Global Chocolate Confectionery Market By Product (Boxed, Molded Bars, Chips and Bites, Truffles and Cups, Others), By Type (Milk, Dark, White), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2025-2034

-

51489

-

February 2025

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

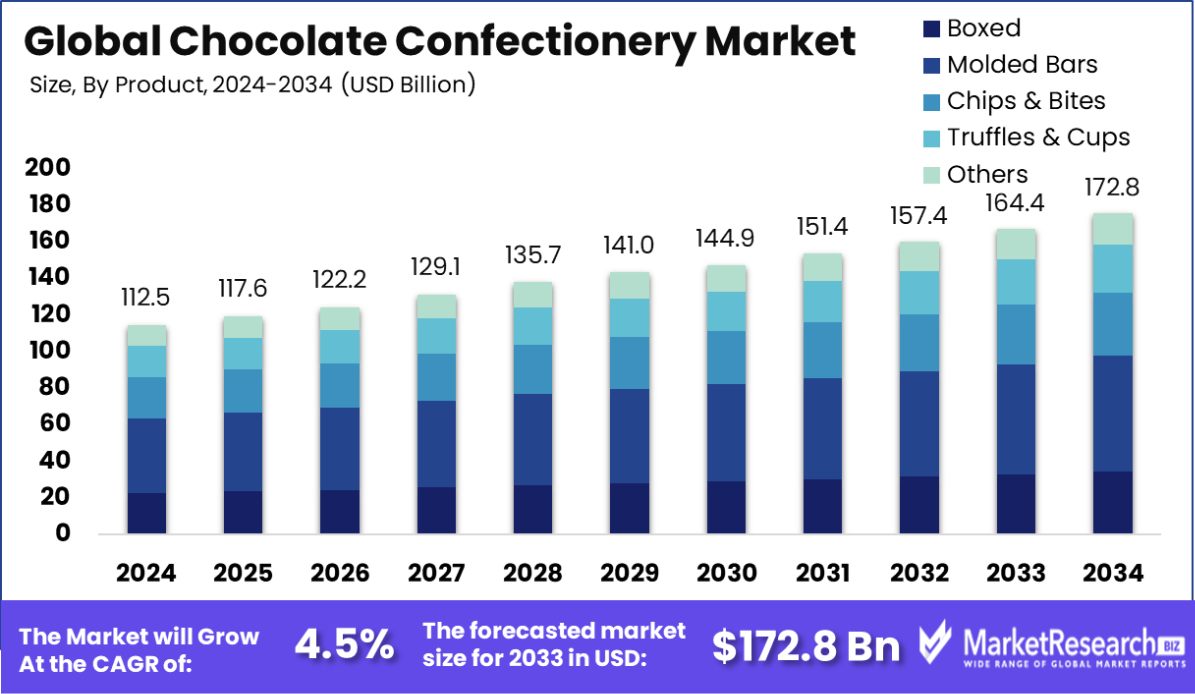

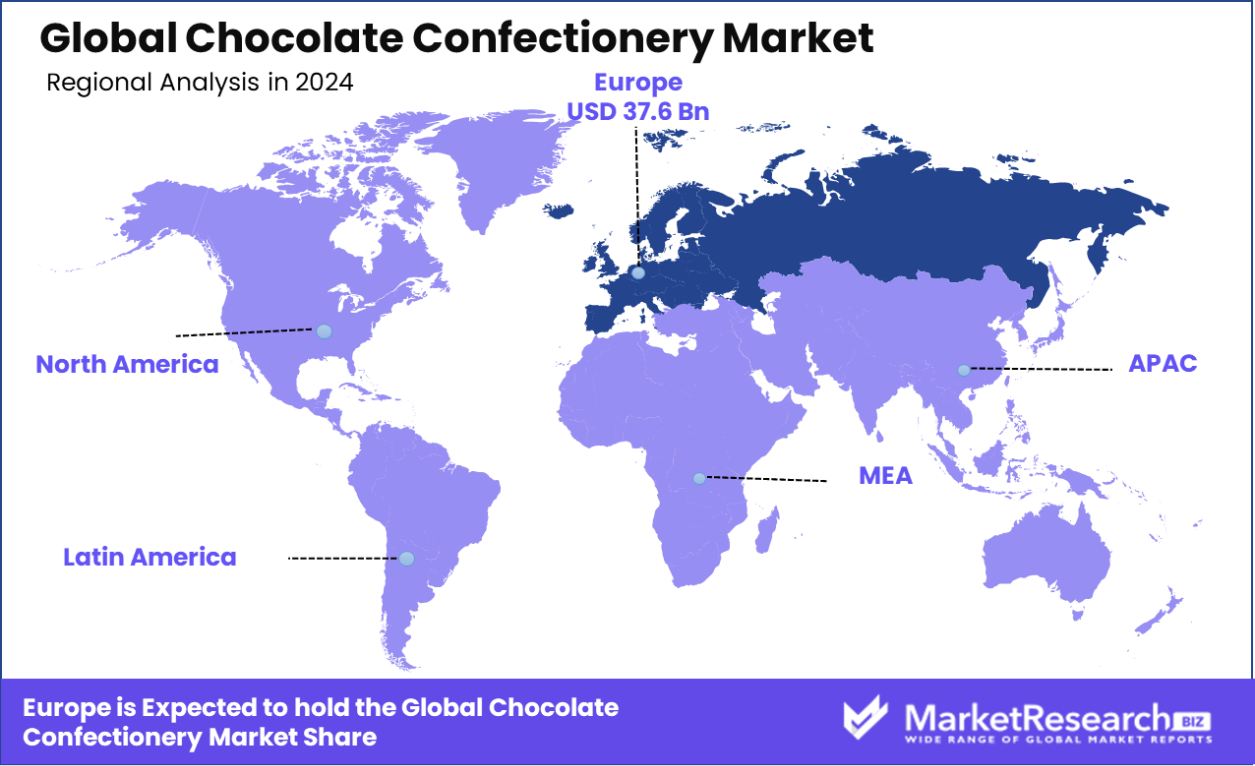

Global Chocolate Confectionery Market was valued at USD 112.5 billion in 2024. It is expected to reach USD 172.8 billion by 2034, with a CAGR of 4.5% during the forecast period from 2025 to 2034. Europe holds 33.5% of the chocolate confectionery market at USD 37.6 billion.

Chocolate confectionery refers to various sweet products made primarily from chocolate and cocoa as key ingredients. This category includes a wide array of products such as chocolate bars, candies, truffles, and seasonal novelties. These treats vary significantly in terms of cocoa content, flavors, fillings, and coatings, catering to a diverse range of tastes and preferences.

The chocolate confectionery market comprises the production and sale of chocolate-based sweets. It is a segment characterized by high consumer demand and has a significant presence in both developed and emerging economies. The market thrives on innovation and the introduction of new flavors, alongside maintaining a strong base of traditional favorites. Consumer preferences for premium and artisanal chocolates are notably driving market growth.

The market's growth is propelled by increasing disposable incomes and the widespread popularity of chocolate as an indulgent treat. The rising trend of gifting confectionery during festivals and special occasions further bolsters market expansion. Additionally, manufacturers are tapping into consumer demands for healthier options by offering chocolates with higher cocoa content and reduced sugar, which are perceived as healthier alternatives.

There is a growing demand for premium and dark chocolates due to their purported health benefits, including being a source of antioxidants. The market also sees opportunities in the expansion of distribution channels, particularly through e-commerce, which makes specialty chocolates more accessible to a broader audience.

Moreover, the use of sustainable and ethically sourced ingredients is becoming a significant factor in consumer purchase decisions, providing new opportunities for brands focusing on ethical production practices.

Key Takeaways

- Global Chocolate Confectionery Market was valued at USD 112.5 billion in 2024. It is expected to reach USD 172.8 billion by 2034, with a CAGR of 4.5% during the forecast period from 2025 to 2034.

- Molded bars hold a 36.5% share in the chocolate confectionery market, indicating their popularity.

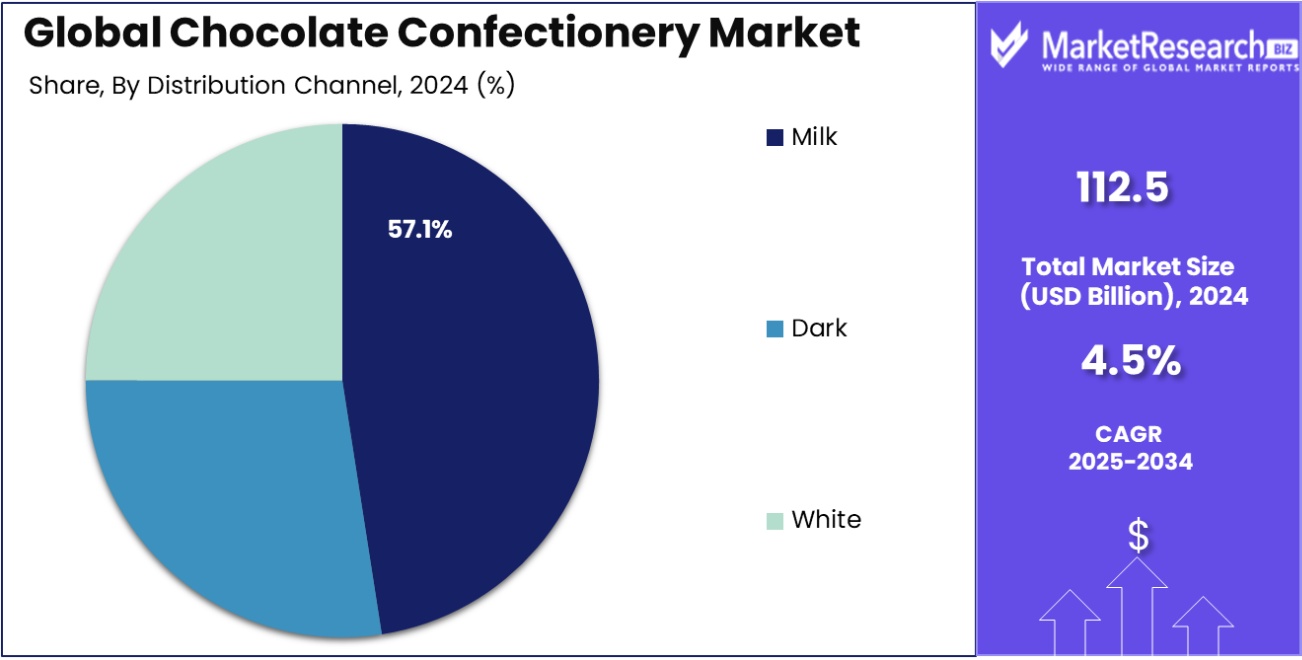

- Milk chocolate dominates with a 57.1% market share, preferred for its creamy texture and sweetness.

- Supermarkets and hypermarkets distribute 43.1% of chocolate confectionery, making them key retail channels.

- The European chocolate confectionery market holds a 33.5% share, valued at USD 37.6 billion.

By Product Analysis

Molded bars hold a 36.5% share in the chocolate confectionery market.

In 2024, Molded Bars held a dominant market position in the By Product segment of the Chocolate Confectionery Market, capturing a 36.5% share. This segment outperformed other categories such as Boxed Assortments, Chips & Bites, and Truffles & Cups, primarily due to its widespread popularity and versatility in various consumer demographics. Molded Bars are favored for their convenience, portion control, and the ability to incorporate a range of flavors and fillings, which appeal to a broad spectrum of tastes and preferences.

The appeal of Molded Bars is enhanced by their adaptability in both premium and mass-market channels, making them a significant driver of growth within the sector. The segment's success is also reflective of evolving consumer trends towards indulgent, high-quality chocolate experiences. As consumers increasingly seek out artisanal and premium products, Molded Bars have been pivotal in meeting these demands by offering sophisticated flavors and textures that differentiate them from traditional offerings.

This trend towards premiumization within the Molded Bars segment is expected to continue, influencing product innovation and marketing strategies across the chocolate confectionery industry. The strategic focus on Molded Bars not only underscores their current market dominance but also indicates their potential to shape future market dynamics in the chocolate confectionery sector.

By Type Analysis

Milk chocolate dominates with 57.1% of the chocolate confectionery market.

In 2024, Milk chocolate held a dominant market position in the By Type segment of the Chocolate Confectionery Market, with a 57.1% share. Its leading status is a testament to the enduring popularity of milk chocolate among consumers, who favor its smooth, creamy texture and sweet, comforting flavor profile. This preference spans across various age groups and demographics, making milk chocolate a staple in households.

The dominance of milk chocolate is also driven by its versatility in various confectionery applications, from simple chocolate bars to intricate confections used in baking and other culinary creations. Its ability to blend with a multitude of flavors, from nuts and caramel to fruits and spices, has allowed manufacturers to continually innovate, keeping consumer interest piqued and the market vibrant.

While milk chocolate continues to hold the lion’s share, it coexists with dark and white chocolate varieties, each catering to distinct taste preferences and dietary considerations. However, the universal appeal of milk chocolate, combined with strategic marketing and widespread availability, ensures its continued prominence in the market landscape. The ongoing preference for milk chocolate is expected to sustain its market superiority, underpinning sales growth in the overall chocolate confectionery sector.

By Distribution Channel Analysis

Supermarkets lead with 43.1% in chocolate confectionery market distribution.

In 2024, Supermarkets & Hypermarkets held a dominant market position in the By Distribution Channel segment of the Chocolate Confectionery Market, with a 43.1% share. This channel's leading status is attributed to its ability to offer a wide assortment of chocolate confectionery products under one roof, coupled with the convenience of one-stop shopping for consumers.

The extensive reach and strategic location of supermarkets and hypermarkets, often in highly trafficked areas, enhance consumer access to a variety of chocolate products, from premium to budget-friendly options.

The success of supermarkets and hypermarkets in this segment is bolstered by their effective marketing strategies, which include attractive product placements, promotions, and discounts that draw in a large number of customers. Additionally, the tactile shopping experience allows consumers to browse and make spontaneous purchases, which is particularly effective for chocolate products that often serve as impulse buys.

While online channels and convenience stores are growing, supermarkets and hypermarkets remain the preferred shopping destination for most consumers looking to purchase chocolate confectionery. The physical presence and the sensory shopping experience they offer are likely to keep them at the forefront of the distribution channels for the foreseeable future.

Key Market Segments

By Product

- Boxed

- Molded Bars

- Chips & Bites

- Truffles & Cups

- Others

By Type

- Milk

- Dark

- White

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online

- Others

Driving Factors

Increased Demand for Premium Products Boosts Market Growth

Consumers are increasingly looking for high-quality, gourmet chocolate, driving significant growth in the premium segment of the chocolate confectionery market. As people become more health-conscious, they are willing to pay a higher price for chocolates that promise superior ingredients or offer health benefits like lower sugar, organic, or fair-trade certifications.

This trend is not just about indulgence; it's also about being mindful of health and ethical standards. Companies are responding by expanding their premium lines, which often boast unique flavors and luxurious packaging, making them attractive for personal treats and as gifts. This shift is reshaping market dynamics by pushing brands to innovate and elevate their product offerings.

Restraining Factors

Rising Health Awareness Curbs Chocolate Confectionery Sales

A significant challenge facing the chocolate confectionery market is the growing health consciousness among consumers. As people become more aware of the health risks associated with sugar and calorie intake, their inclination towards sugary treats like chocolate is declining.

This shift is prompting consumers to opt for healthier snack alternatives or chocolates with health benefits, such as those containing less sugar, no added artificial flavors, or enhanced with superfoods. The market is feeling the pressure to adapt, leading to an increase in the production of health-oriented chocolates, which, while beneficial, struggle to match the appeal of traditional confectionery in taste and indulgence.

Growth Opportunity

Expansion into Emerging Markets Spurs Chocolate Sales Growth

The chocolate confectionery market has a lucrative growth opportunity in expanding into emerging economies. These regions, with growing middle classes and increasing disposable incomes, are becoming hotbeds for consumer spending, including on luxury and indulgent products like chocolate.

As markets in North America and Europe mature, focusing on Asia, Africa, and Latin America could open new avenues for growth. Localizing flavors and creating price-appropriate products can make brands more appealing to diverse consumer bases. Additionally, establishing local manufacturing in these regions can reduce costs and boost market presence, making chocolates more accessible to a broader audience.

Latest Trends

Vegan and Plant-Based Chocolates Gain Market Traction

A notable trend reshaping the chocolate confectionery market is the rising popularity of vegan and plant-based chocolates. This shift is driven by the increasing number of consumers adopting vegan lifestyles and seeking dairy-free alternatives.

Chocolate manufacturers are responding by using plant-based milks like almond, coconut, and oat to create creamy and indulgent vegan-friendly chocolates. These products cater not only to vegans but also to lactose-intolerant and health-conscious consumers. As awareness and acceptance of plant-based diets grow globally, the demand for these chocolates is expected to rise, presenting a significant growth opportunity for innovative confectionery brands.

Regional Analysis

The Chocolate Confectionery Market in Europe holds a 33.5% share, valued at USD 37.6 billion.

The global chocolate confectionery market is segmented into several key regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Europe is the dominating region, holding 33.5% of the market share with a valuation of USD 37.6 billion, driven by a strong tradition of chocolate consumption and a high preference for premium products. North America follows, with a robust market driven by innovative product launches and a significant presence of major confectionery brands.

The Asia Pacific region is witnessing rapid growth due to increasing disposable incomes and the westernization of dietary habits, particularly in countries like China and India. Meanwhile, the Middle East & Africa, though smaller in comparison, is experiencing growth due to rising urbanization and the expansion of retail markets. Latin America also presents a significant opportunity, with countries such as Brazil and Mexico seeing growth in artisanal and premium chocolate products.

Each region's growth is influenced by local consumer preferences, economic conditions, and the varying presence of global and local confectionery manufacturers. The diverse cultural attitudes towards chocolate consumption and the growing awareness of health and wellness are shaping the market dynamics differently across these regions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global chocolate confectionery market is driven by a mix of established industry leaders and emerging premium brands, each influencing market trends through innovation, strategic expansion, and evolving consumer preferences.

Nestlé SA, a market giant, continues to strengthen its position by focusing on healthier, sustainable chocolate alternatives, while Ferrero International is expanding its global footprint with acquisitions and premium offerings. Chocoladefabriken Lindt & Sprüngli AG remains a key player in the luxury segment, leveraging brand loyalty and artisanal quality to sustain demand.

Mars Incorporated and Mondelēz International dominate the mass-market chocolate segment, with their wide product portfolios and strong distribution networks ensuring steady growth. The Hershey Company is advancing through strategic innovations, including plant-based and reduced-sugar chocolates, catering to health-conscious consumers. Barry Callebaut, a leader in cocoa sourcing and processing, plays a crucial role in the market’s supply chain, driving sustainable and innovative chocolate solutions.

In the premium and niche segment, CÉMOI Group and Lake Champlain Chocolates are focusing on organic and ethically sourced chocolate, appealing to eco-conscious consumers. Lotte Corporation and Haribo GmbH & Co. KG continue to expand in the Asia Pacific and European markets, respectively, with strong brand positioning and localized flavors.

Top Key Players in the Market

- Nestle SA

- Ferrero International

- Chocoladefabriken Lindt & Sprungli AG

- Mars Incorporated

- Mondelaz International

- The Hershey Company

- CEMOI Group

- Barry Callebaut

- Lake Champlain Chocolates

- Lotte Corporation

- Haribo Gmbh & Co. KG

- Other Market Players

Recent Developments

- In January 2025, Lindt & Sprüngli reported 7.8% organic sales growth for 2024, reaching 5.47 billion Swiss francs ($5.97 billion). The company announced plans to raise prices again in 2025 due to high cocoa costs.

- In February 2024, Nestlé India announced plans to invest Rs 6,500 crore ($782 million) by 2025 to expand production capacity and distribution reach.

Report Scope

Report Features Description Market Value (2024) USD 112.5 Billion Forecast Revenue (2034) USD 172.8 Billion CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Boxed, Molded Bars, Chips & Bites, Truffles & Cups, Others), By Type (Milk, Dark, White), By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Nestle SA, Ferrero International, Chocoladefabriken Lindt & Sprungli AG, Mars Incorporated, Mondelaz International, The Hershey Company, CEMOI Group, Barry Callebaut, Lake Champlain Chocolates, Lotte Corporation, Haribo Gmbh & Co. KG, Other Market Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Nestle SA

- Ferrero International

- Chocoladefabriken Lindt & Sprungli AG

- Mars Incorporated

- Mondelaz International

- The Hershey Company

- CEMOI Group

- Barry Callebaut

- Lake Champlain Chocolates

- Lotte Corporation

- Haribo Gmbh & Co. KG

- Other Market Players