Bioanalytical Testing Services Market By Test Type (ADME, Pharmacokinetics (PK), Pharmacodynamics (PD), Bioavailability, Bioequivalence, Others), By Application (Oncology, Neurology, Infectious Diseases, Cardiology, Gastroenterology, Others), By End-User (Pharma and Biotechnology Companies, Contract Research Organizations, Research Institutes), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

47425

-

Feb 2025

-

136

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

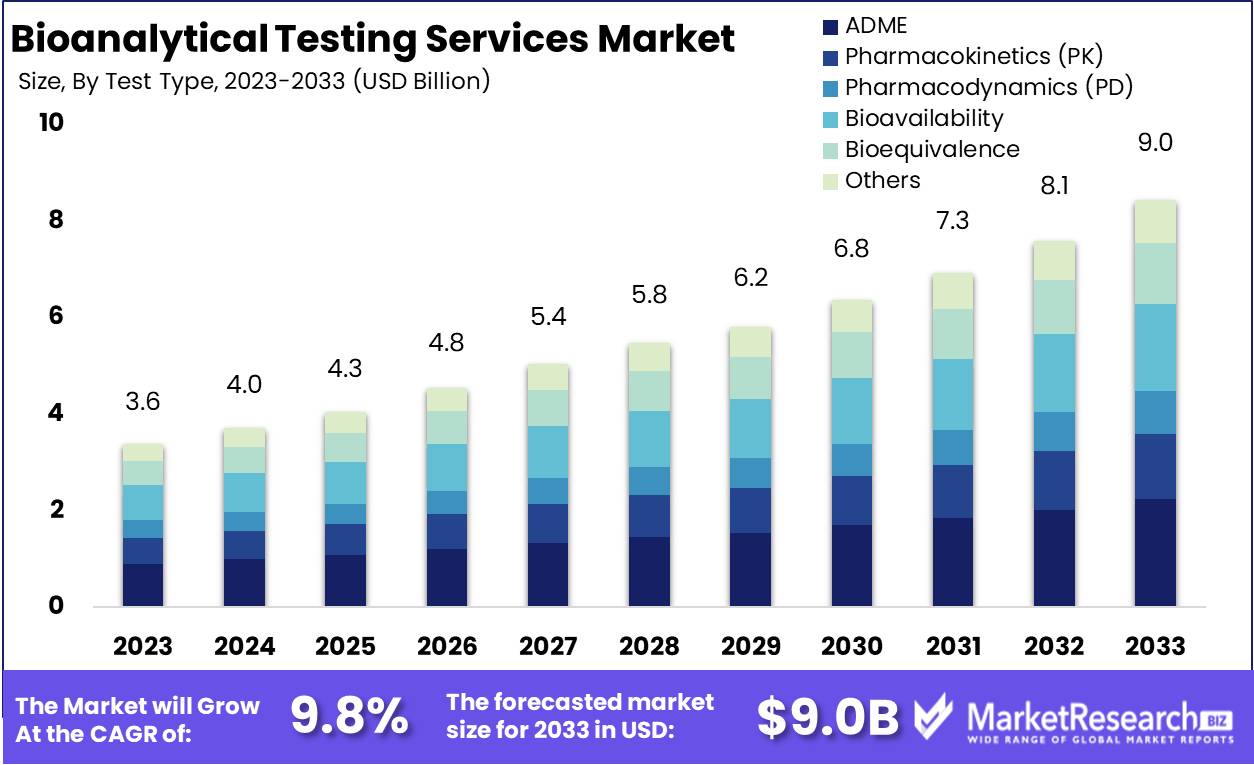

The Global Bioanalytical Testing Services Market was valued at USD 3.6 Bn in 2023. It is expected to reach USD 9.0 Bn by 2033, with a CAGR of 9.8% during the forecast period from 2024 to 2033.

The Bioanalytical Testing Services Market encompasses a range of essential services tailored to assess biological samples for pharmaceutical, biotechnological, and clinical research purposes. It involves the meticulous analysis of biological compounds, such as proteins, DNA, and metabolites, to evaluate drug efficacy, safety, and pharmacokinetics.

These services are vital in ensuring regulatory compliance, facilitating drug development processes, and enhancing overall product quality. With advancements in technology and increasing demand for personalized medicine, the Bioanalytical Testing Services Market is witnessing substantial growth, offering stakeholders invaluable insights into the intricate mechanisms of biological systems and pharmaceutical compounds.

The Bioanalytical Testing Services Market continues to exhibit robust growth, underpinned by evolving regulatory frameworks and technological advancements. The recent release of M10 guidelines by the International Council for Harmonization of Technical Requirements for Pharmaceuticals for Human Use (ICH) has provided clarity and standardization in bioanalytical method validation, driving efficiency and reliability across the industry. This regulatory impetus is complemented by the emergence of WuXi AppTec's open-access platform, fostering collaboration among over 5,800 partners across 30 countries. Such platforms not only streamline processes but also catalyze innovation, thereby enhancing healthcare delivery on a global scale.

These developments are reshaping the landscape of bioanalytical testing services, compelling market players to adapt and innovate to stay competitive. Pharmaceutical companies, biotech firms, and clinical research organizations are increasingly relying on bioanalytical testing services to expedite drug development processes, ensure regulatory compliance, and optimize resource utilization.

As market dynamics evolve, stakeholders need to navigate through complexities and seize opportunities strategically. Collaboration, innovation, and adherence to regulatory standards will be paramount in driving growth and sustaining competitiveness in the Bioanalytical Testing Services Market.

Key Takeaways

- Market Value: The Global Bioanalytical Testing Services Market was valued at USD 3.6 Bn in 2023. It is expected to reach USD 9.0 Bn by 2033, with a CAGR of 9.8% during the forecast period from 2024 to 2033.

- By Test Type: In the bioanalytical testing services market, ADME testing holds a significant 25% share, reflecting its pivotal role in understanding drug absorption, distribution, metabolism, and excretion.

- By Application: Among the various applications of bioanalytical testing services, oncology emerges as a prominent sector, capturing a substantial 30% share, indicative of the extensive testing required in cancer drug development and treatment.

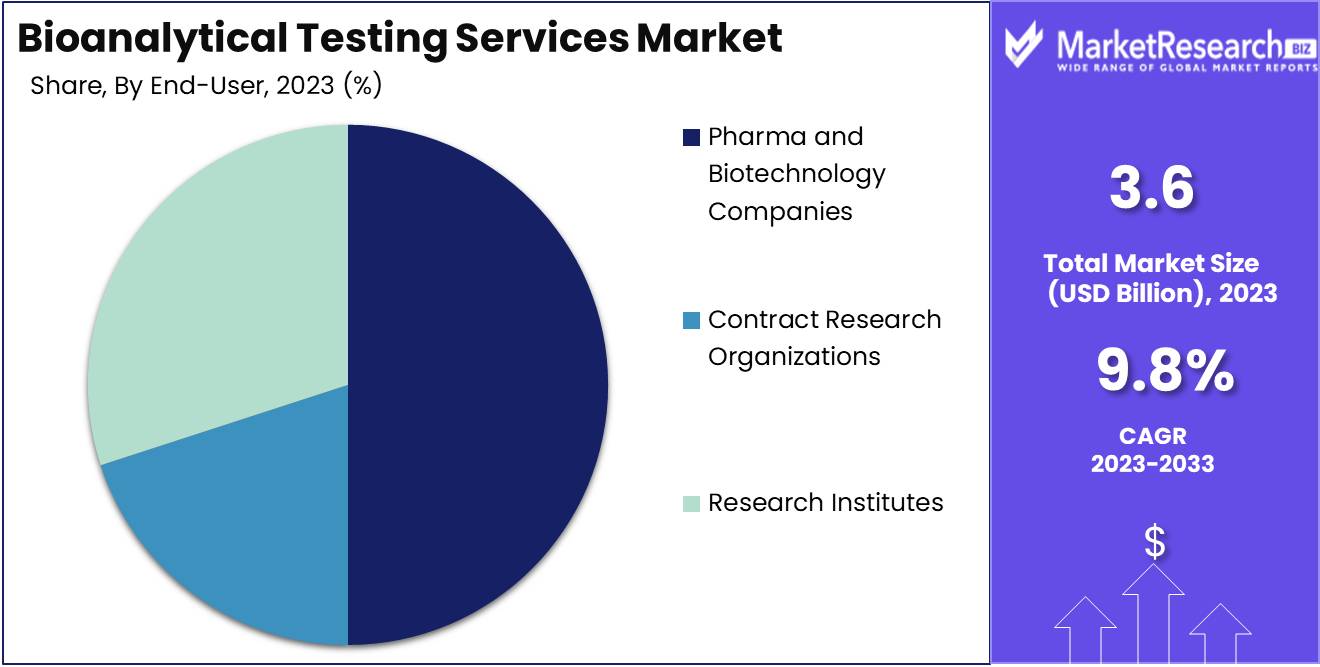

- By End-User: Pharma and biotechnology companies emerge as the leading end-users of bioanalytical testing services, commanding a commanding 50% share, emphasizing their reliance on these services for drug development and regulatory compliance.

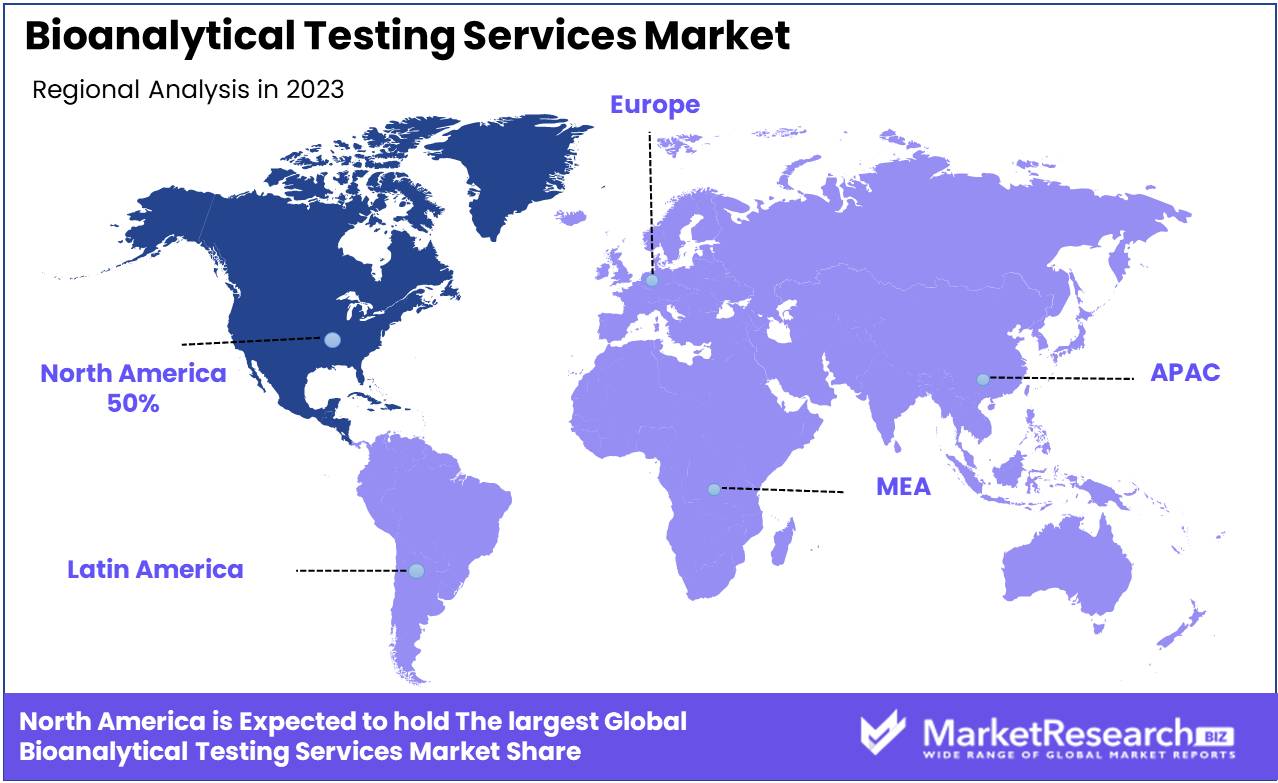

- Regional Dominance: North America dominates the bioanalytical testing services market with 50% share, driven by the presence of major pharmaceutical companies and robust research infrastructure.

- Growth Opportunity: Increasing demand for personalized medicine and biologics offers growth prospects, driving the need for advanced bioanalytical testing services.

Driving factors

Rising Demand for Biologics and Biosimilars

The increasing demand for biologics and biosimilars stands as a pivotal driving force behind the growth of the Bioanalytical Testing Services Market. Biologics, which include human vaccine, blood components, gene therapies, tissues, and recombinant therapeutic proteins, are revolutionizing the pharmaceutical landscape due to their efficacy in treating various diseases like cancer, autoimmune disorders, and genetic diseases. Similarly, biosimilars, which are highly similar versions of already approved biological products, are gaining traction as cost-effective alternatives to their branded counterparts.

As the demand for these complex biopharmaceuticals rises, so does the need for rigorous testing to ensure their safety, efficacy, and quality. Bioanalytical testing services play a crucial role in this process by conducting thorough analyses of biologics and biosimilars, including characterization, method development, validation, stability testing, and quality control. By outsourcing these testing services to specialized providers, pharmaceutical companies can access expertise, technologies, and infrastructure necessary for comprehensive assessment while focusing on their core competencies of drug development and commercialization.

Outsourcing of Testing Services

The outsourcing of bioanalytical testing services emerges as a strategic approach adopted by pharmaceutical, biotechnology, and contract research organizations (CROs) to streamline operations, reduce costs, and access specialized expertise. Outsourcing allows companies to leverage the capabilities of third-party service providers, who often possess state-of-the-art facilities, cutting-edge technologies, and experienced personnel dedicated to bioanalytical testing.

By outsourcing testing services, companies can benefit from increased flexibility, scalability, and efficiency in their drug development processes. External service providers offer a range of specialized assays, analytical methods, and testing platforms tailored to the unique requirements of biologics and biosimilars. Moreover, outsourcing enables companies to accelerate timelines, mitigate risks, and navigate regulatory complexities associated with biopharmaceutical development.

Restraining Factors

Pricing Pressure

Pricing pressure within the pharmaceutical industry exerts a significant influence on the dynamics of the Bioanalytical Testing Services Market. Pharmaceutical companies face mounting pressure to contain costs throughout the drug development and commercialization process, driven by factors such as patent expirations, generic competition, and healthcare reforms aimed at reducing healthcare expenditure.

In response to pricing pressures, pharmaceutical companies seek cost-saving measures without compromising on the quality and safety of their products. Outsourcing bioanalytical testing services emerges as a strategic option to optimize expenses associated with in-house testing facilities, equipment, personnel, and regulatory compliance. Third-party service providers offer competitive pricing models, including fee-for-service arrangements, volume-based discounts, and bundled packages, enabling pharmaceutical companies to achieve cost efficiencies while accessing specialized expertise and resources.

Supply Chain Disruptions

Supply chain disruptions present another critical factor shaping the Bioanalytical Testing Services Market, particularly in the context of global pharmaceutical manufacturing and distribution networks. Disruptions can arise from various sources, including natural disasters, geopolitical tensions, regulatory changes, and public health emergencies such as the COVID-19 pandemic.

These disruptions can adversely affect the availability of raw materials, reagents, consumables, and equipment essential for bioanalytical testing operations. Delays or interruptions in the supply chain can impact testing timelines, result in inventory shortages, and hinder the delivery of testing services to pharmaceutical clients. Furthermore, logistical challenges, transportation restrictions, and border closures may impede the movement of samples, specimens, and data between testing facilities and clients, exacerbating operational complexities and delays.

By Test Type Analysis

Within test types, ADME testing holds a significant portion at 25%.

In 2023, ADME held a dominant market position in the By Test Type segment of the Bioanalytical Testing Services Market, capturing more than a 25% share. ADME, standing for Absorption, Distribution, Metabolism, and Excretion, encompasses a crucial aspect of drug development and safety assessment, making it a cornerstone in the bioanalytical testing landscape.

The Pharmacokinetics (PK) segment constituted another significant portion of the market. Pharmacokinetic studies focus on how the body absorbs, distributes, metabolizes, and excretes drugs, providing essential insights into drug behavior within biological systems. In the Pharmacodynamics (PD) segment, ADME's dominance extended, indicating its comprehensive capabilities in assessing drug effects on biological systems.

Bioavailability testing, another key segment within the Bioanalytical Testing Services Market, evaluates the rate and extent to which a drug reaches systemic circulation, influencing its efficacy and bioequivalence. Bioequivalence testing, which compares the bioavailability of a generic drug to that of a reference drug, constituted a significant portion of the market as well.

The "Others" segment encompassed various specialized tests, including stability testing, biomarker analysis, and formulation analysis, among others. While specific market share details were not provided, the "Others" segment represented a diverse array of testing services catering to specific research and development needs across the pharmaceutical and biotechnology industries.

By Application Analysis

Oncology applications lead with a substantial 30% share.

In 2023, Oncology held a dominant market position in the Bioanalytical Testing Services Market's Oncology segment, capturing more than a 30% share. This significant share underscores the critical role of bioanalytical testing in oncology, where precise and comprehensive analysis is essential for developing and evaluating cancer treatments.

In the Neurology segment, bioanalytical testing services played a pivotal role, contributing to advancements in understanding neurological disorders. While specific market share figures were not provided, Neurology remained a substantial segment within the Bioanalytical Testing Services Market. In the Infectious Diseases segment, bioanalytical testing services were indispensable for diagnosing and monitoring infectious agents, including viruses, bacteria, and parasites.

In the Cardiology segment, bioanalytical testing services facilitated the assessment of cardiovascular health, aiding in the diagnosis, monitoring, and management of heart-related conditions. In Gastroenterology, bioanalytical testing services played a crucial role in diagnosing and managing gastrointestinal disorders, contributing to improved patient outcomes.

Finally, in the "Others" segment encompassing various specialized applications such as immunology, endocrinology, and respiratory diseases, bioanalytical testing services catered to diverse healthcare needs beyond the aforementioned categories.

By End-User Analysis

Pharma and biotechnology companies emerge as the dominant end-users, capturing 50% of the market share.

In 2023, Pharma and Biotechnology Companies held a dominant market position in the End-User segment of the Bioanalytical Testing Services Market, capturing more than a 50% share. This substantial market share underscores the reliance of pharmaceutical and biotechnology firms on bioanalytical testing services to support drug discovery, development, and regulatory compliance processes.

Contract Research Organizations (CROs) emerged as another significant player in the Bioanalytical Testing Services Market, catering to the outsourcing needs of pharmaceutical companies and biotech firms. While specific market share figures were not provided, CROs constituted a notable segment within the End-User category, offering specialized expertise and infrastructure for bioanalytical testing across various stages of drug development.

Research Institutes also played a crucial role in driving demand for bioanalytical testing services, particularly in academia and government-funded research initiatives. Although exact market share data for Research Institutes were not available, they represented a substantial segment within the End-User category, contributing to advancements in biomedical research and providing essential support for preclinical and clinical studies.

Key Market Segments

By Test Type

- ADME

- Pharmacokinetics (PK)

- Pharmacodynamics (PD)

- Bioavailability

- Bioequivalence

- Others

By Application

- Oncology

- Neurology

- Infectious Diseases

- Cardiology

- Gastroenterology

- Others

By End-User

- Pharma and Biotechnology Companies

- Contract Research Organizations

- Research Institutes

Growth Opportunity

Complex Therapeutic Modalities

The year 2024 holds promising opportunities for the global Bioanalytical Testing Services Market, driven by the increasing adoption of complex therapeutic modalities. Biologics, gene therapies, cell-based therapies, and other advanced treatment modalities are reshaping the landscape of modern medicine, offering innovative solutions for previously untreatable diseases. As these complex therapies gain traction in clinical practice, the demand for robust bioanalytical testing services escalates correspondingly.

Bioanalytical testing plays a crucial role in characterizing, quantifying, and ensuring the safety, efficacy, and quality of these intricate therapeutic modalities. Service providers equipped with specialized expertise and cutting-edge technologies are poised to capitalize on this growing demand, offering tailored testing solutions to pharmaceutical, biotechnology, and academic institutions worldwide.

Growing Research and Clinical Trials

The global Bioanalytical Testing Services Market is poised to benefit from the escalating volume of research and clinical trials across therapeutic areas. As pharmaceutical companies intensify their R&D efforts to address unmet medical needs and capitalize on emerging opportunities, the demand for bioanalytical testing services surges. Clinical trials involving biologics, biosimilars, novel drug delivery systems (ndds) in cancer therapy, and personalized medicine approaches require comprehensive analytical support to navigate regulatory requirements, assess drug safety and efficacy, and generate reliable data for informed decision-making.

Bioanalytical testing service providers offer a diverse range of services, including pharmacokinetic studies, biomarker analysis, immunogenicity testing, and bioequivalence assessments, tailored to the specific needs of research and clinical trial sponsors. By partnering with experienced testing providers, pharmaceutical companies can accelerate the pace of drug development, enhance trial efficiency, and maximize the likelihood of regulatory approval, thereby unlocking new avenues for market growth and innovation.

Latest Trends

Biopharmaceutical Focus

In 2024, the global Bioanalytical Testing Services Market continues to experience significant growth, propelled by the sustained focus on biopharmaceuticals. Biologics, including monoclonal antibodies, vaccines, and cell therapies, represent a substantial proportion of new drug approvals and pipelines. With their complex structures and mechanisms of action, biopharmaceuticals necessitate thorough characterization, quality assessment, and safety profiling, all of which are facilitated by bioanalytical testing services.

As the biopharmaceutical sector expands, fueled by advancements in biotechnology and the increasing prevalence of chronic diseases, the demand for specialized testing solutions escalates. Bioanalytical testing service providers equipped with expertise in biologics analysis, state-of-the-art facilities, and regulatory compliance capabilities are poised to capitalize on this trend, catering to the evolving needs of pharmaceutical and biotechnology companies worldwide.

Advanced Analytical Techniques

The year 2024 witnesses a surge in the adoption of advanced analytical techniques within the Bioanalytical Testing Services Market. Traditional analytical methods are being complemented and, in some cases, supplanted by cutting-edge technologies such as mass spectrometry, chromatography, and next-generation sequencing. These advanced techniques offer higher sensitivity, specificity, and throughput, enabling more comprehensive and precise analyses of pharmaceutical compounds, biomarkers, and complex biological matrices.

Advancements in automation, robotics, and informatics streamline workflow efficiencies, reduce turnaround times, and enhance data accuracy and reproducibility. By embracing advanced analytical techniques, bioanalytical testing service providers can differentiate their offerings, stay ahead of evolving regulatory requirements, and meet the growing demand for innovative testing solutions across the biopharmaceutical value chain.

Regional Analysis

North America dominates the global bioanalytical testing services market with a commanding share of approximately 50%

North America asserts its dominance in the global bioanalytical testing services market, commanding a substantial share of approximately 50%. This leadership position is underpinned by advanced healthcare infrastructure, significant investments in research and development, and a robust regulatory framework. North America's bioanalytical testing services market benefits from the presence of key pharmaceutical and biotechnology companies, driving demand for services such as pharmacokinetic studies, biomarker analysis, and toxicology testing.

Europe emerges as another key player in the global bioanalytical testing services market, characterized by a well-established pharmaceutical industry, extensive research activities, and a conducive regulatory environment. The region boasts a strong network of Contract Research Organizations (CROs) offering bioanalytical testing services, catering to the growing demand for drug development and clinical trials.

Asia Pacific presents a rapidly growing market landscape for bioanalytical testing services, driven by factors such as increasing pharmaceutical outsourcing, rising healthcare expenditure, and expanding clinical research activities. Market reports highlight Asia Pacific's emergence as a strategic destination for clinical trials and drug development, with CROs expanding their presence in the region to capitalize on the burgeoning opportunities.

The Middle East & Africa and Latin America regions exhibit promising growth prospects in the bioanalytical testing services market, albeit at a slower pace compared to other regions. The Middle East & Africa region benefits from increasing investments in healthcare infrastructure and rising awareness regarding the importance of bioanalytical testing in drug development and clinical research.

Latin America showcases a growing pharmaceutical industry and rising outsourcing trends, driving demand for bioanalytical testing services. However, market growth in these regions is constrained by challenges such as regulatory complexities and limited access to advanced technologies.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global Bioanalytical Testing Services market is poised for substantial growth, driven by the increasing complexities in drug development and stringent regulatory requirements. Among the key players shaping this landscape, Covance Inc. emerges as a pivotal figure. Renowned for its comprehensive suite of bioanalytical testing services, Covance is positioned to capitalize on the growing demand for high-quality analytical solutions across the pharmaceutical and biotechnology sectors.

Covance's extensive experience and state-of-the-art facilities enable it to offer a wide range of bioanalytical services, including method development, validation, and sample analysis. Its strategic collaborations with pharmaceutical companies and academic institutions further bolster its market position, allowing Covance to address evolving industry needs and provide tailored solutions to its clients.

Charles River Laboratories International, Inc. is another significant player in the global Bioanalytical Testing Services market, renowned for its expertise in preclinical and clinical laboratory services. With a focus on innovation and operational excellence, Charles River Laboratories continues to expand its service offerings and geographic footprint, catering to a diverse clientele ranging from biopharmaceutical companies to government agencies.

SGS SA and Eurofins Scientific are expected to play key roles in driving market growth, leveraging their global presence and specialized expertise in analytical testing. These companies are well-positioned to capitalize on the increasing outsourcing trend in the pharmaceutical industry, offering a wide range of bioanalytical testing services to support drug development programs worldwide.

Market Key Players

- Covance Inc.

- Charles River Laboratories International, Inc.

- SGS SA

- ICON plc

- Eurofins Scientific

- PPD, Inc. (Pharmaceutical Product Development)

- Labcorp Drug Development

- Intertek Group plc

- WuXi AppTec

- PRA Health Sciences, Inc.

- Medpace Holdings, Inc.

- Almac Group

- Frontage Laboratories, Inc.

- Syneos Health

- BioAgilytix Labs

Recent Development

- In May 2024, KCAS Bio partnered with Crux Biolabs to provide harmonized spectral flow cytometry using the Cytek Aurora platform for global clinical research, enhancing services across the US, Europe, and Australia.

- In April 2024, Ardena's nanomedicines facility received GMP approval after a €20 million expansion, adding advanced labs and cleanrooms to support nanomedicine research, development, and manufacturing.

Report Scope

Report Features Description Market Value (2023) USD 3.6 Bn Forecast Revenue (2033) USD 9.0 Bn CAGR (2024-2033) 9.8% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Test Type (ADME, Pharmacokinetics (PK), Pharmacodynamics (PD), Bioavailability, Bioequivalence, Others), By Application (Oncology, Neurology, Infectious Diseases, Cardiology, Gastroenterology, Others), By End-User (Pharma and Biotechnology Companies, Contract Research Organizations, Research Institutes) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Covance Inc., Charles River Laboratories International, Inc., SGS SA, ICON plc, Eurofins Scientific, PPD, Inc. (Pharmaceutical Product Development), Labcorp Drug Development, Intertek Group plc, WuXi AppTec, PRA Health Sciences, Inc., Medpace Holdings, Inc., Almac Group, Frontage Laboratories, Inc., Syneos Health, BioAgilytix Labs Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Covance Inc.

- Charles River Laboratories International, Inc.

- SGS SA

- ICON plc

- Eurofins Scientific

- PPD, Inc. (Pharmaceutical Product Development)

- Labcorp Drug Development

- Intertek Group plc

- WuXi AppTec

- PRA Health Sciences, Inc.

- Medpace Holdings, Inc.

- Almac Group

- Frontage Laboratories, Inc.

- Syneos Health

- BioAgilytix Labs