Market offerings.

In 2023, Equipment held a dominant market position in the Network Monitoring Technology Market's 'By Offering' segment. This category includes critical hardware components, such as routers, switches, and other physical devices, essential for monitoring, managing, and securing network infrastructure. The robust demand for scalable, high-performance equipment, driven by the increasing complexity of modern networks, particularly in large enterprises and data centers, played a crucial role in this dominance. Equipment solutions offered enhanced traffic analysis, and load balancing, and ensured uninterrupted network performance, making them indispensable in high-bandwidth environments.

Network TAPs also held a substantial share within the segment. These devices allowed for passive network traffic analysis without affecting data flow, making them critical in scenarios requiring uninterrupted monitoring. Their application spanned across network security and performance monitoring.

Data Monitoring Switches further solidified their presence by providing efficient data traffic management, enhancing security, and reducing latency across network systems. Their modularity and scalability made them an attractive option.

Software & Services experienced steady growth, offering advanced analytics, real-time network insights, and customizable solutions. Cloud-based monitoring solutions were key drivers, providing flexibility and ease of integration into existing systems.

By Bandwidth Analysis

In 2023, 1 to 10 Gbps segment dominated network monitoring bandwidth.

In 2023, The 1 to 10 Gbps bandwidth segment held a dominant position in the Network Monitoring Technology Market under the By Bandwidth category. This bandwidth range is widely adopted due to its balance between performance and cost, making it ideal for enterprises and service providers managing moderate to high data traffic. It is extensively used in small to medium-sized networks and data centers where 1 to 10 Gbps is sufficient to handle typical operational loads, contributing significantly to the overall market share.

The 40 Gbps segment is gaining traction, driven by the growing need for faster data transmission in large enterprises, cloud data centers, and telecommunications. The increasing adoption of video streaming, IoT, and big data analytics is expected to boost the demand for this bandwidth range.

Meanwhile, the 100 Gbps bandwidth segment is experiencing rapid growth, particularly in hyperscale data centers and industries with ultra-high data requirements. As cloud computing and 5G infrastructure expand, 100 Gbps is poised to capture a substantial share, offering superior capacity and future-proofing for large-scale operations.

By Technology Analysis

In 2023, Ethernet dominated network monitoring due to cost-effectiveness and scalability.

In 2023, Ethernet held a dominant position in the "By Technology" segment of the Network Monitoring Technology Market. Ethernet's widespread adoption can be attributed to its cost-effectiveness, scalability, and compatibility with existing infrastructure. It remains the preferred choice for enterprise networks due to its high data transfer speeds, ease of installation, and low latency, making it suitable for a variety of applications, including data centers and cloud computing.

Fiber Optic technology is also experiencing significant growth, driven by the increasing demand for high-bandwidth, low-latency networks. With its ability to transmit data over long distances with minimal signal degradation, Fiber Optic technology is favored in industries requiring high-speed, long-distance data transmission, such as telecommunications and large-scale enterprise networks.

InfiniBand, while a niche technology, remains critical in high-performance computing (HPC) environments. Its ultra-low latency and high throughput make it ideal for data centers, research institutions, and organizations that require high-speed interconnects. However, its adoption is limited compared to Ethernet and Fiber Optic due to its specialized use cases and higher costs.

By End User Analysis

In 2023, Enterprises held a dominant position in network monitoring technology.

In 2023, Enterprises held a dominant market position in the Network Monitoring Technology Market, driven by the increasing complexity of IT infrastructure and the rising need for cybersecurity measures. Enterprises across various sectors, such as finance, healthcare, and manufacturing, increasingly deployed advanced network monitoring solutions to manage their large-scale networks, ensure uptime, and detect potential threats. The growth of cloud computing and IoT technologies further contributed to the demand for these solutions, enabling enterprises to gain real-time visibility into network performance and troubleshoot issues proactively. As companies expand their digital ecosystems, they invest heavily in sophisticated network monitoring tools to safeguard data and optimize operational efficiency, positioning enterprises as key drivers in the market.

The Telecommunications Industry also played a critical role, as network providers require advanced tools to manage bandwidth, latency, and service continuity. Telecom operators heavily invested in network monitoring systems to ensure optimal service delivery and reduce downtime in their vast networks. As 5G technology proliferates, the demand for network monitoring solutions among telecommunications providers is projected to increase.

Government Organizations have emerged as significant end-users due to their focus on securing national infrastructures from cyber threats. Public sector agencies are investing in advanced monitoring technologies to protect critical systems, including defense, transportation, and healthcare networks. Network security mandates and compliance regulations further drive the adoption of these technologies within government sectors.

Lastly, Cloud Service Providers represent a growing segment in the network monitoring market. As cloud adoption accelerates, these providers are increasingly focused on maintaining high service levels, managing multi-cloud environments, and addressing security concerns. Advanced network monitoring tools are vital for ensuring seamless operations and performance optimization, enabling cloud service providers to meet the evolving demands of their clients. This segment is expected to see sustained growth as more businesses transition to cloud-based infrastructure.

Key Market Segments

By Offering

- Equipment

- Network TAPs

- Data Monitoring Switches

- Software & Services

By Bandwidth

- 1 To 10 Gbps

- 40 Gbps

- 100 Gbps

By Technology

- Ethernet

- Fiber Optic

- InfiniBand

By End User

- Enterprises

- Telecommunications Industry

- Government Organizations

- Cloud Service Providers

Growth Opportunity

Increasing Adoption of Cloud Services

The accelerated adoption of cloud services is driving the need for advanced network monitoring solutions globally. As organizations migrate their workloads to cloud-based infrastructures, the complexity of managing hybrid and multi-cloud environments has risen. According to recent industry estimates, the global cloud computing market is projected to grow by approximately 17%. This surge highlights a growing demand for network monitoring technologies capable of providing real-time visibility, performance tracking, and troubleshooting across diverse and distributed networks. Cloud-native monitoring solutions, with capabilities to address scalability, latency, and security challenges, present significant opportunities for market expansion.

Emergence of Artificial Intelligence (AI) and Machine Learning (ML)

Artificial intelligence (AI) and machine learning (ML) are increasingly becoming integral to network monitoring technology, opening new avenues for growth. AI and ML-based solutions enable predictive analytics, automated anomaly detection, and proactive network management, significantly reducing manual intervention and downtime. The global AI market is forecasted to grow at a CAGR of 37% from 2023 to 2028, indicating a strong potential for integration with network monitoring technologies. These advancements are expected to enhance operational efficiency and optimize network performance, making AI-driven monitoring tools a key growth area in the coming year.

Latest Trends

Growing Demand for Continuous Network Monitoring

The demand for continuous network monitoring is expected to see significant growth. Organizations increasingly recognize the need for real-time insights to ensure optimal network performance and security. The rise of hybrid and cloud infrastructures, alongside the proliferation of connected devices, is driving this trend. Continuous monitoring provides proactive detection of anomalies, reducing downtime and enabling faster responses to cyber threats. As networks become more complex, enterprises seek solutions that offer automated, real-time diagnostics, pushing demand for advanced network monitoring technologies. This trend is poised to reshape network management strategies globally.

Growth of Open Source Network Monitoring Software

The adoption of open-source network monitoring software is anticipated to rise steadily. Open-source tools offer cost-effective alternatives to proprietary solutions, attracting small and medium-sized enterprises (SMEs) and larger organizations looking to optimize IT budgets. The growing flexibility, community support, and scalability of open-source platforms are enhancing their appeal, particularly as enterprises embrace DevOps practices and cloud-native environments. Open-source solutions are now evolving to provide enterprise-grade features, driving increased adoption across industries. As the market matures, open-source software is expected to disrupt traditional players by offering customization options and a reduced total cost of ownership.

Regional Analysis

North America dominates the Network Monitoring Technology Market with a 35% largest share.

The Network Monitoring Technology Market exhibits significant regional variations, with North America emerging as the dominant market. In 2023, North America held the largest market share, accounting for approximately 35% of the global market, driven by the rapid adoption of advanced network infrastructure, growing demand for cloud services, and strong investments in the IT and telecom sectors. Major players in the region, such as Cisco Systems and IBM, have contributed to the market’s growth.

In Europe, the market is also experiencing steady growth, with a focus on improving cybersecurity and compliance with data protection regulations such as GDPR. The region holds nearly 25% of the market share, supported by the expansion of 5G networks and IoT deployments, particularly in countries like Germany, the UK, and France.

The Asia-Pacific region is anticipated to witness the highest CAGR during the forecast period, due to the increased digital transformation initiatives, rapid urbanization, and growing investments in data centers. Countries like China, Japan, and India are leading the growth, contributing to the region’s market share of around 28%.

In the Middle East & Africa, and Latin America, the market remains in the developing phase but is expected to grow as digital infrastructure expands, with market shares of 7% and 5%, respectively, driven by emerging economies like Brazil and the UAE.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Network Monitoring Technology market is shaped by the strategic advancements and competitive positioning of key players, which include established companies and emerging innovators. Viavi Solutions Inc. continues to enhance its portfolio, focusing on high-performance monitoring solutions tailored to complex network environments, particularly in 5G and cloud infrastructures. Juniper Networks, Inc., with its emphasis on automated solutions and AI-driven insights, solidifies its place in optimizing network performance, especially for large enterprises.

Datadog, a leader in cloud monitoring, capitalizes on its robust integration capabilities, catering to the increasing demand for observability across hybrid and multi-cloud environments. Broadcom Inc., leveraging its acquisition of Symantec, continues to strengthen its security-oriented network monitoring solutions, appealing to sectors with stringent compliance requirements.

Kentik and Gigamon both drive innovation with scalable monitoring tools designed for dynamic, large-scale environments, such as hyperscale data centers. Cisco Systems, Inc. maintains its dominance by offering end-to-end visibility solutions that integrate with its broader networking portfolio, further enhanced by its focus on security.

NETSCOUT Systems, Inc. and SolarWinds Worldwide, LLC remain competitive with cost-effective and versatile monitoring tools that address a wide range of enterprise needs. Emerging players like Auvik Networks Inc. and Zenoss Inc. gain traction through their SaaS-based offerings, which appeal to small and medium-sized enterprises seeking cloud-first solutions. Overall, market players are focused on AI-driven, scalable, and security-enhanced network monitoring technologies, which are expected to drive growth and competition.

Market Key Players

- Viavi Solutions Inc

- Juniper Networks, Inc.

- Datadog

- Broadcom Inc.

- Kentik

- Gigamon

- Apcon

- Cisco Systems, Inc.

- Garland Technology

- NETSCOUT Systems, Inc.

- Zoho Corporation Pvt. Ltd.

- Arista Networks, Inc.

- Paessler AG, NETGEAR

- SolarWinds Worldwide, LLC

- VMware, Inc.

- Zenoss Inc.

- Auvik Networks Inc.

- Other Players

Recent Development

- In March 2024, Cisco announced the acquisition of SamKnows, a London-based broadband network monitoring firm. This acquisition aims to bolster Cisco’s efforts in providing reliable, high-performance broadband services, aligning with its broader vision to enhance network performance and monitoring capabilities for global enterprises and internet service providers.

- In February 2024, Cisco announced, in the Global Networking Trends report, that multi-cloud strategies have become increasingly common, with 41% of IT leaders citing secure access across clouds as their biggest challenge. Unified cloud environments combining private and public clouds have gained popularity, pushing the need for advanced network monitoring tools that provide visibility and control across diverse cloud architectures.

- In January 2024, Nokia introduced its MantaRay network management solution, formerly known as NetAct, which offers a scalable and automated approach to network monitoring. This innovation is designed to provide real-time, unified monitoring for service providers, facilitating enhanced network visibility and efficiency.

Report Scope

Report Features Description Market Value (2023) USD 2.5 Billion Forecast Revenue (2033) USD 5.0 Billion CAGR (2024-2032) 7.4% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Offering (Equipment, Network TAPs, Data Monitoring Switches, Software & Services), By Bandwidth (1 To 10 Gbps, 40 Gbps, 100 Gbps), By Technology (Ethernet, Fiber Optic, InfiniBand), By End User (Enterprises, Telecommunications Industry, Government Organizations, Cloud Service Providers) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Viavi Solutions Inc., Juniper Networks, Inc., Datadog, Broadcom Inc., Kentik, Gigamon, Apcon, Cisco Systems, Inc., Garland Technology, NETSCOUT Systems, Inc., Zoho Corporation Pvt. Ltd., Arista Networks, Inc., Paessler AG, NETGEAR, SolarWinds Worldwide, LLC, VMware, Inc., Zenoss Inc., Auvik Networks Inc., Other Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Viavi Solutions Inc

- Juniper Networks, Inc.

- Datadog

- Broadcom Inc.

- Kentik

- Gigamon

- Apcon

- Cisco Systems, Inc.

- Garland Technology

- NETSCOUT Systems, Inc.

- Zoho Corporation Pvt. Ltd.

- Arista Networks, Inc.

- Paessler AG, NETGEAR

- SolarWinds Worldwide, LLC

- VMware, Inc.

- Zenoss Inc.

- Auvik Networks Inc.

- Other Players