Conductive Inks Market By Product (Conductive Silver Ink, Conductive Copper Ink, Conductive Polymers, Carbon Nanotube Ink, , Carbon/Graphene Ink, Others), By Application (Photovoltaic, Membrane Switches, Displays, Automotive, Smart Packaging, Biosensors, Printed Circuit Boards, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

48378

-

July 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

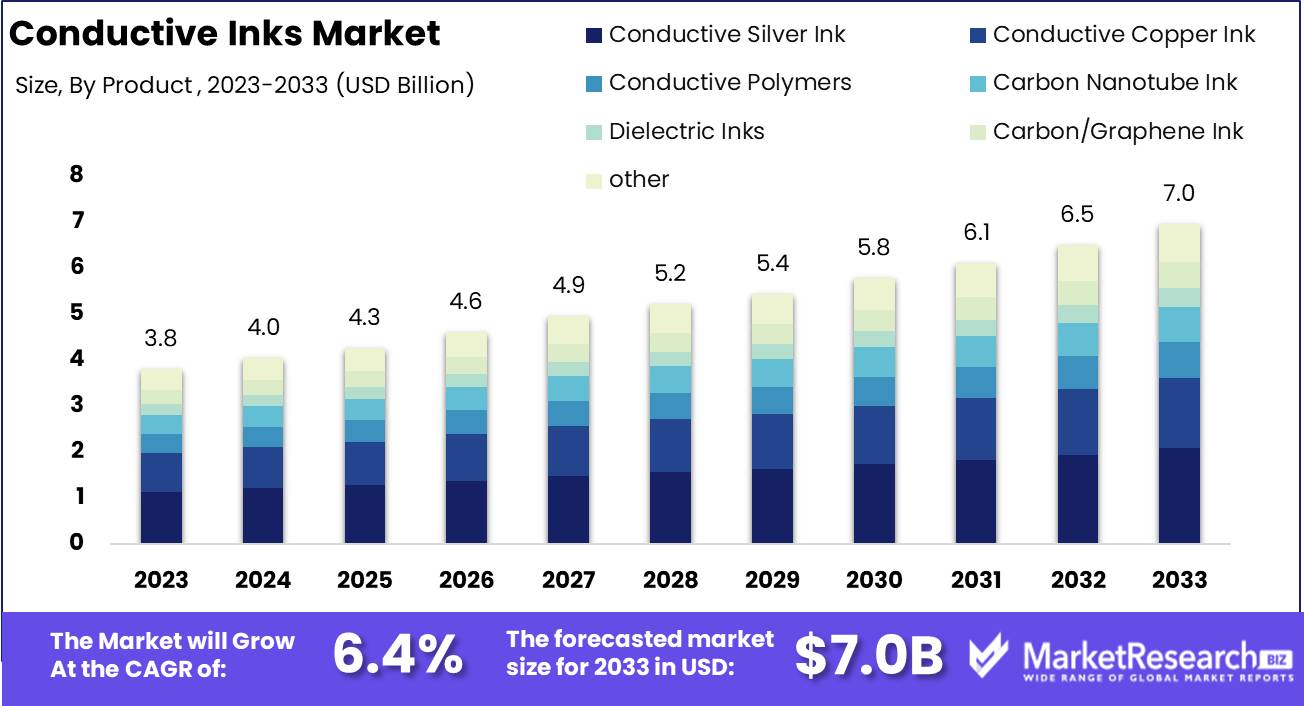

The Conductive Inks Market was valued at USD 3.8 billion in 2023. It is expected to reach USD 7.0 billion by 2033, with a CAGR of 6.4% during the forecast period from 2024 to 2033.

The Conductive Inks Market refers to the industry focused on the development, production, and application of inks that conduct electricity. These specialized inks, typically composed of materials such as silver, carbon, or copper, enable the creation of electronic circuits on flexible substrates, facilitating advancements in printed electronics, touchscreens, RFID tags, and solar panels. This market is driven by the increasing demand for lightweight, cost-effective, and flexible electronic components across various sectors, including consumer electronics, automotive, healthcare, and energy.

The global conductive inks market is poised for significant growth, driven by several key factors. Technological advancements in material science have notably enhanced the performance and cost-efficiency of conductive inks, making them more attractive to a broader range of industries. Notably, the burgeoning demand for flexible electronics, including wearable devices, flexible displays, and advanced sensors, has been a pivotal driver of this market expansion. These applications demand materials that can conform to various shapes and endure mechanical stress while maintaining optimal electrical performance, attributes that conductive inks are increasingly meeting through innovative formulations.

However, the market also faces notable challenges, particularly regarding the technological limitations of alternative materials like copper and carbon. These materials, while cheaper, often fall short in terms of conductivity and durability compared to silver-based inks, which remain the industry standard despite their higher costs. The development of nanomaterials offers a promising avenue to address these issues. By leveraging nanotechnology, manufacturers can enhance the performance characteristics of conductive inks, potentially reducing costs and improving both conductivity and longevity.

As such, the ongoing research and development in nanomaterials are expected to play a crucial role in overcoming current limitations and driving future growth in the conductive inks market. This strategic insight underscores the importance of continued investment in R&D to maintain competitive advantage and meet the evolving demands of high-growth sectors such as flexible electronics.

Key Takeaways

- Market Growth: The Conductive Inks Market was valued at USD 3.8 billion in 2023. It is expected to reach USD 7.0 billion by 2033, with a CAGR of 6.4% during the forecast period from 2024 to 2033.

- By Product: Conductive Silver Ink dominated the diverse conductive ink market.

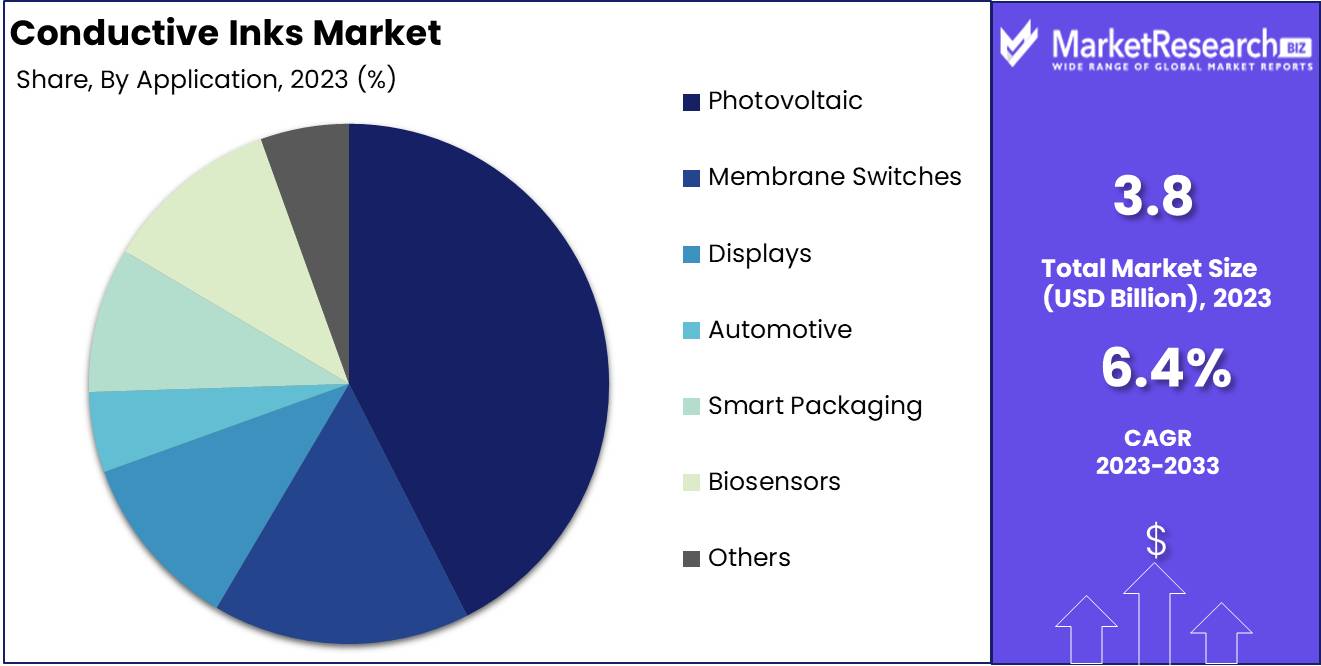

- By Application: Photovoltaic Application dominated the conductive ink market by application.

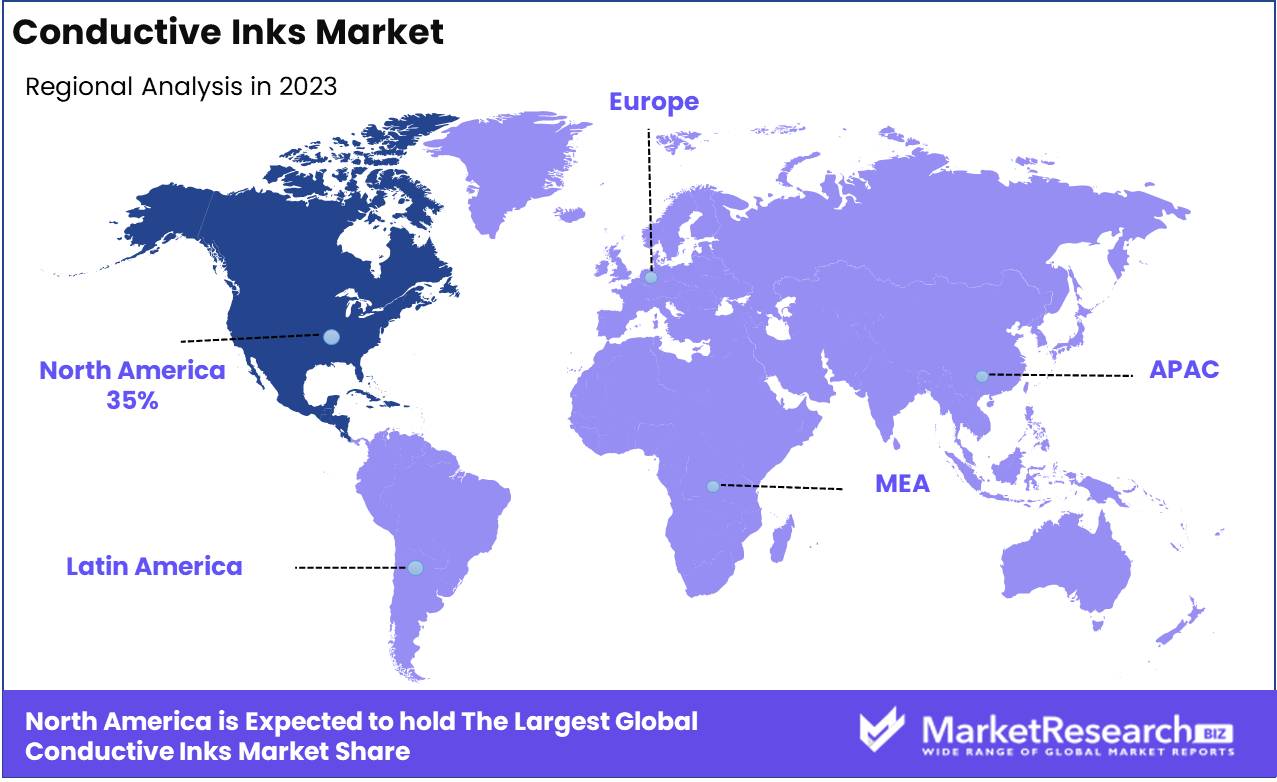

- Regional Dominance: North America leads the conductive inks market at 35%, driving global growth.

- Growth Opportunity: The global conductive inks market will thrive, driven by advances in photovoltaics and biosensors, necessitating strategic investments.

Driving factors

Growing Demand for Printed Electronics: A Catalyst for Conductive Inks Market Expansion

The escalating demand for printed electronics is a pivotal driver for the conductive Inks market. Printed electronics, encompassing applications such as flexible displays, sensors, photovoltaic cells, and wearable devices, leverage conductive inks for their essential conductive pathways. According to industry reports, the printed electronics market is projected to reach USD 19.6 billion by 2025, growing at a CAGR of 13.6% from 2020. This surge is largely attributable to the advantages of printed electronics, including cost-effectiveness, lightweight, flexibility, and the potential for large-area manufacturing.

Conductive inks play a crucial role in these applications by providing the necessary electrical conductivity while maintaining the flexibility and lightweight characteristics of the printed components. Silver-based conductive inks, for example, are extensively used in photovoltaic cells and RFID antennas due to their high conductivity and stability. The innovation in printed electronics demands inks that can deliver reliable performance at a lower cost, driving continuous advancements and adoption in the conductive Inks market.

Expansion of the RFID Market: Boosting Demand for High-Performance Conductive Inks

The RFID market's rapid expansion significantly bolsters the growth of the conductive inks market. RFID technology, which is integral to inventory management, logistics, supply chain operations, and contactless payment systems, relies heavily on conductive inks for the production of RFID antennas.

Conductive inks are essential in this domain as they provide a cost-effective solution for printing RFID antennas on a variety of substrates, including paper, plastic, and textiles. The ongoing improvements in the performance and durability of conductive inks have enabled the production of more efficient and reliable RFID tags, thereby supporting the RFID market's growth. This symbiotic relationship enhances the demand for advanced conductive inks that can meet the stringent requirements of RFID technology.

Advancements in Conductive Ink Technologies: Enabling New Applications and Market Growth

Technological advancements in conductive inks are at the forefront of market growth, driving innovation and expanding application possibilities. Significant progress in the formulation and processing of conductive inks has led to the development of products with improved conductivity, flexibility, and environmental stability. Innovations such as nano-silver inks, copper-based inks, and carbon-based inks have broadened the scope of conductive inks, enabling their use in diverse and high-performance applications.

Nano-silver inks, for instance, offer superior conductivity and can be processed at lower temperatures, making them suitable for flexible and wearable electronics. Copper-based inks, known for their cost-effectiveness compared to silver, are gaining traction in applications where cost is a critical factor. Carbon-based inks, including graphene and carbon nanotube inks, provide unique properties such as high mechanical strength and flexibility, which are essential for emerging applications in flexible electronics and smart textiles.

Restraining Factors

High-End Technology Requirements Restrict Market Penetration

The conductive ink market is heavily reliant on advanced technologies for both production and application. The need for high-end technologies serves as a significant barrier to entry and expansion, particularly for new entrants and smaller firms. High-precision printing techniques, such as inkjet and screen printing, and sophisticated formulations are essential to produce inks that meet the required conductivity, adhesion, and durability standards. These technological requirements necessitate substantial capital investment in R&D and production facilities, which can deter potential market players and limit the overall market growth.

Moreover, the integration of conductive inks into complex electronic devices and circuits demands a high degree of technical expertise and precision, further amplifying the dependency on advanced technologies. This technological barrier can slow down innovation and delay time-to-market for new products, ultimately stifling market growth.

Inferior Properties of Alternative Metals Undermine Substitution Efforts

The market for conductive inks primarily leverages metals such as silver and copper due to their excellent electrical conductivity and stability. However, the properties of alternative metals, such as aluminum and nickel, are often inferior in comparison. These alternative metals generally exhibit lower conductivity, higher oxidation resistance, and reduced flexibility, making them less suitable for high-performance applications.

The reliance on superior metals like silver and copper, which are more expensive and subject to price volatility, also contributes to market constraints. Silver, for instance, commands a significant price premium over other metals, which directly impacts the cost structure of conductive inks. Despite the higher costs, the industry continues to favor silver due to its unparalleled conductive properties, which are crucial for maintaining the performance standards of electronic devices.

By Product Analysis

In 2023, Conductive Silver Ink dominated the diverse conductive ink market.

In 2023, Conductive Silver Ink held a dominant market position in the By Product segment of the Conductive Inks Market. This supremacy can be attributed to its superior electrical conductivity, stability, and compatibility with a wide range of substrates, making it the preferred choice across various high-performance applications. Conductive Copper Ink, while offering a cost-effective alternative to silver, faced challenges due to oxidation and lower conductivity levels.

Conductive Polymers gained traction in flexible and wearable electronics due to their flexibility and ease of processing, although they lagged behind in conductivity compared to metal-based inks. Carbon Nanotube Ink, known for its exceptional electrical and thermal properties, found niche applications in advanced electronics but struggled with high production costs and integration complexities. Dielectric Inks, essential for creating insulating layers in electronic devices, maintained steady demand, driven by the miniaturization of electronics.

Carbon/Graphene Ink emerged as a promising contender, offering high conductivity and mechanical strength, yet its market penetration was hindered by scalability issues. Lastly, the 'Others' category encompassed a variety of emerging and experimental inks, reflecting ongoing innovation and diversification within the conductive inks sector. Together, these segments illustrate a dynamic and evolving market, driven by technological advancements and diverse application requirements.

By Application Analysis

In 2023, Photovoltaic Application dominated the conductive inks market by application.

In 2023, The Photovoltaic Application Segment held a dominant market position in the conductive inks market by application. This leadership can be attributed to the rapid advancements and increased adoption of solar energy technologies. Conductive inks are essential in the production of photovoltaic cells, enhancing efficiency and reducing costs, thus driving their widespread utilization.

Membrane switches, another significant segment, benefited from their extensive use in consumer electronics and industrial control systems. The display segment witnessed substantial growth due to the rising demand for advanced display technologies in smartphones, televisions, and wearable devices.

In the automotive industry, conductive inks were crucial for developing innovative solutions like touch sensors and printed heaters, which cater to the growing trend of smart and electric vehicles. The smart packaging segment saw increased adoption as brands sought innovative ways to enhance product interaction and security through printed electronics.

Biosensors emerged as a vital application, particularly in medical diagnostics, where conductive inks enabled the development of flexible, cost-effective, and highly sensitive sensors. Printed circuit boards (PCBs), a foundational component in electronics manufacturing, continued to rely heavily on conductive inks for their construction and functionality.

Lastly, other applications, including RFID tags and antennas, also contributed to the robust growth of the conductive inks market, demonstrating the material's versatility and critical role in various high-tech applications.

Key Market Segments

By Product

- Conductive Silver Ink

- Conductive Copper Ink

- Conductive Polymers

- Carbon Nanotube Ink

- Dielectric Inks

- Carbon/Graphene Ink

- Others

By Application

- Photovoltaic

- Membrane Switches

- Displays

- Automotive

- Smart Packaging

- Biosensors

- Printed Circuit Boards

- Others

Growth Opportunity

Robust Growth in Photovoltaics Drives Market Expansion

The global conductive inks market is poised for significant growth, driven primarily by advancements in the photovoltaic industry. Conductive inks are essential in the production of solar cells, as they enable the efficient transfer of electrical current. The increasing demand for renewable energy solutions has spurred investments in photovoltaic technology, which, in turn, propels the conductive inks market. The International Energy Agency (IEA) predicts a robust increase in global solar PV capacity, which is expected to surpass 1,500 GW by 2024. This surge is largely attributed to favorable government policies, technological innovations, and a growing emphasis on sustainable energy sources. Consequently, the demand for high-performance conductive inks is set to rise, presenting substantial opportunities for market players.

Biosensors Revolutionizing Medical Diagnostics and Fueling Market Demand

The burgeoning field of biosensors represents another significant growth opportunity for the global conductive inks market. Biosensors, which utilize conductive inks to detect biological elements, are revolutionizing medical diagnostics, environmental monitoring, and food safety. The global biosensors market is anticipated to reach $29 billion by 2024, driven by advancements in healthcare technologies and the increasing prevalence of chronic diseases. Conductive inks play a critical role in enhancing the sensitivity and reliability of biosensors, making them indispensable in the development of next-generation diagnostic tools. This growing demand for biosensors is expected to substantially boost the conductive inks market.

Latest Trends

Increasing Demand for Miniaturization and Enhanced Connectivity in Electronics

The conductive inks market is poised to experience significant growth driven by the rising demand for miniaturization and enhanced connectivity in electronics. As consumer preferences shift towards smaller, more efficient devices, manufacturers are increasingly turning to conductive inks for their ability to enable fine-line printing and flexible circuit designs. These inks facilitate the production of compact, lightweight components without compromising performance, making them ideal for applications in smartphones, tablets, and other compact electronic devices. The trend towards miniaturization not only enhances device portability but also enables the integration of more functionalities, driving innovation and efficiency in electronic manufacturing.

Growth of IoT Devices and Wearable Technology

Another pivotal trend influencing the conductive inks market is the robust growth of IoT devices and wearable technology. The proliferation of smart home devices, industrial IoT applications, and health monitoring wearables is creating a substantial demand for advanced conductive materials. Conductive inks are crucial in developing flexible, durable, and reliable circuits necessary for these applications. Wearable technology, in particular, benefits from conductive inks' ability to form stretchable and conformable circuits that maintain conductivity under stress. As IoT devices and wearables become more prevalent, the need for innovative conductive ink solutions will escalate, fostering market expansion and technological advancements.

Regional Analysis

North America leads the conductive inks market at 35%, driving global growth.

The conductive inks market exhibits significant regional variation, reflecting the diverse industrial bases and technological advancements across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. North America, with the largest market share of approximately 35%, stands as the dominant region, driven by robust growth in the consumer electronics and automotive sectors. The presence of key players and substantial R&D investments further bolster the market.

Europe follows, contributing around 25%, leveraging its strong automotive and renewable energy sectors, particularly in Germany and the Netherlands. The Asia Pacific region is rapidly emerging, accounting for 30% of the market, propelled by the booming electronics manufacturing industries in China, Japan, and South Korea. This region's growth is fueled by increasing demand for smartphones and wearable devices.

The Middle East & Africa, though nascent, is experiencing steady growth due to rising investments in smart grid technologies and renewable energy projects, particularly in the UAE and South Africa. Latin America, with a market share of approximately 5%, is gradually expanding, driven by Brazil and Mexico's growing electronics and automotive industries. The collective growth across these regions underscores the global expansion and diversification of the conductive inks market.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global conductive inks market in 2024 is poised for significant growth, driven by advancements in printed electronics, photovoltaic cells, and flexible displays. Leading the market are prominent companies such as Applied Nanotech Holdings, Inc., Vorbeck Materials Corporation, and DuPont, each leveraging their extensive R&D capabilities to innovate and refine conductive ink formulations.

DuPont, with its robust portfolio and strong global presence, continues to dominate through its high-performance conductive inks tailored for various applications, from flexible circuits to wearable electronics. Sun Chemical Corporation, renowned for its wide range of printing inks, is capitalizing on its expansive distribution network and technical expertise to enhance product offerings and market reach.

PPG Industries, Inc. and Henkel Ag & Co. KgaA are leveraging their deep chemical expertise to produce conductive inks with superior conductivity and environmental stability, catering to the increasing demand for efficient and durable electronic components. Meanwhile, niche players like Creative Materials Inc. and Poly-Ink are gaining traction by focusing on customized solutions for specialized applications, ensuring a competitive edge through innovation and flexibility.

Technological advancements by companies such as Fujikura Ltd., Heraeus Holding, and Novacentrix are driving market growth, particularly in emerging sectors like 3D printed electronics and advanced energy storage solutions. Collaborative efforts and strategic partnerships among these key players are expected to further accelerate market expansion, fostering a dynamic and competitive landscape in the conductive inks sector.

Market Key Players

- Applied Nanotech Holdings, Inc.

- Vorbeck Materials Corporation

- DuPont

- Sun Chemical Corporation

- PPG Industries, Inc.

- Creative Materials Inc.

- Poly-Ink

- Henkel Ag & Co. KgaA

- PChem Associates, Inc.

- Johnson Matthey Colour Technologies

- Fujikura Ltd.

- Heraeus Holding

- Nagase America Corporation

- Engineered Materials Systems

- Epoxies, Etc

- Voxel8

- Methode Electronics

- Novacentrix

- Johnson Matthey

Recent Development

- In May 2024, Nano Dimension Ltd. acquired Essemtec AG, a Swiss company specializing in adaptive, highly flexible SMT pick-and-place equipment. This acquisition aims to integrate Essemtec's advanced manufacturing solutions with Nano Dimension's conductive inks, improving the efficiency and scalability of printed electronics production for various industrial applications.

- In March 2024, DuPont de Nemours, Inc. announced the expansion of its conductive ink portfolio with a new range of sustainable inks. These inks are developed using environmentally friendly processes and materials, aligning with the company's commitment to sustainability and meeting the increasing regulatory requirements for eco-friendly manufacturing in the electronics industry.

- In January 2024, Henkel AG & Co. KGaA launched a new high-performance conductive ink specifically designed for flexible electronics applications. The innovative ink formulation aims to enhance the durability and conductivity of printed electronic circuits, catering to the growing demand for advanced flexible devices in consumer electronics and healthcare sectors.

Report Scope

Report Features Description Market Value (2023) USD 3.8 Billion Forecast Revenue (2033) USD 13.0 Billion CAGR (2024-2032) 6.4% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Conductive Silver Ink, Conductive Copper Ink, Conductive Polymers, Carbon Nanotube Ink, , Carbon/Graphene Ink, Others), By Application (Photovoltaic, Membrane Switches, Displays, Automotive, Smart Packaging, Biosensors, Printed Circuit Boards, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Applied Nanotech Holdings, Inc., Vorbeck Materials Corporation, DuPont, Sun Chemical Corporation, PPG Industries, Inc., Creative Materials Inc., Poly-Ink, Henkel Ag & Co. KgaA, PChem Associates, Inc., Johnson Matthey Colour Technologies, Fujikura Ltd., Heraeus Holding, Nagase America Corporation, Engineered Materials Systems, Epoxies, Etc, Voxel8, Methode Electronics, Novacentrix, Johnson Matthey Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Conductive Inks Market Overview

- 2.1. Conductive Inks Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Conductive Inks Market Dynamics

- 3. Global Conductive Inks Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Conductive Inks Market Analysis, 2016-2021

- 3.2. Global Conductive Inks Market Opportunity and Forecast, 2023-2032

- 3.3. Global Conductive Inks Market Analysis, Opportunity and Forecast, By Product, 2016-2032

- 3.3.1. Global Conductive Inks Market Analysis by Product: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product, 2016-2032

- 3.3.3. Conductive Silver Ink

- 3.3.4. Conductive Copper Ink

- 3.3.5. Conductive Polymers

- 3.3.6. Carbon Nanotube Ink

- 3.3.7. Dielectric Inks

- 3.3.8. Carbon/Graphene Ink

- 3.3.9. Others

- 3.4. Global Conductive Inks Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 3.4.1. Global Conductive Inks Market Analysis by Application: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 3.4.3. Photovoltaic

- 3.4.4. Membrane Switches

- 3.4.5. Displays

- 3.4.6. Automotive

- 3.4.7. Smart Packaging

- 3.4.8. Biosensors

- 3.4.9. Printed Circuit Boards

- 3.4.10. Others

- 4. North America Conductive Inks Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Conductive Inks Market Analysis, 2016-2021

- 4.2. North America Conductive Inks Market Opportunity and Forecast, 2023-2032

- 4.3. North America Conductive Inks Market Analysis, Opportunity and Forecast, By Product, 2016-2032

- 4.3.1. North America Conductive Inks Market Analysis by Product: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product, 2016-2032

- 4.3.3. Conductive Silver Ink

- 4.3.4. Conductive Copper Ink

- 4.3.5. Conductive Polymers

- 4.3.6. Carbon Nanotube Ink

- 4.3.7. Dielectric Inks

- 4.3.8. Carbon/Graphene Ink

- 4.3.9. Others

- 4.4. North America Conductive Inks Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 4.4.1. North America Conductive Inks Market Analysis by Application: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 4.4.3. Photovoltaic

- 4.4.4. Membrane Switches

- 4.4.5. Displays

- 4.4.6. Automotive

- 4.4.7. Smart Packaging

- 4.4.8. Biosensors

- 4.4.9. Printed Circuit Boards

- 4.4.10. Others

- 4.5. North America Conductive Inks Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.5.1. North America Conductive Inks Market Analysis by Country : Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.5.2.1. The US

- 4.5.2.2. Canada

- 4.5.2.3. Mexico

- 5. Western Europe Conductive Inks Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Conductive Inks Market Analysis, 2016-2021

- 5.2. Western Europe Conductive Inks Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Conductive Inks Market Analysis, Opportunity and Forecast, By Product, 2016-2032

- 5.3.1. Western Europe Conductive Inks Market Analysis by Product: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product, 2016-2032

- 5.3.3. Conductive Silver Ink

- 5.3.4. Conductive Copper Ink

- 5.3.5. Conductive Polymers

- 5.3.6. Carbon Nanotube Ink

- 5.3.7. Dielectric Inks

- 5.3.8. Carbon/Graphene Ink

- 5.3.9. Others

- 5.4. Western Europe Conductive Inks Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 5.4.1. Western Europe Conductive Inks Market Analysis by Application: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 5.4.3. Photovoltaic

- 5.4.4. Membrane Switches

- 5.4.5. Displays

- 5.4.6. Automotive

- 5.4.7. Smart Packaging

- 5.4.8. Biosensors

- 5.4.9. Printed Circuit Boards

- 5.4.10. Others

- 5.5. Western Europe Conductive Inks Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.5.1. Western Europe Conductive Inks Market Analysis by Country : Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.5.2.1. Germany

- 5.5.2.2. France

- 5.5.2.3. The UK

- 5.5.2.4. Spain

- 5.5.2.5. Italy

- 5.5.2.6. Portugal

- 5.5.2.7. Ireland

- 5.5.2.8. Austria

- 5.5.2.9. Switzerland

- 5.5.2.10. Benelux

- 5.5.2.11. Nordic

- 5.5.2.12. Rest of Western Europe

- 6. Eastern Europe Conductive Inks Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Conductive Inks Market Analysis, 2016-2021

- 6.2. Eastern Europe Conductive Inks Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Conductive Inks Market Analysis, Opportunity and Forecast, By Product, 2016-2032

- 6.3.1. Eastern Europe Conductive Inks Market Analysis by Product: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product, 2016-2032

- 6.3.3. Conductive Silver Ink

- 6.3.4. Conductive Copper Ink

- 6.3.5. Conductive Polymers

- 6.3.6. Carbon Nanotube Ink

- 6.3.7. Dielectric Inks

- 6.3.8. Carbon/Graphene Ink

- 6.3.9. Others

- 6.4. Eastern Europe Conductive Inks Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 6.4.1. Eastern Europe Conductive Inks Market Analysis by Application: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 6.4.3. Photovoltaic

- 6.4.4. Membrane Switches

- 6.4.5. Displays

- 6.4.6. Automotive

- 6.4.7. Smart Packaging

- 6.4.8. Biosensors

- 6.4.9. Printed Circuit Boards

- 6.4.10. Others

- 6.5. Eastern Europe Conductive Inks Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.5.1. Eastern Europe Conductive Inks Market Analysis by Country : Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.5.2.1. Russia

- 6.5.2.2. Poland

- 6.5.2.3. The Czech Republic

- 6.5.2.4. Greece

- 6.5.2.5. Rest of Eastern Europe

- 7. APAC Conductive Inks Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Conductive Inks Market Analysis, 2016-2021

- 7.2. APAC Conductive Inks Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Conductive Inks Market Analysis, Opportunity and Forecast, By Product, 2016-2032

- 7.3.1. APAC Conductive Inks Market Analysis by Product: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product, 2016-2032

- 7.3.3. Conductive Silver Ink

- 7.3.4. Conductive Copper Ink

- 7.3.5. Conductive Polymers

- 7.3.6. Carbon Nanotube Ink

- 7.3.7. Dielectric Inks

- 7.3.8. Carbon/Graphene Ink

- 7.3.9. Others

- 7.4. APAC Conductive Inks Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 7.4.1. APAC Conductive Inks Market Analysis by Application: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 7.4.3. Photovoltaic

- 7.4.4. Membrane Switches

- 7.4.5. Displays

- 7.4.6. Automotive

- 7.4.7. Smart Packaging

- 7.4.8. Biosensors

- 7.4.9. Printed Circuit Boards

- 7.4.10. Others

- 7.5. APAC Conductive Inks Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.5.1. APAC Conductive Inks Market Analysis by Country : Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.5.2.1. China

- 7.5.2.2. Japan

- 7.5.2.3. South Korea

- 7.5.2.4. India

- 7.5.2.5. Australia & New Zeland

- 7.5.2.6. Indonesia

- 7.5.2.7. Malaysia

- 7.5.2.8. Philippines

- 7.5.2.9. Singapore

- 7.5.2.10. Thailand

- 7.5.2.11. Vietnam

- 7.5.2.12. Rest of APAC

- 8. Latin America Conductive Inks Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Conductive Inks Market Analysis, 2016-2021

- 8.2. Latin America Conductive Inks Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Conductive Inks Market Analysis, Opportunity and Forecast, By Product, 2016-2032

- 8.3.1. Latin America Conductive Inks Market Analysis by Product: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product, 2016-2032

- 8.3.3. Conductive Silver Ink

- 8.3.4. Conductive Copper Ink

- 8.3.5. Conductive Polymers

- 8.3.6. Carbon Nanotube Ink

- 8.3.7. Dielectric Inks

- 8.3.8. Carbon/Graphene Ink

- 8.3.9. Others

- 8.4. Latin America Conductive Inks Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 8.4.1. Latin America Conductive Inks Market Analysis by Application: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 8.4.3. Photovoltaic

- 8.4.4. Membrane Switches

- 8.4.5. Displays

- 8.4.6. Automotive

- 8.4.7. Smart Packaging

- 8.4.8. Biosensors

- 8.4.9. Printed Circuit Boards

- 8.4.10. Others

- 8.5. Latin America Conductive Inks Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.5.1. Latin America Conductive Inks Market Analysis by Country : Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.5.2.1. Brazil

- 8.5.2.2. Colombia

- 8.5.2.3. Chile

- 8.5.2.4. Argentina

- 8.5.2.5. Costa Rica

- 8.5.2.6. Rest of Latin America

- 9. Middle East & Africa Conductive Inks Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Conductive Inks Market Analysis, 2016-2021

- 9.2. Middle East & Africa Conductive Inks Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Conductive Inks Market Analysis, Opportunity and Forecast, By Product, 2016-2032

- 9.3.1. Middle East & Africa Conductive Inks Market Analysis by Product: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product, 2016-2032

- 9.3.3. Conductive Silver Ink

- 9.3.4. Conductive Copper Ink

- 9.3.5. Conductive Polymers

- 9.3.6. Carbon Nanotube Ink

- 9.3.7. Dielectric Inks

- 9.3.8. Carbon/Graphene Ink

- 9.3.9. Others

- 9.4. Middle East & Africa Conductive Inks Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 9.4.1. Middle East & Africa Conductive Inks Market Analysis by Application: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 9.4.3. Photovoltaic

- 9.4.4. Membrane Switches

- 9.4.5. Displays

- 9.4.6. Automotive

- 9.4.7. Smart Packaging

- 9.4.8. Biosensors

- 9.4.9. Printed Circuit Boards

- 9.4.10. Others

- 9.5. Middle East & Africa Conductive Inks Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.5.1. Middle East & Africa Conductive Inks Market Analysis by Country : Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.5.2.1. Algeria

- 9.5.2.2. Egypt

- 9.5.2.3. Israel

- 9.5.2.4. Kuwait

- 9.5.2.5. Nigeria

- 9.5.2.6. Saudi Arabia

- 9.5.2.7. South Africa

- 9.5.2.8. Turkey

- 9.5.2.9. The UAE

- 9.5.2.10. Rest of MEA

- 10. Global Conductive Inks Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Conductive Inks Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Conductive Inks Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Applied Nanotech Holdings, Inc.

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Vorbeck Materials Corporation

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. DuPont

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Sun Chemical Corporation

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. PPG Industries, Inc.

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Creative Materials Inc.

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Poly-Ink

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Henkel Ag & Co. KgaA

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. PChem Associates, Inc.

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Johnson Matthey Colour Technologies

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. Fujikura Ltd.

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. Nagase America Corporation

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 11.16. Engineered Materials Systems

- 11.16.1. Company Overview

- 11.16.2. Financial Highlights

- 11.16.3. Product Portfolio

- 11.16.4. SWOT Analysis

- 11.16.5. Key Strategies and Developments

- 11.17. Epoxies, Etc

- 11.17.1. Company Overview

- 11.17.2. Financial Highlights

- 11.17.3. Product Portfolio

- 11.17.4. SWOT Analysis

- 11.17.5. Key Strategies and Developments

- 11.18. Voxel8

- 11.18.1. Company Overview

- 11.18.2. Financial Highlights

- 11.18.3. Product Portfolio

- 11.18.4. SWOT Analysis

- 11.18.5. Key Strategies and Developments

- 11.19. Methode Electronics

- 11.19.1. Company Overview

- 11.19.2. Financial Highlights

- 11.19.3. Product Portfolio

- 11.19.4. SWOT Analysis

- 11.19.5. Key Strategies and Developments

- 11.20. Novacentrix

- 11.20.1. Company Overview

- 11.20.2. Financial Highlights

- 11.20.3. Product Portfolio

- 11.20.4. SWOT Analysis

- 11.20.5. Key Strategies and Developments

- 11.21. Johnson Matthey

- 11.21.1. Company Overview

- 11.21.2. Financial Highlights

- 11.21.3. Product Portfolio

- 11.21.4. SWOT Analysis

- 11.21.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

"

- List of Figures

- "

- Figure 1: Global Conductive Inks Market Revenue (US$ Mn) Market Share by Product in 2022

- Figure 2: Global Conductive Inks Market Market Attractiveness Analysis by Product, 2016-2032

- Figure 3: Global Conductive Inks Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 4: Global Conductive Inks Market Market Attractiveness Analysis by Application, 2016-2032

- Figure 5: Global Conductive Inks Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 6: Global Conductive Inks Market Market Attractiveness Analysis by Region, 2016-2032

- Figure 7: Global Conductive Inks Market Market Revenue (US$ Mn) (2016-2032)

- Figure 8: Global Conductive Inks Market Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 9: Global Conductive Inks Market Market Revenue (US$ Mn) Comparison by Product (2016-2032)

- Figure 10: Global Conductive Inks Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 11: Global Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 12: Global Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Product (2016-2032)

- Figure 13: Global Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 14: Global Conductive Inks Market Market Share Comparison by Region (2016-2032)

- Figure 15: Global Conductive Inks Market Market Share Comparison by Product (2016-2032)

- Figure 16: Global Conductive Inks Market Market Share Comparison by Application (2016-2032)

- Figure 17: North America Conductive Inks Market Revenue (US$ Mn) Market Share by Productin 2022

- Figure 18: North America Conductive Inks Market Market Attractiveness Analysis by Product, 2016-2032

- Figure 19: North America Conductive Inks Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 20: North America Conductive Inks Market Market Attractiveness Analysis by Application, 2016-2032

- Figure 21: North America Conductive Inks Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 22: North America Conductive Inks Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 23: North America Conductive Inks Market Market Revenue (US$ Mn) (2016-2032)

- Figure 24: North America Conductive Inks Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 25: North America Conductive Inks Market Market Revenue (US$ Mn) Comparison by Product (2016-2032)

- Figure 26: North America Conductive Inks Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 27: North America Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 28: North America Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Product (2016-2032)

- Figure 29: North America Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 30: North America Conductive Inks Market Market Share Comparison by Country (2016-2032)

- Figure 31: North America Conductive Inks Market Market Share Comparison by Product (2016-2032)

- Figure 32: North America Conductive Inks Market Market Share Comparison by Application (2016-2032)

- Figure 33: Western Europe Conductive Inks Market Revenue (US$ Mn) Market Share by Productin 2022

- Figure 34: Western Europe Conductive Inks Market Market Attractiveness Analysis by Product, 2016-2032

- Figure 35: Western Europe Conductive Inks Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 36: Western Europe Conductive Inks Market Market Attractiveness Analysis by Application, 2016-2032

- Figure 37: Western Europe Conductive Inks Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 38: Western Europe Conductive Inks Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 39: Western Europe Conductive Inks Market Market Revenue (US$ Mn) (2016-2032)

- Figure 40: Western Europe Conductive Inks Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 41: Western Europe Conductive Inks Market Market Revenue (US$ Mn) Comparison by Product (2016-2032)

- Figure 42: Western Europe Conductive Inks Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 43: Western Europe Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 44: Western Europe Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Product (2016-2032)

- Figure 45: Western Europe Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 46: Western Europe Conductive Inks Market Market Share Comparison by Country (2016-2032)

- Figure 47: Western Europe Conductive Inks Market Market Share Comparison by Product (2016-2032)

- Figure 48: Western Europe Conductive Inks Market Market Share Comparison by Application (2016-2032)

- Figure 49: Eastern Europe Conductive Inks Market Revenue (US$ Mn) Market Share by Productin 2022

- Figure 50: Eastern Europe Conductive Inks Market Market Attractiveness Analysis by Product, 2016-2032

- Figure 51: Eastern Europe Conductive Inks Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 52: Eastern Europe Conductive Inks Market Market Attractiveness Analysis by Application, 2016-2032

- Figure 53: Eastern Europe Conductive Inks Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 54: Eastern Europe Conductive Inks Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 55: Eastern Europe Conductive Inks Market Market Revenue (US$ Mn) (2016-2032)

- Figure 56: Eastern Europe Conductive Inks Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 57: Eastern Europe Conductive Inks Market Market Revenue (US$ Mn) Comparison by Product (2016-2032)

- Figure 58: Eastern Europe Conductive Inks Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 59: Eastern Europe Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 60: Eastern Europe Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Product (2016-2032)

- Figure 61: Eastern Europe Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 62: Eastern Europe Conductive Inks Market Market Share Comparison by Country (2016-2032)

- Figure 63: Eastern Europe Conductive Inks Market Market Share Comparison by Product (2016-2032)

- Figure 64: Eastern Europe Conductive Inks Market Market Share Comparison by Application (2016-2032)

- Figure 65: APAC Conductive Inks Market Revenue (US$ Mn) Market Share by Productin 2022

- Figure 66: APAC Conductive Inks Market Market Attractiveness Analysis by Product, 2016-2032

- Figure 67: APAC Conductive Inks Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 68: APAC Conductive Inks Market Market Attractiveness Analysis by Application, 2016-2032

- Figure 69: APAC Conductive Inks Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 70: APAC Conductive Inks Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 71: APAC Conductive Inks Market Market Revenue (US$ Mn) (2016-2032)

- Figure 72: APAC Conductive Inks Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 73: APAC Conductive Inks Market Market Revenue (US$ Mn) Comparison by Product (2016-2032)

- Figure 74: APAC Conductive Inks Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 75: APAC Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 76: APAC Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Product (2016-2032)

- Figure 77: APAC Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 78: APAC Conductive Inks Market Market Share Comparison by Country (2016-2032)

- Figure 79: APAC Conductive Inks Market Market Share Comparison by Product (2016-2032)

- Figure 80: APAC Conductive Inks Market Market Share Comparison by Application (2016-2032)

- Figure 81: Latin America Conductive Inks Market Revenue (US$ Mn) Market Share by Productin 2022

- Figure 82: Latin America Conductive Inks Market Market Attractiveness Analysis by Product, 2016-2032

- Figure 83: Latin America Conductive Inks Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 84: Latin America Conductive Inks Market Market Attractiveness Analysis by Application, 2016-2032

- Figure 85: Latin America Conductive Inks Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 86: Latin America Conductive Inks Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 87: Latin America Conductive Inks Market Market Revenue (US$ Mn) (2016-2032)

- Figure 88: Latin America Conductive Inks Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 89: Latin America Conductive Inks Market Market Revenue (US$ Mn) Comparison by Product (2016-2032)

- Figure 90: Latin America Conductive Inks Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 91: Latin America Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 92: Latin America Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Product (2016-2032)

- Figure 93: Latin America Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 94: Latin America Conductive Inks Market Market Share Comparison by Country (2016-2032)

- Figure 95: Latin America Conductive Inks Market Market Share Comparison by Product (2016-2032)

- Figure 96: Latin America Conductive Inks Market Market Share Comparison by Application (2016-2032)

- Figure 97: Middle East & Africa Conductive Inks Market Revenue (US$ Mn) Market Share by Productin 2022

- Figure 98: Middle East & Africa Conductive Inks Market Market Attractiveness Analysis by Product, 2016-2032

- Figure 99: Middle East & Africa Conductive Inks Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 100: Middle East & Africa Conductive Inks Market Market Attractiveness Analysis by Application, 2016-2032

- Figure 101: Middle East & Africa Conductive Inks Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 102: Middle East & Africa Conductive Inks Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 103: Middle East & Africa Conductive Inks Market Market Revenue (US$ Mn) (2016-2032)

- Figure 104: Middle East & Africa Conductive Inks Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 105: Middle East & Africa Conductive Inks Market Market Revenue (US$ Mn) Comparison by Product (2016-2032)

- Figure 106: Middle East & Africa Conductive Inks Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 107: Middle East & Africa Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 108: Middle East & Africa Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Product (2016-2032)

- Figure 109: Middle East & Africa Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 110: Middle East & Africa Conductive Inks Market Market Share Comparison by Country (2016-2032)

- Figure 111: Middle East & Africa Conductive Inks Market Market Share Comparison by Product (2016-2032)

- Figure 112: Middle East & Africa Conductive Inks Market Market Share Comparison by Application (2016-2032)

"

- List of Tables

- "

- Table 1: Global Conductive Inks Market Market Comparison by Product (2016-2032)

- Table 2: Global Conductive Inks Market Market Comparison by Application (2016-2032)

- Table 3: Global Conductive Inks Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 4: Global Conductive Inks Market Market Revenue (US$ Mn) (2016-2032)

- Table 5: Global Conductive Inks Market Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 6: Global Conductive Inks Market Market Revenue (US$ Mn) Comparison by Product (2016-2032)

- Table 7: Global Conductive Inks Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 8: Global Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 9: Global Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Product (2016-2032)

- Table 10: Global Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 11: Global Conductive Inks Market Market Share Comparison by Region (2016-2032)

- Table 12: Global Conductive Inks Market Market Share Comparison by Product (2016-2032)

- Table 13: Global Conductive Inks Market Market Share Comparison by Application (2016-2032)

- Table 14: North America Conductive Inks Market Market Comparison by Application (2016-2032)

- Table 15: North America Conductive Inks Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 16: North America Conductive Inks Market Market Revenue (US$ Mn) (2016-2032)

- Table 17: North America Conductive Inks Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 18: North America Conductive Inks Market Market Revenue (US$ Mn) Comparison by Product (2016-2032)

- Table 19: North America Conductive Inks Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 20: North America Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 21: North America Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Product (2016-2032)

- Table 22: North America Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 23: North America Conductive Inks Market Market Share Comparison by Country (2016-2032)

- Table 24: North America Conductive Inks Market Market Share Comparison by Product (2016-2032)

- Table 25: North America Conductive Inks Market Market Share Comparison by Application (2016-2032)

- Table 26: Western Europe Conductive Inks Market Market Comparison by Product (2016-2032)

- Table 27: Western Europe Conductive Inks Market Market Comparison by Application (2016-2032)

- Table 28: Western Europe Conductive Inks Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 29: Western Europe Conductive Inks Market Market Revenue (US$ Mn) (2016-2032)

- Table 30: Western Europe Conductive Inks Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 31: Western Europe Conductive Inks Market Market Revenue (US$ Mn) Comparison by Product (2016-2032)

- Table 32: Western Europe Conductive Inks Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 33: Western Europe Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 34: Western Europe Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Product (2016-2032)

- Table 35: Western Europe Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 36: Western Europe Conductive Inks Market Market Share Comparison by Country (2016-2032)

- Table 37: Western Europe Conductive Inks Market Market Share Comparison by Product (2016-2032)

- Table 38: Western Europe Conductive Inks Market Market Share Comparison by Application (2016-2032)

- Table 39: Eastern Europe Conductive Inks Market Market Comparison by Product (2016-2032)

- Table 40: Eastern Europe Conductive Inks Market Market Comparison by Application (2016-2032)

- Table 41: Eastern Europe Conductive Inks Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 42: Eastern Europe Conductive Inks Market Market Revenue (US$ Mn) (2016-2032)

- Table 43: Eastern Europe Conductive Inks Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 44: Eastern Europe Conductive Inks Market Market Revenue (US$ Mn) Comparison by Product (2016-2032)

- Table 45: Eastern Europe Conductive Inks Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 46: Eastern Europe Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 47: Eastern Europe Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Product (2016-2032)

- Table 48: Eastern Europe Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 49: Eastern Europe Conductive Inks Market Market Share Comparison by Country (2016-2032)

- Table 50: Eastern Europe Conductive Inks Market Market Share Comparison by Product (2016-2032)

- Table 51: Eastern Europe Conductive Inks Market Market Share Comparison by Application (2016-2032)

- Table 52: APAC Conductive Inks Market Market Comparison by Product (2016-2032)

- Table 53: APAC Conductive Inks Market Market Comparison by Application (2016-2032)

- Table 54: APAC Conductive Inks Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: APAC Conductive Inks Market Market Revenue (US$ Mn) (2016-2032)

- Table 56: APAC Conductive Inks Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: APAC Conductive Inks Market Market Revenue (US$ Mn) Comparison by Product (2016-2032)

- Table 58: APAC Conductive Inks Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 59: APAC Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 60: APAC Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Product (2016-2032)

- Table 61: APAC Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 62: APAC Conductive Inks Market Market Share Comparison by Country (2016-2032)

- Table 63: APAC Conductive Inks Market Market Share Comparison by Product (2016-2032)

- Table 64: APAC Conductive Inks Market Market Share Comparison by Application (2016-2032)

- Table 65: Latin America Conductive Inks Market Market Comparison by Product (2016-2032)

- Table 66: Latin America Conductive Inks Market Market Comparison by Application (2016-2032)

- Table 67: Latin America Conductive Inks Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 68: Latin America Conductive Inks Market Market Revenue (US$ Mn) (2016-2032)

- Table 69: Latin America Conductive Inks Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 70: Latin America Conductive Inks Market Market Revenue (US$ Mn) Comparison by Product (2016-2032)

- Table 71: Latin America Conductive Inks Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 72: Latin America Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 73: Latin America Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Product (2016-2032)

- Table 74: Latin America Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 75: Latin America Conductive Inks Market Market Share Comparison by Country (2016-2032)

- Table 76: Latin America Conductive Inks Market Market Share Comparison by Product (2016-2032)

- Table 77: Latin America Conductive Inks Market Market Share Comparison by Application (2016-2032)

- Table 78: Middle East & Africa Conductive Inks Market Market Comparison by Product (2016-2032)

- Table 79: Middle East & Africa Conductive Inks Market Market Comparison by Application (2016-2032)

- Table 80: Middle East & Africa Conductive Inks Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 81: Middle East & Africa Conductive Inks Market Market Revenue (US$ Mn) (2016-2032)

- Table 82: Middle East & Africa Conductive Inks Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 83: Middle East & Africa Conductive Inks Market Market Revenue (US$ Mn) Comparison by Product (2016-2032)

- Table 84: Middle East & Africa Conductive Inks Market Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 85: Middle East & Africa Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 86: Middle East & Africa Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Product (2016-2032)

- Table 87: Middle East & Africa Conductive Inks Market Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 88: Middle East & Africa Conductive Inks Market Market Share Comparison by Country (2016-2032)

- Table 89: Middle East & Africa Conductive Inks Market Market Share Comparison by Product (2016-2032)

- Table 90: Middle East & Africa Conductive Inks Market Market Share Comparison by Application (2016-2032)

- 1. Executive Summary

-

- Applied Nanotech Holdings, Inc.

- Vorbeck Materials Corporation

- DuPont

- Sun Chemical Corporation

- PPG Industries, Inc.

- Creative Materials Inc.

- Poly-Ink

- Henkel Ag & Co. KgaA

- PChem Associates, Inc.

- Johnson Matthey Colour Technologies

- Fujikura Ltd.

- Heraeus Holding

- Nagase America Corporation

- Engineered Materials Systems

- Epoxies, Etc

- Voxel8

- Methode Electronics

- Novacentrix

- Johnson Matthey