Erythromycin Market Report By Product Type (Erythromycin Tablets, Erythromycin Capsules, Erythromycin Topical, Erythromycin Oral Suspension, Erythromycin Injection), By Application (Respiratory Tract Infections, Skin Infections, Gastrointestinal Infections, Genital Infections, Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies), By End-User (Hospitals, Clinics, Homecare, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

17659

-

August 2024

-

256

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

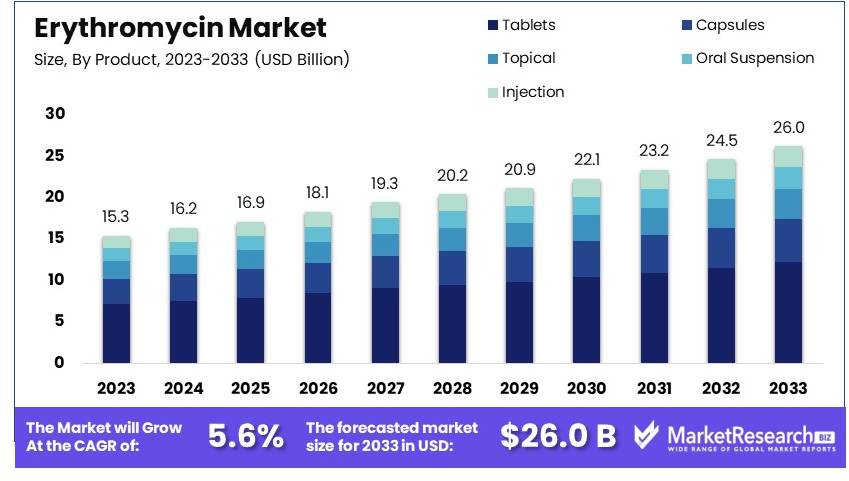

The Global Erythromycin Market size is expected to be worth around USD 26.0 Billion by 2033, from USD 15.3 Billion in 2023, growing at a CAGR of 5.6% during the forecast period from 2024 to 2033.

The Erythromycin Market involves the production and sale of erythromycin, an antibiotic used to treat bacterial infections. It is effective against respiratory tract infections, skin infections, and sexually transmitted diseases. The market is driven by the prevalence of bacterial infections and the need for effective antibiotics. Key consumers are hospitals, clinics, and pharmacies.

Major producers include pharmaceutical companies and generic drug manufacturers. Challenges include antibiotic resistance and stringent regulatory approvals. Growth is supported by ongoing research and development of new formulations. The market benefits from increased healthcare spending and the rising incidence of infectious diseases.

The erythromycin market remains a vital segment within the pharmaceutical industry, bolstered by significant investments in research and development (R&D). Erythromycin, a key antibiotic, continues to play an essential role in treating various bacterial infections, as evidenced by the 1,274,917 prescriptions issued in the United States in 2021. This underscores its sustained relevance in clinical practice.

The pharmaceutical sector's commitment to advancing antibiotics like erythromycin is reflected in substantial R&D expenditures. In Canada, for example, clinical medicine accounted for USD 286 million, basic medicine for USD 277 million, and medical biotechnology for USD 258 million in 2018. These figures represent about a quarter of the in-house spending within the medical and health sciences fields, highlighting the ongoing investment in improving antibiotic therapies.

Erythromycin is available in various formulations, with topical concentrations ranging from 1% to 4%. Its bioavailability varies between 30% and 65%, depending on the ester type used. The drug is primarily metabolized in the liver, with less than 15% excreted unchanged in urine. Its elimination half-life is approximately 1.5 to 2.0 hours, extending to 5 to 6 hours in patients with end-stage renal disease. These pharmacokinetic properties make erythromycin a versatile and widely used antibiotic in both outpatient and inpatient settings.

The market for erythromycin is poised for continued growth, driven by persistent demand for effective antibacterial treatments and ongoing R&D efforts. As antibiotic resistance remains a global challenge, the development of new formulations and enhanced delivery methods for erythromycin is crucial. Companies must prioritize innovation and regulatory compliance to maintain their competitive edge.

In conclusion, the erythromycin market is set for robust growth, supported by significant R&D investments and its enduring clinical importance. Strategic focus on innovation and quality will be essential for companies to leverage opportunities in this dynamic market.

Key Takeaways

- Market Value: The Erythromycin Market was valued at USD 15.3 billion in 2023 and is expected to grow to USD 26.0 billion by 2033, with a CAGR of 5.6%.

- Product Type Analysis: Erythromycin Tablets lead at 47.3%; widely used for their effectiveness.

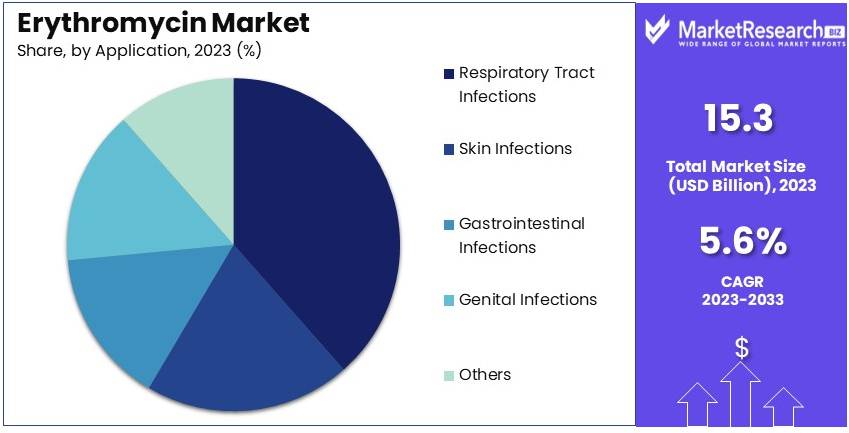

- Application Analysis: Respiratory Tract Infections account for 38.9%; high incidence rates drive demand.

- Distribution Channel Analysis: Hospital Pharmacies dominate with 53.7%; critical for patient care.

- End User Analysis: Hospitals are the major end-users at 61.2%; central to treatment regimes.

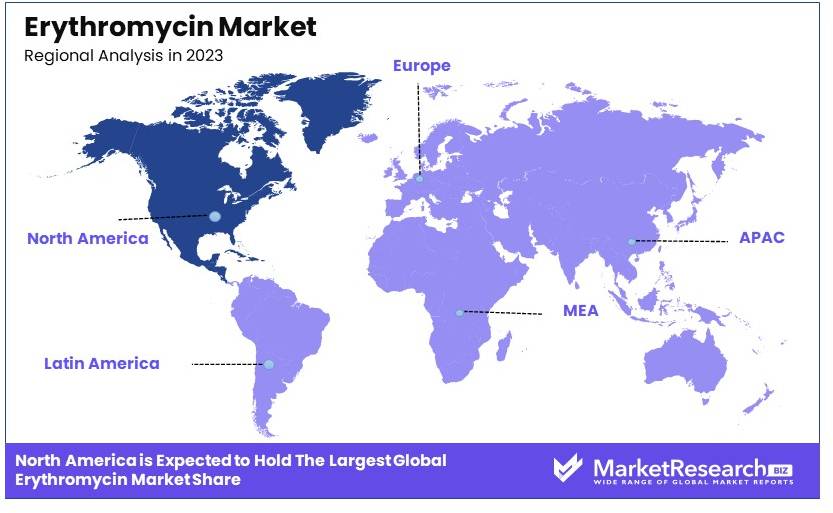

- Dominant Region: North America leads with 35%; high healthcare spending and advanced medical infrastructure.

- Analyst Viewpoint: The Erythromycin Market is expanding due to the prevalence of bacterial infections and ongoing clinical research, with North America as a key contributor to market growth.

Driving Factors

Increasing Prevalence of Bacterial Infections Drives Market Growth

The rising incidence of bacterial infections worldwide is significantly driving the demand for erythromycin. This antibiotic is effective against a wide range of bacteria, making it a crucial treatment for respiratory tract infections, skin infections, and sexually transmitted diseases. According to the World Health Organization, lower respiratory infections were the fourth leading cause of death globally in 2019. This persistent health challenge has led to a continuous need for effective antibiotics like erythromycin.

As bacterial infections remain a major public health issue, healthcare providers increasingly rely on erythromycin for its broad-spectrum efficacy. The ongoing battle against infectious diseases ensures steady demand for this antibiotic. Moreover, the global healthcare system's focus on reducing the burden of bacterial infections further fuels the erythromycin market's growth.

Growing Antibiotic Resistance to First-Line Drugs Drives Market Growth

The increasing resistance of bacteria to commonly used antibiotics is pushing healthcare providers to turn to alternatives like erythromycin. Antibiotic-resistant bacteria cause at least 2.8 million infections in the U.S. each year, according to the Centers for Disease Control and Prevention (CDC). This growing resistance makes established antibiotics like erythromycin crucial, especially when newer antibiotics fail or are not suitable.

The medical community's response to antibiotic resistance involves revisiting older antibiotics, thus revitalizing the demand for erythromycin. As resistance to first-line drugs increases, erythromycin becomes a vital option in the treatment arsenal, ensuring its continued relevance in modern medicine. This trend also encourages research into optimizing the use of erythromycin, further supporting its market growth.

Expanding Applications in Veterinary Medicine Drive Market Growth

Erythromycin's expanding use in veterinary services is another significant driver of its market growth. This antibiotic is widely used to treat infections in livestock and companion animals. For example, it is effective in treating chronic respiratory disease in poultry caused by Mycoplasma gallisepticum. The global increase in meat consumption and the growing pet care market are contributing to the heightened use of erythromycin in animal health.

The veterinary sector's reliance on erythromycin for treating various bacterial infections in animals supports its market expansion. As the demand for meat and pet care products grows, so does the need for effective veterinary antibiotics. This interplay between human and animal health sectors ensures a robust market for erythromycin.

Restraining Factors

Side Effects and Adverse Reactions Restrain Market Growth

Side effects and adverse reactions associated with erythromycin significantly limit its market growth. Erythromycin can cause gastrointestinal issues such as nausea, vomiting, and diarrhea. More severe side effects include interactions with other medications, which can lead to dangerous cardiac arrhythmias.

For instance, combining erythromycin with certain statins can increase the risk of rhabdomyolysis, a severe muscle breakdown condition. These potential side effects make healthcare providers more likely to opt for alternative antibiotics when available, thereby limiting the use and growth of erythromycin in the market.

Generic Competition and Price Pressure Restrain Market Growth

The erythromycin market faces significant pressure from generic competition and resulting price erosion. The availability of multiple generic erythromycin products has led to intense price competition. In the United States, numerous companies produce generic versions, driving down prices.

While this competition benefits consumers and healthcare systems by making the antibiotic more affordable, it reduces profit margins for manufacturers. Lower profits can discourage investment in research and development for new erythromycin formulations or production processes, further hindering market growth.

Product Type Analysis

Erythromycin Tablets dominate with 47.3% due to their convenience and widespread use in treating infections.

Erythromycin Tablets lead the market for erythromycin products, holding a 47.3% share. This dominance is largely due to the ease of administration and the effectiveness of the tablet form in treating a broad range of bacterial infections, including respiratory and skin infections. Tablets are preferred by both patients and healthcare providers for their convenience, precise dosage, and extended shelf life.

Erythromycin Capsules, comprising about 22.6% of the product market, are also significant but less preferred compared to tablets due to their higher cost and lower patient compliance. Erythromycin Topical solutions, representing approximately 13.7% of the market, are essential for direct application on skin infections, offering targeted therapy with minimal systemic absorption.

Erythromycin Oral Suspension, which accounts for 10.4% of the market, is particularly favored for pediatric and geriatric patients who may find swallowing tablets or capsules difficult. Erythromycin Injection, holding a smaller share of about 6%, is crucial for severe cases where immediate and high-concentration dosing is required, typically administered in hospital settings.

The significant share of Erythromycin Tablets is supported by their widespread acceptance for treating various bacterial infections, while the roles of capsules, topical formulations, oral suspensions, and injections contribute to a comprehensive approach in managing different patient needs and conditions.

Application Analysis

Respiratory Tract Infections dominate with 38.9% due to the high prevalence of these conditions globally.

Respiratory Tract Infections (RTIs) are the primary application for erythromycin, accounting for 38.9% of its usage. This dominance is attributed to the high global incidence of RTIs, including pneumonia, bronchitis, and sinusitis, where erythromycin’s effectiveness in treating Gram-positive bacterial infections plays a critical role.

Skin Infections constitute approximately 24.3% of erythromycin’s applications, benefiting from the antibiotic's ability to treat acne and more serious skin conditions like impetigo and cellulitis. Gastrointestinal Infections, making up about 18.4% of the application segment, utilize erythromycin particularly for its motility effects, which are beneficial in treating conditions like gastroparesis.

Genital Infections, including sexually transmitted infections like chlamydia, account for 12.4% of the use of erythromycin. The 'Others' category, which includes a variety of less common infections treated with erythromycin, represents 6% of its applications.

The substantial role of erythromycin in treating Respiratory Tract Infections highlights its importance in global health contexts, while its application in treating other types of infections ensures its utility across a broad spectrum of bacterial diseases.

Distribution Channel Analysis

Hospital Pharmacies dominate with 53.7% due to the critical role they play in immediate patient care.

Hospital Pharmacies are the leading distribution channel for erythromycin, holding a 53.7% market share. This dominance is driven by the necessity for immediate access to antibiotics in hospital settings, where infections often require prompt and effective treatment. Hospital pharmacies ensure the availability of erythromycin, especially in formulations like injections, which are commonly administered in these settings.

Retail Pharmacies, with a 29.3% share, cater to the outpatient market, providing erythromycin primarily in tablet, capsule, and topical forms. Online Pharmacies, though a smaller segment at 17%, are growing rapidly due to the convenience and often lower costs they offer, appealing particularly to patients managing recurrent or long-term conditions.

The preeminence of Hospital Pharmacies in the distribution of erythromycin underscores their essential role in healthcare delivery, complemented by the accessibility provided by Retail and Online Pharmacies, which expand patient access to this critical medication.

End-User Analysis

Hospitals dominate with 61.2% due to the extensive use of erythromycin in inpatient treatment.

Hospitals are the largest end-user of erythromycin, accounting for 61.2% of the market. This high percentage is due to the extensive use of the antibiotic in treating inpatients with severe bacterial infections, where immediate and effective treatment is crucial. Hospitals rely on erythromycin for its broad-spectrum efficacy, especially in cases where patients are allergic to penicillin.

Clinics, which provide services for less severe conditions, hold about 20.8% of the end-user market. Homecare, gaining traction at 12%, reflects the growing trend of managing health conditions, including long-term antibiotic therapies, in more comfortable and cost-effective home environments.

The 'Others' category, which includes specialized care facilities and outpatient services, constitutes about 6% of the market.

The dominant role of hospitals in the use of erythromycin is critical for addressing acute medical needs, while clinics and homecare settings play significant roles in extending care, demonstrating the widespread reliance on this essential antibiotic across various healthcare scenarios.

Key Market Segments

By Product Type

- Erythromycin Tablets

- Erythromycin Capsules

- Erythromycin Topical

- Erythromycin Oral Suspension

- Erythromycin Injection

By Application

- Respiratory Tract Infections

- Skin Infections

- Gastrointestinal Infections

- Genital Infections

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By End-User

- Hospitals

- Clinics

- Homecare

- Others

Growth Opportunities

Expansion in Emerging Markets Offers Growth Opportunity

Expansion in emerging markets presents significant growth opportunities for the erythromycin market. Developing countries, such as India, are experiencing rapid improvements in healthcare access and a growing pharmaceutical market. However, antibiotic resistance is also rising, creating a demand for cost-effective alternatives like erythromycin.

Erythromycin can serve as a more affordable option compared to newer, more expensive antibiotics. Companies that successfully navigate the regulatory landscape and establish strong distribution networks in these regions can capture substantial market growth. The increasing need for effective antibiotics in these expanding markets highlights the potential for erythromycin's growth.

Development of Combination Therapies Offers Growth Opportunity

The development of combination therapies presents a promising growth opportunity for the erythromycin market. Combining erythromycin with other drugs or substances can open new therapeutic avenues. Research indicates potential in combining erythromycin with prokinetic agents for treating gastrointestinal motility disorders.

Such combination therapies can expand erythromycin's market beyond its traditional antibiotic role. By enhancing its therapeutic applications, these innovative treatments can attract a broader patient base and increase the drug's utilization. This development can drive market expansion and position erythromycin as a versatile treatment option.

Trending Factors

Focus on Sustainable Production Methods Are Trending Factors

The focus on sustainable production methods is a trending factor in the erythromycin market. The pharmaceutical industry is increasingly adopting environmentally friendly production practices. For erythromycin, this could involve developing more efficient fermentation processes or exploring synthetic biology approaches.

Companies that demonstrate sustainable production practices can gain a competitive edge. This focus aligns with the growing consumer and regulatory demand for sustainable practices, enhancing the company’s market reputation and appeal. Sustainable production can lead to cost savings and improved environmental compliance, supporting long-term market growth.

Personalized Medicine Approaches Are Trending Factors

Personalized medicine approaches are significantly influencing the erythromycin market. The trend towards personalized medicine involves tailoring treatments based on individual genetic profiles. For erythromycin, genetic testing can determine an individual's likelihood of experiencing side effects or predict its effectiveness against specific bacterial strains.

This targeted use of erythromycin can enhance its efficacy and safety profile, potentially expanding its market in certain patient populations. Personalized medicine can lead to more precise and effective treatments, improving patient outcomes and driving the demand for erythromycin in specific therapeutic contexts.

Regional Analysis

North America Dominates with 35% Market Share in the Erythromycin Market

North America's significant 35% share of the global erythromycin market is largely due to its advanced pharmaceutical industry and strong focus on healthcare innovation. The region hosts several leading pharmaceutical companies heavily invested in research and development, which fosters a steady demand for erythromycin as a key antibiotic. Additionally, the high prevalence of bacterial infections and robust healthcare infrastructure supports the sustained use and distribution of erythromycin across medical facilities.

The dynamics of the erythromycin market in North America are influenced by stringent regulatory standards that ensure the availability of high-quality pharmaceuticals. The region's emphasis on addressing antibiotic resistance also plays a crucial role in maintaining demand for effective and established antibiotics like erythromycin. Furthermore, well-established distribution channels and healthcare insurance systems facilitate widespread access to the drug.

The future role of North America in the erythromycin market is expected to remain influential. Continued investment in healthcare, coupled with ongoing research into antibiotic efficacy and safety, will likely sustain its demand. The region's proactive stance on healthcare regulations and new antibiotic development may further solidify its market position.

Regional Market Share AnalysisEurope: Europe holds approximately 25% of the global erythromycin market. The region's strong pharmaceutical manufacturing base and high healthcare standards drive consistent demand. Additionally, Europe's rigorous health regulatory environment supports the sustained use of well-established antibiotics like erythromycin.

Asia Pacific: Accounting for about 30% of the market, Asia Pacific's share is driven by rapid healthcare sector growth, especially in countries like China and India. Increasing population, expanding healthcare infrastructure, and rising medical needs significantly contribute to the demand for antibiotics.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Erythromycin Market is shaped by several key players who impact its growth and development. Pfizer Inc. and Abbott Laboratories are at the forefront, leveraging extensive research capabilities and global reach to influence market trends. Akorn, Inc. and Teva Pharmaceutical Industries Ltd. focus on providing cost-effective erythromycin solutions, catering to diverse healthcare needs.

Eli Lilly and Company and Astellas Pharma Inc. emphasize innovation and high-quality standards in their erythromycin offerings. Sun Pharmaceutical Industries Ltd. and GlaxoSmithKline plc leverage their strong market presence and extensive distribution networks to maintain a competitive edge. Lupin Limited and Sanofi S.A. contribute through strategic expansion and advanced production capabilities.

Alembic Pharmaceuticals Limited and Zydus Cadila focus on affordability and accessibility, enhancing erythromycin availability in emerging markets. Hikma Pharmaceuticals PLC and Cipla Limited emphasize high-quality generic erythromycin products, meeting global demand effectively. Wockhardt Ltd. supports market growth through continuous innovation and strategic positioning. These companies collectively drive the erythromycin market through strategic initiatives, extensive reach, and commitment to quality.

Market Key Players

- Pfizer Inc.

- Abbott Laboratories

- Akorn, Inc.

- Teva Pharmaceutical Industries Ltd.

- Eli Lilly and Company

- Astellas Pharma Inc.

- Sun Pharmaceutical Industries Ltd.

- GlaxoSmithKline plc

- Lupin Limited

- Sanofi S.A.

- Alembic Pharmaceuticals Limited

- Zydus Cadila

- Hikma Pharmaceuticals PLC

- Cipla Limited

- Wockhardt Ltd.

Recent Developments

February 21, 2024: Researchers at the University of California, Santa Barbara have developed a new class of antibiotics called conjugated oligoelectrolytes (COEs). These molecules have shown promise in killing drug-resistant bacteria without harming mammalian cells. This breakthrough, supported by global collaborations, could potentially lead to effective treatments for resistant bacterial infections in the future.

July 30, 2024: AstraZeneca announced that its drug Calquence has achieved positive results in a Phase III clinical trial for chronic lymphocytic leukemia (CLL). The success in the trial brings the company closer to obtaining approval for a fixed-duration treatment regimen, which is expected to improve patient outcomes and streamline treatment protocols.

Report Scope

Report Features Description Market Value (2023) USD 15.3 Billion Forecast Revenue (2033) USD 26.0 Billion CAGR (2024-2033) 5.6% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Erythromycin Tablets, Erythromycin Capsules, Erythromycin Topical, Erythromycin Oral Suspension, Erythromycin Injection), By Application (Respiratory Tract Infections, Skin Infections, Gastrointestinal Infections, Genital Infections, Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies), By End-User (Hospitals, Clinics, Homecare, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Pfizer Inc., Abbott Laboratories, Akorn, Inc., Teva Pharmaceutical Industries Ltd., Eli Lilly and Company, Astellas Pharma Inc., Sun Pharmaceutical Industries Ltd., GlaxoSmithKline plc, Lupin Limited, Sanofi S.A., Alembic Pharmaceuticals Limited, Zydus Cadila, Hikma Pharmaceuticals PLC, Cipla Limited, Wockhardt Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- Chapter 1 Global Erythromycin Market Overview

- 1.1 Introduction

- 1.2 Global Erythromycin Market segmentation based on Product Type, End-Use and Regions

- 1.3 Global Erythromycin Market Drivers

- 1.4 Global Erythromycin Market Restraints

- 1.5 Global Erythromycin Market Opportunities

- 1.6 Global Erythromycin Market Trends

- 1.7 PEST Analysis

- 1.8 PORTER’s Five Forces Analysis

- 1.9 Macroeconomic Factors

- 1.10 Manufacturing Cost Structure Benchmark

- 1.11 Industry Chain Analysis

- 1.12 Global OTC Drugs Retail Sales (US$ Bn), 2017–2024

- 1.13 North America Healthcare Expenditure and Out-of-Pocket Health Expenditure by Country, 2018

- 1.14 Europe Healthcare Expenditure and Out-of-Pocket Health Expenditure by Country, 2018

- 1.15 Asia-Pacific Healthcare Expenditure and Out-of-Pocket Health Expenditure by Country, 2018

- 1.16 South America Healthcare Expenditure and Out-of-Pocket Health Expenditure by Country, 2018

- 1.17 MEA Healthcare Expenditure and Out-of-Pocket Health Expenditure by Country, 2018

- 1.18 Global Import-Export of Erythromycin, 2015–2019

- 1.18.1 Global Import (US$ 1,000) of Erythromycin by Country, 2015–2019

- 1.18.2 Global Export (US$ 1,000) of Erythromycin by Country, 2015–2019

- 1.18.3 Global Import (Tons) of Erythromycin by Country, 2015–2019

- 1.18.4 Global Export (Tons) of Erythromycin by Country, 2015–2019

- 1.19 Impact of COVID-19 on the Global Erythromycin Market

- 1.19.1 China

- 1.19.2 India

- 1.19.3 The US and Other Countries

- 1.19.4 Coronavirus Total Cases and Total Deaths by Country, 2020 (As of 1st July, 2020)

- 1.20 Opportunity Map Analysis

- 1.20.1 Optimistic Scenario

- 1.20.2 Likely Scenario

- 1.20.3 Conservative Scenario

- 1.21 Market Investment Feasibility Analysis

- 1.22 Opportunity Orbits

- 1.23 Go to Market Strategy – Market Maturity

- 1.24 Regional Market Share and BPS Analysis in Global Erythromycin Market

- Chapter 2 Global Erythromycin Market Overview

- 2.1 Global Erythromycin Market by Product Type

- 2.1.1 Global Erythromycin Revenue (US$ Mn) Comparison by Product Type (2014-2030)

- 2.1.2 Global Erythromycin Revenue (US$ Mn) Market Share by Product Type in 2020

- 2.1.3 Global Erythromycin Market Attractiveness Analysis by Product Type, 2014–2030

- 2.2 Global Erythromycin Market by End-Use

- 2.2.1 Global Erythromycin Revenue (US$ Mn) Comparison by End-Use (2014-2030)

- 2.2.2 Global Erythromycin Revenue (US$ Mn) Market Share by End-Use in 2020

- 2.2.3 Global Erythromycin Market Attractiveness Analysis by End-Use, 2014–2030

- 2.3 Global Erythromycin Market Outlook by Region

- 2.3.1 Global Erythromycin Revenue (US$ Mn) Comparison by Region (2014-2030)

- 2.3.2 Global Erythromycin Revenue (US$ Mn) Market Share by Region in 2020

- 2.3.3 Global Erythromycin Market Attractiveness Analysis by Region, 2014–2030

- 2.4 Global Erythromycin Market Outlook (2014–2030)

- 2.4.1 Global Erythromycin Revenue (US$ Mn) (2014–2021)

- 2.4.2 Global Erythromycin Revenue (US$ Mn) (2022–2030)

- 2.5 Global Erythromycin Revenue (US$ Mn) by Regions

- 2.5.1 Global Erythromycin Revenue (US$ Mn) Comparison by Region (2014–2021)

- 2.5.2 Global Erythromycin Revenue (US$ Mn) Comparison by Region (2022–2030)

- 2.6 Global Erythromycin Revenue (US$ Mn) by Product Type

- 2.6.1 Global Erythromycin Revenue (US$ Mn) Comparison by Product Type (2014–2021)

- 2.6.2 Global Erythromycin Revenue (US$ Mn) Comparison by Product Type (2022–2030)

- 2.7 Global Erythromycin Revenue (US$ Mn) by End-Use

- 2.7.1 Global Erythromycin Revenue (US$ Mn) Comparison by End-Use (2014–2021)

- 2.7.2 Global Erythromycin Revenue (US$ Mn) Comparison by End-Use (2022–2030)

- 2.8 Global Erythromycin Y-o-Y Growth Rate Comparison 2015–2030

- 2.8.1 Global Erythromycin Y-o-Y Growth Rate by Region

- 2.8.2 Global Erythromycin Market Y-o-Y Growth Rate by Product Type

- 2.8.3 Global Erythromycin Y-o-Y Growth Rate by End-Use

- 2.9 Global Erythromycin Share Comparison 2014–2030

- 2.9.1 Global Erythromycin Share by Region

- 2.9.2 Global Erythromycin Market Share by Product Type

- 2.9.3 Global Erythromycin Share by End-Use

- 2.1 Global Erythromycin Market by Product Type

- Chapter 3 North America Erythromycin Market Overview

- 3.1 North America Erythromycin Market by Product Type

- 3.1.1 North America Erythromycin Revenue (US$ Mn) Comparison by Product Type (2014-2030)

- 3.1.2 North America Erythromycin Revenue (US$ Mn) Market Share by Product Type in 2020

- 3.1.3 North America Erythromycin Market Attractiveness Analysis by Product Type, 2014–2030

- 3.2 North America Erythromycin Market by End-Use

- 3.2.1 North America Erythromycin Revenue (US$ Mn) Comparison by End-Use (2014-2030)

- 3.2.2 North America Erythromycin Revenue (US$ Mn) Market Share by End-Use in 2020

- 3.2.3 North America Erythromycin Market Attractiveness Analysis by End-Use, 2014–2030

- 3.3 North America Erythromycin Market Outlook by Region

- 3.3.1 North America Erythromycin Revenue (US$ Mn) Comparison by Region (2014-2030)

- 3.3.2 North America Erythromycin Revenue (US$ Mn) Market Share by Region in 2020

- 3.3.3 North America Erythromycin Market Attractiveness Analysis by Region, 2014–2030

- 3.4 North America Erythromycin Market Outlook (2014–2030)

- 3.4.1 North America Erythromycin Revenue (US$ Mn) (2014–2021)

- 3.4.2 North America Erythromycin Revenue (US$ Mn) (2022–2030)

- 3.5 North America Erythromycin Revenue (US$ Mn) by Regions

- 3.5.1 North America Erythromycin Revenue (US$ Mn) Comparison by Region (2014–2021)

- 3.5.2 North America Erythromycin Revenue (US$ Mn) Comparison by Region (2022–2030)

- 3.6 North America Erythromycin Revenue (US$ Mn) by Product Type

- 3.6.1 North America Erythromycin Revenue (US$ Mn) Comparison by Product Type (2014–2021)

- 3.6.2 North America Erythromycin Revenue (US$ Mn) Comparison by Product Type (2022–2030)

- 3.7 North America Erythromycin Revenue (US$ Mn) by End-Use

- 3.7.1 North America Erythromycin Revenue (US$ Mn) Comparison by End-Use (2014–2021)

- 3.7.2 North America Erythromycin Revenue (US$ Mn) Comparison by End-Use (2022–2030)

- 3.8 North America Erythromycin Y-o-Y Growth Rate Comparison 2015–2030

- 3.8.1 North America Erythromycin Y-o-Y Growth Rate by Region

- 3.8.2 North America Erythromycin Market Y-o-Y Growth Rate by Product Type

- 3.8.3 North America Erythromycin Y-o-Y Growth Rate by End-Use

- 3.9 North America Erythromycin Share Comparison 2014–2030

- 3.9.1 North America Erythromycin Share by Region

- 3.9.2 North America Erythromycin Market Share by Product Type

- 3.9.3 North America Erythromycin Share by End-Use

- 3.1 North America Erythromycin Market by Product Type

- Chapter 4 Europe Erythromycin Market Overview

- 4.1 Europe Erythromycin Market by Product Type

- 4.1.1 Europe Erythromycin Revenue (US$ Mn) Comparison by Product Type (2014-2030)

- 4.1.2 Europe Erythromycin Revenue (US$ Mn) Market Share by Product Type in 2020

- 4.1.3 Europe Erythromycin Market Attractiveness Analysis by Product Type, 2014–2030

- 4.2 Europe Erythromycin Market by End-Use

- 4.2.1 Europe Erythromycin Revenue (US$ Mn) Comparison by End-Use (2014-2030)

- 4.2.2 Europe Erythromycin Revenue (US$ Mn) Market Share by End-Use in 2020

- 4.2.3 Europe Erythromycin Market Attractiveness Analysis by End-Use, 2014–2030

- 4.3 Europe Erythromycin Market Outlook by Region

- 4.3.1 Europe Erythromycin Revenue (US$ Mn) Comparison by Region (2014-2030)

- 4.3.2 Europe Erythromycin Revenue (US$ Mn) Market Share by Region in 2020

- 4.3.3 Europe Erythromycin Market Attractiveness Analysis by Region, 2014–2030

- 4.4 Europe Erythromycin Market Outlook (2014–2030)

- 4.4.1 Europe Erythromycin Revenue (US$ Mn) (2014–2021)

- 4.4.2 Europe Erythromycin Revenue (US$ Mn) (2022–2030)

- 4.5 Europe Erythromycin Revenue (US$ Mn) by Regions

- 4.5.1 Europe Erythromycin Revenue (US$ Mn) Comparison by Region (2014–2021)

- 4.5.2 Europe Erythromycin Revenue (US$ Mn) Comparison by Region (2022–2030)

- 4.6 Europe Erythromycin Revenue (US$ Mn) by Product Type

- 4.6.1 Europe Erythromycin Revenue (US$ Mn) Comparison by Product Type (2014–2021)

- 4.6.2 Europe Erythromycin Revenue (US$ Mn) Comparison by Product Type (2022–2030)

- 4.7 Europe Erythromycin Revenue (US$ Mn) by End-Use

- 4.7.1 Europe Erythromycin Revenue (US$ Mn) Comparison by End-Use (2014–2021)

- 4.7.2 Europe Erythromycin Revenue (US$ Mn) Comparison by End-Use (2022–2030)

- 4.8 Europe Erythromycin Y-o-Y Growth Rate Comparison 2015–2030

- 4.8.1 Europe Erythromycin Y-o-Y Growth Rate by Region

- 4.8.2 Europe Erythromycin Market Y-o-Y Growth Rate by Product Type

- 4.8.3 Europe Erythromycin Y-o-Y Growth Rate by End-Use

- 4.9 Europe Erythromycin Share Comparison 2014–2030

- 4.9.1 Europe Erythromycin Share by Region

- 4.9.2 Europe Erythromycin Market Share by Product Type

- 4.9.3 Europe Erythromycin Share by End-Use

- 4.1 Europe Erythromycin Market by Product Type

- Chapter 5 Asia-Pacific Erythromycin Market Overview

- 5.1 Asia-Pacific Erythromycin Market by Product Type

- 5.1.1 Asia-Pacific Erythromycin Revenue (US$ Mn) Comparison by Product Type (2014-2030)

- 5.1.2 Asia-Pacific Erythromycin Revenue (US$ Mn) Market Share by Product Type in 2020

- 5.1.3 Asia-Pacific Erythromycin Market Attractiveness Analysis by Product Type, 2014–2030

- 5.2 Asia-Pacific Erythromycin Market by End-Use

- 5.2.1 Asia-Pacific Erythromycin Revenue (US$ Mn) Comparison by End-Use (2014-2030)

- 5.2.2 Asia-Pacific Erythromycin Revenue (US$ Mn) Market Share by End-Use in 2020

- 5.2.3 Asia-Pacific Erythromycin Market Attractiveness Analysis by End-Use, 2014–2030

- 5.3 Asia-Pacific Erythromycin Market Outlook by Region

- 5.3.1 Asia-Pacific Erythromycin Revenue (US$ Mn) Comparison by Region (2014-2030)

- 5.3.2 Asia-Pacific Erythromycin Revenue (US$ Mn) Market Share by Region in 2020

- 5.3.3 Asia-Pacific Erythromycin Market Attractiveness Analysis by Region, 2014–2030

- 5.4 Asia-Pacific Erythromycin Market Outlook (2014–2030)

- 5.4.1 Asia-Pacific Erythromycin Revenue (US$ Mn) (2014–2021)

- 5.4.2 Asia-Pacific Erythromycin Revenue (US$ Mn) (2022–2030)

- 5.5 Asia-Pacific Erythromycin Revenue (US$ Mn) by Regions

- 5.5.1 Asia-Pacific Erythromycin Revenue (US$ Mn) Comparison by Region (2014–2021)

- 5.5.2 Asia-Pacific Erythromycin Revenue (US$ Mn) Comparison by Region (2022–2030)

- 5.6 Asia-Pacific Erythromycin Revenue (US$ Mn) by Product Type

- 5.6.1 Asia-Pacific Erythromycin Revenue (US$ Mn) Comparison by Product Type (2014–2021)

- 5.6.2 Asia-Pacific Erythromycin Revenue (US$ Mn) Comparison by Product Type (2022–2030)

- 5.7 Asia-Pacific Erythromycin Revenue (US$ Mn) by End-Use

- 5.7.1 Asia-Pacific Erythromycin Revenue (US$ Mn) Comparison by End-Use (2014–2021)

- 5.7.2 Asia-Pacific Erythromycin Revenue (US$ Mn) Comparison by End-Use (2022–2030)

- 5.8 Asia-Pacific Erythromycin Y-o-Y Growth Rate Comparison 2015–2030

- 5.8.1 Asia-Pacific Erythromycin Y-o-Y Growth Rate by Region

- 5.8.2 Asia-Pacific Erythromycin Market Y-o-Y Growth Rate by Product Type

- 5.8.3 Asia-Pacific Erythromycin Y-o-Y Growth Rate by End-Use

- 5.9 Asia-Pacific Erythromycin Share Comparison 2014–2030

- 5.9.1 Asia-Pacific Erythromycin Share by Region

- 5.9.2 Asia-Pacific Erythromycin Market Share by Product Type

- 5.9.3 Asia-Pacific Erythromycin Share by End-Use

- 5.1 Asia-Pacific Erythromycin Market by Product Type

- Chapter 6 South America Erythromycin Market Overview

- 6.1 South America Erythromycin Market by Product Type

- 6.1.1 South America Erythromycin Revenue (US$ Mn) Comparison by Product Type (2014-2030)

- 6.1.2 South America Erythromycin Revenue (US$ Mn) Market Share by Product Type in 2020

- 6.1.3 South America Erythromycin Market Attractiveness Analysis by Product Type, 2014–2030

- 6.2 South America Erythromycin Market by End-Use

- 6.2.1 South America Erythromycin Revenue (US$ Mn) Comparison by End-Use (2014-2030)

- 6.2.2 South America Erythromycin Revenue (US$ Mn) Market Share by End-Use in 2020

- 6.2.3 South America Erythromycin Market Attractiveness Analysis by End-Use, 2014–2030

- 6.3 South America Erythromycin Market Outlook by Region

- 6.3.1 South America Erythromycin Revenue (US$ Mn) Comparison by Region (2014-2030)

- 6.3.2 South America Erythromycin Revenue (US$ Mn) Market Share by Region in 2020

- 6.3.3 South America Erythromycin Market Attractiveness Analysis by Region, 2014–2030

- 6.4 South America Erythromycin Market Outlook (2014–2030)

- 6.4.1 South America Erythromycin Revenue (US$ Mn) (2014–2021)

- 6.4.2 South America Erythromycin Revenue (US$ Mn) (2022–2030)

- 6.5 South America Erythromycin Revenue (US$ Mn) by Regions

- 6.5.1 South America Erythromycin Revenue (US$ Mn) Comparison by Region (2014–2021)

- 6.5.2 South America Erythromycin Revenue (US$ Mn) Comparison by Region (2022–2030)

- 6.6 South America Erythromycin Revenue (US$ Mn) by Product Type

- 6.6.1 South America Erythromycin Revenue (US$ Mn) Comparison by Product Type (2014–2021)

- 6.6.2 South America Erythromycin Revenue (US$ Mn) Comparison by Product Type (2022–2030)

- 6.7 South America Erythromycin Revenue (US$ Mn) by End-Use

- 6.7.1 South America Erythromycin Revenue (US$ Mn) Comparison by End-Use (2014–2021)

- 6.7.2 South America Erythromycin Revenue (US$ Mn) Comparison by End-Use (2022–2030)

- 6.8 South America Erythromycin Y-o-Y Growth Rate Comparison 2015–2030

- 6.8.1 South America Erythromycin Y-o-Y Growth Rate by Region

- 6.8.2 South America Erythromycin Market Y-o-Y Growth Rate by Product Type

- 6.8.3 South America Erythromycin Y-o-Y Growth Rate by End-Use

- 6.9 South America Erythromycin Share Comparison 2014–2030

- 6.9.1 South America Erythromycin Share by Region

- 6.9.2 South America Erythromycin Market Share by Product Type

- 6.9.3 South America Erythromycin Share by End-Use

- 6.1 South America Erythromycin Market by Product Type

- Chapter 7 MEA Erythromycin Market Overview

- 7.1 MEA Erythromycin Market by Product Type

- 7.1.1 MEA Erythromycin Revenue (US$ Mn) Comparison by Product Type (2014-2030)

- 7.1.2 MEA Erythromycin Revenue (US$ Mn) Market Share by Product Type in 2020

- 7.1.3 MEA Erythromycin Market Attractiveness Analysis by Product Type, 2014–2030

- 7.2 MEA Erythromycin Market by End-Use

- 7.2.1 MEA Erythromycin Revenue (US$ Mn) Comparison by End-Use (2014-2030)

- 7.2.2 MEA Erythromycin Revenue (US$ Mn) Market Share by End-Use in 2020

- 7.2.3 MEA Erythromycin Market Attractiveness Analysis by End-Use, 2014–2030

- 7.3 MEA Erythromycin Market Outlook by Region

- 7.3.1 MEA Erythromycin Revenue (US$ Mn) Comparison by Region (2014-2030)

- 7.3.2 MEA Erythromycin Revenue (US$ Mn) Market Share by Region in 2020

- 7.3.3 MEA Erythromycin Market Attractiveness Analysis by Region, 2014–2030

- 7.4 MEA Erythromycin Market Outlook (2014–2030)

- 7.4.1 MEA Erythromycin Revenue (US$ Mn) (2014–2021)

- 7.4.2 MEA Erythromycin Revenue (US$ Mn) (2022–2030)

- 7.5 MEA Erythromycin Revenue (US$ Mn) by Regions

- 7.5.1 MEA Erythromycin Revenue (US$ Mn) Comparison by Region (2014–2021)

- 7.5.2 MEA Erythromycin Revenue (US$ Mn) Comparison by Region (2022–2030)

- 7.6 MEA Erythromycin Revenue (US$ Mn) by Product Type

- 7.6.1 MEA Erythromycin Revenue (US$ Mn) Comparison by Product Type (2014–2021)

- 7.6.2 MEA Erythromycin Revenue (US$ Mn) Comparison by Product Type (2022–2030)

- 7.7 MEA Erythromycin Revenue (US$ Mn) by End-Use

- 7.7.1 MEA Erythromycin Revenue (US$ Mn) Comparison by End-Use (2014–2021)

- 7.7.2 MEA Erythromycin Revenue (US$ Mn) Comparison by End-Use (2022–2030)

- 7.8 MEA Erythromycin Y-o-Y Growth Rate Comparison 2015–2030

- 7.8.1 MEA Erythromycin Y-o-Y Growth Rate by Region

- 7.8.2 MEA Erythromycin Market Y-o-Y Growth Rate by Product Type

- 7.8.3 MEA Erythromycin Y-o-Y Growth Rate by End-Use

- 7.9 MEA Erythromycin Share Comparison 2014–2030

- 7.9.1 MEA Erythromycin Share by Region

- 7.9.2 MEA Erythromycin Market Share by Product Type

- 7.9.3 MEA Erythromycin Share by End-Use

- 7.1 MEA Erythromycin Market by Product Type

- Chapter 8 Global Erythromycin Market Company Profiles

- 8.1 Market Competition Scenario Analysis

- 8.2 Overview of Major Market Players

- 8.3 Company Profiles

- 8.3.1 Pfizer Inc.

- 8.3.1.1 Company Overview

- 8.3.1.2 Business Description

- 8.3.1.3 Product Portfolio

- 8.3.1.4 Key Financials

- 8.3.1.5 Key Developments

- 8.3.1.6 SWOT Analysis

- 8.3.2 AbbVie Inc.

- 8.3.2.1 Company Overview

- 8.3.2.2 Business Description

- 8.3.2.3 Product Portfolio

- 8.3.2.4 Key Financials

- 8.3.2.5 Key Developments

- 8.3.2.6 SWOT Analysis

- 8.3.3 Abbott Laboratories

- 8.3.3.1 Company Overview

- 8.3.3.2 Business Description

- 8.3.3.3 Product Portfolio

- 8.3.3.4 Key Financials

- 8.3.3.5 Key Developments

- 8.3.3.6 SWOT Analysis

- 8.3.4 Ercros S.A.

- 8.3.4.1 Company Overview

- 8.3.4.2 Business Description

- 8.3.4.3 Product Portfolio

- 8.3.4.4 Key Financials

- 8.3.4.5 Key Developments

- 8.3.5 Genesis Pharmaceutical, Inc. (Pierre Fabre Dermo-Cosmetique The US, Inc.)

- 8.3.5.1 Company Overview

- 8.3.5.2 Business Description

- 8.3.5.3 Product Portfolio (Genesis Pharmaceutical, Inc.)

- 8.3.6 Akorn, Inc.

- 8.3.6.1 Company Overview

- 8.3.6.2 Business Description

- 8.3.6.3 Product Portfolio

- 8.3.6.4 Key Financials

- 8.3.6.5 Key Developments

- 8.3.7 Alembic Pharmaceuticals Ltd.

- 8.3.7.1 Company Overview

- 8.3.7.2 Business Description

- 8.3.7.3 Product Portfolio

- 8.3.7.4 Key Financials

- 8.3.7.5 Key Developments

- 8.3.8 Ani Pharmaceuticals, Inc.

- 8.3.8.1 Company Overview

- 8.3.8.2 Business Description

- 8.3.8.3 Product Portfolio

- 8.3.9 Ningxia Qiyuan Pharmaceutical Co., Ltd.

- 8.3.9.1 Company Overview

- 8.3.9.2 Business Description

- 8.3.9.3 Product Portfolio

- 8.3.10 Teligent Inc.

- 8.3.10.1 Company Overview

- 8.3.10.2 Business Description

- 8.3.10.3 Product Portfolio

- 8.3.10.4 Key Financials

- 8.3.10.5 Key Developments

- 8.3.11 Anuh Pharma Limited

- 8.3.11.1 Company Overview

- 8.3.11.2 Business Description

- 8.3.11.3 Product Portfolio

- 8.3.11.4 Key Financials

- 8.3.1 Pfizer Inc.

- Chapter 9 Methodology and Data Source

- 9.1 Methodology/Research Approach

- 9.1.1 Market Size Estimation

- 9.2 Market Breakdown and Data Triangulation

- 9.3 Data Source

- 9.3.1 Secondary Sources

- 9.3.2 Primary Sources

- 9.1 Methodology/Research Approach

- Chapter 10 About Us

- 10.1 Who we are:

- Chapter 11 Disclaimer

- Chapter 1 Global Erythromycin Market Overview

-

- Pfizer Inc.

- Abbott Laboratories

- Akorn, Inc.

- Teva Pharmaceutical Industries Ltd.

- Eli Lilly and Company

- Astellas Pharma Inc.

- Sun Pharmaceutical Industries Ltd.

- GlaxoSmithKline plc

- Lupin Limited

- Sanofi S.A.

- Alembic Pharmaceuticals Limited

- Zydus Cadila

- Hikma Pharmaceuticals PLC

- Cipla Limited

- Wockhardt Ltd.