Chamomile Extract Market By Type (Pharmaceutical Grade, Industrial Grade, Food Grade, Others), By Form (Liquid, Powder, By Nature (Organic, Conventional), By Application (Food And Beverages, Pharmaceuticals, Dietary Supplements, Personal Care and Cosmetics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

45744

-

April 2024

-

136

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

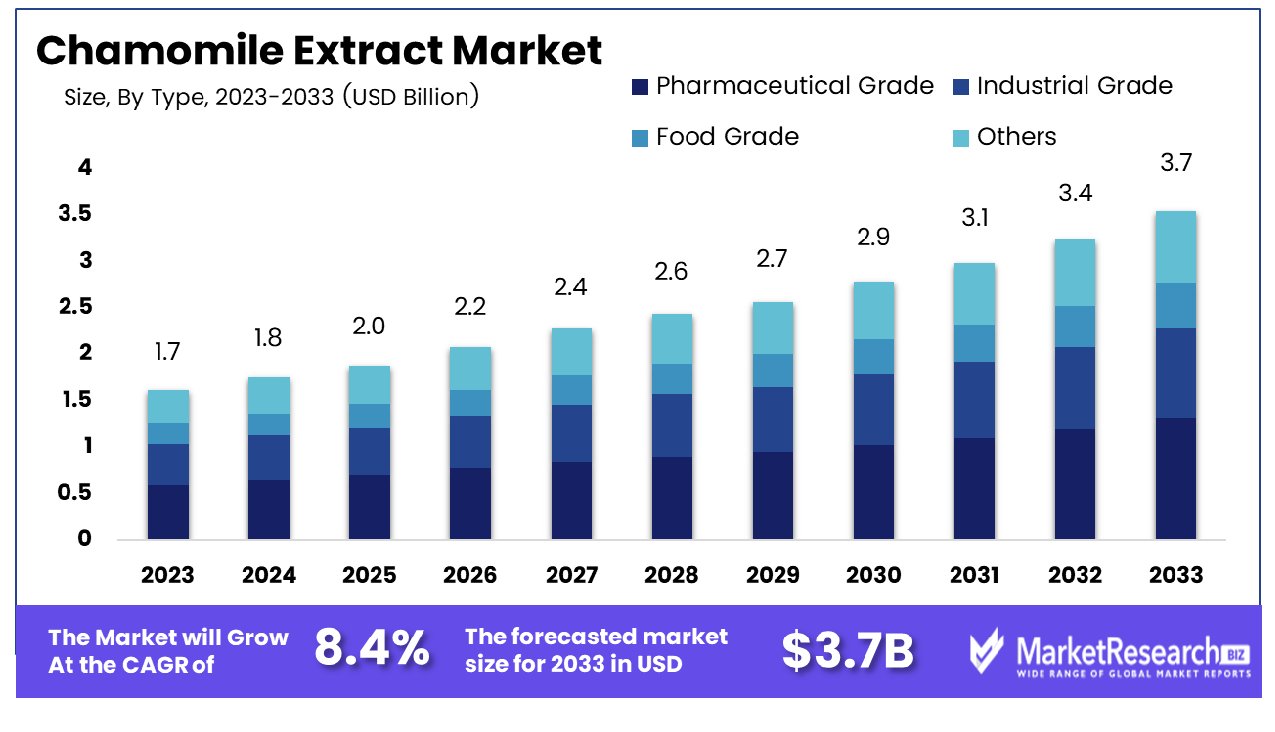

The Global Chamomile Extract Market was valued at USD 1.7 Bn in 2023. It is expected to reach USD 3.7 Bn by 2033, with a CAGR of 8.4% during the forecast period from 2024 to 2033.

The Chamomile Extract Market encompasses the global trade and consumption of extracts derived from the chamomile plant, renowned for its therapeutic properties. This market segment is characterized by a growing demand for natural remedies and wellness products, driven by increasing consumer awareness of health benefits. Chamomile extract finds extensive application across various industries, including pharmaceuticals, cosmetics, and food & beverages, owing to its anti-inflammatory, antioxidant, and soothing properties.

Market dynamics are influenced by factors such as evolving consumer preferences, regulatory frameworks, and advancements in extraction technologies. Industry players strategize to capitalize on emerging opportunities and address evolving consumer needs within this dynamic market landscape.

Market dynamics are influenced by factors such as evolving consumer preferences, regulatory frameworks, and advancements in extraction technologies. Industry players strategize to capitalize on emerging opportunities and address evolving consumer needs within this dynamic market landscape.The Chamomile Extract Market demonstrates promising growth prospects, driven by escalating consumer demand for natural and botanical ingredients across diverse industries. Chamomile's versatile properties, including anti-inflammatory, antioxidant, and soothing attributes, position it as a coveted ingredient in skincare, pharmaceuticals, and food and beverage sectors.

Supportive data underscores chamomile extract's efficacy in skincare formulations, particularly in sunblock products. Clinically certified with SPF 60, sunblocks enriched with chamomile exhibit dual benefits of UV protection and anti-aging effects, complemented by the soothing properties of Aloe Vera extracts. This convergence of functionalities enhances consumer appeal, fostering market penetration and product differentiation.

The availability of chamomile extract in varied concentrations, ranging from 1:1 to 4:1, underscores its versatility in formulation applications. This flexibility caters to diverse product requirements, enabling manufacturers to tailor formulations to specific efficacy targets and consumer preferences.

Key Takeaways

- Market Value: The Global Chamomile Extract Market was valued at USD 1.7 Bn in 2023. It is expected to reach USD 3.7 Bn by 2033, with a CAGR of 8.4% during the forecast period from 2024 to 2033.

- By Type: The pharmaceutical grade of chamomile extract is the largest segment, holding a 40% market share, attributed to its extensive use in health-related products.

- By Form: Liquid chamomile extract is preferred in various applications, making up 65% of the market due to its versatility and easy integration.

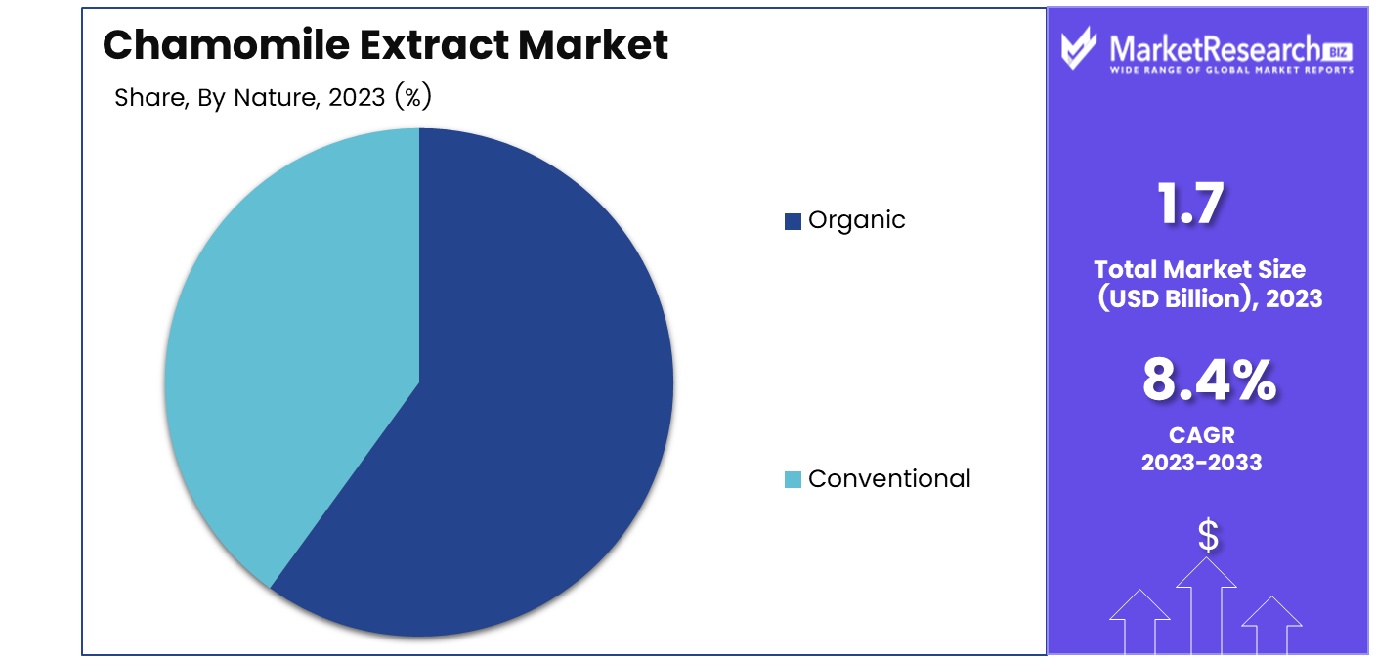

- By Nature: Organic chamomile extract is experiencing rapid growth, capturing 70% of the market, reflecting a global trend towards organic products.

- By Application: The pharmaceuticals application of chamomile extract commands a 30% market share, driven by the extract's recognized medicinal properties.

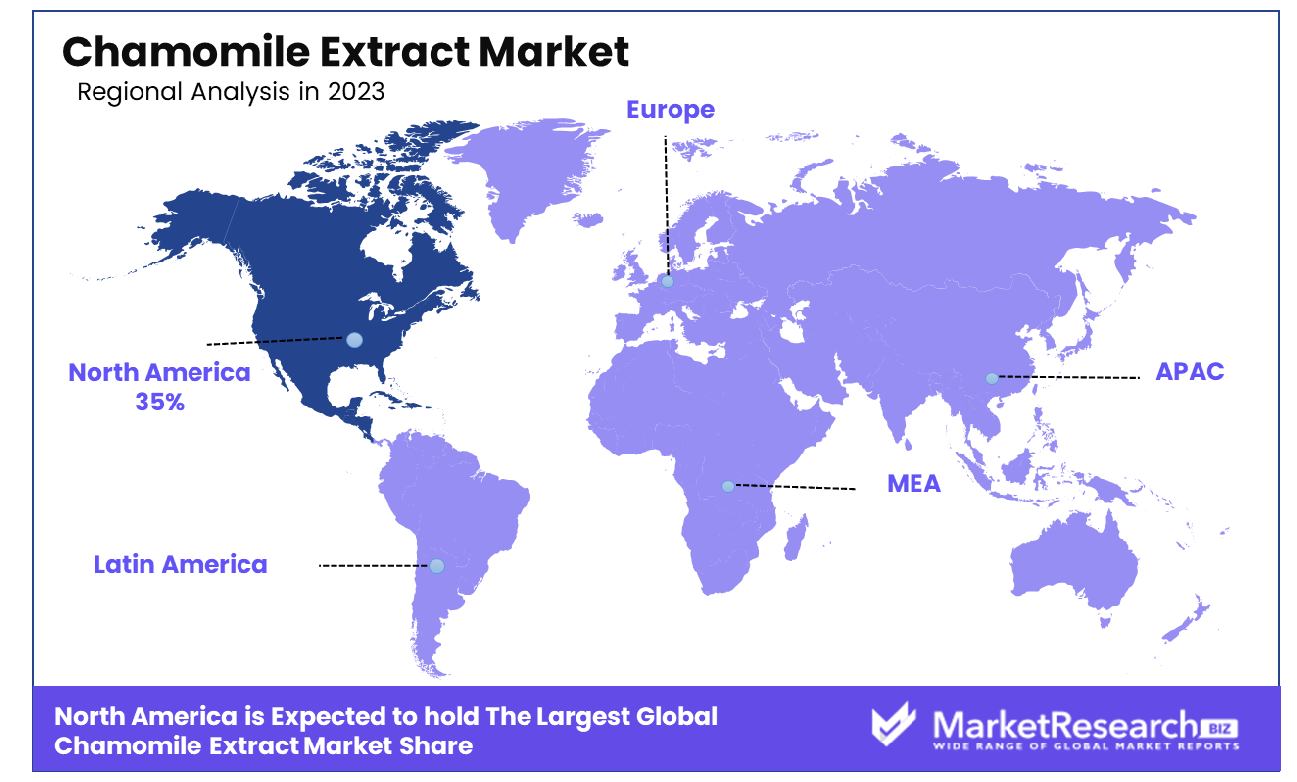

- Regional Dominance: North America Dominates with approximately 35% market share, driven by high consumer awareness and preference for natural and organic wellness products.

- Growth Opportunities: The chamomile extract market presents promising opportunities, fueled by growing consumer preference for herbal remedies and the expanding application scope across various industries.

Driving factors

Demand for Natural Ingredients

The burgeoning demand for natural ingredients has been a significant driver propelling the growth of the Chamomile Extract Market. With consumers increasingly prioritizing health-conscious choices, there's a palpable shift towards products derived from natural sources. Chamomile, renowned for its therapeutic properties and gentle effects, stands as a prime beneficiary of this trend.

Its natural composition resonates well with consumers seeking alternatives to synthetic or chemically processed products. As per market research data, the global demand for natural ingredients in various sectors, including organic cosmetics, pharmaceuticals, and food and beverages, has been on a steady rise.

Consumer Awareness of Benefits

The growing consumer awareness of the myriad benefits associated with chamomile extract has played a pivotal role in driving market expansion. In recent years, there has been a notable uptick in health-conscious consumer behavior, characterized by a heightened interest in herbal beauty products and natural wellness solutions. This heightened awareness has led to increased scrutiny of product ingredients, with consumers actively seeking out chamomile-based products for their perceived health benefits.

Research studies highlighting the therapeutic properties of chamomile, such as its anti-anxiety, anti-inflammatory, and sleep-promoting effects, have contributed to elevating its status among consumers. Moreover, the rise of wellness influencers and online health communities has facilitated the dissemination of information regarding the efficacy of chamomile extract in addressing various health concerns, further fueling consumer interest.

Synergy with Growth in E-commerce Sales

The parallel growth of e-commerce sales has provided a robust platform for the expansion of the Chamomile Extract Market. As consumers increasingly turn to online platforms for their purchasing needs, the accessibility and convenience offered by e-commerce channels have amplified the reach of chamomile-based products to a global audience.

This digital migration has facilitated the proliferation of niche products like chamomile extract, enabling direct-to-consumer brands and specialty retailers to tap into geographically dispersed markets with relative ease. The personalized marketing capabilities afforded by e-commerce platforms allow vendors to tailor their messaging to resonate with specific consumer segments interested in natural ingredients and wellness products. This targeted approach enhances brand visibility and fosters consumer engagement, thereby driving demand for chamomile extract products in the digital marketplace.

Restraining Factors

Manufacturing Shutdowns Due to Regulations

During times of conflict, governments often impose strict regulations on manufacturing activities for various reasons, including resource conservation, national security, and environmental protection. These regulations can range from limitations on energy consumption to restrictions on hazardous material usage. Compliance with these regulations may require significant investments in upgrading equipment or implementing new processes, causing disruptions in manufacturing operations.

Heightened security measures and restrictions on movement may impede the transportation of goods and personnel to manufacturing facilities. As a consequence, businesses may face forced shutdowns, delays in production schedules, and increased operational costs, further straining already tense economic conditions.

Economic Disturbances Affecting Trade

War inevitably brings about economic disturbances that ripple through global trade networks. Uncertainty and instability in conflict zones can lead to a decline in consumer confidence and investment, affecting demand for goods and services worldwide. Disrupted supply chains and heightened geopolitical tensions can result in trade barriers such as tariffs, quotas, and embargoes, hindering the flow of goods between nations.

Currency devaluation, inflation, and fluctuating commodity prices further complicate international trade dynamics. Businesses reliant on exports or imports may experience decreased revenue, reduced market access, and increased financial risks. Overall, economic disturbances stemming from war can significantly disrupt trade patterns, leading to widespread economic hardship and uncertainty on a global scale.

By Type Analysis

Pharmaceutical Grade extracts led with over 40% market share, emphasizing quality and compliance with standards.

In 2023, Pharmaceutical Grade held a dominant market position in the Chamomile Extract Market, specifically in the segment categorized by type. Accounting for more than 40% of the market share, Pharmaceutical Grade Chamomile Extract emerged as the preferred choice among consumers and industries alike. This segment's robust performance was attributed to several factors, including the increasing demand for high-quality chamomile extracts for medicinal purposes and the stringent regulatory standards governing pharmaceutical-grade products.

Industrial Grade Chamomile Extract followed Pharmaceutical Grade, albeit with a significantly lower market share. While Industrial Grade products found applications across various industrial sectors, such as cosmetics and personal care, their market penetration remained constrained due to quality concerns and limited suitability for human consumption.

Food Grade Chamomile Extract captured a noteworthy portion of the market, albeit trailing behind Pharmaceutical Grade. The segment witnessed steady growth owing to the rising consumer inclination towards natural and organic ingredients in food and beverage products. Additionally, the widespread recognition of chamomile's health benefits further fueled the demand for Food Grade extracts in culinary applications and functional foods.

The Others category encompassed a diverse range of chamomile extract products that did not fall under the aforementioned classifications. This segment accounted for a marginal share of the market, primarily comprising specialty formulations, niche applications, or products with unique compositions catering to specific consumer preferences or industrial requirements.

By Form Analysis

Liquid extracts captured more than 65% market share, favored for their ease of use and versatility.

In 2023, Liquid held a dominant market position in the Chamomile Extract Market, specifically within the segment categorized by form. With a commanding share of over 65%, Liquid Chamomile Extract emerged as the preferred form among consumers and industries. This segment's strong performance can be attributed to several factors, including ease of use, versatility in applications, and faster absorption rates compared to other forms.

Liquid Chamomile Extract found widespread adoption across various industries, including pharmaceuticals, personal care, and food and beverage. Its popularity stemmed from the convenience it offered in formulations, such as tinctures, syrups, and beverages, where precise dosing and rapid assimilation were crucial factors driving consumer preference.

Powder Chamomile Extract followed Liquid, albeit with a significantly smaller market share. Powdered forms of chamomile extract were primarily utilized in applications requiring dry formulations, such as encapsulated supplements, powdered beverage mixes, and cosmetics. While Powder Chamomile Extract catered to specific market niches, its adoption was relatively limited compared to Liquid due to factors such as formulation complexity and potential degradation of active compounds during processing.

Despite Liquid Chamomile Extract's dominance, both forms presented unique advantages and opportunities for market players. Liquid formulations appealed to consumers seeking convenient and fast-acting solutions, while Powder formulations catered to those prioritizing stability, shelf-life, and versatility in product development.

By Nature Analysis

Organic extracts held over 70% market share, fueled by the growing demand for natural and sustainable products.

In 2023, Organic held a dominant market position in the Chamomile Extract Market, particularly within the segment categorized by nature. With a commanding share of over 70%, Organic Chamomile Extract emerged as the preferred choice among consumers and industries. This segment's remarkable performance can be attributed to the growing consumer preference for natural and sustainably sourced ingredients, coupled with the increasing awareness of the benefits associated with organic products.

Organic Chamomile Extracts are derived from chamomile plants grown without the use of synthetic pesticides, herbicides, or fertilizers, ensuring purity and environmental sustainability. This resonated strongly with consumers seeking clean-label products and prioritizing health and wellness. Additionally, Organic Chamomile Extracts often undergo rigorous certification processes to guarantee compliance with organic standards, further bolstering consumer confidence in their quality and authenticity.

Conventional Chamomile Extracts, while still relevant in the market, trailed behind Organic counterparts with a smaller market share. These extracts are sourced from chamomile plants cultivated using conventional farming practices, which may involve the use of synthetic chemicals. While Conventional Chamomile Extracts may offer cost advantages and wider availability, they face increasing scrutiny from consumers and regulatory bodies concerned about potential pesticide residues and environmental impacts.

By Application Analysis

Pharmaceuticals dominated with over 30% market share, driven by the medicinal properties of chamomile extracts.

In 2023, Pharmaceuticals held a dominant market position in the Chamomile Extract Market, particularly within the segment categorized by application. With a commanding share of more than 30%, Chamomile Extracts found their primary utilization in pharmaceutical formulations, indicating their significant therapeutic potential and pharmacological relevance.

Chamomile Extracts in Pharmaceuticals garnered substantial traction due to their well-documented medicinal properties, including anti-inflammatory, anti-anxiety, and gastrointestinal benefits. Pharmaceutical companies leveraged these attributes to develop a wide range of pharmaceutical formulations, such as tablets, capsules, and topical preparations, targeting various health conditions ranging from insomnia and anxiety to digestive disorders and skin ailments.

Food and Beverages emerged as another prominent application segment for Chamomile Extracts, albeit with a lower market share compared to Pharmaceuticals. Chamomile-infused food and beverage products gained popularity among consumers seeking natural remedies and functional ingredients in their diet. These products encompassed a diverse range, including chamomile teas, herbal infusions, flavored beverages, and culinary ingredients, capitalizing on chamomile's soothing aroma and purported health benefits.

Dietary Supplements represented a significant application segment for Chamomile Extracts, catering to consumers' growing interest in preventive healthcare and wellness. Chamomile supplements offered convenient and standardized dosing options, appealing to individuals seeking natural alternatives for stress relief, sleep support, and digestive health management.

Personal Care and Cosmetics constituted another niche yet burgeoning application segment for Chamomile Extracts. The inclusion of chamomile extracts in skincare, haircare, and cosmetic formulations was driven by their anti-inflammatory, antioxidant, and soothing properties, targeting sensitive and reactive skin types and addressing concerns such as irritation, redness, and premature aging.

The Others category encompassed diverse and emerging applications for Chamomile Extracts, including veterinary products, aromatherapy formulations, and household products. While these segments held smaller market shares compared to Pharmaceuticals and other mainstream applications, they represented avenues for innovation and differentiation in the Chamomile Extract Market.

Key Market Segments

By Type

- Pharmaceutical Grade

- Industrial Grade

- Food Grade

- Others

By Form

- Liquid

- Powder

By Nature

- Organic

- Conventional

By Application

- Food And Beverages

- Pharmaceuticals

- Dietary Supplements

- Personal Care and Cosmetics

- Others

Growth Opportunity

Health Consciousness Among Consumers

In 2024, the global Chamomile Extract Market presents a promising landscape, largely propelled by the burgeoning health consciousness among consumers. With an increasing focus on holistic wellness and natural remedies, there’s a growing preference for products like chamomile extract, renowned for its various health benefits.

Consumers are actively seeking alternatives to synthetic pharmaceuticals, gravitating towards herbal supplements and extracts known for their therapeutic properties. This shift in consumer behavior provides a significant growth opportunity for the chamomile extract market, as it aligns perfectly with the product’s perceived health benefits.

Expansion in the Food & Beverage Industry

The food and beverage industry continues to expand, catering to evolving consumer preferences and dietary trends. Chamomile extract finds applications in a variety of products within this sector, including teas, infusions, baked goods, and even savory dishes.

Its subtle floral flavor and potential health benefits make it a sought-after ingredient among manufacturers aiming to cater to health-conscious consumers. As the food and beverage industry diversifies and innovates, the demand for chamomile extract is expected to surge, presenting lucrative opportunities for market players.

Rising Demand for Organic Cosmetics

The cosmetic industry is witnessing a paradigm shift towards organic and natural ingredients, driven by increasing awareness regarding the potential adverse effects of synthetic chemicals. Chamomile extract, with its anti-inflammatory and soothing properties, is gaining traction as a key ingredient in organic skincare and cosmetic products.

As consumers prioritize sustainability and ingredient transparency, the demand for organic cosmetics featuring chamomile extract is projected to rise significantly. This presents a substantial growth avenue for players in the chamomile extract market, particularly those catering to the cosmetics industry.

Latest Trends

Rise in Chamomile Oil Use in Aromatherapy

Chamomile oil's popularity in aromatherapy is experiencing a notable upsurge in 2024. Consumers are increasingly turning to natural remedies for stress relief, relaxation, and overall well-being, driving the demand for chamomile-infused products. This trend is propelled by growing awareness of the therapeutic properties of chamomile oil, including its calming and anti-inflammatory effects.

As consumers prioritize holistic approaches to health and wellness, the market for chamomile oil in aromatherapy is expected to expand further, presenting lucrative opportunities for market players.

Focus on New Product Development and Sustainability

In response to evolving consumer preferences and regulatory pressures, industry players are intensifying their focus on new product development and sustainability initiatives. Innovation in product formulations, packaging, and production processes is crucial for staying competitive in the market.

There is a growing emphasis on sustainable sourcing practices, ethical supply chains, and eco-friendly packaging solutions to minimize the environmental impact of chamomile extract production. Companies that prioritize sustainability and offer innovative, environmentally friendly products are likely to gain a competitive edge and foster consumer loyalty.

Regional Analysis

North America Dominates Chamomile Extract Market: 35% Global Share

North America dominates the chamomile extract market, accounting for approximately 35% of the global market share. The region's dominance can be attributed to the increasing consumer preference for natural and organic products, coupled with the growing awareness regarding the health benefits of chamomile extract. Furthermore, the presence of key market players and the well-established pharmaceutical and cosmetics industries in countries like the United States and Canada contribute to the region's significant market share.

Europe holds a substantial share in the global chamomile extract market, owing to the region's rich history of traditional herbal medicine and the widespread use of chamomile extract in pharmaceuticals, personal care, and food and beverage industries. Countries such as Germany, France, and the United Kingdom are major consumers of chamomile extract, driven by a growing inclination towards natural and plant-based ingredients.

The Asia Pacific region is emerging as a lucrative market for chamomile extract, driven by factors such as the rising disposable income, changing consumer lifestyles, and growing awareness regarding the health benefits of herbal extracts. Countries like China, India, and Japan are witnessing increasing demand for chamomile extract, particularly in the cosmetics and personal care sectors.

The Middle East & Africa region represents a niche market for chamomile extract, with moderate growth potential. Factors such as the growing adoption of herbal supplements and the rising demand for natural ingredients in cosmetics and personal care products drive market growth in this region. Countries like South Africa and the United Arab Emirates are witnessing increasing consumption of chamomile extract, primarily driven by a shift towards healthier lifestyles and a preference for herbal remedies.

Latin America exhibits promising growth opportunities for the chamomile extract market, fueled by factors such as the rising demand for natural ingredients in the food and beverage industry and the growing popularity of herbal remedies in traditional medicine practices. Countries like Brazil and Mexico are key consumers of chamomile extract, driven by the expanding pharmaceutical and cosmetics sectors.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global Chamomile Extract market is poised for significant growth, with key players such as Kshipra Biotech Private Limited, Bio Answer Holdings Inc., Infinator Pvt Ltd, Oregon's Wild Harvest, Hollywood Secrets, Changsha Vigorous-Tech, Carmine Country Private Limited, Gehrlicher Pharmazeutische Extrakte, Vaadi Herbals Private Limited, and BRM Chemicals driving innovation and market expansion.

Kshipra Biotech Private Limited stands out as a prominent player, leveraging its expertise in biotechnology to develop advanced extraction techniques that enhance the potency and purity of chamomile extracts. With a focus on sustainability and quality, Kshipra Biotech is well-positioned to capture a significant share of the market.

Bio Answer Holdings Inc. is another key player known for its research-driven approach and commitment to product development. By investing in R&D, Bio Answer Holdings continuously introduces new formulations and applications for chamomile extract, catering to diverse consumer needs and preferences.

Infinator Pvt Ltd, with its cutting-edge extraction technology and extensive distribution network, is expected to strengthen its presence in both established and emerging markets. The company's strategic partnerships and investments in marketing initiatives further solidify its position in the global market.

Oregon's Wild Harvest, Hollywood Secrets, and Vaadi Herbals Private Limited are recognized for their emphasis on organic farming practices and natural ingredient sourcing. As consumer demand for clean-label products continues to rise, these companies are well-positioned to capitalize on this trend and gain a competitive edge in the market.

Market Key Players

- Kshipra Biotech Private Limited

- Bio Answer Holdings Inc.

- Infinator Pvt Ltd

- Oregon's Wild Harvest.

- Hollywood Secrets

- Changsha Vigorous-Tech

- Carmine Country Private Limited

- Gehrlicher Pharmazeutische Extrakte

- Vaadi Herbals Private Limited

- BRM Chemicals

Recent Development

In March 2024, GreenTech Ventures Backed innovative chamomile extract extraction technology for sustainable agriculture.

In December 2023, Nature's Essence Inc., secured $7 million for advancing organic chamomile farming and developing extracts for natural cosmetics, aiming at sustainable beauty solutions.

Report Scope

Report Features Description Market Value (2023) USD 1.7 Bn Forecast Revenue (2033) USD 3.7 Bn CAGR (2024-2033) 8.4% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Pharmaceutical Grade, Industrial Grade, Food Grade, Others), By Form (Liquid, Powder, By Nature (Organic, Conventional), By Application (Food And Beverages, Pharmaceuticals, Dietary Supplements, Personal Care and Cosmetics, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Kshipra Biotech Private Limited, Bio Answer Holdings Inc., Infinator Pvt Ltd, Oregon's Wild Harvest., Hollywood Secrets, Changsha Vigorous-Tech, Carmine Country Private Limited, Gehrlicher Pharmazeutische Extrakte, Vaadi Herbals Private Limited, BRM Chemicals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Chamomile Extract Market Overview

- 2.1. Chamomile Extract Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Chamomile Extract Market Dynamics

- 3. Global Chamomile Extract Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Chamomile Extract Market Analysis, 2016-2021

- 3.2. Global Chamomile Extract Market Opportunity and Forecast, 2023-2032

- 3.3. Global Chamomile Extract Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 3.3.1. Global Chamomile Extract Market Analysis by By Type: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 3.3.3. Pharmaceutical Grade

- 3.3.4. Industrial Grade

- 3.3.5. Food Grade

- 3.3.6. Others

- 3.4. Global Chamomile Extract Market Analysis, Opportunity and Forecast, By By Form, 2016-2032

- 3.4.1. Global Chamomile Extract Market Analysis by By Form: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Form, 2016-2032

- 3.4.3. Liquid

- 3.4.4. Powder

- 3.5. Global Chamomile Extract Market Analysis, Opportunity and Forecast, By By Nature, 2016-2032

- 3.5.1. Global Chamomile Extract Market Analysis by By Nature: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Nature, 2016-2032

- 3.5.3. Organic

- 3.5.4. Conventional

- 3.6. Global Chamomile Extract Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 3.6.1. Global Chamomile Extract Market Analysis by By Application: Introduction

- 3.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 3.6.3. Food And Beverages

- 3.6.4. Pharmaceuticals

- 3.6.5. Dietary Supplements

- 3.6.6. Personal Care and Cosmetics

- 3.6.7. Others

- 4. North America Chamomile Extract Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Chamomile Extract Market Analysis, 2016-2021

- 4.2. North America Chamomile Extract Market Opportunity and Forecast, 2023-2032

- 4.3. North America Chamomile Extract Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 4.3.1. North America Chamomile Extract Market Analysis by By Type: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 4.3.3. Pharmaceutical Grade

- 4.3.4. Industrial Grade

- 4.3.5. Food Grade

- 4.3.6. Others

- 4.4. North America Chamomile Extract Market Analysis, Opportunity and Forecast, By By Form, 2016-2032

- 4.4.1. North America Chamomile Extract Market Analysis by By Form: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Form, 2016-2032

- 4.4.3. Liquid

- 4.4.4. Powder

- 4.5. North America Chamomile Extract Market Analysis, Opportunity and Forecast, By By Nature, 2016-2032

- 4.5.1. North America Chamomile Extract Market Analysis by By Nature: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Nature, 2016-2032

- 4.5.3. Organic

- 4.5.4. Conventional

- 4.6. North America Chamomile Extract Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 4.6.1. North America Chamomile Extract Market Analysis by By Application: Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 4.6.3. Food And Beverages

- 4.6.4. Pharmaceuticals

- 4.6.5. Dietary Supplements

- 4.6.6. Personal Care and Cosmetics

- 4.6.7. Others

- 4.7. North America Chamomile Extract Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.7.1. North America Chamomile Extract Market Analysis by Country : Introduction

- 4.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.7.2.1. The US

- 4.7.2.2. Canada

- 4.7.2.3. Mexico

- 5. Western Europe Chamomile Extract Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Chamomile Extract Market Analysis, 2016-2021

- 5.2. Western Europe Chamomile Extract Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Chamomile Extract Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 5.3.1. Western Europe Chamomile Extract Market Analysis by By Type: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 5.3.3. Pharmaceutical Grade

- 5.3.4. Industrial Grade

- 5.3.5. Food Grade

- 5.3.6. Others

- 5.4. Western Europe Chamomile Extract Market Analysis, Opportunity and Forecast, By By Form, 2016-2032

- 5.4.1. Western Europe Chamomile Extract Market Analysis by By Form: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Form, 2016-2032

- 5.4.3. Liquid

- 5.4.4. Powder

- 5.5. Western Europe Chamomile Extract Market Analysis, Opportunity and Forecast, By By Nature, 2016-2032

- 5.5.1. Western Europe Chamomile Extract Market Analysis by By Nature: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Nature, 2016-2032

- 5.5.3. Organic

- 5.5.4. Conventional

- 5.6. Western Europe Chamomile Extract Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 5.6.1. Western Europe Chamomile Extract Market Analysis by By Application: Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 5.6.3. Food And Beverages

- 5.6.4. Pharmaceuticals

- 5.6.5. Dietary Supplements

- 5.6.6. Personal Care and Cosmetics

- 5.6.7. Others

- 5.7. Western Europe Chamomile Extract Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.7.1. Western Europe Chamomile Extract Market Analysis by Country : Introduction

- 5.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.7.2.1. Germany

- 5.7.2.2. France

- 5.7.2.3. The UK

- 5.7.2.4. Spain

- 5.7.2.5. Italy

- 5.7.2.6. Portugal

- 5.7.2.7. Ireland

- 5.7.2.8. Austria

- 5.7.2.9. Switzerland

- 5.7.2.10. Benelux

- 5.7.2.11. Nordic

- 5.7.2.12. Rest of Western Europe

- 6. Eastern Europe Chamomile Extract Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Chamomile Extract Market Analysis, 2016-2021

- 6.2. Eastern Europe Chamomile Extract Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Chamomile Extract Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 6.3.1. Eastern Europe Chamomile Extract Market Analysis by By Type: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 6.3.3. Pharmaceutical Grade

- 6.3.4. Industrial Grade

- 6.3.5. Food Grade

- 6.3.6. Others

- 6.4. Eastern Europe Chamomile Extract Market Analysis, Opportunity and Forecast, By By Form, 2016-2032

- 6.4.1. Eastern Europe Chamomile Extract Market Analysis by By Form: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Form, 2016-2032

- 6.4.3. Liquid

- 6.4.4. Powder

- 6.5. Eastern Europe Chamomile Extract Market Analysis, Opportunity and Forecast, By By Nature, 2016-2032

- 6.5.1. Eastern Europe Chamomile Extract Market Analysis by By Nature: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Nature, 2016-2032

- 6.5.3. Organic

- 6.5.4. Conventional

- 6.6. Eastern Europe Chamomile Extract Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 6.6.1. Eastern Europe Chamomile Extract Market Analysis by By Application: Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 6.6.3. Food And Beverages

- 6.6.4. Pharmaceuticals

- 6.6.5. Dietary Supplements

- 6.6.6. Personal Care and Cosmetics

- 6.6.7. Others

- 6.7. Eastern Europe Chamomile Extract Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.7.1. Eastern Europe Chamomile Extract Market Analysis by Country : Introduction

- 6.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.7.2.1. Russia

- 6.7.2.2. Poland

- 6.7.2.3. The Czech Republic

- 6.7.2.4. Greece

- 6.7.2.5. Rest of Eastern Europe

- 7. APAC Chamomile Extract Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Chamomile Extract Market Analysis, 2016-2021

- 7.2. APAC Chamomile Extract Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Chamomile Extract Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 7.3.1. APAC Chamomile Extract Market Analysis by By Type: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 7.3.3. Pharmaceutical Grade

- 7.3.4. Industrial Grade

- 7.3.5. Food Grade

- 7.3.6. Others

- 7.4. APAC Chamomile Extract Market Analysis, Opportunity and Forecast, By By Form, 2016-2032

- 7.4.1. APAC Chamomile Extract Market Analysis by By Form: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Form, 2016-2032

- 7.4.3. Liquid

- 7.4.4. Powder

- 7.5. APAC Chamomile Extract Market Analysis, Opportunity and Forecast, By By Nature, 2016-2032

- 7.5.1. APAC Chamomile Extract Market Analysis by By Nature: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Nature, 2016-2032

- 7.5.3. Organic

- 7.5.4. Conventional

- 7.6. APAC Chamomile Extract Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 7.6.1. APAC Chamomile Extract Market Analysis by By Application: Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 7.6.3. Food And Beverages

- 7.6.4. Pharmaceuticals

- 7.6.5. Dietary Supplements

- 7.6.6. Personal Care and Cosmetics

- 7.6.7. Others

- 7.7. APAC Chamomile Extract Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.7.1. APAC Chamomile Extract Market Analysis by Country : Introduction

- 7.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.7.2.1. China

- 7.7.2.2. Japan

- 7.7.2.3. South Korea

- 7.7.2.4. India

- 7.7.2.5. Australia & New Zeland

- 7.7.2.6. Indonesia

- 7.7.2.7. Malaysia

- 7.7.2.8. Philippines

- 7.7.2.9. Singapore

- 7.7.2.10. Thailand

- 7.7.2.11. Vietnam

- 7.7.2.12. Rest of APAC

- 8. Latin America Chamomile Extract Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Chamomile Extract Market Analysis, 2016-2021

- 8.2. Latin America Chamomile Extract Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Chamomile Extract Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 8.3.1. Latin America Chamomile Extract Market Analysis by By Type: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 8.3.3. Pharmaceutical Grade

- 8.3.4. Industrial Grade

- 8.3.5. Food Grade

- 8.3.6. Others

- 8.4. Latin America Chamomile Extract Market Analysis, Opportunity and Forecast, By By Form, 2016-2032

- 8.4.1. Latin America Chamomile Extract Market Analysis by By Form: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Form, 2016-2032

- 8.4.3. Liquid

- 8.4.4. Powder

- 8.5. Latin America Chamomile Extract Market Analysis, Opportunity and Forecast, By By Nature, 2016-2032

- 8.5.1. Latin America Chamomile Extract Market Analysis by By Nature: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Nature, 2016-2032

- 8.5.3. Organic

- 8.5.4. Conventional

- 8.6. Latin America Chamomile Extract Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 8.6.1. Latin America Chamomile Extract Market Analysis by By Application: Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 8.6.3. Food And Beverages

- 8.6.4. Pharmaceuticals

- 8.6.5. Dietary Supplements

- 8.6.6. Personal Care and Cosmetics

- 8.6.7. Others

- 8.7. Latin America Chamomile Extract Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.7.1. Latin America Chamomile Extract Market Analysis by Country : Introduction

- 8.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.7.2.1. Brazil

- 8.7.2.2. Colombia

- 8.7.2.3. Chile

- 8.7.2.4. Argentina

- 8.7.2.5. Costa Rica

- 8.7.2.6. Rest of Latin America

- 9. Middle East & Africa Chamomile Extract Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Chamomile Extract Market Analysis, 2016-2021

- 9.2. Middle East & Africa Chamomile Extract Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Chamomile Extract Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 9.3.1. Middle East & Africa Chamomile Extract Market Analysis by By Type: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 9.3.3. Pharmaceutical Grade

- 9.3.4. Industrial Grade

- 9.3.5. Food Grade

- 9.3.6. Others

- 9.4. Middle East & Africa Chamomile Extract Market Analysis, Opportunity and Forecast, By By Form, 2016-2032

- 9.4.1. Middle East & Africa Chamomile Extract Market Analysis by By Form: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Form, 2016-2032

- 9.4.3. Liquid

- 9.4.4. Powder

- 9.5. Middle East & Africa Chamomile Extract Market Analysis, Opportunity and Forecast, By By Nature, 2016-2032

- 9.5.1. Middle East & Africa Chamomile Extract Market Analysis by By Nature: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Nature, 2016-2032

- 9.5.3. Organic

- 9.5.4. Conventional

- 9.6. Middle East & Africa Chamomile Extract Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 9.6.1. Middle East & Africa Chamomile Extract Market Analysis by By Application: Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 9.6.3. Food And Beverages

- 9.6.4. Pharmaceuticals

- 9.6.5. Dietary Supplements

- 9.6.6. Personal Care and Cosmetics

- 9.6.7. Others

- 9.7. Middle East & Africa Chamomile Extract Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.7.1. Middle East & Africa Chamomile Extract Market Analysis by Country : Introduction

- 9.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.7.2.1. Algeria

- 9.7.2.2. Egypt

- 9.7.2.3. Israel

- 9.7.2.4. Kuwait

- 9.7.2.5. Nigeria

- 9.7.2.6. Saudi Arabia

- 9.7.2.7. South Africa

- 9.7.2.8. Turkey

- 9.7.2.9. The UAE

- 9.7.2.10. Rest of MEA

- 10. Global Chamomile Extract Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Chamomile Extract Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Chamomile Extract Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Kshipra Biotech Private Limited

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Bio Answer Holdings Inc.

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Infinator Pvt Ltd

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Oregon's Wild Harvest.

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Hollywood Secrets

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Changsha Vigorous-Tech

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Carmine Country Private Limited

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Gehrlicher Pharmazeutische Extrakte

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Vaadi Herbals Private Limited

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. BRM Chemicals

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- 1. Executive Summary

-

- Kshipra Biotech Private Limited

- Bio Answer Holdings Inc.

- Infinator Pvt Ltd

- Oregon's Wild Harvest.

- Hollywood Secrets

- Changsha Vigorous-Tech

- Carmine Country Private Limited

- Gehrlicher Pharmazeutische Extrakte

- Vaadi Herbals Private Limited

- BRM Chemicals