Fertility Services Market By Procedure(IVF with ICSI, IUI, Others), By Donar(Fresh Non-donor, Frozen Non-donor), By End-User(Fertility Clinics, Hospitals), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

25235

-

Jul 2023

-

182

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

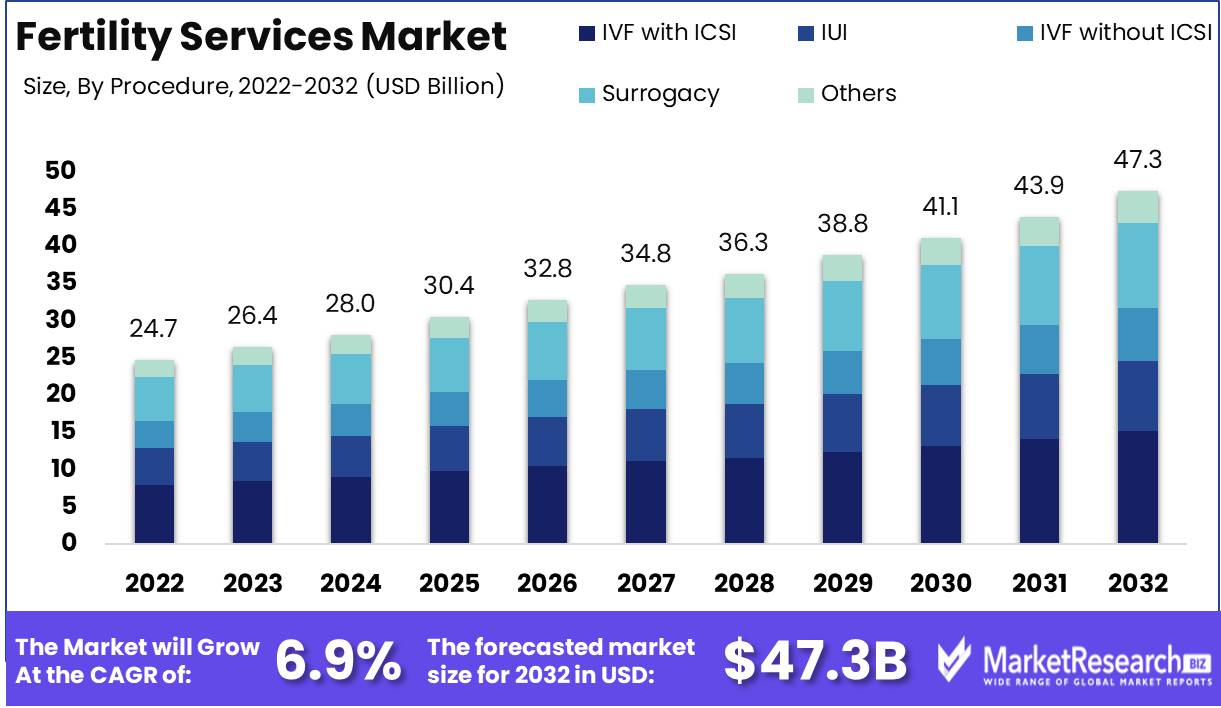

Fertility Services Market size is expected to be worth around USD 47.3 Bn by 2032 from USD 24.7 Bn in 2022, growing at a CAGR of 6.9% during the forecast period from 2023 to 2032.

The fertility services market refers to the variety of services and treatments available to individuals and couples who are having trouble conceiving or carrying a pregnancy to term. These services include a range of medical, surgical, and assisted reproductive technologies designed to assist individuals in overcoming infertility and achieving their desire to establish a family. The objectives of fertility services include the diagnosis of the causes of infertility, the provision of appropriate treatments, and the achievement of healthy pregnancies.

It is impossible to overstate the significance of the fertility services market, as it addresses a fundamental human desire to reproduce and have offspring. Numerous factors, including age, lifestyle, and medical conditions, contribute to the difficulty of conceiving, which impacts a sizable portion of the population and affects fertility. Individuals and couples facing these obstacles can pursue their desires of starting a family thanks to the availability of fertility services, which gives them hope and support.

The creation of assisted reproductive technologies such as in vitro fertilization (IVF) and intracytoplasmic sperm injection (ICSI) is one of the most significant developments in the fertility services market. These techniques have revolutionized reproductive medicine, making it possible to conceive a child outside the body and increasing the likelihood of a healthy pregnancy. Other advancements include preimplantation genetic testing, embryo cryopreservation, and egg freezing, which provide couples and individuals pursuing fertility treatments with additional options.

Additionally, the fertility services market has attracted significant investment and incorporated numerous products and services. Pharmaceutical companies, medical device manufacturers, and biotechnology companies are investing heavily in research and development to enhance and introduce new fertility treatment options. This investment has led to the availability of a vast array of fertility drugs, diagnostic instruments, and medical devices that aid in the diagnosis and treatment of infertility.

Driving factors

Assisted reproductive technology (ART) expansion

In the field of fertility treatments, Assisted Reproductive Technology (ART) has become a breakthrough. It incorporates various procedures and techniques that assist individuals or couples with infertility issues in achieving pregnancy. In vitro fertilization (IVF), intracytoplasmic sperm injection (ICSI), and surrogacy are examples of ART treatments. These cutting-edge techniques have revolutionized the fertility services market by providing a glimmer of hope to those who are unable to conceive naturally.

Innovations in Fertility Treatments and Methods

Significant advancements in treatments and techniques have been made in the field of fertility services, providing more effective and individualized solutions to individuals in need. Fertility specialists are now able to diagnose and treat the specific causes of infertility, resulting in higher success rates. In addition, advancements in genetic testing and screening have improved the ability to identify potential disorders and abnormalities in embryos, allowing for the selection of healthier embryos for IVF procedures.

Increasing Public Understanding and Acceptance of Fertility Services

The awareness and acceptance of fertility services have increased dramatically over time. As the stigma associated with infertility and reproductive disorders has diminished, more individuals and couples are seeking professional help. This change in perception has increased public awareness of infertility, available treatment options, and the significance of pursuing timely interventions. Consequently, the demand for fertility services has skyrocketed, propelling the growth of the fertility services market.

Increasing Interest in Fertility Preservation

Fertility preservation has become an integral component of the fertility services market, which caters to individuals who desire to preserve their reproductive potential for future family planning. The rising demand for fertility preservation techniques has been fueled by factors such as delayed childbearing due to career priorities, medical conditions, and personal circumstances. These techniques, which include oocyte cryopreservation (egg freezing) and sperm cryopreservation (sperm freezing), enable individuals to retain viable reproductive cells for future use, even if their fertility is compromised in the future.

Restraining Factors

Legal and Ethical Considerations

In addition to the financial burden, the fertility services market may also be affected by potential ethical and legal considerations. Assisted reproduction techniques, such as sperm or egg donation, surrogacy, and preimplantation genetic screening, can pose intricate ethical concerns. These procedures may challenge traditional notions of family and kinship as they involve third parties. Furthermore, legal frameworks governing fertility treatments can vary from country to country and even state to state. For individuals pursuing fertility services, navigating these complexities can be overwhelming, further complicating the process.

Potential Compliance and Regulatory Requirements

Potential regulatory and compliance requirements are another factor limiting the growth of the fertility services market. Fertility clinics and the healthcare professionals who provide these services are subject to numerous regulations and standards to ensure patient safety and ethical conduct. Compliance with these requirements is essential for delivering high-quality care and preserving a trustworthy reputation. However, meeting these standards can be a resource-intensive endeavor for fertility clinics, potentially resulting in increased costs and restricted access to services. In addition, stricter regulations may further restrict the availability and adaptability of certain fertility treatments, thereby limiting the reproductive options of potential individuals.

Procedure Analysis

The procedure for IVF with ICSI has emerged as the dominant factor in the fertility services market. The combination of in vitro fertilization (IVF) and intracytoplasmic sperm injection (ICSI) has revolutionized assisted reproductive technology in this segment. In vitro fertilization (IVF) with intracytoplasmic sperm injection (ICSI) entails the extraction of eggs from the ovaries and the injection of a single sperm directly into each egg to increase the likelihood of fertilization. Due to its high success rate and ability to treat male factor infertility, this procedure has acquired tremendous popularity.

The emergence of IVF with ICSI has been substantially influenced by the economic development of emerging economies. As these economies develop, the demand for sophisticated healthcare services, such as fertility treatments, increases. Increasing disposable income and awareness of infertility treatments have resulted in an increase in the number of couples pursuing IVF with ICSI as a treatment.

Consumer trends and behavior concerning IVF with ICSI have also played a significant role in its dominance in the fertility services market. Today's society is increasingly accepting and receptive of assisted reproductive technologies. Couples are increasingly prepared to investigate and invest in fertility treatments.

Donar Analysis

The utilization of fresh non-donor eggs has dominated the fertility services market. Fresh non-donor eggs are eggs extracted from a woman's own ovaries for use in fertility treatments. Because fresh eggs have a greater possibility of fertilization and implantation than frozen eggs, this method has gained popularity due to its higher success rates.

Similar to IVF with ICSI, the adoption of fresh non-donor eggs has been spurred by economic development in emerging economies. As these economies expand, healthcare expenditures rise, resulting in a greater demand for fertility treatments. Couples in these regions are opting for fresh, non-donor eggs because they are more accessible and less expensive than donor eggs.

Consumer trends and attitudes toward fresh, non-donor eggs have also contributed to this product's dominance in the fertility services market. Using one's own ova to conceive is preferred because it provides a biological link between the parents and the child. The desire for genetic connection has increased the demand for fresh, non-donor eggs.

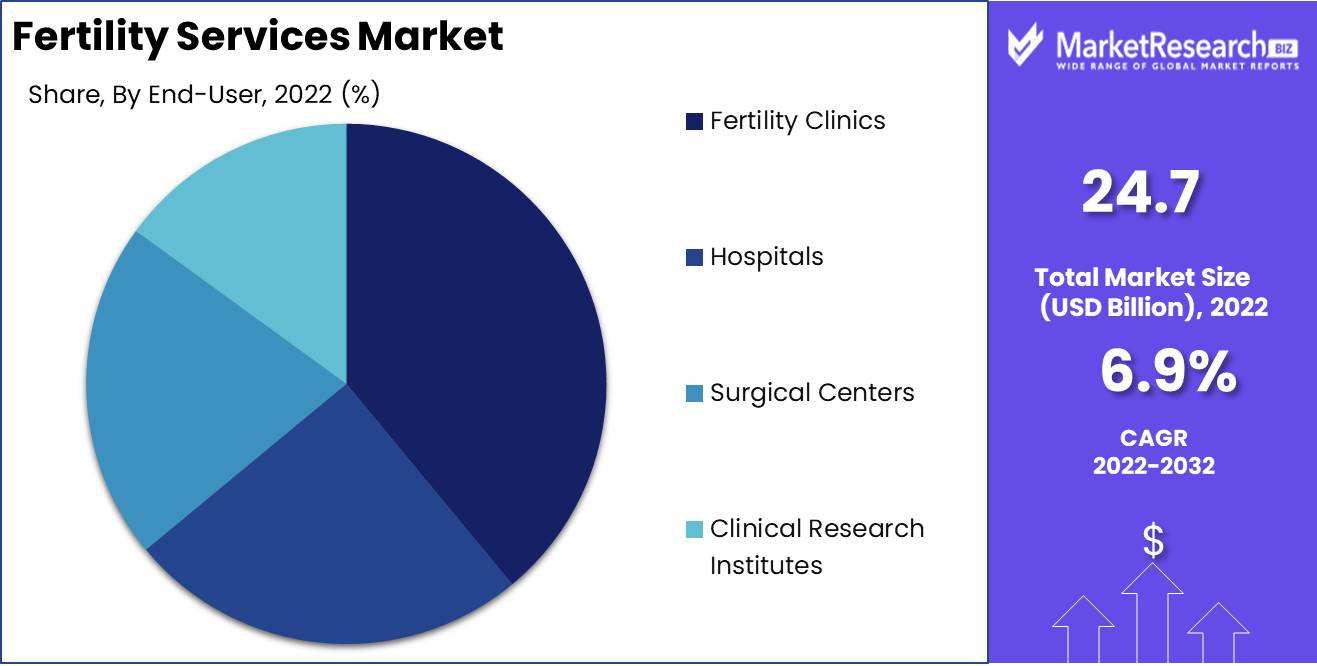

End-User Analysis

The dominant segment of the fertility services market is fertility clinics. These clinics offer a variety of assisted reproductive technology services, such as IVF, ICSI, egg storage, and fertility preservation. Fertility clinics provide comprehensive care and individualized treatment programs, making them the top choice for couples seeking fertility services.

The emergence of fertility clinics has been significantly influenced by the growth of emergent economies. As these economies expand, the demand for specialized healthcare services, such as fertility treatments, increases. Fertility clinics offer cutting-edge treatments and technologies, drawing clients from both domestic and international markets.

Additionally, consumer trends and behavior toward fertility clinics have contributed to their market dominance. When it comes to their fertility voyage, a growing number of couples opt for professional guidance and expertise. Fertility clinics provide couples with the necessary resources and guidance throughout the process in a nurturing environment.

Key Market Segments

By Procedure

- IVF with ICSI

- IUI

- IVF without ICSI

- Surrogacy

- Others

By Donar

- Fresh Non-donor

- Frozen Non-donor

- Egg & Embryo Banking

- Fresh Donor

- Frozen Donor

By End-User

- Fertility Clinics

- Hospitals

- Surgical Centers

- Clinical Research Institutes

Growth Opportunity

Innovations in Technology to Improve Assisted Reproduction Techniques

The evolution of reproductive technologies has revolutionized the market for fertility services. Couples struggling with infertility have greater chances of becoming pregnant as a result of constant innovation. The effectiveness and success rates of in vitro fertilization (IVF) techniques and procedures have increased. As the demand for assisted reproductive technologies increases, fertility service providers must invest in the adoption and incorporation of these cutting-edge techniques into their practices.

Preimplantation genetic diagnosis (PGD) and preimplantation genetic screening (PGS) have become indispensable tools for assuring the selection of healthy embryos for implantation thanks to the development of cutting-edge genetic testing and screening techniques.

Diversification and Development of Specialized Fertility Services

While comprehensive fertility services comprise a vast array of treatments and procedures, niche specialization is possible. By specializing in specific areas such as fertility preservation, LGBTQ+ fertility services, and reproductive endocrinology, fertility clinics can meet the specialized requirements of patients and establish themselves as leaders in their respective fields. The demand for customized services is on the rise, and patients are frequently willing to travel to seek out the expertise of clinics specializing in their specific fertility issues.

Moreover, expanding into niche markets can stimulate development by targeting specific demographic groups. For example, there is an increasing trend of individuals delaying parenthood, which has led to an increase in demand for fertility services among senior age groups.

Utilizing Telemedicine and Digital Platforms for Comprehensive Patient Care

Utilizing telemedicine and digital platforms can provide holistic support to patients throughout their fertility journey in an increasingly digital world. Telemedicine can provide remote consultations, monitoring, and counseling, reducing the need for in-person visits and increasing the accessibility of fertility services. This is especially advantageous for patients in rural or underserved areas who may not have simple access to fertility clinics.

Digital platforms can be used to provide exhaustive educational materials, online support groups, and personalized fertility trackers. By providing a wealth of information and fostering a supportive community, fertility clinics can increase their patients' chances of success by ensuring they remain engaged and informed.

Latest Trends

Development of In Vitro Fertilization (IVF) Techniques

In recent years, IVF procedures have skyrocketed in popularity, allowing countless couples and individuals to realize their desire of becoming parents. IVF is now a safe and effective method for overcoming infertility, thanks to advances in reproductive technologies. This trend is influenced by several factors, including changing lifestyles, delayed childbearing, increased awareness, and a growing acceptance of assisted reproductive technologies. With our expertise in fertility services, we ensure that you receive first-rate care and have access to cutting-edge IVF procedures that are tailored to your individual requirements.

Egg and sperm donation services are in high demand.

In recent years, the demand for egg and sperm donation services has increased dramatically. This can be attributed to a number of factors, including rising infertility rates, genetic disorders, social acceptability, and a broader acceptance of nontraditional family structures. Our fertility clinic takes a comprehensive and ethical approach to egg and sperm donation, ensuring the highest standards of donor screening, which leads to successful outcomes and the realization of your parental goals.

Preimplantation genetic testing (PGT) utilization

Preimplantation Genetic Testing (PGT) has revolutionized reproductive medicine by allowing prospective parents to screen embryos before implantation for genetic abnormalities. PGT provides significant insight into the chromosomal or genetic composition of an embryo, thereby decreasing the risk of genetic disorders and increasing the likelihood of a successful pregnancy. Our fertility clinic employs cutting-edge PGT techniques, ensuring the highest level of precision and enhancing your reproductive voyage as a whole.

Increase in Fertility Tourism and International Reproductive Care

Fertility tourism and cross-border reproductive care have acquired significant traction, with individuals and couples increasingly seeking fertility treatments abroad. This trend is influenced by cost-effectiveness, accessibility to cutting-edge technologies, privacy concerns, and legal factors. Combining world-class medical facilities, seasoned healthcare professionals, and a patient-centered approach, our fertility center is a destination of choice for international patients seeking top-tier fertility services.

Regional Analysis

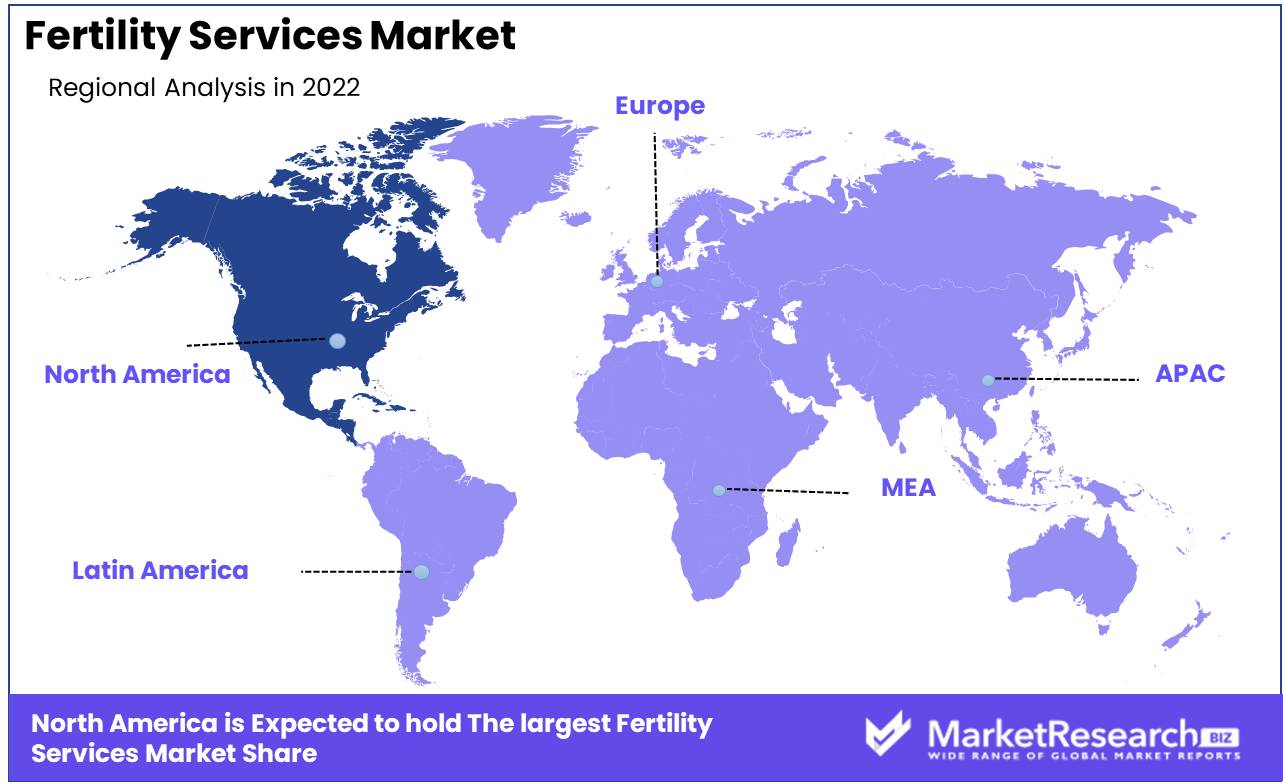

The Fertility Services Market is dominated by the North America region.

In the realm of fertility services, North America has emerged as a dominant force, consistently driving the market toward unprecedented development and progress. North America has become a hub for individuals seeking fertility treatments and solutions due to its sophisticated healthcare infrastructure, cutting-edge technological advancements, and unwavering commitment to quality.

A number of important factors contribute to North America's dominance in the fertility services market region. Firstly, the region is home to an extensive network of fertility clinics and centers that provide a variety of services to meet the diverse requirements of patients. These facilities are outfitted with state-of-the-art equipment and staffed with highly qualified reproductive medicine specialists.

In addition, North America takes great pride in its technological leadership in the field of fertility services. From advanced genetic testing to cutting-edge assisted reproductive technologies such as in vitro fertilization (IVF) and intrauterine insemination (IUI), the region consistently pushes the limits of what is possible in the realm of assisted reproduction. This dedication to innovation has propelled North America into the limelight, attracting patients from all over the world who are seeking the highest standards of care.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Japanese multinational corporation Olympus Corporation has emerged as a major player in the fertility services market. Olympus, renowned for its cutting-edge imaging technologies, offers innovative imaging and documentation solutions in the field of assisted reproductive technologies (ART). Olympus offers high-resolution cameras, microscopes, and imaging systems that increase the success rates of fertility treatments by leveraging their expertise in medical devices.

Cooper Companies Inc., based in the United States, has emerged as a major player in the fertility services market. Cooper Companies excels at providing comprehensive solutions throughout the fertility journey, with a concentration on women's health. Their assortment of fertility products includes sophisticated fertility monitors, ovulation instruments, and specialized diagnostic equipment. Cooper Companies recognizes the significance of personalized care in the field of fertility. By providing customized solutions for infertility diagnosis, ovulation monitoring, and fertility preservation, they empower individuals and couples to make informed decisions about their reproductive health.

Instituto Bernabeu, a renowned fertility clinic based in Spain, has gained global recognition for its innovative research and patient-centered approach. With a team of highly trained fertility specialists, Instituto Bernabeu provides a comprehensive range of assisted reproduction techniques and innovative, individualized treatments. One of the most distinguishing characteristics of Instituto Bernabeu is its holistic approach to reproductive medicine. Recognizing the complexity of infertility, the clinic views fertility treatment as an integrated, multidisciplinary procedure.

Australia-based Virtus Health is a major player in the fertility services market, specializing in assisted reproductive technology. Virtus Health, a network of top fertility clinics, aims to make fertility solutions more accessible to a broader audience. Virtus Health has established itself as a pioneer in the field of fertility treatments through strategic partnerships, innovative research, and state-of-the-art facilities. Virtus Health prioritizes individualized care, recognizing that each patient's fertility journey is distinct. Utilizing advanced reproductive technologies such as in vitro fertilization (IVF), intracytoplasmic sperm injection (ICSI), and preimplantation genetic screening (PGS), they employ individualized treatment plans.

Top Key Players in Fertility Services Market

- Olympus Corporation (Japan)

- The Cooper Companies Inc. (U.S.)

- Instituto Bernabeu (Spain)

- Virtus Health (Australia)

- CooperSurgical Inc. (U.S.)

- Vitrolife (Sweden)

- CARE Fertility (U.K.)

- INVO Bioscience (U.S.)

- Monash IVF (Australia)

- Fertility Focus Limited (U.S.)

- Carolinas Fertility Institute (U.S.)

- Apollo Hospitals Enterprise Ltd. (India)

- Merck KGaA (Germany)

- LABOTECT GMBH (Germany)

- Medicover (Sweden)

Recent Development

- In 2023, IVFMD a renowned provider of fertility services, announced its intention to introduce a revolutionary platform that will revolutionize the accessibility and affordability of fertility treatments. This strategic move will disrupt the fertility services market, giving hope to countless individuals and couples who desire to establish or grow their families.

- In 2022, Crio plans to introduce new products and services in order to meet the evolving requirements of its patients. This expansion will provide a broader selection of options, empowering individuals and couples on their fertility journey even more.

- In 2021, Already a forerunner in fertility services, Progyny unveiled an innovative initiative. Progyny announced its intention to launch a brand-new fertility services brand in response to the ongoing demand for more convenient fertility treatments. This innovation seeks to address the ongoing demand for accessible care by offering patients greater convenience and peace of mind throughout the fertility process.

Report Scope

Report Features Description Market Value (2022) USD 24.7 Bn Forecast Revenue (2032) USD 47.3 Bn CAGR (2023-2032) 6.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Procedure(IVF with ICSI, IUI, Others), By Donar(Fresh Non-donor, Frozen Non-donor), By End-User(Fertility Clinics, Hospitals) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Olympus Corporation (Japan), The Cooper Companies Inc. (U.S.), Instituto Bernabeu (Spain), Virtus Health (Australia), CooperSurgical Inc. (U.S.), Vitrolife (Sweden), CARE Fertility (U.K.), INVO Bioscience (U.S.), Monash IVF (Australia), Fertility Focus Limited (U.S.), Carolinas Fertility Institute (U.S.), Apollo Hospitals Enterprise Ltd. (India), Merck KGaA (Germany), LABOTECT GMBH (Germany), Medicover (Sweden) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Fertility Services Market Overview

- 2.1. Fertility Services Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Fertility Services Market Dynamics

- 3. Global Fertility Services Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Fertility Services Market Analysis, 2016-2021

- 3.2. Global Fertility Services Market Opportunity and Forecast, 2023-2032

- 3.3. Global Fertility Services Market Analysis, Opportunity and Forecast, By By Procedure, 2016-2032

- 3.3.1. Global Fertility Services Market Analysis by By Procedure: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Procedure, 2016-2032

- 3.3.3. IVF with ICSI

- 3.3.4. IUI

- 3.3.5. IVF without ICSI

- 3.3.6. Surrogacy

- 3.3.7. Others

- 3.4. Global Fertility Services Market Analysis, Opportunity and Forecast, By By Donar, 2016-2032

- 3.4.1. Global Fertility Services Market Analysis by By Donar: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Donar, 2016-2032

- 3.4.3. Fresh Non-donor

- 3.4.4. Frozen Non-donor

- 3.4.5. Egg & Embryo Banking

- 3.4.6. Fresh Donor

- 3.4.7. Frozen Donor

- 3.5. Global Fertility Services Market Analysis, Opportunity and Forecast, By By End-User, 2016-2032

- 3.5.1. Global Fertility Services Market Analysis by By End-User: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User, 2016-2032

- 3.5.3. Fertility Clinics

- 3.5.4. Hospitals

- 3.5.5. Surgical Centers

- 3.5.6. Clinical Research Institutes

- 4. North America Fertility Services Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Fertility Services Market Analysis, 2016-2021

- 4.2. North America Fertility Services Market Opportunity and Forecast, 2023-2032

- 4.3. North America Fertility Services Market Analysis, Opportunity and Forecast, By By Procedure, 2016-2032

- 4.3.1. North America Fertility Services Market Analysis by By Procedure: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Procedure, 2016-2032

- 4.3.3. IVF with ICSI

- 4.3.4. IUI

- 4.3.5. IVF without ICSI

- 4.3.6. Surrogacy

- 4.3.7. Others

- 4.4. North America Fertility Services Market Analysis, Opportunity and Forecast, By By Donar, 2016-2032

- 4.4.1. North America Fertility Services Market Analysis by By Donar: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Donar, 2016-2032

- 4.4.3. Fresh Non-donor

- 4.4.4. Frozen Non-donor

- 4.4.5. Egg & Embryo Banking

- 4.4.6. Fresh Donor

- 4.4.7. Frozen Donor

- 4.5. North America Fertility Services Market Analysis, Opportunity and Forecast, By By End-User, 2016-2032

- 4.5.1. North America Fertility Services Market Analysis by By End-User: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User, 2016-2032

- 4.5.3. Fertility Clinics

- 4.5.4. Hospitals

- 4.5.5. Surgical Centers

- 4.5.6. Clinical Research Institutes

- 4.6. North America Fertility Services Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.6.1. North America Fertility Services Market Analysis by Country : Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.6.2.1. The US

- 4.6.2.2. Canada

- 4.6.2.3. Mexico

- 5. Western Europe Fertility Services Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Fertility Services Market Analysis, 2016-2021

- 5.2. Western Europe Fertility Services Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Fertility Services Market Analysis, Opportunity and Forecast, By By Procedure, 2016-2032

- 5.3.1. Western Europe Fertility Services Market Analysis by By Procedure: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Procedure, 2016-2032

- 5.3.3. IVF with ICSI

- 5.3.4. IUI

- 5.3.5. IVF without ICSI

- 5.3.6. Surrogacy

- 5.3.7. Others

- 5.4. Western Europe Fertility Services Market Analysis, Opportunity and Forecast, By By Donar, 2016-2032

- 5.4.1. Western Europe Fertility Services Market Analysis by By Donar: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Donar, 2016-2032

- 5.4.3. Fresh Non-donor

- 5.4.4. Frozen Non-donor

- 5.4.5. Egg & Embryo Banking

- 5.4.6. Fresh Donor

- 5.4.7. Frozen Donor

- 5.5. Western Europe Fertility Services Market Analysis, Opportunity and Forecast, By By End-User, 2016-2032

- 5.5.1. Western Europe Fertility Services Market Analysis by By End-User: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User, 2016-2032

- 5.5.3. Fertility Clinics

- 5.5.4. Hospitals

- 5.5.5. Surgical Centers

- 5.5.6. Clinical Research Institutes

- 5.6. Western Europe Fertility Services Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.6.1. Western Europe Fertility Services Market Analysis by Country : Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.6.2.1. Germany

- 5.6.2.2. France

- 5.6.2.3. The UK

- 5.6.2.4. Spain

- 5.6.2.5. Italy

- 5.6.2.6. Portugal

- 5.6.2.7. Ireland

- 5.6.2.8. Austria

- 5.6.2.9. Switzerland

- 5.6.2.10. Benelux

- 5.6.2.11. Nordic

- 5.6.2.12. Rest of Western Europe

- 6. Eastern Europe Fertility Services Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Fertility Services Market Analysis, 2016-2021

- 6.2. Eastern Europe Fertility Services Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Fertility Services Market Analysis, Opportunity and Forecast, By By Procedure, 2016-2032

- 6.3.1. Eastern Europe Fertility Services Market Analysis by By Procedure: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Procedure, 2016-2032

- 6.3.3. IVF with ICSI

- 6.3.4. IUI

- 6.3.5. IVF without ICSI

- 6.3.6. Surrogacy

- 6.3.7. Others

- 6.4. Eastern Europe Fertility Services Market Analysis, Opportunity and Forecast, By By Donar, 2016-2032

- 6.4.1. Eastern Europe Fertility Services Market Analysis by By Donar: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Donar, 2016-2032

- 6.4.3. Fresh Non-donor

- 6.4.4. Frozen Non-donor

- 6.4.5. Egg & Embryo Banking

- 6.4.6. Fresh Donor

- 6.4.7. Frozen Donor

- 6.5. Eastern Europe Fertility Services Market Analysis, Opportunity and Forecast, By By End-User, 2016-2032

- 6.5.1. Eastern Europe Fertility Services Market Analysis by By End-User: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User, 2016-2032

- 6.5.3. Fertility Clinics

- 6.5.4. Hospitals

- 6.5.5. Surgical Centers

- 6.5.6. Clinical Research Institutes

- 6.6. Eastern Europe Fertility Services Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.6.1. Eastern Europe Fertility Services Market Analysis by Country : Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.6.2.1. Russia

- 6.6.2.2. Poland

- 6.6.2.3. The Czech Republic

- 6.6.2.4. Greece

- 6.6.2.5. Rest of Eastern Europe

- 7. APAC Fertility Services Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Fertility Services Market Analysis, 2016-2021

- 7.2. APAC Fertility Services Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Fertility Services Market Analysis, Opportunity and Forecast, By By Procedure, 2016-2032

- 7.3.1. APAC Fertility Services Market Analysis by By Procedure: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Procedure, 2016-2032

- 7.3.3. IVF with ICSI

- 7.3.4. IUI

- 7.3.5. IVF without ICSI

- 7.3.6. Surrogacy

- 7.3.7. Others

- 7.4. APAC Fertility Services Market Analysis, Opportunity and Forecast, By By Donar, 2016-2032

- 7.4.1. APAC Fertility Services Market Analysis by By Donar: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Donar, 2016-2032

- 7.4.3. Fresh Non-donor

- 7.4.4. Frozen Non-donor

- 7.4.5. Egg & Embryo Banking

- 7.4.6. Fresh Donor

- 7.4.7. Frozen Donor

- 7.5. APAC Fertility Services Market Analysis, Opportunity and Forecast, By By End-User, 2016-2032

- 7.5.1. APAC Fertility Services Market Analysis by By End-User: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User, 2016-2032

- 7.5.3. Fertility Clinics

- 7.5.4. Hospitals

- 7.5.5. Surgical Centers

- 7.5.6. Clinical Research Institutes

- 7.6. APAC Fertility Services Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.6.1. APAC Fertility Services Market Analysis by Country : Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.6.2.1. China

- 7.6.2.2. Japan

- 7.6.2.3. South Korea

- 7.6.2.4. India

- 7.6.2.5. Australia & New Zeland

- 7.6.2.6. Indonesia

- 7.6.2.7. Malaysia

- 7.6.2.8. Philippines

- 7.6.2.9. Singapore

- 7.6.2.10. Thailand

- 7.6.2.11. Vietnam

- 7.6.2.12. Rest of APAC

- 8. Latin America Fertility Services Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Fertility Services Market Analysis, 2016-2021

- 8.2. Latin America Fertility Services Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Fertility Services Market Analysis, Opportunity and Forecast, By By Procedure, 2016-2032

- 8.3.1. Latin America Fertility Services Market Analysis by By Procedure: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Procedure, 2016-2032

- 8.3.3. IVF with ICSI

- 8.3.4. IUI

- 8.3.5. IVF without ICSI

- 8.3.6. Surrogacy

- 8.3.7. Others

- 8.4. Latin America Fertility Services Market Analysis, Opportunity and Forecast, By By Donar, 2016-2032

- 8.4.1. Latin America Fertility Services Market Analysis by By Donar: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Donar, 2016-2032

- 8.4.3. Fresh Non-donor

- 8.4.4. Frozen Non-donor

- 8.4.5. Egg & Embryo Banking

- 8.4.6. Fresh Donor

- 8.4.7. Frozen Donor

- 8.5. Latin America Fertility Services Market Analysis, Opportunity and Forecast, By By End-User, 2016-2032

- 8.5.1. Latin America Fertility Services Market Analysis by By End-User: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User, 2016-2032

- 8.5.3. Fertility Clinics

- 8.5.4. Hospitals

- 8.5.5. Surgical Centers

- 8.5.6. Clinical Research Institutes

- 8.6. Latin America Fertility Services Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.6.1. Latin America Fertility Services Market Analysis by Country : Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.6.2.1. Brazil

- 8.6.2.2. Colombia

- 8.6.2.3. Chile

- 8.6.2.4. Argentina

- 8.6.2.5. Costa Rica

- 8.6.2.6. Rest of Latin America

- 9. Middle East & Africa Fertility Services Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Fertility Services Market Analysis, 2016-2021

- 9.2. Middle East & Africa Fertility Services Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Fertility Services Market Analysis, Opportunity and Forecast, By By Procedure, 2016-2032

- 9.3.1. Middle East & Africa Fertility Services Market Analysis by By Procedure: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Procedure, 2016-2032

- 9.3.3. IVF with ICSI

- 9.3.4. IUI

- 9.3.5. IVF without ICSI

- 9.3.6. Surrogacy

- 9.3.7. Others

- 9.4. Middle East & Africa Fertility Services Market Analysis, Opportunity and Forecast, By By Donar, 2016-2032

- 9.4.1. Middle East & Africa Fertility Services Market Analysis by By Donar: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Donar, 2016-2032

- 9.4.3. Fresh Non-donor

- 9.4.4. Frozen Non-donor

- 9.4.5. Egg & Embryo Banking

- 9.4.6. Fresh Donor

- 9.4.7. Frozen Donor

- 9.5. Middle East & Africa Fertility Services Market Analysis, Opportunity and Forecast, By By End-User, 2016-2032

- 9.5.1. Middle East & Africa Fertility Services Market Analysis by By End-User: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User, 2016-2032

- 9.5.3. Fertility Clinics

- 9.5.4. Hospitals

- 9.5.5. Surgical Centers

- 9.5.6. Clinical Research Institutes

- 9.6. Middle East & Africa Fertility Services Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.6.1. Middle East & Africa Fertility Services Market Analysis by Country : Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.6.2.1. Algeria

- 9.6.2.2. Egypt

- 9.6.2.3. Israel

- 9.6.2.4. Kuwait

- 9.6.2.5. Nigeria

- 9.6.2.6. Saudi Arabia

- 9.6.2.7. South Africa

- 9.6.2.8. Turkey

- 9.6.2.9. The UAE

- 9.6.2.10. Rest of MEA

- 10. Global Fertility Services Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Fertility Services Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Fertility Services Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Olympus Corporation (Japan)

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. The Cooper Companies Inc. (U.S.)

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Instituto Bernabeu (Spain)

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Virtus Health (Australia)

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. CooperSurgical Inc. (U.S.)

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Vitrolife (Sweden)

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. CARE Fertility (U.K.)

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. INVO Bioscience (U.S.)

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Monash IVF (Australia)

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Fertility Focus Limited (U.S.)

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13. Carolinas Fertility Institute (U.S.)

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. Apollo Hospitals Enterprise Ltd. (India)

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. Merck KGaA (Germany)

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 11.16. LABOTECT GMBH (Germany)

- 11.16.1. Company Overview

- 11.16.2. Financial Highlights

- 11.16.3. Product Portfolio

- 11.16.4. SWOT Analysis

- 11.16.5. Key Strategies and Developments

- 11.17. Medicover (Sweden)

- 11.17.1. Company Overview

- 11.17.2. Financial Highlights

- 11.17.3. Product Portfolio

- 11.17.4. SWOT Analysis

- 11.17.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- List of Figures

- Figure 1: Global Fertility Services Market Revenue (US$ Mn) Market Share by By Procedure in 2022

- Figure 2: Global Fertility Services Market Attractiveness Analysis by By Procedure, 2016-2032

- Figure 3: Global Fertility Services Market Revenue (US$ Mn) Market Share by By Donarin 2022

- Figure 4: Global Fertility Services Market Attractiveness Analysis by By Donar, 2016-2032

- Figure 5: Global Fertility Services Market Revenue (US$ Mn) Market Share by By End-Userin 2022

- Figure 6: Global Fertility Services Market Attractiveness Analysis by By End-User, 2016-2032

- Figure 7: Global Fertility Services Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 8: Global Fertility Services Market Attractiveness Analysis by Region, 2016-2032

- Figure 9: Global Fertility Services Market Revenue (US$ Mn) (2016-2032)

- Figure 10: Global Fertility Services Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 11: Global Fertility Services Market Revenue (US$ Mn) Comparison by By Procedure (2016-2032)

- Figure 12: Global Fertility Services Market Revenue (US$ Mn) Comparison by By Donar (2016-2032)

- Figure 13: Global Fertility Services Market Revenue (US$ Mn) Comparison by By End-User (2016-2032)

- Figure 14: Global Fertility Services Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 15: Global Fertility Services Market Y-o-Y Growth Rate Comparison by By Procedure (2016-2032)

- Figure 16: Global Fertility Services Market Y-o-Y Growth Rate Comparison by By Donar (2016-2032)

- Figure 17: Global Fertility Services Market Y-o-Y Growth Rate Comparison by By End-User (2016-2032)

- Figure 18: Global Fertility Services Market Share Comparison by Region (2016-2032)

- Figure 19: Global Fertility Services Market Share Comparison by By Procedure (2016-2032)

- Figure 20: Global Fertility Services Market Share Comparison by By Donar (2016-2032)

- Figure 21: Global Fertility Services Market Share Comparison by By End-User (2016-2032)

- Figure 22: North America Fertility Services Market Revenue (US$ Mn) Market Share by By Procedurein 2022

- Figure 23: North America Fertility Services Market Attractiveness Analysis by By Procedure, 2016-2032

- Figure 24: North America Fertility Services Market Revenue (US$ Mn) Market Share by By Donarin 2022

- Figure 25: North America Fertility Services Market Attractiveness Analysis by By Donar, 2016-2032

- Figure 26: North America Fertility Services Market Revenue (US$ Mn) Market Share by By End-Userin 2022

- Figure 27: North America Fertility Services Market Attractiveness Analysis by By End-User, 2016-2032

- Figure 28: North America Fertility Services Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 29: North America Fertility Services Market Attractiveness Analysis by Country, 2016-2032

- Figure 30: North America Fertility Services Market Revenue (US$ Mn) (2016-2032)

- Figure 31: North America Fertility Services Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 32: North America Fertility Services Market Revenue (US$ Mn) Comparison by By Procedure (2016-2032)

- Figure 33: North America Fertility Services Market Revenue (US$ Mn) Comparison by By Donar (2016-2032)

- Figure 34: North America Fertility Services Market Revenue (US$ Mn) Comparison by By End-User (2016-2032)

- Figure 35: North America Fertility Services Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 36: North America Fertility Services Market Y-o-Y Growth Rate Comparison by By Procedure (2016-2032)

- Figure 37: North America Fertility Services Market Y-o-Y Growth Rate Comparison by By Donar (2016-2032)

- Figure 38: North America Fertility Services Market Y-o-Y Growth Rate Comparison by By End-User (2016-2032)

- Figure 39: North America Fertility Services Market Share Comparison by Country (2016-2032)

- Figure 40: North America Fertility Services Market Share Comparison by By Procedure (2016-2032)

- Figure 41: North America Fertility Services Market Share Comparison by By Donar (2016-2032)

- Figure 42: North America Fertility Services Market Share Comparison by By End-User (2016-2032)

- Figure 43: Western Europe Fertility Services Market Revenue (US$ Mn) Market Share by By Procedurein 2022

- Figure 44: Western Europe Fertility Services Market Attractiveness Analysis by By Procedure, 2016-2032

- Figure 45: Western Europe Fertility Services Market Revenue (US$ Mn) Market Share by By Donarin 2022

- Figure 46: Western Europe Fertility Services Market Attractiveness Analysis by By Donar, 2016-2032

- Figure 47: Western Europe Fertility Services Market Revenue (US$ Mn) Market Share by By End-Userin 2022

- Figure 48: Western Europe Fertility Services Market Attractiveness Analysis by By End-User, 2016-2032

- Figure 49: Western Europe Fertility Services Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 50: Western Europe Fertility Services Market Attractiveness Analysis by Country, 2016-2032

- Figure 51: Western Europe Fertility Services Market Revenue (US$ Mn) (2016-2032)

- Figure 52: Western Europe Fertility Services Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 53: Western Europe Fertility Services Market Revenue (US$ Mn) Comparison by By Procedure (2016-2032)

- Figure 54: Western Europe Fertility Services Market Revenue (US$ Mn) Comparison by By Donar (2016-2032)

- Figure 55: Western Europe Fertility Services Market Revenue (US$ Mn) Comparison by By End-User (2016-2032)

- Figure 56: Western Europe Fertility Services Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 57: Western Europe Fertility Services Market Y-o-Y Growth Rate Comparison by By Procedure (2016-2032)

- Figure 58: Western Europe Fertility Services Market Y-o-Y Growth Rate Comparison by By Donar (2016-2032)

- Figure 59: Western Europe Fertility Services Market Y-o-Y Growth Rate Comparison by By End-User (2016-2032)

- Figure 60: Western Europe Fertility Services Market Share Comparison by Country (2016-2032)

- Figure 61: Western Europe Fertility Services Market Share Comparison by By Procedure (2016-2032)

- Figure 62: Western Europe Fertility Services Market Share Comparison by By Donar (2016-2032)

- Figure 63: Western Europe Fertility Services Market Share Comparison by By End-User (2016-2032)

- Figure 64: Eastern Europe Fertility Services Market Revenue (US$ Mn) Market Share by By Procedurein 2022

- Figure 65: Eastern Europe Fertility Services Market Attractiveness Analysis by By Procedure, 2016-2032

- Figure 66: Eastern Europe Fertility Services Market Revenue (US$ Mn) Market Share by By Donarin 2022

- Figure 67: Eastern Europe Fertility Services Market Attractiveness Analysis by By Donar, 2016-2032

- Figure 68: Eastern Europe Fertility Services Market Revenue (US$ Mn) Market Share by By End-Userin 2022

- Figure 69: Eastern Europe Fertility Services Market Attractiveness Analysis by By End-User, 2016-2032

- Figure 70: Eastern Europe Fertility Services Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 71: Eastern Europe Fertility Services Market Attractiveness Analysis by Country, 2016-2032

- Figure 72: Eastern Europe Fertility Services Market Revenue (US$ Mn) (2016-2032)

- Figure 73: Eastern Europe Fertility Services Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 74: Eastern Europe Fertility Services Market Revenue (US$ Mn) Comparison by By Procedure (2016-2032)

- Figure 75: Eastern Europe Fertility Services Market Revenue (US$ Mn) Comparison by By Donar (2016-2032)

- Figure 76: Eastern Europe Fertility Services Market Revenue (US$ Mn) Comparison by By End-User (2016-2032)

- Figure 77: Eastern Europe Fertility Services Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 78: Eastern Europe Fertility Services Market Y-o-Y Growth Rate Comparison by By Procedure (2016-2032)

- Figure 79: Eastern Europe Fertility Services Market Y-o-Y Growth Rate Comparison by By Donar (2016-2032)

- Figure 80: Eastern Europe Fertility Services Market Y-o-Y Growth Rate Comparison by By End-User (2016-2032)

- Figure 81: Eastern Europe Fertility Services Market Share Comparison by Country (2016-2032)

- Figure 82: Eastern Europe Fertility Services Market Share Comparison by By Procedure (2016-2032)

- Figure 83: Eastern Europe Fertility Services Market Share Comparison by By Donar (2016-2032)

- Figure 84: Eastern Europe Fertility Services Market Share Comparison by By End-User (2016-2032)

- Figure 85: APAC Fertility Services Market Revenue (US$ Mn) Market Share by By Procedurein 2022

- Figure 86: APAC Fertility Services Market Attractiveness Analysis by By Procedure, 2016-2032

- Figure 87: APAC Fertility Services Market Revenue (US$ Mn) Market Share by By Donarin 2022

- Figure 88: APAC Fertility Services Market Attractiveness Analysis by By Donar, 2016-2032

- Figure 89: APAC Fertility Services Market Revenue (US$ Mn) Market Share by By End-Userin 2022

- Figure 90: APAC Fertility Services Market Attractiveness Analysis by By End-User, 2016-2032

- Figure 91: APAC Fertility Services Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 92: APAC Fertility Services Market Attractiveness Analysis by Country, 2016-2032

- Figure 93: APAC Fertility Services Market Revenue (US$ Mn) (2016-2032)

- Figure 94: APAC Fertility Services Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 95: APAC Fertility Services Market Revenue (US$ Mn) Comparison by By Procedure (2016-2032)

- Figure 96: APAC Fertility Services Market Revenue (US$ Mn) Comparison by By Donar (2016-2032)

- Figure 97: APAC Fertility Services Market Revenue (US$ Mn) Comparison by By End-User (2016-2032)

- Figure 98: APAC Fertility Services Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 99: APAC Fertility Services Market Y-o-Y Growth Rate Comparison by By Procedure (2016-2032)

- Figure 100: APAC Fertility Services Market Y-o-Y Growth Rate Comparison by By Donar (2016-2032)

- Figure 101: APAC Fertility Services Market Y-o-Y Growth Rate Comparison by By End-User (2016-2032)

- Figure 102: APAC Fertility Services Market Share Comparison by Country (2016-2032)

- Figure 103: APAC Fertility Services Market Share Comparison by By Procedure (2016-2032)

- Figure 104: APAC Fertility Services Market Share Comparison by By Donar (2016-2032)

- Figure 105: APAC Fertility Services Market Share Comparison by By End-User (2016-2032)

- Figure 106: Latin America Fertility Services Market Revenue (US$ Mn) Market Share by By Procedurein 2022

- Figure 107: Latin America Fertility Services Market Attractiveness Analysis by By Procedure, 2016-2032

- Figure 108: Latin America Fertility Services Market Revenue (US$ Mn) Market Share by By Donarin 2022

- Figure 109: Latin America Fertility Services Market Attractiveness Analysis by By Donar, 2016-2032

- Figure 110: Latin America Fertility Services Market Revenue (US$ Mn) Market Share by By End-Userin 2022

- Figure 111: Latin America Fertility Services Market Attractiveness Analysis by By End-User, 2016-2032

- Figure 112: Latin America Fertility Services Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 113: Latin America Fertility Services Market Attractiveness Analysis by Country, 2016-2032

- Figure 114: Latin America Fertility Services Market Revenue (US$ Mn) (2016-2032)

- Figure 115: Latin America Fertility Services Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 116: Latin America Fertility Services Market Revenue (US$ Mn) Comparison by By Procedure (2016-2032)

- Figure 117: Latin America Fertility Services Market Revenue (US$ Mn) Comparison by By Donar (2016-2032)

- Figure 118: Latin America Fertility Services Market Revenue (US$ Mn) Comparison by By End-User (2016-2032)

- Figure 119: Latin America Fertility Services Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 120: Latin America Fertility Services Market Y-o-Y Growth Rate Comparison by By Procedure (2016-2032)

- Figure 121: Latin America Fertility Services Market Y-o-Y Growth Rate Comparison by By Donar (2016-2032)

- Figure 122: Latin America Fertility Services Market Y-o-Y Growth Rate Comparison by By End-User (2016-2032)

- Figure 123: Latin America Fertility Services Market Share Comparison by Country (2016-2032)

- Figure 124: Latin America Fertility Services Market Share Comparison by By Procedure (2016-2032)

- Figure 125: Latin America Fertility Services Market Share Comparison by By Donar (2016-2032)

- Figure 126: Latin America Fertility Services Market Share Comparison by By End-User (2016-2032)

- Figure 127: Middle East & Africa Fertility Services Market Revenue (US$ Mn) Market Share by By Procedurein 2022

- Figure 128: Middle East & Africa Fertility Services Market Attractiveness Analysis by By Procedure, 2016-2032

- Figure 129: Middle East & Africa Fertility Services Market Revenue (US$ Mn) Market Share by By Donarin 2022

- Figure 130: Middle East & Africa Fertility Services Market Attractiveness Analysis by By Donar, 2016-2032

- Figure 131: Middle East & Africa Fertility Services Market Revenue (US$ Mn) Market Share by By End-Userin 2022

- Figure 132: Middle East & Africa Fertility Services Market Attractiveness Analysis by By End-User, 2016-2032

- Figure 133: Middle East & Africa Fertility Services Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 134: Middle East & Africa Fertility Services Market Attractiveness Analysis by Country, 2016-2032

- Figure 135: Middle East & Africa Fertility Services Market Revenue (US$ Mn) (2016-2032)

- Figure 136: Middle East & Africa Fertility Services Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 137: Middle East & Africa Fertility Services Market Revenue (US$ Mn) Comparison by By Procedure (2016-2032)

- Figure 138: Middle East & Africa Fertility Services Market Revenue (US$ Mn) Comparison by By Donar (2016-2032)

- Figure 139: Middle East & Africa Fertility Services Market Revenue (US$ Mn) Comparison by By End-User (2016-2032)

- Figure 140: Middle East & Africa Fertility Services Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 141: Middle East & Africa Fertility Services Market Y-o-Y Growth Rate Comparison by By Procedure (2016-2032)

- Figure 142: Middle East & Africa Fertility Services Market Y-o-Y Growth Rate Comparison by By Donar (2016-2032)

- Figure 143: Middle East & Africa Fertility Services Market Y-o-Y Growth Rate Comparison by By End-User (2016-2032)

- Figure 144: Middle East & Africa Fertility Services Market Share Comparison by Country (2016-2032)

- Figure 145: Middle East & Africa Fertility Services Market Share Comparison by By Procedure (2016-2032)

- Figure 146: Middle East & Africa Fertility Services Market Share Comparison by By Donar (2016-2032)

- Figure 147: Middle East & Africa Fertility Services Market Share Comparison by By End-User (2016-2032)

List of Tables

- Table 1: Global Fertility Services Market Comparison by By Procedure (2016-2032)

- Table 2: Global Fertility Services Market Comparison by By Donar (2016-2032)

- Table 3: Global Fertility Services Market Comparison by By End-User (2016-2032)

- Table 4: Global Fertility Services Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 5: Global Fertility Services Market Revenue (US$ Mn) (2016-2032)

- Table 6: Global Fertility Services Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 7: Global Fertility Services Market Revenue (US$ Mn) Comparison by By Procedure (2016-2032)

- Table 8: Global Fertility Services Market Revenue (US$ Mn) Comparison by By Donar (2016-2032)

- Table 9: Global Fertility Services Market Revenue (US$ Mn) Comparison by By End-User (2016-2032)

- Table 10: Global Fertility Services Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 11: Global Fertility Services Market Y-o-Y Growth Rate Comparison by By Procedure (2016-2032)

- Table 12: Global Fertility Services Market Y-o-Y Growth Rate Comparison by By Donar (2016-2032)

- Table 13: Global Fertility Services Market Y-o-Y Growth Rate Comparison by By End-User (2016-2032)

- Table 14: Global Fertility Services Market Share Comparison by Region (2016-2032)

- Table 15: Global Fertility Services Market Share Comparison by By Procedure (2016-2032)

- Table 16: Global Fertility Services Market Share Comparison by By Donar (2016-2032)

- Table 17: Global Fertility Services Market Share Comparison by By End-User (2016-2032)

- Table 18: North America Fertility Services Market Comparison by By Donar (2016-2032)

- Table 19: North America Fertility Services Market Comparison by By End-User (2016-2032)

- Table 20: North America Fertility Services Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 21: North America Fertility Services Market Revenue (US$ Mn) (2016-2032)

- Table 22: North America Fertility Services Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 23: North America Fertility Services Market Revenue (US$ Mn) Comparison by By Procedure (2016-2032)

- Table 24: North America Fertility Services Market Revenue (US$ Mn) Comparison by By Donar (2016-2032)

- Table 25: North America Fertility Services Market Revenue (US$ Mn) Comparison by By End-User (2016-2032)

- Table 26: North America Fertility Services Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 27: North America Fertility Services Market Y-o-Y Growth Rate Comparison by By Procedure (2016-2032)

- Table 28: North America Fertility Services Market Y-o-Y Growth Rate Comparison by By Donar (2016-2032)

- Table 29: North America Fertility Services Market Y-o-Y Growth Rate Comparison by By End-User (2016-2032)

- Table 30: North America Fertility Services Market Share Comparison by Country (2016-2032)

- Table 31: North America Fertility Services Market Share Comparison by By Procedure (2016-2032)

- Table 32: North America Fertility Services Market Share Comparison by By Donar (2016-2032)

- Table 33: North America Fertility Services Market Share Comparison by By End-User (2016-2032)

- Table 34: Western Europe Fertility Services Market Comparison by By Procedure (2016-2032)

- Table 35: Western Europe Fertility Services Market Comparison by By Donar (2016-2032)

- Table 36: Western Europe Fertility Services Market Comparison by By End-User (2016-2032)

- Table 37: Western Europe Fertility Services Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 38: Western Europe Fertility Services Market Revenue (US$ Mn) (2016-2032)

- Table 39: Western Europe Fertility Services Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 40: Western Europe Fertility Services Market Revenue (US$ Mn) Comparison by By Procedure (2016-2032)

- Table 41: Western Europe Fertility Services Market Revenue (US$ Mn) Comparison by By Donar (2016-2032)

- Table 42: Western Europe Fertility Services Market Revenue (US$ Mn) Comparison by By End-User (2016-2032)

- Table 43: Western Europe Fertility Services Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 44: Western Europe Fertility Services Market Y-o-Y Growth Rate Comparison by By Procedure (2016-2032)

- Table 45: Western Europe Fertility Services Market Y-o-Y Growth Rate Comparison by By Donar (2016-2032)

- Table 46: Western Europe Fertility Services Market Y-o-Y Growth Rate Comparison by By End-User (2016-2032)

- Table 47: Western Europe Fertility Services Market Share Comparison by Country (2016-2032)

- Table 48: Western Europe Fertility Services Market Share Comparison by By Procedure (2016-2032)

- Table 49: Western Europe Fertility Services Market Share Comparison by By Donar (2016-2032)

- Table 50: Western Europe Fertility Services Market Share Comparison by By End-User (2016-2032)

- Table 51: Eastern Europe Fertility Services Market Comparison by By Procedure (2016-2032)

- Table 52: Eastern Europe Fertility Services Market Comparison by By Donar (2016-2032)

- Table 53: Eastern Europe Fertility Services Market Comparison by By End-User (2016-2032)

- Table 54: Eastern Europe Fertility Services Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: Eastern Europe Fertility Services Market Revenue (US$ Mn) (2016-2032)

- Table 56: Eastern Europe Fertility Services Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: Eastern Europe Fertility Services Market Revenue (US$ Mn) Comparison by By Procedure (2016-2032)

- Table 58: Eastern Europe Fertility Services Market Revenue (US$ Mn) Comparison by By Donar (2016-2032)

- Table 59: Eastern Europe Fertility Services Market Revenue (US$ Mn) Comparison by By End-User (2016-2032)

- Table 60: Eastern Europe Fertility Services Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 61: Eastern Europe Fertility Services Market Y-o-Y Growth Rate Comparison by By Procedure (2016-2032)

- Table 62: Eastern Europe Fertility Services Market Y-o-Y Growth Rate Comparison by By Donar (2016-2032)

- Table 63: Eastern Europe Fertility Services Market Y-o-Y Growth Rate Comparison by By End-User (2016-2032)

- Table 64: Eastern Europe Fertility Services Market Share Comparison by Country (2016-2032)

- Table 65: Eastern Europe Fertility Services Market Share Comparison by By Procedure (2016-2032)

- Table 66: Eastern Europe Fertility Services Market Share Comparison by By Donar (2016-2032)

- Table 67: Eastern Europe Fertility Services Market Share Comparison by By End-User (2016-2032)

- Table 68: APAC Fertility Services Market Comparison by By Procedure (2016-2032)

- Table 69: APAC Fertility Services Market Comparison by By Donar (2016-2032)

- Table 70: APAC Fertility Services Market Comparison by By End-User (2016-2032)

- Table 71: APAC Fertility Services Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 72: APAC Fertility Services Market Revenue (US$ Mn) (2016-2032)

- Table 73: APAC Fertility Services Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 74: APAC Fertility Services Market Revenue (US$ Mn) Comparison by By Procedure (2016-2032)

- Table 75: APAC Fertility Services Market Revenue (US$ Mn) Comparison by By Donar (2016-2032)

- Table 76: APAC Fertility Services Market Revenue (US$ Mn) Comparison by By End-User (2016-2032)

- Table 77: APAC Fertility Services Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 78: APAC Fertility Services Market Y-o-Y Growth Rate Comparison by By Procedure (2016-2032)

- Table 79: APAC Fertility Services Market Y-o-Y Growth Rate Comparison by By Donar (2016-2032)

- Table 80: APAC Fertility Services Market Y-o-Y Growth Rate Comparison by By End-User (2016-2032)

- Table 81: APAC Fertility Services Market Share Comparison by Country (2016-2032)

- Table 82: APAC Fertility Services Market Share Comparison by By Procedure (2016-2032)

- Table 83: APAC Fertility Services Market Share Comparison by By Donar (2016-2032)

- Table 84: APAC Fertility Services Market Share Comparison by By End-User (2016-2032)

- Table 85: Latin America Fertility Services Market Comparison by By Procedure (2016-2032)

- Table 86: Latin America Fertility Services Market Comparison by By Donar (2016-2032)

- Table 87: Latin America Fertility Services Market Comparison by By End-User (2016-2032)

- Table 88: Latin America Fertility Services Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 89: Latin America Fertility Services Market Revenue (US$ Mn) (2016-2032)

- Table 90: Latin America Fertility Services Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 91: Latin America Fertility Services Market Revenue (US$ Mn) Comparison by By Procedure (2016-2032)

- Table 92: Latin America Fertility Services Market Revenue (US$ Mn) Comparison by By Donar (2016-2032)

- Table 93: Latin America Fertility Services Market Revenue (US$ Mn) Comparison by By End-User (2016-2032)

- Table 94: Latin America Fertility Services Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 95: Latin America Fertility Services Market Y-o-Y Growth Rate Comparison by By Procedure (2016-2032)

- Table 96: Latin America Fertility Services Market Y-o-Y Growth Rate Comparison by By Donar (2016-2032)

- Table 97: Latin America Fertility Services Market Y-o-Y Growth Rate Comparison by By End-User (2016-2032)

- Table 98: Latin America Fertility Services Market Share Comparison by Country (2016-2032)

- Table 99: Latin America Fertility Services Market Share Comparison by By Procedure (2016-2032)

- Table 100: Latin America Fertility Services Market Share Comparison by By Donar (2016-2032)

- Table 101: Latin America Fertility Services Market Share Comparison by By End-User (2016-2032)

- Table 102: Middle East & Africa Fertility Services Market Comparison by By Procedure (2016-2032)

- Table 103: Middle East & Africa Fertility Services Market Comparison by By Donar (2016-2032)

- Table 104: Middle East & Africa Fertility Services Market Comparison by By End-User (2016-2032)

- Table 105: Middle East & Africa Fertility Services Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 106: Middle East & Africa Fertility Services Market Revenue (US$ Mn) (2016-2032)

- Table 107: Middle East & Africa Fertility Services Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 108: Middle East & Africa Fertility Services Market Revenue (US$ Mn) Comparison by By Procedure (2016-2032)

- Table 109: Middle East & Africa Fertility Services Market Revenue (US$ Mn) Comparison by By Donar (2016-2032)

- Table 110: Middle East & Africa Fertility Services Market Revenue (US$ Mn) Comparison by By End-User (2016-2032)

- Table 111: Middle East & Africa Fertility Services Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 112: Middle East & Africa Fertility Services Market Y-o-Y Growth Rate Comparison by By Procedure (2016-2032)

- Table 113: Middle East & Africa Fertility Services Market Y-o-Y Growth Rate Comparison by By Donar (2016-2032)

- Table 114: Middle East & Africa Fertility Services Market Y-o-Y Growth Rate Comparison by By End-User (2016-2032)

- Table 115: Middle East & Africa Fertility Services Market Share Comparison by Country (2016-2032)

- Table 116: Middle East & Africa Fertility Services Market Share Comparison by By Procedure (2016-2032)

- Table 117: Middle East & Africa Fertility Services Market Share Comparison by By Donar (2016-2032)

- Table 118: Middle East & Africa Fertility Services Market Share Comparison by By End-User (2016-2032)

- 1. Executive Summary

-

- Olympus Corporation (Japan)

- The Cooper Companies Inc. (U.S.)

- Instituto Bernabeu (Spain)

- Virtus Health (Australia)

- CooperSurgical Inc. (U.S.)

- Vitrolife (Sweden)

- CARE Fertility (U.K.)

- INVO Bioscience (U.S.)

- Monash IVF (Australia)

- Fertility Focus Limited (U.S.)

- Carolinas Fertility Institute (U.S.)

- Apollo Hospitals Enterprise Ltd. (India)

- Merck KGaA (Germany)

- LABOTECT GMBH (Germany)

- Medicover (Sweden)