Medical Membrane Market By Material (Polysulfone (PSU) and Polyether Sulfone (PES), Modified Acrylics, Polyethylene (PE), Others), By Technology (Microfiltration, Nanofiltration, Reverse Osmosis, Ultrafiltration, Dialysis, Gas Separation), By Application (Pharmaceutical Filtration, Drug Delivery, Hemodialysis, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

49041

-

July 2024

-

136

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

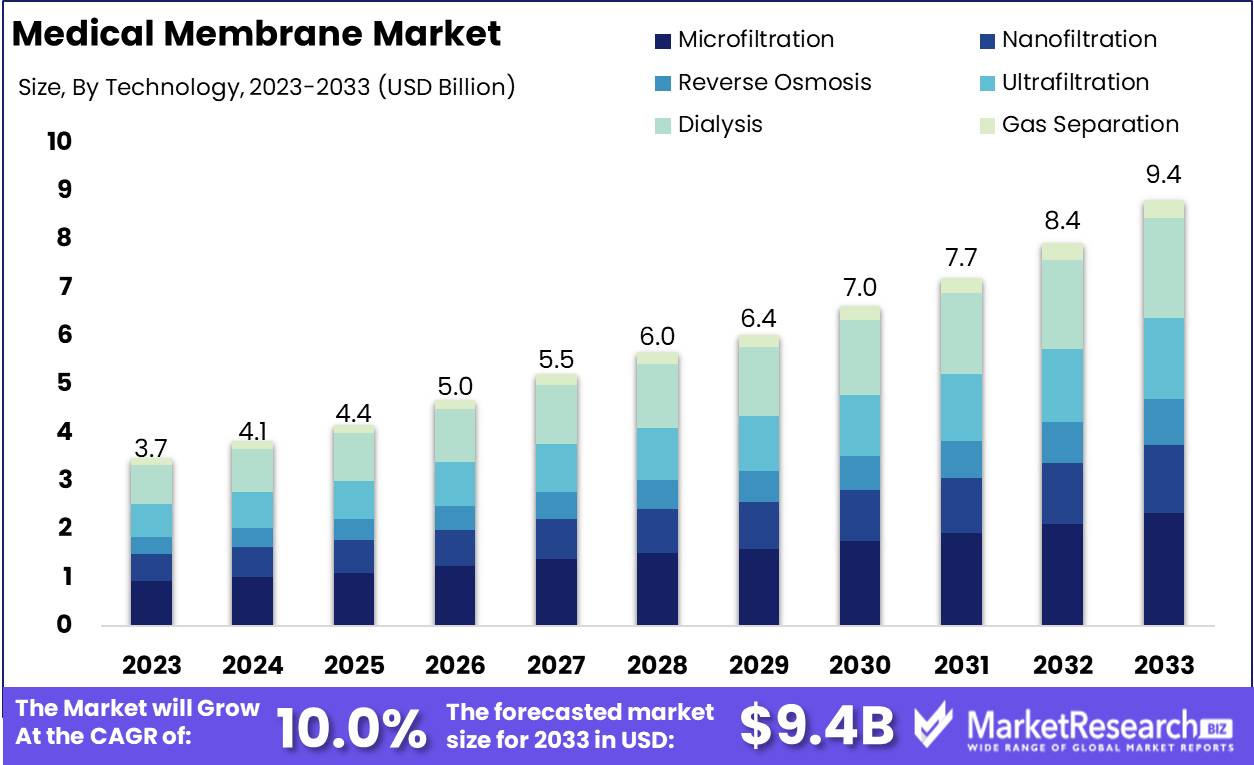

The Global Medical Membrane Market was valued at USD 3.7 Bn in 2023. It is expected to reach USD 9.4 Bn by 2033, with a CAGR of 10% during the forecast period from 2024 to 2033.

The Medical Membrane Market involves the production and application of semi-permeable membranes used in various medical and life sciences applications. These membranes play a crucial role in processes such as dialysis, drug delivery, filtration, and tissue regeneration. Designed to selectively allow the passage of certain molecules while blocking others, medical membranes are essential in ensuring the efficacy and safety of medical treatments and devices. The market is driven by advancements in biotechnology, increasing prevalence of chronic diseases, and a growing demand for high-performance medical technologies, leading to continuous innovation and expansion in the sector.

The Medical Membrane Market is poised for significant growth, driven by ongoing advancements in biotechnology and the rising prevalence of chronic diseases that necessitate sophisticated medical treatments. These semi-permeable membranes are indispensable in critical applications such as dialysis, drug delivery, and tissue regeneration. One notable aspect is their limited lifespan, typically ranging from 6 to 10 years, which necessitates regular replacement and underscores the importance of continuous innovation in membrane technology.

The Medical Membrane Market is poised for significant growth, driven by ongoing advancements in biotechnology and the rising prevalence of chronic diseases that necessitate sophisticated medical treatments. These semi-permeable membranes are indispensable in critical applications such as dialysis, drug delivery, and tissue regeneration. One notable aspect is their limited lifespan, typically ranging from 6 to 10 years, which necessitates regular replacement and underscores the importance of continuous innovation in membrane technology.Nanofiltration, a process utilizing pores in the 1-10 nanometer range, exemplifies the cutting-edge developments within this market. This technology allows for precise molecular separation based on size, enhancing the efficacy of medical procedures and treatment outcomes. As healthcare systems worldwide seek to improve patient care while managing costs, the demand for high-performance medical membranes is expected to surge.

Regulatory advancements and increasing investments in healthcare infrastructure further bolster market expansion. Companies operating in this space are focusing on enhancing the durability and functionality of medical membranes to meet the growing needs of the healthcare industry. The integration of nanotechnology and other advanced materials science innovations is likely to drive the next wave of growth, offering more efficient and cost-effective solutions.

Key Takeaways

- Market Growth: The Global Medical Membrane Market was valued at USD 3.7 Bn in 2023. It is expected to reach USD 9.4 Bn by 2033, with a CAGR of 10% during the forecast period from 2024 to 2033.

- By Material: Polysulfone (PSU) and Polyether Sulfone (PES) materials are extensively used, representing 30% of the market, due to their excellent biocompatibility and stability.

- By Technology: Microfiltration technology accounts for 25%, crucial for achieving precise separations in medical applications.

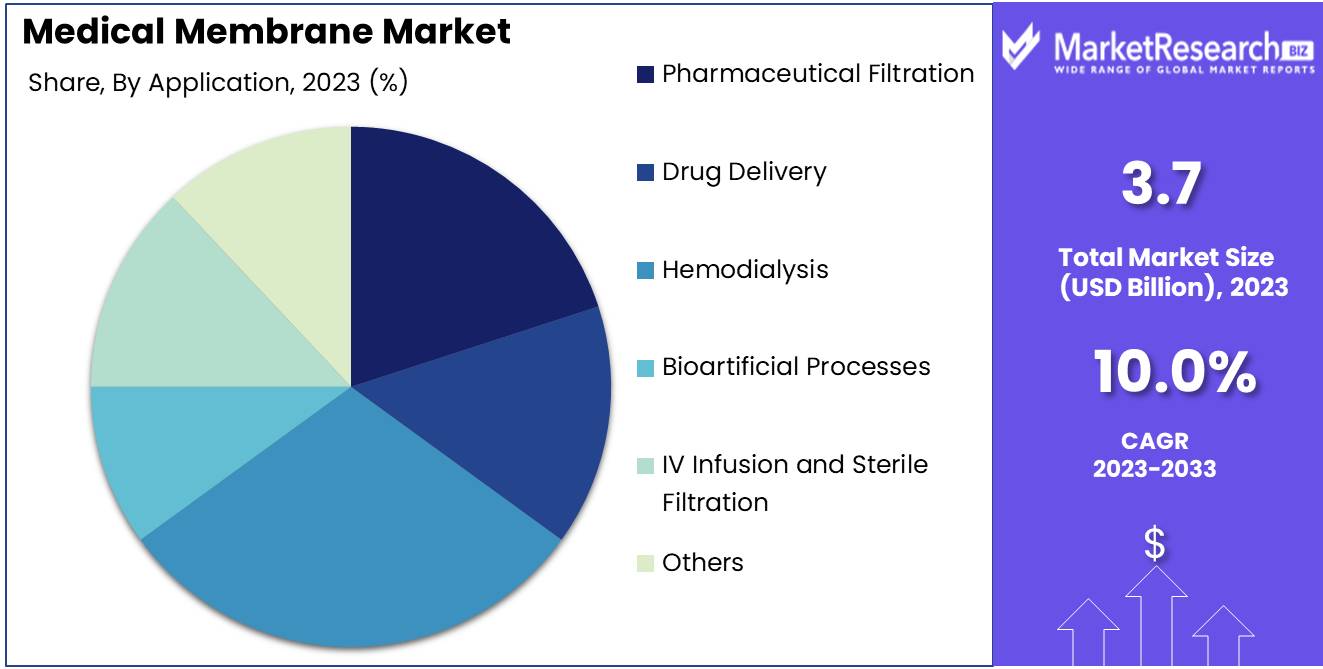

- By Application: Hemodialysis is a leading application, utilizing 30% of these membranes, reflecting the critical demand for efficient dialysis treatments.

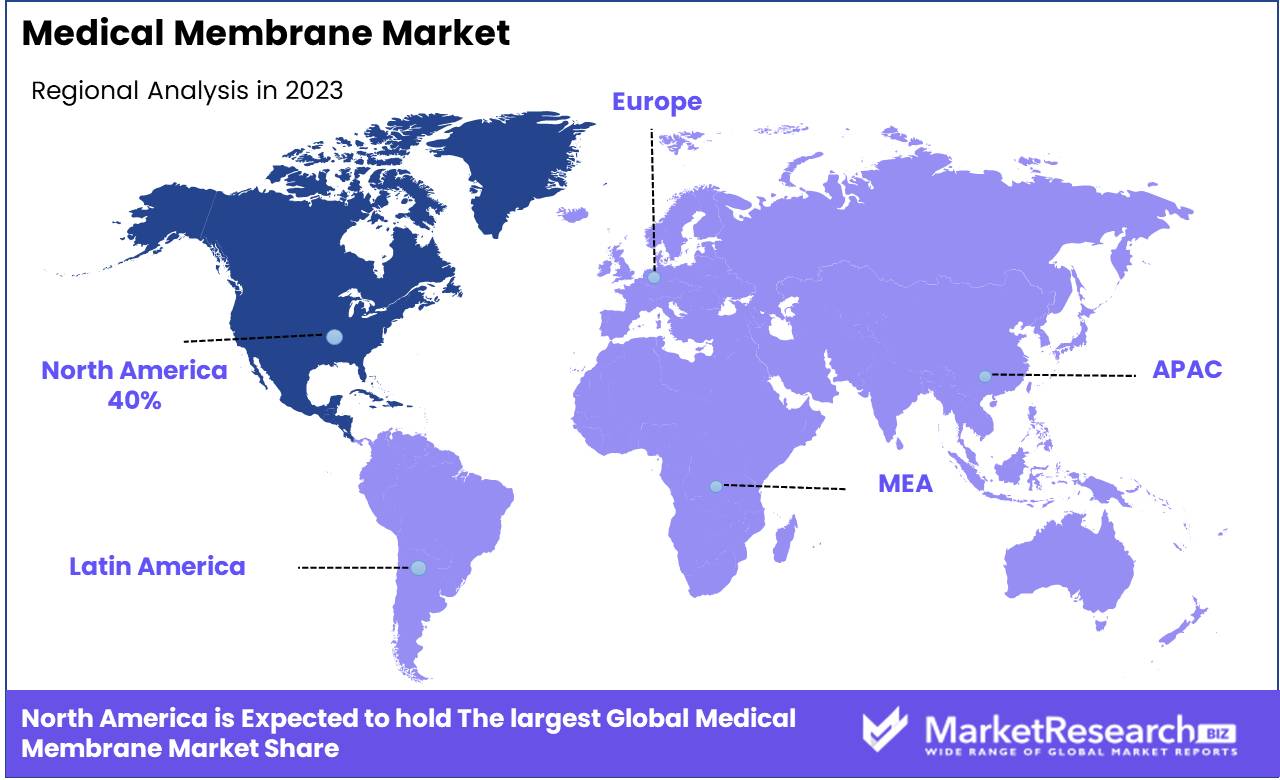

- Regional Dominance: North America dominates the market with a 40% share, driven by rapid advancements in healthcare infrastructure and increasing medical needs.

- Growth Opportunity: Innovations in organic and bio-based soil amendments are poised to capture demand from the growing sustainable agriculture sector.

Driving factors

Increasing Prevalence of Chronic Diseases

The rising prevalence of chronic diseases such as diabetes, kidney disorders, and cardiovascular diseases is a critical driver of the medical membrane market. With chronic diseases on the rise globally, there is a heightened demand for medical treatments that rely on advanced filtration and separation technologies. Medical membranes are integral to devices used in dialysis, blood screening, purification, and other critical care applications.

As the incidence of chronic diseases continues to climb, the need for efficient and reliable medical membrane technologies is expected to grow, thereby driving market expansion.

Growing Demand for Advanced Medical Treatments

The growing demand for advanced medical treatments further fuels the growth of the medical membrane market. Advances in medical science have led to the development of sophisticated treatments that require precise and effective filtration, such as organ transplants, advanced wound care, and biopharmaceutical production. Medical membranes play a pivotal role in these applications, ensuring that fluids are accurately filtered and purified.

This demand for cutting-edge medical treatments is spurred by an aging global population, increased healthcare spending, and greater accessibility to advanced healthcare services, all of which contribute to the burgeoning need for high-performance medical membranes.

Technological Advancements in Membrane Materials

Technological advancements in membrane materials significantly enhance the medical membrane market. Innovations in materials science have led to the development of membranes with improved biocompatibility, higher filtration efficiency, and enhanced durability. These advancements enable the production of membranes that can meet the stringent requirements of modern medical applications, such as high-flux dialysis membranes and specialized membranes for drug delivery systems.

As technology continues to evolve, the capabilities of medical membranes are expanding, opening new avenues for their application and driving market growth.

Restraining Factors

High Production Costs

High production costs are a significant challenge for the growth of the medical membrane market. The manufacturing of medical membranes involves complex processes and the use of advanced materials, which can be expensive. This high cost of production translates to higher prices for end-users, potentially limiting the market's accessibility and expansion, particularly in cost-sensitive regions.

The need for continuous investment in research and development to improve membrane performance and develop new applications further contributes to the overall production costs. While these investments are crucial for innovation, they also raise the financial barriers to entry and scalability within the market.

Stringent Regulatory Requirements

Stringent regulatory requirements present another substantial barrier to the growth of the medical membrane market. Medical membranes used in various applications, such as dialysis and drug delivery systems, must adhere to rigorous standards set by health authorities and regulatory bodies. These standards ensure that the products are safe, effective, and reliable for patient use.

Meeting these regulatory requirements often involves extensive testing, certification processes, and compliance with complex regulatory frameworks, which can be time-consuming and costly. For manufacturers, this means higher operational costs and longer time-to-market for new products, potentially slowing down innovation and market growth.

By Material Analysis

Polysulfone (PSU) and Polyether Sulfone (PES) dominated the By Material segment of the Medical Membrane Market in 2023, capturing more than a 30% share.

In 2023, Polysulfone (PSU) and Polyether Sulfone (PES) held a dominant market position in the By Material segment of the Medical Membrane Market, capturing more than a 30% share. The widespread adoption of PSU and PES in medical applications is driven by their superior thermal stability, chemical resistance, and excellent mechanical properties. These materials are particularly favored in applications such as hemodialysis, water purification, and pharmaceutical filtration due to their reliability and efficiency in separating and purifying fluids.

Modified Acrylics are also utilized in the medical membrane market, known for their flexibility and ease of fabrication. These materials are often used in applications requiring high transparency and UV resistance. Despite their beneficial properties, the market share of modified acrylics remains smaller compared to PSU and PES due to their lower thermal and chemical resistance.

Polyethylene (PE) membranes are valued for their cost-effectiveness and versatility. They are widely used in medical applications such as microfiltration and ultrafiltration. However, their limited chemical resistance and lower mechanical strength compared to PSU and PES restrict their market share.

Polytetrafluoroethylene (PTFE) is highly prized for its exceptional chemical resistance and low friction properties. PTFE membranes are commonly used in sterile filtration and venting applications. Despite their excellent performance, the high cost of PTFE limits its broader adoption, resulting in a smaller market share compared to more cost-effective materials.

Polyvinylidene Fluoride (PVDF) is another important material in the medical membrane market, known for its excellent chemical resistance, mechanical properties, and ability to withstand harsh conditions. PVDF membranes are used in various filtration applications, including biopharmaceutical processes.

Others include a variety of materials such as cellulose acetate and nylon, which are used in specialized medical membrane applications. While these materials offer specific advantages, their market share is relatively small due to the dominance of more widely applicable and efficient materials like PSU and PES.

By Technology Analysis

Microfiltration dominated the By Technology segment of the Medical Membrane Market in 2023, capturing more than a 25% share.

In 2023, Microfiltration held a dominant market position in the By Technology segment of the Medical Membrane Market, capturing more than a 25% share. This significant market share is driven by the wide range of applications microfiltration membranes are used in, including sterile filtration, bacteria removal, and clarification processes in the pharmaceutical and biotechnology industries. The efficiency and reliability of microfiltration in removing contaminants without altering the essential properties of the liquids make it a preferred choice for many medical and laboratory applications.

Nanofiltration membranes are increasingly used for separating small molecules and ions, making them suitable for applications such as water purification and softening, as well as in the pharmaceutical industry for removing organic compounds.

Reverse Osmosis technology is widely recognized for its effectiveness in desalination and ultra-purification processes. It is used in applications where the highest levels of purity are required, such as in the production of ultrapure water for medical use.

Ultrafiltration is commonly used in protein separation, virus removal, and wastewater treatment. Its ability to retain high molecular weight solutes while allowing water and low molecular weight solutes to pass makes it valuable in various medical and industrial applications.

Dialysis is essential for renal replacement therapy in patients with kidney failure. The widespread use of dialysis membranes in healthcare underscores their importance. The market share for dialysis is more limited compared to microfiltration, as its application is highly specialized and confined to a specific medical need.

Gas Separation membranes are used to separate gases for various medical and industrial applications, including oxygen enrichment and anesthesia delivery. While gas separation technology is crucial for certain medical procedures, its market share is relatively small due to its niche application area.

By Application Analysis

Hemodialysis dominated the By Application segment of the Medical Membrane Market in 2023, capturing more than a 30% share.

In 2023, Hemodialysis held a dominant market position in the By Application segment of the Medical Membrane Market, capturing more than a 30% share. This significant market share is driven by the increasing kidney fibrosis treatment and the growing number of patients requiring renal replacement therapy. Hemodialysis membranes are critical for filtering waste products and excess fluids from the blood, making them indispensable in life-saving treatments for patients with kidney failure.

Pharmaceutical Filtration is another vital application within the medical membrane market, essential for ensuring the purity and safety of pharmaceutical products. Membranes used in this sector help in removing contaminants, bacteria, and particulates from liquid formulations.

Drug Delivery systems leverage medical membranes to control the release of therapeutic agents. These membranes are integral to the design of advanced drug delivery systems, including transdermal patches and implantable devices.

Bioartificial Processes involve the use of membranes in bioartificial organs and tissue engineering. These applications are at the forefront of medical innovation, aiming to replicate or support natural biological functions. Despite their potential, the market share for bioartificial processes is still emerging and remains smaller compared to more established applications like hemodialysis.

IV Infusion and Sterile Filtration applications are critical in healthcare settings for ensuring the sterility and safety of intravenous fluids and medications. Membranes used in these processes help prevent microbial contamination and ensure patient safety. While essential, the market share for IV infusion and sterile filtration is relatively limited compared to the extensive use of hemodialysis membranes.

Others encompass a range of specialized applications such as water purification for medical facilities, respiratory therapies, and diagnostic devices. These applications, while important, contribute a smaller overall share to the medical membrane market due to their niche nature and specific use cases.

Key Market Segments

By Material

- Polysulfone (PSU) and Polyether Sulfone (PES)

- Modified Acrylics

- Polyethylene (PE)

- Polytetrafluoroethylene (PTFE)

- Polyvinylidene Fluoride (PVDF)

- Others

By Technology

- Microfiltration

- Nanofiltration

- Reverse Osmosis

- Ultrafiltration

- Dialysis

- Gas Separation

By Application

- Pharmaceutical Filtration

- Drug Delivery

- Hemodialysis

- Bioartificial Processes

- IV Infusion and Sterile Filtration

- Others

Growth Opportunity

Development of Innovative and High-Performance Membranes

In 2024, the development of innovative and high-performance membranes presents a substantial opportunity for the medical membrane market. Advances in materials science are driving the creation of membranes with enhanced biocompatibility, higher filtration precision, and increased durability. These high-performance membranes are essential for applications in critical areas such as dialysis, drug delivery, and surgical implants.

Innovations such as nanotechnology and smart materials are expected to revolutionize membrane performance, enabling more efficient medical treatments and improved patient outcomes. This continuous innovation not only meets the growing demands of the healthcare industry but also opens up new applications and markets for medical membranes.

Expansion in Home Healthcare and Wearable Devices

The expansion of home healthcare and wearable medical devices is another significant growth opportunity for the medical membrane market in 2024. With an increasing emphasis on patient-centric care and the management of chronic diseases at home, the demand for reliable and efficient medical membranes is rising. Wearable devices that monitor vital signs, administer medications, or perform filtration functions rely heavily on advanced membrane technologies.

As smart medical devices become more prevalent, particularly among aging populations and in regions with limited access to traditional healthcare facilities, the market for medical membranes is poised to expand substantially. This shift towards home-based and pediatric healthcare solutions underscores the importance of developing membranes that are not only high-performing but also adaptable to diverse and innovative applications.

Latest Trends

Adoption of Nanotechnology in Membrane Design

In 2024, the adoption of nanotechnology in membrane design is poised to be a transformative trend for the medical membrane market. Nanotechnology enables the creation of membranes with unprecedented levels of precision and functionality. These nanotechnology-enhanced membranes exhibit superior filtration capabilities, increased surface area, and enhanced durability. Such advancements are critical for applications in dialysis, drug delivery, and diagnostic devices, where high performance and reliability are paramount.

The integration of nanomaterials also allows for the development of multifunctional membranes that can perform a range of tasks simultaneously, thereby improving the efficiency and efficacy of medical treatments. As nanotechnology continues to evolve, its incorporation into membrane design is expected to drive significant innovation and growth within the market.

Rising Use of Medical Membranes in Water Purification Systems

Another notable trend for 2024 is the rising use of medical membranes in water purification systems. Access to clean water is a fundamental health concern, and medical-grade membranes are increasingly being utilized in advanced water purification technologies. These membranes offer high filtration efficiency and are capable of removing contaminants at a microscopic level, making them ideal for producing safe drinking water.

The crossover application of medical membranes in water purification not only addresses global health issues but also expands the market for membrane technologies beyond traditional medical applications. This trend underscores the versatility and critical importance of high-performance membranes in addressing a wide range of health and environmental challenges.

Regional Analysis

Medical Membrane Market by Region: North America, Europe, Asia Pacific, Middle East & Africa, Latin America

In 2023, North America dominated the Medical Membrane Market, capturing a substantial 40% share. This dominance is driven by advanced healthcare infrastructure, significant investment in medical research and development, and the high prevalence of chronic diseases requiring advanced medical treatments. The United States and Canada lead in the adoption of medical membranes for applications such as hemodialysis, pharmaceutical filtration, and drug delivery systems. The region's stringent regulatory standards and focus on healthcare innovation further support its leading market position.

Europe holds a significant share of the market, driven by robust healthcare systems and a strong emphasis on medical technology advancements. The region's commitment to improving patient outcomes and adopting advanced medical solutions contributes to its substantial market share, though slightly less than North America's.

Asia Pacific is experiencing rapid growth in the medical membrane market, fueled by increasing healthcare investments, a rising number of chronic disease cases, and improving healthcare infrastructure. The region's large population base and growing demand for advanced medical treatments drive the expansion of the market.

Middle East & Africa shows promising potential for growth in the medical membrane market, supported by increasing healthcare expenditure and efforts to enhance medical facilities. The adoption of advanced medical technologies and rising awareness about medical treatments are driving market growth.

Latin America is emerging as a growing market for medical membranes. The region benefits from improvements in healthcare systems and a growing focus on medical advancements. While the market share is expanding, it is still smaller compared to dominant regions due to economic variability and slower adoption of advanced medical technologies.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global Medical Membrane Market is marked by rapid advancements and a robust presence of several key industry players, each contributing significantly to the market's dynamics in 2024. Companies such as 3M Company, W. L. Gore & Associates, Inc., and Asahi Kasei Corporation are at the forefront, driving innovation and technological advancements in this sector.

3M Company continues to dominate with its cutting-edge membrane technologies that enhance medical device performance. Its focus on R&D has led to the development of membranes that offer superior filtration capabilities, critical for respiratory devices and surgical applications. The integration of smart technology into its products is setting new standards for efficacy and safety in medical treatments.

W. L. Gore & Associates, Inc. is renowned for its expertise in producing durable and biocompatible membranes used in a variety of medical applications, including implantable devices. Its products are pivotal in reducing infections and improving the clinical outcomes of medical interventions.

Asahi Kasei Corporation, a leader in the Asian market, leverages its capabilities in chemical technology to produce high-quality medical membranes that address the critical needs of dialysis and pharmaceutical filtration. The company's strategic expansions and collaborations have strengthened its market reach and portfolio.

Other notable players like Merck KGaA and Sartorius AG are enhancing their offerings with specialized membranes that support rigorous regulatory requirements for purity and performance in the pharmaceutical and biotechnology industries.

Market Key Players

- 3M Company

- W. L. Gore & Associates, Inc.

- Asahi Kasei Corporation

- Hangzhou Cobetter Filtration Equipment Co., Ltd.

- Johnson & Johnson Services, Inc.

- Amniox Medical, Inc.

- Nipro Corporation

- Amifrox Medical, Inc.

- Medtronic plc

- Sartorius AG

- Merck KGaA

- Mann+Hummel GmbH

- Pall Corporation

- B. Braun Melsungen AG

- Hoffmann-La Roche Ltd

Recent Development

Report Scope

Report Features Description Market Value (2023) USD 3.7 Bn Forecast Revenue (2033) USD 9.4 Bn CAGR (2024-2033) 10% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Polysulfone (PSU) and Polyether Sulfone (PES), Modified Acrylics, Polyethylene (PE), Polytetrafluoroethylene (PTFE), Polyvinylidene Fluoride (PVDF), Others), By Technology (Microfiltration, Nanofiltration, Reverse Osmosis, Ultrafiltration, Dialysis, Gas Separation), By Application (Pharmaceutical Filtration, Drug Delivery, Hemodialysis, Bioartificial Processes, IV Infusion and Sterile Filtration, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape 3M Company, W. L. Gore & Associates, Inc., Asahi Kasei Corporation, Hangzhou Cobetter Filtration Equipment Co., Ltd., Johnson & Johnson Services, Inc., Amniox Medical, Inc., Nipro Corporation, Amifrox Medical, Inc., Medtronic plc, Sartorius AG, Merck KGaA, Mann+Hummel GmbH, Pall Corporation, B. Braun Melsungen AG, Hoffmann-La Roche Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Medical Membrane Market Overview

- 2.1. Medical Membrane Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Medical Membrane Market Dynamics

- 3. Global Medical Membrane Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Medical Membrane Market Analysis, 2016-2021

- 3.2. Global Medical Membrane Market Opportunity and Forecast, 2023-2032

- 3.3. Global Medical Membrane Market Analysis, Opportunity and Forecast, By By Material, 2016-2032

- 3.3.1. Global Medical Membrane Market Analysis by By Material: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material, 2016-2032

- 3.3.3. Polysulfone (PSU) and Polyether Sulfone (PES)

- 3.3.4. Modified Acrylics

- 3.3.5. Polyethylene (PE)

- 3.3.6. Polytetrafluoroethylene (PTFE)

- 3.3.7. Polyvinylidene Fluoride (PVDF)

- 3.3.8. Others

- 3.4. Global Medical Membrane Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 3.4.1. Global Medical Membrane Market Analysis by By Technology: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 3.4.3. Microfiltration

- 3.4.4. Nanofiltration

- 3.4.5. Reverse Osmosis

- 3.4.6. Ultrafiltration

- 3.4.7. Dialysis

- 3.4.8. Gas Separation

- 3.5. Global Medical Membrane Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 3.5.1. Global Medical Membrane Market Analysis by By Application: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 3.5.3. Pharmaceutical Filtration

- 3.5.4. Drug Delivery

- 3.5.5. Hemodialysis

- 3.5.6. Bioartificial Processes

- 3.5.7. IV Infusion and Sterile Filtration

- 3.5.8. Others

- 4. North America Medical Membrane Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Medical Membrane Market Analysis, 2016-2021

- 4.2. North America Medical Membrane Market Opportunity and Forecast, 2023-2032

- 4.3. North America Medical Membrane Market Analysis, Opportunity and Forecast, By By Material, 2016-2032

- 4.3.1. North America Medical Membrane Market Analysis by By Material: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material, 2016-2032

- 4.3.3. Polysulfone (PSU) and Polyether Sulfone (PES)

- 4.3.4. Modified Acrylics

- 4.3.5. Polyethylene (PE)

- 4.3.6. Polytetrafluoroethylene (PTFE)

- 4.3.7. Polyvinylidene Fluoride (PVDF)

- 4.3.8. Others

- 4.4. North America Medical Membrane Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 4.4.1. North America Medical Membrane Market Analysis by By Technology: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 4.4.3. Microfiltration

- 4.4.4. Nanofiltration

- 4.4.5. Reverse Osmosis

- 4.4.6. Ultrafiltration

- 4.4.7. Dialysis

- 4.4.8. Gas Separation

- 4.5. North America Medical Membrane Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 4.5.1. North America Medical Membrane Market Analysis by By Application: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 4.5.3. Pharmaceutical Filtration

- 4.5.4. Drug Delivery

- 4.5.5. Hemodialysis

- 4.5.6. Bioartificial Processes

- 4.5.7. IV Infusion and Sterile Filtration

- 4.5.8. Others

- 4.6. North America Medical Membrane Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.6.1. North America Medical Membrane Market Analysis by Country : Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.6.2.1. The US

- 4.6.2.2. Canada

- 4.6.2.3. Mexico

- 5. Western Europe Medical Membrane Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Medical Membrane Market Analysis, 2016-2021

- 5.2. Western Europe Medical Membrane Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Medical Membrane Market Analysis, Opportunity and Forecast, By By Material, 2016-2032

- 5.3.1. Western Europe Medical Membrane Market Analysis by By Material: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material, 2016-2032

- 5.3.3. Polysulfone (PSU) and Polyether Sulfone (PES)

- 5.3.4. Modified Acrylics

- 5.3.5. Polyethylene (PE)

- 5.3.6. Polytetrafluoroethylene (PTFE)

- 5.3.7. Polyvinylidene Fluoride (PVDF)

- 5.3.8. Others

- 5.4. Western Europe Medical Membrane Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 5.4.1. Western Europe Medical Membrane Market Analysis by By Technology: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 5.4.3. Microfiltration

- 5.4.4. Nanofiltration

- 5.4.5. Reverse Osmosis

- 5.4.6. Ultrafiltration

- 5.4.7. Dialysis

- 5.4.8. Gas Separation

- 5.5. Western Europe Medical Membrane Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 5.5.1. Western Europe Medical Membrane Market Analysis by By Application: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 5.5.3. Pharmaceutical Filtration

- 5.5.4. Drug Delivery

- 5.5.5. Hemodialysis

- 5.5.6. Bioartificial Processes

- 5.5.7. IV Infusion and Sterile Filtration

- 5.5.8. Others

- 5.6. Western Europe Medical Membrane Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.6.1. Western Europe Medical Membrane Market Analysis by Country : Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.6.2.1. Germany

- 5.6.2.2. France

- 5.6.2.3. The UK

- 5.6.2.4. Spain

- 5.6.2.5. Italy

- 5.6.2.6. Portugal

- 5.6.2.7. Ireland

- 5.6.2.8. Austria

- 5.6.2.9. Switzerland

- 5.6.2.10. Benelux

- 5.6.2.11. Nordic

- 5.6.2.12. Rest of Western Europe

- 6. Eastern Europe Medical Membrane Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Medical Membrane Market Analysis, 2016-2021

- 6.2. Eastern Europe Medical Membrane Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Medical Membrane Market Analysis, Opportunity and Forecast, By By Material, 2016-2032

- 6.3.1. Eastern Europe Medical Membrane Market Analysis by By Material: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material, 2016-2032

- 6.3.3. Polysulfone (PSU) and Polyether Sulfone (PES)

- 6.3.4. Modified Acrylics

- 6.3.5. Polyethylene (PE)

- 6.3.6. Polytetrafluoroethylene (PTFE)

- 6.3.7. Polyvinylidene Fluoride (PVDF)

- 6.3.8. Others

- 6.4. Eastern Europe Medical Membrane Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 6.4.1. Eastern Europe Medical Membrane Market Analysis by By Technology: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 6.4.3. Microfiltration

- 6.4.4. Nanofiltration

- 6.4.5. Reverse Osmosis

- 6.4.6. Ultrafiltration

- 6.4.7. Dialysis

- 6.4.8. Gas Separation

- 6.5. Eastern Europe Medical Membrane Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 6.5.1. Eastern Europe Medical Membrane Market Analysis by By Application: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 6.5.3. Pharmaceutical Filtration

- 6.5.4. Drug Delivery

- 6.5.5. Hemodialysis

- 6.5.6. Bioartificial Processes

- 6.5.7. IV Infusion and Sterile Filtration

- 6.5.8. Others

- 6.6. Eastern Europe Medical Membrane Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.6.1. Eastern Europe Medical Membrane Market Analysis by Country : Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.6.2.1. Russia

- 6.6.2.2. Poland

- 6.6.2.3. The Czech Republic

- 6.6.2.4. Greece

- 6.6.2.5. Rest of Eastern Europe

- 7. APAC Medical Membrane Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Medical Membrane Market Analysis, 2016-2021

- 7.2. APAC Medical Membrane Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Medical Membrane Market Analysis, Opportunity and Forecast, By By Material, 2016-2032

- 7.3.1. APAC Medical Membrane Market Analysis by By Material: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material, 2016-2032

- 7.3.3. Polysulfone (PSU) and Polyether Sulfone (PES)

- 7.3.4. Modified Acrylics

- 7.3.5. Polyethylene (PE)

- 7.3.6. Polytetrafluoroethylene (PTFE)

- 7.3.7. Polyvinylidene Fluoride (PVDF)

- 7.3.8. Others

- 7.4. APAC Medical Membrane Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 7.4.1. APAC Medical Membrane Market Analysis by By Technology: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 7.4.3. Microfiltration

- 7.4.4. Nanofiltration

- 7.4.5. Reverse Osmosis

- 7.4.6. Ultrafiltration

- 7.4.7. Dialysis

- 7.4.8. Gas Separation

- 7.5. APAC Medical Membrane Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 7.5.1. APAC Medical Membrane Market Analysis by By Application: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 7.5.3. Pharmaceutical Filtration

- 7.5.4. Drug Delivery

- 7.5.5. Hemodialysis

- 7.5.6. Bioartificial Processes

- 7.5.7. IV Infusion and Sterile Filtration

- 7.5.8. Others

- 7.6. APAC Medical Membrane Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.6.1. APAC Medical Membrane Market Analysis by Country : Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.6.2.1. China

- 7.6.2.2. Japan

- 7.6.2.3. South Korea

- 7.6.2.4. India

- 7.6.2.5. Australia & New Zeland

- 7.6.2.6. Indonesia

- 7.6.2.7. Malaysia

- 7.6.2.8. Philippines

- 7.6.2.9. Singapore

- 7.6.2.10. Thailand

- 7.6.2.11. Vietnam

- 7.6.2.12. Rest of APAC

- 8. Latin America Medical Membrane Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Medical Membrane Market Analysis, 2016-2021

- 8.2. Latin America Medical Membrane Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Medical Membrane Market Analysis, Opportunity and Forecast, By By Material, 2016-2032

- 8.3.1. Latin America Medical Membrane Market Analysis by By Material: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material, 2016-2032

- 8.3.3. Polysulfone (PSU) and Polyether Sulfone (PES)

- 8.3.4. Modified Acrylics

- 8.3.5. Polyethylene (PE)

- 8.3.6. Polytetrafluoroethylene (PTFE)

- 8.3.7. Polyvinylidene Fluoride (PVDF)

- 8.3.8. Others

- 8.4. Latin America Medical Membrane Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 8.4.1. Latin America Medical Membrane Market Analysis by By Technology: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 8.4.3. Microfiltration

- 8.4.4. Nanofiltration

- 8.4.5. Reverse Osmosis

- 8.4.6. Ultrafiltration

- 8.4.7. Dialysis

- 8.4.8. Gas Separation

- 8.5. Latin America Medical Membrane Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 8.5.1. Latin America Medical Membrane Market Analysis by By Application: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 8.5.3. Pharmaceutical Filtration

- 8.5.4. Drug Delivery

- 8.5.5. Hemodialysis

- 8.5.6. Bioartificial Processes

- 8.5.7. IV Infusion and Sterile Filtration

- 8.5.8. Others

- 8.6. Latin America Medical Membrane Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.6.1. Latin America Medical Membrane Market Analysis by Country : Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.6.2.1. Brazil

- 8.6.2.2. Colombia

- 8.6.2.3. Chile

- 8.6.2.4. Argentina

- 8.6.2.5. Costa Rica

- 8.6.2.6. Rest of Latin America

- 9. Middle East & Africa Medical Membrane Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Medical Membrane Market Analysis, 2016-2021

- 9.2. Middle East & Africa Medical Membrane Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Medical Membrane Market Analysis, Opportunity and Forecast, By By Material, 2016-2032

- 9.3.1. Middle East & Africa Medical Membrane Market Analysis by By Material: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Material, 2016-2032

- 9.3.3. Polysulfone (PSU) and Polyether Sulfone (PES)

- 9.3.4. Modified Acrylics

- 9.3.5. Polyethylene (PE)

- 9.3.6. Polytetrafluoroethylene (PTFE)

- 9.3.7. Polyvinylidene Fluoride (PVDF)

- 9.3.8. Others

- 9.4. Middle East & Africa Medical Membrane Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 9.4.1. Middle East & Africa Medical Membrane Market Analysis by By Technology: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 9.4.3. Microfiltration

- 9.4.4. Nanofiltration

- 9.4.5. Reverse Osmosis

- 9.4.6. Ultrafiltration

- 9.4.7. Dialysis

- 9.4.8. Gas Separation

- 9.5. Middle East & Africa Medical Membrane Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 9.5.1. Middle East & Africa Medical Membrane Market Analysis by By Application: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 9.5.3. Pharmaceutical Filtration

- 9.5.4. Drug Delivery

- 9.5.5. Hemodialysis

- 9.5.6. Bioartificial Processes

- 9.5.7. IV Infusion and Sterile Filtration

- 9.5.8. Others

- 9.6. Middle East & Africa Medical Membrane Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.6.1. Middle East & Africa Medical Membrane Market Analysis by Country : Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.6.2.1. Algeria

- 9.6.2.2. Egypt

- 9.6.2.3. Israel

- 9.6.2.4. Kuwait

- 9.6.2.5. Nigeria

- 9.6.2.6. Saudi Arabia

- 9.6.2.7. South Africa

- 9.6.2.8. Turkey

- 9.6.2.9. The UAE

- 9.6.2.10. Rest of MEA

- 10. Global Medical Membrane Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Medical Membrane Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Medical Membrane Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. 3M Company

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. W. L. Gore & Associates, Inc.

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Asahi Kasei Corporation

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Hangzhou Cobetter Filtration Equipment Co., Ltd.

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Johnson & Johnson Services, Inc.

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Amniox Medical, Inc.

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Nipro Corporation

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Amifrox Medical, Inc.

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Medtronic plc

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Sartorius AG

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. Merck KGaA

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. Pall Corporation

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 11.16. B. Braun Melsungen AG

- 11.16.1. Company Overview

- 11.16.2. Financial Highlights

- 11.16.3. Product Portfolio

- 11.16.4. SWOT Analysis

- 11.16.5. Key Strategies and Developments

- 11.17. Hoffmann-La Roche Ltd

- 11.17.1. Company Overview

- 11.17.2. Financial Highlights

- 11.17.3. Product Portfolio

- 11.17.4. SWOT Analysis

- 11.17.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- 1. Executive Summary

-

- 3M Company

- W. L. Gore & Associates, Inc.

- Asahi Kasei Corporation

- Hangzhou Cobetter Filtration Equipment Co., Ltd.

- Johnson & Johnson Services, Inc.

- Amniox Medical, Inc.

- Nipro Corporation

- Amifrox Medical, Inc.

- Medtronic plc

- Sartorius AG

- Merck KGaA

- Mann+Hummel GmbH

- Pall Corporation

- B. Braun Melsungen AG

- Hoffmann-La Roche Ltd