Global Positioning Systems (GPS) Market By Device Type (Standalone GPS Devices, GPS-Enabled Smartphones, Wearables), By End-User Industry (Automotive, Aviation, Marine, Agriculture, Telecommunications, Outdoor and Sports), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

25393

-

Aug 2023

-

181

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

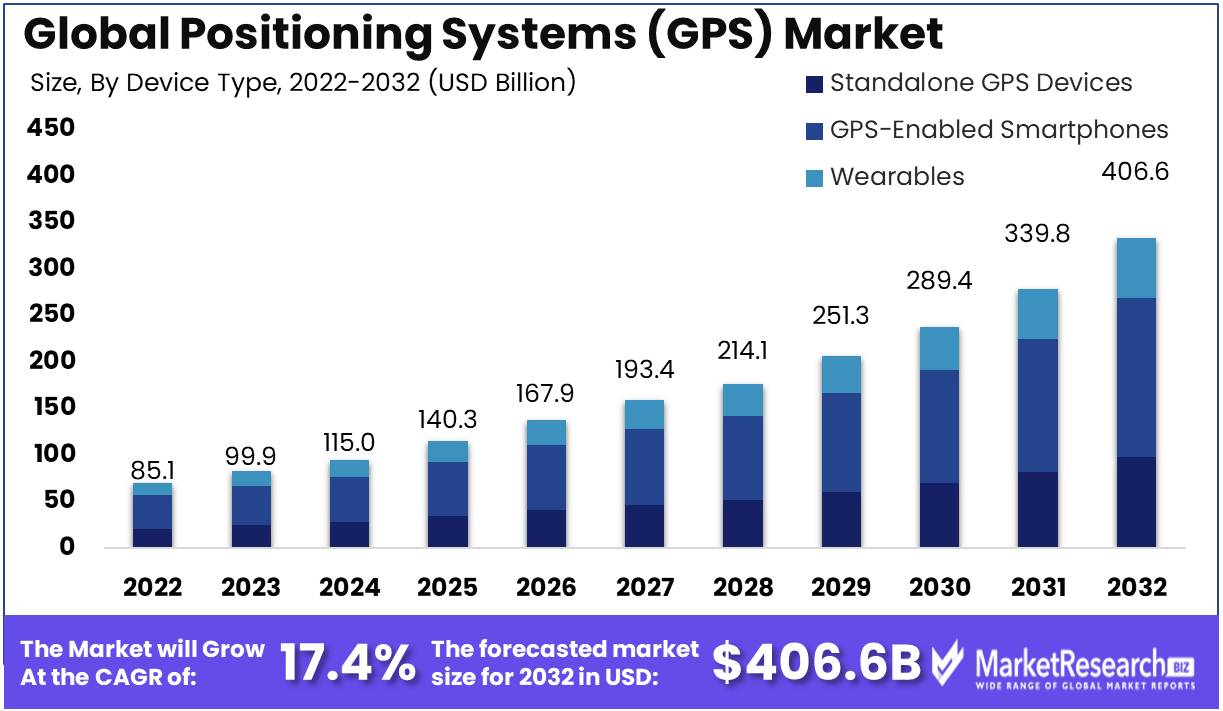

Global Positioning Systems (GPS) Market size is expected to be worth around USD 406.6 Bn by 2032 from USD 85.1 Bn in 2022, growing at a CAGR of 17.4% during the forecast period from 2023 to 2032.

In today's fast-paced and interconnected world, the importance of accurate and dependable location services has grown. Global Positioning Systems (GPS) have revolutionized navigation and tracking of our physical environment. GPS, also known as a satellite navigation system, is a technology that facilitates the precise determination of location and time anywhere on or near the surface of the Earth. GPS technology was initially developed for military purposes but has since found widespread use in civilian sectors.

The ability to precisely determine an individual's location in real-time has had a significant influence on numerous industries and sectors. GPS has become an indispensable component of navigation systems in the transportation industry, providing vehicles with accurate directions and assisting them in avoiding traffic congestion. In addition, GPS is extensively utilized in the aviation and maritime industries for navigation and tracking, thereby improving safety and productivity.

The integration of GPS technology into wearable devices, such as smartwatches and fitness monitors, is one of the notable innovations in the Global Positioning Systems (GPS) market. These devices not only provide accurate location tracking but also valuable health and fitness information. The incorporation of GPS into smartphones is an additional significant development that enables users to access location-based services such as maps, geotagging, and social media check-ins.

The market for Global Positioning Systems (GPS) is primarily driven by the rising demand for accurate location services, the development of satellite technology, and the proliferation of applications that utilize GPS data. In addition, the development of new and enhanced positioning techniques, such as real-time kinematics (RTK) and assisted GPS (A-GPS), has increased the industry-wide adoption of GPS technology.

Driving Factors

Increasing Demand for Location Based Services and Navigation Systems

Location-based services and navigation are now an integral part of daily life due to the accelerated growth of technology and the prevalence of smartphones. These GPS-dependent services provide real-time user location data for personalized experiences and advertisements, thereby bolstering the GPS market. GPS systems are essential for navigation in industries such as the automobile industry, facilitating efficient routes and directions.

The Growth of the Automotive and Transportation Sectors

The expansion of the automotive and transportation industries has increased demand for GPS systems. In-car GPS technology provides real-time updates, safety functions, and entertainment. Ridesharing and car summoning increase this demand. Moreover, fleet management in transportation is dependent on GPS. In commercial vehicles, devices aid in tracking, route optimization, and efficiency, reducing petroleum consumption. Data in real-time improves logistics by streamlining processes and enhancing customer satisfaction.

Expansion of the Smartphone and Wearable Device Markets

The surge in smartphone and peripheral sectors has boosted the need for gadgets embedding GPS features, facilitating on-the-move location-based services. This GPS technology is now crucial for tasks like spotting facilities, tracking health, and recovering lost possessions. The trend is especially pronounced in the rising demand for fitness trackers and smartwatches, fueling the wearable market's dependence on GPS for precise route and distance tracking. This upswing in health and activity monitoring is expected to propel substantial expansion in the GPS market.

Advancements in GPS Technology and Satellite Systems

Continuous improvements to GPS technology and satellite networks have increased their precision, dependability, and usefulness. Global Navigation Satellite Systems (GNSS) such as GPS, GLONASS, Galileo, and BeiDou have enhanced global accessibility to positioning and navigation services. Using satellite constellations and terrestrial components, these systems provide precise and uninterrupted positioning information. The incorporation of sophisticated satellite features, such as more precise signals and receivers for multiple constellations, has significantly increased the Global Positioning Systems (GPS) market.

Rising Adoption of Precision Agriculture and Fleet Management Solutions

The growing need for precision agriculture and fleet management is driving the expansion of the GPS market. In agriculture, GPS enhances precision with accurate field boundaries, crop monitoring, and automation. Fleet management utilizes GPS for vehicle tracking, optimal routes, fuel efficiency, and driver safety. This adoption of GPS responds to the demand for streamlined logistics and cost savings in both agriculture and transportation.

Restraining Factors

Potential Signal Interference and Accuracy Limitations

GPS systems rely significantly on multiple satellite signals for precise positioning, velocity, and time synchronization. Environmental factors such as lofty buildings, dense vegetation, and inclement weather can interfere with signal reception and reduce precision. Natural and manmade structures (tunnels, overpasses) also impede GPS precision. Manufacturers counteract this with improved antennas, enhanced satellite signals, and sophisticated signal processing. Multi-constellation receivers that utilize signals from multiple navigation systems increase precision and decrease interference, thereby reducing market restrictions for Global Positioning Systems (GPS).

Potential Privacy and Security Concerns

Significant privacy and security concerns have arisen in the Global Positioning Systems (GPS) market due to the expanding use of GPS technology in various industries, such as transportation, logistics, and personal navigation. GPS data can be exploited, jeopardizing privacy and possibly compromising sensitive information. In response, stringent global privacy regulations and data protection laws have been implemented. These regulations are adhered to by GPS manufacturers and service providers by implementing robust encryption, secure data transmission, and user-consent data collection. Additionally, the continued incorporation of advanced network security technologies increases consumer confidence in GPS systems.

Potential Cost and Infrastructure Requirements

Investments are required for the development and maintenance of GPS infrastructure, which includes satellite networks, control stations, and data centers. These expenditures affect the competitiveness of GPS systems. When establishing such infrastructure in remote regions, substantial efforts and investments are required to overcome obstacles. However, technology, economies of scale, and partnerships improve GPS accessibility. Continued hardware cost reduction, improved integration, and cloud-based solutions lighten the financial burden, thereby promoting GPS technology adoption across industries.

Device Type Analysis

In the ever-changing world of technology, it is impossible to ignore the dominance of GPS-enabled smartphones in the global positioning systems market. These smartphones have become the preferred devices for navigation and location monitoring due to their adaptability and extensive feature set.

The integration of GPS technology into smartphones has revolutionized our navigation and exploration of the globe. We can now access real-time directions, discover nearby points of interest, and monitor our fitness activities with just a few taps on our screens. These advantages have made GPS-enabled smartphones the preferred option among consumers.

Emerging economies' economic growth is one of the most important factors propelling the adoption of GPS-enabled smartphones. Due to factors such as rising disposable income and technological advancements, these economies have witnessed a rapid increase in the number of people who own smartphones.

As these emerging economies continue to develop, the demand for GPS-enabled smartphones increases. This is primarily due to the increasing demand for navigation and location tracking services, both for personal and business use. With the rise of e-commerce and delivery services, GPS-enabled smartphones play a crucial role in ensuring timely and accurate deliveries.

Application Analysis

The navigation subsegment of the global positioning systems market has emerged as the dominant force in terms of GPS applications. Navigation systems have become an integral part of our daily lives, making travel convenient and dependable.

The navigation segment includes devices that offer turn-by-turn directions, real-time traffic updates, and suggested alternate routes. These devices have revolutionized and made travel more efficient by reducing travel time and the likelihood of getting disoriented. They enable users to easily investigate new locations and navigate unfamiliar terrains.

The adoption of navigation systems has been substantially influenced by the economic growth of emergent economies. As these economies expand and urbanize, the demand for efficient transportation systems increases. The importance of navigation systems in managing traffic congestion and optimizing travel routes cannot be overstated.

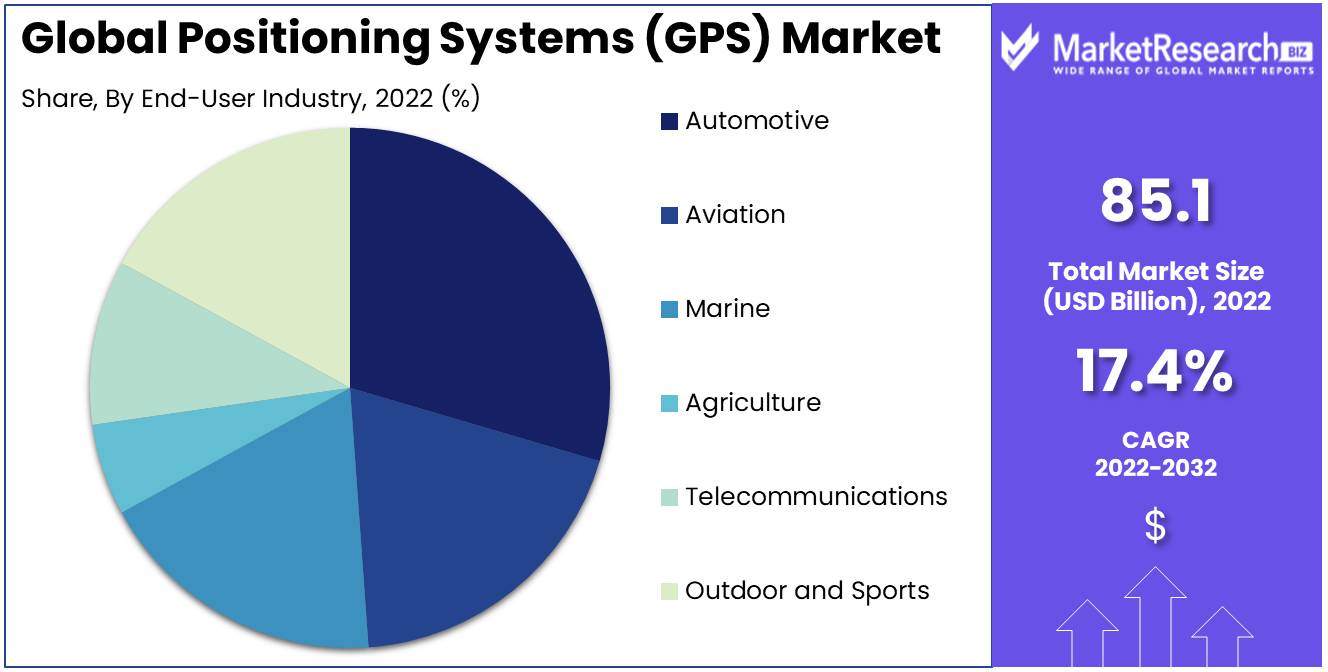

End-User Industry Analysis

In the market for global positioning systems (GPS), the automotive sector has become the dominant force. GPS technology has become an integral component of modern vehicles, providing features such as real-time navigation, fleet management, and the recovery of stolen vehicles.

The incorporation of GPS systems into vehicles has revolutionized the way we navigate and travel. It has improved the safety, efficiency, and convenience of our travels. GPS technology has become a necessity in both personal and commercial vehicles due to its ability to provide precise directions and optimize fuel consumption.

The economic development of emerging societies has had a significant impact on the automotive industry's adoption of GPS systems. As these economies develop, the demand for advanced automotive technologies that improve safety, fuel economy, and connectivity increases.

In addition, the thriving e-commerce industry in emerging economies has increased demand for efficient transportation and logistics services. GPS systems enable fleet managers to monitor their vehicles, optimize routes, and ensure on-time deliveries, thereby driving the automotive industry's adoption of GPS technology.

Key Market Segments

Device Type

- Standalone GPS Devices

- GPS-Enabled Smartphones

- Wearables

Application

- Navigation

- Tracking and Monitoring

- Timing and Synchronization

- Geotagging and Mapping

End-User Industry

- Automotive

- Aviation

- Marine

- Agriculture

- Telecommunications

- Outdoor and Sports

Growth Opportunity

Integration of GPS in Wearable Devices for Healthcare Tracking

Due to factors such as advanced receivers, smartphone expansion, collaboration with navigation providers, and adoption in recreation, autonomous vehicles, and drones, the Global Positioning Systems (GPS) market has expanded. Still, additional development potential exists. Integrating GPS into health monitors is one approach. With the growing demand for fitness trackers, the addition of GPS can monitor activities and locations. This aides emergency services, healthcare, and the monitoring of the elderly and chronic patients. This GPS-wearable integration represents a growth opportunity for the market.

Utilization of GPS in Agriculture for Precision Farming

The market for global positioning systems (GPS) has an expansion opportunity in agriculture, specifically precision farming. This involves using GPS to improve agricultural operations, increase productivity, and reduce expenses. By incorporating GPS technology into agricultural equipment such as tractors, producers can achieve greater precision in activities such as planting and spraying. In addition, GPS aides in field mapping, identifying problem areas, and crop health monitoring, thereby guiding irrigation and fertilization decisions. This promotes efficient resource management and crop yields, thereby advancing the Global Positioning Systems (GPS) market via precision agriculture.

Integration of GPS in Disaster Management Systems

The Global Positioning Systems (GPS) market can expand through the incorporation of GPS technology into disaster management systems. In times of emergency, it is crucial to have access to accurate and prompt information. By incorporating GPS receivers, responders are able to efficiently trace individuals, assess the impact of a disaster, and distribute resources. GPS aids in mapping affected areas, identifying evacuation routes, and real-time monitoring, thereby improving the efficacy of emergency response. This integration promises a promising future for the market for Global Positioning Systems (GPS) by enhancing disaster management.

Latest Trends

Revolutionizing Navigation with GPS-Enabled Smartphones

GPS-equipped smartphones have transformed navigation, offering accurate location tracking, efficient route finding, and easy exploration. The GPS smartphone market experiences constant growth as major players meet rising consumer demand. This integration elevates user experiences, opening doors to innovative location-based applications and services.

Fitness Tracking Gets a Boost from Wearable GPS Devices

The demand for wearable GPS devices and fitness trackers is soaring. These wearables, enhanced with GPS technology, accurately monitor activities like running, walking, and cycling. Outdoor enthusiasts benefit as GPS integration tracks routes, measures distances, and offers real-time progress monitoring. This trend presents ample opportunities for innovative wearable offerings.

Revolutionizing Logistics with GPS

GPS technology is reshaping logistics and supply chain management. As global trade increases, businesses rely on GPS for operational efficiency, enhanced tracking, and real-time shipment visibility. GPS-enabled tracking devices provide insights into asset location, optimize delivery routes, and mitigate inventory risks. Integration in logistics streamlines processes for seamless global goods flow.

Precision Agriculture and Asset Tracking Transformed by GPS

Precision agriculture leverages GPS for field mapping, soil analysis, irrigation optimization, and crop monitoring. This increases yields and promotes sustainable farming. In asset tracking, GPS revolutionizes asset management, from vehicles to high-value equipment. Real-time tracking improves utilization, prevents theft, and streamlines maintenance, transforming industries.

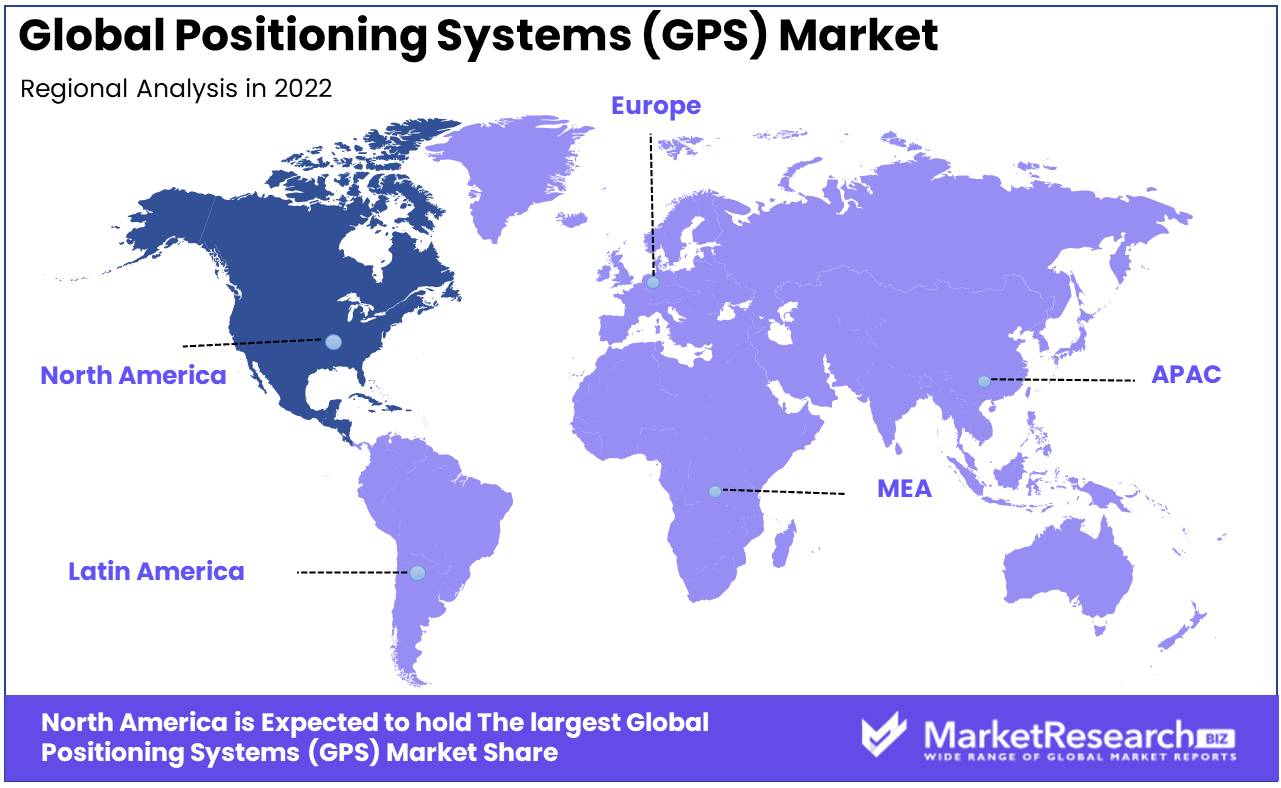

Regional Analysis

North America Continent Our esteemed organization, which dominates the GPS (Global Positioning Systems) market, takes great delight in providing comprehensive insights into the global market trends and emerging technologies that shape our world. Today, we delve into the GPS (Global Positioning Systems) market, which has revolutionized navigation and tracking systems worldwide.

In recent years, the Global Positioning Systems (GPS) market has expanded significantly due to the rising demand for precision location services in industries such as automotive, transportation, and healthcare. As both businesses and individuals recognize the importance of precise positioning, the market has witnessed a surge in adoption. This growth has enabled North America to become the dominant region in the Global Positioning Systems (GPS) market, establishing its dominance.

Several factors contribute to North America's dominant position in the Global Positioning Systems (GPS) market. To begin with, the region possesses a robust technological infrastructure and a highly developed economy that encourages innovation and investment. This has resulted in the development of cutting-edge GPS technologies and advanced navigation systems, placing North American businesses at the vanguard of the market.

In addition, North America benefits from a regulatory framework that encourages the expansion of the GPS industry. Governments in the region have enacted policies to promote the adoption and integration of GPS systems across multiple industries, enabling businesses to leverage location-based services to improve operational efficiency and consumer experience.

Furthermore, North America's Global Positioning Systems (GPS) market dominance can be attributed to successful partnerships between private companies, research institutions, and the government. Collaboration has facilitated the creation of innovative technologies, ensuring that the region remains at the vanguard of GPS developments. Such collaborations have led to the implementation of GPS systems in numerous applications, including autonomous vehicles, precision agriculture, and emergency services.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Calamp is the foremost provider of telematics and networked intelligence solutions with headquarters in the United States. With their comprehensive GPS technology, Calamp empowers businesses in a variety of industries to improve operational efficiency, cut costs, and enhance safety. Fleet management, asset monitoring, and supply chain optimization are just a few of the industries catered to by their extensive selection of innovative products and services.

Orbocomm, also situated in the United States, specializes in M2M and IoT solutions. Orbocomm provides end-to-end telematics platforms that facilitate efficient asset management, logistics, and industrial operations by leveraging their extensive knowledge of GPS technology. Their solutions empower organizations to make informed decisions and optimize their performance by providing real-time data and analytics.

Qualcomm Technologies Inc., a prominent American telecommunications company, performs a crucial role in the development of GPS technology. They enable the seamless incorporation of GPS features into mobile devices, automobiles, and smart wearables with their cutting-edge Snapdragon processors and Qualcomm Snapdragon Automotive platforms. Qualcomm Technologies Inc.'s commitment to delivering unparalleled performance and connectivity continues to drive innovation and influence the future of GPS technology.

Sierra Wireless, headquartered in Canada, is a global leader in IoT solutions and wireless communication modules. Their extensive selection of GPS-enabled products serves a variety of industries, including the automotive, healthcare, energy, and industrial automation sectors. Sierra Wireless is distinguished by its robust and dependable GPS technology, which enables organizations to track and manage their assets effectively.

Hexagon, a Swedish technology corporation, provides an extensive selection of GPS-enabled solutions for industries such as geospatial, manufacturing, and construction. Their portfolio consists of cutting-edge GPS tracking devices, precise positioning systems, and software platforms that enable businesses to optimize workflows, boost productivity, and increase safety. Hexagon's dedication to innovation and precision solidifies its position as a global GPS market leader.

Top Key Players in Positioning Systems (GPS) Market

- Calamp (U.S.)

- Orbocomm (U.S.)

- Qualcomm Technologies Inc (U.S.)

- Sierra Wireless (Canada)

- Hexagon (Sweden)

- Queclink Wireless Solutions Co. Ltd. (China)

- Shenzhen Concox Information Technology Co. Ltd.(China)

- Laird (U.K)

- TomTom International BV (Netherlands)

- Meitrack Group (China)

- Teltonika (Lithuania)

- TomTom International BV. (Amsterdam)

- ATrack Technology Inc. (Taiwan)

- Verizon (U.S.)

- Trackimo (U.S.)

- Geotab Inc. (Canada)

Recent Development

- In 2023, Garmin, an industry leader in GPS technology, has shook the industry by announcing a new line of GPS devices designed specifically for use in automobiles. This revolutionary innovation seeks to improve in-car navigation by incorporating cutting-edge features, empowering drivers with real-time data, and ensuring seamless connectivity. These innovations will propel vehicle navigation systems to new heights, promising safer and more efficient travel.

- In 2022, TomTom, an already dominant player in the GPS market, announced the expansion of its GPS production capacity in China in order to satisfy the rapidly expanding global demand for navigation systems. This strategic move demonstrates the company's commitment to enhancing its manufacturing capabilities and assuring a seamless global supply chain for its clients. TomTom will be able to maintain its competitive advantage and meet rising market demands by consolidating its presence in the largest GPS manufacturing center.

- In 2021, Trimble, a renowned provider of innovative GPS solutions, joined forces with technology titan Google to develop a new GPS technology specifically for autonomous vehicles. This game-changing partnership aims to surmount the unique challenges autonomous vehicles face, such as precise positioning, real-time data exchange, and robust connectivity. This revolutionary technology promises to open up new frontiers for self-driving vehicle navigation by combining Google's immense technical prowess and Trimble's expertise in precise positioning.

- In 2020, Qualcomm, a global leader in wireless communications technology, shook up the GPS market with its acquisition of Veoneer, an innovative company specializing in the development of GPS technology for automotive applications. This move represents Qualcomm's strategic expansion into the automotive industry, where GPS systems play an essential role in advanced driver assistance systems (ADAS) and autonomous driving. With the combination of Veoneer's knowledge and Qualcomm's extensive resources and engineering prowess, groundbreaking advancements and innovations in GPS technology are imminent.

Report Scope

Report Features Description Market Value (2022) USD 85.1 Bn Forecast Revenue (2032) USD 406.6 Bn CAGR (2023-2032) 17.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Device Type (Standalone GPS Devices, GPS-Enabled Smartphones, Wearables)

Application (Navigation, Tracking and Monitoring, Timing and Synchronization, Geotagging and Mapping)

End-User Industry (Automotive, Aviation, Marine, Agriculture, Telecommunications, Outdoor and Sports)Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Calamp (US), Orbocomm (US), Qualcomm Technologies Inc (US), Sierra Wireless (Canada), Hexagon (Sweden), Queclink Wireless Solutions Co. Ltd. (China), Shenzhen Concox Information Technology Co. Ltd. (China) , Laird (UK), TomTom International BV (Netherlands), Meitrack Group (China), Teltonika (Lithuania), TomTom International BV. (Amsterdam), ATrack Technology Inc. (Taiwan), Verizon (US), Trackimo (US), Geotab Inc. (Canada) Customization Scope Customization for segments, region/country-level will be provided. Furthermore, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Global Positioning Systems (GPS) Market Overview

- 2.1. Global Positioning Systems (GPS) Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Global Positioning Systems (GPS) Market Dynamics

- 3. Global Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Global Positioning Systems (GPS) Market Analysis, 2016-2021

- 3.2. Global Global Positioning Systems (GPS) Market Opportunity and Forecast, 2023-2032

- 3.3. Global Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, By Device Type, 2016-2032

- 3.3.1. Global Global Positioning Systems (GPS) Market Analysis By Device Type: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Device Type, 2016-2032

- 3.3.3. Standalone GPS Devices

- 3.3.4. GPS-Enabled Smartphones

- 3.3.5. Wearables

- 3.4. Global Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 3.4.1. Global Global Positioning Systems (GPS) Market Analysis By Application: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 3.4.3. Navigation

- 3.4.4. Tracking and Monitoring

- 3.4.5. Timing and Synchronization

- 3.4.6. Geotagging and Mapping

- 3.5. Global Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, By End-User Industry, 2016-2032

- 3.5.1. Global Global Positioning Systems (GPS) Market Analysis By End-User Industry: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User Industry, 2016-2032

- 3.5.3. Automotive

- 3.5.4. Aviation

- 3.5.5. Marine

- 3.5.6. Agriculture

- 3.5.7. Telecommunications

- 3.5.8. Outdoor and Sports

- 4. North America Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Global Positioning Systems (GPS) Market Analysis, 2016-2021

- 4.2. North America Global Positioning Systems (GPS) Market Opportunity and Forecast, 2023-2032

- 4.3. North America Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, By Device Type, 2016-2032

- 4.3.1. North America Global Positioning Systems (GPS) Market Analysis By Device Type: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Device Type, 2016-2032

- 4.3.3. Standalone GPS Devices

- 4.3.4. GPS-Enabled Smartphones

- 4.3.5. Wearables

- 4.4. North America Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 4.4.1. North America Global Positioning Systems (GPS) Market Analysis By Application: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 4.4.3. Navigation

- 4.4.4. Tracking and Monitoring

- 4.4.5. Timing and Synchronization

- 4.4.6. Geotagging and Mapping

- 4.5. North America Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, By End-User Industry, 2016-2032

- 4.5.1. North America Global Positioning Systems (GPS) Market Analysis By End-User Industry: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User Industry, 2016-2032

- 4.5.3. Automotive

- 4.5.4. Aviation

- 4.5.5. Marine

- 4.5.6. Agriculture

- 4.5.7. Telecommunications

- 4.5.8. Outdoor and Sports

- 4.6. North America Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, By Country, 2016-2032

- 4.6.1. North America Global Positioning Systems (GPS) Market Analysis by Country : Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country, 2016-2032

- 4.6.2.1. The US

- 4.6.2.2. Canada

- 4.6.2.3. Mexico

- 5. Western Europe Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Global Positioning Systems (GPS) Market Analysis, 2016-2021

- 5.2. Western Europe Global Positioning Systems (GPS) Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, By Device Type, 2016-2032

- 5.3.1. Western Europe Global Positioning Systems (GPS) Market Analysis By Device Type: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Device Type, 2016-2032

- 5.3.3. Standalone GPS Devices

- 5.3.4. GPS-Enabled Smartphones

- 5.3.5. Wearables

- 5.4. Western Europe Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 5.4.1. Western Europe Global Positioning Systems (GPS) Market Analysis By Application: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 5.4.3. Navigation

- 5.4.4. Tracking and Monitoring

- 5.4.5. Timing and Synchronization

- 5.4.6. Geotagging and Mapping

- 5.5. Western Europe Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, By End-User Industry, 2016-2032

- 5.5.1. Western Europe Global Positioning Systems (GPS) Market Analysis By End-User Industry: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User Industry, 2016-2032

- 5.5.3. Automotive

- 5.5.4. Aviation

- 5.5.5. Marine

- 5.5.6. Agriculture

- 5.5.7. Telecommunications

- 5.5.8. Outdoor and Sports

- 5.6. Western Europe Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, By Country, 2016-2032

- 5.6.1. Western Europe Global Positioning Systems (GPS) Market Analysis by Country : Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country, 2016-2032

- 5.6.2.1. Germany

- 5.6.2.2. France

- 5.6.2.3. The UK

- 5.6.2.4. Spain

- 5.6.2.5. Italy

- 5.6.2.6. Portugal

- 5.6.2.7. Ireland

- 5.6.2.8. Austria

- 5.6.2.9. Switzerland

- 5.6.2.10. Benelux

- 5.6.2.11. Nordic

- 5.6.2.12. Rest of Western Europe

- 6. Eastern Europe Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Global Positioning Systems (GPS) Market Analysis, 2016-2021

- 6.2. Eastern Europe Global Positioning Systems (GPS) Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, By Device Type, 2016-2032

- 6.3.1. Eastern Europe Global Positioning Systems (GPS) Market Analysis By Device Type: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Device Type, 2016-2032

- 6.3.3. Standalone GPS Devices

- 6.3.4. GPS-Enabled Smartphones

- 6.3.5. Wearables

- 6.4. Eastern Europe Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 6.4.1. Eastern Europe Global Positioning Systems (GPS) Market Analysis By Application: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 6.4.3. Navigation

- 6.4.4. Tracking and Monitoring

- 6.4.5. Timing and Synchronization

- 6.4.6. Geotagging and Mapping

- 6.5. Eastern Europe Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, By End-User Industry, 2016-2032

- 6.5.1. Eastern Europe Global Positioning Systems (GPS) Market Analysis By End-User Industry: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User Industry, 2016-2032

- 6.5.3. Automotive

- 6.5.4. Aviation

- 6.5.5. Marine

- 6.5.6. Agriculture

- 6.5.7. Telecommunications

- 6.5.8. Outdoor and Sports

- 6.6. Eastern Europe Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, By Country, 2016-2032

- 6.6.1. Eastern Europe Global Positioning Systems (GPS) Market Analysis by Country : Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country, 2016-2032

- 6.6.2.1. Russia

- 6.6.2.2. Poland

- 6.6.2.3. The Czech Republic

- 6.6.2.4. Greece

- 6.6.2.5. Rest of Eastern Europe

- 7. APAC Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Global Positioning Systems (GPS) Market Analysis, 2016-2021

- 7.2. APAC Global Positioning Systems (GPS) Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, By Device Type, 2016-2032

- 7.3.1. APAC Global Positioning Systems (GPS) Market Analysis By Device Type: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Device Type, 2016-2032

- 7.3.3. Standalone GPS Devices

- 7.3.4. GPS-Enabled Smartphones

- 7.3.5. Wearables

- 7.4. APAC Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 7.4.1. APAC Global Positioning Systems (GPS) Market Analysis By Application: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 7.4.3. Navigation

- 7.4.4. Tracking and Monitoring

- 7.4.5. Timing and Synchronization

- 7.4.6. Geotagging and Mapping

- 7.5. APAC Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, By End-User Industry, 2016-2032

- 7.5.1. APAC Global Positioning Systems (GPS) Market Analysis By End-User Industry: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User Industry, 2016-2032

- 7.5.3. Automotive

- 7.5.4. Aviation

- 7.5.5. Marine

- 7.5.6. Agriculture

- 7.5.7. Telecommunications

- 7.5.8. Outdoor and Sports

- 7.6. APAC Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, By Country, 2016-2032

- 7.6.1. APAC Global Positioning Systems (GPS) Market Analysis by Country : Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country, 2016-2032

- 7.6.2.1. China

- 7.6.2.2. Japan

- 7.6.2.3. South Korea

- 7.6.2.4. India

- 7.6.2.5. Australia & New Zeland

- 7.6.2.6. Indonesia

- 7.6.2.7. Malaysia

- 7.6.2.8. Philippines

- 7.6.2.9. Singapore

- 7.6.2.10. Thailand

- 7.6.2.11. Vietnam

- 7.6.2.12. Rest of APAC

- 8. Latin America Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Global Positioning Systems (GPS) Market Analysis, 2016-2021

- 8.2. Latin America Global Positioning Systems (GPS) Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, By Device Type, 2016-2032

- 8.3.1. Latin America Global Positioning Systems (GPS) Market Analysis By Device Type: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Device Type, 2016-2032

- 8.3.3. Standalone GPS Devices

- 8.3.4. GPS-Enabled Smartphones

- 8.3.5. Wearables

- 8.4. Latin America Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 8.4.1. Latin America Global Positioning Systems (GPS) Market Analysis By Application: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 8.4.3. Navigation

- 8.4.4. Tracking and Monitoring

- 8.4.5. Timing and Synchronization

- 8.4.6. Geotagging and Mapping

- 8.5. Latin America Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, By End-User Industry, 2016-2032

- 8.5.1. Latin America Global Positioning Systems (GPS) Market Analysis By End-User Industry: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User Industry, 2016-2032

- 8.5.3. Automotive

- 8.5.4. Aviation

- 8.5.5. Marine

- 8.5.6. Agriculture

- 8.5.7. Telecommunications

- 8.5.8. Outdoor and Sports

- 8.6. Latin America Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, By Country, 2016-2032

- 8.6.1. Latin America Global Positioning Systems (GPS) Market Analysis by Country : Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country, 2016-2032

- 8.6.2.1. Brazil

- 8.6.2.2. Colombia

- 8.6.2.3. Chile

- 8.6.2.4. Argentina

- 8.6.2.5. Costa Rica

- 8.6.2.6. Rest of Latin America

- 9. Middle East & Africa Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Global Positioning Systems (GPS) Market Analysis, 2016-2021

- 9.2. Middle East & Africa Global Positioning Systems (GPS) Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, By Device Type, 2016-2032

- 9.3.1. Middle East & Africa Global Positioning Systems (GPS) Market Analysis By Device Type: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Device Type, 2016-2032

- 9.3.3. Standalone GPS Devices

- 9.3.4. GPS-Enabled Smartphones

- 9.3.5. Wearables

- 9.4. Middle East & Africa Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 9.4.1. Middle East & Africa Global Positioning Systems (GPS) Market Analysis By Application: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 9.4.3. Navigation

- 9.4.4. Tracking and Monitoring

- 9.4.5. Timing and Synchronization

- 9.4.6. Geotagging and Mapping

- 9.5. Middle East & Africa Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, By End-User Industry, 2016-2032

- 9.5.1. Middle East & Africa Global Positioning Systems (GPS) Market Analysis By End-User Industry: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User Industry, 2016-2032

- 9.5.3. Automotive

- 9.5.4. Aviation

- 9.5.5. Marine

- 9.5.6. Agriculture

- 9.5.7. Telecommunications

- 9.5.8. Outdoor and Sports

- 9.6. Middle East & Africa Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, By Country, 2016-2032

- 9.6.1. Middle East & Africa Global Positioning Systems (GPS) Market Analysis by Country : Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country, 2016-2032

- 9.6.2.1. Algeria

- 9.6.2.2. Egypt

- 9.6.2.3. Israel

- 9.6.2.4. Kuwait

- 9.6.2.5. Nigeria

- 9.6.2.6. Saudi Arabia

- 9.6.2.7. South Africa

- 9.6.2.8. Turkey

- 9.6.2.9. The UAE

- 9.6.2.10. Rest of MEA

- 10. Global Global Positioning Systems (GPS) Market Analysis, Opportunity and Forecast, By Region, 2016-2032

- 10.1. Global Global Positioning Systems (GPS) Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region, 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Global Positioning Systems (GPS) Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Calamp (U.S.)

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Orbocomm (U.S.)

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Qualcomm Technologies Inc (U.S.)

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Sierra Wireless (Canada)

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Hexagon (Sweden)

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Queclink Wireless Solutions Co. Ltd. (China)

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Shenzhen Concox Information Technology Co. Ltd.(China)

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Laird (U.K)

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. TomTom International BV (Netherlands)

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Meitrack Group (China)

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13. Teltonika (Lithuania)

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. TomTom International BV. (Amsterdam)

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. ATrack Technology Inc. (Taiwan)

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 11.16. Verizon (U.S.)

- 11.16.1. Company Overview

- 11.16.2. Financial Highlights

- 11.16.3. Product Portfolio

- 11.16.4. SWOT Analysis

- 11.16.5. Key Strategies and Developments

- 11.17. Trackimo (U.S.)

- 11.17.1. Company Overview

- 11.17.2. Financial Highlights

- 11.17.3. Product Portfolio

- 11.17.4. SWOT Analysis

- 11.17.5. Key Strategies and Developments

- 11.18. Geotab Inc. (Canada)

- 11.18.1. Company Overview

- 11.18.2. Financial Highlights

- 11.18.3. Product Portfolio

- 11.18.4. SWOT Analysis

- 11.18.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

"

- List of Figures

- "

- Figure 1: Global Global Positioning Systems (GPS) Market Revenue (US$ Mn) Market Share By Device Type in 2022

- Figure 2: Global Global Positioning Systems (GPS) Market Attractiveness Analysis By Device Type, 2016-2032

- Figure 3: Global Global Positioning Systems (GPS) Market Revenue (US$ Mn) Market Share By Applicationin 2022

- Figure 4: Global Global Positioning Systems (GPS) Market Attractiveness Analysis By Application, 2016-2032

- Figure 5: Global Global Positioning Systems (GPS) Market Revenue (US$ Mn) Market Share By End-User Industryin 2022

- Figure 6: Global Global Positioning Systems (GPS) Market Attractiveness Analysis By End-User Industry, 2016-2032

- Figure 7: Global Global Positioning Systems (GPS) Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 8: Global Global Positioning Systems (GPS) Market Attractiveness Analysis by Region, 2016-2032

- Figure 9: Global Global Positioning Systems (GPS) Market Revenue (US$ Mn) (2016-2032)

- Figure 10: Global Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 11: Global Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By Device Type (2016-2032)

- Figure 12: Global Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Figure 13: Global Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By End-User Industry (2016-2032)

- Figure 14: Global Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 15: Global Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By Device Type (2016-2032)

- Figure 16: Global Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Figure 17: Global Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By End-User Industry (2016-2032)

- Figure 18: Global Global Positioning Systems (GPS) Market Share Comparison by Region (2016-2032)

- Figure 19: Global Global Positioning Systems (GPS) Market Share Comparison By Device Type (2016-2032)

- Figure 20: Global Global Positioning Systems (GPS) Market Share Comparison By Application (2016-2032)

- Figure 21: Global Global Positioning Systems (GPS) Market Share Comparison By End-User Industry (2016-2032)

- Figure 22: North America Global Positioning Systems (GPS) Market Revenue (US$ Mn) Market Share By Device Typein 2022

- Figure 23: North America Global Positioning Systems (GPS) Market Attractiveness Analysis By Device Type, 2016-2032

- Figure 24: North America Global Positioning Systems (GPS) Market Revenue (US$ Mn) Market Share By Applicationin 2022

- Figure 25: North America Global Positioning Systems (GPS) Market Attractiveness Analysis By Application, 2016-2032

- Figure 26: North America Global Positioning Systems (GPS) Market Revenue (US$ Mn) Market Share By End-User Industryin 2022

- Figure 27: North America Global Positioning Systems (GPS) Market Attractiveness Analysis By End-User Industry, 2016-2032

- Figure 28: North America Global Positioning Systems (GPS) Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 29: North America Global Positioning Systems (GPS) Market Attractiveness Analysis by Country, 2016-2032

- Figure 30: North America Global Positioning Systems (GPS) Market Revenue (US$ Mn) (2016-2032)

- Figure 31: North America Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 32: North America Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By Device Type (2016-2032)

- Figure 33: North America Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Figure 34: North America Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By End-User Industry (2016-2032)

- Figure 35: North America Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 36: North America Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By Device Type (2016-2032)

- Figure 37: North America Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Figure 38: North America Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By End-User Industry (2016-2032)

- Figure 39: North America Global Positioning Systems (GPS) Market Share Comparison by Country (2016-2032)

- Figure 40: North America Global Positioning Systems (GPS) Market Share Comparison By Device Type (2016-2032)

- Figure 41: North America Global Positioning Systems (GPS) Market Share Comparison By Application (2016-2032)

- Figure 42: North America Global Positioning Systems (GPS) Market Share Comparison By End-User Industry (2016-2032)

- Figure 43: Western Europe Global Positioning Systems (GPS) Market Revenue (US$ Mn) Market Share By Device Typein 2022

- Figure 44: Western Europe Global Positioning Systems (GPS) Market Attractiveness Analysis By Device Type, 2016-2032

- Figure 45: Western Europe Global Positioning Systems (GPS) Market Revenue (US$ Mn) Market Share By Applicationin 2022

- Figure 46: Western Europe Global Positioning Systems (GPS) Market Attractiveness Analysis By Application, 2016-2032

- Figure 47: Western Europe Global Positioning Systems (GPS) Market Revenue (US$ Mn) Market Share By End-User Industryin 2022

- Figure 48: Western Europe Global Positioning Systems (GPS) Market Attractiveness Analysis By End-User Industry, 2016-2032

- Figure 49: Western Europe Global Positioning Systems (GPS) Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 50: Western Europe Global Positioning Systems (GPS) Market Attractiveness Analysis by Country, 2016-2032

- Figure 51: Western Europe Global Positioning Systems (GPS) Market Revenue (US$ Mn) (2016-2032)

- Figure 52: Western Europe Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 53: Western Europe Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By Device Type (2016-2032)

- Figure 54: Western Europe Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Figure 55: Western Europe Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By End-User Industry (2016-2032)

- Figure 56: Western Europe Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 57: Western Europe Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By Device Type (2016-2032)

- Figure 58: Western Europe Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Figure 59: Western Europe Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By End-User Industry (2016-2032)

- Figure 60: Western Europe Global Positioning Systems (GPS) Market Share Comparison by Country (2016-2032)

- Figure 61: Western Europe Global Positioning Systems (GPS) Market Share Comparison By Device Type (2016-2032)

- Figure 62: Western Europe Global Positioning Systems (GPS) Market Share Comparison By Application (2016-2032)

- Figure 63: Western Europe Global Positioning Systems (GPS) Market Share Comparison By End-User Industry (2016-2032)

- Figure 64: Eastern Europe Global Positioning Systems (GPS) Market Revenue (US$ Mn) Market Share By Device Typein 2022

- Figure 65: Eastern Europe Global Positioning Systems (GPS) Market Attractiveness Analysis By Device Type, 2016-2032

- Figure 66: Eastern Europe Global Positioning Systems (GPS) Market Revenue (US$ Mn) Market Share By Applicationin 2022

- Figure 67: Eastern Europe Global Positioning Systems (GPS) Market Attractiveness Analysis By Application, 2016-2032

- Figure 68: Eastern Europe Global Positioning Systems (GPS) Market Revenue (US$ Mn) Market Share By End-User Industryin 2022

- Figure 69: Eastern Europe Global Positioning Systems (GPS) Market Attractiveness Analysis By End-User Industry, 2016-2032

- Figure 70: Eastern Europe Global Positioning Systems (GPS) Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 71: Eastern Europe Global Positioning Systems (GPS) Market Attractiveness Analysis by Country, 2016-2032

- Figure 72: Eastern Europe Global Positioning Systems (GPS) Market Revenue (US$ Mn) (2016-2032)

- Figure 73: Eastern Europe Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 74: Eastern Europe Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By Device Type (2016-2032)

- Figure 75: Eastern Europe Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Figure 76: Eastern Europe Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By End-User Industry (2016-2032)

- Figure 77: Eastern Europe Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 78: Eastern Europe Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By Device Type (2016-2032)

- Figure 79: Eastern Europe Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Figure 80: Eastern Europe Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By End-User Industry (2016-2032)

- Figure 81: Eastern Europe Global Positioning Systems (GPS) Market Share Comparison by Country (2016-2032)

- Figure 82: Eastern Europe Global Positioning Systems (GPS) Market Share Comparison By Device Type (2016-2032)

- Figure 83: Eastern Europe Global Positioning Systems (GPS) Market Share Comparison By Application (2016-2032)

- Figure 84: Eastern Europe Global Positioning Systems (GPS) Market Share Comparison By End-User Industry (2016-2032)

- Figure 85: APAC Global Positioning Systems (GPS) Market Revenue (US$ Mn) Market Share By Device Typein 2022

- Figure 86: APAC Global Positioning Systems (GPS) Market Attractiveness Analysis By Device Type, 2016-2032

- Figure 87: APAC Global Positioning Systems (GPS) Market Revenue (US$ Mn) Market Share By Applicationin 2022

- Figure 88: APAC Global Positioning Systems (GPS) Market Attractiveness Analysis By Application, 2016-2032

- Figure 89: APAC Global Positioning Systems (GPS) Market Revenue (US$ Mn) Market Share By End-User Industryin 2022

- Figure 90: APAC Global Positioning Systems (GPS) Market Attractiveness Analysis By End-User Industry, 2016-2032

- Figure 91: APAC Global Positioning Systems (GPS) Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 92: APAC Global Positioning Systems (GPS) Market Attractiveness Analysis by Country, 2016-2032

- Figure 93: APAC Global Positioning Systems (GPS) Market Revenue (US$ Mn) (2016-2032)

- Figure 94: APAC Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 95: APAC Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By Device Type (2016-2032)

- Figure 96: APAC Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Figure 97: APAC Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By End-User Industry (2016-2032)

- Figure 98: APAC Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 99: APAC Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By Device Type (2016-2032)

- Figure 100: APAC Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Figure 101: APAC Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By End-User Industry (2016-2032)

- Figure 102: APAC Global Positioning Systems (GPS) Market Share Comparison by Country (2016-2032)

- Figure 103: APAC Global Positioning Systems (GPS) Market Share Comparison By Device Type (2016-2032)

- Figure 104: APAC Global Positioning Systems (GPS) Market Share Comparison By Application (2016-2032)

- Figure 105: APAC Global Positioning Systems (GPS) Market Share Comparison By End-User Industry (2016-2032)

- Figure 106: Latin America Global Positioning Systems (GPS) Market Revenue (US$ Mn) Market Share By Device Typein 2022

- Figure 107: Latin America Global Positioning Systems (GPS) Market Attractiveness Analysis By Device Type, 2016-2032

- Figure 108: Latin America Global Positioning Systems (GPS) Market Revenue (US$ Mn) Market Share By Applicationin 2022

- Figure 109: Latin America Global Positioning Systems (GPS) Market Attractiveness Analysis By Application, 2016-2032

- Figure 110: Latin America Global Positioning Systems (GPS) Market Revenue (US$ Mn) Market Share By End-User Industryin 2022

- Figure 111: Latin America Global Positioning Systems (GPS) Market Attractiveness Analysis By End-User Industry, 2016-2032

- Figure 112: Latin America Global Positioning Systems (GPS) Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 113: Latin America Global Positioning Systems (GPS) Market Attractiveness Analysis by Country, 2016-2032

- Figure 114: Latin America Global Positioning Systems (GPS) Market Revenue (US$ Mn) (2016-2032)

- Figure 115: Latin America Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 116: Latin America Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By Device Type (2016-2032)

- Figure 117: Latin America Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Figure 118: Latin America Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By End-User Industry (2016-2032)

- Figure 119: Latin America Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 120: Latin America Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By Device Type (2016-2032)

- Figure 121: Latin America Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Figure 122: Latin America Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By End-User Industry (2016-2032)

- Figure 123: Latin America Global Positioning Systems (GPS) Market Share Comparison by Country (2016-2032)

- Figure 124: Latin America Global Positioning Systems (GPS) Market Share Comparison By Device Type (2016-2032)

- Figure 125: Latin America Global Positioning Systems (GPS) Market Share Comparison By Application (2016-2032)

- Figure 126: Latin America Global Positioning Systems (GPS) Market Share Comparison By End-User Industry (2016-2032)

- Figure 127: Middle East & Africa Global Positioning Systems (GPS) Market Revenue (US$ Mn) Market Share By Device Typein 2022

- Figure 128: Middle East & Africa Global Positioning Systems (GPS) Market Attractiveness Analysis By Device Type, 2016-2032

- Figure 129: Middle East & Africa Global Positioning Systems (GPS) Market Revenue (US$ Mn) Market Share By Applicationin 2022

- Figure 130: Middle East & Africa Global Positioning Systems (GPS) Market Attractiveness Analysis By Application, 2016-2032

- Figure 131: Middle East & Africa Global Positioning Systems (GPS) Market Revenue (US$ Mn) Market Share By End-User Industryin 2022

- Figure 132: Middle East & Africa Global Positioning Systems (GPS) Market Attractiveness Analysis By End-User Industry, 2016-2032

- Figure 133: Middle East & Africa Global Positioning Systems (GPS) Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 134: Middle East & Africa Global Positioning Systems (GPS) Market Attractiveness Analysis by Country, 2016-2032

- Figure 135: Middle East & Africa Global Positioning Systems (GPS) Market Revenue (US$ Mn) (2016-2032)

- Figure 136: Middle East & Africa Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 137: Middle East & Africa Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By Device Type (2016-2032)

- Figure 138: Middle East & Africa Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Figure 139: Middle East & Africa Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By End-User Industry (2016-2032)

- Figure 140: Middle East & Africa Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 141: Middle East & Africa Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By Device Type (2016-2032)

- Figure 142: Middle East & Africa Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Figure 143: Middle East & Africa Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By End-User Industry (2016-2032)

- Figure 144: Middle East & Africa Global Positioning Systems (GPS) Market Share Comparison by Country (2016-2032)

- Figure 145: Middle East & Africa Global Positioning Systems (GPS) Market Share Comparison By Device Type (2016-2032)

- Figure 146: Middle East & Africa Global Positioning Systems (GPS) Market Share Comparison By Application (2016-2032)

- Figure 147: Middle East & Africa Global Positioning Systems (GPS) Market Share Comparison By End-User Industry (2016-2032)

"

- List of Tables

- "

- Table 1: Global Global Positioning Systems (GPS) Market Comparison By Device Type (2016-2032)

- Table 2: Global Global Positioning Systems (GPS) Market Comparison By Application (2016-2032)

- Table 3: Global Global Positioning Systems (GPS) Market Comparison By End-User Industry (2016-2032)

- Table 4: Global Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 5: Global Global Positioning Systems (GPS) Market Revenue (US$ Mn) (2016-2032)

- Table 6: Global Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 7: Global Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By Device Type (2016-2032)

- Table 8: Global Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Table 9: Global Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By End-User Industry (2016-2032)

- Table 10: Global Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 11: Global Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By Device Type (2016-2032)

- Table 12: Global Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Table 13: Global Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By End-User Industry (2016-2032)

- Table 14: Global Global Positioning Systems (GPS) Market Share Comparison by Region (2016-2032)

- Table 15: Global Global Positioning Systems (GPS) Market Share Comparison By Device Type (2016-2032)

- Table 16: Global Global Positioning Systems (GPS) Market Share Comparison By Application (2016-2032)

- Table 17: Global Global Positioning Systems (GPS) Market Share Comparison By End-User Industry (2016-2032)

- Table 18: North America Global Positioning Systems (GPS) Market Comparison By Application (2016-2032)

- Table 19: North America Global Positioning Systems (GPS) Market Comparison By End-User Industry (2016-2032)

- Table 20: North America Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 21: North America Global Positioning Systems (GPS) Market Revenue (US$ Mn) (2016-2032)

- Table 22: North America Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 23: North America Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By Device Type (2016-2032)

- Table 24: North America Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Table 25: North America Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By End-User Industry (2016-2032)

- Table 26: North America Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 27: North America Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By Device Type (2016-2032)

- Table 28: North America Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Table 29: North America Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By End-User Industry (2016-2032)

- Table 30: North America Global Positioning Systems (GPS) Market Share Comparison by Country (2016-2032)

- Table 31: North America Global Positioning Systems (GPS) Market Share Comparison By Device Type (2016-2032)

- Table 32: North America Global Positioning Systems (GPS) Market Share Comparison By Application (2016-2032)

- Table 33: North America Global Positioning Systems (GPS) Market Share Comparison By End-User Industry (2016-2032)

- Table 34: Western Europe Global Positioning Systems (GPS) Market Comparison By Device Type (2016-2032)

- Table 35: Western Europe Global Positioning Systems (GPS) Market Comparison By Application (2016-2032)

- Table 36: Western Europe Global Positioning Systems (GPS) Market Comparison By End-User Industry (2016-2032)

- Table 37: Western Europe Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 38: Western Europe Global Positioning Systems (GPS) Market Revenue (US$ Mn) (2016-2032)

- Table 39: Western Europe Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 40: Western Europe Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By Device Type (2016-2032)

- Table 41: Western Europe Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Table 42: Western Europe Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By End-User Industry (2016-2032)

- Table 43: Western Europe Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 44: Western Europe Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By Device Type (2016-2032)

- Table 45: Western Europe Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Table 46: Western Europe Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By End-User Industry (2016-2032)

- Table 47: Western Europe Global Positioning Systems (GPS) Market Share Comparison by Country (2016-2032)

- Table 48: Western Europe Global Positioning Systems (GPS) Market Share Comparison By Device Type (2016-2032)

- Table 49: Western Europe Global Positioning Systems (GPS) Market Share Comparison By Application (2016-2032)

- Table 50: Western Europe Global Positioning Systems (GPS) Market Share Comparison By End-User Industry (2016-2032)

- Table 51: Eastern Europe Global Positioning Systems (GPS) Market Comparison By Device Type (2016-2032)

- Table 52: Eastern Europe Global Positioning Systems (GPS) Market Comparison By Application (2016-2032)

- Table 53: Eastern Europe Global Positioning Systems (GPS) Market Comparison By End-User Industry (2016-2032)

- Table 54: Eastern Europe Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: Eastern Europe Global Positioning Systems (GPS) Market Revenue (US$ Mn) (2016-2032)

- Table 56: Eastern Europe Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: Eastern Europe Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By Device Type (2016-2032)

- Table 58: Eastern Europe Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Table 59: Eastern Europe Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By End-User Industry (2016-2032)

- Table 60: Eastern Europe Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 61: Eastern Europe Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By Device Type (2016-2032)

- Table 62: Eastern Europe Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Table 63: Eastern Europe Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By End-User Industry (2016-2032)

- Table 64: Eastern Europe Global Positioning Systems (GPS) Market Share Comparison by Country (2016-2032)

- Table 65: Eastern Europe Global Positioning Systems (GPS) Market Share Comparison By Device Type (2016-2032)

- Table 66: Eastern Europe Global Positioning Systems (GPS) Market Share Comparison By Application (2016-2032)

- Table 67: Eastern Europe Global Positioning Systems (GPS) Market Share Comparison By End-User Industry (2016-2032)

- Table 68: APAC Global Positioning Systems (GPS) Market Comparison By Device Type (2016-2032)

- Table 69: APAC Global Positioning Systems (GPS) Market Comparison By Application (2016-2032)

- Table 70: APAC Global Positioning Systems (GPS) Market Comparison By End-User Industry (2016-2032)

- Table 71: APAC Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 72: APAC Global Positioning Systems (GPS) Market Revenue (US$ Mn) (2016-2032)

- Table 73: APAC Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 74: APAC Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By Device Type (2016-2032)

- Table 75: APAC Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Table 76: APAC Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By End-User Industry (2016-2032)

- Table 77: APAC Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 78: APAC Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By Device Type (2016-2032)

- Table 79: APAC Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Table 80: APAC Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By End-User Industry (2016-2032)

- Table 81: APAC Global Positioning Systems (GPS) Market Share Comparison by Country (2016-2032)

- Table 82: APAC Global Positioning Systems (GPS) Market Share Comparison By Device Type (2016-2032)

- Table 83: APAC Global Positioning Systems (GPS) Market Share Comparison By Application (2016-2032)

- Table 84: APAC Global Positioning Systems (GPS) Market Share Comparison By End-User Industry (2016-2032)

- Table 85: Latin America Global Positioning Systems (GPS) Market Comparison By Device Type (2016-2032)

- Table 86: Latin America Global Positioning Systems (GPS) Market Comparison By Application (2016-2032)

- Table 87: Latin America Global Positioning Systems (GPS) Market Comparison By End-User Industry (2016-2032)

- Table 88: Latin America Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 89: Latin America Global Positioning Systems (GPS) Market Revenue (US$ Mn) (2016-2032)

- Table 90: Latin America Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 91: Latin America Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By Device Type (2016-2032)

- Table 92: Latin America Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Table 93: Latin America Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By End-User Industry (2016-2032)

- Table 94: Latin America Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 95: Latin America Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By Device Type (2016-2032)

- Table 96: Latin America Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Table 97: Latin America Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By End-User Industry (2016-2032)

- Table 98: Latin America Global Positioning Systems (GPS) Market Share Comparison by Country (2016-2032)

- Table 99: Latin America Global Positioning Systems (GPS) Market Share Comparison By Device Type (2016-2032)

- Table 100: Latin America Global Positioning Systems (GPS) Market Share Comparison By Application (2016-2032)

- Table 101: Latin America Global Positioning Systems (GPS) Market Share Comparison By End-User Industry (2016-2032)

- Table 102: Middle East & Africa Global Positioning Systems (GPS) Market Comparison By Device Type (2016-2032)

- Table 103: Middle East & Africa Global Positioning Systems (GPS) Market Comparison By Application (2016-2032)

- Table 104: Middle East & Africa Global Positioning Systems (GPS) Market Comparison By End-User Industry (2016-2032)

- Table 105: Middle East & Africa Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 106: Middle East & Africa Global Positioning Systems (GPS) Market Revenue (US$ Mn) (2016-2032)

- Table 107: Middle East & Africa Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 108: Middle East & Africa Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By Device Type (2016-2032)

- Table 109: Middle East & Africa Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Table 110: Middle East & Africa Global Positioning Systems (GPS) Market Revenue (US$ Mn) Comparison By End-User Industry (2016-2032)

- Table 111: Middle East & Africa Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 112: Middle East & Africa Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By Device Type (2016-2032)

- Table 113: Middle East & Africa Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Table 114: Middle East & Africa Global Positioning Systems (GPS) Market Y-o-Y Growth Rate Comparison By End-User Industry (2016-2032)

- Table 115: Middle East & Africa Global Positioning Systems (GPS) Market Share Comparison by Country (2016-2032)

- Table 116: Middle East & Africa Global Positioning Systems (GPS) Market Share Comparison By Device Type (2016-2032)

- Table 117: Middle East & Africa Global Positioning Systems (GPS) Market Share Comparison By Application (2016-2032)

- Table 118: Middle East & Africa Global Positioning Systems (GPS) Market Share Comparison By End-User Industry (2016-2032)

- 1. Executive Summary

-

- Calamp (U.S.)

- Orbocomm (U.S.)

- Qualcomm Technologies Inc (U.S.)

- Sierra Wireless (Canada)