Fish Oil Market By Grade(Feed Grade Fish Oil, Food Grade Fish Oil), By Process(Crude Fish Oil, Refined Fish Oil), By Product(Anchovy Oil, Salmon Oil, Others), By End User(Aqua-feed, Food & Beverages, Dietary Supplements), By Sales Channel(Offline Sales Channel, Online Sales Channel), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

23451

-

Jan 2024

-

156

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Fish Oil Market Size, Share, Trends Analysis

- Fish Oil Market Dynamics

- Fish Oil Market Segmentation Analysis

- Fish Oil Industry Segments

- Fish Oil Market Growth Opportunity

- Fish Oil Market Regional Analysis

- Fish Oil Industry By Region

- Fish Oil Market Share Analysis

- Fish Oil Industry Key Players

- Fish Oil Market Recent Development

- Report Scope

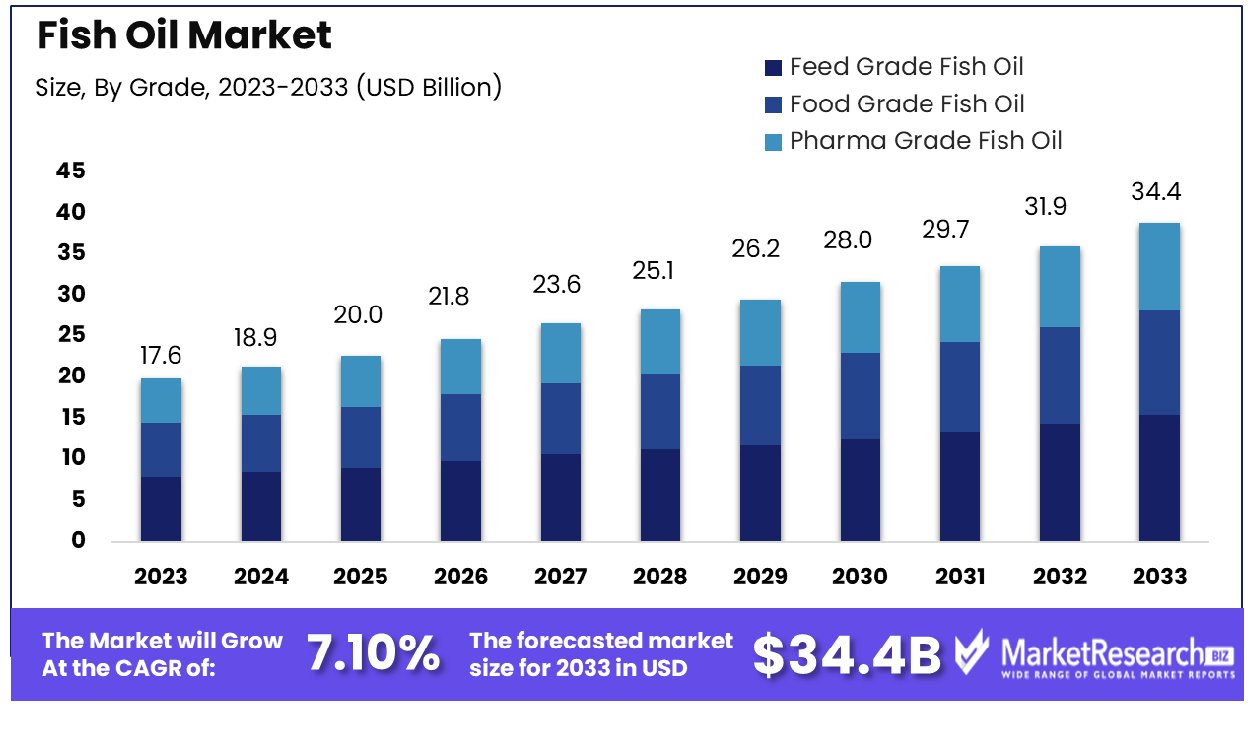

The fish oil market was valued at USD 17.6 billion in 2023. It is expected to reach USD 34.4 billion by 2033, with a CAGR of 7.10% during the forecast period from 2024 to 2033.

The surge in demand for healthier dietary habits and changes in customer preferences are some of the main key factors for the fish oil market. The oil extracted by fish comes from tissues of fatty fish such as mackerel, salmon, and tuna. The method of processing comprises putting pressure on cooked fish and then separating oil from the derived liquid. Researchers believe that the intake of fish oil will decrease cardio-related issues. Fish and other seafood packaging are an exceptional source of long-chain omega-3s -3s and medical researchers also thought that the decreasing rate of heart disease was because of the omega-3s in fatty fish.

A report published by Cardiac Interventions in December 2023, highlights that Ischemic heart disease is the main cause of worldwide CVD mortality, with an age-standardized rate per 100,000 of 108.8 deaths, followed by intracerebral hemorrhage and ischemic stroke. Moreover, according to a report published by Centres for Disease Control and Prevention in May 2023, highlights that In the USA, every 40 seconds a person suffers from a heart attack. Each year more than 805,000 people in the US have heart attacks. Out of these, 605,000 people undergo with first heart attack and 200,000 individuals already have heart attack. There are about 1 out of 5 individuals who have silent heart attacks, the damage is already done but the concerned people are not aware of it.

Similarly, an article published by PCR online in September 2023, emphasizes that more than around 620 million people have heart and circulatory diseases across the globe. Each year around 60 million individuals all across the globe have a heart or circulatory disease. Worldwide it is anticipated that 1 in 13 people are living with a heart or circulatory disease.

The abundant presence of omega-3s in fish oil aids in enhancing heart health. Many researchers suggest that the intake of fish and other seafood is part of a balanced food diet. Fish oil supplements have low triglyceride levels and help in decreasing the risk of heart attack or stroke. The proof is that omega-3 supplements enhance heart health and help people who have heart disease.

Not only this, fish oil also helps regulate blood pressure, enhances cognitive functions, lessens rheumatoid arthritis, and also helps in improving eyesight and vision. Fish oil is also used in skincare for decreasing skin aging, promoting brighter skin, and avoiding hormonal acne. The demand for fish oil will rapidly increase due to the various advantages that it provides in healthcare as well as in personal skincare, which will help in market expansion during the forecast period.

Fish Oil Market Dynamics

Health Awareness Elevates Fish Oil Market

The increasing recognition among consumers regarding the significance of health and wellness is fueling the growth of the fish oils market. The core of this trend lies in the recognized health benefits of omega-3 fatty acids, particularly EPA and DHA, found abundantly in fish oil. These nutrients, endorsed by the American Heart Association for their cardiovascular benefits, have spurred consumer demand. Major retailers like CVS and Amazon report growing fish oil sales, reflecting this trend. The knowledge about omega-3s' role in reducing cardiovascular events has made fish oil supplements a staple in health-conscious diets.

Nutritional Supplement Industry's Expansion Boosts Fish Oil Sales

The supplements market. Projected to grow at a CAGR of 8% through 2026, this upsurge provides a significant tailwind for fish oil products. Fish oil, as a vital component of the supplement sector, benefits from the overall industry's growth trajectory. This trend is not isolated but intertwined with rising health awareness and evolving consumer preferences toward natural and preventive healthcare solutions.

Aquaculture Growth Sustains Fish Oil Supply

With global aquaculture production reaching unprecedented levels and projected to account for 55% of total fish production by 2032, the demand for fish oil as a key feed ingredient is escalating. Dominated by Asia, particularly China, this sector's rapid growth necessitates substantial inputs of fishmeal and oil. The sustained growth in aquaculture is poised to have lasting implications on the fish oil industry, potentially ensuring a steady demand for years to come.

Pet Health Focus Stimulates Fish Oil Market

The increasing emphasis on pet health, particularly in Europe and the U.S., is a significant driver for the fish oil market. With over 80% of pet owners prioritizing their pets' health, fish oil has become a sought-after supplement, valued for its benefits to pets' skin and coats. The U.S. pet supplement market, projected to reach $2 billion by 2025, underscores this trend.

Commoditization and Price Competition Dampen Fish Oil Market Expansion

This surge has intensified price competition, significantly eroding profit margins for manufacturers. The presence of private label store brands exacerbates this trend by offering lower-priced alternatives, compelling other brands to reduce their prices to remain competitive. This market dynamic leads to a race to the bottom in terms of pricing, diminishing the overall profitability of the sector and potentially compromising product quality as manufacturers seek cost-cutting measures to maintain their market presence.

Stringent Regulations Impede Fish Oil Market Growth

The fish oil industry is tightly regulated, with stringent quality control measures imposed by organizations such as the Global Organization for EPA and DHA Omega-3s (GOED) and NSF International. Compliance with these regulations adds layers of complexity and cost to the production process. For instance, obtaining pharmaceutical-grade certification for fish oil products entails substantial expenses, contributing to higher production costs.

Fish Oil Market Segmentation Analysis

By Grade Analysis

Feed Grade Fish Oil is the most popular segment of the market for fish oil. The primary reason is the massive market for fish oil that is used in aquaculture and feed for livestock where it can be used to enhance the growth, development, and overall health of animal feed. Feed-grade fish oil is rich in omega-3 fatty acids, which are essential for the health of aquatic animals, particularly species like salmon, trout, and carp.

Food Grade Fish Oil and Pharma Grade Fish Oil also have substantial market share. Food-grade fish oil is used in cooking and food preparation, while pharma-grade fish oil is used in pharmaceuticals due to its high purity and concentration of beneficial omega-3 fatty acids. Yet, the apex demand in the aquaculture sector illustrates the growing impact on Feed feed-grade fish Oil.

By Product Analysis

Anchovy Oil is the dominant product of the market for fish oil with a 32.5% part. Anchovy oil is highly valued for its high content of omega-3 fatty acids, particularly EPA and DHA, making it a preferred choice for aquafeed and dietary supplements. The anchovy fishery stands as one of the world's largest and most sustainable, ensuring a reliable source of premium fish oil.

Salmon Oil is experiencing faster growth due to its popularity in dietary supplements and health foods. Tuna Oil, Cod Liver Oil, Sardine Oil, Squalene Oil, Krill Oil, Menhaden Oil, and others also contribute to the market. Each of these oils has unique properties and applications, but the widespread availability and high omega-3 content of Anchovy Oil make it the market leader.

By End User Analysis

Aqua-feed stands out as the primary consumer segment within the fish oil market. This segment delves into the utilization of fish oil in the diets of various aquatic organisms, including crustaceans, Cyprinids, eels, marine fish such as salmon and trout, and Tilapia. Essential fatty acids offered in fish oils are vital to the growth and health of these species in the water which makes it a crucial ingredient in aqua-feed.

The Food & Beverages, Dietary Supplements, and Cosmetic & herbal Beauty Products sectors also significantly use fish oil. In dietary supplements, fish oil is valued for its health benefits, while in cosmetics, it's used for its skin-nourishing properties.

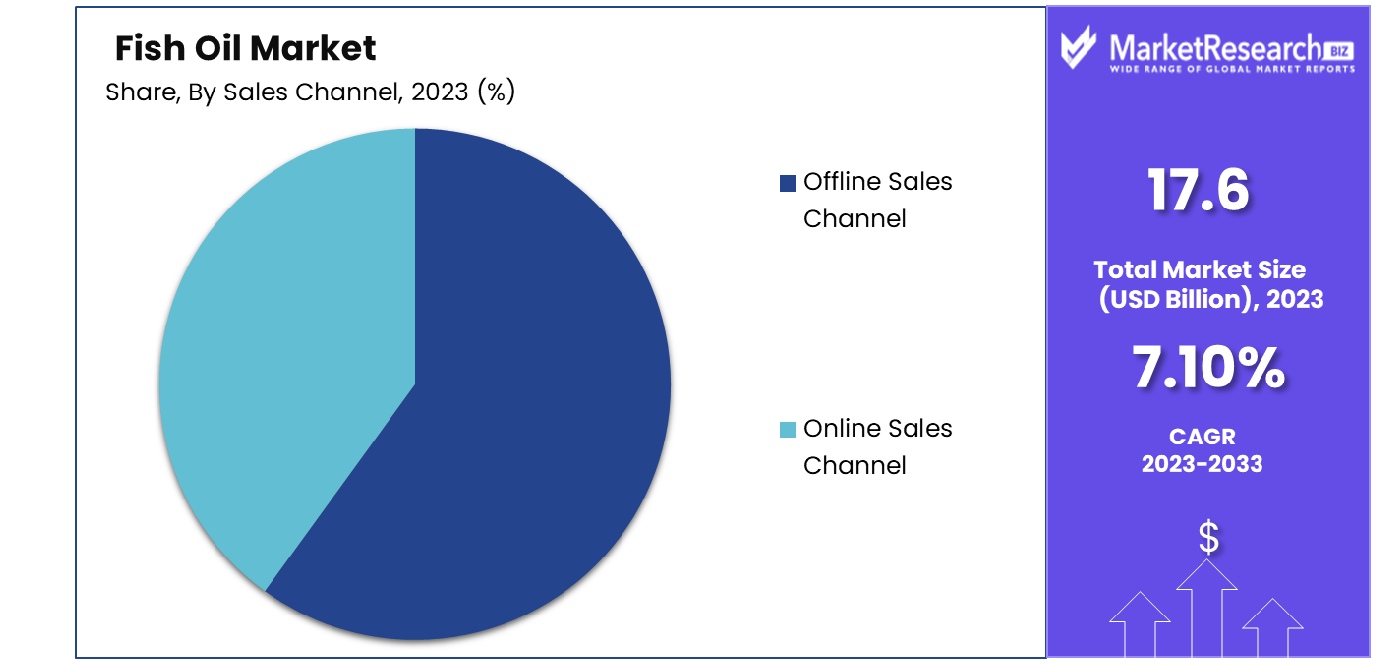

By Sales Channel Analysis

Offline Sales Channel is the most popular sales channel in the market for fish oil with a 59.5% share. This channel includes supermarkets/hypermarkets, departmental stores, convenience stores, and other retail outlets. Customers' ability to examine in person a vast range of products made from fish oil in retail stores is an essential factor in the massive online sales.

The Online Sales Channel, comprising company websites and e-commerce platforms, is also growing. Online channels offer convenience, a wide selection, and often competitive pricing. However, the enduring presence and popularity of physical stores when it comes to purchasing food and health items ensure that Offline Sales Channel Offline Sales Channel at the top of the sales for fish oil.

Fish Oil Industry Segments

By Grade

- Feed Grade Fish Oil

- Food Grade Fish Oil

- Pharma Grade Fish Oil

By Process

- Crude Fish Oil

- Refined Fish Oil

- Modified Fish Oil

By Product

- Anchovy Oil

- Salmon Oil

- Tuna Oil

- Cod Liver Oil

- Sardine Oil

- Squalene Oil

- Krill Oil

- Menhaden Oil

- Others

By End User

- Aqua-feed [Crustaceans, Eels, Cyprinids, Marine Fish, Salmon & Trout, Tilapias]

- Food & Beverages

- Dietary Supplements

- Cosmetic & Beauty Products

By Sales Channel

- Offline Sales Channel [Supermarkets/Hypermarkets, Departmental Stores, Convenience Store, Other Sales Channel]

- Online Sales Channel [Company Website, E-commerce Platform]

Fish Oil Market Growth Opportunity

Sustainability Focus: A Key Differentiator in the Fish Oil Market

The critical state of global fish stocks, with 87% being either overexploited or fully exploited, presents a unique opportunity for growth in the fish oil market through a focus on sustainability. Consumers are increasingly concerned about overfishing and environmental impact, leading to higher demand for sustainably sourced products.

Major Companies can capitalize on this by obtaining certifications like Friend of the Sea, as seen with Wiley's Finest wild-caught fish oil. Highlighting sustainable practices and responsible sourcing can help key companies gain consumer trust and stand out in a crowded market, driving growth and fostering a more sustainable industry.

Leveraging E-commerce Channels: Expanding the Fish Oil Market Reach

The growing trend of online vitamin and supplement sales, with 77% of US sales occurring on platforms like Amazon, offers a significant expansion opportunity for the fish oil market. Direct-to-consumer (DTC) healthcare, which includes a broad range of products like nutraceuticals, is a rapidly growing industry, currently valued at around $700 billion. By adopting DTC models and leveraging e-commerce channels, fish oil brands can reduce overhead and distribution costs, enhance customer engagement, and build loyalty. Companies like PureLabel Nutrition are leading the way with subscription-based DTC models, demonstrating the potential of online sales in expanding market reach.

New Delivery Formats: Innovating Fish Oil Consumption

The introduction of new delivery formats for fish oil, such as powdered and flavored options, opens up new market opportunities, appealing to consumers who are averse to traditional capsules. The development of child-friendly formats like flavored gummies, exemplified by Nature's Dynamics, addresses the needs of younger demographics and expands the consumer base. Innovations like the conversion of omega-3 oils into stabilized fine powders by Dynamic Extractions and Formulations (DEF) demonstrate the versatility of fish oil products.

Fish Oil Market Regional Analysis

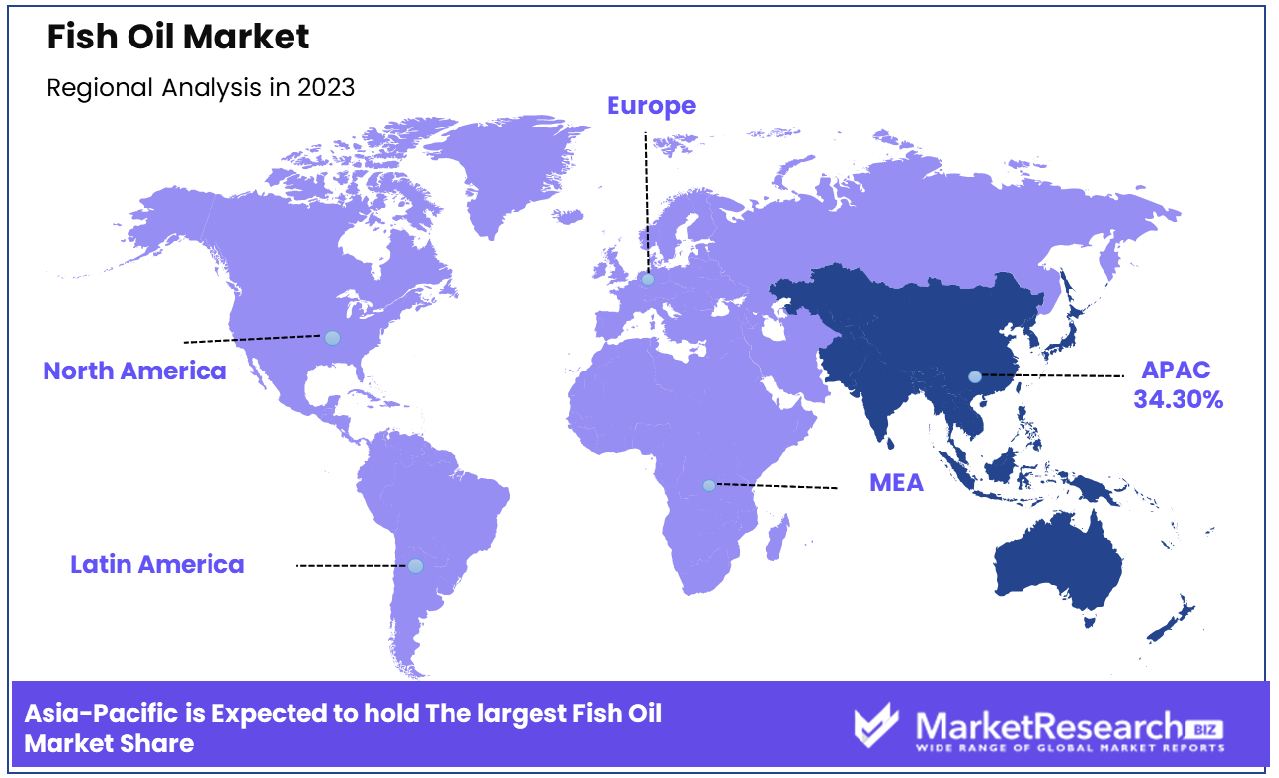

Asia-Pacific Dominates with 34.30% Market Share in Fish Oil Market

Asia-Pacific's dominance in the fish oil market, holding a 34.30% share, is significantly influenced by its lead in global aquaculture production. China, a pivotal country in the region, accounts for 57.8% of the global aquaculture output which is a significant contribution to the global fish oil market. This dominance is supported by the region's extensive coastline, favorable climate for aquaculture, and high fish consumption rates.

The market for fish oil in Asia-Pacific is driven through a mix of traditional fishing methods as well as modern aquaculture practices. The region's diverse aquatic ecosystems contribute to a wide variety of fish species, which are key raw materials for fish oil production. Furthermore, the increasing acknowledgment of the health advantages associated with omega-3 acids found in fish oil is driving consumer demand throughout the region.

Europe: Advanced Processing Technology and Sustainability Focus

Europe’s fish oil market is driven by advanced processing technology and a strong focus on sustainability in fishing practices. Countries like Norway and Iceland are significant contributors, known for their high-quality fish oil products. The region’s stringent regulations on sustainable fishing and ethical sourcing play a crucial role in market dynamics.

North America: Growing Health Consciousness and Diverse Applications

The North American fish oil market is flourishing, aided by an increasing awareness among consumers of the benefits of health and the many uses of the oil. The United States, ranking 17th in aquaculture production, with marine aquaculture accounting for 7% of its total domestic seafood production, contributes to the region’s market share.

Fish Oil Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

The Fish Oil Market, is an area of vital importance to its health benefits as well as industry applications. The listed companies play a key role in shaping the global demand and supply dynamics. TripleNine Group A/S and FMC Corporation are significant players, known for their large-scale fish oil production. They play a crucial role in meeting the global demand, particularly for Omega-3 fatty acids, which are essential for human health.

Pesquera Diamante S.A., Croda International PLC, and Omega Protein Corporation are key in providing fish oil for dietary supplements and pharmaceutical applications. Their strategic focus on product purity and sustainability significantly influences consumer preferences and market trends.

Fish Oil Industry Key Players

- Marvesa Holding N.V.

- Pesquera Diamante S.A.

- Foodcorp Chile S.A (Austevoll Seafood ASA)

- DSF

- FMC Corporation

- Pelagia AS

- TripleNine Group A/S

- Croda International PLC

- Omega Protein Corporation

- OLVEA Fish Oils (OLVEA)

- Camanchaca

- China Fishery Group Limited

- Corpesca S.A.

- Oceana Group Limited

- Colpex International

- FF Skagen A/S

- Pesquera Exalmar

- Copeinca AS

- BASF SE

- DSM

- Koninklijke DSM N.V.

Fish Oil Market Recent Development

- In 2023, The IFFO released its latest analysis of market trends in marine ingredients, for the period January-July 2023. The numbers reflect a drop in catches around the world, the IFFO says, with both fishmeal and fish oil production lagging behind last year's levels. During the first seven months of 2023, total fishmeal production had fallen by around 31% compared with July 2022, while global fish oil production had dropped 30%.

- In 2023, Peru, which produces 20 percent of the global fish oil supply, canceled its first-season anchovy harvest, due to a lack of mature fish. Producing omega-3 fatty acids in Camelina may represent a way to enable a predictable supply of high-quality omega-3 oils to meet the global demand for EPA and DHA.

- In June 2022, Halozyme Therapeutics, Inc. announced the commercial launch of TLANDO (testosterone undecanoate), an oral treatment indicated for testosterone replacement therapy in adult males for conditions associated with a deficiency or absence of endogenous testosterone.

- In February 2022, Pfizer Inc. and OPKO Health, Inc. announced that the European Commission has granted marketing authorization for the next-generation long-acting recombinant human growth hormone NGENLA, a once-weekly injection to treat children and adolescents from 3 years of age with growth disturbance due to insufficient secretion of growth hormone.

Report Scope

Report Features Description Market Value (2023) USD 17.63 Billion Forecast Revenue (2033) USD 34.4 Billion CAGR (2024-2032) 7.10% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Grade(Feed Grade Fish Oil, Food Grade Fish Oil, Pharma Grade Fish Oil), By Process(Crude Fish Oil, Refined Fish Oil, Modified Fish Oil), By Product(Anchovy Oil, Salmon Oil, Tuna Oil, Cod Liver Oil, Sardine Oil, Squalene Oil, Krill Oil, Menhaden Oil, Others), By End User(Aqua-feed [Crustaceans, Eels, Cyprinids, Marine Fish, Salmon & Trout, Tilapias], Food & Beverages, Dietary Supplements, Cosmetic & Beauty Products), By Sales Channel(Offline Sales Channel [Supermarkets/Hypermarkets, Departmental Stores, Convenience Store, Other Sales Channel], Online Sales Channel [Company Website, E-commerce Platform]) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Marvesa Holding N.V., Pesquera Diamante S.A., Foodcorp Chile S.A (Austevoll Seafood ASA), DSF, FMC Corporation, Pelagia AS, TripleNine Group A/S, Croda International PLC, Omega Protein Corporation, OLVEA Fish Oils (OLVEA), Camanchaca, China Fishery Group Limited, Corpesca S.A., Oceana Group Limited, Colpex International, FF Skagen A/S, Pesquera Exalmar, Copeinca AS, BASF SE, DSM, Koninklijke DSM N.V. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Marvesa Holding N.V.

- Pesquera Diamante S.A.

- Foodcorp Chile S.A (Austevoll Seafood ASA)

- DSF

- FMC Corporation

- Pelagia AS

- TripleNine Group A/S

- Croda International PLC

- Omega Protein Corporation

- OLVEA Fish Oils (OLVEA)

- Camanchaca

- China Fishery Group Limited

- Corpesca S.A.

- Oceana Group Limited

- Colpex International

- FF Skagen A/S

- Pesquera Exalmar

- Copeinca AS

- BASF SE

- DSM

- Koninklijke DSM N.V.