Molded Pulp Packaging Market Report By Molded Type (Transfer Molded, Thermoformed Fiber, Processed Pulp, Thick Wall), By Source (Wood Pulp, Non-Wood Pulp), By Type (Rotary Molding, Fiber Thermoforming/Wet Press, Industrial Molding Pulp/Dry Press), By Product (Trays, End Caps, Bowls & Cups, Clamshells, Plates, Others), By End Use, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

46388

-

May 2024

-

291

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

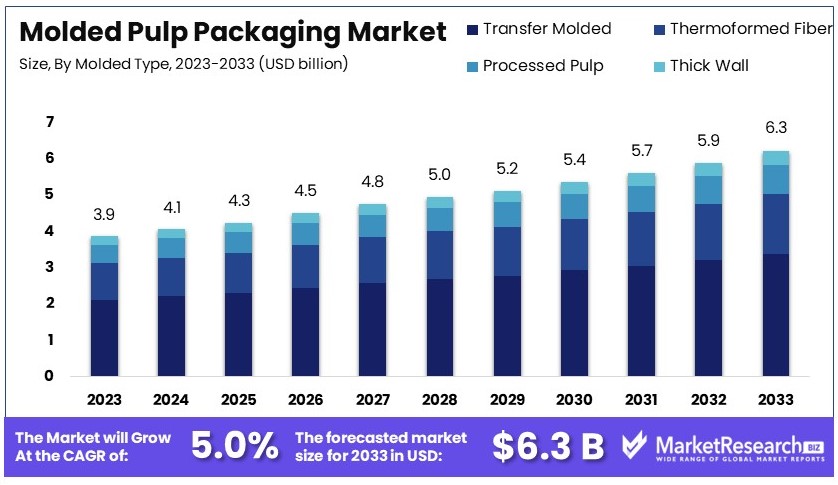

The Global Molded Pulp Packaging Market size is expected to be worth around USD 6.3 billion by 2033, from USD 3.9 billion in 2023, growing at a CAGR of 5.0% during the forecast period from 2024 to 2033.

The Molded Pulp Packaging Market involves eco-friendly packaging solutions made from recycled paper. This market includes trays, clamshells, and containers used for packaging food, electronics, and other products. The market growth is driven by the rising demand for sustainable packaging, stringent environmental regulations, and consumer preference for eco-friendly products.

Key players are Huhtamaki, UFP Technologies, and Sonoco Products Company. Molded pulp packaging is biodegradable, recyclable, and cost-effective. It helps reduce plastic waste, aligns with sustainability goals, and meets increasing regulatory requirements. The market supports environmental conservation and offers businesses a green packaging alternative.

The Molded Pulp Packaging Market is experiencing significant growth driven by the rising demand for sustainable packaging solutions. This market's expansion is fueled by increasing consumer awareness of environmental issues and stringent government regulations promoting eco-friendly packaging. Molded pulp packaging, made from recycled paper, is biodegradable and recyclable, making it an attractive option for various industries, including food and beverage, electronics, and healthcare.

China, as the world's largest exporter of packaged goods, accounts for approximately 12% of global packaging exports. This dominant position underscores the country's substantial influence on the market's dynamics. Germany and the United States also play crucial roles, contributing around 8% and 6% of global packaging exports, respectively. These countries' strong manufacturing capabilities and commitment to sustainable practices further propel the market's growth.

Technological advancements in production processes have enhanced the quality and durability of molded pulp packaging, expanding its application scope. Innovations such as advanced molding techniques and the use of hybrid materials have improved product performance, making molded pulp a viable alternative to traditional packaging materials.

In conclusion, the Molded Pulp Packaging Market is set for robust growth, driven by environmental concerns, regulatory support, and technological advancements. With key players like China, Germany, and the United States leading the charge, the market is well-positioned to meet the evolving demands of consumers and industries worldwide.

Key Takeaways

- Market Value: The Global Molded Pulp Packaging Market is expected to grow from USD 3.9 billion in 2023 to approximately USD 6.3 billion by 2033, at a CAGR of 5.0%.

- Molded Type Analysis: Transfer Molded dominates with 54.4% due to its cost-effectiveness and versatility.

- Source Analysis: Wood Pulp dominates with 79.5% due to its availability and cost-effectiveness.

- Type Analysis: Rotary Molding dominates with 39.2% due to high production efficiency and versatility.

- Product Analysis: Trays dominate with 36.3% due to widespread use in food packaging and food service disposables.

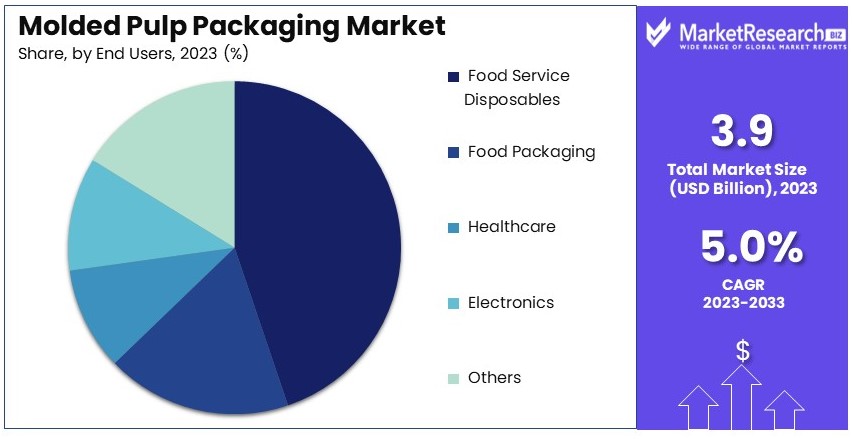

- End Use Analysis: Food Service Disposables dominate with 44.3% due to high demand for sustainable packaging solutions.

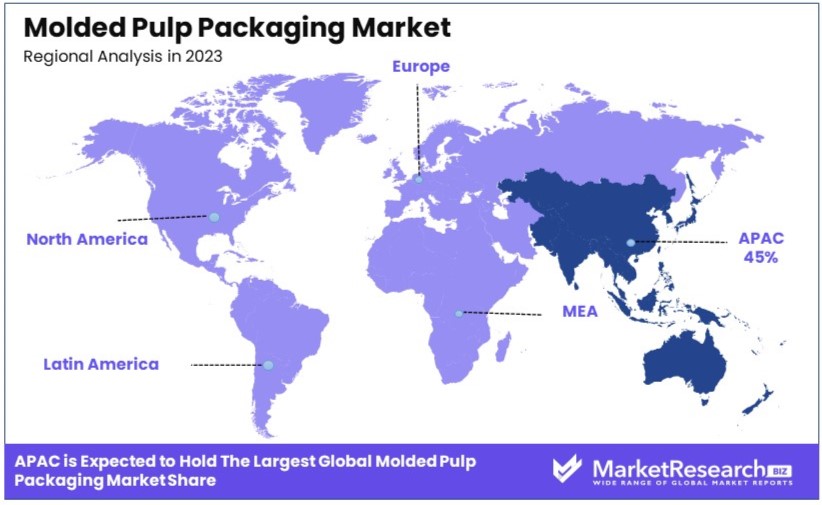

- Dominant Region: Asia Pacific dominates with a 45% market share, driven by large-scale manufacturing and demand for sustainable packaging.

- High Growth Region: North America holds a 25% market share, driven by increasing consumer demand for eco-friendly packaging solutions.

- Analyst Viewpoint: The overall market is experiencing steady growth with moderate competition, driven by sustainability trends and advancements in molded pulp technology. Future growth will be fueled by increasing adoption of eco-friendly packaging and expansion in emerging markets.

Driving Factors

Increasing Demand for Sustainable Packaging Solutions Drives Market Growth

Consumers and businesses are increasingly prioritizing sustainability, which is significantly driving the demand for molded pulp packaging. This type of packaging is biodegradable, recyclable, and made from renewable resources, making it an eco-friendly alternative to traditional plastic and foam packaging. This shift is evident in the adoption of molded pulp packaging by major companies like Dell, Ikea, and Puma, who aim to reduce their environmental impact. The rise in environmental awareness among consumers has pushed businesses to adopt sustainable packaging solutions, further propelling the market growth.

This growth is fueled by consumers' preference for products that contribute to environmental conservation. Molded pulp is emerging as an eco-friendly alternative in the packaging industry, particularly for vacuum packaging applications. As more businesses adopt eco-friendly practices, the molded pulp packaging market is expected to see continuous expansion. Additionally, the cost-effectiveness and versatility of molded pulp packaging make it a favorable choice for companies looking to enhance their sustainability credentials while maintaining operational efficiency.

Stringent Regulations on Plastic Packaging Drives Market Growth

Governments worldwide are enforcing strict regulations to curb the use of single-use plastics, creating significant opportunities for the molded pulp packaging market. These regulations aim to reduce plastic waste and promote sustainable alternatives. Molded pulp packaging stands out as a viable and cost-effective substitute for plastic, aligning with regulatory requirements. For instance, the European Union's Single-Use Plastics Directive, which targets a ban on certain single-use plastic products, has opened new avenues for molded pulp packaging manufacturers.

The impact of these regulations is profound, with the global market for molded pulp packaging expected to grow at a CAGR of 7.2% from 2023 to 2028. These policies not only drive the demand for sustainable packaging but also encourage innovation and investment in eco-friendly packaging solutions. As companies strive to comply with environmental regulations, the adoption of molded pulp packaging is anticipated to increase, further supporting market growth.

Growing E-commerce Industry Drives Market Growth

The rapid expansion of the e-commerce sector is boosting the demand for protective and lightweight packaging solutions. Molded pulp packaging, with its excellent cushioning properties, is ideally suited for e-commerce applications, ensuring product safety during shipping. Major e-commerce players like Amazon have collaborated with molded pulp packaging manufacturers to develop sustainable packaging solutions, reflecting the industry's shift towards eco-friendly practices.

The e-commerce industry's growth, with a projected CAGR of 14.7% from 2023 to 2030, underscores the increasing need for efficient packaging solutions. Molded pulp packaging not only meets the protective requirements of e-commerce but also aligns with the sector's sustainability goals. This synergy between e-commerce growth and sustainable packaging solutions drives the market for molded pulp packaging, indicating a strong upward trajectory in the coming years.

Restraining Factors

Limited Awareness and Perception Restrains Market Growth

Limited awareness and understanding about molded pulp packaging among consumers and businesses pose a significant challenge to market growth. Many consumers still do not recognize the environmental benefits and practical applications of molded pulp packaging. This lack of knowledge can lead to misconceptions, such as perceiving molded pulp packaging as less durable or less attractive compared to traditional materials like plastic or foam.

For example, marketing campaigns and educational efforts are essential to change these perceptions and highlight the advantages of molded pulp packaging. Without these efforts, the adoption rate remains slow, impacting overall market expansion. Despite the environmental benefits, the market growth is hindered by the persistent perception issues, which can only be mitigated through targeted awareness programs.

Technological Limitations Restrain Market Growth

Technological limitations in the production processes and equipment used for molded pulp packaging are another major restraint. These limitations often involve challenges in achieving complex designs and customizations, which restrict the range of products that can utilize molded pulp packaging effectively. Industries that require intricate packaging solutions or have specific design requirements may find it difficult to adopt molded pulp packaging due to these constraints.

For instance, some industries with detailed product designs face challenges in using molded pulp packaging, which currently lacks the technological sophistication to meet their needs. This limitation not only restricts market growth but also limits the potential expansion into diverse industrial sectors. Investing in advanced production technologies is crucial to overcome these barriers and enhance the market's growth prospects.

Molded Type Analysis

Transfer Molded dominates with 54.4% due to cost-effectiveness and versatility.

The molded pulp packaging market can be segmented by molded type, including transfer molded, thermoformed fiber, processed pulp, and thick wall. Among these, the transfer molded segment is the dominant sub-segment, accounting for 54.4% of the market. Transfer molded products are widely used due to their cost-effectiveness and versatility.

They can be easily produced and customized for various applications, including food service disposables, electronics packaging, and more. This segment benefits from low production costs and high efficiency, making it a preferred choice for many industries. Additionally, the transfer molding process allows for the production of intricate shapes and designs, further increasing its applicability and popularity.

Thermoformed fiber is another significant sub-segment within the molded type category. This segment is gaining traction due to its superior quality and strength compared to other molded types. Thermoformed fiber products are used in applications requiring higher durability and aesthetics, such as electronics packaging and high-end food service disposables. The growth of this segment is driven by advancements in thermoforming technology, which enable the production of more complex and durable packaging solutions.

Processed pulp and thick wall segments also play crucial roles in the molded pulp packaging market. Processed pulp products are known for their smooth surface and fine texture, making them suitable for premium packaging applications. Thick wall molded pulp products are used in heavy-duty packaging applications due to their robust structure and high impact resistance. Both segments contribute to the overall growth of the molded pulp packaging market by catering to specific niche applications that require unique properties.

Source Analysis

Wood Pulp dominates with 79.5% due to availability and cost-effectiveness.

The source segment of the molded pulp packaging market includes wood pulp and non-wood pulp. Wood pulp is the dominant sub-segment, accounting for 79.5% of the market. This dominance is attributed to the widespread availability and cost-effectiveness of wood pulp. Wood pulp is a renewable resource, making it an environmentally friendly option for molded pulp packaging. Its abundance ensures a steady supply for manufacturers, reducing production costs and increasing market penetration. The use of wood pulp in molded pulp packaging also aligns with the growing demand for sustainable packaging solutions, further driving its dominance in the market.

Non-wood pulp, although a smaller segment, is gaining attention due to its potential environmental benefits. Non-wood pulp sources include agricultural residues, grasses, and other plant fibers. These materials are often by-products of other industries, making them a sustainable option for molded pulp packaging. The growth of the non-wood pulp segment is driven by increasing research and development efforts to improve the quality and usability of these alternative fibers. As technology advances, non-wood pulp could become a more significant player in the molded pulp packaging market, providing additional options for sustainable packaging solutions.

Type Analysis

Rotary Molding dominates with 39.2% due to high production efficiency and versatility.

The type segment of the molded pulp packaging market includes rotary molding, fiber thermoforming/wet press, and industrial molding pulp/dry press. Rotary molding is the dominant sub-segment, accounting for 39.2% of the market. Rotary molding offers high production efficiency and versatility, making it a preferred choice for many manufacturers. This process allows for continuous production of molded pulp products, significantly reducing production time and costs. The versatility of rotary molding enables the production of a wide range of products, from simple trays to complex packaging solutions, catering to various industry needs.

Fiber thermoforming, also known as wet press, is another important sub-segment. This process produces high-quality, smooth-surfaced molded pulp products with excellent strength and durability. Fiber thermoforming is used in applications where aesthetics and product performance are critical, such as premium food packaging and electronic product packaging. The growth of this segment is driven by advancements in thermoforming technology, which enable the production of more intricate and durable packaging solutions.

Industrial molding pulp, or dry press, is used for heavy-duty packaging applications. This process produces thick-walled, robust packaging solutions that offer superior protection for fragile or heavy items. Industrial molding pulp products are commonly used in the electronics and automotive industries, where product protection is paramount. The segment's growth is fueled by increasing demand for reliable and sturdy packaging solutions in these sectors.

Product Analysis

Trays dominate with 36.3% due to widespread use in food packaging and food service disposables.

The product segment of the molded pulp packaging market includes trays, end caps, bowls & cups, clamshells, plates, and others. Trays are the dominant sub-segment, accounting for 36.3% of the market. Trays are widely used in food packaging and food service disposables due to their versatility, durability, and cost-effectiveness. They provide an excellent solution for packaging a variety of food items, from fresh produce to ready-to-eat meals. The demand for trays is driven by the growing food and beverage industry, particularly the increasing trend towards convenience foods and takeout services.

End caps are another significant sub-segment within the product category. These products are used primarily in electronics packaging to protect delicate components during transportation and storage. The growth of the end caps segment is driven by the increasing demand for consumer electronics and the need for reliable packaging solutions to ensure product safety.

Bowls and cups are commonly used in the food service industry, especially for serving soups, salads, and beverages. The demand for these products is driven by the increasing trend towards sustainable and biodegradable food service disposables. Clamshells and plates are also important segments, catering to the food packaging and food service industries. These products provide convenient and eco-friendly options for packaging and serving food items, further contributing to the growth of the molded pulp packaging market.

End Use Analysis

Food Service Disposables dominate with 44.3% due to high demand for sustainable packaging solutions.

The end use segment of the molded pulp packaging market includes disposable food service item, food packaging, healthcare, electronics, and others. Food service disposables are the dominant sub-segment, accounting for 44.3% of the market. The demand for sustainable and biodegradable packaging solutions in the food service industry drives the growth of this segment. Consumers and businesses are increasingly seeking eco-friendly alternatives to traditional plastic disposables, leading to a surge in demand for molded pulp packaging products like trays, bowls, cups, and plates. The tea industry is embracing molded pulp in tea capsules as a sustainable packaging solution, responding to consumer demand for eco-conscious options.

Food packaging is another significant sub-segment within the end use category. Molded pulp packaging is widely used for packaging fresh produce, bakery items, and ready-to-eat meals. The growth of this segment is driven by the increasing demand for convenient and sustainable packaging solutions in the food and beverage industry. Healthcare is also an important end-use sector, where molded pulp packaging is used for packaging medical devices and supplies. The need for sterile, reliable, and eco-friendly packaging solutions in the healthcare industry contributes to the growth of this segment.

Electronics is another key end-use segment for molded pulp packaging. The increasing demand for consumer electronics drives the need for protective packaging solutions to ensure product safety during transportation and storage. Molded pulp packaging provides an effective solution for protecting delicate electronic components, further supporting the growth of this segment. Other end-use applications, including automotive and industrial packaging, also contribute to the overall growth of the molded pulp packaging market by catering to specific niche applications that require unique packaging properties.

Key Market Segments

By Molded Type

- Transfer Molded

- Thermoformed Fiber

- Processed Pulp

- Thick Wall

By Source

- Wood Pulp

- Non-Wood Pulp

By Type

- Rotary Molding

- Fiber Thermoforming/Wet Press

- Industrial Molding Pulp/Dry Press

By Product

- Trays

- End Caps

- Bowls & Cups

- Clamshells

- Plates

- Others

By End Use

- Food Service Disposables

- Food Packaging

- Healthcare

- Electronics

- Others

Growth Opportunities

Expansion into New Market Segments Offers Growth Opportunity

Molded pulp packaging has the potential to expand into new market segments beyond traditional applications in electronics, food, and consumer goods. Industries like pharmaceuticals, cosmetics, and automotive components are exploring the use of molded pulp packaging for their specific needs. This packaging can provide excellent cushioning and protective properties, making it suitable for delicate medical devices and automotive parts.

The market for molded pulp packaging in these new segments is expected to grow as these industries seek sustainable and reliable packaging solutions. For example, the pharmaceutical industry can benefit from molded pulp packaging for the safe transportation of medical devices, which can help drive market growth.

Product Innovation and Customization Offers Growth Opportunity

Manufacturers have significant opportunities to innovate and develop customized molded pulp packaging solutions tailored to specific industry needs. This could include new designs, additional features like moisture resistance or insulation, and specialized product packaging.

Collaborations with food and beverage companies can lead to the development of insulated packaging solutions for temperature-sensitive products like fresh produce or frozen foods. These innovations not only meet industry-specific requirements but also enhance the appeal and functionality of molded pulp packaging. By focusing on product innovation and customization, manufacturers can tap into new market opportunities and drive the growth of the molded pulp packaging market.

Trending Factors

Innovative Packaging Design Are Trending Factors

Molded pulp packaging manufacturers are exploring innovative design techniques to enhance aesthetics, functionality, and user experience. This includes advanced molding techniques, integrating branding elements, and exploring new shapes and forms.

Collaborations with designers and artists help create visually appealing and unique packaging solutions that stand out on retail shelves. Innovative designs can attract more consumers and differentiate products in a competitive market. By focusing on design innovation, manufacturers can meet the growing demand for aesthetically pleasing and functional packaging, thus driving market trends and growth.

Integration of Smart Packaging Technologies Are Trending Factors

The integration of smart packaging technologies, such as sensors, QR codes, or NFC tags, is gaining traction across various industries. Molded pulp packaging manufacturers can incorporate these technologies into their products, enabling features like product traceability, temperature monitoring, or interactive consumer experiences.

For instance, molded pulp packaging for pharmaceuticals or perishable foods can include temperature sensors or QR codes to provide real-time monitoring and tracking throughout the supply chain. These smart packaging solutions enhance product safety and consumer engagement, making them a trending factor in the molded pulp packaging market. By adopting smart technologies, manufacturers can offer added value and functionality, driving market growth and innovation.

Regional Analysis

Asia Pacific Dominates with 45% Market Share

Asia Pacific's dominance in the molded pulp packaging market is driven by several factors. The region has a large population, leading to high demand for packaged goods. Rapid industrialization and urbanization contribute to the increased use of sustainable packaging solutions. Governments in countries like China and India are implementing strict regulations against plastic usage, further boosting the demand for molded pulp packaging. Additionally, the presence of numerous manufacturers in the region ensures a steady supply of molded pulp products, keeping costs competitive.

The diverse economies within Asia Pacific, from advanced markets like Japan and South Korea to emerging ones like Vietnam and Indonesia, create a dynamic landscape for molded pulp packaging. High consumption rates in food and beverage sectors, along with growing e-commerce activities, drive the demand for packaging solutions. The region's robust manufacturing sector also supports the widespread adoption of molded pulp packaging due to its cost-effectiveness and environmental benefits.

North America: 25% Market Share

North America holds a 25% market share in the molded pulp packaging market. The region benefits from a strong emphasis on sustainability and environmental regulations, driving the demand for eco-friendly packaging. The presence of major e-commerce players and a well-established food and beverage industry further supports market growth. North America's molded pulp packaging market is projected to grow at a rate of 6% annually, with continued investment in sustainable packaging solutions.

Europe: 20% Market Share

Europe accounts for 20% of the molded pulp packaging market. The region's strict environmental regulations and consumer preference for sustainable products drive market demand. Countries like Germany, France, and the UK lead in adopting molded pulp packaging solutions. The market in Europe is expected to grow at a rate of 5.5% annually, driven by innovations in packaging technology and increased awareness of environmental issues.

Middle East & Africa: 5% Market Share

The Middle East & Africa region holds a 5% share of the molded pulp packaging market. The demand is primarily driven by the food and beverage industry and increasing urbanization. However, the market growth is relatively slower, with a projected annual growth rate of 4%, due to economic challenges and lower consumer awareness of sustainable packaging benefits.

Latin America: 5% Market Share

Latin America also holds a 5% share of the molded pulp packaging market. The region's growth is driven by the food and beverage sector and rising environmental awareness. Countries like Brazil and Mexico are leading in the adoption of molded pulp packaging. The market is expected to grow at a rate of 4.5% annually, supported by governmental initiatives to reduce plastic usage and promote sustainability.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The molded pulp packaging market is characterized by the presence of several key players, each contributing to the industry's growth and innovation. Companies like Alta Global Inc, Best Plus Pulp Co, and CMPC are significant due to their extensive product portfolios and focus on sustainability. DS Smith and Enviropak leverage advanced technologies and innovative designs to meet diverse packaging needs, enhancing their market influence. Hartmann and Huhtamaki Ltd are prominent for their global reach and strong customer base, which strategically positions them as market leaders.

Molpack Corporation Ltd and YFY Jupiter drive market growth through their commitment to eco-friendly solutions and continuous product development. Pacific Pulp Molding and Smurfit Kappa are noted for their emphasis on quality and customer satisfaction, strengthening their competitive edge. Sonoco Products Company and Stora Enso's extensive research and development efforts enable them to introduce cutting-edge products, further solidifying their market positions. Western Pulp Products Company focuses on specialized packaging solutions, catering to niche markets and contributing to the overall market diversity.

Collectively, these companies drive innovation, sustainability, and growth in the molded pulp packaging market. Their strategic initiatives and market influence ensure the continued expansion and evolution of the industry, addressing global packaging needs effectively.

Market Key Players

- Alta Global Inc

- Best Plus Pulp Co

- CMPC

- DS Smith

- Enviropak

- Hartmann

- Huhtamaki Ltd

- Molpack Corporation Ltd

- YFY Jupiter

- Pacific Pulp Molding

- Smurfit Kappa

- Sonoco Products Company

- Stora Enso

- Western Pulp Products Company

Recent Developments

- On April 2024, Packaging Corporation of America (PCA) donated $1.6 million to the University of Maine to establish the UMaine Sustainable Packaging Initiative, focusing on renewable and recyclable packaging made from forest fiber. This initiative aims to accelerate the transition to sustainable packaging within the pulp and paper industry. The donation will support research, development activities, and industry support, positioning the University of Maine as a world leader in sustainable packaging.

- On July 2023, The Navigator Company proceeded with an investment project to build a moulded fibre packaging plant at the Cacia pulp mill complex in Aveiro, Portugal. This investment is part of Navigator's packaging business strategy, with production planned to start in the first half of 2024. The plant will produce moulded fibre packaging from eucalyptus fiber, aiming to substitute plastic packaging in the food service and food packaging market. Developing biodegradable barrier properties is a significant challenge in this project.

Report Scope

Report Features Description Market Value (2023) USD 3.9 Billion Forecast Revenue (2033) USD 6.3 Billion CAGR (2024-2033) 5.0% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Molded Type (Transfer Molded, Thermoformed Fiber, Processed Pulp, Thick Wall), By Source (Wood Pulp, Non-Wood Pulp), By Type (Rotary Molding, Fiber Thermoforming/Wet Press, Industrial Molding Pulp/Dry Press), By Product (Trays, End Caps, Bowls & Cups, Clamshells, Plates, Others), By End Use (Food Service Disposables, Food Packaging, Healthcare, Electronics, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Alta Global Inc, Best Plus Pulp Co, CMPC, DS Smith, Enviropak, Hartmann, Huhtamaki Ltd, Molpack Corporation Ltd, YFY Jupiter, Pacific Pulp Molding, Smurfit Kappa, Sonoco Products Company, Stora Enso, Western Pulp Products Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Alta Global Inc

- Best Plus Pulp Co

- CMPC

- DS Smith

- Enviropak

- Hartmann

- Huhtamaki Ltd

- Molpack Corporation Ltd

- YFY Jupiter

- Pacific Pulp Molding

- Smurfit Kappa

- Sonoco Products Company

- Stora Enso

- Western Pulp Products Company