Fleet Telematics Market By Type (Embedded, Tethered, Integrated), By Application (Infotainment, Remote Diagnosis, Navigation, Safety and Security, Others), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

47003

-

June 2024

-

300

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

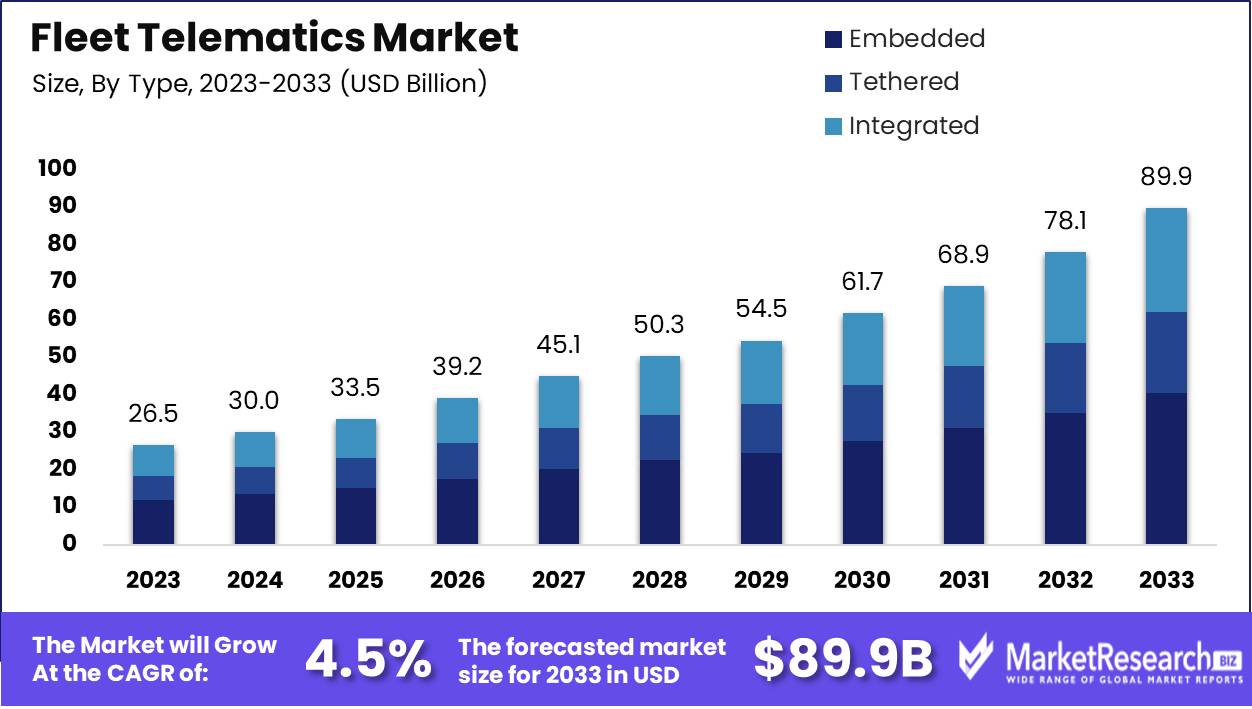

The Fleet Telematics Market was valued at USD 26.5 Billion in 2023. It is expected to reach USD 89.9 Billion by 2033, with a CAGR of 4.5% during the forecast period from 2024 to 2033.

The Fleet Telematics Market encompasses technologies and services that utilize GPS, telecommunications, and data analytics to monitor and manage commercial vehicle fleets. This market includes solutions for vehicle tracking, route optimization, driver behavior analysis, fuel management, and predictive maintenance.

The fleet telematics market is poised for robust growth, driven by regulatory mandates, increasing urbanization, and rising disposable incomes. Regulatory requirements for the installation of telematics systems in vehicles have become a significant catalyst, ensuring compliance and safety across fleets.

Additionally, urbanization is contributing to higher vehicle utilization rates, which, combined with increasing per capita disposable income, is fostering greater investment in telematics solutions. This trend is particularly pronounced among fleet operators, who are adopting telematics at an accelerated pace to optimize operations, reduce costs, and enhance overall efficiency.

Furthermore, the commercial vehicle telematics software segment is experiencing substantial growth, with a projected compound annual growth rate (CAGR) of 14.3% from 2023 to 2028. This segment is anticipated to reach USD 10.3 billion by 2028, underscoring the significant investment being channeled into telematics technologies. Fleet operators are driving this expansion, leveraging telematics to gain real-time insights into vehicle performance, driver behavior, and logistical efficiencies. As these technologies evolve, they are becoming indispensable tools for fleet management, enabling operators to achieve operational excellence and competitive advantage. The convergence of these factors positions the fleet telematics market as a pivotal component of the broader transportation and logistics ecosystem, poised for sustained growth and innovation.

Key Takeaways

- Market Growth: The Fleet Telematics Market was valued at USD 26.5 Billion in 2023. It is expected to reach USD 89.9 Billion by 2033, with a CAGR of 4.5% during the forecast period from 2024 to 2033.

- By Type: In 2023, Embedded Systems dominated the fleet telematics market segment.

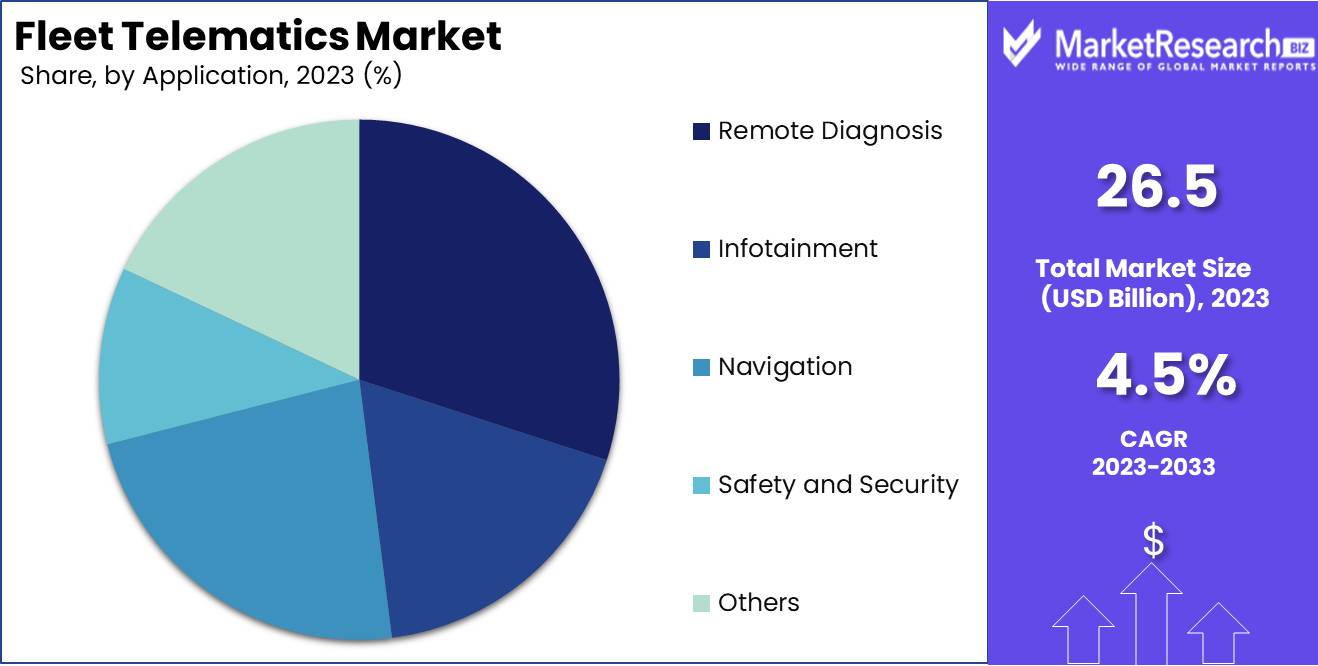

- By Application: In 2023, Remote Diagnosis dominated Fleet Telematics with real-time vehicle health monitoring.

- By Vehicle Type: In 2023, Passenger Cars dominated Fleet Telematics, driven by widespread adoption.

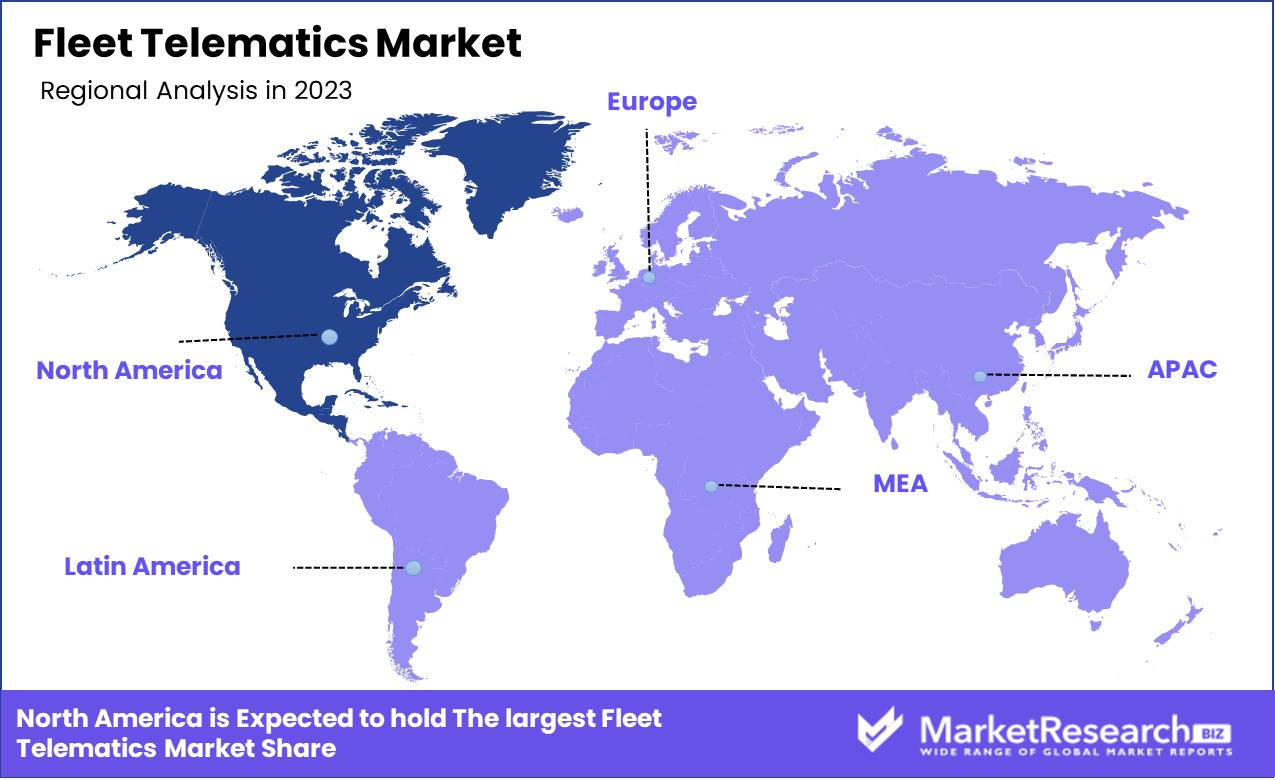

- Regional Dominance: North America dominates fleet telematics with a 35% largest market share due to advanced regulations.

- Growth Opportunity: By prioritizing compliance, innovation, and partnerships, companies can drive significant growth in the fleet telematics market.

Driving factors

Growing Need for Efficient Fleet Management and Optimization of Operations

The increasing demand for efficient fleet management and operations optimization are pivotal drivers in expanding the fleet telematics market. Businesses continually seek ways to enhance their logistics, reduce operational costs, and improve delivery times. Fleet telematics systems provide real-time data and analytics, enabling fleet managers to monitor vehicle locations, driver behavior, and overall fleet performance. This data-driven approach allows for optimized routing, reduced idle times, and better asset utilization, resulting in significant cost savings and operational efficiencies.

A key statistical indicator supporting this trend is the substantial reduction in operational costs reported by companies utilizing fleet telematics. For instance, studies indicate that businesses can achieve up to a 15% decrease in fuel expenses and a 20% reduction in maintenance costs through the implementation of telematics solutions. These savings are critical for businesses operating large fleets, where even small percentage improvements can translate into considerable financial benefits.

Increasing Adoption of Connected Vehicles and Demand for Advanced Telematics Solutions

The surge in the adoption of connected vehicles and the growing demand for advanced telematics solutions are accelerating market growth. The Internet of Things (IoT) and advancements in wireless communication technologies have enabled vehicles to become increasingly connected, facilitating seamless integration with telematics systems. Connected vehicles equipped with sophisticated telematics solutions offer real-time insights into vehicle health, driving patterns, and environmental conditions, enhancing the overall efficiency and safety of fleet operations.

The adoption rate of connected vehicles is on a steep incline, with projections indicating that by 2025, approximately 76 million connected cars will be on the road globally. This proliferation of connected electric vehicles drives the need for more advanced telematics solutions capable of handling the vast amounts of data generated, leading to increased investments in telematics technologies by automotive manufacturers and fleet operators alike.

Rising Focus on Vehicle Safety, Fuel Efficiency, and Emissions Reduction

The emphasis on vehicle safety, fuel efficiency, and emissions reduction is a crucial factor propelling the fleet telematics market forward. Regulatory pressures and environmental concerns are pushing fleet operators to adopt technologies that ensure compliance with safety standards and environmental regulations. Telematics systems play a vital role in monitoring and enhancing vehicle safety by providing real-time alerts on hazardous driving behaviors, maintenance issues, and accident detection.

Furthermore, telematics solutions contribute significantly to fuel efficiency and emissions reduction. By analyzing driving patterns and vehicle models performance data, these systems can suggest optimal driving practices and routes, reducing fuel consumption and lowering carbon emissions. Statistics reveal that telematics-enabled fleets can achieve up to a 25% improvement in fuel efficiency, aligning with global sustainability goals and regulatory requirements.

Restraining Factors

High Initial Investment and Installation Costs: A Barrier to Fleet Telematics Adoption

The fleet telematics market, while poised for significant growth due to its potential to enhance operational efficiency and cost savings, faces notable restraint from high initial investment and installation costs. Implementing fleet telematics systems requires substantial capital expenditure, including the purchase of hardware, software, and ancillary equipment. For many small to medium-sized enterprises (SMEs), these upfront costs can be prohibitive. According to industry reports, the initial setup for a comprehensive telematics solution can range from $200 to $1,500 per vehicle, depending on the complexity and features of the system. This considerable financial outlay can deter many potential adopters, especially in an economic environment where cost management is critical.

Moreover, the installation process itself can be labor-intensive and costly. It often necessitates the hiring of specialized technicians and may involve vehicle downtime, further adding to the total cost of ownership. These expenses can be particularly burdensome for companies with large fleets, where the cumulative costs can escalate rapidly.

Integration Complexity: A Technical Challenge Hindering Market Expansion

Another significant restraining factor for the fleet telematics market is the complexity associated with integrating these systems into existing fleet operations. Fleet telematics solutions often need to be tailored to specific operational requirements, which can vary widely across different industries and companies. This customization process can be both technically challenging and time-consuming, requiring deep integration with various existing software systems such as fleet management platforms, logistics and supply chain management software, and enterprise resource planning (ERP) systems.

The complexity of integration is compounded by the need for interoperability between different telematics solutions and legacy systems. Many fleet operators use a mix of old and new technologies, making seamless integration difficult.

By Type Analysis

In 2023, Embedded Systems dominated the fleet telematics market segment.

In 2023, Embedded Systems held a dominant market position in the By Type segment of the Fleet Telematics Market. This dominance can be attributed to several critical factors. Firstly, embedded telematics solutions are integrated directly into the vehicle's hardware, offering superior reliability and seamless functionality compared to aftermarket solutions. These systems facilitate real-time data collection and transmission, which is crucial for fleet management operations aiming for efficiency and cost reduction.

Conversely, tethered telematics systems, which rely on external devices connected to the vehicle, lag in market share due to their susceptibility to connectivity issues and less streamlined integration. Despite these challenges, tethered systems still play a role, particularly in retrofitting older fleets with modern telematics capabilities at a lower initial cost.

Integrated systems, which blend aspects of both embedded and tethered solutions, are gaining traction. They offer a balanced approach, providing robust features of embedded systems with the flexibility and cost-effectiveness of tethered solutions. However, their adoption is currently limited by the need for standardization and interoperability across different vehicle makes and models. As technology evolves, integrated solutions are expected to grow, potentially reshaping the competitive landscape in the fleet telematics market.

By Application Analysis

In 2023, Remote Diagnosis dominated Fleet Telematics with real-time vehicle health monitoring.

In 2023, Remote Diagnosis held a dominant market position in the "By Application" segment of the Fleet Telematics Market. This leadership can be attributed to the increasing need for real-time vehicle health monitoring and predictive maintenance capabilities. Fleet operators are increasingly recognizing the value of minimizing downtime and extending vehicle lifespans through advanced diagnostics. In contrast, the Infotainment segment also saw significant traction, driven by the rising demand for enhanced driver experience and passenger satisfaction. Navigation systems remain critical, primarily due to their role in optimizing route efficiency and reducing fuel consumption. Safety and Security applications are equally vital, addressing growing concerns around vehicle theft and driver safety through robust tracking and alert systems.

Lastly, the "Others" category, encompassing features like fleet management and fuel monitoring, continues to evolve, catering to the diverse needs of fleet operators. Each sub-segment underscores the multifaceted nature of fleet telematics, reflecting the industry's shift towards more integrated, intelligent, and comprehensive telematics solutions. This holistic approach is reshaping how fleet operators manage their assets, ensuring improved operational efficiency and cost-effectiveness.

By Vehicle Type Analysis

In 2023, Passenger Cars dominated Fleet Telematics, driven by widespread adoption.

In 2023, Passenger Cars held a dominant market position in the by-vehicle type segment of the Fleet Telematics Market. This predominance is attributed to several factors. Firstly, the growing adoption of telematics systems by individual and commercial fleet operators has significantly driven demand. Enhanced safety features, real-time vehicle tracking, and improved fuel efficiency offered by telematics are particularly appealing to this segment. Furthermore, the rise of ride-sharing services and rental fleets has amplified the need for advanced fleet management solutions.

Conversely, Light Commercial Vehicles (LCVs) are experiencing substantial growth due to the expanding e-commerce sector, which necessitates efficient last-mile delivery solutions. The integration of telematics in LCVs ensures timely deliveries, route optimization, and lower operational costs, making them increasingly indispensable.

Heavy Commercial Vehicles (HCVs) also show promising growth, primarily driven by the logistics and transportation sectors. The use of telematics in HCVs aids in regulatory compliance reduces downtime through predictive maintenance, and enhances driver performance, thereby optimizing the supply chain.

Key Market Segments

By Type

- Embedded

- Tethered

- Integrated

By Application

- Infotainment

- Remote Diagnosis

- Navigation

- Safety and Security

- Others

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Growth Opportunity

AIS 140 Integration

The integration of AIS 140 standards is set to be a significant growth driver for the global fleet telematics market in 2024. Mandated by the Indian government for commercial vehicles, AIS 140 compliance ensures the inclusion of intelligent transportation systems (ITS) to enhance safety, efficiency, and transparency. This regulatory push is expected to catalyze widespread adoption of telematics solutions not only in India but also to inspire similar regulatory frameworks globally. The standardization promotes interoperability and encourages fleet operators to invest in advanced telematics solutions, thereby driving market growth. Companies operating in this sector must focus on developing AIS 140-compliant products to capitalize on this opportunity.

Investments and Start-up Proliferation

The fleet telematics market is witnessing an influx of investments and a surge in start-up activities, which are crucial for innovation and market expansion. Venture capital and private equity firms are recognizing the potential of telematics in transforming fleet management, leading to substantial funding in technology development and market penetration efforts. Start-ups are spearheading innovative solutions such as real-time analytics, predictive maintenance, and AI-driven insights, which are attracting significant attention and resources. This vibrant investment landscape not only fuels competition but also drives technological advancements, offering fleet operators sophisticated tools to enhance operational efficiency, reduce costs, and improve safety.

Latest Trends

Integration of Advanced Telematics Solutions

In 2024, the fleet telematics market is poised to see significant advancements driven by the integration of sophisticated telematics solutions. The industry is moving beyond basic GPS tracking and vehicle diagnostics to incorporate a comprehensive suite of functionalities. These include predictive maintenance, driver behavior monitoring, and advanced route optimization. The deployment of artificial intelligence (AI) and machine learning (ML) within telematics systems enables fleets to not only collect data but also derive actionable insights that can improve operational efficiency and reduce costs. For instance, AI-driven predictive maintenance alerts can preemptively identify vehicle issues, thereby minimizing downtime and extending vehicle lifespan.

Emphasis on Real-time Data and Analytics

Real-time data and analytics are becoming paramount in the fleet telematics landscape. The demand for instant insights is accelerating, driven by the need for heightened operational transparency and rapid decision-making. Fleets equipped with real-time tracking and analytics capabilities can monitor vehicle locations, driver performance, and fuel consumption dynamically, allowing for immediate corrective actions. This trend is especially relevant in logistics and delivery services, where real-time data can significantly enhance delivery accuracy and customer satisfaction. Furthermore, the ability to analyze real-time data streams facilitates more responsive and adaptive fleet management strategies, thereby optimizing resource allocation and improving overall service levels.

Regional Analysis

North America dominates fleet telematics with a 35% largest market share due to advanced regulations.

North America stands as the dominant region, commanding approximately 35% of the global market share. The high penetration rate is attributable to stringent regulatory requirements for fleet management, advanced infrastructure, and the widespread adoption of telematics solutions by leading logistics and transportation companies. The United States, in particular, is a significant contributor due to its robust economy and progressive technological landscape.

Europe follows, driven by regulations like the European Union's mandate for eCall in all new cars, which has significantly boosted telematics deployment. The region's mature automotive industry and focus on sustainability also foster market growth, with countries like Germany, the UK, and France at the forefront. Asia Pacific is experiencing rapid growth, projected to witness the highest CAGR in the coming years. This surge is fueled by the increasing industrialization, expanding logistics sector, and supportive government initiatives in countries like China, Japan, and India. China's burgeoning e-commerce sector further amplifies the demand for efficient fleet management solutions.

Middle East & Africa show promising growth potential, driven by the increasing need for efficient fleet management in the oil & gas and logistics sectors. However, the market remains nascent, with growth primarily concentrated in the Gulf Cooperation Council (GCC) countries. Latin America is gradually embracing fleet telematics, with Brazil and Mexico leading the charge. The adoption is propelled by the region's growing logistics industry and the need for cost-effective fleet management solutions amidst economic fluctuations.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

Actsoft is renowned for its comprehensive mobile workforce management solutions, focusing on optimizing workforce productivity and reducing operational costs. Its versatile telematics platforms cater to various industries, ensuring a robust market presence. Ctrack, an Inseego company, leverages its expertise in IoT and fleet management to offer cutting-edge telematics solutions. The company's strong emphasis on data analytics and real-time tracking positions it well to capitalize on growing demand. Daimler Fleetboard GmbH integrates advanced telematics with its vehicle manufacturing prowess, offering seamless solutions for commercial fleets. Its deep integration with Daimler trucks provides a competitive edge, particularly in the heavy vehicle segment.

Deere & Company leverages its agricultural equipment expertise to provide specialized telematics solutions for farming and construction equipment. Its focus on precision agriculture and smart farming enhances its market position. Fleetmatics Group PLC (now part of Verizon Connect) continues to be a significant player with its strong customer base and comprehensive telematics solutions that enhance fleet efficiency and safety. HARMAN International brings its expertise in connected car technologies to the fleet telematics space, focusing on infotainment, navigation, and vehicle management systems that cater to diverse fleet needs. KORE Wireless is a leader in IoT and M2M communications, providing robust connectivity solutions that are essential for advanced telematics systems. Its global reach and strong network partnerships bolster its market standing.

Masternaut Limited, a Michelin company, offers extensive fleet management solutions with a focus on reducing carbon footprint and enhancing operational efficiency, aligning with the growing emphasis on sustainability. MiX Telematics provides versatile solutions across multiple industries, emphasizing safety, compliance, and operational efficiency. Its strong analytical capabilities and global footprint make it a formidable competitor. Sprint Corporation (now part of T-Mobile) leverages its telecommunications infrastructure to offer reliable connectivity solutions essential for real-time telematics data transmission. TomTom International BV is known for its superior navigation and mapping technologies, which are critical components of advanced telematics systems. Its continuous innovation in location-based services ensures sustained market relevance.

Trimble Inc. offers comprehensive telematics and transportation management solutions, excelling in sectors like agriculture, construction, and logistics. Its focus on integrating hardware, software, and services provides holistic fleet management solutions. Verizon is a powerhouse in the telematics market through its Verizon Connect division, offering a wide array of fleet management solutions. Its strong telecommunications background and extensive customer base support its market leadership.

Market Key Players

- Actsoft

- Ctrack an Inseego company

- Daimler Fleetboard GmbH

- Deere & Company

- Fleetmatics Group PLC

- HARMAN International

- KORE Wireless

- Masternaut Limited

- MiX Telematics

- Sprint Corporation

- TomTom International BV

- Trimble Inc.

- Verizon

Recent Development

- In February 2024, Geotab partnered with Daimler Truck North America (DTNA) to integrate Freightliner truck data with Geotab's MyGeotab platform using DTNA's Data-as-a-Service (DaaS) technology. This integration enhances fleet management by providing unified data access and improving safety, operational efficiency, and sustainability without requiring additional hardware.

- In February 2024, Phillips Connect and Noregon collaborated to integrate Connect1 trailer data into TripVision Remote Diagnostics. This partnership aims to enhance fleet maintenance by offering comprehensive insights into trailer health and brake faults, thereby streamlining maintenance operations and boosting fleet efficiency.

- In September 2023, Airbiquity partnered with Tessolve to integrate OTAmatic and LOGmatic solutions with Tessolve's TERA devices. This integration provides secure software updates and flexible data logging capabilities, facilitating OEM development and deployment processes for connected vehicles.

Report Scope

Report Features Description Market Value (2023) USD 26.5 Billion Forecast Revenue (2033) USD 89.9 Billion CAGR (2024-2032) 4.5% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Embedded, Tethered, Integrated), By Application (Infotainment, Remote Diagnosis, Navigation, Safety and Security, Others), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Actsoft, Ctrack an Inseego company, Daimler Fleetboard GmbH, Deere & Company, Fleetmatics Group PLC, HARMAN International, KORE Wireless, Masternaut Limited, MiX Telematics, Sprint Corporation, TomTom International BV, Trimble Inc., Verizon Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Fleet Telematics Market Overview

- 2.1. Fleet Telematics Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Fleet Telematics Market Dynamics

- 3. Global Fleet Telematics Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Fleet Telematics Market Analysis, 2016-2021

- 3.2. Global Fleet Telematics Market Opportunity and Forecast, 2023-2032

- 3.3. Global Fleet Telematics Market Analysis, Opportunity and Forecast, By Type, 2016-2032

- 3.3.1. Global Fleet Telematics Market Analysis by Type: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type, 2016-2032

- 3.3.3. Embedded

- 3.3.4. Tethered

- 3.3.5. Integrated

- 3.4. Global Fleet Telematics Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 3.4.1. Global Fleet Telematics Market Analysis by Application: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 3.4.3. Infotainment

- 3.4.4. Remote Diagnosis

- 3.4.5. Navigation

- 3.4.6. Safety and Security

- 3.4.7. Others

- 3.5. Global Fleet Telematics Market Analysis, Opportunity and Forecast, By Vehicle Type , 2016-2032

- 3.5.1. Global Fleet Telematics Market Analysis by Vehicle Type : Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Vehicle Type , 2016-2032

- 3.5.3. Passenger Cars

- 3.5.4. Light Commercial Vehicles

- 3.5.5. Heavy Commercial Vehicles

- 4. North America Fleet Telematics Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Fleet Telematics Market Analysis, 2016-2021

- 4.2. North America Fleet Telematics Market Opportunity and Forecast, 2023-2032

- 4.3. North America Fleet Telematics Market Analysis, Opportunity and Forecast, By Type, 2016-2032

- 4.3.1. North America Fleet Telematics Market Analysis by Type: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type, 2016-2032

- 4.3.3. Embedded

- 4.3.4. Tethered

- 4.3.5. Integrated

- 4.4. North America Fleet Telematics Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 4.4.1. North America Fleet Telematics Market Analysis by Application: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 4.4.3. Infotainment

- 4.4.4. Remote Diagnosis

- 4.4.5. Navigation

- 4.4.6. Safety and Security

- 4.4.7. Others

- 4.5. North America Fleet Telematics Market Analysis, Opportunity and Forecast, By Vehicle Type , 2016-2032

- 4.5.1. North America Fleet Telematics Market Analysis by Vehicle Type : Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Vehicle Type , 2016-2032

- 4.5.3. Passenger Cars

- 4.5.4. Light Commercial Vehicles

- 4.5.5. Heavy Commercial Vehicles

- 4.6. North America Fleet Telematics Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.6.1. North America Fleet Telematics Market Analysis by Country : Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.6.2.1. The US

- 4.6.2.2. Canada

- 4.6.2.3. Mexico

- 5. Western Europe Fleet Telematics Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Fleet Telematics Market Analysis, 2016-2021

- 5.2. Western Europe Fleet Telematics Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Fleet Telematics Market Analysis, Opportunity and Forecast, By Type, 2016-2032

- 5.3.1. Western Europe Fleet Telematics Market Analysis by Type: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type, 2016-2032

- 5.3.3. Embedded

- 5.3.4. Tethered

- 5.3.5. Integrated

- 5.4. Western Europe Fleet Telematics Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 5.4.1. Western Europe Fleet Telematics Market Analysis by Application: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 5.4.3. Infotainment

- 5.4.4. Remote Diagnosis

- 5.4.5. Navigation

- 5.4.6. Safety and Security

- 5.4.7. Others

- 5.5. Western Europe Fleet Telematics Market Analysis, Opportunity and Forecast, By Vehicle Type , 2016-2032

- 5.5.1. Western Europe Fleet Telematics Market Analysis by Vehicle Type : Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Vehicle Type , 2016-2032

- 5.5.3. Passenger Cars

- 5.5.4. Light Commercial Vehicles

- 5.5.5. Heavy Commercial Vehicles

- 5.6. Western Europe Fleet Telematics Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.6.1. Western Europe Fleet Telematics Market Analysis by Country : Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.6.2.1. Germany

- 5.6.2.2. France

- 5.6.2.3. The UK

- 5.6.2.4. Spain

- 5.6.2.5. Italy

- 5.6.2.6. Portugal

- 5.6.2.7. Ireland

- 5.6.2.8. Austria

- 5.6.2.9. Switzerland

- 5.6.2.10. Benelux

- 5.6.2.11. Nordic

- 5.6.2.12. Rest of Western Europe

- 6. Eastern Europe Fleet Telematics Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Fleet Telematics Market Analysis, 2016-2021

- 6.2. Eastern Europe Fleet Telematics Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Fleet Telematics Market Analysis, Opportunity and Forecast, By Type, 2016-2032

- 6.3.1. Eastern Europe Fleet Telematics Market Analysis by Type: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type, 2016-2032

- 6.3.3. Embedded

- 6.3.4. Tethered

- 6.3.5. Integrated

- 6.4. Eastern Europe Fleet Telematics Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 6.4.1. Eastern Europe Fleet Telematics Market Analysis by Application: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 6.4.3. Infotainment

- 6.4.4. Remote Diagnosis

- 6.4.5. Navigation

- 6.4.6. Safety and Security

- 6.4.7. Others

- 6.5. Eastern Europe Fleet Telematics Market Analysis, Opportunity and Forecast, By Vehicle Type , 2016-2032

- 6.5.1. Eastern Europe Fleet Telematics Market Analysis by Vehicle Type : Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Vehicle Type , 2016-2032

- 6.5.3. Passenger Cars

- 6.5.4. Light Commercial Vehicles

- 6.5.5. Heavy Commercial Vehicles

- 6.6. Eastern Europe Fleet Telematics Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.6.1. Eastern Europe Fleet Telematics Market Analysis by Country : Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.6.2.1. Russia

- 6.6.2.2. Poland

- 6.6.2.3. The Czech Republic

- 6.6.2.4. Greece

- 6.6.2.5. Rest of Eastern Europe

- 7. APAC Fleet Telematics Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Fleet Telematics Market Analysis, 2016-2021

- 7.2. APAC Fleet Telematics Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Fleet Telematics Market Analysis, Opportunity and Forecast, By Type, 2016-2032

- 7.3.1. APAC Fleet Telematics Market Analysis by Type: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type, 2016-2032

- 7.3.3. Embedded

- 7.3.4. Tethered

- 7.3.5. Integrated

- 7.4. APAC Fleet Telematics Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 7.4.1. APAC Fleet Telematics Market Analysis by Application: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 7.4.3. Infotainment

- 7.4.4. Remote Diagnosis

- 7.4.5. Navigation

- 7.4.6. Safety and Security

- 7.4.7. Others

- 7.5. APAC Fleet Telematics Market Analysis, Opportunity and Forecast, By Vehicle Type , 2016-2032

- 7.5.1. APAC Fleet Telematics Market Analysis by Vehicle Type : Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Vehicle Type , 2016-2032

- 7.5.3. Passenger Cars

- 7.5.4. Light Commercial Vehicles

- 7.5.5. Heavy Commercial Vehicles

- 7.6. APAC Fleet Telematics Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.6.1. APAC Fleet Telematics Market Analysis by Country : Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.6.2.1. China

- 7.6.2.2. Japan

- 7.6.2.3. South Korea

- 7.6.2.4. India

- 7.6.2.5. Australia & New Zeland

- 7.6.2.6. Indonesia

- 7.6.2.7. Malaysia

- 7.6.2.8. Philippines

- 7.6.2.9. Singapore

- 7.6.2.10. Thailand

- 7.6.2.11. Vietnam

- 7.6.2.12. Rest of APAC

- 8. Latin America Fleet Telematics Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Fleet Telematics Market Analysis, 2016-2021

- 8.2. Latin America Fleet Telematics Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Fleet Telematics Market Analysis, Opportunity and Forecast, By Type, 2016-2032

- 8.3.1. Latin America Fleet Telematics Market Analysis by Type: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type, 2016-2032

- 8.3.3. Embedded

- 8.3.4. Tethered

- 8.3.5. Integrated

- 8.4. Latin America Fleet Telematics Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 8.4.1. Latin America Fleet Telematics Market Analysis by Application: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 8.4.3. Infotainment

- 8.4.4. Remote Diagnosis

- 8.4.5. Navigation

- 8.4.6. Safety and Security

- 8.4.7. Others

- 8.5. Latin America Fleet Telematics Market Analysis, Opportunity and Forecast, By Vehicle Type , 2016-2032

- 8.5.1. Latin America Fleet Telematics Market Analysis by Vehicle Type : Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Vehicle Type , 2016-2032

- 8.5.3. Passenger Cars

- 8.5.4. Light Commercial Vehicles

- 8.5.5. Heavy Commercial Vehicles

- 8.6. Latin America Fleet Telematics Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.6.1. Latin America Fleet Telematics Market Analysis by Country : Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.6.2.1. Brazil

- 8.6.2.2. Colombia

- 8.6.2.3. Chile

- 8.6.2.4. Argentina

- 8.6.2.5. Costa Rica

- 8.6.2.6. Rest of Latin America

- 9. Middle East & Africa Fleet Telematics Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Fleet Telematics Market Analysis, 2016-2021

- 9.2. Middle East & Africa Fleet Telematics Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Fleet Telematics Market Analysis, Opportunity and Forecast, By Type, 2016-2032

- 9.3.1. Middle East & Africa Fleet Telematics Market Analysis by Type: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type, 2016-2032

- 9.3.3. Embedded

- 9.3.4. Tethered

- 9.3.5. Integrated

- 9.4. Middle East & Africa Fleet Telematics Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 9.4.1. Middle East & Africa Fleet Telematics Market Analysis by Application: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 9.4.3. Infotainment

- 9.4.4. Remote Diagnosis

- 9.4.5. Navigation

- 9.4.6. Safety and Security

- 9.4.7. Others

- 9.5. Middle East & Africa Fleet Telematics Market Analysis, Opportunity and Forecast, By Vehicle Type , 2016-2032

- 9.5.1. Middle East & Africa Fleet Telematics Market Analysis by Vehicle Type : Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Vehicle Type , 2016-2032

- 9.5.3. Passenger Cars

- 9.5.4. Light Commercial Vehicles

- 9.5.5. Heavy Commercial Vehicles

- 9.6. Middle East & Africa Fleet Telematics Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.6.1. Middle East & Africa Fleet Telematics Market Analysis by Country : Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.6.2.1. Algeria

- 9.6.2.2. Egypt

- 9.6.2.3. Israel

- 9.6.2.4. Kuwait

- 9.6.2.5. Nigeria

- 9.6.2.6. Saudi Arabia

- 9.6.2.7. South Africa

- 9.6.2.8. Turkey

- 9.6.2.9. The UAE

- 9.6.2.10. Rest of MEA

- 10. Global Fleet Telematics Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Fleet Telematics Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Fleet Telematics Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Actsoft

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Ctrack an Inseego company

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Daimler Fleetboard GmbH

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Deere & Company

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Fleetmatics Group PLC

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. HARMAN International

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. KORE Wireless

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Masternaut Limited

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. MiX Telematics

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Sprint Corporation

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. TomTom International BV

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. Verizon

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

"

- List of Figures

- "

- Figure 1: Global Fleet Telematics Market Revenue (US$ Mn) Market Share by Type in 2022

- Figure 2: Global Fleet Telematics Market Market Attractiveness Analysis by Type, 2016-2032

- Figure 3: Global Fleet Telematics Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 4: Global Fleet Telematics Market Market Attractiveness Analysis by Application, 2016-2032

- Figure 5: Global Fleet Telematics Market Revenue (US$ Mn) Market Share by Vehicle Type in 2022

- Figure 6: Global Fleet Telematics Market Market Attractiveness Analysis by Vehicle Type , 2016-2032

- Figure 7: Global Fleet Telematics Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 8: Global Fleet Telematics Market Market Attractiveness Analysis by Region, 2016-2032

- Figure 9: Global Fleet Telematics Market Market Revenue (US$ Mn) (2016-2032)

- Figure 10: Global Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 11: Global Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Figure 12: Global Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 13: Global Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Vehicle Type (2016-2032)

- Figure 14: Global Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 15: Global Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Figure 16: Global Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 17: Global Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Vehicle Type (2016-2032)

- Figure 18: Global Fleet Telematics Market Market Share Comparison by Region (2016-2032)

- Figure 19: Global Fleet Telematics Market Market Share Comparison by Type (2016-2032)

- Figure 20: Global Fleet Telematics Market Market Share Comparison by Application (2016-2032)

- Figure 21: Global Fleet Telematics Market Market Share Comparison by Vehicle Type (2016-2032)

- Figure 22: North America Fleet Telematics Market Revenue (US$ Mn) Market Share by Typein 2022

- Figure 23: North America Fleet Telematics Market Market Attractiveness Analysis by Type, 2016-2032

- Figure 24: North America Fleet Telematics Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 25: North America Fleet Telematics Market Market Attractiveness Analysis by Application, 2016-2032

- Figure 26: North America Fleet Telematics Market Revenue (US$ Mn) Market Share by Vehicle Type in 2022

- Figure 27: North America Fleet Telematics Market Market Attractiveness Analysis by Vehicle Type , 2016-2032

- Figure 28: North America Fleet Telematics Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 29: North America Fleet Telematics Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 30: North America Fleet Telematics Market Market Revenue (US$ Mn) (2016-2032)

- Figure 31: North America Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 32: North America Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Figure 33: North America Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 34: North America Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Vehicle Type (2016-2032)

- Figure 35: North America Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 36: North America Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Figure 37: North America Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 38: North America Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Vehicle Type (2016-2032)

- Figure 39: North America Fleet Telematics Market Market Share Comparison by Country (2016-2032)

- Figure 40: North America Fleet Telematics Market Market Share Comparison by Type (2016-2032)

- Figure 41: North America Fleet Telematics Market Market Share Comparison by Application (2016-2032)

- Figure 42: North America Fleet Telematics Market Market Share Comparison by Vehicle Type (2016-2032)

- Figure 43: Western Europe Fleet Telematics Market Revenue (US$ Mn) Market Share by Typein 2022

- Figure 44: Western Europe Fleet Telematics Market Market Attractiveness Analysis by Type, 2016-2032

- Figure 45: Western Europe Fleet Telematics Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 46: Western Europe Fleet Telematics Market Market Attractiveness Analysis by Application, 2016-2032

- Figure 47: Western Europe Fleet Telematics Market Revenue (US$ Mn) Market Share by Vehicle Type in 2022

- Figure 48: Western Europe Fleet Telematics Market Market Attractiveness Analysis by Vehicle Type , 2016-2032

- Figure 49: Western Europe Fleet Telematics Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 50: Western Europe Fleet Telematics Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 51: Western Europe Fleet Telematics Market Market Revenue (US$ Mn) (2016-2032)

- Figure 52: Western Europe Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 53: Western Europe Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Figure 54: Western Europe Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 55: Western Europe Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Vehicle Type (2016-2032)

- Figure 56: Western Europe Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 57: Western Europe Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Figure 58: Western Europe Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 59: Western Europe Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Vehicle Type (2016-2032)

- Figure 60: Western Europe Fleet Telematics Market Market Share Comparison by Country (2016-2032)

- Figure 61: Western Europe Fleet Telematics Market Market Share Comparison by Type (2016-2032)

- Figure 62: Western Europe Fleet Telematics Market Market Share Comparison by Application (2016-2032)

- Figure 63: Western Europe Fleet Telematics Market Market Share Comparison by Vehicle Type (2016-2032)

- Figure 64: Eastern Europe Fleet Telematics Market Revenue (US$ Mn) Market Share by Typein 2022

- Figure 65: Eastern Europe Fleet Telematics Market Market Attractiveness Analysis by Type, 2016-2032

- Figure 66: Eastern Europe Fleet Telematics Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 67: Eastern Europe Fleet Telematics Market Market Attractiveness Analysis by Application, 2016-2032

- Figure 68: Eastern Europe Fleet Telematics Market Revenue (US$ Mn) Market Share by Vehicle Type in 2022

- Figure 69: Eastern Europe Fleet Telematics Market Market Attractiveness Analysis by Vehicle Type , 2016-2032

- Figure 70: Eastern Europe Fleet Telematics Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 71: Eastern Europe Fleet Telematics Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 72: Eastern Europe Fleet Telematics Market Market Revenue (US$ Mn) (2016-2032)

- Figure 73: Eastern Europe Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 74: Eastern Europe Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Figure 75: Eastern Europe Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 76: Eastern Europe Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Vehicle Type (2016-2032)

- Figure 77: Eastern Europe Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 78: Eastern Europe Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Figure 79: Eastern Europe Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 80: Eastern Europe Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Vehicle Type (2016-2032)

- Figure 81: Eastern Europe Fleet Telematics Market Market Share Comparison by Country (2016-2032)

- Figure 82: Eastern Europe Fleet Telematics Market Market Share Comparison by Type (2016-2032)

- Figure 83: Eastern Europe Fleet Telematics Market Market Share Comparison by Application (2016-2032)

- Figure 84: Eastern Europe Fleet Telematics Market Market Share Comparison by Vehicle Type (2016-2032)

- Figure 85: APAC Fleet Telematics Market Revenue (US$ Mn) Market Share by Typein 2022

- Figure 86: APAC Fleet Telematics Market Market Attractiveness Analysis by Type, 2016-2032

- Figure 87: APAC Fleet Telematics Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 88: APAC Fleet Telematics Market Market Attractiveness Analysis by Application, 2016-2032

- Figure 89: APAC Fleet Telematics Market Revenue (US$ Mn) Market Share by Vehicle Type in 2022

- Figure 90: APAC Fleet Telematics Market Market Attractiveness Analysis by Vehicle Type , 2016-2032

- Figure 91: APAC Fleet Telematics Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 92: APAC Fleet Telematics Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 93: APAC Fleet Telematics Market Market Revenue (US$ Mn) (2016-2032)

- Figure 94: APAC Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 95: APAC Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Figure 96: APAC Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 97: APAC Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Vehicle Type (2016-2032)

- Figure 98: APAC Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 99: APAC Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Figure 100: APAC Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 101: APAC Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Vehicle Type (2016-2032)

- Figure 102: APAC Fleet Telematics Market Market Share Comparison by Country (2016-2032)

- Figure 103: APAC Fleet Telematics Market Market Share Comparison by Type (2016-2032)

- Figure 104: APAC Fleet Telematics Market Market Share Comparison by Application (2016-2032)

- Figure 105: APAC Fleet Telematics Market Market Share Comparison by Vehicle Type (2016-2032)

- Figure 106: Latin America Fleet Telematics Market Revenue (US$ Mn) Market Share by Typein 2022

- Figure 107: Latin America Fleet Telematics Market Market Attractiveness Analysis by Type, 2016-2032

- Figure 108: Latin America Fleet Telematics Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 109: Latin America Fleet Telematics Market Market Attractiveness Analysis by Application, 2016-2032

- Figure 110: Latin America Fleet Telematics Market Revenue (US$ Mn) Market Share by Vehicle Type in 2022

- Figure 111: Latin America Fleet Telematics Market Market Attractiveness Analysis by Vehicle Type , 2016-2032

- Figure 112: Latin America Fleet Telematics Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 113: Latin America Fleet Telematics Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 114: Latin America Fleet Telematics Market Market Revenue (US$ Mn) (2016-2032)

- Figure 115: Latin America Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 116: Latin America Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Figure 117: Latin America Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 118: Latin America Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Vehicle Type (2016-2032)

- Figure 119: Latin America Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 120: Latin America Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Figure 121: Latin America Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 122: Latin America Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Vehicle Type (2016-2032)

- Figure 123: Latin America Fleet Telematics Market Market Share Comparison by Country (2016-2032)

- Figure 124: Latin America Fleet Telematics Market Market Share Comparison by Type (2016-2032)

- Figure 125: Latin America Fleet Telematics Market Market Share Comparison by Application (2016-2032)

- Figure 126: Latin America Fleet Telematics Market Market Share Comparison by Vehicle Type (2016-2032)

- Figure 127: Middle East & Africa Fleet Telematics Market Revenue (US$ Mn) Market Share by Typein 2022

- Figure 128: Middle East & Africa Fleet Telematics Market Market Attractiveness Analysis by Type, 2016-2032

- Figure 129: Middle East & Africa Fleet Telematics Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 130: Middle East & Africa Fleet Telematics Market Market Attractiveness Analysis by Application, 2016-2032

- Figure 131: Middle East & Africa Fleet Telematics Market Revenue (US$ Mn) Market Share by Vehicle Type in 2022

- Figure 132: Middle East & Africa Fleet Telematics Market Market Attractiveness Analysis by Vehicle Type , 2016-2032

- Figure 133: Middle East & Africa Fleet Telematics Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 134: Middle East & Africa Fleet Telematics Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 135: Middle East & Africa Fleet Telematics Market Market Revenue (US$ Mn) (2016-2032)

- Figure 136: Middle East & Africa Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 137: Middle East & Africa Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Figure 138: Middle East & Africa Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 139: Middle East & Africa Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Vehicle Type (2016-2032)

- Figure 140: Middle East & Africa Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 141: Middle East & Africa Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Figure 142: Middle East & Africa Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 143: Middle East & Africa Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Vehicle Type (2016-2032)

- Figure 144: Middle East & Africa Fleet Telematics Market Market Share Comparison by Country (2016-2032)

- Figure 145: Middle East & Africa Fleet Telematics Market Market Share Comparison by Type (2016-2032)

- Figure 146: Middle East & Africa Fleet Telematics Market Market Share Comparison by Application (2016-2032)

- Figure 147: Middle East & Africa Fleet Telematics Market Market Share Comparison by Vehicle Type (2016-2032)

"

- List of Tables

- "

- Table 1: Global Fleet Telematics Market Market Comparison by Type (2016-2032)

- Table 2: Global Fleet Telematics Market Market Comparison by Application (2016-2032)

- Table 3: Global Fleet Telematics Market Market Comparison by Vehicle Type (2016-2032)

- Table 4: Global Fleet Telematics Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 5: Global Fleet Telematics Market Market Revenue (US$ Mn) (2016-2032)

- Table 6: Global Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 7: Global Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Table 8: Global Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 9: Global Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Vehicle Type (2016-2032)

- Table 10: Global Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 11: Global Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Table 12: Global Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 13: Global Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Vehicle Type (2016-2032)

- Table 14: Global Fleet Telematics Market Market Share Comparison by Region (2016-2032)

- Table 15: Global Fleet Telematics Market Market Share Comparison by Type (2016-2032)

- Table 16: Global Fleet Telematics Market Market Share Comparison by Application (2016-2032)

- Table 17: Global Fleet Telematics Market Market Share Comparison by Vehicle Type (2016-2032)

- Table 18: North America Fleet Telematics Market Market Comparison by Application (2016-2032)

- Table 19: North America Fleet Telematics Market Market Comparison by Vehicle Type (2016-2032)

- Table 20: North America Fleet Telematics Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 21: North America Fleet Telematics Market Market Revenue (US$ Mn) (2016-2032)

- Table 22: North America Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 23: North America Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Table 24: North America Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 25: North America Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Vehicle Type (2016-2032)

- Table 26: North America Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 27: North America Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Table 28: North America Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 29: North America Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Vehicle Type (2016-2032)

- Table 30: North America Fleet Telematics Market Market Share Comparison by Country (2016-2032)

- Table 31: North America Fleet Telematics Market Market Share Comparison by Type (2016-2032)

- Table 32: North America Fleet Telematics Market Market Share Comparison by Application (2016-2032)

- Table 33: North America Fleet Telematics Market Market Share Comparison by Vehicle Type (2016-2032)

- Table 34: Western Europe Fleet Telematics Market Market Comparison by Type (2016-2032)

- Table 35: Western Europe Fleet Telematics Market Market Comparison by Application (2016-2032)

- Table 36: Western Europe Fleet Telematics Market Market Comparison by Vehicle Type (2016-2032)

- Table 37: Western Europe Fleet Telematics Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 38: Western Europe Fleet Telematics Market Market Revenue (US$ Mn) (2016-2032)

- Table 39: Western Europe Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 40: Western Europe Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Table 41: Western Europe Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 42: Western Europe Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Vehicle Type (2016-2032)

- Table 43: Western Europe Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 44: Western Europe Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Table 45: Western Europe Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 46: Western Europe Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Vehicle Type (2016-2032)

- Table 47: Western Europe Fleet Telematics Market Market Share Comparison by Country (2016-2032)

- Table 48: Western Europe Fleet Telematics Market Market Share Comparison by Type (2016-2032)

- Table 49: Western Europe Fleet Telematics Market Market Share Comparison by Application (2016-2032)

- Table 50: Western Europe Fleet Telematics Market Market Share Comparison by Vehicle Type (2016-2032)

- Table 51: Eastern Europe Fleet Telematics Market Market Comparison by Type (2016-2032)

- Table 52: Eastern Europe Fleet Telematics Market Market Comparison by Application (2016-2032)

- Table 53: Eastern Europe Fleet Telematics Market Market Comparison by Vehicle Type (2016-2032)

- Table 54: Eastern Europe Fleet Telematics Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: Eastern Europe Fleet Telematics Market Market Revenue (US$ Mn) (2016-2032)

- Table 56: Eastern Europe Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: Eastern Europe Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Table 58: Eastern Europe Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 59: Eastern Europe Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Vehicle Type (2016-2032)

- Table 60: Eastern Europe Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 61: Eastern Europe Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Table 62: Eastern Europe Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 63: Eastern Europe Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Vehicle Type (2016-2032)

- Table 64: Eastern Europe Fleet Telematics Market Market Share Comparison by Country (2016-2032)

- Table 65: Eastern Europe Fleet Telematics Market Market Share Comparison by Type (2016-2032)

- Table 66: Eastern Europe Fleet Telematics Market Market Share Comparison by Application (2016-2032)

- Table 67: Eastern Europe Fleet Telematics Market Market Share Comparison by Vehicle Type (2016-2032)

- Table 68: APAC Fleet Telematics Market Market Comparison by Type (2016-2032)

- Table 69: APAC Fleet Telematics Market Market Comparison by Application (2016-2032)

- Table 70: APAC Fleet Telematics Market Market Comparison by Vehicle Type (2016-2032)

- Table 71: APAC Fleet Telematics Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 72: APAC Fleet Telematics Market Market Revenue (US$ Mn) (2016-2032)

- Table 73: APAC Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 74: APAC Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Table 75: APAC Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 76: APAC Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Vehicle Type (2016-2032)

- Table 77: APAC Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 78: APAC Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Table 79: APAC Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 80: APAC Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Vehicle Type (2016-2032)

- Table 81: APAC Fleet Telematics Market Market Share Comparison by Country (2016-2032)

- Table 82: APAC Fleet Telematics Market Market Share Comparison by Type (2016-2032)

- Table 83: APAC Fleet Telematics Market Market Share Comparison by Application (2016-2032)

- Table 84: APAC Fleet Telematics Market Market Share Comparison by Vehicle Type (2016-2032)

- Table 85: Latin America Fleet Telematics Market Market Comparison by Type (2016-2032)

- Table 86: Latin America Fleet Telematics Market Market Comparison by Application (2016-2032)

- Table 87: Latin America Fleet Telematics Market Market Comparison by Vehicle Type (2016-2032)

- Table 88: Latin America Fleet Telematics Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 89: Latin America Fleet Telematics Market Market Revenue (US$ Mn) (2016-2032)

- Table 90: Latin America Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 91: Latin America Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Table 92: Latin America Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 93: Latin America Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Vehicle Type (2016-2032)

- Table 94: Latin America Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 95: Latin America Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Table 96: Latin America Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 97: Latin America Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Vehicle Type (2016-2032)

- Table 98: Latin America Fleet Telematics Market Market Share Comparison by Country (2016-2032)

- Table 99: Latin America Fleet Telematics Market Market Share Comparison by Type (2016-2032)

- Table 100: Latin America Fleet Telematics Market Market Share Comparison by Application (2016-2032)

- Table 101: Latin America Fleet Telematics Market Market Share Comparison by Vehicle Type (2016-2032)

- Table 102: Middle East & Africa Fleet Telematics Market Market Comparison by Type (2016-2032)

- Table 103: Middle East & Africa Fleet Telematics Market Market Comparison by Application (2016-2032)

- Table 104: Middle East & Africa Fleet Telematics Market Market Comparison by Vehicle Type (2016-2032)

- Table 105: Middle East & Africa Fleet Telematics Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 106: Middle East & Africa Fleet Telematics Market Market Revenue (US$ Mn) (2016-2032)

- Table 107: Middle East & Africa Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 108: Middle East & Africa Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Table 109: Middle East & Africa Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 110: Middle East & Africa Fleet Telematics Market Market Revenue (US$ Mn) Comparison by Vehicle Type (2016-2032)

- Table 111: Middle East & Africa Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 112: Middle East & Africa Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Table 113: Middle East & Africa Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 114: Middle East & Africa Fleet Telematics Market Market Y-o-Y Growth Rate Comparison by Vehicle Type (2016-2032)

- Table 115: Middle East & Africa Fleet Telematics Market Market Share Comparison by Country (2016-2032)

- Table 116: Middle East & Africa Fleet Telematics Market Market Share Comparison by Type (2016-2032)

- Table 117: Middle East & Africa Fleet Telematics Market Market Share Comparison by Application (2016-2032)

- Table 118: Middle East & Africa Fleet Telematics Market Market Share Comparison by Vehicle Type (2016-2032)

- 1. Executive Summary

-

- Actsoft

- Ctrack an Inseego company

- Daimler Fleetboard GmbH

- Deere & Company

- Fleetmatics Group PLC

- HARMAN International

- KORE Wireless

- Masternaut Limited

- MiX Telematics

- Sprint Corporation

- TomTom International BV

- Trimble Inc.

- Verizon