Insulated Thermal Box Liners Market By Material Type Distribution (Polyethylene (PE) Foam, Polyurethane (PU) Foam, Others), By End-Use Industry Share (Food & Beverages, Pharmaceuticals, Chemicals, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

50779

-

August 2024

-

300

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

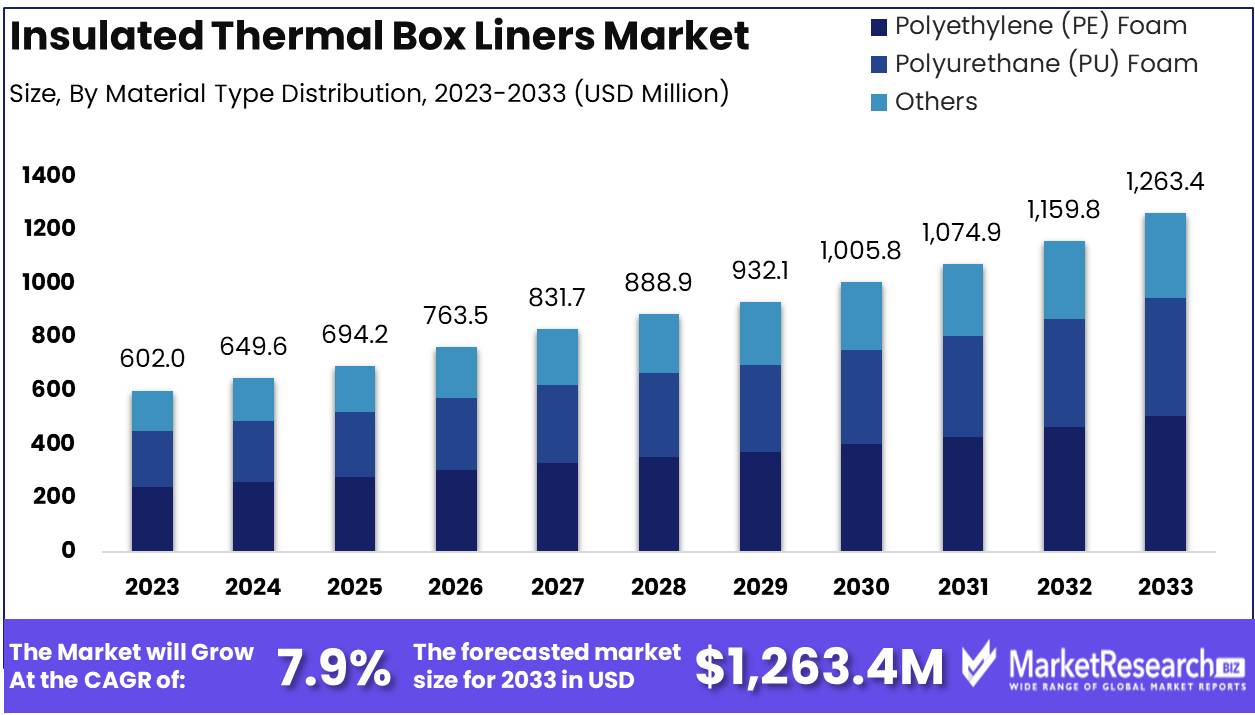

The Insulated Thermal Box Liners Market was valued at USD 602.0 million in 2023. It is expected to reach USD 1,263.4 million by 2033, with a CAGR of 7.9% during the forecast period from 2024 to 2033.

The Insulated Thermal Box Liners Market refers to the industry segment focused on the production and distribution of thermal liners designed to maintain temperature-sensitive products during transit. These liners, often made from advanced insulating materials like polyethylene or metalized films, are critical in sectors such as pharmaceuticals, food, and biotechnology, where maintaining precise temperature control is essential for product integrity.

The insulated thermal box liners market is experiencing a notable growth trajectory driven by the increasing demand for temperature-sensitive packaging, particularly in the pharmaceutical and food sectors. As the global supply chain becomes more reliant on maintaining product integrity during transit, the need for effective thermal insulation solutions is paramount. The market's expansion is further fueled by the rise of e-commerce and direct-to-consumer deliveries, where maintaining temperature control is critical.

However, the industry faces significant challenges, including high production costs and disposal and recycling issues, which could impede market growth if not addressed. The cost-intensive nature of producing advanced insulated materials remains a barrier to wider adoption, particularly in emerging markets where cost sensitivity is higher.

Moreover, the environmental impact of these materials is under scrutiny, with a growing emphasis on sustainable practices. This has led to increased research and development efforts aimed at innovating material technology to create more cost-effective and eco-friendly solutions. For instance, the development of biodegradable or recyclable insulated liners could mitigate environmental concerns while reducing long-term costs. The market is at a pivotal point where the integration of innovative materials and technologies could significantly enhance growth prospects. As such, the insulated thermal box liners market is poised for transformation, with the potential for significant advances in both market penetration and environmental impact reduction.

Key Takeaways

- Market Growth: The Insulated Thermal Box Liners Market was valued at USD 602.0 million in 2023. It is expected to reach USD 1,263.4 million by 2033, with a CAGR of 7.9% during the forecast period from 2024 to 2033.

- By Material Type Distribution: Polyethylene (PE) Foam dominated with over 40% market share.

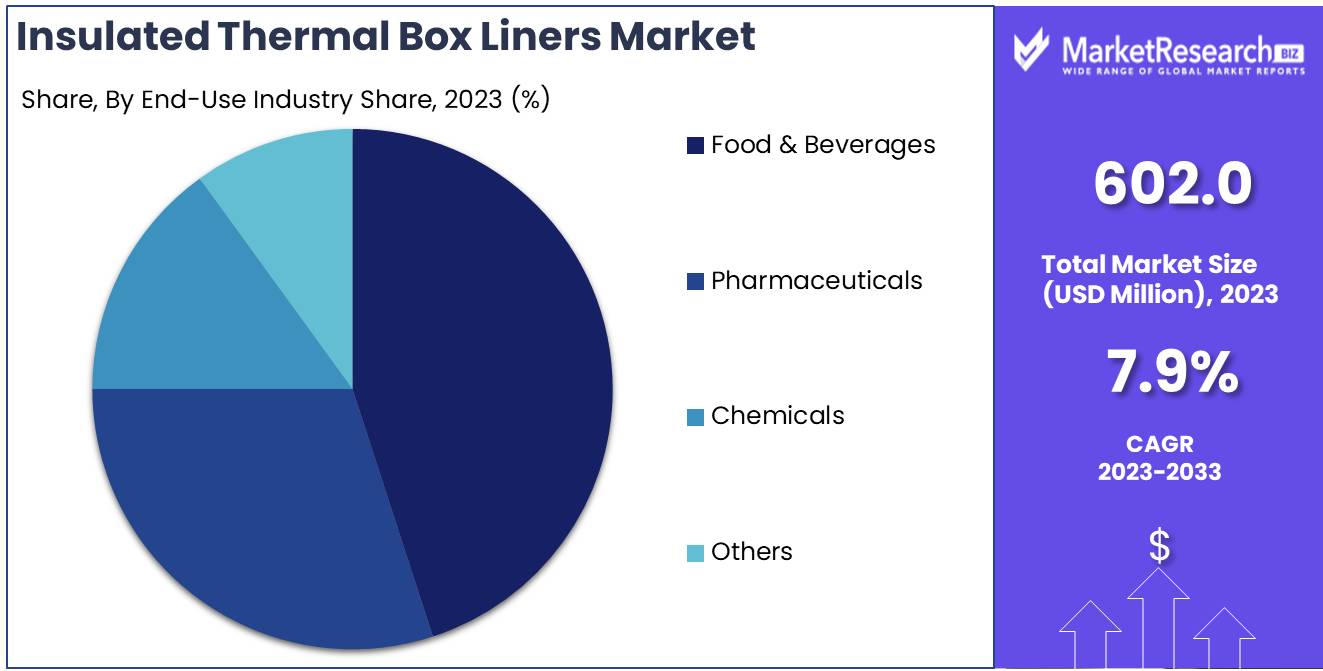

- By End-Use Industry Share: Food & Beverages dominated the Insulated Thermal Box Liners Market.

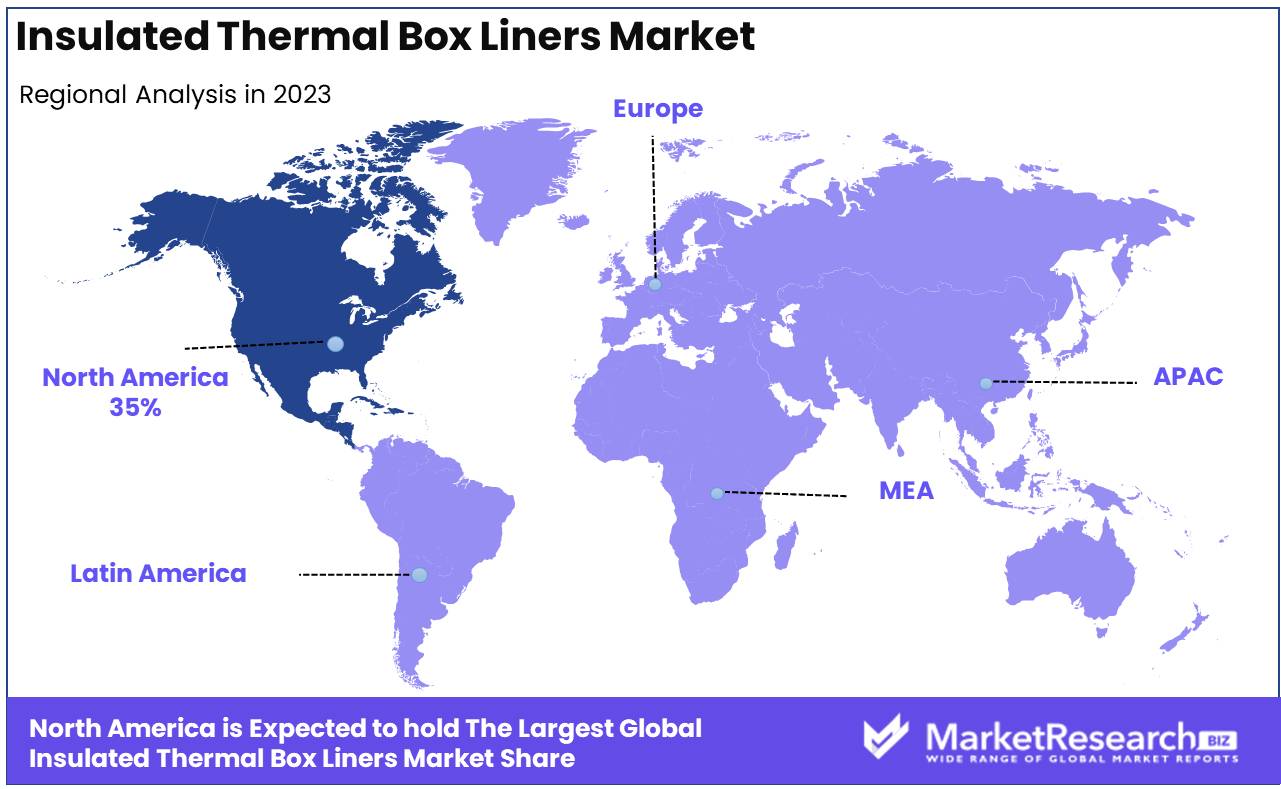

- Regional Dominance: North America dominates the global Insulated Thermal Box Liners Market, leading with a 35% largest market share.

- Growth Opportunity: The insulated thermal box liners market is set to capitalize on the dual opportunities presented by the increasing demand for temperature-sensitive products and the adoption of sustainable materials, positioning it for robust expansion.

Driving factors

Increasing Global Trade Activities: A Catalyst for Market Expansion

The surge in global trade activities has been a significant driver for the growth of the insulated thermal box liners market. With the globalization of supply chains and the increasing demand for perishable and temperature-sensitive goods across borders, there has been a corresponding rise in the need for effective thermal insulation solutions. Insulated thermal box liners are essential in ensuring that products, particularly food and pharmaceuticals, maintain their required temperatures during transit.

According to recent data, global trade volumes have grown steadily, with a compound annual growth rate (CAGR) of approximately 4.7% over the past decade. This increase in trade volume, especially in sectors requiring strict temperature control, directly correlates with the rising demand for insulated thermal box liners. As international trade continues to expand, the market for these liners is expected to grow in tandem, driven by the need for reliable and efficient temperature regulation during long-distance shipping.

Regulatory Compliance: Ensuring Safety and Driving Innovation

Regulatory compliance plays a crucial role in shaping the insulated thermal box liners market. Stringent regulations imposed by governments and international bodies on the transportation of temperature-sensitive products, such as pharmaceuticals and perishable foods, have necessitated the use of high-quality thermal insulation solutions. For instance, guidelines set by organizations such as the Food and Drug Administration (FDA) and the European Medicines Agency (EMA) mandate that certain products must be transported within specific temperature ranges to ensure their efficacy and safety. These regulatory requirements have pushed manufacturers to innovate and develop advanced insulated thermal box liners that meet or exceed compliance standards. The pressure to adhere to these regulations not only ensures the consistent quality and safety of transported goods but also drives the market as companies seek to avoid penalties and ensure the integrity of their products during transit.

Demand from the Pharmaceutical Sector: A Major Growth Driver

The pharmaceutical sector represents a substantial portion of the demand for insulated thermal box liners. This demand is largely driven by the need to maintain the cold chain for temperature-sensitive drugs, vaccines, and biologics, which require precise temperature control from the point of manufacture to the point of administration. The global pharmaceutical market, valued at approximately $1.3 trillion in 2020, continues to expand, with a growing emphasis on biologics and personalized medicine, both of which are highly temperature-sensitive. The COVID-19 pandemic further underscored the importance of reliable cold chain logistics, as vaccines requiring ultra-cold storage were distributed worldwide. As the pharmaceutical industry continues to grow and the development of temperature-sensitive products increases, the demand for insulated thermal box liners is expected to rise significantly, fueling market growth.

Restraining Factors

Competition from Alternative Packaging Solutions: A Significant Restraint on Market Expansion

The growth of the Insulated Thermal Box Liners Market is significantly hindered by the increasing competition from alternative packaging solutions. These alternatives, such as reusable thermal packaging, vacuum-insulated panels, and active temperature-controlled packaging, often offer enhanced performance in terms of temperature control and longevity. Moreover, the versatility and reusability of these alternatives make them more attractive to certain segments of the market, particularly those focused on long-term cost-efficiency and environmental sustainability.

This competition has led to a diversion of potential customers who might otherwise have opted for insulated thermal box liners. For instance, in industries such as pharmaceuticals and perishable food items, where maintaining a specific temperature range is critical, the precision and reliability of alternative packaging solutions can outweigh the relatively lower cost of insulated thermal box liners. As a result, the market share for insulated thermal box liners is being challenged, thereby restraining its growth potential.

Logistical Challenges: Limiting the Market Penetration and Adoption Rates

Logistical challenges also pose a substantial restraint on the growth of the Insulated Thermal Box Liners Market. These challenges include the high costs associated with the transportation and storage of insulated thermal box liners, which are often bulkier compared to alternative solutions. The storage space required for these liners, particularly when they are used in large volumes, can add to the overall logistical costs for companies, making them a less attractive option compared to more compact or reusable alternatives.

Additionally, the complexity of supply chains in industries like pharmaceuticals, where products must often be shipped across long distances and through various climate zones, can exacerbate the limitations of insulated thermal box liners. If the liners are not robust enough to maintain consistent temperatures throughout the journey, the risk of spoilage increases, leading companies to seek more reliable packaging options.

Furthermore, the distribution networks for insulated thermal box liners may not be as well-developed as those for more established packaging solutions, which can limit their availability in certain regions. This restricted access hinders market penetration, particularly in emerging markets where the demand for reliable thermal packaging is growing but infrastructure remains underdeveloped.

By Material Type Distribution Analysis

In 2023, Polyethylene (PE) Foam dominated with over 40% market share.

In 2023, Polyethylene (PE) Foam held a dominant market position in the By Material Type Distribution segment of the Insulated Thermal Box Liners Market, capturing more than a 40% share. The superior thermal insulation properties, cost-effectiveness, and widespread availability of PE Foam have driven its extensive adoption across various industries, including pharmaceuticals, food and beverages, and logistics. The material's lightweight nature and recyclability further enhance its appeal, making it the preferred choice for maintaining temperature-sensitive goods during transit.

Polyurethane (PU) Foam, accounting for a significant portion of the remaining market share, is valued for its excellent thermal resistance and durability. Its usage is particularly prominent in applications requiring prolonged insulation performance, despite being more expensive than PE Foam.

The Others category, encompassing materials such as EPS foam and paper-based liners, represents a smaller yet growing segment. These alternatives are gaining traction due to increasing environmental concerns and the demand for sustainable packaging solutions, though their market penetration remains limited compared to the dominant PE Foam segment.

In 2023, Food & Beverages dominated the Insulated Thermal Box Liners Market.

In 2023, The Food & Beverages segment held a dominant market position in the Insulated Thermal Box Liners Market, capturing more than a 45% share by end-use industry. The high demand for temperature-sensitive products, particularly in the perishable goods sector, significantly contributed to this segment's prominence. With the rise of e-commerce and direct-to-consumer food delivery services, the need for reliable thermal protection during transit has become critical. The segment's growth is further fueled by increasing consumer preference for fresh and frozen food products, driving the adoption of insulated packaging solutions across the industry.

In contrast, the Pharmaceuticals segment accounted for a substantial portion of the market, driven by stringent regulatory requirements for maintaining the integrity of temperature-sensitive drugs and vaccines during transportation. This segment is expected to grow steadily due to ongoing advancements in biologics and personalized medicine.

The Chemicals segment also contributed notably, especially in transporting temperature-sensitive industrial chemicals. Others, including the electronics and cosmetics sectors, captured a smaller yet significant market share, highlighting the broad applicability of insulated thermal box liners.

Key Market Segments

By Material Type Distribution

- Polyethylene (PE) Foam

- Polyurethane (PU) Foam

- Others

By End-Use Industry Share

- Food & Beverages

- Pharmaceuticals

- Chemicals

- Others

Growth Opportunity

Increasing Demand for Temperature-Sensitive Products

The rise in demand for temperature-sensitive products, including pharmaceuticals, biologics, and perishable food items, is a key driver of market expansion. As the global healthcare and food industries continue to grow, the need for reliable temperature-controlled packaging solutions has intensified. Insulated thermal box liners, with their ability to maintain stable temperatures during transit, have become indispensable in ensuring product integrity and compliance with stringent regulatory requirements. This growing reliance on temperature-sensitive products is expected to propel the market's growth trajectory, creating opportunities for manufacturers to develop advanced, high-performance liners.

Adoption of Sustainable and Eco-Friendly Materials

In parallel, the shift towards sustainability is reshaping the insulated thermal box liners market. Consumers and businesses are increasingly prioritizing eco-friendly and biodegradable materials, responding to global concerns about environmental impact and regulatory pressures. This trend has led to the development of innovative materials that offer both thermal insulation and environmental benefits. Companies that invest in sustainable packaging solutions stand to gain a competitive advantage, as they align with the growing preference for greener products. The adoption of such materials is anticipated to not only meet consumer demand but also to drive long-term market growth.

Latest Trends

Rise of Smart and Connected Packaging

The Insulated Thermal Box Liners market is poised to experience a significant transformation driven by the rise of smart and connected packaging. As industries such as pharmaceuticals, food, and biotechnology demand higher levels of temperature control, the integration of IoT-enabled sensors and real-time tracking systems within thermal box liners is expected to grow. These advancements will allow for continuous monitoring of temperature-sensitive products during transit, ensuring compliance with regulatory standards and reducing the risk of spoilage. The increased adoption of smart packaging solutions will likely enhance supply chain transparency and operational efficiency, positioning manufacturers who invest in these technologies at a competitive advantage.

Customization and Personalization

Another trend that will shape the market is the growing demand for customization and personalization in insulated thermal box liners. As e-commerce and direct-to-consumer channels expand, businesses are seeking packaging solutions that not only meet thermal requirements but also align with brand identity and consumer preferences. Customization options, such as bespoke sizes, colors, and branding elements, are becoming essential for companies looking to differentiate their products and enhance customer experience. Additionally, the rise of subscription services and meal-kit deliveries is driving the need for personalized packaging solutions that cater to specific user requirements, further propelling the market’s growth.

Regional Analysis

North America dominates the global Insulated Thermal Box Liners Market, leading with a 35% largest market share.

The Insulated Thermal Box Liners Market exhibits diverse growth patterns across different regions, driven by varying demand dynamics and industrial activities. North America stands as the dominant region, accounting for approximately 35% of the global market share. This dominance is attributed to the robust growth of the pharmaceutical and food & beverage industries, particularly in the United States and Canada. The region's stringent regulations regarding the transportation of temperature-sensitive goods further bolster the demand for high-performance thermal liners.

Europe follows closely, holding a significant market share due to the increasing adoption of insulated packaging in the pharmaceutical sector, particularly in countries like Germany, France, and the UK. The region's focus on sustainability and reducing carbon footprints has led to innovations in eco-friendly insulated liners, driving market growth.

The Asia Pacific region is expected to witness the fastest growth, with a compound annual growth rate (CAGR) exceeding 8% over the forecast period. This growth is driven by the rapid expansion of e-commerce and cold chain logistics in countries like China, India, and Japan, coupled with rising consumer demand for fresh and frozen foods.

In the Middle East & Africa, the market is gradually expanding, supported by the growing pharmaceutical industry and increasing investments in cold chain infrastructure, particularly in the Gulf Cooperation Council (GCC) countries. Latin America also presents a growing market, with Brazil and Mexico leading the region due to increased exports of perishable goods and pharmaceuticals, further driving the demand for insulated thermal box liners.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global insulated thermal box liners market is poised for significant growth, driven by the rising demand for temperature-sensitive goods, particularly in the pharmaceutical, food, and biotechnology sectors. Key players, including Sonoco Products Company and Sealed Air Corporation, continue to lead the market by leveraging their extensive R&D capabilities and strong global distribution networks.

Sonoco Products Company remains a formidable force, offering a broad range of thermal packaging solutions that cater to various industries. Their focus on innovation and sustainability aligns with the market’s increasing demand for eco-friendly packaging options.

Sealed Air Corporation, known for its Cryovac brand, maintains a strong market position by providing advanced insulation solutions that ensure product integrity during transportation. Their continued investment in developing high-performance materials underscores their commitment to enhancing the durability and effectiveness of thermal box liners.

Smaller but specialized players like Polar Thermal Packaging Ltd. and Insulated Products Corporation are also expected to gain market traction, particularly in niche markets where tailored solutions are critical. These companies are likely to focus on innovation and strategic partnerships to expand their market reach.

Cold Chain Technologies and Softbox Systems Ltd. are projected to capitalize on the growing demand for cold chain logistics, driven by the global expansion of e-commerce and the need for reliable temperature-controlled packaging solutions.

In conclusion, the competitive landscape will be characterized by strategic innovation, sustainability initiatives, and a focus on meeting the complex requirements of temperature-sensitive product transportation.

Market Key Players

- Sonoco Products Company

- Sealed Air Corporation

- Thermal Packaging Solutions

- Polar Thermal Packaging Ltd.

- Insulated Products Corporation

- ACH Foam Technologies

- Cold Chain Technologies

- Softbox Systems Ltd.

- Tempack Packaging Solutions S.L.

- Cryopak Industries Inc.

Recent Development

- In July 2024, Sealed Air announced the expansion of its TempGuard™ line, which includes new insulated box liners made from recycled materials. This development is part of the company's broader sustainability initiative, aiming to reduce environmental impact while maintaining the effectiveness of thermal protection during transportation.

- In May 2024, Coldkeepers LLC introduced an advanced version of their insulated thermal liners that integrate phase change materials (PCM) for enhanced temperature control. This product is particularly suited for the pharmaceutical industry, ensuring more precise temperature management over extended periods.

- In December 2023, Thermal Shipping Solutions (TSS) received a U.S. patent for their Renewliner, a curbside recyclable insulated box liner. This PET-based liner is designed for cold temperature preservation and is fully recyclable, addressing sustainability concerns within the industry. The innovation provides a lighter and more cost-effective alternative to traditional materials like Styrofoam, with applications in various industries including pharmaceuticals and food services.

Report Scope

Report Features Description Market Value (2023) USD 602.0 million Forecast Revenue (2033) USD 1,263.4 million CAGR (2024-2032) 7.9% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Material Type Distribution (Polyethylene (PE) Foam, Polyurethane (PU) Foam, Others), By End-Use Industry Share (Food & Beverages, Pharmaceuticals, Chemicals, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Sonoco Products Company, Sealed Air Corporation, Thermal Packaging Solutions, Polar Thermal Packaging Ltd., Insulated Products Corporation, ACH Foam Technologies, Cold Chain Technologies, Softbox Systems Ltd., Tempack Packaging Solutions S.L., Cryopak Industries Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Insulated Thermal Box Liners Market Overview

- 2.1. Insulated Thermal Box Liners Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Insulated Thermal Box Liners Market Dynamics

- 3. Global Insulated Thermal Box Liners Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Insulated Thermal Box Liners Market Analysis, 2016-2021

- 3.2. Global Insulated Thermal Box Liners Market Opportunity and Forecast, 2023-2032

- 3.3. Global Insulated Thermal Box Liners Market Analysis, Opportunity and Forecast, By Material Type Distribution, 2016-2032

- 3.3.1. Global Insulated Thermal Box Liners Market Analysis by Material Type Distribution: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Material Type Distribution, 2016-2032

- 3.3.3. Polyethylene (PE) Foam

- 3.3.4. Polyurethane (PU) Foam

- 3.3.5. Others

- 3.4. Global Insulated Thermal Box Liners Market Analysis, Opportunity and Forecast, By End-Use Industry Share, 2016-2032

- 3.4.1. Global Insulated Thermal Box Liners Market Analysis by End-Use Industry Share: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-Use Industry Share, 2016-2032

- 3.4.3. Food & Beverages

- 3.4.4. Pharmaceuticals

- 3.4.5. Chemicals

- 3.4.6. Others

- 4. North America Insulated Thermal Box Liners Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Insulated Thermal Box Liners Market Analysis, 2016-2021

- 4.2. North America Insulated Thermal Box Liners Market Opportunity and Forecast, 2023-2032

- 4.3. North America Insulated Thermal Box Liners Market Analysis, Opportunity and Forecast, By Material Type Distribution, 2016-2032

- 4.3.1. North America Insulated Thermal Box Liners Market Analysis by Material Type Distribution: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Material Type Distribution, 2016-2032

- 4.3.3. Polyethylene (PE) Foam

- 4.3.4. Polyurethane (PU) Foam

- 4.3.5. Others

- 4.4. North America Insulated Thermal Box Liners Market Analysis, Opportunity and Forecast, By End-Use Industry Share, 2016-2032

- 4.4.1. North America Insulated Thermal Box Liners Market Analysis by End-Use Industry Share: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-Use Industry Share, 2016-2032

- 4.4.3. Food & Beverages

- 4.4.4. Pharmaceuticals

- 4.4.5. Chemicals

- 4.4.6. Others

- 4.5. North America Insulated Thermal Box Liners Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.5.1. North America Insulated Thermal Box Liners Market Analysis by Country : Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.5.2.1. The US

- 4.5.2.2. Canada

- 4.5.2.3. Mexico

- 5. Western Europe Insulated Thermal Box Liners Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Insulated Thermal Box Liners Market Analysis, 2016-2021

- 5.2. Western Europe Insulated Thermal Box Liners Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Insulated Thermal Box Liners Market Analysis, Opportunity and Forecast, By Material Type Distribution, 2016-2032

- 5.3.1. Western Europe Insulated Thermal Box Liners Market Analysis by Material Type Distribution: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Material Type Distribution, 2016-2032

- 5.3.3. Polyethylene (PE) Foam

- 5.3.4. Polyurethane (PU) Foam

- 5.3.5. Others

- 5.4. Western Europe Insulated Thermal Box Liners Market Analysis, Opportunity and Forecast, By End-Use Industry Share, 2016-2032

- 5.4.1. Western Europe Insulated Thermal Box Liners Market Analysis by End-Use Industry Share: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-Use Industry Share, 2016-2032

- 5.4.3. Food & Beverages

- 5.4.4. Pharmaceuticals

- 5.4.5. Chemicals

- 5.4.6. Others

- 5.5. Western Europe Insulated Thermal Box Liners Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.5.1. Western Europe Insulated Thermal Box Liners Market Analysis by Country : Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.5.2.1. Germany

- 5.5.2.2. France

- 5.5.2.3. The UK

- 5.5.2.4. Spain

- 5.5.2.5. Italy

- 5.5.2.6. Portugal

- 5.5.2.7. Ireland

- 5.5.2.8. Austria

- 5.5.2.9. Switzerland

- 5.5.2.10. Benelux

- 5.5.2.11. Nordic

- 5.5.2.12. Rest of Western Europe

- 6. Eastern Europe Insulated Thermal Box Liners Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Insulated Thermal Box Liners Market Analysis, 2016-2021

- 6.2. Eastern Europe Insulated Thermal Box Liners Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Insulated Thermal Box Liners Market Analysis, Opportunity and Forecast, By Material Type Distribution, 2016-2032

- 6.3.1. Eastern Europe Insulated Thermal Box Liners Market Analysis by Material Type Distribution: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Material Type Distribution, 2016-2032

- 6.3.3. Polyethylene (PE) Foam

- 6.3.4. Polyurethane (PU) Foam

- 6.3.5. Others

- 6.4. Eastern Europe Insulated Thermal Box Liners Market Analysis, Opportunity and Forecast, By End-Use Industry Share, 2016-2032

- 6.4.1. Eastern Europe Insulated Thermal Box Liners Market Analysis by End-Use Industry Share: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-Use Industry Share, 2016-2032

- 6.4.3. Food & Beverages

- 6.4.4. Pharmaceuticals

- 6.4.5. Chemicals

- 6.4.6. Others

- 6.5. Eastern Europe Insulated Thermal Box Liners Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.5.1. Eastern Europe Insulated Thermal Box Liners Market Analysis by Country : Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.5.2.1. Russia

- 6.5.2.2. Poland

- 6.5.2.3. The Czech Republic

- 6.5.2.4. Greece

- 6.5.2.5. Rest of Eastern Europe

- 7. APAC Insulated Thermal Box Liners Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Insulated Thermal Box Liners Market Analysis, 2016-2021

- 7.2. APAC Insulated Thermal Box Liners Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Insulated Thermal Box Liners Market Analysis, Opportunity and Forecast, By Material Type Distribution, 2016-2032

- 7.3.1. APAC Insulated Thermal Box Liners Market Analysis by Material Type Distribution: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Material Type Distribution, 2016-2032

- 7.3.3. Polyethylene (PE) Foam

- 7.3.4. Polyurethane (PU) Foam

- 7.3.5. Others

- 7.4. APAC Insulated Thermal Box Liners Market Analysis, Opportunity and Forecast, By End-Use Industry Share, 2016-2032

- 7.4.1. APAC Insulated Thermal Box Liners Market Analysis by End-Use Industry Share: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-Use Industry Share, 2016-2032

- 7.4.3. Food & Beverages

- 7.4.4. Pharmaceuticals

- 7.4.5. Chemicals

- 7.4.6. Others

- 7.5. APAC Insulated Thermal Box Liners Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.5.1. APAC Insulated Thermal Box Liners Market Analysis by Country : Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.5.2.1. China

- 7.5.2.2. Japan

- 7.5.2.3. South Korea

- 7.5.2.4. India

- 7.5.2.5. Australia & New Zeland

- 7.5.2.6. Indonesia

- 7.5.2.7. Malaysia

- 7.5.2.8. Philippines

- 7.5.2.9. Singapore

- 7.5.2.10. Thailand

- 7.5.2.11. Vietnam

- 7.5.2.12. Rest of APAC

- 8. Latin America Insulated Thermal Box Liners Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Insulated Thermal Box Liners Market Analysis, 2016-2021

- 8.2. Latin America Insulated Thermal Box Liners Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Insulated Thermal Box Liners Market Analysis, Opportunity and Forecast, By Material Type Distribution, 2016-2032

- 8.3.1. Latin America Insulated Thermal Box Liners Market Analysis by Material Type Distribution: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Material Type Distribution, 2016-2032

- 8.3.3. Polyethylene (PE) Foam

- 8.3.4. Polyurethane (PU) Foam

- 8.3.5. Others

- 8.4. Latin America Insulated Thermal Box Liners Market Analysis, Opportunity and Forecast, By End-Use Industry Share, 2016-2032

- 8.4.1. Latin America Insulated Thermal Box Liners Market Analysis by End-Use Industry Share: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-Use Industry Share, 2016-2032

- 8.4.3. Food & Beverages

- 8.4.4. Pharmaceuticals

- 8.4.5. Chemicals

- 8.4.6. Others

- 8.5. Latin America Insulated Thermal Box Liners Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.5.1. Latin America Insulated Thermal Box Liners Market Analysis by Country : Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.5.2.1. Brazil

- 8.5.2.2. Colombia

- 8.5.2.3. Chile

- 8.5.2.4. Argentina

- 8.5.2.5. Costa Rica

- 8.5.2.6. Rest of Latin America

- 9. Middle East & Africa Insulated Thermal Box Liners Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Insulated Thermal Box Liners Market Analysis, 2016-2021

- 9.2. Middle East & Africa Insulated Thermal Box Liners Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Insulated Thermal Box Liners Market Analysis, Opportunity and Forecast, By Material Type Distribution, 2016-2032

- 9.3.1. Middle East & Africa Insulated Thermal Box Liners Market Analysis by Material Type Distribution: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Material Type Distribution, 2016-2032

- 9.3.3. Polyethylene (PE) Foam

- 9.3.4. Polyurethane (PU) Foam

- 9.3.5. Others

- 9.4. Middle East & Africa Insulated Thermal Box Liners Market Analysis, Opportunity and Forecast, By End-Use Industry Share, 2016-2032

- 9.4.1. Middle East & Africa Insulated Thermal Box Liners Market Analysis by End-Use Industry Share: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-Use Industry Share, 2016-2032

- 9.4.3. Food & Beverages

- 9.4.4. Pharmaceuticals

- 9.4.5. Chemicals

- 9.4.6. Others

- 9.5. Middle East & Africa Insulated Thermal Box Liners Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.5.1. Middle East & Africa Insulated Thermal Box Liners Market Analysis by Country : Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.5.2.1. Algeria

- 9.5.2.2. Egypt

- 9.5.2.3. Israel

- 9.5.2.4. Kuwait

- 9.5.2.5. Nigeria

- 9.5.2.6. Saudi Arabia

- 9.5.2.7. South Africa

- 9.5.2.8. Turkey

- 9.5.2.9. The UAE

- 9.5.2.10. Rest of MEA

- 10. Global Insulated Thermal Box Liners Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Insulated Thermal Box Liners Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Insulated Thermal Box Liners Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Sonoco Products Company

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Sealed Air Corporation

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Thermal Packaging Solutions

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Polar Thermal Packaging Ltd.

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Insulated Products Corporation

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. ACH Foam Technologies

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Cold Chain Technologies

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Softbox Systems Ltd.

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Tempack Packaging Solutions S.L.

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Cryopak Industries Inc.

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

"

- List of Figures

- "

- Figure 1: Global Insulated Thermal Box Liners Market Revenue (US$ Mn) Market Share by Material Type Distribution in 2022

- Figure 2: Global Insulated Thermal Box Liners Market Market Attractiveness Analysis by Material Type Distribution, 2016-2032

- Figure 3: Global Insulated Thermal Box Liners Market Revenue (US$ Mn) Market Share by End-Use Industry Sharein 2022

- Figure 4: Global Insulated Thermal Box Liners Market Market Attractiveness Analysis by End-Use Industry Share, 2016-2032

- Figure 5: Global Insulated Thermal Box Liners Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 6: Global Insulated Thermal Box Liners Market Market Attractiveness Analysis by Region, 2016-2032

- Figure 7: Global Insulated Thermal Box Liners Market Market Revenue (US$ Mn) (2016-2032)

- Figure 8: Global Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 9: Global Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by Material Type Distribution (2016-2032)

- Figure 10: Global Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by End-Use Industry Share (2016-2032)

- Figure 11: Global Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 12: Global Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by Material Type Distribution (2016-2032)

- Figure 13: Global Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by End-Use Industry Share (2016-2032)

- Figure 14: Global Insulated Thermal Box Liners Market Market Share Comparison by Region (2016-2032)

- Figure 15: Global Insulated Thermal Box Liners Market Market Share Comparison by Material Type Distribution (2016-2032)

- Figure 16: Global Insulated Thermal Box Liners Market Market Share Comparison by End-Use Industry Share (2016-2032)

- Figure 17: North America Insulated Thermal Box Liners Market Revenue (US$ Mn) Market Share by Material Type Distributionin 2022

- Figure 18: North America Insulated Thermal Box Liners Market Market Attractiveness Analysis by Material Type Distribution, 2016-2032

- Figure 19: North America Insulated Thermal Box Liners Market Revenue (US$ Mn) Market Share by End-Use Industry Sharein 2022

- Figure 20: North America Insulated Thermal Box Liners Market Market Attractiveness Analysis by End-Use Industry Share, 2016-2032

- Figure 21: North America Insulated Thermal Box Liners Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 22: North America Insulated Thermal Box Liners Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 23: North America Insulated Thermal Box Liners Market Market Revenue (US$ Mn) (2016-2032)

- Figure 24: North America Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 25: North America Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by Material Type Distribution (2016-2032)

- Figure 26: North America Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by End-Use Industry Share (2016-2032)

- Figure 27: North America Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 28: North America Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by Material Type Distribution (2016-2032)

- Figure 29: North America Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by End-Use Industry Share (2016-2032)

- Figure 30: North America Insulated Thermal Box Liners Market Market Share Comparison by Country (2016-2032)

- Figure 31: North America Insulated Thermal Box Liners Market Market Share Comparison by Material Type Distribution (2016-2032)

- Figure 32: North America Insulated Thermal Box Liners Market Market Share Comparison by End-Use Industry Share (2016-2032)

- Figure 33: Western Europe Insulated Thermal Box Liners Market Revenue (US$ Mn) Market Share by Material Type Distributionin 2022

- Figure 34: Western Europe Insulated Thermal Box Liners Market Market Attractiveness Analysis by Material Type Distribution, 2016-2032

- Figure 35: Western Europe Insulated Thermal Box Liners Market Revenue (US$ Mn) Market Share by End-Use Industry Sharein 2022

- Figure 36: Western Europe Insulated Thermal Box Liners Market Market Attractiveness Analysis by End-Use Industry Share, 2016-2032

- Figure 37: Western Europe Insulated Thermal Box Liners Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 38: Western Europe Insulated Thermal Box Liners Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 39: Western Europe Insulated Thermal Box Liners Market Market Revenue (US$ Mn) (2016-2032)

- Figure 40: Western Europe Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 41: Western Europe Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by Material Type Distribution (2016-2032)

- Figure 42: Western Europe Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by End-Use Industry Share (2016-2032)

- Figure 43: Western Europe Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 44: Western Europe Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by Material Type Distribution (2016-2032)

- Figure 45: Western Europe Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by End-Use Industry Share (2016-2032)

- Figure 46: Western Europe Insulated Thermal Box Liners Market Market Share Comparison by Country (2016-2032)

- Figure 47: Western Europe Insulated Thermal Box Liners Market Market Share Comparison by Material Type Distribution (2016-2032)

- Figure 48: Western Europe Insulated Thermal Box Liners Market Market Share Comparison by End-Use Industry Share (2016-2032)

- Figure 49: Eastern Europe Insulated Thermal Box Liners Market Revenue (US$ Mn) Market Share by Material Type Distributionin 2022

- Figure 50: Eastern Europe Insulated Thermal Box Liners Market Market Attractiveness Analysis by Material Type Distribution, 2016-2032

- Figure 51: Eastern Europe Insulated Thermal Box Liners Market Revenue (US$ Mn) Market Share by End-Use Industry Sharein 2022

- Figure 52: Eastern Europe Insulated Thermal Box Liners Market Market Attractiveness Analysis by End-Use Industry Share, 2016-2032

- Figure 53: Eastern Europe Insulated Thermal Box Liners Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 54: Eastern Europe Insulated Thermal Box Liners Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 55: Eastern Europe Insulated Thermal Box Liners Market Market Revenue (US$ Mn) (2016-2032)

- Figure 56: Eastern Europe Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 57: Eastern Europe Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by Material Type Distribution (2016-2032)

- Figure 58: Eastern Europe Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by End-Use Industry Share (2016-2032)

- Figure 59: Eastern Europe Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 60: Eastern Europe Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by Material Type Distribution (2016-2032)

- Figure 61: Eastern Europe Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by End-Use Industry Share (2016-2032)

- Figure 62: Eastern Europe Insulated Thermal Box Liners Market Market Share Comparison by Country (2016-2032)

- Figure 63: Eastern Europe Insulated Thermal Box Liners Market Market Share Comparison by Material Type Distribution (2016-2032)

- Figure 64: Eastern Europe Insulated Thermal Box Liners Market Market Share Comparison by End-Use Industry Share (2016-2032)

- Figure 65: APAC Insulated Thermal Box Liners Market Revenue (US$ Mn) Market Share by Material Type Distributionin 2022

- Figure 66: APAC Insulated Thermal Box Liners Market Market Attractiveness Analysis by Material Type Distribution, 2016-2032

- Figure 67: APAC Insulated Thermal Box Liners Market Revenue (US$ Mn) Market Share by End-Use Industry Sharein 2022

- Figure 68: APAC Insulated Thermal Box Liners Market Market Attractiveness Analysis by End-Use Industry Share, 2016-2032

- Figure 69: APAC Insulated Thermal Box Liners Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 70: APAC Insulated Thermal Box Liners Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 71: APAC Insulated Thermal Box Liners Market Market Revenue (US$ Mn) (2016-2032)

- Figure 72: APAC Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 73: APAC Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by Material Type Distribution (2016-2032)

- Figure 74: APAC Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by End-Use Industry Share (2016-2032)

- Figure 75: APAC Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 76: APAC Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by Material Type Distribution (2016-2032)

- Figure 77: APAC Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by End-Use Industry Share (2016-2032)

- Figure 78: APAC Insulated Thermal Box Liners Market Market Share Comparison by Country (2016-2032)

- Figure 79: APAC Insulated Thermal Box Liners Market Market Share Comparison by Material Type Distribution (2016-2032)

- Figure 80: APAC Insulated Thermal Box Liners Market Market Share Comparison by End-Use Industry Share (2016-2032)

- Figure 81: Latin America Insulated Thermal Box Liners Market Revenue (US$ Mn) Market Share by Material Type Distributionin 2022

- Figure 82: Latin America Insulated Thermal Box Liners Market Market Attractiveness Analysis by Material Type Distribution, 2016-2032

- Figure 83: Latin America Insulated Thermal Box Liners Market Revenue (US$ Mn) Market Share by End-Use Industry Sharein 2022

- Figure 84: Latin America Insulated Thermal Box Liners Market Market Attractiveness Analysis by End-Use Industry Share, 2016-2032

- Figure 85: Latin America Insulated Thermal Box Liners Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 86: Latin America Insulated Thermal Box Liners Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 87: Latin America Insulated Thermal Box Liners Market Market Revenue (US$ Mn) (2016-2032)

- Figure 88: Latin America Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 89: Latin America Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by Material Type Distribution (2016-2032)

- Figure 90: Latin America Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by End-Use Industry Share (2016-2032)

- Figure 91: Latin America Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 92: Latin America Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by Material Type Distribution (2016-2032)

- Figure 93: Latin America Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by End-Use Industry Share (2016-2032)

- Figure 94: Latin America Insulated Thermal Box Liners Market Market Share Comparison by Country (2016-2032)

- Figure 95: Latin America Insulated Thermal Box Liners Market Market Share Comparison by Material Type Distribution (2016-2032)

- Figure 96: Latin America Insulated Thermal Box Liners Market Market Share Comparison by End-Use Industry Share (2016-2032)

- Figure 97: Middle East & Africa Insulated Thermal Box Liners Market Revenue (US$ Mn) Market Share by Material Type Distributionin 2022

- Figure 98: Middle East & Africa Insulated Thermal Box Liners Market Market Attractiveness Analysis by Material Type Distribution, 2016-2032

- Figure 99: Middle East & Africa Insulated Thermal Box Liners Market Revenue (US$ Mn) Market Share by End-Use Industry Sharein 2022

- Figure 100: Middle East & Africa Insulated Thermal Box Liners Market Market Attractiveness Analysis by End-Use Industry Share, 2016-2032

- Figure 101: Middle East & Africa Insulated Thermal Box Liners Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 102: Middle East & Africa Insulated Thermal Box Liners Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 103: Middle East & Africa Insulated Thermal Box Liners Market Market Revenue (US$ Mn) (2016-2032)

- Figure 104: Middle East & Africa Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 105: Middle East & Africa Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by Material Type Distribution (2016-2032)

- Figure 106: Middle East & Africa Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by End-Use Industry Share (2016-2032)

- Figure 107: Middle East & Africa Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 108: Middle East & Africa Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by Material Type Distribution (2016-2032)

- Figure 109: Middle East & Africa Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by End-Use Industry Share (2016-2032)

- Figure 110: Middle East & Africa Insulated Thermal Box Liners Market Market Share Comparison by Country (2016-2032)

- Figure 111: Middle East & Africa Insulated Thermal Box Liners Market Market Share Comparison by Material Type Distribution (2016-2032)

- Figure 112: Middle East & Africa Insulated Thermal Box Liners Market Market Share Comparison by End-Use Industry Share (2016-2032)

"

- List of Tables

- "

- Table 1: Global Insulated Thermal Box Liners Market Market Comparison by Material Type Distribution (2016-2032)

- Table 2: Global Insulated Thermal Box Liners Market Market Comparison by End-Use Industry Share (2016-2032)

- Table 3: Global Insulated Thermal Box Liners Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 4: Global Insulated Thermal Box Liners Market Market Revenue (US$ Mn) (2016-2032)

- Table 5: Global Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 6: Global Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by Material Type Distribution (2016-2032)

- Table 7: Global Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by End-Use Industry Share (2016-2032)

- Table 8: Global Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 9: Global Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by Material Type Distribution (2016-2032)

- Table 10: Global Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by End-Use Industry Share (2016-2032)

- Table 11: Global Insulated Thermal Box Liners Market Market Share Comparison by Region (2016-2032)

- Table 12: Global Insulated Thermal Box Liners Market Market Share Comparison by Material Type Distribution (2016-2032)

- Table 13: Global Insulated Thermal Box Liners Market Market Share Comparison by End-Use Industry Share (2016-2032)

- Table 14: North America Insulated Thermal Box Liners Market Market Comparison by End-Use Industry Share (2016-2032)

- Table 15: North America Insulated Thermal Box Liners Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 16: North America Insulated Thermal Box Liners Market Market Revenue (US$ Mn) (2016-2032)

- Table 17: North America Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 18: North America Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by Material Type Distribution (2016-2032)

- Table 19: North America Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by End-Use Industry Share (2016-2032)

- Table 20: North America Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 21: North America Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by Material Type Distribution (2016-2032)

- Table 22: North America Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by End-Use Industry Share (2016-2032)

- Table 23: North America Insulated Thermal Box Liners Market Market Share Comparison by Country (2016-2032)

- Table 24: North America Insulated Thermal Box Liners Market Market Share Comparison by Material Type Distribution (2016-2032)

- Table 25: North America Insulated Thermal Box Liners Market Market Share Comparison by End-Use Industry Share (2016-2032)

- Table 26: Western Europe Insulated Thermal Box Liners Market Market Comparison by Material Type Distribution (2016-2032)

- Table 27: Western Europe Insulated Thermal Box Liners Market Market Comparison by End-Use Industry Share (2016-2032)

- Table 28: Western Europe Insulated Thermal Box Liners Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 29: Western Europe Insulated Thermal Box Liners Market Market Revenue (US$ Mn) (2016-2032)

- Table 30: Western Europe Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 31: Western Europe Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by Material Type Distribution (2016-2032)

- Table 32: Western Europe Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by End-Use Industry Share (2016-2032)

- Table 33: Western Europe Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 34: Western Europe Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by Material Type Distribution (2016-2032)

- Table 35: Western Europe Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by End-Use Industry Share (2016-2032)

- Table 36: Western Europe Insulated Thermal Box Liners Market Market Share Comparison by Country (2016-2032)

- Table 37: Western Europe Insulated Thermal Box Liners Market Market Share Comparison by Material Type Distribution (2016-2032)

- Table 38: Western Europe Insulated Thermal Box Liners Market Market Share Comparison by End-Use Industry Share (2016-2032)

- Table 39: Eastern Europe Insulated Thermal Box Liners Market Market Comparison by Material Type Distribution (2016-2032)

- Table 40: Eastern Europe Insulated Thermal Box Liners Market Market Comparison by End-Use Industry Share (2016-2032)

- Table 41: Eastern Europe Insulated Thermal Box Liners Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 42: Eastern Europe Insulated Thermal Box Liners Market Market Revenue (US$ Mn) (2016-2032)

- Table 43: Eastern Europe Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 44: Eastern Europe Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by Material Type Distribution (2016-2032)

- Table 45: Eastern Europe Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by End-Use Industry Share (2016-2032)

- Table 46: Eastern Europe Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 47: Eastern Europe Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by Material Type Distribution (2016-2032)

- Table 48: Eastern Europe Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by End-Use Industry Share (2016-2032)

- Table 49: Eastern Europe Insulated Thermal Box Liners Market Market Share Comparison by Country (2016-2032)

- Table 50: Eastern Europe Insulated Thermal Box Liners Market Market Share Comparison by Material Type Distribution (2016-2032)

- Table 51: Eastern Europe Insulated Thermal Box Liners Market Market Share Comparison by End-Use Industry Share (2016-2032)

- Table 52: APAC Insulated Thermal Box Liners Market Market Comparison by Material Type Distribution (2016-2032)

- Table 53: APAC Insulated Thermal Box Liners Market Market Comparison by End-Use Industry Share (2016-2032)

- Table 54: APAC Insulated Thermal Box Liners Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: APAC Insulated Thermal Box Liners Market Market Revenue (US$ Mn) (2016-2032)

- Table 56: APAC Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: APAC Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by Material Type Distribution (2016-2032)

- Table 58: APAC Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by End-Use Industry Share (2016-2032)

- Table 59: APAC Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 60: APAC Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by Material Type Distribution (2016-2032)

- Table 61: APAC Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by End-Use Industry Share (2016-2032)

- Table 62: APAC Insulated Thermal Box Liners Market Market Share Comparison by Country (2016-2032)

- Table 63: APAC Insulated Thermal Box Liners Market Market Share Comparison by Material Type Distribution (2016-2032)

- Table 64: APAC Insulated Thermal Box Liners Market Market Share Comparison by End-Use Industry Share (2016-2032)

- Table 65: Latin America Insulated Thermal Box Liners Market Market Comparison by Material Type Distribution (2016-2032)

- Table 66: Latin America Insulated Thermal Box Liners Market Market Comparison by End-Use Industry Share (2016-2032)

- Table 67: Latin America Insulated Thermal Box Liners Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 68: Latin America Insulated Thermal Box Liners Market Market Revenue (US$ Mn) (2016-2032)

- Table 69: Latin America Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 70: Latin America Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by Material Type Distribution (2016-2032)

- Table 71: Latin America Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by End-Use Industry Share (2016-2032)

- Table 72: Latin America Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 73: Latin America Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by Material Type Distribution (2016-2032)

- Table 74: Latin America Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by End-Use Industry Share (2016-2032)

- Table 75: Latin America Insulated Thermal Box Liners Market Market Share Comparison by Country (2016-2032)

- Table 76: Latin America Insulated Thermal Box Liners Market Market Share Comparison by Material Type Distribution (2016-2032)

- Table 77: Latin America Insulated Thermal Box Liners Market Market Share Comparison by End-Use Industry Share (2016-2032)

- Table 78: Middle East & Africa Insulated Thermal Box Liners Market Market Comparison by Material Type Distribution (2016-2032)

- Table 79: Middle East & Africa Insulated Thermal Box Liners Market Market Comparison by End-Use Industry Share (2016-2032)

- Table 80: Middle East & Africa Insulated Thermal Box Liners Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 81: Middle East & Africa Insulated Thermal Box Liners Market Market Revenue (US$ Mn) (2016-2032)

- Table 82: Middle East & Africa Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 83: Middle East & Africa Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by Material Type Distribution (2016-2032)

- Table 84: Middle East & Africa Insulated Thermal Box Liners Market Market Revenue (US$ Mn) Comparison by End-Use Industry Share (2016-2032)

- Table 85: Middle East & Africa Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 86: Middle East & Africa Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by Material Type Distribution (2016-2032)

- Table 87: Middle East & Africa Insulated Thermal Box Liners Market Market Y-o-Y Growth Rate Comparison by End-Use Industry Share (2016-2032)

- Table 88: Middle East & Africa Insulated Thermal Box Liners Market Market Share Comparison by Country (2016-2032)

- Table 89: Middle East & Africa Insulated Thermal Box Liners Market Market Share Comparison by Material Type Distribution (2016-2032)

- Table 90: Middle East & Africa Insulated Thermal Box Liners Market Market Share Comparison by End-Use Industry Share (2016-2032)

- 1. Executive Summary

-

- Sonoco Products Company

- Sealed Air Corporation

- Thermal Packaging Solutions

- Polar Thermal Packaging Ltd.

- Insulated Products Corporation

- ACH Foam Technologies

- Cold Chain Technologies

- Softbox Systems Ltd.

- Tempack Packaging Solutions S.L.

- Cryopak Industries Inc.