Cannabis Cultivation Market Report By Type (Hemp, Marijuana), By Application (Medical, Recreational, Industrial), By Biomass (Hemp Seed, Flowers, Others), By Marijuana Growing Medium (Soil, Hydroponics, Aeroponics, Aquaponics), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

48673

-

July 2024

-

285

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

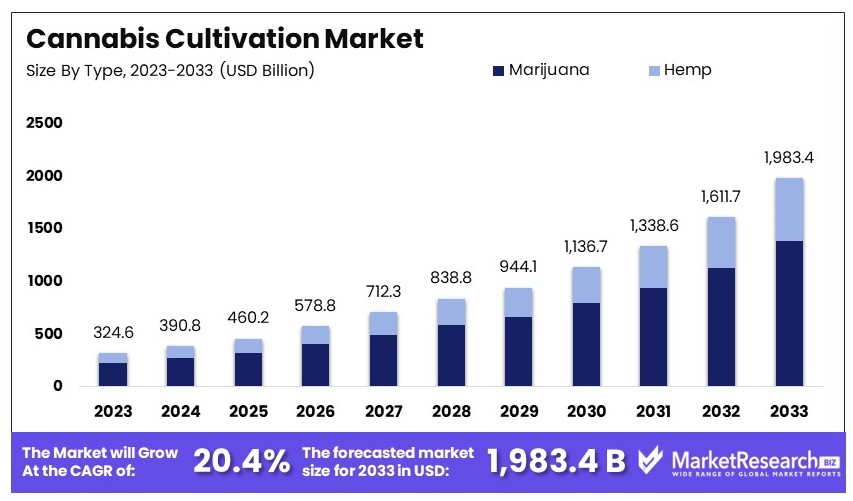

The Global Cannabis Cultivation Market size is expected to be worth around USD 1,983.4 Billion by 2033, from USD 324.6 Billion in 2023, growing at a CAGR of 20.4% during the forecast period from 2024 to 2033.

The Cannabis Cultivation Market deals with the farming and production of cannabis for medical, recreational, and therapeutic purposes. This market is expanding due to changing legal landscapes and growing acceptance of cannabis benefits.

It encompasses various cultivation methods, from traditional outdoor farming to advanced hydroponic systems, focusing on the production of diverse strains with specific cannabinoid profiles. The market's growth is propelled by increasing legalization, technological advancements in cultivation practices, and rising consumer demand for cannabis products.

The cannabis cultivation market is witnessing robust growth, influenced by evolving government reforms and regulatory frameworks. In the United States, diverse state-specific tax structures play a crucial role in regulating cannabis sales. For example, New York's potency-based tax and Michigan's 10% excise tax on recreational marijuana sales are noteworthy. These measures have not only ensured regulatory compliance but also generated significant tax revenues, with Michigan collecting $111 million in excise taxes in 2021.

Strategic investments and partnerships are pivotal in driving the market forward. Companies are continuously innovating to expand their market presence and diversify product offerings. For instance, Tilray Brands introduced Solei Bites, a THC edible, in April 2022, marking a significant addition to its product portfolio. Additionally, HEXO Corp and Tilray Brands formed a strategic alliance to bolster their positions in the Canadian market. These collaborations highlight the industry's focus on product innovation and market expansion.

The increasing legalization of cannabis for both medical and recreational use across various regions is another significant factor propelling market growth. This trend is coupled with growing public acceptance and the rising demand for cannabis products, leading to a surge in cultivation activities.

Furthermore, technological advancements in cultivation techniques and the adoption of sustainable farming practices are enhancing yield quality and efficiency. These developments are critical in meeting the rising demand while ensuring environmental sustainability.

The cannabis cultivation market is poised for substantial growth. Government regulations, strategic partnerships, product innovations, and technological advancements collectively create a robust foundation for continued expansion in this dynamic industry.

Key Takeaways

- Market Value: The Cannabis Cultivation Market was valued at USD 324.6 billion in 2023 and is expected to reach USD 1,983.4 billion by 2033, with a CAGR of 20.4%.

- Type Analysis: Marijuana dominates with 70%, driven by its medical and recreational uses.

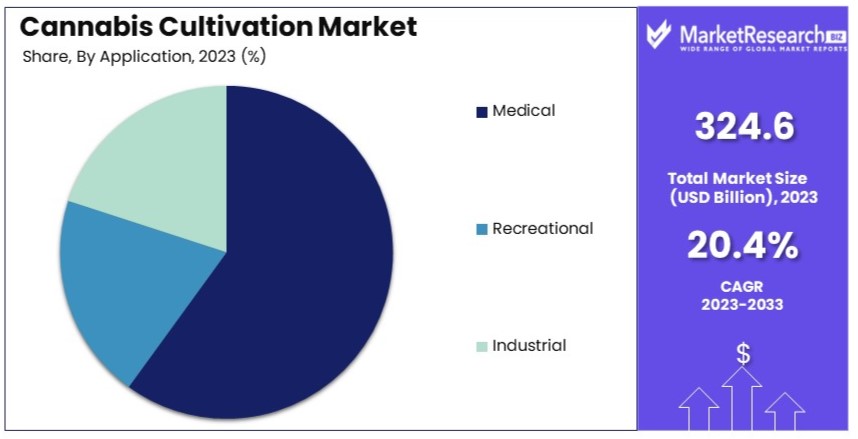

- Application Analysis: Medical applications lead with 60%, highlighting its therapeutic potential.

- Biomass Analysis: Flowers dominate with 80%, essential for both medical and recreational products.

- Growing Medium Analysis: Soil leads with 50%, preferred for its natural growth conditions.

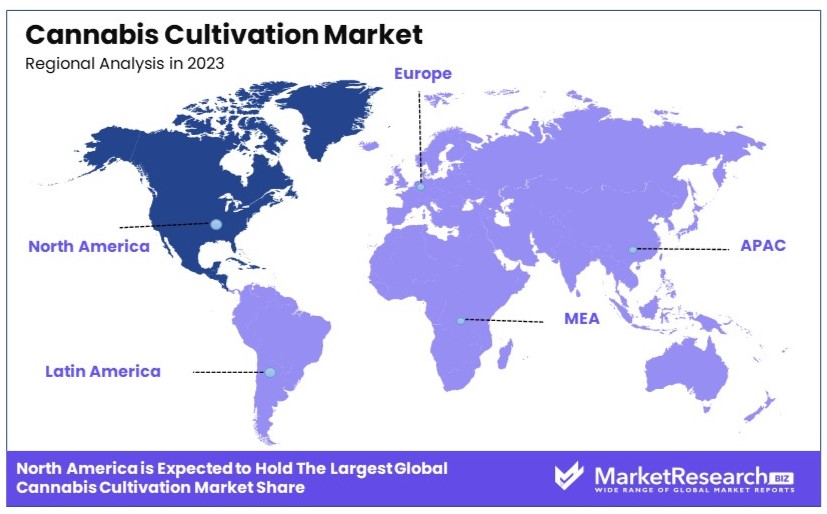

- Dominant Region: North America leads with 45%, driven by legalization and demand for cannabis products.

- Analyst Viewpoint: The market is rapidly expanding with high competition, expected to grow with increasing legalization and medical research.

- Growth Opportunities: Key players can focus on innovative cultivation techniques and expand their presence in legalized markets to boost growth.

Driving Factors

Legalization and Regulatory Changes Drive Market Growth

The legalization of cannabis in various regions has been a critical catalyst for the expansion of the cannabis cultivation market. As countries and states enact laws permitting medical and recreational cannabis use, new opportunities for legal cultivation have surged.

For instance, the 2018 legalization of recreational cannabis in Canada significantly opened the market for licensed growers, resulting in increased production to meet the rising consumer demand. This regulatory shift not only boosts market size by increasing the number of legal operations but also helps in mitigating the risks associated with illegal markets. As legalization spreads, the market is expected to see sustained growth, driven by both increased supply capacity and broader acceptance.

Rising Acceptance and Demand Catalyze Market Expansion

Growing societal acceptance and the recognized medicinal benefits of cannabis are profoundly influencing market dynamics. As public and medical opinion shifts towards recognizing cannabis as a valuable treatment for ailments such as chronic pain, epilepsy, and multiple sclerosis, demand escalates.

This heightened demand propels the cultivation sector, as suppliers scale operations to meet both patient and recreational user needs. The increasing consumer base, supported by ongoing research and endorsement by the medical community, continues to drive market growth and encourages new players to enter the market.

Technological Advancements in Cultivation Boost Efficiency and Yield

Technological innovations in cannabis cultivation are significantly enhancing production efficiency and crop quality. Advanced cultivation methods like hydroponics and controlled-environment agriculture allow growers to maximize yield while minimizing environmental impacts and operational costs. For example, indoor vertical farming employs sophisticated lighting systems and space-efficient setups to produce cannabis year-round, independent of external climate conditions.

These advancements not only improve the scalability of operations but also ensure consistent product quality, which is crucial for medical cannabis producers. The integration of these technologies is vital for sustaining market growth and meeting the increasing demands of a sophisticated consumer base.

Restraining Factors

Stringent Regulations and Legal Barriers Restrain Cannabis Cultivation Market Growth

Stringent regulations and legal barriers significantly impact the cannabis cultivation market. In many regions, cannabis cultivation is still heavily regulated, with strict licensing requirements and cultivation limits. For instance, in the Netherlands, only a few government-licensed producers are allowed to cultivate cannabis legally.

These regulations increase the complexity and cost of starting and operating a cannabis cultivation business. Strict quality control measures further add to operational costs. This regulatory burden slows market growth, as potential cultivators may be deterred by the high barriers to entry and ongoing compliance challenges.

Stigma and Social Acceptance Restrain Cannabis Cultivation Market Growth

Stigma and social acceptance issues hinder the growth of the cannabis cultivation market. Despite increasing legalization, cannabis use and cultivation still face societal stigma in many areas. This negative perception can lead to resistance from certain segments of the population and impact consumer acceptance.

For example, some employers maintain strict anti-cannabis policies even in regions where it is legal. This societal resistance can reduce demand and limit market expansion. The lingering stigma affects public opinion and can slow the broader acceptance and normalization of cannabis cultivation.

Type Analysis

Marijuana dominates with 70% due to its widespread use in both medical and recreational sectors.

In the cannabis cultivation market, the distinction between hemp and marijuana is significant due to their different uses and legal statuses. Marijuana, containing higher levels of THC, is the dominant sub-segment, largely driven by its growing acceptance and legalization in various regions for both medical and recreational purposes. Its high demand stems from its potent therapeutic properties and its popularity as a recreational substance.

Hemp, on the other hand, contains lower THC levels and is primarily used for industrial applications such as the production of CBD products, hemp clothing, and biodegradable plastics. Although it has a smaller share in the market compared to marijuana, the versatility of hemp makes it a key player in the market, with potential for significant growth as more industrial and medicinal uses are developed.

The dominance of marijuana is supported by significant investments from companies and governments in cultivating facilities, advanced breeding techniques, and product development to cater to consumer demand and comply with regulatory standards.

Application Analysis

Medical dominates with 60% due to the increasing global recognition of cannabis’s therapeutic benefits.

The application segment in the cannabis cultivation market is broadly categorized into medical, recreational, and industrial. Medical use dominates due to the increasing global recognition and legalization of cannabis for treating a range of conditions such as chronic pain, epilepsy, and multiple sclerosis. The growth in this segment is supported by a growing body of research that underscores cannabis's therapeutic benefits, coupled with rising patient advocacy and acceptance in the healthcare community.

Recreational use is also significant and growing rapidly where legalization has occurred, driven by changing societal attitudes and an increasing consumer base that appreciates cannabis for personal enjoyment and wellness.

Industrial applications, while currently the smallest segment, hold great potential due to hemp’s environmental benefits and its uses in producing a variety of products from biofuels to textiles. This segment is expected to expand as technologies improve and regulatory landscapes evolve to support more widespread hemp cultivation.

Biomass Analysis

Flowers dominate with 80% due to their high cannabinoid content, making them ideal for both recreational and medical use.

In the biomass segment of the cannabis cultivation market, flowers, hemp seeds, and others are the primary categories. Flowers hold the largest market share because they contain the highest concentration of cannabinoids, which are key to the therapeutic and psychoactive effects of cannabis. This makes them highly sought after for processing into consumables, smoking products, and medicinal formulations.

Hemp seeds are also an important sub-segment, known for their nutritional benefits and use in creating hemp oil, which is rich in proteins and fatty acids. The market for hemp seeds is expanding as awareness of their health benefits grows.

The "others" category includes stems and leaves, which are primarily used for industrial purposes like making hemp fiber or for cannabis extract of minor cannabinoids. This sub-segment is poised for growth as more comprehensive utilization techniques are developed.

Marijuana Growing Medium Analysis

Soil dominates with 50% due to its ease of use and effectiveness in supporting plant growth.

The choice of growing medium in the marijuana cultivation market is critical, with soil, hydroponics, aeroponics, and aquaponics as the main types. Soil is the most traditional and widely used medium due to its simplicity, cost-effectiveness, and ability to support healthy plant growth with adequate nutrients and a natural buffer for the roots.

Hydroponics is growing rapidly as a segment due to its ability to produce higher yields and faster growth cycles by growing plants in a water-based, nutrient-rich solution. This method is particularly favored in areas with limited land or where soil quality is poor.

Aeroponics and aquaponics are less common but innovative, using mist or water environments, respectively, to grow marijuana. These technologies are highly efficient in terms of water and nutrient usage and are gaining popularity among cultivators seeking sustainable and technologically advanced cultivation methods.

The adoption of advanced cultivation mediums like hydroponics, aeroponics, and aquaponics is indicative of the market's move towards more sustainable and efficient production methods, catering to the needs of a sophisticated consumer and regulatory environment.

Key Market Segments

Type

- Hemp

- Marijuana

Application

- Medical

- Recreational

- Industrial

Biomass

- Hemp Seed

- Flowers

- Others

Marijuana Growing Medium

- Soil

- Hydroponics

- Aeroponics

- Aquaponics

Growth Opportunities

Expansion into New Markets Offers Growth Opportunity

As more countries and states legalize cannabis for medical and recreational use, cultivators have significant growth opportunities to enter new markets. This expansion involves setting up cultivation facilities, obtaining necessary licenses, and complying with local regulations.

For instance, the recent legalization of recreational cannabis in Mexico offers substantial growth potential for cultivators. By capitalizing on these new markets, cannabis cultivators can increase their production capacity, access a broader customer base, and enhance their market presence.

Research and Development Offers Growth Opportunity

Investing in research and development (R&D) presents growth opportunities in the cannabis cultivation industry. R&D efforts focus on developing new strains, improving cultivation techniques, and exploring medical applications.

Innovations such as high-yield, disease-resistant strains can significantly boost cultivation efficiency and profitability. By prioritizing R&D, cultivators can achieve product differentiation and gain competitive advantages. These advancements lead to higher quality products, attracting more consumers and driving market growth.

Trending Factors

Sustainability and Eco-Friendly Practices Are Trending Factors

There is a growing trend towards sustainable and eco-friendly practices in cannabis cultivation. This includes using renewable energy sources, conserving water, and adopting organic cultivation methods. Cultivators implementing these practices appeal to environmentally conscious consumers and stand out in the market.

For example, some cultivators use solar energy to power their facilities and recycle water to reduce waste. By focusing on sustainability, cultivators can reduce their environmental impact and attract a loyal customer base, driving market expansion.

Craft Cannabis and Artisanal Cultivation Are Trending Factors

The trend towards craft cannabis and artisanal cultivation is gaining momentum, similar to the craft beer movement. Consumers are seeking unique, small-batch strains with distinct flavors and effects. This trend has created a niche market for boutique cultivators who prioritize quality over quantity.

Artisanal cultivators experiment with unique growing techniques and terroir to produce distinctive strains. By focusing on craft cannabis, these cultivators can cater to discerning consumers looking for exclusive products, contributing to market growth.

Regional Analysis

North America Dominates with 45% Market Share in the Cannabis Cultivation Market

North America’s strong 45% market share in the cannabis cultivation market is primarily influenced by widespread legalization and commercialization, especially in the United States and Canada. These countries have advanced regulatory frameworks that support both medical and recreational cannabis use. The region also benefits from significant investment in cannabis research and cultivation technologies, leading to high-yield and quality production.

The market dynamics in North America are characterized by an increasing acceptance of cannabis for both medical and recreational purposes. The presence of a large number of licensed dispensaries and sophisticated supply chains efficiently meets the growing consumer demand. Additionally, ongoing innovations in cultivation practices and sustainability measures further strengthen the region’s market position.

The future of North America in the cannabis cultivation market looks increasingly robust. With more U.S. states and potentially other countries in the region moving toward legalization, there is expected growth in both consumer base and production capacity. Technological advancements in cultivation and processing are also likely to enhance productivity and product quality, reinforcing North America’s dominance.

Regional Market Shares and Dynamics:

Europe: Europe holds approximately 20% of the market. The region’s market growth is supported by changing legislation in countries like Germany and the UK, where medical cannabis is increasingly being legalized. Europe's strong pharmaceutical sector also plays a key role in driving the demand for medical cannabis.

Asia Pacific: Asia Pacific accounts for about 15% of the market. Although regulatory challenges persist, countries like Thailand and Australia are gradually opening up to the medical cannabis market, which could potentially boost the region's market share.

Middle East & Africa: This region represents around 10% of the market. Interest in cannabis cultivation is emerging, with countries like Israel leading in medical cannabis research and technological innovations.

Latin America: Latin America also holds about 10% of the global market. Countries like Uruguay and Colombia have established legal frameworks that favor cannabis cultivation, positioning them as leading exporters in the region.

North America’s leadership in the global cannabis cultivation market is solidified by its progressive legalization landscape, significant investment in technology, and strong consumer demand, positioning it for ongoing growth and influence in the industry.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Cannabis Cultivation Market is led by several prominent companies. Canopy Growth Corporation and Aurora Cannabis Inc. are market leaders with extensive cultivation operations and strong global presence. They focus on innovation and product diversification.

Aphria Inc. and Tilray, Inc. are notable for their large-scale production and strategic acquisitions. Their strong R&D capabilities enhance their market positions.

Cronos Group Inc. and GW Pharmaceuticals plc excel in medical cannabis and cannabinoid-based medicines. They leverage strong research partnerships and regulatory compliance.

Organigram Holdings Inc. and Green Thumb Industries Inc. are recognized for their high-quality products and efficient cultivation methods. Their strategies include expanding product lines and enhancing market reach.

Curaleaf Holdings, Inc. and Trulieve Cannabis Corp. stand out for their extensive retail networks and strong brand recognition. Their focus on customer experience and product availability boosts their influence.

Harvest Health & Recreation Inc. and Cresco Labs Inc. are significant players due to their vertical integration and multi-state operations. They prioritize innovation and market expansion.

Hexo Corp. and MedMen Enterprises Inc. are known for their premium products and strong marketing strategies. Their focus on branding and customer loyalty enhances their market positions.

The Scotts Miracle-Gro Company is notable for its agricultural expertise and entry into the cannabis market through subsidiary investments. Its strategic positioning in cultivation technology enhances its influence.

Overall, the market features a mix of large, diversified corporations and specialized firms, each contributing to growth through innovation, strategic acquisitions, and market expansion.

Market Key Players

- Canopy Growth Corporation

- Aurora Cannabis Inc.

- Aphria Inc.

- Tilray, Inc.

- Cronos Group Inc.

- GW Pharmaceuticals plc

- Organigram Holdings Inc.

- Green Thumb Industries Inc.

- Curaleaf Holdings, Inc.

- Trulieve Cannabis Corp.

- Harvest Health & Recreation Inc.

- Cresco Labs Inc.

- Hexo Corp.

- MedMen Enterprises Inc.

- The Scotts Miracle-Gro Company

Recent Developments

- June 2024 / Innovative Industrial Properties (IIP): Innovative Industrial Properties (IIP) announced the acquisition of a 16-acre property in Ocala, Florida, for $13 million. The site will be developed into a 98,000-square-foot cannabis cultivation facility in partnership with AYR Wellness. This project, with a total cost of $43 million, aims to expand AYR's production capacity in Florida, which already includes 64 dispensary locations.

- February 2024 / New York Cannabis Regulations: New York regulators approved new rules allowing adults to cultivate cannabis at home for personal use. This regulatory change is part of the state's broader effort to legalize and regulate cannabis, following the legalization of recreational cannabis in 2021. The new rules are expected to boost home cultivation practices across the state.

- July 2023 / Ghana's Parliament: Ghana's Parliament passed the Narcotics Control Commission Amendment Bill, 2023, granting the Ministry of Interior the authority to issue licenses for cannabis cultivation. This legislative change is expected to facilitate the growth of the cannabis industry in Ghana, enabling the exploration of cannabis for industrial and medicinal uses.

Report Scope

Report Features Description Market Value (2023) USD 324.6 Billion Forecast Revenue (2033) USD 1,983.4 Billion CAGR (2024-2033) 20.4% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Hemp, Marijuana), By Application (Medical, Recreational, Industrial), By Biomass (Hemp Seed, Flowers, Others), By Marijuana Growing Medium (Soil, Hydroponics, Aeroponics, Aquaponics) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Canopy Growth Corporation, Aurora Cannabis Inc., Aphria Inc., Tilray, Inc., Cronos Group Inc., GW Pharmaceuticals plc, Organigram Holdings Inc., Green Thumb Industries Inc., Curaleaf Holdings, Inc., Trulieve Cannabis Corp., Harvest Health & Recreation Inc., Cresco Labs Inc., Hexo Corp., MedMen Enterprises Inc., The Scotts Miracle-Gro Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Canopy Growth Corporation

- Aurora Cannabis Inc.

- Aphria Inc.

- Tilray, Inc.

- Cronos Group Inc.

- GW Pharmaceuticals plc

- Organigram Holdings Inc.

- Green Thumb Industries Inc.

- Curaleaf Holdings, Inc.

- Trulieve Cannabis Corp.

- Harvest Health & Recreation Inc.

- Cresco Labs Inc.

- Hexo Corp.

- MedMen Enterprises Inc.

- The Scotts Miracle-Gro Company