Diethyl Phthalate Market By Type (Industrial Grade, Cosmetic Grade), By Purity (High Purity, Ultra-high Purity), By Application (Blinder, Plasticizer, Solvent, Cosmetic Ingredient, Alcohol Denaturant, Others), By End User (Cosmetic & Personal Care, Plastics & Polymers, Surfactants, Agrochemicals, Paints, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

50005

-

August 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

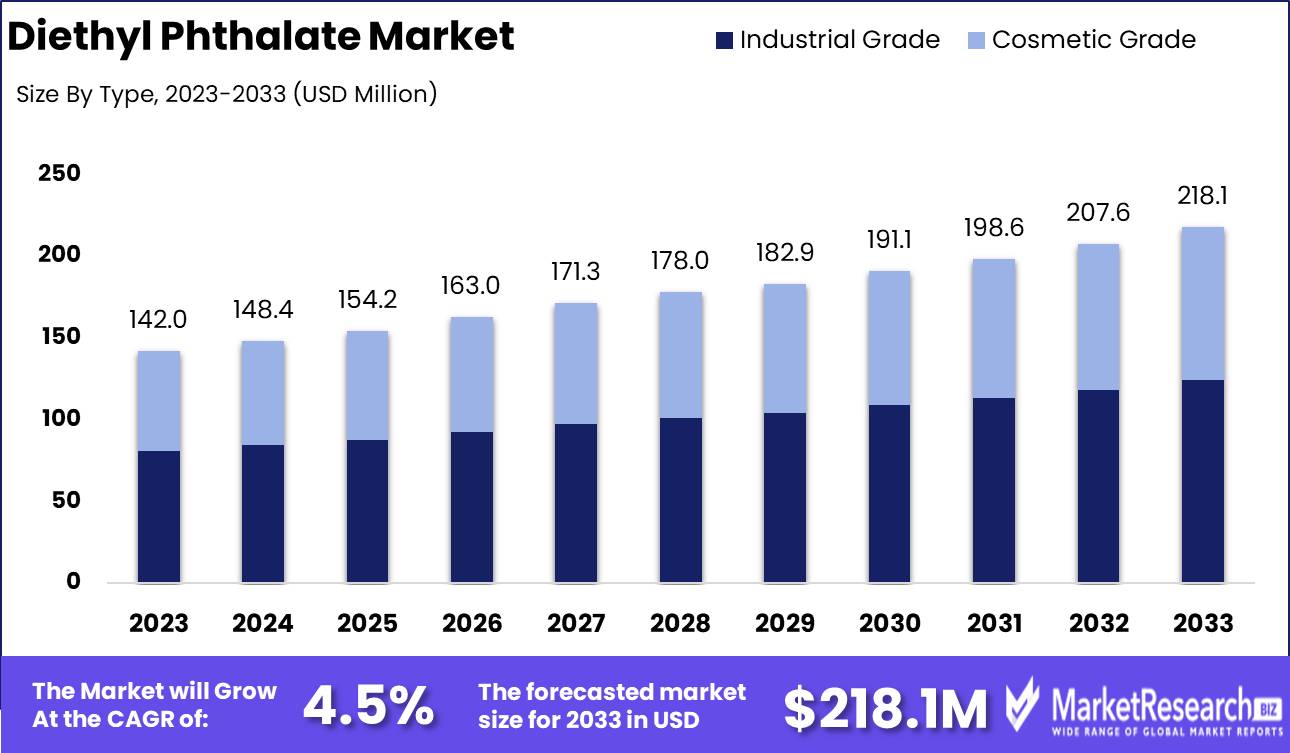

The Diethyl Phthalate Market was valued at USD 142.0 million in 2023. It is expected to reach USD 218.1 million by 2033, with a CAGR of 4.5% during the forecast period from 2024 to 2033.

The Diethyl Phthalate (DEP) market encompasses the production, distribution, and utilization of DEP, a phthalate ester commonly used as a plasticizer in the manufacturing of plastics and resins. This market is driven by DEP’s widespread applications in consumer goods, cosmetics, pharmaceuticals, and industrial processes, where it imparts flexibility, durability, and longevity to various products.

The Diethyl Phthalate (DEP) market is poised for significant growth, driven by its increasing application in various industries. A primary catalyst is the burgeoning demand in personal care and cosmetics, where DEP is utilized as a solvent and fixative in fragrances and skincare products. This demand is fueled by rising consumer expenditure on personal grooming and an expanding middle-class population in emerging economies. Additionally, DEP’s role in plastics and resins has expanded, particularly in the production of flexible packaging materials and coatings.

However, the market faces regulatory constraints due to health and environmental concerns associated with phthalates, leading to stringent regulations in North America and Europe. Despite these challenges, the market is witnessing innovative product development as manufacturers seek to create safer, more environmentally friendly alternatives. Technological advancements in production processes are also enhancing efficiency and reducing costs, further supporting market growth.

Furthermore, companies are increasingly focusing on R&D to develop non-toxic and biodegradable substitutes, responding to regulatory pressures and growing consumer awareness about sustainability. This trend towards greener alternatives is expected to shape the future landscape of the DEP market. The interplay between regulatory dynamics and technological innovation will be crucial in determining market trajectories. Companies that can navigate these regulatory challenges while leveraging technological advancements and innovative product development are likely to emerge as market leaders. In conclusion, while regulatory constraints present significant hurdles, the DEP market is expected to sustain its growth momentum through strategic innovations and the adoption of advanced technologies, catering to the evolving demands of various end-use industries.

Key Takeaways

- Market Growth: The Diethyl Phthalate Market was valued at USD 142.0 million in 2023. It is expected to reach USD 218.1 million by 2033, with a CAGR of 4.5% during the forecast period from 2024 to 2033.

- By Type: Industrial Grade DEP dominated due to extensive industrial applications.

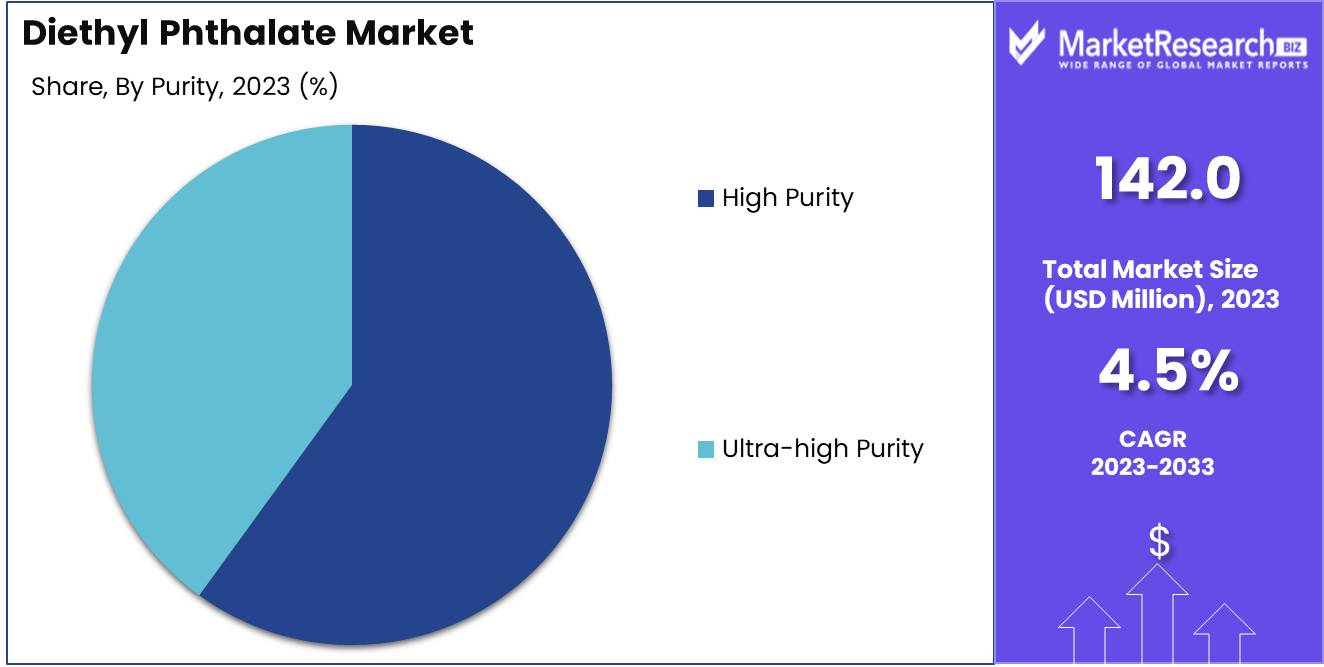

- By Purity: High Purity diethyl phthalate dominated due to stringent industry standards.

- By Application: The Plasticizer segment dominated the Diethyl Phthalate market.

- By End User: Cosmetic & Personal Care dominated the Diethyl Phthalate market.

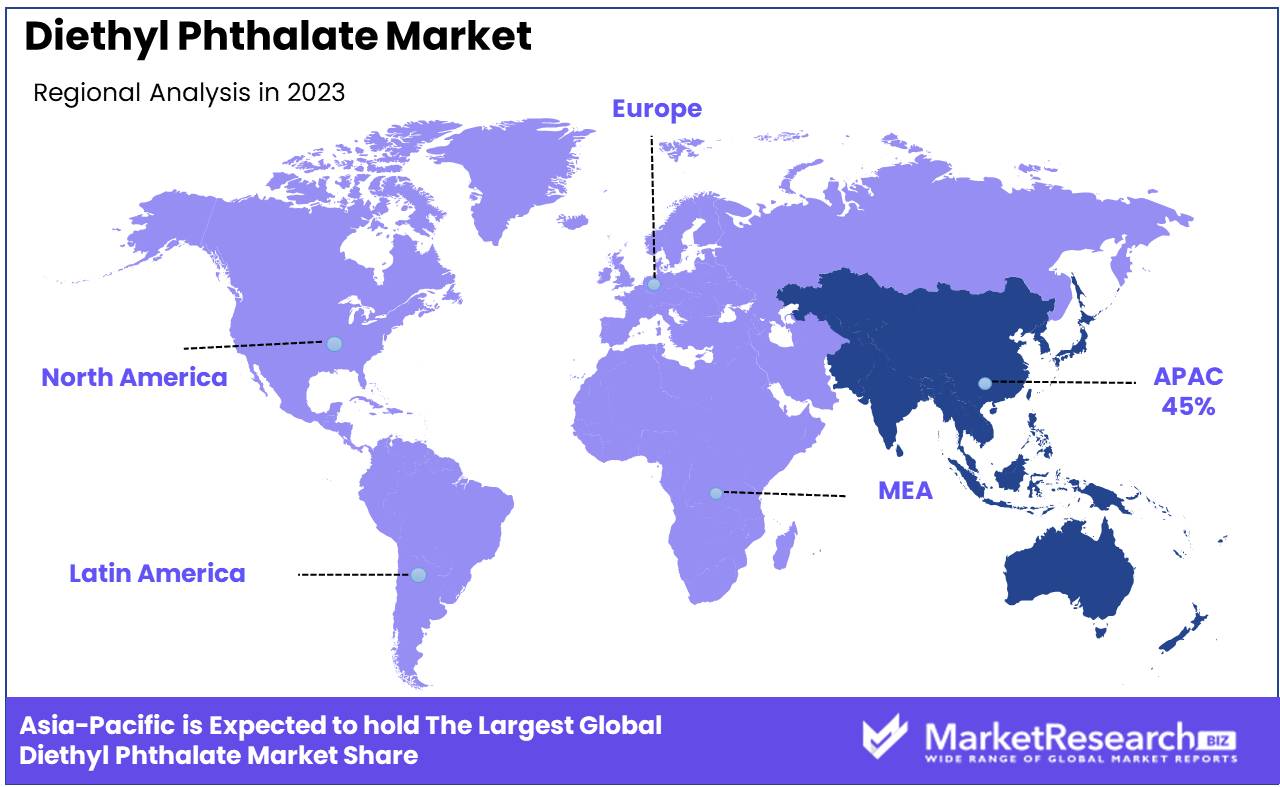

- Regional Dominance: Asia Pacific dominates the Diethyl Phthalate market, holding over a 45% largest share.

- Growth Opportunity: The global DEP market is poised for robust growth, driven by rising demand from the plastic and polymer industry and the expanding packaging sector.

Driving factors

Increasing Consumption of Cosmetics and Personal Care Products

The cosmetics and personal care industry is experiencing significant growth, propelled by rising consumer awareness about personal grooming and hygiene. Diethyl phthalate (DEP) plays a crucial role in this sector as a solvent and fixative in fragrances, ensuring longevity and consistency of scents in various products such as perfumes, deodorants, and lotions. According to market data, the global cosmetics market is projected to grow at a CAGR of 5.3% from 2021 to 2028, significantly boosting the demand for DEP.

The increasing disposable income and changing lifestyles in emerging economies further amplify this trend, driving the adoption of DEP in formulations aimed at diverse consumer segments. This robust growth in the cosmetics and personal care market directly translates into heightened demand for DEP, solidifying its position as an indispensable component in the formulation of high-quality personal care products.

Rising Demand from the Plastic Industry

The plastic industry’s expansion significantly contributes to the growth of the diethyl phthalate market. DEP is extensively used as a plasticizer to enhance the flexibility, durability, and longevity of various plastic products, particularly in polyvinyl chloride (PVC) applications. The global plastic market, expected to reach USD 721.14 billion by 2027, grows at a robust CAGR of 3.2% from 2020, reflecting increasing applications in packaging, construction, automotive, and electronics industries. This surge in demand for flexible and durable plastic materials directly correlates with the heightened need for DEP.

Additionally, the push towards more sustainable and high-performance materials further cements DEP’s role, as manufacturers seek to meet stringent quality and performance standards. The integration of DEP in plastic manufacturing processes not only enhances product quality but also supports industry-wide innovation and material advancements.

Adoption in Modern Agricultural Techniques

The adoption of modern agricultural techniques is another critical driver for the diethyl phthalate market. DEP is utilized in the formulation of pesticides and insecticides, where it acts as an effective carrier solvent, ensuring the stability and efficacy of active ingredients. The global agricultural adjuvants market is projected to grow at a CAGR of 5.1% from 2021 to 2026, underpinned by the increasing need for efficient crop protection solutions. As the agricultural sector strives to meet the growing food demand driven by a burgeoning global population, the use of advanced chemical formulations becomes imperative. DEP’s role in enhancing the effectiveness of agrochemical products supports higher crop yields and improved pest management, thereby contributing to overall agricultural productivity. The integration of DEP in modern agricultural practices exemplifies its importance in achieving sustainable and efficient farming operations.

Restraining Factors

Raw Material Price Volatility: A Key Constraint on Diethyl Phthalate Market Growth

Raw material price volatility significantly hampers the growth of the Diethyl Phthalate (DEP) market. Diethyl phthalate is primarily derived from petrochemicals, which are subject to fluctuating prices due to variations in crude oil prices, geopolitical instability, and shifts in supply and demand dynamics. This volatility affects production costs, making it challenging for manufacturers to maintain stable pricing structures, ultimately impacting their profitability and competitive positioning.

For instance, a surge in crude oil prices can lead to increased costs for petrochemical derivatives, thereby elevating the overall cost of DEP production. This, in turn, can result in higher prices for end-users, such as manufacturers in the plasticizers, cosmetics, and personal care industries, potentially leading to reduced demand. The unpredictable nature of raw material costs necessitates robust risk management strategies and may drive manufacturers to seek alternative materials or suppliers, which can further complicate production processes and supply chain logistics.

Moreover, price instability can deter new entrants into the market due to the heightened financial risk, thus limiting market expansion. Companies are often forced to allocate significant resources to hedge against price fluctuations, diverting funds that could otherwise be invested in innovation or capacity expansion.

Technological Advancements: A Double-Edged Sword for Diethyl Phthalate Market Development

Technological advancements present both opportunities and challenges for the Diethyl Phthalate market. On one hand, innovations in production processes can enhance efficiency, reduce costs, and improve product quality. For example, advancements in chemical engineering and process optimization can lead to more efficient manufacturing techniques, reducing waste and energy consumption, which can lower overall production costs and make DEP more competitive against alternative materials.

However, these technological advancements also pose significant threats to the market. The development of new, more environmentally friendly plasticizers and alternative materials, driven by regulatory pressures and growing environmental concerns, can reduce the demand for traditional plasticizers like DEP. For instance, the rise of bio-based plasticizers, which offer similar performance characteristics without the associated environmental and health risks, is gaining traction. As companies and consumers become more environmentally conscious, the shift towards sustainable alternatives is likely to accelerate, further diminishing the market share of DEP.

By Type Analysis

In 2023, Industrial-grade DEP dominated due to extensive industrial applications.

In 2023, Industrial-grade diethyl phthalate (DEP) held a dominant market position in the "By Type" segment of the Diethyl Phthalate Market. This dominance can be attributed to its extensive applications across multiple industries such as plastics manufacturing, automotive, and industrial coatings. Industrial Grade DEP is favored for its efficacy as a plasticizer, enhancing the flexibility and durability of materials, which is crucial for heavy-duty applications. Its superior performance in withstanding extreme temperatures and chemical exposures further cements its preference in these sectors.

Conversely, Cosmetic Grade DEP, while significant, caters primarily to the personal care and cosmetics industry. This grade is utilized for its role in enhancing the texture and longevity of products such as perfumes and skincare items. Despite the cosmetic sector's growth, the broader and more diverse application of industrial-grade DEP across critical industrial domains underpins its leading market share. The robust demand from industrial applications ensures that industrial-grade DEP remains the predominant segment, driven by ongoing industrialization and the need for high-performance materials.

By Purity Analysis

In 2023, High Purity diethyl phthalate dominated due to stringent industry standards.

In 2023, High Purity diethyl phthalate held a dominant market position in the "By Purity" segment of the Diethyl Phthalate Market. This can be attributed to its widespread application in the manufacturing of plastics, coatings, and personal care products, where stringent purity standards are essential for product performance and safety. High Purity diethyl phthalate ensures minimal impurities, making it ideal for sensitive applications that demand consistent quality and regulatory compliance. Its dominance is further reinforced by robust demand from industries requiring high-grade materials to meet specific industry norms and consumer expectations. The superior attributes of High Purity diethyl phthalate, such as its excellent solubility and low volatility, contribute to its extensive adoption.

Ultra-high Purity diethyl phthalate, while also important, caters to niche markets where ultra-stringent purity levels are critical, such as in pharmaceuticals and specialized coatings. Despite its smaller market share compared to High Purity, the Ultra-high Purity segment is growing steadily, driven by advancements in manufacturing technologies and increasing regulatory standards. Both segments collectively highlight the importance of purity levels in diethyl phthalate applications, reflecting a nuanced market landscape where quality and compliance drive market dynamics.

By Application Analysis

In 2023, The Plasticizer segment dominated the Diethyl Phthalate market.

In 2023, The Plasticizer segment held a dominant market position in the Diethyl Phthalate market. As a key plasticizer, Diethyl Phthalate is extensively used to enhance the flexibility and durability of plastics, particularly in polyvinyl chloride (PVC) products. This application segment benefits from the rising demand for flexible PVC in various industries, including construction, automotive, and consumer goods. The plasticizer’s ability to improve the performance and lifespan of plastic products makes it a preferred choice among manufacturers, driving its significant market share. Additionally, regulatory frameworks supporting the use of safer and more efficient plasticizers further bolster its adoption.

The Solvent segment also plays a critical role, leveraging Diethyl Phthalate’s excellent solubility properties in various applications. It is widely used in the production of coatings, inks, and adhesives, where its ability to dissolve other substances effectively is crucial. The growing industrial demand for high-performance solvents is driving the segment’s expansion. Meanwhile, the Cosmetic Ingredient segment benefits from the increasing consumer preference for high-quality personal care products. Diethyl Phthalate is valued for its role in enhancing the texture and consistency of cosmetics, contributing to a growing market share.

The Alcohol Denaturant segment utilizes Diethyl Phthalate to render alcohol unfit for consumption, a necessary process in various industrial and consumer applications. Finally, the Others segment encompasses diverse uses, including its application as a fixative in perfumes and an additive in various formulations, reflecting its versatility and wide-ranging utility in the market. Each of these segments underscores Diethyl Phthalate’s multifaceted applications and their respective growth trajectories within the broader market context.

By End User Analysis

In 2023, Cosmetic & Personal Care dominated the Diethyl Phthalate market.

In 2023, The Cosmetic & Personal Care segment held a dominant market position in the Diethyl Phthalate (DEP) Market, primarily driven by its extensive use as a solvent and fixative in perfumes, lotions, and other personal care products. The segment's growth is underpinned by increasing consumer demand for premium and diverse cosmetic products, which has led manufacturers to prioritize DEP for its stability and effectiveness in enhancing product longevity. Moreover, the rising awareness of grooming and self-care, particularly in emerging markets, has significantly contributed to the segment's expansion.

The Diethyl Phthalate Market is segmented by end users into six key categories: Cosmetic & Personal Care, Plastics & Polymers, Surfactants, Agrochemicals, Paints, and Others. The Plastics & Polymers segment benefits from DEP's role as a plasticizer, enhancing the flexibility and durability of plastic products. In the Surfactants segment, DEP is valued for its ability to improve the efficiency and performance of detergents and cleaning agents.

The Agrochemicals segment leverages DEP as a carrier solvent in pesticides, ensuring effective application and adherence of active ingredients. In the Paints segment, DEP is utilized to enhance the paint's spreadability and finish quality. The 'Others' category encompasses various niche applications, including lubricants, and coatings, where DEP's versatile properties are leveraged. Each segment's growth trajectory is shaped by unique industry dynamics and regulatory frameworks, driving the overall demand for DEP in diverse industrial applications.

Key Market Segments

By Type

- Industrial Grade

- Cosmetic Grade

By Purity

- High Purity

- Ultra-high Purity

By Application

- Blinder

- Plasticizer

- Solvent

- Cosmetic Ingredient

- Alcohol Denaturant

- Others

By End User

- Cosmetic & Personal Care

- Plastics & Polymers

- Surfactants

- Agrochemicals

- Paints

- Others

Growth Opportunity

Rising Demand from the Plastic and Polymer Industry

The global diethyl phthalate (DEP) market is set to experience significant growth, driven primarily by increasing demand from the plastic and polymer industry. DEP, a versatile plasticizer, enhances the flexibility and durability of plastics, making it indispensable in various applications. The burgeoning plastic industry, particularly in emerging economies, is a key driver. As industries shift towards more durable and flexible plastic products, DEP usage is expected to rise. Furthermore, technological advancements in polymer production are likely to expand DEP applications, fostering market growth. The global plastic market's expansion, projected to reach $580 billion by 2027, underscores the substantial opportunities for DEP.

Expansion of the Packaging Industry

Another critical growth opportunity for the DEP market lies in the expansion of the packaging industry. The increasing demand for flexible and durable packaging solutions in sectors such as food and beverages, personal care, and pharmaceuticals is propelling the need for effective plasticizers like DEP. The global packaging market is expected to grow at a CAGR of 5.6%, reaching $1.2 trillion by 2028. This growth is attributed to the rising e-commerce sector and the need for extended product shelf-life, both of which DEP facilitates through its plasticizing properties. The shift towards sustainable and efficient packaging solutions further bolsters DEP demand, presenting lucrative opportunities for market players.

Latest Trends

Increased Demand for Cosmetics

The Diethyl Phthalate (DEP) market is projected to witness significant growth largely driven by increased demand in the cosmetics industry. DEP is widely utilized as a solvent and fixative in various personal care products, including perfumes, lotions, and hair sprays. As consumer preferences shift towards higher-quality and long-lasting cosmetic products, the demand for DEP is expected to rise. Additionally, the expanding middle-class population in emerging economies is fueling the consumption of cosmetics, further propelling the market. The robust growth of the cosmetics sector, particularly in Asia Pacific and North America, underscores the critical role of DEP in meeting industry requirements for product stability and performance.

Environmental Regulations

Despite the positive market outlook, the Diethyl Phthalate market faces challenges due to stringent environmental regulations. Governments and regulatory bodies across Europe and North America are increasingly scrutinizing the use of phthalates due to their potential health and environmental impacts. These regulations are prompting manufacturers to seek alternative plasticizers and solvents, which could hinder market growth. However, this also presents an opportunity for innovation in developing eco-friendly substitutes that comply with regulatory standards. Companies investing in research and development to create sustainable and non-toxic alternatives are likely to gain a competitive edge in the market.

Regional Analysis

Asia Pacific dominates the Diethyl Phthalate market, holding over a 45% largest share.

The Diethyl Phthalate (DEP) market exhibits significant regional variances driven by industrial applications, regulatory frameworks, and economic conditions. In North America, the DEP market is bolstered by the robust cosmetics and personal care industries, with the region accounting for approximately 20% of global consumption. Stringent environmental regulations and a shift towards non-phthalate plasticizers could moderate growth here. Europe, similarly influenced by regulatory standards, shows a steady demand in the automotive and electronics sectors, contributing to around 18% of the market. The region's stringent REACH regulations push manufacturers towards safer alternatives, affecting DEP's growth trajectory.

Asia Pacific dominates the DEP market, holding over 45% of the global share. This dominance is attributed to rapid industrialization, substantial growth in the packaging, textiles, and personal care sectors, and comparatively lenient regulatory environments. China and India are pivotal players due to their expanding manufacturing bases and significant investments in infrastructure and consumer goods production.

The Middle East & Africa and Latin America, collectively contributing to about 17% of the market, exhibit moderate growth influenced by the increasing use of DEP in emerging manufacturing sectors. However, economic instability and fluctuating regulatory policies in these regions present both opportunities and challenges for market expansion.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Diethyl Phthalate (DEP) market in 2024 is poised for dynamic growth, driven by the strategic initiatives of several key industry players. BASF SE and ExxonMobil Chemical remain at the forefront due to their extensive R&D investments and strong distribution networks, ensuring they capitalize on emerging opportunities and maintain market leadership. Eastman Chemical Company and LG Chem are also critical players, leveraging advanced production technologies to enhance product quality and operational efficiencies, thus expanding their market share.

Farinia Group and Aekyung Petrochemical are noteworthy for their regional dominance and innovative approaches to sustainable practices, addressing the growing demand for environmentally friendly plasticizers. UPC Technology and Teknor Apex Company focus on diversified product portfolios and strategic partnerships, bolstering their positions in various end-user industries such as automotive and consumer goods.

The KLJ Group and Jayfle Plasticizers continue to innovate within niche markets, emphasizing product customization to meet specific client needs, thereby driving customer loyalty and retention. Mitsubishi Chemical Corporation and Nan Ya Plastics Corporation, Ltd. benefit from their integrated value chains, providing them with a competitive edge in cost management and supply chain resilience.

Polynt SpA and Jiangsu Lemon Chemical & Technology Co., Ltd. are investing in capacity expansions to meet the escalating demand, particularly in the Asia-Pacific region. Vertellus Holdings LLC focuses on sustainability and regulatory compliance, positioning itself as a reliable partner for environmentally conscious clients. Collectively, these companies' strategic maneuvers and technological advancements are pivotal in shaping the global DEP market's trajectory.

Market Key Players

- BASF SE

- ExxonMobil Chemical

- Eastman Chemical Company

- LG Chem

- Farinia Group

- Aekyung Petrochemical

- UPC Technology

- Teknor Apex Company

- KLJ Group

- Jayfle Plasticizers

- Mitsubishi Chemical Corporation

- Nan Ya Plastics Corporation, Ltd.

- Polynt SpA

- Jiangsu Lemon Chemical & Technology Co., Ltd.

- Vertellus Holdings LLC

Recent Development

In May 2024, Merck KGaA announced an investment in research and development to explore new applications for Diethyl Phthalate in the pharmaceutical and personal care industries. This initiative is part of Merck's strategy to diversify its product offerings and leverage DEP's properties in new, innovative ways.

In March 2024, Eastman Chemical Company introduced a new eco-friendly alternative to Diethyl Phthalate. This new product aims to provide similar functional benefits while reducing environmental impact, aligning with the company's sustainability goals and the increasing regulatory pressures on phthalate use.

In February 2024, BASF SE announced the expansion of its production capacity for Diethyl Phthalate at its Ludwigshafen site in Germany. This move is aimed at meeting the growing demand for DEP in various industrial applications, including its use as a plasticizer in the manufacturing of plastics and resins.Report Scope

Report Features Description Market Value (2023) USD 142.0 Million Forecast Revenue (2033) USD 218.1 Million CAGR (2024-2032) 4.5% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Industrial Grade, Cosmetic Grade), By Purity (High Purity, Ultra-high Purity), By Application (Blinder, Plasticizer, Solvent, Cosmetic Ingredient, Alcohol Denaturant, Others), By End User (Cosmetic & Personal Care, Plastics & Polymers, Surfactants, Agrochemicals, Paints, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape BASF SE, ExxonMobil Chemical, Eastman Chemical Company, LG Chem, Farinia Group, Aekyung Petrochemical, UPC Technology, Teknor Apex Company, KLJ Group, Jayfle Plasticizers, Mitsubishi Chemical Corporation, Nan Ya Plastics Corporation, Ltd., Polynt SpA, Jiangsu Lemon Chemical & Technology Co., Ltd., Vertellus Holdings LLC Customization Scope Customization for segments at the regional/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- BASF SE

- ExxonMobil Chemical

- Eastman Chemical Company

- LG Chem

- Farinia Group

- Aekyung Petrochemical

- UPC Technology

- Teknor Apex Company

- KLJ Group

- Jayfle Plasticizers

- Mitsubishi Chemical Corporation

- Nan Ya Plastics Corporation, Ltd.

- Polynt SpA

- Jiangsu Lemon Chemical & Technology Co., Ltd.

- Vertellus Holdings LLC