Global Chia Seeds Market By Color(White, Black, Brown), By Product Type(Grounded Chia Seeds, Whole Chia Seeds, Chia Seed Oil), By End Use(Food and Beverages, Nutraceuticals, Cosmetics), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

4138

-

August 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

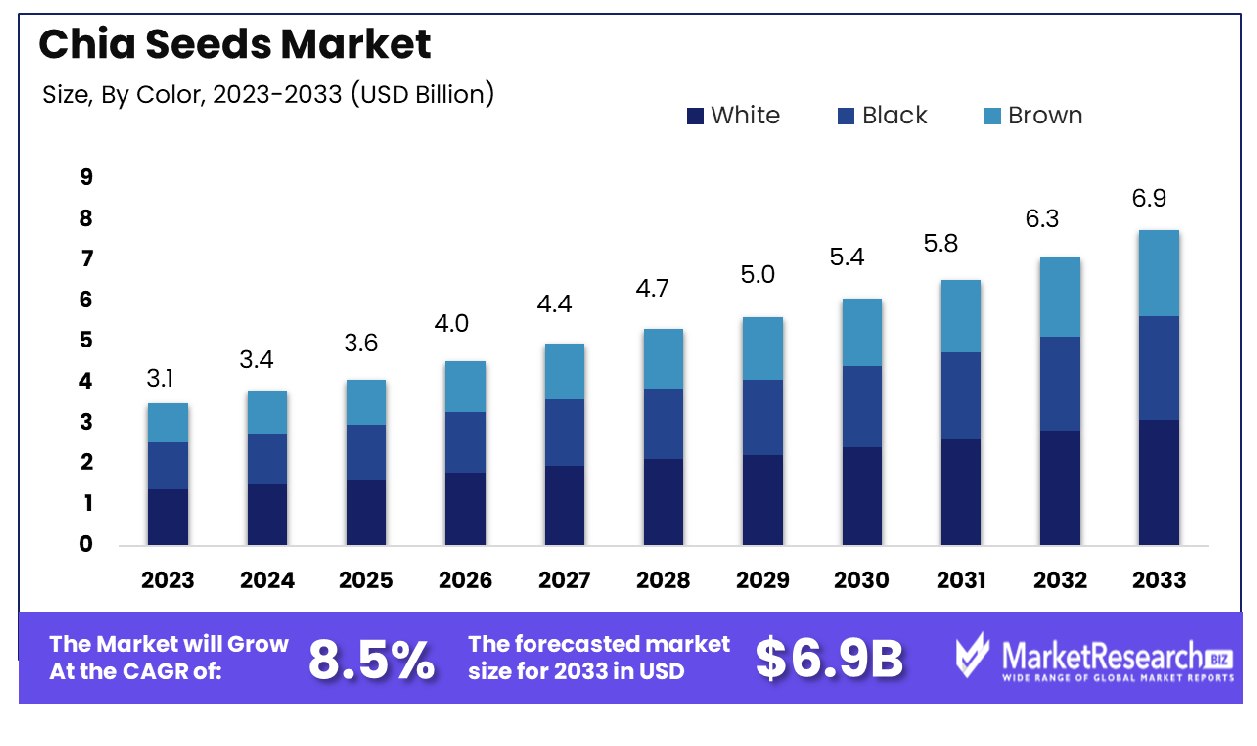

The Global Chia Seeds Market was valued at USD 3.1 billion in 2023. It is expected to reach USD 6.9 billion by 2033, with a CAGR of 8.5% during the forecast period from 2024 to 2033.

The Chia Seeds Market encompasses the global production, distribution, and sale of chia seeds, recognized for their nutritional benefits and applications in food & beverage, nutraceuticals, and cosmetics industries. This market is analyzed for its growth drivers, such as increasing consumer awareness of health and wellness and the rise in vegan and gluten-free diets.

Stakeholders, including producers, distributors, and end-users, focus on leveraging the seeds' omega-3 fatty acids, proteins, and fiber content. The strategic landscape involves assessing the market size, consumer trends, and competitive positioning, crucial for Product Managers aiming to capitalize on emerging opportunities within this sector.

The Chia Seeds Market is poised for significant growth, driven by the rising consumer demand for health-centric food options and an expanding wellness industry. As consumers increasingly prioritize nutritious dietary choices, the market for chia seeds is responding dynamically. These seeds, known for their robust nutritional profile, offer approximately 486 calories per 100 grams, with a composition that includes about 31% fats—predominantly omega-3 fatty acids. This high omega-3 content, approximately 17 grams per 100 grams, aligns with the growing consumer preference for foods that support cardiovascular health and cognitive function.

Moreover, chia seeds are a remarkable source of dietary fiber, providing 34.4 grams per 100 grams, which aids in digestive health and satiety. The protein content is also noteworthy at 16.5 grams per 100 grams, making chia seeds a favored ingredient in the diets of health-conscious consumers, particularly those following plant-based diets. The market benefits from these nutritional advantages, as they make chia seeds a versatile component in various food products, ranging from baked goods to health bars and beverages.

The integration of chia seeds into a broad array of products highlights their appeal as a multi-functional superfood. Market leaders and innovators are tapping into this versatility to expand their consumer base and explore new market segments, particularly in regions with a pronounced focus on health and wellness. Thus, the strategic positioning within the Chia Seeds Market involves leveraging the intrinsic health benefits of chia seeds to meet the sophisticated demands of health-aware consumers, promising substantial growth in this sector.

Key Takeaways

- Market Growth: The Global Chia Seeds Market was valued at USD 3.1 billion in 2023. It is expected to reach USD 6.9 billion by 2033, with a CAGR of 8.5% during the forecast period from 2024 to 2033.

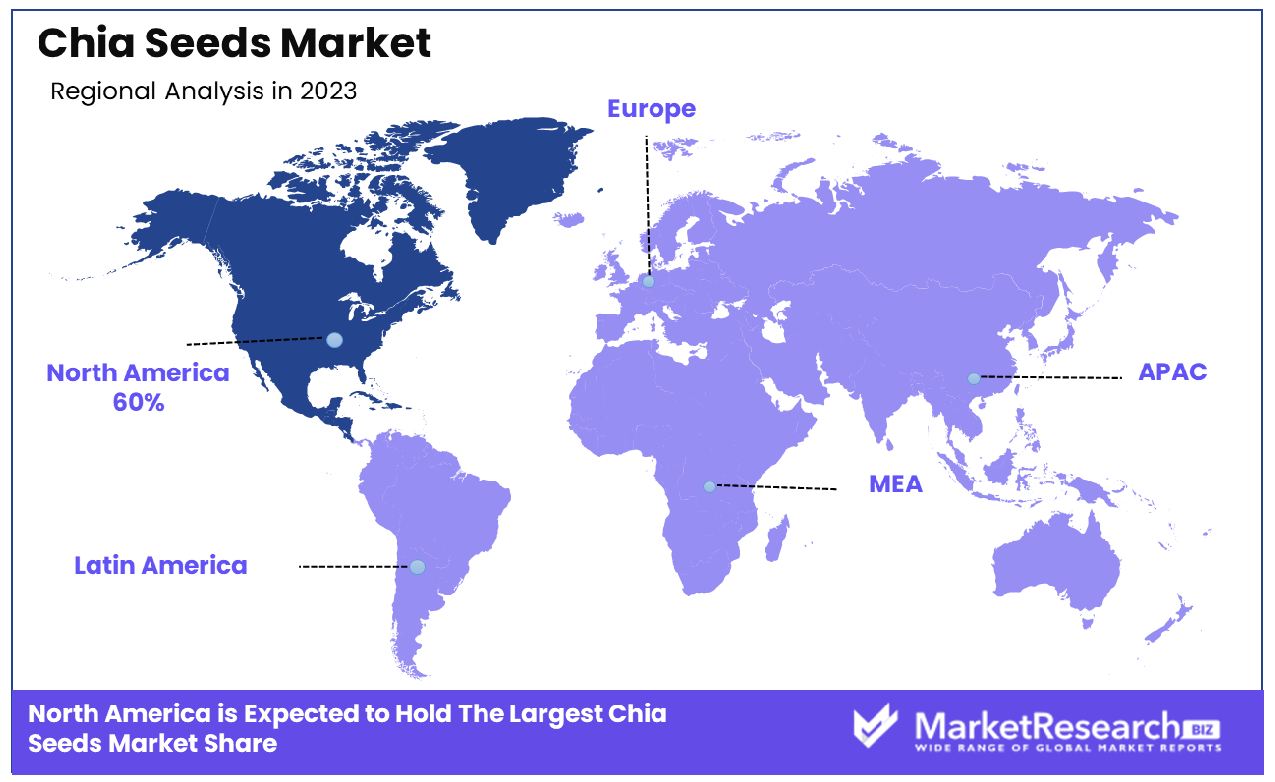

- Regional Dominance: North America holds 60% of the Chia Seeds Market.

- By Color: White chia seeds dominate, representing 45% of the market.

- By Product Type: Whole chia seeds dominate, accounting for 60% of product types.

- By End Use: The food and beverages segment dominates with a 55% market share.

Driving factors

Rising Popularity of Superfoods Among Health-Conscious Consumers

The burgeoning interest in superfoods has significantly propelled the Chia Seeds Market. As awareness of nutritional benefits broadens, health-conscious consumers are increasingly turning to chia seeds for their exceptional omega-3 fatty acids, antioxidants, fiber, and protein content.

This shift is largely fueled by a growing societal focus on wellness and preventative healthcare, where individuals prefer natural and nutrient-rich food options. Market analysis indicates that the superfoods category, with chia seeds at the forefront, is witnessing a robust annual growth rate, reflecting a deep-rooted trend toward health optimization through diet.

Increasing Incorporation of Dietary Supplements and Functional Foods

Chia seeds' versatility has facilitated their integration into a wide array of dietary supplements and functional foods, enhancing market penetration and consumer reach. This trend is supported by the dual rise in consumer demand for convenience and nutritional efficacy in food products.

As manufacturers respond to this demand, chia seeds are being increasingly utilized in products ranging from baked goods to smoothies, thereby broadening the consumer base and fostering market growth. The expansion into diverse food applications underscores the seed's adaptability and enhances its appeal across different consumer segments.

Growing Demand for Plant-Based Protein Sources

The shift towards plant-based diets has spotlighted chia seeds as a vital source of plant protein. This consumer shift is driven by factors including sustainability concerns, health trends, and ethical considerations regarding animal welfare.

Chia seeds offer a high-quality, non-soy protein alternative that is attracting vegetarians, vegans, and flexitarians alike. The market for plant-based proteins is expanding rapidly, with chia seeds positioned as a key player due to their nutritional profile and the growing endorsement from dieticians and health practitioners.

Restraining Factors

Fluctuations in Chia Seed Production Due to Climatic Changes

The chia seeds market faces significant challenges due to fluctuations in production, primarily influenced by climatic changes. As a crop largely dependent on specific climatic conditions, chia seeds are susceptible to variations in weather patterns, including droughts and excessive rainfall, which can drastically affect yield.

These inconsistencies can lead to volatility in supply and price, making it difficult for producers to predict market dynamics and for consumers to maintain steady consumption patterns. This unpredictability can deter new entrants and investors who seek stable markets for long-term engagements, thereby restraining market growth.

Limited Awareness in Emerging Markets

Another significant barrier to the expansion of the chia seeds market is the limited awareness of their health benefits in emerging markets. While chia seeds have gained substantial popularity in developed regions due to widespread marketing and the presence of a health-conscious consumer base, emerging markets lag in exposure and consumer education.

This lack of awareness hinders adoption and limits market penetration, as potential consumers in these regions are not fully informed about the nutritional value and diverse uses of chia seeds in their diets.

By Color Analysis

White chia seeds dominated the market with a 45% share, preferred for their versatility.

In 2023, White held a dominant market position in the By Color segment of the Chia Seeds Market, capturing more than a 45% share. The values at the start indicate that white chia seeds have achieved substantial market preference due to their perceived purity and versatility in various culinary applications. This segmental dominance can be attributed to several factors, including consumer preference for aesthetically appealing food products and the nutritional benefits associated with white chia seeds.

White chia seeds are often favored for their neutral color, which blends seamlessly into a variety of dishes without altering their appearance. This characteristic makes them particularly popular among health-conscious consumers who incorporate chia seeds into smoothies, yogurts, and baked goods. The high omega-3 fatty acid content, dietary fiber, and protein found in white chia seeds further enhance their appeal, driving their market share.

In comparison, Black chia seeds held the second-largest market share in the Color segment. Black chia seeds are recognized for their slightly higher antioxidant content compared to white chia seeds. Despite their dark color, which can influence the appearance of food products, they remain a significant choice for consumers prioritizing nutritional value over aesthetic considerations.

Brown chia seeds, although less prevalent in the market, still maintained a notable presence. This segment appeals to a niche market, particularly among consumers who prefer organic and unprocessed food products. Brown chia seeds are often marketed for their rustic and natural appearance, appealing to a demographic that values minimally processed foods.

The chia seeds market is driven by increasing consumer awareness of health and wellness, and the versatility of chia seeds in various dietary applications. White chia seeds, in particular, have capitalized on these trends, reinforcing their dominant market position in the By Color segment. The growth trajectory for each color segment is expected to continue, influenced by ongoing research and development, consumer preferences, and marketing strategies emphasizing the unique benefits of each color variant.

By Product Type Analysis

Whole chia seeds dominate the market, holding a commanding 60% share.

In 2023, Whole Chia Seeds held a dominant market position in the By Product Type segment of the Chia Seeds Market, capturing more than a 60% share. This substantial market dominance is driven by several factors, including consumer preference for whole, unprocessed foods and the versatility of whole chia seeds in various culinary applications.

Whole chia seeds are highly valued for their ability to retain their nutritional integrity, offering a rich source of omega-3 fatty acids, dietary fiber, and protein. Consumers are increasingly incorporating whole chia seeds into their diets by adding them to smoothies, yogurts, salads, and baked goods. The ease of use and ability to swell in liquid, creating a gel-like consistency, also contribute to their popularity, enhancing their functional appeal in a range of recipes.

Grounded Chia Seeds held the second-largest market share in the By Product Type segment. Ground chia seeds are particularly favored by consumers looking for a more easily digestible form of chia seeds. Grinding chia seeds enhances their nutrient bioavailability, making the proteins, fats, and vitamins more accessible to the body. This segment appeals to health-conscious individuals who seek to maximize the nutritional benefits of chia seeds. Ground chia seeds are commonly used in baking and as an ingredient in health supplements, contributing to their market presence.

Chia Seed Oil, while holding a smaller market share compared to whole and grounded chia seeds, still represents a significant segment. Chia seed oil is prized for its high content of omega-3 fatty acids and antioxidants, making it a popular choice in both the culinary and cosmetic industries. Its application as a premium cooking oil and a key ingredient in skincare products underscores its niche but growing market appeal.

The chia seeds market, segmented by product type, is influenced by increasing consumer awareness of health and wellness, coupled with the versatility and functional benefits of chia seeds in various applications. Whole chia seeds, in particular, have leveraged these trends to secure their dominant market position. The growth outlook for each product type segment is expected to remain positive, driven by ongoing innovations, consumer preferences, and strategic marketing efforts highlighting the unique advantages of each chia seed product type.

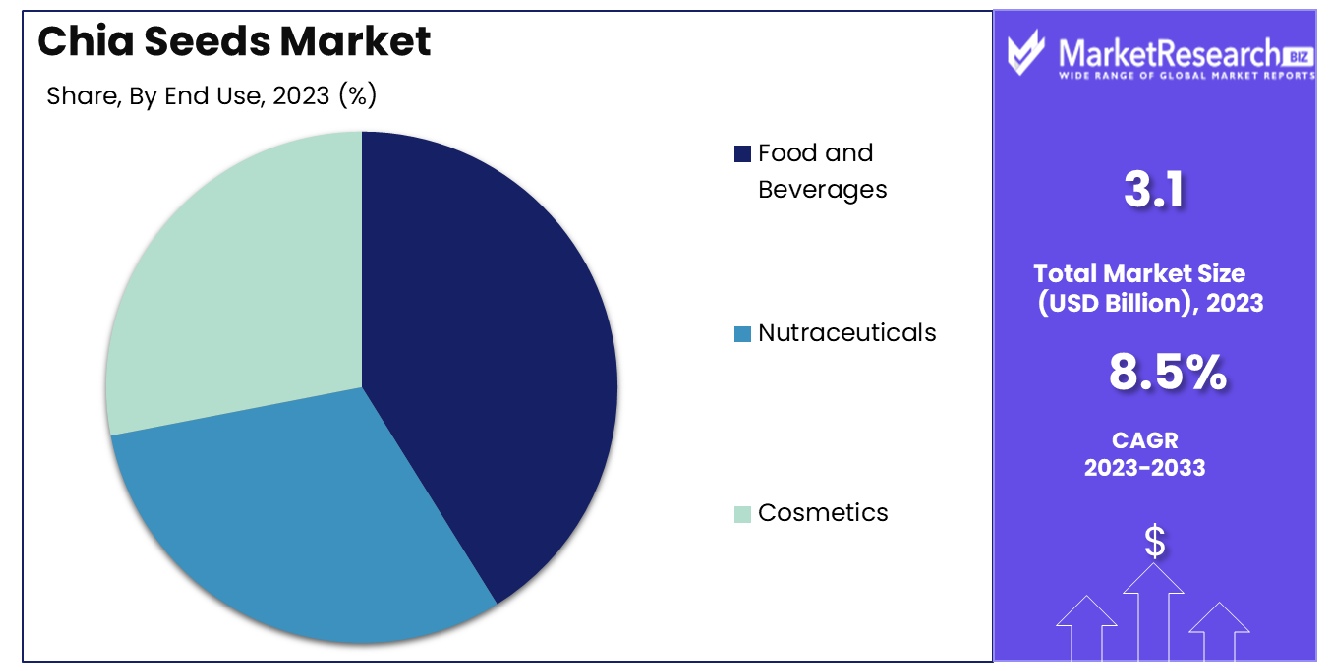

By End-Use Analysis

The food and beverages sector dominates, accounting for 55% of the chia seeds market share.

In 2023, Food and Beverages held a dominant market position in the By End Use segment of the Chia Seeds Market, capturing more than a 55% share. This significant market presence is largely driven by the widespread incorporation of chia seeds into various food and beverage products, reflecting their growing popularity among health-conscious consumers.

Food and Beverages represent the largest end-use segment for chia seeds, attributed to their versatile application in a wide range of products. Chia seeds are increasingly being used as an ingredient in bakery products, cereals, snacks, beverages, and dairy products. Their high nutritional content, including omega-3 fatty acids, dietary fiber, and proteins, makes them an attractive addition to health-focused food and beverage products. The trend towards clean-label and plant-based ingredients further supports the integration of chia seeds into this segment.

Nutraceuticals held the second-largest market share in the By End Use segment. The nutraceutical industry leverages the health benefits of chia seeds, incorporating them into dietary supplements and functional foods aimed at improving overall health and well-being. Chia seeds are recognized for their potential to support heart health, improve digestive function, and provide sustained energy. The growing consumer awareness of these benefits drives their application in nutraceutical products, which are marketed for their health-boosting properties.

Cosmetics, while accounting for a smaller portion of the market, still represent a notable segment within the chia seeds market. Chia seed oil, rich in omega-3 fatty acids and antioxidants, is utilized in skincare and haircare products due to its moisturizing, anti-inflammatory, and anti-aging properties. The increasing demand for natural and organic ingredients in the cosmetics industry has bolstered the use of chia seed oil, highlighting its niche but significant market presence.

The chia seeds market, segmented by end-use, is influenced by evolving consumer preferences toward health and wellness, and the versatility of chia seeds in various applications. The Food and Beverages segment has capitalized on these trends to maintain its dominant market position. The growth prospects for each end-use segment remain robust, driven by ongoing research and development, consumer education, and targeted marketing strategies that emphasize the unique benefits of chia seeds in food, nutraceutical, and cosmetic applications.

Key Market Segments

By Color

- White

- Black

- Brown

By Product Type

- Grounded Chia Seeds

- Whole Chia Seeds

- Chia Seed Oil

By End Use

- Food and Beverages

- Nutraceuticals

- Cosmetics

Growth Opportunity

Expansion of Distribution Channels in Untapped Regions

The year 2023 presents substantial opportunities for the global Chia Seeds Market through the expansion of distribution channels into untapped regions. This strategic move capitalizes on the increasing globalization of health food trends and the rising middle-class populations in these areas, who are becoming more health-conscious.

By entering new markets, particularly in regions such as Asia and Eastern Europe, companies can tap into fresh consumer bases eager for nutritious and innovative food options. The establishment of robust distribution networks in these regions not only extends market reach but also enhances brand visibility and consumer engagement, driving long-term market growth.

Development of New Product Formulations Incorporating Chia Seeds

Another promising avenue in 2023 is the development of new product formulations that incorporate chia seeds. The versatility of chia seeds makes them an ideal ingredient in a variety of food products, ranging from breakfast cereals and energy bars to beverages and dairy alternatives.

Innovations in product development that highlight the unique texture and nutritional profile of chia seeds can meet the growing consumer demand for functional foods that support a healthy lifestyle. Furthermore, leveraging the plant-based protein appeal of chia seeds can attract a broader demographic, including vegans and vegetarians, thereby expanding the consumer market.

Latest Trends

Use of Chia Seeds in Gluten-Free and Vegan Products

In 2023, one of the most notable trends in the global Chia Seeds Market is their increased use of gluten-free and vegan products. This trend aligns with the rising consumer preference for dietary inclusivity, catering to individuals with specific dietary restrictions and ethical food choices. Chia seeds are naturally gluten-free and rich in nutrients, making them an excellent ingredient in products targeting the gluten-intolerant and health-conscious consumer segments.

Additionally, their high protein and omega-3 fatty acid content make them particularly appealing in the vegan market, where finding nutrient-dense, plant-based options can be challenging. As manufacturers continue to innovate within these niches, chia seeds are becoming a staple ingredient, driving growth in this segment and reinforcing the seeds' versatility in food production.

Increasing Popularity of Chia-Based Snacks and Beverages

Another emerging trend is the increasing popularity of chia-based snacks and beverages. The convenience factor combined with health benefits makes chia-based products highly attractive to consumers looking for quick, nutritious options. Beverages like chia-infused smoothies and chia-based hydrating drinks are gaining traction for their energy-boosting and hydrating properties, particularly among fitness enthusiasts and active consumers.

Similarly, snacks such as chia bars, puddings, and granola mixes are becoming popular for on-the-go consumption. These products cater to the busy lifestyles of modern consumers while aligning with their increasing health consciousness, further propelling market growth.

Regional Analysis

North America leads the Chia Seeds Market with a commanding 60% share, driven by health-conscious consumers.

The global Chia Seeds Market demonstrates distinctive growth patterns and trends across various regional markets. North America dominates the market, holding approximately 60% of the global share. This substantial market presence is driven by a heightened awareness of health and wellness, particularly in the United States and Canada, where chia seeds are increasingly incorporated into various health foods and dietary supplements. The region’s robust health food infrastructure and consumer willingness to adopt novel dietary trends significantly contribute to its leading position.

In Europe, the market is expanding rapidly due to the rising popularity of vegan and gluten-free diets, especially in countries like Germany, the UK, and France. European consumers' growing preference for natural and non-GMO food products is expected to further drive the demand for chia seeds, positioning Europe as a key player in the global market landscape.

The Asia Pacific region is emerging as a fast-growing market for chia seeds, attributed to increasing urbanization and changing lifestyles, particularly in China, India, and Australia. The region's burgeoning middle class is becoming more health-conscious, which is likely to increase the demand for nutritious and easy-to-prepare food options such as chia-based products.

In Latin America, where chia seeds are native, the market is driven by both traditional uses and modern applications in health foods. Countries like Mexico and Argentina are significant producers, contributing to both regional consumption and global exports.

The Middle East & Africa region, though smaller in comparison, shows potential for growth, particularly through the incorporation of chia seeds in traditional foods and new health-focused product launches, catering to an increasingly health-aware consumer base.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

The global Chia Seeds Market in 2023 is significantly shaped by the strategic initiatives and competitive positioning of key players such as Navitas Organics, Glanbia Nutritionals, and Salba Smart Natural Products. Navitas Organics continues to leverage its strong brand reputation and wide distribution network to maintain a robust market presence. Their commitment to organic and sustainably sourced products resonates well with health-conscious consumers, driving substantial market share.

Glanbia Nutritionals stands out with its focus on innovative nutritional solutions, integrating chia seeds into a broad range of functional food products. This approach not only diversifies their product portfolio but also strengthens their position in the health and wellness sector. Similarly, Salba Smart Natural Products emphasizes high-quality, nutritionally superior chia seeds, appealing to a niche market of health enthusiasts seeking premium products.

Mamma Chia and Nutiva Inc. are also notable players, with Mamma Chia pioneering chia-based beverages and snacks, capitalizing on the trend of convenient, health-oriented food products. Nutiva Inc.'s extensive range of organic superfoods, including chia seeds, enhances its appeal to consumers prioritizing organic and non-GMO products.

Benexia Europa and Garden of Life are leveraging their strong supply chain and product innovation capabilities to expand their market footprint. Spectrum Organics Products LLC, The Chia Company, and Chia Bia Slovakia continue to focus on high-quality offerings and effective marketing strategies to capture a broader consumer base.

Other key players like Naturkost & Übelhör, ChiaCorp, Sesajal SA De CV, and Bioglan are focusing on expanding their global reach and enhancing product quality to stay competitive. Their efforts in research and development, along with strategic partnerships and acquisitions, are crucial in driving market growth and innovation.

Market Key Players

- Navitas Organics

- Glanbia Nutritionals

- Salba Smart Natural Products

- Mamma Chia

- Nutiva Inc.

- Benexia Europa

- Garden of Life

- Spectrum Organics Products LLC

- The Chia Company

- Chia Bia Slovakia

- Naturkost &Übelhör

- ChiaCorp

- Sesajal SA De CV

- Bioglan

Recent Development

- In February 2023, Navitas Organics launched a new line of flavored chia seeds aimed at enhancing consumer experience with additional health benefits. This product expansion seeks to cater to the growing consumer interest in nutritious and easy-to-prepare foods.

- In June 2022, Glanbia Nutritionals announced in June 2022 the construction of a new processing plant dedicated to chia and other superfoods. This expansion is designed to increase their processing capacity by 50%, aligning with their strategy to meet the escalating demand for superfoods globally.

- In January 2022, Mamma Chia introduced a new 'chia beverage' that integrates chia seeds with natural fruit juices, aiming at the beverage market. This product launch targets health-conscious consumers looking for functional drinks that provide hydration and nutrition.

Report Scope

Report Features Description Market Value (2023) USD 3.1 Billion Forecast Revenue (2033) USD 6.9 Billion CAGR (2024-2032) 8.5% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Color(White, Black, Brown), By Product Type(Grounded Chia Seeds, Whole Chia Seeds, Chia Seed Oil), By End Use(Food and Beverages, Nutraceuticals, Cosmetics) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Navitas Organics, Glanbia Nutritionals, Salba Smart Natural Products, Mamma Chia, Nutiva Inc., Benexia Europa, Garden of Life, Spectrum Organics Products LLC, The Chia Company, Chia Bia Slovakia, Naturkost &Übelhör, ChiaCorp, Sesajal SA De CV, Bioglan Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Chia Seeds Market Overview

- 2.1. Chia Seeds Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Chia Seeds Market Dynamics

- 3. Global Chia Seeds Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Chia Seeds Market Analysis, 2016-2021

- 3.2. Global Chia Seeds Market Opportunity and Forecast, 2023-2032

- 3.3. Global Chia Seeds Market Analysis, Opportunity and Forecast, By By Color, 2016-2032

- 3.3.1. Global Chia Seeds Market Analysis by By Color: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Color, 2016-2032

- 3.3.3. White

- 3.3.4. Black

- 3.3.5. Brown

- 3.4. Global Chia Seeds Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 3.4.1. Global Chia Seeds Market Analysis by By Product Type: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 3.4.3. Grounded Chia Seeds

- 3.4.4. Whole Chia Seeds

- 3.4.5. Chia Seed Oil

- 3.5. Global Chia Seeds Market Analysis, Opportunity and Forecast, By By End Use, 2016-2032

- 3.5.1. Global Chia Seeds Market Analysis by By End Use: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End Use, 2016-2032

- 3.5.3. Food and Beverages

- 3.5.4. Nutraceuticals

- 3.5.5. Cosmetics

- 4. North America Chia Seeds Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Chia Seeds Market Analysis, 2016-2021

- 4.2. North America Chia Seeds Market Opportunity and Forecast, 2023-2032

- 4.3. North America Chia Seeds Market Analysis, Opportunity and Forecast, By By Color, 2016-2032

- 4.3.1. North America Chia Seeds Market Analysis by By Color: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Color, 2016-2032

- 4.3.3. White

- 4.3.4. Black

- 4.3.5. Brown

- 4.4. North America Chia Seeds Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 4.4.1. North America Chia Seeds Market Analysis by By Product Type: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 4.4.3. Grounded Chia Seeds

- 4.4.4. Whole Chia Seeds

- 4.4.5. Chia Seed Oil

- 4.5. North America Chia Seeds Market Analysis, Opportunity and Forecast, By By End Use, 2016-2032

- 4.5.1. North America Chia Seeds Market Analysis by By End Use: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End Use, 2016-2032

- 4.5.3. Food and Beverages

- 4.5.4. Nutraceuticals

- 4.5.5. Cosmetics

- 4.6. North America Chia Seeds Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.6.1. North America Chia Seeds Market Analysis by Country : Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.6.2.1. The US

- 4.6.2.2. Canada

- 4.6.2.3. Mexico

- 5. Western Europe Chia Seeds Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Chia Seeds Market Analysis, 2016-2021

- 5.2. Western Europe Chia Seeds Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Chia Seeds Market Analysis, Opportunity and Forecast, By By Color, 2016-2032

- 5.3.1. Western Europe Chia Seeds Market Analysis by By Color: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Color, 2016-2032

- 5.3.3. White

- 5.3.4. Black

- 5.3.5. Brown

- 5.4. Western Europe Chia Seeds Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 5.4.1. Western Europe Chia Seeds Market Analysis by By Product Type: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 5.4.3. Grounded Chia Seeds

- 5.4.4. Whole Chia Seeds

- 5.4.5. Chia Seed Oil

- 5.5. Western Europe Chia Seeds Market Analysis, Opportunity and Forecast, By By End Use, 2016-2032

- 5.5.1. Western Europe Chia Seeds Market Analysis by By End Use: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End Use, 2016-2032

- 5.5.3. Food and Beverages

- 5.5.4. Nutraceuticals

- 5.5.5. Cosmetics

- 5.6. Western Europe Chia Seeds Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.6.1. Western Europe Chia Seeds Market Analysis by Country : Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.6.2.1. Germany

- 5.6.2.2. France

- 5.6.2.3. The UK

- 5.6.2.4. Spain

- 5.6.2.5. Italy

- 5.6.2.6. Portugal

- 5.6.2.7. Ireland

- 5.6.2.8. Austria

- 5.6.2.9. Switzerland

- 5.6.2.10. Benelux

- 5.6.2.11. Nordic

- 5.6.2.12. Rest of Western Europe

- 6. Eastern Europe Chia Seeds Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Chia Seeds Market Analysis, 2016-2021

- 6.2. Eastern Europe Chia Seeds Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Chia Seeds Market Analysis, Opportunity and Forecast, By By Color, 2016-2032

- 6.3.1. Eastern Europe Chia Seeds Market Analysis by By Color: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Color, 2016-2032

- 6.3.3. White

- 6.3.4. Black

- 6.3.5. Brown

- 6.4. Eastern Europe Chia Seeds Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 6.4.1. Eastern Europe Chia Seeds Market Analysis by By Product Type: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 6.4.3. Grounded Chia Seeds

- 6.4.4. Whole Chia Seeds

- 6.4.5. Chia Seed Oil

- 6.5. Eastern Europe Chia Seeds Market Analysis, Opportunity and Forecast, By By End Use, 2016-2032

- 6.5.1. Eastern Europe Chia Seeds Market Analysis by By End Use: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End Use, 2016-2032

- 6.5.3. Food and Beverages

- 6.5.4. Nutraceuticals

- 6.5.5. Cosmetics

- 6.6. Eastern Europe Chia Seeds Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.6.1. Eastern Europe Chia Seeds Market Analysis by Country : Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.6.2.1. Russia

- 6.6.2.2. Poland

- 6.6.2.3. The Czech Republic

- 6.6.2.4. Greece

- 6.6.2.5. Rest of Eastern Europe

- 7. APAC Chia Seeds Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Chia Seeds Market Analysis, 2016-2021

- 7.2. APAC Chia Seeds Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Chia Seeds Market Analysis, Opportunity and Forecast, By By Color, 2016-2032

- 7.3.1. APAC Chia Seeds Market Analysis by By Color: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Color, 2016-2032

- 7.3.3. White

- 7.3.4. Black

- 7.3.5. Brown

- 7.4. APAC Chia Seeds Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 7.4.1. APAC Chia Seeds Market Analysis by By Product Type: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 7.4.3. Grounded Chia Seeds

- 7.4.4. Whole Chia Seeds

- 7.4.5. Chia Seed Oil

- 7.5. APAC Chia Seeds Market Analysis, Opportunity and Forecast, By By End Use, 2016-2032

- 7.5.1. APAC Chia Seeds Market Analysis by By End Use: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End Use, 2016-2032

- 7.5.3. Food and Beverages

- 7.5.4. Nutraceuticals

- 7.5.5. Cosmetics

- 7.6. APAC Chia Seeds Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.6.1. APAC Chia Seeds Market Analysis by Country : Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.6.2.1. China

- 7.6.2.2. Japan

- 7.6.2.3. South Korea

- 7.6.2.4. India

- 7.6.2.5. Australia & New Zeland

- 7.6.2.6. Indonesia

- 7.6.2.7. Malaysia

- 7.6.2.8. Philippines

- 7.6.2.9. Singapore

- 7.6.2.10. Thailand

- 7.6.2.11. Vietnam

- 7.6.2.12. Rest of APAC

- 8. Latin America Chia Seeds Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Chia Seeds Market Analysis, 2016-2021

- 8.2. Latin America Chia Seeds Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Chia Seeds Market Analysis, Opportunity and Forecast, By By Color, 2016-2032

- 8.3.1. Latin America Chia Seeds Market Analysis by By Color: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Color, 2016-2032

- 8.3.3. White

- 8.3.4. Black

- 8.3.5. Brown

- 8.4. Latin America Chia Seeds Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 8.4.1. Latin America Chia Seeds Market Analysis by By Product Type: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 8.4.3. Grounded Chia Seeds

- 8.4.4. Whole Chia Seeds

- 8.4.5. Chia Seed Oil

- 8.5. Latin America Chia Seeds Market Analysis, Opportunity and Forecast, By By End Use, 2016-2032

- 8.5.1. Latin America Chia Seeds Market Analysis by By End Use: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End Use, 2016-2032

- 8.5.3. Food and Beverages

- 8.5.4. Nutraceuticals

- 8.5.5. Cosmetics

- 8.6. Latin America Chia Seeds Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.6.1. Latin America Chia Seeds Market Analysis by Country : Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.6.2.1. Brazil

- 8.6.2.2. Colombia

- 8.6.2.3. Chile

- 8.6.2.4. Argentina

- 8.6.2.5. Costa Rica

- 8.6.2.6. Rest of Latin America

- 9. Middle East & Africa Chia Seeds Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Chia Seeds Market Analysis, 2016-2021

- 9.2. Middle East & Africa Chia Seeds Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Chia Seeds Market Analysis, Opportunity and Forecast, By By Color, 2016-2032

- 9.3.1. Middle East & Africa Chia Seeds Market Analysis by By Color: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Color, 2016-2032

- 9.3.3. White

- 9.3.4. Black

- 9.3.5. Brown

- 9.4. Middle East & Africa Chia Seeds Market Analysis, Opportunity and Forecast, By By Product Type, 2016-2032

- 9.4.1. Middle East & Africa Chia Seeds Market Analysis by By Product Type: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product Type, 2016-2032

- 9.4.3. Grounded Chia Seeds

- 9.4.4. Whole Chia Seeds

- 9.4.5. Chia Seed Oil

- 9.5. Middle East & Africa Chia Seeds Market Analysis, Opportunity and Forecast, By By End Use, 2016-2032

- 9.5.1. Middle East & Africa Chia Seeds Market Analysis by By End Use: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End Use, 2016-2032

- 9.5.3. Food and Beverages

- 9.5.4. Nutraceuticals

- 9.5.5. Cosmetics

- 9.6. Middle East & Africa Chia Seeds Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.6.1. Middle East & Africa Chia Seeds Market Analysis by Country : Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.6.2.1. Algeria

- 9.6.2.2. Egypt

- 9.6.2.3. Israel

- 9.6.2.4. Kuwait

- 9.6.2.5. Nigeria

- 9.6.2.6. Saudi Arabia

- 9.6.2.7. South Africa

- 9.6.2.8. Turkey

- 9.6.2.9. The UAE

- 9.6.2.10. Rest of MEA

- 10. Global Chia Seeds Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Chia Seeds Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Chia Seeds Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Navitas Organics

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Glanbia Nutritionals

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Salba Smart Natural Products

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Mamma Chia

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Nutiva Inc.

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Benexia Europa

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Garden of Life

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Spectrum Organics Products LLC

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. The Chia Company

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Chia Bia Slovakia

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. Naturkost &Übelhör

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. Sesajal SA De CV

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 11.16. Bioglan

- 11.16.1. Company Overview

- 11.16.2. Financial Highlights

- 11.16.3. Product Portfolio

- 11.16.4. SWOT Analysis

- 11.16.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

"

- List of Figures

- "

- Figure 1: Global Chia Seeds Market Revenue (US$ Mn) Market Share by By Color in 2022

- Figure 2: Global Chia Seeds Market Market Attractiveness Analysis by By Color, 2016-2032

- Figure 3: Global Chia Seeds Market Revenue (US$ Mn) Market Share by By Product Typein 2022

- Figure 4: Global Chia Seeds Market Market Attractiveness Analysis by By Product Type, 2016-2032

- Figure 5: Global Chia Seeds Market Revenue (US$ Mn) Market Share by By End Usein 2022

- Figure 6: Global Chia Seeds Market Market Attractiveness Analysis by By End Use, 2016-2032

- Figure 7: Global Chia Seeds Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 8: Global Chia Seeds Market Market Attractiveness Analysis by Region, 2016-2032

- Figure 9: Global Chia Seeds Market Market Revenue (US$ Mn) (2016-2032)

- Figure 10: Global Chia Seeds Market Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 11: Global Chia Seeds Market Market Revenue (US$ Mn) Comparison by By Color (2016-2032)

- Figure 12: Global Chia Seeds Market Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Figure 13: Global Chia Seeds Market Market Revenue (US$ Mn) Comparison by By End Use (2016-2032)

- Figure 14: Global Chia Seeds Market Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 15: Global Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By Color (2016-2032)

- Figure 16: Global Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Figure 17: Global Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By End Use (2016-2032)

- Figure 18: Global Chia Seeds Market Market Share Comparison by Region (2016-2032)

- Figure 19: Global Chia Seeds Market Market Share Comparison by By Color (2016-2032)

- Figure 20: Global Chia Seeds Market Market Share Comparison by By Product Type (2016-2032)

- Figure 21: Global Chia Seeds Market Market Share Comparison by By End Use (2016-2032)

- Figure 22: North America Chia Seeds Market Revenue (US$ Mn) Market Share by By Colorin 2022

- Figure 23: North America Chia Seeds Market Market Attractiveness Analysis by By Color, 2016-2032

- Figure 24: North America Chia Seeds Market Revenue (US$ Mn) Market Share by By Product Typein 2022

- Figure 25: North America Chia Seeds Market Market Attractiveness Analysis by By Product Type, 2016-2032

- Figure 26: North America Chia Seeds Market Revenue (US$ Mn) Market Share by By End Usein 2022

- Figure 27: North America Chia Seeds Market Market Attractiveness Analysis by By End Use, 2016-2032

- Figure 28: North America Chia Seeds Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 29: North America Chia Seeds Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 30: North America Chia Seeds Market Market Revenue (US$ Mn) (2016-2032)

- Figure 31: North America Chia Seeds Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 32: North America Chia Seeds Market Market Revenue (US$ Mn) Comparison by By Color (2016-2032)

- Figure 33: North America Chia Seeds Market Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Figure 34: North America Chia Seeds Market Market Revenue (US$ Mn) Comparison by By End Use (2016-2032)

- Figure 35: North America Chia Seeds Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 36: North America Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By Color (2016-2032)

- Figure 37: North America Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Figure 38: North America Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By End Use (2016-2032)

- Figure 39: North America Chia Seeds Market Market Share Comparison by Country (2016-2032)

- Figure 40: North America Chia Seeds Market Market Share Comparison by By Color (2016-2032)

- Figure 41: North America Chia Seeds Market Market Share Comparison by By Product Type (2016-2032)

- Figure 42: North America Chia Seeds Market Market Share Comparison by By End Use (2016-2032)

- Figure 43: Western Europe Chia Seeds Market Revenue (US$ Mn) Market Share by By Colorin 2022

- Figure 44: Western Europe Chia Seeds Market Market Attractiveness Analysis by By Color, 2016-2032

- Figure 45: Western Europe Chia Seeds Market Revenue (US$ Mn) Market Share by By Product Typein 2022

- Figure 46: Western Europe Chia Seeds Market Market Attractiveness Analysis by By Product Type, 2016-2032

- Figure 47: Western Europe Chia Seeds Market Revenue (US$ Mn) Market Share by By End Usein 2022

- Figure 48: Western Europe Chia Seeds Market Market Attractiveness Analysis by By End Use, 2016-2032

- Figure 49: Western Europe Chia Seeds Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 50: Western Europe Chia Seeds Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 51: Western Europe Chia Seeds Market Market Revenue (US$ Mn) (2016-2032)

- Figure 52: Western Europe Chia Seeds Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 53: Western Europe Chia Seeds Market Market Revenue (US$ Mn) Comparison by By Color (2016-2032)

- Figure 54: Western Europe Chia Seeds Market Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Figure 55: Western Europe Chia Seeds Market Market Revenue (US$ Mn) Comparison by By End Use (2016-2032)

- Figure 56: Western Europe Chia Seeds Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 57: Western Europe Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By Color (2016-2032)

- Figure 58: Western Europe Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Figure 59: Western Europe Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By End Use (2016-2032)

- Figure 60: Western Europe Chia Seeds Market Market Share Comparison by Country (2016-2032)

- Figure 61: Western Europe Chia Seeds Market Market Share Comparison by By Color (2016-2032)

- Figure 62: Western Europe Chia Seeds Market Market Share Comparison by By Product Type (2016-2032)

- Figure 63: Western Europe Chia Seeds Market Market Share Comparison by By End Use (2016-2032)

- Figure 64: Eastern Europe Chia Seeds Market Revenue (US$ Mn) Market Share by By Colorin 2022

- Figure 65: Eastern Europe Chia Seeds Market Market Attractiveness Analysis by By Color, 2016-2032

- Figure 66: Eastern Europe Chia Seeds Market Revenue (US$ Mn) Market Share by By Product Typein 2022

- Figure 67: Eastern Europe Chia Seeds Market Market Attractiveness Analysis by By Product Type, 2016-2032

- Figure 68: Eastern Europe Chia Seeds Market Revenue (US$ Mn) Market Share by By End Usein 2022

- Figure 69: Eastern Europe Chia Seeds Market Market Attractiveness Analysis by By End Use, 2016-2032

- Figure 70: Eastern Europe Chia Seeds Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 71: Eastern Europe Chia Seeds Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 72: Eastern Europe Chia Seeds Market Market Revenue (US$ Mn) (2016-2032)

- Figure 73: Eastern Europe Chia Seeds Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 74: Eastern Europe Chia Seeds Market Market Revenue (US$ Mn) Comparison by By Color (2016-2032)

- Figure 75: Eastern Europe Chia Seeds Market Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Figure 76: Eastern Europe Chia Seeds Market Market Revenue (US$ Mn) Comparison by By End Use (2016-2032)

- Figure 77: Eastern Europe Chia Seeds Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 78: Eastern Europe Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By Color (2016-2032)

- Figure 79: Eastern Europe Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Figure 80: Eastern Europe Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By End Use (2016-2032)

- Figure 81: Eastern Europe Chia Seeds Market Market Share Comparison by Country (2016-2032)

- Figure 82: Eastern Europe Chia Seeds Market Market Share Comparison by By Color (2016-2032)

- Figure 83: Eastern Europe Chia Seeds Market Market Share Comparison by By Product Type (2016-2032)

- Figure 84: Eastern Europe Chia Seeds Market Market Share Comparison by By End Use (2016-2032)

- Figure 85: APAC Chia Seeds Market Revenue (US$ Mn) Market Share by By Colorin 2022

- Figure 86: APAC Chia Seeds Market Market Attractiveness Analysis by By Color, 2016-2032

- Figure 87: APAC Chia Seeds Market Revenue (US$ Mn) Market Share by By Product Typein 2022

- Figure 88: APAC Chia Seeds Market Market Attractiveness Analysis by By Product Type, 2016-2032

- Figure 89: APAC Chia Seeds Market Revenue (US$ Mn) Market Share by By End Usein 2022

- Figure 90: APAC Chia Seeds Market Market Attractiveness Analysis by By End Use, 2016-2032

- Figure 91: APAC Chia Seeds Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 92: APAC Chia Seeds Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 93: APAC Chia Seeds Market Market Revenue (US$ Mn) (2016-2032)

- Figure 94: APAC Chia Seeds Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 95: APAC Chia Seeds Market Market Revenue (US$ Mn) Comparison by By Color (2016-2032)

- Figure 96: APAC Chia Seeds Market Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Figure 97: APAC Chia Seeds Market Market Revenue (US$ Mn) Comparison by By End Use (2016-2032)

- Figure 98: APAC Chia Seeds Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 99: APAC Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By Color (2016-2032)

- Figure 100: APAC Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Figure 101: APAC Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By End Use (2016-2032)

- Figure 102: APAC Chia Seeds Market Market Share Comparison by Country (2016-2032)

- Figure 103: APAC Chia Seeds Market Market Share Comparison by By Color (2016-2032)

- Figure 104: APAC Chia Seeds Market Market Share Comparison by By Product Type (2016-2032)

- Figure 105: APAC Chia Seeds Market Market Share Comparison by By End Use (2016-2032)

- Figure 106: Latin America Chia Seeds Market Revenue (US$ Mn) Market Share by By Colorin 2022

- Figure 107: Latin America Chia Seeds Market Market Attractiveness Analysis by By Color, 2016-2032

- Figure 108: Latin America Chia Seeds Market Revenue (US$ Mn) Market Share by By Product Typein 2022

- Figure 109: Latin America Chia Seeds Market Market Attractiveness Analysis by By Product Type, 2016-2032

- Figure 110: Latin America Chia Seeds Market Revenue (US$ Mn) Market Share by By End Usein 2022

- Figure 111: Latin America Chia Seeds Market Market Attractiveness Analysis by By End Use, 2016-2032

- Figure 112: Latin America Chia Seeds Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 113: Latin America Chia Seeds Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 114: Latin America Chia Seeds Market Market Revenue (US$ Mn) (2016-2032)

- Figure 115: Latin America Chia Seeds Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 116: Latin America Chia Seeds Market Market Revenue (US$ Mn) Comparison by By Color (2016-2032)

- Figure 117: Latin America Chia Seeds Market Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Figure 118: Latin America Chia Seeds Market Market Revenue (US$ Mn) Comparison by By End Use (2016-2032)

- Figure 119: Latin America Chia Seeds Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 120: Latin America Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By Color (2016-2032)

- Figure 121: Latin America Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Figure 122: Latin America Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By End Use (2016-2032)

- Figure 123: Latin America Chia Seeds Market Market Share Comparison by Country (2016-2032)

- Figure 124: Latin America Chia Seeds Market Market Share Comparison by By Color (2016-2032)

- Figure 125: Latin America Chia Seeds Market Market Share Comparison by By Product Type (2016-2032)

- Figure 126: Latin America Chia Seeds Market Market Share Comparison by By End Use (2016-2032)

- Figure 127: Middle East & Africa Chia Seeds Market Revenue (US$ Mn) Market Share by By Colorin 2022

- Figure 128: Middle East & Africa Chia Seeds Market Market Attractiveness Analysis by By Color, 2016-2032

- Figure 129: Middle East & Africa Chia Seeds Market Revenue (US$ Mn) Market Share by By Product Typein 2022

- Figure 130: Middle East & Africa Chia Seeds Market Market Attractiveness Analysis by By Product Type, 2016-2032

- Figure 131: Middle East & Africa Chia Seeds Market Revenue (US$ Mn) Market Share by By End Usein 2022

- Figure 132: Middle East & Africa Chia Seeds Market Market Attractiveness Analysis by By End Use, 2016-2032

- Figure 133: Middle East & Africa Chia Seeds Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 134: Middle East & Africa Chia Seeds Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 135: Middle East & Africa Chia Seeds Market Market Revenue (US$ Mn) (2016-2032)

- Figure 136: Middle East & Africa Chia Seeds Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 137: Middle East & Africa Chia Seeds Market Market Revenue (US$ Mn) Comparison by By Color (2016-2032)

- Figure 138: Middle East & Africa Chia Seeds Market Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Figure 139: Middle East & Africa Chia Seeds Market Market Revenue (US$ Mn) Comparison by By End Use (2016-2032)

- Figure 140: Middle East & Africa Chia Seeds Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 141: Middle East & Africa Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By Color (2016-2032)

- Figure 142: Middle East & Africa Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Figure 143: Middle East & Africa Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By End Use (2016-2032)

- Figure 144: Middle East & Africa Chia Seeds Market Market Share Comparison by Country (2016-2032)

- Figure 145: Middle East & Africa Chia Seeds Market Market Share Comparison by By Color (2016-2032)

- Figure 146: Middle East & Africa Chia Seeds Market Market Share Comparison by By Product Type (2016-2032)

- Figure 147: Middle East & Africa Chia Seeds Market Market Share Comparison by By End Use (2016-2032)

"

- List of Tables

- "

- Table 1: Global Chia Seeds Market Market Comparison by By Color (2016-2032)

- Table 2: Global Chia Seeds Market Market Comparison by By Product Type (2016-2032)

- Table 3: Global Chia Seeds Market Market Comparison by By End Use (2016-2032)

- Table 4: Global Chia Seeds Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 5: Global Chia Seeds Market Market Revenue (US$ Mn) (2016-2032)

- Table 6: Global Chia Seeds Market Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 7: Global Chia Seeds Market Market Revenue (US$ Mn) Comparison by By Color (2016-2032)

- Table 8: Global Chia Seeds Market Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Table 9: Global Chia Seeds Market Market Revenue (US$ Mn) Comparison by By End Use (2016-2032)

- Table 10: Global Chia Seeds Market Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 11: Global Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By Color (2016-2032)

- Table 12: Global Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Table 13: Global Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By End Use (2016-2032)

- Table 14: Global Chia Seeds Market Market Share Comparison by Region (2016-2032)

- Table 15: Global Chia Seeds Market Market Share Comparison by By Color (2016-2032)

- Table 16: Global Chia Seeds Market Market Share Comparison by By Product Type (2016-2032)

- Table 17: Global Chia Seeds Market Market Share Comparison by By End Use (2016-2032)

- Table 18: North America Chia Seeds Market Market Comparison by By Product Type (2016-2032)

- Table 19: North America Chia Seeds Market Market Comparison by By End Use (2016-2032)

- Table 20: North America Chia Seeds Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 21: North America Chia Seeds Market Market Revenue (US$ Mn) (2016-2032)

- Table 22: North America Chia Seeds Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 23: North America Chia Seeds Market Market Revenue (US$ Mn) Comparison by By Color (2016-2032)

- Table 24: North America Chia Seeds Market Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Table 25: North America Chia Seeds Market Market Revenue (US$ Mn) Comparison by By End Use (2016-2032)

- Table 26: North America Chia Seeds Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 27: North America Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By Color (2016-2032)

- Table 28: North America Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Table 29: North America Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By End Use (2016-2032)

- Table 30: North America Chia Seeds Market Market Share Comparison by Country (2016-2032)

- Table 31: North America Chia Seeds Market Market Share Comparison by By Color (2016-2032)

- Table 32: North America Chia Seeds Market Market Share Comparison by By Product Type (2016-2032)

- Table 33: North America Chia Seeds Market Market Share Comparison by By End Use (2016-2032)

- Table 34: Western Europe Chia Seeds Market Market Comparison by By Color (2016-2032)

- Table 35: Western Europe Chia Seeds Market Market Comparison by By Product Type (2016-2032)

- Table 36: Western Europe Chia Seeds Market Market Comparison by By End Use (2016-2032)

- Table 37: Western Europe Chia Seeds Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 38: Western Europe Chia Seeds Market Market Revenue (US$ Mn) (2016-2032)

- Table 39: Western Europe Chia Seeds Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 40: Western Europe Chia Seeds Market Market Revenue (US$ Mn) Comparison by By Color (2016-2032)

- Table 41: Western Europe Chia Seeds Market Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Table 42: Western Europe Chia Seeds Market Market Revenue (US$ Mn) Comparison by By End Use (2016-2032)

- Table 43: Western Europe Chia Seeds Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 44: Western Europe Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By Color (2016-2032)

- Table 45: Western Europe Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Table 46: Western Europe Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By End Use (2016-2032)

- Table 47: Western Europe Chia Seeds Market Market Share Comparison by Country (2016-2032)

- Table 48: Western Europe Chia Seeds Market Market Share Comparison by By Color (2016-2032)

- Table 49: Western Europe Chia Seeds Market Market Share Comparison by By Product Type (2016-2032)

- Table 50: Western Europe Chia Seeds Market Market Share Comparison by By End Use (2016-2032)

- Table 51: Eastern Europe Chia Seeds Market Market Comparison by By Color (2016-2032)

- Table 52: Eastern Europe Chia Seeds Market Market Comparison by By Product Type (2016-2032)

- Table 53: Eastern Europe Chia Seeds Market Market Comparison by By End Use (2016-2032)

- Table 54: Eastern Europe Chia Seeds Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: Eastern Europe Chia Seeds Market Market Revenue (US$ Mn) (2016-2032)

- Table 56: Eastern Europe Chia Seeds Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: Eastern Europe Chia Seeds Market Market Revenue (US$ Mn) Comparison by By Color (2016-2032)

- Table 58: Eastern Europe Chia Seeds Market Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Table 59: Eastern Europe Chia Seeds Market Market Revenue (US$ Mn) Comparison by By End Use (2016-2032)

- Table 60: Eastern Europe Chia Seeds Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 61: Eastern Europe Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By Color (2016-2032)

- Table 62: Eastern Europe Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Table 63: Eastern Europe Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By End Use (2016-2032)

- Table 64: Eastern Europe Chia Seeds Market Market Share Comparison by Country (2016-2032)

- Table 65: Eastern Europe Chia Seeds Market Market Share Comparison by By Color (2016-2032)

- Table 66: Eastern Europe Chia Seeds Market Market Share Comparison by By Product Type (2016-2032)

- Table 67: Eastern Europe Chia Seeds Market Market Share Comparison by By End Use (2016-2032)

- Table 68: APAC Chia Seeds Market Market Comparison by By Color (2016-2032)

- Table 69: APAC Chia Seeds Market Market Comparison by By Product Type (2016-2032)

- Table 70: APAC Chia Seeds Market Market Comparison by By End Use (2016-2032)

- Table 71: APAC Chia Seeds Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 72: APAC Chia Seeds Market Market Revenue (US$ Mn) (2016-2032)

- Table 73: APAC Chia Seeds Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 74: APAC Chia Seeds Market Market Revenue (US$ Mn) Comparison by By Color (2016-2032)

- Table 75: APAC Chia Seeds Market Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Table 76: APAC Chia Seeds Market Market Revenue (US$ Mn) Comparison by By End Use (2016-2032)

- Table 77: APAC Chia Seeds Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 78: APAC Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By Color (2016-2032)

- Table 79: APAC Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Table 80: APAC Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By End Use (2016-2032)

- Table 81: APAC Chia Seeds Market Market Share Comparison by Country (2016-2032)

- Table 82: APAC Chia Seeds Market Market Share Comparison by By Color (2016-2032)

- Table 83: APAC Chia Seeds Market Market Share Comparison by By Product Type (2016-2032)

- Table 84: APAC Chia Seeds Market Market Share Comparison by By End Use (2016-2032)

- Table 85: Latin America Chia Seeds Market Market Comparison by By Color (2016-2032)

- Table 86: Latin America Chia Seeds Market Market Comparison by By Product Type (2016-2032)

- Table 87: Latin America Chia Seeds Market Market Comparison by By End Use (2016-2032)

- Table 88: Latin America Chia Seeds Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 89: Latin America Chia Seeds Market Market Revenue (US$ Mn) (2016-2032)

- Table 90: Latin America Chia Seeds Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 91: Latin America Chia Seeds Market Market Revenue (US$ Mn) Comparison by By Color (2016-2032)

- Table 92: Latin America Chia Seeds Market Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Table 93: Latin America Chia Seeds Market Market Revenue (US$ Mn) Comparison by By End Use (2016-2032)

- Table 94: Latin America Chia Seeds Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 95: Latin America Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By Color (2016-2032)

- Table 96: Latin America Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Table 97: Latin America Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By End Use (2016-2032)

- Table 98: Latin America Chia Seeds Market Market Share Comparison by Country (2016-2032)

- Table 99: Latin America Chia Seeds Market Market Share Comparison by By Color (2016-2032)

- Table 100: Latin America Chia Seeds Market Market Share Comparison by By Product Type (2016-2032)

- Table 101: Latin America Chia Seeds Market Market Share Comparison by By End Use (2016-2032)

- Table 102: Middle East & Africa Chia Seeds Market Market Comparison by By Color (2016-2032)

- Table 103: Middle East & Africa Chia Seeds Market Market Comparison by By Product Type (2016-2032)

- Table 104: Middle East & Africa Chia Seeds Market Market Comparison by By End Use (2016-2032)

- Table 105: Middle East & Africa Chia Seeds Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 106: Middle East & Africa Chia Seeds Market Market Revenue (US$ Mn) (2016-2032)

- Table 107: Middle East & Africa Chia Seeds Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 108: Middle East & Africa Chia Seeds Market Market Revenue (US$ Mn) Comparison by By Color (2016-2032)

- Table 109: Middle East & Africa Chia Seeds Market Market Revenue (US$ Mn) Comparison by By Product Type (2016-2032)

- Table 110: Middle East & Africa Chia Seeds Market Market Revenue (US$ Mn) Comparison by By End Use (2016-2032)

- Table 111: Middle East & Africa Chia Seeds Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 112: Middle East & Africa Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By Color (2016-2032)

- Table 113: Middle East & Africa Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By Product Type (2016-2032)

- Table 114: Middle East & Africa Chia Seeds Market Market Y-o-Y Growth Rate Comparison by By End Use (2016-2032)

- Table 115: Middle East & Africa Chia Seeds Market Market Share Comparison by Country (2016-2032)

- Table 116: Middle East & Africa Chia Seeds Market Market Share Comparison by By Color (2016-2032)

- Table 117: Middle East & Africa Chia Seeds Market Market Share Comparison by By Product Type (2016-2032)

- Table 118: Middle East & Africa Chia Seeds Market Market Share Comparison by By End Use (2016-2032)

- 1. Executive Summary

-

- Navitas Organics

- Glanbia Nutritionals

- Salba Smart Natural Products

- Mamma Chia

- Nutiva Inc.

- Benexia Europa

- Garden of Life

- Spectrum Organics Products LLC

- The Chia Company

- Chia Bia Slovakia

- Naturkost &Übelhör

- ChiaCorp

- Sesajal SA De CV

- Bioglan