Beverage Carton Packaging Machinery Market By Type (Horizontal end side-load, Top-load, Wraparound, Vertical leaflet, Vertical sleeve), By Form (Automatic, Semi-automatic), By Application (Alcoholic beverages, Soft drinks, Dairy beverages), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

43178

-

June 2024

-

181

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

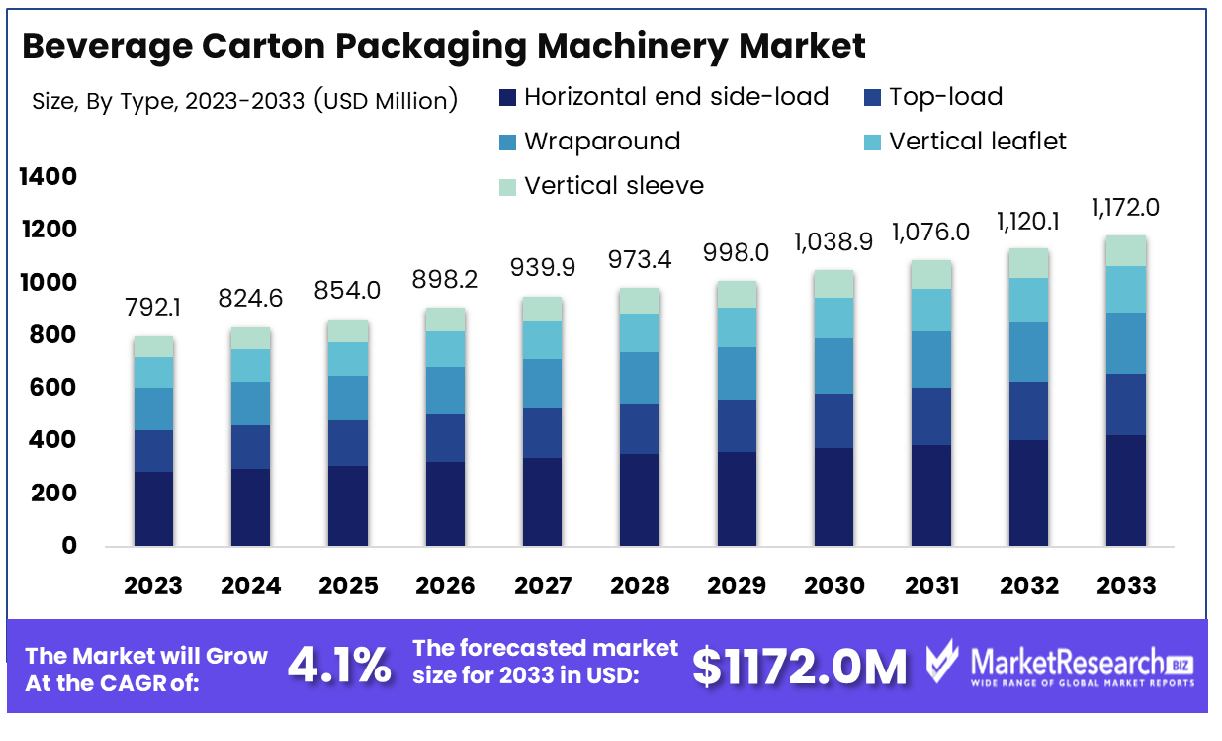

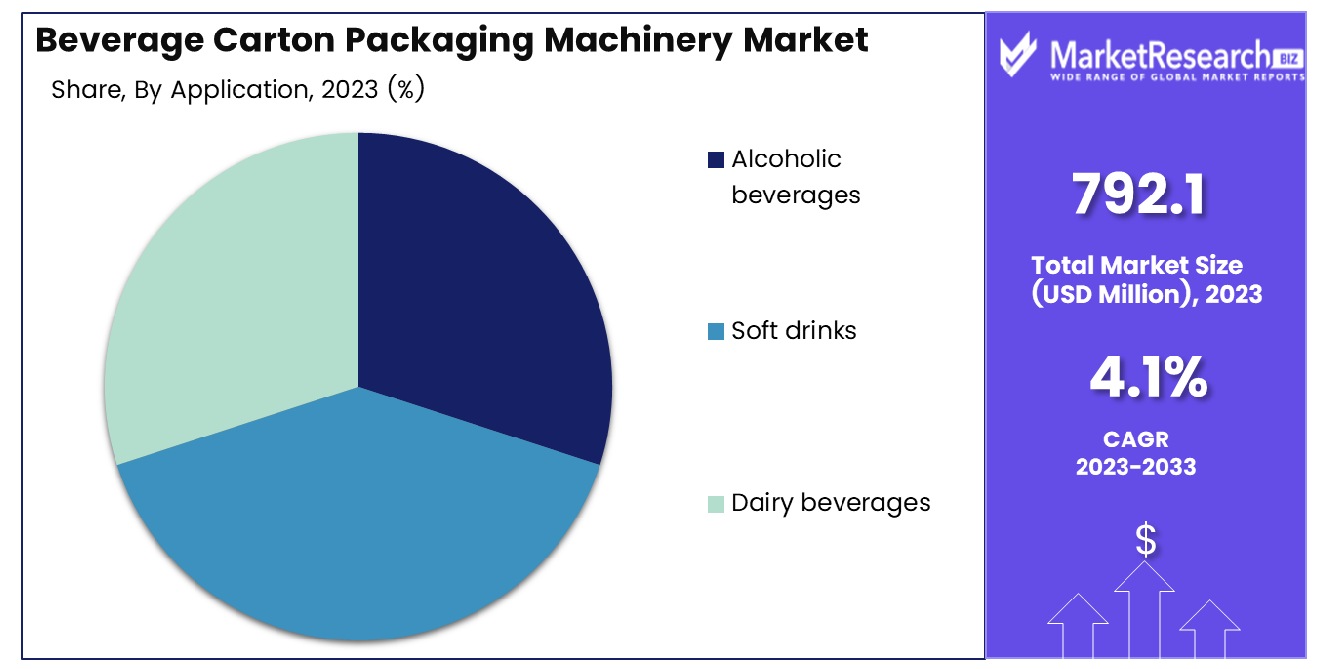

The Global Beverage Carton Packaging Machinery Market was valued at USD 792.1 Mn in 2023. It is expected to reach USD 1172.0 Mn by 2033, with a CAGR of 4.1% during the forecast period from 2024 to 2033.

The Beverage Carton Packaging Machinery Market encompasses the specialized sector within the packaging industry dedicated to the design, production, and distribution of machinery tailored specifically for beverage carton packaging processes. These machines are engineered to efficiently handle the unique demands of packaging various beverages, ensuring precision, speed, and quality throughout the production cycle. With a focus on enhancing productivity, reducing downtime, and meeting evolving consumer preferences, this market segment drives innovation in packaging technology. Companies operating within this market play a crucial role in enabling beverage manufacturers to achieve optimal efficiency and effectiveness in their packaging operations, thereby enhancing competitiveness and meeting market demands.

The Beverage Carton Packaging Machinery Market is poised for robust growth, driven by several key factors within the packaging industry landscape. With plastic production projected to more than double by 2050, reaching an estimated 756 million tons, there is a heightened focus on sustainable packaging solutions. This surge in plastic production underscores the urgent need for eco-friendly alternatives, positioning beverage carton packaging as a viable and increasingly attractive option for manufacturers worldwide.

The Beverage Carton Packaging Machinery Market is poised for robust growth, driven by several key factors within the packaging industry landscape. With plastic production projected to more than double by 2050, reaching an estimated 756 million tons, there is a heightened focus on sustainable packaging solutions. This surge in plastic production underscores the urgent need for eco-friendly alternatives, positioning beverage carton packaging as a viable and increasingly attractive option for manufacturers worldwide.The global market for functional foods and beverages is on a trajectory towards exponential expansion, forecasted to surpass $500 billion by 2028. As consumer preferences pivot towards healthier beverage options, there arises a corresponding demand for packaging machinery capable of accommodating a diverse array of functional beverages. The versatility and adaptability of beverage carton packaging machinery position it favorably to capture a significant share of this burgeoning market segment.

The Beverage Carton Packaging Machinery Market presents a compelling investment opportunity for stakeholders across the value chain. Manufacturers are urged to capitalize on the growing momentum towards sustainable packaging solutions by enhancing their capabilities in beverage carton packaging machinery. By aligning with evolving consumer preferences for healthier beverage options, companies can position themselves for sustained growth and competitive advantage in the dynamic global marketplace.

Key Takeaways

- Market Value: The Global Beverage Carton Packaging Machinery Market was valued at USD 792.1 Mn in 2023. It is expected to reach USD 1172.0 Mn by 2033, with a CAGR of 4.1% during the forecast period from 2024 to 2033.

- By Type: Horizontal end side-load systems dominate the market with a 35% share, due to their efficiency and suitability for high-speed packaging lines.

- By Form: Automatic machinery, with a 65% market share, leads the market owing to its ability to enhance productivity and reduce labor costs.

- By Application: The Soft drinks sector dominates the market with a 40% share, driven by the high consumption volume and demand for packaged beverages.

- Regional Dominance: Europe dominates the Beverage Carton Packaging Machinery Market with a 40% market share, driven by high demand for sustainable packaging solutions and advanced manufacturing capabilities.

- Growth Opportunity: The Beverage Carton Packaging Machinery Market has significant growth opportunities in the shift towards eco-friendly and recyclable packaging solutions.

Driving factors

Rising Demand for Premium Beverages

The surge in the demand for premium beverages significantly propels the growth of the Beverage Carton Packaging Machinery Market. As consumers increasingly seek high-quality and premium beverages, beverage manufacturers are under pressure to ensure that their products not only meet but exceed consumer expectations. This trend is particularly evident in the alcoholic beverage sector, where premiumization has become a key strategy for market players to differentiate their products and command higher prices.

Premium beverages often come packaged in cartons, as they offer several advantages such as better preservation of flavor and longer shelf life compared to other packaging materials. This preference for carton packaging among premium beverage manufacturers directly translates into an increased demand for beverage carton packaging machinery.

Sustainability and Eco-Friendly Packaging

The emphasis on sustainability and eco-friendly packaging practices is another key driver of growth in the Beverage Carton Packaging Machinery Market. With growing environmental concerns and increasing awareness among consumers about the impact of packaging waste on the planet, beverage companies are actively seeking sustainable packaging solutions to reduce their carbon footprint and meet regulatory requirements.

Carton packaging is inherently eco-friendly, as it is made from renewable resources such as paperboard, which is biodegradable and recyclable. As a result, it aligns well with the sustainability goals of beverage manufacturers and resonates with environmentally conscious consumers. Governments worldwide are implementing stringent regulations to curb plastic pollution and promote sustainable packaging alternatives. For instance, bans on single-use plastics and initiatives to promote recycling are driving beverage companies to adopt more sustainable packaging options like cartons.

Restraining Factors

Maintenance and Operational Costs

While the Beverage Carton Packaging Machinery Market experiences growth propelled by various factors, it faces challenges stemming from maintenance and operational costs. The machinery involved in carton packaging requires regular maintenance to ensure optimal performance and longevity. This includes routine inspections, repairs, and upgrades, all of which incur additional costs for beverage manufacturers.

The complexity of modern packaging machinery necessitates skilled technicians for maintenance and operation. Hiring and retaining qualified personnel adds to the operational expenses for companies utilizing beverage carton packaging equipment. Unexpected breakdowns or downtime due to maintenance issues can disrupt production schedules, leading to losses in revenue and productivity. To mitigate these risks, beverage companies often invest in preventive maintenance programs and spare parts inventory, adding further to their operational expenditures.

Dependence on Beverage Industry Performance

The growth of the Beverage Carton Packaging Machinery Market is closely tied to the performance of the beverage industry. Any fluctuations or downturns in the beverage sector can directly impact the demand for carton packaging machinery. Economic factors, consumer preferences, and industry trends influence the consumption patterns of beverages, thereby affecting the production requirements of beverage manufacturers. For example, during periods of economic recession, consumers may reduce discretionary spending on premium beverages, leading to lower demand for carton packaging machinery.

Shifts in consumer preferences towards alternative packaging formats or beverage categories can also impact the demand for carton packaging equipment. For instance, the rising popularity of ready-to-drink (RTD) beverages in PET bottles or aluminum cans may divert investments away from carton packaging machinery.

By Type Analysis

Horizontal end side-load machinery captured over 35% of the Beverage Carton Packaging Machinery Market's By Type segment.

In 2023, Horizontal end side-load held a dominant market position in the "By Type" segment of the Beverage Carton Packaging Machinery Market, capturing more than a 35% share. Horizontal end side-load machinery emerged as a preferred choice among beverage manufacturers due to its efficiency, versatility, and ability to handle a wide range of carton sizes and formats.

Top-load machinery followed closely behind Horizontal end side-load, showcasing its significant presence in the market. With its capability to efficiently package cartons from the top, this type of machinery appealed to manufacturers seeking high-speed and reliable packaging solutions for their beverage products.

Wraparound machinery represented another notable segment within the Beverage Carton Packaging Machinery Market. Offering a wrap-around packaging approach, this machinery type appealed to manufacturers looking for compact and space-saving packaging solutions while maintaining product integrity and visual appeal.

Vertical leaflet machinery, while holding a smaller market share compared to the leading segments, offered unique capabilities in inserting leaflets or promotional materials into beverage cartons. This machinery type catered to manufacturers aiming to enhance product packaging with additional informational or marketing materials.

Vertical sleeve machinery rounded out the segmentation of the Beverage Carton Packaging Machinery Market. Although holding a relatively smaller market share, vertical sleeve machinery provided manufacturers with the capability to apply shrink sleeves or labels to beverage cartons, adding branding and aesthetic value to the packaging.

By Form Analysis

Automatic machinery secured over 65% of the Beverage Carton Packaging Machinery Market's By Form segment.

In 2023, Automatic held a dominant market position in the By Form segment of the Beverage Carton Packaging Machinery Market, capturing more than a 65% share. Automatic machinery emerged as the preferred choice among beverage manufacturers due to its efficiency, speed, and ability to streamline production processes.

Semi-automatic machinery followed behind Automatic, representing a notable segment within the market. While holding a smaller market share compared to Automatic machinery, semi-automatic equipment appealed to manufacturers with lower production volumes or those seeking more flexible packaging solutions.

Automatic machinery's dominance in the market can be attributed to its ability to automate various stages of the packaging process, including carton forming, filling, sealing, and labeling, thereby reducing labor costs and increasing production throughput. These machines are equipped with advanced features such as programmable controls, integrated sensors, and servo motors, enabling precise and consistent packaging operations.

Semi-automatic machinery, while offering manual intervention in certain stages of the packaging process, still provided efficiency gains compared to fully manual methods. These machines were favored by smaller-scale beverage manufacturers or those requiring more hands-on control over packaging operations.

By Application Analysis

Soft drinks dominated the Beverage Carton Packaging Machinery Market's By Application segment with over 40% share.

In 2023, Soft drinks held a dominant market position in the By Application segment of the Beverage Carton Packaging Machinery Market, capturing more than a 40% share. The widespread consumption of soft drinks across various demographics and regions propelled the demand for efficient and reliable packaging solutions within this segment.

Alcoholic beverages represented another significant application segment within the Beverage Carton Packaging Machinery Market. While holding a substantial market share, the dominance of soft drinks indicated their higher volume and broader consumer base compared to alcoholic beverages, driving the preference for packaging machinery tailored to meet the demands of soft drink production.

Dairy beverages constituted a notable segment within the market, reflecting the growing popularity of dairy-based products and alternative milk beverages. While capturing a portion of the market share, dairy beverages faced competition from soft drinks in terms of consumer preference and market penetration, influencing the dynamics of the packaging machinery market within this segment.

Key Market Segments

By Type

- Horizontal end side-load

- Top-load

- Wraparound

- Vertical leaflet

- Vertical sleeve

By Form

- Automatic

- Semi-automatic

By Application

- Alcoholic beverages

- Soft drinks

- Dairy beverages

Growth Opportunity

Growing Demand for Functional Beverages

The beverage landscape is witnessing a notable shift towards functional beverages, which offer health benefits beyond basic nutrition. These beverages, enriched with vitamins, minerals, antioxidants, and other bioactive compounds, are gaining traction among health-conscious consumers seeking products that support their wellness goals.

Functional beverages often come in carton packaging due to its suitability for preserving the nutritional integrity of the contents and providing a convenient format for consumption. This growing segment of the beverage market translates into increased demand for carton packaging machinery capable of efficiently handling diverse product formulations and packaging requirements.

Increasing Focus on Convenience

Consumers today value convenience more than ever, driving the demand for beverages that align with their on-the-go lifestyles. Ready-to-drink (RTD) beverages, single-serve packs, and portable formats are gaining popularity, reflecting the need for convenient and portable beverage solutions. Carton packaging offers the flexibility to accommodate these convenience-driven preferences while ensuring product freshness and integrity.

The adoption of advanced beverage carton packaging machinery equipped with features such as automated filling, sealing, and labeling capabilities enhances production efficiency and enables manufacturers to meet the growing demand for convenient beverage packaging formats. As beverage companies strive to capitalize on this trend, investments in state-of-the-art carton packaging machinery are expected to surge, presenting lucrative opportunities for market players.

Latest Trends

Integration of Automation and Digital Technologies

Automation is revolutionizing the beverage packaging industry, and its integration into carton packaging machinery is a prominent trend driving efficiency and productivity. Automated systems streamline production processes, from carton forming and filling to sealing and palletizing, reducing manual intervention and minimizing the risk of errors.

The integration of digital technologies such as IoT sensors and data analytics enables real-time monitoring of equipment performance, predictive maintenance, and optimization of production workflows. This convergence of automation and digitalization enhances operational efficiency, improves product quality, and ultimately boosts the competitiveness of beverage carton packaging machinery manufacturers.

Development of Smart Packaging Solutions

Smart packaging solutions are gaining momentum in the beverage industry, offering enhanced functionalities such as product traceability, tamper-evident seals, and interactive consumer engagement. Beverage carton packaging machinery is evolving to accommodate the integration of smart features, including RFID tags, QR codes, and NFC-enabled labels.

These technologies enable brands to deliver personalized consumer experiences, gather valuable data insights, and strengthen brand loyalty. As consumer expectations for transparency and authenticity continue to rise, the development of smart packaging solutions presents a lucrative opportunity for innovation in the beverage carton packaging machinery market.

Growing Demand for Compact Machinery

Compactness is emerging as a key consideration for beverage manufacturers seeking to optimize floor space and increase production flexibility. Compact beverage carton packaging machinery offers a smaller footprint without compromising on performance, making it ideal for facilities with limited space constraints or those looking to expand capacity without major infrastructure changes.

Compact machinery enables quick installation and easier reconfiguration, allowing beverage companies to adapt to changing market demands and production requirements more efficiently. As the demand for flexible and scalable packaging solutions grows, compact beverage carton packaging machinery is expected to gain traction, driving market growth and adoption in 2024 and beyond.

Regional Analysis

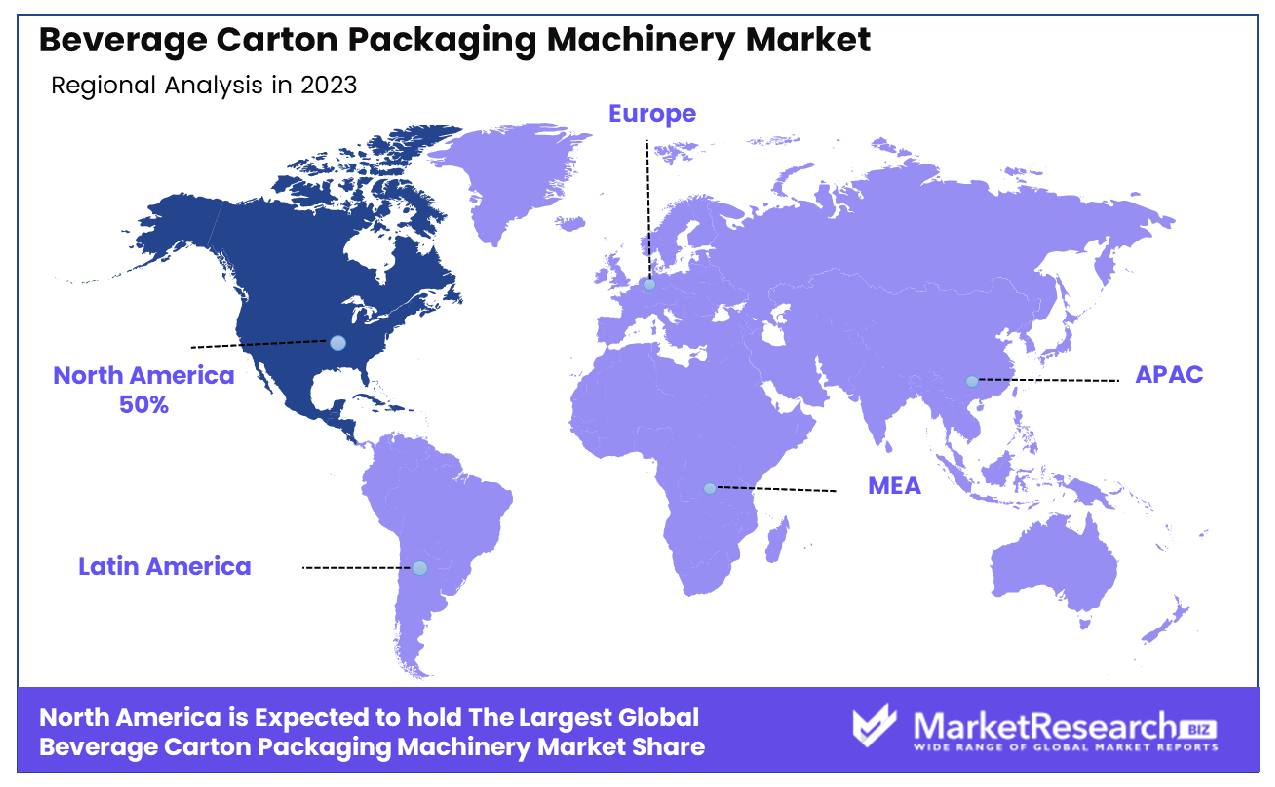

North America dominates the Beverage Carton Packaging Machinery Market with a 40% share, driven by advanced manufacturing and sustainability.

The Beverage Carton Packaging Machinery Market is marked by notable regional disparities, each influenced by distinct industrial and economic dynamics. North America, holding the largest market share at 40%, dominates the sector. This leadership is attributed to the region's advanced manufacturing capabilities, high consumption of packaged beverages, and continuous technological innovations. The presence of leading machinery manufacturers and substantial investments in research and development further bolster this dominance.

Europe trails closely, driven by stringent environmental regulations that promote sustainable packaging solutions and a well-established beverage industry. Countries such as Germany, France, and Italy lead in adopting advanced packaging technologies, reflecting the region's focus on automation and efficiency.

Asia Pacific is witnessing the fastest growth, spurred by rapid industrialization, rising disposable incomes, and increasing urbanization in countries like China, India, and Japan. The burgeoning middle class and expanding beverage market in these countries contribute significantly to the demand for advanced packaging machinery. Moreover, favorable government policies supporting manufacturing advancements and foreign investments play a crucial role in this growth trajectory.

The Middle East & Africa region showcases moderate growth, particularly in economically diversified countries like the UAE and South Africa, where there is a rising demand for packaged beverages driven by lifestyle changes and increased consumer spending. However, political instability and underdeveloped infrastructure in certain areas pose challenges to market expansion.

Latin America presents a mixed outlook, with Brazil and Mexico leading the market due to their sizable beverage industries and increasing adoption of modern packaging technologies. Economic fluctuations and regional disparities in infrastructure development affect overall growth potential.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global beverage carton packaging machinery market in 2024 is poised for robust growth, driven by key players that are continually advancing their technologies and expanding their market reach. Leading the charge is ACG Worldwide, known for its comprehensive solutions in the packaging industry. ACG’s focus on innovation and customer-centric approach ensures it remains a critical player in the market.

KHS and Krones are two major players with a strong foothold in the beverage packaging machinery sector. KHS's expertise in efficient, sustainable packaging solutions aligns well with the increasing demand for eco-friendly packaging. Krones, with its extensive product portfolio and cutting-edge technology, continues to lead the market by providing integrated solutions that enhance productivity and reduce operational costs.

GPI Equipment and Bosch Packaging Technology are also significant contributors. GPI Equipment's reputation for high-quality, reliable machinery positions it well within the industry, while Bosch’s advanced automation solutions and focus on industry 4.0 technologies ensure its competitive edge.

Econocorp and Jacob White Packaging Ltd. offer versatile and cost-effective solutions that cater to small and medium-sized enterprises, helping them to compete effectively. Bradman Lake Group, Mitsubishi Electric, and R.A. Jones stand out for their commitment to technological advancements and efficient production systems, providing high-speed, reliable machinery that meets the diverse needs of the beverage industry.

Mpac Group plc and Douglas Machine Inc. are notable for their innovative packaging solutions and strong customer support, ensuring they remain key players in the market. Sidel and Tishma Technologies, with their focus on flexibility and sustainability, cater to the evolving demands of the market, ensuring their strong presence.

Market Key Players

- ACG Worldwide

- KHS

- Krones

- GPI Equipment

- Bosch Packaging Technology

- Econocorp

- Jacob White Packaging Ltd.

- Bradman Lake Group

- Mitsubishi Electric

- R.A. Jones

- Mpac Group plc

- Douglas Machine Inc.

- Sidel

- Tishma Technologies

- Syntegon Technology GmbH

- Cariba S.r.l

Recent Development

- In May 2024, Refresco partners with Zotefoams for a sustainable "mono-material barrier" beverage carton trial, aiming for recyclability and reduced environmental impact.

- In April 2024, Tetra Pak transitions from packaging supplier to innovation partner, supporting FMCG companies with sustainable solutions and product development expertise across various sectors.

Report Scope

Report Features Description Market Value (2023) USD 792.1 Mn Forecast Revenue (2033) USD 1172.0 Mn CAGR (2024-2033) 4.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Horizontal end side-load, Top-load, Wraparound, Vertical leaflet, Vertical sleeve), By Form (Automatic, Semi-automatic), By Application (Alcoholic beverages, Soft drinks, Dairy beverages) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape ACG Worldwide, KHS, Krones, GPI Equipment, Bosch Packaging Technology, Econocorp, Jacob White Packaging Ltd., Bradman Lake Group, Mitsubishi Electric, R.A. Jones, Mpac Group plc, Douglas Machine Inc., Sidel, Tishma Technologies, Syntegon Technology GmbH, Cariba S.r.l Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- ACG Worldwide

- KHS

- Krones

- GPI Equipment

- Bosch Packaging Technology

- Econocorp

- Jacob White Packaging Ltd.

- Bradman Lake Group

- Mitsubishi Electric

- R.A. Jones

- Mpac Group plc

- Douglas Machine Inc.

- Sidel

- Tishma Technologies

- Syntegon Technology GmbH

- Cariba S.r.l