Distillation Systems Market By Component (Column Shells, Plates & Packings, Reboilers & Heaters, Condensers, Others), By End-use (Petroleum & Biorefinery, Water Treatment, Pharmaceuticals, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

50534

-

August 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

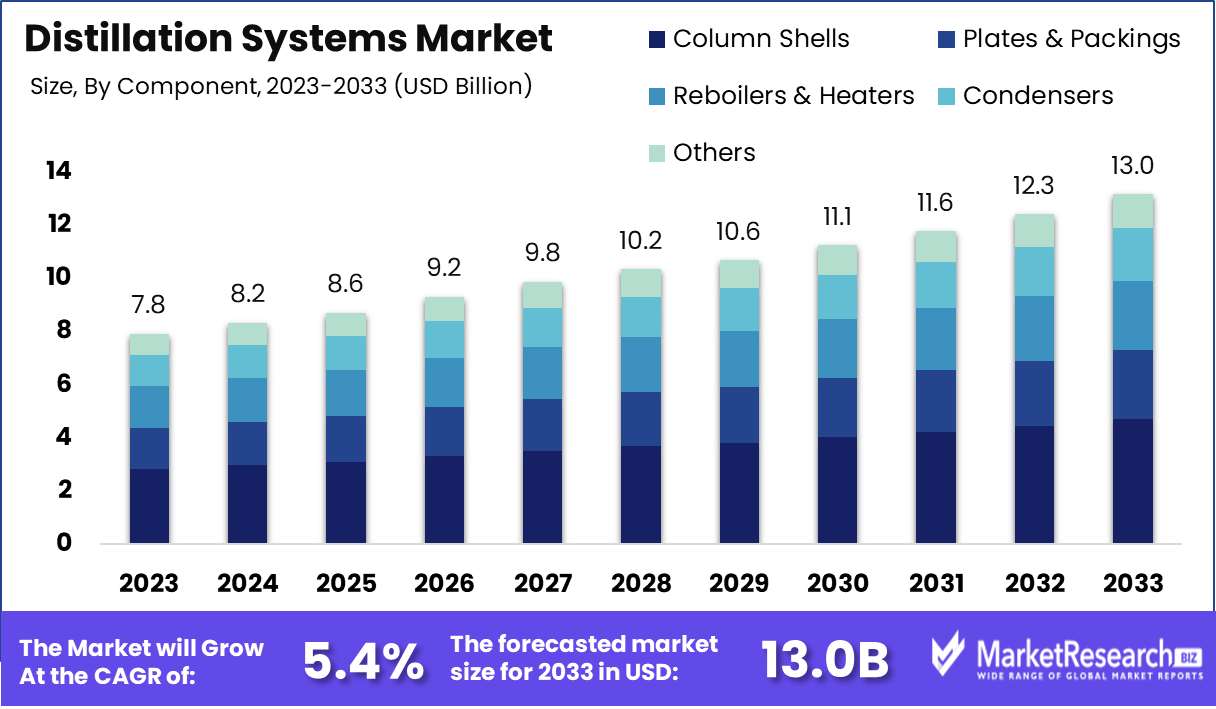

The Distillation Systems Market was valued at USD 7.8 billion in 2023. It is expected to reach USD 13.0 billion by 2033, with a CAGR of 5.4% during the forecast period from 2024 to 2033.

The Distillation Systems Market encompasses the global industry involved in the design, manufacturing, and deployment of distillation equipment used to separate liquid mixtures into their component parts based on differences in boiling points. This market serves various industries, including oil and gas, chemicals, pharmaceuticals, and food and beverages, where precise separation of components is critical for product quality and operational efficiency.

The Distillation Systems Market is experiencing significant growth, driven by the increasing demand for distilled beverages and biofuels. As emerging economies continue to industrialize, the need for purified water has surged, further propelling the market. However, the high initial investment and maintenance costs associated with distillation systems present substantial challenges, particularly for small and medium-sized enterprises. Despite these barriers, advancements in automation and control systems are transforming the industry, enabling more efficient and cost-effective distillation processes. This technological progress is expected to mitigate some of the cost-related challenges, making distillation systems more accessible to a broader range of industries.

Furthermore, the integration of advanced automation technologies is anticipated to enhance the precision and scalability of distillation processes, catering to the growing demand for high-quality distilled products. This is particularly relevant in sectors such as pharmaceuticals and chemicals, where the purity of distilled products is paramount. As these industries continue to expand, the demand for sophisticated distillation systems is likely to increase, presenting lucrative opportunities for market players. However, companies must carefully navigate the cost challenges and leverage technological advancements to maintain a competitive edge in this evolving market landscape.

Key Takeaways

- Market Growth: The Distillation Systems Market was valued at USD 7.8 billion in 2023. It is expected to reach USD 13.0 billion by 2033, with a CAGR of 5.4% during the forecast period from 2024 to 2033.

- By Component: Column shells dominate in distillation, enhancing efficiency across multiple industries.

- By End-use: Petroleum & Biorefinery dominates Distillation Systems Market across diverse industries.

- Regional Dominance: North America leads the Distillation Systems Market with a 35% largest share.

- Growth Opportunity: The intersection of rising water treatment needs and the expanding petrochemical sector presents a compelling growth opportunity for the global distillation systems market.

Driving factors

Growing Industrialization and Urbanization: Catalysts for Expanding Distillation Systems Demand

The rapid pace of industrialization and urbanization across emerging economies is a significant driver for the growth of the distillation systems market. As industries expand to meet the demands of growing urban populations, there is an increasing need for efficient and scalable separation technologies, of which distillation is a cornerstone. This trend is particularly pronounced in sectors such as chemical manufacturing, pharmaceuticals, and food and beverage production, where distillation systems are critical for producing high-purity products. The global shift towards more industrialized economies, especially in Asia-Pacific, is expected to lead to a surge in demand for these systems, driving market growth.

Rising Demand in Petrochemical and Refinery Industries: A Key Driver of Market Expansion

The petrochemical and refinery industries are among the largest consumers of distillation systems, making their demand dynamics crucial to the market’s growth. With the increasing global demand for petrochemical products and refined fuels, driven by expanding transportation, manufacturing, and energy sectors, there is a corresponding need for more advanced and efficient distillation systems. This demand is further amplified by the ongoing modernization of refinery infrastructure to meet stricter environmental regulations and improve operational efficiency. As a result, the distillation systems market is poised for substantial growth, supported by investments in upgrading and expanding refinery capacities worldwide.

Water Scarcity and Treatment Needs: Driving Innovation and Adoption in Distillation Technologies

Water scarcity is becoming an increasingly critical global issue, pushing the demand for advanced water treatment solutions. Distillation systems, known for their ability to purify water by removing impurities, salts, and other contaminants, are gaining prominence as a viable solution to address this challenge. The growing need for clean water in both industrial and residential sectors is driving the adoption of distillation technologies.

Furthermore, advancements in energy-efficient distillation processes are making these systems more attractive for large-scale water treatment applications. The pressing global need for sustainable water management solutions is expected to significantly contribute to the growth of the distillation systems market.

Restraining Factors

Lack of Knowledge and Expertise: A Barrier to Innovation and Efficiency

The distillation systems market faces significant restraint due to the lack of knowledge and expertise among potential users and operators. This shortage hinders the adoption of advanced distillation technologies which are essential for optimizing production processes and achieving higher efficiency levels. Industries often hesitate to invest in sophisticated distillation setups due to the scarcity of skilled professionals who can operate and manage these systems effectively. The impact of this factor is profound, particularly in emerging markets where technical education and training programs are less developed. Consequently, this gap not only limits market expansion but also affects the technological advancement of distillation systems.

Maintenance Challenges: Increasing Operational Costs and Downtime

Maintenance challenges present another significant hurdle for the growth of the distillation systems market. Distillation units, especially those that handle complex mixtures or operate under severe conditions, require consistent and often costly maintenance to ensure optimal performance and safety. The need for regular upkeep can lead to increased operational costs and downtime, affecting the overall productivity and profitability of end-users. This factor becomes particularly restrictive for small to medium-sized enterprises (SMEs) that may not have the financial flexibility to afford high maintenance costs. Moreover, unexpected breakdowns and the need for specialized maintenance services can further exacerbate the issue, leading to prolonged system downtimes and reduced operational efficiency.

By Component Analysis

Column shells dominate in distillation, enhancing efficiency across multiple industries.

In 2023, The Distillation Systems Market saw various components playing crucial roles in its operation and efficiency. Column shells, as the primary structural components of distillation columns, held a dominant market position, integral for the separation processes in industries such as oil and gas, chemicals, and pharmaceuticals. Their design and material composition are pivotal for handling different pressures and temperatures, influencing overall system effectiveness.

Plates & packings, another critical segment, are essential for enhancing contact between vapor and liquid phases within columns, facilitating efficient mass transfer. Innovations in design and materials have improved their efficiency, catering to stringent purity standards required in sectors like fine chemicals and essential oils.

Reboilers & heaters are at the heart of the distillation process, providing the necessary heat to vaporize liquid mixtures. Their energy efficiency and compatibility with various heating methods have been focal points for development, aiming to reduce operational costs and environmental impact.

Condensers function to convert vapor back to liquid, playing a key role in the system's energy conservation and throughput capabilities. Advances in condenser technology focus on maximizing condensation with minimal energy expenditure.

The "Others" category encompasses additional components such as feed preheaters and pressure control systems, which optimize the distillation process by improving energy utilization and system stability. Each component's evolution reflects the market's move towards more sustainable and cost-effective distillation operations.

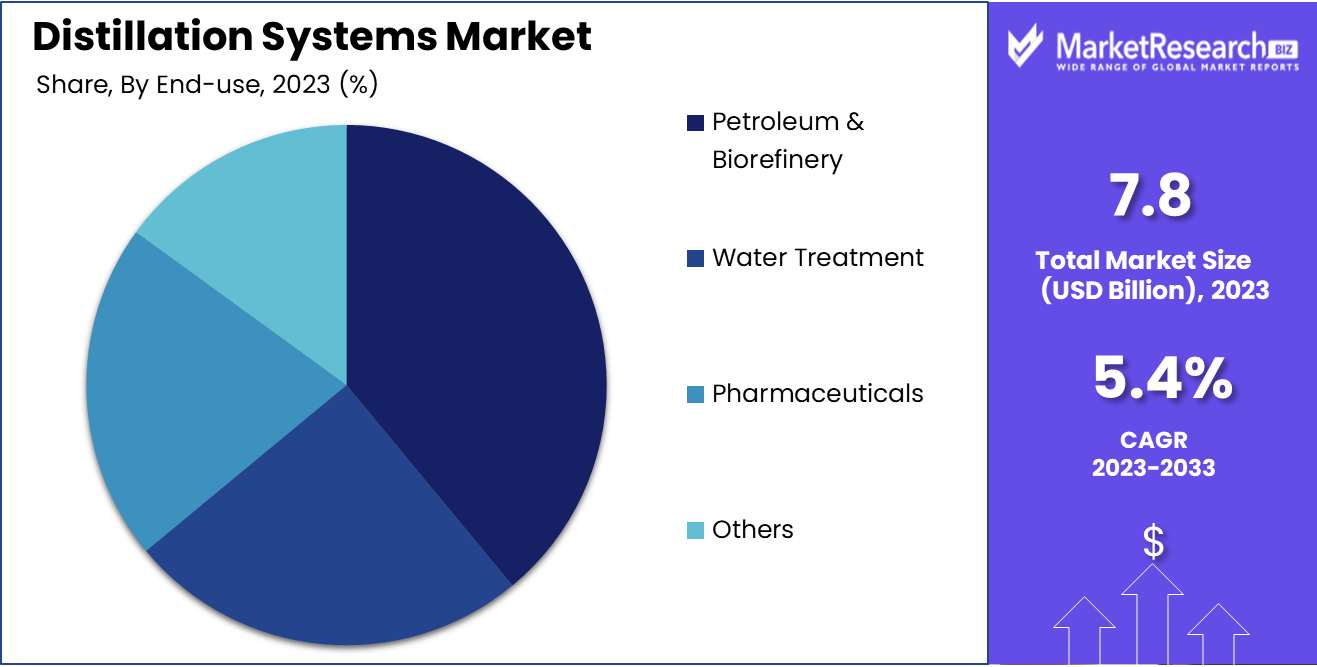

By End-use Analysis

Petroleum & Biorefinery dominates Distillation Systems Market across diverse industries.

In 2023, The Distillation Systems Market saw the Petroleum & Biorefinery segment assert a commanding presence within the By End-use category. This segment benefits significantly from the ongoing global demand for refined petroleum products and biofuels, driving investments in advanced distillation technologies. These systems are pivotal in refining crude oil into various grades of fuels and processing biomass into biofuels, aligning with the global shift toward sustainable energy sources. The need for efficient separation processes to enhance yield and reduce energy consumption further bolsters the adoption of cutting-edge distillation systems in this sector.

Conversely, the Water Treatment segment capitalized on the escalating urgency for potable water and stringent environmental regulations. Distillation plays a crucial role in desalination and the purification of industrial wastewater, making it indispensable in regions grappling with water scarcity.

In the Pharmaceuticals category, distillation systems are essential for the precise separation of chemical compounds and the purification of essential drugs, underscoring their criticality in maintaining stringent quality standards in pharmaceutical production.

The Others segment, encompassing food and beverage, cosmetics, and chemical industries, also integrates distillation systems to ensure product purity and adhere to regulatory standards, highlighting the versatility and expansive application of distillation technology across multiple industries.

Key Market Segments

By Component

- Column Shells

- Plates & Packings

- Reboilers & Heaters

- Condensers

- Others

By End-use

- Petroleum & Biorefinery

- Water Treatment

- Pharmaceuticals

- Others

Growth Opportunity

Growth in Water Treatment Demand

The global distillation systems market is poised for significant growth, driven by the increasing demand for efficient water treatment solutions. As water scarcity intensifies and concerns about water quality rise, industries and municipalities are investing heavily in advanced distillation technologies to ensure a reliable supply of clean water. This trend is particularly pronounced in regions with limited freshwater resources, where distillation systems are becoming essential for desalination and wastewater treatment. The growing emphasis on sustainability and stringent regulatory requirements further fuel this demand, positioning water treatment as a key growth driver for the distillation systems market.

Expansion in the Petrochemical Sector

Another critical opportunity for the distillation systems market is the expansion of the petrochemical sector. As global energy demand continues to rise, the petrochemical industry is experiencing robust growth, particularly in emerging economies. Distillation systems play a vital role in refining and separating petrochemical products, making them indispensable for industry operations. The ongoing investments in new petrochemical facilities, coupled with the modernization of existing infrastructure, are expected to drive significant demand for advanced distillation systems. This expansion not only supports market growth but also underscores the essential role of distillation technology in the broader energy and chemical industries.

Latest Trends

Rising Demand for Clean Water

The Distillation Systems Market is poised to experience significant growth driven by the rising global demand for clean water. As water scarcity intensifies due to climate change, population growth, and industrial expansion, the need for efficient water purification technologies has become more critical. Distillation systems, known for their ability to remove impurities and provide high-quality water, are increasingly being adopted by industries and municipalities. The surge in investments in desalination projects, particularly in arid regions, is expected to further boost the market. This trend underscores the strategic importance of distillation systems in addressing the global water crisis.

Automation and Control Systems

The integration of automation and advanced control systems is another key trend shaping the Distillation Systems Market. As industries seek to enhance operational efficiency and reduce human error, the adoption of automated distillation processes is on the rise. Advanced control systems enable real-time monitoring, precise temperature control, and optimized energy consumption, leading to more efficient and cost-effective operations.

Additionally, the incorporation of IoT and AI technologies is expected to further revolutionize distillation processes, allowing for predictive maintenance and enhanced system performance. This trend highlights the ongoing digital transformation within the industry, positioning distillation systems as a critical component of smart manufacturing and water treatment solutions.

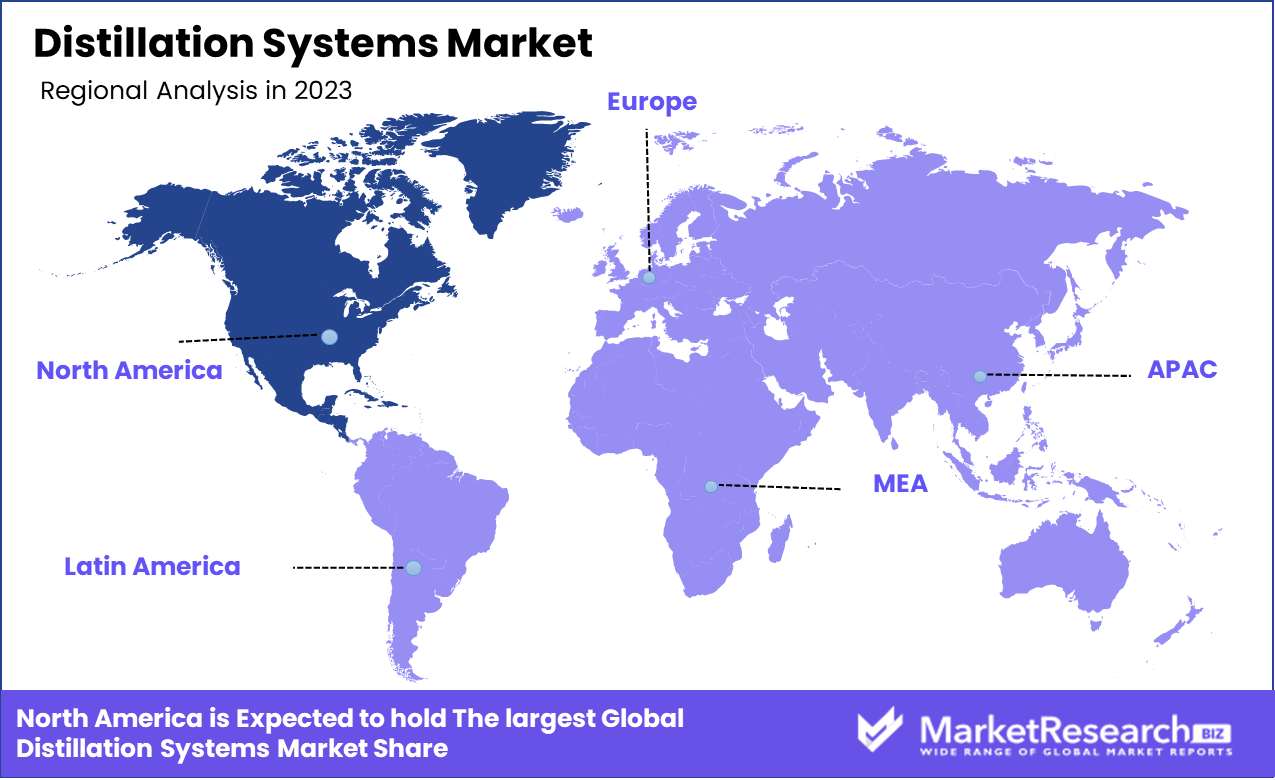

Regional Analysis

North America leads the Distillation Systems Market with a 35% largest share.

The Distillation Systems Market exhibits varied growth patterns across different regions, reflecting regional industrial demands and technological advancements. In North America, the market is significantly driven by the strong presence of the oil & gas and chemical industries, which extensively use distillation processes. This region dominates the global market, accounting for approximately 35% of the total market share. The advanced technological infrastructure and stringent environmental regulations further bolster market growth in North America.

Europe follows closely, with robust demand from the pharmaceutical and food & beverage sectors, which rely on distillation for product purification and separation processes. The region holds a substantial market share, driven by ongoing investments in process optimization and sustainability.

In the Asia Pacific region, rapid industrialization, especially in countries like China and India, is a key factor propelling market expansion. The increasing adoption of distillation systems in petrochemical and water treatment industries contributes to this region's growth, accounting for a significant portion of the global market.

The Middle East & Africa region sees steady demand, particularly from the oil refining and desalination sectors, while Latin America experiences moderate growth driven by the chemical and alcohol distillation industries. Collectively, these regions contribute to the global market’s expansion, with North America leading the charge.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Distillation Systems Market is expected to witness robust growth, driven by advancements in process optimization and increasing demand across various end-use industries. Among the key players, GEA and Alfa Laval stand out as market leaders, capitalizing on their strong R&D capabilities and extensive product portfolios. Both companies are likely to continue leveraging their expertise in thermal separation processes, focusing on enhancing energy efficiency and reducing operational costs for clients.

SPX FLOW and Sulzer are poised to strengthen their positions through strategic acquisitions and partnerships, expanding their presence in emerging markets. Their emphasis on modular and scalable distillation solutions is expected to resonate well with the growing demand for customized systems in the chemical and pharmaceutical sectors.

Core Laboratories and Anton Paar are likely to maintain their focus on precision and analytical distillation systems, catering to niche applications in oil and gas as well as research laboratories. These companies are expected to benefit from the rising need for advanced analytical tools in quality control and product development.

Meanwhile, Praj Industries and L&T Hydrocarbon Engineering are anticipated to play crucial roles in the bioethanol and petrochemical sectors, respectively. Their expertise in large-scale distillation projects and sustainable technologies is expected to align with the global push toward cleaner and more efficient energy production.

Emerging players like PILODIST and EPIC Modular Process Systems may focus on innovation and agility, targeting specific market segments with specialized offerings. Overall, the competitive landscape in 2024 will likely be characterized by a blend of technological innovation, strategic partnerships, and a strong emphasis on sustainability.

Market Key Players

- GEA

- Alfa Laval

- SPX FLOW

- Sulzer

- Core Laboratories

- PILODIST

- Anton Paar

- Praj Industries

- L&T Hydrocarbon Engineering

- EPIC Modular Process Systems

- BÜFA Composite System

- Bosch Packaging Technology.

- FENIX Process Technologies Pvt.Ltd.

- Kevin Enterprises Pvt. Ltd.

- HAT International Ltd.

- Tianjin Univtech Co. Ltd.

- Core Laboratories

Recent Development

- In July 2024, Alfa Laval announced the launch of a new range of energy-efficient distillation systems aimed at reducing energy consumption by up to 30%. The new system, named AlfaLaval DistilX, integrates advanced heat recovery technology, which is expected to enhance the company's market position in sustainable solutions.

- In June 2024, GEA Group unveiled its latest modular distillation system designed for the pharmaceutical and chemical industries. The new system, GEA PharmaDistil, emphasizes high purity and efficiency, making it ideal for producing active pharmaceutical ingredients (APIs) and fine chemicals.

- In May 2024, Thermo Fisher Scientific expanded its distillation system offerings by acquiring a leading distillation technology firm, PureTech Distillers, for $200 million. This acquisition is expected to strengthen Thermo Fisher's capabilities in providing advanced distillation solutions for the biopharmaceutical sector.

Report Scope

Report Features Description Market Value (2023) USD 7.8 Billion Forecast Revenue (2033) USD 13.0 Billion CAGR (2024-2032) 5.4% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Column Shells, Plates & Packings, Reboilers & Heaters, Condensers, Others), By End-use (Petroleum & Biorefinery, Water Treatment, Pharmaceuticals, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape GEA, Alfa Laval, SPX FLOW, Sulzer, Core Laboratories, PILODIST, Anton Paar, Praj Industries, L&T Hydrocarbon Engineering, EPIC Modular Process Systems, BÜFA Composite System, Bosch Packaging Technology., FENIX Process Technologies Pvt.Ltd., Kevin Enterprises Pvt. Ltd., HAT International Ltd., Tianjin Univtech Co. Ltd., Core Laboratories Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- GEA

- Alfa Laval

- SPX FLOW

- Sulzer

- Core Laboratories

- PILODIST

- Anton Paar

- Praj Industries

- L&T Hydrocarbon Engineering

- EPIC Modular Process Systems

- BÜFA Composite System

- Bosch Packaging Technology.

- FENIX Process Technologies Pvt.Ltd.

- Kevin Enterprises Pvt. Ltd.

- HAT International Ltd.

- Tianjin Univtech Co. Ltd.

- Core Laboratories