Chinese Medicine Market Report By Type of Chinese Medicine (Herbal Medicine (Traditional Chinese Herbal Medicine), Acupuncture, Tai Chi, Qigong, Tui Na (Chinese Massage), Cupping Therapy, Moxibustion, Dietary Therapy), By Herbal Medicine Classification (Single Herbs, Herbal Formulas, Patent Medicines), By Therapeutic Focus, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

45560

-

May 2024

-

291

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

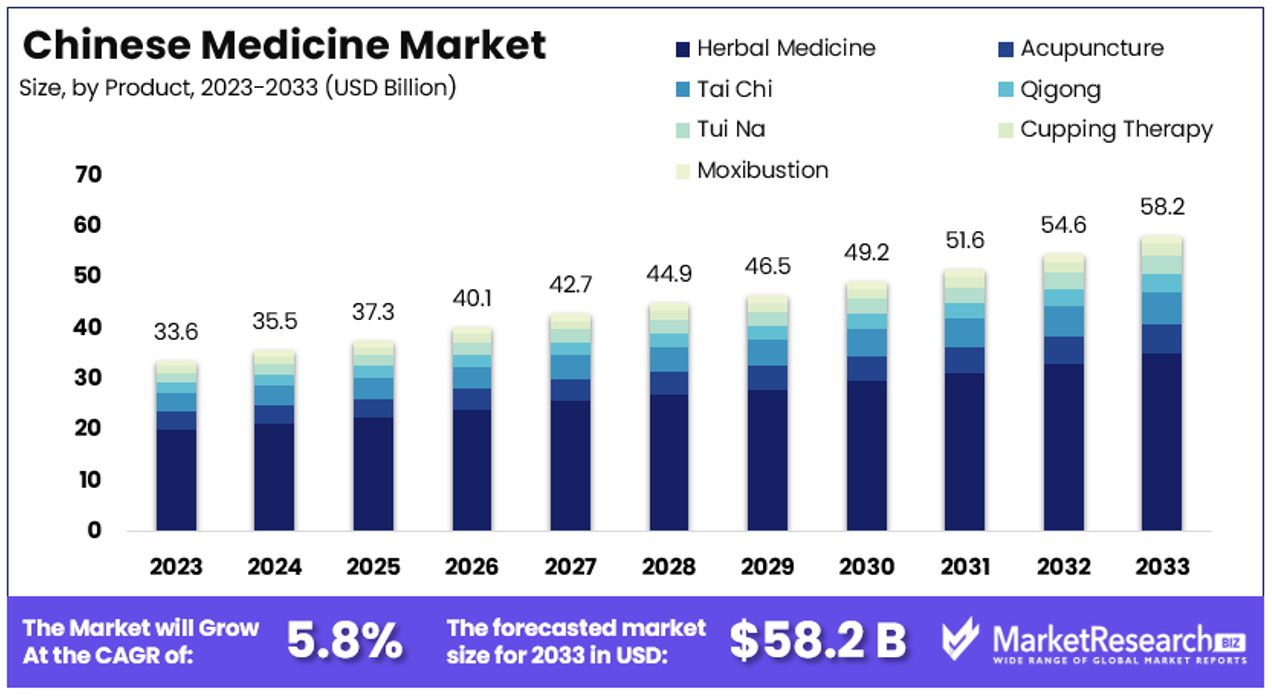

The Global Chinese Medicine Market size is expected to be worth around USD 58.2 Billion by 2033, from USD 33.6 Billion in 2023, growing at a CAGR of 5.8% during the forecast period from 2024 to 2033.

The Chinese Medicine Market refers to the industry involved in the production, distribution, and sale of traditional Chinese medicinal products. This market encompasses a range of products including herbs, acupuncture supplies, and traditional remedies that are rooted in centuries-old practices. As the demand for holistic and alternative treatments grows globally, this market is experiencing significant expansion.

Key drivers include increasing consumer awareness of natural health products and the integration of traditional Chinese medicine (TCM) with Western healthcare practices. The market offers substantial opportunities for development and investment, particularly in areas of innovation and international export.

The Chinese Medicine Market is characterized by significant depth and diversity, shaped largely by cultural heritage and modern health trends. In 2022, the number of visits to traditional Chinese medicine (TCM) practitioners in China exemplified the market's extensive reach, totaling 2.64 billion. This accounts for 32.3% of all healthcare visits nationwide, underscoring the integral role of TCM in the healthcare landscape.

Regionally, the utilization of TCM shows marked variation, reflecting differing cultural acceptance and accessibility. In urban areas, engagement with TCM practitioners is relatively lower, with utilization rates varying from 1.3% to 5.6% across different provinces. This contrasts sharply with rural areas, where reliance on TCM can be as high as 57% in certain provinces. The disparity suggests a more entrenched tradition of TCM in rural communities, possibly due to limited access to conventional healthcare services.

Moreover, the market demonstrates a distinct socioeconomic dimension. TCM's prevalence is notably higher among lower-income populations, with over 30% utilization in the lowest income quintile in some areas. This trend indicates that TCM is not only a culturally ingrained practice but also an economically accessible form of healthcare for lower-income groups.

Considering these dynamics, the Chinese Medicine Market presents unique opportunities for growth and innovation. The sector is ripe for increased investment, particularly in areas that bridge the gap between traditional practices and modern healthcare needs. Companies and investors looking to enter or expand in this market will find robust prospects in developing TCM applications that are accessible to urban populations and tailored to contemporary health issues, potentially increasing its acceptance and utilization across broader demographics.

Key Takeaways

- Market Value: The Global Chinese Medicine Market is projected to reach USD 58.2 billion by 2033, experiencing growth from USD 33.6 billion in 2023, with a steady CAGR of 5.8% during the forecast period from 2024 to 2033.

- Type of Chinese Medicine Analysis: Herbal Medicine dominates the market with 60% market share, driven by its widespread acceptance and integration into daily health routines.

- Herbal Medicine Classification Analysis: Within Herbal Medicine, Herbal Formulas lead with 45% market share, valued for their tailored approach to complex health issues.

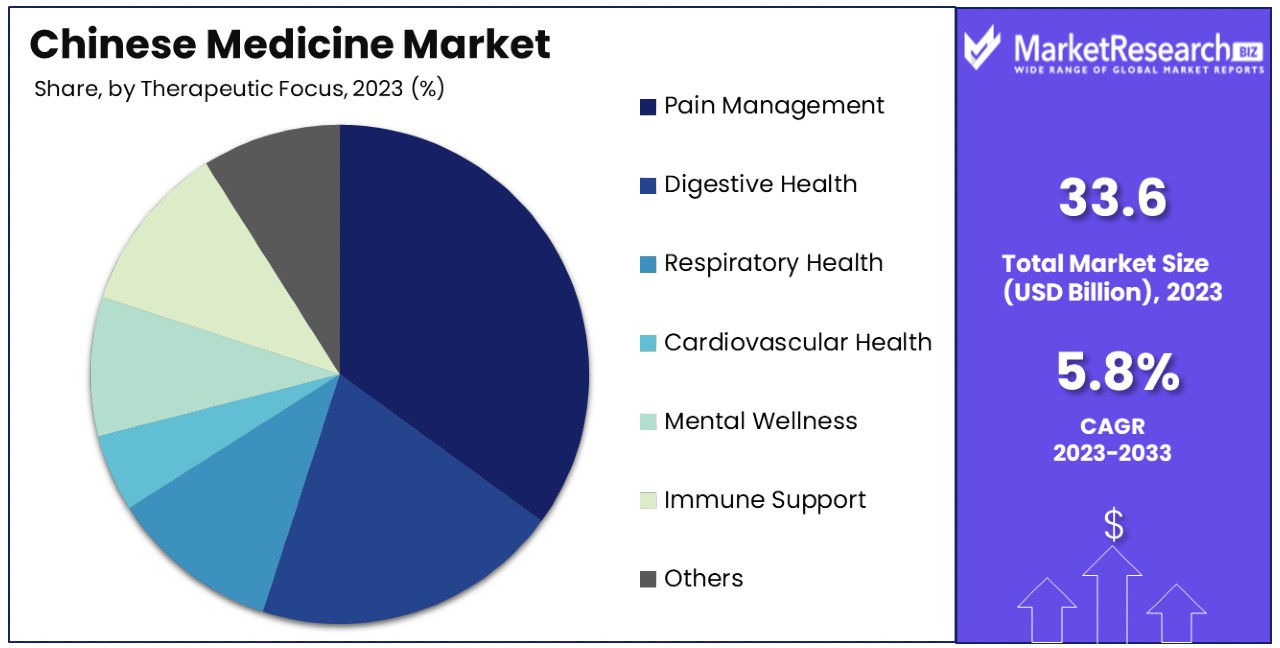

- Therapeutic Focus Analysis: Pain Management emerges as the dominant therapeutic focus with 35% market share, effective in treating chronic conditions and improving quality of life.

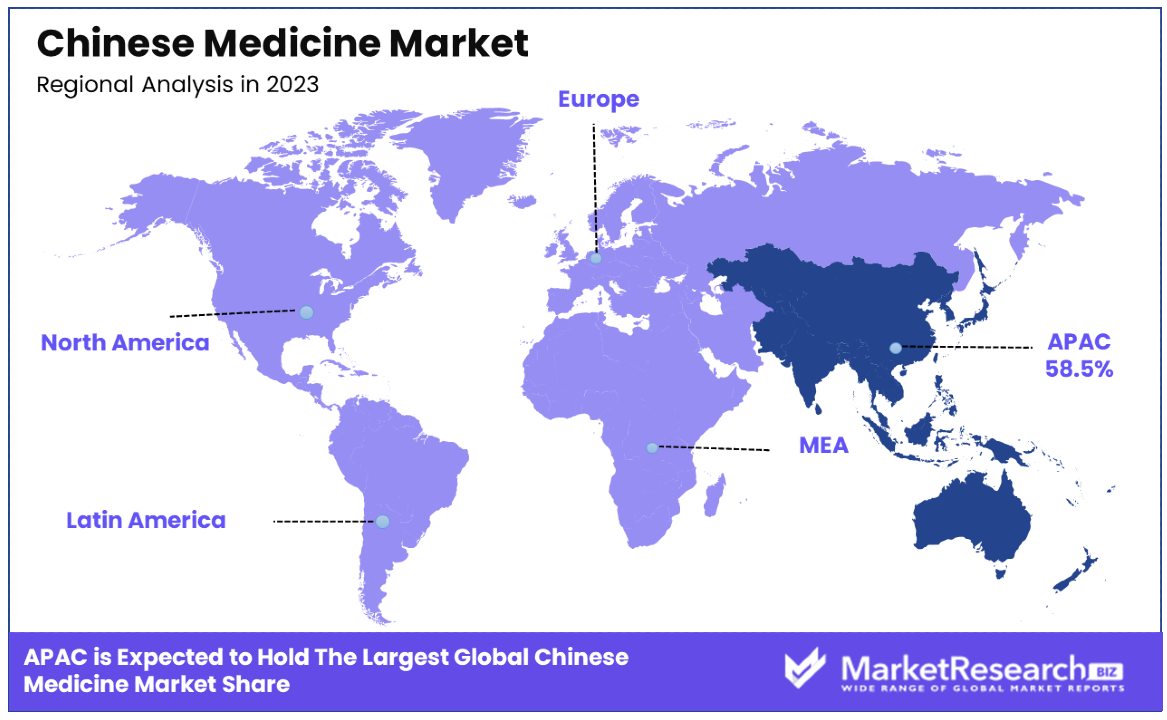

- APAC: Dominates the market with a 58.5% market share, driven by the deep-rooted cultural acceptance of traditional Chinese medicine (TCM) and increasing adoption of holistic health practices.

- North America: Holds approximately 20% of the market share, showing significant growth potential due to rising consumer interest in alternative and holistic therapies, and the growing integration of TCM in health practices.

- Analyst Viewpoint: Analysts anticipate steady growth in the Chinese Medicine Market, driven by increasing consumer preference for natural and holistic health solutions, and growing recognition of TCM's effectiveness by healthcare professionals.

- Growth Opportunities: Growth opportunities lie in expanding product offerings, enhancing quality control and standardization of herbal medicines, leveraging digital platforms for distribution and education, and establishing strategic partnerships for research and development.

Driving Factors

Increasing Prevalence of Chronic Diseases Drives Market Growth

The growing incidence of chronic diseases worldwide significantly contributes to the expansion of the Chinese Medicine Market. Chronic conditions such as arthritis, diabetes, and cardiovascular diseases have become more prevalent, prompting patients to explore alternative and complementary treatments. Chinese medicine, known for its holistic approach, offers remedies that are increasingly sought after for symptom management and overall well-being enhancement.

For instance, remedies like ginseng and ginger, recognized for their anti-inflammatory and immunomodulatory properties, are particularly favored for treating conditions like rheumatoid arthritis. This trend is not isolated but part of a larger movement towards integrative health practices, where patients combine Western medical treatments with traditional therapies. This integration supports the sustained growth of the Chinese Medicine Market by broadening its acceptance across different patient demographics and increasing its relevance in modern therapeutic regimes.

Growing Acceptance and Integration Drives Market Growth

The integration of Chinese medicine into global healthcare systems marks a pivotal development in the market's expansion. Countries around the world, led by China, are increasingly recognizing and institutionalizing Chinese medicine through supportive policies, research funding, and clinical trials. For example, China’s government initiatives such as the "Silk Road Economic Belt and the 21st-century Maritime Silk Road" aim to promote and modernize traditional Chinese medicine (TCM).

These efforts facilitate the establishment of specialized TCM hospitals and clinics, enhancing the market's structure and accessibility. The formal integration of TCM into healthcare systems not only increases its legitimacy but also encourages ongoing investments in research and development. These developments contribute to robust market growth by enhancing the quality and effectiveness of TCM treatments and expanding their global reach.

Cultural Heritage and Traditional Beliefs Drive Market Growth

The sustained demand for Chinese medicine is deeply intertwined with the cultural heritage and traditional beliefs prevalent in many Asian countries. In regions like China, Japan, and South Korea, traditional remedies are not merely medical treatments but are part of the cultural fabric. This cultural affinity ensures a continued trust and reliance on traditional remedies, supporting a stable market demand.

Herbal remedies such as ginseng and wolfberry, ingrained in daily practices and often passed down through generations, exemplify this trend. The intrinsic value placed on these traditional treatments by millions not only maintains a steady consumer base but also attracts global interest in the authenticity and heritage of Chinese medicine. This factor fosters a market environment ripe for growth, driven by both domestic consumption and increasing international appeal.

Restraining Factors

Lack of Standardization and Quality Control Restrains Market Growth

The Chinese Medicine Market faces significant challenges due to the lack of standardization and quality control across its various segments. Despite ongoing efforts to modernize and regulate the industry, inconsistencies remain in manufacturing practices, raw material sourcing, and product formulation. These inconsistencies can lead to safety and efficacy concerns among consumers and healthcare providers.

For instance, instances of heavy metal contamination and adulteration in herbal products have not only drawn regulatory scrutiny but also heightened consumer skepticism. This issue limits the market's growth by undermining consumer confidence and complicating the approval processes for new products, thereby restricting market expansion and acceptance, particularly in international markets where safety standards are rigorously enforced.

Limited Scientific Evidence and Clinical Trials Restrains Market Growth

The growth of the Chinese Medicine Market is also curtailed by the limited scientific evidence and lack of comprehensive clinical trials supporting the efficacy and safety of many traditional Chinese medicine (TCM) treatments.

While interest in TCM is increasing, the medical community and regulatory bodies in Western markets demand robust clinical research to validate these treatments, especially for serious conditions like cancer. The absence of extensive, well-structured clinical studies hampers the mainstream acceptance and integration of TCM, particularly in regions that rely heavily on empirical evidence for medical practices. This skepticism limits the adoption of Chinese medicine treatments, impacting market growth by restricting access to new and potentially large markets.

Type of Chinese Medicine Analysis

Herbal Medicine dominates with 60% due to its widespread acceptance and integration into daily health routines.

Herbal Medicine, particularly Traditional Chinese Herbal Medicine, represents the largest and most influential segment within the Chinese Medicine Market. This dominance is attributed to its deep historical roots and widespread acceptance, both within and outside China. Traditional Chinese Herbal Medicine includes a variety of single herbs, herbal formulas, and patent medicines, each catering to different health needs and preferences.

Single herbs such as ginseng and goji berries are highly sought after for their general health benefits and are often used in personal health regimens. Herbal formulas, which combine multiple herbs to enhance therapeutic effects, address more specific health concerns like digestive issues or respiratory conditions. Patent medicines, which are standardized herbal formulas produced on a large scale, offer convenience and consistency, making them popular among consumers who might not have the time or knowledge to prepare traditional formulas.

Other segments within this category also contribute to the market's growth but to a lesser extent. Acupuncture, for example, is highly regarded for pain management and is increasingly recognized in Western medicine for its benefits, which helps drive its popularity in non-Asian markets. Tai Chi and Qigong are not only practiced for their health benefits but also for their spiritual and mental wellness attributes, aligning well with the global trend towards holistic and preventive healthcare practices.

Tui Na, cupping therapy, and moxibustion, while smaller in market share, play crucial roles in the comprehensive approach that characterizes Chinese medicine. These practices are often used in conjunction with herbal medicines and acupuncture, providing a full spectrum of care that appeals to consumers interested in comprehensive alternative health approaches.

Dietary therapy, another vital segment, integrates nutritional practices with traditional Chinese medicinal principles, further illustrating the holistic approach of Chinese medicine. This segment underscores the importance of diet in maintaining balance and health, resonating with the global shift towards dietary and lifestyle changes for disease prevention and health promotion.

Herbal Medicine Classification Analysis

Herbal Formulas dominate with 45% due to their tailored approach to complex health issues.

Within the broader Herbal Medicine segment, Herbal Formulas stand out as the dominant sub-segment. This dominance is primarily due to their ability to address complex health conditions through tailored combinations of herbs, which enhance therapeutic efficacy while mitigating side effects. These formulas are based on centuries-old recipes that have been refined through continuous practice and modern research, making them both traditional and innovative.

Single Herbs, while individually popular for simpler health benefits like boosting energy or improving sleep, do not address multiple or complex health issues as effectively as herbal formulas. However, they remain essential as foundational components of the formulas themselves.

Patent Medicines, though convenient and growing in use, face challenges regarding standardization and quality control, which can affect consumer trust and market growth. Despite these challenges, they provide an entry point for consumers new to Chinese medicine, offering a bridge between traditional practices and modern lifestyles.

Therapeutic Focus Analysis

Pain Management dominates with 35% due to its effectiveness in treating chronic conditions and enhancing quality of life.

The Therapeutic Focus segment of the Chinese Medicine Market is led by Pain Management, which is highly effective in addressing both acute and chronic pain through non-invasive techniques. Practices such as acupuncture, Tui Na, and herbal remedies are commonly utilized to alleviate pain, reduce inflammation, and improve mobility. This effectiveness is particularly appealing in an aging global population that increasingly prefers non-pharmacological treatments due to concerns over side effects associated with conventional pain medications.

Other areas within the Therapeutic Focus segment, such as Digestive Health and Respiratory Health, also play significant roles but are more niche in their appeal. Digestive Health benefits from herbal formulas designed to enhance gut health and treat conditions like IBS, which are becoming more prevalent due to modern dietary habits. Respiratory Health gains relevance in the context of global health challenges like pollution and respiratory diseases.

The segments focusing on Cardiovascular Health, Mental Wellness, and Immune Support are emerging as critical areas due to rising health consciousness and the prevalence of related conditions. These segments are expected to grow significantly as research continues to reveal the benefits of Chinese medicinal practices in these areas, potentially shifting market dynamics in the future.

Key Market Segments

By Type of Chinese Medicine

- Herbal Medicine (Traditional Chinese Herbal Medicine)

- Acupuncture

- Tai Chi

- Qigong

- Tui Na (Chinese Massage)

- Cupping Therapy

- Moxibustion

- Dietary Therapy

By Herbal Medicine Classification

- Single Herbs

- Herbal Formulas

- Patent Medicines

By Therapeutic Focus

- Pain Management

- Digestive Health

- Respiratory Health

- Cardiovascular Health

- Mental Wellness

- Immune Support

- Others

Growth Opportunities

Development of Innovative Product Offerings Offers Growth Opportunity

The ongoing evolution of consumer preferences alongside advances in scientific research presents a substantial growth opportunity for the Chinese Medicine Market through the development of innovative product offerings. Companies within this sector are well-positioned to innovate by combining traditional Chinese medicine formulations with modern delivery methods.

This could include the creation of TCM-based nutraceuticals and functional foods, or even topical formulations tailored to specific health concerns or consumer demographics, such as working professionals or athletes seeking natural performance enhancers. By innovating in product form and function, companies can attract a broader customer base, increase product usage among existing customers, and penetrate markets typically dominated by conventional healthcare products. These advancements are not only enhancing the market appeal of Chinese medicine but are also setting new standards for efficacy and convenience in holistic health solutions.

Integration with Mainstream Healthcare Offers Growth Opportunity

Increased collaboration and integration of Chinese medicine within mainstream healthcare systems represent a significant growth avenue for the market. Establishing collaborative care models and developing evidence-based treatment protocols can lead to broader acceptance and adoption of Chinese medicine practices. For example, the integration of TCM-based therapies in hospitals or clinics for pain management, post-surgical recovery, or chronic disease management can leverage the unique strengths of both traditional and modern medicinal practices.

This integration facilitates a more comprehensive approach to healthcare, appealing to patients and healthcare providers alike. It also opens up new markets for Chinese medicine products and practices, particularly in regions where traditional medicine is less known. As such, this integration not only promotes market growth but also enhances the credibility and reliability of Chinese medicine in the eyes of the global medical community.

Trending Factors

Personalized and Precision Chinese Medicine Are Trending Factors

The trend towards personalized and precision Chinese medicine is shaping the market significantly. This approach involves tailoring treatments and remedies to individual genetic profiles, lifestyle, and environmental factors, leveraging advancements in genomics and big data analytics. Chinese medicine practitioners are increasingly able to develop targeted and effective treatment plans.

For instance, companies are innovating by creating personalized TCM formulations based on genetic profiles or employing AI-powered diagnostic tools to recommend customized herbal combinations. This trend is driven by a broader movement in healthcare towards personalization, which is proving to be more effective in treating and managing diseases. As consumer demand for personalized healthcare solutions grows, this trend not only attracts more users but also enhances patient outcomes, positioning Chinese medicine as a modern, science-backed field.

Sustainability and Eco-friendly Practices Are Trending Factors

Sustainability and eco-friendly practices are becoming crucial trending factors in the Chinese Medicine Market. With growing environmental concerns and a shift towards sustainability in consumer preferences, companies in the Chinese medicine sector are increasingly focusing on sustainable sourcing of raw materials, environmentally-friendly manufacturing processes, and sustainable packaging options.

For example, there are initiatives to cultivate medicinal herbs through organic and regenerative farming practices and to use renewable energy in production facilities. These practices not only respond to consumer demand for more ethical and sustainable products but also help companies mitigate risks associated with environmental regulations and resource scarcity. This trend not only enhances the market's appeal to environmentally-conscious consumers but also helps companies establish a competitive edge in a rapidly evolving marketplace.

Regional Analysis

APAC Dominates with 58.5% Market Share

Asia-Pacific (APAC) holds the largest share of the Chinese Medicine Market, primarily due to its deep-rooted cultural heritage and widespread acceptance of traditional practices. This region, particularly China, has been the cradle of traditional Chinese medicine (TCM), with these practices woven into the everyday health regimen of millions. Additionally, government support for TCM, including substantial funding for research and infrastructure, coupled with a robust regulatory framework, further strengthens this dominance.

The market dynamics in APAC are influenced by the high population base, increasing healthcare expenditure, and a growing middle class that is more inclined towards health and wellness. This demographic shift increases the demand for traditional and natural health products. Furthermore, the presence of numerous local players who have a deep understanding of traditional medicine and its integration into modern healthcare drives competition and innovation within the region.

Looking forward, APAC’s influence on the global Chinese Medicine Market is expected to continue growing. With rising global interest in holistic and preventative healthcare, coupled with ongoing advancements in TCM research and international expansion of Asian-based companies, APAC will likely maintain or even increase its market share.

Regional Market Shares:

- North America: The market share in North America is around 20%. The region shows significant growth potential due to increasing consumer interest in alternative and holistic therapies, and the growing integration of TCM in health practices.

- Europe: Holding approximately 10% of the market, Europe is seeing a rise in the adoption of Chinese medicine, driven by growing consumer awareness and regulatory support for alternative medicines.

- Middle East & Africa: This region accounts for about 5% of the market. The adoption is gradually increasing with the rising awareness and acceptance of alternative and complementary medicines.

- Latin America: With a 6.5% market share, Latin America is slowly embracing Chinese medicine, influenced by an increasing number of practitioners and a growing population seeking natural health remedies.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the evolving landscape of the Chinese Medicine Market, key players such as Tasly Pharmaceutical Group, Kangmei Pharmaceutical Co. Ltd., and Beijing TongRenTang significantly shape market dynamics through their integration of Traditional Chinese Medicine (TCM) with elements of Western medicine. This blend enhances the quality of life for patients by providing a wide range of treatment options beyond conventional medicine. These companies, along with others like TSUMURA and YUNNAN BAIYAO, are pivotal in bridging the gap between science-based medicine and natural medicines, thereby expanding the pharmaceutical market beyond prescription drugs.

Firms like Guangzhou Pharma and Sanjiu emphasize the market’s shift towards Complementary and Alternative Medicine, which incorporates effective drugs derived from both Asian Medicine and chemical drugs. This approach is increasingly recognized within the Chinese market, highlighting a shift in patient preferences and market concentration. Jiangsu Kanion Pharmaceutical Co. Ltd. and PIEN TZE HUANG further contribute to this trend by focusing on innovations that merge TCM with modern pharmaceutical practices, thus broadening the market size and enhancing patient care. Collectively, these companies not only compete but also collaborate within a complex framework of market forces, driving growth and innovation in both local and global contexts.

Market Key Players

- Tasly Pharmaceutical Group

- Kangmei Pharmaceutical Co. Ltd.

- Beijing TongRenTang

- TSUMURA (Japan)

- YUNNAN BAIYAO

- Guangzhou Pharma

- Sanjiu

- Jiangsu Kanion Pharmaceutical Co. Ltd.

- PIEN TZE HUANG

Recent Developments

- On May 2024, researchers led by Yong-Xian Cheng discovered that the Chinese red-headed centipede (Scolopendra subspinipes mutilans), long used in traditional Chinese medicine, contains alkaloids that exhibit anti-inflammatory and anti-renal-fibrosis properties in cell cultures. This finding could pave the way for developing treatments for kidney disease.

- On March 2024, a new study found that a compound called Schisandrin B, found in a plant known as five-flavor berry or magnolia berry, is very effective against colon cancer, particularly in the disease's later stages. The plant is already widely available online, though it should be taken only under medical supervision due to several known adverse drug interactions.

- On November 2023, a report discussed how nanotechnology could enhance the delivery of traditional Chinese medicine, promising improved clinical outcomes. Nano-delivery systems can help address the low bioavailability of natural products, making the treatment of renal fibrosis with Chinese medicine more promising.

Report Scope

Report Features Description Market Value (2023) USD 33.6 Billion Forecast Revenue (2033) USD 58.2 Billion CAGR (2024-2033) 5.80% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type of Chinese Medicine (Herbal Medicine (Traditional Chinese Herbal Medicine), Acupuncture, Tai Chi, Qigong, Tui Na (Chinese Massage), Cupping Therapy, Moxibustion, Dietary Therapy), By Herbal Medicine Classification (Single Herbs, Herbal Formulas, Patent Medicines), By Therapeutic Focus (Pain Management, Digestive Health, Respiratory Health, Cardiovascular Health, Mental Wellness, Immune Support, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Tasly Pharmaceutical Group, Kangmei Pharmaceutical Co. Ltd., Beijing TongRenTang, TSUMURA (Japan), YUNNAN BAIYAO, Guangzhou Pharma, Sanjiu, Jiangsu Kanion Pharmaceutical Co. Ltd., PIEN TZE HUANG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Chinese Medicine Market Overview

- 2.1. Chinese Medicine Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Chinese Medicine Market Dynamics

- 3. Global Chinese Medicine Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Chinese Medicine Market Analysis, 2016-2021

- 3.2. Global Chinese Medicine Market Opportunity and Forecast, 2023-2032

- 3.3. Global Chinese Medicine Market Analysis, Opportunity and Forecast, By Type of Chinese Medicine, 2016-2032

- 3.3.1. Global Chinese Medicine Market Analysis by Type of Chinese Medicine: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type of Chinese Medicine, 2016-2032

- 3.3.3. Herbal Medicine

- 3.3.4. Acupuncture

- 3.3.5. Tai Chi

- 3.3.6. Qigong

- 3.3.7. Tui Na

- 3.3.8. Cupping Therapy

- 3.3.9. Moxibustion

- 3.3.10. Dietary Therapy

- 3.4. Global Chinese Medicine Market Analysis, Opportunity and Forecast, By Herbal Medicine Classification, 2016-2032

- 3.4.1. Global Chinese Medicine Market Analysis by Herbal Medicine Classification: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Herbal Medicine Classification, 2016-2032

- 3.4.3. Single Herbs

- 3.4.4. Herbal Formulas

- 3.4.5. Patent Medicines

- 3.5. Global Chinese Medicine Market Analysis, Opportunity and Forecast, By Therapeutic Focus, 2016-2032

- 3.5.1. Global Chinese Medicine Market Analysis by Therapeutic Focus: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Therapeutic Focus, 2016-2032

- 3.5.3. Pain Management

- 3.5.4. Digestive Health

- 3.5.5. Respiratory Health

- 3.5.6. Cardiovascular Health

- 3.5.7. Mental Wellness

- 3.5.8. Immune Support

- 3.5.9. Others

- 4. North America Chinese Medicine Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Chinese Medicine Market Analysis, 2016-2021

- 4.2. North America Chinese Medicine Market Opportunity and Forecast, 2023-2032

- 4.3. North America Chinese Medicine Market Analysis, Opportunity and Forecast, By Type of Chinese Medicine, 2016-2032

- 4.3.1. North America Chinese Medicine Market Analysis by Type of Chinese Medicine: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type of Chinese Medicine, 2016-2032

- 4.3.3. Herbal Medicine

- 4.3.4. Acupuncture

- 4.3.5. Tai Chi

- 4.3.6. Qigong

- 4.3.7. Tui Na

- 4.3.8. Cupping Therapy

- 4.3.9. Moxibustion

- 4.3.10. Dietary Therapy

- 4.4. North America Chinese Medicine Market Analysis, Opportunity and Forecast, By Herbal Medicine Classification, 2016-2032

- 4.4.1. North America Chinese Medicine Market Analysis by Herbal Medicine Classification: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Herbal Medicine Classification, 2016-2032

- 4.4.3. Single Herbs

- 4.4.4. Herbal Formulas

- 4.4.5. Patent Medicines

- 4.5. North America Chinese Medicine Market Analysis, Opportunity and Forecast, By Therapeutic Focus, 2016-2032

- 4.5.1. North America Chinese Medicine Market Analysis by Therapeutic Focus: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Therapeutic Focus, 2016-2032

- 4.5.3. Pain Management

- 4.5.4. Digestive Health

- 4.5.5. Respiratory Health

- 4.5.6. Cardiovascular Health

- 4.5.7. Mental Wellness

- 4.5.8. Immune Support

- 4.5.9. Others

- 4.6. North America Chinese Medicine Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.6.1. North America Chinese Medicine Market Analysis by Country : Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.6.2.1. The US

- 4.6.2.2. Canada

- 4.6.2.3. Mexico

- 5. Western Europe Chinese Medicine Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Chinese Medicine Market Analysis, 2016-2021

- 5.2. Western Europe Chinese Medicine Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Chinese Medicine Market Analysis, Opportunity and Forecast, By Type of Chinese Medicine, 2016-2032

- 5.3.1. Western Europe Chinese Medicine Market Analysis by Type of Chinese Medicine: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type of Chinese Medicine, 2016-2032

- 5.3.3. Herbal Medicine

- 5.3.4. Acupuncture

- 5.3.5. Tai Chi

- 5.3.6. Qigong

- 5.3.7. Tui Na

- 5.3.8. Cupping Therapy

- 5.3.9. Moxibustion

- 5.3.10. Dietary Therapy

- 5.4. Western Europe Chinese Medicine Market Analysis, Opportunity and Forecast, By Herbal Medicine Classification, 2016-2032

- 5.4.1. Western Europe Chinese Medicine Market Analysis by Herbal Medicine Classification: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Herbal Medicine Classification, 2016-2032

- 5.4.3. Single Herbs

- 5.4.4. Herbal Formulas

- 5.4.5. Patent Medicines

- 5.5. Western Europe Chinese Medicine Market Analysis, Opportunity and Forecast, By Therapeutic Focus, 2016-2032

- 5.5.1. Western Europe Chinese Medicine Market Analysis by Therapeutic Focus: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Therapeutic Focus, 2016-2032

- 5.5.3. Pain Management

- 5.5.4. Digestive Health

- 5.5.5. Respiratory Health

- 5.5.6. Cardiovascular Health

- 5.5.7. Mental Wellness

- 5.5.8. Immune Support

- 5.5.9. Others

- 5.6. Western Europe Chinese Medicine Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.6.1. Western Europe Chinese Medicine Market Analysis by Country : Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.6.2.1. Germany

- 5.6.2.2. France

- 5.6.2.3. The UK

- 5.6.2.4. Spain

- 5.6.2.5. Italy

- 5.6.2.6. Portugal

- 5.6.2.7. Ireland

- 5.6.2.8. Austria

- 5.6.2.9. Switzerland

- 5.6.2.10. Benelux

- 5.6.2.11. Nordic

- 5.6.2.12. Rest of Western Europe

- 6. Eastern Europe Chinese Medicine Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Chinese Medicine Market Analysis, 2016-2021

- 6.2. Eastern Europe Chinese Medicine Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Chinese Medicine Market Analysis, Opportunity and Forecast, By Type of Chinese Medicine, 2016-2032

- 6.3.1. Eastern Europe Chinese Medicine Market Analysis by Type of Chinese Medicine: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type of Chinese Medicine, 2016-2032

- 6.3.3. Herbal Medicine

- 6.3.4. Acupuncture

- 6.3.5. Tai Chi

- 6.3.6. Qigong

- 6.3.7. Tui Na

- 6.3.8. Cupping Therapy

- 6.3.9. Moxibustion

- 6.3.10. Dietary Therapy

- 6.4. Eastern Europe Chinese Medicine Market Analysis, Opportunity and Forecast, By Herbal Medicine Classification, 2016-2032

- 6.4.1. Eastern Europe Chinese Medicine Market Analysis by Herbal Medicine Classification: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Herbal Medicine Classification, 2016-2032

- 6.4.3. Single Herbs

- 6.4.4. Herbal Formulas

- 6.4.5. Patent Medicines

- 6.5. Eastern Europe Chinese Medicine Market Analysis, Opportunity and Forecast, By Therapeutic Focus, 2016-2032

- 6.5.1. Eastern Europe Chinese Medicine Market Analysis by Therapeutic Focus: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Therapeutic Focus, 2016-2032

- 6.5.3. Pain Management

- 6.5.4. Digestive Health

- 6.5.5. Respiratory Health

- 6.5.6. Cardiovascular Health

- 6.5.7. Mental Wellness

- 6.5.8. Immune Support

- 6.5.9. Others

- 6.6. Eastern Europe Chinese Medicine Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.6.1. Eastern Europe Chinese Medicine Market Analysis by Country : Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.6.2.1. Russia

- 6.6.2.2. Poland

- 6.6.2.3. The Czech Republic

- 6.6.2.4. Greece

- 6.6.2.5. Rest of Eastern Europe

- 7. APAC Chinese Medicine Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Chinese Medicine Market Analysis, 2016-2021

- 7.2. APAC Chinese Medicine Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Chinese Medicine Market Analysis, Opportunity and Forecast, By Type of Chinese Medicine, 2016-2032

- 7.3.1. APAC Chinese Medicine Market Analysis by Type of Chinese Medicine: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type of Chinese Medicine, 2016-2032

- 7.3.3. Herbal Medicine

- 7.3.4. Acupuncture

- 7.3.5. Tai Chi

- 7.3.6. Qigong

- 7.3.7. Tui Na

- 7.3.8. Cupping Therapy

- 7.3.9. Moxibustion

- 7.3.10. Dietary Therapy

- 7.4. APAC Chinese Medicine Market Analysis, Opportunity and Forecast, By Herbal Medicine Classification, 2016-2032

- 7.4.1. APAC Chinese Medicine Market Analysis by Herbal Medicine Classification: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Herbal Medicine Classification, 2016-2032

- 7.4.3. Single Herbs

- 7.4.4. Herbal Formulas

- 7.4.5. Patent Medicines

- 7.5. APAC Chinese Medicine Market Analysis, Opportunity and Forecast, By Therapeutic Focus, 2016-2032

- 7.5.1. APAC Chinese Medicine Market Analysis by Therapeutic Focus: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Therapeutic Focus, 2016-2032

- 7.5.3. Pain Management

- 7.5.4. Digestive Health

- 7.5.5. Respiratory Health

- 7.5.6. Cardiovascular Health

- 7.5.7. Mental Wellness

- 7.5.8. Immune Support

- 7.5.9. Others

- 7.6. APAC Chinese Medicine Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.6.1. APAC Chinese Medicine Market Analysis by Country : Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.6.2.1. China

- 7.6.2.2. Japan

- 7.6.2.3. South Korea

- 7.6.2.4. India

- 7.6.2.5. Australia & New Zeland

- 7.6.2.6. Indonesia

- 7.6.2.7. Malaysia

- 7.6.2.8. Philippines

- 7.6.2.9. Singapore

- 7.6.2.10. Thailand

- 7.6.2.11. Vietnam

- 7.6.2.12. Rest of APAC

- 8. Latin America Chinese Medicine Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Chinese Medicine Market Analysis, 2016-2021

- 8.2. Latin America Chinese Medicine Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Chinese Medicine Market Analysis, Opportunity and Forecast, By Type of Chinese Medicine, 2016-2032

- 8.3.1. Latin America Chinese Medicine Market Analysis by Type of Chinese Medicine: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type of Chinese Medicine, 2016-2032

- 8.3.3. Herbal Medicine

- 8.3.4. Acupuncture

- 8.3.5. Tai Chi

- 8.3.6. Qigong

- 8.3.7. Tui Na

- 8.3.8. Cupping Therapy

- 8.3.9. Moxibustion

- 8.3.10. Dietary Therapy

- 8.4. Latin America Chinese Medicine Market Analysis, Opportunity and Forecast, By Herbal Medicine Classification, 2016-2032

- 8.4.1. Latin America Chinese Medicine Market Analysis by Herbal Medicine Classification: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Herbal Medicine Classification, 2016-2032

- 8.4.3. Single Herbs

- 8.4.4. Herbal Formulas

- 8.4.5. Patent Medicines

- 8.5. Latin America Chinese Medicine Market Analysis, Opportunity and Forecast, By Therapeutic Focus, 2016-2032

- 8.5.1. Latin America Chinese Medicine Market Analysis by Therapeutic Focus: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Therapeutic Focus, 2016-2032

- 8.5.3. Pain Management

- 8.5.4. Digestive Health

- 8.5.5. Respiratory Health

- 8.5.6. Cardiovascular Health

- 8.5.7. Mental Wellness

- 8.5.8. Immune Support

- 8.5.9. Others

- 8.6. Latin America Chinese Medicine Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.6.1. Latin America Chinese Medicine Market Analysis by Country : Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.6.2.1. Brazil

- 8.6.2.2. Colombia

- 8.6.2.3. Chile

- 8.6.2.4. Argentina

- 8.6.2.5. Costa Rica

- 8.6.2.6. Rest of Latin America

- 9. Middle East & Africa Chinese Medicine Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Chinese Medicine Market Analysis, 2016-2021

- 9.2. Middle East & Africa Chinese Medicine Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Chinese Medicine Market Analysis, Opportunity and Forecast, By Type of Chinese Medicine, 2016-2032

- 9.3.1. Middle East & Africa Chinese Medicine Market Analysis by Type of Chinese Medicine: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type of Chinese Medicine, 2016-2032

- 9.3.3. Herbal Medicine

- 9.3.4. Acupuncture

- 9.3.5. Tai Chi

- 9.3.6. Qigong

- 9.3.7. Tui Na

- 9.3.8. Cupping Therapy

- 9.3.9. Moxibustion

- 9.3.10. Dietary Therapy

- 9.4. Middle East & Africa Chinese Medicine Market Analysis, Opportunity and Forecast, By Herbal Medicine Classification, 2016-2032

- 9.4.1. Middle East & Africa Chinese Medicine Market Analysis by Herbal Medicine Classification: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Herbal Medicine Classification, 2016-2032

- 9.4.3. Single Herbs

- 9.4.4. Herbal Formulas

- 9.4.5. Patent Medicines

- 9.5. Middle East & Africa Chinese Medicine Market Analysis, Opportunity and Forecast, By Therapeutic Focus, 2016-2032

- 9.5.1. Middle East & Africa Chinese Medicine Market Analysis by Therapeutic Focus: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Therapeutic Focus, 2016-2032

- 9.5.3. Pain Management

- 9.5.4. Digestive Health

- 9.5.5. Respiratory Health

- 9.5.6. Cardiovascular Health

- 9.5.7. Mental Wellness

- 9.5.8. Immune Support

- 9.5.9. Others

- 9.6. Middle East & Africa Chinese Medicine Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.6.1. Middle East & Africa Chinese Medicine Market Analysis by Country : Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.6.2.1. Algeria

- 9.6.2.2. Egypt

- 9.6.2.3. Israel

- 9.6.2.4. Kuwait

- 9.6.2.5. Nigeria

- 9.6.2.6. Saudi Arabia

- 9.6.2.7. South Africa

- 9.6.2.8. Turkey

- 9.6.2.9. The UAE

- 9.6.2.10. Rest of MEA

- 10. Global Chinese Medicine Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Chinese Medicine Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Chinese Medicine Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Tasly Pharmaceutical Group

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Kangmei Pharmaceutical Co. Ltd.

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Beijing TongRenTang

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. TSUMURA (Japan)

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. YUNNAN BAIYAO

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Guangzhou Pharma

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Sanjiu

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Jiangsu Kanion Pharmaceutical Co. Ltd.

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. PIEN TZE HUANG

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- List of Figures

- Figure 1: Global Chinese Medicine Market Revenue (US$ Mn) Market Share by Type of Chinese Medicine in 2022

- Figure 2: Global Chinese Medicine Market Attractiveness Analysis by Type of Chinese Medicine, 2016-2032

- Figure 3: Global Chinese Medicine Market Revenue (US$ Mn) Market Share by Herbal Medicine Classificationin 2022

- Figure 4: Global Chinese Medicine Market Attractiveness Analysis by Herbal Medicine Classification, 2016-2032

- Figure 5: Global Chinese Medicine Market Revenue (US$ Mn) Market Share by Therapeutic Focusin 2022

- Figure 6: Global Chinese Medicine Market Attractiveness Analysis by Therapeutic Focus, 2016-2032

- Figure 7: Global Chinese Medicine Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 8: Global Chinese Medicine Market Attractiveness Analysis by Region, 2016-2032

- Figure 9: Global Chinese Medicine Market Revenue (US$ Mn) (2016-2032)

- Figure 10: Global Chinese Medicine Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 11: Global Chinese Medicine Market Revenue (US$ Mn) Comparison by Type of Chinese Medicine (2016-2032)

- Figure 12: Global Chinese Medicine Market Revenue (US$ Mn) Comparison by Herbal Medicine Classification (2016-2032)

- Figure 13: Global Chinese Medicine Market Revenue (US$ Mn) Comparison by Therapeutic Focus (2016-2032)

- Figure 14: Global Chinese Medicine Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 15: Global Chinese Medicine Market Y-o-Y Growth Rate Comparison by Type of Chinese Medicine (2016-2032)

- Figure 16: Global Chinese Medicine Market Y-o-Y Growth Rate Comparison by Herbal Medicine Classification (2016-2032)

- Figure 17: Global Chinese Medicine Market Y-o-Y Growth Rate Comparison by Therapeutic Focus (2016-2032)

- Figure 18: Global Chinese Medicine Market Share Comparison by Region (2016-2032)

- Figure 19: Global Chinese Medicine Market Share Comparison by Type of Chinese Medicine (2016-2032)

- Figure 20: Global Chinese Medicine Market Share Comparison by Herbal Medicine Classification (2016-2032)

- Figure 21: Global Chinese Medicine Market Share Comparison by Therapeutic Focus (2016-2032)

- Figure 22: North America Chinese Medicine Market Revenue (US$ Mn) Market Share by Type of Chinese Medicinein 2022

- Figure 23: North America Chinese Medicine Market Attractiveness Analysis by Type of Chinese Medicine, 2016-2032

- Figure 24: North America Chinese Medicine Market Revenue (US$ Mn) Market Share by Herbal Medicine Classificationin 2022

- Figure 25: North America Chinese Medicine Market Attractiveness Analysis by Herbal Medicine Classification, 2016-2032

- Figure 26: North America Chinese Medicine Market Revenue (US$ Mn) Market Share by Therapeutic Focusin 2022

- Figure 27: North America Chinese Medicine Market Attractiveness Analysis by Therapeutic Focus, 2016-2032

- Figure 28: North America Chinese Medicine Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 29: North America Chinese Medicine Market Attractiveness Analysis by Country, 2016-2032

- Figure 30: North America Chinese Medicine Market Revenue (US$ Mn) (2016-2032)

- Figure 31: North America Chinese Medicine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 32: North America Chinese Medicine Market Revenue (US$ Mn) Comparison by Type of Chinese Medicine (2016-2032)

- Figure 33: North America Chinese Medicine Market Revenue (US$ Mn) Comparison by Herbal Medicine Classification (2016-2032)

- Figure 34: North America Chinese Medicine Market Revenue (US$ Mn) Comparison by Therapeutic Focus (2016-2032)

- Figure 35: North America Chinese Medicine Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 36: North America Chinese Medicine Market Y-o-Y Growth Rate Comparison by Type of Chinese Medicine (2016-2032)

- Figure 37: North America Chinese Medicine Market Y-o-Y Growth Rate Comparison by Herbal Medicine Classification (2016-2032)

- Figure 38: North America Chinese Medicine Market Y-o-Y Growth Rate Comparison by Therapeutic Focus (2016-2032)

- Figure 39: North America Chinese Medicine Market Share Comparison by Country (2016-2032)

- Figure 40: North America Chinese Medicine Market Share Comparison by Type of Chinese Medicine (2016-2032)

- Figure 41: North America Chinese Medicine Market Share Comparison by Herbal Medicine Classification (2016-2032)

- Figure 42: North America Chinese Medicine Market Share Comparison by Therapeutic Focus (2016-2032)

- Figure 43: Western Europe Chinese Medicine Market Revenue (US$ Mn) Market Share by Type of Chinese Medicinein 2022

- Figure 44: Western Europe Chinese Medicine Market Attractiveness Analysis by Type of Chinese Medicine, 2016-2032

- Figure 45: Western Europe Chinese Medicine Market Revenue (US$ Mn) Market Share by Herbal Medicine Classificationin 2022

- Figure 46: Western Europe Chinese Medicine Market Attractiveness Analysis by Herbal Medicine Classification, 2016-2032

- Figure 47: Western Europe Chinese Medicine Market Revenue (US$ Mn) Market Share by Therapeutic Focusin 2022

- Figure 48: Western Europe Chinese Medicine Market Attractiveness Analysis by Therapeutic Focus, 2016-2032

- Figure 49: Western Europe Chinese Medicine Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 50: Western Europe Chinese Medicine Market Attractiveness Analysis by Country, 2016-2032

- Figure 51: Western Europe Chinese Medicine Market Revenue (US$ Mn) (2016-2032)

- Figure 52: Western Europe Chinese Medicine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 53: Western Europe Chinese Medicine Market Revenue (US$ Mn) Comparison by Type of Chinese Medicine (2016-2032)

- Figure 54: Western Europe Chinese Medicine Market Revenue (US$ Mn) Comparison by Herbal Medicine Classification (2016-2032)

- Figure 55: Western Europe Chinese Medicine Market Revenue (US$ Mn) Comparison by Therapeutic Focus (2016-2032)

- Figure 56: Western Europe Chinese Medicine Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 57: Western Europe Chinese Medicine Market Y-o-Y Growth Rate Comparison by Type of Chinese Medicine (2016-2032)

- Figure 58: Western Europe Chinese Medicine Market Y-o-Y Growth Rate Comparison by Herbal Medicine Classification (2016-2032)

- Figure 59: Western Europe Chinese Medicine Market Y-o-Y Growth Rate Comparison by Therapeutic Focus (2016-2032)

- Figure 60: Western Europe Chinese Medicine Market Share Comparison by Country (2016-2032)

- Figure 61: Western Europe Chinese Medicine Market Share Comparison by Type of Chinese Medicine (2016-2032)

- Figure 62: Western Europe Chinese Medicine Market Share Comparison by Herbal Medicine Classification (2016-2032)

- Figure 63: Western Europe Chinese Medicine Market Share Comparison by Therapeutic Focus (2016-2032)

- Figure 64: Eastern Europe Chinese Medicine Market Revenue (US$ Mn) Market Share by Type of Chinese Medicinein 2022

- Figure 65: Eastern Europe Chinese Medicine Market Attractiveness Analysis by Type of Chinese Medicine, 2016-2032

- Figure 66: Eastern Europe Chinese Medicine Market Revenue (US$ Mn) Market Share by Herbal Medicine Classificationin 2022

- Figure 67: Eastern Europe Chinese Medicine Market Attractiveness Analysis by Herbal Medicine Classification, 2016-2032

- Figure 68: Eastern Europe Chinese Medicine Market Revenue (US$ Mn) Market Share by Therapeutic Focusin 2022

- Figure 69: Eastern Europe Chinese Medicine Market Attractiveness Analysis by Therapeutic Focus, 2016-2032

- Figure 70: Eastern Europe Chinese Medicine Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 71: Eastern Europe Chinese Medicine Market Attractiveness Analysis by Country, 2016-2032

- Figure 72: Eastern Europe Chinese Medicine Market Revenue (US$ Mn) (2016-2032)

- Figure 73: Eastern Europe Chinese Medicine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 74: Eastern Europe Chinese Medicine Market Revenue (US$ Mn) Comparison by Type of Chinese Medicine (2016-2032)

- Figure 75: Eastern Europe Chinese Medicine Market Revenue (US$ Mn) Comparison by Herbal Medicine Classification (2016-2032)

- Figure 76: Eastern Europe Chinese Medicine Market Revenue (US$ Mn) Comparison by Therapeutic Focus (2016-2032)

- Figure 77: Eastern Europe Chinese Medicine Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 78: Eastern Europe Chinese Medicine Market Y-o-Y Growth Rate Comparison by Type of Chinese Medicine (2016-2032)

- Figure 79: Eastern Europe Chinese Medicine Market Y-o-Y Growth Rate Comparison by Herbal Medicine Classification (2016-2032)

- Figure 80: Eastern Europe Chinese Medicine Market Y-o-Y Growth Rate Comparison by Therapeutic Focus (2016-2032)

- Figure 81: Eastern Europe Chinese Medicine Market Share Comparison by Country (2016-2032)

- Figure 82: Eastern Europe Chinese Medicine Market Share Comparison by Type of Chinese Medicine (2016-2032)

- Figure 83: Eastern Europe Chinese Medicine Market Share Comparison by Herbal Medicine Classification (2016-2032)

- Figure 84: Eastern Europe Chinese Medicine Market Share Comparison by Therapeutic Focus (2016-2032)

- Figure 85: APAC Chinese Medicine Market Revenue (US$ Mn) Market Share by Type of Chinese Medicinein 2022

- Figure 86: APAC Chinese Medicine Market Attractiveness Analysis by Type of Chinese Medicine, 2016-2032

- Figure 87: APAC Chinese Medicine Market Revenue (US$ Mn) Market Share by Herbal Medicine Classificationin 2022

- Figure 88: APAC Chinese Medicine Market Attractiveness Analysis by Herbal Medicine Classification, 2016-2032

- Figure 89: APAC Chinese Medicine Market Revenue (US$ Mn) Market Share by Therapeutic Focusin 2022

- Figure 90: APAC Chinese Medicine Market Attractiveness Analysis by Therapeutic Focus, 2016-2032

- Figure 91: APAC Chinese Medicine Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 92: APAC Chinese Medicine Market Attractiveness Analysis by Country, 2016-2032

- Figure 93: APAC Chinese Medicine Market Revenue (US$ Mn) (2016-2032)

- Figure 94: APAC Chinese Medicine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 95: APAC Chinese Medicine Market Revenue (US$ Mn) Comparison by Type of Chinese Medicine (2016-2032)

- Figure 96: APAC Chinese Medicine Market Revenue (US$ Mn) Comparison by Herbal Medicine Classification (2016-2032)

- Figure 97: APAC Chinese Medicine Market Revenue (US$ Mn) Comparison by Therapeutic Focus (2016-2032)

- Figure 98: APAC Chinese Medicine Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 99: APAC Chinese Medicine Market Y-o-Y Growth Rate Comparison by Type of Chinese Medicine (2016-2032)

- Figure 100: APAC Chinese Medicine Market Y-o-Y Growth Rate Comparison by Herbal Medicine Classification (2016-2032)

- Figure 101: APAC Chinese Medicine Market Y-o-Y Growth Rate Comparison by Therapeutic Focus (2016-2032)

- Figure 102: APAC Chinese Medicine Market Share Comparison by Country (2016-2032)

- Figure 103: APAC Chinese Medicine Market Share Comparison by Type of Chinese Medicine (2016-2032)

- Figure 104: APAC Chinese Medicine Market Share Comparison by Herbal Medicine Classification (2016-2032)

- Figure 105: APAC Chinese Medicine Market Share Comparison by Therapeutic Focus (2016-2032)

- Figure 106: Latin America Chinese Medicine Market Revenue (US$ Mn) Market Share by Type of Chinese Medicinein 2022

- Figure 107: Latin America Chinese Medicine Market Attractiveness Analysis by Type of Chinese Medicine, 2016-2032

- Figure 108: Latin America Chinese Medicine Market Revenue (US$ Mn) Market Share by Herbal Medicine Classificationin 2022

- Figure 109: Latin America Chinese Medicine Market Attractiveness Analysis by Herbal Medicine Classification, 2016-2032

- Figure 110: Latin America Chinese Medicine Market Revenue (US$ Mn) Market Share by Therapeutic Focusin 2022

- Figure 111: Latin America Chinese Medicine Market Attractiveness Analysis by Therapeutic Focus, 2016-2032

- Figure 112: Latin America Chinese Medicine Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 113: Latin America Chinese Medicine Market Attractiveness Analysis by Country, 2016-2032

- Figure 114: Latin America Chinese Medicine Market Revenue (US$ Mn) (2016-2032)

- Figure 115: Latin America Chinese Medicine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 116: Latin America Chinese Medicine Market Revenue (US$ Mn) Comparison by Type of Chinese Medicine (2016-2032)

- Figure 117: Latin America Chinese Medicine Market Revenue (US$ Mn) Comparison by Herbal Medicine Classification (2016-2032)

- Figure 118: Latin America Chinese Medicine Market Revenue (US$ Mn) Comparison by Therapeutic Focus (2016-2032)

- Figure 119: Latin America Chinese Medicine Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 120: Latin America Chinese Medicine Market Y-o-Y Growth Rate Comparison by Type of Chinese Medicine (2016-2032)

- Figure 121: Latin America Chinese Medicine Market Y-o-Y Growth Rate Comparison by Herbal Medicine Classification (2016-2032)

- Figure 122: Latin America Chinese Medicine Market Y-o-Y Growth Rate Comparison by Therapeutic Focus (2016-2032)

- Figure 123: Latin America Chinese Medicine Market Share Comparison by Country (2016-2032)

- Figure 124: Latin America Chinese Medicine Market Share Comparison by Type of Chinese Medicine (2016-2032)

- Figure 125: Latin America Chinese Medicine Market Share Comparison by Herbal Medicine Classification (2016-2032)

- Figure 126: Latin America Chinese Medicine Market Share Comparison by Therapeutic Focus (2016-2032)

- Figure 127: Middle East & Africa Chinese Medicine Market Revenue (US$ Mn) Market Share by Type of Chinese Medicinein 2022

- Figure 128: Middle East & Africa Chinese Medicine Market Attractiveness Analysis by Type of Chinese Medicine, 2016-2032

- Figure 129: Middle East & Africa Chinese Medicine Market Revenue (US$ Mn) Market Share by Herbal Medicine Classificationin 2022

- Figure 130: Middle East & Africa Chinese Medicine Market Attractiveness Analysis by Herbal Medicine Classification, 2016-2032

- Figure 131: Middle East & Africa Chinese Medicine Market Revenue (US$ Mn) Market Share by Therapeutic Focusin 2022

- Figure 132: Middle East & Africa Chinese Medicine Market Attractiveness Analysis by Therapeutic Focus, 2016-2032

- Figure 133: Middle East & Africa Chinese Medicine Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 134: Middle East & Africa Chinese Medicine Market Attractiveness Analysis by Country, 2016-2032

- Figure 135: Middle East & Africa Chinese Medicine Market Revenue (US$ Mn) (2016-2032)

- Figure 136: Middle East & Africa Chinese Medicine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 137: Middle East & Africa Chinese Medicine Market Revenue (US$ Mn) Comparison by Type of Chinese Medicine (2016-2032)

- Figure 138: Middle East & Africa Chinese Medicine Market Revenue (US$ Mn) Comparison by Herbal Medicine Classification (2016-2032)

- Figure 139: Middle East & Africa Chinese Medicine Market Revenue (US$ Mn) Comparison by Therapeutic Focus (2016-2032)

- Figure 140: Middle East & Africa Chinese Medicine Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 141: Middle East & Africa Chinese Medicine Market Y-o-Y Growth Rate Comparison by Type of Chinese Medicine (2016-2032)

- Figure 142: Middle East & Africa Chinese Medicine Market Y-o-Y Growth Rate Comparison by Herbal Medicine Classification (2016-2032)

- Figure 143: Middle East & Africa Chinese Medicine Market Y-o-Y Growth Rate Comparison by Therapeutic Focus (2016-2032)

- Figure 144: Middle East & Africa Chinese Medicine Market Share Comparison by Country (2016-2032)

- Figure 145: Middle East & Africa Chinese Medicine Market Share Comparison by Type of Chinese Medicine (2016-2032)

- Figure 146: Middle East & Africa Chinese Medicine Market Share Comparison by Herbal Medicine Classification (2016-2032)

- Figure 147: Middle East & Africa Chinese Medicine Market Share Comparison by Therapeutic Focus (2016-2032)

- List of Tables

- Table 1: Global Chinese Medicine Market Comparison by Type of Chinese Medicine (2016-2032)

- Table 2: Global Chinese Medicine Market Comparison by Herbal Medicine Classification (2016-2032)

- Table 3: Global Chinese Medicine Market Comparison by Therapeutic Focus (2016-2032)

- Table 4: Global Chinese Medicine Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 5: Global Chinese Medicine Market Revenue (US$ Mn) (2016-2032)

- Table 6: Global Chinese Medicine Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 7: Global Chinese Medicine Market Revenue (US$ Mn) Comparison by Type of Chinese Medicine (2016-2032)

- Table 8: Global Chinese Medicine Market Revenue (US$ Mn) Comparison by Herbal Medicine Classification (2016-2032)

- Table 9: Global Chinese Medicine Market Revenue (US$ Mn) Comparison by Therapeutic Focus (2016-2032)

- Table 10: Global Chinese Medicine Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 11: Global Chinese Medicine Market Y-o-Y Growth Rate Comparison by Type of Chinese Medicine (2016-2032)

- Table 12: Global Chinese Medicine Market Y-o-Y Growth Rate Comparison by Herbal Medicine Classification (2016-2032)

- Table 13: Global Chinese Medicine Market Y-o-Y Growth Rate Comparison by Therapeutic Focus (2016-2032)

- Table 14: Global Chinese Medicine Market Share Comparison by Region (2016-2032)

- Table 15: Global Chinese Medicine Market Share Comparison by Type of Chinese Medicine (2016-2032)

- Table 16: Global Chinese Medicine Market Share Comparison by Herbal Medicine Classification (2016-2032)

- Table 17: Global Chinese Medicine Market Share Comparison by Therapeutic Focus (2016-2032)

- Table 18: North America Chinese Medicine Market Comparison by Herbal Medicine Classification (2016-2032)

- Table 19: North America Chinese Medicine Market Comparison by Therapeutic Focus (2016-2032)

- Table 20: North America Chinese Medicine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 21: North America Chinese Medicine Market Revenue (US$ Mn) (2016-2032)

- Table 22: North America Chinese Medicine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 23: North America Chinese Medicine Market Revenue (US$ Mn) Comparison by Type of Chinese Medicine (2016-2032)

- Table 24: North America Chinese Medicine Market Revenue (US$ Mn) Comparison by Herbal Medicine Classification (2016-2032)

- Table 25: North America Chinese Medicine Market Revenue (US$ Mn) Comparison by Therapeutic Focus (2016-2032)

- Table 26: North America Chinese Medicine Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 27: North America Chinese Medicine Market Y-o-Y Growth Rate Comparison by Type of Chinese Medicine (2016-2032)

- Table 28: North America Chinese Medicine Market Y-o-Y Growth Rate Comparison by Herbal Medicine Classification (2016-2032)

- Table 29: North America Chinese Medicine Market Y-o-Y Growth Rate Comparison by Therapeutic Focus (2016-2032)

- Table 30: North America Chinese Medicine Market Share Comparison by Country (2016-2032)

- Table 31: North America Chinese Medicine Market Share Comparison by Type of Chinese Medicine (2016-2032)

- Table 32: North America Chinese Medicine Market Share Comparison by Herbal Medicine Classification (2016-2032)

- Table 33: North America Chinese Medicine Market Share Comparison by Therapeutic Focus (2016-2032)

- Table 34: Western Europe Chinese Medicine Market Comparison by Type of Chinese Medicine (2016-2032)

- Table 35: Western Europe Chinese Medicine Market Comparison by Herbal Medicine Classification (2016-2032)

- Table 36: Western Europe Chinese Medicine Market Comparison by Therapeutic Focus (2016-2032)

- Table 37: Western Europe Chinese Medicine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 38: Western Europe Chinese Medicine Market Revenue (US$ Mn) (2016-2032)

- Table 39: Western Europe Chinese Medicine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 40: Western Europe Chinese Medicine Market Revenue (US$ Mn) Comparison by Type of Chinese Medicine (2016-2032)

- Table 41: Western Europe Chinese Medicine Market Revenue (US$ Mn) Comparison by Herbal Medicine Classification (2016-2032)

- Table 42: Western Europe Chinese Medicine Market Revenue (US$ Mn) Comparison by Therapeutic Focus (2016-2032)

- Table 43: Western Europe Chinese Medicine Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 44: Western Europe Chinese Medicine Market Y-o-Y Growth Rate Comparison by Type of Chinese Medicine (2016-2032)

- Table 45: Western Europe Chinese Medicine Market Y-o-Y Growth Rate Comparison by Herbal Medicine Classification (2016-2032)

- Table 46: Western Europe Chinese Medicine Market Y-o-Y Growth Rate Comparison by Therapeutic Focus (2016-2032)

- Table 47: Western Europe Chinese Medicine Market Share Comparison by Country (2016-2032)

- Table 48: Western Europe Chinese Medicine Market Share Comparison by Type of Chinese Medicine (2016-2032)

- Table 49: Western Europe Chinese Medicine Market Share Comparison by Herbal Medicine Classification (2016-2032)

- Table 50: Western Europe Chinese Medicine Market Share Comparison by Therapeutic Focus (2016-2032)

- Table 51: Eastern Europe Chinese Medicine Market Comparison by Type of Chinese Medicine (2016-2032)

- Table 52: Eastern Europe Chinese Medicine Market Comparison by Herbal Medicine Classification (2016-2032)

- Table 53: Eastern Europe Chinese Medicine Market Comparison by Therapeutic Focus (2016-2032)

- Table 54: Eastern Europe Chinese Medicine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: Eastern Europe Chinese Medicine Market Revenue (US$ Mn) (2016-2032)

- Table 56: Eastern Europe Chinese Medicine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: Eastern Europe Chinese Medicine Market Revenue (US$ Mn) Comparison by Type of Chinese Medicine (2016-2032)

- Table 58: Eastern Europe Chinese Medicine Market Revenue (US$ Mn) Comparison by Herbal Medicine Classification (2016-2032)

- Table 59: Eastern Europe Chinese Medicine Market Revenue (US$ Mn) Comparison by Therapeutic Focus (2016-2032)

- Table 60: Eastern Europe Chinese Medicine Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 61: Eastern Europe Chinese Medicine Market Y-o-Y Growth Rate Comparison by Type of Chinese Medicine (2016-2032)

- Table 62: Eastern Europe Chinese Medicine Market Y-o-Y Growth Rate Comparison by Herbal Medicine Classification (2016-2032)

- Table 63: Eastern Europe Chinese Medicine Market Y-o-Y Growth Rate Comparison by Therapeutic Focus (2016-2032)

- Table 64: Eastern Europe Chinese Medicine Market Share Comparison by Country (2016-2032)

- Table 65: Eastern Europe Chinese Medicine Market Share Comparison by Type of Chinese Medicine (2016-2032)

- Table 66: Eastern Europe Chinese Medicine Market Share Comparison by Herbal Medicine Classification (2016-2032)

- Table 67: Eastern Europe Chinese Medicine Market Share Comparison by Therapeutic Focus (2016-2032)

- Table 68: APAC Chinese Medicine Market Comparison by Type of Chinese Medicine (2016-2032)

- Table 69: APAC Chinese Medicine Market Comparison by Herbal Medicine Classification (2016-2032)

- Table 70: APAC Chinese Medicine Market Comparison by Therapeutic Focus (2016-2032)

- Table 71: APAC Chinese Medicine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 72: APAC Chinese Medicine Market Revenue (US$ Mn) (2016-2032)

- Table 73: APAC Chinese Medicine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 74: APAC Chinese Medicine Market Revenue (US$ Mn) Comparison by Type of Chinese Medicine (2016-2032)

- Table 75: APAC Chinese Medicine Market Revenue (US$ Mn) Comparison by Herbal Medicine Classification (2016-2032)

- Table 76: APAC Chinese Medicine Market Revenue (US$ Mn) Comparison by Therapeutic Focus (2016-2032)

- Table 77: APAC Chinese Medicine Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 78: APAC Chinese Medicine Market Y-o-Y Growth Rate Comparison by Type of Chinese Medicine (2016-2032)

- Table 79: APAC Chinese Medicine Market Y-o-Y Growth Rate Comparison by Herbal Medicine Classification (2016-2032)

- Table 80: APAC Chinese Medicine Market Y-o-Y Growth Rate Comparison by Therapeutic Focus (2016-2032)

- Table 81: APAC Chinese Medicine Market Share Comparison by Country (2016-2032)

- Table 82: APAC Chinese Medicine Market Share Comparison by Type of Chinese Medicine (2016-2032)

- Table 83: APAC Chinese Medicine Market Share Comparison by Herbal Medicine Classification (2016-2032)

- Table 84: APAC Chinese Medicine Market Share Comparison by Therapeutic Focus (2016-2032)

- Table 85: Latin America Chinese Medicine Market Comparison by Type of Chinese Medicine (2016-2032)

- Table 86: Latin America Chinese Medicine Market Comparison by Herbal Medicine Classification (2016-2032)

- Table 87: Latin America Chinese Medicine Market Comparison by Therapeutic Focus (2016-2032)

- Table 88: Latin America Chinese Medicine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 89: Latin America Chinese Medicine Market Revenue (US$ Mn) (2016-2032)

- Table 90: Latin America Chinese Medicine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 91: Latin America Chinese Medicine Market Revenue (US$ Mn) Comparison by Type of Chinese Medicine (2016-2032)

- Table 92: Latin America Chinese Medicine Market Revenue (US$ Mn) Comparison by Herbal Medicine Classification (2016-2032)

- Table 93: Latin America Chinese Medicine Market Revenue (US$ Mn) Comparison by Therapeutic Focus (2016-2032)

- Table 94: Latin America Chinese Medicine Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 95: Latin America Chinese Medicine Market Y-o-Y Growth Rate Comparison by Type of Chinese Medicine (2016-2032)

- Table 96: Latin America Chinese Medicine Market Y-o-Y Growth Rate Comparison by Herbal Medicine Classification (2016-2032)

- Table 97: Latin America Chinese Medicine Market Y-o-Y Growth Rate Comparison by Therapeutic Focus (2016-2032)

- Table 98: Latin America Chinese Medicine Market Share Comparison by Country (2016-2032)

- Table 99: Latin America Chinese Medicine Market Share Comparison by Type of Chinese Medicine (2016-2032)

- Table 100: Latin America Chinese Medicine Market Share Comparison by Herbal Medicine Classification (2016-2032)

- Table 101: Latin America Chinese Medicine Market Share Comparison by Therapeutic Focus (2016-2032)

- Table 102: Middle East & Africa Chinese Medicine Market Comparison by Type of Chinese Medicine (2016-2032)

- Table 103: Middle East & Africa Chinese Medicine Market Comparison by Herbal Medicine Classification (2016-2032)

- Table 104: Middle East & Africa Chinese Medicine Market Comparison by Therapeutic Focus (2016-2032)

- Table 105: Middle East & Africa Chinese Medicine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 106: Middle East & Africa Chinese Medicine Market Revenue (US$ Mn) (2016-2032)

- Table 107: Middle East & Africa Chinese Medicine Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 108: Middle East & Africa Chinese Medicine Market Revenue (US$ Mn) Comparison by Type of Chinese Medicine (2016-2032)

- Table 109: Middle East & Africa Chinese Medicine Market Revenue (US$ Mn) Comparison by Herbal Medicine Classification (2016-2032)

- Table 110: Middle East & Africa Chinese Medicine Market Revenue (US$ Mn) Comparison by Therapeutic Focus (2016-2032)

- Table 111: Middle East & Africa Chinese Medicine Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 112: Middle East & Africa Chinese Medicine Market Y-o-Y Growth Rate Comparison by Type of Chinese Medicine (2016-2032)

- Table 113: Middle East & Africa Chinese Medicine Market Y-o-Y Growth Rate Comparison by Herbal Medicine Classification (2016-2032)

- Table 114: Middle East & Africa Chinese Medicine Market Y-o-Y Growth Rate Comparison by Therapeutic Focus (2016-2032)

- Table 115: Middle East & Africa Chinese Medicine Market Share Comparison by Country (2016-2032)

- Table 116: Middle East & Africa Chinese Medicine Market Share Comparison by Type of Chinese Medicine (2016-2032)

- Table 117: Middle East & Africa Chinese Medicine Market Share Comparison by Herbal Medicine Classification (2016-2032)

- Table 118: Middle East & Africa Chinese Medicine Market Share Comparison by Therapeutic Focus (2016-2032)

- 1. Executive Summary

-

- Tasly Pharmaceutical Group

- Kangmei Pharmaceutical Co. Ltd.

- Beijing TongRenTang

- TSUMURA (Japan)

- YUNNAN BAIYAO

- Guangzhou Pharma

- Sanjiu

- Jiangsu Kanion Pharmaceutical Co. Ltd.

- PIEN TZE HUANG