Global Clinical Workflow Solutions Market By Type Outlook(Data Integration Solutions(EMR Integration Solutions, Medical Image Integration Solutions), Real-time Communication Solutions(Nurse Call Alert Systems), Workflow Automation Solutions(Patient Flow Management Solutions), Care Collaboration Solutions(Medication Administration Solutions, Rounding Solutions, Other Care Collaboration Solutions), Enterprise Reporting & Analytics Solutions), By End-use(Hospitals, Ambulatory Care Centers), By Region And Companies - Industry Segment Outlook, Market Ass

-

46581

-

May 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

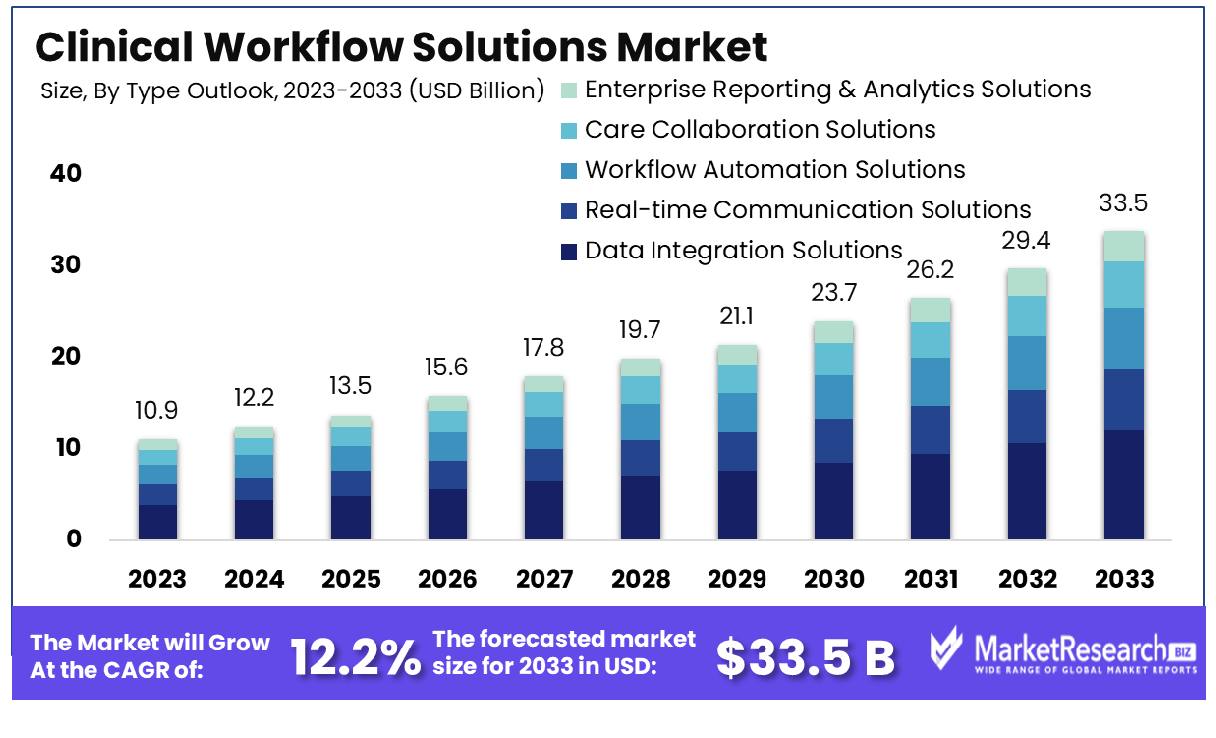

The Global Clinical Workflow Solutions Market was valued at USD 10.9 billion in 2023. It is expected to reach USD 33.5 billion by 2033, with a CAGR of 12.2% during the forecast period from 2024 to 2033.

The Clinical Workflow Solutions Market encapsulates a dynamic ecosystem of software, hardware, and integrated systems designed to streamline and optimize healthcare processes. These solutions span patient registration, appointment scheduling, electronic health records (EHR) management, and billing, aiming to enhance operational efficiency, patient care quality, and regulatory compliance within clinical settings.

As healthcare organizations increasingly prioritize digitization and interoperability, the Clinical Workflow Solutions Market witnesses sustained growth, driven by the imperative to mitigate administrative burdens, reduce medical errors, and improve overall healthcare delivery. Key stakeholders, from Vice Presidents to Product Managers, navigate this market landscape to harness innovative solutions that propel their institutions toward enhanced productivity and patient-centric care paradigms.

The Clinical Workflow Solutions Market is witnessing a significant paradigm shift driven by evolving healthcare landscapes and the pervasive integration of digital technologies. As healthcare systems worldwide grapple with the imperative of efficiency amidst rising costs and growing patient populations, the adoption of clinical workflow solutions emerges as a strategic imperative. These solutions encompass a spectrum of digital tools and platforms designed to optimize and automate healthcare processes, from patient registration and scheduling to clinical documentation and billing.

According to the OECD Health Statistics 2023, the global healthcare expenditure to GDP ratio saw a marginal decline, indicating a concerted effort towards cost containment and operational efficiency. This underscores the urgency for healthcare providers to embrace innovative solutions that can enhance clinical workflows while mitigating resource constraints. Moreover, insights from Digitalis Medical reveal a robust growth trajectory for the digital health market, underpinned by a projected CAGR of 15.1% between 2021-2028. This growth trajectory signifies a burgeoning demand for digital health technologies capable of revolutionizing clinical workflows and driving operational excellence.

In the wake of these developments, stakeholders across the healthcare ecosystem are increasingly investing in clinical workflow solutions to navigate the complexities of modern healthcare delivery. From hospitals and clinics to ambulatory care centers and specialty practices, the imperative to optimize clinical workflows transcends organizational boundaries. By leveraging digital innovations, such as electronic health records (EHRs), telemedicine platforms, and AI-powered decision support systems, healthcare providers can unlock unprecedented efficiencies, improve patient outcomes, and enhance the overall quality of care delivery.

As the healthcare industry continues its digital transformation journey, the Clinical Workflow Solutions Market stands poised for sustained growth and innovation, offering a compelling value proposition for stakeholders committed to reimagining healthcare delivery in the 21st century.

Key Takeaways

- Market Growth: The Global Clinical Workflow Solutions Market was valued at USD 10.9 billion in 2023. It is expected to reach USD 33.5 billion by 2033, with a CAGR of 12.2% during the forecast period from 2024 to 2033.

- By Type Outlook: Data Integration Solutions dominates the market at 27.2%.

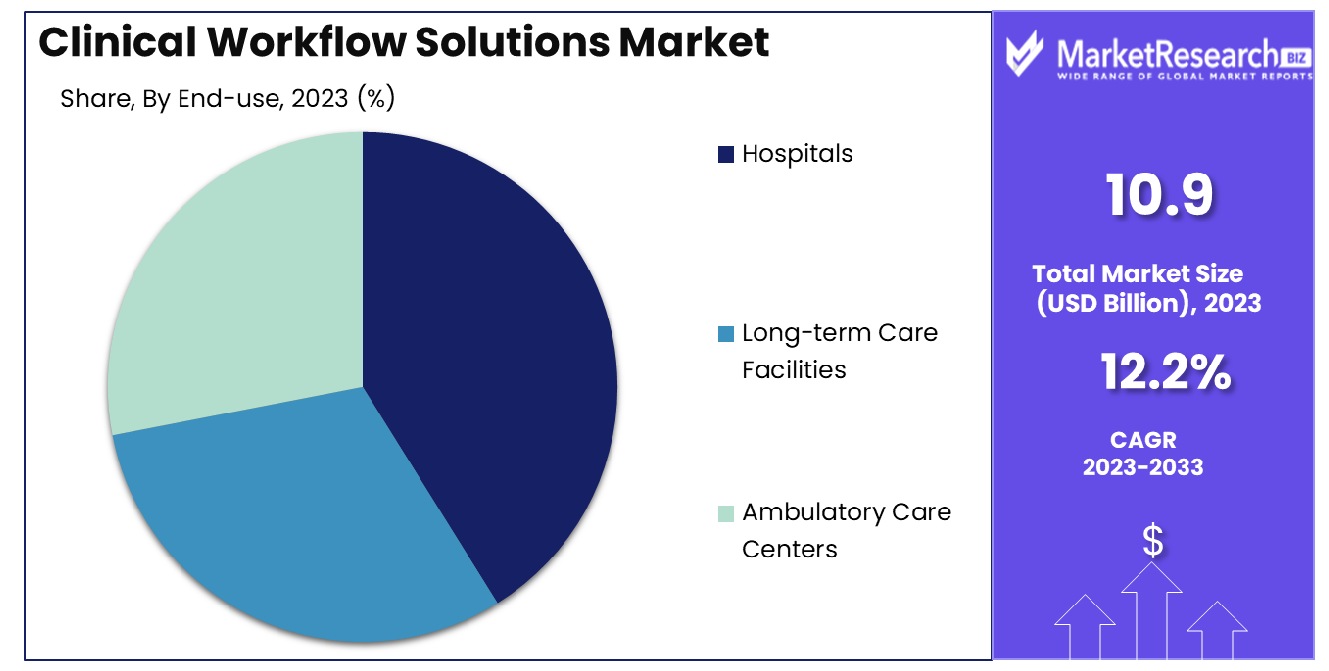

- By End-use: Hospitals lead the market by a substantial margin at 45%.

- Regional Dominance: In North America, the Clinical Workflow Solutions Market dominates with a 42% market share.

- Growth Opportunity: In 2023, the global Clinical Workflow Solutions Market presents significant opportunities driven by a focus on patient engagement and improved care delivery, fostering innovation and growth in healthcare technology.

Driving factors

Advantages of Clinical Workflow Solutions in Enhancing Patient Care and Safety

Clinical workflow solutions play a pivotal role in augmenting patient care and safety within healthcare settings. These solutions streamline processes, improve communication among healthcare professionals, and enhance overall efficiency. By integrating electronic health records (EHR) systems, appointment scheduling, and medical billing, clinical workflow solutions optimize resource allocation and reduce errors.

According to recent studies, healthcare facilities utilizing such solutions have reported significant improvements in patient outcomes, with reduced medication errors and enhanced coordination among care teams. Moreover, the implementation of clinical decision support systems (CDSS) embedded within workflow solutions further contributes to patient safety by providing real-time alerts and evidence-based recommendations to clinicians.

Consequently, the market for clinical workflow solutions continues to expand as healthcare providers increasingly prioritize patient-centered care and strive to mitigate risks associated with manual processes.

Growing Telehealth and Remote Patient Monitoring Markets

The exponential growth of telehealth and remote patient monitoring markets synergistically drives the demand for clinical workflow solutions. As healthcare delivery transitions towards remote and virtual care models, there is a pressing need for integrated platforms that facilitate seamless communication and data exchange between patients and providers.

Clinical workflow solutions enable remote consultations, remote monitoring of vital signs, and remote prescription management, fostering continuity of care beyond traditional healthcare settings. With the global telehealth market projected to reach USD 559.52 billion by 2027, the demand for interoperable clinical workflow solutions is expected to escalate, catering to the evolving needs of both healthcare organizations and patients.

Rise in the Prevalence of Cancer & Chronic Diseases

The rising prevalence of cancer and chronic diseases worldwide underscores the necessity for efficient clinical workflow solutions. Managing complex treatment regimens, coordinating multidisciplinary care teams, and ensuring timely interventions pose substantial challenges in healthcare delivery.

Clinical workflow solutions mitigate these challenges by automating care pathways, facilitating care coordination, and optimizing resource utilization. By integrating data from various sources, including diagnostic tests, imaging studies, and treatment plans, these solutions enable personalized and timely interventions, thereby improving patient outcomes.

Furthermore, the growing emphasis on value-based care models incentivizes healthcare providers to invest in technologies that enhance care quality and patient satisfaction. Consequently, the prevalence of cancer and chronic diseases serves as a catalyst for the adoption of clinical workflow solutions, driving market expansion amidst evolving healthcare landscapes.

Restraining Factors

Regulatory and Compliance Challenges

Regulatory and compliance challenges pose significant hurdles to the growth of the clinical workflow solutions market. Healthcare organizations must adhere to stringent regulations governing data privacy, security, and interoperability, such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States and the General Data Protection Regulation (GDPR) in the European Union.

Compliance with these regulations necessitates robust data encryption, audit trails, and access controls within clinical workflow solutions, increasing implementation complexity and costs. Moreover, evolving regulatory landscapes and frequent updates require continuous monitoring and adaptation, further straining resources. As a result, healthcare providers may hesitate to invest in clinical workflow solutions, fearing non-compliance penalties and operational disruptions.

Limited IT Infrastructure in Developing Countries

Limited IT infrastructure in developing countries presents a significant barrier to the widespread adoption of clinical workflow solutions. Infrastructure gaps, including inadequate internet connectivity, unreliable power supply, and outdated hardware, hinder the deployment and functionality of digital health technologies. Without the requisite infrastructure to support electronic health records (EHR) systems, telehealth platforms, and interoperable networks, healthcare providers in these regions struggle to leverage the benefits of clinical workflow solutions.

Additionally, limited financial resources and competing priorities within healthcare budgets impede investments in IT infrastructure upgrades. Consequently, disparities in healthcare access and quality persist, exacerbating healthcare inequities between developed and developing countries.

By Type Outlook Analysis

Data Integration Solutions dominated with a 27.2% share in the market.

In 2023, Data Integration Solutions held a dominant market position in the Type Outlook segment of the Clinical Workflow Solutions Market, capturing more than a 27.2% share. This segment encompasses various essential components facilitating seamless integration and management of clinical data within healthcare facilities. Data Integration Solutions primarily include EMR Integration Solutions, Medical Image Integration Solutions, Real-time Communication Solutions, Workflow Automation Solutions, Care Collaboration Solutions, and Enterprise Reporting & Analytics Solutions.

EMR Integration Solutions play a pivotal role in consolidating electronic medical records (EMRs) across different departments, streamlining patient data access for healthcare providers. Similarly, Medical Image Integration Solutions enable efficient storage and retrieval of medical images such as X-rays, MRIs, and CT scans, enhancing diagnostic capabilities and patient care.

Real-time Communication Solutions encompass Nurse Call Alert Systems and Unified Communication Solutions, facilitating immediate communication among healthcare staff for prompt patient care delivery and coordination.

Workflow Automation Solutions, comprising Patient Flow Management Solutions and Nursing & Staff Scheduling Solutions, optimize operational efficiencies by automating routine tasks and resource allocation, thereby enhancing workflow productivity and patient throughput.

Care Collaboration Solutions, including Medication Administration Solutions, Perinatal Care Management Solutions, Rounding Solutions, and other specialized collaboration tools like Specimen Collection Solutions and Blood Products Administration Solutions, foster interdisciplinary care coordination, ensuring seamless information exchange and treatment delivery.

Lastly, Enterprise Reporting & Analytics Solutions offer comprehensive insights into clinical operations and performance metrics, empowering healthcare providers with data-driven decision-making capabilities to improve patient outcomes and operational efficiencies.

By End-use Analysis

Hospitals held the largest share, accounting for 45% of the market.

In 2023, Hospitals held a dominant market position in the By End-use segment of the Clinical Workflow Solutions Market, capturing more than a 45% share. This segment encompasses various healthcare facilities that utilize clinical workflow solutions to streamline operations and enhance patient care delivery. Hospitals, Long-term Care Facilities, and Ambulatory Care Centers represent key end-users driving demand and adoption within this market.

Hospitals, as the primary providers of acute care services, accounted for the largest share in the Clinical Workflow Solutions Market. With complex and diverse patient populations, hospitals rely heavily on advanced workflow solutions to manage clinical processes efficiently. These solutions include EMR integration, real-time communication systems, workflow automation, and care collaboration tools, enabling hospitals to optimize resource utilization, minimize errors, and improve patient outcomes.

Long-term Care Facilities, catering to individuals requiring extended medical and support services, also constituted a significant portion of the market. These facilities encompass nursing homes, rehabilitation centers, and assisted living facilities, where clinical workflow solutions play a crucial role in managing residents' health records, medication administration, care coordination, and communication among staff members.

Ambulatory Care Centers, including outpatient clinics, urgent care centers, and surgical centers, represented another substantial segment within the Clinical Workflow Solutions Market. With a focus on delivering timely and efficient care outside traditional hospital settings, ambulatory care centers leverage workflow solutions to streamline patient flow, appointment scheduling, medical documentation, and communication between healthcare providers.

Overall, the dominance of Hospitals in the By End-use segment underscores the central role of acute care facilities in driving the adoption of clinical workflow solutions. However, the increasing demand from Long-term Care Facilities and Ambulatory Care Centers indicates a growing recognition of the importance of efficient clinical workflows across diverse healthcare settings.

Key Market Segments

By Type Outlook

Data Integration Solutions

- EMR Integration Solutions

- Medical Image Integration Solutions

Real-time Communication Solutions

- Nurse Call Alert Systems

- Unified Communication Solutions

Workflow Automation Solutions

- Patient Flow Management Solutions

- Nursing & Staff Scheduling Solutions

Care Collaboration Solutions

- Medication Administration Solutions

- Perinatal Care Management Solutions

- Rounding Solutions

- Other Care Collaboration Solutions (Specimen Collection Solutions and Blood Products Administration Solutions)

Enterprise Reporting & Analytics Solutions

By End-use

- Hospitals

- Long-term Care Facilities

- Ambulatory Care Centers

Growth Opportunity

Focus on Patient Engagement and Experience

In 2023, the global Clinical Workflow Solutions Market is poised for substantial growth, primarily driven by an increasing focus on enhancing patient engagement and experience. Healthcare providers worldwide are recognizing the importance of patient-centric care models, leading to a surge in demand for innovative solutions that streamline workflows while prioritizing patient satisfaction. Clinical workflow solutions that integrate patient engagement tools, such as mobile applications for appointment scheduling, virtual consultations, and personalized health information portals, are expected to witness significant adoption.

These solutions not only empower patients by providing them with greater control over their healthcare journey but also contribute to improved outcomes and higher patient satisfaction rates. As healthcare organizations continue to prioritize patient-centered care, the demand for clinical workflow solutions that enhance patient engagement is expected to drive market growth substantially in 2023.

Growing Demand for Improved Patient Care

Another key driver propelling the global Clinical Workflow Solutions Market in 2023 is the escalating demand for enhanced patient care. With an increasing emphasis on value-based care delivery models and the rising complexity of healthcare systems, there is a growing need for solutions that optimize clinical workflows, reduce administrative burdens, and improve overall patient care quality. Clinical workflow solutions equipped with advanced features such as predictive analytics, interoperability, and real-time monitoring capabilities enable healthcare providers to deliver more personalized and efficient care to patients.

These solutions facilitate seamless coordination among healthcare teams, streamline processes, and ensure timely interventions, ultimately leading to better patient outcomes. Consequently, the market is witnessing heightened demand for clinical workflow solutions that empower healthcare organizations to deliver superior patient care, positioning it for significant opportunities in 2023.

Latest Trends

Increasing Initiatives by Public and Private Organizations

The global Clinical Workflow Solutions Market in 2023 is experiencing a surge in initiatives by both public and private organizations aimed at enhancing healthcare delivery systems. Governments and healthcare authorities worldwide are increasingly recognizing the importance of efficient clinical workflows in improving patient outcomes and reducing healthcare costs.

As a result, there is a growing emphasis on investing in advanced clinical workflow solutions that streamline processes, improve care coordination, and enhance overall operational efficiency within healthcare facilities.

Moreover, private healthcare providers are also proactively investing in innovative workflow solutions to gain a competitive edge, meet regulatory requirements, and deliver high-quality care services to patients. This trend is driving the adoption of sophisticated clinical workflow technologies, such as electronic health records (EHR) systems, clinical decision support tools, and telemedicine platforms, across various healthcare settings globally.

Increasing Demand for Standardization of Clinical Workflow in Developed Nations

In 2023, the global Clinical Workflow Solutions Market is witnessing a notable trend toward the standardization of clinical workflows, particularly in developed nations. With the increasing complexity of healthcare delivery systems and the proliferation of digital health technologies, there is a growing recognition of the need for standardized processes to ensure interoperability, data exchange, and seamless integration of healthcare information systems.

Developed countries, in particular, are witnessing a heightened demand for clinical workflow solutions that adhere to standardized protocols and interoperability standards, such as HL7 and FHIR.

These initiatives aim to facilitate data exchange across disparate healthcare systems, promote care coordination among healthcare providers, and ultimately improve patient outcomes. Consequently, the market is witnessing a rise in the adoption of standardized clinical workflow solutions to meet the evolving needs of healthcare delivery in developed nations.

Regional Analysis

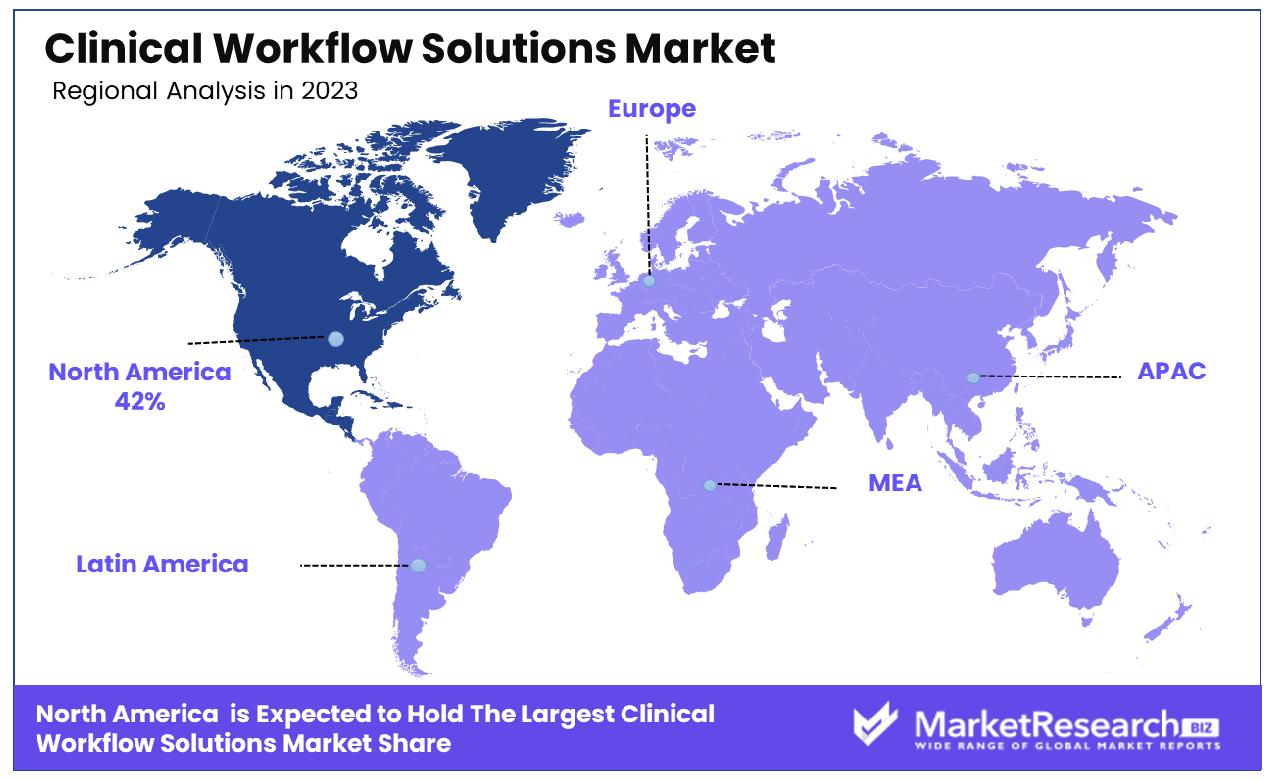

In North America, the Clinical Workflow Solutions Market accounts for a significant 42% of the global share.

North America, being at the forefront of technological advancements in healthcare, holds a dominant position in the clinical workflow solutions market, commanding a significant share of approximately 42%. This is attributable to the region's robust healthcare infrastructure, coupled with a high level of awareness regarding the benefits of integrating digital solutions into clinical workflows. Moreover, favorable government initiatives aimed at promoting healthcare IT adoption further bolster market growth in this region.

Europe emerges as another prominent market for clinical workflow solutions, driven by the presence of established healthcare systems across countries like Germany, the United Kingdom, and France. The region benefits from increasing investments in healthcare IT infrastructure and a growing emphasis on enhancing patient care through streamlined workflows. Europe accounts for a substantial share of the global market, with a notable focus on interoperability and data exchange standards to ensure seamless integration of clinical systems.

Asia Pacific exhibits immense growth potential in the clinical workflow solutions market, fueled by rapid urbanization, rising healthcare expenditure, and increasing demand for advanced healthcare technologies. Countries like China, India, and Japan are witnessing significant investments in healthcare IT infrastructure, leading to the adoption of digital solutions to optimize clinical processes and improve patient outcomes. The region's market share is steadily expanding, driven by initiatives to modernize healthcare delivery and improve accessibility to quality care.

Middle East & Africa and Latin America present emerging markets for clinical workflow solutions, characterized by growing awareness regarding the benefits of digital healthcare solutions and investments in healthcare infrastructure. While these regions currently hold a smaller share of the global market, ongoing initiatives aimed at digitizing healthcare systems and improving healthcare access are expected to drive market growth in the coming years.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global Clinical Workflow Solutions Market witnessed notable traction, with key players strategically positioning themselves to capitalize on evolving market dynamics. Among the prominent contenders, Veradigm Inc., formerly known as Allscripts Healthcare Solutions, Inc., emerges as a significant force driving innovation and shaping the market landscape. With a rich legacy in healthcare technology solutions, Veradigm leverages its extensive expertise to deliver comprehensive clinical workflow solutions tailored to meet the evolving needs of healthcare organizations worldwide.

Cerner Corporation, following its acquisition by Oracle Corporation, also stands out as a formidable player in the market. The integration of Cerner's robust clinical solutions with Oracle's advanced technology ecosystem signifies a synergistic approach to driving digital transformation in healthcare. This strategic alliance positions Cerner as a key enabler of interoperable and integrated clinical workflows, empowering healthcare providers to deliver high-quality care while optimizing operational efficiencies.

NXGN Management, LLC, McKesson Corporation, and Koninklijke Philips N.V. continue to reinforce their positions as industry leaders, leveraging their diverse portfolios and global reach to address the complex challenges faced by healthcare organizations. These companies are at the forefront of developing innovative solutions that streamline clinical workflows, enhance patient engagement, and improve healthcare outcomes.

Furthermore, the market landscape is enriched by the contributions of technology giants like Cisco Systems, Inc., Getinge AB., Vocera Communications, Inc., Spok Inc., and AMETEK, Inc. These companies bring to the table a wealth of expertise in networking, communication, medical equipment, and data analytics, fostering collaborative efforts to drive innovation and reshape the future of healthcare delivery.

Market Key Players

- Veradigm Inc. (formerly Allscripts Healthcare Solutions, Inc.)

- Cerner Corporation (acquired by Oracle Corporation)

- NXGN Management, LLC

- McKesson Corporation

- Koninklijke Philips N.V.

- Cisco Systems, Inc.

- Getinge AB.

- Vocera Communications, Inc.

- Spok Inc.

- AMETEK, Inc.

Recent Development

- In January 2024, Mayo Clinic Platform and Techcyte collaborate to pioneer a digital pathology platform, revolutionizing pathology services worldwide with AI-driven solutions for enhanced efficiency and global access.

- In September 2023, Healthcare providers are ramping up IT spending, prioritizing AI adoption. Epic partners with Microsoft Azure for patient message drafting. Mayo Clinic tests Google-powered data search. NYU Langone pilots EHR note analysis by Nuance.

Report Scope

Report Features Description Market Value (2023) USD 10.9 Billion Forecast Revenue (2033) USD 33.5 Billion CAGR (2024-2032) 12.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type Outlook(Data Integration Solutions(EMR Integration Solutions, Medical Image Integration Solutions), Real-time Communication Solutions(Nurse Call Alert Systems, Unified Communication Solutions), Workflow Automation Solutions(Patient Flow Management Solutions, Nursing & Staff Scheduling Solutions), Care Collaboration Solutions(Medication Administration Solutions, Perinatal Care Management Solutions, Rounding Solutions, Other Care Collaboration Solutions (Specimen Collection Solutions and Blood Products Administration Solutions)), Enterprise Reporting & Analytics Solutions), By End-use(Hospitals, Long-term Care Facilities, Ambulatory Care Centers) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Veradigm Inc. (formerly Allscripts Healthcare Solutions, Inc.), Cerner Corporation (acquired by Oracle Corporation), NXGN Management, LLC, McKesson Corporation, Koninklijke Philips N.V., Cisco Systems, Inc., Getinge AB., Vocera Communications, Inc., Spok Inc., AMETEK, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Veradigm Inc. (formerly Allscripts Healthcare Solutions, Inc.)

- Cerner Corporation (acquired by Oracle Corporation)

- NXGN Management, LLC

- McKesson Corporation

- Koninklijke Philips N.V.

- Cisco Systems, Inc.

- Getinge AB.

- Vocera Communications, Inc.

- Spok Inc.

- AMETEK, Inc.