Kidney Fibrosis Treatment Market By Treatment Type (Angiotensin-converting enzyme (ACE) inhibitors, Angiotensin II receptor blockers (ARBs), Pirfenidone, Renin Inhibitors, Vasopeptidase Inhibitors, Others), By Diagnosis (Blood tests, Urine tests, Imaging tests, Kidney biopsy), By End-User (Clinics, Research Center, Hospitals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

48547

-

July 2024

-

136

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

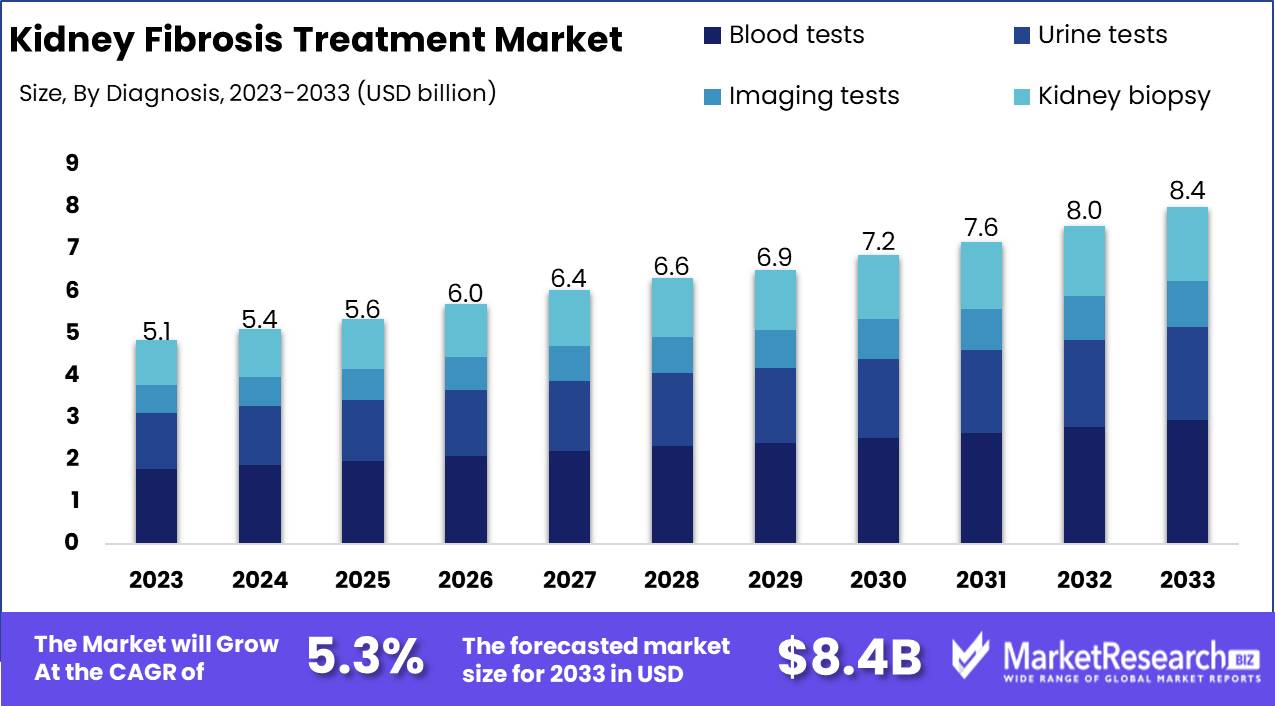

The Global Kidney Fibrosis Treatment Market was valued at USD 5.1 Bn in 2023. It is expected to reach USD 8.4 Bn by 2033, with a CAGR of 5.3% during the forecast period from 2024 to 2033.

The Kidney Fibrosis Treatment Market comprises therapies and interventions aimed at addressing kidney fibrosis, a condition characterized by the scarring and stiffening of kidney tissues. This market includes a range of pharmaceuticals, biologics, and emerging therapies designed to halt or reverse the progression of fibrosis, improve kidney function, and enhance patient outcomes. Innovations in this market are driven by a growing understanding of the molecular pathways involved in fibrosis, leading to targeted treatments. As chronic kidney disease prevalence rises globally, the demand for effective kidney fibrosis treatments is increasing, highlighting the market's significant growth potential and critical importance in nephrology care.

The Kidney Fibrosis Treatment Market is experiencing significant advancements as the understanding of fibrotic mechanisms and therapeutic approaches evolves. Chronic kidney disease (CKD), often progressing to kidney fibrosis, poses a substantial healthcare burden globally, thereby amplifying the need for innovative treatments. Recent developments, such as CRISPR/Cas9 gene editing, have shown potential in restoring wild-type podocin gene expression and treating genetic kidney diseases like steroid-resistant nephrotic syndrome (SRNS). This breakthrough highlights the market's trajectory towards personalized medicine and targeted therapies.

The Kidney Fibrosis Treatment Market is experiencing significant advancements as the understanding of fibrotic mechanisms and therapeutic approaches evolves. Chronic kidney disease (CKD), often progressing to kidney fibrosis, poses a substantial healthcare burden globally, thereby amplifying the need for innovative treatments. Recent developments, such as CRISPR/Cas9 gene editing, have shown potential in restoring wild-type podocin gene expression and treating genetic kidney diseases like steroid-resistant nephrotic syndrome (SRNS). This breakthrough highlights the market's trajectory towards personalized medicine and targeted therapies.The emergence of novel pharmacological interventions like BT173, an oral drug targeting the TGF-β1/Smad3 pathway, has demonstrated efficacy in reducing kidney fibrosis in preclinical models. This underscores the critical role of molecularly targeted therapies in addressing the complex pathophysiology of kidney fibrosis. The integration of such cutting-edge technologies and drugs is expected to drive the market forward, offering promising avenues for effective treatment and improved patient outcomes.

The growing prevalence of CKD, driven by factors such as aging populations, diabetes, and hypertension, necessitates advanced therapeutic solutions. The Kidney Fibrosis Treatment Market is thus poised for robust growth, supported by a strong pipeline of innovative therapies and increased investment in research and development.

Key Takeaways

- Market Value: The Global Kidney Fibrosis Treatment Market was valued at USD 5.1 Bn in 2023. It is expected to reach USD 8.4 Bn by 2033, with a CAGR of 5.3% during the forecast period from 2024 to 2033.

- By Treatment Type: Angiotensin-converting enzyme (ACE) inhibitors dominate the treatment market with a 30% share due to their efficacy in managing kidney fibrosis.

- By Diagnosis: Blood tests lead the diagnostic market, holding a 35% share, as they are essential for early and accurate detection of kidney fibrosis.

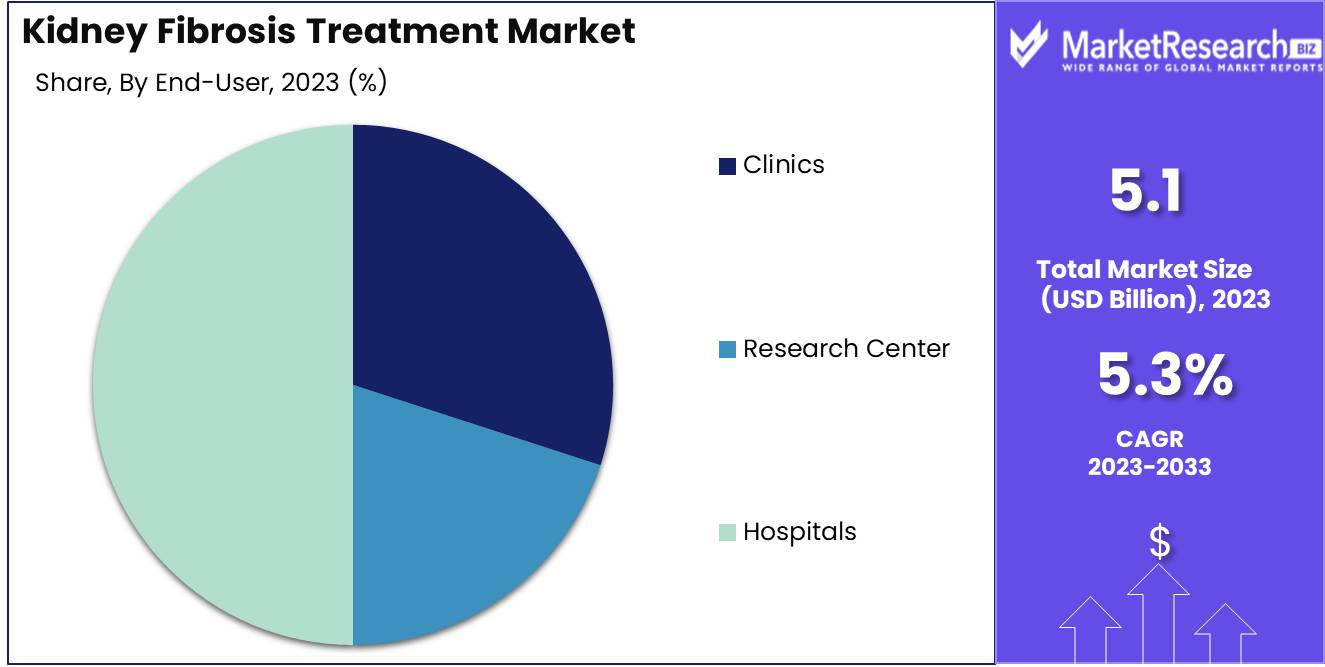

- By End-User: Hospitals are the primary end-users, making up 50% of the market, driven by their capability to provide comprehensive kidney fibrosis treatment.

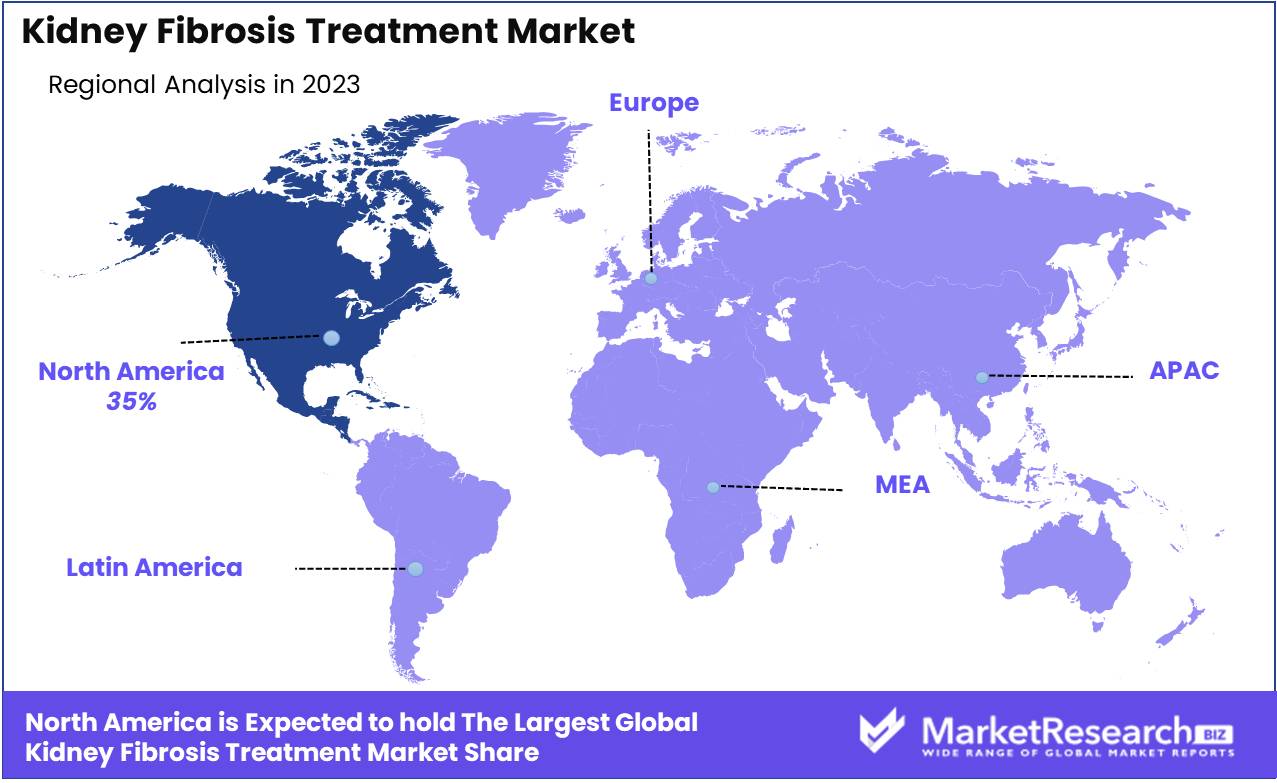

- Regional Dominance: North America dominates the Kidney Fibrosis Treatment Market with a 35% share, attributed to advanced healthcare infrastructure and higher prevalence of kidney diseases.

- Growth Opportunity: The development of novel therapies targeting kidney fibrosis mechanisms and the increasing prevalence of chronic kidney diseases present significant growth opportunities in the KF treatment market.

Driving factors

Increasing Prevalence of Chronic Kidney Diseases Driving Market Demand

The escalating prevalence of chronic kidney diseases (CKD) is a primary driver of growth in the Kidney Fibrosis Treatment Market. As the global population ages and lifestyle-related risk factors such as diabetes and hypertension become more widespread, the incidence of CKD continues to rise. This increase in CKD cases directly correlates with a heightened need for effective kidney fibrosis treatments.

Patients suffering from CKD are at significant risk of developing kidney fibrosis, a condition characterized by the progressive scarring of kidney tissue, which can ultimately lead to renal failure if untreated. The growing patient pool necessitates the development and deployment of advanced therapeutic options, propelling the market forward.

Advancements in Diagnostic Techniques Enhancing Treatment Efficacy

Technological advancements in diagnostic techniques are significantly contributing to the growth of the Kidney Fibrosis Treatment Market. Innovations in imaging technologies, biomarkers, and genetic testing have vastly improved the accuracy and efficiency of diagnosing kidney fibrosis. For instance, the use of advanced imaging modalities such as MRI and ultrasound elastography allows for non-invasive, precise detection and monitoring of fibrotic changes in the kidney.

The identification of novel biomarkers has facilitated early and more accurate diagnosis, enabling timely intervention and better management of the disease. These advancements not only enhance the efficacy of existing treatments but also drive the development of new therapeutic approaches, expanding the market.

Early Diagnosis and Treatment Leading to Better Outcomes

The emphasis on early diagnosis and treatment is another crucial factor driving the Kidney Fibrosis Treatment Market. Early detection of kidney fibrosis is essential for preventing the progression to end stage renal disease (ESRD). With the availability of improved diagnostic tools, healthcare providers can identify kidney fibrosis at earlier stages, allowing for prompt and more effective treatment interventions.

Early treatment can significantly slow disease progression, reduce complications, and improve the quality of life for patients. This proactive approach is supported by various health initiatives and screening programs aimed at increasing awareness and early detection of CKD and kidney fibrosis. Consequently, the demand for early-stage treatments and therapeutic solutions is on the rise, fostering market growth.

Restraining Factors

High Cost of Treatment as a Market Constraint

The high cost of treatment is a significant barrier to the growth of the Kidney Fibrosis Treatment Market. Advanced therapeutic options for kidney fibrosis, including novel drugs and biologics, often come with substantial price tags. These costs can be prohibitive for patients, especially in regions with limited healthcare funding or where out-of-pocket expenses are high. Furthermore, the financial burden of long-term treatment for chronic conditions like kidney fibrosis can be overwhelming for many patients.

High treatment costs also pose challenges for healthcare systems and insurers, potentially limiting the accessibility and adoption of these advanced therapies. Addressing this issue is crucial for expanding the market reach and ensuring that effective treatments are accessible to a broader patient population.

Limited Availability of Effective Therapies Hindering Market Growth

The limited availability of effective therapies is another critical challenge facing the Kidney Fibrosis Treatment Market. Despite advancements in research, the therapeutic options currently available are still relatively few and often only moderately effective in slowing the progression of kidney fibrosis. Many existing treatments primarily focus on managing symptoms rather than halting or reversing the underlying fibrotic processes.

This lack of curative therapies means that there is a substantial unmet need within the market. The development pipeline for kidney fibrosis treatments is active, but translating promising research into approved and widely available treatments takes time. Consequently, the current scarcity of highly effective therapies continues to constrain market growth.

By Treatment Type Analysis

ACE inhibitors held 30% of the Kidney Fibrosis Treatment Market by treatment type.

In 2023, Angiotensin-converting enzyme (ACE) inhibitors held a dominant market position in the By Treatment Type segment of the Kidney Fibrosis Treatment Market, capturing more than a 30% share. This leading position reflects the widespread clinical acceptance and efficacy of ACE inhibitors in managing kidney fibrosis, a condition characterized by the progressive scarring of kidney tissue leading to chronic kidney disease (CKD).

ACE Inhibitors are extensively used due to their proven effectiveness in reducing proteinuria, slowing the progression of renal damage, and improving overall renal function. They work by inhibiting the enzyme responsible for converting angiotensin I to angiotensin II, a potent vasoconstrictor that contributes to kidney damage.

Angiotensin II Receptor Blockers (ARBs) are another significant segment within the kidney fibrosis treatment market. While ARBs also target the renin-angiotensin system, they do so by blocking the receptors for angiotensin II, offering an alternative for patients who may not tolerate ACE inhibitors.

Pirfenidone, an antifibrotic agent, is gaining attention for its direct action on fibrotic processes. It has shown promise in clinical trials for reducing fibrosis and inflammation in kidney tissues, representing a growing segment as research continues to validate its benefits.

Renin Inhibitors target the initial step of the renin-angiotensin-aldosterone system, offering another pathway to mitigate kidney damage. While currently less prominent than ACE inhibitors or ARBs, renin inhibitors are an emerging treatment with potential for significant market growth.

Vasopeptidase Inhibitors, which combine the inhibition of neutral endopeptidase and ACE, offer a dual mechanism of action to combat kidney fibrosis. Despite being a smaller market segment, these inhibitors are recognized for their potential to provide comprehensive treatment benefits by addressing multiple pathways involved in fibrosis.

Others, including various investigational and adjunct therapies, constitute a smaller share of the market. This category includes novel treatments and combination therapies under development, reflecting the ongoing innovation in kidney fibrosis treatment.

By Diagnosis Analysis

Blood tests captured 35% of the Kidney Fibrosis Treatment Market by diagnosis.

In 2023, Blood tests held a dominant market position in the By Diagnosis segment of the Kidney Fibrosis Treatment Market, capturing more than a 35% share. This leading position underscores the central role of blood tests in the early detection, monitoring, and management of kidney fibrosis, a condition marked by the gradual scarring and deterioration of kidney function. Blood tests are pivotal in diagnosing kidney fibrosis as they provide critical information on kidney function through markers such as serum creatinine and estimated glomerular filtration rate (eGFR).

Urine tests are also essential in diagnosing kidney fibrosis, detecting proteinuria, and other abnormalities that indicate kidney damage. While they hold a smaller market share compared to blood tests, urine tests are crucial for a comprehensive assessment of kidney function and are often used in conjunction with blood tests to provide a more complete diagnostic picture.

Imaging tests, such as ultrasound, CT scans, and MRI, play a significant role in diagnosing and assessing the extent of kidney fibrosis. These tests provide detailed visuals of kidney structure and any physical abnormalities or scarring. Although imaging tests are more costly and less frequently performed than blood tests, they are invaluable for confirming a diagnosis and evaluating the progression of fibrosis.

Kidney biopsy remains the gold standard for diagnosing kidney fibrosis, offering direct examination of kidney tissue to assess the extent and nature of the fibrosis. Despite being invasive and carrying some risk, kidney biopsies are crucial for definitive diagnosis and guiding treatment plans. However, due to their invasive nature, they represent a smaller share of the diagnostic market.

By End-User Analysis

Hospitals dominated the Kidney Fibrosis Treatment Market by end-user with a 50% share.

In 2023, Hospitals held a dominant market position in the By End-User segment of the Kidney Fibrosis Treatment Market, capturing more than a 50% share. This significant market share underscores the critical role hospitals play in the diagnosis, treatment, and management of kidney fibrosis, a chronic condition characterized by the progressive scarring of kidney tissue. Hospitals are the primary centers for comprehensive kidney care, equipped with advanced diagnostic tools, specialized medical professionals, and the capacity for complex treatments.

Clinics, while holding a smaller market share compared to hospitals, are essential in providing accessible and routine care for kidney fibrosis patients. Clinics often serve as the first point of contact for patients, offering initial screenings, regular monitoring, and management of less severe cases of kidney fibrosis. They play a critical role in early detection and ongoing patient management, referring more complex cases to hospitals when necessary.

Research Centers are pivotal in advancing the understanding and treatment of kidney fibrosis through cutting-edge research and clinical trials. These centers are involved in discovering new biomarkers for early diagnosis, developing novel therapeutic approaches, and testing the efficacy of new treatments.

Key Market Segments

By Treatment Type

- Angiotensin-converting enzyme (ACE) inhibitors

- Angiotensin II receptor blockers (ARBs)

- Pirfenidone

- Renin Inhibitors

- Vasopeptidase Inhibitors

- Others

By Diagnosis

- Blood tests

- Urine tests

- Imaging tests

- Kidney biopsy

By End-User

- Clinics

- Research Center

- Hospitals

Growth Opportunity

Development of Novel Therapeutics Driving Market Expansion

The development of novel therapeutics represents a significant opportunity for growth in the Kidney Fibrosis Treatment Market in 2024. Advances in biotechnology and a deeper understanding of the molecular mechanisms underlying kidney fibrosis are leading to the creation of innovative drugs that target the disease more effectively. These new therapies aim to not only slow the progression of fibrosis but also potentially reverse the damage.

Several promising candidates are currently in clinical trials, and their successful approval and commercialization could revolutionize treatment paradigms. The introduction of these novel therapeutics is expected to meet the unmet medical needs of patients, thereby expanding the market significantly.

Expansion in Emerging Markets Fueling Growth

The expansion of the Kidney Fibrosis Treatment Market into emerging markets is another critical growth opportunity for 2024. Countries in Asia-Pacific, Latin America, and Africa are witnessing rising incidences of chronic kidney diseases, driven by increasing prevalence of diabetes and hypertension. However, these regions have historically had limited access to advanced healthcare solutions. As healthcare infrastructure improves and economic conditions strengthen, there is a growing demand for effective kidney fibrosis treatments.

Pharmaceutical companies are increasingly focusing on these markets, leveraging strategies such as affordable pricing, localized production, and strategic partnerships to enhance accessibility. This expansion not only broadens the market base but also drives overall growth by tapping into previously underserved populations.

Latest Trends

Biomarkers for Early Detection Enhancing Treatment Outcomes

The utilization of biomarkers for early detection is emerging as a pivotal trend in the Kidney Fibrosis Treatment Market for 2024. Biomarkers, which are measurable indicators of the severity or presence of a disease, offer significant advantages in diagnosing kidney fibrosis at earlier stages. Early detection through biomarkers enables timely intervention, which can slow the progression of fibrosis and improve patient outcomes.

Innovations in genetic, protein, and metabolic biomarkers are facilitating more precise and non-invasive diagnostic methods. This trend is expected to drive demand for diagnostic tools and early-stage treatments, ultimately enhancing the efficacy of therapeutic strategies and reducing the long-term burden of the disease.

Increasing Investment in R&D Fueling Market Innovation

Another critical trend in 2024 is the increasing investment in research and development (R&D) within the Kidney Fibrosis Treatment Market. Pharmaceutical companies and biotech firms are dedicating substantial resources to the discovery and development of new treatments. This surge in R&D investment is driven by the high unmet medical need and the potential for significant market returns. The focus areas include not only novel therapeutic agents but also advanced diagnostic technologies and personalized medicine approaches.

These investments are expected to yield breakthrough treatments and improve the overall standard of care for patients with kidney fibrosis. The heightened R&D activity also fosters collaborations between industry, academia, and healthcare providers, accelerating the translation of scientific discoveries into clinical applications.

Regional Analysis

North America's dominance at 35% reflects its advanced healthcare ecosystem, significant research investments, and high disease prevalence.The Kidney Fibrosis Treatment market displays distinct regional variations, driven by differences in healthcare infrastructure, prevalence of kidney diseases, and investment in medical research. North America leads the global market with a 35% share, driven by a high incidence of chronic kidney diseases and substantial investments in healthcare R&D. The presence of advanced medical facilities, coupled with significant funding for biotechnology and pharmaceutical companies, supports the development and adoption of innovative fibrosis treatments in the United States and Canada.

In Europe, the market is strengthened by a robust healthcare system and substantial government funding for medical research. Countries such as Germany, France, and the UK are prominent players, with increasing prevalence of kidney-related ailments due to an aging population and lifestyle diseases. Additionally, regulatory frameworks like the European Medicines Agency (EMA) facilitate the approval and market entry of new treatments.

The Asia Pacific region is witnessing rapid growth, fueled by rising healthcare expenditures and increasing awareness about kidney health. Countries like China, Japan, and India are at the forefront, driven by a high burden of chronic kidney diseases and expanding healthcare infrastructure. Government initiatives and growing investments in healthcare innovation further stimulate market growth in this region.

In the Middle East & Africa, the market is expanding gradually, with countries like Saudi Arabia, UAE, and South Africa making significant strides. Improvements in healthcare infrastructure and rising investments in medical research are pivotal, along with growing incidences of kidney diseases linked to diabetes and hypertension, prevalent in this region.

Latin America shows a steady increase in market growth, with Brazil and Mexico as key contributors. The rising burden of chronic kidney diseases, coupled with improving healthcare services and increasing government initiatives for better disease management, drives the market forward.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global Kidney Fibrosis Treatment market is anticipated to experience robust growth driven by advancements in medical research and an increasing prevalence of chronic kidney diseases. Leading the charge are key players such as La Jolla Pharmaceutical Company, BioLine Rx Ltd, and Galectin Therapeutics, who are at the forefront of developing novel therapies aimed at halting or reversing fibrosis progression. La Jolla Pharmaceutical Company’s focus on innovative therapeutic approaches positions it as a significant player, while BioLine Rx Ltd leverages its extensive pipeline of investigational drugs to address unmet medical needs in kidney fibrosis.

Merck & Co. and Pfizer continue to play pivotal roles, with their vast resources and extensive research capabilities driving the development of effective treatment options. Merck & Co.'s commitment to expanding its portfolio of renal disease treatments aligns well with the growing market demands. Similarly, Pfizer’s strong research background and global reach enable it to make substantial contributions to advancing kidney fibrosis treatments.

InterMune and F. Hoffmann-La Roche Ltd. (Roche) are key players due to their focus on targeted therapies and biologics that offer promising results in clinical trials. Roche’s leadership in biotechnology and its strategic investments in renal research highlight its significant market presence. ProMetic Life-Sciences Inc. and Teva Pharmaceuticals contribute with their focus on innovative drug development and large-scale production capabilities, respectively, catering to the growing demand for kidney fibrosis treatments.

Genzyme Corporation, a subsidiary of Sanofi, and Roche, with their specialized expertise in rare diseases and biologics, are poised to make substantial impacts on the market. Their continued focus on research and development, coupled with strategic collaborations, positions them as crucial players in the fight against kidney fibrosis.

Market Key Players

- La Jolla Pharmaceutical Company

- BioLine Rx Ltd

- Galectin Therapeutics

- Merck & Co.

- InterMune

- Pfizer

- F. Hoffman-La Roche Ltd.

- ProMetic Life-Sciences Inc.

- Teva Pharmaceuticals

- Roche

- Genzyme Corporation

Recent Development

- In June 2024, FibroGen initiated a Phase 3 clinical trial for a new antifibrotic drug aimed at treating kidney fibrosis, promising improved patient outcomes.

- In May 2024, Galapagos NV announced positive results from a Phase 2 trial of their novel therapy, showing significant reduction in kidney fibrosis progression.

Report Scope

Report Features Description Market Value (2023) USD 5.1 Bn Forecast Revenue (2033) USD 8.4 Bn CAGR (2024-2033) 5.3% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Treatment Type (Angiotensin-converting enzyme (ACE) inhibitors, Angiotensin II receptor blockers (ARBs), Pirfenidone, Renin Inhibitors, Vasopeptidase Inhibitors, Others), By Diagnosis (Blood tests, Urine tests, Imaging tests, Kidney biopsy), By End-User (Clinics, Research Center, Hospitals) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape La Jolla Pharmaceutical Company, BioLine Rx Ltd, Galectin Therapeutics, Merck & Co., InterMune, Pfizer, F. Hoffman-La Roche Ltd., ProMetic Life-Sciences Inc., Teva Pharmaceuticals, Roche, Genzyme Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Kidney Fibrosis Treatment Market Overview

- 2.1. Kidney Fibrosis Treatment Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Kidney Fibrosis Treatment Market Dynamics

- 3. Global Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Kidney Fibrosis Treatment Market Analysis, 2016-2021

- 3.2. Global Kidney Fibrosis Treatment Market Opportunity and Forecast, 2023-2032

- 3.3. Global Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, By By Treatment Type, 2016-2032

- 3.3.1. Global Kidney Fibrosis Treatment Market Analysis by By Treatment Type: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Treatment Type, 2016-2032

- 3.3.3. Angiotensin-converting enzyme (ACE) inhibitors

- 3.3.4. Angiotensin II receptor blockers (ARBs)

- 3.3.5. Pirfenidone

- 3.3.6. Renin Inhibitors

- 3.3.7. Vasopeptidase Inhibitors

- 3.3.8. Others

- 3.4. Global Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, By By Diagnosis, 2016-2032

- 3.4.1. Global Kidney Fibrosis Treatment Market Analysis by By Diagnosis: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Diagnosis, 2016-2032

- 3.4.3. Blood tests

- 3.4.4. Urine tests

- 3.4.5. Imaging tests

- 3.4.6. Kidney biopsy

- 3.5. Global Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, By By End-User, 2016-2032

- 3.5.1. Global Kidney Fibrosis Treatment Market Analysis by By End-User: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User, 2016-2032

- 3.5.3. Clinics

- 3.5.4. Research Center

- 3.5.5. Hospitals

- 4. North America Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Kidney Fibrosis Treatment Market Analysis, 2016-2021

- 4.2. North America Kidney Fibrosis Treatment Market Opportunity and Forecast, 2023-2032

- 4.3. North America Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, By By Treatment Type, 2016-2032

- 4.3.1. North America Kidney Fibrosis Treatment Market Analysis by By Treatment Type: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Treatment Type, 2016-2032

- 4.3.3. Angiotensin-converting enzyme (ACE) inhibitors

- 4.3.4. Angiotensin II receptor blockers (ARBs)

- 4.3.5. Pirfenidone

- 4.3.6. Renin Inhibitors

- 4.3.7. Vasopeptidase Inhibitors

- 4.3.8. Others

- 4.4. North America Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, By By Diagnosis, 2016-2032

- 4.4.1. North America Kidney Fibrosis Treatment Market Analysis by By Diagnosis: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Diagnosis, 2016-2032

- 4.4.3. Blood tests

- 4.4.4. Urine tests

- 4.4.5. Imaging tests

- 4.4.6. Kidney biopsy

- 4.5. North America Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, By By End-User, 2016-2032

- 4.5.1. North America Kidney Fibrosis Treatment Market Analysis by By End-User: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User, 2016-2032

- 4.5.3. Clinics

- 4.5.4. Research Center

- 4.5.5. Hospitals

- 4.6. North America Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.6.1. North America Kidney Fibrosis Treatment Market Analysis by Country : Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.6.2.1. The US

- 4.6.2.2. Canada

- 4.6.2.3. Mexico

- 5. Western Europe Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Kidney Fibrosis Treatment Market Analysis, 2016-2021

- 5.2. Western Europe Kidney Fibrosis Treatment Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, By By Treatment Type, 2016-2032

- 5.3.1. Western Europe Kidney Fibrosis Treatment Market Analysis by By Treatment Type: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Treatment Type, 2016-2032

- 5.3.3. Angiotensin-converting enzyme (ACE) inhibitors

- 5.3.4. Angiotensin II receptor blockers (ARBs)

- 5.3.5. Pirfenidone

- 5.3.6. Renin Inhibitors

- 5.3.7. Vasopeptidase Inhibitors

- 5.3.8. Others

- 5.4. Western Europe Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, By By Diagnosis, 2016-2032

- 5.4.1. Western Europe Kidney Fibrosis Treatment Market Analysis by By Diagnosis: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Diagnosis, 2016-2032

- 5.4.3. Blood tests

- 5.4.4. Urine tests

- 5.4.5. Imaging tests

- 5.4.6. Kidney biopsy

- 5.5. Western Europe Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, By By End-User, 2016-2032

- 5.5.1. Western Europe Kidney Fibrosis Treatment Market Analysis by By End-User: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User, 2016-2032

- 5.5.3. Clinics

- 5.5.4. Research Center

- 5.5.5. Hospitals

- 5.6. Western Europe Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.6.1. Western Europe Kidney Fibrosis Treatment Market Analysis by Country : Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.6.2.1. Germany

- 5.6.2.2. France

- 5.6.2.3. The UK

- 5.6.2.4. Spain

- 5.6.2.5. Italy

- 5.6.2.6. Portugal

- 5.6.2.7. Ireland

- 5.6.2.8. Austria

- 5.6.2.9. Switzerland

- 5.6.2.10. Benelux

- 5.6.2.11. Nordic

- 5.6.2.12. Rest of Western Europe

- 6. Eastern Europe Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Kidney Fibrosis Treatment Market Analysis, 2016-2021

- 6.2. Eastern Europe Kidney Fibrosis Treatment Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, By By Treatment Type, 2016-2032

- 6.3.1. Eastern Europe Kidney Fibrosis Treatment Market Analysis by By Treatment Type: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Treatment Type, 2016-2032

- 6.3.3. Angiotensin-converting enzyme (ACE) inhibitors

- 6.3.4. Angiotensin II receptor blockers (ARBs)

- 6.3.5. Pirfenidone

- 6.3.6. Renin Inhibitors

- 6.3.7. Vasopeptidase Inhibitors

- 6.3.8. Others

- 6.4. Eastern Europe Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, By By Diagnosis, 2016-2032

- 6.4.1. Eastern Europe Kidney Fibrosis Treatment Market Analysis by By Diagnosis: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Diagnosis, 2016-2032

- 6.4.3. Blood tests

- 6.4.4. Urine tests

- 6.4.5. Imaging tests

- 6.4.6. Kidney biopsy

- 6.5. Eastern Europe Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, By By End-User, 2016-2032

- 6.5.1. Eastern Europe Kidney Fibrosis Treatment Market Analysis by By End-User: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User, 2016-2032

- 6.5.3. Clinics

- 6.5.4. Research Center

- 6.5.5. Hospitals

- 6.6. Eastern Europe Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.6.1. Eastern Europe Kidney Fibrosis Treatment Market Analysis by Country : Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.6.2.1. Russia

- 6.6.2.2. Poland

- 6.6.2.3. The Czech Republic

- 6.6.2.4. Greece

- 6.6.2.5. Rest of Eastern Europe

- 7. APAC Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Kidney Fibrosis Treatment Market Analysis, 2016-2021

- 7.2. APAC Kidney Fibrosis Treatment Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, By By Treatment Type, 2016-2032

- 7.3.1. APAC Kidney Fibrosis Treatment Market Analysis by By Treatment Type: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Treatment Type, 2016-2032

- 7.3.3. Angiotensin-converting enzyme (ACE) inhibitors

- 7.3.4. Angiotensin II receptor blockers (ARBs)

- 7.3.5. Pirfenidone

- 7.3.6. Renin Inhibitors

- 7.3.7. Vasopeptidase Inhibitors

- 7.3.8. Others

- 7.4. APAC Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, By By Diagnosis, 2016-2032

- 7.4.1. APAC Kidney Fibrosis Treatment Market Analysis by By Diagnosis: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Diagnosis, 2016-2032

- 7.4.3. Blood tests

- 7.4.4. Urine tests

- 7.4.5. Imaging tests

- 7.4.6. Kidney biopsy

- 7.5. APAC Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, By By End-User, 2016-2032

- 7.5.1. APAC Kidney Fibrosis Treatment Market Analysis by By End-User: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User, 2016-2032

- 7.5.3. Clinics

- 7.5.4. Research Center

- 7.5.5. Hospitals

- 7.6. APAC Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.6.1. APAC Kidney Fibrosis Treatment Market Analysis by Country : Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.6.2.1. China

- 7.6.2.2. Japan

- 7.6.2.3. South Korea

- 7.6.2.4. India

- 7.6.2.5. Australia & New Zeland

- 7.6.2.6. Indonesia

- 7.6.2.7. Malaysia

- 7.6.2.8. Philippines

- 7.6.2.9. Singapore

- 7.6.2.10. Thailand

- 7.6.2.11. Vietnam

- 7.6.2.12. Rest of APAC

- 8. Latin America Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Kidney Fibrosis Treatment Market Analysis, 2016-2021

- 8.2. Latin America Kidney Fibrosis Treatment Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, By By Treatment Type, 2016-2032

- 8.3.1. Latin America Kidney Fibrosis Treatment Market Analysis by By Treatment Type: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Treatment Type, 2016-2032

- 8.3.3. Angiotensin-converting enzyme (ACE) inhibitors

- 8.3.4. Angiotensin II receptor blockers (ARBs)

- 8.3.5. Pirfenidone

- 8.3.6. Renin Inhibitors

- 8.3.7. Vasopeptidase Inhibitors

- 8.3.8. Others

- 8.4. Latin America Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, By By Diagnosis, 2016-2032

- 8.4.1. Latin America Kidney Fibrosis Treatment Market Analysis by By Diagnosis: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Diagnosis, 2016-2032

- 8.4.3. Blood tests

- 8.4.4. Urine tests

- 8.4.5. Imaging tests

- 8.4.6. Kidney biopsy

- 8.5. Latin America Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, By By End-User, 2016-2032

- 8.5.1. Latin America Kidney Fibrosis Treatment Market Analysis by By End-User: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User, 2016-2032

- 8.5.3. Clinics

- 8.5.4. Research Center

- 8.5.5. Hospitals

- 8.6. Latin America Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.6.1. Latin America Kidney Fibrosis Treatment Market Analysis by Country : Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.6.2.1. Brazil

- 8.6.2.2. Colombia

- 8.6.2.3. Chile

- 8.6.2.4. Argentina

- 8.6.2.5. Costa Rica

- 8.6.2.6. Rest of Latin America

- 9. Middle East & Africa Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Kidney Fibrosis Treatment Market Analysis, 2016-2021

- 9.2. Middle East & Africa Kidney Fibrosis Treatment Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, By By Treatment Type, 2016-2032

- 9.3.1. Middle East & Africa Kidney Fibrosis Treatment Market Analysis by By Treatment Type: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Treatment Type, 2016-2032

- 9.3.3. Angiotensin-converting enzyme (ACE) inhibitors

- 9.3.4. Angiotensin II receptor blockers (ARBs)

- 9.3.5. Pirfenidone

- 9.3.6. Renin Inhibitors

- 9.3.7. Vasopeptidase Inhibitors

- 9.3.8. Others

- 9.4. Middle East & Africa Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, By By Diagnosis, 2016-2032

- 9.4.1. Middle East & Africa Kidney Fibrosis Treatment Market Analysis by By Diagnosis: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Diagnosis, 2016-2032

- 9.4.3. Blood tests

- 9.4.4. Urine tests

- 9.4.5. Imaging tests

- 9.4.6. Kidney biopsy

- 9.5. Middle East & Africa Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, By By End-User, 2016-2032

- 9.5.1. Middle East & Africa Kidney Fibrosis Treatment Market Analysis by By End-User: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User, 2016-2032

- 9.5.3. Clinics

- 9.5.4. Research Center

- 9.5.5. Hospitals

- 9.6. Middle East & Africa Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.6.1. Middle East & Africa Kidney Fibrosis Treatment Market Analysis by Country : Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.6.2.1. Algeria

- 9.6.2.2. Egypt

- 9.6.2.3. Israel

- 9.6.2.4. Kuwait

- 9.6.2.5. Nigeria

- 9.6.2.6. Saudi Arabia

- 9.6.2.7. South Africa

- 9.6.2.8. Turkey

- 9.6.2.9. The UAE

- 9.6.2.10. Rest of MEA

- 10. Global Kidney Fibrosis Treatment Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Kidney Fibrosis Treatment Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Kidney Fibrosis Treatment Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. La Jolla Pharmaceutical Company

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. BioLine Rx Ltd

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Galectin Therapeutics

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Merck & Co.

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. InterMune

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Pfizer

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. F. Hoffman-La Roche Ltd.

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. ProMetic Life-Sciences Inc.

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Teva Pharmaceuticals

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Roche

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. Genzyme Corporation

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- 1. Executive Summary

-

- La Jolla Pharmaceutical Company

- BioLine Rx Ltd

- Galectin Therapeutics

- Merck & Co.

- InterMune

- Pfizer

- F. Hoffman-La Roche Ltd.

- ProMetic Life-Sciences Inc.

- Teva Pharmaceuticals

- Roche

- Genzyme Corporation