Japanese Sake Market Forecast, Trend Analysis & Competition Tracking - Global Industry Insights 2015 to 2031

-

27613

-

May 2023

-

186

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Demand for Japanese Sake from 2015 to 2020 Vs. Future Market Projections for 2021-2031

From 2015 to 2020, sales of Japanese Sake have increased at a stable rate, expanding at over 2% CAGR.

Japanese Sake (also spelled saké) is a type of alcoholic beverage made by fermenting rice after the rice grains are polished to remove the bran. Sake is a traditional drink of Japan and has been prepared in the country for over 1,000 years. Sake is often referred to as wine, but the brewing process is entirely different. The Alcohol by Volume (ABV) of Sake is much higher than most alcoholic beverages. The sake rice is milled in such a technique that it mainly contains starch. A specific fungus is added to the rice mash, which helps in converting the starch into sugar. After that, the sugar is allowed to ferment in the presence of yeast. The taste, aroma, fragrance, and quality of the Sake majorly depend on the fermentation process. The most crucial factor determining the type of Sake produced is the amount of milled rice—the more the milled sake rice, the more delicate and clear the flavor of the drink. Cooking sake usually has a lower alcohol content and a dash of salt, due to which it is also used for cooking Asian delicacies.

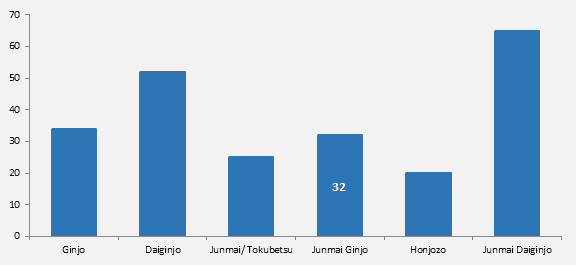

Sake is usually served in porcelain flasks known as tokkuri, and Sake is poured into small ceramic cups called sakazuki or choko. Sake is served at room temperature, warm, hot, or chilled. Sake is commonly sold at restaurants traditionally in units called 'go.' There are currently around 1,800 sake breweries across Japan, especially famous Sake producing regions such as Niigata, Kobe, and Kyoto. Some of the sake breweries offer tours of their facilities. Several types of Sake are available in the market: Ginjo, Daiginjo, Junmai/ Tokubetsu, Junmai Ginjo, Honjozo, and Junmai Daiginjo.

Global Japanese Sake Market Revenue Outlook:

The global Japanese Sake market is valued at US$ 7.5 Bn in 2020 and projected to register а САGR of close to 3% by 2031.

Urbanization has been continuing rapidly. Premium or super-premium beverages are currently associated with class and sophistication, resulting in increasing consumers looking for innovative or unique drinking experiences. This has led to an inclination towards experimentation with different varieties of Japanese Sake, apart from various other alcoholic and non-alcoholic drinks and beverages, which is expected to increase the demand for Japanese Sake.

Increasing popularity and dependence on online sales and e-Commerce platforms, duty-free shops, and the growing tourism sector, coupled with changing lifestyles of consumers, evolving beverage preferences, and increasing breweries and wineries, are also anticipated to boost sales of Japanese Sake. Moreover, an increasing number of hotels and restaurants and a growing cultural inclination towards Asian cuisines and beverages are expected to boost the market's revenue growth further.

However, various health-related issues such as cirrhosis of the liver and stomach or liver cancer triggered by excessive Japanese sake consumption may have a negative impact on the growth of the Japanese sake market. In addition, tax and higher excise duties levied on imported and local alcoholic beverages will likely hamper the market growth.

Nonetheless, introducing innovative production techniques such as the centrifuge technique, which applies pressure to extract the Sake from the fermented mash, creates an excellent quality of the beverage, and adoption of Sake in many skin and cosmetic products to provide lucrative opportunities for the market growth.

Japanese Sake Average Price (US$/ 1.8 L Bottle), 2021

To learn more about this report, request for sample report

Import-Export Analysis of Japanese Sake, under H.S. code 220600, 2016-2020

The import of Japanese Sake (H.S. Code – 220600) increased by 13.7% in 2020 to reach a value of US$ 1.7 Bn, while the export increased by 20.5%. Major importing countries in this category include the U.S., accounting for 29.7% of the total global imports. The U.K., Japan, Hong Kong, and China follow the U.S. Major exporting countries of Japanese Sake include Japan, Mexico, Italy, Canada, and Sweden.

Import (US$ ‘000) of Japanese Sake (H.S. Code – 220600) by Country, 2016-2020

Importing Country 2016 2017 2018 2019 2020 The US XXX.X XXX.X XXX.X XXX.X 513464 Germany XXX.X XXX.X XXX.X XXX.X XXX.X Japan XXX.X XXX.X XXX.X XXX.X XXX.X China XXX.X XXX.X XXX.X XXX.X XXX.X India XXX.X XXX.X XXX.X XXX.X XXX.X XXX XXX.X XXX.X XXX.X XXX.X XXX.X Global XXX.X XXX.X XXX.X 1517345 1725442 To learn more about this report, request for sample report

Export (US$ ‘000) of Japanese Sake (H.S. Code – 220600) by Country, 2016-2020

Exporting Country 2016 2017 2018 2019 2020 Japan XXX.X XXX.X XXX.X XXX.X XXX.X Mexico XXX.X XXX.X XXX.X XXX.X XXX.X Italy XXX.X XXX.X XXX.X XXX.X XXX.X Canada XXX.X XXX.X XXX.X XXX.X XXX.X Sweden XXX.X XXX.X XXX.X XXX.X XXX.X XXX XXX.X XXX.X XXX.X XXX.X XXX.X Global XXX.X XXX.X XXX.X 1514155 1824192 To learn more about this report, request for sample report

Japanese Sake imports declined by 4.0% during the Q1 of 2020 compared to the previous quarter due to the trade restrictions imposed to contain the coronavirus. Nonetheless, the imports stabilized in Q2-2020, increasing to US$ 371 Mn, gaining by 20.5% from the previous quarter. On the other hand, the exports declined by 12.6% in Q1-2020 of the prior quarter and, post the lockdown relaxations, and online deliveries noted a subsequent growth of 13.8% in Q2-2020.

Regional Analysis:

Asia-Pacific is anticipated to hold a significant share of the global Japanese Sake market. The region is also expected to register the highest growth rates over the forecast period. The growing number of restaurants and breweries in developed and developing economies such as Japan, South Korea, China, India, etc., are expected to increase demand for Japanese Sake. Robust growth of the tourism sector in China, Japan, and India is also likely to provide profitable opportunities for the development of the market.

COVID-19 Impact Analysis:

The initial lockdown during Q1 and Q2 2020 caused severe disruptions in the supply chain of Japanese Sake. Lack of raw materials and finished goods from major suppliers in Japan and halts in the movement of finished products stagnated the market growth. The closure of liquor outlets and restaurants further exacerbated the situation. Relaxation of regulations post the initial lockdown and distribution through online markets helped the market to normalcy.

Nonetheless, various industry players in the global Japanese Sake market are increasingly focusing on establishing successful collaborations, acquisitions, and joint venture activities to enhance their respective customer bases. These players are also growing their supply capabilities to meet customer requirements on a local and global scale. This factor, paired with promising industrialization prospects in developing economies of the Asia-Pacific region, such as China, India, Japan, South Korea, etc., are expected to create massive business opportunities for key players over the forecast period.

Competitive Landscape:

The Japanese sake market landscape appears highly fragmented, with a significant chunk of it being dominated by players in Japan.

- Takara Holdings Inc.

- Hakutsuru Sake Brewing Co., Ltd.

- Gekkeikan Sake Co. Ltd.

- Ozeki Corporation

- Asahi Shuzo

- Kiku-Masamune Sake Brewing Co. Ltd.

- Kizakura co., Ltd.

- Hakkaisan Brewery Co., Ltd.

- Sekiya Brewery Co., Ltd.

- Hananomai Brewing Co. Ltd.

- Fujii Shuzo Co. Ltd.

- Kokuryu Sake Brewing Corporation

- Tenzan Sake Brewer Company

- Other Key Players

Report Scope

- Forecast Period: 2022-2031

- Actual Year: 2021

- Historical Data Available for: 2015-2020

Key Regions Covered

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Key Segments Covered

Japanese Sake Market, By Sake Type

- Ginjo

- Daiginjo

- Junmai/ Tokubetsu

- Junmai Ginjo

- Junmai Daiginjo

- Honjozo

Japanese Sake Market, By Consumer Age

- Below 20 years

- 20-40 years

- 40-60 years

- Above 60 years

Attribute Report Details Market Size Ask For Market Size Growth Rate Ask For Growth Rate Key Companies Ask For Companies Report Coverage Revenue analysis, Competitive landscape, Key company analysis, Market Trends, Key segments, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis and more… Historical Data Period 2015-2020 Base Year 2022 Forecast Period 2022-2031 Region Scope North America, Europe, Asia-Pacific, South America, Middle East & Africa Country Scope United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa Revenue in US$ Mn To learn more about this report, request for sample report

-

-

- Takara Holdings Inc.

- Hakutsuru Sake Brewing Co., Ltd.

- Gekkeikan Sake Co. Ltd.

- Ozeki Corporation

- Asahi Shuzo

- Kiku-Masamune Sake Brewing Co. Ltd.

- Kizakura co., Ltd.

- Hakkaisan Brewery Co., Ltd.

- Sekiya Brewery Co., Ltd.

- Hananomai Brewing Co. Ltd.

- Fujii Shuzo Co. Ltd.

- Kokuryu Sake Brewing Corporation

- Tenzan Sake Brewer Company

- Other Key Players