Geriatric Care Services Market By Service (Home Care, Adult Day Care, Institutional Care), By Service Provider (Public and Private), By Payment Source (Public Insurance, Private Insurance, Out-of-pocket, Others), By Application (Respiratory Diseases, Diabetes, Osteoporosis, Heart Diseases, Neurological Diseases, Kidney Diseases, Arthritis, Cance, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

47770

-

June 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

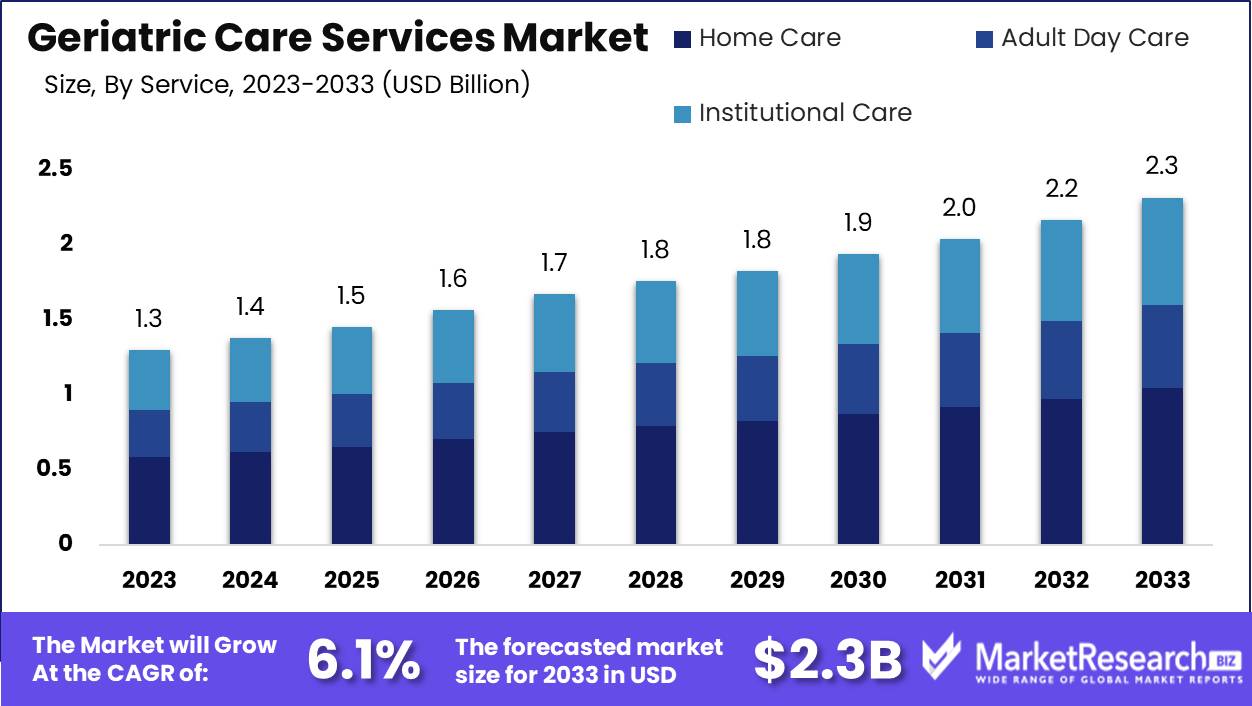

The Geriatric Care Services Market was valued at USD 1.3 billion in 2023. It is expected to reach USD 2.3 billion by 2033, with a CAGR of 6.1% during the forecast period from 2024 to 2033.

The Geriatric Care Services Market encompasses a range of healthcare and support services tailored to the needs of the elderly population. This market includes in-home care, assisted living facilities, nursing homes, and specialized medical services addressing chronic conditions, mobility issues, and cognitive impairments common among older adults. Driven by the aging global population, rising healthcare costs, and advancements in medical technology, the market is expanding rapidly.

The geriatric care services market is poised for significant transformation driven by demographic shifts and evolving care models. The anticipated shortage of approximately 1 million home health aides and personal care aides by 2026 in the U.S. underscores the urgent need for scalable, efficient solutions to address the burgeoning demand for elder care. This shortage presents both a challenge and an opportunity: while the gap in the workforce could strain service delivery, it also incentivizes innovation in recruitment, training, and retention strategies within the sector. Enhanced government policies and increased funding for elder care services are crucial. They alleviate the financial burden on families and catalyze improvements in service quality and accessibility, fostering a more sustainable care ecosystem.

Simultaneously, the geriatric care landscape is shifting towards integrated care models that amalgamate healthcare, social services, and community support. This holistic approach is essential for addressing the complex needs of the elderly, promoting better health outcomes, and enhancing overall well-being.

Moreover, the market for assistive technologies, growing at a CAGR of 9%, is pivotal in this evolution. Innovations in mobility aids and smart home devices are significantly improving the quality of life for older adults, enabling greater independence and safety. As these trends converge, stakeholders across the healthcare spectrum must prioritize strategic investments and policy frameworks that support a seamless, integrated care continuum for the elderly, ensuring a balanced approach to meeting their diverse needs.

Key Takeaways

- Market Growth: The Geriatric Care Services Market was valued at USD 1.3 billion in 2023. It is expected to reach USD 2.3 billion by 2033, with a CAGR of 6.1% during the forecast period from 2024 to 2033.

- By Service: Home Care dominates the geriatric care market with rising home-based preferences.

- By Service Provider: The Public sector dominated geriatric care services through extensive resources.

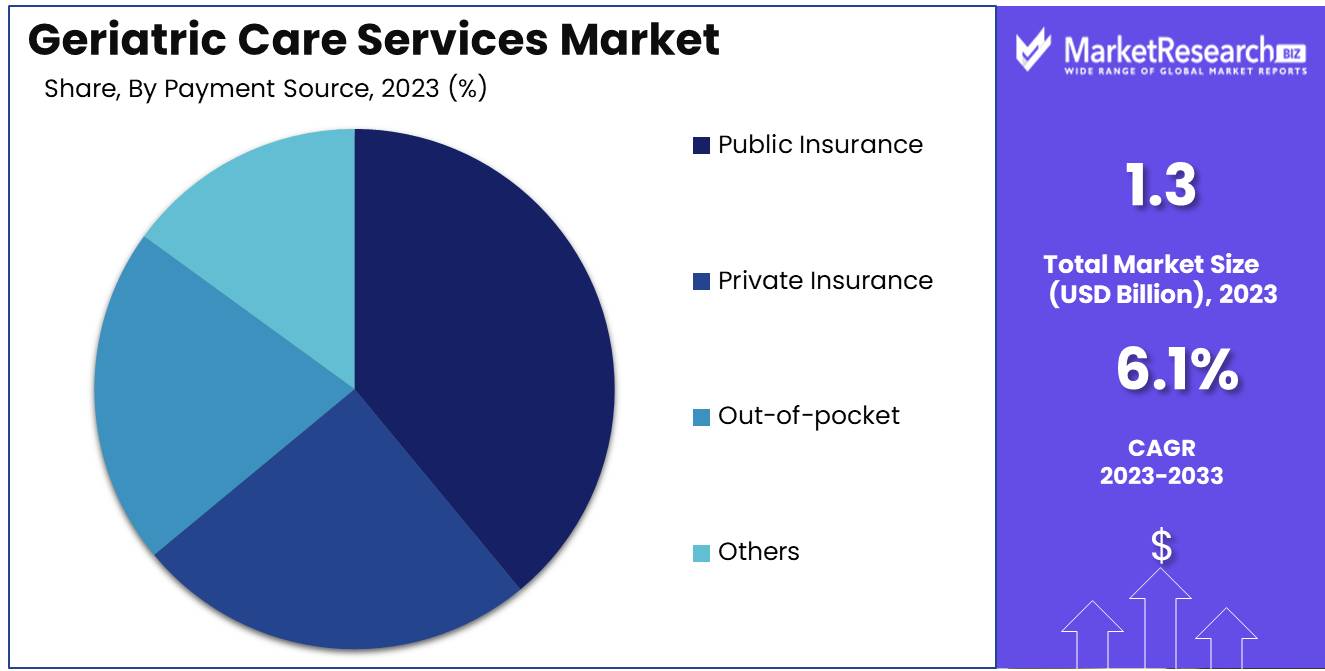

- By Payment Source: Public Insurance dominated the Geriatric Care Services Payment Source segment.

- By Application: Respiratory Diseases dominated the geriatric care services market application segment.

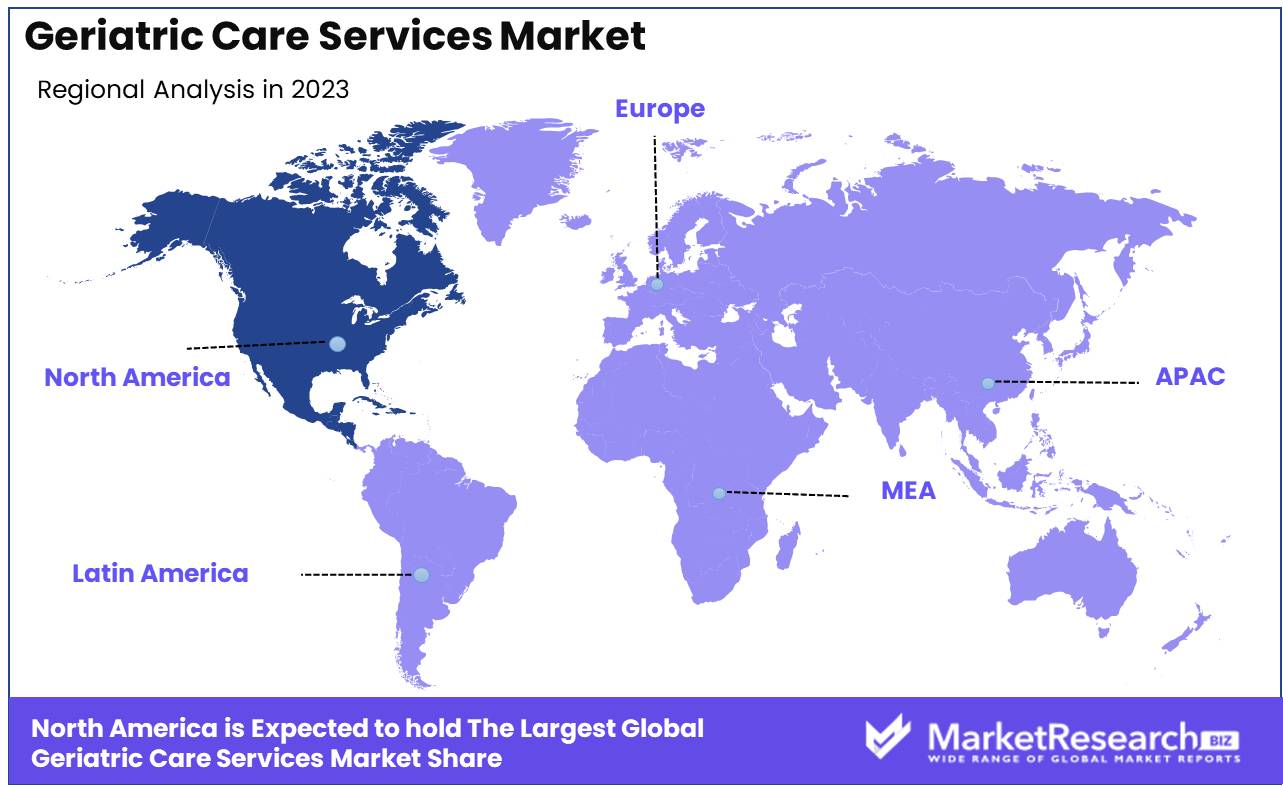

- Regional Dominance: North America dominates the geriatric care services market with a 40% share.

- Growth Opportunity: Private sector participation and improved reimbursement policies will drive growth and innovation in the geriatric care market.

Driving factors

Rapidly Aging Global Population: Catalyzing the Demand for Geriatric Care Services

The global population is aging at an unprecedented rate, driving a significant increase in the demand for geriatric care services. According to the United Nations, the number of people aged 65 and older is projected to more than double by 2050, reaching approximately 1.5 billion. This demographic shift is primarily due to increased life expectancy and declining birth rates in many countries. As the elderly population grows, so does the need for specialized healthcare services that cater to age-related conditions, including mobility issues, cognitive decline, and chronic illnesses. This surge in the elderly demographic is a primary driver for the expansion of the geriatric care market, encompassing services such as home care, nursing homes, and assisted living facilities.

Increasing Prevalence of Chronic Diseases: Elevating the Necessity for Comprehensive Geriatric Care

Chronic diseases such as diabetes, cardiovascular diseases, arthritis, and dementia are becoming more prevalent, particularly among the elderly. The World Health Organization (WHO) estimates that chronic diseases account for approximately 60% of all deaths globally, with a significant portion of these affecting older adults. The rising incidence of these conditions necessitates continuous and comprehensive care, which the geriatric care services market is uniquely positioned to provide. Specialized geriatric care services, including chronic disease management programs, physical therapy, and mental health support, are essential to improve the quality of life for older adults and manage the complexities associated with long-term illnesses. The growing burden of chronic diseases is therefore a substantial contributor to the expansion and diversification of geriatric care services.

Shift Towards Patient-Centric Care: Enhancing the Quality and Accessibility of Geriatric Services

The healthcare industry is increasingly adopting a patient-centric approach, emphasizing personalized care that respects the preferences and needs of patients. This shift is particularly significant in the context of geriatric care, where individualized attention and customized care plans can dramatically improve outcomes and patient satisfaction. Patient-centric care models focus on holistic well-being, integrating physical, emotional, and social health considerations. Innovations such as telehealth, remote monitoring, and personalized care plans are becoming integral to geriatric care, making services more accessible and efficient. By prioritizing the unique requirements of elderly patients, this approach not only improves the quality of care but also drives the growth of the geriatric care services market by increasing demand for innovative and patient-friendly solutions.

Restraining Factors

High Cost of Care: A Significant Barrier to Market Expansion

The high cost of geriatric care services presents a formidable barrier to the market's growth. Geriatric care, which includes long-term care, home healthcare, and assisted living facilities, often involves substantial financial outlays. These expenses can be prohibitive for many families, particularly in regions with lower median incomes or inadequate insurance coverage. According to industry reports, the average annual cost for a private room in a nursing home in the United States exceeded $100,000 in 2023. Home healthcare services, though generally less expensive, still represent a significant financial burden, with costs averaging around $50,000 per year for full-time care.

This high cost is driven by several factors, including the rising wages of healthcare professionals, the increasing price of medical supplies and equipment, and the necessity for specialized facilities designed to cater to the elderly population. Furthermore, the aging population is growing rapidly, and with it, the demand for geriatric care services. However, the high costs associated with these services mean that a significant portion of the elderly population may not have access to the care they need. This financial barrier limits market growth by reducing the potential customer base, as many families either cannot afford these services or must deplete their savings to do so, leading to financial insecurity.

Regulatory Challenges: Navigating Complex Compliance Landscapes

Regulatory challenges also significantly impact the growth trajectory of the geriatric care services market. The sector is heavily regulated to ensure the safety and well-being of elderly patients, with regulations varying widely across different regions and countries. Compliance with these regulations often requires substantial investment in administrative processes, staff training, and infrastructure upgrades. For instance, in the United States, the Centers for Medicare & Medicaid Services (CMS) and state health departments impose stringent standards on geriatric care providers, including requirements for staffing ratios, patient care protocols, and facility certifications.

These regulatory requirements can be costly and time-consuming to meet, particularly for smaller providers who may lack the resources of larger healthcare organizations. The need for continuous compliance with evolving regulations adds an additional layer of complexity and expense, potentially deterring new entrants from joining the market. Moreover, non-compliance can result in severe penalties, including fines, loss of licensure, and reputational damage, further deterring investment and innovation within the sector.

By Service Analysis

Home Care dominates the geriatric care market with rising home-based preferences.

In 2023, Home Care held a dominant market position in the By Service segment of the Geriatric Care Services Market. This segment includes Home Care, Adult Day Care, and Institutional Care. Home Care services, offering personalized and cost-effective care, cater to the rising preference among the elderly to age in place. The flexibility and comfort provided by Home Care options, such as in-home nursing, personal care, and companion services, have significantly driven its popularity.

Adult daycare services, which offer a blend of health, social, and therapeutic support, serve as a crucial respite for caregivers while promoting social engagement among seniors. Despite its benefits, its market share remains secondary to Home Care due to limited daily availability and less personalized attention.Institutional Care, encompassing nursing homes and assisted living facilities, provides comprehensive medical and living support for those requiring constant supervision. However, the higher costs and a growing trend towards home-based solutions have restrained its market growth. Collectively, these segments reflect a dynamic geriatric care market increasingly driven by preferences for home-based care solutions.

By Service Provider Analysis

In 2023, The Public sector dominated geriatric care services through extensive resources.

In 2023, Public held a dominant market position in the By Service Provider segment of the Geriatric Care Services Market. The Public sector, encompassing government-funded hospitals, community health centers, and non-profit organizations, leveraged extensive resources and comprehensive coverage to serve a vast demographic of elderly individuals. This dominance is attributed to several key factors. Firstly, public service providers benefit from significant government subsidies and policies aimed at supporting geriatric care, ensuring accessibility and affordability for a larger population. Secondly, the integration of advanced healthcare technologies within public institutions has enhanced the quality of care, contributing to better patient outcomes and higher satisfaction rates.

Additionally, public providers often have established networks of multidisciplinary professionals, including geriatricians, social workers, and physiotherapists, offering holistic and coordinated care. Furthermore, public awareness campaigns and preventive health programs have been pivotal in promoting healthy aging and early detection of age-related conditions. As the global elderly population continues to grow, the Public sector's role in providing reliable and comprehensive geriatric care services is expected to expand, reinforcing its market leadership.

By Payment Source Analysis

In 2023, Public Insurance dominated the Geriatric Care Services Payment Source segment.

In 2023, Public Insurance held a dominant market position in the by-payment source segment of the Geriatric Care Services Market. This predominance is attributed to government initiatives aimed at subsidizing healthcare for the elderly, ensuring broad access to essential services. Public insurance programs, such as Medicare in the United States, provide extensive coverage for various geriatric care services, thereby driving significant market penetration.

Conversely, Private Insurance has also carved a substantial niche, appealing to a demographic willing to pay higher premiums for comprehensive and expedited care. These policies often cover services and amenities not included in public insurance plans, enhancing their attractiveness.

Out-of-pocket expenditures, while less dominant, remain a critical component, particularly in regions with limited insurance coverage or for services not fully covered by insurance. This segment includes expenses for home care, specialized treatments, and non-medical support services, reflecting the diverse needs and preferences of the elderly population.

Lastly, the Others category encompasses various alternative payment methods, including long-term care insurance, philanthropic funding, and community-based support systems, which collectively contribute to the market's financial ecosystem by offering additional flexibility and coverage options for geriatric care.

By Application Analysis

In 2023, Respiratory Diseases dominated the geriatric care services market application segment.

In 2023, Respiratory Diseases held a dominant market position in the "By Application" segment of the Geriatric Care Services Market. This segment encompasses a broad spectrum of conditions affecting the elderly, with respiratory diseases being particularly prevalent due to aging-related declines in lung function and the increased susceptibility to infections like pneumonia and chronic obstructive pulmonary disease (COPD).

Diabetes, another significant application segment, remains a critical focus, driven by the rising incidence of type 2 diabetes among older adults. Osteoporosis continues to be a major concern, given its high prevalence and the severe impact of fractures on the elderly population. Heart diseases, including coronary artery disease and heart failure, represent a substantial segment due to the cardiovascular risks associated with aging.

Neurological diseases such as Alzheimer's and Parkinson's significantly influence the market, necessitating specialized care services. Kidney diseases, notably chronic kidney disease, require ongoing management, contributing to their market share. Arthritis remains a prominent condition, impacting mobility and quality of life. Cancer care for the elderly involves extensive treatment and support services, reflecting its critical role. The "Others" category includes various conditions like vision and hearing impairments, which also demand tailored geriatric care services.

Key Market Segments

By Service

- Home Care

- Adult Day Care

- Institutional Care

By Service Provider

- Public

- Private

By Payment Source

- Public Insurance

- Private Insurance

- Out-of-pocket

- Others

By Application

- Respiratory Diseases

- Diabetes

- Osteoporosis

- Heart Diseases

- Neurological Diseases

- Kidney Diseases

- Arthritis

- Cancer

- Others

Growth Opportunity

Increasing Private Sector Participation

The global geriatric care services market is poised for substantial growth, driven primarily by the increasing participation of the private sector. Private investments are accelerating innovations in senior care, ranging from advanced medical technologies to more personalized in-home care services. Companies are recognizing the lucrative potential of the aging population, leading to the development of specialized care facilities and sophisticated healthcare solutions tailored to the elderly. This trend is expected to enhance service quality, expand access to care, and stimulate market competition, ultimately benefiting consumers through better service offerings and cost efficiencies.

Improving Reimbursement Policies

Another pivotal factor contributing to market growth is the improvement in reimbursement policies. Governments and insurance companies worldwide are revising their policies to provide better financial support for geriatric care services. These changes are making high-quality care more affordable and accessible for the elderly population. Enhanced reimbursement frameworks are likely to spur demand for various services, including long-term care, home healthcare, and assisted living facilities. This policy shift is crucial in addressing the financial burden on families and ensuring that seniors receive the necessary care without significant financial strain.

Latest Trends

Integration of Technology: Revolutionizing Geriatric Care Through Advanced Solutions

The geriatric care services market is poised to undergo significant transformation driven by the integration of technology. The adoption of telehealth, remote monitoring, and AI-powered diagnostics is becoming increasingly prevalent, enabling more efficient and personalized care for the elderly. Telehealth services, in particular, have gained momentum, providing seniors with easier access to healthcare professionals and reducing the need for in-person visits. Remote monitoring devices, such as wearables and home sensors, facilitate continuous health tracking, allowing for timely interventions and improved management of chronic conditions.

Additionally, AI-powered tools are enhancing diagnostic accuracy and streamlining administrative processes, thereby reducing costs and improving care quality. As technology continues to evolve, its integration into geriatric care services is expected to enhance patient outcomes, operational efficiency, and overall service delivery.

Government Initiatives and Funding: Driving Expansion and Accessibility in Geriatric Care Services

Government initiatives and increased funding are critical drivers of growth in the geriatric care services market. We anticipate a surge in government-backed programs aimed at supporting the aging population. Policymakers are increasingly recognizing the importance of providing adequate care for seniors, leading to the implementation of various initiatives to expand access and improve the quality of geriatric services. These initiatives often include funding for community-based care programs, subsidies for long-term care facilities, and investments in workforce training to address the shortage of geriatric care professionals.

Enhanced funding and support from governments are expected to alleviate some of the financial burdens on families, making geriatric care services more accessible to a broader segment of the population. This trend underscores the growing recognition of the need for comprehensive, high-quality care solutions tailored to the unique needs of the elderly, ensuring a more sustainable and inclusive approach to geriatric care.

Regional Analysis

North America dominates the geriatric care services market with a 40% share.

The global geriatric care services market exhibits significant regional variations, influenced by demographic trends, healthcare infrastructure, and economic development. North America leads the market, accounting for approximately 40% of the global share, driven by a substantial aging population, advanced healthcare services, and robust insurance coverage. The United States, in particular, dominates this region with its high per capita healthcare expenditure and a growing preference for home-based care services.

In Europe, the market benefits from comprehensive public healthcare systems and a significant elderly population, with countries like Germany, the UK, and France spearheading growth due to their well-established geriatric care frameworks. The Asia Pacific region is experiencing rapid market expansion, fueled by increasing life expectancy and rising healthcare investments, especially in Japan, China, and India. These countries are progressively adopting advanced geriatric care models to cater to their large elderly populations.

The Middle East & Africa and Latin America are emerging markets for geriatric care services. In the Middle East, particularly in the UAE and Saudi Arabia, investments in healthcare infrastructure and a growing awareness of elderly care are driving market growth. Latin America, led by Brazil and Mexico, is also witnessing an uptick in geriatric care services, albeit at a slower pace due to economic constraints and varying healthcare quality.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global geriatric care services market is poised for significant transformation, driven by demographic shifts and the increasing demand for quality care among the aging population. Key players in this market, such as Amedisys Incorporated and Brookdale Senior Living Incorporated, are at the forefront, leveraging their expansive networks and comprehensive service offerings to cater to this growing segment.

Amedisys Incorporated is enhancing its home healthcare services, focusing on personalized and technology-integrated solutions to improve patient outcomes. Brookdale Senior Living Incorporated continues to expand its assisted living and memory care facilities, emphasizing holistic and community-centric care models.

GGNSC Holdings and Home Instead Senior Care Incorporated are advancing in-home care services, integrating telehealth and remote monitoring technologies to provide seamless, continuous care. Kindred Healthcare Incorporated, with its extensive rehabilitation services, is targeting post-acute care, aiming to reduce hospital readmissions through effective transitional care programs.

Extendicare Incorporated and Genesis HealthCare Corporation are strengthening their skilled nursing and long-term care services, focusing on enhancing care quality through staff training and advanced clinical protocols. Gentiva Health Services Incorporated and Skilled Healthcare Group Incorporated are investing in palliative and hospice care, addressing the nuanced needs of terminally ill patients with compassionate, patient-centered approaches.

Senior Care Centers of America and Sunrise Senior Living Incorporated are innovating in senior housing and lifestyle services, incorporating wellness programs and state-of-the-art facilities to ensure a high quality of life for residents.

Collectively, these companies are shaping the future of geriatric care by prioritizing quality, accessibility, and innovation, positioning themselves as key influencers in a rapidly evolving market.

Market Key Players

- Amedisys Incorporated

- Brookdale Senior Living Incorporated

- GGNSC Holdings

- Home Instead Senior Care Incorporated

- Kindred Healthcare Incorporated

- Senior Care Centers of America

- Extendicare Incorporated

- Genesis HealthCare Corporation

- Gentiva Health Services Incorporated

- Skilled Healthcare Group Incorporated

- Sunrise Senior Living Incorporated

Recent Development

- In April 2024, Brookdale Senior Living partnered with Optum, a subsidiary of UnitedHealth Group, to integrate advanced health management services into its senior living communities. The collaboration focuses on providing coordinated care and leveraging data analytics to improve health outcomes for residents.

- In March 2024, Amedisys Inc. announced the expansion of its home health services to include a comprehensive telehealth program specifically designed for elderly patients. This initiative aims to enhance remote patient monitoring and telemedicine consultations, ensuring better accessibility and convenience for senior patients.

- In February 2024, InnovAge, a leader in the Program of All-Inclusive Care for the Elderly (PACE), expanded its services to two new states, Arizona and Nevada. This expansion is part of InnovAge's strategy to increase its footprint and provide holistic care services to more elderly individuals across the United States.

Report Scope

Report Features Description Market Value (2023) USD 1.3 Billion Forecast Revenue (2033) USD 2.3 Billion CAGR (2024-2032) 6.1% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service (Home Care, Adult Day Care, Institutional Care), By Service Provider (Public and Private), By Payment Source (Public Insurance, Private Insurance, Out-of-pocket, Others), By Application (Respiratory Diseases, Diabetes, Osteoporosis, Heart Diseases, Neurological Diseases, Kidney Diseases, Arthritis, Cance, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Amedisys Incorporated, Brookdale Senior Living Incorporated, GGNSC Holdings, Home Instead Senior Care Incorporated, Kindred Healthcare Incorporated, Senior Care Centers of America, Extendicare Incorporated, Genesis HealthCare Corporation, Gentiva Health Services Incorporated, Skilled Healthcare Group Incorporated, Sunrise Senior Living Incorporated Customization Scope Customization for segments at the regional/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Amedisys Incorporated

- Brookdale Senior Living Incorporated

- GGNSC Holdings

- Home Instead Senior Care Incorporated

- Kindred Healthcare Incorporated

- Senior Care Centers of America

- Extendicare Incorporated

- Genesis HealthCare Corporation

- Gentiva Health Services Incorporated

- Skilled Healthcare Group Incorporated

- Sunrise Senior Living Incorporated