Hardware Security Module Market By Product Type (Smart Cards, LAN based/ Network Attached, PCI-Based/ Embedded Plugins, USB-Based/ Portable), By Deployment Mode (On-premise, Cloud), By Application (Payment Processing, Code and Document Signing, Security Sockets Layer (SSL) and Transport Security Layer (TSL), Others), By Industry Vertical (BFSI, IT and Telecommunication, Government, Consumer Goods and Retail, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

50622

-

August 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

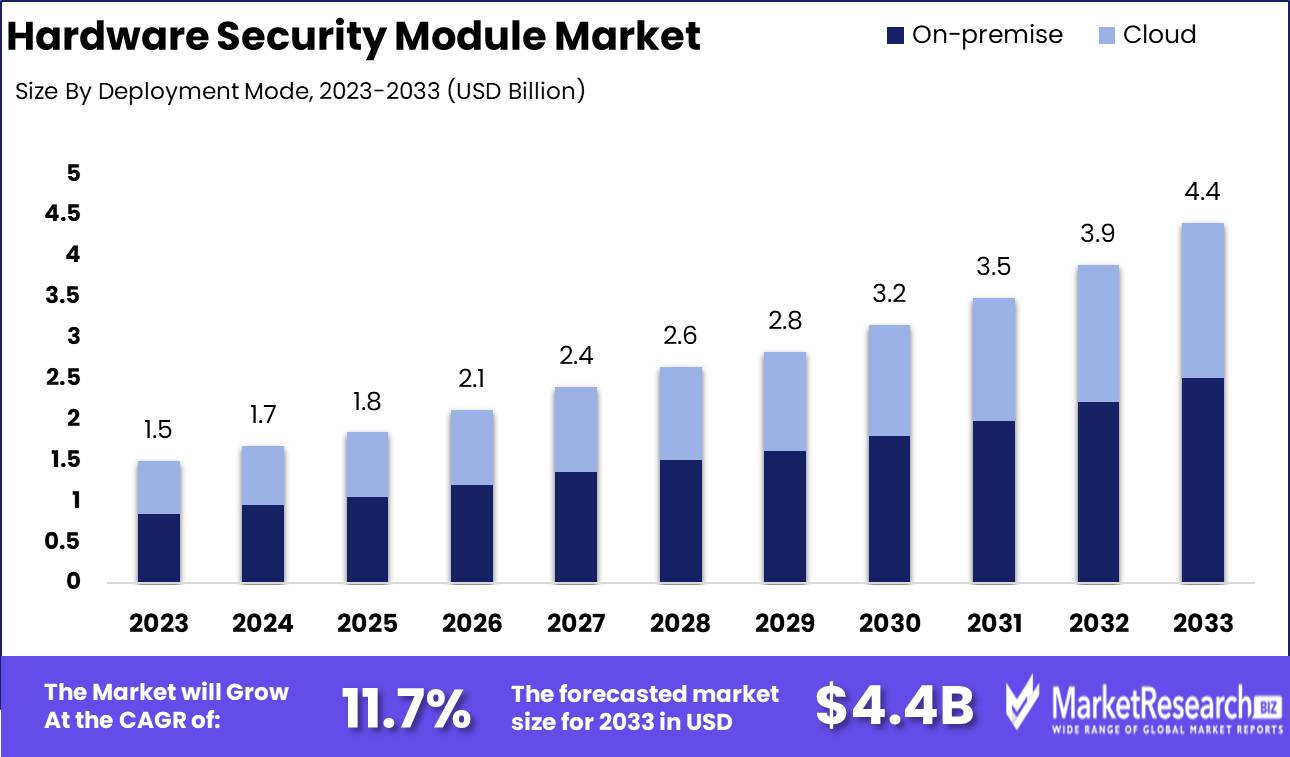

The Hardware Security Module Market was valued at USD 1.5 billion in 2023. It is expected to reach USD 4.4 billion by 2033, with a CAGR of 11.7% during the forecast period from 2024 to 2033.

The Hardware Security Module (HSM) Market encompasses the global industry focused on the development, deployment, and management of dedicated cryptographic devices designed to safeguard and manage digital keys, perform encryption, and ensure secure transactions. HSMs are critical in industries requiring high levels of data security, such as banking, government, and healthcare, where they protect sensitive information from cyber threats.

The Hardware Security Module (HSM) market is poised for robust growth, driven by the escalating need for enhanced data protection in an increasingly digitalized world. The surge in cybersecurity threats, particularly from sophisticated cyberattacks targeting sensitive financial and personal information, has heightened the demand for HSMs. These modules are critical in ensuring the security of cryptographic keys, thereby safeguarding data integrity and confidentiality.

However, the market's expansion is tempered by several challenges, including the high cost of implementation and the complexity involved in integrating HSMs with existing IT infrastructure. Organizations, particularly small and medium-sized enterprises (SMEs), often struggle with these barriers, limiting widespread adoption. Despite these hurdles, the market is expected to benefit significantly from ongoing technological advancements, which are likely to reduce costs and simplify integration processes over time.

Technological innovations, such as the development of more user-friendly and scalable HSM solutions, are anticipated to drive future market growth. The increasing adoption of cloud services and the rise of the Internet of Things (IoT) further underscore the need for robust security solutions, positioning HSMs as indispensable in protecting against emerging cyber threats. Additionally, the growing regulatory requirements across various industries, particularly in finance and healthcare, are likely to further fuel demand for HSMs. As organizations continue to navigate the complexities of digital transformation, the importance of integrating secure hardware solutions will become increasingly apparent, solidifying the HSM market's critical role in the broader cybersecurity landscape.

Key Takeaways

- Market Growth: The Hardware Security Module Market was valued at USD 1.5 billion in 2023. It is expected to reach USD 4.4 billion by 2033, with a CAGR of 11.7% during the forecast period from 2024 to 2033.

- By Product Type: Smart Cards dominated the Hardware Security Module market.

- By Deployment Mode: On-premise Solutions Held a Dominant Market Position in the By Deployment Mode Segment of the Hardware Security Module Market

- By Application: Payment Processing led HSM market dominance, driving demand across applications.

- By Industry Vertical: BFSI dominated the HSM market due to stringent security demands.

- Regional Dominance: Europe dominates the HSM market, holding a 35% largest market share.

- Growth Opportunity: The global HSM market is set to experience substantial opportunities driven by escalating cybersecurity concerns and increased adoption within the financial services sector.

Driving factors

Increasing Cyber Threats and Data Breaches: A Catalyst for HSM Adoption

The rising frequency and sophistication of cyber threats and data breaches have become a significant driver for the Hardware Security Module (HSM) market. As organizations across industries face escalating risks to their sensitive data, the demand for robust encryption solutions has surged. Hardware Security Modules, known for their ability to generate, store, and manage cryptographic keys securely, are increasingly being adopted to mitigate these risks. According to industry reports, the global cost of data breaches is expected to reach $10.5 trillion annually by 2025, underscoring the urgent need for enhanced security measures like HSMs. This growing threat landscape compels businesses to prioritize data protection, thereby driving the market growth of HSMs.

Stringent Data Security Regulations: Mandating the Use of HSMs

The global regulatory environment surrounding data security has become increasingly stringent, further propelling the growth of the Hardware Security Module market. Regulations such as the General Data Protection Regulation (GDPR) in Europe, the California Consumer Privacy Act (CCPA) in the U.S., and other regional data protection laws mandate the protection of sensitive information through robust security practices. These regulations often require organizations to implement encryption and key management solutions to ensure compliance, making HSMs an essential component in achieving regulatory adherence. Failure to comply with these regulations can result in significant financial penalties, prompting businesses to invest in HSMs to avoid legal repercussions and protect their reputations.

Increasing Focus on Cloud Security: Driving Demand for Cloud-Based HSM Solutions

As organizations increasingly migrate to cloud environments, the focus on securing cloud-based data has intensified, contributing to the growth of the HSM market. Cloud service providers and enterprises are increasingly adopting cloud-based HSM solutions to ensure the security of data stored and processed in the cloud. These HSMs offer the same level of security as traditional on-premise solutions but with the added flexibility and scalability needed in cloud environments. The global cloud security market is projected to grow at a CAGR of 13.9% from 2023 to 2030, highlighting the expanding demand for cloud-based security solutions, including HSMs. This trend is further amplified by the increasing use of multi-cloud and hybrid cloud strategies, where secure key management becomes critical for maintaining data integrity and confidentiality across diverse platforms.

Restraining Factors

Complexity of Implementation: A Barrier to Widespread Adoption

The complexity associated with the implementation of Hardware Security Modules (HSMs) is a significant restraining factor in the market's growth. HSMs are highly specialized devices designed to manage cryptographic keys and perform cryptographic operations in a secure environment. However, the technical expertise required for their integration into existing IT infrastructures can be daunting for many organizations. This complexity extends to the configuration, management, and maintenance of these devices, often necessitating specialized training and support.

As a result, smaller enterprises and those with limited technical resources may hesitate to adopt HSMs, opting instead for less complex, albeit less secure, alternatives. This reluctance stymies the broader adoption of HSMs, thereby limiting market expansion, particularly among small to medium-sized businesses (SMBs) that could otherwise benefit from enhanced security.

Competition from Software-Based Solutions: A Cost-Effective Alternative

The rise of software-based security solutions presents formidable competition to the HSM market. While HSMs offer superior security through their dedicated hardware, software-based solutions provide a more flexible and cost-effective alternative. These solutions can be easily deployed across various platforms without the need for specialized hardware, making them more attractive to organizations with budget constraints or those that prioritize ease of implementation.

Additionally, advancements in software-based security have narrowed the security gap between these solutions and traditional HSMs, making the latter less appealing to cost-conscious enterprises. This competition has led to a slowing of HSM market growth, as organizations weigh the benefits of hardware-based security against the lower costs and operational flexibility of software-based options. The impact is particularly pronounced in markets where cost considerations and ease of deployment are paramount.

By Product Type Analysis

In 2023, Smart Cards dominated the Hardware Security Module market.

In 2023, Smart Cards held a dominant market position in the By Product Type segment of the Hardware Security Module (HSM) Market. The increasing adoption of smart cards across various industries, including banking, government, and telecommunications, significantly contributed to their market dominance. Smart cards are widely recognized for their robust security features, which make them ideal for applications requiring secure data storage and encryption. The demand for secure authentication and identity management solutions further bolstered the growth of smart cards within this segment.

LAN-based/Network-attached HSMs also witnessed substantial growth in 2023 due to their ability to provide centralized security management for multiple applications across an organization's network. This product type is favored by enterprises seeking to enhance their cybersecurity posture by securing cryptographic keys and sensitive data in a networked environment.

PCI-Based/Embedded Plugins maintained a strong presence, driven by their integration into existing IT infrastructure, offering a seamless and cost-effective solution for organizations with high-security needs.

USB-Based/Portable HSMs catered to niche markets requiring portability and flexibility, particularly in scenarios where secure data transfer is essential. While not as dominant as the other categories, USB-based HSMs remain a vital component of the overall market landscape.

By Deployment Mode Analysis

In 2023, On-premise Solutions Held a Dominant Market Position in the By Deployment Mode Segment of the Hardware Security Module Market

In 2023, The On-premise deployment mode held a dominant position in the Hardware Security Module (HSM) market, primarily driven by the demand for high-security environments where organizations require full control over their cryptographic operations. On-premise HSMs are favored by sectors such as banking, financial services, and government, where data sensitivity and compliance requirements are paramount. These sectors prefer on-premise solutions due to their ability to offer enhanced security, reduced latency, and greater customization options.

Conversely, the cloud deployment mode is witnessing significant growth, driven by its scalability, cost-effectiveness, and ease of integration with existing IT infrastructure. Cloud-based HSMs appeal to enterprises seeking to leverage the benefits of cloud computing while ensuring data security. Small and medium-sized enterprises (SMEs) are particularly inclined toward cloud HSMs due to the lower initial investment and flexibility. While on-premise solutions maintain a dominant share, the cloud segment is expected to gain traction in the coming years as organizations increasingly adopt hybrid cloud models, balancing security with operational efficiency.

By Application Analysis

Payment Processing led to HSM market dominance, driving demand across applications.

In 2023, Payment Processing held a dominant market position in the Hardware Security Module (HSM) Market's By Application segment. The critical role of HSMs in securing financial transactions contributed significantly to this dominance. Payment processing applications, requiring stringent security protocols to safeguard sensitive data such as card details and transaction information, drove the demand for robust HSM solutions. The increased adoption of digital payments and the expansion of e-commerce globally further reinforced the need for HSMs in payment processing, positioning this segment at the forefront of the market.

Code and Document Signing followed closely, driven by the growing importance of ensuring the authenticity and integrity of software and documents in an era of rising cyber threats. Security Sockets Layer (SSL) and Transport Security Layer (TSL) applications also witnessed substantial growth due to their essential role in securing online communications. Authentication and Application-Level Encryption segments demonstrated steady growth, fueled by the increasing need for secure user authentication and data encryption across various industries. Finally, the Others segment, encompassing a range of niche applications, maintained a smaller but vital share, reflecting the versatility and broad applicability of HSMs across diverse sectors.

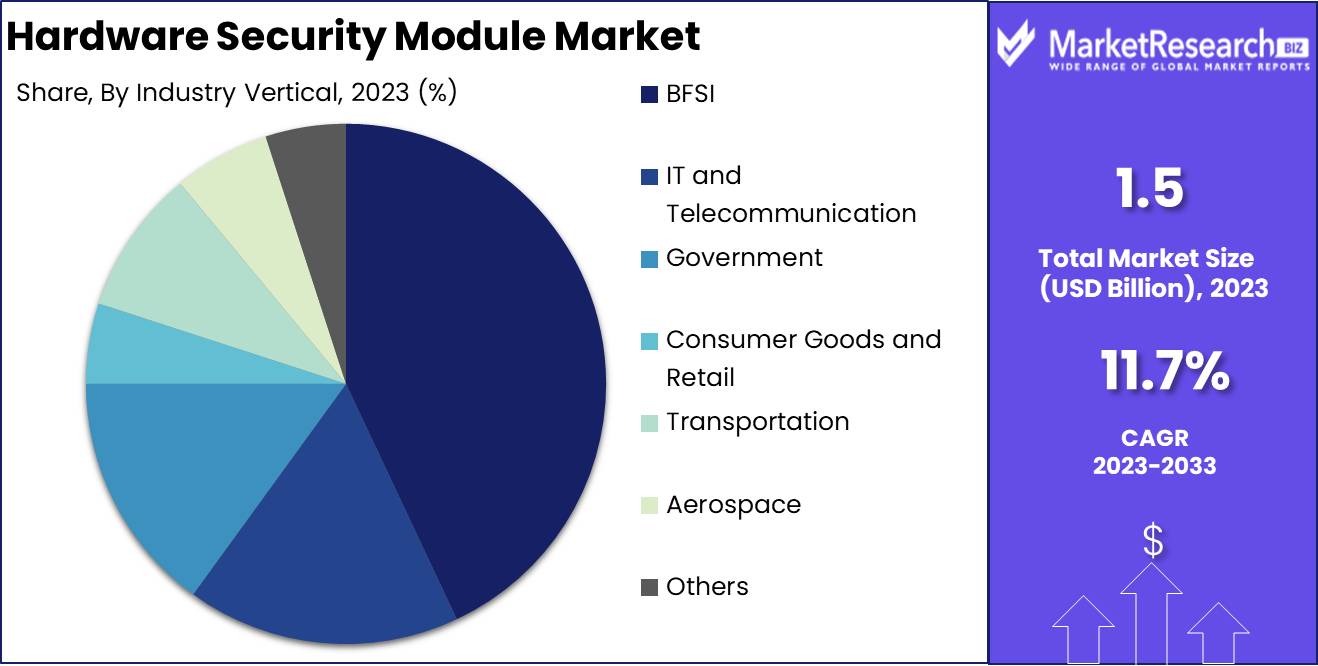

By Industry Vertical Analysis

In 2023, BFSI dominated the HSM market due to stringent security demands.

In 2023, The BFSI segment held a dominant market position in the Hardware Security Module (HSM) Market, driven by the sector's stringent security requirements and the need for robust encryption solutions to protect sensitive financial data. The BFSI sector's adoption of HSMs is fueled by the increasing complexity of cyber threats, regulatory mandates, and the sector's critical need to ensure the integrity and confidentiality of financial transactions. This dominance is expected to continue as financial institutions increasingly prioritize cybersecurity investments.

The IT and Telecommunications segment followed closely, leveraging HSMs to secure large volumes of data and communications. With the proliferation of cloud services and IoT devices, the demand for secure data transmission and storage is paramount, making HSMs a vital component in these industries.

The Government sector also emerged as a significant player, driven by the need for secure communication and data protection in national security and public service applications. This sector's reliance on HSMs is bolstered by government initiatives to strengthen cybersecurity infrastructure.

In the Consumer Goods and Retail segment, HSMs are increasingly used to secure payment systems and customer data, reflecting the industry's response to rising e-commerce activities and the associated security challenges.

The Transportation and Aerospace segments are investing in HSMs to protect critical systems and communications, particularly in the context of smart transportation and defense applications. As these sectors adopt more connected technologies, the need for robust security measures, such as HSMs, is becoming increasingly critical.

Lastly, the 'Others' category encompasses various industries, including healthcare and energy, where HSMs are utilized to secure sensitive information and critical infrastructures. The diverse application of HSMs across these industries highlights the broadening scope of cybersecurity needs in today's digital landscape.

Key Market Segments

By Product Type

- Smart Cards

- LAN Based/ Network Attached

- PCI-Based/ Embedded Plugins

- USB-Based/ Portable

By Deployment Mode

- On-premise

- Cloud

By Application

- Payment Processing

- Code and Document Signing

- Security Sockets Layer (SSL) and Transport Security Layer (TSL)

- Authentication

- Application-Level Encryption

- Others

By Industry Vertical

- BFSI

- IT and Telecommunication

- Government

- Consumer Goods and Retail

- Transportation

- Aerospace

- Others

Growth Opportunity

Enhanced Cybersecurity Infrastructure

The global Hardware Security Module (HSM) market is poised for significant growth, driven primarily by the rising cybersecurity threats that organizations across various sectors face. As cyber-attacks become more sophisticated and frequent, the demand for robust security solutions has escalated. HSMs, known for their ability to provide secure key management and encryption, are increasingly being adopted to fortify cybersecurity infrastructure. This growing need for enhanced security measures presents a substantial opportunity for HSM providers to expand their market presence. Companies that offer advanced, scalable, and compliant HSM solutions are well-positioned to capitalize on this trend, especially as regulatory requirements for data protection continue to tighten.

Expansion in Financial Services

The financial services sector, traditionally a major user of HSMs, is expected to see an even greater adoption rate. With the increasing digitization of banking and financial services, coupled with the surge in online transactions, the need for secure processing and storage of sensitive data is paramount. HSMs play a critical role in safeguarding financial data, ensuring the integrity and confidentiality of transactions, and meeting stringent compliance standards. As financial institutions expand their digital offerings, the demand for HSMs is likely to grow, creating lucrative opportunities for market players. Furthermore, the integration of HSMs in emerging technologies such as blockchain and digital currencies within the financial sector presents additional avenues for growth.

Latest Trends

Integration with DevOps Practices

The Hardware Security Module (HSM) market is expected to witness a significant trend in the integration with DevOps practices. As organizations increasingly adopt DevOps to accelerate software development cycles, the need for secure and automated cryptographic key management becomes paramount. HSMs are evolving to seamlessly integrate with DevOps pipelines, offering automated encryption and decryption services, secure key storage, and digital signing functionalities. This trend is driven by the growing demand for secure coding practices and the need to embed security earlier in the development lifecycle. HSMs are being tailored to fit into continuous integration/continuous deployment (CI/CD) workflows, ensuring that security is maintained without slowing down the pace of development.

Enhanced Security for IoT Ecosystems

The rapid expansion of the Internet of Things (IoT) is creating new security challenges, particularly in safeguarding sensitive data transmitted across IoT networks. HSMs are expected to play a crucial role in enhancing security within IoT ecosystems. HSMs will be increasingly deployed to manage cryptographic keys for IoT devices, ensuring secure communication channels and protecting data integrity. The trend towards using HSMs in IoT is fueled by the need to address vulnerabilities in IoT devices, which are often seen as weak points in network security. As IoT devices proliferate in critical sectors such as healthcare, automotive, and smart cities, the adoption of HSMs for securing these devices will become a key focus, driving market growth.

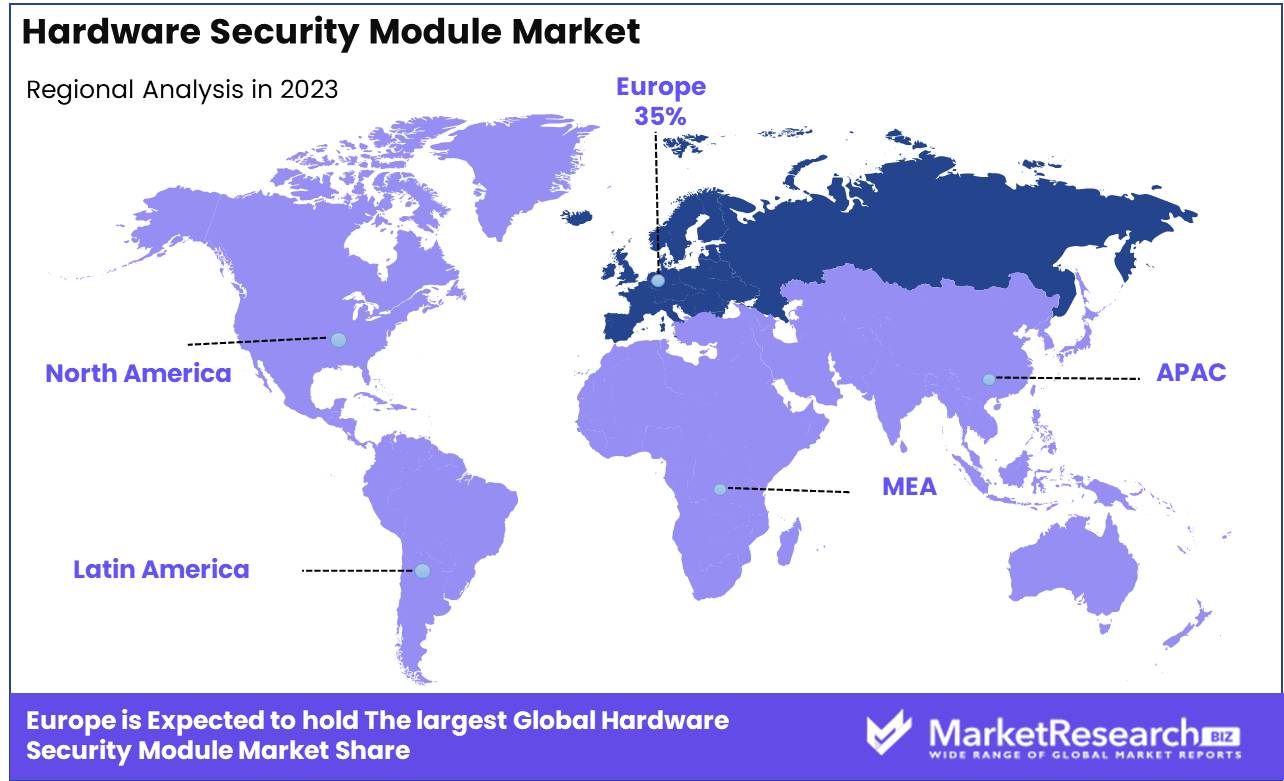

Regional Analysis

Europe dominates the HSM market, holding a 35% largest market share.

The Hardware Security Module (HSM) Market is witnessing substantial growth across various regions, with Europe emerging as the dominant player, holding a significant market share of approximately 35%. Europe’s leadership in the HSM market is driven by the region’s stringent data protection regulations, such as the General Data Protection Regulation (GDPR), which have heightened the demand for secure cryptographic solutions. Additionally, the presence of key market players and advanced technological infrastructure in countries like Germany, France, and the UK further solidifies Europe’s dominant position.

North America follows closely, fueled by robust growth in sectors such as banking, financial services, and insurance (BFSI), and the increasing adoption of cloud-based services. The region is characterized by high awareness and early adoption of HSMs, supported by stringent regulatory frameworks like the Federal Information Processing Standard (FIPS). North America holds a substantial market share, contributing approximately 30% to the global market.

The Asia Pacific region is experiencing rapid growth, driven by the increasing digitalization and expansion of IT infrastructure in countries like China, Japan, and India. The growing emphasis on cybersecurity and the rising number of cyber threats are propelling the adoption of HSMs in this region, which currently holds around 25% of the market share.

Meanwhile, the Middle East & Africa, and Latin America are also witnessing steady growth in the HSM market. These regions are gradually adopting HSMs due to increasing investments in IT security and infrastructure, contributing the remaining 10% to the global market.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Hardware Security Module (HSM) market is poised for significant growth, driven by increasing demand for robust security solutions across various industries. Key players, such as Gemalto NV and Thales eSecurity, continue to dominate the market, leveraging their extensive portfolios of cryptographic products and services. Both companies are capitalizing on the rising need for secure encryption in sectors like finance, government, and healthcare, maintaining their competitive edge through continuous innovation and strategic partnerships.

IBM and Hewlett Packard Enterprise (HPE) represent the U.S. contingent with strong market positions, particularly in data center and cloud security applications. These companies are focusing on integrating HSM technology with broader cybersecurity frameworks, addressing the evolving threats in an increasingly digital world. Futurex and Ultra Electronics further enhance the U.S. presence, offering specialized HSM solutions tailored for high-assurance environments.

European players, such as Ultimaco GmbH and Atos SE, are also critical to the market landscape, particularly in the context of compliance with stringent regional data protection regulations like GDPR. Meanwhile, Yubico and Ledger SAS are making strides in the market with their innovative hardware-based authentication and cryptocurrency security solutions, respectively.

Emerging companies like ellipticSecure and Realsec are expected to drive competition, focusing on niche markets and innovative applications of HSM technology. Overall, the market's growth is underscored by the convergence of cybersecurity needs across sectors, with these key players strategically positioned to meet the demand for enhanced data protection.

Market Key Players

- Gemalto NV (Netherlands)

- Thales eSecurity (France)

- Ultimaco GmbH (Germany)

- IBM (U.S.)

- Futurex (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- Atos SE (France)

- Yubico (U.S.)

- Ultra Electronics (U.K.)

- SWIFT (Belgium)

- Securosys SA (Switzerland)

- CardContact Systems GmbH (Germany)

- Ledger SAS (France)

- SPYRUS (U.S.)

- West One Technical Ltd. (U.K.)

- ASSA ABLOY (Sweden)

- Micro Focus (U.K.)

- SANSEC (Netherlands)

- Lattice Semiconductor (U.S.)

- ellipticSecure (Austria)

- Realsec (Spain)

Recent Development

- In July 2024, Thales Group announced the release of its new Luna Network HSM 8, which offers enhanced cryptographic processing capabilities and improved performance for high-security applications. The Luna Network HSM 8 is designed to support emerging use cases such as quantum-resistant cryptography and blockchain-based applications, ensuring that organizations can maintain security in a rapidly evolving digital landscape.

- In June 2024, Entrust launched its new nShield Connect+ HSM series, which integrates advanced features to support digital transformation initiatives. The nShield Connect+ series is engineered to provide scalability and flexibility, enabling businesses to adapt to growing security demands, particularly in the cloud and hybrid environments. This launch is part of Entrust's strategy to bolster its position in the cybersecurity market.

- In May 2024, IBM expanded its Cloud Hyper Protect Crypto Services with the introduction of the IBM z16 hardware security module. The IBM z16 HSM is tailored for enterprise-level encryption and key management, offering enhanced capabilities for securing sensitive data in cloud and on-premises environments. This development underscores IBM's commitment to advancing security infrastructure in response to increasing cyber threats.

Report Scope

Report Features Description Market Value (2023) USD 1.5 Billion Forecast Revenue (2033) USD 4.4 Billion CAGR (2024-2032) 11.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Smart Cards, LAN based/ Network Attached, PCI-Based/ Embedded Plugins, USB-Based/ Portable), By Deployment Mode (On-premise, Cloud), By Application (Payment Processing, Code and Document Signing, Security Sockets Layer (SSL) and Transport Security Layer (TSL), Authentication, Application-Level Encryption, Others), By Industry Vertical (BFSI, IT and Telecommunication, Government, Consumer Goods and Retail, Transportation, Aerospace, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Gemalto NV (Netherlands), Thales eSecurity (France), Ultimaco GmbH (Germany), IBM (U.S.), Futurex (U.S.), Hewlett Packard Enterprise Development LP (U.S.), Atos SE (France), Yubico (U.S.), Ultra Electronics (U.K.), SWIFT (Belgium), Securosys SA (Switzerland), CardContact Systems GmbH (Germany), Ledger SAS (France), SPYRUS (U.S.), West One Technical Ltd. (U.K.), ASSA ABLOY (Sweden), Micro Focus (U.K.), SANSEC (Netherlands), Lattice Semiconductor (U.S.), ellipticSecure (Austria), Realsec (Spain) Customization Scope Customization for segments at the regional/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Gemalto NV (Netherlands)

- Thales eSecurity (France)

- Ultimaco GmbH (Germany)

- IBM (U.S.)

- Futurex (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- Atos SE (France)

- Yubico (U.S.)

- Ultra Electronics (U.K.)

- SWIFT (Belgium)

- Securosys SA (Switzerland)

- CardContact Systems GmbH (Germany)

- Ledger SAS (France)

- SPYRUS (U.S.)

- West One Technical Ltd. (U.K.)

- ASSA ABLOY (Sweden)

- Micro Focus (U.K.)

- SANSEC (Netherlands)

- Lattice Semiconductor (U.S.)

- ellipticSecure (Austria)

- Realsec (Spain)