Global Beef Tallow Market By Product Types(Food Grade, Industry Grade), By Application(Production of biodiesel, Aviation fuel, Food, Cosmetic Products, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

44767

-

April 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

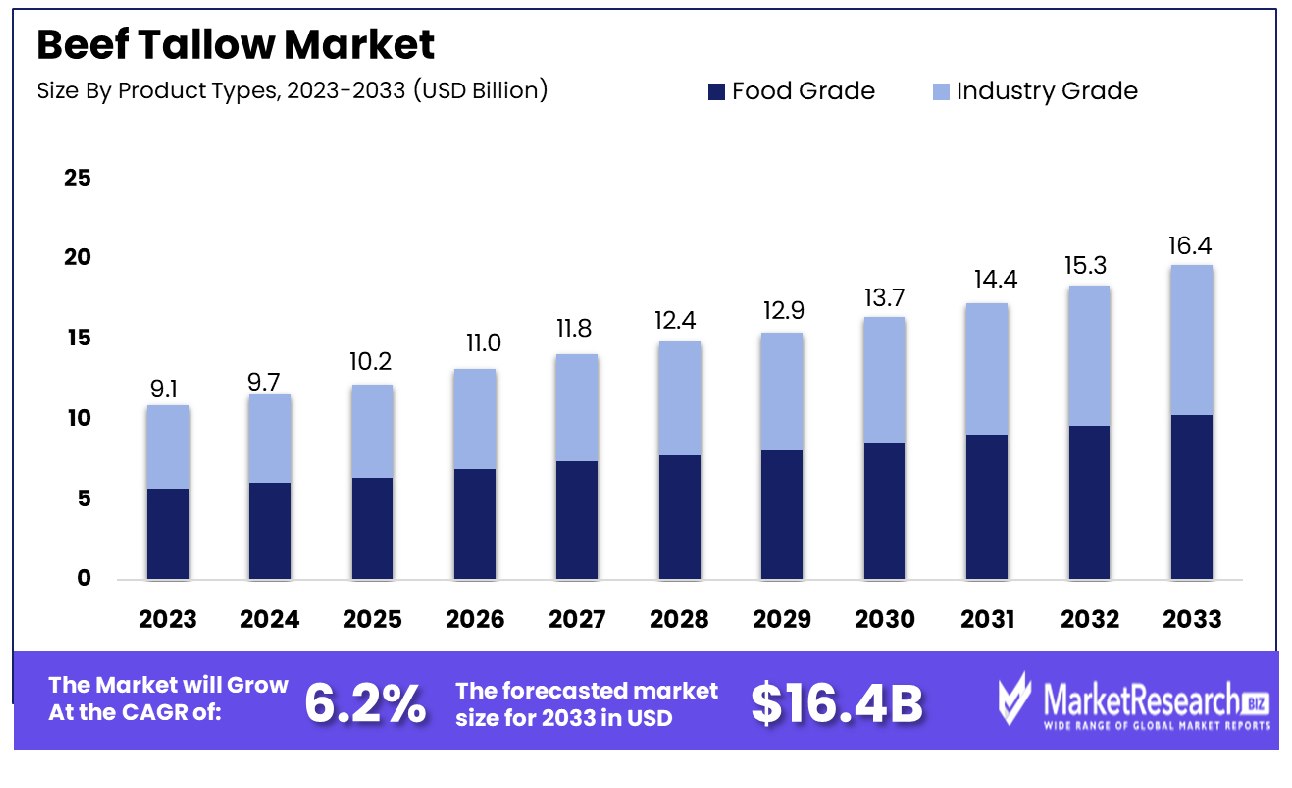

The Global Beef Tallow Market was valued at USD 9.1 Billion in 2023. It is expected to reach USD 16.4 Billion by 2033, with a CAGR of 6.2% during the forecast period from 2024 to 2033.

The beef tallow is defined as the concentrated form of beef fat, generally obtained by heating and filtering the fatty tissue of cattle. It is a versatile and broadly used ingredient in cooking, food production, and different industrial applications. With a high smoke point, beef tallow is optimal for frying and deep frying, divulging a rich flavor and crispy textures to fried foods.

In addition to cooking uses, beef tallow is used in the production of soaps, skincare products, and candles due to its moisturizing features and potential to develop a stable lather. It also serves as a source of energy in animal feed and biofuel production. Moreover, being disparaged for its saturated fat content, beef tallow has experienced a resurrection in popularity among proponents of old cooking techniques and sustainable resource usage by contributing to its continued presence in contemporary industries.

The importance of utilizing underlies its diversified advantages across different industries and applications. Starting from culinary to industrial usage, beef tallow provides unique benefits that are being widely recognized and embraced. In the culinary world, beef tallow has much attention for its high smoke point which makes it an ideal choice for frying and deep frying.

Unlike several vegetable oils, it remains constant at high temperatures by conveying a desirable flavor and crispiness to fried foods. Additionally, beef tallow comprises a balanced ratio of saturated and unsaturated fats which makes it an ideal substitute for oils with higher levels of unhealthy trans fats.

Beef tallow finds utility in the production of soaps, candles, and skincare products. Its moisturizing features make it a precious ingredient in skincare formulations, while its capability to develop a steady lather improves the quality of soaps. Moreover, it serves as a sustainable resource for biofuel production by providing a substitute for fossil fuels and by contributing to efforts focused on decreasing carbon emissions.

The use of beef tallows in animal feed offers a source of energy and nutrition for livestock by supporting their health and well-being. This versatile component thus plays an important role in different sectors by promoting sustainability, flavor improvement, and economic viability all across the boards. The demand for the beef tallow is not limited to culinary, it is also used in cosmetic industries that will help in market expansion in the coming years.

Key Takeaways

- Market Growth: The Global Beef Tallow Market was valued at USD 9.1 Billion in 2023. It is expected to reach USD 16.4 Billion by 2033, with a CAGR of 6.2% during the forecast period from 2024 to 2033.

- By Product Types: Food-grade beef tallow dominates due to its high demand for food.

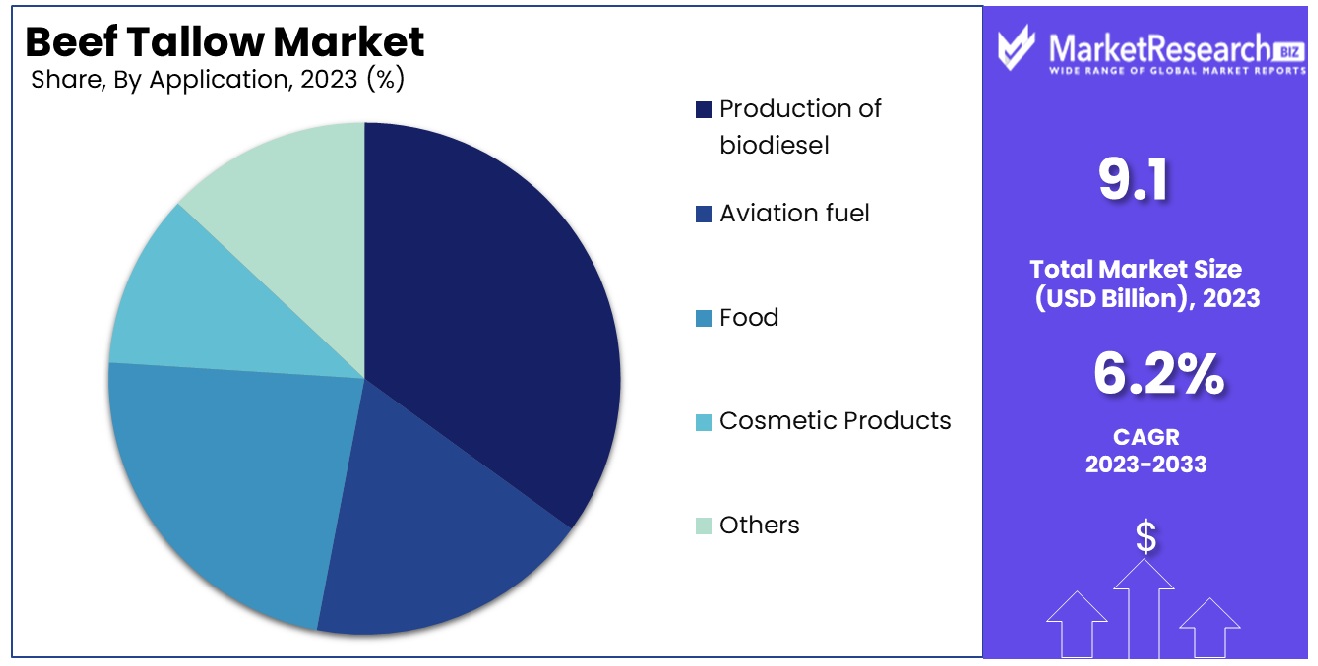

- By Application: Biodiesel production is the leading application, driven by sustainable fuel initiatives.

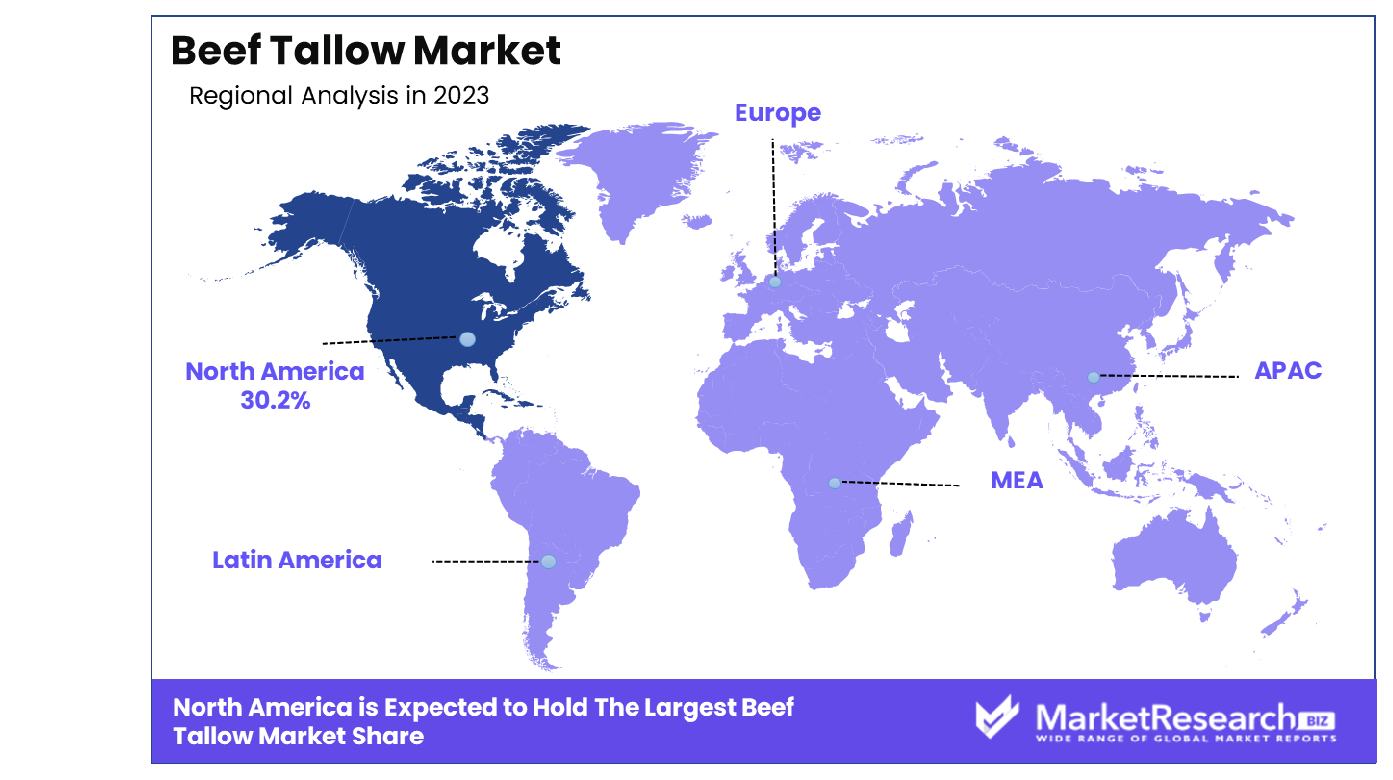

- Regional Dominance: In 2023, North America held a 30.2% share of the global beef tallow market.

- Growth Opportunity: In 2023, the global beef tallow market is set to grow due to rising interest in traditional cooking and expanding industrial uses like biodiesel and personal care products.

Driving factors

Enhanced Appeal in the Food and Beverage Sector

The food and beverage industry's increasing predilection for beef tallow, attributed to its distinctive flavor and texture, plays a significant role in propelling the market forward. Beef tallow imparts a rich, savory flavor and a unique mouthfeel that are highly prized in culinary applications, particularly in high-end restaurants and processed food products.

This specific demand contributes to the growing market size, as chefs and food manufacturers seek quality ingredients that elevate their offerings. The trend towards gourmet and artisanal food products further amplifies this demand, making beef a sought-after commodity in this sector.

Diversification into Pharmaceuticals and Cosmetics

Beef tallow's moisturizing and emollient properties have garnered attention from the pharmaceutical and cosmetic industries, marking a pivotal shift in its market dynamics. These industries value beef tallow for its high stearic and oleic acid content, which are known to nourish and maintain skin barrier function.

The expansion of natural and organic product lines in cosmetics and skincare, which often leverage traditional and naturally-derived ingredients like tallow, reflects a broader consumer shift towards wellness and sustainability. Consequently, this drives a significant uptick in the demand for beef tallow, diversifying its applications and stabilizing market growth against fluctuations in other sectors.

Increased Output from Industrial Meat Processing

The proliferation of industrial meat processing facilities directly correlates with an increased production of beef tallow as a byproduct. This rise in supply capacity not only meets the growing demand from previously mentioned industries but also stabilizes tallow prices and enhances market accessibility.

The efficiency of modern meat processing technology has optimized the extraction and processing of tallow, ensuring a consistent and high-quality product enters the market. This factor is critical in maintaining a supply-demand balance, which is essential for the sustained growth of the beef tallow market across various industries.

Restraining Factors

Influence of Dietary Preferences and Cultural Factors

Dietary preferences and cultural factors significantly impact the beef tallow market by influencing consumer behavior and purchasing decisions. In regions where vegetarianism or veganism is prevalent, or where beef consumption is culturally restricted, the demand for beef tallow naturally diminishes. This can lead to regional disparities in market performance, where sales might flourish in areas with fewer dietary restrictions but falter where such constraints are strong.

Additionally, the global shift towards healthier diets that emphasize low-fat and cholesterol-free options can restrain beef tallow demand, as it is perceived as less healthy compared to plant-based fats and oils. This evolving dietary landscape necessitates market adaptations, potentially limiting growth in sectors sensitive to these market trends.

Regulatory Impacts on Market Dynamics

Regulatory constraints concerning fat content and labeling further complicate the beef tallow market landscape. Governments and health organizations may impose limits on the usage of animal fats in food products, driven by public health initiatives aimed at reducing cardiovascular diseases and other health concerns associated with high saturated fat consumption.

Such regulations not only restrict the volume of tallow that can be incorporated into food products but also affect consumer perceptions, as labeling requirements make the fat content more visible and potentially deter purchases. The need to comply with these regulations can lead to increased production costs and operational complexities for tallow producers, inhibiting market growth by adding barriers to both the supply and demand sides.

By Product Types Analysis

Food grade tallow leads are favored for their purity and safety in food applications.

In 2023, Food Grade held a dominant market position in the By Product Types segment of the Beef Tallow Market, which also includes Industry Grade categories. This trend can be attributed to the escalating demand for high-quality, sustainable ingredients in the food industry. Food-grade beef tallow is extensively utilized in culinary applications due to its superior flavor profile and nutritional benefits, including high levels of vitamins A, D, E, and K, as well as essential fatty acids.

The preference for food-grade beef tallow over industry-grade is further bolstered by growing consumer awareness of health and wellness food, which has led to an increased demand for natural and minimally processed foods. This segment's expansion is also supported by its versatile use in the production of bio-ingredients for dietary supplements, a sector that continues to see robust growth.

Market analyses indicate that the food-grade segment accounted for approximately 65% of the total market share in 2023, a reflection of its widespread acceptance and diverse applications in both commercial and residential cooking. The sustained preference for natural ingredients over synthetic alternatives has further cemented Food Grade Tallow's position in the market.

Moreover, the industry forecasts predict a continuing upward trajectory for this segment, driven by innovations in food technology and a growing preference for sustainable and ethically sourced products. The integration of food-grade beef tallow into organic and non-GMO food products is likely to open new avenues for growth and market expansion.

By Application Analysis

Biodiesel production leads to usage, capitalizing on tallow's high energy content and renewability.

In 2023, the production of biodiesel held a dominant market position in the By Application segment of the Beef Tallow Market, alongside other key applications such as aviation fuel, food, cosmetic products, and others. The predominance of biodiesel production is driven by global initiatives to reduce carbon emissions and the transition towards renewable energy sources.

Beef tallow, as a feedstock for biodiesel, offers a high cetane number and significant carbon neutrality, which makes it an attractive alternative to traditional petroleum diesel. The segment's growth is facilitated by supportive regulatory frameworks and incentives for sustainable fuel production, particularly in regions committed to environmental sustainability.

Market data reveal that biodiesel production accounted for approximately 55% of the total usage of beef tallow in 2023. This application benefits from the dual advantage of utilizing byproducts from the meat processing industry and contributing to waste reduction, aligning with the circular economy principles.

The rising demand for biodiesel is further propelled by advancements in processing technologies that enhance the efficiency and cost-effectiveness of converting animal fats into high-quality biodiesel. These technological improvements are expected to continue driving the expansion of this market segment.

Forecast market trends suggest an enduring growth in the biodiesel sector, spurred by increasing government mandates on renewable fuel quotas and the automotive industry's gradual shift towards sustainable alternatives. As such, the biodiesel application of beef tallow is poised to maintain its market dominance, underscoring its integral role in fostering sustainable energy solutions.

Key Market Segments

By Product Types

- Food Grade

- Industry Grade

By Application

- Production of biodiesel

- Aviation fuel

- Food

- Cosmetic Products

- Others

Growth Opportunity

Growing Interest in Traditional Cooking Methods

In 2023, the global beef tallow market is poised to benefit significantly from a resurgence of interest in traditional cooking methods. This trend can be largely attributed to a heightened consumer desire for authentic, heritage-rich culinary experiences. As the public becomes more aware of the flavor benefits and nutritional aspects of using animal fats such as beef tallow in cooking, demand is expected to rise.

Notably, beef tallow offers a unique flavor profile that cannot be easily replicated by vegetable-based alternatives. This shift is also supported by the growing consumer preference for natural and minimally processed foods, positioning beef tallow as a premium ingredient in both home kitchens and professional culinary settings.

Expansion of Industrial Applications of Beef Tallow

Simultaneously, the industrial sector presents substantial growth opportunities for the beef tallow market in 2023. Beef tallow is increasingly utilized in a variety of applications beyond the food industry, including biodiesel production, soap making, and other personal care products. The versatility of beef tallow, coupled with its cost-effectiveness and sustainable attributes, makes it an attractive option for manufacturers seeking alternatives to petrochemical-derived products.

As industries continue to prioritize sustainability, the demand for beef tallow in industrial applications is expected to experience robust growth. This trend is further bolstered by regulatory support for green manufacturing practices and the global shift towards renewable resources, underscoring the strategic significance of beef tallow in the broader industrial landscape.

Latest Trends

Resurgence of Traditional Cooking Methods

The global beef tallow market is witnessing a notable resurgence in traditional cooking methods, driven by a renewed appreciation for heritage and authenticity in culinary practices. In 2023, this trend is influencing consumer behavior significantly, with more individuals and restaurants opting for beef tallow due to its rich flavor and traditional appeal.

The use of beef tallow in cooking not only enhances taste profiles but also aligns with the increasing consumer preference for natural and sustainable ingredients. This cultural shift back to traditional fats highlights a broader movement towards transparency and sustainability in food sourcing, thus driving increased demand in the beef tallow market.

Expanding Industrial Applications of Beef Tallow

Parallel to its culinary resurgence, beef tallow is expanding its footprint in various industrial applications. Its utility in the production of biodiesel as a renewable energy source is particularly significant, reflecting the industry’s push towards more sustainable energy solutions. Furthermore, beef tallow is gaining traction in the manufacturing of soaps and personal care items, where it is prized for its natural properties and effectiveness compared to synthetic alternatives.

These expanding uses are supported by a growing industrial commitment to sustainability, with companies increasingly investing in natural ingredients to improve their environmental impact and meet consumer expectations for green products. The versatility and environmental benefits of beef tallow are making it an increasingly valuable commodity in diverse market sectors.

Regional Analysis

In 2023, North America holds a 30.2% share of the global beef tallow market.

The global beef tallow market demonstrates diverse regional dynamics, with significant contributions from North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Each region presents unique market characteristics and growth opportunities based on cultural preferences and industrial applications.

North America emerges as the dominating region, accounting for 30.2% of the global market. This prominence is driven by robust demand in both the food industry and emerging biofuel applications, reflecting the region’s advanced industrial landscape and its proactive adoption of sustainable practices.

Europe follows closely, leveraging its strong culinary traditions that favor natural and high-quality fats like beef tallow. The market in Europe is also bolstered by stringent environmental regulations that promote the use of organic and sustainable materials in industrial applications, including the production of biofuels and personal care products.

In Asia Pacific, the market is expanding rapidly due to increasing awareness and acceptance of beef tallow’s benefits in traditional cooking. Additionally, the region is experiencing growth in industrial sectors that utilize beef tallow in manufacturing processes, driven by economic development and increasing environmental awareness.

The Middle East & Africa region is witnessing gradual growth, influenced by expanding industrial uses of beef tallow. The availability of raw materials and the growing personal care sector contribute to the regional market’s expansion.

Latin America, although smaller in market share, is seeing an increase in the use of beef tallow due to rising demand in the food service sector and local industries focusing on natural ingredients.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global beef tallow market is significantly shaped by the activities of key players such as Armour Lard, Tallow Products, York Foods, PIERMEN B.V., Rothsay, NH Foods, HRR, Cargill, Essential Depot, and Aboissa Vegetable Oils. Each company contributes distinctively, driven by strategic initiatives, geographic reach, and product innovation.

Armour Lard and Tallow Products are traditional stalwarts in the market, known for their long-standing expertise in the production of high-quality beef tallow. These companies have capitalized on the growing trend of traditional cooking methods, enhancing their market presence by emphasizing the authenticity and purity of their products.

York Foods and PIERMEN B.V. have effectively expanded their market reach by diversifying their applications of beef tallow, not just in foods but also in industrial sectors such as biodiesel and cosmetics. This strategy has enabled them to tap into new market segments, appealing to a broader consumer base concerned with sustainability.

Rothsay and NH Foods emphasize sustainable practices in their operations, aligning with global trends towards environmentally friendly production processes. Their commitment to sustainability has strengthened their brand reputation and consumer trust, especially in markets sensitive to environmental issues.

HRR, Cargill, and Essential Depot focus on innovation and technological advancements to improve the efficiency and quality of their beef tallow products. Their efforts are critical in maintaining competitiveness in a market that demands high standards for both product quality and ethical production.

Lastly, Aboissa Vegetable Oils leverages its expertise in vegetable oils to provide unique blends and specialized products, expanding the utility of beef tallow in various industrial applications.

Market Key Players

- Armour lard

- Tallow Products

- York Foods

- PIERMEN B.V.

- Rothsay

- NH Foods

- HRR

- Cargill

- Essential Depot

- Aboissa Vegetable Oils

Recent Development

- In February 2024, Prof. Shulamit Levenberg of the Technion leads Aleph Farms, pioneering cultured meat. Aleph received approval to market lab-grown steak, a milestone in cellular agriculture, reflecting Levenberg's innovative work.

- In February 2024, Yonsei University researchers developed hybrid rice infused with lab-grown beef cells, offering higher protein and lower carbon footprint than traditional beef production, potentially revolutionizing sustainable food sources.

- In March 2023, Lotte Mart's Grocery sales soared, doubling competitors' growth rates, credited to its Fresh Food Quality Improvement Project and Distribution Structure Innovation, leading to a fivefold increase in operating profit.

Report Scope

Report Features Description Market Value (2023) USD 9.1 Billion Forecast Revenue (2033) USD 16.4 Billion CAGR (2024-2032) 6.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Types(Food Grade, Industry Grade), By Application(Production of biodiesel, Aviation fuel, Food, Cosmetic Products, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Armour lard, Tallow Products, York Foods, PIERMEN B.V., Rothsay, NH Foods, HRR, Cargill, Essential Depot, Aboissa Vegetable Oils Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Armour lard

- Tallow Products

- York Foods

- PIERMEN B.V.

- Rothsay

- NH Foods

- HRR

- Cargill

- Essential Depot

- Aboissa Vegetable Oils