Cloud Managed Service Market By Service Type (Managed Business Services, Managed Network Services and Others), By Deployment (Public Cloud, Private Cloud), By Enterprise Size( SMEs, Large Enterprises), By Vertical (BFSI, IT and Telecommunications and Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

51154

-

Sept 2024

-

335

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

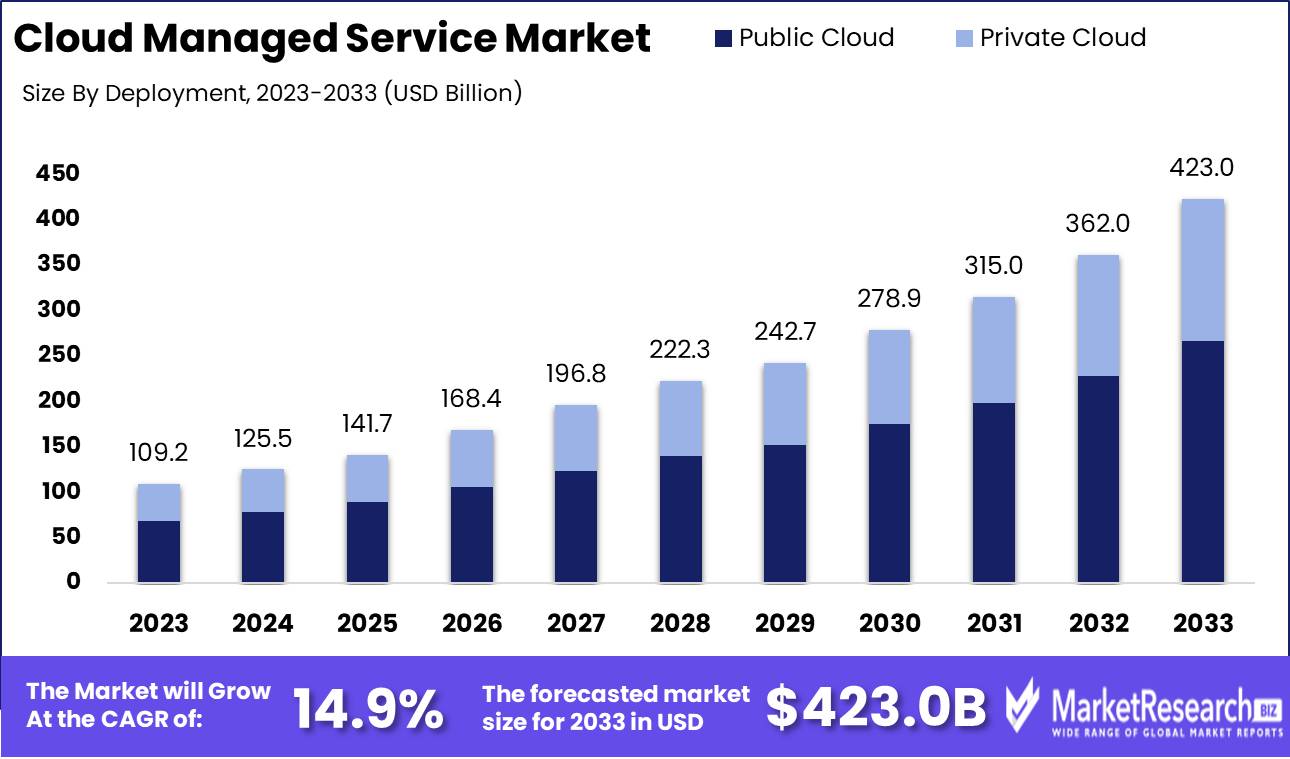

The Global Cloud Managed Service Market was valued at USD 109.2 Billion in 2023. It is expected to reach USD 423.0 Billion by 2033, with a Compound annual growth rate (CAGR) of 14.9% during the forecast period from 2024 to 2033.

The Cloud Managed Service Market encompasses a range of third-party services that manage an organization's cloud infrastructure, applications, and operations. These services enable businesses to offload IT responsibilities such as cloud monitoring, optimization, security, and governance to specialized providers, enhancing operational efficiency and reducing complexity. With the increasing adoption of cloud computing across industries, managed services play a crucial role in streamlining cloud deployment, ensuring scalability, and driving innovation. As organizations seek to focus on core competencies while managing cloud environments cost-effectively, the cloud managed service market is poised for sustained growth, supported by advanced automation and security solutions.

The Cloud Managed Services market is experiencing robust growth, driven by a confluence of factors such as increased digitalization, the demand for scalable solutions, and the rapid adoption of AI technologies. In Q2 2024, global spending on cloud infrastructure services surged by 19% year-on-year, reaching $78.2 billion, with leading players such as AWS, Microsoft Azure, and Google Cloud collectively growing by 24% and capturing 63% of the market share. AWS, reporting a 19% growth, has made significant investments, including a $230 million commitment to its Generative AI Accelerator, underscoring the growing importance of AI in cloud services. Notably, Microsoft's Azure and Google Cloud, with growth rates of 29% and 30% respectively, continue to outpace AWS in percentage terms, signaling increased competition in the cloud ecosystem.

The managed services sector is witnessing a trend toward larger, more strategic investments, especially in AI and cloud-driven transformations. In 2023, over 1,800 managed services deals totaling $100 billion were signed, with the stable average deal size reflecting a shift toward high-value engagements. Strategic acquisitions and partnerships, such as Accenture’s acquisition of Navisite in January 2024 and Capgemini's deepened partnership with AWS, further illustrate the industry's focus on enhancing cloud transformation capabilities and generative AI solutions. Furthermore, Hitachi’s $2.1 billion investment in generative AI underscores the sector’s push toward leveraging AI for industrial applications, such as predictive maintenance and operational efficiencies. These developments highlight a market poised for sustained growth, fueled by technological advancements and the ongoing digital transformation across industries.

Key Takeaways

- Market Growth: Cloud Managed Services Market is projected to grow from USD 109.2 billion in 2023 to USD 423.0 billion by 2033, at a CAGR of 14.9%.

- By Service Type: Managed Security Services dominate with over 36% market share, driven by growing cybersecurity concerns.

- By Deployment: Public Cloud leads with a 63% share, driven by cost-efficiency and scalability.

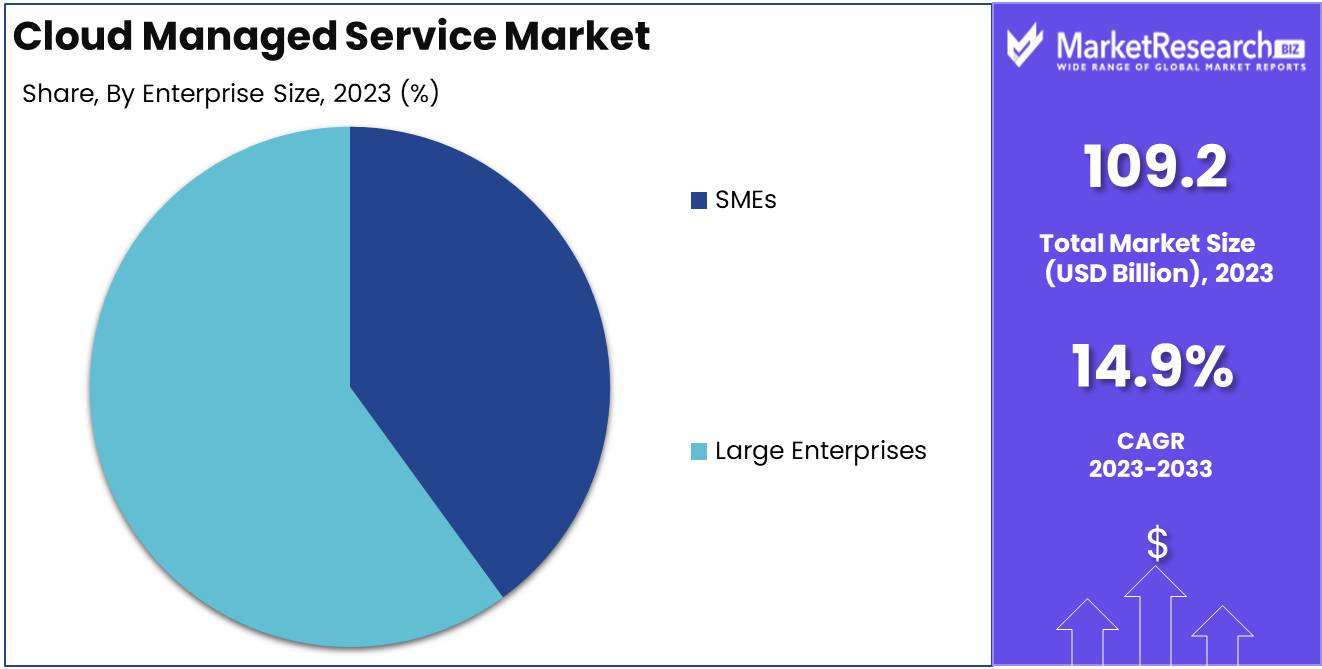

- By Enterprise Size: Large Enterprises dominate with 61% share due to the need for scalable IT solutions and robust security.

- By Vertical Analysis: IT and Telecommunications lead with 28.3%, fueled by cloud infrastructure demands in digital transformation.

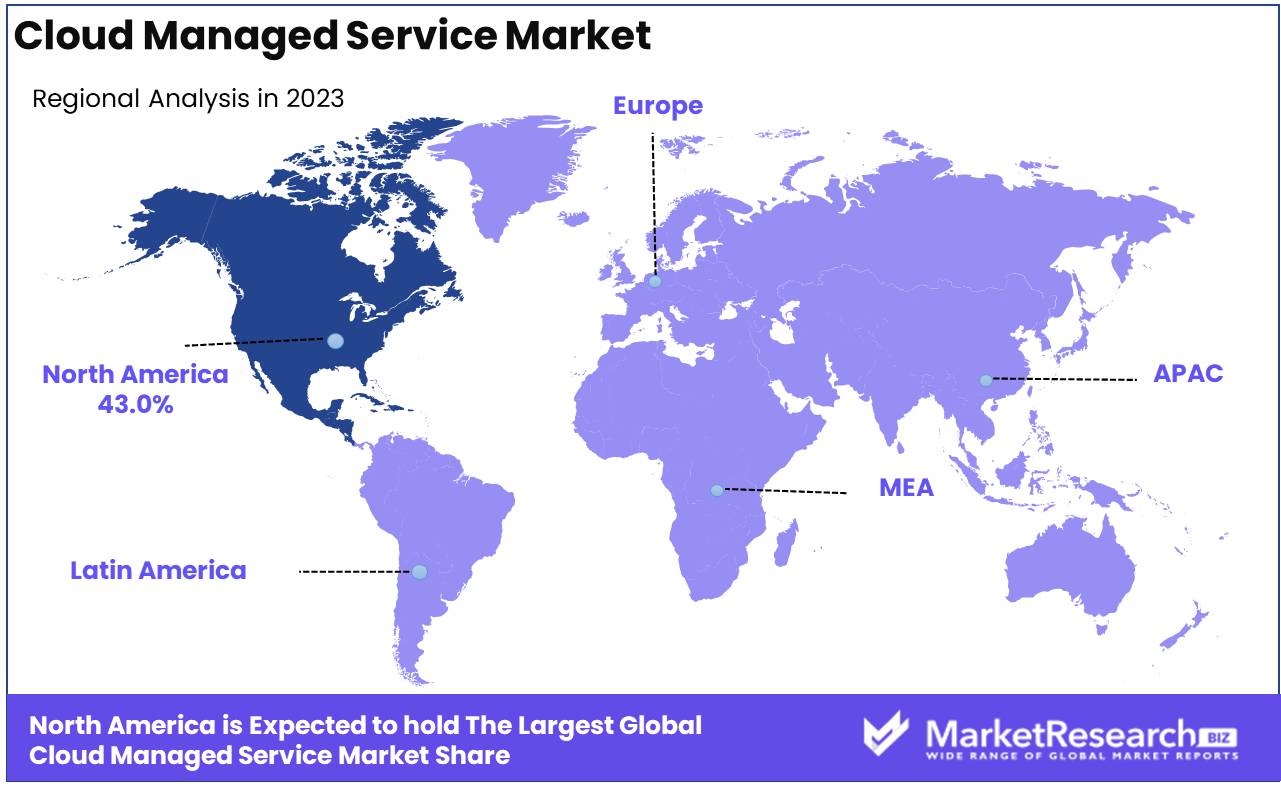

- Growth Opportunity: North America leads with a 43% share, driven by advanced cloud adoption across sectors like healthcare and finance.

- Restraining Factor: Stringent compliance and security regulations remain a challenge, particularly in Europe due to GDPR.

- Regional Growth: North America Dominates with 43% market share, driven by advanced cloud adoption in healthcare, finance, and retail sectors.

Driving Factors

Enhanced Security and Compliance

As data breaches and cyber threats rise globally, the demand for cloud managed services (CMS) offering advanced security solutions and compliance support has intensified. Organizations across industries face increasing pressure to protect sensitive information while adhering to stringent regulatory frameworks like GDPR in Europe or HIPAA in the United States. Cloud managed service providers have responded by integrating security protocols such as encryption, intrusion detection systems (IDS), and multi-factor authentication within their offerings.

The ability of CMS providers to offer 24/7 monitoring, automated compliance updates, and real-time threat intelligence mitigates risks associated with cybersecurity breaches, which cost businesses an average of $4.35 million per breach globally (according to IBM’s 2023 Cost of a Data Breach report). This has encouraged organizations, particularly in highly regulated industries such as finance, healthcare, and legal sectors, to adopt cloud services with the confidence that they can meet evolving regulatory demands without compromising on data protection. The enhanced security posture offered by these services not only drives adoption but also builds long-term trust, which is crucial for the sustained growth of the cloud managed services market.

Technological Advancements

The rapid evolution of cloud technologies, including faster networks, enhanced connectivity through 5G, and sophisticated tools like AI and machine learning, is fundamentally reshaping the cloud managed services landscape. These advancements enable more efficient management of cloud environments and provide the scalability required to meet growing business demands.

Improvements in connectivity, particularly with the deployment of 5G, have enhanced the accessibility and performance of cloud services, reducing latency and enabling real-time data processing and management. This is particularly significant in sectors such as healthcare, finance, and telecommunications, where real-time data analytics and secure, low-latency communication are essential. For example, AI-powered security solutions can now proactively detect and mitigate threats, further enhancing the attractiveness of cloud managed services in highly sensitive environments.

This wave of technological progress also facilitates multi-cloud and hybrid cloud deployments, where organizations can seamlessly integrate on-premise and cloud-based systems. According to a Gartner report, by 2025, over 85% of enterprises are expected to adopt a cloud-first principle, in large part due to these advanced capabilities, which enable businesses to innovate faster and more cost-effectively. In this sense, technological advancements not only reduce operational complexity but also expand the range of industries that can benefit from cloud services, thereby propelling market growth.

Restraining Factors

Security and Compliance

As businesses increasingly adopt cloud solutions, the demand for robust security and compliance protocols has surged, becoming a critical driver for the cloud managed service market. Organizations must address growing concerns over data breaches, ransomware attacks, and privacy violations by adopting advanced security measures such as encryption, multi-factor authentication, and consistent security audits. Compliance with stringent industry regulations, such as GDPR in Europe or HIPAA in healthcare, is also paramount, as non-compliance can lead to significant financial penalties and damage to a company's reputation.

This focus on security is fueling demand for managed service providers (MSPs) that offer comprehensive, end-to-end solutions capable of ensuring regulatory adherence and safeguarding sensitive data. A strong security posture not only helps maintain customer trust but also positions businesses competitively in a digital economy where data integrity is non-negotiable. Furthermore, as security threats evolve, MSPs that can offer adaptive and scalable security solutions are particularly well-positioned to capture market share.

Vendor Relationship Management

Vendor relationship management plays a pivotal role in expanding the cloud managed service market, as businesses increasingly rely on strong partnerships with MSPs to optimize cloud performance, cost-effectiveness, and security. By maintaining close communication with their cloud providers, organizations can ensure that their evolving business needs are met through timely updates, feature rollouts, and tailored service offerings.

The ability of MSPs to offer flexible, customer centric services aligned with the changing technological and operational demands of businesses helps organizations achieve operational efficiency while controlling costs. MSPs that excel in customer relationships can provide proactive insights, enabling businesses to extract greater value from their cloud investments through improved performance and reduced downtime.

By Service Type Analysis

Managed Security Services Dominates the Largest Market Share, Exceeding 36.0% in the 2023 Cloud Managed Service Market

In 2023, Managed Security Services held a dominant market position in the "By Service Type" segment of the Cloud Managed Service Market, capturing more than a 36.0% share. This strong market presence can be attributed to the rising importance of cybersecurity as organizations increasingly adopt cloud technologies, coupled with heightened regulatory requirements and the growing sophistication of cyber threats.

This segment encompasses a broad range of IT services that organizations outsource to enhance operational efficiency and reduce costs. Although it trails behind Managed Security Services in market share, Managed Business Services are experiencing steady growth, driven by a demand for expertise in cloud migration, process automation, and IT management.

As businesses continue to expand their cloud infrastructure, the need for reliable and scalable network management solutions has surged. Managed Network Services have gained traction due to the growing complexity of multi-cloud environments, and the need for organizations to optimize their network performance across distributed IT infrastructures. This segment represents a crucial support function for organizations adopting hybrid cloud architectures.

This segment is critical to ensuring seamless cloud operations, offering end-to-end management of IT infrastructure, including servers, storage, and data centers. Managed Infrastructure Services have seen moderate growth, as businesses continue to leverage cloud platforms to enhance scalability and flexibility while minimizing operational disruptions.

As noted, Managed Security Services dominate the cloud managed service market, commanding more than 36.0% of the market share in 2023. This is driven by the increasing number of cloud breaches and the growing demand for advanced security measures such as real-time threat monitoring, identity management, and compliance solutions. Enterprises are prioritizing security management as a key element in their digital transformation strategies.

With the proliferation of remote work and mobile device usage, Managed Mobility Services are growing in importance. This segment focuses on managing the complexity of mobile devices, applications, and security within cloud-based environments. The segment's growth is expected to accelerate as organizations invest in enhancing employee productivity and securing mobile endpoints.

This segment supports the rising demand for unified communication platforms, which integrate tools such as VoIP, video conferencing, and instant messaging. Managed Communication and Collaboration Services have gained popularity as businesses increasingly rely on cloud-based solutions to enhance workforce collaboration, particularly in a remote or hybrid work setting. Although still developing, this segment shows strong potential for growth as enterprises continue to embrace cloud-native communication tools.

By Deployment Analysis

Public Cloud Holds Largest Market Share Over 63.0% in the Cloud Managed Services Market

In 2023, Public Cloud held a dominant market position in the By Deployment segment of the Cloud Managed Services Market, capturing more than a 63.0% share. This commanding lead can be attributed to the widespread adoption of public cloud solutions by businesses seeking scalability, cost efficiency, and ease of implementation. Public Cloud offerings provide on-demand resources without the need for significant upfront capital investment, making them an attractive option for enterprises of all sizes, particularly small and medium-sized businesses (SMBs) that lack the internal IT infrastructure to manage complex cloud environments.

Public Cloud services also benefit from continuous innovation and improvements in security, which further bolsters their appeal across various industries. The flexibility to scale resources according to demand, coupled with robust third-party management capabilities, has solidified the public cloud as the preferred deployment model for organizations looking to optimize their IT operations.

By Enterprise Size

Large Enterprises Lead Cloud Managed Services Market with 61.0% Share in 2023

In 2023, Large Enterprises held a dominant position in the By Enterprise Size segment of the Cloud Managed Services Market, capturing more than 61.0% of the overall market share. The robust adoption of cloud services by large-scale organizations is driven by the need for scalable IT infrastructure, enhanced security solutions, and seamless operational management across global networks. Large enterprises often require extensive cloud support to manage complex workloads, ensure data compliance, and facilitate digital transformation efforts. This trend is expected to continue as organizations increasingly integrate advanced technologies such as AI, big data analytics, and IoT into their operational frameworks.

On the other hand, Small and Medium-sized Enterprises (SMEs), while still experiencing growth in cloud managed services adoption, held a relatively smaller market share compared to large enterprises. SMEs are leveraging cloud solutions to optimize cost structures and improve operational efficiency, though financial constraints and limited in-house expertise often limit their investments in fully managed services. However, with evolving cloud models and more tailored solutions, SMEs are projected to increase their share in the coming years as these businesses scale and demand more sophisticated cloud management solutions.

By Vertical Analysis

IT and Telecommunications: Dominating Segment with Largest Market Share of 28.3% in Cloud Managed Service Market

In 2023, IT and Telecommunications held a dominant market position in the "By Vertical" segment of the Cloud Managed Service Market, capturing more than a 28.3% share. The sector’s leadership is driven by increasing reliance on cloud infrastructure to handle complex operations, data storage, and enhanced connectivity demands. As businesses undergo digital transformation, the need for managed services that offer scalability, security, and robust cloud solutions becomes essential, making IT and Telecommunications the largest consumer of cloud managed services.

The Banking, Financial Services, and Insurance (BFSI) sector follows closely, with growing demand for cloud services driven by the need to enhance operational efficiency, manage financial data securely, and comply with stringent regulatory frameworks. The adoption of cloud-managed services in this vertical is further fueled by the increasing volume of transactions and the need for enhanced customer experience through digital banking.The Government and Public Sector are progressively adopting cloud-managed services as part of their digitalization initiatives. Cloud infrastructure supports efforts to modernize public services, improve data accessibility, and bolster cybersecurity. However, regulatory challenges and legacy systems slow down the overall adoption rate compared to private sectors like IT and telecommunications.

In Healthcare and Life Sciences, cloud-managed services are gaining traction as medical institutions, pharmaceutical companies, and research organizations strive to streamline operations, improve patient data management, and adopt telemedicine solutions. The growing emphasis on data security and compliance with health regulations further accelerates cloud adoption in this vertical.

Retail and Consumer Goods companies are increasingly using cloud-managed services to support e-commerce platforms, inventory management, and customer relationship management (CRM) systems. The demand for real-time analytics and personalized shopping experiences drives this sector's cloud adoption, allowing businesses to remain competitive in the digital landscape.

Manufacturing is progressively utilizing cloud-managed services to support Industry 4.0 technologies, such as IoT, AI, and automation. Cloud platforms enable manufacturers to streamline supply chains, optimize production processes, and implement predictive maintenance systems, helping them improve operational efficiency and reduce costs.The Energy and Utilities sector is integrating cloud-managed services to enhance operational reliability, facilitate smart grid technologies, and manage vast amounts of data collected from various sources. The sector also benefits from cloud solutions in achieving sustainability goals and improving resource management through data analytics.

Aerospace and Defense organizations require secure, scalable cloud-managed services to manage sensitive data, streamline operational processes, and enhance communication systems. The need for robust security features and compliance with stringent government regulations positions this sector as a growing market for cloud solutions, though its market share remains relatively smaller compared to other industries.

Key Market Segments

By Service Type

- Managed Business Services

- Managed Network Services

- Managed Infrastructure Services

- Managed Security Services

- Managed Mobility Services

- Managed Communication and Collaboration Services

By Deployment

- Public Cloud

- Private Cloud

By Enterprise Size

- SMEs

- Large Enterprises

By Vertical

- BFSI

- IT and Telecommunications

- Government and Public Sector

- Healthcare and Life Sciences

- Retail and Consumer Goods

- Manufacturing

- Energy and Utilities

- Aerospace and Defense

- Others

Growth Opportunity

Edge Computing and IoT Integration

The surge in edge computing and IoT adoption is creating new demands for cloud managed services. As industries such as manufacturing, logistics, and smart cities integrate IoT solutions, the need for managing distributed infrastructures becomes paramount. MSPs offering edge-cloud integration services will be particularly well-positioned to capitalize on this trend.

These services include seamless data management, real-time analytics, and enhanced security for decentralized networks. As IoT adoption accelerates, businesses will seek MSPs capable of supporting complex, geographically distributed systems, thus creating a significant opportunity for growth in the sector.

AI, Automation, and Advanced Analytics Integration

The integration of AI and automation into cloud managed services represents another high-value growth avenue. AI-driven solutions can automate cloud provisioning, patch management, and resource optimization, improving operational efficiency while reducing costs. MSPs providing AI-powered monitoring and predictive analytics can help businesses optimize performance and prevent system disruptions proactively.

Furthermore, the increasing emphasis on data-driven decision-making across industries makes advanced analytics a key differentiator for MSPs. By offering these innovative solutions, MSPs can meet the evolving demands of enterprises and unlock new revenue streams in 2024.

Latest Trends

Hybrid and Multi-Cloud Adoption

As enterprises pursue greater flexibility and risk mitigation, hybrid and multi-cloud strategies are gaining momentum. Hybrid cloud environments, which combine on-premises infrastructure with public cloud services, allow businesses to optimize workloads while maintaining control over sensitive data. Multi-cloud approaches, leveraging multiple public cloud platforms, offer redundancy, cost optimization, and the ability to avoid vendor lock-in. In 2024, managed service providers (MSPs) will play a crucial role in helping organizations orchestrate these complex ecosystems, providing integration, monitoring, and optimization services.

Focus on Security and Compliance

With the rapid expansion of cloud adoption, the need for robust security and compliance solutions has never been more critical. As cyber threats evolve and regulations such as GDPR and CCPA tighten, organizations face increased pressure to secure their cloud environments. Managed services focused on proactive threat detection, compliance audits, and governance frameworks will be in high demand. Providers that offer advanced security features, including zero-trust architecture and automated compliance reporting, will be particularly well-positioned to capture market share in 2024.

Regional Analysis

Cloud Managed Services Market North America Leads with 43.0% largest revenue share

North America holds the dominant share of the global cloud managed services market, accounting for approximately 43.0% of total revenue. This region's leadership is largely due to robust cloud adoption across industries such as healthcare, finance, and retail. The U.S., in particular, continues to lead the cloud journey, supported by advanced digital infrastructure, strong enterprise demand for cloud services, and the adoption of hybrid cloud strategies. Canada is also witnessing a growing interest in managed cloud services, with enterprises seeking to streamline business processes and enhance scalability. The healthcare industry in the U.S. has been a major driver, leveraging cloud solutions for better patient data management and operational efficiencies.

Europe is a significant player in the cloud managed services market, driven by stringent data protection regulations such as GDPR and an increasing focus on digitizing business processes. Key markets such as Germany, France, and the UK are leading in cloud adoption, particularly in sectors like manufacturing, healthcare, and financial services. Germany and the UK, in particular, have shown strong investments in cloud services as businesses seek to enhance their digital agility. France is also embracing managed cloud services to facilitate its healthcare digitization initiatives. However, the market growth is moderated by cautious cloud adoption in certain countries like Spain and Italy, where digital transformation is still evolving.

The Asia Pacific region is experiencing rapid growth in cloud managed services, fueled by increasing digitalization initiatives and cloud-first strategies in countries like China, Japan, and India. Enterprises across the region are leveraging managed services to optimize their cloud journey, reduce IT complexities, and enhance business agility. China leads in cloud adoption due to its burgeoning e-commerce sector and aggressive technological advancements. Japan and South Korea are focusing on cloud services to drive innovation in business processes, particularly in healthcare and manufacturing. Emerging markets such as India and Vietnam are also growing rapidly, with SMEs adopting cloud solutions to reduce operational costs.

In Latin America, cloud managed services are gaining momentum, especially in countries like Mexico and Brazil. The region's cloud market is driven by increasing digital transformation efforts aimed at optimizing business processes, improving customer experiences, and enhancing operational efficiencies. Brazil, the largest market in the region, has seen significant uptake of cloud services in the healthcare sector, where cloud solutions are helping to streamline patient data management. Mexico is also showing strong growth, with enterprises adopting managed services to support their cloud journey, although the rest of Latin America lags due to infrastructure challenges and economic instability.

The Middle East & Africa (MEA) is an emerging market for cloud managed services, with growth being driven by digital transformation efforts across sectors like finance, government, and healthcare. Saudi Arabia and the UAE are leading the cloud journey in this region, with significant government-backed initiatives to digitalize public and private sectors. South Africa is another key market, where businesses are increasingly adopting cloud solutions to modernize their operations and improve service delivery.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2024, the global Cloud Managed Services market is characterized by an intensely competitive landscape, driven by a diverse range of players offering differentiated solutions. Major market players, including IBM Corporation and Cisco Systems, Inc., are at the forefront, leveraging their deep-rooted expertise in IT infrastructure and cloud technologies. IBM, with its extensive hybrid cloud capabilities and strong AI integration, positions itself as a leader in transforming cloud ecosystems. Similarly, Cisco continues to capitalize on its robust networking solutions, enhancing its managed service offerings through security and cloud-native infrastructure.

Telefonaktiebolaget LM Ericsson and Verizon are prominent in the telecommunications space, utilizing their vast network infrastructures to deliver highly secure, scalable cloud solutions. Their focus on integrating cloud with 5G technologies sets them apart in the managed service domain, particularly for enterprise customers seeking low-latency solutions.

Professional services giants such as Accenture and NTT DATA Corporation bring their consulting expertise to the fore, enabling businesses to navigate the complexities of cloud transformation. Their advisory and managed service portfolios help organizations optimize cloud strategies for efficiency and agility.

Asian-based competitors like Huawei Technologies Co., Ltd. and Fujitsu are increasingly gaining global traction with competitive pricing and strong technical capabilities, while CHINA HUAXIN and Trianz are emerging players focusing on niche segments.

CenturyLink also remains a formidable player, emphasizing network-centric cloud managed services, strengthening its presence through strategic acquisitions. Collectively, these players shape a dynamic and evolving competitive landscape in the global cloud managed services market.

Market Key Players

- IBM Corporation

- Cisco Systems, Inc.

- Telefonaktiebolaget LM Ericsson

- Verizon

- Accenture

- NTT DATA Corporation

- Huawei Technologies Co., Ltd.

- Fujitsu

- CHINA HUAXIN

- CenturyLink

- Trianz

Recent Development

- In January 2024, Accenture acquired Navisite, adding around 1,500 cloud professionals to its team. This acquisition is intended to strengthen Accenture's cloud transformation and infrastructure engineering capabilities, enabling the company to support a broader range of clients across industries such as technology, healthcare, and manufacturing.

- In 2024, Hitachi and Microsoft expanded their partnership, with a focus on generative AI to drive innovation in sectors like energy, manufacturing, and social infrastructure. Their collaboration includes joint projects on predictive maintenance in rail infrastructure and applying generative AI to enhance operational efficiencies.

- In January 2024, Capgemini and AWS deepened their strategic partnership to accelerate the implementation of generative AI solutions. This collaboration aims to help enterprises scale AI technologies, improving operational efficiencies in industries such as healthcare, manufacturing, and public services.

- In 2024, Hitachi announced a $2.1 billion investment in generative AI to capitalize on new growth opportunities and enhance its Lumada platform, particularly in industrial applications. Their partnership with Microsoft includes the integration of Azure OpenAI Service into mission-critical systems.

Report Scope

Report Features Description Market Value (2023) USD 109.2 Bn Forecast Revenue (2033) USD 423.0 Bn CAGR (2024-2032) 14.9% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service Type(Managed Business Services, Managed Network Services, Managed Infrastructure Services, Managed Security Services, Managed Mobility Services, Managed Communication and Collaboration Services), By Deployment (Public Cloud, Private Cloud), By Enterprise Size( SMEs, Large Enterprises), By Vertical (BFSI, IT and Telecommunications, Government and Public Sector, Healthcare and Life Sciences, Retail and Consumer Goods, Manufacturing, Energy and Utilities, Aerospace and Defense, Others), Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape IBM Corporation, Cisco Systems, Inc., Telefonaktiebolaget LM Ericsson, Verizon, Accenture, NTT DATA Corporation, Huawei Technologies Co., Ltd., Fujitsu, CHINA HUAXIN, CenturyLink, Trianz Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-